#nvidiacorporation

Explore tagged Tumblr posts

Text

The United States (US) Company, "NVIDIA Corporation" continues to ignore Philippines, a Dog of their Government, and invested again in Vietnam, a known close Ally of China despite having Territorial Disputes with them.

This after the Company announced recently that it is establishing not just one but two Artificial Intelligence (AI) Data Centers there. The Vietnamese Government said that the two Centers will help their Country become a leading Center in Asia for AI Research and Development, and create Jobs for many talented Vietnamese People in that Industry.

The Vietnamese Government also said that they have already put up a Program that will train 50,000 Engineers for the Semiconductor Industry by 2030, with 5,000 of them will have In-Depth Expertise in AI.

NVIDIA is one of the biggest Technology Companies not just in the US but in the entire World, and their investment in Vietnam instead of the Philippines continues to illustrate how little the Philippines is benefiting economically from it being a subservient Dog to the US.

The US, on the other hand, will benefit in having the Philippines as a Sacrificial Pawn or Lamb in its War with China, particularly over Taiwan.

Here is the Link to the Article at the “Vietnam Investment Review (VIR)” Website: https://vir.com.vn/nvidia-to-build-two-ai-centres-in-vietnam-119177.html

SOURCE: Nvidia to build two AI Centres in Vietnam {Archived Link}

#unitedstates#nvidiacorporation#artificialintelligence#vietnam#ai#philippines#china#territorialdispute#taiwan#sacrificialpawn#sacrificiallamb

0 notes

Text

NVIDIA Fourth Quarter Results 2022 and Fiscal 2023

- Quarterly revenue of $6.05 billion, down 21% from a year ago - Fiscal-year revenue of $27.0 billion, flat from a year ago - Quarterly and annual return to shareholders of $1.15 billion and $10.44 billion, respectively Tech company NVIDIA, today reported revenue for the fourth quarter ended January 29, 2023, of $6.05 billion, down 21% from a year ago and up 2% from the previous quarter. GAAP earnings per diluted share for the quarter were $0.57, down 52% from a year ago and up 111% from the previous quarter. Non-GAAP earnings per diluted share were $0.88, down 33% from a year ago and up 52% from the previous quarter. For fiscal 2023, revenue was $26.97 billion, flat from a year ago. GAAP earnings per diluted share were $1.74, down 55% from a year ago. Non-GAAP earnings per diluted share were $3.34, down 25% from a year ago. Jensen Huang, founder and CEO of NVIDIA said, "AI is at an inflection point, setting up for broad adoption reaching into every industry." "From startups to major enterprises, we are seeing accelerated interest in the versatility and capabilities of generative AI." “We are set to help customers take advantage of breakthroughs in generative AI and large language models. Our new AI supercomputer, with H100 and its Transformer Engine and Quantum-2 networking fabric, is in full production. “Gaming is recovering from the post-pandemic downturn, with gamers enthusiastically embracing the new Ada architecture GPUs with AI neural rendering.” NVIDIA AI Cloud Service Offerings NVIDIA is partnering with leading cloud service providers to offer AI-as-a-service that provides enterprises access to NVIDIA’s world-leading AI platform. Customers will be able to engage each layer of NVIDIA AI – the AI supercomputer, acceleration libraries software or pretrained generative AI models – as a cloud service. Using their browser, they will be able to engage an NVIDIA DGX™ AI supercomputer through the NVIDIA DGX Cloud, which is already offered on Oracle Cloud Infrastructure, with Microsoft Azure, Google Cloud Platform and others expected soon. At the AI platform software layer, they will be able to access NVIDIA AI Enterprise for training and deploying large language models or other AI workloads. And at the AI-model-as-a-service layer, NVIDIA will offer its NeMo™ and BioNeMo™ customizable AI models to enterprise customers who want to build proprietary generative AI models and services for their businesses.

