#online income tax return file

Explore tagged Tumblr posts

Text

Our ITR Filing Plan Starting from for salaried person rs749 but now we offer only rs 499 , offer valid only 21 july 2024 so hurry up file your ITR with taxring Why choose taxring read Description Click here to choose the plan that suits you best! https://taxring.com/service/top-plan…

File your ITR with TaxRing and enjoy:

- Easy and quick filing process - Expert assistance from our team of CAs - Maximum refund guaranteed - Filing for last 3 years' returns - Tax planning and consultation - Refund claims and follow-up

Don't wait, file your ITR now and avoid unnecessary penalties and fees!

whatsapp now - +91 9711296343

Visit us - https://taxring.com

#itr filing#taxring#income tax#taxation#itr#taxes#taxation services#itr filing last date#itr filing for fy 2023-24#income tax filing#income tax calculator#income tax department#income tax return#income tax notice#file itr#capital gain#file itr for salaried#file itr for business#itr filing online#return filing

2 notes

·

View notes

Text

The year 2025 brings significant updates for individuals and businesses navigating their income tax and GST obligations. Staying informed about changes in filing deadlines and compliance requirements is essential for ensuring smooth financial operations and avoiding penalties. This article covers the latest developments in income tax return filing, GST registration, TDS filing online, and GST return filing, while highlighting their advantages. Read.

#legal services#tax#legal#Income Tax Return Filing#income tax return filing for salaried person#GST Registration#advantages of gst registration#GST Return Filing#file gst return#tds return filing#tds filing online

0 notes

Text

Everything You Need to Know About E-Filing Your Income Tax Return

Filing income tax returns (ITR) is a crucial annual obligation for every taxpayer in India. The process has been significantly streamlined with the advent of online filing systems, making it more convenient and accessible than ever before. Here’s a comprehensive guide to help you navigate the online ITR filing process seamlessly.

0 notes

Text

Simplify GST Return Filing with Licit 360: Your Trusted Partner for Tax Compliance

Navigating the complexities of tax filing can be overwhelming, but Licit 360 is here to simplify the process for you. Whether you need to Simplify GST Return Filing with Licit 360, File Your Income Tax Returns Online, or require TDS Return Filing Services in Indore, we provide a seamless experience. Our comprehensive services also enable you to File Your PF Returns Online and manage SIC Return Filing Online with ease and efficiency.

Why Choose Licit 360 for Tax Filing Services?

Licit 360 is your one-stop solution for all tax-related services, offering a user-friendly platform designed to cater to individual and business needs. Here’s why you should trust us:

Expert Assistance: Our team of experienced professionals ensures accurate and timely filing of your GST, income tax, TDS, PF, and SIC returns.

Time-Saving Solutions: We streamline the filing process, reducing paperwork and saving you valuable time.

Affordable Services: Our pricing is transparent and competitive, making tax compliance accessible for everyone.

Secure Transactions: We prioritize data privacy and ensure your sensitive information is secure.

GST Return Filing Made Easy

Filing GST returns can be complex, but Licit 360 simplifies the process with its intuitive platform. We ensure compliance with the latest regulations, helping businesses avoid penalties and focus on growth. Whether it’s monthly, quarterly, or annual GST filings, we’ve got you covered.

File Your Income Tax Returns Online

With Licit 360, filing income tax returns has never been easier. Our platform guides you through every step, ensuring accurate calculations and prompt submission. Whether you’re an individual or a business, we help you maximize your tax benefits while ensuring compliance.

TDS Return Filing Services in Indore

For businesses in Indore, managing TDS returns can be challenging. Licit 360 offers expert TDS Return Filing Services in Indore, ensuring timely and error-free submissions. From preparing TDS statements to filing returns, we handle it all.

File Your PF Returns Online

Stay compliant with Provident Fund regulations by filing your PF returns online with Licit 360. Our platform simplifies the process, ensuring accurate submissions and timely compliance, so you can focus on your core business activities.

SIC Return Filing Online

Social Insurance Contribution (SIC) returns are critical for businesses and employees. Licit 360’s SIC Return Filing Online service ensures that your contributions are accurately reported and filed on time, avoiding any legal complications.

How Licit 360 Works

Sign Up: Register on our platform and provide your basic details.

Upload Documents: Upload the necessary documents securely through our portal.

Review and Submit: Review the prepared returns and submit them online with our assistance.

Stay Compliant: Enjoy peace of mind knowing your taxes are filed accurately and on time.

Get Started with Licit 360 Today!

