#pension planner

Explore tagged Tumblr posts

Text

Secure Your Future withIndiaFirst Life Guaranteed Pension Plan

Plan for a worry-free retirement with IndiaFirst Life's Guaranteed Pension Plan. This annuity plan ensures a guaranteed income for life. Get ready for an empowered tomorrow by exploring the benefits of this pension plan designed to safeguard your future.

0 notes

Text

Generational Wealth

Pave a way for your children and grandchildren to be financially safe for generations with our expert advice on generational wealth. Learn strategies for wealth creation through right investments and inheritance planning by our professionals. With this, you can safeguard the next generation and build a sustainable economic base through well-placed investments.

#Generational wealth#property investment#swiss pension transfer#Budget Planner#Retirement Calculator

1 note

·

View note

Text

How Does NPS Investment Help Save Taxes?

Securing your retirement is crucial, but did you know you can also save taxes while planning for it? The National Pension System (NPS) in India is designed not only to build a retirement corpus but also to offer substantial tax benefits to investors.

Understanding NPS

The National Pension System (NPS) is a voluntary retirement savings scheme where individuals can invest regularly during their working years to build a retirement fund. It is regulated by the Pension Fund Regulatory and Development Authority (PFRDA) and offers features tailored to promote long-term savings. If you wish to invest, reach out to professionals offering NPS investment services in Cochin.

Key Features of NPS

Subscriber Accounts: Each NPS subscriber receives a unique Permanent Retirement Account Number (PRAN), which remains with them throughout their career, providing portability across jobs and locations.

Investment Flexibility: Investors can choose from multiple Pension Fund Managers (PFMs) offering various investment strategies. This flexibility allows investors to select an asset allocation mix that aligns with their risk tolerance and financial goals.

Tier System: NPS operates through two tiers:

Tier I: This tier is the primary retirement savings account with restricted withdrawal options before retirement.

Tier II: A voluntary savings account with higher liquidity, allowing withdrawals akin to a regular savings account.

Government Contribution: Government employees benefit from an additional contribution of up to 14% of their salary from the Government of India towards their NPS corpus.

Auto-Choice Option: For investors who prefer a hands-off approach, NPS offers an auto-choice option. This feature automatically allocates investments across asset classes based on the investor's age.

Tax Benefits of NPS Investment

Investing in NPS offers significant tax advantages, making it a preferred choice for retirement planning:

Tax Deduction under Section 80C: Contributions towards Tier I NPS accounts qualify for a tax deduction of up to Rs. 1.5 lakh per year under the Section 80C of Income Tax Act.

Additional Tax Deduction under Section 80CCD(1B): Beyond the Section 80C limit, salaried individuals and self-employed can claim an additional deduction of up to Rs. 50,000 per year for contributions to NPS under Section 80CCD(1B). This increases the total potential deduction to Rs. 2 lakh per year.

How NPS Investments Help Save Taxes

By contributing to NPS:

Reduced Taxable Income: Contributions to NPS reduce your taxable income for the year in which they are made. This lowers your overall tax liability.

Enhanced Deductions: The combined deductions under Sections 80C and 80CCD(1B) allow you to optimize your tax savings, potentially reducing the amount of tax payable significantly.

Additional Considerations

Tax Implications on Withdrawal: While contributions to NPS offer tax benefits, a portion of the accumulated corpus withdrawn at retirement is taxable. However, the tax-efficient structure of NPS ensures that the benefits of tax deferral during the accumulation phase outweigh the tax implications at withdrawal.

Long-term Commitment: NPS is designed for long-term savings and retirement planning. Withdrawal options are limited before retirement age, encouraging investors to stay committed to their retirement goals.

Conclusion

The National Pension System (NPS) not only serves as a robust retirement planning tool but also provides substantial tax benefits to investors. By leveraging the deductions available under Sections 80C and 80CCD(1B), individuals can effectively manage their tax liabilities while building a secure financial future through NPS. Thirukochi Financial Services can guide you through the best NPS investment plan in Kochi. However, it's essential to assess your financial goals, risk appetite, and retirement needs before committing to NPS, ensuring it aligns with your long-term financial strategy.

#national pension scheme planner in cochin#nps scheme planner in cochin#pension planners in kochi#nps investment plan in kochi#nps investment services in cochin#best mutual fund distributor in cochin#mutual funds investment services in cochin#best wealth management company in cochin#financial investment in cochin#investment services in cochin#investment experts in cochin#mutual funds plan in cochin#wealth management advisors in cochin#amfi registered mutual fund distributor in cochin#contact financial experts in cochin

0 notes

Link

At Wills & Trusts, our dedicated team have amassed a huge amount of experience in pension planning and support.

Our experts work on a bespoke basis – we know that no two individuals or sets of circumstances and visions are alike.

We provide holistic support and advice when it comes to your pension plans, working through a strategy that is right and beneficial to you.

We are passionate and experienced in ensuring that your pensions are proactively managed, to safeguard your hard-earned wealth and to continually maximise their potential, to the benefit of you and your family.

Get in touch with our advisers today and let us help you create your legacy.