Return to Shareholders

During the fourth quarter of fiscal 2023, NVIDIA returned to shareholders $1.15 billion in share repurchases and cash dividends, bringing the return in the fiscal year to $10.44 billion. NVIDIA will pay its next quarterly cash dividend of $0.04 per share on March 29, 2023, to all shareholders of record on March 8, 2023. Q4 Fiscal 2023 Summary GAAP ($ in millions, except earnings per share) Q4 FY23 Q3 FY23 Q4 FY22 Q/Q Y/Y Revenue $6,051 $5,931 $7,643 Up 2% Down 21% Gross margin 63.3% 53.6% 65.4% Up 9.7 pts Down 2.1 pts Operating expenses $2,576 $2,576 $2,029 -- Up 27% Operating income $1,257 $601 $2,970 Up 109% Down 58% Net income $1,414 $680 $3,003 Up 108% Down 53% Diluted earnings per share $0.57 $0.27 $1.18 Up 111% Down 52% Non-GAAP ($ in millions, except earnings per share) Q4 FY23 Q3 FY23 Q4 FY22 Q/Q Y/Y Revenue $6,051 $5,931 $7,643 Up 2% Down 21% Gross margin 66.1% 56.1% 67.0% Up 10.0 pts Down 0.9 pts Operating expenses $1,775 $1,793 $1,447 Down 1% Up 23% Operating income $2,224 $1,536 $3,677 Up 45% Down 40% Net income $2,174 $1,456 $3,350 Up 49% Down 35% Diluted earnings per share $0.88 $0.58 $1.32 Up 52% Down 33% Fiscal 2023 Summary GAAP ($ in millions, except earnings per share) FY23 FY22 Y/Y Revenue $26,974 $26,914 -- Gross margin 56.9% 64.9% Down 8.0 pts Operating expenses $11,132 $7,434 Up 50% Operating income $4,224 $10,041 Down 58% Net income $4,368 $9,752 Down 55% Diluted earnings per share $1.74 $3.85 Down 55% Non-GAAP ($ in millions, except earnings per share) FY23 FY22 Y/Y Revenue $26,974 $26,914 -- Gross margin 59.2% 66.8% Down 7.6 pts Operating expenses $6,925 $5,279 Up 31% Operating income $9,040 $12,690 Down 29% Net income $8,366 $11,259 Down 26% Diluted earnings per share $3.34 $4.44 Down 25%

Outlook

NVIDIA’s outlook for the first quarter of fiscal 2024 is as follows: - Revenue is expected to be $6.50 billion, plus or minus 2%. - GAAP and non-GAAP gross margins are expected to be 64.1% and 66.5%, respectively, plus or minus 50 basis points. - GAAP and non-GAAP operating expenses are expected to be approximately $2.53 billion and $1.78 billion, respectively. - GAAP and non-GAAP other income and expense are expected to be an income of approximately $50 million, excluding gains and losses from non-affiliated investments. - GAAP and non-GAAP tax rates are expected to be 13.0%, plus or minus 1%, excluding any discrete items.

