#ola electric ipo dates

Explore tagged Tumblr posts

Text

OLA Electric IPO - No. 1 Indian eScooter maker coming to IPO - to Apply or Not? Risky? Monopoly Multibagger?

End of Ice Age?… This could be the start of the end for Internal Combustion Engine (ICE) Petrol/Diesel cars & scooters/motorcycles … for… Stone age did not end due to the lack of stones. Ola Electric, the e-scooter manufacturer submitted its initial draft papers to SEBI to initiate an initial public offering (IPO) aimed at raising ₹5,500 crore. New equity share issuance amounting to… Read…

View On WordPress

#ola electric#ola electric ipo#ola electric ipo analysis#ola electric ipo date#ola electric ipo dates#Ola Electric IPO details#ola electric ipo gmp#ola electric ipo gmp review#ola electric ipo latest gmp#ola electric ipo latest news#ola electric ipo price#ola electric ipo price band#ola electric ipo review#ola electric ipo size#ola electric news#ola electric scooter#ola electric scooter ipo#ola ipo#ola ipo news#ola ipo review

0 notes

Text

#Ola Ipo#upcoming ipo#share market#investment#new ipo listed companies#ipo alert#ipo news#new ipo#ipo investm

0 notes

Text

If you are looking for Invest Ola Electric Mobility IPO then first to all Open a demat Trading Account & Elite Wealth limited Provide Free Open Online Demat Account minimum Document required. We are provide many benefits Low Brokerage, Free Research Recommendation and Life Time Free* AMC, Call n Trade facility. With the best stock brokers, you may open your demat account quickly and easily. If you more information visit a website: https://elitewealth.in/ola-electric-mobility-ipo-details-issue-price-date-news-allotment-status-gmp-link-updates/

#Applyforupcomingolaelectricmobilityipo#olaelectricmobilityipogmp#olaelectricmobilityipoallotmentstatus#olaelectricmobilityipodate#olaelectricmobilityipolistingdate

0 notes

Text

Ola Electric IPO: Prices Set at Rs 72-76 Per Share, Aiming to Raise Over Rs 6,100 Crore

Ola Electric Mobility Limited, the Bengaluru-based electric vehicle (EV) manufacturer, has announced the price band for its upcoming initial public offering (IPO). The shares will be offered at a price range of Rs 72–76 each, with the IPO set to open for subscription on August 2 and close on August 6. Investors can bid for a minimum of 197 shares and in multiples of 197 shares thereafter.

IPO Details

. Price Band: Rs 72–76 per share

. IPO Opening Date: August 2

. IPO Closing Date: August 6

. Minimum Bid: 197 shares

At the upper end of the price band, Ola Electric aims to raise Rs 6,145 crore, while the lower end targets Rs 6,111 crore. The IPO will consist of a fresh issue of up to Rs 5,500 crore and an offer for sale (OFS) of up to 8.49 crore shares worth Rs 645 crore. There is also a reservation for eligible employees.

Use of Proceeds

According to Bhavish Aggarwal, Chairman and Managing Director of Ola Electric, the proceeds from the fresh issue will be allocated as follows:

Rs 1,227.6 crore for capital expenditure by subsidiary OCT

Rs 800 crore for repayment or pre-payment of debt

Rs 1,600 crore for research and product development

Rs 350 crore for organic growth initiatives and general corporate purposes

Company Overview

Ola Electric specializes in manufacturing electric vehicles and core EV components, including battery packs, motors, and vehicle frames, at its Ola Futurefactory. The company aims to capitalize on the growing trend of EV adoption in India and plans to expand into select international markets.

Since delivering its first model, the Ola S1 Pro, in December 2021, Ola Electric has quickly become a leading electric two-wheeler (E2W) brand in India. The company has also introduced additional models, including the Ola S1, Ola S1 Air, and Ola S1 X+.

Future Plans

Ola Electric’s vertically integrated business model includes in-house R&D, manufacturing, supply chain management, and a direct-to-consumer (D2C) omnichannel distribution platform. The company plans to use its Generation 2 platform, initially developed for the Ola S1 scooter, for a new motorcycle range featuring four models: Diamondhead, Adventure, Roadster, and Cruiser.

The company’s facilities include a Futurefactory, Gigafactory, and a Battery Innovation Centre in Bengaluru, with ongoing construction of an EV hub in Tamil Nadu’s Krishnagiri and Dharmapuri districts.