Simplify your tax filing process and stay compliant with Licit 360. Whether you’re an individual taxpayer or a business owner, our tailored solutions ensure that your tax filing needs are met with precision and ease.

#GST return filing services in Indore#TDS return filing services online#income tax return filing online

0 notes

Text

A tax audit is an official evaluation of an individual’s or organisation’s financial records to ensure their tax returns are correct and by the law. While “audit” may sound intimidating, it’s important to understand that audits are frequently regular operations. Understanding the fundamentals can help you remain prepared.

#Income Tax Return Filing Services#Income Tax Return Registration#Income Tax Efiling Online India#ITR Online Registration

0 notes

Text

Filing your income tax return may seem difficult, but it goes much more smoothly if you avoid common blunders. Unknowingly, many people commit mistakes that result in fines, delays, or even additional expenses. If you are among those people who make mistakes while filing income tax returns, get professional help from Eazy Startups and make Income Tax Return Filing Online in India hassle-free.

#Income Tax Return Filing Online in India#Income Tax Return Filing Online#Online Income Tax Filing in India#Online Income Tax Filing#Income Tax Return Filing#Howrah#India

0 notes

Text

How to File Your Income Tax Return Online Quickly

Filing income tax returns (ITR) is a crucial annual obligation for every taxpayer in India. The process has been significantly streamlined with the advent of online filing systems, making it more convenient and accessible than ever before. Here’s a comprehensive guide to help you navigate the online ITR filing process seamlessly.

Why File Income Tax Returns Online?

Online filing offers several advantages over traditional paper filing:

Convenience: File from anywhere, anytime, reducing dependency on physical visits to tax offices.

Accuracy: Built-in validation checks minimise errors, ensuring your return is filed correctly.

Speed: Instant acknowledgement and quicker processing by tax authorities.

Security: Data encryption and secure authentication protocols protect your personal and financial information.

Steps to File Income Tax Return Online

1. Preparation: Gather Documents and Information

Before you begin, ensure you have the following:

PAN: Permanent Account Number

Form 16: Issued by your employer, detailing your income and tax deducted at source (TDS).

Bank Statements: Statements showing interest earned on savings accounts and fixed deposits.

Investment Proofs: Details of investments eligible for deductions under Section 80C, 80D, etc.

Other Income Documents: Any income from house property, capital gains, or other sources.

2. Choose the Correct Form

Select the appropriate ITR form based on your income sources:

ITR-1 (Sahaj): For salaried individuals with income up to ₹50 lakh, one house property, and income from other sources.

ITR-2: For individuals and HUFs having income from more than one house property, capital gains, etc.

ITR-3: This is for individuals and HUFs with income from business or profession.

3. Register on the Income Tax Department’s e-Filing Portal

Register on the portal using your PAN if you're a new user. Existing users can log in with their credentials.

4. Fill and Submit the Form

Download the applicable ITR form and fill in the details offline or online.

Validate the form using built-in validation utilities.

Submit the form. You may digitally sign it using Aadhaar OTP or DSC (Digital Signature Certificate) or submit it without a signature.

5. Verification

After submitting the form, verify your return within 120 days of filing. You can verify electronically through Aadhaar OTP or EVC (Electronic Verification Code) or by sending a signed physical copy to the CPC Bengaluru.

6. Acknowledgment and Processing

Upon successful verification, the Income Tax Department will process your return. You will receive an acknowledgement (ITR-V) via email. This serves as proof of filing until the return is processed.

Tips for Smooth Filing

Keep Records: Maintain records of income, deductions, and investments throughout the year.

Stay Updated: Be aware of changes in tax laws and filing procedures.

Seek Assistance: Consult a tax professional for complex scenarios or filing questions.

Filing income tax returns online ensures compliance with tax laws while leveraging technology for a hassle-free experience. Embrace the convenience and efficiency of e-filing to manage your tax obligations effectively.

0 notes

Photo

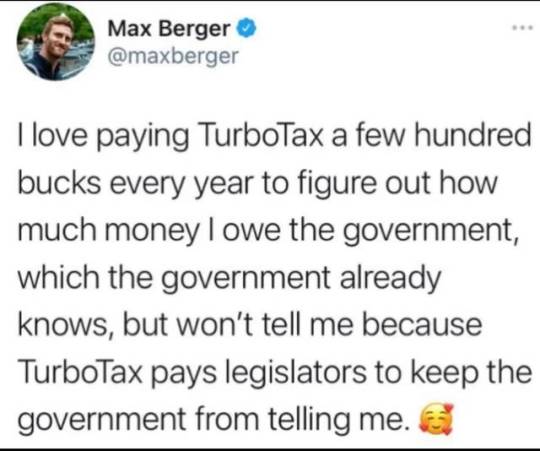

[Image description: a tweet by Max Berger (@/maxberger) that reads, "I love paying TurboTax a few hundred bucks every year to figure out how much money I owe the government, which the government already knows, but won't tell me because TurboTax pays legislators to keep the government from telling me. 🥰" /End description.]

