#personal investment is more important than market demand

Note

Heyy

Do you have any advice on starting a real estate business as in just buying and renting out property?

Thanks 🤍

Yes!

**For the record, I have personally done a few flips/rehabs. Apart from that, I knew/know most of the realtors in this city and relating companies as I worked with most real estate/mortgage and title companies here when I had an agency.

First you need to be able to learn the market and research comparables. When looking to buy properties there are important factors to consider to make sure you are not paying overprice for a property as well as that the are is on demand, ensuring it will be easier to rent out the property.

The location of the property and its proximity to amenities like schools, shopping centers, grocery stores, transportation etc. Also that the area is safe.

You also want to look for areas that has future development plans, this will raise the value of your property.

If you have worked with investment companies, you will quickly learn that buying a property that is not in the best condition, a rehab property, could be a very smart play. You want to make sure of course to check the comparables and ensure that the property is underpriced compared to the other homes in the area. Once you rehab the property, it could raise or even surpass the value of the other homes in the area.

Any home that you would look into to buy for renting out should have elements that you intend to upgrade on. There are a lot of reasons for this but the most important one is how it raises your price and potential earnings. Redoing a kitchen or a bathroom can immediately raise the value of your home anywhere from 5-50k. A project that will cost you anywhere from 3-10k on average for a standards nice kitchen depending on your area.

Overall you still want to look at the comps to make sure you are getting a fair deal. Calculate the potential annual rent as a percentage of the properties price. This will give you an idea of the return on your investment. Also make sure that the potential rental income exceeds the monthly expenses. If not it does not make sense.

Check the vacancy rates in the area you want to purchase in, if its high there may be a low demand and not a good area to invest in.

Also you want to think about how easy it would be to sell the property if you need to. In demand areas tend to be more liquid.

So important, to understand the landlord/ tenant laws in your state. Including their rights and eviction process etc. Nothing worst than having a horrible tenant and not being legally able to remove them.

There are a lot of rate plans depending on your specific situation and mortgage rates also vary significantly by state. Make sure to get the best deal for you. Some states a first time can give as little as 1-5% down depending if you are a first time/ entrepreneur etc.

Property insurance is another cost factor to consider when working out your numbers as this varies by area.

Managing a few properties on your own is easy, but after a handful, you may want to consider hiring a property management company to handle these things for you.

I would strongly urge you to get a lawyer to draw up renter contracts.

To grow this business what you want to do, and this is a general overview: down payment for house, fix, rent out, refinance, use refinance to purchase another property and have enough to put into upgrades/repairs on the second purchase and repeat.

I can get into taxes on this too if you want.

53 notes

·

View notes

Text

Narwhal

Narwhal is a meme. It is a very old meme from back in 2016 and many have forgotten the history of this card. However, its importance in discussions about reserved list bulk and buyouts deserves to be recorded. After all, if we do not know our history we may be doomed to repeat it. In 2016, there were some amount of reserved list buyouts. Particularly, some cards were being purchased seemingly without reason. Typically, a reserved list card spikes in price because of natural demand. Maybe a new card comes out that synergizes perfectly with a reserved list card. Perhaps, a newly released set creates a strong two card infinite combo in commander or some other format. These scenarios sometimes trigger reserved list spikes because there is genuine demand as players jam the latest hot commodity into a deck. 2016 was the first time I saw some reserved list market movement that seemed to be based on manipulation rather than legitimate demand. It is possible that this was the year where it finally clicked that reserved list cards were in limited supply. Reserved list cards can never be reprinted but many reserved list cards were already approaching twenty years old. There was some concern that a group of people or a very wealthy individual would buy up all the bulk on the reserved list for pennies each. Even if there was no desire for any of the reserved list cards currently, some people knew that buying thousands of copies of a card for fifty cents could be very profitable even if those cards only ever reached a maximum of ten dollars per copy. Some people chose to cast their net very wide and buy reserved list cards despite playability or demand. The thought was that reserved list cards would all eventually rise in price due to scarcity and collectability rather than demand or playability. Some people had more discretion and only bought reserved list cards that they thought had potential playability in the long term. Do not forget that every card in the game just needs a single powerful interaction to skyrocket in price. Cards with unique or unusual effects also had strong speculation but there are clearly some reserved list cards that just don't do anything. Narwhal is one such card. For 4 mana you get a 2/2 with first strike and protection from red. Notably, first strike is considered a color pie break in blue but this is not a sufficient reason to play it. The flavor is awesome though! How are you attacking first with that huge horn in the way? How are you casting that fireball on my creature that is under water? The reason I bring all of this up is because in 2016 a youtube personality, formerly called mtglion, started buying out narwhals and then discussing it on his youtube channel. I am not sure if those old videos are still on his youtube channel but he is still active under the new name: UMU. His goal was not to break the market and spike narwhals so he could become rich. Instead, he wanted to see how easily a single individual could manipulate the market of reserved list bulk. Mtglion openly stated that he was buying out copies of narwhal to see the reaction. It was a meme. The card was selected because the probability that the card would ever have genuine demand due to playability was astronomically low. Instead, narwhals are cute, silly little animals and everyone loves those guys. Does anyone remember that episode of Futurama with the narwhals? Would people finally see that reserved list cards are an investment that will go up? Would people get scared that the reserved list was entering the hands of investors looking to pump but not dump? Would certain people hold a monopoly on certain reserved list cards completely controlling the market? At first, the price of narwhal did go up. In June 2016, a single near mint copy of Narwhal was almost ten dollars! That is insane for a card with artificial demand created by someone openly stating that they are manipulating the market. One person literally did move the market and he did not even need thousands of dollars to do it.

#magic the gathering#magic the card game#commander legends#youtube#commander#mtg#blogatog#arena#mark rosewater#reserved list#mtglion#umu#narwhal#rudy#alpha investments#tolarian community college#mtg commander#mtg arena#magic the gathering arena#magic arena#magic card game#magic#mtgstocks#mtgo#edhrec#edh#cedh

8 notes

·

View notes

Text

Maximizing Your Profit: A Comprehensive Guide to Selling Land for Cash

Selling land for cash is an attractive option for property owners who want to expedite the sale process, avoid lengthy negotiations, and secure a lump sum payment. Unlike traditional real estate transactions involving homes or commercial buildings, selling land comes with unique challenges and opportunities. Whether you own vacant plots, farmland, or recreational property, understanding the intricacies of selling land for cash is crucial to ensure you maximize your profit and minimize risks. This guide will walk you through the essential steps, key considerations, and benefits of, as well as offer insight into market dynamics, finding buyers, and avoiding common pitfalls. From understanding the paperwork involved to knowing how to market your land effectively, being well-prepared can lead to a smooth and profitable transaction.

The Benefits of Selling Land for Cash: Why It’s a Smart Choice?

There are several advantages to selling land for cash that make it a smart choice for many property owners. One of the primary benefits is the speed of the transaction. Cash sales typically proceed much faster than those involving financing, as they eliminate the need for buyer mortgage approvals, appraisals, or loan contingencies. This expedites the closing process, allowing the seller to receive payment quickly. For those looking to liquidate assets for other investments or personal needs, selling land for cash offers immediate liquidity, making it an attractive option for individuals in need of quick financial flexibility. Another significant benefit is the reduced likelihood of the sale falling through. Since cash buyers do not need to secure a loan, there’s less risk of last-minute financing issues that could derail the transaction.