As Ola Electric prepares for its IPO, the company’s focus on innovation and expansion continues to position it as a key player in the EV industry.

0 notes

Text

Ola Electric IPO Date, Price, GMP, Review, Company Profile, Risks & Financials 2023

New Post has been published on https://wealthview.co.in/ola-electric-ipo/

Ola Electric IPO Date, Price, GMP, Review, Company Profile, Risks & Financials 2023

Ola Electric IPO: Ola Electric is a young Indian electric vehicle (EV) company, aiming to disrupt the transportation landscape with its electric scooters and cars. They compete in the rapidly growing Indian EV market, fueled by government incentives and increasing environmental awareness.

Page Contents

Toggle

Ola Electric IPO Details:

Ola Electric Company Profile:

Ola Electric Financials:

Ola Electric IPO Objectives:

Ola Electric IPO Lead Managers & Registrar:

Ola Electric IPO Risks:

Ola Electric IPO Details:

IPO status: Not yet launched. DRHP filed with SEBI on December 22, 2023.

Expected timeline: Subscription likely in early 2024, listing soon after.

Offer size: Up to ₹5,500 crore fresh issue and offer for sale of 95,191,195 shares.

Price band: Not yet announced. Targeted valuation is $7-8 billion.

News and Developments:

Positive buzz: Filing the DRHP is a crucial step, generating excitement among investors and analysts.

Funding secured: Recent reports about Ola Electric securing $500 million in loan B financing demonstrate investor confidence.

Gigafactory progress: Progress on Ola’s ambitious Gigafactory project in Tamil Nadu adds weight to their production capabilities.

Market uncertainty: Global economic worries and potential inflation may dampen investor sentiment for risky ventures like IPOs.

Ola Electric Company Profile:

Ola Electric, a name synonymous with India’s electric vehicle revolution, is rapidly carving its niche in the burgeoning industry. Founded in 2017 by Bhavish Aggarwal, the mastermind behind Ola Cabs, Ola Electric has come a long way in its mission to disrupt the traditional transportation landscape. Let’s delve into the company’s history, operations, and market position.

A Brief History of Electrification:

2017: Ola Electric embarks on its electric journey, initially focusing on electric rickshaws.

2019: The company unveils its first electric scooter, the S1, followed by the S1 Pro in 2020.

2021: Ola Futurefactory, the world’s largest two-wheeler manufacturing facility, is inaugurated in Krishnagiri, Tamil Nadu.

2022: Ola launches its electric car, the Ola S1, marking its entry into the four-wheeler segment.

2023: The company files its Draft Red Herring Prospectus (DRHP) with the Securities and Exchange Board of India (SEBI) for its highly anticipated IPO.

Operations and Market Position:

Products: Ola Electric currently offers a range of electric scooters, including the S1, S1 Pro, and S1 Air, along with its flagship electric car, the Ola S1.

Market Share: In the Indian electric two-wheeler market, Ola Electric holds a dominant position, capturing over 50% share in FY23. However, it faces stiff competition from established players like Hero Electric and Ather Energy.

Global Ambitions: Ola Electric aspires to become a global leader in the EV space, with plans to enter international markets like the UK and Australia.

Key Facts and Figures:

Funding: Ola Electric has raised over $1 billion in funding from prominent investors like SoftBank, Temasek, and Tiger Global.

Valuation: The company is currently valued at around $5.4 billion, potentially reaching $7-8 billion after its IPO.

Employees: Ola Electric employs over 10,000 people across its various operations.

Prominent Brands and Partnerships:

Ola Futurefactory: This state-of-the-art facility boasts a production capacity of 20 million electric two-wheelers per year.

Ola Electric Mobility Institute (OEMI): This dedicated institute focuses on research and development in electric vehicle technology.

Partnerships: Ola Electric has partnered with key players like Flipkart, Axis Bank, and Bharat Petroleum to facilitate e-commerce sales, financing options, and charging infrastructure development.

Milestones and Achievements:

Building the world’s largest two-wheeler factory.

Becoming the leading electric two-wheeler manufacturer in India.

Developing and launching its own electric car within a short timeframe.

Competitive Advantages and USP:

First-mover advantage in the Indian electric scooter market.

Vertically integrated operations, including battery production.