#pension planning#pension planning uk#pension planning advice#pension planning consultants#financial planning#financial planner

0 notes

Note

G I X Y D

:)

selfship a-z ask game ->

cw. slight angst on "I"

G - Greetings what was their first meeting like?

𝔃𝓱𝓸𝓷𝓰𝓵𝓲 ᡣ𐭩 this fic hahaha

ⲇⳑ ⲏⲇⳕτⲏⲇϻ ᡣ𐭩 at al haitham's grandmother's house, while the adults are chatting over teatime: "what'cha reading?" "…. a book." "…. fair enough. *proceeds to take a book from the shelf and reads it beside him*"

𝔴𝔯𝔦𝔬𝔱𝔥𝔢𝔰𝔩𝔢𝔶 ᡣ𐭩 "*is especially nervous bc oh no he's hot* hello, your grace." "oh, hi. *notices i'm trembling like a pitiful wet dog* haha, relax, i don't bite." "*dies a little inside* y-yes, your grace...."

I - Imagine what do they imagine their futures together like?

𝔃𝓱𝓸𝓷𝓰𝓵𝓲 ᡣ𐭩 all contracts comes to an end eventually, once the conditions are fulfilled ー and the same goes for ours. but until then, he'll just enjoy walking in the long winding path that is an immortal's life. maybe a few kids, watch over our descendants, be awed at the technological advancements of liyue… as they say, when the boat gets to the bridge-head, it will naturally go straight.

ⲇⳑ ⲏⲇⳕτⲏⲇϻ ᡣ𐭩 we're both chronic planners, so we have regular talks about it and therefore a clear plan on what we want or not want to do in the future. married, preferably two kids, a nice pension plan, some savings in the bank, adopt a dog when the kids leave the nest, enjoy retirement reading books and doing whatever nerdy hobbies we want to enjoy.

𝔴𝔯𝔦𝔬𝔱𝔥𝔢𝔰𝔩𝔢𝔶 ᡣ𐭩 this man keeps telling himself not to dream too high lest it all crash down horribly at the end. honestly, with his past i think a part of him desperately wants a happy little family of his own, but the other half is so afraid he'll fuck it all up because he's never really truly experienced familial love. but deep in his heart he really just wants a resemblance of a normal life ー he knows his situation isn't ideal, but he wants a little family he can care for and be surrounded with as his fists get weaker and he passes down the title of the fortress' administrator to a suitable successor.

X - X-ray how do they help the other if they’re sick or tired?

𝔃𝓱𝓸𝓷𝓰𝓵𝓲 ᡣ𐭩 he's big on acts of service and words of affirmation, so he'll brew a pot of osmanthus tea and either sits me down to relax (if i'm tired) or tuck me in to bed (if i'm sick). househusband material, will cook and do all the chores flawlessly. liwei and liwen (especially the former) tries to sneak past him to cuddle with me, but he'd scoop up the littol noodles and distract them somehow ᰔᩚ

ⲇⳑ ⲏⲇⳕτⲏⲇϻ ᡣ𐭩 makes sure to tick all the steps in 'how to care for a sick person' book. but also he takes all the things that his grandparents do for him whenever he got sick ᰔᩚ like making me soup and (if i plead enough times) humming a calming lullaby to help me sleep hehe

𝔴𝔯𝔦𝔬𝔱𝔥𝔢𝔰𝔩𝔢𝔶 ᡣ𐭩 makes sure that i'm taking time off from work, calls sigewinne for a home visit, and most of all, if i have fever, he'd personally use his hand as a cold compress. none of the staffs in the fortress of meropide would ever imagine they'd hear an excuse "sorry, can't come to work today, i need to be my wife's compress." from their administrator but they let him skip work since they know he deserves the rest anyway :3

Y - Yes who would propose? What would the proposal be like?

answered here ->

D - Danger how do they react to finding out the other person is in trouble?

...... *squints* i seem to remember answering a selfship ask game with this prompt last time...

𝔃𝓱𝓸𝓷𝓰𝓵𝓲 ᡣ𐭩 if it's within liyue, i'd like to think that he'd know almost immediately, but if not, it would be a little more complicated. depending on the severity of said danger... hmm.... well.... let's just say he wouldn't take it just lying down....

ⲇⳑ ⲏⲇⳕτⲏⲇϻ ᡣ𐭩 have we ever seen al haitham truly furious or 'panicked' in-game? (mmm that azar cutscene... yummy... but i mean that's him acting mad so does it count??) i'd like to think that he still tries to be rational, figure out a way to handle things efficiently... but push a man hard enough and he'll break eventually. just remember what they say about the quiet/calm ones...

𝔴𝔯𝔦𝔬𝔱𝔥𝔢𝔰𝔩𝔢𝔶 ᡣ𐭩 ohohoho- ahem. i mean, we've seen it in his story quest. man takes action immediately. will throw a few punches if need be. if the duke wants somebody dead, he needs no justification. understood? ˙ ᵕ ˙

8 notes

·

View notes

Text

What Was Ours Is Now Theirs

The huge increase in the urban population of 19th Century Britain was accompanied by dysentery, typhoid and cholera.

