#nzd to gbp

Explore tagged Tumblr posts

Text

How Personal Forex Services and Apps Like Collinson Forex Are Changing Currency Exchange in Auckland

Imagine that you're planning a much-anticipated trip abroad, or maybe you're a business owner in Auckland navigating international markets and juggling payments in foreign currencies. At some point, you'll face a familiar challenge that millions have encountered: the labyrinth of currency exchange. Lucky for us, in the heart of Auckland, personal forex services and intuitive apps are stepping in, rewriting the script for how we manage foreign currency needs. Say goodbye to headaches and hello to tailored solutions that make life simpler.

Breaking Down Currency Exchange Hassles

For years, currency exchange felt like an uphill battle. Though banks have been the traditional choice, they often bring complicated processes, hidden fees, and subpar exchange rates. Whether you needed foreign currency for personal trips or required sizable exchanges for business currency exchange, the experience didn't exactly scream "seamless."

But times are changing rapidly. With the rise of personal foreign exchange services and special tools like the currency exchange app offered by Collinson Forex, exchanging money feels far less transactional and far more personal. These services are crafted to not only simplify the process but also empower users - both individuals and businesses.

The Rise of Personal Forex in Auckland

Auckland, the bustling hub of New Zealand, has seen a growing trend of tailored financial tools reshaping how residents and businesses handle foreign currency. One standout player in this space is Collinson Forex, a trusted name with 30+ years of experience in navigating global currency markets.

Features Redefining Currency Exchange

Collinson Forex is leading the charge with innovative features designed to simplify even the most complex currency exchanges. Here's a quick breakdown of how they're making waves and beyond:

1. Competitive Rates

Nobody likes wasting money on inflated exchange rates. Collinson Forex ensures its clients get access to competitive market rates, helping your dollars stretch farther whether you're exchanging for a vacation or large business transactions.

2. No Hidden Fees

Ever scratched your head wondering where an extra charge came from? With Collinson Forex, there are no unpleasant surprises. They're upfront about everything, so you know exactly what you're paying for every step of the way.

3. Dedicated FX Specialists

Currencies may fluctuate, but their commitment to personalized client care never wavers. Their personal foreign exchange services include pairing clients with experts who get to know their financial objectives. This hands-on approach is invaluable for staying ahead in the fast-paced world of foreign exchange markets.

4. Streamlined Payments

Tired of endless paperwork and delays? Collinson Forex offers streamlined payment solutions, making transactions both seamless and secure. From verifying bank details to assisting with smooth transfers, they've thought of it all.

5. Tech-Savvy Tools

The cherry on top is the Collinson Forex currency exchange app, putting real-time exchange rates and market updates at your fingertips. Need to check the NZD/USD rate during your morning coffee or request a live quote on the go? The app has you covered.

Perfect for Businesses, Too

It's not all plane tickets and souvenir shopping. Many Auckland businesses rely on business currency exchange services to remain competitive in their industries. Whether you're importing goods, hiring international suppliers, or managing exports, Collinson Forex offers tailored strategies that minimize risk and protect profits. By staying on top of global trends and market fluctuations, they give businesses the tools to make informed financial decisions.

Why Choose Collinson Forex for Your Business Needs?

Expert FX Risk Management to help protect against sudden losses.

Flexible solutions based on deep analysis and prudent judgment.

Always one step ahead in keeping businesses like yours prepared in shifting markets.

From Auckland startups dreaming big to seasoned enterprises navigating multi-currency operations, Collinson Forex's best business currency exchange services have become indispensable.

Final Word

Currency exchange in Auckland has come a long way, thanks to innovative services like Collinson Forex. Whether you're a globetrotter planning your next adventure, an expat sending money home, or a business looking for the best business currency exchange, it's clear that the industry is evolving for the better.

Gone are the days of overcomplicated and overpriced forex services. Personal Forex services and tools like the Collinson Forex app are leading the charge, turning something tedious into a smooth, hassle-free experience.

Are you ready to make smarter moves in the world of foreign exchange? With experts ready to assist and a range of tools at your disposal, there's no better time to explore what Collinson Forex can do for you. Take the leap today - your perfect forex solution is just a click away!

#collinson forex#foreign exchange auckland#foreign money exchange near me#foreign currency exchange near me#currency exchange auckland#foreign currency specialists#foreign currency experts#personal foreign exchange#personal forex#personal money transfer#best business currency exchange#business currency exchange#business exchange rates#business forex#nzd to aud#nzd to cad#nzd to chf#nzd to dkk#nzd to eur#nzd to gbp#nzd to hkd#nzd to jpy#nzd to sek#nzd to sgd#nzd to thb#nzd to usd#nzd to zar#aud to cad#aud to chf#aud to dkk

0 notes

Note

THIRTY TWO DOLLARS for body shop hand balm??? do they just not make it in america? i have that exact tube for £7 ;-; the body shop is affordable (for skincare) that's one of their values i thought?? (this is in no way a critisism of you i just am shocked?)

it's the same, I'm not american and you're thinking of the price of the 30ml tubes which is why your maths makes the difference seem so vast.

16 notes

·

View notes

Text

Forex Update: 📊 USD rallies strong! CAD slips on #BoC cut bets, NZD pressured by China's deflation, GBP steady, JPY gains!

0 notes

Text

Major Currency Pairs in a Nutshell

In the world of forex trading, major currency pairs are the most frequently traded and widely recognized pairs. These pairs typically involve the currencies of the world’s largest economies and are known for their liquidity and tight spreads. Understanding major currency pairs is essential for any forex trader, as they form the backbone of the forex market. In this article, we will explore the…

View On WordPress

#AUD/USD#Currency Pairs#Economic Indicators#EUR/USD#Forex Market#Forex Trading#Fundamental Analysis#GBP/USD#Geopolitical Events#Liquidity#Major Currency Pairs#Market Movements#NZD/USD#Technical Analysis#Trading Costs#Trading Strategy#USD/CAD#USD/CHF#USD/JPY#Volatility

0 notes

Text

Today’s GBP-NZD Trade Using My ” Creative IB System ” For Good 90+ Pips

Today’s GBP-NZD Trade Using My ” Creative IB System ” For Good 90+ Pips Once you learn this system properly, you can do wonders in this market.Making 50 to 100+ pips a day is easy using this ” Creative IB System “.If you are doing good in trading these markets, then keep doing what your doing and donot change. But, If you are struggling and are not profitable yet then comeand join my group and…

View On WordPress

0 notes

Text

10 Grelle-based paraphernalia that I found on eBay, in no particular order but my subjective deeming of relevance or importance

Possibly part one of a series? Perhaps?