#I'm honestly embarrassed I didn't know there were options for filing online through the IRS#BUT I have been using FreeTaxUSA for a few years and it's good. Straightforward and with definitions for stuff#you do have to pay $15 for state returns (if you have income taxes in your state)#but that's it. AND if you have 1099s IT WILL FUCKING LET YOU FILE THEM WITH THE REST OF YOUR FREE FED RETURN#needing to not pay a million bucks to file 2 state returns (when I moved) and my damn 1099s made me yeet right out of turbotax#and wow it's fucking amazing not being upsold on every other page#can't wait to see if TurboTax will let me completely delete my information with them once 10 years have passed since I last used them

150K notes

·

View notes

Text

If You Lost Your PAN Card, complete guide to How to Apply for a Duplicate pan card!

What is a Duplicate PAN Card?

A Duplicate PAN (Permanent Account Number) card is a reissued version of the original PAN card, typically requested when the original is lost, damaged, or needs to be replaced. The PAN card is a crucial document in India, used for various financial transactions and tax purposes, serving as a unique identifier for individuals and entities.

Steps to Apply for Duplicate PAN Card Online

1. Visit the Official Website: Go to the websites of NSDL (now Protean) or UTIITSL. 2. Select the Application Type: Choose “Reprint of PAN Card” or “Duplicate PAN Card”. 3. Fill in the Form: Provide necessary details like your PAN, name, and date of birth. 4. Submit Documents: Upload required documents, such as identity proof. 5. Pay the Fee: Make the payment using the available online options. 6. Receive Acknowledgment: After submission, you’ll receive an acknowledgment receipt with a token number for tracking.

Applying Duplicate PAN Card Without Changes

If you need a duplicate PAN card without any changes in personal details, the process is simplified. Follow the same online steps as above, ensuring you select the option for a duplicate without changes. Your existing information will be retained.

Who Can Apply For Duplicate PAN Card?

Any individual or entity that holds a PAN card can apply for a duplicate. This includes:

- Indian citizens - Non-resident Indians (NRIs) - Companies - Partnerships - Trusts

When to Apply for a Duplicate PAN Card

You should apply for a duplicate PAN card in the following situations:

- Loss or theft of the original card - Damage or wear and tear making the card unreadable - Incorrect details on the original card (if needing a change, opt for the correction process instead)

Documents Required for a Duplicate PAN Application

To apply for a duplicate PAN card, you typically need:

- A copy of your lost or damaged PAN card (if available) - Identity proof (e.g., Aadhar, passport, voter ID) - Address proof (e.g., utility bill, bank statement) - Passport-sized photographs - Payment receipt (for online applications)

Fees to Apply for a Duplicate PAN Card

The fee for applying for a duplicate PAN card varies based on the applicant’s location:

- For Indian residents: Approximately ₹110 (including GST) - For applicants outside India: Approximately ₹1,020 (including GST)

Check the latest fee structure on the official websites before applying.

Steps to Download a Duplicate PAN Card

Once your duplicate PAN card application is approved, you can download it:

1. Visit the PAN Service Website: Go to NSDL or UTIITSL. 2. Select ‘Download PAN’: Look for the option to download the e-PAN. 3. Enter Details: Provide your PAN and acknowledgment number. 4. Authenticate with OTP: An OTP will be sent to your registered mobile number for verification. 5. Download the Card: After verification, download the e-PAN card.

Steps to Surrender a Duplicate PAN Card

If you have received a duplicate PAN card but realize you have multiple PANs, it’s advisable to surrender the extra one:

1. Write a Request Letter: Address it to the Income Tax Department, mentioning your details and PAN numbers. 2. Include Documents: Attach copies of your PAN cards and identity proof. 3. Submit: Send the letter to the appropriate IT office or online via the official portal.

Conclusion

A duplicate PAN card is essential for maintaining seamless financial transactions and tax compliance. The process for obtaining one, whether online or offline, is straightforward. Ensuring you have a valid PAN card helps in avoiding penalties and facilitates smoother dealings with banks and other financial institutions.

