#parabolic SAR

Explore tagged Tumblr posts

Text

10 Forex Strategies for Scalping

Scalping is a popular trading strategy in the forex market, characterized by short-term trades aimed at capturing small price movements. This strategy requires quick decision-making, discipline, and a keen understanding of the market. In this article, we’ll explore 10 effective forex strategies for scalping that can help traders maximize their profits while minimizing risk. 1. Moving Average…

#Bollinger Bands#Candlestick Patterns#CCI#Crossovers#Divergence#Entry and Exit Points#Fibonacci Retracement#Forex#Forex Market#Forex Strategies#MACD#MACD Line#Momentum Indicator#Moving Average#Moving Average Convergence Divergence#Overbought Conditions#Oversold Conditions#Parabolic SAR#Pivot Points#Price Action#Price Movements#Relative Strength#RSI#Scalping#Scalping Strategy#Security#Signal Line#Stochastic Oscillator#Stop-Loss#Support And Resistance

0 notes

Text

PARABOLIC SAR (STOP AND REVERSE) INDICATOR

The Parabolic SAR (Stop and Reverse) indicator is a technical analysis tool that is used to determine the potential direction of an asset’s price movement. It is a popular tool among traders and investors as it helps them identify entry and exit points for trades. The Parabolic SAR indicator plots points on a chart above or below an asset’s price. When the price is moving in an upward direction,…

View On WordPress

1 note

·

View note

Text

Best Technical Indicator for Trend Reversal: A Comprehensive Guide

When it comes to successful trading, identifying trend reversals is one of the most crucial skills you can develop. Spotting a reversal before the market fully shifts direction can help you get in or out of a trade at just the right moment. But how do you accurately predict trend reversals? This is where technical indicators come in handy. In this guide, we’ll explore the best technical indicators for trend reversal, their advantages, and how you can use them effectively in your trading strategy.

1. Moving Average Convergence Divergence (MACD)

The Moving Average Convergence Divergence (MACD) is one of the most popular technical indicators used by traders to identify trend reversals. It consists of two moving averages that oscillate around a zero line, providing valuable insights into momentum shifts. A crossover of the MACD line and the signal line is often used as a signal for potential trend reversals.

How to Use MACD for Trend Reversals: When the MACD line crosses above the signal line, it could indicate a potential bullish reversal. Conversely, when the MACD line crosses below the signal line, it may signal a bearish reversal. Traders often look for divergence between MACD and price action as an additional confirmation of a trend reversal.

2. Relative Strength Index (RSI)

The Relative Strength Index (RSI) is another powerful indicator for spotting trend reversals. RSI measures the strength of a security’s price action by comparing the average gains and losses over a specified period, typically 14 days.

How to Use RSI for Trend Reversals: The RSI moves between 0 and 100. When the RSI is above 70, it is considered overbought, which may suggest a potential bearish reversal. On the other hand, an RSI below 30 indicates that the market is oversold, hinting at a possible bullish reversal. Divergence between RSI and price action is also a strong signal for an upcoming trend reversal.

3. Bollinger Bands

Bollinger Bands are another useful tool for identifying trend reversals. Bollinger Bands consist of a middle band, which is a moving average, and two outer bands that represent standard deviations of the price.

How to Use Bollinger Bands for Trend Reversals: When the price moves outside the Bollinger Bands, it often indicates that the asset is overextended, and a reversal may be imminent. Traders look for price rejection at the bands and confirmation in the form of candlestick patterns to anticipate a reversal.

4. Stochastic Oscillator

The Stochastic Oscillator is a momentum indicator that can also be useful for predicting trend reversals. It compares the closing price of an asset to its price range over a certain period to determine the strength of a trend.

How to Use the Stochastic Oscillator for Trend Reversals: When the Stochastic lines cross above 80, it suggests that the market is overbought, indicating a possible trend reversal to the downside. Conversely, when the Stochastic lines cross below 20, it indicates that the market is oversold, signaling a potential bullish reversal.

5. Parabolic SAR

The Parabolic Stop and Reverse (SAR) is a trend-following indicator designed to highlight potential points where a trend might reverse.

