#payroll and bookkeeping

Explore tagged Tumblr posts

Text

Payroll and Bookkeeping Services Simplify Your Business Finances

Running a business involves managing many tasks. Payroll and bookkeeping are two important aspects that help businesses stay organized. These services simplify financial management and allow business owners to focus on growth.

What Are Payroll and Bookkeeping Services?

Payroll services manage employee wages, taxes, and benefits. Bookkeeping services track income, expenses, and financial records. Together, they keep business finances accurate and up to date.

Benefits of Payroll Services

Payroll services ensure employees are paid on time. They calculate wages, deductions, and taxes correctly. This helps avoid mistakes and legal issues. Payroll services also handle tax filings and generate pay stubs.

Benefits of Bookkeeping Services

Bookkeeping services track daily transactions. They create financial reports and manage invoices. These services help businesses understand their cash flow and make better financial decisions.

Why Outsource Payroll and Bookkeeping?

Outsourcing these services saves time and reduces errors. Professionals use advanced software to handle finances efficiently. It also ensures businesses follow tax laws and regulations.

Conclusion

Payroll and bookkeeping services simplify business finances. They help businesses stay organized, save time, and avoid costly mistakes. Outsourcing these tasks allows business owners to focus on what matters most growing their business.

#payroll and bookkeeping services#human resources and accounting#accounts payable and receivable#Small Business Bookkeeping Northern Virginia#Northern VA Bookkeeping for Small Businesses#payable and receivable management#bookkeeping for dispensaries#payroll and bookkeeping#payroll companies in florida#Bookkeeping Services Northern VA#Accounting Services Ashburn VA#Small Business Accounting Northern VA#Bookkeeping for Professional Services in Northern VA#Local Small Business Bookkeeping Services#payroll and hr services for small business

1 note

·

View note

Text

Locally Owned Bookkeeping Service in Omaha

Newland Bookkeeping & Tax Services is a locally owned bookkeeping service in Omaha, Nebraska, specializing in accurate financial management and tax solutions. We offer tailored bookkeeping, payroll, and tax preparation services to help businesses stay financially organized. Trust our local bookkeeping experts in Omaha for reliable and professional support.

#Locally Owned Bookkeeping Service in Omaha#Payroll Services Providers in Nebraska#Bookkeeping Services in Nebraska#Newland Bookkeeping Small Business Services

2 notes

·

View notes

Text

Why CPA Firms Are Choosing to Outsource Tax Preparation: A Data-Driven Look

In recent years, more and more CPA firms are turning to outsourced tax preparation services to enhance their operations and improve client satisfaction. This shift is not just a passing trend; it's driven by tangible, data-backed benefits that offer significant value. Here’s a closer look at why CPA firms are increasingly choosing to outsource their tax preparation needs.

1. Cost Savings and Efficiency:

Outsourcing tax preparation allows CPA firms to significantly reduce overhead costs. Hiring, training, and retaining full-time employees for tax season can be expensive, especially when demand fluctuates. According to a survey by the National Association of Tax Professionals, firms that outsource tax preparation report a 20-30% reduction in operating costs. By outsourcing, firms can allocate their budget more effectively, investing in growth and client services rather than overhead.

2. Access to Specialized Expertise:

Tax laws and regulations are constantly evolving, making it difficult for CPA firms to stay on top of every update. Outsourcing providers specialize in tax preparation, which means they have a team of experts who are up-to-date with the latest tax codes and compliance requirements. This is critical for CPA firms that want to avoid costly mistakes. In fact, 60% of firms that outsource report improved compliance and accuracy in their filings.

3. Scalability During Peak Seasons:

Tax season is a demanding time for CPA firms, often requiring firms to increase their staffing levels temporarily. However, hiring temporary staff can lead to issues such as training delays and quality control. Outsourcing provides scalability without the need for a hiring surge. Providers can quickly ramp up or down based on demand, allowing CPA firms to handle seasonal fluctuations more efficiently. 75% of CPA firms say outsourcing provides the flexibility they need during high-demand periods.

4. Increased Focus on Core Services:

By outsourcing tax preparation, CPA firms free up their internal teams to focus on higher-value services such as tax planning, consulting, and client relationship management. This helps firms build stronger client relationships and add more value beyond just preparing tax returns. A study by QuickBooks found that firms that outsource routine tasks like tax prep are able to increase revenue from advisory services by as much as 40%.

