#p2p bitcoin exchange

Explore tagged Tumblr posts

Photo

Coin Developer India for your upcoming project as they are the top Peer-to-Peer Bitcoin Exchange Development Company in India. Their team is full of skilled professional experts who are serving clients with the best blockchain solutions.

0 notes

Text

Cryptocurrency

Challenges Faced by P2P Cryptocurrency Exchanges in India

Looking for legal guidance on the p2p cryptocurrency exchange India? Then, Finlaw consultancy will provide you with expert advice on the regulatory landscape and operational strategies for p2p cryptocurrency exchanges in India.

1 note

·

View note

Text

CoinEx Campus Tour: Empowering Nigerian Students With Crypto Knowledge & Opportunities

CoinEx, a leading cryptocurrency exchange platform, successfully hosted its Campus Tour event on July 20th, 2024, at Ladoke Akintola University in Nigeria. The event, themed “Unlocking Potential Through Shared Success,” exceeded initial expectations with a turnout of over 269 registered users from cryptocurrency and blockchain communities. The event commenced with a glamorous Red Carpet…

#bitcoin#Bitcoin in Nigeria#Blockchain communities#Blockchain Lautech#blockchain technology#BTC#Campus#COINEX#CoinEx brand#CoinEx Campus Tour#CoinEx Exchange#CoinEx P2P#CoinEx Platform#CoinEx souvenirs#crypto learnings#cryptocurrency#Ladoke Akintola University#LAU#Nigeria#Tour

0 notes

Text

0 notes

Text

Best Cryptocurrency Exchange in UAE

We have been a P2P service provider for over a year now and have since partnered with various exchanges like Binance, and Huobi to be merchants working with them to provide this service on their platforms. With thousands of trades, and millions of dollars in volume monthly, we are proud and confident to say, we are the best P2P provider in the UAE. Let us know if you have any questions. Visit our website Now!

#Cryptocurrency#btc#bitcoin#Cryptocurrency Exchange in UAE#Cryptocurrency Exchange#buy and sell cryptocurrency#buy dubai property with cryptocurrency#crypto pay dubai#p2p crypto exchange uae

0 notes

Note

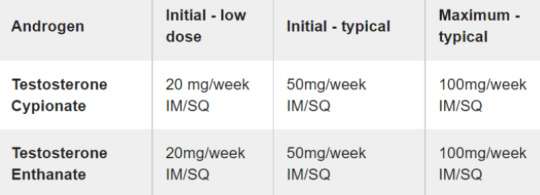

It’s possible to diy ftm hrt???

yeah dude. you can do this all on your phone too though it is less secure to use tor on one. keep in mind it's not really the most anonymous thing to send people paypal money for crypto or use tor on your phone but the police could not give less of a shit about people buying steroids or drugs in general for personal use. if you're not selling or buying distribution amounts they doooon't care

all you have to do is download tor (google it and click the first result or use the play store)

go on tor.taxi and pick a market, open the market link in tor [I use incognito]

get a crypto wallet [I used cake wallet]

buy bitcoin/monero/whatever with a P2P market, basically crypto version of reddit marketplaces [I used localmonero and sent paypal money in exchange for monero, make sure to follow the directions the market gives you, like not sending any money unless it says it's ok, you can always cancel if you feel like you're getting scammed and make sure to pick someone with lots of reviews]

send the crypto into your wallet on the market, wait

look up testosterone and make sure that it is shipping DOMESTICALLY. don't bother with customs. keep in mind 10ml = ten doses, if you're like me and take 2[50]mg biweekly. it'll be twenty if you take it every week.

place order! just fill out your shipping info and pay lol

it's pretty simple, remember to log in and release the money once your package arrives! [go to your orders and click the button that says release funds]. the other person is waiting on their money and it's helpful to release it as soon as you get what you ordered.

I hope this helps anon

116 notes

·

View notes

Text

B-u-y Verified Cash App Accounts: Your Key to Secure Transactions

B-u-ying verified Cash App accounts is risky and often illegal. It's better to create and verify your own account.

If you want to more information just knock us – Contact US

24 Hours Reply/Contact

Telegram: @Seo2Smm

Skype: Seo2Smm

WhatsApp: +1 (413) 685-6010

▬▬▬▬▬▬▬▬▬▬▬

Verified Cash App accounts offer increased transaction limits and added security. Many users seek verified accounts for easier financial management. However, B-u-ying a verified account poses significant risks. These include potential scams, account closures, and legal repercussions. Always prioritize safety and legality by verifying your own Cash App account.

The verification process is straightforward and ensures your account remains secure. By doing so, you avoid the pitfalls associated with purchased accounts. Remember, maintaining control over your financial tools is crucial for security. Protect your financial information by adhering to legal methods. Creating and verifying your own account is the safest and most reliable option.

The Rise Of Cash App In Digital Transactions

In recent years, Cash App has revolutionized digital transactions. This platform has made sending and receiving money easier than ever. People now prefer Cash App for its simplicity and speed. But what led to its meteoric rise in the world of digital payments?

Popularity Of Peer-to-peer Payment Systems

Peer-to-peer (P2P) payment systems have gained immense popularity. These systems allow people to transfer money directly to one another. There are no intermediaries involved. This makes transactions faster and more convenient.

Cash App stands out among these P2P systems. It offers more than just basic money transfers. Users can also B-u-y and sell Bitcoin, invest in stocks, and even get a virtual debit card. This versatility has contributed to its widespread adoption.

Below is a table illustrating the features that make Cash App unique:

Feature

Description

Money Transfers

Send and receive money instantly

Bitcoin Transactions

B-u-y, sell, and hold Bitcoin

Stock Investments

Invest in stocks with no commission fees

Virtual Debit Card

Use a virtual card for online purchases

Cash App's Impact On Financial Exchange

Cash App has significantly impacted the way people handle money. Traditional banking methods are often slow and cumbersome. Cash App offers a faster alternative. This has led to a shift in how people manage their finances.

Many users find Cash App more reliable for daily transactions. The app's security measures also ensure peace of mind. Encryption technology protects user data, making transactions secure.

Here's a list of ways Cash App has changed financial exchange:

Speed: Instant transfers save time.

Convenience: Easy to use interface.

Security: Advanced encryption protects data.

Versatility: Multiple financial services in one app.

These features make Cash App a preferred choice for many. As its popularity grows, so does its impact on digital transactions.

Why Verified Accounts Matter

In today's digital age, financial transactions happen online. Verified Cash App accounts ensure that these transactions are secure and reliable. A verified account means trust and authenticity, reducing risks for users.

Security In Digital Payments

Security is critical in digital payments. With a verified Cash App account, you get higher protection against fraud. Verified accounts go through identity checks, making it safer for transactions.

Below is a table showing the security features for verified and unverified accounts:

Features

Verified Account

Unverified Account

Identity Checks

Yes

No

Transaction Limits

Higher

Lower

Fraud Protection

Enhanced

Basic

Benefits Of Having A Verified Status

Verified status on Cash App brings many benefits. Here are some key advantages:

Higher Transaction Limits: Send and receive more money.

Enhanced Security: Protect your funds with better security measures.

Credibility: Gain trust from others when making transactions.

With these benefits, using a verified Cash App account becomes a seamless experience. For those who often deal with money transfers, having a verified account is a must.

The Verification Process Explained

Understanding the verification process for Cash App accounts can help you ensure your transactions are secure. Verified accounts offer several benefits, including increased transaction limits and added security features. Let's dive into the steps to verify your Cash App account and address common hurdles you might face.

Steps To Verify Your Cash App Account

Open the Cash App: Launch the Cash App on your mobile device.

Tap on the Profile Icon: This is located in the top right corner of your screen.

