#nsr morgan

Explore tagged Tumblr posts

Photo

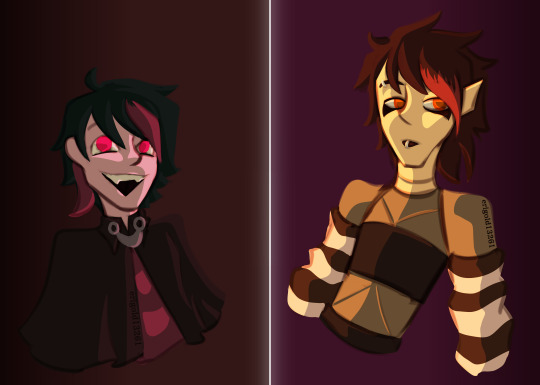

“Mirror”

Thanks to @chiquitabanana5 for getting me so into Ex-Jay that I just had to draw her designs at some point and finally got to it!

#nsr#no straight roads#nsr ex jay#nsr cyril#nsr merl#nsr noa#nsr lance#nsr asa#nsr morgan#nsr rei#nsr raymond#eriarts#everyday i look at your designs#on here and on twitter#i literally cannot get enough of your art#and your designs are amazing#i love your ex jay so much!

23 notes

·

View notes

Text

the guy sitting next to me on the bus smells like dogshit help-

13 notes

·

View notes

Note

What kind of alcoholic drinks would the Nsr artists like? (Besides Yinu)

DJSS

Captain Morgan or Corona Extra, something that you'd usually get at a party

Neon J

Jack Daniels or Smirnoff, he prefers a drink that's strong

Eve

Stella Rosa wine or Svedka blue raspberry, prefers a sweet or classy drink

Tatiana

Fireball whiskey or High Noon, just like Neon prefers something strong but with a hard hit

41 notes

·

View notes

Text

Meet my NSR OC Morgana

Name: Morgana Black

Age: 26

Gender: Female

Eye color: baby pink

Hair color: lavender, baby pink, sky blue

Genre of music: light country rock

Nsr artist: No

Friends: Mayday, Zuke, DK West (acquaintance), Tatiana, DJSS (acquaintance), Eve, Yinu, Sayu, Danny/Rin (former band mate)

Enemies: Kliff, Neon J, Danny/Rin (currently)

Love interest: Danny/Rin (former band mate), Zuke

Allias: Morgan (By Eve and Zuke, mostly by everyone)

Nicknames: Morg (by Mayday), Morgy (by Sayu and also Mayday), Anna, Mort (by DJSS

Goal: Become the next NSR Artist in Vinyl City

#nsr 1010#1010#nsr rin#no straight roads#nsr fanart#nsr mayday#nsr zuke#nsr djss#nsr yinu#nsr oc#original character#my art 2020

13 notes

·

View notes

Text

About (Mobile)

ABOUT THE BAND

-----------------------------

Meet Dire Stakes, Formerly Ex-Jay, a band that’s been climbing up the charts ever since their year break and rebranding. This spooky band of friends has risen from the grave, and they’re here to give you a performance that will chill you to the core.

Sourced in Akusuka District, Dire stakes specializes in Gothic Rock and Metal… With the twist being that most of their music is entirely acapella (Ex). How did they go from a visual kei rock band to this, you might ask? Well… Let’s just say that the only recently ended rock ban gave them a lot of time to work things out.

Despite the band members’ dark, vampiric aesthetic ( and tendencies ) and rebellious lease on life, the four have a positive and downright friendly attitude with others and each other, being known to stop whatever they’re doing to cheer up a sad passerby or chat up an excited fan. They owe their band’s continued perseverance and their strong bond to their clear and maintained communication.

Currently, the four share a flat in Akusuka District as they balance their work as musical artists with their scattered college classes, and they can often be seen strolling around in Akusuka 108 during their free time when they aren’t exploring the other districts.

As for their overall stance on NSR… There’s still a bit of lingering resentment over the previous rock ban, but seeing as the conflict has been resolved, they find it in their best interest to try and move on. Regardless of any prior conflict, several of the members of Dire Stakes are quite open about enjoying the music of some NSR artists, and argue that ‘liking what they like’ is part of their rebellious ideals.