Essential Steps for a Smooth Transaction When Selling Land for Cash

To ensure a smooth and successful transaction when selling land for cash, there are several essential steps that sellers should follow. The first step is conducting a thorough assessment of your land’s value. It’s important to research comparable land sales in the area and possibly seek an appraisal to determine a fair asking price. Overpricing or underpricing your land can deter buyers or result in a loss of potential profit, so getting this right is critical. Once the value is determined, preparing the land for sale is the next step. This includes gathering all necessary documentation, such as the deed, tax information, survey reports, and any relevant zoning or environmental regulations. Having this information readily available not only speeds up the process but also reassures potential buyers of the land’s legitimacy and condition. Marketing the property effectively is another crucial step. Listing the land on popular real estate platforms, engaging with local realtors, and utilizing signage can help attract cash buyers.

Understanding the Market: Key Factors Affecting Selling Land for Cash

The real estate market, particularly for land, can be influenced by several factors that sellers need to be aware of when selling land for cash. Market conditions, including supply and demand, play a significant role in determining how quickly a property will sell and at what price. For instance, if there’s a high demand for land in a particular area due to population growth or economic development, sellers may find that they can command a higher price. Conversely, in a saturated market with more land available than buyers, it may take longer to sell, and sellers may need to adjust their pricing expectations. The location of the land is another critical factor. Proximity to cities, infrastructure, utilities, and amenities can greatly affect the desirability and value of the land. Properties that are easily accessible and near development projects are often more appealing to buyers, while remote or undeveloped land may require more marketing effort.

How to Find Reliable Buyers When Selling Land for Cash?

Finding reliable cash buyers when selling land requires a combination of marketing strategies, networking, and due diligence. One of the most effective ways to attract serious cash buyers is by listing your land on reputable real estate platforms that specialize in land sales. Websites like Zillow, LandWatch, and Realtor.com offer a wide audience and tools to showcase your property effectively. Providing high-quality images, detailed descriptions, and information about the land’s potential uses can significantly increase interest. Another strategy is to network with local real estate agents and land brokers who may have clients looking for land investments.

Common Mistakes to Avoid When Selling Land for Cash

Selling land for cash can be a straightforward process, but several common mistakes can derail the transaction or result in financial loss. One of the most frequent mistakes is overpricing or underpricing the land. While sellers naturally want to maximize their profit, pricing the land too high can deter potential buyers, especially in a competitive market. On the other hand, pricing it too low may lead to missed opportunities for a higher return. Conducting proper market research and seeking professional appraisals can help avoid this pitfall. Another mistake is neglecting to prepare the land for sale. This includes not gathering the necessary documentation or failing to disclose important information about the property.

The Role of Paperwork in Selling Land for Cash: What You Need to Know?

While selling land for cash can simplify the transaction process, proper paperwork is still essential to ensure a legal and secure sale. The most critical document in any land sale is the deed, which proves ownership and must be transferred to the buyer upon completion of the sale. Sellers need to ensure that the deed is clear of any liens or encumbrances that could complicate the transaction. Title searches are often conducted to verify the land’s legal status and ensure there are no claims against it. Another important document is the purchase agreement, which outlines the terms and conditions of the sale, including the sale price, payment schedule, and any contingencies. This contract protects both the buyer and seller by clarifying the responsibilities of each party.

The Pros and Cons of Selling Land for Cash: A Detailed Analysis

Selling land for cash comes with its pros and cons that sellers should carefully consider. One of the biggest advantages is the speed of the transaction. Cash sales tend to close much faster than those involving financing, which can take weeks or even months to complete. For sellers in need of quick liquidity, this is a significant benefit. Cash sales also typically involve fewer contingencies and less paperwork, reducing the complexity of the transaction. Additionally, cash buyers are often more motivated to close the deal quickly, which can provide peace of mind for sellers. However, there are some potential downsides to selling land for cash. For one, cash buyers may expect a discount in exchange for the speed and simplicity of the sale.

Conclusion

Selling land for cash can be a highly profitable and efficient way to liquidate property, provided that the process is managed carefully. Understanding the market, pricing the land correctly, finding reliable buyers, and avoiding common mistakes are all crucial elements to a successful transaction. While cash sales offer the benefit of speed and simplicity, sellers should still be diligent in their paperwork and vetting of potential buyers to ensure a smooth and legally sound sale. By following best practices and being aware of the key factors affecting land sales, property owners can maximize their profits and achieve a successful outcome.

2 notes

·

View notes

Text

Benefits of Paid Education in Croatia

Unilife Abroad Career Solutions

Benefits of Paid Education in Croatia

Safety

When it comes to public safety, Croatia is an example to be followed. In 2020, the US State Department ranked Croatia at the highest safety category, thanks to economic and political stability factors. The Croatian population can walk freely around their cities, enjoying the country without any significant safety concerns.

Affordable living

If you’re worried Croatia will be as expensive as other popular European destinations, you can rest easy. Croatia is cheaper than most countries in the European Union , and a single person can get by with just under US$800 per month. Rent for a one-bedroom apartment can be as low as $350, and general expenses such as electricity, water, and internet will amount to approximately $210. Keep in mind cooking your own food is cheaper than eating at restaurants and you’ll be able to enjoy a comfortable life in Croatia.

Job opportunities

Croatia has a great job market for locals and foreigners alike. Unemployment rates are low, and more than 50.000 foreigners find work in Croatia every year. Because of the high demand for workers in different sectors, the government allows international students to work in the country during their stay.

Multicultural environment

Croatia’s location makes access to the rest of Europe extremely easy. This easy connection to other countries makes Croatia a multicultural country, with visitors from different parts of the world who get to enjoy the country’s welcoming environment. Locals are friendly and patient with foreigners and will love to help you learn the local language during your stay.

Quality of life

There are many reasons why the quality of life in Croatia is so high. The country’s investment in high-quality education and public safety, plus its stable economy and affordable costs make Croatia one of the best countries in Europe to live in. In the larger cities, the population’s satisfaction is even higher, and international students can enjoy all the benefits of a Croatian lifestyle when they choose this beautiful country as their destination.

World-class research

Croatia is known for its history-making inventors including Nikola Tesla, Franjo Hanaman, and Slavoljub Penkala. The country invests heavily in innovation and research, which benefits entrepreneurs and academics alike. Students in engineering and technology-related fields, especially, will find in Croatia an ideal spot to develop new ideas among some of the brightest minds in the world.

Unilife abroad career solutions

Studying abroad is an important procedure, but it is no longer a difficult one. A good study abroad consultant assists students by advising them on the best time to apply for admission to a particular university. We advise Indian students who want to study abroad.

Contact us : 8428440444 , 8428999090 , 8608777070

Mail ID : [email protected] , [email protected]

2 notes

·

View notes

Text

Why Market analysis is important in the modern day business setting?

The importance of market analysis is similar to the importance of research in prior to any huge investment. In simple language, market analysis is simply learning about the map before getting along with a treasure hunt. That said, it helps you understand the territory, recognize where the treasure (or opportunity) lies, and come up with the finest course of action to reach it while avoiding potential pitfalls.

On the other hand, for any new company, before getting market entry Saudi Arabia this "plan" can help in proper guidance and implementation of strategies. Moreover, this post will dive into why market analysis is crucial for the success of any new company and how you must go about it.

What is Market Analysis and how it can help?

Talking in layman’s terms, market analysis includes gathering and analyzing data around the industry you're entering, potential clients, and your competitors. It's around replying key questions: Is there a request for your product or service? Who are your clients? What are their needs and inclinations? Who are your competitors, and what can you offer that they can't? This understanding is foundational since it talks regarding each angle of your business strategy from product improvement to promoting, cost, and more.

On the other hand, market analysis helps you distinguish both opportunities and challenges inside your target domain. Moreover, it can uncover gaps within the market that your products or services can fill, making you appear where the "treasure" lies.