5. Reduced Risk and Improved Accuracy:

Tax preparation is complex, and errors can lead to costly penalties or audits. By outsourcing to a specialized provider, firms minimize the risk of mistakes. Many outsourcing firms utilize advanced technology and follow rigorous quality control measures to ensure accuracy. According to Accounting Today, 80% of firms that outsource tax preparation report fewer errors and reduced risk of audits.

Conclusion:

Outsourcing tax preparation services offers numerous benefits to CPA firms, including cost savings, access to expertise, scalability, and improved accuracy. By leveraging these advantages, CPA firms can streamline their operations, enhance client satisfaction, and position themselves for long-term success. In an increasingly competitive landscape, outsourcing tax preparation is not just a smart move—it’s becoming an essential strategy for growth and efficiency. For CPA firms looking to streamline tax preparation and enhance service offerings, partnering with an experienced outsourcing provider can be the key to unlocking these benefits.

2 notes

·

View notes

Text

Optimize Your Firm’s Financial Management with White Bull! Accounting and CPA firms: Discover the efficiency of outsourced financial solutions. From bookkeeping and payroll to tax preparation, White Bull provides seamless support tailored to the unique needs of professional firms. Let us handle the details so you can focus on what matters most—serving your clients!

👉 Visit us: white-bull.com

#accounting#bookkeeping#payroll#tax returns#outsourced accounting services#AccountingFirms#CPAFirms#OutsourcedAccounting#BookkeepingServices#PayrollSolutions

2 notes

·

View notes

Text

NSI Accounting: Reliable Financial Reporting You Can Trust

Ensure your financial statements are accurate and compliant with NSI Accounting. We deliver detailed financial reporting that provides a clear picture of your business’s financial health.

3 notes

·

View notes

Text

Bookkeeping Company in Denver

Aqtoro is the best Bookkeeping Company in Denver that understands the needs and concerns of businesses as the accounting needs of every firm are unique, and accordingly, our experts provide the right online bookkeeping services to businesses in Denver.

#Bookkeeping and Accounting Services For Small Business in Denver#Accounting and Bookkeeping Services in Denver#payroll & bookkeeping services in denver#Bookkeeping Company in Denver#Online Bookkeeping in Denver#Bookkeeping and Tax Services Denver#Local Bookkeeping Services Denver

3 notes

·

View notes

Text

Payroll outsourcing in UK

Breathe Easy, Business Owners: Why Payroll outsourcing in UK with MAS LLP is Your Secret Weapon Running a business in the UK is exhilarating, but managing payroll? Not so much. Between HMRC deadlines, complex calculations, and ever-changing regulations, payroll can quickly become a time-consuming headache. That's where MAS LLP comes in, your one-stop shop for Payroll outsourcing in UK that takes the weight off your shoulders and lets you focus on what matters most: growing your business.

Why Choose MAS LLP for Payroll outsourcing in UK?

Expertise You Can Trust: Our team of qualified and experienced payroll professionals are the best in the business. They stay up-to-date on the latest HMRC regulations, ensuring your business remains compliant and avoids costly penalties. Accuracy Guaranteed: Say goodbye to manual calculations and spreadsheets. We leverage cutting-edge technology and robust processes to deliver error-free payroll every time. Time is Money: Free yourself and your team from the payroll burden. Outsourcing allows you to dedicate your valuable time and resources to core business activities that drive growth. Peace of Mind: Rest assured knowing your employees are paid accurately and on time, every time. We handle everything from deductions and taxes to payslips and reports, giving you complete peace of mind. Personalized Service: You're not just a number with MAS LLP. We believe in building strong relationships with our clients, providing you with a dedicated account manager who understands your unique needs and is always available to answer your questions. Beyond Payroll: The MAS LLP Advantage

MAS LLP goes beyond just processing payroll. We offer a comprehensive suite of accounting outsourcing services designed to streamline your finances and give you a clear picture of your business health.

Bookkeeping: From daily transactions to account reconciliation, we keep your books meticulously organized and error-free. VAT Compliance: Navigate the complexities of VAT regulations with our expert guidance and minimize risks. Management Reporting: Gain valuable insights into your finances with customized reports and analysis that help you make informed decisions. Cloud-Based Solutions: Access your financial data securely anytime, anywhere, with our user-friendly cloud platform. Partner with MAS LLP and Reclaim Your Time and Focus

Payroll outsourcing in UK with MAS LLP isn't just about ticking boxes; it's about investing in the future of your business. We empower you to focus on what you do best, while we handle the nitty-gritty of payroll with accuracy, efficiency, and a personal touch.