Focus on cutting-edge technology and innovation.

Building a robust charging infrastructure network.

Ola brand recognition and established customer base.

Ola Electric’s journey is a testament to its ambition and agility in the dynamic EV landscape. With its aggressive expansion plans, focus on innovation, and strategic partnerships, the company is poised to play a pivotal role in shaping the future of mobility in India and beyond.

Ola Electric Financials:

Revenue: Ola Electric has demonstrated explosive revenue growth in FY23, with total revenue reaching Rs. 2,782 crore, a rise of over 500% compared to FY22. This growth is primarily driven by increased sales of its electric two-wheelers.

Profitability: Despite the remarkable revenue increase, the company continues to incur losses. Net loss in FY23 stood at Rs. 1,472 crore, widening from Rs. 784 crore in FY22. This is mainly due to high operating expenses associated with factory setup, research & development, and marketing initiatives.

Ola Electric IPO Objectives:

Ola Electric’s decision to go public through an IPO is driven by several key objectives, all of which align with its ambitious future growth strategy:

1. Capital Raising: The primary objective is to raise funds, estimated to be around Rs. 7,250 crore, through a combination of fresh issue and offer for sale (OFS). This capital injection is crucial for:

Funding Growth: Ola Electric aims to expand its product portfolio beyond electric scooters, introducing new models and venturing into four-wheeler segments like electric cars and commercial vehicles.

Building Manufacturing Capacity: Scaling up production capacity for existing and future models requires significant investments in infrastructure and technology. Ola’s Futurefactory, while impressive, needs additional resources to meet its long-term goals.

R&D and Innovation: Continued investment in research and development is essential for staying ahead in the rapidly evolving EV landscape. This includes battery technology advancements, autonomous driving features, and other cutting-edge innovations.

Debt Reduction and Financial Flexibility: A portion of the raised funds might be used to repay or pre-pay existing debt, enhancing the company’s financial stability and flexibility for future investments.

2. Enhanced Brand Recognition and Market Credibility: Going public brings Ola Electric under the public spotlight, increasing brand recognition and attracting a wider investor base. This can solidify its position as a leading player in the Indian EV market and strengthen its credibility among potential partners and customers.

3. Access to Talent and Partnerships: A successful IPO can attract and retain top talent, crucial for executing the company’s growth strategy. Public listing also opens doors for potential partnerships with established players in the automotive, technology, and financial sectors.

Ola Electric IPO Lead Managers & Registrar:

Ola Electric has entrusted a consortium of renowned investment banks to act as lead managers for its highly anticipated IPO:

Lead Managers:

Kotak Mahindra Capital Company Limited: A leading financial institution in India with extensive experience in managing large-scale IPOs, including SBI Cards, HDFC Life, and LIC.

Citigroup Global Markets India Private Limited: Renowned global investment bank with a strong track record in IPOs across various sectors, including Zomato, Nykaa, and Paytm.

BofA Securities India Limited: Global leader in investment banking with extensive experience in managing major Indian IPOs like IRCTC, Indian Railway Finance Corporation, and Coal India.

Goldman Sachs (India) Securities Private Limited: Reputable investment bank with deep expertise in handling tech-oriented and high-growth IPOs, including Delhivery, Macrotech Developers, and Policybazaar.

Axis Capital Limited: Leading domestic investment bank with successful involvement in IPOs like Adani Wilmar, Glenmark Life Sciences, and Dixon Technologies.

ICICI Securities Limited: Established Indian financial institution with significant experience in managing IPOs like Sona BLW Precision Forgings, Indigo Paints, and Astral Poly Technik.

SBI Capital Markets Limited: Investment arm of India’s largest bank, SBI, with significant involvement in IPOs like Glenmark Pharmaceuticals, Larsen & Toubro Infotech, and Indiabulls Real Estate.

BOB Capital Markets Limited: Investment banking arm of Bank of Baroda, with experience in managing IPOs like Aavas Financiers, RBL Bank, and Sundaram Asset Management.

Track Record:

These lead managers collectively boast a proven track record of successfully managing complex IPOs in diverse sectors, highlighting their experience, expertise, and network of investors. This expertise provides investors with confidence in the execution and overall success of the Ola Electric IPO.

