#online financial planner

Text

Navigating the World of Finance: ArthaSarathi's Expert Financial Advice

3 notes

·

View notes

Text

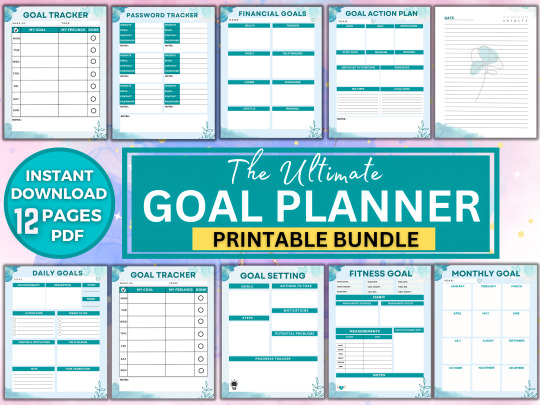

Printable Goal planner bundle. Daily Monthly Yearly Quarterly Action Fitness Financial Smart Setting Goals, Notes, Vision Board Printable

Introducing our Goal Planner Bundle, the ultimate tool for achieving your goals and staying organized. This comprehensive bundle includes a wide range of Printable or Digital Editible planner templates that are designed to help you set and achieve your goals, whether they are personal or professional.

The bundle includes:

Goal Tracker: This template is designed to help you set and track your progress on your goals, whether they are short-term or long-term.

Daily Goal Planner: This template is designed to help you plan your day, set and track your daily goals, and prioritize your tasks.

Goal Setting Worksheets: These worksheets are designed to help you set and achieve your goals, by breaking them down into smaller, manageable steps.

Fitness Goal Planner: This template is designed to help you set and achieve your fitness goals, by tracking your progress and creating a workout plan.

Monthly Goal Planner: This template is designed to help you plan your month, set and track your goals, and prioritize your tasks.

Goal Action Plan: This template is designed to help you create a step-by-step plan of action for achieving your goals.

Password Tracker: This template is designed to help you keep track of your passwords and login information, in a safe and secure way.

Reflections: This template is designed to help you reflect on your progress and achievements, and to identify areas for improvement.

Notes: This template is designed to help you take notes, write down your thoughts and ideas, and keep track of important information.

Vision Board: This template is designed to help you create a visual representation of your goals and dreams, and to stay motivated and focused.

Financial Goals: This template is designed to help you set and track your financial goals, and to create a budget and plan for achieving them.

All templates are fully customizable and come in different designs, layouts, and colors. They are also compatible with different devices and platforms. Whether you're looking to improve your productivity, set and achieve your goals, stay organized, or manage your finances, this bundle has got you covered. With the Goal Planner Bundle, you'll have everything you need to set and achieve your goals, stay organized, and live your best life.

Product info:

- Printable PDF Us Letter Size - A4 Size - A5 Size

- You can also upload to your favorite digital notetaking app and plan digitally!

- Print and write or use digitally!

- Undated planners so you can use the template over and over again!

Digital means its ready to download straight away after buying! No waiting, and no shipping fees. Purchase once and its yours forever!

*No physical product will be shipped, props are not included*

Thank you for visiting!

#Planner 2023#Digital Planner#Goal Tracker#Daily Goal Planner#Goal Setting Worksheets#Fitness Goal Planner#Monthly Goal Planner#Goal Action Plan#Password Tracker#Reflections#notes#Vision Board#Financial Goals#goal planner#goal planner 2023#goal planner template#goal planner journal#goal planner app#goal planner online#goal planner printable#goal planner pdf#goal planner pdf free#goal planner template excel#goal 30 planner#goal planner book#goal planner excel#goal planner free#goal planner kmart#goal planner sheet#goal setting

4 notes

·

View notes

Text

You can find a reliable financial advisor in Rewa through referrals, online reviews, or certifications. Checking their experience, client feedback, and understanding of financial products will ensure they provide trustworthy guidance. For more information, visit https://www.investrack.co.in/