The poor were blamed for cholera outbreaks, the result of their ‘ignorance’, lack of hygiene and general moral depravity. The prevailing orthodoxy was that laissez-faire capitalism and the management of water property for profit would provide solutions. It didn’t, and both municipal and state solutions – public ownership and management of water resources – were needed to solve the problem. Eventually it was recognised that easy access to a clean water supply was a basic human need, via the Public Health Acts. But with the re-emergence of neo-liberal and neo-conservative ideas about the role of the state and the importance of market solutions to social problems, all this is changing.

Britain is water rich, with adequate rainfall and only occasional water shortages. Until recently, water was generally seen as a common good and water planners saw any form of supply restriction, even a hosepipe ban, as an admission of failure. Regional water authorities pooled access to water resources and made long term plans for a London ring main, recharging aquifers from winter river water. People and organisations cooperated to manage water resources relatively effectively and to save water when it was needed, such as during the drought of 1975/76. However, water was privatised by the Tories in 1989, despite defeat in The House of Lords and the threat of prosecution by the EU on water quality standards, attacks by environmental groups over standards and questions about the fate of water authorities’ huge land holdings. As a result, the average household experienced an increase in water costs of 67% between 1989 and 1995. Company profits rose by an average of 20% to 1993 and are still high. The highest charging area of Britain, South West Water, took 4.9% of income from a household of 2 adults and 2 children, 7.6% from a lone parent and child and 9.1% from single pensioners in 1994. The profits of the water supply companies are being subsidised by the poorest people in Britain, those least able to pay. Thousands of households now regularly have their water supply cut off. In the Sandwell Health Authority area (in the West Midlands), over 1,400 households were cut off in 1991/2 and cases of hepatitis and dysentery rose tenfold. In 1994 2m households fell into water arrears, with 12,500 disconnected. Half of the water companies in England and Wales have selectively introduced or are testing pre-payment meters. The increased use of metering, most often in poorer households, has either increased water bills or resulted in forced cuts in water use by those who need it most. Non-payers are automatically cut off and the supply is not restored until the debt is paid. 10,000 meters have been installed in Birmingham since 1992; there have been over 2,000 disconnections. The water companies have responded to increasing criticism of their disconnection policies by devoting a tiny proportion of their profits to charitable trusts that help the poorest customers. This is pure PR and gives the corporations tax advantages. In the 1980s and in 1994–96, community campaigns defeated attempts to introduce water taxes in Dublin; see Issue 3 of ‘Red and Black Revolution’ for an excellent analysis.

Encouraged by a surge of prosperity in the 1960s, the Spanish have ignored the fact that they live in a semi-arid country prone to periodic, lengthy droughts. Golf courses have been built for tourists, swimming pools for themselves and there are many lawns and gardens requiring daily watering. Farmers have diversified from their traditional drought resistant produce such as figs and olives into water-hungry crops like rice and strawberries. The result is that Spain is now the world’s 4th highest per capita consumer of water after the US, Canada and Russia. Now it has to build huge dams and pay the cost to divert rivers to over-developed areas, amid growing environmental and community opposition. Other factors (which apply elsewhere) are laws giving producers the right to squander resources so long as there is a consumer demand to be satisfied; and the role of the centralised State (largely controlled by business influences), with its control of revenue, command of resources, expertise and power to enforce policy on citizens, in arbitrating the management of resources.

#freedom#ecology#climate crisis#anarchism#resistance#community building#practical anarchy#practical anarchism#anarchist society#practical#revolution#daily posts#communism#anti capitalist#anti capitalism#late stage capitalism#organization#grassroots#grass roots#anarchists#libraries#leftism#social issues#economy#economics#climate change#climate#anarchy works#environmentalism#environment

3 notes

·

View notes

Text

ATTN: instead of me, (Ar Apu Roy) was being engaged as "BUILDING PLANNER" at NEARBY my RURAL_VILLAGE residence_my "HOME ADDRESS" to URBAN LOCAL BODY, "KHOWAI NAGAR PANCHAYAT", initiated by appointment Dtd. 04-05-2009,if it so happened I had been being engaged as a "BUILDING PLANNER", in the year 2004(April/May)....i would be getting more earnings from the Owners at "KHOWAI NAGAR PANCHAYAT" Area at that time..... there was a gap of 5(years),which I joined later..... 5(Five) yrs means 60(Sixty) months, I had my earnings more at my home town, as far as my "PROFESSION OF ARCHITECTURE" concerned...... From that earnings, I would give my contribution with money to my family, esp to my MOTHER.... Though at that time_period concerned, my MOTHER was a family Pensioner, from my FATHER'S REGULAR GOVERNMENT SERVICE..... Accordingly, if so happened, my MOTHER was happy enough with my activity of my "ARCHITECTURAL JOB WORKS".........(THANK YOU)...... <<<FOUNDER, CEO&ARCHITECT, on behalf of "ARCH DESIGNING STUDIO" (IND)...

2 notes

·

View notes

Text

The trouble is, the artist clearly doesn't have any idea of how reality works. Cities are barely planned at all - urban planners have to deal with the dynamic nature of human behaviour, which is largely out of their control. Where are you living? Where were you living? Where will you be living? Vast numbers of people have to suddenly move in response to completely unpredictable changes.