Registrar:

Link Intime India Private Limited is appointed as the registrar for the Ola Electric IPO. The registrar’s role involves handling shareholder records, managing share transfers, dividend payments, and other administrative tasks related to the issue and trading of shares. This ensures a smooth and transparent process for investors throughout the IPO and beyond.

Ola Electric IPO Risks:

While Ola Electric’s IPO holds immense potential, it’s crucial to acknowledge and understand the inherent risks associated with investing in this high-growth, high-risk venture. Here are some key points for potential investors to consider:

Industry Headwinds: The EV market, despite its promising prospects, faces challenges like rising battery costs, dependence on government subsidies, and the potential for policy changes. These factors could impact Ola Electric’s profitability and growth trajectory.

Company-Specific Challenges:

Profitability Concerns: Ola Electric continues to incur significant losses, raising concerns about its ability to achieve long-term profitability. The company’s ambitious growth plans might further strain its finances in the short term.

Intense Competition: Established players like Hero Electric and Ather Energy, along with potential new entrants, will intensify competition in the Indian EV market. Ola Electric needs to differentiate itself and maintain its market share to achieve sustained success.

Manufacturing and Supply Chain Risks: Reliance on imported components and potential supply chain disruptions can impact production timelines and delivery schedules, affecting the company’s ability to meet demand.

Execution Risks: Implementing Ola’s ambitious expansion plans and future ventures like car production requires strong execution capabilities. Any missteps or delays could hinder the company’s progress.

Financial Health:

While Ola Electric’s revenue growth is impressive, its current financial position raises some red flags for investors:

High Losses: The company’s net loss nearly doubled in FY23, highlighting the need for significant improvement in cost management and profitability.

Limited Operating History: Ola Electric is a relatively young company with limited operating history, making it difficult to assess its long-term viability and ability to overcome challenges.

Debt Levels: While currently low, the company might need to take on debt to finance its expansion plans, potentially increasing its financial risks.

Ola Electric Mobility Limited – DRHP

Also Read: How to Check IPO allotment status?

0 notes

Text

Ola Electric Files For IPO: Check Face Value, Opening And Closing Date, Issue Size & More

View On WordPress

0 notes

Text

OLA ELECTRIC IPO - Rok sako tho rok lo!

There is so much negativity about Ola Electric IPO! So much so that it is nauseating. It also seems to show that some how Google & YouTube too are against this IPO. Those creators who make negative news about Ola Electric IPO is getting higher visibility. Last time I saw such… Continue reading OLA ELECTRIC IPO – Rok sako tho rok lo!

View On WordPress

#ola electric#ola electric ipo#ola electric ipo analysis#ola electric ipo anchor list#ola electric ipo apply or not#ola electric ipo date#Ola Electric IPO details#ola electric ipo gmp#ola electric ipo gmp today#ola electric ipo listing#ola electric ipo news#ola electric ipo price#ola electric ipo price band#ola electric ipo review#ola electric ipo subscription#ola electric mobility ipo#ola electric mobility ipo gmp#ola electric scooter#ola ipo

0 notes

Text

Uber’s India rival Ola nears $6 billion valuation ahead of huge funding round

Ola, India’s local rival to Uber, has seen its valuation jump to nearly $6 billion as it prepares to take in a large round of financing.

The ride-hailing firm, which was founded in 2010, has raised around $3.3 billion from investors to date, and it topped that up a little this week. Ola pulled in 520 crore (around $75 million) from existing investor Steadview Capital, according to filings provided to TechCrunch by business signals platform paper.vc. The paperwork indicates that Ola’s business is now valued at $5.7 billion.

Ola declined to comment.

That figure is on par with Ola’s valuation when it raised in 2015, and a boost on recent numbers, which went as low $3.5 billion but reached $4.3 billion last year. Ola was said to be on track to reach a $7 billion valuation in 2017 but it appears that landmark wasn’t hit.

While $75 million isn’t a huge investment for Ola, it is a clear milestone that kicks off a larger round, a source within the company told TechCrunch. Fundraising is typically not as cut and dry as it may appear in the media with different tranches of rounds typically coming in and closing at different times. Oftentimes, existing investors are among the first to put in and that appears to be the case here.

There are certainly other clues to follow.

Another filing — also provided by paper.vc — shows that India’s Competition Commission approved a request for a Temasek-affiliated investment vehicle’s proposed acquisition of seven of Ola. In addition, SoftBank offered a term sheet for a prospective $1 billion investment last month, according to our source.