Select 'Personal': Navigate to the 'Personal' tab in your profile settings.

Enter Personal Information: Provide your full name, date of birth, and the last four digits of your social security number.

Submit the Information: Tap 'Submit' to send your information for verification.

Wait for Confirmation: Cash App will review your details and confirm your verification status via email or notification.

Common Verification Hurdles

While verifying your Cash App account is usually straightforward, you may encounter some common issues. Addressing these hurdles can expedite the process.

Incorrect Information: Ensure your name and date of birth match your official documents.

Incomplete Details: Double-check that all required fields are filled out correctly.

Age Restriction: You must be at least 18 years old to verify a Cash App account.

Document Verification: Sometimes, additional documents like a driver's license may be required.

Network Issues: Ensure you have a stable internet connection while submitting your details.

By following these steps and being aware of potential hurdles, you can successfully verify your Cash App account. This enhances your security and increases your transaction limits.

B-u-ying Verified Cash App Accounts

Purchasing verified Cash App accounts can streamline your transactions. This offers a hassle-free way to access additional features and benefits. It's crucial to know where to B-u-y these accounts. Ensure you avoid scams and fraudulent sellers.

Legitimate Sources For Purchasing

Look for trusted websites that sell verified Cash App accounts. These platforms usually have positive reviews and customer feedback. They often provide secure payment options to protect your transactions. Use reputable forums and online marketplaces known for their reliable sellers. Always check the seller's history and ratings before making a purchase.

Source

Features

Trusted Websites

Positive reviews, customer feedback, secure payment options

Reputable Forums

Reliable sellers, seller history, ratings

Avoiding Scams And Fraudulent Sellers

To avoid scams, never share your personal information with unknown sellers. Use escrow services to hold your payment until you receive the account. Verify the account before finalizing the purchase. Research the seller thoroughly by checking reviews and ratings. Avoid deals that seem too good to be true. They are often scams.

Never share personal information

Use escrow services

Verify the account

Research the seller

Avoid deals too good to be true

The Legal Perspective

B-u-ying verified Cash App accounts may seem like a quick solution. But it's important to understand the legal implications. This section will explore the lawfulness and consequences of using illegitimate accounts.

Understanding The Lawfulness

When you B-u-y a verified Cash App account, you must consider the legal aspects. Cash App accounts must comply with the platform's terms of service. Violating these terms can lead to serious legal issues.

The act of purchasing or selling verified accounts might be considered fraudulent. Fraud involves deceiving others for financial gain. Many jurisdictions have strict laws against such practices.

It's important to understand that the use of false identities or forged documents is illegal. Using someone else's identity without permission is identity theft. This is a serious crime and can result in severe penalties.

Consequences Of Illegitimate Account Use

Using an illegitimate Cash App account can have significant repercussions. Your account might get permanently banned. This means you lose access to funds and services.

There are also legal consequences to consider. You could face criminal charges for fraud or identity theft. This can lead to fines or even imprisonment.

Moreover, your personal information might be compromised. Hackers and scammers often target illegitimate accounts. This can result in financial loss and damage to your reputation.

It's also worth noting that financial institutions monitor suspicious activity. They report such activities to authorities. This can lead to an investigation and legal action.

Legal Aspect

Consequences

Violation of Terms

Account Ban

Fraud

Fines and Imprisonment

Identity Theft

Severe Legal Penalties

Data Compromise

Financial Loss

Essential Features Of Verified Accounts

Verified Cash App accounts offer numerous benefits. These accounts provide enhanced functionalities. Let's explore the essential features that make verified accounts a must-have.

Increased Limits And Capabilities

Verified accounts have higher transaction limits. Users can send and receive more money daily. This is perfect for business owners. They can handle larger transactions effortlessly.

Unverified accounts have strict limits. Users can only send up to $250 weekly. Verified accounts remove these restrictions. They allow users to send up to $7,500 weekly.

Feature

Unverified Account

Verified Account

Weekly Sending Limit

$250

$7,500

Weekly Receiving Limit

$1,000

No Limit

Receiving limits are also higher with verified accounts. Users can receive unlimited amounts. This ensures seamless transactions. It provides a smoother experience.

Access To Advanced Functions

Verified accounts unlock advanced features. Users gain access to a Cash App card. This card works like a debit card. It can be used for purchases and withdrawals.

Direct deposit is another key feature. Users can receive their salary directly in their Cash App account. This makes managing finances easier. It's a secure and efficient method.

Cash App Card: Use it like a debit card.

Direct Deposit: Receive salary directly.

Bitcoin Transactions: B-u-y, sell, and hold Bitcoin.

Bitcoin transactions are also available. Users can B-u-y, sell, and hold Bitcoin. This opens up new investment opportunities. It makes Cash App a versatile tool.

B-u-ying verified Cash App accounts can greatly benefit users. They provide higher limits and advanced functions. These features make financial management easier and more efficient.

How Verification Enhances Security

B-u-ying verified Cash App accounts can significantly enhance your security. Verification ensures that the account is genuine and trustworthy. This process involves multiple checks and balances to confirm the identity of the account holder. Verified accounts are less likely to be involved in fraudulent activities.

Protection Against Fraud

Verified accounts offer strong protection against fraud. Fraudsters often use unverified accounts for illegal activities. Verification adds a layer of credibility. It helps to identify and block suspicious activities. This reduces the risk of scams and fraudulent transactions.

Verified accounts are also more likely to be monitored. Cash App keeps a close watch on verified accounts to ensure they follow all rules and regulations. This continuous monitoring helps in early detection of any unusual activity.

Layered Security Measures

Verification introduces multiple layers of security. Each layer adds an extra level of protection. This makes it more difficult for unauthorized users to access the account. Here are some of the security measures involved:

Identity Verification: Confirms the identity of the account holder through official documents.

Two-Factor Authentication (2FA): Adds an extra step to log in, making unauthorized access harder.

Transaction Monitoring: Keeps track of all transactions to detect any irregularities.

Encryption: Ensures that all data transferred is secure and cannot be easily accessed by hackers.

These security measures work together to provide a robust defense. They make sure that only authorized users can access the account. This comprehensive security setup gives users peace of mind.

Security Measure

Benefit

Identity Verification

Confirms account legitimacy

Two-Factor Authentication

Prevents unauthorized access

Transaction Monitoring

Detects suspicious activities

Encryption

Secures data transfer

In summary, B-u-ying verified Cash App accounts enhances security by introducing multiple layers of protection. These measures work together to safeguard your money and data.

The Role Of Customer Support

When B-u-ying verified Cash App accounts, customer support plays a crucial role. They ensure smooth verification and maintain account security. Let's explore how they help in these areas.

Assistance With Verification Issues

Verification issues can cause delays and frustrations. Customer support teams are trained to handle these problems swiftly. They guide you through each step of the verification process.

Here are some common verification issues they assist with:

Incorrect personal details

Document submission errors

Account linking problems

Quick resolution of these issues ensures a seamless experience. Timely assistance helps in making the process stress-free.

Maintaining Account Security Post-purchase

After purchasing a verified Cash App account, maintaining security is essential. Customer support provides valuable tips and guidelines.

Here are some security measures they recommend:

Security Measure

Explanation

Two-Factor Authentication

Adding an extra layer of security

Regular Password Updates

Changing passwords frequently

Monitoring Account Activity

Checking for any unusual transactions

Implementing these measures helps keep your account safe. Customer support ensures you are well-informed about these practices.

User Experiences With Verified Accounts

Verified Cash App accounts provide many benefits. Users share their experiences with these accounts. Their stories help others make informed decisions.