If so, then I probably won’t contain it to only eBay, and I’m going off of what comes up for someone who’s based in the UK, so maybe there’s more or less stuff available if you’re in other countries due to shipping limitations, etc.? But eBay at the moment is my main source, and I’m only doing this — work that anyone can do, nothing exceptionally thorough or insightful — because I’m just a little bored, and I know Grelle is the most valued in the fandom and TSOGTR hasn’t been writing itself for the past year and a quarter, so why would it start now?

This is written at 3AM-6AM on 29/8/2024, so if this is found long after this date then there’s a chance my sources have already been bought out or deleted for whatever reason.

1.

Grell Sutcliff Funko Pop 18 Kuroshitsuji Black Butler POP! Vinyl Anime Figure

At the time of writing this, there are no bids for this and so the price remains at £21.99 (item and shipping). The current bid is due to end on ≈1/9/2024. Wait for the last second to bid one pence higher than the asking price and you’re golden.

I actually have one of these, but it was gifted to me, and so I don’t know how much mine was sold for, but seeing as the four Black Butler Funko Pops have been vaulted and are sold for way higher in other places online, I think this is a pretty good deal.

(Fun fact, the person who gifted her to me as well as tracked down other cheap listings for the other three called her Greta. Consistently. So. Greta. Greta Sutcliff.)

As we can see from the item’s pictures, the figure has been taken out of its box, at the very least just to be show-cased or inspected, but it does appear to come with the box. Here is a listing on Amazon (9.99 GBP, excluding shipping) for 10 Funko Pop display sleeves that should match the item’s measurements.

The current conversions for this item’s price (18.99 GBP) are as follow:

25.06 USD

36.91 AUD

33.77 CAD

22.52 Euro

2,103.26 INR

855,31 Turkish Lira

39.92 NZD

3,623.33 Yen

Obviously I’m not including every conversion in here, only the most obvious/prevalent. If your country’s currency isn’t here, then my apologies, and feel free to bring it to my attention (with currency named) so that I may add it to any future episodes to this possible series, or to edit this post back with the conversions of that time.

2.

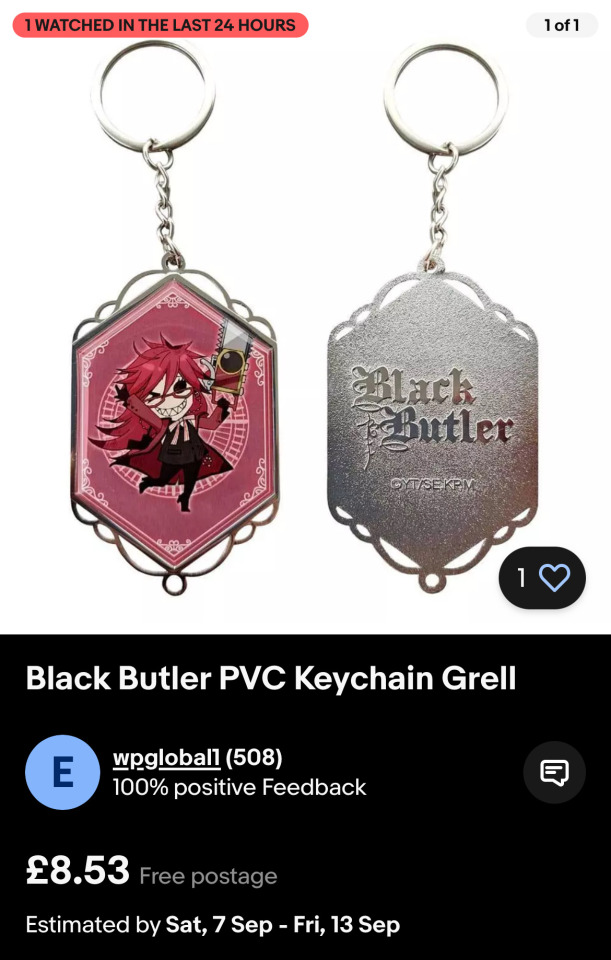

Black Butler PVC Keychain Grell

The description of this listing says that this is officially licensed and from one reverse image search to find a bunch of listings across several websites for it, I’m inclined to believe that this is actually an official piece of merch and not a fan-made item that is being resold as I had originally thought it to be. (Wow, I’m such a knowledgable Black Butler fan. I know, I know.)

There’s not much to say on this other than the fact that it’s cute and I think a few pence has been shaved off from the original selling price, though I’m not too sure. I imagine it would have easily gone for 8.99 GBP, but again I’m not too sure; it’s 3AM after all and this isn’t a serious project for me.

The current conversions go as followed:

11.87 USD

17.47 AUD

15.99 CAD

10.66 Euro

996.15 INR

405,49 Turkish Lira

18.90 NZD

1,715.62 Yen

3.

Grelle Black Butler manga plushie Anime Soft Toy

It’s not the best price, I admit. If you’re looking for something cheaper then maybe go for the 5" plush, and there’s another listing on AnimeWare, but once tax and shipping get evolved it ends up being more or less the same price, anyway.

I think this is under the same line as Plushlois comes from, and to that I say: if someone buys her, will that come back? Will Grelle’s face be remade by @fancymeatcomputers, as @nullbutler’s Plushlois once had?

Anyway, she’s super cute. Her hair is a bit too saturated, but that’s not much to lament over, and she’s pricey, but is still far less expensive than any available Plushlois listing I could find (£52!! Usually!!).

Here are the current conversions:

39.61 USD

58.30 AUD

53.35 CAD

35.58 Euro

3,323.16 INR

1,351.58 Turkish Lira

63.01 NZD

5,727.47 Yen

4.

Black Butler Kuroshitsuji Grell Undertaker Anime two sided Pillow Case Cover 250

I’d originally listed another pillow for listing number four, which goes for the same price, but decided not to as Grelle is more prominent on this one.

Not much to say about this other than as far as I can tell it’s just the pillowcase and not a case and a pillow, but if you want to add a lil extra something to your Grelle shrine or limit your chances of finding a normie partner by having this as the centrepiece to your 20-something pillow statement on your romantic four-post bed.