Like in Detroit. There was no reasonable way to predict that the automobile industry would collapse in America due to automation and due to the opening up of trade with China by Richard Nixon which caused the change from communism to a weird hybrid totalitarian capitalist-communist country. With slavery, and not a lot of blackjack. Urban planners have to make models for what they think the future will be like. They can be right. They are often wrong. Sometimes terribly wrong. The collapse of industries is taking place very quickly now, as the sag aftra strike showed. Almost every writer in Hollywood could be replaced by a pocket calculator running Eliza. It wouldn't do a worse job at a Batwoman script.

The sheer wave of smug from these faces nearly eliminated the local raccoon population, and was responsible for a global cull of sealife not seen since Godzilla was pregnant. But seriously, these fvckers caused the local industries to collapse. Hollywood has been around for near a century, and they caused it to grind to a halt. The irony is that people like Drew Barrymore proved they were utterly useless, and had Hollywood had any balls left, they would have been pushed out of the way with farm machinery so that capable workers could come in and do the jobs instead. So Hollywood is weaker than it ever was, while rival industries are exploding. The British film industry is undergoing a revival, and social media platforms keep on booming, even if they still can't make any profit.

The collapse of the Star System means that even youtubers are becoming household names. As was pointed out, even minor youtubers were getting more views than major channels, and the biggest ones? Swedish YouTuber Felix Kjellberg, known online as PewDiePie, has uploaded over 4,700 videos on the YouTube platform.[1][a] Having accumulated over 28 billion video views and 111 million subscribers. PewDiePie's channel ranks as the 45th-most-viewed on YouTube.[2][b] Due to PewDiePie's YouTube channel having been the most-subscribed on the platform from 2013 through 2019, and it remaining one of the most since, his channel's videos have attracted substantial media coverage.

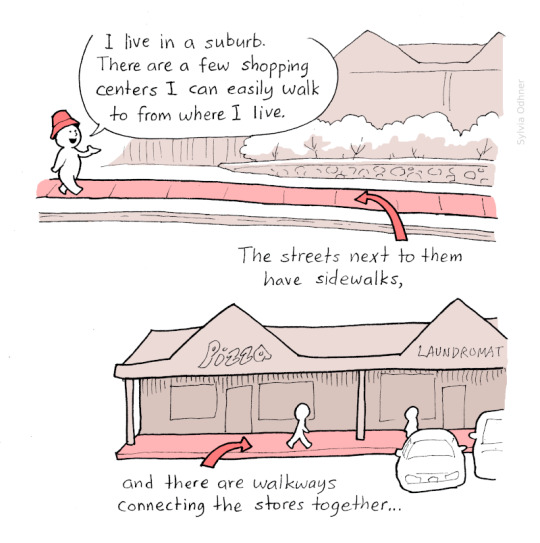

Some dude working from home IN SWEDEN can outproduce the Hollywood studios. Who could have predicted that twenty years ago? How do you plan ahead for that? Walkways, in Australia, are paid for by local councils from the revenues generated by rates. What happened here was that they were trusting the banks to invest it for them. The financial system, according to insiders, was getting people to take it to race tracks and betting it on horses. Flip a coin - heads I win, tails you lose. If the horse won, the pensioners got some of the winnings - but if the horse lost, the pensioner savings were lost.

Reckless behaviour caused a global collapse. Councils lost their money. Suddenly there was nothing in the piggybank. Money means life. Not having money means not repairing roads, means not having pedestrian crossings or overpasses. That means bodies on the roads. And the financial industries were bailed out instead of being punished. I think there was ONE European country where they faced consequences. Otherwise, if anything, they were rewarded with the funds of taxpayers. As a kid, I participated in a demonstration. There was no safe place for us to cross the road. We succeeded in getting media attention, and we got the council to spend funds to save our lives. The reason they hadn't? Because our suburb had grown quickly. It was rural when I moved in. Horses were ridden on the roads, and I would walk over a few streets and buy honey and fruits. All of that was gone in a decade. How do you plan for that? The decision to drastically increase the Australian population was done by world leaders, who said that it was racist to enforce our borders. The increase in immigration meant people who had to go somewhere. They went to the places like Cherrybrook and West Pennant Hills. It was suddenly just another suburb, and the roads were country roads. You had heavy traffic on single lanes, you had kids trying to ride their bikes on the footpaths only to be told by the government that was now a crime and they had to ride on the roads, you had no hope of planning for any of that. And I am sure equivalent stories are everywhere. Look at Covid. Suddenly world production was artificially halted whilst governments printed worthless money to pretend to be creating wealth. The globe stopped work for two years. Businesses, two years later, are still collapsing now from the after effects. And that was very minor, much more of a strong flu. Go back and look at genuinely dangerous epidemics like the Spanish Flu, which was ten times deadlier at the very least. The local medical centre has a two week wait now. They used to be same day. Why? Because the government imposed covid restrictions that required huge amounts of extra work but they couldn't charge for it. And never lifted the restrictions. The plague ended, but government plods on, mindless and vast. It can't respond quickly. So the doctors left the practice, and government restrictions stop competition from being allowed in. Two weeks. People around here die trying to get help. Completely for artificial reasons; because of government interference in the free market. Because they responded to a crisis years ago, responded blindly and in a panic, and haven't bothered responding to the end of the crisis.

