#payment gateway license rbi

Explore tagged Tumblr posts

Text

Grow Faster with a Payment Gateway License in India

A payment gateway license in India enables businesses to streamline online transactions, ensuring secure and seamless payment processing. By obtaining payment gateway registration, businesses can build customer trust and comply with regulatory requirements set by the Reserve Bank of India (RBI). This license facilitates integration with multiple payment methods like UPI, credit cards, and net banking, offering users diverse payment options. Additionally, it enhances transaction transparency and reduces fraud risks.

#legal services#legal#tax#payment gateway license#apply for payment gateway#payment gateway registration#payment gateway license rbi#payment gateway

0 notes

Text

PA-PG License Registration with RBI

In the fast-evolving world of digital payments, businesses are increasingly relying on Payment Aggregators (PA) and Payment Gateways (PG) to facilitate seamless online transactions. These entities play a crucial role in the e-commerce and fintech ecosystems, ensuring smooth fund transfers between customers and merchants. However, to operate as a Payment Aggregator or Payment Gateway in India, businesses must secure a PA-PG license from the Reserve Bank of India (RBI). Obtaining this license ensures compliance with RBI’s regulations, safeguarding customers’ funds and maintaining trust in digital payment systems.

At our company, we specialize in PA-PG License Registration with the RBI, offering end-to-end assistance to businesses looking to establish themselves as Payment Aggregators or Gateways. This blog explores the significance of the PA-PG license RBI, the registration process, common challenges, and how our services can streamline the journey to regulatory compliance.

What is a PA-PG License and Why is it Important?

A Payment Aggregator acts as an intermediary that collects payments on behalf of merchants, enabling online businesses to accept a wide range of payment methods. A Payment Gateway, on the other hand, provides the technical infrastructure for securely processing transactions between the customer’s bank and the merchant’s bank. Both PAs and PGs handle sensitive financial data and transactions, which is why they must operate under strict regulatory frameworks.

The RBI PA-PG license is mandatory for businesses offering these services in India. This license ensures that the company adheres to essential guidelines related to data security, fund management, and customer protection. It also serves as a marker of credibility and trust for businesses, signaling to customers and merchants that their financial transactions are in safe hands.

PA-PG License Registration Process: A Step-by-Step Overview

The process of obtaining a PA-PG license from the RBI involves several key stages, each requiring thorough preparation and compliance with regulatory norms. Here’s a breakdown of the steps involved in the registration process:

Eligibility Check: Before applying for the license, businesses must ensure they meet the RBI’s eligibility criteria. Some of the basic requirements include a minimum net worth of ₹15 crores for Payment Aggregators and technical infrastructure to handle secure transactions for Payment Gateways.

Application Submission: The first step in the formal registration process is submitting an application to the RBI. The application should include essential details such as the company’s business model, organizational structure, and compliance mechanisms.

Documentation: Along with the application, businesses need to submit a host of supporting documents. These include:

Company incorporation certificates

Net worth certificates

Details of board members and directors

Compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) guidelines

Operational and risk management processes

Technical infrastructure for secure payment processing

RBI Review and Scrutiny: Once the application is submitted, the RBI conducts a thorough review of the business’s financials, operational capabilities, and security measures. This is a detailed process, ensuring that the company can meet all regulatory requirements.

Compliance with IT Act and Security Guidelines: Payment Aggregators and Gateways must also comply with provisions under the Information Technology Act and RBI’s cybersecurity guidelines to ensure secure transactions and data protection.

Issuance of License: If the application and accompanying documents meet all requirements, the RBI grants the PA-PG license, allowing the business to legally operate as a Payment Aggregator or Gateway in India.

Common Challenges in PA-PG License Registration

While the steps involved in securing a PA-PG license may appear straightforward, there are several challenges that businesses often face during the process:

Regulatory Complexity: Navigating the complex regulatory framework set by the RBI can be daunting. The guidelines are strict, and even minor discrepancies in the application or documentation can lead to delays or rejection.

Technical Compliance: RBI places a strong emphasis on secure transaction processing and data protection. Meeting the necessary technical requirements, such as implementing robust fraud detection and data encryption mechanisms, can be challenging for new businesses.

Financial Requirements: Maintaining the minimum net worth of ₹15 crores can be difficult for smaller businesses or startups looking to enter the Payment Aggregator or Gateway space. This financial threshold must be met consistently, even post-license issuance.

