#or a lump sum of 10k

Text

haha my old slumlord is demanding 12k for home repairs but this bitch ain’t had us on a lease for two years and that house was crumbling long before we moved in

get fucked my guy I’ll see you in court

#he actually billed 17k#but was so reasonable he was willing to take 12k#or a lump sum of 10k#I’m actually trying to stave off an anxiety spiral abt this but I’m pretty sure he has no legal ground here#he also missed the deadline after our move out to do an inspection and present us with a list of damages#he ALSO did not have air or heat in the house and we had to use RV heaters in the winter#the air was a window unit shoved into a hole in the wall#this asshole surprised he has to spend money on his house from the 40s#I very much cannot afford a lawyer and this is. taxing on already high anxiety levels#but such is life#text post#personal post

4 notes

·

View notes

Text

GOD I wish I could afford fun things.

#I will never not hate the fact that if I were handed 10k it'd be blown on necessities instantly#I can't even fantasize about being given a lump sum because it wouldn't be fun#like wyd with 10k. um#fix my life??#can we talk about the like 3rd 10k in a 30k gift instead lmfao

3 notes

·

View notes

Text

Oof... lot of stupid just kind of stressful dreams

Would not have minded the one where I fifty million dollars being real though. Could have spent like five mil max on doing work on the house and like helping some people out around here, and then had the rest put in the hands of an accountant to shepherd for me till such time as I maybe wanted to invest some of it in a business or something

Despite what my grandfather used to say of "you can't live on a million dollars anymore" (as if he knew)... like fuck you can't, particularly if you already have a house

Oh that would have been nice

#sometimes I see a post for someone who needs teeth surgery on here like really severe whole mouth stuff#and I could have been like 'poof it's done'#many people could be put into a significantly better situation for about 10k lump sum#which with 50 mil... yeah... I could have afforded to do that for a lot of people

0 notes

Text

Could Mr. Bennet have saved money for his daughters?

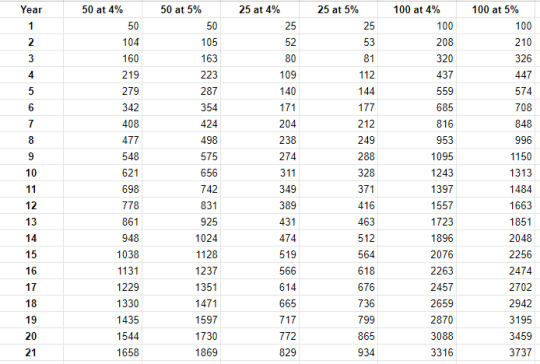

I am the sort of person who hears that girls would have so many thousand in their fortunes (JA never uses the word “dowry”, fun fact) and I cannot understand how someone with £2000/year makes a £3000 pound lump sum for their daughter. Because my brain doesn’t math very well inside itself. So I made up some tables to see what Mr. Bennet could have done if he was prudent.

First, let's be realistic, how much can they save? I am giving three different scenarios, £25, £50, and £100 per annum per daughter. £100 each I think might be a little high, since their income is £2000 a year, that would be 25% of their income! I think £50 is well within reason, that would be only £250 per annum and therefore 12% of their income.

I did both 4% and 5% interest. These are both government bonds. I know that both are mentioned in Jane Austen’s works. The 4% might be safer and a better investment for a dowry. But there isn’t a huge difference. Anyway, here is Jane’s dowry, over 21 years:

Even if they saved only £50/year, Jane now has almost £2000 as a dowry. It’s not the £10k worthy of a baronet, but that is certainly a good start!

If the Bennets tried hard and save £100 per year, she has almost £4000, which is what her mother brought to the marriage. Even the modest £25 per year would give the girls £1000 each by their 21st birthday, which if their father died would be combined with the £1000 stipulated in the marriage articles and give them a comfortable income. Even John Dashwood acknowledges in Sense & Sensibility that increasing his half-sister’s fortunes from £1000 to £2000 would make a big difference in their comfort (and then he doesn’t do it because he and his wife are the worst).