#AMFI registered Mutual Fund Distributor in Rewa#Mutual Fund Distributor in Rewa#mutual funds advisor in Rewa#online investment schemes in Rewa#mutual fund investment companies in Rewa#mutual fund advisor in Rewa#investment consultants in Rewa#mutual fund investment in Rewa#best Mutual Fund Distributors in Rewa#financial consultants in Rewa#financial advisor in Rewa#financial company in Rewa#financial companies in Rewa#financial planning in Rewa#best broker for mutual funds in Rewa#mutual fund company in Rewa#mutual fund investment planner in Rewa#best mutual fund for sip india in Rewa#mutual funds investment plans in Rewa#loan against mutual funds in Rewa#loan against mutual fund services in Rewa#finance company in Rewa#stock brokers in Rewa#share brokers in Rewa#portfolio management services in Rewa#financial services in Rewa#financial planner in Rewa#demat account services in Rewa#equity advisor services in Rewa#insurance agent in Rewa

0 notes

Text

Certified Financial Planner

A highly qualified expert who advises people and families in reaching their financial objectives is a Certified Financial Planner (CFP). They offer direction on investments, planning for retirement, tax strategies, planning for the future, and more with careful planning and knowledgeable advice. CFPs provide their clients with customized options that guarantee a secure financial future.

#economy#entrepreneur#accaglobal#acca coaching#acca classes#finance#acca course#acca online#fintram#marketing#certified financial planner

0 notes

Text

Investment Advisory & Financial Freedom App | Cube Wealth (bankoncube.com)

Cube Wealth is a financial freedom app that connects users with investment advisors who can help them grow their wealth. Cube Wealth boasts a team of experienced advisors and a user-friendly interface. Users can invest in a variety of assets through Cube Wealth.

#financial advisory services#best financial advisors#personal financial advisors#best financial advisor in india#online financial advisor#professional financial advisor#financial investment advisor#financial advisory consultant#financial advisor planner

1 note

·

View note

Text

Open New Doors of Finance Careers with Key Professional Finance Courses of AAFM India

Introduction:

For every finance professional who has completed their studies or still studying to master finance knowledge and become ready to climb the ladder of a successful finance career, then AAFM India is the one-for-all solution for you to cover all your requirements and fulfil unique learning needs. AAFM India is one of the best financial education institutions in the country as well as on the globe which offers the best modules for all types of financial courses that have the power to assist students in developing essential skill sets and using the financial knowledge in the best practical way to thrive in the dynamic financial world of the 21st century. AAFM India has it all for finance professionals in India, ranging from beginner financial planning courses to professional courses in finance and advanced finance courses for everyone who wants to gain global and superior expert knowledge in the evolving field of finance.

AAFM India: The Road to Financial Career Success For Everyone.

AAFM India is an esteemed affiliate member of the prestigious American Academy of Financial Management, and aims at the bullseye to set globally accepted finance education standards for finance professionals in India. AAFM India's financial courses are available in countless countries and have built a reliable reputation as the most preferred educational institute of today to obtain world-class finance education with high precision for people seeking quality education in the finance industry. There are all kinds of financial courses at AAFM India for all education needs of modern students which include financial planning courses, CFP Course (Certified Financial Planner), short-term courses in finance and a range of professional courses in finance, helping present students to grow swiftly and effectively in the field of finance job industry.

Financial Planning Courses By AAFM India:

Planning finances on a personal and professional level are completely different dimensions which is why AAFM financial planning courses are an essential thing for finance students for a rewarding career in the fast-changing world of today. AAFM India’s different financial planning courses are created together with the best learning modules, industry relevant knowledge and practise of all the needed practical skills by an expert finance professional to effectively manage finances in both personal and corporate matters successfully. If you are a finance professional who is in the process of starting a fresh career as a financial advisor, or any other relevant job and looking to widen your horizons of your financial management principles, our course will deliver unmatched knowledge and high-quality education with real-world insights on the use of learnt practical knowledge which can be applied for success in real-life financially challenging scenarios.

CFP Course (Certified Financial Planner):

AAFM India's Certified Financial Planner (CFP) Course is most preferred by all finance students around the globe and is considered a golden opportunity to learn financial planning and become globally certified as a Certified Financial Planner. The curriculum is designed to include all essential elements for quality effective learning and includes all essential subjects such as investment planning, retirement planning, estate planning, and tax planning, to provide students with every tool they need to perform exceptionally well in the field of finance anywhere in the world. Certified Financial Planners by AAFM India, are highly desirable and sought-after by both top recruiting employers and professional financial clients for their high level of competence and adherence to the latest and finest financial practices.