Ongoing Compliance: Securing the license is just the first step. Businesses must ensure continued compliance with RBI’s evolving regulations, including quarterly filings, KYC checks, and cybersecurity audits.

How Our PA-PG License Registration Service Helps You

At our company, we provide end-to-end support for businesses seeking PA-PG License Registration with the RBI. Here’s how we simplify the process for you:

Expert Consultation: We start by assessing your business’s eligibility and guiding you through the RBI’s regulatory framework. Our team ensures that you understand the compliance requirements and helps you develop a strong foundation for your PA or PG services.

Application Preparation and Documentation: We handle the preparation of your license application, ensuring that all necessary details and documents are accurately compiled. From incorporation certificates to compliance with KYC/AML norms, we ensure that your application is complete and ready for submission.

Technical Advisory: Our team provides guidance on meeting the RBI’s technical requirements, including transaction security, fraud detection, and data encryption protocols. We help you align your payment infrastructure with the RBI’s cybersecurity guidelines.

Net Worth Compliance: We assist in preparing and maintaining your company’s financial documents, ensuring that you meet the RBI’s minimum net worth criteria of ₹15 crores. We also provide advisory on raising capital if needed.

Liaison with RBI: We act as your representative in communicating with the RBI, ensuring that any queries or additional requirements are addressed promptly. Our proactive approach helps reduce delays and speeds up the approval process.

Post-License Compliance: Once the license is issued, our support doesn’t end. We provide ongoing advisory services to ensure that your business remains compliant with RBI’s regulations, including KYC updates, cybersecurity audits, and regular filings.

Why Choose Us?

With extensive experience in PA-PG License Registration, we understand the intricacies of the RBI’s regulatory requirements. Our services are designed to provide a smooth, hassle-free experience, helping you obtain your license quickly and efficiently.

We offer:

Comprehensive Solutions: From initial consultation to post-license compliance, we cover every aspect of the license registration process.

Expert Guidance: Our team of professionals has in-depth knowledge of RBI’s regulatory frameworks and ensures your application meets the highest standards.

Timely Delivery: We streamline the application process, minimizing delays and increasing your chances of approval.

Conclusion

Securing an RBI PA-PG License is essential for businesses looking to operate as Payment Aggregators or Payment Gateways in India. While the process can be complex, our expert team is here to simplify it for you. From ensuring compliance to managing the application process, we take care of everything, allowing you to focus on growing your business in the dynamic world of digital payments.

0 notes

Text

Payment Aggregator Licensing in India

As updated by the RBI in March 2020, its released framework regarding payment aggregators' and further continuation compliance stated the payment gateways now need to obtain a license and certification from PCI DSS to keep their merchant transactions as it is and smooth going.

Learn More: NBFC Advisory

3 notes

·

View notes

Text

Exploring the Legal and Compliance Aspects of Payout Services in India

Payout services in India have become indispensable for businesses looking to streamline financial transactions, from salary disbursements to vendor payments. However, with the increasing adoption of these services comes the critical need to understand the legal and compliance framework surrounding them. This blog dives into the legal and regulatory aspects of payout services in India, helping businesses navigate the landscape with confidence.

The Regulatory Framework for Payout Services in India

1. Reserve Bank of India (RBI) Guidelines

The Reserve Bank of India (RBI) regulates most financial transactions, including those conducted through payout services. Service providers must comply with the following guidelines:

Payment and Settlement Systems Act, 2007: Payout service providers must obtain necessary licenses under this Act to operate legally.

Prepaid Payment Instruments (PPI) Regulations: If payouts are made using PPIs, such as wallets, providers must adhere to these regulations.

Know Your Customer (KYC): RBI mandates strict KYC norms to prevent fraud and ensure customer verification.

2. Data Protection and Privacy Laws

India’s Information Technology (IT) Act, 2000 and the upcoming Digital Personal Data Protection Act emphasize safeguarding user data. Payout service providers must:

Implement robust data encryption measures.

Ensure secure storage and transmission of sensitive information.

Obtain user consent before data collection and usage.

3. Goods and Services Tax (GST) Compliance

Payout services often attract GST. Providers and businesses must:

Ensure correct GST registration.

Issue proper invoices for services rendered.

File accurate GST returns periodically.

4. Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF)

Under the Prevention of Money Laundering Act (PMLA), 2002, payout services are required to:

Report suspicious transactions to the Financial Intelligence Unit (FIU-IND).