An alternative plan would be to put aside the £4000 that Mrs. Bennet brought into the marriage and only reinvest that income. It does seem that the mother’s money was often locked up in a “life interest” and then given to the children, which is true for the Bennets as well. Just saving the initial £4000 and never adding to it except re-investing the income would have yielded around £11,00, or £2200 for each daughter.

Also, I really want to know how the son plan would have worked in the first place. Like Mr. Bennet Jr. is going to agree to break the entail and sell off a bunch of his inheritance, when he could just keep the entail and then get the whole pie? Or was the plan just to burden his own son with the care of a mom and five sisters? Not clear. Probably also a bad plan.

#pride and prejudice#mr. bennet#save some money for your daughters#jane austen#I know it takes like a tiny amount of effort#but I believe in you#except I don't because you didn't do any of this#Mr. Morland did more with a small income#this was like Mr. Bennet's one job#and he totally failed#not even a basic emergency fund

380 notes

·

View notes

Note

which would you prefer if given the choice, 10k a year for 10 years or 100k in a lump sum & why?

100k because I’ll invest in my money and make more..

1 note

·

View note

Text

"If the government gave everyone money, the prices of everything would go up" just do it in secret. Everyone making under a certain amount gets a lump sum 10k and we just don't tell the landlords. They'll never know.

0 notes

Text

Two 50 million Tether (USDT) transactions have been transferred from Bitfinex to the “Tether Treasury” address, according to transfer receipts from Whale Alert. Both transactions took place on Oct. 2, 2023, two minutes apart. The first lump sum of 50 million USDT occurred at 9:43 am UTC and was worth $50,039,125. The second was at 9:45 am UTC and was worth $50,038,875. According to data from CryptoQuant, stablecoin holdings in exchanges have steadily declined over the past year, beginning around November 2022. Stablecoin holdings on exchange reserves 2023. Source: CryptoQuantBefore the decline, around the beginning of 2021, stablecoin holdings on crypto exchanges hit a new all-time high (ATH), with coins like USDT flooding in. These new market conditions have spurred comments from the crypto community on X (formerly Twitter), who have responded to the massive transfers by calling them a “pump.” This refers to pumping a stock or a specific token to entice investors toward purchasing that particular asset. However, on Sept. 29, the market intelligence platform Santiment posted about the market trends, including a remark that Tether “sharks and whales” are gaining buying power, which it said is “generally a bullish combination.” #Bitcoin's sharks & whales, which we define as 10 to 10K $BTC wallets, have now accumulated to their highest amount held in 2023 (13.03M $BTC). Additionally #Tether sharks & whales are accumulating buying power. This is generally a #bullish combination. pic.twitter.com/dIcq1sUNJY— Santiment (@santimentfeed) September 28, 2023

According to Cointelegraph’s own analysis, stablecoins have been experiencing a 17-month decline, with investors moving to more traditional assets.This comes as the Federal Reserve in the United States, a place that has already had a rocky relationship with stablecoins, on Sept. 28 called the assets a potential “source of financial instability.” It said that its findings show that, “stablecoins are vulnerable to runs during periods of broad crypto market dislocation as well as idiosyncratic stress events.”This asset type has also been a major talking point for officials in lawsuits plaguing the crypto industry. In the Securities and Exchange Commission (SEC) vs. Binance case, the stablecoin issuer Circle (USDC) recently argued that stablecoins are not securities. Despite this Tether has seen a rise in Tether-based stablecoin loans in the year 2023.

0 notes

Text

6/19/23

238.0

In: Adderall, Wellbutrin, McDonald’s large vanilla iced coffee (230), pizza rolls (420), ranch (140) 790

Out: 10,274 steps. Fitbit says -2816

Total: -2026

Today:

I woke up feeling awful. My whole body aches. I hate this adjustment part. If I want to stop going through it the only answer is to stop giving up and just keep going.