Ready to ditch the payroll headaches and get back to business? Contact MAS LLP today for a free consultation and discover how we can help you breathe easy and achieve your business goals.

Note: This blog post is just a starting point. Feel free to adapt it to include specific details about MAS LLP's services, testimonials from satisfied clients, or special offers to attract potential customers.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services#Payroll outsourcing in UK

4 notes

·

View notes

Video

tumblr

Guide to successful financial audit!

If you want to know more please click here

#accounting#accounting software#business#accountant#finance#tax#bookkeeping#smallbusiness#taxes#entrepreneur#payroll#accountingservices#cpa#taxseason#businessowner#money#incometax#accountants#audit#bookkeeper#accountingsoftware#gst

8 notes

·

View notes

Text

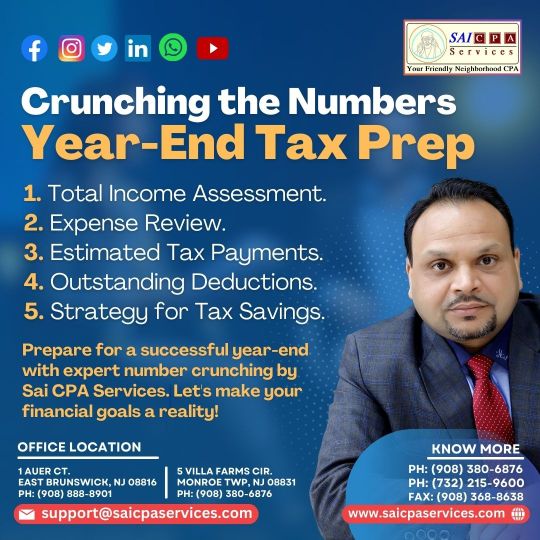

Smart Finances, Bright Future: ‘SAI CPA Services' Year-End Tax Planning Strategies

Introduction:

As the year winds down, it's time to ensure your financial house is in order. SAI CPA Services is here to equip you with straightforward and effective year-end tax planning strategies. Let's simplify the process, so you can confidently navigate the path to financial success in the coming year.

Financial Health Check:

Begin by reviewing your income and expenses for the year. Identify opportunities to manage your cash flow strategically, setting the stage for a solid year-end tax plan.

Fortify Your Future with Retirement Savings:

Boost your retirement savings by maximizing contributions to your retirement accounts. Beyond securing your financial future, this step offers immediate tax advantages by reducing your taxable income.

Uncover Tax Credits:

Explore available tax credits tailored to your situation. Whether it's education-related credits or incentives for energy-efficient upgrades, these credits can significantly impact your year-end tax liability.

Investment Smart:

If your investment portfolio includes losses, consider employing tax-loss harvesting. Selling investments with losses can help offset gains and potentially reduce your overall tax burden.

Healthy Savings with HSAs and FSAs:

Review your contributions to Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs). These accounts not only promote health but also provide valuable tax benefits.

Give and Receive:

If you plan to make charitable contributions, do so before the year concludes. Beyond supporting causes you believe in, charitable giving can result in valuable tax deductions.

Stay Informed on Tax Changes:

Keep yourself updated on recent tax law changes that may impact your financial situation. Staying informed enables you to make proactive decisions aligned with the current tax landscape.

Consult SAI CPA Services:

For personalized guidance, schedule a consultation with SAI CPA Services. Our experienced team is ready to assist you in crafting a tailored year-end tax plan that suits your unique circumstances.

Conclusion:

Year-end tax planning doesn't have to be complex. With these simple yet effective strategies and the support of SAI CPA Services, you can take control of your financial destiny. Maximize your returns, minimize your tax liability, and stride into the new year with confidence in your financial well-being.