Testimonials And Reviews

Many users have shared positive testimonials about verified Cash App accounts. Here are a few:

John D.: "I feel more secure using a verified account. My transactions are quick and safe."

Sarah W.: "Verification made my account trustworthy. More people are willing to send me money."

Mike T.: "Customer service improved once my account was verified. Issues get resolved faster."

Real-world Benefits And Drawbacks

Verified accounts offer real-world benefits and some drawbacks. Let's explore them:

Benefits

Drawbacks

Increased transaction limits

Enhanced security

Better customer support

Verification process can be time-consuming

Privacy concerns

Occasional technical issues

Users generally find the benefits outweigh the drawbacks. Verified Cash App accounts provide a secure and efficient way to manage money.

Integrating Verified Accounts Into Daily Life

B-u-y Verified Cash App Accounts can simplify your daily life. They offer secure transactions, easy money management, and a seamless online shopping experience. Let’s explore how these accounts can be integrated into your everyday activities.

Personal Finance Management

Using a verified Cash App account for personal finance management is smart. It allows you to track your spending and save money effectively. You can set up automatic deposits and withdrawals, ensuring your bills are always paid on time.

Budgeting becomes easier with categorized transactions. Here’s a simple table to show how you can categorize your expenses:

Category

Monthly Budget ($)

Spent ($)

Groceries

300

250

Utilities

150

140

Entertainment

100

90

Streamlining Online Purchases

Streamlining online purchases with a verified Cash App account is convenient. It speeds up checkout processes and ensures secure transactions. Many online stores accept Cash App, making shopping easier.

Here are some benefits of using a verified account for online shopping:

Quick payments with saved card details

Enhanced security with two-factor authentication

Instant notifications for every transaction

Enjoy shopping without worrying about payment issues. Verified accounts provide peace of mind and efficiency.

Verified Vs. Unverified Accounts

Cash App offers two types of accounts: verified and unverified. Each type has its unique features and restrictions. Understanding these differences is crucial for making the best choice for your needs.

Comparing Features And Restrictions

Feature

Verified Account

Unverified Account

Transaction Limits

Higher limits

Lower limits

Security

Enhanced security features

Basic security

Account Features

Access to all features

Limited features

Support

Priority support

Standard support

Making The Upgrade Decision

Upgrading to a verified Cash App account offers several benefits. These include higher transaction limits and enhanced security features.

Verified accounts provide access to all Cash App features. This means you can use every feature without restrictions.

Priority support is another advantage. Verified account holders get faster responses from customer support.

If you handle large transactions or need extra security, a verified account is the best choice.

If you want to more information just knock us – Contact US

24 Hours Reply/Contact

Telegram: @Seo2Smm

Skype: Seo2Smm

WhatsApp: +1 (413) 685-6010

▬▬▬▬▬▬▬▬▬▬▬

The Cost Of Verification

B-u-ying verified Cash App accounts can be a smart move. It saves time and effort. But understanding the costs is essential. This section dives into the pricing and benefits.

Pricing Structure For Verified Accounts

The cost of verified Cash App accounts varies. Different factors affect the price. Here is a simple breakdown:

Account Type

Price Range

Basic Verified Account

$50 - $100

Premium Verified Account

$100 - $200

Business Verified Account

$200 - $500

Basic Verified Accounts are the cheapest. They have basic features like sending and receiving money. Premium Verified Accounts offer more features. They include higher transaction limits. Business Verified Accounts cost the most. They offer the highest limits and extra features for businesses.

Cost-benefit Analysis

Let's look at the benefits versus the costs. A Basic Verified Account is ideal for simple transactions. It's affordable and meets basic needs.

Low Cost: $50 - $100

Basic Features: Send and receive money

Suitable for personal use

Premium Verified Accounts offer more value. They cost more but provide higher transaction limits.

Mid-range Cost: $100 - $200

Higher Limits: More than basic accounts

Extra Features: Suitable for heavy users

Business Verified Accounts are the most expensive. They are worth the cost for businesses.

High Cost: $200 - $500

Highest Limits: Ideal for business transactions

Additional Features: Extra tools for business needs

Choosing the right account depends on your needs. Weigh the costs and benefits carefully.

Security Best Practices For Account Holders

Owning a verified Cash App account is convenient. It is essential to follow security best practices. This ensures your financial information stays safe. Below are key practices you should adopt.

Protecting Your Financial Information

Always keep your Cash App password strong and unique. Avoid using easily guessable passwords. Use a combination of letters, numbers, and symbols.

Enable two-factor authentication on your account. This adds an extra layer of security. You will need a code sent to your phone to log in.

Never share your login details with anyone. Be cautious of phishing attempts. Fraudsters may try to trick you into giving away your details.

Regular Monitoring And Account Maintenance

Check your account activity regularly. Look for any suspicious transactions. Report anything unusual to Cash App support immediately.

Keep your app updated to the latest version. Updates often include important security patches. This helps protect against new threats.

Use secure networks when accessing your Cash App account. Avoid using public Wi-Fi for financial transactions. Public networks are less secure.

Consider setting up alerts for transactions. This way, you will be notified of any activity. You can catch unauthorized transactions quickly.

Review your linked accounts and cards periodically. Remove any that you no longer use. This reduces the risk of unauthorized access.

Security Measure

Action

Strong Password

Use a mix of characters

Two-Factor Authentication

Enable it for extra security

Regular Monitoring

Check your account activity

App Updates

Keep your app updated

Secure Networks

Avoid public Wi-Fi

Transaction Alerts

Set up notifications

By following these best practices, you can keep your Cash App account secure. Always stay vigilant and proactive.

The Future Of Cash App And Verification

The future of Cash App hinges on secure and verified accounts. Digital payment platforms are evolving, and Cash App is at the forefront. Understanding trends and changes in verification processes is key to staying ahead.

Trends In Digital Payment Security

Digital payment security is advancing rapidly. Biometric authentication like fingerprint and facial recognition is becoming standard. These methods offer higher security compared to traditional passwords.

End-to-end encryption ensures data privacy.

Multi-factor authentication (MFA) adds an extra layer of security.

AI and machine learning are used to detect fraudulent activities.

These trends make digital transactions safer and more reliable. As a result, users can trust platforms like Cash App with their financial data.

Anticipated Changes To Verification Processes

Verification processes will continue to evolve. Real-time verification is expected to become the norm. This means users can get verified instantly, enhancing user experience.

Here are some anticipated changes:

Automated KYC (Know Your Customer) procedures.

Blockchain technology for secure and transparent verification.

Enhanced AI algorithms to streamline verification.

These changes aim to make the verification process faster and more secure. Users will enjoy seamless access to their accounts while ensuring their data is protected.

Comparing Cash App To Other Payment Platforms

Choosing the right payment platform can be challenging. Cash App stands out with unique features. Let's explore how Cash App compares to other platforms.

Features Unique To Cash App

Cash App offers instant transfers. You can send and receive money within seconds. This makes it convenient for quick payments.

Another unique feature is the Cash Card. It's a customizable debit card linked to your Cash App balance. You can use it for everyday purchases.

Bitcoin trading is also integrated. Users can B-u-y, sell, and hold Bitcoin directly in the app. This is not common in many other payment platforms.

The app also supports direct deposits. Users can receive their paychecks directly into their Cash App account. This adds a layer of convenience.

What Sets Verified Cash App Accounts Apart

Verified Cash App accounts come with extra security. They require users to verify their identity. This adds an extra layer of protection against fraud.

Verified accounts have higher transaction limits. You can send and receive larger amounts of money. This is useful for businesses and individuals with higher transaction needs.

Another benefit is customer support. Verified users get priority support. This ensures any issues are resolved quickly.