How to Use Parabolic SAR for Trend Reversals: The Parabolic SAR plots dots above or below price bars. When the dots switch from being below to above the price, it indicates a potential bearish reversal. Conversely, when they move from above to below the price, a bullish reversal is likely. Traders often use Parabolic SAR along with other indicators like RSI or MACD for better accuracy.

6. Fibonacci Retracement Levels

Fibonacci Retracement is not a typical technical indicator, but it can provide valuable insight into where trend reversals are likely to occur. The key Fibonacci levels (23.6%, 38.2%, 50%, 61.8%) are often used to anticipate areas of potential support or resistance where the price might reverse.

How to Use Fibonacci Retracement for Trend Reversals: During an uptrend, if the price retraces to a key Fibonacci level and finds support, it could signal the end of the pullback and the start of a reversal back to the uptrend. Similarly, in a downtrend, Fibonacci levels can help predict resistance levels where a bearish reversal might occur.

Conclusion: Choosing the Best Indicator for Trend Reversals

Identifying the best technical indicator for trend reversal ultimately depends on your trading style, experience, and preference. Indicators like MACD, RSI, Bollinger Bands, Stochastic Oscillator, Parabolic SAR, and Fibonacci Retracement are all effective in identifying potential trend reversals. To improve the accuracy of your predictions, it’s often recommended to use a combination of these indicators along with proper risk management techniques.

Remember that no indicator can provide a 100% guarantee of a trend reversal. Market conditions and external factors also play a significant role in price movements. Always test and backtest your strategies before applying them in a live market.

If you’re looking for more insights and tools to enhance your trading strategy, visit Miyagi Trading. At Miyagi Trading, we provide the best trading resources, indicators, and expert advice to help you stay ahead of the market. Whether you’re a beginner or an experienced trader, our goal is to help you make informed decisions and achieve consistent results. Explore our range of tools and start improving your trading skills today!

0 notes

Text

A Estratégia Forex para Seguimento de Te... https://tradeemais.com/estrategia-forex-para-seguimento-de-tendencia-guia-completo?feed_id=8924&_unique_id=6721bd29a4f19

0 notes

Text

Forex Best Indicator for Trend Reversal: Maximize Your Trading Success

Looking for the Forex best indicator for trend reversal. Discover proven tools like the MACD, RSI, and Parabolic SAR on MiyagiTrading, designed to enhance trading precision by signaling market shifts with accuracy. These powerful indicators are customizable and ideal for spotting entry and exit points, helping you stay ahead of trends. Tailor your strategy with MiyagiTrading’s advanced tools to gain reliable insights in dynamic markets and boost your trading outcomes.