Short-Term Courses in Finance by AAFM India:

For students who have a true deep desire to upgrade their finance knowledge, AAFM India offers a range of professional short-term courses in the field of finance, which not only provide a complete and wide understanding of finance education and guidelines but also cover all the important finance topics in depth with practical applications. If you are a fresh graduate or an experienced financial professional, who wants to reach a higher position or a rewarding career in finance and work with the top companies on a global scale, our short-term courses in finance provide the needed expertise and knowledge to make sure your dream job in financial field chases you till success.

Major benefits of AAFM India Professional Courses In Finance:

1. Specialized Financial Expertise:

AAFM India’s professional courses in finance offer students the choice of receiving specialized and desired financial education they need to obtain expertise across different areas of finance. In that way, they can stand out among their peers.

2. Practical Application Of Knowledge:

AAFM India’s courses concentrate not only on delivering exceptional theoretical knowledge but also on the practical application of the same through an introduction to regular real-world practical exercises and case studies to become the best at their future finance job.

3. Improved Career Flexibility:

Because of holistic financial knowledge in all AAFM India certifications, finance professionals are free to explore a wide range of rewarding career paths within the financial industry and on the road of life, ranging from wealth management courses to finance management courses.

4. Professional Mentorship and Guidance:

The AAFM India courses are taught by the best finance teachers in the world who offer the best mentoring and guidance to build expert finance professionals from aspiring finance students to become successful in the competitive job industry of the finance sector.

5. Earning More And Global Recognition:

All AAFM India certification holders are known to earn more than others who are not certified and are globally recognized and well respected by top recruiters of the world. By obtaining global finance knowledge, students can flourish in the internal field of finance and earn handsomely for their effective financial services.

Conclusion: Get Certified With AAFM India For A Swiftly Successful Finance Career

AAFM India is more than just a reliable companion for sailing the student boats of a financial career to the shore of success and achieving superior financial freedom. The unique range of professional finance courses and detailed emphasis on superior quality and excellence in financial education make AAFM India the best destination to receive a globally recognized certification to achieve all career objectives and open new doors of rewarding opportunities for finance professionals or students of India in the national or international finance sector. If you are a novice, amateur or professional in the field of finance, AAFM India has the best resources to provide you with all the necessary and mandatory knowledge as well as tools, professional mentoring and expert learning assistance that you need to succeed at every step of your ambitious financial career. Earn your value by becoming certified in the financial job market and becoming irreplaceable in the evolving financial world of the global society.

#best finance courses#certified financial planner#cfp india#wealth management course#cfp course#financial planning courses#financial advisor course#finance certifications#corporate training courses#financial training#short term courses in finance#professional course in finance#real estate training online#finance certification india

0 notes

Text

How to Choose the Best Online Financial Planner Diploma Program

When it comes to managing finances, the need for skilled financial planners is on the rise. The right financial planner can make the difference between a comfortable retirement and an uncertain future. As the demand for these experts grows, so does the demand for quality education and certification in the field. If you're considering a career as a financial advisor, or looking to enhance your expertise, choosing the right financial planner diploma program online is a crucial step.

by Lukasz Radziejewski (https://unsplash.com/@radziejewski)

In this article, we'll guide you through the key factors to consider when selecting an online financial planner diploma program that will equip you with the necessary skills and credentials to succeed in this competitive industry.

Understanding the Role of a Financial Planner

Before diving into the selection process, let's define what a financial planner does. Financial planners assist clients in managing their finances, including investment strategies, estate planning, tax issues, and retirement preparation. They must be proficient in financial laws and regulations and possess strong analytical and interpersonal skills.

Why Certification Matters

Gaining a certification, such as a Certified Financial Planner (CFP) designation, is an important step in establishing credibility and trust with clients. It shows that you have met education, examination, experience, and ethical requirements.

Key Considerations When Choosing an Online Program

Choosing an online financial planner diploma program requires careful consideration of several factors to ensure that the program aligns with your career goals and learning style.

Curriculum and Specializations

The curriculum should cover a wide range of topics relevant to financial planning, including risk management, investment planning, tax planning, retirement savings, and estate planning. Some programs may offer specializations in areas like investment courses or estate planning, which can be beneficial if you have a specific career path in mind.