Maintain records of transactions for a prescribed period.

Train employees to detect and report potential money laundering activities.

Key Compliance Challenges for Payout Services

1. Adhering to Evolving Regulations

The regulatory landscape for financial services is dynamic, with frequent updates to rules. Payout service providers must remain vigilant and adapt quickly to avoid penalties.

2. Ensuring Cross-Border Payment Compliance

For businesses dealing with international payouts, compliance with Foreign Exchange Management Act (FEMA) regulations and anti-money laundering norms is crucial.

3. Mitigating Cybersecurity Risks

With the growing threat of cyberattacks, payout services must invest in advanced security measures to protect user data and maintain regulatory compliance.

4. Managing Vendor and Partner Compliance

Payout services often collaborate with third-party providers. Ensuring these partners meet legal and compliance standards is essential to avoid liability.

Best Practices for Legal and Compliance Adherence

1. Partnering with Licensed Service Providers

Businesses should work with RBI-licensed payout service providers who have a track record of regulatory compliance.

2. Regular Compliance Audits

Conduct periodic audits to identify and address compliance gaps, ensuring adherence to legal requirements.

3. Investing in Technology

Leverage advanced technologies like AI-driven fraud detection systems and secure payment gateways to enhance compliance and data security.

4. Employee Training

Educate staff on the latest regulations and compliance standards to mitigate human error and ensure smooth operations.

5. Maintaining Transparent Records

Keep detailed and accurate records of all transactions to facilitate audits and regulatory reporting.

Conclusion

Navigating the legal and compliance aspects of payout services and online payment service providers in India is vital for businesses aiming to leverage these solutions effectively. By understanding the regulatory framework and implementing best practices, businesses can ensure seamless operations while avoiding legal pitfalls. As the financial ecosystem evolves, staying informed and proactive about compliance will be key to sustained success in the digital economy.

0 notes

Text

In today’s fast-paced world, digital transactions have become the lifeline of businesses. From online shopping to paying bills, customers expect seamless payments. But here’s the catch—only those with a Payment Aggregator (PA) License can legally handle such payments. If you're planning to start your own payment gateway business, this guide will walk you through every step to get that coveted PA license from the Reserve Bank of India (RBI).

0 notes

Link

0 notes

Text

Neaobanks in India StartupHR Toolkit

Neobank is a fintech firm that provides a smooth banking experience. It is a digital banking solution that operates digital platforms like web applications or websites. These financial enterprises provide value-added services, personalized experiences, and data-driven insights to their valuable customer base by leveraging digital platforms.

Neobanks provide a mobile banking experience with a debit card and saving account. The Top Neaobanks in India are tech base and they do not have any physical presence across India they only operate virtually.

According to the source, the future of Neobanks is very bright. it is expected that $390 Billion will be raised by Neo bank in a couple of years.

Here is the list of 21 Neaobanks in India

1. Niyo

Niyo bank is the perfect back for international travelers. Bank offer you zero forex markup, free lounge access, and 5% interest on savings accounts. You can load INR and pay 150+ currencies without any charges.

2. Jupiter

Jupiter is 100% digital and zero percent painful. They have RBI licensed. Also, they offer various features like zero balance accounts, mutual fund portfolio analyzers, visa debit cards, autopilot saving, pre-salary accounts, and no hidden fees.

3. RazorpayX

Through its astoundingly smooth banking features, RazorPayX aids these SMEs so they may properly run their businesses. The robust gateway offers a wide range of features, including straightforward integration, 100+ payment methods, a superior checkout experience, quick settlements, dashboard reporting, a PCI DSS Level 1 compliant solution, subscription plans, a high success rate, and in-depth insights & reporting.

4. FI Money

FI, has been authorised by the RBI. It includes a variety of advantages, like earning rewards for saving money, no hidden costs, no minimum balance requirement, INR 5 lakh in insured funds, commission-free mutual funds, and no foreign exchange markup. It may also be withdrawn from any ATM. Federal Bank is a partner of FI Money. Additionally, the Neo Bank offers a savings account with an annual interest rate of 5.1%. If users want to make an early withdrawal, they will be charged 1% of their savings account's interest rate.

5. Mahila Money

In India, Mahila Money is a full-stack financial platform operated by Neobank that offers enormous assistance to female business owners in urban and suburban locations. "#JiyoApneDumPe" is the neo bank's tagline.