At the same time, it can also highlight potential challenges, such as strong competition or administrative obstacles, permitting you to plan techniques to overcome them. Also, without this investigation, you might miss profitable opportunities or run headlong into challenges that may have been dodged. Moreover, it is quite important if you are getting along with company formation in Abu Dhabi Global Market.

Customizing your services and products

Every customer of the modern era looks for personalized products and services. That said, one of the key benefits of market analysis is that it empowers you to tailor your products or services to the requirements and inclinations of your target customers. Also, by understanding what your potential customers are looking for, you can design your offerings to meet those needs better than your competitors. Moreover, this can be a critical differentiator during company formation in Dubai International Financial Center.

The importance of Strategic Decision Making

On the other hand, Market analysis informs strategic decision-making. Additionally, it provides the data and insights needed to make informed choices about where to allocate resources, which markets to enter, and how to position your company. For instance, if market analysis for market entry Saudi Arabia reveals a high demand for a particular service in an underserved region, a new company might decide to focus its efforts on that region. Without these insights, companies risk making decisions based on assumptions rather than facts, which can lead to costly mistakes.

Proper Risk Management is important

If you are an entrepreneur, you must know that starting a new company is inherently risky, but market analysis can help mitigate some of these risks. Also, by providing a clear picture of the market, it allows companies to make calculated risks rather than taking blind leaps of faith. For example, if analysis shows that a specific market segment is shrinking, a company might decide to focus its resources elsewhere. This way, you can thereby avoid potential losses during company formation in Abu Dhabi Global Market. In essence, market analysis acts as a risk management tool, helping new companies navigate uncertain waters more safely.

The significance of fund procurement

For new companies and new businesses looking for investment, an intensive market analysis is frequently a prerequisite. That said, Investors need to see that you got a profound understanding of the market you're entering, including the cost, client socioeconomics, and competitive scene. Moreover, a comprehensive, market analysis can make the difference between securing funding and being turned away. This is because it illustrates that you simply have done your homework and are making data-driven choices during company formation in Dubai International Financial Center.

Long-term planning is the key

At last, market investigation isn't just around the present but also regarding laying the foundation for long-term success. Moreover, it helps you set practical objectives and targets, plan for development, and expect future patterns and changes within the markets. Also, by routinely updating your marketing analysis, you'll stay ahead of the competition, adjusting your procedures to meet modern day market needs.

Final words

Hence, we can say that market analysis is an irreplaceable tool for the success of any new company. Moreover, it will offer detailed knowledge required to explore the markets, distinguish and seize opportunities, customize services to client needs, make key choices, oversee risks, secure funding, and plan for the long term.

That said, within the competitive and ever-changing market scene, skipping market analysis is like setting on a journey without a map. It’s possible, but it also increases the probability of getting misguided or running haywire. This is where by offering your time and assets into the market analysis, new companies can increase their chances of success and create a path for a prosperous future.

#market entry Saudi Arabia#company formation in Abu Dhabi Global Market#company formation in Dubai International Financial Center

2 notes

·

View notes

Text

ELI5: The Silicon Valley Bank Collapse

TL:DR SVB made a somewhat risky investment which went poorly in changing market conditions, and didn’t have the money to pay back their depositors. The FDIC has decided to fund the remaining bank accounts, but shareholders will realize a total loss on their stock.

If you haven’t been following the news, the second biggest bank collapse in American history just happened. But you probably have no idea what that means, so I’m going to explain it all in simple terms, with no frills, no biases, and no opinions.

Please let me know if I get anything wrong here. While I do work in finance, I’ve heard conflicting sources on some of the events.

The Basics of How Banks Work

Left to their own devices, people ordinarily wouldn’t just give their wealth to someone else for safekeeping. But these days there are many incentives for the average person to lend their money to a bank. Yes, there’s the matter of security (robbers can steal physical tender, such as physical bills and valuables), but there is also interest. By lending your money to a bank (like a loan!), the bank then uses your balance to invest in the stock market or major projects such as other peoples’ mortgages, with the promise that all of the money you’ve placed with them will be returned to you when you ask... with a little bit extra as interest. That’s your incentive for placing your money with them.

The point is, you placed your money with a bank, and in exchange for you lending them your money, they’ve promised to give it back to you when you ask, with a little bit extra. That’s important to understanding the next topic.

Investments, Reserves, and Insolvency

Okay, but how do banks generate the “little bit extra” that they promised to give you in exchange for borrowing your money? Through investments!

Investments can be a lot of things. Mortgages are investments- a bank can lend someone a big chunk of money, and in exchange the bank receives cash monthly that ends up being worth more than they loaned out. They can be investments into the stock market- buying stocks at low price, watching the price rise, and selling them high is a way to net profit. There are other types of investments too, like bonds (mini loans), CDs (low risk, long-term investments that guarantee profits that bank customers can take out), and options (very complicated). What they have in common is that you lend your money, and hopefully get more back (though there’s some risk of loss).

As an example, let’s pretend you’ve put $20,000 in a bank account. The bank could then take $10,000 and put it into a risk-free investment that returns at 2%. One year later, the return is $10,200, at least $10,000 of which must return to you. The bank may take $100 of that as their own profit and return the remaining $10,100 to your account- the remaining $100 is your interest. (This is a theoretical example. My own bank account hasn’t generated nearly that much in interest.)

But let’s say the investment isn’t risk-free. They’ve taken $10,000 of your money, invested in that 2% return project, and it flopped. Ouch. Now they’re out $10,000- of your money! That doesn’t seem fair!

That’s why banks have reserves. It’s a buffer/stockpile of cash or liquid assets (things that can be converted to cash really quickly) that covers a depositor’s finances should the bank’s own investments go south, OR if people need to pull out their money. Banks usually have a dedicated team of analysts that calculate the amount of reserves a bank can safely set aside to cover these sorts of events. This covers souring investments as well as times when a big customer is planning to pull out a ton of savings. That $10,000 is a drop in the bucket for them, but something like $1 million is more concerning.

So, even if the investment goes south, at least you’ve still got that guaranteed $20,000 on demand in case of, say, a medical emergency.

... At least, that’s how it should work.

If a bank doesn’t have enough reserves/quick money to fulfill its obligations of money on demand to everyone who lent it to them, it becomes insolvent- basically bankrupt unless they do a lot of stuff to get money fast really quickly. This can involve pulling money out of investments (which costs money to do, and is not something any investor would want to do unless they need a lot of money really really fast). This is the worst case scenario for any financial institution and one they want to prevent at all costs.

Understandably, the insolvency of the bank you’re keeping your money at is a terrifying situation for people who really need that money. And it was a common situation up until the 1930′s.

Bank Runs

You probably know someone who lived through the Great Depression who has a large stockpile of cash and refuses to use credit cards or banks. Some people probably even call them stupid for doing so. I’m not going to call your money hoarding grandparents stupid, since they’re operating off a very real fear- the fear that a bank won’t have the legal tender to give them their money when they ask. That situation was VERY COMMON before the FDIC was created in 1933 to insure the deposits of its member banks.

What would happen is that you’d hear that some news about how a certain bank was having financial trouble, and might close very, very soon. You freak out and realize that if they close, you’ve given your money to them, and now you’re not going to get it back! You go to a branch of the bank to withdraw all of your money, only to find that everyone else had the same thoughts as you, and the branch is already out of physical tender. As more and more people realize they’re about to lose all of their savings, the bank is drained at an exponentially increasing rate- and soon, the bank has become insolvent.