Contact Us:- https://www.saicpaservices.com/ https://www.facebook.com/AjayKCPA https://www.instagram.com/sai_cpa_services/ https://twitter.com/SaiCPA https://www.linkedin.com/in/saicpaservices/ (908) 380-6876

1 Auer Ct, East Brunswick, New Jersey 08816

#SAI CPA SERVICES#Year & Tax Planning#CPA Firm#Payroll Services#Accounting & Bookkeeping Services#New Jersey#Tax Services

2 notes

·

View notes

Text

Payroll Accuracy: Tips for Error-Free Payroll Processing

The processing of payroll is an essential operational task inside an organisation, as it guarantees the accurate and timely compensation of personnel. Nevertheless, the intricacy of payroll computations and the dynamic nature of tax legislation might provide a significant challenge in undertaking this endeavour. Mistakes in payroll administration can lead to employee dissatisfaction, non-compliance with regulations, and potential legal ramifications. In order to mitigate such complexities, it is imperative to give precedence to the precision of payroll calculations. Discover the strategic advantages of outsourcing your payroll to VNC Global - an excellent Payroll management company in Singapore. Choose VNC Global for secure and cost-effective payroll management.

This blog post aims to examine key strategies that can facilitate accurate payroll processing and enhance search engine optimisation (SEO) endeavours.

● Stay Informed About Tax Laws:

Keeping up-to-date with tax rules is crucial for maintaining payroll accuracy due to the frequent changes in tax regulations. It is imperative to consistently assess and examine the tax regulations at the federal, state, and municipal levels in order to guarantee adherence and conformity. It is advisable to utilise tax compliance software or seek guidance from tax professionals in order to ensure the maintenance of an updated payroll system.

● Implement Robust Payroll Software:

It is advisable to allocate resources towards the acquisition of dependable payroll software capable of managing intricate computations and streamlining diverse payroll procedures. These technologies have the potential to reduce errors that are commonly associated with human calculations and data entry. Some commonly used payroll software alternatives are ADP, Gusto, and QuickBooks.

● Maintain Accurate Employee Records:

It is vital to ensure the up-to-dateness and accuracy of all employee information, encompassing tax forms, personal particulars, and bank account details. The presence of erroneous personnel data can result in payment inaccuracies and non-compliance concerns. It is imperative to consistently assess and revise employee records. Experience the peace of mind that comes with organized financial records. Connect with VNC Global - the most trusted provider of Bookkeeping services for small businesses in Singapore and transform your business together.

● Use a Standardized Payroll Process:

Establishing a standardised procedure for payroll processing entails the development of a comprehensive framework that delineates the sequential stages involved, commencing from the first data entry phase and culminating in the distribution of the payroll. Ensuring uniformity in payroll operations can aid in mitigating the probability of errors.

● Double-Check Calculations:

Despite the utilisation of sophisticated payroll software, it remains imperative to conduct a thorough verification of computations in order to identify and rectify any potential errors. Incorrect payments can occur as a result of a minor error during data entry or due to a software malfunction. It is imperative to conduct a comprehensive examination of each paycheck prior to initiating the payroll processing procedure.

● Cross-Train Payroll Staff:

To mitigate the risk of excessive dependence on a sole payroll administrator, it is advisable to implement cross-training measures for the payroll staff. It is advisable to implement a cross-training programme for the payroll workforce, ensuring that multiple employees have the necessary skills and knowledge to effectively manage payroll tasks. Implementing this measure will effectively mitigate potential interruptions that may arise due to personnel turnover or absence.

● Conduct Regular Audits:

It is recommended to conduct regular audits of the payroll system in order to rapidly identify and resolve any problems or anomalies that may arise. These audits have the potential to identify any potential concerns prior to their escalation into severe difficulties. Maximize your time and resources by outsourcing your Accounting services for small businesses in Singapore to VNC Global. Request a quote to simplify your financial tasks.

● Seek Professional Help:

It is advisable to explore the option of engaging the services of a professional payroll service provider in order to outsource your payroll processing. These organisations possess expertise in payroll and tax compliance, hence diminishing the probability of errors.

Final Thoughts:

The maintenance of payroll accuracy is of utmost importance in ensuring employee satisfaction, adhering to tax requirements, and mitigating potential legal complexities. One can effectively decrease errors in payroll processing by acquiring knowledge of tax rules, utilising dependable software, upholding precise record-keeping practises, and adhering to standardised procedures. Furthermore, the implementation of routine audits and the utilisation of professional assistance, when deemed essential, can significantly augment the level of accuracy. Ensuring payroll accuracy is crucial not only for the welfare of employees but also for the prosperity of the organisation.

Effortlessly manage your payroll with a tailored payroll system in Singapore. Reach out now to VNC Global’s accurate Payroll management system in Singapore and see how we can enhance your payroll processes.