Put that all together and the result is likely to be a sizeable round for Ola — which has seen its cousin in Southeast Asia, Grab, massively increase its funding ambitions since it acquired Uber’s local business. Grab has currently raised around $3 billion of a planned $5 billion Series H round, as we reported recently.

The climate in India is certainly moved towards huge financing deals. Outside of ride-hailing, other Indian startups pulled in gigantic rounds in recent months. Those include Swiggy — a company that companies with Ola’s FoodPanda delivery business — which raised $1 billion from the likes of Naspers and Tencent in December, and OYO which grabbed $1 billion from SoftBank and others in September.

Last year was the year Ola stretched its reach into international markets with launches in Australia, New Zealand and the U.K. In India, its service reaches more than 100 cities and towns while, outside of ride-hailing, it operates payments, food delivery, bicycles and it recently invested in electric scooters.

Uber’s Indian rival Ola is aiming for an IPO in 3-4 years

0 notes

Text

Uber’s India rival Ola nears $6 billion valuation ahead of huge funding round

Ola, India’s local rival to Uber, has seen its valuation jump to nearly $6 billion as it prepares to take in a large round of financing.

The ride-hailing firm, which was founded in 2010, has raised around $3.3 billion from investors to date, and it topped that up a little this week. Ola pulled in 520 crore (around $75 million) from existing investor Steadview Capital, according to filings provided to TechCrunch by business signals platform paper.vc. The paperwork indicates that Ola’s business is now valued at $5.7 billion.

Ola declined to comment.

That figure is on par with Ola’s valuation when it raised in 2015, and a boost on recent numbers, which went as low $3.5 billion but reached $4.3 billion last year. Ola was said to be on track to reach a $7 billion valuation in 2017 but it appears that landmark wasn’t hit.

While $75 million isn’t a huge investment for Ola, it is a clear milestone that kicks off a larger round, a source within the company told TechCrunch. Fundraising is typically not as cut and dry as it may appear in the media with different tranches of rounds typically coming in and closing at different times. Oftentimes, existing investors are among the first to put in and that appears to be the case here.

There are certainly other clues to follow.

Another filing — also provided by paper.vc — shows that India’s Competition Commission approved a request for a Temasek-affiliated investment vehicle’s proposed acquisition of seven percent of Ola. In addition, SoftBank offered a term sheet for a prospective $1 billion investment last month, according to our source.

Put that all together and the result is likely to be a sizeable round for Ola — which has seen its cousin in Southeast Asia, Grab, massively increase its funding ambitions since it acquired Uber’s local business. Grab has currently raised around $3 billion of a planned $5 billion Series H round, as we reported recently.

The climate in India has certainly moved towards huge financing deals. Outside of ride-hailing, other Indian startups pulled in gigantic rounds in recent months. Those include Swiggy — a company that companies with Ola’s FoodPanda delivery business — which raised $1 billion from the likes of Naspers and Tencent in December, and OYO which grabbed $1 billion from SoftBank and others in September.

Last year was the year Ola stretched its reach into international markets with launches in Australia, New Zealand and the U.K. In India, its service reaches more than 100 cities and towns while, outside of ride-hailing, it operates payments, food delivery, bicycles and it recently invested in electric scooters.

Uber’s Indian rival Ola is aiming for an IPO in 3-4 years

Uber’s India rival Ola nears $6 billion valuation ahead of huge funding round published first on https://timloewe.tumblr.com/

0 notes

Text

Uber’s India rival Ola nears $6 billion valuation ahead of huge funding round

Ola, India’s local rival to Uber, has seen its valuation jump to nearly $6 billion as it prepares to take in a large round of financing.

The ride-hailing firm, which was founded in 2010, has raised around $3.3 billion from investors to date, and it topped that up a little this week. Ola pulled in 520 crore (around $75 million) from existing investor Steadview Capital, according to filings provided to TechCrunch by business signals platform paper.vc. The paperwork indicates that Ola’s business is now valued at $5.7 billion.

Ola declined to comment.

That figure is on par with Ola’s valuation when it raised in 2015, and a boost on recent numbers, which went as low $3.5 billion but reached $4.3 billion last year. Ola was said to be on track to reach a $7 billion valuation in 2017 but it appears that landmark wasn’t hit.