Banks have defenses for this- suspending withdrawals, limiting withdrawals, and asking their central bank for more liquid funds. But in the case of a bank run, or a bank panic, which is a bunch of banks experiencing bank runs at once, those defenses might fail entirely.

The FDIC, an American Government Corporation, was created as an insurance company for banks. Basically, banks pay dues to the FDIC, and in the case of the bank’s insolvency, the FDIC guarantees deposits up to about $250,000. It was created partially as a way to avoid future bank runs and protect consumers in the case of a bank collapse.

Interest Rates and Inflation

You’ve probably heard about the Federal Reserve hiking interest rates or keeping them low throughout the recent pandemic, but what does that actually mean, and why is it relevant here?

The Federal Reserve sets target interest rates- basically, setting the price at which major banks can borrow from the government. This ends up forming the basis for other types of loans you can get from banks- mortgages, car loans, etc.. Periodically these are revised with regards to economic conditions.

Basically, raising interest rates is used to encourage people to STOP borrowing money and START lending money- the return for lending is higher, and the price of borrowing is higher. Lowering interest rates is used to encourage people to START borrowing money and STOP lending money- the return for lending is lower, and the price of borrowing is lower.

(This is why you always want a loan with a low interest rate, btw!)

(And keep in mind that these are with regards to major economic decisions, and not necessarily the types of loans an ordinary person would get.)

Now, why is inflation relevant? Yes, it’s really high right now, and that means that the prices of everything are increasing a lot! The Federal Reserve’s answer to that is to increase interest rates- by making it more costly to borrow money, they’re hoping to stop an unsustainable level of price increases in everything else.

I think I get it. Now what’s going on?

Silicon Valley Bank was a fast-growing bank that, in recent years, held a lot of funds for entrepreneurs and tech startups- about 50% of all venture capital money in the US! What this means is a. a lot of large accounts in b. mainly one sector of the economy (technology).

That being said, the bank would most certainly not outpace inflation if they didn’t invest it. However, at the time, they couldn’t find any places they could loan money to.

Furthermore, the tech/crypto/startup sector of the economy has been going through hard times for a while. Many needed to slowly pull out funds from the bank, further straining the amount of liquid cash on hand.

In 2021, SVB instead decided to invest in mortgage-backed securities with the deposits placed with them. Mortgages are basically very long loans, but they can also be very risky. Mortgage-backed securities are based on mortgages. (The risk surrounding mortgage-backed securities is one reason for the housing crisis of 2008.) It should also be noted that they’re very susceptible to changes in interest rates- if interest rates increase, mortgage-backed securities lose their value.

In 2022, we got severe inflation.

And then, the Federal Reserve’s answer to severe inflation: raising interest rates.

And the mortgage-backed securities that SVB took out became unprofitable!

Now remember how I said that banks need to be able to not only provide customers their deposits on demand, but also give it back with interest? Because the investment in mortgage-backed securities failed, SVB didn’t have money for interest OR deposits, and not enough in reserves to fill the gap. They would be insolvent, if they didn’t come up with a lot of money really, really fast.

Word spread fast- depositors had already realized that the bank had become insolvent, and they demanded their deposits back. In other words, SVB went through a bank run, losing their money over the course of three days.

The FDIC then stepped in. Now this is a bit of an unusual case, because the FDIC only insures accounts up to $250,000. Most venture capital startups have accounts that are many times that. However, the FDIC has decided (with their own member deposits, not taxpayer money) that all of the venture capital money will be paid. All of the bankers will get their deposits back.

SVB is still closing, however, and shareholders and stockholders will not be compensated for the stock loss.

So while shareholders lose out, every creditor/depositor who invested will be getting their money back. As for Silicon Valley Bank, it’s being administered by the FDIC up until it’s time for it to close down.

#silicon valley bank#eli5#economics#finance#the more you know!#life as an aj#okay what other tags should i put in here#please reblog if you found this informative i worked VERY hard on it!#this is 1.8k words

10 notes

·

View notes

Text

Week 8 - Lesson Learned Presentation (Midterm)

In the past eight weeks, I gained valuable insights that provided me with an essential understanding of the startup process.

Week 1: Each of us completed a Myers-Briggs Type Indicator personality test, and I discovered that I was a Commander (ENTJ). An ENJT is a person who possesses the Extraverted, Intuitive, Thinking, and Judging personality qualities. These personality types are visionary and have a strong sense of direction, allowing them to motivate and inspire others to work toward a common objective.

Week 2: This week, our team Gamechangers was formed with the goal of making a significant impact on the world by cracking the system and changing the game. It acts as a reminder for us to continue striving for our objectives and developing creative solutions with the potential to alter the market. A compelling and memorable team name can encourage and inspire us to go beyond our comfort zones and strive for excellence in our job.

Week 3: Identifying the Value Proposition Canvas showed me that it is an important tool for technopreneurs to employ in the product development process because it can assist them in creating a more compelling and successful value proposition that connects with their target consumers. This experience has taught me the significance of gathering client input and performing market research to verify concepts and obtain insights that may drive innovation.

Week 4: Effective communication and storytelling are two essential skills necessary for success in both the personal and professional worlds. Technopreneurs who wish to flourish in the cutthroat world of entrepreneurship need to have strong communication and narrative abilities. Technopreneurs may improve their connections, motivate people, and raise their chances of success by improving these talents. This week, we had the opportunity to learn more about the various issues and difficulties we can encounter as commuters without revealing any potential solutions.

Week 5: The preparation of interviews and hypothesis testing are two crucial tools for technopreneurs. Technopreneurs may reduce risk, verify assumptions, and improve the chance of producing a successful product or service by combining interview planning with hypothesis testing. Technopreneurs may increase their chances of accomplishing their company objectives and having a positive influence on their sector by approaching product creation in a methodical and data-driven manner.

Week 6: In this week, validation is a key phase in technopreneurship since it allows ideas and solutions to be validated and determined if they match consumer demands and market demand. Technopreneurs may identify possible impediments, clarify their value proposition, and make educated product development decisions by confirming assumptions early in the product development process. This can help them reduce risk, prevent costly mistakes, and boost their prospects of market success.

Week 7: This lecture taught me that technopreneurship is more than just technical skills; it also necessitates a thorough understanding of user interface (UI) and user experience (UX) design principles. UI/UX design is an important consideration for technopreneurs who want to create products that are both functional and appealing to users. By investing in good UI/UX design, technopreneurs can increase their chances of creating successful products that are well-received in the marketplace.

In conclusion, I learned a lot about the startup process, beginning with a personality test and building a team with a catchy name. I also gained knowledge about the Value Proposition Canvas, effective storytelling and communication, interview planning, and hypothesis testing. It emphasized the need of validation in technopreneurship as well as the relevance of understanding user interface/user experience (UI/UX) design concepts. Overall, these experiences gave me a better knowledge of the necessary tools and abilities for success as a technopreneur.

7 notes

·

View notes

Text

In a financialized world, can currencies shape geopolitics? Hardly a week passes without a pundit forecasting the future of the global order on the basis of subtle changes in the stock of currencies and gold stashed in central banks—as if a few more Chinese renminbi in South America, a little more gold in Asia, or the price of a virtual currency anticipates a world that is more democratic, autocratic, or libertarian. The same goes for broader trends, such as the growing share of Chinese renminbi and other forms of “autocratic money” in commodities trade, sovereign lending, and other global markets historically dominated by the West.