Related article: How to track your Pan card status? , Pan card application form pdf

#Duplicate PAN card#Lost PAN card#Apply for PAN card#PAN card reissue#PAN card application process#Online PAN card duplicate#Offline PAN card duplicate#PAN card fees#PAN card documents required#PAN card tracking#Income Tax PAN#e-PAN card download#Surrender PAN card#PAN card for individuals#PAN card for NRIs#Surrender Duplicate PAN Card#Surrender Duplicate PAN Card how to apply#download pan card online#pan application form pdf#apply pan card application#income tax login#income tax return#taxring#itr filing#gst registration#tax refund#income tax audit#tax audit#income tax

0 notes

Text

Feeling Lost? Here’s Your Roadmap to How to find a good tax consultant in India?

Are you searching for the best online tax consultant India? There’s nowhere else to look! Our team of tax experts specializes in offering knowledgeable solutions catered to your particular financial circumstances. We ensure everyone, individual or business, can easily manage the complicated tax environment.

Navigating the world of taxes can feel overwhelming, especially with the complexity of income tax laws in India. Finding the right tax consultant is key to ensuring your financial health stays in check. If you’re confused about where to start, don’t worry. We’re here to help guide you on the path to finding a good tax consultant in India. And if you want to skip the search, look no further than TaxDunia — recognized as one of the best income tax consultant in India.

Why You Need a Tax Consultant

Handling taxes involves a lot of details, deadlines, and paperwork. Even a small mistake can lead to penalties or lost money. A qualified tax consultant ensures that your tax filings are done correctly and on time, while also helping you save as much money as possible. Best Income Tax Advisors can also guide you through complex tax laws, so you’re always on the right side of the law. We are registered with recognized as qualified professionals, best accounting tax and advisory services in India.

Steps to Find a Good Tax Consultant

Look for Experience and Expertise The first step in finding the right tax consultant is to check their experience. An expert who has been in the field for years will know how to handle various tax situations, from income tax filings to audits. Our Company, for example, brings years of experience and a strong reputation for helping clients with a wide range of tax needs.

Check for Certification Your tax consultant should be certified by recognized authorities. Look for Chartered Accountants (CAs) or Certified Public Accountants (CPAs) in India. This ensures that the person you hire is fully trained and knowledgeable about the latest tax laws and regulations.

Ask for Recommendations Getting recommendations from friends, family, or business associates is a great way to start. If a consultant comes highly recommended, they are likely to provide good service. Our company has earned positive reviews from clients all over India, thanks to its transparent and reliable service.

TaxDunia is widely recognized as the Top 10 best income tax consultant in India. The company stands out with its team of skilled professionals who provide comprehensive tax solutions tailored to both individuals and businesses. From income tax filings and strategic tax planning to managing complex tax laws, we offer expertise that you can trust.

Our Complete Services: -

At TaxDunia, we offer a range of professional services designed to meet your needs. This blog provides an overview of our offerings and how we can assist you with various business and tax requirements in India.

Private Limited Company Registration Service in India

Starting a business in India involves several steps, with one of the most crucial being Private Limited Company Registration Service in India. This process ensures that your business is legally recognized and offers you the benefits of limited liability, credibility, and easier access to capital. At our company, we streamline this process for you, handling all necessary paperwork and compliance requirements to set up your pvt ltd company registration service seamlessly.

Online Company Registration in India

For those who prefer convenience, our Online Company Registration in India service is an ideal choice. We understand that time is valuable, so we offer a user-friendly online platform to simplify your Company Registration Service in India. Our team ensures that your registration process is quick and efficient, allowing you to focus on growing your business while we take care of the formalities.

One Person Company (OPC) and Public Limited Company Registration

If you’re considering starting a business on your own, our One Person Company Registration Service in India is tailored for solo entrepreneurs. This structure offers limited liability while allowing you to retain full control. Our OPC Registration Service simplifies ensuring compliance and a smooth process.

Public Limited Company Registration

Alternatively, if you’re looking to form a larger corporation, our Public Limited Company Registration Service is designed to help you meet the requirements for public trading and raising capital.

Firm Registration Services

For those in need of Firm Registration Services, we provide comprehensive solutions to get your partnership or LLP firm officially recognized. Our services include handling all necessary documentation and compliance requirements, ensuring that your firm is legally established and ready to operate.