Here is list of the Top 21 Neobanks in India 2022

0 notes

Text

RBI grants in-principal approval to fintech major Razorpay to operate as a payment aggregator

RBI grants in-principal approval to fintech major Razorpay to operate as a payment aggregator

The Reserve Bank of India (RBI) has granted in-principle approval to the Fintech major ‘Razorpay’, Stripe, Pine Labs, and 1Pay to operate as a payment aggregator. Earlier, in order to ensure safety of merchants and consumers, the RBI issued a payment aggregator framework in March 2020 stating that payment gateways will be mandated to have a license in order to acquire merchants and provide them…

View On WordPress

0 notes

Text

View: Challenges & Future of Neo banks in India

Did you notice how the steady growth of daily usage of smart devices led to the seismic shift in traditional banking practices? Yes, the concept that is bringing this incredible change in the Fintech industry is the NEO banks.

Did you know that you can find the NEO bank for teenagers? These NEO banks are available for adults and aim to instill a sense of financial independence in kids. So, these NEO banks are available for you only digitally. Since they do not have any physical branches, the operational expenses are pretty low, enabling them to offer customized banking services at minimal or no charges.

Understanding Growth Of NEO Banks In India

In India, these banks aren't directly regulated by RBI as they cannot grant licenses for virtual bank operations. But it authorizes the traditional banks to outsource their functions following specific guidelines for code of conduct and risk management. In this country, the NEO banks will typically enter into outsourcing arrangements with the old banks to serve the underbanked sectors.

But know that banks cannot outsource core management functions like compliance, internal audit, decision-making, investment portfolio management, KYC, sanctioning loans, etc. So, these outsourcing obligations are ultimately the responsibility of the banks, who might even try to push down compliance contractually with the NEO banks.

Challenges Of NEO Banks In India

So, even if the NEO banks are steadily growing in India, there is still a debate about their future in the Fintech industry. Why? The concept has its own set of drawbacks and challenges that follow and might even hinder its overall growth in this market. How? Let's find out:

Security Challenges

Apart from offering debit card for teenagers in India, these banks also deal with many delicate and sensitive financial information like bank account details, passwords, identity data, etc. Sometimes, integrating these data and information with third-party components like social network buttons, chatbots, analytics systems, and payment gateways can compromise the product's overall security.

No Physical Branches Is Still Not Working

Although the NEO banks function with the concept of being digital banks, they still need to tie up with the traditional banks in India. Since its inception, this concept could not work independently using the online platform thoroughly. Instead, it required integrating with the conventional banks to offer services like the prepaid card for teens and more.

COVID-19 Pandemic

The Covid-19 pandemic has been affecting the Fintech industry pretty severely. During this crisis, the users aren't much enthusiastic about taking many risks, especially related to their finances. So even if the NEO banking concept has proven to be an outstanding idea, people still stick to their traditional banking methods.

Of course, the lockdown period increased dependency on digital banks for daily transactions. But at the same time, people are still not very sure about completely switching to NEO banking methods.

What Is The Future Of NEO Banks In India?

To always keep in mind about these digital banks is that it offers equal opportunities for all. From offering seamless banking for teens to people with lower income, these banks are targeting every niche of the audience to expand and dominate the Fintech industry pretty well.

In 2014, RBI introduced a secured environment that was technology-driven for further financial inclusion. Accordingly, none other than online banking methods aim to provide small savings accounts and other remittance services and payment facilities to the underbanked population. However, RBBI also cleared that they never refer to these methods as completely virtual banks with no branches.

But with the onset of the COVID-19 pandemic, the world saw a massive increase in digital banking and the utmost need to opt for NEO banking methods.

Although RBI might not allow 100% digital banking facilities, NEO banks are set to dominate and steadily grow in this country in the next few years. However, given the huge benefits of these digital banks, there are doubts whether these traditional banks can compete with NEO banks.

0 notes

Text

Key Differences between Payment Gateways and Payment Aggregators

Payment Gateways and Payment Aggregators are not the same thing.

An online payment gateway is software that enables online transactions, whereas a payment aggregator is a collection of all these payment gateways. It is critical to understand the differences and similarities between the two.

-Photo created by pch.vector on freepik

What is a Payment Gateway?

A Payment Gateway is an application that allows for online transactions. It is a payment mechanism that allows cards, net banking, and e-wallet payments to be made. Payment gateways allow you to accept online payments.