I got the coffee to hopefully help the aches. I feel like I got hit by a car… I’m going to need some Tylenol if it doesn’t work. I can’t spend my day feeling like this. Ughhh.

Also have a stuffy nose. Did I mention I hate this adjustment part?… ugh.

Can’t give in. Can’t stop. Won’t stop. I’m too obese to be having these side effects of… “eating less”.

Edit:

It’s 9pm. I stopped feeling terrible about an hour after I made that update.

I had a pretty chill day.

Got 3 hours of overtime for work! Pretty excited about that.

My daughter is insisting I lay with her until she falls asleep (she’s 6) so I’ll finish my 10k steps later.

I can’t believe I’m not even the tiniest bit hungry.

— just venting about life and money for the rest of this so skip if you want —

Since I worked 3 hours over I didn’t get any crocheting done today. I’m not happy about that. But maybe I can get something made before I go to bed tonight. Not many more days until the craft show. Plus my stores aren’t selling much at all because they are so empty. I need to worry about the stores more than I do the shows. Idk why I don’t.

Today I spent a while looking on Zillow for houses. Problem is… idk where I want to live. Since my job is remote I can literally move anywhere I want to. But.. I can’t afford the houses I want in the areas I want to be in lmao. I thought about moving back home (an hour and a half away) but my kids dad just moved down here to be closer to them and he’s been helping out SO much I’d hate to mess that up. I do want to be down here. I do Not want to stay because of him or move closer to him. I do like it around here. I’ve only lived her for about 18 months. I do not feel safe in the part of the city I live in and we definitely have outgrown a 3bedroom apartment. Myself and an almost 14 year old son, 10 year old son, 8 year old son, and 6 year old daughter. Right now I have my room, the 14 and 10 year old share a room, and the 8 and 6 year old share a room. But the 14 year old NEEDS his own room. Puberty and all that. So I’ve been looking for a 4 bedroom for us. Moving to another apartment or rental is not an option unfortunately.

I either need a huge increase in income or I need a lot more saved up than I have currently to afford a 4 bedroom around here in a better part of town/the city.

I think that’s why I worry so much about the shows. It’s a lot of money in 1 day instead of a steady way lower amount of money monthly.

I need the steady. But I also want the lump sum to throw into savings faster.

I need more hours in the day.

My work did tell me today I can get up to 10 hours of overtime per week if I want them until they tell us differently. I could definitely use that extra $270/week! Hopefully I’ll stay disciplined enough to throw all the extra in savings. We will see I guess. I’m bad about wanting to throw it on credit card debt, which isn’t bad, but i really need it in savings right now.

I guess I’m more stressed about that than I realized. Damn.

I did find a house back home I could easily afford and it has everything we’re looking for. But. It’s back home.

I think I need to see a therapist again. For the first time in my life my anger is starting to get out of control. I’ve never been an angry person. But it seems like I go from a 3 to a 10 in a finger snap lately. I’m worried what that’s doing to my kids learning/development. I don’t want them to have any more anger issues than they already do… I really really need to work on it and I need some strategies and help. I had to give up therapy when I moved here. I miss my old therapist. I don’t think she’s still working there though, I looked her up on fb (I already know 😂) and it says she works at the school system now. I thought about texting her and just saying hey but I realized I only have her work cell number and it might not still be her number. I would be absolutely crushed if I texted it and someone wrote back they weren’t her. Idk.

Well I think my daughter is asleep now. Off to do 7.2k steps I go!

0 notes

Text

Homes For Sale San Antonio

Choosing an actual property professional/counselor continues to be an important a half of this course of. Many households reside Downtown and residents are inclined to lean liberal. The population of renters on this neighborhood quantities to 70%. The typical home worth in Downtown San Antonio is $581,232 and home values have gone up 17.4% over the past 12 months. The common rent for a 1-bedroom house in Downtown San Antonio, San Antonio, TX is currently $1,500, and the average lease price for a 2-bedroom apartment for rent in Downtown San Antonio, TX is $2181.