Verified accounts also allow for more features. You can access advanced settings and options. This includes additional security settings and more.

Feature

Cash App

Other Platforms

Instant Transfers

Yes

Varies

Customizable Debit Card

Yes

No

Bitcoin Trading

Yes

Few

Direct Deposits

Yes

Varies

Higher Transaction Limits

Yes (Verified)

Varies

The Impact Of Verified Accounts On Peer-to-peer Transactions

Peer-to-peer transactions have become a staple in modern finance. Platforms like Cash App have revolutionized how we transfer money. With the rise of digital transactions, the need for verified accounts has grown. Verified accounts bring several advantages to users, enhancing trust and efficiency in transactions.

Building Trust In The Community

Trust is crucial in peer-to-peer transactions. Verified accounts on Cash App offer a layer of security. Users feel safer when dealing with verified profiles. This reduces the risk of fraud and scams.

Verified accounts have undergone a thorough verification process. This ensures the identity of the account holder. Trustworthy transactions create a positive environment for all users. This helps build a strong community.

Benefits

Impact

Enhanced Security

Reduces Fraud

Increased Trust

Encourages More Transactions

Verified Identity

Safer Community

Facilitating Smoother Transactions

Smoother transactions are another benefit of verified accounts. Verification streamlines the process of sending and receiving money. Transactions happen quicker and with fewer errors.

Verified users often enjoy higher transaction limits. This allows for larger transfers with ease. Faster processing times ensure that money reaches the recipient without delay.

Quick transfers

Higher limits

Fewer errors

These advantages make using verified Cash App accounts a smart choice. Users can enjoy a seamless experience with every transaction.

Case Studies: Successful Use Of Verified Accounts

Verified Cash App accounts have transformed how individuals and businesses handle transactions. Below are real-life examples of successful uses of verified accounts.

Businesses Leveraging Verified Cash App Accounts

Many businesses use verified Cash App accounts to streamline payments and enhance customer trust. Below are a few examples:

Business

Use Case

Outcome

Local Cafes

Accepting quick payments

Increased customer satisfaction

Freelancers

Receiving client payments

Reduced payment delays

Online Stores

Processing orders

Faster transaction times

Local cafes use verified accounts to accept quick payments. This leads to increased customer satisfaction. Freelancers receive client payments with less hassle. This results in reduced payment delays. Online stores process orders faster. This ensures quicker transaction times.

Individual Success Stories

Many individuals also benefit from using verified Cash App accounts. Here are some success stories:

John, a college student, pays his rent easily with a verified account.

Maria, a mom, sends allowances to her kids instantly.

Tom, an artist, receives payments for his artwork promptly.

John, a college student, uses his verified account to pay his rent. This process is quick and hassle-free. Maria, a mom, sends allowances to her kids instantly. This allows her to manage family finances efficiently. Tom, an artist, receives payments for his artwork promptly. This enables him to focus more on his creative work.

Troubleshooting Common Issues With Verified Accounts

Managing a verified Cash App account can sometimes present challenges. Users may encounter transaction problems or account recovery issues. This section addresses common issues and provides solutions to ensure a seamless experience.

Resolving Transaction Problems

Transaction issues can frustrate users. Follow these steps to resolve common problems:

Ensure your account has sufficient funds.

Verify the recipient's details before sending money.

Check your internet connection for stability.

Update your Cash App to the latest version.

Restart your device to clear any temporary glitches.

If transactions still fail, contact Cash App support. Provide them with transaction details for quick resolution.

Account Recovery And Support

Recovering a Cash App account is crucial if you lose access. Here’s a step-by-step guide:

Open the Cash App and click on the profile icon.

Select the "Support" option.

Choose "Something Else" and then "Account Recovery."

Follow the on-screen instructions to verify your identity.

If you face further issues, contact Cash App support directly via email or their support hotline. They will guide you through the recovery process.

Issue

Solution

Failed Transactions

Check funds, verify recipient, and update the app.

Account Locked

Contact support and verify identity.

Always keep your app updated and secure to avoid common issues. Follow these tips to ensure a smooth experience with your verified Cash App account.

The Ethical Considerations Of Account Verification

B-u-ying verified Cash App accounts can seem convenient. But, it raises significant ethical questions. Understanding these concerns helps in making informed decisions. Let's explore the fairness and accessibility issues and the debate over B-u-ying and selling accounts.

Fairness And Accessibility

Fairness is a major concern. Verified accounts give advantages. These include higher transaction limits and added security. But B-u-ying these accounts can create an uneven playing field. Some users may never get the chance to verify their accounts.

Accessibility is another key issue. Some users face difficulties in verifying their accounts. These obstacles can include lack of proper documentation or limited access to verification resources. B-u-ying a verified account may seem like a quick fix. Yet, it undermines the efforts of those who follow the proper procedures.

Issue

Impact

Fairness

Creates an uneven playing field

Accessibility

Excludes users facing verification difficulties

The Debate Over B-u-ying And Selling Accounts

The practice of B-u-ying and selling verified Cash App accounts sparks a heated debate. Supporters argue it provides a solution for those who can't verify their accounts. They believe it helps users access the benefits of verified accounts quickly.

Critics, on the other hand, see it as a shortcut. They argue it undermines the integrity of the verification process. This practice can expose users to potential scams and frauds. It also encourages dishonest behavior.

Supporters' View: Quick access to benefits

Critics' View: Undermines verification integrity

Potential Risks: Scams and frauds

Understanding both sides of this debate is crucial. Making informed decisions helps maintain fairness and security in digital transactions.

Maximizing The Benefits Of Your Verified Account

Owning a verified Cash App account can significantly enhance your financial transactions. With a verified account, you unlock many features. These features make managing money simpler and more efficient. Below, we explore tips and strategies to maximize the benefits of your verified Cash App account.

If you want to more information just knock us – Contact US

24 Hours Reply/Contact

Telegram: @Seo2Smm

Skype: Seo2Smm

WhatsApp: +1 (413) 685-6010

▬▬▬▬▬▬▬▬▬▬▬

Tips For Efficient Financial Management

Managing your finances effectively is key to financial stability. Here are some tips to help you make the most of your verified Cash App account:

Track Your Spending: Use the app's transaction history to monitor your expenses. This helps in identifying spending patterns.

Set Up Notifications: Enable notifications for transactions. This keeps you updated on your account activity in real-time.

Create a Budget: Use the app to categorize your spending. This helps in setting and sticking to a budget.

Utilize Direct Deposit: Direct deposits can save time and ensure timely access to your funds.

Make Use of Boosts: Cash App offers "Boosts" that provide discounts when using the Cash Card. Take advantage of these offers to save money.

Leveraging Verified Status For Business

A verified Cash App account can be a powerful tool for business owners. Here's how you can leverage your verified status:

Streamlined Payments: Receive payments from clients quickly and securely. This reduces the hassle of delayed payments.

Professional Appearance: A verified account adds a level of trust and professionalism to your business transactions.

Cash App for Business: Switch to a business account to unlock additional features like detailed transaction reports and tax documentation.

QR Code Payments: Use QR codes for easy, contactless payments. This is especially useful for in-person transactions.

Instant Transfers: Use the instant transfer feature to move funds to your bank account immediately. This ensures you always have access to your money.

Maximize your verified Cash App account by implementing these strategies. Efficient financial management and leveraging your verified status can enhance both personal and business transactions.

Frequently Asked Questions

How Do I Get A Verified Cash App Account?

To get a verified Cash App account, provide your full name, date of birth, and the last four digits of your SSN. Follow the prompts in the app to complete the verification process.

How Much Can A Verified Cash App Receive?

A verified Cash App account can receive an unlimited amount of money. This makes it ideal for larger transactions.