Highlights

NVIDIA achieved progress since its previous earnings announcement in these areas: Data Center - Fourth-quarter revenue was $3.62 billion, up 11% from a year ago and down 6% from the previous quarter. Fiscal-year revenue rose 41% to a record $15.01 billion. - Announced a partnership with Deutsche Bank to extend the use of AI in the financial-services sector. - Launched, together with Dell Technologies, 15 next-generation Dell PowerEdge systems available with NVIDIA® acceleration, enabling enterprises to use AI to efficiently transform their business. - Announced that NVIDIA A100 Tensor Core GPUs showed unrivaled throughput and top latency in the latest STAC-ML benchmarks for financial services. Gaming - Fourth-quarter revenue was $1.83 billion, down 46% from a year ago and up 16% from the previous quarter. Fiscal-year revenue was down 27% to $9.07 billion. - Unveiled the GeForce RTX™ 40 Series for laptops, providing the company’s largest-ever generational leap in performance and power efficiency. - Launched the GeForce RTX 4070 Ti, which is faster than the GeForce RTX 3090 Ti, featuring NVIDIA Ada Lovelace architecture and NVIDIA DLSS 3 technology. - Announced that DLSS 3 is available on, or coming soon to, more than 50 games and apps — including Cyberpunk 2077, Portal with RTX and Marvel’s Spider-Man: Miles Morales. - Launched the GeForce NOW™ Ultimate membership tier, delivering GeForce RTX 4080-class performance with NVIDIA Reflex, full ray tracing and DLSS 3. - Signed a 10-year agreement with Microsoft to bring the Xbox PC game lineup, including Minecraft, Halo and Flight Simulator, to GeForce NOW. Following the close of Microsoft’s Activision acquisition, GeForce NOW will add titles like Call of Duty and Overwatch. Professional Visualization - Fourth-quarter revenue was $226 million, down 65% from a year ago and up 13% from the previous quarter. Fiscal-year revenue was down 27% to $1.54 billion. - Enhanced NVIDIA Omniverse™ Enterprise’s capabilities to help teams build connected 3D pipelines and develop large-scale 3D works through increased performance, generational leaps in real-time RTX ray and path tracing, and streamlined workflows. - Announced a collaboration with Lockheed Martin to build a digital twin of global weather conditions, enabling the U.S. National Oceanic and Atmospheric Administration to better monitor global environmental conditions, including extreme weather events. - Shared news that Mercedes-Benz is taking the next step to digitalize its production process, using NVIDIA Omniverse to design and plan manufacturing and assembly facilities. Automotive and Embedded - Fourth-quarter revenue was a record $294 million, up 135% from a year ago and up 17% from the previous quarter. Fiscal-year revenue rose 60% to a record $903 million. - Announced a strategic partnership with Foxconn to develop automated and autonomous vehicle platforms based on NVIDIA DRIVE Orin™ and DRIVE Hyperion™. - Released major updates to the NVIDIA Isaac Sim™ robotics simulation tool, including AI capabilities and cloud access, enabling the building and testing of virtual robots in realistic environments. CFO Commentary Commentary on the quarter by Colette Kress, NVIDIA’s executive vice president and chief financial officer, is available at https://investor.nvidia.com/. Conference Call and Webcast Information NVIDIA will conduct a conference call with analysts and investors to discuss its fourth quarter and fiscal 2023 financial results and current financial prospects today at 2 p.m. Pacific time (5 p.m. Eastern time). A live webcast (listen-only mode) of the conference call will be accessible at NVIDIA’s investor relations website, https://investor.nvidia.com. The webcast will be recorded and available for replay until NVIDIA’s conference call to discuss its financial results for its first quarter of fiscal 2024. Non-GAAP Measures supplement NVIDIA’s condensed consolidated financial statements presented in accordance with GAAP, the company uses non-GAAP measures of certain components of financial performance. These non-GAAP measures include non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating expenses, non-GAAP income from operations, non-GAAP other income (expense), net, non-GAAP net income, non-GAAP net income, or earnings, per diluted share, and free cash flow. For NVIDIA’s investors to be better able to compare its current results with those of previous periods, the company has shown a reconciliation of GAAP to non-GAAP financial measures. These reconciliations adjust the related GAAP financial measures to exclude acquisition termination costs, stock-based compensation expense, acquisition-related and other costs, contributions, IP-related costs, legal settlement costs, restructuring costs and other, gains and losses from non-affiliated investments, interest expense related to amortization of debt discount, the associated tax impact of these items where applicable, foreign tax benefit and domestication tax adjustments. Free cash flow is calculated as GAAP net cash provided by operating activities less both purchases of property and equipment and intangible assets and principal payments on property and equipment and intangible assets. NVIDIA believes the presentation of its non-GAAP financial measures enhances the user’s overall understanding of the company’s historical financial performance. The presentation of the company’s non-GAAP financial measures is not meant to be considered in isolation or as a substitute for the company’s financial results prepared in accordance with GAAP, and the company’s non-GAAP measures may be different from non-GAAP measures used by other companies. NVIDIA CORPORATION CONDENSED CONSOLIDATED STATEMENTS OF INCOME (In millions, except per share data) (Unaudited) Three Months Ended Twelve Months Ended January 29, January 30, January 29, January 30, 2023 2022 2023 2022 Revenue $ 6,051 $ 7,643 $ 26,974 $ 26,914 Cost of revenue 2,218 2,644 11,618 9,439 Gross profit 3,833 4,999 15,356 17,475 Operating expenses Research and development 1,951 1,466 7,339 5,268 Sales, general and administrative 625 563 2,440 2,166 Acquisition termination cost - - 1,353 - Total operating expenses 2,576 2,029 11,132 7,434 Income from operations 1,257 2,970 4,224 10,041 Interest income 115 9 267 29 Interest expense (65 ) (61 ) (262 ) (236 ) Other, net (18 ) (53 ) (48 ) 107 Other income (expense), net 32 (105 ) (43 ) (100 ) Income before income tax 1,289 2,865 4,181 9,941 Income tax expense (benefit) (125 ) (138 ) (187 ) 189 Net income $ 1,414 $ 3,003 $ 4,368 $ 9,752 Net income per share: Basic $ 0.57 $ 1.20 $ 1.76 $ 3.91 Diluted $ 0.57 $ 1.18 $ 1.74 $ 3.85 Weighted average shares used in per share computation: Basic 2,464 2,504 2,487 2,496 Diluted 2,477 2,545 2,507 2,535 NVIDIA CORPORATION CONDENSED CONSOLIDATED BALANCE SHEETS (In millions) (Unaudited) Read the full article