Demand would raise the price of your San Antonioinvestment property and you want to be able to flip it for a lump sum profit. The neighborhoods in San Antonio must be safe to stay in and should have a low crime fee. The neighborhoods must be close to basic amenities, public services, colleges, and shopping malls. The average family in San Antonio has 2.8 people while the U.S. family has 2.6. These stats characterize a neighborhood that's youthful and has more kids than common. San Antonio’s quickly growing economic system implies that most of the youngsters born right here will stay right here, fueling the San Antonio actual estate market for one other generation.

It was the smoothest transaction I’ve ever accomplished, and I’ve accomplished about 5 homes in my lifetime. I was ready for extra paperwork, but none ever got here. You may be eligible for up to a $10k cash advance. Fill out our form or speak with a Sundae local expert to search out out if Sundae is an efficient match for your property. The email account is assigned with two different roles. Enjoy the advantages of a single-family home now and determine later.

This article aimed to coach buyers who're eager to spend cash on San Antonio actual estate. Purchasing an funding property requires plenty of examine, planning, and budgeting. We always suggest doing all of your analysis and taking the assistance of a real estate investment counselor. This is a diversified community, with homes representing a variety of periods and kinds. In basic, homes in Oakland Estates are about $135,000 – $750,000 and sit on 2-acre lots with four bedrooms and three bogs. It can be an excellent space for rental property funding as more than 85% of the inhabitants contains renters.

The San Antonio-New Braunfels Housing Market Area encompasses eight counties in south-central Texas. The principal metropolis of San Antonio, the seventh most populous in the homes for sale san antonio tx United States, is in Bexar County. The metropolis of New Braunfels, in Comal and Guadalupe Counties, is 30 miles northeast of the city of San Antonio.

Home Partners' Lease Purchase and Choice Lease applications are supplied and administered by Home Partners Holdings LLC. Resident and property should meet eligibility criteria, that are topic to alter. Resident must qualify for a mortgage from a third-party lender or pay the acquisition value in cash to train the right to buy a house. Home Partners isn't a mortgage company, does not present financing for a resident to buy a home, and can't guarantee that a resident will have the ability to get hold of a mortgage mortgage. ©2022 Home Partners Holdings LLC. All rights reserved. HOME PARTNERS, HOME PARTNERS OF AMERICA, CHOICE LEASE, the Home Partners of America emblem and A NEW PATH TO HOMEOWNERSHIP are Reg. You can work together with your agent, or we’ll join you with one.

This neighborhood is ideal for those looking for single-family homes. Investing in San Antonio's actual estate is often a worthy funding due to a gradual price of appreciation. It’s only sensible to consider how one can and must be investing your cash. There are many explanation why the San Antonio actual estate market is going homes for sale san antonio tx strong today and is for certain to remain robust for years to return. San Antonio is a fast-growing city that literally can't sustain with the inhabitants progress, maintaining rental rates and property values excessive. Redevelopment on the south side and as land use shifts creates alternative.

You would possibly encounter some inspiring, foolish or, merely put, interesting content that's price sharing with the world. Thankfully an Instagram page called @zillowgonewild has received you covered with must-see Zillow listings in a single place. So, pandas, we current you with these unique locations within the hopes that seeing them will revive your internal baby new homes san antonio and make you have a look at housing a bit extra creatively. From huge villas to literal mancaves, you'll find it all. The median DFW home price in October was $394,900, up 12.3% from October 2021. But the $394,900 median final month was down from the $399,000 median worth in September and the $405,000 median in August, according to the latest Re/Max National Housing Report.

This lovely 5 beds 3.00 baths house is situated at Cobbles Loop San Antonio, TX and listed at $436,000 with 2716 sqft of dwelling space. Monthly fee amount doesn't embrace property taxes, owners insurance or monthly mortgage insurance and subsequently shall be higher. The principal and interest fee is based on an interest rate of 6.5% and APR of 3.94%, 30-YR Fixed FHA loan with three.5% down fee. Credit terms are based on credit score and current market, rates may vary. Income and/or geographic restrictions might apply to completely different loan choices including $0 down financing.