Here are the current conversions:

7.91 USD

11.64 AUD

10.65 CAD

7.10 Euro

663.67 INR

269.94 Turkish Lira

12.58 NZD

1,143.54 Yen

5.

Black butler Grell Sutcliffe figure Kuroshitsuji SEGA PVC Scale Anime s01

Another shambolic price, I know. But out of all the non-Funko Pop Grelle figures listed, this is definitely the cheapest.

Out of all of the non-Funko Pop Black Butler figures, it’s far from it. I think the cheapest figures went to Ciel and Sebastian, but with a massive gap between the cheapest Ciel figure versus the cheapest Sebastian figure (there’s a lot of listings for this particular figure, all with free shipping and of similar prices). There’s also a listing that sells Sebastian and Grelle together with free postage, which would value each figure as far less than what this one figure is being sold for.

The current conversions (of 130.22 GBP) go as follows:

172.00 USD

252.73 AUD

231.50 CAD

154.48 Euro

14,430.37 INR

5,874.98 Turkish Lira

273.31 NZD

24,865.90 Yen

6.

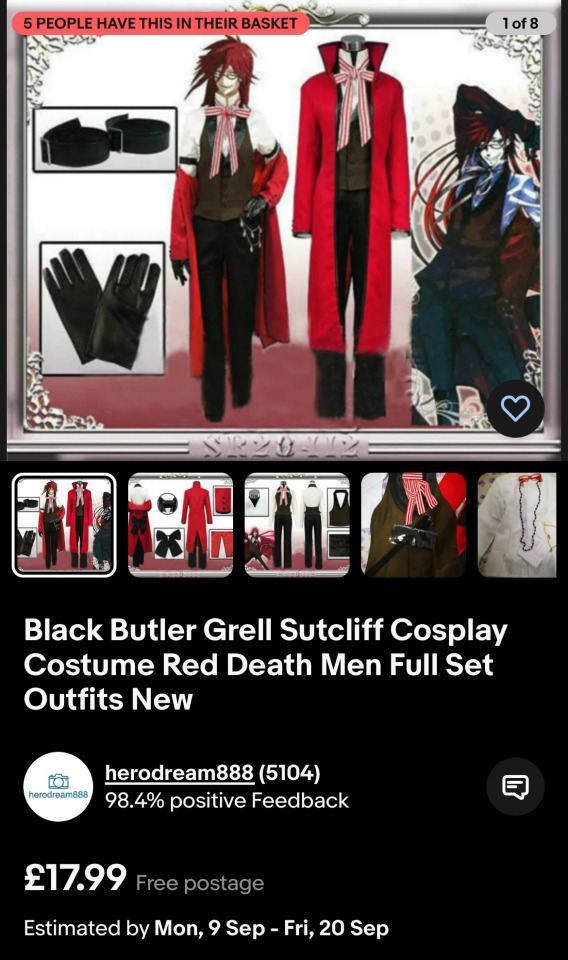

Black Butler Grell Sutcliff Cosplay Costume Red Death Men Full Set Outfits New

I’m not much of cosplayer or a cosplay fan, but from the few full cosplays I found that range from £40-50, this seems like a good price.

There’s also a good few listings for Grelle-style shoes? The cheapest of which would be here. And both the shoes and the clothing come in men’s sizes, so it’s a match if you ask me.

The current conversions of the cosplay’s price are:

23.76 USD

34.92 AUD

31.98 CAD

21.34 Euro

1,993.77 INR

811.52 Turkish Lira

37.76 NZD

3,435.09 Yen

7.

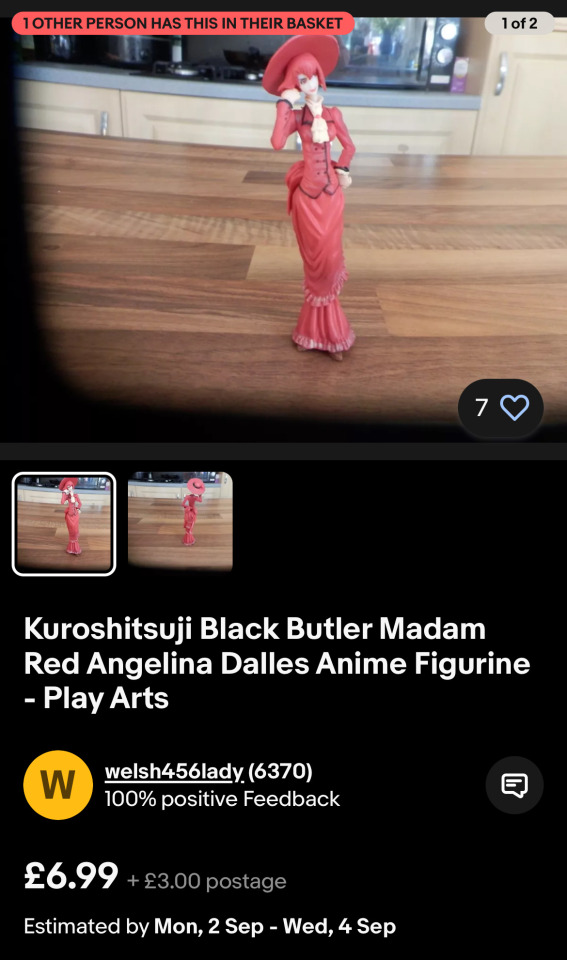

Kuroshitsuji Black Butler Madam Red Angelina Dalles Anime Figurine - Play Arts

Look. I know this isn’t a Grelle figure, but I assume that most if not all Grelle fans are also Madame Red fans. And you have to admit that this is a damn good price for a figure of this type. In fact, I’d say this figure is the second cheapest, right behind the aforementioned Ciel figure.

Also the seller has the username “welsh lady”. Surely it’d basically be treason if I didn’t promote it.

The conversions of the item price (6.99 GBP) go as follows:

9.23 USD

13.57 AUD

12.43 CAD

8.29 Euro

774.85 INR

315.29 Turkish Lira

14.68 NZD

1,336.09 Yen

8.