What Id Can I Use To Verify Cash App Bitcoin?

You can use a driver's license, state ID, or passport to verify Bitcoin on Cash App. Ensure your ID is valid and clear.

How Can I Verify My Cash App Without Ssn?

You can't fully verify Cash App without an SSN. You can still send and receive limited amounts.

Conclusion

Verified Cash App accounts provide security and convenience. They ensure smooth transactions and enhanced trust. Make sure to B-u-y from reputable sources to avoid scams. Verified accounts can significantly improve your financial experience. Take the step today and enjoy the benefits of a verified Cash App account.

4 notes

·

View notes

Text

Cash App The Pros, Cons and Features of The Popular Payment Service

Keep reading for a deeper look into Cash App.

What Is Cash App? that allows individuals to quickly send, receive and invest money. Block, Inc., formerly Square, Inc., launched the app in 2013 (initially named Square Cash) to compete with mobile payment apps like Venmo and PayPal.

Get it Now – Cash App Money Generator https://www.helth.shop Get it Now – Cash App Money Generator

Cash App is a financial platform, not a bank. It provides banking services and debit cards through its bank partners. The balance in your account is insured by the Federal Deposit Insurance Corporation (FDIC) through partner banks. Cash App provides investing services through Cash App Investing LLC, registered with the Securities and Exchange Commission (SEC) as a broker-dealer and a member of the Financial Industry Regulation Authority (FINRA).

Through Cash App, users can send and receive money, get a debit card and set up direct deposits. The investing feature allows users to invest in stocks for as little as $1. This is done by buying pieces of stock, called fractional shares. Consumers can also buy, sell or transfer Bitcoin through the app.

With Cash App Taxes (formerly Credit Karma Tax), users can file their taxes for no charge. With this service, Cash App is quickly becoming a one-stop shop for financial services.

How Does Cash App Work? To use Cash App, you must first download the mobile app, available for iOS (4.7 stars out of 5) and Android (4.6 stars out of 5). You can also sign up for an account online. The app features several tabs for its various services, including banking, debit card, payments, investing and Bitcoin.

Send and Receive Money After setting up an account, you’ll link an existing bank account to your Cash App account. Once a payment source is connected, you can send or receive money through the mobile app. Users can enter a dollar amount from the green payment tab and tap “Request” or “Pay” to create a payment.

Each Cash App user creates a unique username, called a $Cashtag. You can find individuals or businesses to pay or request money by searching for their $Cashtag. You can also search for individuals by name, phone number or email address. You can choose to send funds from your Cash App balance or your linked funding source.

Transfer Money The money is kept in your Cash App balance when you receive payments. You can keep it there or transfer it to your linked bank account. Cash App charges a fee for instant transfers (0.5% to 1.75% of the transfer amount, with a minimum fee of $0.25), but you can also choose a no-fee standard transfer, which typically takes one to three business days to complete.

Add Money To add money to your Cash App account, navigate to the app’s banking tab and press “Add Cash.” Select the decided amount and tap “Add.”

Who Can Use Cash App? Cash App is for individuals ages 13 and older. Users ages 13 to 18 require approval from a parent or guardian to access expanded Cash App features like P2P transactions, direct deposit and a Cash Card.

Other features, such as investing and Bitcoin, are only available for Cash App users who are at least 18.

Does Cash App Offer a Debit Card? Cash App users can receive a Cash Card, which is a debit card tied to their Cash App account. Like most debit cards, the Cash Card can be used to make purchases online and in person. You can also add your Cash Card to digital wallets like Apple Pay or Google Pay.

Users can also use Cash Cards at ATMs. Cash App charges a $2 fee per ATM transaction. In addition, the ATM owner may charge a separate fee for ATM use. For users who receive direct deposits of at least $300 each month, Cash App reimburses ATM fees, including third-party ATM fees, for up to three ATM withdrawals per 31-day period (up to $7 in fees per withdrawal).

Cash Card transactions are subject to the following withdrawal limits

★ Sign up free from the link below. 👇👇👇👇👇👇👇👇👇 https://www.helth.shop

Get it Now – Cash App Money Generator https://www.helth.shop Get it Now – Cash App Money Generator

$310 per transaction $1,000 per 24-hour period $1,000 per seven-day period What Does It Cost To Use Cash App? Cash App costs nothing to download and create an account. And it doesn’t charge fees for many of its services. Standard transfers from a Cash App balance to a linked bank account are fee-free, but a small fee is charged for instant transfers.

Users that request a Cash Card are subject to fees for ATM use. Cash App may also charge a fee when you’re buying or selling Bitcoin. The fee is listed before you complete the transaction.

How Long Does It Take To Send Money? Cash App payments are instant and funds are available to use immediately in most instances. If your account shows payment pending, you may need to take action and follow the steps provided by the app to complete the transaction.

What Are the Dollar Limits on Cash App? Cash App restricts how much you can send or receive when you first open an account. Users can send up to $1,000 per 30-day period and receive up to $1,000 per 30-day period.

Cash App users can have their account verified to access higher limits. Sending limits vary depending on what you’re approved for by Cash App. Once verified, there is no limit to how much money you can receive through the mobile app.

Is Cash App Safe? Cash App says it employs the latest encryption and fraud protection technology to protect its users. As a security measure, the app will send you a one-time-use login code when logging into your account. Cash App also offers optional settings to enable additional security measures. By enabling a security lock, for example, every Cash App payment requires your passcode. You can also disable your Cash Card within the app, which could come in handy if your card is lost or stolen.Keep reading for a deeper look into Cash App.

What Is Cash App? Cash App is a P2P payment app that allows individuals to quickly send, receive and invest money. Block, Inc., formerly Square, Inc., launched the app in 2013 (initially named Square Cash) to compete with mobile payment apps like Venmo and PayPal.

Cash App is a financial platform, not a bank. It provides banking services and debit cards through its bank partners. The balance in your account is insured by the Federal Deposit Insurance Corporation (FDIC) through partner banks. Cash App provides investing services through Cash App Investing LLC, registered with the Securities and Exchange Commission (SEC) as a broker-dealer and a member of the Financial Industry Regulation Authority (FINRA).

Through Cash App, users can send and receive money, get a debit card and set up direct deposits. The investing feature allows users to invest in stocks for as little as $1. This is done by buying pieces of stock, called fractional shares. Consumers can also buy, sell or transfer Bitcoin through the app.

With Cash App Taxes (formerly Credit Karma Tax), users can file their taxes for no charge. With this service, Cash App is quickly becoming a one-stop shop for financial services.

How Does Cash App Work? To use Cash App, you must first download the mobile app, available for iOS (4.7 stars out of 5) and Android (4.6 stars out of 5). You can also sign up for an account online. The app features several tabs for its various services, including banking, debit card, payments, investing and Bitcoin.

Send and Receive Money After setting up an account, you’ll link an existing bank account to your Cash App account. Once a payment source is connected, you can send or receive money through the mobile app. Users can enter a dollar amount from the green payment tab and tap “Request” or “Pay” to create a payment.

Each Cash App user creates a unique username, called a $Cashtag. You can find individuals or businesses to pay or request money by searching for their $Cashtag. You can also search for individuals by name, phone number or email address. You can choose to send funds from your Cash App balance or your linked funding source.

Transfer Money The money is kept in your Cash App balance when you receive payments. You can keep it there or transfer it to your linked bank account. Cash App charges a fee for instant transfers (0.5% to 1.75% of the transfer amount, with a minimum fee of $0.25), but you can also choose a no-fee standard transfer, which typically takes one to three business days to complete.

Add Money To add money to your Cash App account, navigate to the app’s banking tab and press “Add Cash.” Select the decided amount and tap “Add.”