This punditry is not unwarranted. And yet punditry inevitably misses some crucial context—context that only fine-grained case studies can provide. Societies have always created currencies with a political function in mind—but the qualities of a currency, in turn, can also shape politics, both domestic and global. Ekaterina Pravilova’s The Ruble: A Political History persuasively offers Russia’s currency as a case study in the entanglement of money and power, and in so doing, encourages us to understand what catalyzes these global trends. A 200-year “biography of a currency,” the book positions the ruble as both an important part of imperial organization and an unexpected anchor of Soviet influence. The ruble also emerges, amid political and financial crisis, as a potential instrument of Russian democracy—yet its history ultimately demonstrates how a currency can become a primary tool for creating and maintaining an autocracy.

And while Russia’s singular monetary history has earned its economy a “backward” reputation, better known for profiting from geopolitical chaos than sound policy, it has also made the country a pioneer, leading it in a direction that many autocracies are headed today—namely, toward greater isolation from the West’s financial ecosystem. Whether that will also involve greater financial cooperation with other autocratic powers, including, as many anticipate, increased denomination of its trade and investment in China’s renminbi, depends on the Russian government’s conception of its own currency—and the related strength of its own autocracy.

When Russia first issued paper rubles in 1769, nobody considered these assignats to be real money. Catherine the Great implored Russians to trust the state, and so made these bills exchangeable for copper and silver coins stored in Assignat Banks. Before long, the expanding Russian empire demanded more paper, and Catherine supplied it in excess of the state’s stock of metal—that is to say, on credit. She vouched for assignats even amid inflation, and with no independent central bank to hold her accountable, their value depended on the sanctity of the sovereign’s word.

Assignats thus became Russia’s initial form of autocratic money, projecting Catherine’s absolute authority. At a time when the rest of Europe was demanding monetary accountability, Russia backed its currency’s value with its monarch’s “sublime power” rather than any material collateral. When Nicholas I reformed the system in 1839, replacing assignats with silver-based bills backed by the “entire patrimony of the state” rather than a mere personal promise, he intended to maintain this autocracy; indeed, the state’s wealth was not nearly sufficient to provide this support, given that it only had sufficient silver to back up one-sixth of the rubles in circulation. There was no way to actually redeem the entire nation’s wealth under these conditions: Unlike the gold reserves in Europe’s central banks, which were independent from their state’s treasury, Russia’s bullion reserve—representing the bulk of its tangible wealth—was the only one in Europe directly controlled by the state.

Liberal economists and intellectuals in Russia took issue with this lack of monetary independence. Inevitably, a monarch succumbs to the temptation to generate revenue by printing more money, leading to inflation. If money truly represented the nation’s wealth, as Nicholas I claimed, then the tsar should be prevented from destroying that wealth. Since the people bore the cost of the tsar’s excessive money printing, and they lacked political representation, the “people’s ruble” should be convertible—to gold, silver, or something else—and the state should not issue money beyond this wealth.

Russian nationalists countered that convertibility impeded the tsar’s ability to finance wars that would expand the empire and defend Christian Orthodoxy. Where else would Russia get money? If the tsar couldn’t print it as needed, he’d have to take it from foreigners in exchange for Russia’s sovereignty. Having observed that the French monarchy’s large borrowing required it to cede power to its creditors, Russia avoided borrowing in any significant way until its 1877 war with Turkey. To some, its fiscal prudence had been a virtue—even leading U.S. diplomat Alexander Hill Everett to imagine a world in which Europe was united under Russia’s military, the only one not funded by public debt.

But Sergei Witte, a savvy bureaucrat who defined Russia’s monetary thinking in the 1890s, and the central figure in Pravilova’s history, agreed that backing the currency with gold was a good idea—but not because a gold standard forced the state to commit to rational monetary policy and limited its demands for cash, as liberals hoped. Rather, Witte believed that adopting gold would become a source of stability for the ruble and national pride for Russia; a necessary reassurance to foreign creditors; and, finally, admission to the club of economically civilized nations. Russia’s conservative faction thus spun the liberal idea of convertibility into the rhetoric of the monarchy.

In 1897, Russia, Europe’s only gold-producing country and claiming its largest bullion reserve, became the last major economy to join the gold standard. Witte’s gold-backed paper and small silver change was immediately unpopular among peasants, urbanites, and indigenous Russians alike. Billed as a necessary step toward modernity, Witte’s reform struck many as a return to a medieval economy. Some asked why a relatively poor European country was stockpiling gold, rather than spending it on, say, public education. “All of thinking Russia was against” it, Witte admitted, to the point that journalists in France, the country whose monetary thinking so influenced his plan, called it a “monetary coup d’état.”

Though a coup captures the reform’s dubious origins—Witte’s backroom dealings, a secret decree, and few administrative controls—this isn’t totally accurate. Russia managed to avoid the political revolutions that had forced many of Europe’s other gold standards. And as unpopular as the reform was with Russian citizens, it did please one important faction. According to one source, foreigners invested more capital in Russia in the year after Witte’s reform than the prior 40 years combined.

Although Russia is perhaps better known for defaulting on its debt—most notably in 1918 and 1998—it was the state’s devotion to servicing its foreign loans, even at the expense of its domestic obligations, that would trigger the country’s most important political revolutions.

As its empire expanded, Russia became one of the most aggressive participants in capital markets, and Witte’s gold standard locked it in a vicious cycle: The bigger it became, the more money it needed to print or borrow, and the more gold it needed to hold in reserve. But the more it held in reserve, the less it had to spend, so the more it needed to print or borrow. Soon, Russia was borrowing gold abroad in order to sustain the rate at which it was printing gold-backed rubles, overlooking the fact that this cross-collateralized its bullion reserve, exposing it to both foreign and domestic creditors.

Most countries would simply suspend gold convertibility during war and issue fiat currency instead, but the size of Russia’s foreign debts prevented this. Revolutionaries, fed up with the state’s unaccountable, debt-funded budgets, called for an end to foreign borrowing at the expense of the Russian people. Hoping to expose the state’s insolvency, they circulated a manifesto, partly drafted by Leon Trotsky, that started a run on the regime. Depositors emptied their savings accounts, refusing to pay taxes or accept rubles for payment, while panicked creditors tried to offload Russian bonds.

The regime survived this financial crisis, but the revolution’s calls for political reform had some success: In 1905, Russia transitioned to a constitutional monarchy, and a year later elected its first legislature. However, the State Duma was given little power to separate the State Bank from the treasury, and the state maintained total monetary control.

Whereas, in the eyes of liberals and revolutionaries, the gold standard in other European countries signified true constitutionalism—political representation that demanded transparent financial policy—Russia’s gold policy was supposed to compensate for its lack of such assurances. But for Russians, the government’s rationale was a joke that, according to Vladimir Lenin, then an exiled Bolshevik leader, “made the entire world laugh.”

The viability of this unusual system was tested yet again during the First World War, which caused a race for gold that saw Russia pay unprecedented prices for it on foreign markets and led the state to call in all the country’s gold except the holiest Orthodox relics. “You’ve got a lot of gold trinkets,” read one official’s announcement, and “it is your patriotic duty to deliver all this useless luxury to the state.” Many of these trinkets were worth more in their original form than melted into gold bars. Some Russians, fearing seizure, melted their stashes of gold coins, the easier to carry them out of the country as newly crafted necklaces. The scheme netted only 655,000 rubles—enough for 13 days of wartime expenses.

World War I proved too much for Russia’s financial policy, and in 1914 it abandoned the gold standard. An income tax (which was transparent) and government bonds (which were voluntary) had replaced convertibility as the democratic mechanisms akin to a stake in Russia’s government, but they provided neither sufficient revenue to the state, nor adequate representation to the people.