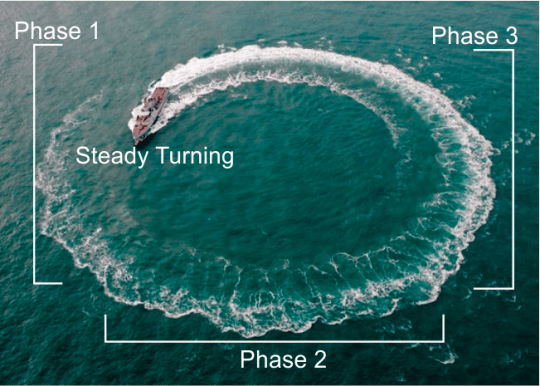

The government's turning circle depends on the size. The bigger it gets, the slower and more dangerous it becomes.

Have a look at tax history. Again and again, a temporary levy would be introduced for a crisis. Then reasons would be found to increase the duration - it was too convenient, too delicious, for a government to give up.

Governments only give up power when they are forced to, and make decisions that are not to their benefit extremely slowwwwwly. So how can ordinary people make a difference? One: Make sure there's money in the till. Get involved in a grassroots level. Where's the money going? If your government is paying for illegal immigrants, then you can't be surprised that they have nothing left for the actual citizens. You get what you deserve if you are a Leftist and your environment goes to shit because of your policies. You chose this outcome.

Places like San Francisco are now hellholes because of Leftist policies. Same with Paris.

You get what you deserve. Unless you are suffering because Leftists elsewhere are forcing your borders open, and then the question becomes, how are you opposing Leftism? What can you do to motivate a community to protect themselves against this colonisation? And if you are a Leftist, and still don't understand why there has to be consequences to your idiocy; well, there's no explaining things to an imbecile.

Honestly, Idiocracy is looking more and more like a documentary.

The Shopping Center Disconnect

41K notes

·

View notes

Text

Moving Into Aged Care

If you are under 65 and thinking about moving into ndis aged care, your AFA YPIRAC System Coordinator can help you to test your eligibility for the NDIS.

Once you’ve tested your eligibility, you can attend a planning meeting with an NDIS planner. This will give you the opportunity to discuss your goals and explore home and living options.

Residential Aged Care

Generally, residential aged care is best for people who are more frail and unable to live independently in their own homes. It provides comprehensive support, healthcare services and access to social activities in a safe and secure environment. Some homes also have lifestyle and leisure staff who organise social and recreational activities. If a participant decides to permanently move into residential aged care they will cease as an NDIS participant and will transfer to the Government funded aged care system.

If you are a younger NDIS participant in residential aged care, it may be possible to avoid entry or moving out by using your NDIS plan to explore alternative home and living options. Your support coordinator and the NDIA’s specialist YPIRAC team can help you identify an alternative home and living goal and support you to explore the options to achieve that goal. Approved providers that support NDIS participants in residential aged care will have responsibilities under both the Aged Care Quality and Safety Commission and the NDIS Commission regulatory frameworks.

The NDIS

The ndis disability gives participants choice and control over the supports they receive. After the initial access request is approved, individuals work with an NDIS representative to create their individual plan. This process is thorough and designed to ensure the supports provided meet each person’s goals. Regular plan reviews are also conducted to reflect changes in a participant’s circumstances.

NDIS support services can include everything from home help to assistance with social and community participation. Capacity building supports can be used to assist participants to learn new skills or to find employment. Personal care support may be available for daily living tasks such as bathing and dressing, while a home care package can cover general household chores like cleaning and cooking.

If you are a younger NDIS participant currently accessing residential aged care, your NDIA contact, planner or support coordinator can work with you to explore alternative home and living options using your funded supports. To get started, visit the AFA website or call 1800 771 663.

Aged Care Fees & Payments

There are several different fees associated with aged care, depending on your individual circumstances. You can expect to pay a basic daily care fee – which covers things like meals, electricity and cleaning – that’s set by the Government at 85% of the single Age Pension. You may also need to pay a means tested care fee, which is an additional contribution towards your day-to-day care costs and determined through a means assessment.

You’ll likely need to pay an accommodation fee as well, which is typically expressed in terms of a Refundable Accommodation Deposit (RAD) or a Daily Accommodation Payment (DAP). These are lump sum payments that you agree with your provider ahead of time and are usually fully refundable when you leave.

You’ll also need to pay extra service fees for anything that goes beyond standard care offerings – such as special recreational activities, outings and added entertainment options. These fees should be clearly communicated to residents and clearly itemised.

Aged Care Options

For those NDIS participants turning 65, there are options to stay in the NDIS or transfer to My Aged Care. Whether a participant chooses to remain in the NDIS or move into aged care, their support needs will be funded.

This may include home care packages or residential aged care. The NDIA can also fund an alternative home and living option like an accessible housing unit or Specialist Disability Accommodation (SDA).

The NDIS will help participants to explore a range of options including home modifications, private rental market, community housing or other group residential settings, as well as SDA vacancies.

AFA encourages NDIS participants who are currently accessing aged care to talk to their NDIS support coordinator or planner. AFA can test their eligibility for the NDIS and help them to find an alternative home and living option.