Visit:- https://miyagitrading.com/best-trend-reversal-indicator/

0 notes

Link

NASA and SpaceX’s launch of the Crew-9 mission will be center stage this week. The launch of two new International Space Station crew members is currently scheduled for Thursday from the recently crew-certified Space Launch Complex 40 (SLC-40) at the Cape Canaveral Space Force Station (CCSFS). Meanwhile, in California, another Falcon 9 will lift the only scheduled Starlink mission for this week from Vandenberg Space Force Base (VSFB) on Wednesday. In Asia, an H-IIA rocket is set to launch a government reconnaissance satellite from Japan, while China is preparing to launch three missions this week. The frequency of SpaceX’s Starlink launches will be slightly curtailed for a few weeks. Both of SpaceX’s Florida launch pads are currently occupied by high-priority missions, with Launch Complex 39A (LC-39A) being configured for Falcon Heavy’s forthcoming launch of Europa Clipper in October, and Crew-9 is being prepared at SLC-40. CASC Jielong-3 | Multiple Payloads Expected to launch on Tuesday, Sep. 24, at 02:30 UTC aboard the sea launch vessel Dongfang Htangtiangang in Chinese coastal waters in the Yellow Sea, a Jielong-3 rocket will launch multiple Chinese payloads into Earth orbit. Jielong-3 is a medium-sized, four-stage, solid-fueled rocket developed by the China Aerospace and Technology Corporation (CASC). The rocket features a large fairing 3.35 m in diameter at a total height of 31.9 m. This mission will be the fourth sea-launched Jielong-3. Previous Chinese sea launch. (Credit:CASC) The rocket will carry multiple payloads including Ganzhou-1, a C-band radar sensing satellite, to cover the northwest region of China. Massing at 285 kg, Ganzhou-1 will fly in a Sun-synchronous orbit at an altitude of 500 km. This is the first of an expected constellation of six satellites, which will provide global availability for imaging within 10 to 12 hours. A second payload featured on this mission is the Jilin University No. 1 — an optical sensing satellite carrying newly developed meter-level sensing instruments developed by the University. CASC Lijian-1 | Multiple Payloads This mission, carrying five Chinese satellites, will launch from Jiuquan Satellite Launch Center on Tuesday, September 24, at 23:35 UTC. It will be flown by the Lijian-1, also known as Kinetica-1, a four-stage solid-fuelled rocket. This mission will serve as the fourth flight of this rocket. Amongst the payloads are remote sensing satellites, including AIRSAT-01 and 02 — the first satellites of the AIRSAT constellation being built and operated by China Science and Technology Satellite Group Co., Ltd. The main payload featured on these two satellites is a Ku-band synthetic aperture radar, with an imaging resolution better than one meter, which is mainly used for all-day and all-weather high-resolution microwave remote sensing imaging of Earth. The mission claims that the flat-panel SAR satellite system aboard uses the unfolded cylindrical parabolic SAR antenna for the first time on any satellite, with onboard imaging processing capabilities. SpaceX Falcon 9 | Starlink Group 9-8 With Space Launch Complex 4E (SLC-4E) at VSFB being the only pad open for Starlink launches this week, SpaceX is targeting Tuesday, Sep. 24, at 8:59 PM PDT (Wednesday, Sep. 25, at 03:59 UTC) to launch the Starlink Group 9-8 mission. The precise number of Starlink satellites being launched is not yet known. Falcon 9 is expected to fly on the regular southeasterly trajectory used by Starlink missions, and its currently unannounced booster will land approximately 600 km downrange on the drone ship Of Course I Still Love You. An H-IIA 202 rocket lifts off from the Tanegashima Space Center in Japan. (Credit: Mitsubishi Heavy Industries, Ltd. / JAXA) MHI H-IIA 202 | IGS-Radar 8 A Mitsubishi Heavy Industries H-IIA rocket will launch IGS-Radar 8, a Japanese government radar reconnaissance satellite, from pad LA-Y1 at the Tanegashima Space Center in Japan. Delayed by unsuitable weather earlier in the month, the mission is now scheduled to liftoff on Thursday, Sep. 26, at 05:24 UTC. IGS-Radar 8 will fly to a Sun-synchronous orbit and will operate for both national defense and civil natural disaster monitoring purposes for Japan. H-IIA is a two-stage rocket with two strap-on solid rocket motors. This mission will serve as the rocket’s 49th flight, with 42 consecutive successes to date. This will be the second H-IIA flight this year. SpaceX Falcon 9 | Crew-9 Delayed from the original mid-August launch date while NASA waited for the outcome of Boeing’s Starliner issues, Crew-9 is now scheduled to launch on Thursday, Sept. 26, at 2:05 PM EDT (18:05 UTC). Falcon 9 booster B1085 will fly on its second flight during this mission, having previously flown Starlink Group 10-5. Dragon arrives at pad 40 in Florida ahead of next week's @NASA Crew-9 launch to the @Space_Station pic.twitter.com/YEJwWPPnmp — SpaceX (@SpaceX) September 20, 2024 Launching from SLC-40 at CCSFS, Crew-9 will be the first use of SLC-40 for a crewed flight. SpaceX built the crew access arm and tower at the pad throughout 2023. The first use of the access arm was to late-load cargo aboard the CRS-30 Cargo Dragon in March, but the certification for its use for crewed launches was only recently completed. Crew-9 will utilize Crew Dragon C212 Freedom, which will be flying on its fourth flight. Previous missions were Crew-4, Axiom Mission 2, and Axiom Mission 3. Freedom and its trunk — the service module, which is disposed of after each flight — arrived at the integration hanger at the pad on the Saturday before launch. The booster will perform a return-to-launch-site (RTLS) landing following launch —this booster’s first— and land at Landing Zone-1, a few miles south of the launch pad at the Cape. Dragon recovery vessel Megan left Port Canaveral on Saturday, heading for the Gulf of Mexico for abort recovery duties if required. This mission will have only two crew members aboard, instead of the original four, to leave seats for the Starliner Crewed Flight Test (CFT) crew— Butch Wilmore and Suni Williams — who will return home with Crew-9 next February. The Starliner crew remained aboard ISS following the decision to return their spacecraft uncrewed following safety concerns related to Starliner’s thrusters and helium leaks in its propulsion system. Falcon 9 B1085-2 for the Crew 9 mission is rolling at KSC ahead of launching two humans to the ISS. It will be launching from SLC-40, as SpaceX utilizes that pad's upgrades for Crew Dragon.https://t.co/tANS0dWyIH pic.twitter.com/zzapNARtAd — Chris Bergin – NSF (@NASASpaceflight) September 16, 2024 Crew-9 is commanded by Tyler “Nick” Hague from NASA. Hague will be accompanied by mission specialist Aleksandr Gorbunov from Roscosmos, who will be flying on his first mission. Hague has logged 203 days in space from two missions aboard the ISS, as well as three spacewalks. The Crew-9 crew will become members of the Expedition 72 crew aboard the Station. They will join NASA astronauts Wilmore, Williams, and Don Pettit, and Roscosmos cosmonauts Alexey Ovchinin and Ivan Vagner in conducting scientific research and maintenance activities on ISS. The two remaining Crew-9 astronauts — Zena Cardman and Stephanie Wilson — will be reassigned to a mission at a later date according to a NASA statement. This launch will be the 180th orbital launch attempt this year. CASC Chang Zheng 2D | Unknown Payload A Chang Zheng (Long March) 2D is expected to launch from Site 9401 (SLS-2) at Jiuquan Satellite Launch Center, China, on Friday, Sep.27, at 10:35 UTC carrying an unknown payload. There is very little information available regarding this mission at present. The 2D variation of the booster is a two-stage vehicle used to launch payloads to low-Earth orbit or Sun synchronous orbit. (Lead Image: A previous launch of a Falcon 9 Starlink mission from Vandenberg. Credit: Pauline Acalin for NSF) The post Launch Roundup: NASA Crew-9 to fly half-empty, Starlink and Chinese launches continue appeared first on NASASpaceFlight.com.