Faculty and Industry Expertise

The quality of the faculty is a critical aspect of any educational program. Look for programs that employ instructors with real-world experience in financial planning. Their insights and practical knowledge will be invaluable as you navigate the complexities of the financial world.

Flexibility and Format

As an online learner, you'll want a program that offers flexibility to fit your schedule. Consider the format of the course delivery, such as live online classes, pre-recorded lectures, or a combination of both. Also, check if the program allows you to learn at your own pace or if it follows a strict schedule.

Technology and Resources

An online program should provide robust technology platforms that facilitate learning and interaction with peers and instructors. Additionally, access to digital resources like financial planning software, online libraries, and research materials will support your education.

Support Services

Effective online programs offer comprehensive support services, including academic advising, career services, and technical support. These resources can be critical to your success as a remote learner.

Cost and Financial Aid

While the cost of the program is an important factor, it should not be the only consideration. Evaluate the overall value of the program, including the quality of education, resources provided, and the potential return on investment. Check if the institution offers financial aid, scholarships, or payment plans.

Top Online Financial Planner Diploma Programs

by Marissa Grootes (https://unsplash.com/@marissacristina)

Let's look at some of the leading online financial planner diploma programs that meet the criteria outlined above. While this is not an exhaustive list, it provides a starting point for your research.

Certified Financial Planner Toronto

For those in the Toronto area or looking for Canadian certification, the Certified Financial Planner program at Toronto-based institutions offers comprehensive training in financial planning. These programs are designed to align with FP Canada standards and prepare students for the CFP examination.

Financial Planner Certification Online

There are several online certification programs that offer flexibility and comprehensive training. These programs are ideal for those who need to balance their studies with other commitments. They provide the necessary coursework and preparation for certification exams.

Investment Courses

For individuals interested in focusing on investments, there are diploma programs that specialize in investment strategies and portfolio management. These programs offer in-depth knowledge that is valuable for a career in investment advisory services.

Navigating the Online Learning Experience

Online education requires self-discipline and effective time management. To make the most of your online financial planner diploma program, establish a study schedule, participate actively in discussions and networking opportunities, and utilize all available resources provided by the program.

Tips for Success in an Online Program

Set clear goals for what you want to achieve with your diploma.

Stay organized and manage your time effectively.

Engage with your classmates and instructors to form professional connections.

Take advantage of virtual office hours and academic support services.

The Path to Becoming a Certified Financial Planner

Once you've completed your diploma program, the next step is to prepare for the certification exams. Earning a certification such as the CFP designation involves passing rigorous exams and meeting experience requirements.

Preparing for Certification Exams

Take advantage of exam preparation resources offered by your program or through external providers. Practice exams, study groups, and review courses can help increase your chances of success.

Continuing Education

The financial industry is constantly evolving, and ongoing education is essential. After becoming certified, continue to engage in professional development opportunities to stay current with industry trends and regulations.

Conclusion

Choosing the best online financial planner diploma program is a pivotal step in your journey to becoming a skilled financial advisor. By considering the factors outlined in this article and conducting thorough research, you can select a program that meets your needs and sets you on a path to a rewarding career in financial planning.

Remember, the key to success lies not only in the program you choose but also in your commitment to learning and professional growth. With the right education and determination, you can become an expert financial planner, ready to guide clients toward a secure financial future.

#certified financial planner course online#certified financial planner ontario#certified financial planner toronto#financial planner certification online#financial planning certificate program online#certified financial planner training online#financial advisor course online canada

0 notes

Text

Practical & Edgy Financial Courses | Quest by Finology

Discover practical and insightful financial courses at Quest by Finology. Say goodbye to boring classes and learn only what matters. Explore courses on stock market, personal finance, mutual funds, and more.

#financial courses#stock market courses online free#certified financial planner course#stock market training#stock market courses for beginners#personal finance course#best stock market courses

0 notes

Text

How Can Investors Achieve Their Financial Goals With Mutual Funds?

It's important to understand your financial objectives and align your investments with them when you want to invest in mutual funds. This clears up your decisions and prevents you from making impulsive choices influenced by market trends.