0 notes

Text

ABSLI Assured Income Plus offers long term regular income for 20, 25 & 30 years with lump sum option. Get ₹47.16 lakhs guaranteed benefit @₹10k/month*.

0 notes

Text

Advice Appreciated!

Hey, we're in the US (Texas) and will be applying to college very soon!

We want to go into geological or planetary sciences, research based.

What are some good colleges? What comes to mind for people?

We have a 1490 SAT and a 4.0 weighted gpa, so I think we're pretty good?? But our school is very small and we're not top 10%, luckily our school does not rank if you aren't top 10%.

However, we can't expect any financial aid because our parents make too much(~180k). They also refuse to pay for college, wanting us to work for it like they had to. We are going to receive a lump sum of 80k at 18 and we can't ask for any more after that.

I'm very worried about cost because I'm finding that good school are about 30k a year and I'm unsure if we can earn 10k during a school year without massive grade drops. I should be good for grad school because you can be declared independent then.

Does anyone have any advice at all? Is there something I can do? Affordable research schools people know of?

Any and all help is appreciated!

#college#geology#school#advice#please#applications#research#science#rocks#fossils#paleontology#financial aid

73 notes

·

View notes

Note

Hi bitches! I was wondering, what are the circumstances where it’s a good idea to pay cash for a large purchase (like a car or a house) as opposed to getting a loan, assuming you have that much money? Thank you!!

When you've weighed the opportunity cost of giving up that large lump sum!

If you have $20k, and you want to spend $10k of that on a car so you don't have to pay interest on a car loan... that's a pretty safe decision!

If you have $10k, and you want to spend $10k on a car so you don't have to pay interest on a car loan... that's a risky decision!

You never want to wipe out 100% of your cash reserves. Emergencies and unforeseen shit happens all the time, my lamb!

You Must Be This Big to Be an Emergency Fund

On Emergency Fund Remorse… and Bacon Emergencies

But now let's talk about ROI! If the stock market is currently crushing it and returning 8% interest, and you have the opportunity to get a loan on that $10k car for only 2% interest, you could make MORE money by investing your $10k than you'll pay in interest on the car loan. But that also depends on your tolerance for debt and risk. More here:

Investing Deathmatch: Paying off Debt vs. Investing in the Stock Market

Season 3, Episode 2: "I Inherited Money. Should I Pay Off Debt, Invest It, or Blow It All on a Car?"

76 notes

·

View notes

Text

Most frustrating thing happened a few days ago this debt collector called and was like “u owe ur university 14k” and i was like “ok” and my mom wanted to know the settlement amount so we could at least have a dollar amount to know the minimum amount and to see if i could put aside some from some checks so we could pay it in a lump sum in like a year or something and she was going to PARTIALLY help (partially is keyword here) and so we asked and it was 10k thats not doable and they know that and the debt collector on the phone was like “just ask ur parents to pay it” and that made me so mad i just hung up and my mom asked why and i told her why and she was like…what an ignorant thing to say and i was like well yeah and she was like who just has 10k to do that with and i was like i have no idea and i would never even ask my mom for 10k cause what the hell lmao like she dont got that i dont got that it was just like…u gotta be way outta touch to just ask someone that and the partially thing was like since she make more than me she could put some aside in a fund as well so we could like pay it off later im just like ajdndnd

9 notes

·

View notes

Note

cracks me up that people think jedi are like... rich?? the whole jedi thing is seriously about not pursuing material possession, like sure, they have some personal things, but they're.... not wealthy! if i remember right most of what the order have is essentially donated by the republic? they might have a fancy temple but that's pretty much been built and maintained and improved over millenia, probably by the order itself? do we ever actually see jedi handle money outside of missions? lol