0 notes

Text

Mastering Trading with the Parabolic SAR: A Comprehensive Guide

Introduction In the dynamic world of financial markets, traders are constantly seeking tools and indicators to assist them in making informed decisions. One such tool that has gained popularity among traders is the Parabolic Stop and Reverse (SAR) indicator. Developed by Welles Wilder, the Parabolic SAR is a versatile indicator that can help traders identify potential trend reversals, set…

View On WordPress

#Financial market trading indicators#Financial Markets#learn technical analysis#moving average#Moving average and Parabolic SAR#Parabolic SAR#Parabolic SAR reversal strategy#Parabolic SAR trading strategies#Risk Management#SAR calculation#SAR interpretation#Stop-Loss#Stop-loss with Parabolic SAR#technical analysis#technical analysis tools#Trading Indicators#Trading Strategies#Trading with SAR indicator#Trend Following#Trend following with Parabolic SAR#Trend Reversal

0 notes

Text

Understanding Forex Trend Indicators

In the world of foreign exchange trading, identifying the direction of a trend is crucial for making informed trading decisions. Forex trend indicators are tools that help traders determine whether a currency pair is trending upward, downward, or moving sideways. These indicators are fundamental for devising strategies and executing trades effectively. Let’s explore some of the most commonly used Forex trend indicators and how they can enhance your trading performance.

Moving Averages

Moving averages are among the most popular trend indicators. They smooth out price data to help identify the direction of the trend. The Simple Moving Average (SMA) calculates the average price over a specific number of periods, while the Exponential Moving Average (EMA) gives more weight to recent prices. By comparing different moving averages, such as the 50-period and 200-period, traders can identify potential buy or sell signals. When a shorter-term moving average crosses above a longer-term one, it may indicate an uptrend, while the opposite crossover could signal a downtrend.

Average True Range (ATR)

The Average True Range (ATR) measures market volatility rather than direction. However, understanding volatility is crucial for trend analysis. A higher ATR indicates increased volatility, which often accompanies strong trends. Traders use ATR to set stop-loss orders and to gauge the potential range of price movements. A rising ATR suggests that a trend may be gaining strength, whereas a declining ATR could indicate a potential reversal or weakening trend.