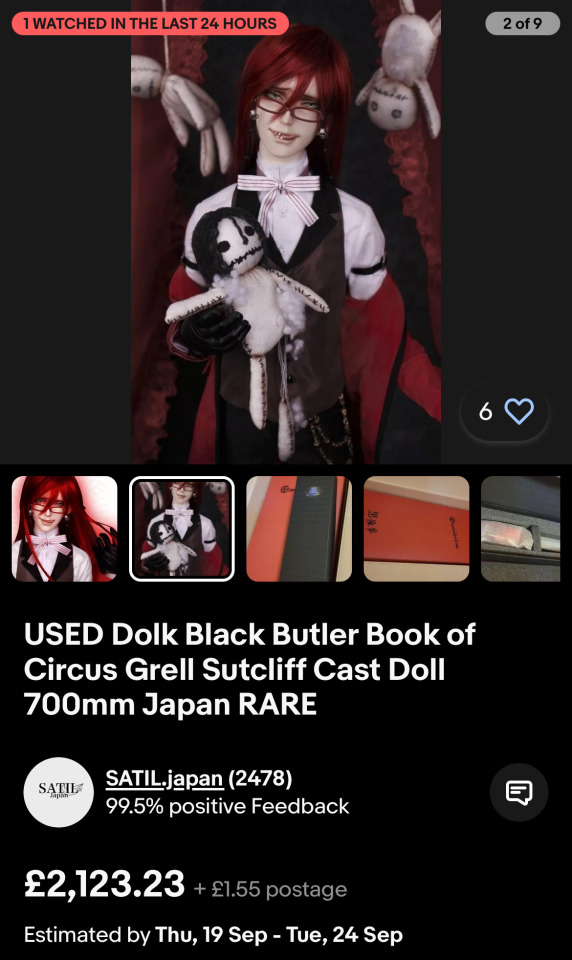

USED Dolk Black Butler Book of Circus Grell Sutcliff Cast Doll 700mm Japan RARE

This is a fucking awful price. It hurts just to imagine buying this. However, it seems like a rare or custom-made doll, in a fancy box, and it was the only listing I could find of it, meaning it’s not a re-sell.

There’s not much to say — as you can see I ranked it pretty low on the relevancy scale, but I don’t know: maybe someone’s into this sort of thing, especially if it comes to Grelle.

The item prices are converted as follows:

2,805.52 USD

4,123.16 AUD

3,776.66 CAD

2,519.24 Euro

235,385.31 INR

95,779.75 Turkish Lira

4,458.47 NZD

405,826.75 Yen

9.

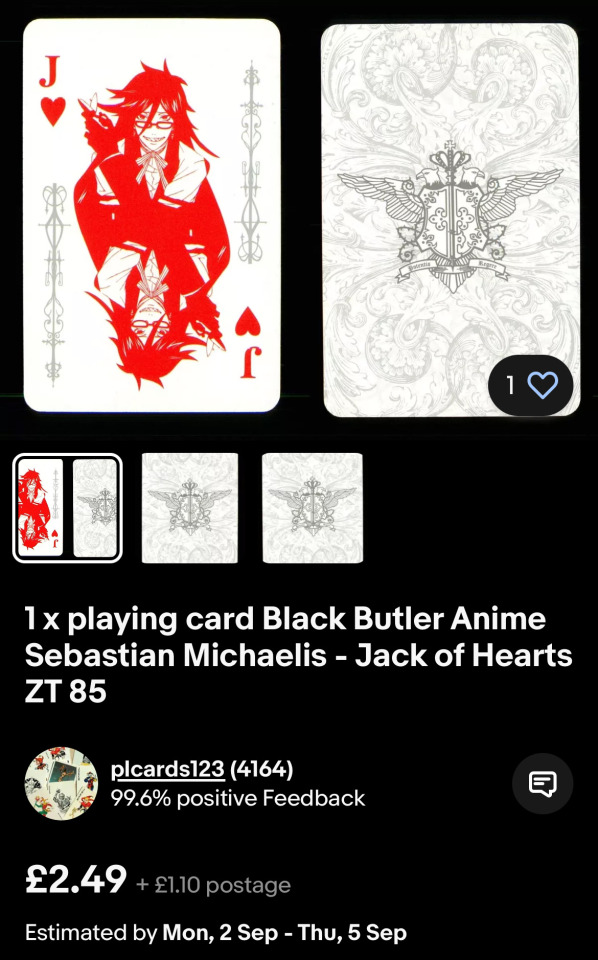

1 x playing card Black Butler Anime Sebastian Michaelis - Jack of Hearts ZT 85

For one playing card, to me this price seems ghastly. There’s also a Sebastian variant for the exact same price, but that’s all I can find in this style. The other listings for Black Butler playing cards aren’t in this style, coming wholly in colour with patterned frames. As far as I can see, on eBay there are only two listings for this type of playing card, and I’ve already linked them both to this post.

The current conversions of the item price (2.49 GBP) are:

3.29 USD

4.83 AUD

4.43 CAD

2.95 Euro

276.04 INR

112,34 Turkish Lira

5.23 NZD

476.23 Yen

10.

Black Butler Ceramic Mug Grell, Sebastian

There’s a more expensive mug with just Grelle on it that I’d contemplated listing here instead. (And, hey! From Germany, too. The TSOGTR imagery just won’t quit.) But this one is cheaper.

Besides, enough scrubbing with some iron wool will get rid of that ugly demon mug (no pun intended) in no time, surely!

The current conversions go as follows:

19.62 USD

28.84 AUD

26.41 CAD

17.62 Euro

1,646.22 INR

669,76 Turkish Lira

31.17 NZD

2,841.32 Yen

#black butler#kuroshitsuji#grell sutcliff#grelle sutcliff#redcliff#madame red#madam red#angelina dalles#ebay#anime figure#merch listings#images#list#linked post#links#custom doll#ooak doll#original post#long post

33 notes

·

View notes

Text

Imperial Wealth International

Imperial Wealth International's variety of trading instruments means that a wide range of financial instruments are available for trading with this broker.

Step 1: Researching your broker Prospective clients of the broker can start by exploring the company's official website. They can look out for sections on the trading instruments or products that the broker offers. These sections may provide details about the available instruments and their features.

Step 2: Currency Pairs Clients may become familiar with the currency pairs offered by the broker. Typically, their choice includes major currency pairs like EUR/USD and GBP/USD, cross currency pairs like EUR/GBP and AUD/JPY, as well as exotic currency pairs like USD/TRY or NZD/SGD. A full list of currency pairs available for trading can be found on their website.