Understanding Goal-Based Investing

Goal-based investing is about linking your mutual funds' investment decisions to specific financial goals you want to achieve in the future. Instead of investing without a purpose, this method ensures that every investment you make serves a specific goal, whether it's buying a house, saving for your child's education, or planning for retirement. If you wish to know more, reach out to the best investment advisory in Aurangabad.

Types of Goals for Goal-Based Investing

Short-Term Goals: These are goals you aim to achieve within a relatively short time, like saving for a vacation or buying a new gadget.

Medium-Term Goals: Medium-term goals take a bit longer to achieve, such as buying a car or saving for a down payment on a house.

Long-Term Goals: Long-term goals require more time and planning, like saving for retirement or building a college fund for your children.

Benefits of Goal-Based Investing

Clarity and Focus: Setting specific financial goals helps you stay focused on what you want to achieve, even when the market goes up and down.

Disciplined Investing: Having clear goals encourages disciplined investing habits, so you're less likely to stray from your plan.

Optimized Asset Allocation: Tailoring your investments to match your goals ensures you're investing in a way that suits your needs and timeline.

Avoiding Emotional Decisions: When you have goals in mind, you're less likely to make impulsive decisions based on short-term market movements.

Measurable Progress: Setting goals allows you to track your progress over time, giving you a sense of accomplishment as you work towards achieving each one.

Conclusion

Goal-based investing provides a roadmap for your financial journey, helping you make informed decisions and stay on track to reach your goals. Experts like Amritkar Services offer mutual funds investment plans in Aurangabad that align with specific objectives, so you can build a brighter financial future while staying focused and disciplined along the way.

#Mutual fund investment services in Aurangabad#best retirement planning company in Aurangabad#financial planner in Aurangabad#family financial planning in Aurangabad#best investment advisory in Aurangabad#wealth management advisor in Aurangabad#mutual fund planner in Aurangabad#mutual funds schemes in Aurangabad#online investment in mutual fund in Aurangabad#tax saver mutual fund advisor in Aurangabad#mutual funds investment plans in Aurangabad

0 notes

Text

Personal Financial Planning services

Our Personal Financial Planning services offer comprehensive guidance tailored to your goals and circumstances. We provide expert advice on budgeting, investment strategies, retirement planning, insurance coverage, and more. Our certified professionals work closely with you to develop a personalized financial roadmap that aligns with your aspirations and risk tolerance. With a focus on long-term financial security and wealth accumulation, we empower you to make informed decisions and achieve financial freedom. Trust us to navigate the complexities of personal finance and optimize your financial well-being.

0 notes

Text

Navigating Online Certification Courses for Finance, Investing, and the Stock Market in India

Introduction:

In the current ever-evolving financial realm, it has become imperative for individuals to arm themselves with knowledge and skills in finance, investing, and the stock market. Online learning platforms offer an accessible and flexible option for pursuing online certification courses to gain valuable insights and expertise. A notable platform that offers a variety of courses tailored to the Indian market is Finology Quest. This article aims to examine the advantages of online certification courses and showcase some of the options available through Finology Quest, avoiding any promotional language.

Strengthening Financial Acumen:

A strong foundational knowledge of finance is crucial for making well-informed decisions, managing personal finances, and reaching long-term financial objectives. Online certification courses provide individuals with a structured learning experience, covering essential topics such as financial planning, budgeting, risk management, and investment strategies. The courses presented on Finology Quest are designed to provide practical knowledge from industry experts, assisting individuals in developing a comprehensive understanding of financial concepts.

Mastery of Investing:

Investing requires expertise and understanding in order to generate wealth and attain financial security. Online certification courses in investing equip learners with the knowledge necessary to make wise investment decisions. Finology Quest's courses encompass various aspects of investing, including fundamental and technical analysis, portfolio management, and strategies for selecting stocks, bonds, and other investment instruments. These courses provide individuals with the tools to evaluate investment opportunities and manage risks with confidence.

Grasping the Dynamics of the Stock Market:

For those intrigued by the dynamic world of stock markets, it is vital to comprehend market mechanics, trading strategies, and the factors influencing stock performance. Online certification courses focusing on the stock market offered by platforms such as Finology Quest explore topics such as market analysis, stock valuation techniques, and the impact of economic trends and geopolitical factors on stock prices. These courses provide learners with a comprehensive understanding of the stock market, empowering them to make informed investment decisions.