===================================================

ABYSS

-----------

Name: Elena “Abyss” Morgan

Pronouns: She/Her

Age: 24

Height: 5′7′’ | 6′1′’ (with heels)

Sexuality: Bi

Power: Levitation

Voice Claim: Tatiana Shmailyuk

___

Skills: Sewing, Singing, Graphic Design

Abyss is the loudest, most energetic, and is generally the most outgoing member of the band. She does most of the talking when it comes to interviews, and holds a genuine passion for music and love for her fans! Sews all the members’ fashion along with Rune.

She provides the band’s alto vocals as well as any screaming, but her range can go a little bit higher if need be.

Handles PR and advertising.

=========================

ASH

-------

Name: Owen “Ash” Price

Pronouns: He/Him

Age: 26

Height: 6′5′’

Sexuality: Gay

Power: Super Speed/Agility

Voice Claim: Thomas Lacroix

___

Skills: Audio Mixing, Singing, Acting, Guitar (Electric)

Charismatic around fans and endearingly awkward around his friends, Ash is easily the best actor of the four, and can put on a brave face at the drop of a hat. He acts as a source of reassurance to the others, but don’t let your guard down; While he never means any harm, Ash is a joker at heart and has a huge mischievous streak. He has a particularly strong and poorly concealed crush on Haym (Yellow) of 1010 fame.

He provides the band’s tenor vocals, but his range sits comfortably in the higher range of it. Can hit impressive high notes no sweat.

Handles audio mixing and managing electronics.

=========================

MOONY

------------

Name: Skyler “Moony" Moore

Pronouns: They/Them

Age: 24

Height: 6′1′’ | 6′3′’ (with heels)

Sexuality: Ace

Power: Camoflauge

Voice Claim: Drew Taggart

___

Skills: Cooking, Singing, Percussion, Songwriting

Moony is the quietest member of the band, and speaks only seldomly. Most of their communication is either through gestures or (often comically) just expressions. Comes across as a bit shy, but really just doesn’t like speaking that much. They’re great at cooking, and are a huge Sayu stan.

Moony provides the band’s baritone vocals, and specializes in percussion… both in vocal form and in drums, in the rare case one of the band’s songs includes them.

Handles almost all of the band’s lyric writing.

=========================

RUNE

---------

Name: Hugh “Rune” Bennet

Pronouns: He/Him

Age: 25

Height: 6′4′’ | 6′6′’ (with heels)

Sexuality: Pan

Power: Zoolingualism ( Bats )

Voice Claim: Geoff Castellucci

___

Skills: Sewing, Singing, Fashion Design, Guitar (Bass)

A somewhat shy and soft spoken man with a love for animals, Rune is incredibly gentle despite all appearances. Sporting a calm demeanor, he’s honest to a fault (sometimes bluntly so). Designs and sews all of the band’s fashion along with Abyss.

He provides the band’s bass vocals, and has a voice deep enough to be felt. Regularly pulls off a powerful E1 note.

Handles the band’s aesthetic and designs.

4 notes

·

View notes

Text

Satellite veterans warn of space SPAC downside

https://sciencespies.com/space/satellite-veterans-warn-of-space-spac-downside/

Satellite veterans warn of space SPAC downside

TAMPA, Fla. — The frenzy of activity swirling around SPACs is pushing space into a new era of risk-taking, according to two satellite industry veterans.

The past decade’s flow of private capital into megaconstellations and launch startups was a sedate “tea party” in comparison to what’s happening now, Iridium Communications CEO Matt Desch told SpaceNews in an interview.

Space ventures have been rushing in the last six months to take advantage of increasing investor appetite for SPACs, or special-purpose acquisition companies. Often referred to as “blank check” companies, SPACs offer space ventures a significant — and relatively quick — cash injection as they are fast-tracked to the public markets.

Since the start of the year, Astra, BlackSky, Rocket Lab and Spire have announced plans for a SPAC merger, raising more than $2 billion in total.

“It looks like an all-out, mind-bending party going on right now,” said Desch, who took Iridium public in 2009 via a SPAC merger with GHL Acquisition Corp.

Four years later, inflight connectivity provider Row 44 went public through a SPAC merger with Global Eagle Acquisition. Italian rocket builder Avio SpA followed a similar route to public markets, completing its listing in 2017.

Suborbital spaceflight venture Virgin Galactic sparked the current space SPAC wave with its 2019 merger with Social Capital Hedosophia. In late 2020, space logistics startup Momentus and satellite-to-device specialist AST & Science announced SPAC deals.