THIS IS ONE OF THOSE THINGS THAT IS FOREVER BOTH FRUSTRATING AND HILARIOUS THAT WE DON’T KNOW MORE.I kind of get where the idea comes from, they live in a beautiful Temple that’s pretty huge (it’d have to be to house 10k+ people) and they do live on the surface of Coruscant, which is where most of the rich people live, so it feels like the Jedi must be rich, too, right?But you’re exactly right--that Temple has been there for a millennia, it’s not like they came to Coruscant a hundred years ago or whatever and said, “Buy us the fanciest place you have!” That’s been their home for thousands of years!Further we have no idea how much money the Jedi have, as an institution or on a personal level! We don’t know how their money is budgeted, if they get a lump sum from the Republic and internally do as they wish with it or if they have to itemize everything and submit a budget report!It’s never said directly (as far as I’m aware) that they get their money from the Republic, but I can’t imagine it would be anything else, given that they are under the jurisdiction of the Senate and have been granted a certain amount of legal authority to do their jobs as part of the Republic peacekeepers.Yet we don’t know if individual Jedi are given stipends to do what they want with or if they just make withdrawals from a central account and are trusted to be reasonable with it, we don’t know if they put in a requisition for something they want or if they go buy it themselves or what.We see that Jedi don’t really have a ton of possessions (and most of them don’t seem to really need or want them), but they do have some. Part of this is an animation budget issue (things are hella expensive to animate and the animated shows were not spending the kind of money the movies were!), but we see the shrine in Barriss’ room, we see the plants in Depa’s room, we see Anakin with the posters and lamps and crates and droid parts and workshop table in his room, etc. How were those things paid for? We have no idea! I think one of the big things that makes the Jedi seem rich is that they don’t worry about money, like if you’re not worrying about money, then you must be rich, that’s kind of how everything else in the galaxy operates. And we see them on these huge, expensive ships that are called Jedi cruisers, we see them with Jedi starfighters in their hangars, we see their Temple is beautiful, we see them not worry about how to pay for things, we see them plunk down credits on missions without worry, and we think, oh, they must have a lot money.But we know nothing of where that money comes from or how much of it there is or even how much the Jedi individually really have a strong sense of money, given that they seem to be strongly a communal culture, rather than an individual one. And we do know that those giant expensive cruisers are the Republic’s, not the Jedi’s. And who knows about the starfighters, if they’re budgeted for the Jedi or if they’re funded as part of the war.We have no idea how much money the Jedi have as an organization or as individuals, we have no idea how much they’re just like “lol how does money work I have no idea!” versus “the Force will provide, money is useful, but not something I should twist myself into knots over” versus “we have enough to do what we need to do so we don’t worry about it”.IT’S SO FRUSTRATING, I WANT TO KNOW THESE NERDY DETAILS, STAR WARS, PLEASE TELL ME ABOUT JEDI BUDGETARY DIVISIONS AND HOW MUCH THEY HAVE AND HOW THEY GET IT AND, OKAY, IT’S KIND OF HILARIOUS HOW LITTLE WE KNOW, BUT ALSO TELL ME ALREADY

262 notes

·

View notes

Text

10 Ways to Successfully Use Influencer Marketing by Julian Shapiro

Influencer marketing is expected to hit $13.8B in 2021, according to a recent report. This is an increase from $9.7B in 2020. With companies large and small seeing major returns from influencer campaigns, here's a cheat sheet for founders on successfully utilizing influencer marketing.

1. Seek relationships with fast-growing influencers: They'll likely charge less than inflated, slower-growth accounts, and they’ll get you in front of their rapidly growing audiences.

2. Work with creators, not "influencers:" Creators are craftspeople. They are writers, photographers, artists, etc. They put more value into the content they create than legacy social media celebrities do.

Simply put, they care more about the quality of their craft than their follower count, which can mean more engagement and commerce.

3. Seek long-term relationships over one-off campaigns: Brands that are repeatedly shown to an influencer's loyal following build deeper affinity over time.

Find influencers who want to be a true representative of your brand. This leads to more consumer trust in the long run.