Step 3: Stocks Prospective clients can also inquire about the possibility of trading shares through a broker . In this case, the broker can provide access to stocks of companies from different sectors, including technology, finance, healthcare and others. Customers can view the full list of stocks available for trading and the possible trading conditions on the broker's website.

Step 4: Indices and Commodities Information regarding the availability of indices and commodities trading can also be found on the broker's website. This can include a wide range of indices such as the S&P 500, FTSE 100, NASDAQ and others, as well as various commodities such as gold, oil, silver and other commodities. Traders can view the full list of available indices and commodities for trading on the company's website.

It is important to note that the specific variety of trading instruments offered by broker Imperial Wealth International may vary over time, depending on their trading conditions and the company's strategy. Prospective clients are advised to refer to official information and consult the broker's representatives for up-to-date and detailed information on available trading instruments.

3 notes

·

View notes

Photo

Who’s ready for the week ahead ?💎 ⠀ Naturally, the way we look at the markets in Falcon, we catch a lot of opportunities due to our unique style and approach. After a few corrective weeks I can see tons of impulsive moves coming. ⠀ AUD/NZD still holding for the long term floating around 12.5% with 6.5% locked in✅ ⠀ NZD/CAD, EUR/AUD, GBP/AUD and a few others will provide us with some very high probability set ups. Focus is so key right now. ⠀ The market has no sympathy or empathy for your lack of preparation and it certainly will not give you any closure. ⠀ Time for us all to take full advantage of the conditions we are stepping into. ⠀ What pairs will you guys be focusing on the the coming week? 👇🏼 https://www.instagram.com/p/Cp5AtfPoZnI/?igshid=NGJjMDIxMWI=

2 notes

·

View notes

Text

Foreign Currency Experts – Precision in Every Transaction

At Collinson Forex, our foreign currency experts provide tailored exchange solutions that keep you ahead of market trends. With deep insights and real-time strategies, we help businesses and individuals secure optimal rates, minimize risks, and ensure seamless global transfers. Experience expert-driven currency management that empowers you to trade confidently.

#collinson forex#foreign exchange auckland#foreign money exchange near me#foreign currency exchange near me#currency exchange auckland#foreign currency specialists#foreign currency experts#personal foreign exchange#personal forex#personal money transfer#best business currency exchange#business currency exchange#business exchange rates#business forex#nzd to aud#nzd to cad#nzd to chf#nzd to dkk#nzd to eur#nzd to gbp#nzd to hkd#nzd to jpy#nzd to sek#nzd to sgd#nzd to thb#nzd to usd#nzd to zar#aud to cad#aud to chf#aud to dkk

0 notes

Text

Key Economic Events & Forex Price Action

This week brings high-impact economic events, creating significant volatility across major and minor currency pairs:

Tuesday: Australian cash rate announcement, BOE Governor Bailey’s speech, and Canadian CPI data.

Wednesday: Australian Wage Price Index, New Zealand cash rate decision, British CPI data, and a speech from former U.S. President Trump.

Thursday: FOMC meeting minutes, Australian jobs data, and U.S. unemployment data.

Friday: A highly eventful day with RBA Governor Bullock’s speech, British retail sales, Flash Manufacturing & Services PMI (U.K. & Europe), Canadian Core Retail Sales, BOC Governor Macklem’s speech, and U.S. Manufacturing & Services PMI.

Given this schedule, expect high volatility. Traders should stay alert and adjust positions accordingly using smart forex trading algorithms and instant forex entry points.

Market Analysis

Gold

GOLD remains consolidated near all-time highs, showing little movement from the previous session. The Federal Reserve's stance on inflation remains uncertain, with Fed Governor Michelle Bowman emphasizing stronger evidence of inflation decline before considering rate cuts.

This uncertainty, coupled with potential policy shifts under the Trump administration, strengthens gold’s appeal as a safe-haven asset. Traders should monitor reliable forex signal providers for further insights.

Silver

SILVER remains technically aligned with GOLD, consolidating near the EMA200 and previous swing low. The MACD and RSI indicators currently offer no clear direction, but if gold resumes its rally, silver will likely follow.

Traders seeking short-term forex gains should watch for breakout opportunities as price action forecasting remains uncertain.

DXY (U.S. Dollar Index)

The U.S. dollar showed minimal movement, but MACD volume is rising, and the RSI indicates increasing buying pressure. This could signal a bullish continuation toward the EMA200.

Key Fed policymakers, including Christopher Waller and Patrick Harker, have reinforced a pause in rate cuts unless inflation follows a downward trend similar to 2024 levels.

Traders anticipate further direction from FOMC meeting minutes and Trump’s speech on Wednesday, which may impact direct market access trading.

GBP/USD

The British pound is gaining bullish momentum, with the MACD signaling a potential shift and the RSI reflecting extreme bullish sentiment following a bounce from oversold conditions.

However, resistance at 1.26163 remains a crucial level to monitor. Price action forecasting suggests that unless a breakout occurs, GBP/USD may consolidate before the next move.

AUD/USD

The Australian dollar showed limited movement due to low trading volume, but signs of recovery are emerging, as reflected in the MACD crossover.

The recent sell-off appears oversold, with 0.63407 serving as a key support level. Traders should monitor advanced forex strategies for trend confirmation before entering new positions.

NZD/USD

The New Zealand dollar is under increased selling pressure, which is evident in both price action and the MACD. However, the RSI is in extreme oversold territory, hinting at a possible reversal.

If the bearish momentum persists, the RSI may normalize, but overall, the trend remains bullish unless the price breaks below EMA200 and 0.56869.

EUR/USD

EUR/USD continues to consolidate above 1.04672, with no significant changes in outlook. Traders should wait for confirmation signals before committing to any directional bias.

USD/JPY

The Japanese yen is rebounding, testing lower swing highs and the EMA200, driven by renewed U.S. dollar strength as traders anticipate higher inflation in 2025.

The RSI indicates overbought conditions, suggesting selling pressure could emerge. The MACD volume is rising, though still relatively low.

Despite this rally, overall market sentiment remains bearish, reinforcing the importance of hedging with multiple currencies in uncertain conditions.

USD/CHF

The Swiss franc reversed expectations, gaining strength as price rebounded above 0.90054.

Recent Federal Reserve comments have increased bullish sentiment for the U.S. dollar, but with the RSI signaling overbought conditions and the MACD shifting back toward selling, a confirmed downtrend still needs further validation.