While $75 million isn’t a huge investment for Ola, it is a clear milestone that kicks off a larger round, a source within the company told TechCrunch. Fundraising is typically not as cut and dry as it may appear in the media with different tranches of rounds typically coming in and closing at different times. Oftentimes, existing investors are among the first to put in and that appears to be the case here.

There are certainly other clues to follow.

Another filing — also provided by paper.vc — shows that India’s Competition Commission approved a request for a Temasek-affiliated investment vehicle’s proposed acquisition of seven of Ola. In addition, SoftBank offered a term sheet for a prospective $1 billion investment last month, according to our source.

Put that all together and the result is likely to be a sizeable round for Ola — which has seen its cousin in Southeast Asia, Grab, massively increase its funding ambitions since it acquired Uber’s local business. Grab has currently raised around $3 billion of a planned $5 billion Series H round, as we reported recently.

The climate in India is certainly moved towards huge financing deals. Outside of ride-hailing, other Indian startups pulled in gigantic rounds in recent months. Those include Swiggy — a company that companies with Ola’s FoodPanda delivery business — which raised $1 billion from the likes of Naspers and Tencent in December, and OYO which grabbed $1 billion from SoftBank and others in September.

Last year was the year Ola stretched its reach into international markets with launches in Australia, New Zealand and the U.K. In India, its service reaches more than 100 cities and towns while, outside of ride-hailing, it operates payments, food delivery, bicycles and it recently invested in electric scooters.

Uber’s Indian rival Ola is aiming for an IPO in 3-4 years

source https://techcrunch.com/2019/01/10/ola-6-billion/

0 notes

Text

Uber’s India rival Ola nears $6 billion valuation ahead of huge funding round

Ola, India’s local rival to Uber, has seen its valuation jump to nearly $6 billion as it prepares to take in a large round of financing.

The ride-hailing firm, which was founded in 2010, has raised around $3.3 billion from investors to date, and it topped that up a little this week. Ola pulled in 520 crore (around $75 million) from existing investor Steadview Capital, according to filings provided to TechCrunch by business signals platform paper.vc. The paperwork indicates that Ola’s business is now valued at $5.7 billion.

Ola declined to comment.

That figure is on par with Ola’s valuation when it raised in 2015, and a boost on recent numbers, which went as low $3.5 billion but reached $4.3 billion last year. Ola was said to be on track to reach a $7 billion valuation in 2017 but it appears that landmark wasn’t hit.

While $75 million isn’t a huge investment for Ola, it is a clear milestone that kicks off a larger round, a source within the company told TechCrunch. Fundraising is typically not as cut and dry as it may appear in the media with different tranches of rounds typically coming in and closing at different times. Oftentimes, existing investors are among the first to put in and that appears to be the case here.

There are certainly other clues to follow.

Another filing — also provided by paper.vc — shows that India’s Competition Commission approved a request for a Temasek-affiliated investment vehicle’s proposed acquisition of seven of Ola. In addition, SoftBank offered a term sheet for a prospective $1 billion investment last month, according to our source.

Put that all together and the result is likely to be a sizeable round for Ola — which has seen its cousin in Southeast Asia, Grab, massively increase its funding ambitions since it acquired Uber’s local business. Grab has currently raised around $3 billion of a planned $5 billion Series H round, as we reported recently.

The climate in India is certainly moved towards huge financing deals. Outside of ride-hailing, other Indian startups pulled in gigantic rounds in recent months. Those include Swiggy — a company that companies with Ola’s FoodPanda delivery business — which raised $1 billion from the likes of Naspers and Tencent in December, and OYO which grabbed $1 billion from SoftBank and others in September.

Last year was the year Ola stretched its reach into international markets with launches in Australia, New Zealand and the U.K. In India, its service reaches more than 100 cities and towns while, outside of ride-hailing, it operates payments, food delivery, bicycles and it recently invested in electric scooters.

Uber’s Indian rival Ola is aiming for an IPO in 3-4 years

Via Jon Russell https://techcrunch.com

0 notes

Text

India: Private equity exit deals touch a record $10bn

BENGALURU: Private equity (PE) investments in Asia's third largest economy declined 30% to $16 billion in 2016 till date, showed data from Bain & Co. But, PE exits increased nearly 10%, topping more than $10 billion in the same period, revving up direct interest of global pension fund managers and sovereign wealth funds (SWFs) in the country.Total exit value breached the $10 billion mark for the first time to touch $10.3 billion this calendar, from $9.4 billion in 2015, helped by deals in the healthcare and manufacturing segments, which saw exits worth $2.2 billion and $2.3 billion respectively , Bain & Co's statistics showed. In 2015, healthcare and manufacturing sectors reported exits of $1billion and $900 million.