Moving Average Convergence Divergence (MACD)

The Moving Average Convergence Divergence (MACD) is a versatile indicator that combines moving averages with momentum analysis. It consists of two lines: the MACD line and the signal line. When the MACD line crosses above the signal line, it generates a bullish signal, suggesting the potential for an upward trend. Conversely, when the MACD line crosses below the signal line, it could indicate a bearish trend. The MACD also includes a histogram that represents the difference between the MACD and signal lines, providing additional insight into trend strength.

Bollinger Bands

Bollinger Bands consist of a middle band (SMA) and two outer bands that represent standard deviations from the SMA. The bands expand and contract based on market volatility. When the bands widen, it indicates increased volatility and potential trend strength. Conversely, when the bands contract, it suggests lower volatility and a potential trend reversal or consolidation. Traders use Bollinger Bands to identify potential entry and exit points based on price touching or breaching the bands.

Ichimoku Cloud

The Ichimoku Cloud is a comprehensive indicator that provides information on support and resistance levels, Forex Trading Robot, and momentum. It consists of five lines: Tenkan-sen, Kijun-sen, Senkou Span A, Senkou Span B, and Chikou Span. The area between Senkou Span A and Senkou Span B forms the “cloud.” Price above the cloud indicates an uptrend, while price below the cloud suggests a downtrend. The cloud’s thickness can also provide insights into the strength of the trend.

Parabolic SAR

The Parabolic SAR (Stop and Reverse) is a trend-following indicator that provides potential entry and exit points. It appears as dots on the chart, with dots below the price indicating an uptrend and dots above the price signaling a downtrend. The indicator helps traders set trailing stop-loss orders and recognize potential trend reversals.

0 notes

Text

What is SAR – Parabolic Stop and Reverse?

Parabolic SAR, or Parabolic Stop and Reverse, is a technical analysis indicator that indicates whether the market is in a bull or bear phase rather than predicting price movements.

0 notes

Text

Unveiling Parabolic SAR: A Comprehensive Guide

In the ever-evolving landscape of technical analysis, traders and investors seek tools that offer clarity amidst market volatility and uncertainty. Enter the Parabolic SAR (Stop and Reverse) indicator, a powerful tool designed to identify potential trend reversals and provide valuable insights into market dynamics. Whether you're a novice trader or a seasoned investor, understanding the mechanics and applications of the Parabolic SAR can be instrumental in making informed trading decisions and navigating the complexities of financial markets.

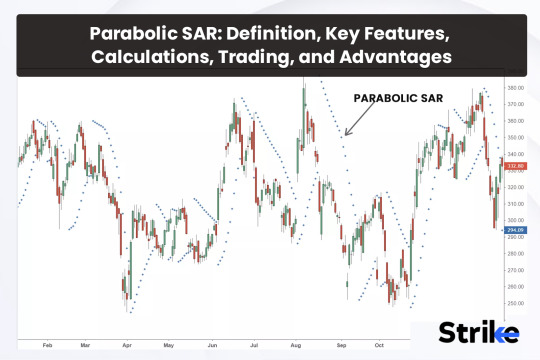

Introduction to Parabolic SAR:

Developed by Welles Wilder, the Parabolic SAR is a trend-following indicator that highlights potential trend reversals in financial markets. It accomplishes this by plotting points on a chart that represent potential stop-loss levels, adjusting these points dynamically as the price of an asset changes over time.

How Does Parabolic SAR Work?

The Parabolic SAR indicator places dots either above or below the price of an asset, depending on the direction of the trend. During an uptrend, the dots are below the price, while during a downtrend, the dots are above the price. The spacing between the dots increases as the trend accelerates, hence the "parabolic" nature of the indicator.

Interpreting Parabolic SAR Readings:

The primary use of Parabolic SAR is to identify potential trend reversals and establish trailing stop-loss levels. Traders typically interpret Parabolic SAR signals as follows:

Uptrend:

When the Parabolic SAR dots are below the price, it indicates an uptrend.

Traders may consider entering long positions or maintaining existing long positions as long as the dots remain below the price.

The dots serve as dynamic trailing stop-loss levels, gradually rising as the trend progresses.

Downtrend:

Conversely, when the Parabolic SAR dots are above the price, it signals a downtrend.