#registered ndis provider#registered ndis provider melbourne#ndis provider#ndis aged care#ndis support worker#ndis disability

0 notes

Text

IL LIBRO DEL RISPARMIO

Oltre 40 Sfide di Risparmio: Ogni sfida è progettata per aiutarti a risparmiare denaro in modo efficace e divertente. Che tu stia cercando di ridurre le spese quotidiane o di risparmiare per un grande obiettivo, troverai sfide adatte a ogni esigenza.

Budget Planner

Sfide dei centesimi

Sfide degli euro

Sfide di 24 - 25 - 30 - 40 e 50 giorni

Sfide 6 - 26 e 52 settimane

Fondo Pensione

Fondo per Natale

Fondo di Emergenza

Fondo Viaggi

Schede Libere per Creare le Tue Sfide

#soldi #risparmio #sfidadelrisparmio #moneychallenge #savemoney

0 notes

Photo

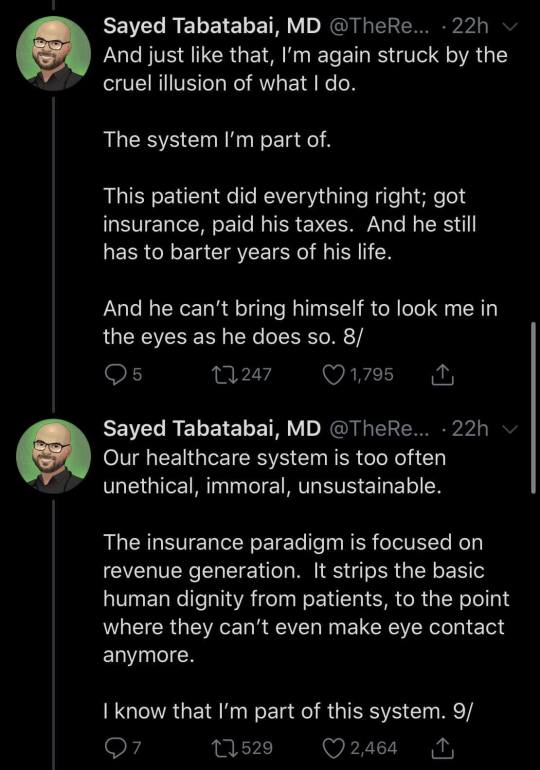

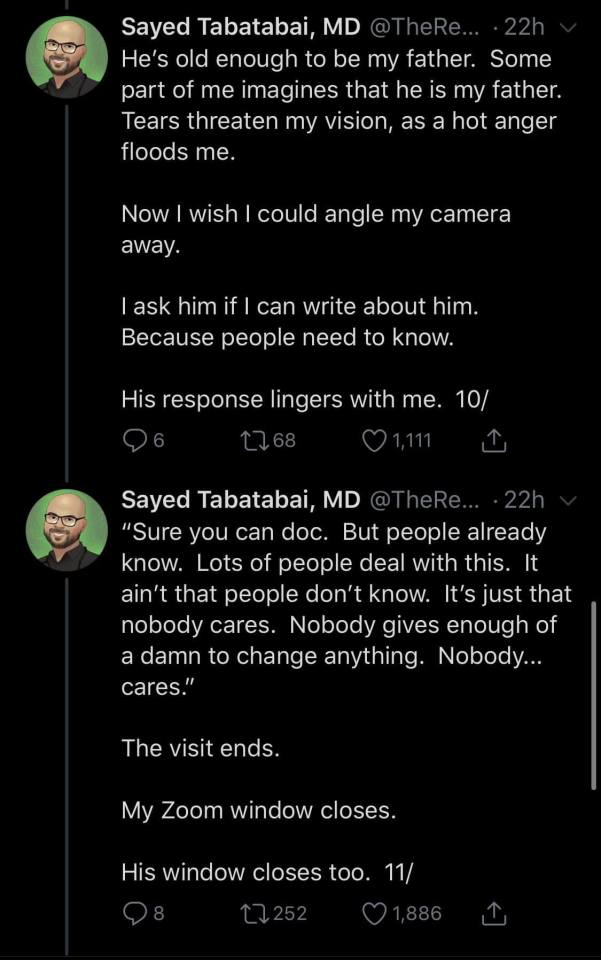

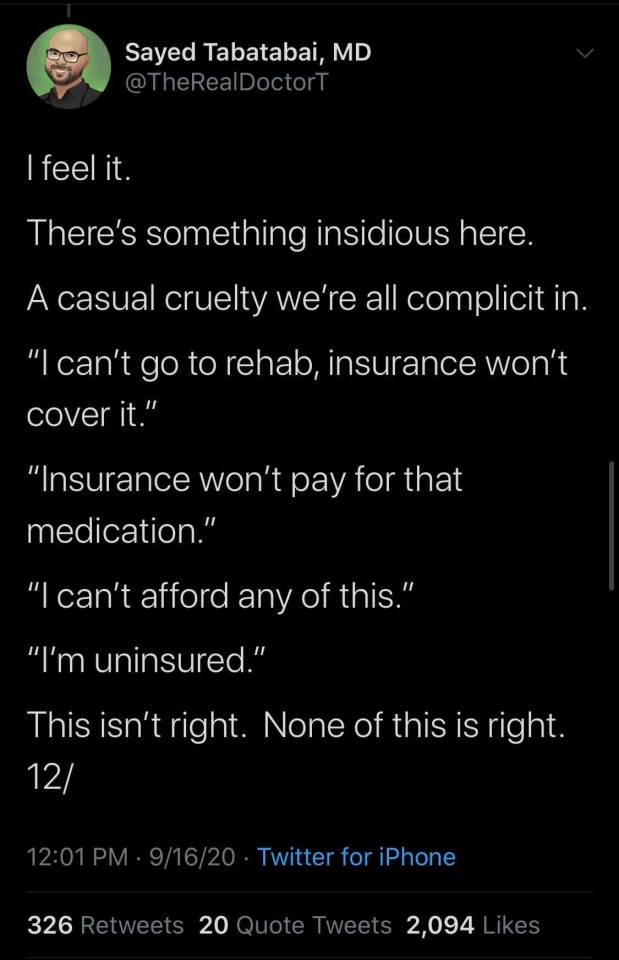

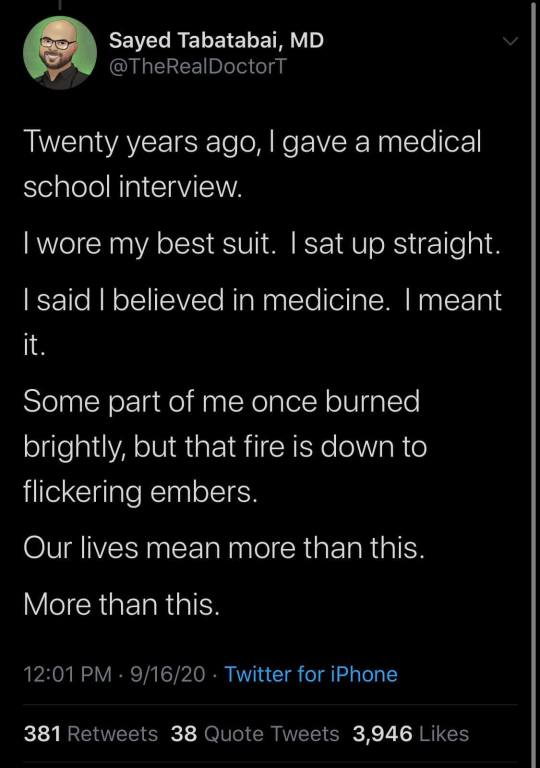

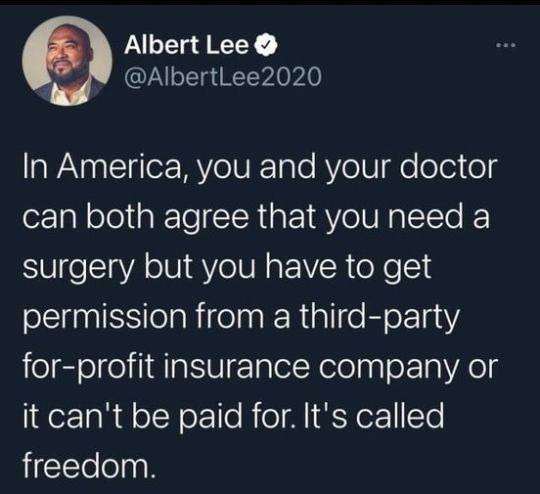

also, publicly funded retirement pensions go hand in hand with universal healthcare. If the political will to stop pointless suffering was there, the possible negative side effects from putting exploitative private insurance out of business would be more than accounted for because left-wing policy planners are, in fact, not idiots :)

Our system is broken. It is cruel. It is dehumanizing, degrading, and it’s vile nature is so, so unnecessary.

We need universal healthcare today in America. We needed it 40 years ago. It’s cheaper, it’s simpler, it’s more efficient, it’s more effective and it is so, so, so much less cruel than what we have.

Additional sources/references:

Universal Healthcare Cost in America would be cheaper by trillions of dollars

The US has worse life expectancies than socialized healthcare countries

We have worse generalized healthcare results

We have the most expensive care

Our system is so cruel and unique that doctors from other countries literally can’t believe what happens here

I can’t tell you where or how to activate to help solve this. There are politicians, groups, and activists pushing for this in so many ways. I can tell you when, though.

Now.

#Also how I wish universal healthcare actually made private insurance disappear#Unfortunately as the French case shows they're more than capable of parasiting these systems too

102K notes

·

View notes

Text

Retirement Planning: Why Financial Planners Offer More Than Just Advice

Retirement planning involves more than saving money. Financial planners provide a comprehensive approach that includes managing pensions, investment strategies, and healthcare planning. Partnering with a financial planner can ensure a comfortable and secure retirement.

0 notes

Text

Why is it Important to Find the Best Mutual Fund Distributor in Cochin?