What is a Payment Aggregator?

Payment Aggregator combines all of these payment gateways. Payment aggregators are service providers who process payments for e-commerce merchants. They enable merchants to accept bank transfers without the need for a bank-affiliated merchant account.

In contrast to the traditional model, which distributes a merchant account to each merchant, payment gateway aggregators use a single merchant account to represent a number of merchants.

Examples of Payment Gateway and Payment Aggregator

Payment aggregators can provide payment gateways, but payment gateways cannot provide payment aggregators.

Billdesk, CCAvenue, and PayUMoney are a few examples of payment gateway aggregators. For a fee, these companies provide online payment gateway services to various merchants. These best payment gateway service providers collect money from customers on behalf of the merchant and deposit it into the merchant's account after a set period of time, usually three days, depending on the payment aggregator's policies.

Banks are the most common payment gateways in India. Public and private banks such as HDFC, AXIS, ICICI, and others are among them.

Difference between Payment Gateways & Payment Aggregators

Payment gateways and payment aggregators are both included. A payment aggregator does not need to be a payment gateway, but a payment gateway will require an aggregator.

Options: Online Payment Gateways India allow merchants to deal in a specific payment option placed on the portal, whereas Payment Aggregators offer a variety of payment options, including bank transfers, credit/debit cards, e-wallet transactions, and, most recently, UPI.

Small Businesses: Payment gateways use payment aggregators to cater to small businesses. This is because small businesses generally find the transaction fees charged by payment gateways to be prohibitively expensive and complicated.

Intermediary & Interface: Payment Gateways act as an intermediary between merchants and customers who wish to pay for goods or services purchased from the site. A payment aggregator serves as an interface for said intermediaries to accept payments and make settlements.

Ownership: Payment aggregators (financial service providers) in India own payment gateways, which act as a processing unit for implementing online payments. Payment gateways are used by merchants and vendors who are unable to accept payments directly.

License: Payment gateways must obtain RBI approval before they can begin operations. A payment aggregator, on the other hand, must obtain a payment aggregator licence as well as the necessary Payment Card Industry (Data Security Standard/ PCI DSS) certification.

How payment gateways and payment aggregators help small businesses

After integrating with payment aggregators, payment gateways can quickly gain access to small businesses.

Payment aggregators are inexpensive for small-scale transactions.

The payment aggregator model typically offers a platform for online transaction processing with low or no startup fees and fixed costs.

How payment gateways and payment aggregators work together

It is a common misconception that payment gateways alone are sufficient for payment processing. This would work in a physical store (for example, a POS machine), but not online. An online payment gateway is merely the transaction's technological side. It primarily handles the data in payment messages.

Payment gateways use a bank to issue merchant accounts behind the scenes. When there are a large number of merchants applying for merchant accounts and willing to process payments, the authorising banks will have to organise both the underwriting and fund transfer processes for multiple merchants, which could become cumbersome.

Payment aggregators stepped in to help. Payment aggregators go through the acquiring bank's underwriting process and process payments for a large number of smaller sub-merchants.

In the payment aggregator vs. payment gateway debate, you cannot pick one over the other. While one is required, the other is a payment processing option.

Don't be concerned if you can't decide which payment gateway aggregator to use. SifiPay has been in the game long enough to seamlessly process your payments, as well as assist you in setting up payment links, online stores, and tracking all of your transactions in one place.

#online banking#banking solution#online payment#payment gateway#online transactions#digital wallets#fintech#upi#credit cards#payment aggregators#merchants#customers

0 notes

Text

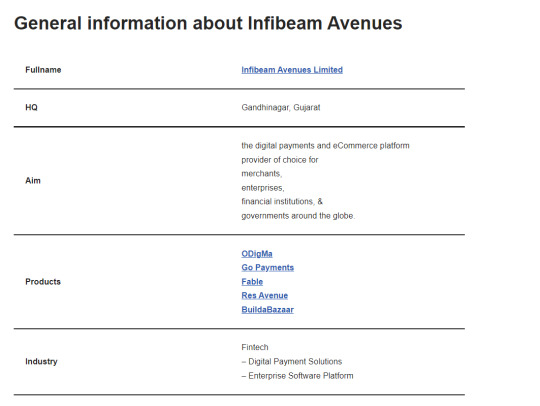

Infibeam Avenues: A Good company to Invest

I’ll discuss these topics

General information about Infibeam

Vision & Mission

5 – 10 Years – Goals of Infibeam

Journey of Infibeam

Good points

Revenue Model

Strong Balance Sheet

Bad points

Financial performance

Conclusion

You can visit my Site for a better reading experience.