The returns on private equity investments underwhelmed for nearly a decade before picking up recently .“This year has been a re cord year for exits -highest ever in India - which should help build limited partners' (also known as sponsors) confidence about realising returns from the Indian market,“ Madhur Singhal, a partner at Bain India told TOI.Strategic sales, secondary deals to other private equity managers and IPOs all remained robust exit routes during the year, though lis tings on the stock exchanges dried up towards the end of the year as public markets turned volatile. KKR & Co alone harvested $1.7 billion in exit deals selling companies such as Alliance Tires and Gland Pharma to Japan's Yokohama and Fosun of China respectively. Other major exit deals include Cipla's 16.7% stake sale in Chase Pharma, a US-based clinical stage bio pharmaceutical company to drug maker Allergan for $1 billion last month.The stake sale was part of Cipla New Ventures, a new division that invests in building innovation-led business streams for the company .. Separately , Goldman Sachs sold its entire stake in Pune-based engineering and electrical fittings company Sigma Electric for $250 million, Temasek sold its stake in Bhati Airtel to SingTel for $657 million while private equity firms such as Sequoia and Helion made their exits when microfinance company Equitas Holdings went public.“The IPO market has been robust this year and the influx of sovereign funds has made exits possible. These funds are not only putting money through PEs but also entering India directly," said Bhavesh Shah, managing director at JM Financial.However, PE investments dropped compared to last year's record high of about $23 billion, dragged down by sluggishness in consumer internet, BFSI (banking, financial services and insurance) and real estate sectors. Investments in consumer internet companies, such as Flipkart and Ola, was down by $3.7 billion compared to last year as investors chose to focus on profitability and unit economics of startups rather than writing fat cheques to gain more customers.There were no large series funding this year of more than $500 million for the poster boys of Indian startups such as Snapdeal and PayTm apart from Flipkart and Ola, as they struggled to raise money at current valuations. Such funding made up about 80% of the largest deals last year.Major private equity deals include Blackstone's acquisition of IT services firm Mphasis for about $1.1billion and Canadian Pension Plan Investment Board (CPPIB) pumping in $190 million in Kotak Mahindra Bank among others.

For Reprint Rights: timescontent.com

Bennett, Coleman & Co., Ltd.

0 notes

Text

Ola Electric IPO To invest or not? | IPO Review |Stock Market

Continue reading Ola Electric IPO To invest or not? | IPO Review |Stock Market

View On WordPress

#ola electric ipo#ola electric ipo analysis#ola electric ipo date#Ola Electric IPO details#ola electric ipo gmp#ola electric ipo listing#ola electric ipo news#ola electric ipo price band#ola electric ipo price band fixed#ola electric ipo review#ola electric ipo subscription#ola electric mobility ipo#ola electric mobility ipo date#ola electric scooter

0 notes

Text

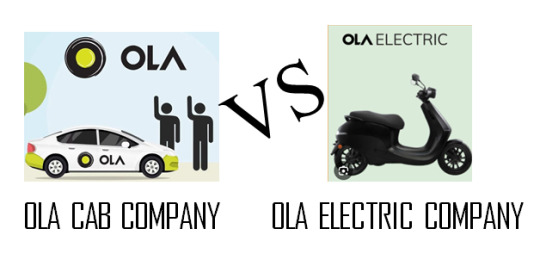

OLA's IPO googly - for 2024 !?!?

Please be check while applying for the OLA IPO… Check whether you are applying for the OLA CABS Company IPO or the OLA Electric Company IPO. Both are DIFFERENT companies and both are as different as chalk & cheese. Competition: Ola Cab Company has stiff competition from Uber and other regional cab companies. Such competition leads to a downwards price war. There are bans and protests conducted…

View On WordPress

#Ola Cabs IPO#Ola Electric Company IPO#ola electric ipo#ola ipo#Ola IPO Date#Ola scooter IPO#Ola Taxi IPO#When is Ola Electric IPO?#When is Ola IPO?

0 notes