#Payroll management company in Singapore#Bookkeeping services for small businesses in Singapore#Accounting services for small businesses in Singapore#Payroll management system in Singapore#VNC Global

3 notes

·

View notes

Text

Why Should Small Businesses Consider Professional Bookkeeping Services?

Financial management is one of many duties and responsibilities that must be balanced when running a small business. There are compelling reasons to think about hiring professional bookkeeping services, even if some business owners would try to do their own bookkeeping.

Compliance and tax support are additional advantages of professional bookkeeping services for small business. Bookkeeping professionals are well-versed in tax laws and regulations, ensuring that small businesses remain compliant and avoid penalties. They stay updated on changes in tax laws and provide accurate and timely tax support, including preparation and filing of tax returns. This helps small business owners navigate the complexities of tax compliance, reducing stress and ensuring adherence to legal requirements.

Conclusion, small businesses should seriously consider professional bookkeeping services due to the expertise, accuracy, time savings, financial insights, cost savings, compliance support, and tax expertise they offer. By outsourcing bookkeeping tasks, entrepreneurs can focus on their core business activities, make informed decisions based on accurate financial data, and ultimately drive the success of their small business.

#Bookkeeping service for small business#accounting and bookkeeping service#Payroll service#Bookkeeping service#Outsourced bookkeeping service

2 notes

·

View notes

Text

The Importance of Accurate Bookkeeping for Small Businesses

Running a small business requires meticulous attention to finances. One of the most critical yet often overlooked aspects of managing a business is accurate bookkeeping. Proper bookkeeping ensures financial stability, compliance, and growth, allowing business owners to focus on scaling their operations rather than getting bogged down by disorganized financial records. In today’s competitive market, small businesses can greatly benefit from outsourced bookkeeping USA services, such as those offered by Raha Financials.

1. What is Bookkeeping, and Why Does It Matter?

Bookkeeping is the systematic recording, organizing, and tracking of financial transactions. It serves as the foundation for accounting and financial management, helping business owners maintain a clear picture of their financial health. Without accurate bookkeeping, small businesses may struggle with tax compliance, cash flow management, and financial decision-making.

Key Benefits of Proper Bookkeeping:

Ensures accurate financial reporting

Simplifies tax filing and compliance

Enhances cash flow management

Aids in securing business loans and investments

Reduces the risk of financial fraud and errors

2. How Bookkeeping Impacts Business Growth

Small businesses aiming for long-term success must prioritize bookkeeping. With organized financial records, businesses can track income and expenses efficiently, identify growth opportunities, and make informed financial decisions. Accurate bookkeeping also plays a vital role in financial forecasting, helping businesses set realistic goals and allocate resources effectively.

For instance: If a business owner notices a pattern of high expenses in a specific area, they can take proactive steps to cut costs and improve profitability. On the other hand, identifying steady revenue growth can signal the right time to expand operations or hire additional staff.

3. Common Bookkeeping Challenges Faced by Small Businesses

While bookkeeping is essential, many small business owners struggle to maintain accurate records due to various challenges:

Lack of Time: Managing bookkeeping alongside daily operations can be overwhelming.

Limited Financial Knowledge: Many business owners lack expertise in accounting principles.

Human Errors: Manual bookkeeping increases the risk of mistakes, which can lead to financial mismanagement.

Regulatory Compliance: Keeping up with changing tax laws and financial regulations can be daunting.

To overcome these challenges, many businesses are turning to outsourced bookkeeping USA services like Raha Financials, which offer professional bookkeeping solutions tailored to business needs.

4. The Advantages of Outsourcing Bookkeeping Services

Outsourcing bookkeeping to a trusted financial service provider like Raha Financials can save time, reduce errors, and provide expert financial insights. Here are some compelling reasons why small businesses should consider outsourcing:

Cost Savings

Hiring a full-time, in-house bookkeeper can be costly, considering salaries, benefits, and training expenses. Outsourcing provides access to expert bookkeepers at a fraction of the cost.

Accuracy and Compliance

Professional bookkeeping services ensure financial accuracy and compliance with tax regulations, minimizing the risk of errors, penalties, or audits.

Scalability

As businesses grow, their financial management needs evolve. Outsourced bookkeeping services can scale with the business, offering flexible solutions that adapt to changing demands.

Focus on Core Business Activities

By delegating bookkeeping tasks to experts, business owners can concentrate on expanding their operations, improving customer service, and increasing profitability.