My website -

TOPLISTING

Vision & Mission

Mission – is to provide world-class state-of-the-art fintech platforms for trade, commerce, and payments.

Vision – is to enhance the way customers and merchants live, trade, and transact through the digitization and democratization of commerce.

Infibeam wants to build a world-class Fintech company as Fintech is ‘Next Generation’ and capable of delivering a 10X value proposition to the customer.

5 – 10 Years – Goals of Infibeam

20 million merchants by FY 2031

2+ Million agents by FY 2026

Plans to have a footprint in 12-15 countries in the next three years

Commercially launch credit business and expand credit offering with various value added services

Good points

Revenue Model –

82% of gross revenue is transaction based as of FY21.

. The company also earns fixed annuity like revenue from its Platforms business in the form

license fee,

subscription fee,

setup costs,

development fees,

maintenance charges and through value added services.

_

Strong Balance Sheet

Total non current assets FY21 – ₹2667 crore

Total non current Liabilities FY21 – ₹53 crore

Consolidated Profit After Tax – ₹70.2 crore FY21

Net Cash flow from Operating Act FY21 – ₹155 crore

Cash and cash equivalents – ₹178 crore FY21

_

Huge demand in the country, In FY 2020-21 the value of transactions processed increased by 64% to 139,405 crores from 85,251 crores in FY 2019-20.

The company has a huge buyer list including small, medium, and large businesses, governments, banks, and financial institutions.

Infibeam has recently applied for a Retail Payments License from the Reserve Bank of India (RBI)

through its subsidiary SoHum Bharat Digital Payments (“So Hum”) along with consortium partners Jio Platforms, Google & Facebook.

This helps further the ambition of IAL to be a one-stop digital payments provider.

Government support – the platform being adopted by the Government of India for its e-marketplace. it is a plus point from investors’ view.

Covid Impact – 50% of customers shifted online for general store products. source: RBSA advisors

The company has increased its global presence – Oman, The USA, and the GCC region.

The company will soon launch neo (digital) banking and lending business through syndication with various lenders

Bad points

intense competition from Many Competitors, & in upcoming years competition is supposed to increase.

PayPal India

PayU

Paytm

RazorPay

Instamojo

Cashfree

EBS

BillDesk

HDFC Payment Gateway

PayUbiz

Atom Payment Gateway

Cashfree

Infibeam Avenues is in the Technology space where MIT graduates are working hard to make a low-cost product.

The company had many demergers in its journey. like Suvidhaa, DRC solutions, Ingenious eCommerce. Which minimized its revenue.

Infibeam Avenues had acquired many companies that question the company’s inability to create its own products. or the company is late to trap the early benefits.

Government regulation is evolving and unfavorable changes could harm its business in the future.

The low percentage of Promoters shareholding. it shows a lack of confidence from the promoter’s side.

Conclusion

The growth of millennials & high smartphone penetration indicates a strong headroom for growth.

India, with its 1.4 billion population, jumped on the digital bandwagon and is steadily racing ahead.

Most Indian families now have access to at least one mobile, and thus, the telecom and internet revolution paved the way

for other technological revolutions such as fintech, e-commerce, digital banking, e-governance, and more.

online shopping and online banking got a huge acceleration due to the pandemic.

Indian Digital payments industry currently stands at 2,153 Trillion and will grow at 27% CAGR to reach 7,092 Tn by FY25, as per the Annual Report.

Infibeam’s current aim is to make enterprises and banks customers and

enter payment issuance business to offer neo banking and lending to small and medium enterprises and the corporates.

Infibeam Avenues is in the Technology space where MIT graduates are working hard to make a low-cost product.

many strong competitors may kill Investors’ will to invest in this company.

It’s up to Investors to choose positive future growth or discard it for having no strong economic moats.

Thanks for reading

Do comment & share

TOPLISTING

0 notes

Text

Obtaining a payment gateway license offers numerous benefits for businesses. It ensures legal compliance, protecting companies from penalties and legal challenges while enhancing credibility among merchants and customers. This credibility boosts trust and strengthens the business's reputation.