4. Start with nano- and micro-influencers: Most startups should start with nano- or micro-influencers rather than macro-influencers. What's the difference?

Nano: ~10k followers or less

Micro: ~10-100k

Macro: 100k+

As influencers grow, their audiences become more diverse. When this occurs, it's harder to deliver personalized messages, which causes a decline in engagement and conversion.

Influencers with smaller followings are more accessible and trusted than their celebrity counterparts. You’ll also get better targeting (higher conversion) for a lower fee since they have less reach.

5. Create campaigns aligned with your influencers' values: Brands that win with influencer marketing have figured out that they get a higher ROI when they create campaigns that make their influencers feel like they're promoting themselves. Here's how:

Start small: Run giveaways with your influencers. Let them provide value (free product) to their audiences.

Then scale: Create products with your best, long-term influencers. They're brand ambassadors. Run a collaboration. Get them to invest in your brand.

6. Offer creative control: Rather than providing word-for-word scripts, give influencers creative control over content.

Why?

The content needs to be authentic.

The influencer knows what resonates with their audience. Their creativity and perspective can mean a better chance of going viral and getting good engagement.

7. Use a hybrid pricing model: Brands are tired of wasting money on campaigns that lack a clear return, so some are moving away from paying lump sums for creator posts.

Instead, they compensate influencers based on the conversions they drive (like an affiliate model).

It doesn't have to be one or the other, though. Try a hybrid approach:

Pay some money upfront for the creator's content.

Then, also pay a percentage of each sale that comes in through their affiliate link.

This can lead to long-term, win/win influencer partnerships.

8. Influencer marketing = designing a community: You’re working with humans, not dashboards.

Each influencer is a relationship. Put in the work to find the right influencers. Once you find great long-term influencer partners, incentivize them to activate other great influencers.

Here's how:

Create a referral system for them to sign up other influencers.

Give them a percentage of sales generated by influencers they activate.

9. Know when to gift: Gifting = sending influencers products for free.

This often works best for nano-influencers who usually aren't "full-time" influencers. If they like your product, ask them to post about it.

Brands get low-cost exposure since their cost is inventory (not cash).

10. Use a survey to improve attribution: Attribution is notoriously difficult in influencer marketing.

You can try to see how much traffic/sales come in through influencers' URL or discount codes. But this doesn’t always tell the whole story. People may hear about you from an influencer but decide to purchase later.

The workaround?

Add a post-purchase attribution survey. Figure out how many people first heard about you from an influencer.

Do you work with influencers? What are some of your best tips on building relationships with the right people to represent your brand?

5 notes

·

View notes

Text

the past year has permanently upended my sense of money like i way surviving paycheck to paycheck for years and so did my parents so. going from working seasonally with a brutal dead season, living in broke hell, i've been weirdly comfortable this past year bc of unemployment/stimulus payments/student loans but honestly what happened is i've been so depressed that with the safety net of the eviction moratorium, i just stopped paying rent or applying for unemployment bc i had plenty of money for more immediate financial shit. so now i'm just trying to fix this nightmare i've ended up with (and i think it's okay now! i think rent is good). having a lump sum of $10k in my savings account to live on at one point or ending up with $13k in debt. randomly getting direct deposits for thousands of dollars out of nowhere. i made $27k last year and it was insane like i felt so rich. that's not very much money at all but i could buy whatever tf i wanted like i bought $200 docs and spent hundreds on ordering food. it's just weird bc i worked and rented for two years and the deep bitterness i felt that whole time makes sense because i was being deeply exploited. lmfao i think money is relative --- like obv you hit adulthood and things start getting expensive fast but also maybe you start making more and your whole perception changes. on the other hand i'm still reeling at these articles i saw when car shopping that were like CARS UNDER $20K TO BUY YOUR 16-YEAR-OLD BRAND NEW DRIVER. that's insane to me like my family would never, period, certainly not for a teenager :/ it's fucked that people have that kind of money. asdfghjk i don't feel poor but reality is shocking

1 note

·

View note