5. Why Choose Raha Financials for Bookkeeping?

Raha Financials specializes in providing top-tier outsourced bookkeeping USA services, catering to the unique needs of small businesses. Their experienced team offers tailored financial solutions, ensuring accuracy, efficiency, and compliance.

Key Services Offered by Raha Financials:

Recording financial transactions

Bank and credit card reconciliation

Payroll processing

Financial statement preparation

Tax preparation and filing assistance

Expense tracking and cash flow management

By choosing Raha Financials, small businesses can enjoy peace of mind knowing that their finances are in expert hands.

6. Tips for Maintaining Accurate Bookkeeping Records

Even with outsourced bookkeeping, small business owners should adopt best practices to keep their financial records organized:

Keep Personal and Business Finances Separate: Maintaining separate accounts avoids confusion and simplifies tax filing.

Track All Expenses: Record all transactions, including small purchases, to maintain accurate financial records.

Use Digital Accounting Software: Cloud-based solutions streamline bookkeeping and improve accuracy.

Regularly Review Financial Statements: Monthly reviews help identify discrepancies and track financial performance.

Work with a Trusted Bookkeeping Service: Collaborating with a reliable firm like Raha Financials ensures professional management of financial records.

Conclusion

Accurate bookkeeping is the backbone of any successful small business. It provides financial clarity, aids in decision-making, and ensures compliance with tax regulations. For businesses struggling with bookkeeping, outsourcing to Raha Financials, a leading provider of outsourced bookkeeping USA, is a smart and cost-effective solution. By leveraging professional bookkeeping services, small businesses can optimize financial management, reduce stress, and focus on growth.

If you’re looking for expert bookkeeping assistance, consider Raha Financials to streamline your financial processes and take your business to the next level!

#Raha Financials#outsourced accounting and bookkeeping services#outsourced bookkeeping usa#software integration services#Tax Planning and Filing Services#global payroll services#financial management services

0 notes

Text

https://www.classifiedads.com/financial_services/7z1102tzc3ddw

#Payroll Management Services Florida#Tax Planning in Port St. Lucie Fl#Bookkeeping Services in Port St. Lucie Florida#Tax Planning services in Port St. Lucie Florida#IRS Representation Services in Florida

0 notes

Text

Billing Software in Shirwal

In today’s fast-paced business landscape, managing financial transactions accurately and efficiently is vital for success. Whether you run a small store or a large enterprise in Shirwal, having a reliable Billing Software can significantly enhance your operational efficiency. At TSP Group, we offer cutting-edge Billing Software in Shirwal designed to automate and simplify your billing processes, helping you save time and reduce errors.

Why Choose Billing Software for Your Business in Shirwal?

Manual billing can be time-consuming and prone to human errors. By implementing advanced Billing Software in Shirwal, you can streamline your invoicing, payment tracking, and financial reporting. TSP Group’s solution ensures seamless handling of sales, taxes, and discounts, making your financial management more precise and efficient.

Key Features of TSP Group’s Billing Software

✅ Automated Invoicing: Generate accurate invoices with just a few clicks, reducing the chances of mistakes. ✅ Tax Compliance: Our Billing Software in Shirwal is GST-compliant, helping you calculate taxes accurately and generate tax reports effortlessly. ✅ Inventory Management: Keep track of your stock levels and automatically update inventory as you make sales. ✅ Multiple Payment Options: Accept payments through various modes, including cash, credit/debit cards, and UPI, ensuring convenience for your customers. ✅ Reporting and Analytics: Gain insights into your sales performance, outstanding payments, and business trends through real-time reports.

Benefits of Using TSP Group’s Billing Software

Increased Accuracy: Minimize billing errors and improve record-keeping accuracy.

Time Efficiency: Save valuable time by automating repetitive tasks.

Cost-Effective: Reduce overhead costs by eliminating manual processes.

Better Decision-Making: Leverage data analytics to make informed business decisions.

Why TSP Group?

At TSP Group, we specialize in providing robust and scalable Billing Software in Shirwal tailored to meet your business needs. Our software is user-friendly, customizable, and backed by expert support to ensure smooth implementation and operation.

Upgrade Your Billing System Today!

If you’re looking to enhance your business efficiency and accuracy, invest in Billing Software in Shirwal by TSP Group. Contact us today to schedule a demo and experience the benefits of automated billing firsthand.