#payment gateway license#payment gateway registration#payment gateway license rbi#payment gateway without company registration#payment gateway

0 notes

Photo

Corpbiz provides the services of Payment Gateway License, which is directed under the Payment and Settlement Systems Act, 2007. It is a set up by the RBI which delivers all sorts of regulations and administration of payment systems in India.This is intermediary elements in between the banks and the websites promoting the delivery of Transaction reports.

https://corpbiz.io/payment-gateway-license

0 notes

Text

Paytm IPO

Buy the Pre IPO of the Paytm from us and get all the details and regular updates. Paytm is an Indian e-commerce payment system and financial technology company, based out of Noida, India. Paytm is available in 11 Indian languages and offers online use-cases like mobile recharges, utility bill payments, travel, movies, and events bookings as well as in-store payments at grocery stores, fruits and vegetable shops, restaurants, parking, tolls, pharmacies and educational institutions with the Paytm QR code. California based PayPal had filed a case against Paytm in the Indian trademark office for using a logo similar to its own on 18 November 2016. As of January 2018, Paytm is valued at $10 billion and it is planning to launch its initial public offering (IPO) in 2022.

As per the company, over 7 million merchants across India use this QR code to accept payments directly into their bank account. The company also uses advertisements and paid promotional content to generate revenues.

Paytm was founded in August 2010 with an initial investment of $2 million by its founder Vijay Shekhar Sharma in Noida, a region adjacent to India's capital New Delhi. It started off as a prepaid mobile and DTH recharge platform, and later added data card, postpaid mobile and landline bill payments in 2013.

By January 2014, the company launched the Paytm Wallet, and the Indian Railways and Uber added it as a payment option. It launched into e-commerce with online deals and bus ticketing. In 2015, it unveiled more use-cases like education fees, metro recharges, electricity, gas, and water bill payments. It also started powering the payment gateway for Indian Railways.

In 2016, Paytm launched movies, events and amusement parks ticketing as well as flight ticket bookings and Paytm QR. Later that year, it launched rail bookings and gift cards.

Paytm's registered user base grew from 11.8 million in August 2014 to 104 million in August 2015. Its travel business crossed $500 million in annualised GMV run rate, while booking 2 million tickets per month.

In 2017, Paytm became India's first payment app to cross over 100 million app downloads. The same year, it launched Paytm Gold, a product that allowed users to buy as little as ₹1 of pure gold online. It also launched Paytm Payments Bank and ‘Inbox’, a messaging platform with in-chat payments among other products. By 2018, it started allowing merchants to accept Paytm, UPI and card payments directly into their bank accounts at 0% charge. It also launched the ‘Paytm for Business’ app which is now called Business with Paytm App, allowing merchants to track their payments and day-to-day settlements instantly. This led its merchant base to grow to more than 7 million by March 2018.

The company launched two new wealth management products - Paytm Gold Savings Plan and Gold Gifting to simplify long-term savings. It launched into gaming and investments, partnering with AGTech to launch a mobile games platform Gamepind, and setting up Paytm Money with an investment of ₹9 crore to bring investment and wealth management products for Indians.

In May 2019, Paytm partnered with Citibank to launch credit cards.

In October 2011, Sapphire Ventures (fka SAP Ventures) invested $10 million in One97 Communications Ltd. In March 2015, Paytm received its huge stake from Chinese e-commerce company Alibaba Group based in Hangzhou, China, after Ant Financial Services Group, an Alibaba Group affiliate, took 40% stock in Paytm as part of a strategic agreement. Soon after, it received backing from Ratan Tata, the MD of Tata Sons.

In August 2016, Paytm raised funding from Mountain Capital, one of Taiwan-based MediaTek's investment funds at a valuation of over $5 billion.

In May 2017, Paytm received its biggest round of stake by a single investor – SoftBank which also has a large stake in Alibaba, thus bringing the company's valuation to an estimated $10 billion. In August 2018, Berkshire Hathaway invested $356 million for 3%- 4% stake in Paytm, although Berkshire Hathaway confirmed that Warren Buffett was not involved in the transaction.

On November 25 2019, Paytm raised $1 billion in a funding round led by US asset manager T Rowe Price along with existing investors Ant Financial and SoftBank Vision Fund.

In 2013, Paytm acquired Plustxt for around less than $2 million. Plustxt was started by IIT graduates Pratyush Prasanna, Parag Arora, Lokesh Chauhan and Lohit V that allowed fast text messaging in any Indian Language.