Who Can Use Cash App? Cash App is for individuals ages 13 and older. Users ages 13 to 18 require approval from a parent or guardian to access expanded Cash App features like P2P transactions, direct deposit and a Cash Card.

Other features, such as investing and Bitcoin, are only available for Cash App users who are at least 18.

Does Cash App Offer a Debit Card? Cash App users can receive a Cash Card, which is a debit card tied to their Cash App account. Like most debit cards, the Cash Card can be used to make purchases online and in person. You can also add your Cash Card to digital wallets like Apple Pay or Google Pay.

Users can also use Cash Cards at ATMs. Cash App charges a $2 fee per ATM transaction. In addition, the ATM owner may charge a separate fee for ATM use. For users who receive direct deposits of at least $300 each month, Cash App reimburses ATM fees, including third-party ATM fees, for up to three ATM withdrawals per 31-day period (up to $7 in fees per withdrawal).

Cash Card transactions are subject to the following withdrawal limits:

$310 per transaction $1,000 per 24-hour period $1,000 per seven-day period What Does It Cost To Use Cash App? Cash App costs nothing to download and create an account. And it doesn’t charge fees for many of its services. Standard transfers from a Cash App balance to a linked bank account are fee-free, but a small fee is charged for instant transfers.

Users that request a Cash Card are subject to fees for ATM use. Cash App may also charge a fee when you’re buying or selling Bitcoin. The fee is listed before you complete the transaction.

How Long Does It Take To Send Money? Cash App payments are instant and funds are available to use immediately in most instances. If your account shows payment pending, you may need to take action and follow the steps provided by the app to complete the transaction.

What Are the Dollar Limits on Cash App? Cash App restricts how much you can send or receive when you first open an account. Users can send up to $1,000 per 30-day period and receive up to $1,000 per 30-day period.

Cash App users can have their account verified to access higher limits. Sending limits vary depending on what you’re approved for by Cash App. Once verified, there is no limit to how much money you can receive through the mobile app

Is Cash App Safe? . As a security measure, the app will send you a one-time-use login code when logging into your account. Cash App also offers optional settings to enable additional security measures. By enabling a security lock, for example, every Cash App payment requires your passcode. You can also disable your Cash Card within the app, which could come in handy if your card is lost or stolen.

2 notes

·

View notes

Text

Compra de criptomonedas

Existen diferentes formas de comprar criptomonedas

Exchanges centralizados

Para explicarlo fácil, son lo equivalente a los bancos o a los brookers. Necesitarás registrarte con datos personales, incluyendo KYC. La ventaja es que es sencillo. La desventaja es que las criptos que compras las mantiene el exchange, no tu.

Los más conocidos son Binance, Coinbase y Kraken.

2. P2P

Es el método que otorga más privacidad. Consiste en llegar a un acuerdo con otra persona y comprarle sus criptomonedas a cambio de mandarle dinero.

Existen plataformas que actuan de intermediario para evitar que te estafen: Paydece, Hodl Hodl o Paxful.

3. Cajeros cripto

Existen cajeros donde ingresas el dinero a cambio de la criptomoneda que quieras, o al revés, envías tus criptomonedas y te pagan con dinero.

Son sencillos de usar, aunque, no hay por todos los lugares. Suele haber muchos en las principales ciudades.

Si quieres aprender sobre Bitcoin y criptomonedas, no olvides seguirme en mi página principal:

https://www.tumblr.com/comprarbitcoin

0 notes

Text

Binance Clone Script: Revenue Blueprint

Trump came back after a one-term break.

The price of the Bitcoin peaks at 75,000 USD.

Cryptocurrencies are accepted everywhere. And getting known to even developing and some under-developed countries. There's one reason.

Top developed countries like the USA have contributed a lot to it. It ranks as the country with the largest number of crypto ATMs in the world.

Top business ventures and start-ups also started investing in the crypto business. They've created the trend of cloning the top platforms like Binance and took significant revenue.

The revenue model of the Binance clone script is diverse.

Let's examine them individually.

Binance Clone Script: Revenue Blueprint

Trading Fee

Every trade that occurs within the platform does carry fees. Binance clone script is celebrated all over the world for its various trading options.

Spot trade, margin trade, futures, and P2P do executes with transaction fees.

In margin trading, you can earn large profits. Your users repay the funds with interest after the trade ends.

In P2P, users deposit their fiat and get crypto in return. When they receive their crypto, your platform deducts a part from it.

Withdrawal/Deposit Fee

After the completion of trading, users withdraw or deposit their funds.

While performing those, your platform deducts a portion from it.

Withdrawal fees fluctuate depending on network congestion.

Staking

You provide an option for the traders to use their crypto to earn rewards.

Users lock their crypto for a flexible or a fixed interval and earn crypto as a reward for it.

From that final reward, your Binance clone script takes a percentage from it.

Launchpad

You can help new projects for start-ups to raise funds. You can calculate and allocate the token sales.

You can charge a fee and keep a portion of the tokens.

OTC

Over-the-counter (OTC) enables your users to trade bulk orders in one go. So, the transaction charges will also be so high. It executes the trades without impacting the market prices of your Binance clone script.

This not only boosts revenue to your platform. It also grabs more institutional investors to your exchange platform.

Loan services

With collateral, your users can borrow funds whenever they want.

You can earn interest on this to your Binance clone script when they repay.

This makes your platform open for borrowers too. Our traditional banks require a lot to process and sanction loans.

Partnerships

You'll reach a greater user base by partnering with other business ventures or organizations.

It also helps your platform to improve by sharing technologies with other exchange platforms.

Marketing

It involves two angles. One is marketing your Binance clone script to grab more users. Another one is helping other platforms to reach a greater user base.

Let's bring this to a close now.

Ultimate Summary

Binance clone script is positioned to generate income across various sectors of the cryptocurrency market.

And we've seen every possibility you can generate revenue.

You can empower your start-up with the Binance clone script to reach new heights.

The ball is in your court to embrace this opportunity. Farewell for now, entrepreneurs.

Get Free Demo,Mail: [email protected]

Whatsapp: +91 9361357439

Web: https://www.trioangle.com/binance-clone/

1 note

·

View note

Text

How to Sell and Withdraw Pi Coins: A Complete Guide.

As Pi Network gains popularity, more users are exploring ways to convert their Pi coins into usable currencies like USD or USDT. While the Pi cryptocurrency isn’t fully tradable on mainstream exchanges yet, there are ways to prepare and stay informed so you can be ready to trade Pi coins once they become available on the open market. In this guide, we’ll cover essential steps on how to sell, withdraw, and convert your Pi coins, making it easy to understand your options on platforms like pitether.com.

What is Pi Network?

Pi Network is a digital currency project developed to make cryptocurrency mining accessible to everyday users. Unlike traditional cryptocurrencies like Bitcoin or Ethereum, Pi Network allows users to mine Pi coins directly from their mobile devices without consuming much energy. However, Pi is still in its testing phase, which means it isn’t fully tradable on major exchanges, though it holds potential for future use and exchange once it becomes publicly available.

How to Withdraw Pi Coins

Since Pi coins aren’t yet available on popular crypto exchanges, you may be wondering how you can withdraw or sell your mined Pi coins. Here’s a step-by-step guide to get you prepared for when Pi becomes available for trading:

Complete KYC Verification: Before you can withdraw your Pi coins, the Pi Network requires you to complete a KYC (Know Your Customer) verification process. This process confirms your identity and ensures that you’re a legitimate user. Make sure to submit all the necessary documents and wait for confirmation.