Advantages of Online Certification Courses:

Online certification courses in finance, investing, and the stock market offer several benefits. They provide flexible learning options, allowing individuals to study at their own pace and convenience. This aspect is particularly advantageous for working professionals or individuals with other commitments. Additionally, online courses often offer interactive learning materials, quizzes, and case studies, facilitating a practical understanding of the subject matter. The ability to access course materials and resources even after completion ensures that learners can revisit and reinforce their knowledge whenever needed.

Courses Offered on Finology Quest:

Finology Quest stands out as a prominent online learning platform offering a range of online certification courses in finance, investing, and the stock market in India. The platform features courses designed by industry experts to cater to different skill levels, from beginners to advanced learners. The courses cover various topics, including financial planning, equity analysis, technical analysis, derivatives, and more. Finology Quest's emphasis on practical knowledge and its user-friendly interface have garnered positive feedback from learners seeking to enhance their financial expertise.

Conclusion:

The availability of online certification courses has revolutionized the way individuals learn and acquire expertise in finance, investing, and the stock market. Platforms like Finology Quest provide an essential opportunity for individuals in India to access high-quality courses and gain practical knowledge from industry experts. Enrollment in these courses offers the chance to enhance financial literacy, master the art of investing, and develop a thorough understanding of the stock market. Investing in one's financial education is an investment in long-term success, and online certification courses serve as essential stepping stones towards financial expertise.

#financial courses#stock market courses online free#certified financial planner course#stock market training