Traders may consider entering short positions or holding existing short positions as long as the dots remain above the price.

Similar to uptrends, the dots act as dynamic trailing stop-loss levels, descending as the downtrend continues.

Strategies for Using Parabolic SAR:

Trend Reversals:

When the price crosses over the Parabolic SAR dots, it may signal a potential trend reversal.

For example, when the price crosses above the dots during a downtrend, it could indicate a bullish reversal, prompting traders to consider exiting short positions or even entering long positions.

Trailing Stop-Loss:

Traders can use the Parabolic SAR dots as dynamic trailing stop-loss levels to protect profits and manage risk.

As the trend progresses, the stop-loss levels adjust accordingly, allowing traders to lock in gains while giving the trade room to breathe.

Confirmation with Other Indicators:

Combine Parabolic SAR with other technical indicators or chart patterns to confirm signals and enhance trading decisions.

For example, use Parabolic SAR in conjunction with moving averages or oscillators to validate trend direction and momentum.

Limitations and Considerations:

While Parabolic SAR offers valuable insights into trend reversals and trailing stop-loss levels, traders should be aware of its limitations and exercise caution:

Whipsaws: In choppy or ranging markets, Parabolic SAR may generate false signals, resulting in whipsaws and potential losses.

Adaptability: Adjust the parameters of Parabolic SAR (e.g., acceleration factor) to suit the specific characteristics of the asset and trading timeframe.

Confirmation: Always confirm Parabolic SAR signals with other technical indicators or fundamental analysis to reduce the likelihood of false positives.

Conclusion:

In the dynamic world of financial markets, the Parabolic SAR stands as a beacon of clarity, offering traders valuable insights into trend dynamics and potential reversal points. Whether you're a day trader, swing trader, or long-term investor, incorporating Parabolic SAR into your trading toolkit can enhance your ability to identify profitable opportunities, manage risk, and optimize returns. By mastering the interpretation and application of Parabolic SAR signals, traders can navigate the complexities of financial markets with confidence and precision, striving towards greater profitability and success.

0 notes

Text

Exness Pakistan

6 top ADX indicator strategies to use in online trading

Traders use different types of strategies on a platform because they enable them to get more ideas about various things. The Average Directional Index (ADX) is one of the indicators that allows a trader to measure the strength of a trend with high accuracy. A high ADX indicates a strong trend, and a low ADX suggests a weak market. ADX is useful for both day trading and swing trading purposes that let traders make the most informed decisions. Whether it is a new or experienced trader, they should know the top ADX strategies in online trading.

What are the best ADX strategies to follow in trading?

Combining ADX with Parabolic SAR

A trader should consider combining ADX with parametric SAR because they provide ways to know current trends and potential reversal points. For instance, one can identify a bullish trend when the ADX line is above 25 and the parabolic SAR is below the price bars. This combination works well for identifying a strong trend with potential for further upside.

Using ADX in the Directional Movement (DM) system

One should consider using ADX in the Directional Movement (DM) system that has three lines. It provides methods to measure bullish movements, apart from evaluating the strength of a trend. However, it is wise to combine the same with other tools to get more insights.

Evaluating a strong trend

Traders should evaluate a strong trend when the reading goes above 25. A reading above 25 indicates a strong trend and the likelihood of a trend developing. This, in turn, gives ways to proceed further that will help achieve the best results.

Determining the direction of a trend

A trader should determine the direction of a trend by using the last 50 candlesticks. Using a sample size of 50 candlesticks gives ways to determine a trend. The Exness Pakistan trading platform allows traders to trade different types of assets with the best indicators. It allows a trader to focus more on various things with high accuracy.

ADX price divergence

ADX price divergence issues a warning against a trend during the trading process. On the other hand, a trader should learn more about the strategy with more attention.

The Holy Grail

The Holy Grail strategy involves combining ADX with a moving average that helps find pullbacks using price action. Traders should learn strategies from different sources to maximize efficiency in trading.