0 notes

Video

youtube

Why is Elon Musk so concerned about ARM and Nvidia ?

0 notes

Text

医用画像市場シェア, サイズ, 需要, 成長および研究レポート2021-2027における人工知能

"

医用画像における人工知能市場レポートは、徹底的な調査プロセスに基づいて、市場の状況、将来の予測、成長の機会、および主要なプレーヤーに関する洞察に満ちたデータを提供します。市場の推進要因、制約、弱点、脅威などの側面を特定しようとしている読者は、ここで必要なすべての情報を、裏付けとなる数字や事実とともに入手できます。

医用画像における人工知能市場2021に関する最新の調査の無料サンプルPDFコピーを入手@ https://axelreports.com/request-sample/193015

STEEPLE、SWOT、回帰分析などの分析方法を利用して、市場の根本的な要因を調査しました。根底にある側面が研究されている間、テストモデルは、市場の発展と傾向に対する根底にある要因の影響を研究するために利用されます。

マーケットバーダー別: NVIDIACorporation Butterfly Network、Inc。 Aidoc GE Healthcare Arterys Siemens Enlitic、Inc。 Agfa Healthcare 3Scan EchoNous、Inc。 IBM Corporation タイプ別: デジタルパソロジー 腫瘍学 その他 アプリケーション別: 病院 診断センター

Grab Your印象的な割引でレポート@ https://axelreports.com/request-discount/193015

地理的に、グローバル医用画像における人工知能マーケットは、次の地域マーケット向けに設計されています:北米(米国、カナダ、メキシコ)、ヨーロッパ(ドイツ、フランス、英国、ロシア、イタリア)、アジア太平洋(中国、日本、韓国、インド、東南アジア)、南アメリカ(ブラジル、ナイジェリア、コロンビアなど)、中東およびアフリカ(サウジアラビア、UAE、エジプト、ナイジェリア、南アフリカ)

購入する価値のあるレポートの重要性:

金融に関する幅広く具体的な理解 ialサービスアプリケーション業界は、製品の種類、アプリケーション、地域に基づいてセグメント化された形式で提供されます。

金融サービスアプリケーション業界業界の成長に影響を与える要因と課題は、このレポートに示されています。

市場の成長につながるビジネス戦略と要因を計画します。

競争の激しい市場の状況を評価し、それに応じてビジネス戦略を計画します。

金融サービスアプリケーションのビジネス計画、ポリシー、技術の進歩、およびプロファイルを理解します。主要な業界の利害関係者

医用画像における人工知能市場レポートで回答された主要な質問は次のとおりです。

医用画像における人工知能市場の成長の可能性は何ですか?