0 notes

Text

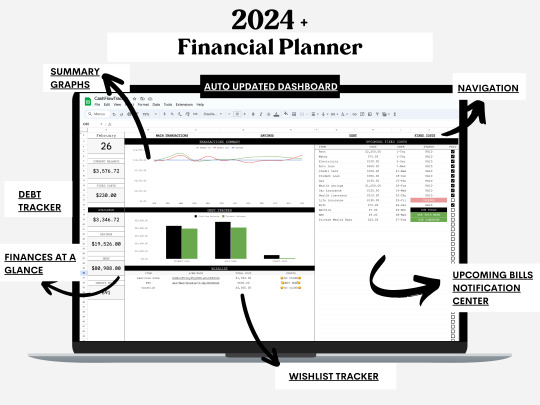

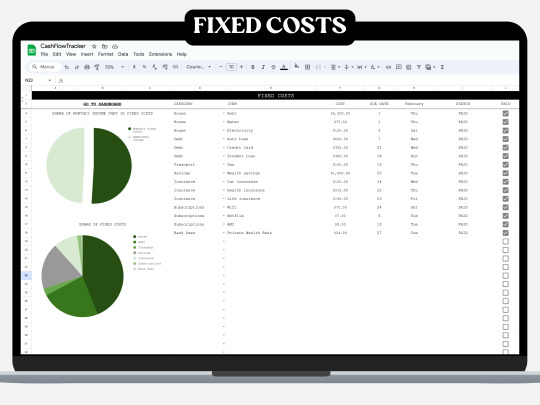

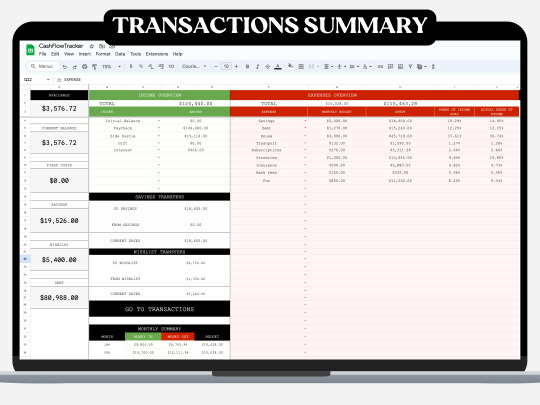

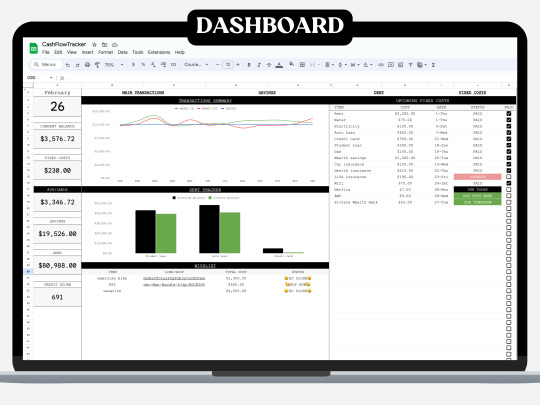

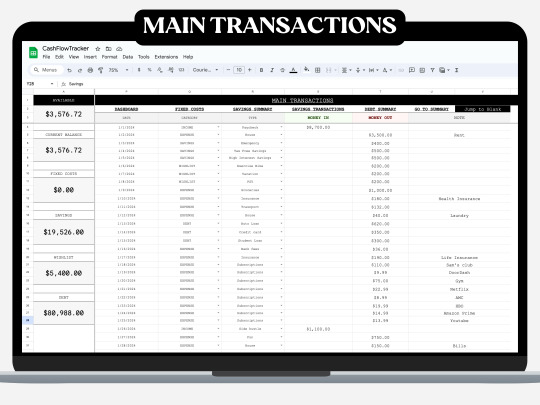

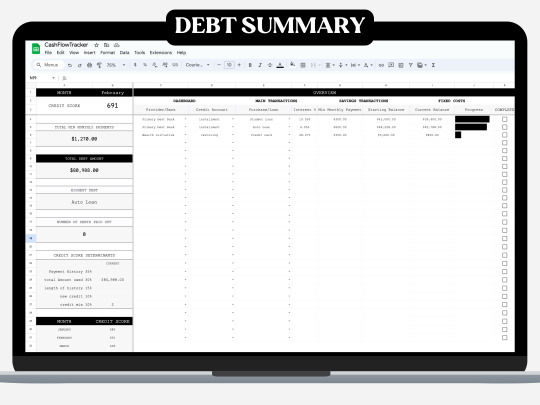

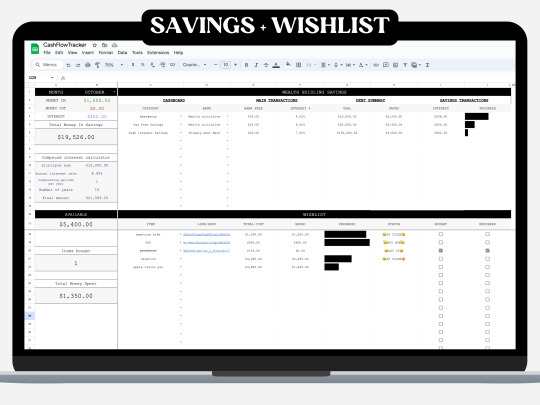

Like what you see... download using the link below

Spend time with your money so that it is not so quick to leave you.

By taking the time to plan out your finances and then track the plan you will see exactly where you money is going and you will be able to better guide and keep it.

This all inclusive income and expenses Cash Flow Tracker will help you live that life.

Features include:

Payments coming up notification center,

Summary graphs,

Wishlist Tracker,

Savings Tracker with a compound interest calculator,

Budgets,

Debt Tracker,

Share of income calculations and more.

#big tech#google#financial planning#planner#savings#budget#spreadsheets#template#wishlist#tracker#cashflow#passive income#online income#extra income#financial#earn money fast#finance

1 note

·

View note

Text

E-Insurance account is soon going to become a mandatory thing while buying new insurance policies and even while renewing your existing policies. This applies to all kind of insurance policies be it Life, Health, Motor, Travel etc.

As per IRDA (Issuance of e-Insurance Policies) regulations, 2016; from 1 October 2016, most of the Insurance policies will be issued in electronic form. Electronic Insurance policies will be issued if either the sum assured or either the Sum assured or Single/Annual Premium criteria is met, as mentioned in the table below. For more information visit Financial Advisor for NRIs in India

0 notes

Text

What Are the Types of Financial Services in Rewa?

When it comes to managing your money, having the right financial services can make a big difference. There are several types of financial services in Rewa to help you with everything from saving for the future to investing wisely. Let's look at some of the key financial services.