Thus, even the Bolsheviks, so eager to eliminate money on the way to socialism, found that they still needed it, and generated revenue by printing rubles beyond anything seen by their imperial predecessors. (The Bolshevik-created bureaucracy would soon employ three times as many officials as the imperial government.) Financing the government through monetary emission was not the Bolsheviks’ original plan, but central planning required coordination, and money helped organize resources. Soon, revolutionaries were simply trying to manage the ruble’s depreciation and maintain the state’s monopoly on money-printing.

Reflecting on these mishaps, the early Soviet state consulted a group of experts in 1920 to consider whether money should, in fact, exist under socialism. One participant, Vladimir Zheleznov, argued that money was the only language expressing social needs. To be sure, it represents a “compromise between personal freedom and social organization,” but Zheleznov suggested that each person has an economic interest—even under socialism—and this interest is expressed in money.

Zheleznov’s view, which drew on the Aristotelian concept of money (nomisma) as a tool of reciprocity among citizens, informed the Soviet Union’s New Economic Policy (NEP) in 1921. The NEP allowed citizens to keep money in any amount, replaced Soviet food requisitions with proper transparent taxes, and replaced the imperial ruble with a Soviet one. But just as ancient Greek currency became, over time, a tool for imperialism, the Soviet reform returned Russia to Witte’s imperial standard.

Lenin, like Witte, thought gold might attract foreign investors the way it had after 1897. And so the new treasury notes, which were backed by the state’s credit just like Nicholas I’s bills, circulated alongside bank notes ostensibly backed 25 percent by gold. But with its gold reserves impaired by the war effort (and its Gulag camps yet to properly restart gold mining in Siberia), Lenin’s forces had to raid the last stash of gold in the country, the coffers of the Orthodox church.

But even as it stockpiled gold, the state never actually sanctioned the ruble’s convertibility as promised. “If a certain Ivanov comes to [the] State Bank” demanding gold, said the people’s commissar of finance, then they would assume Ivanov is a counterrevolutionary hoping to buy “a little gold mug with the tsar’s portrait.” With so many unexchangeable rubles circulating, Russians once again saw convertibility as “a panacea for our economy,” but subsequent reforms in 1947 and 1961 did not grant monetary independence—according to Pravilova, they merely reaffirmed the political role of Soviet money as “an instrument of governance, propaganda, and Cold War diplomacy.”

Both imperial and Soviet governments meddled with the monetary system without changing the institutional and political foundations of Russia’s economy, nor fixing its fundamental problem: a lack of productivity. It is no wonder, then, that former Soviet states celebrated their independence by issuing their own national currencies.

The Central Bank of Russia finally achieved independence in the early 1990s. But the ruble, which was never fully convertible under a pseudo-gold standard, has become a favored tool of Russia’s current leadership for shifting the burden of war and sanctions to the Russian people.

Reflecting on Putin’s reign, Pravilova writes that the ruble has absorbed the cost of attacks on Chechnya, Georgia, Crimea, and Ukraine. Putin’s second invasion of Ukraine in 2022 rendered the ruble mostly inconvertible to Western currencies and limited Russia’s access to global finance. Once more, the ruble became a symbol of autocracy and autarky to the West, while its exchange rate prophesied Russia’s fate in its latest war. It is why Putin rushed to stabilize the ruble after the invasion, and why the Biden administration hastened to declare its sanctions on Russia had reduced the currency to “rubble.”

Several scholars have argued that money can play a role in creating and shaping democracy, and Pravilova demonstrates that powerful rulers can use the very same instruments to control the public and consolidate their autocracy. While most of Europe was democratizing and developing the modern toolkit of central banking, Russia managed domestic crisis by changing the ruble’s form, value, or metallic backing, often in lieu of political reform. By designing a currency that maintains autocracy, true monetary accountability will remain beyond the public’s reach.

Before Russia’s gold standard was co-opted by monarchists for the sake of securing foreign credit, it was a way for liberals to demand government accountability under a regime that did not offer true political representation for its people. This concept was always undermined by a lack of monetary independence in Russia, which became liberals’ second major demand for accountability. The ruble remains one of many marginal currencies—occasionally sanctioned, constantly fluctuating, and rarely circulating outside trade alliances—issued by autocrats hoping to retain the centrality of the state over the monetary system.

From Turkish President Recep Tayyip Erdogan’s historically inflationary policies to Indian Prime Minister Narendra Modi’s unilateral seizure of rupees, Putin is far from the only ruler forcing the costs of his regime on citizens who lack proper representation. Some of these rulers have sought new means to defend their autocratic model and challenge the U.S. dollar network with monetary symbols of their authority.

Today, autocratic countries make more than half of the world’s gold purchases, some of which insulate their economies from Western meddling or back trade-oriented cryptocurrencies. Broader currency alliances aim to directly challenge the dollar standard, but attempts in Latin America and other emerging markets have crumbled for lack of a stable keystone currency.

China’s renminbi may be the politically aligned alternative they seek. About 2.5 percent of foreign official currency reserves are held in renminbi, with almost one-third of that amount owned by Russia alone. Chinese President Xi Jinping’s capital controls make the renminbi’s convertibility into Western currencies doubtful, limiting its utility for now. A larger alliance of smaller currencies allays some of that concern, but it also means that, as in imperial Russia, it is the autocrat’s promise that backs up the renminbi, and financial stability depends on his goodwill.

Faced with this prospect, The Ruble contributes to a recently reinvigorated debate: What is money? Is it a mechanism of exchange and credit, or a tool of governance and coercion? A check on autocratic power or a symbol of that power? The ruble’s role at the center of crisis and reform shows that it could be all these things, or none of them. After all, currency not only reflects the political order—it actively shapes it.

6 notes

·

View notes

Text

# The Rise of Electric Bikes: A Trend that's Gaining Momentum in the US

As the world continues to focus on reducing its carbon footprint and promoting eco-friendly alternatives, electric bikes (e-bikes) are gaining significant momentum in the United States. These bikes, which were once a niche market, have now become a popular choice for many Americans looking to reduce their environmental impact while also enjoying the benefits of an efficient and fun mode of transportation.

## The Expanding E-Bike Market

In recent years, the electric bike market has seen substantial growth, with sales in the US increasing by an impressive 145% from 2019 to 2021. This trend shows no signs of slowing down, with experts predicting continued strong growth in the coming years. The reasons behind this impressive growth are multifaceted.

### Environmental Benefits

As climate change becomes an increasingly pressing issue, many consumers are seeking ways to reduce their carbon emissions. E-bikes offer this opportunity by providing a low-emission alternative to traditional forms of transportation. With the average e-bike producing significantly fewer greenhouse gas emissions than a car or even a bus, these bikes provide an eco-friendly option for those looking to do their part in protecting the environment.

### Health Benefits

In addition to their environmental impact, e-bikes offer numerous health benefits for riders. Cycling, in general, is an excellent form of cardiovascular exercise that can help improve overall fitness and reduce the risk of chronic illnesses such as heart disease and diabetes. The electric assist provided by e-bikes allows riders to tackle longer distances and more challenging terrains with less physical exertion, making them more accessible for a wider range of fitness levels.

### Economic Benefits

While the upfront costs of an e-bike can be higher than a traditional bike, the long-term savings can be substantial. E-bikes are significantly cheaper to maintain and operate than cars, with lower fuel and insurance costs. Additionally, e-bikes can often be used in place of a second car, making them an attractive option for households looking to cut transportation costs.

## Infrastructure and Policy Support

Recognizing the potential benefits of e-bikes, many cities in the US have started to invest in infrastructure and policies that support their use. Bike lanes and trails are becoming more common, making it safer and more convenient for e-bike riders to navigate urban areas. Additionally, federal and state-level policies are being implemented to encourage the adoption of e-bikes, such as tax incentives and grants for businesses that promote their use.