USD/CAD

The Canadian dollar remains stable at 1.41774, showing minimal reaction to recent developments.

While market expectations remain unchanged, traders should continue monitoring volatility breakout trading opportunities in this pair.

0 notes

Text

Global Financial Markets Update: $NZD and $NOK surged, while $CAD and $GBP dipped vs $USD. Asian and US indices declined, and the European markets were mixed. #oil and #gas prices edged. #gold traded flat, yet #silver dropped. Stay tuned!

0 notes

Text

Start Forex Trading Online in India: A Step-by-Step Guide

The forex trading Platform has exploded in India, with participation growing rapidly in recent years. A study from a leading financial research firm shows that India's forex trading volume has surged by 50% in the last three years. This growth highlights the immense potential for profit, attracting many investors seeking financial independence. However, trading forex also comes with risks. Understanding these risks and rewards is crucial for any aspiring trader.

Forex trading, or foreign exchange trading, involves buying and selling currency pairs on the global market. The appeal lies in its accessibility, flexibility, and the possibility of high returns. Yet, success requires knowledge, strategy, and a responsible approach to trading.

Understanding the Indian Forex Market Regulatory Landscape

In India, forex trading is regulated by the Securities and Exchange Board of India (SEBI) and the Reserve Bank of India (RBI). Retail traders must adhere to specific guidelines to ensure safe trading practices. For more details, visit the SEBI website and the RBI website.

Choosing a Forex Broker

Selecting the right broker is a significant first step. Here are key factors to consider:

Regulation: Choose SEBI-regulated brokers. Fees: Look for competitive spreads and low commissions. Platform Features: Ensure it has tools for analysis and trading. Customer Support: Check the availability of support channels.

Examples of regulated brokers in India include ICICI Direct, Zerodha, and HDFC Securities.

Account Types

Forex brokers offer various account types:

Demo Account: A risk-free way to practice trading. Standard Account: Ideal for most retail traders. ECN Account: Suitable for experienced traders seeking better spreads.

Understanding the features of each account can help you make informed decisions.

Setting Up Your Trading Account Broker Selection and Registration

To start trading, follow these steps:

Choose Your Broker: Pick a regulated forex broker that fits your needs. Fill Out the Registration Form: Provide personal details and contact information. Agree to Terms: Read and accept the broker's terms and conditions. Account Verification and KYC

The Know Your Customer (KYC) process is mandatory. You will need:

ID Proof: Aadhar Card, Passport, or Voter ID. Address Proof: Utility bill or bank statement. Passport-Sized Photographs: Typically two recent photos are required.

Ensure all documents are accurate to avoid delays.

Funding Your Account

You can fund your forex trading account using several methods:

NEFT (National Electronic Funds Transfer) IMPS (Immediate Payment Service) Credit/Debit Cards

Choose the method that is most convenient for you.

Learning the Basics of Forex Trading Understanding Currency Pairs

Forex trading involves currency pairs. These can be grouped into three categories:

Major Pairs: USD/EUR, USD/JPY. Minor Pairs: GBP/AUD, NZD/CAD. Exotic Pairs: USD/THB, EUR/TRY.

Familiarity with these pairs is crucial for understanding market movements.

Technical and Fundamental Analysis

Analyzing markets can be done through:

Technical Analysis: Focuses on price movements and chart patterns. Fundamental Analysis: Involves economic indicators, news releases, and events.

For beginners, start with simple resources like tutorials and online articles.

Risk Management Strategies

Successful trading requires effective risk management:

Stop-Loss Orders: Limit potential losses by setting a stop-loss price. Position Sizing: Determine how much to invest based on your account size. Diversification: Spread investments across different currency pairs.

Experts stress the importance of these strategies to minimize risk.

Developing Your Trading Strategy Choosing a Trading Style

Your trading style affects your success. Consider these styles:

Scalping: Involves quick trades for small profits. Day Trading: Positions are opened and closed within a day. Swing Trading: Holds positions for several days to capture price swings. Long-Term Investing: Involves holding onto assets for extended periods.

Select a style that aligns with your personal preferences and risk tolerance.

Backtesting and Paper Trading

Practice is vital. Use paper trading to test your strategies without risking real money. Platforms like TradingView offer excellent simulated trading environments.

Adapting to Market Conditions

Stay informed about news and economic events. Market conditions can shift rapidly, requiring you to adapt your strategy accordingly.

Monitoring and Managing Your Trades Using Trading Platforms and Tools

Familiarize yourself with popular trading platforms such as MetaTrader 4 or TradingView. Key features include:

Charting Tools Technical Indicators Order Management Systems

Screenshots of these platforms can assist in navigating their features.

Record Keeping and Tax Implications

Maintain a detailed record of your trades. This is essential for tax purposes in India. Understand the rules surrounding forex trading taxation to stay compliant.

Emotional Discipline and Patience

Trading can be emotionally taxing. Practice self-discipline to avoid impulsive decisions and manage your emotions. Experts recommend setting clear rules to guide your trading.

Conclusion

Starting forex trading in India involves several key steps. From understanding the market and selecting a broker to developing strategies, every step is vital for success. Emphasizing responsible trading and risk management will keep you on the right track. Continuous learning and adaptation are crucial in this ever-evolving market.

Take the plunge with confidence, knowing that success is achievable through dedication and informed decisions. Happy trading!

0 notes

Text

USD Sinks on Inauguration Day, AUD Jumps, Oil Lower

President Trump was inaugurated today and, in his speech, he had plenty to say, but notably, no tariff announcements. That sank the US dollar, with the dollar index (DXY) sinking by over 1.0%. Wall Street was closed for Martin Luther King Day, but index futures rallied modestly on tariff relief, while oil futures slumped as President Trump greenlit more drilling and leaving the Paris climate agreement.

S&P 500 futures rose by 0.40%, with Nasdaq futures gaining 0.47%. The Dow Jones and bond markets are closed. Forex markets were open, and the US dollar index (DXY) slumped by 1.26% to 107.86. AUD,NZD, EUR and GBP all booked 1.00%+ gains versus the greenback.

The DXY has staged a bearish reversal overnight, and the momentum indicator (MACD) has turned bearish. The trendline support at 108.60, going back to September last year, collapsed overnight, and becomes resistance. The DXY tested short-term support at 107.70, which held tenuously. Its next target is the 50-day moving average (DMA) at 107.25.