1 note

·

View note

Video

youtube

⚡ Pocket Option Parabolic Sar 1 Minute Options 🔥

0 notes

Video

youtube

Parabolic SAR no MetaTrader 5: Seguindo a Tendência no Forex

Assista esse vídeo sobre Parabolic SAR no MetaTrader 5 - Seguindo a Tendência no Forex. Acesse aqui mais informações: https://www.ganhardinheiro.com/2023/10/parabolic-sar-no-metatrader-5-seguindo.html

0 notes

Text

A Estratégia Forex para Seguimento de Te... https://tradeemais.com/estrategia-forex-para-seguimento-de-tendencia-guia-completo?feed_id=8308&_unique_id=671e28913b997

0 notes

Text

A Complete Guide to Trend-Following Indicators

There are many distinct trading indicators available on the financial markets, each with a specific function. These indicators are useful for assessing, trading, and making money from the constantly shifting state of price movement.

It is crucial to group these indicators according to their application and the market conditions in which they are most effective for analyzing price movement and providing trading tips.

But before proceeding further, let’s proceed to know what is a trend following a trading strategy.

What Is a Trend Following Indicators?

Technical tools called trend-following indicators assess the strength and direction of trends throughout the selected time frame. Some trend-following indicators are plotted right on the price panel, sending out negative signals when they are above the price and bullish signals when they are below the price. Others are drawn below the panel, producing up- and down-ticks from 0 to 100 or over a central ‘zero’ line, producing bullish or bearish divergences when opposing prices.

The majority of trend-following indicators are ‘lagging’, which means that they produce a buy or sell signal after a trend or reversal has already begun. The most common trailing trend-following indicator is the moving average. These indicators can also be ‘leading’, which means they anticipate price action before it occurs by comparing momentum across many time frames and doing multiple calculations. A well-liked leading trend-following indicator is the parabolic stop and reverse (Parabolic SAR).

There are three main purposes for these indicators. They first make an effort to inform the technician of a changing trend or impending reversal. Second, they make an effort to forecast both short- and long-term price movements. Thirdly, they validate findings and indications in the price pattern and other technical indicators. The parameters used to create the trend-following indication have the most influence on signal dependability. Examples include the generation of distinct buy and sell signals by a 50-day moving average and a 200-day moving average, which may be effective in one-time frame but not the other.

Top Trend-following Indicators

Here, in this section, we will explain the best trend following indicators. Let’s take a quick look:

Moving Averages

One of the most often used trend-following indicators is the moving average. The average price of an asset over a given period of time is shown by a moving average, which is a line. Before making a transaction while you trade forex online, you should frequently use moving averages to confirm the direction and intensity of a trend.

Moving Average Convergence Divergence (MACD)

The difference between two moving averages is measured by the trend-following indicator known as the Moving Average Convergence Divergence (MACD). In order to enter or exit transactions at the ideal time traders frequently use the MACD to spot changes in momentum or trend direction.

Bollinger Bands

A common trend-following indicator called Bollinger Bands uses a series of lines to depict the top and bottom of a trading range. Bollinger Bands are frequently used by traders to assist spot overbought and oversold market circumstances as well as probable trend reversals.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is another popular trend-following indicator. By contrasting the average gains and losses over a given time period, the RSI gauges the force of a trend.

The RSI is often used by traders to spot overbought and oversold market conditions, which can aid them in making better trading decisions.

Trend Following advantages

Numerous benefits of trend following method include:

Big victories are possible, unlike with previous strategies.

Minimal transaction costs.

Your entrances and exits don’t have to be timed perfectly.

As the trend gets stronger, you could increase your position to increase your chances of making money.

Trend Following Disadvantages

Additionally, there are several drawbacks to trend following, the most prevalent of which are as follows:

It can be difficult mentally to ride the trend.

The win rate (number of winning trades divided by the number of lost trades) is lower.

Because trend following demands that the trend be already in motion, you’ll miss the trend’s beginning.

Final Thoughts

On a leading Forex trading platform, the trader can predict the stock price and choose the optimum time to purchase or sell the stock by using a trend-following technique, which is straightforward. To develop the technique, one needs just employ one trading indicator or one or more indicators in combination.

You can use the different methods for your trades now that you are aware of what trend trading is and what it entails. Before using your strategies, you must, however, perfect them. Use all the tools you have at your disposal, including charts, candlestick patterns, research data, and other tools, to examine the trends.

Originally Published on Theomnibuzz

Source: https://theomnibuzz.com/a-complete-guide-to-trend-following-indicators/

0 notes