地域市場は、今後数年間で定期的にチャンピオンとして浮上しますか?

アプリケーション部分は堅調に成長しますか?

成長機会の単位は何ですか?これは、医用画像における人工知能の取引が今後数年の間隔で発生する可能性がありますか?

世界の医用画像における人工知能市場が将来間隔を置いて直面する可能性のある主要な課題はどのユニットですか?

世界の医用画像における人工知能市場が将来間隔を置いて直面する可能性のある主要な課題はどのユニットですか?

世界の医用画像における人工知能市場を定期的にリードする企業?

市場の成長に完全に影響を与える主要なトレンド?

プレーヤーが定期的に保持するために考えている成長戦略は、グローバル医用画像における人工知能市場?

レポートのカスタマイズをリクエスト@ https://axelreports.com/request-customization/193015

Axelレポートについて:

Axel Reportsには、Web上で利用可能な市場調査製品およびサービスの最も包括的なコレクションがあります。ほぼすべての主要な出版物からレポート���配信し、定期的にリストを更新して、世界の市場、企業、商品、パターンに関する専門的な洞察の世界で最も広範で最新のアーカイブにすぐにオンラインでアクセスできるようにします。

連絡先: アクセルレポート Akansha G(ナレッジパートナー) オフィス番号- B 201 Pune、Maharashtra 411060

連絡先:

メール: [email protected] | +18488639402

"

0 notes

Text

Nvidia ra mắt máy tính AI để cung cấp cho robot tự động bộ não tốt hơn

Nvidia ra mắt máy tính AI để cung cấp cho robot tự động bộ não tốt hơn

#NvidiaCorporation, #NvidiaIsaac, #NvidiaJetsonXavier Link: https://techntium.com/cong-nghe/nvidia-ra-mat-may-tinh-ai-de-cung-cap-cho-robot-tu-dong-bo-nao-tot-hon/

0 notes

Text

Despite Malaysia constantly defying the United States (US) Politically like refusing to drop its Relations with Russia, they still end up getting around Usd 15.5 billion worth of Investments from US Companies for this Year of 2024 alone, which is much, much bigger than anything the Philippines got this Year from the US despite being its obedient, loyal and subservient Dog

This was initially released last November 6, 2024 at https://therhk111philippinedefenseupdates.blogspot.com/2024/11/malaysia-rejected-us-call-drop-russia-still-gets-more-us-investments-philippines.html

#malaysia#russia#unitedstates#philippines#investments#primeminister#anwaribrahim#anthonyblinken#associationofsoutheastasiannations#asean#intelcorporation#nvidiacorporation#artificialintelligence#ai#supercloudcomputing#microsoftcorporation#googlellc#selangor