## The Future of E-Bikes in the US

As the popularity of e-bikes continues to rise, the industry is expected to innovate and evolve to meet the growing demand. Advances in battery technology, for example, are likely to lead to bikes with longer ranges and faster charging times, making them even more attractive to potential riders.

E-bikes are also set to play a significant role in the future of urban transportation. As cities become more congested and public transportation struggles to keep up with demand, e-bikes offer a sustainable and efficient solution to urban mobility challenges.

The rise of e-bikes in the United States is a trend that shows no signs of slowing down. With their numerous benefits—both environmental and personal—these bikes are poised to become an increasingly important fixture in the American transportation landscape.

2 notes

·

View notes

Note

I am that anon and I've spent so much time thinking about the overlaps between kpop and f1. Not necessarily in a bad way because there's nothing wrong with enjoying either but both fandoms and industries have some drawbacks that are extremely similar. The "fan wars" thing and this attitude of fans thinking they're somehow superior because of the group or driver they stan, or even the gatekeeping attitude of trying to keep new fans out because they know more about this thing because they stanned this driver or group first. There's also this weird focus on looks in both to where it almost makes it seem like talent doesn't even matter anymore. I feel like this is glaringly obvious in kpop fandom and even if you watch idol survival shows and see extremely talented singers and rappers eliminated or judged on the basis of not having the right look. But it's been growing in the f1 fandom too. I have even seen large numbers of people agree that Max has no place in f1 because he's not hot enough to be marketable. That has nothing to do with driving a car, and a multi time world champion is going to attract tons of sponsorships so I'm pretty sure driving is more important there too. It also isn't as obvious with every idol group or driver, but there are some unhealthy body image standards and just discussions around weight in both fandoms and industries that make me v uncomfortable. This is a lot lighter than other topics too, but I also feel like neither fandom can let mistakes and things that don't matter in the long run go without bringing it up over and over again? I don't mean this in like a "this person said something problematic" but more in reference to their actual jobs. I've seen loads of ridiculous fan wars where kpop fans will share a video of the ONE time an extremely talented vocalist's voice cracked on stage, to try to assert that vocalist isn't talented. It very much gives off the same vibes as like people mentioning Sochi with Lando, or people mentioning how Max crashed a lot when he first joined F1, you get the idea. Clearly it would become a problem in either industry if it was becoming a repeated behavior, but this standard both are held to where if you make a single mistake, people write you off and claim you're untalented for your entire career is kind of weird and puts even more pressure in already high-pressure environments. It's not necessarily f1 directly, but I also think there's a pretty strong case to be made about the investments that go into idol training and f1 feeder series. Huge monetary investments, sometimes leaving their family and friends behind for years, very very little chance for most of making it in either if they're honest, more talent flooding the markets of both than really there is room for. There's also the same thing with like "big companies" giving their groups a much higher chance of success versus small companies that is very similar to the whole top team / midfield or backmarker team dynamic in f1. Like 9 times out of 10 the success either are able to achieve depends mostly on the contract they sign. Also, and probably most obvious, the FAN SERVICE. And don't get me wrong, I love a good wholesome hug when an idol or driver is going through it or maybe even happy and celebrating. I don't necessarily like these seemingly forced for PR "bromances," and I know a lot of people liked it, but I found things like the crowd yelling to Lando and Daniel to kiss on that one fan stage kind of creepy? Like I wouldn't care if they DID want to kiss, don't get me wrong, there's just something weird about fans demanding they do it. Its almost to where people can't separate like RPF from reality at times. It gives off the same vibes as people shipping idols until they basically start avoiding each other to avoid dating rumors. I don't even know how long this is getting, but I'm sure it's like a novel, so I will stop there but yeah. Many thoughts. 😅

HELP anon i must say that i was a little scared when i first saw this in my inbox dkghsdgsd. but don't worry!!

I used to be a kpop fan from 2015ish to 2019ish (? lines def aren't clear) and got "officially" into f1 early 2021 so for me it's more of a flow from one to the other and getting a lot of deja vu moments.

The "fan wars" thing and this attitude of fans thinking they're somehow superior because of the group or driver they stan, or even the gatekeeping attitude of trying to keep new fans out because they know more about this thing because they stanned this driver or group first.

Please, the fanwar flashbacks i keep getting is exhausting. And then especially when I think back about the solo stans vs other solo stans or the group stans vs solo stans.

Back then it would be baekhyun stans vs chanyeol stans (excuse me, I forgot the name for the solo fandom sdkhgsd. I can remember that exols used to be eris but that's about it!) and nowadays it's chirlies vs carlos fans, and what used to be exols vs armys because red bull fans vs Mercedes fans.

There's also this weird focus on looks in both to where it almost makes it seem like talent doesn't even matter anymore. I feel like this is glaringly obvious in kpop fandom and even if you watch idol survival shows and see extremely talented singers and rappers eliminated or judged on the basis of not having the right look.

Oh. My. God. The visuals!! The discussions there used to be within group fandoms over who was the main visual, who had no right being a rapper/singer/dancer simply because they relied on their visuals and the discussions about visuals in itself was. Something.

But it's been growing in the f1 fandom too. I have even seen large numbers of people agree that Max has no place in f1 because he's not hot enough to be marketable. That has nothing to do with driving a car, and a multi time world champion is going to attract tons of sponsorships so I'm pretty sure driving is more important there too.

I feel like some part of the f1 fandom is letting some off track factors play too much into the on track expectations and facts. Just because a driver is the next pretty it boy doesn't mean he will automatically do well, and just because someone isn't conventionally pretty doesn't mean he shouldn't have a place in a team... You can definitely enjoy a drivers looks or aesthetic but some have seemed to forgotten that their actions on track speak for themselves.

It also isn't as obvious with every idol group or driver, but there are some unhealthy body image standards and just discussions around weight in both fandoms and industries that make me v uncomfortable.

The reactions to Max during winter break but general body pictures are crazy. In both the kpop and f1 fandom fans seem to have some kind of image in their head of what "healthy" should look like and they fucking riot when reality doesn't match it.

Clearly it would become a problem in either industry if it was becoming a repeated behavior, but this standard both are held to where if you make a single mistake, people write you off and claim you're untalented for your entire career is kind of weird and puts even more pressure in already high-pressure environments.

You're totally right here anon, but it also weirds me out at times because like, in the end for both fandoms it counts that these people are fans and 90% of the time do not know all the facts or just can't look at it objectively. Both fandoms desperately need people to step back, take a breath and remember it's either a sport or music. ffs.

(...) but I also think there's a pretty strong case to be made about the investments that go into idol training and f1 feeder series. Huge monetary investments, sometimes leaving their family and friends behind for years, very very little chance for most of making it in either if they're honest, more talent flooding the markets of both than really there is room for. There's also the same thing with like "big companies" giving their groups a much higher chance of success versus small companies that is very similar to the whole top team / midfield or backmarker team dynamic in f1. Like 9 times out of 10 the success either are able to achieve depends mostly on the contract they sign.

The way being a red bull junior or a Ferrari academy driver is so alike to being an SM/YG trainee. They offer the best training, but also have the most new drivers/trainees vying for their attention. And let's be real, feeder series are totally the pd101 of f1.

Also, and probably most obvious, the FAN SERVICE. (....) I don't necessarily like these seemingly forced for PR "bromances," and I know a lot of people liked it, but I found things like the crowd yelling to Lando and Daniel to kiss on that one fan stage kind of creepy? (...) there's just something weird about fans demanding they do it.