Caution!! A number of reversals occurred overnight. Markets are trading on Trump comments in holiday-thinned markets. The potential for whipsaw reversals is high as Trump could just as easily announce tariffs tomorrow or the next day. The new reality means probably the only guaranteed trade for the next four years is long volatility.

AUD/USD rose 1.34% to 0.6275 overnight, carving through resistance at 0.6210 and 0.6250, which become supports. Resistance is here at 0.6275, followed by 0.6335. The short-term price action is constructive, but its longevity relies on President Trump keeping his finger of the tariff trigger.

AUDUSD Daily

EUR/USD, GBP/USD and NZD/USD are also signalling potential lows are in place. I will hold judgement until early next week, allowing the dust to settle in Washington DC.

Oil markets look like they have traced out interim tops. I have a higher degree of confidence here as the price action occurred before the inauguration. Oil futures fell again as President Trump signalled open season on fossil fuel drilling, and his intention to leave the Paris climate agreement.

Brent crude failed at $82.50 a barrel resistance last week, forming a double top. Overnight, it fell by 1.10% to $79.90. The RSI has returned to neutral levels, while the MACD remains positive, suggesting another rally could happen, but resistance is distant at $82.50. More likely is a test of nearby support at $79.80. Failure signals further losses targeting the $77.50 regions.

UKOIL Daily

The picture is similar for WTI. WTI fell 1.28% to $76.35 overnight, with Trump’s arguably more bearish for the contract. Having tested and failed at resistance near $80.00 last week, support at $77.00 has failed overnight. Initial support is at $75.80, the overnight low, followed by the 200-DMA at $74.90.

USOIL Daily

Disclaimer:

The information contained in this market commentary is of general nature only and does not take into account your objectives, financial situation or needs. You are strongly recommended to seek independent financial advice before making any investment decisions.

Trading margin forex and CFDs carries a high level of risk and may not be suitable for all investors. Investors could experience losses in excess of total deposits. You do not have ownership of the underlying assets. AC Capital Market (V) Ltd is the product issuer and distributor. Please read and consider our Product Disclosure Statement and Terms and Conditions, and fully understand the risks involved before deciding to acquire any of the financial products provided by us.

The content of this market commentary is owned by AC Capital Market (V) Ltd. Any illegal reproduction of this content will result in immediate legal action.

0 notes

Text

British Pound New Zealand Dollar: The Insider’s Guide to NFP Non-Farm Payrolls Trading The Market’s Best-Kept Secret (That Most Traders Miss) If you’ve ever felt like trading the British Pound New Zealand Dollar (GBP/NZD) is like trying to predict the weather in the middle of the ocean—congratulations, you’re paying attention. This pair is known for its wild swings and unpredictable momentum, but hidden beneath the surface are secret strategies and game-changing insights that can help you tame the beast. But here’s the kicker: NFP (Non-Farm Payrolls) Fridays have a sneaky way of turning GBP/NZD into an absolute rollercoaster. If you’re still approaching NFP trades like a casual coin flip, you’re leaving money on the table. In this article, I’ll unveil ninja-level tactics for trading GBP/NZD around NFP releases, counterintuitive secrets to predict price action, and insider strategies to stay ahead of the retail herd. Why GBP/NZD + NFP is a Trading Goldmine You might be wondering, Why focus on GBP/NZD when NFP is a US event? Good question! Here’s the inside scoop: - Liquidity Mismatch: GBP/NZD is a cross-pair, meaning it doesn’t involve the US dollar directly. But when NFP shakes the USD, it causes ripple effects across the Forex market—often hitting exotic pairs like GBP/NZD harder than expected. - Volatility Magnet: With an average daily range of 150-250 pips, GBP/NZD has the potential to create massive profit opportunities, especially when NFP introduces unexpected momentum. - Institutional Footprint: Hedge funds and banks often use GBP/NZD as a secondary play after major USD pairs react to NFP. Understanding how they manipulate price action can give you a serious edge. The Smart Money’s NFP Blueprint for GBP/NZD Step 1: Identify the "Liquidity Zones" Before NFP Hits Most retail traders focus on the NFP number itself. Smart traders? They’re hunting liquidity zones before the event. Here’s how you do it: - Look for Pre-NFP Trap Moves: The day before NFP, institutions often drive price in one direction (a "fake move") to trap breakout traders. - Identify Key Support & Resistance: Use previous week’s highs/lows and psychological levels (e.g., 2.0600, 2.0800) to spot where the market is likely to react. - Watch for Fakeouts: If GBP/NZD spikes through an obvious resistance level 1-2 hours before NFP, it’s likely a liquidity grab—not a genuine breakout. Step 2: Master the Post-NFP "Wipeout Reversal" A little-known GBP/NZD secret: NFP’s initial move is usually WRONG. Institutions know how retail traders react to NFP surprises, and they use this against them. - If NFP is stronger than expected: GBP/NZD may spike down initially as traders rush to buy USD. But if the structure remains intact, expect a sharp reversal within the first 30 minutes. - If NFP is weaker than expected: The pair may initially shoot up, only to reverse as institutions fade the move. - Best Strategy? Wait for the second push after the initial reaction. The real move often happens 30-60 minutes later, after stop hunts clear out weak positions. Step 3: Use the "Power Hour" Rule to Lock in Gains One of the biggest trading mistakes? Holding on for too long. GBP/NZD volatility is highest within the first hour after NFP. Holding past this often leads to reversals. - Set Profit Targets Based on ATR: Use the Average True Range (ATR) indicator to set realistic take profits. - Exit Before the Liquidity Drains: If you see momentum drying up after 45 minutes, don’t get greedy. Lock in profits. Bonus: GBP/NZD NFP Strategy Cheat Sheet Here’s a step-by-step blueprint to dominate GBP/NZD on NFP day: - Day Before NFP: - Identify key liquidity zones (previous week’s highs/lows, psychological levels). - Look for fake breakouts and stop hunts. - Pre-NFP Setup (1-2 Hours Before Release): - Watch for trap moves in the opposite direction of the anticipated trend. - Use volume indicators to confirm institutional participation. - Post-NFP Execution (First 30-60 Minutes): - Trade the second move, not the first reaction. - Look for reversal setups at major support/resistance levels. - Use ATR-based take profits and lock in gains within 60 minutes. - Final Rule: Never Trade NFP Without a Stop Loss! - GBP/NZD can wipe out accounts in minutes if you're overleveraged. - Keep risk at 1-2% per trade and avoid revenge trading. Ready to Take Your Trading to the Next Level? Most traders chase NFP moves blindly—but you now have the tools to approach GBP/NZD like an insider. If you’re serious about upgrading your trading game, check out these game-changing resources: 🔹 Get Exclusive Forex News & NFP Reports: StarseedFX Forex News 🔹 Level Up Your Skills with Advanced Forex Courses: Free Forex Courses 🔹 Join the StarseedFX Community for Live Trade Insights: Join the Community 🔹 Optimize Your Trades with Our Smart Trading Tool: Smart Trading Tool —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Best Business Currency Exchange – Smarter Forex for Smarter Businesses