In 2015, Paytm invested $5 million in auto-rickshaw aggregator and hyperlocal delivery firm Jugnoo. The funds were meant to enable Jugnoo to scale up its operations across the country, and improve its driver efficiency. It also acquired Delhi-based consumer behaviour prediction platform Shifu and local services startup Near.in.

In 2016, Paytm invested in logistics startups LogiNext and XpressBees.

In April 2017, Paytm invested in healthcare startup QorQL which uses artificial intelligence (AI) and big data to help doctors improve their productivity and quality of care, and enable patients to manage their health better. In July 2017, it acquired a majority stake in online ticketing and events platform Insider.in, backed by event management company Only Much Louder (OML) and mobile loyalty startup MobiQuest. The same year, Paytm acquired Little & Nearbuy, and merged both.

In June 2018, the company acquired the startup Cube26.

In July 2015, One97 Communications, the firm that owns the brand Paytm, acquired the title sponsorship rights for India's domestic and international cricket matches at home for a period of four years starting in August 2015. The rights include sponsor branding of series with the title sponsor logo, designation as the title sponsor of the series, visibility at the stadium, and broadcast sponsorship rights. This also includes all BCCI domestic (Ranji Trophy, Duleep Trophy, etc.) matches in India.

Previously, Paytm had acquired sponsorship rights during the 8th season of Indian Premier League. It has also served as an associate sponsor on Sony TV network (which has the telecast rights for IPL) and was the official partner of the IPL team Mumbai Indians. In March 2018, Paytm became the Umpire Partner of the IPL for five years.

On August 2015, Paytm received a license from Reserve Bank of India to launch the payments bank. The Paytm Payments Bank is a separate entity in which founder Vijay Shekhar Sharma will hold 51% share, One97 Communications holds 39% and 10% will be held by a subsidiary of One97 and Sharma. The bank was officially inaugurated in November 2017 by the Indian Finance Minister, Arun Jaitley. The inauguration ceremony featured prominent banking personalities including former RBI Executive Director PV Bhaskar, Saama Capital Director Ash Lilani and former Shriram Group Director GS Sundarajan.

It was set to launch over 100,000 banking outlets across India by end of 2018. However, the bank's branches are yet to touch double digits.

Paytm Payments Bank has appointed veteran banker Satish Kumar Gupta as its new Managing Director and CEO.

In February 2017, Paytm launched its Paytm Mall app, which allows consumers to shop from 1.4 lakh registered sellers. Paytm Mall is B2C model inspired by model of China's largest B2C retail platform TMall. For 1.4 lakh sellers registered, products have to pass through Paytm-certified warehouses and channels to ensure consumer trust. Paytm Mall has set up 17 fulfilment centers across India andpartnered with 40+ couriers. Paytm Mall raised $200 million from Alibaba Group and SAIF Partners in March, 2018. In May 2018, it posted a loss of approximately Rs 1,800 crore with a revenue of Rs 774 crore for financial year 2018. Additionally, the market share of Paytm Mall dropped to 3 percent in 2018 from 5.6 percent in 2017.

On May 2018, the Indian investigative news agency Cobrapost released a video of an undercover reporter meeting with Paytm's vice president, Ajay Shekhar Sharma who is brother of Vijay Shekhar Sharma. During the meeting, he reportedly said the company provided the Indian government with the personal data of paytm users in the Indian state of Jammu and Kashmir by violating user's privacy and policies. This went viral through internet, throughout the day. Later, Buzzfeed reported that, Sharma has close ties with India's ruling party Bhartiya Janata Party. Meanwhile, in response, the company tweeted that, it never shared user's data with third parties in which it again denied the contents of the video and stated that it never received requests from law enforcement on twitter. Paytm also stated that any person claiming otherwise “is not aware of the policy and is not authorised to speak on behalf of the company”.

0 notes

Text

RBI grants in-principal approval to fintech major Razorpay to operate as a payment aggregator

RBI grants in-principal approval to fintech major Razorpay to operate as a payment aggregator

The Reserve Bank of India (RBI) has granted in-principle approval to the Fintech major ‘Razorpay’, Stripe, Pine Labs, and 1Pato operate as a payment aggregator. Earlier, in order to ensure safety of merchants and consumers, the RBI had issued a payment aggregator framework in March 2020 stating that payment gateways will be mandated to have a license in order to acquire merchants and provide them…

View On WordPress

0 notes