Check Pi Wallet Availability: After completing KYC verification, Pi Network provides an official wallet, called the Pi Wallet, where you can store your coins. Download the Pi Wallet app from Pi Network’s official website, create an account, and set up a secure PIN. You can then transfer your Pi coins from the mining app to this wallet.

Transfer to Pi Wallet: Once your Pi Wallet is set up, go to your Pi Network app, navigate to your account balance, and select the option to transfer your mined Pi coins into your Pi Wallet. Ensure that you’ve securely backed up your wallet’s private key as it is required for accessing your funds.

Await Network Update for Withdrawals: Pi Network is still in its testing phase, so currently, you can only withdraw Pi coins once they become publicly tradable on major exchanges. Pi Network plans to launch in an open market in the near future, where withdrawal and trading options will become more accessible.

How to Sell Pi Coins

If you’re looking to sell Pi coins, here are the key steps to prepare for selling once Pi becomes publicly available:

Monitor Pi Network’s Updates: Stay updated on Pi Network’s official announcements. Follow their social media channels and official website to be aware of any news regarding exchange listings or partnerships.

Use pitether.com for Trading Information: Websites like pitether.com will likely provide updates on trading options once Pi coins are accessible for public trading. Keep an eye on such platforms for guidance on exchange listings, trading processes, and withdrawal options.

Consider Peer-to-Peer (P2P) Platforms: Some users may explore peer-to-peer trading options on platforms that allow private transactions between individuals. This option may involve higher risks and lacks the security of regulated exchanges, so always use caution and ensure you’re transacting with reputable parties.

Choose a Trusted Exchange: Once Pi is listed on exchanges, select a reliable cryptocurrency exchange that supports Pi coin trading. Top exchanges usually offer a range of features, including security, easy withdrawals, and high liquidity. Some popular options include Binance, Coinbase, and KuCoin, though you’ll need to verify if they support Pi at the time of its official launch.

How to Convert Pi Coins to USD or USDT

Once Pi Network officially launches and Pi coins become available on exchanges, converting them to fiat currencies like USD or stablecoins like USDT will become much easier. Here’s what you’ll need to do:

Select an Exchange with USD or USDT Pairs: Check if your chosen exchange offers trading pairs like PI/USD or PI/USDT. If they do, you’ll be able to directly convert your Pi coins into USD or USDT. This step is essential for ensuring smooth transactions.

Complete KYC Verification on the Exchange: Most exchanges require KYC verification before you can trade or withdraw large sums. Complete this verification to unlock full trading functionality.

Place a Sell Order: On the exchange, navigate to the trading section, select Pi from the list of cryptocurrencies, and place a sell order. You can either use a market order (selling at the current price) or a limit order (selling at a specified price). Once the order is fulfilled, you’ll receive USD or USDT in your account.

Withdraw to Your Bank or Wallet: After selling Pi for USD or USDT, you can withdraw your funds to a bank account (for USD) or a digital wallet (for USDT). Always verify your withdrawal address and check for any transaction fees.

Is Pi Network a Good Investment?

As with any cryptocurrency, Pi Network carries a degree of risk, especially as it is still in its testing phase. However, it also has potential due to its large user base and innovative approach to mobile mining. Keep in mind that the value of Pi may vary based on demand, network updates, and how the cryptocurrency market views Pi’s long-term viability.

Conclusion

While it may still be a waiting game to withdraw, sell, or convert Pi coins, following the above steps can ensure you’re ready once Pi Network goes live on public exchanges. Complete your KYC verification, stay updated with Pi Network news, and keep an eye on websites like pitether.com for trading options and conversion guides. With careful preparation, you’ll be in a good position to manage your Pi coins effectively as the project matures.

0 notes

Text

How to use Binance, how to buy and sell Bitcoin and cryptocurrencies via P2P, Binance exchange lecture

youtube

0 notes

Text

Exploring Ethereum: Where to Buy and Invest

Ethereum has emerged as a leading cryptocurrency, captivating the attention of investors and enthusiasts alike. As the second-largest digital asset by market capitalization, Ethereum's unique features and growth potential make it an attractive option for diversifying their investment portfolios. If you're interested in buying Ethereum, understanding where and how to purchase this digital currency is crucial. This article explores various avenues for acquiring Ethereum and offers insights into making informed investment decisions.

Understanding Ethereum

Before delving into the purchasing options, it’s essential to understand Ethereum. Launched in 2015 by Vitalik Buterin and a group of developers, Ethereum is a decentralized platform that enables developers to build and deploy smart contracts and decentralized applications (dApps). Unlike Bitcoin, which primarily serves as a digital currency, Ethereum’s versatility allows it to support many applications beyond simple transactions, including decentralized finance (DeFi), non-fungible tokens (NFTs), and more.

Cryptocurrency Exchanges

One of the most common ways to buy Ethereum is through cryptocurrency exchanges. These platforms allow users to trade various cryptocurrencies, including Ethereum, for fiat currency (like USD) or other digital assets. When selecting an exchange, consider security, fees, user experience, and available payment methods. Most exchanges offer an easy signup process, allowing you to create an account, verify your identity, and link a payment method. Once your account is set up, you can buy Ethereum using bank transfers, credit cards, or other cryptocurrencies.

Peer-to-Peer (P2P) Platforms

Peer-to-peer platforms provide another avenue for buying Ethereum. These platforms connect buyers and sellers directly, enabling individuals to negotiate prices and payment methods. P2P platforms often have built-in escrow services, which add a layer of security to transactions. When using a P2P platform, checking the seller's reputation and transaction history is essential to ensure a safe purchase. This method can be particularly beneficial if you seek localized transactions or alternative payment options.

Crypto ATMs

Cryptocurrency ATMs are physical machines that allow users to buy Ethereum using cash or credit cards. These ATMs provide a convenient and straightforward method for purchasing digital currencies, especially for those who prefer to use something other than online exchanges. However, it’s essential to note that fees at crypto ATMs can be higher than those on exchanges, so it's wise to check the rates before proceeding.

Investment Platforms

For those who prefer a more hands-off approach to investing, certain investment platforms allow users to buy Ethereum without needing to manage the assets directly. These platforms enable you to invest in Ethereum through a managed fund, offering diversification and professional management. While this option may come with higher fees, it can be an excellent choice for those new to cryptocurrency or those who want to minimize their involvement in the day-to-day management of their investments.

Making Informed Investment Decisions

Thorough research is essential when considering where to buy Ethereum. Look into the exchange or platform’s security measures, user reviews, and the fees associated with buying Ethereum. Additionally, stay informed about market trends and developments within the Ethereum ecosystem. As with any investment, investing only what you can afford to lose and diversifying your portfolio to mitigate risks is crucial.

Buying Ethereum offers a unique opportunity to participate in the evolving world of digital currencies. Whether you choose a cryptocurrency exchange, a peer-to-peer platform, a crypto ATM, or an investment platform, understanding your options and conducting thorough research will help you make informed decisions. As you embark on your journey to buy Ethereum, stay vigilant and continuously educate yourself about this dynamic market to maximize your investment potential.

0 notes

Text

Why Should You Choose a Cryptocurrency Exchange Development Company?

Introduction:

As the world moves more to digital finance, cryptocurrency stands as an important participant in providing secure, decentralized, and unique means of conducting transactions. Due to the growing interest in decentralized virtual currency such as Digits, Bitcoins, and Ethereum, merchants are now considering the market for enterprise exchanges for digital currencies. Justtry Technologies is one of the top cryptocurrency exchange development companies aim to allow enterprises and start-up to develop highly secure and efficient trading platforms that cater to the increasing demand for digital currencies. Whether it involves a white-label site or a fully personalized platform, Justtry Technologies guarantees that companies can keep up today’s rapidly changing market.