THEY DID WHAT NOW??? But yes, that gives the same energy as fans demanding idols to do kisses etc on vlive/youtube lives. It's creepy as fuck and it makes fans seem like they truly think they can demand the craziest things from "their" idols/drivers.

Its almost to where people can't separate like RPF from reality at times. It gives off the same vibes as people shipping idols until they basically start avoiding each other to avoid dating rumors. I don't even know how long this is getting, but I'm sure it's like a novel, so I will stop there but yeah. Many thoughts. 😅

My only blessing is that while drivers seem to be aware of the "joke" romances, is that they seem less aware of RPF. (We are going to exclude that time where people close to max started reading my 4433 for fun and just could NOT shut their fucking mouth).

Which is kind of wild to me, because while kpop fans did talk a lot about rpf on twitter they also censorred a lot of stuff as like, ch*nyeol instead of chanyeol ( i guess the mv0 instead of mv1 of f1 only then less negative and more for safety), and some idols were aware of it, it was mostly ignored and looked away. You made sure you followed the right people so you were either surrounded by camp anti rpf or camp rpf.

With f1 rpf it's very much more containted to tumble and ao3, except lately i have seen a trend where people have become less afraid of mentioning actual rpf on twitter. Which scares me a little because drivers feel more active on twitter skdghds.

Yet at the same time ship names seem much more common knowledge and also accepted within the whole fandom (i.e. lestappen gets used by "bros" on reddit as emotional support rivals but also by ao3 writers.). So in f1 the line between "joking" implied shipping/rpf and actual shipping/rpf seems way thinner than in kpop, where back when i was there, you either used certain names or you absolutely Did Not Even Think About it.

Fuck I remember days where baekhyun fans would talk about chanyeol in a positive way and would censor chanyeol's name just to prevent chanbaek shippers from interacting.

Anyways thank you so much for your message and your interesting insight in your view on it!

I was about to say that i'll share my twitter thread about this topic on this page but i realized i got pics of myself on there so help me That Is Not Happening.

#anon#missha things#observations about the overlap between kpop fans and f1 fans#kpop#f1#cw: body image#cw: rpf talk

4 notes

·

View notes

Text

Challenges Faced By Automotive Component Manufacturing Companies In 2022

Noteworthy availability and technology implanted inside today's cars has heightened interest in related technologies and cross-channel collaboration for everything from safety to smart cars to service provided by automotive component manufacturing companies.

However, as cars become more unpredictable, so do their operating guidelines. Even if it's in a digital system, Millennials don't want to deal with a long, confusing manual. They prefer to use trials to learn about their vehicle's capabilities, but when they do require assistance, they must use a conversational interface to receive customized, context-specific assistance.

Global brands have become more aware of the impact customer experience has on steadfastness and income, yet few have been able to give clients the experience that matters most—not the experience that surprises or delights them, but the one that lives up to their expectations. Customers anticipate that car brands will mirror the same availability and reconciliation that they currently find in their vehicles throughout the remainder of the customer journey.

They expect consistency and continuity in brand understanding, whether they're visiting a dealership, driving one of your cars, exploring your website, or collaborating with you on social media. They anticipate that it will be simple to find answers and personalized help, regardless of where, when, or on what device.

The automotive components manufacturing industry is experiencing massive disruption and transformation. Convergence between technology companies and automakers is blurring industry lines and expanding the traditional automotive company's boundaries. Consumers are shifting from an ownership-centric to a service-centric mindset. The supply chain will be central to this transformation because service has surpassed item as the most important purchaser need, the customer experience will determine the ultimate fate of car brands—far more than the cars you deliver.

Here are five of the biggest challenges and disruptions in the automotive component manufacturing companies

Attracting talent

As the automotive components manufacturing industry continues to transform, manufacturers will need to continue attracting the best and brightest talent in order to keep up with customer’s demands.

Overloading

Automotive component manufacturing companies, like all businesses, experience ups and downs. Overcapacity occurs when a producer has already invested resources such as payroll and materials into building a specific quantity, only to discover later that they do not require producing as much as they had planned. As a result, there is an overspending that can disrupt cash flow and result in waste. Increased manufacturing floor responsiveness and improved master production scheduling are excellent ways to avoid overcapacity.

Globalization

Increased global competition implies lower market prices for a variety of vehicles: once again, most solutions call for increased efficiency to compensate for a minor margin of income. Consumers are becoming increasingly concerned about sustainability. As a result, auto component manufacturers must work harder to produce more environmentally friendly vehicles and to improve their manufacturing skills.

Urbanization

At the moment, consumers have a diverse set of criteria for their vehicles, many of which are relevant to urbanization. They include smaller vehicles, improved maneuverability, and increased fuel efficiency.

The automotive components manufacturing industry serves as a single source of customer legitimacy, providing a complete history of customer interactions across channels, one interface for agents to use regardless of communication platform and a dependable, comprehensive source of customer voice insights. A combined hub also enables OEMs to collect best practices from dealerships and share them across the organization.

#automotive component manufacturers#Automotive components companies#electric vehicle component manufacturers in india#automotive sustainability#sustainability in automotive industry#auto parts manufacturers in india

2 notes

·

View notes

Text

https://twitter.com/butchanarchy/status/1348796277379588096

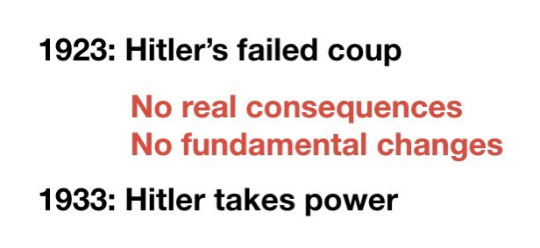

[image ID: four lines of text on a white background that read,

1923: Hitler’s failed coup

No real consequences

No fundamental changes

1933: Hitler takes power

/end image ID]

Seeing this image floating around, and while the message it sends is generally true and important (that fascism unchallenged leads to fascism building power), it leaves out important political factors between 1923 and 1933 we should learn from.

So, here’s what happened:

1923 Beer Hall Putsch: Inspired by Mussolini’s March on Rome in 1922, Hitler decides that a coup is the appropriate strategy to seize power in Germany. He had the support of elements of the German military (a crucial point in any coup), most notable among them General Ludendorff.

Their intention was to kidnap leaders of the Bavarian government and to accept Hitler as their leader, and, with the support of WWI General Ludendorff, win over the German military, proclaim national revolt, and bring down the German government in Berlin.

The coup was a total failure. The Bavarian leaders wouldn’t agree to Hitler’s demands until Ludendorff came and personally convinced them to, but word came back that the Nazis’ move to take over the army barracks had failed. Then the Bavarian leaders escape.

However, this WAS an important point in Hitler gaining power. This is because, at his trail, Hitler used the media coverage to get his messages out to the entire German public. The judges for his trial were Nazi sympathizers, and allowed him to talk as long as he wanted.

The court’s verdict? Treason carried a possible life sentence, but he was only committed to 5 years, and served only 9 months, in which he wrote Mein Kampf, had a private cell with a view, was allowed to receive visitors, and had his own private secretary.

After Hitler was released in 1924, he realized that taking power would not be possible without the support of the German Army and other established institutions. So, he decided to enter the world of electoral politics.

On this strategy he said: “Instead of working to achieve power by an armed coup we shall have to hold our noses and enter the Reichstag [...] If outvoting them takes longer than outshooting them, at least the results will be guaranteed by their own Constitution!”

Also important to note the the Nazi Party was organized like a government itself. This was so when they finally seized power over the German State, the Nazi “government in waiting” could slip into place.