Income Tax Return Filing Service in India

Managing taxes can be daunting, but with our Income Tax Return Filing Service in India, you can ease your worries. We offer expert assistance in ITR Return Filing Service, ensuring that your income tax returns are filed accurately and on time. Our consultants are skilled in handling various tax scenarios, from individual to corporate tax returns.

NRI Tax Consultancy and Filing Services

If you’re an NRI, navigating Indian tax regulations can be particularly challenging. Our NRI Tax Consultancy Service is designed to provide you with expert advice on handling your Indian income and tax obligations. We also offer NRI ITR Filing Service in India to ensure that your returns are filed correctly, complying with all relevant tax laws.

GST Return Filing Services

Managing GST compliance can be complex, but with our GST Return Filing Services in India, you get expert support for all your GST needs. From GST Registration Service to Online GST Return Filing, we cover all aspects of goods and services tax filing. Our team ensures that you remain compliant with GST regulations and avoid any potential penalties.

Trademark Registration Services

Protecting your intellectual property is crucial. Our Trademark Registration Consultants offer comprehensive best Trademark Registration Service in India, including trade mark online registration. We guide you through the entire process to ensure your brand is legally protected.

Copyright Registration Services

Similarly, for those needing best Copyright Registration service in India, our Best Copyright Consultant services help you safeguard your creative works with ease.

Patent Registration Services

Innovation is a key driver of business success. With our Patent Registration Service in India, you can protect your inventions and ideas. Our team of Best Patent Consultants in India provides expert guidance throughout the online Patent Registration Services in India process, helping you secure your intellectual property rights.

Sole Proprietorship Firm Registration

For solo entrepreneurs and small business owners, we offer Sole Proprietorship Registration Service. Our services ensure that your business is properly registered and compliant with all relevant regulation.

Proprietorship Firm Registration

Setting up a proprietorship firm is a straightforward way for solo entrepreneurs to start a business. We offer comprehensive Proprietorship Firm Registration services to help you establish your business efficiently. You can also register proprietorship firm online with our user-friendly platform, ensuring a quick and hassle-free registration process. We handle all the necessary paperwork and compliance, allowing you to focus on your business.

TDS Return Filing Service & Top Consultants

Managing TDS (Tax Deducted at Source) can be complex. Our TDS Return Filing Service in India ensures accurate and timely submission of your TDS returns. We are recognized as Top TDS Return Consultants in India, offering expert guidance to ensure compliance with tax regulations and avoid penalties. Trust us to simplify your TDS management and keep your finances in order.

Foreign Company Registration in India

Expanding into the Indian market requires understanding local regulations. Our Foreign Company Registration in India service assists international businesses in setting up operations in India. We handle all the paperwork and compliance requirements, helping you establish your presence in the Indian market smoothly.

Conclusion

At TaxDunia, we are dedicated to offering comprehensive solutions for all your business and tax needs. From Private Limited Company Registration to GST Return Filing Services, our expert team supports you at every step. If you’re searching for online tax consultant services near me, look no further. Visit our website www.taxdunia.com to explore how we can assist you in achieving your business and tax goals. With our expertise, you can concentrate on your core activities while we handle the complexities of registration and compliance efficiently.

#Top Income Tax Consultants#Best Income Tax Advisors#Tax Consultant Services#best income tax consultant in india#Best online tax consultant India#online Tax consultant services near me#Top 10 best income tax consultant in india#tax consultants#finance#itr filing#gst filling#itr filling#taxdunia#income tax#gst return

0 notes

Text

"Personal Tax Filing Made Easy with Services Plus"

Ready to handle your Personal Tax Return without the stress? At Services Plus, we've got your back! Our seamless process makes Filing Individual Tax a breeze. Whether you're a first-timer or a seasoned pro, our platform simplifies the entire Tax Return for Individuals experience. Prefer doing it from the comfort of your couch? No problem! You can easily File Personal Taxes Online with us. Let's make Income Tax Return Filing stress-free and straightforward together. Trust Services Plus to get it done right, so you can focus on what really matters!

Address- C 203, 3rd Floor, Sector 63, Noida

Call- +91 9899184918

Website- www.servicesplus.in

Email- [email protected]

#Personal Tax Return Filing#Individual Tax Filing#Tax Return for Individuals#File Personal Taxes Online#Income Tax Return Filing#Personal Tax Return Assistance#Online Tax Filing Services

0 notes

Text

Timely filing of Tax Deducted at Source (TDS) returns is critical for small businesses aiming to comply with tax regulations. Beyond being a legal obligation, it directly impacts a company’s financial credibility, ensuring seamless operations.