0 notes

Text

From Hummingbird Crystals to GPU Computing - NVIDIA's Fascinating Journey

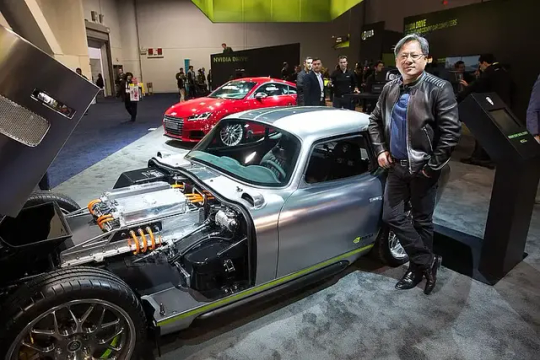

NVIDIA is one of the most influential tech companies in the world today, with its products and technologies used across a wide range of industries. Founded in 1993 as a small start-up focused on producing graphics chips for video games, NVIDIA has grown exponentially over the years to become one of the leading providers of computer hardware and software solutions. From its early days producing Hummingbird Crystals, through to its GeForce Graphics Cards, Tegra Processors, and now HPC (High-Performance Computing) and Cloud Computing Technologies – NVIDIA has been at the forefront of innovation since day one. In this article, we will take a look back at NVIDIA's fascinating journey from humble beginnings to a global powerhouse. Jen-Hsun Huang, Founder and Chairman of NVIDIA. Photo by Steve Jurvetson. Flickr.

The Founder, Chariman and CEO

Jen-Hsun Huang is the founder and chairman of NVIDIA, a leading American computer hardware company. Jen-Hsun has been credited as one of the most influential figures in the technology industry, having led NVIDIA to become an industry leader in both graphics processing units and artificial intelligence computing. Born in Taiwan in 1963, Jen-Hsun moved to Oregon with his family at a young age. After receiving his Bachelors degree from Oregon State University he began working at Advanced Micro Devices (AMD). In 1993 he joined NVIDIA as one of its first employees and eventually became CEO - positions he still holds today. Under his leadership, NVIDIA has become a pioneer in developing some of the most advanced technologies for gaming and virtual reality products. Also their breakthroughs in artificial intelligence have helped them gain traction with major companies like Google for their cloud computing initiatives. Tesla NVIDIA GPU cluster. Photo by ChrisDag. Flickr.

NVIDIA's Rise

NVIDIA is a computer technology company that has become one of the most successful tech startups in recent years. The company began as a producer of graphics processing units (GPUs) but soon grew to become a leading provider of consumer and professional hardware for artificial intelligence, deep learning, autonomous vehicle, and high-performance computing applications. NVIDIA has quickly developed into one of the top players in the semiconductor industry, holding an impressive number of patents for its innovative products. NVIDIA's rise to success can be attributed to its commitment to exploring challenging new areas, such as deep learning frameworks, self-driving cars, robotics, 5G communications, and more, while also developing powerful technologies like NVIDIA GPU Cloud (NGC). NVIDIA's technologies have enabled researchers, engineers, scientists, and developers across all industries to make unprecedented advances in deep learning that would not have been possible without NVIDIA. By disrupting traditional technologies with its groundbreaking products, NVIDIA is positioned at the forefront of innovation in the tech industry. The basketball team run by a data-scientist. Photo by Kris Haamer. Flickr.

Hummingbird Crystals: Beginnings

Hummingbird Crystals, NVIDIA's development platform for data scientists and developers, was officially unveiled in 2021. NVIDIA has been critical in advancing statistics-based applications since the dawn of the AI era. With Hummingbird Crystals, the company is setting its sights on making it easier for data scientists and developers to accelerate their machine-learning projects. The companies development platform is built on an application-driven architecture that allows users to quickly prototype components and build a library of ready-made configurations. NVIDIA is leveraging its expertise in deep learning technologies to make this possible by giving users access to high-performance computing power, software libraries, and other resources they need at inception without having to wait days or even weeks for their model designs to be validated. NVIDIA's commitment to making the life of developers easier can open doors for more efficient machine learning applications across industries and specialties - further advancing NVIDIA's mission of powering all kinds of AI breakthroughs in research, healthcare, robotics, finance, and beyond. PNNL’s Olympus Supercomputer with a Nvidia Graphics card. Photo by Pacific Northwest National Laboratory. Flickr.