✔️ TSP Group – Your Trusted Partner for Billing Software in Shirwal

0 notes

Text

Bookkeeping Services for Small Business | Accurate & Reliable

Get expert Bookkeeping Services For Small Business with Collab Accounting AU. We handle financial records, payroll, and tax compliance, so you can focus on growing your business. 3 Hanley St, Stanhope Gardens, NSW 2768 Call +61 2 8005 8155 for professional bookkeeping support today!

#Bookkeeping Services For Small Business#outsource payroll services#bookkeeping services for startups

0 notes

Text

Best Payroll and HR Services for Small Businesses

Running a small business comes with many challenges, especially when it comes to managing payroll and human resources (HR). Small business owners often struggle with payroll processing, tax compliance, and employee benefits. This is where Best Payroll and HR Services for Small Businesses come in. They help businesses save time, reduce errors, and comply with labor laws. In this article, we will explore the best payroll and HR services for small businesses and how they can benefit your company.

Why Small Businesses Need Payroll and HR Services

Managing payroll and HR tasks manually can be time-consuming and complex. Small businesses need payroll and HR services for several reasons:

Compliance with labor laws: Payroll and HR services ensure that businesses follow employment laws and tax regulations.

Accurate payroll processing: These services help businesses calculate employee wages, taxes, and benefits without errors.

Employee benefits management handles health insurance, retirement plans, and other benefits.

Time-saving solutions: Payroll and HR services automate many processes, allowing business owners to focus on growth.

Top Payroll and HR Services for Small Businesses

There are many payroll and HR services available, but some stand out for their affordability, ease of use, and reliability. Here are the best options:

1. Gusto

Gusto is a popular payroll and HR service designed for small businesses. It offers features such as payroll processing, tax filing, and employee benefits management. Gusto also provides HR tools, including hiring and onboarding support.

Key Features:

Automated payroll and tax filing

Employee benefits management

Hiring and onboarding tools

Time tracking and reporting

2. ADP Run

ADP Run is a great payroll service for small businesses that need a scalable solution. It offers payroll processing, direct deposit, and tax compliance. ADP also provides HR tools, including background checks and employee handbook creation.

Key Features:

Automated payroll processing

Tax filing and compliance support

Employee benefits and retirement plans

HR support and compliance tools

3. Paychex

Paychex is a comprehensive payroll and HR service designed for small businesses. It provides payroll processing, tax filing, and HR management tools. Paychex also offers employee benefits administration and time tracking.

Key Features:

Payroll processing and tax filing

HR and compliance support

Employee benefits management

Mobile app for easy access

4. QuickBooks Payroll

QuickBooks Payroll is an excellent option for businesses already using QuickBooks for accounting. It offers payroll processing, tax filing, and direct deposit. QuickBooks Payroll also integrates seamlessly with QuickBooks Online.

Key Features:

Payroll processing with direct deposit

Tax filing and compliance

Integration with QuickBooks accounting software

Employee benefits and HR support

5. OnPay

OnPay is a budget-friendly payroll and HR service for small businesses. It provides payroll processing, tax filing, and employee benefits management. OnPay is known for its user-friendly interface and excellent customer support.

Key Features:

Affordable pricing

Payroll processing and tax filing

Employee benefits and compliance support

Easy-to-use platform

How to Choose the Right Payroll and HR Service

When selecting a payroll and HR service for your small business, consider the following factors:

Cost: Choose a service that fits your budget while offering the features you need.

Ease of use: The platform should be user-friendly and easy to navigate.

Integration: If you use accounting software, look for a payroll service that integrates with it.

Customer support: Reliable customer service is essential in case you need assistance.

Compliance support: Ensure the service helps with tax filing and labor law compliance.

Conclusion

Payroll and HR services can simplify business operations, ensuring compliance and reducing the risk of errors. Gusto, ADP Run, Paychex, QuickBooks Payroll, and On Pay are among the best options for small businesses. Choosing the right service depends on your specific needs, budget, and business size. By investing in a reliable payroll and HR service, you can save time, improve efficiency, and focus on growing your business.

#Payroll service Northern Virginia#Payroll and HR Services for Small Businesses#Bookkeeping Services Northern VA#Accounting Services Ashburn VA#Small Business Accounting Northern VA#Bookkeeping for Professional Services in Northern VA#Local Small Business Bookkeeping Services#Northern VA Bookkeeping for Small Businesses#Small Business Bookkeeping Northern Virginia#Accounting Services for Small Businesses#Expert Accounting for Small Businesses#Affordable Small Business Accounting Services

0 notes