#tds return filing#legal services#legal#tax#online tds return filing#Income Tax Return Filing#salary return filing#GST Return Filing#file gst return#GST Registration#new gst registration

0 notes

Text

Everything You Need to Know About E-Filing Your Income Tax Return

Filing income tax returns (ITR) is a crucial annual obligation for every taxpayer in India. The process has been significantly streamlined with the advent of online filing systems, making it more convenient and accessible than ever before. Here’s a comprehensive guide to help you navigate the online ITR filing process seamlessly.

Why File Income Tax Returns Online?

Online filing offers several advantages over traditional paper filing:

Convenience: File from anywhere, anytime, reducing dependency on physical visits to tax offices.

Accuracy: Built-in validation checks minimise errors, ensuring your return is filed correctly.

Speed: Instant acknowledgement and quicker processing by tax authorities.

Security: Data encryption and secure authentication protocols protect your personal and financial information.

Steps to File Income Tax Return Online

1. Preparation: Gather Documents and Information

Before you begin, ensure you have the following:

PAN: Permanent Account Number

Form 16: Issued by your employer, detailing your income and tax deducted at source (TDS).

Bank Statements: Statements showing interest earned on savings accounts and fixed deposits.

Investment Proofs: Details of investments eligible for deductions under Section 80C, 80D, etc.

Other Income Documents: Any income from house property, capital gains, or other sources.

2. Choose the Correct Form

Select the appropriate ITR form based on your income sources:

ITR-1 (Sahaj): For salaried individuals with income up to ₹50 lakh, one house property, and income from other sources.

ITR-2: For individuals and HUFs having income from more than one house property, capital gains, etc.

ITR-3: This is for individuals and HUFs with income from business or profession.

3. Register on the Income Tax Department’s e-Filing Portal

Register on the portal using your PAN if you're a new user. Existing users can log in with their credentials.

4. Fill and Submit the Form

Download the applicable ITR form and fill in the details offline or online.

Validate the form using built-in validation utilities.

Submit the form. You may digitally sign it using Aadhaar OTP or DSC (Digital Signature Certificate) or submit it without a signature.

5. Verification

After submitting the form, verify your return within 120 days of filing. You can verify electronically through Aadhaar OTP or EVC (Electronic Verification Code) or by sending a signed physical copy to the CPC Bengaluru.

6. Acknowledgment and Processing

Upon successful verification, the Income Tax Department will process your return. You will receive an acknowledgement (ITR-V) via email. This serves as proof of filing until the return is processed.

Tips for Smooth Filing

Keep Records: Maintain records of income, deductions, and investments throughout the year.

Stay Updated: Be aware of changes in tax laws and filing procedures.

Seek Assistance: Consult a tax professional for complex scenarios or filing questions.

Filing income tax returns online ensures compliance with tax laws while leveraging technology for a hassle-free experience. Embrace the convenience and efficiency of e-filing to manage your tax obligations effectively.

0 notes

Text

KVR TAX Services is the Udyam Registration services in Hyderabad. Apply now for the new udyam aadhar registration, in Gachibowli, Flimnagar, Kondapur, Lingampally.

#gst registration certificate in hyderabad#goods and service tax registration in hyderabad#register a business in hyderabad#register company in hyderabad#firm gst registration process in hyderabad#registration of firm process in hyderabad#income tax filing in hyderabad#incometax return filing in hyderabad#Msme Registration Consultants in hyderabad#MSME Registration Online in hyderabad#iec code registration in hyderabad#export and import registration in hyderabad

0 notes

Text

Income tax Consultant India | Secure Online Tax Filing

Paper Tax is a renowned income tax consultant in Indore, providing all possible solutions in the area of taxation with its experienced professionals. Call: 0731 4629991 https://bit.ly/3SL12kJ

#accounting#finance#Online Income Tax Return Filing#Income Tax Consultant Online#Income Tax Consultant India#Income Tax Return Filing Service#File Income Tax Return Online

0 notes

Text

#CA#Chartered Accountants#Accountants#Online Accounting Services#GST Accountants#Accounting Consultants#Balance Sheet Preparation#Accounting Services for Shares#GST Returns#ITR#Income Tax returns#Audit#Taxation#Service Tax#ROC Filing#Corporate Accounting#Company Compliance#Payroll Accounting Services#Online International Accounting Services#Financial Accounting Services#Online CA Services

1 note

·

View note