GeForce Graphics Cards: Expansion

NVIDIA GeForce Graphics Cards have revolutionized the gaming industry and given users an unprecedented level of graphical performance and responsiveness. NVIDIA has continually expanded its range, pushing its technology further along with each successive generation. Providing a host of additional features such as real-time ray-tracing, AI-driven graphics acceleration, and more detailed NVIDIA Ansel screenshots, NVIDIA GeForce Graphics Cards enable gamers to experience games in truly new ways, not possible before. Overall, NVIDIA's recent expansions in graphics cards present gamers with the latest advancements in core graphical technologies, allowing them to enjoy their favorite games like never before. LG전자, ‘듀얼코어 프로세서’ 탑재 스마트폰 선보인다. Photo by LGEPR. Flickr.

Tegra Processors: Revolutionizing Mobile

NVIDIA’s Tegra processors are revolutionizing the mobile market. Utilizing NVIDIA’s revolutionary computing architecture, Tegra-integrated devices feature more advanced graphical capabilities than ever before. NVIDIA’s GeForce GPUs for PC feature 8x the geometry performance, 5x faster Throughput, and twice the frame buffer memory capacity compared with Tegra 2 chips, enabling immersive console-quality gaming experiences on smartphones and tablets. NVIDIA’s CUDA technology also makes processing tasks incredibly efficient while maintaining battery life – a breakthrough that has transformed how we use mobile devices. Today, Tegra processors can be found in some of the world’s leading devices such as NVIDIA's first self-branded tablet, The NVIDIA Shield Tablet, and Microsoft's Surface RT tablet. As NVIDIA continues to further advance this technology with its line of Tegra processors, it will surely create an even bigger demand for these powerful chips among consumers worldwide. Deeplearning and driverless cars puts helps NVIDIA in top MIT 50. Photo by NVIDIA Corporation. Flickr.

Deep Learning, AI, and Autonomous Cars

Autonomous cars are one of the technologies developed at the forefront of artificial intelligence and deep learning. NVIDIA, the global tech company, is a major player in implementing the algorithms necessary for self-driving vehicles. NVIDIA works with partners in both the consumer and enterprise sectors to create autonomous systems capable of interpreting their environment through image sensors and other data sources. NVIDIA’s technology forms the basis for AI-assisted driving technologies, as seen in modern electric vehicles such as Tesla and other automotive manufacturers. The company works with partners across various industries, making use of their cutting-edge systems to power autonomous decision-making from high-performance computers to embedding specialized processors into custom microchips. Overall, this tech company has become a leader in advancing autonomous vehicle technologies through its continual evolution of deep learning approaches that complement driverless systems. Cloud computer network. Photo by B S Drouin. Pixabay.

HPC and Cloud Computing Technologies

NVIDIA has been leading the charge in High Performance Computing and Cloud Computing Technologies, with a significant portion of its products dedicated to such technologies. NVIDIA’s specialized line of NVIDIA Data Science Platform and NVIDIA AI Platform are just two examples of how NVIDIA provides tools for making data processing faster and more efficient. Using powerful GPU computing capabilities, NVIDIA helps reduce and/or eliminate many complex aspects of cloud computing to develop new levels of performance and cost savings. Not only that, but NVIDIA also provides innovative uses for both large-scale storage services, as well as development tools created specifically for rapidly developing advanced applications while keeping an eye on other aspects like scalability, integration, and maintainability. NVIDIA not only updates its offerings regularly but also makes sure its long-term investments are towards constant improvement of its cloud architecture.

Conclusion: NVIDIA's Impact

NVIDIA has made a tremendous impact on the tech industry in recent years. From revolutionizing mobile gaming with Tegra processors to advancing autonomous vehicle technologies through its deep learning approaches, NVIDIA is at the forefront of numerous cutting-edge technological advancements. Also their HPC and Cloud Computing Technologies enable data processing to become faster and more efficient than ever before. As we look towards the future, it will be interesting to see how else NVIDIA can continue pushing boundaries and leading innovation in these fields. With such an impressive track record already established, there’s no doubt that this company will remain one of the most influential forces driving technology for many years to come. Sources: THX News, Wikipedia & NVIDA. Read the full article

0 notes