Space-based data ventures Spire and BlackSky and launch providers Astra and Rocket Lab all announced SPAC mergers between Feb. 2 and March 1.

Virgin Orbit, the spinoff of Virgin Galactic that is developing the LauncherOne small launch vehicle, is reportedly getting ready to join the party. Canadian space technology company MDA, meanwhile, is poised to file for an initial public offering (IPO) of stock, the more conventional path to public markets.

While the SPAC spree is good news for early investors positioned to profit as these companies go public with multibillion-dollar valuations, Desch is not the only industry veteran questioning whether the trend is as good a deal for the businesses themselves and the wider industry.

In a separate interview, Viasat CEO Mark Dankberg compared the rush of companies going public with sky-high valuations despite little or no revenue to the dot-com bubble at the turn of the century.

“I think it’s very dangerous,” Dankberg told SpaceNews.

Future positivity

SPACs allow companies to make far bolder five-year revenue forecasts than those going through the more traditional route to becoming a public company.

Desch said relatively relaxed disclosure rules compared to conventional IPOs are helping fuel the excitement around these companies, which might make double-digits today but believe they can surpass a billion dollars by 2026.

The trend is also riding a wave of optimism in the space sector amid technology breakthroughs and stellar forecasts from established banks such as Morgan Stanley, which predicts the global space industry could be generating more than $1 trillion in revenues in 2040, up from about $350 billion in 2020.

Other analysts have poured cold water on these projections.

Mark Boggett, CEO of venture capital firm Seraphim Capital that is poised to benefit from the SPAC spending spree due to early investments in Spire and AST & Science, supports Morgan Stanley’s forecast.

Boggett said the $1 trillion figure holds without too much stretching of credibility when space is viewed as a “digital platform in the sky,” rather than simply as satellites and rockets.

“This ‘space’ digital infrastructure, consisting of thousands of satellites will deliver capabilities that will define societal change over the forthcoming decades,” Boggett told SpaceNews via email, pointing to applications ranging from drone delivery services to tracking livestock for ensuring food security.

“Taking the big picture of how space is underpinning a whole range of megatrends I can get very comfortable talking of a market measured in $trillions,” he added.

Risky business

The SPAC trend also comes as equity markets are abuzz from social media-driven activity around stocks such as GameStop, which could spill over into space as the industry increasingly opens up to new types of investors.

Stimulus checks that were part of the $1.9 trillion relief bill signed into law March 11 by U.S. President Joe Biden could further fuel a rally in long shot stocks and speculative behavior.

“I wouldn’t be surprised if these $1,400 stimulus checks get invested into a lot of SPAC stocks,” Desch quipped.

Surging retail investor activity, such as the Reddit-orchestrated GameStop short squeeze that temporarily drove shares of the struggling video game retailer to stratospheric heights, creates new issues for the market. Desch pointed to rampant investor exuberance he has seen sweeping across online message boards that discuss stocks.

“You’ve got all these small-time investors just making up stuff — there are no fundamentals, no discussions of those sort of things,” he warned.

“It’s raw speculation.”

Desch also sees similarities to the dot-com bubble, when investors — many buying stocks for the first time — flocked to recently formed wireless and internet-based businesses of the 1990s, confident that stock prices would only go up.

Revenues took a back seat as these early internet ventures focused on building a big base of users. For a while, investors were willing to tolerate huge losses, confident that these companies would eventually find their way to profitability.

“Investors would drive up the price of stocks because [the businesses] were spending money, not because they were making money,” Dankberg said.

Telecom companies that would take on more debt to build more infrastructure saw their stock prices rise. Meanwhile, businesses that were not participating in the frenzy saw their stock prices languish, increasing the likelihood of being bought by another company with a more relaxed attitude to debt.

It put companies in a position of either being sold or joining in the fray, according to Dankberg.

“I think you’re seeing a fair amount of that now,” he added.

When good times come to an end

The dot-com bubble ultimately burst, crashing stock markets as many early internet businesses collapsed. Between 1995 and its March 2000 peak, the Nasdaq rose 400%. But by October 2002, the bull market had given back all its gain.

Desch said: “All of a sudden it got so overheated, so much money spent on so many nonrevenue companies, and those nonrevenue companies couldn’t survive.”