1. Banking Services

Banks are the backbone of financial services. In Rewa, you can find a variety of banks offering services like savings accounts, fixed deposits, and loans. Whether you need a personal loan, a home loan, or a business loan, banks have got you covered. They also provide services like internet banking and mobile banking, making it easy to manage your finances from anywhere.

2. Investment Services

If you’re looking to grow your wealth, investment services are essential. In Rewa, you can find mutual fund distributors and firms that offer investment services. These include mutual funds, stocks, bonds, and other investment options. A financial planner in Rewa can help you choose the right investments based on your financial goals and risk tolerance.

3. Insurance Services

Insurance is crucial for protecting yourself and your family from unexpected events. In Rewa, you can find various insurance services, including health insurance, life insurance, and general insurance. These services help you cover medical expenses, secure your family’s future, and protect your assets.

4. Tax Planning Services

Tax planning is an important aspect of financial management. In Rewa, there are professionals who can help you with tax planning and filing your tax returns. They can guide you on how to save taxes legally and make the most of tax-saving investments.

5. Retirement Planning Services

If you want a comfortable and secure future, then it is crucial to plan for retirement. In Rewa, you can find services that help you plan for retirement. These include pension plans, retirement savings accounts, and other investment options designed to provide a steady income after you retire.

6. Loan Services

Loans are a common financial service that many people need at some point. In Rewa, you can find various loan services, including personal loans, home loans, car loans, and business loans. These services help you get the funds you need for different purposes, whether it’s buying a house, starting a business, or covering personal expenses.

7. Wealth Management Services

For those with significant assets, wealth management services are essential. In Rewa, wealth management firms offer services like portfolio management, estate planning, and investment advisory. These services help you manage your wealth effectively and ensure that your assets are protected and growing.

Conclusion

In conclusion, Rewa offers a wide range of financial services to meet your needs. Whether you’re looking for banking services, investment options, insurance, tax planning, retirement planning, loans, or wealth management, you can find it all. A financial planner can help you navigate these services and make the best choices for your financial future.

If you’re looking for expert advice and comprehensive financial services, we are here to help. Visit our website for more information and to get started on your financial journey.

Managing your finances doesn’t have to be complicated. With the right services and guidance, you can achieve your financial goals and secure a bright future for yourself and your family.

#AMFI registered Mutual Fund Distributor in Rewa#Mutual Fund Distributor in Rewa#mutual funds advisor in Rewa#online investment schemes in Rewa#mutual fund investment companies in Rewa#mutual fund advisor in Rewa#investment consultants in Rewa#mutual fund investment in Rewa#best Mutual Fund Distributors in Rewa#financial consultants in Rewa#financial advisor in Rewa#financial company in Rewa#financial companies in Rewa#financial planning in Rewa#best broker for mutual funds in Rewa#mutual fund company in Rewa#mutual fund investment planner in Rewa#best mutual fund for sip india in Rewa#mutual funds investment plans in Rewa#loan against mutual funds in Rewa#loan against mutual fund services in Rewa#finance company in Rewa#stock brokers in Rewa#share brokers in Rewa#portfolio management services in Rewa#financial services in Rewa#financial planner in Rewa#demat account services in Rewa#equity advisor services in Rewa#insurance agent in Rewa

0 notes

Text

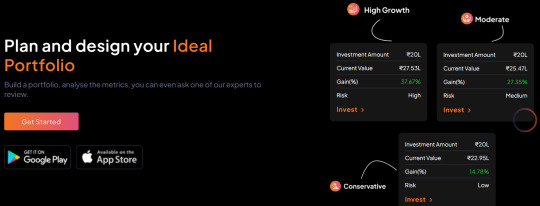

Portfolio Designer – A Unique Strategy to Build & Customise Your Portfolio | Sigfyn

An exclusive approach for an ideal mutual fund portfolio that suits your financial needs powered by algorithms. Enhance returns and manage risk by diversifying investments across different asset classes.

#portfolio designer#portfolio management#Certified Investment Planner#Asset Allocation#Risk Management#Investment Planning#Portfolio Insights#Mutual Fund Portfolio#Mutual Funds Schemes#Investment Advisors#Best HDFC Mutual Funds#HDFC Mutual Funds Online#SIP Investment Services#HDFC MF#Financial Advisory Services#Financial Planning Company#Sigfyn

0 notes