Thirukochi Financial Services stands out as the best mutual fund distributor in Cochin, offering expert guidance and a wide range of mutual funds to help clients achieve their financial goals, investors can access personalized advice, diversified portfolios, and superior customer service. For more information, visit https://www.thirukochi.co.in/

#best mutual fund distributor in cochin#mutual funds investment services in cochin#financial investment in cochin#investment experts in cochin#investment services in cochin#wealth management advisors in cochin#best wealth management company in cochin#mutual funds plan in cochin#AMFI Registered mutual fund distributor in cochin#contact financial experts in cochin#Fixed Deposit Services cochin#national pension scheme planners in kochi#nps financial planner in cochin#Mutual Fund Distributor in Kerala#Mutual fund Distributor in Cochin/ Ernakulam#Mutual fund agent in Trivandrum#Mediclaim agent in cochin#Mutual fund Distributors in Ernakulam#Mutual fund Distributor in Cochin

0 notes

Link

Job title: Financial Planner - Dubai Company: Click & Connect Online Job description: Our client was established for more than 15 years in Dubai, United Arab Emirates, and they specialize in areas such as personal and corporate wealth management, retirement planning, business protection, life insurance, education fee plans, UK pensions & transfers, offshore investments and mortgages.Their team of consultants is highly experienced, with solid track records in their respective fields of expertise. All following the structure, theory and process established by Chartered Insurance Institute (CII) and Chartered Institute of Securities and Investments (CISI) in the UK. They keep abreast of all the latest industry developments and international best practices and can navigate you through a wide range of financial products and complex regulatory environments.Their approach is traditionally conservative. They maintain a strong balance between opportunity and risk, with the constant aim of enhancing the performance of your assets or investments. They partner with the leading global financial institutions, known throughout the industry for their best-in-class experience, first-rate market knowledge and outstanding performance track records. hey welcome you to visit our office where we can accommodate you in a comfortable, relaxed setting and in the dependable hands of our specialist team.Overview Our client is a Financial Planning Division of a leading firm, headquartered in Media City, Dubai. Who pride themselves on the enhanced service they provide their clients, the ethics and values that they continually demonstrate and the streamline processes that they have adopted making their business lean. They are now in an exciting growth phase and are seeking to expand their already successful advisory team. If you are looking for a sustainable and rewarding business model and want to make a difference in your clients lives and financial wellbeing, then we want to hear from you.By Joining this firm you will; Work for a brand you can be proud of Receive above average commissions / fees due to a transparent fee structure Be supported up to PA level with a dedicated administration team Be provided with individual and team training that supports your development Have long term career stability with a buy-out agreement built into your contract Have access to an in-house Analyst to provide you active analysis and portfolio management Be part of a friendly, supportive team that go the extra mile Participate in organized client events Who we are looking for; An ethical, trustworthy, financially sound, professional team player that has a natural instinct to deliver top quality service An experienced IFA with an active and transferable client bank over 5 million AUM Industry qualified with aspirations to achieve a minimum of level 4 within 12 months Excellent communication and organizational skills Work for a brand you can be proud of Receive above average commissions / fees due to a transparent fee structure Be supported up to PA level with a dedicated administration team Be provided with individual and team training that supports your development Have long term career stability with a buy-out agreement built into your contract Have access to an in-house Analyst to provide you active analysis and portfolio management Be part of a friendly, supportive team that go the extra mile Participate in organized client events Expected salary: Location: Dubai Job date: Fri, 18 Oct 2024 22:50:27 GMT Apply for the job now!

0 notes

Text

Retirement Planning for Indian Armed Forces Officers: Securing Your Financial Future

Retirement for Indian Armed Forces officers presents unique challenges and opportunities. With early retirement often occurring in their 50s, compared to civilians who work longer, planning for a secure and financially independent future becomes crucial. At HFI Wealth Creators, we specialize in offering tailored retirement solutions designed specifically for armed forces personnel, ensuring a smooth transition from active duty to a financially stable retirement.

Why Retirement Planning is Essential

Retiring early means you have a longer post-retirement period to plan for, and without a well-structured financial strategy, maintaining your lifestyle could become difficult. Officers often face unique challenges such as frequent relocations and managing multiple investments in different locations. A customized retirement plan ensures your savings, pension, and investments are aligned to secure your future.

Stages of Retirement Planning

At HFI Wealth Creators, we guide you through the different stages of retirement planning:

Early Career (20s-30s): Start early by making disciplined savings and investments. Focus on building a strong financial foundation with long-term growth in mind.

Mid-Career (30s-40s): This stage is about balancing retirement planning with family responsibilities, such as children’s education. Diversify your investments in equities, debt, and real estate to maximize growth while maintaining stability.

Pre-Retirement (50s): As you near retirement, your focus should shift to preserving your accumulated wealth. Ensure your portfolio has a healthy balance between growth and stability with an emphasis on income-generating assets like bonds and annuities.

Secure Your Financial Future TodayOur expert planners at HFI Wealth Creators are here to help you navigate retirement with confidence. Let us design a strategy that supports your financial goals and ensures long-term stability for you and your family. Plan today to secure tomorrow!

0 notes

Text

Retirement Financial Planner Near Me

A retirement financial planner near me provides personalized financial advice to ensure you’re prepared for retirement. Based in Australia, these professionals understand the intricacies of superannuation, tax laws, and age pension benefits. By working with a local planner, you’ll receive tailored advice that’s specific to your circumstances and goals, helping you optimize your savings and investments to secure your financial future.

0 notes