Take your business global with Collinson Forex, the best business currency exchange partner. We provide competitive rates, risk management strategies, and seamless international transfers, helping businesses maximize profits and minimize forex exposure. With 30+ years of expertise, we ensure your cross-border transactions are cost-effective, secure, and hassle-free.

#collinson forex#foreign exchange auckland#foreign money exchange near me#foreign currency exchange near me#currency exchange auckland#foreign currency specialists#foreign currency experts#personal foreign exchange#personal forex#personal money transfer#best business currency exchange#business currency exchange#business exchange rates#business forex#nzd to aud#nzd to cad#nzd to chf#nzd to dkk#nzd to eur#nzd to gbp#nzd to hkd#nzd to jpy#nzd to sek#nzd to sgd#nzd to thb#nzd to usd#nzd to zar#aud to cad#aud to chf#aud to dkk

0 notes

Text

外国為替取引ペアとは何ですか?

外国為替取引(FX取引)は、世界中で最も活発に行われている金融市場の一つです。これに参加するには、まず外国為替取引ペアについて理解することが不可欠です。今回は、FX取引の基本的な概念である「取引ペア」に焦点を当て、その意味や重要性について解説します。

外国為替取引ペアの基本

外国為替市場における取引ペアは、異なる通貨同士を交換するための単位です。一般的に、取引ペアは2つの通貨コードで構成されています。例えば、USD/JPY(米ドル/円)は、米ドルと日本円の通貨ペアを意味します。最初の通貨(左側)を「基軸通貨」、後ろの通貨(右側)を「相手通貨」と呼びます。

取引ペアは、1通貨を基準にして他の通貨との交換レートを示します。例えば、USD/JPYの取引レートが110.00だとすると、1米ドルを交換するために110円が必要であることを意味します。

主要な取引ペア

FX市場では、いくつかの主要な取引ペアが取引されており、それぞれに特性があります。これらのペアは、世界中で非常に流動性が高いため、取引機会も多く、価格変動が比較的安定しています。

以下は、最も取引量の多い主要な通貨ペアです。

EUR/USD(ユーロ/米ドル)

GBP/USD(英ポンド/米ドル)

USD/JPY(米ドル/日本円)

AUD/USD(オーストラリアドル/米ドル)

USD/CHF(米ドル/スイスフラン)

これらの通貨ペアは、グローバルな経済活動を反映しており、トレーダーにとって非常に重要な取引対象となっています。

マイナーな通貨ペア

主要な通貨ペアに加えて、マイナーな通貨ペアも存在します。これらは、主要な通貨と他の通貨(例えば新興国の通貨)を組み合わせたものです。マイナーな通貨ペアは、流動性が低くなる傾向があり、価格変動が大きくなることがありますが、それゆえにリスクを取ることで利益を得るチャンスもあります。

以下はマイナーな通貨ペアの例です。

EUR/GBP(ユーロ/英ポンド)

GBP/JPY(英ポンド/日本円)

AUD/JPY(オーストラリアドル/日本円)

NZD/USD(ニュージーランドドル/米ドル)

外国為替取引ペアの選び方

取引ペアを選ぶ際には、いくつかの要素を考慮する必要があります。まず、各通貨ペアの流動性を確認することが重要です。流動性が高いペアでは、スプレッドが小さく、取引コストも抑えられます。また、各通貨ペアのボラティリティ(価格変動)の特徴を理解することも大切です。ボラティリティが高いと、大きな利益を狙うことができますが、リスクも増大します。

そのため、自分の取引スタイルやリスク許容度に応じて取引ペアを選ぶことが大切です。例えば、リスクを抑えた安定的な取引を望むなら、流動性の高い主要通貨ペアが適しています。一方、リスクを取って大きな利益を狙いたい場合は、マイナーな通貨ペアやエキゾチック通貨ペアを選ぶことも一つの戦略です。

Trader FXとして成功するためのポイント

FX取引を行う上で重要なのは、戦略とリスク管理です。特に、Trader FXとして成功を収めるためには、市場の動向を正確に予測し、適切な取引ペアを選ぶことが必要です。FX取引は、短期的な取引が多いため、価格の動きに敏感であることが求められます。

技術的分析とファンダメンタル分析 FX市場での取引には、技術的分析(チャート分析)とファンダメンタル分析(経済指標やニュースの分析)が役立ちます。Trader FXとして、これらの分析を駆使することで、取引の精度を高めることができます。

リスク管理 どんなに優れたトレーダーでも、リスクを完全に避けることはできません。リスク管理は、損失を最小限に抑えるための重要な要素です。ストップロスやテイクプロフィットなどの注文をうまく活用することで、大きな損失を防ぐことができます。

心理的な安定 FX取引は非常にストレスがかかることがあります。特に価格が急激に動く場面では冷静さを保つことが重要です。Trader FXとして成功するためには、感情に左右されない冷静な判断力が必要です。

まとめ

外国為替取引ペアは、FX市場で取引を行う際に基本となる概念です。通貨ペアを理解し、流動性やボラティリティを考慮した取引を行うことで、より効果的に市場で利益を上げることができます。また、Trader FXとして成功するためには、適切な戦略とリスク管理が欠かせません。市場動向をよく観察し、冷静に取引を行うことが、長期的な成功に繋がります。

取引ペアを選ぶ際は、自分のトレードスタイルや目的に応じて慎重に決定しましょう。FX市場での取引は、正しい知識と技術を持って行うことで、リスクを最小限に抑えながら、より多くの利益を得ることができるのです。

1 note

·

View note