Cryptocurrency Exchange Development: Why is it important for Your Business?

Cryptocurrencies became popular among businesses and investors, traders who sought reliable places to purchase or sell and trade cryptocurrencies. For the business, designing your own cryptocurrency exchange has its benefits – the additional income and the possibility to become a reference point in terms of blockchain solutions for your customers.

Justtry Technologies provides various kinds of cryptocurrency exchange software development that aid various businesses to succeed in the modern competitive market. Our solutions in the area of cryptocurrency exchanges including P2P, decentralized platforms or others are not only effective but also safe and legal at an international level.

Custom Cryptocurrency Exchange Development Services:

Our cryptocurrency exchange development services are unique to every client depending on the kind of company you run, whether new to the market or an already existing one seeking to venturing into the market for blockchain companies. Here are the key services we provide:

White Label Cryptocurrency Exchange Development: Want to get to market fast? We do offer ready-made white label cryptocurrency exchange solutions which enable you to launch your own branded exchange within the shortest time possible. These solutions are created independently of the brand and come ready made with the newest enhancements in security and scalability.

Decentralized Cryptocurrency Exchange Development: DEX has gained much popularity with the introduction of decentralized finance (DeFi). By contrast, the decentralized exchange (DEX) enables direct trading between users and does not hold user funds. At Justtry Technologies, we provide expert development services for decentralized exchanges that are secure and reliable for users.

P2P Cryptocurrency Exchange Development: P2P exchanges provide a possibility for users to buy and sell without involving third parties. These exchanges are conveniently designed for hopeful transparency and as such integrate business values that cherish user anonymity. The solutions being offered by our P2P exchange include measures to enhance the safety of the exchange.

Cryptocurrency exchange platforms

Here at Justtry Technologies, we know that it takes much more than mere engineering skills to create a successful Cryptocurrency exchange – it takes an understanding of the core of the blockchain and the peculiarities of the virtual currency world. That’s why all our platforms come with these key features:

Advanced Security Protocols: Security is the key to any kind of cryptocurrency exchange. Some of the features that we incorporate into your platform include; two-factor authentication (2FA), Account Data Encryption, and robust anti-money laundering (AML).

High Scalability: Our platforms are fully scalable to accommodate high frequency of transactions to support the growth of your exchange.

Liquidity Management: It is very important to have liquidity in any exchange to ensure every transaction is successful. In the Each of your exchanges that you have created, we put in place liquidity management measures to make sure you will always have enough money for trading.

Multi-currency Support: We create systems for numerous types of coins to ensure more options for clients and increase the number of people using your exchange.

Why Justtry Technologies for the Development of Cryptocurrency Exchange?

Being a leading cryptocurrency exchange software solution provider, Justtry Technologies has accumulated all the experience in blockchain, software, and security services. We are not just developing an exchange but want to design a solution that is safe, can grow with our clients and is easy to use. Here’s why you should choose us:

Tailored Solutions: You won’t see us perpetuating the cookie-cutter model of organizational change. Whether you require a white label solution, or a completely bespoke exchange, we build platforms to your specification.

Blockchain Expertise: With several years of experience in blockchain technology, our team provides you with a product based on the newest technology innovations.

Security First Approach: It goes without saying that security is paramount in the realm of digital finance, so it is of great importance for us to ensure high levels of security throughout all the platforms we are creating.

End-to-End Services: Our services include the conceptualization of exchange and help you choose the most suitable platform as well as services that can help you manage and update your exchange even after the launch.

Cryptocurrency Exchange Future

The cryptocurrency market is emerging, and the need for secure, fast, and easy to use stock exchanges will only continue to rise. Given the new trends in decentralized finance (DeFi), there will be even more demands for decentralized cryptocurrency exchange development. Working with Justtry Technologies means that you make sure you are equipped for these trends with a platform that was designed for the future.

#cryptocurrency exchange development#cryptocurrency exchange development services#white label cryptocurrency exchange development#cryptocurrency exchange development firm#p2p cryptocurrency exchange development#decentralized cryptocurrency exchange development#cryptocurrency exchange development companies#cryptocurrency exchange development agency

0 notes

Text

USDT Quick Purchase and BTC Exchange Guide

With the popularity of digital currencies, more and more people are paying attention to and trying to invest in mainstream digital currencies such as Bitcoin. In order to help everyone purchase Bitcoin more conveniently, we will provide a detailed introduction to the process of using the CoinMapAi platform to purchase USDT and exchange BTC through shortcuts, while also highlighting our advantages and features.

Advantages of CoinMapAi platform

Safe and reliable: CoinMapAi collaborates with multiple well-known banks and payment institutions to ensure the security of funds and provide comprehensive transaction protection. Convenient and fast: Provides a one click quick way to purchase USDT without the need for cumbersome registration and verification processes, simplifying the purchasing process. Diversified trading: supports multiple digital currency transactions to meet the needs of different investors.

Visit the CoinMapAi platform and register an account. Bind bank card or third-party payment platform. Enter the quantity and price of BTC you want to purchase. Choose USDT as the exchange tool. Confirm purchase and complete payment. Wait for transaction confirmation to receive BTC.

We invite you to consider the advantages of CoinMapAi and share them with your friends and colleagues. Any user who registers through your link will receive generous promotion rewards. At the same time, recommending users to successfully purchase BTC will also have additional rewards waiting for you!

In this increasingly popular market for digital currencies, CoinMapAi is committed to providing secure, convenient, and efficient digital currency trading services. We believe that through our platform, you will find it easier to achieve your investment dreams in mainstream digital currencies such as Bitcoin. Come join us and explore the charm of digital currencies together!

Use the shortcut to purchase USDT and exchange it for Bitcoin (BTC)

Step 1. Click to purchase cryptocurrency and select a card

Step 2. Enter the amount of Bitcoin (BTC) you want

Step 3. Click on P2P purchase

Step 4: Click on the transaction, search for Bitcoin (BTC) and purchase its token.

0 notes

Text

Bitcoin Leads as Most Adopted: India Triumphs, US Lags Behind – Chainalysis Insights

Key Points

India and Nigeria lead global crypto adoption, despite regulatory hurdles and high trade taxes.

Bitcoin ETFs have significantly spurred BTC activity worldwide, driving growth in high-income regions.

The fifth annual Chainalysis Global Crypto Adoption Index report has been released, revealing valuable insights into grassroots crypto adoption worldwide.

The report, which covers data from Q3 2021 to Q2 2024, has introduced a refined methodology that focuses on DeFi activity and excludes P2P cryptocurrency exchange trade volumes.

Chainalysis Crypto Adoption Report

The latest findings show India and Nigeria leading in global crypto adoption, with Indonesia emerging as the fastest-growing market.

Despite a challenging legal environment and high trade taxes, India has maintained its position as the global leader in cryptocurrency adoption for the second consecutive year.

The country has been operating under stringent regulations since 2018, including recent actions by the Financial Intelligence Unit (FIU) in December 2023. However, these regulatory measures have not discouraged Indian investors from participating in the global cryptocurrency market.

US Crypto Adoption

In contrast, despite significant media attention, the United States only ranks 4th in global crypto adoption, falling behind India, Nigeria, and Indonesia.

However, the report noted that the launch of the Spot Bitcoin (BTC) ETF in the United States has significantly spurred BTC activity worldwide, leading to substantial growth in institutional transfers and high-income regions like North America and Western Europe.

Bitcoin Dominates

As expected, Bitcoin has emerged as the most popular cryptocurrency and a key driver of crypto adoption.

From the surge in interest around Bitcoin ETFs to its growing relevance in political discussions, BTC consistently attracts attention and impacts the broader crypto market.

0 notes