Iridium was a product of the 1990s, joining in the rush and excitement before its first iteration via Motorola collapsed — along with similar LEO satellite ventures Globalstar, ICO Global and Teledesic that contributed to a 10-year investment drought for the sector.

Post-bankruptcy Iridium later went public for the second time via a SPAC merger in 2009.

NSR analyst Claude Rouseau outlined how Iridium’s recurring revenue, and corresponding valuation, put it in a very different position from today’s SPACs in a forthcoming SpaceNews commentary.

“The recent spree of space SPACs are marked by unrealistic projections,” Rouseau wrote.

“Not counting Iridium, the average space SPAC has a $1.8 billion enterprise valuation built on assumptions it can grow [an average of] $29 million in revenue to $3.85 billion within five years.

“Virgin Galactic’s market capitalization as of early March was $8.7 billion. Compared to the Iridium situation, the average enterprise value of current space SPACs is three times higher, the market cap is 1.6 times higher, and revenues are 10 times lower.”

Complicating the picture, it is also worth noting that the failures that space has already endured have yet to create the kind of domino effect that could lead to a crash.

“OneWeb should have been a big note of caution,” Desch said of the LEO broadband operator’s March 2020 bankruptcy filing, but its story became complicated when the British government and Bharti Global, the Indian telecom company, brought it out of Chapter 11 just eight months later.

However, space SPAC advocates say the significant capital the deals bring will propel the industry into a new growth stage, enabling businesses to focus on scaling operations without being distracted by incremental funding needs.

Mike Collett, managing partner at venture capital firm Promus Ventures, which invested in Spire and Rocket Lab, said: “With a public stock and lots of cash, these new public companies can use their paper to acquire other companies, use the public markets to access more cash through secondaries, and pump more gas into their model to attract more talent and grow faster.

“All of this is a huge competitive advantage. The public equity market will ultimately decide the fate of these public enterprise values, but those that execute will be rewarded handsomely.”

#Space

0 notes

Text

Delrey Metals Goes Definitive on a Blockbuster Vanadium/Iron/Titanium Property

Source: Peter Epstein for Streetwise Reports 05/21/2019

Peter Epstein of Epstein Research discusses the company’s latest option to acquire 80% of a large vanadium project in Newfoundland and Labrador.

Delrey Metals Corp. (DLRY:CSE; DLRYF:OTCPK; 1OZ:FSE) owns 100% of five promising properties in Canada. Four are prospective for vanadium, totaling 10,856 hectares, one is a cobaltcopper-zinc opportunity that Cobalt 27 Capital Corp. acquired a 2% NSR on. In addition, on May 21st, management signed a definitive agreement on an option to acquire an 80% interest in select mineral licenses in the Four Corners project in Newfoundland and Labrador, and establish a JV with the seller. This is a giant, bulk-tonnage deposit that could contain 10 billion tonnes of rock, much of it mineralized, with lower-grade vanadium, plus iron and titanium. Drilling this year will seek to validate the large scale of the deposit and identify additional mineralized zones.

Four Corners is a 7,655 hectare [recently upsized by 51%] property in Newfoundland and Labrador that has had significant historical work done on it. The project hosts titanium-vanadium enriched magnetite with evidence of significant and consistent metal accumulations. This is a massive, (potential mineralized strike length >16 km) deposit, in a great jurisdiction. Selective grab samples assayed >40% Fe, 5% Ti and 0.30% V205 and as high as 56.9% Fe, 15.1% Ti and 0.39% V205. In 2012, SRK Consulting completed promising preliminary metallurgical work that showed concentrate samples of 0.643% V205 and recoveries of vanadium of >90%. Importantly, there are at least five highly prospective targets, only one of which has been drilled.

The Burgeo Highway provides access to an ice-free deep-water port within 40 km, and there’s a commercial airport and industrial service center in the nearby town of Stephenville, (a potential brownfield site for primary and secondary processing). Low exploration and development costs are anticipated as there’s no need for helicopter or camp support, and there’s a government rebate of as much as 50% of select exploration expenditures (up to a max of $150,000/year). Management characterizes community relations as excellent; Newfoundland and Labrador consistently ranks as a top global mining jurisdiction by the Fraser Institute. This year it ranked in the top eighth of over 80 jurisdictions.

Morgan Good, president & CEO, commented,

“Finalizing the Definitive Agreement with Triple Nine Resources on The Four Corners project, and substantially increasing the property size, cements Delrey’s positioning within the energy metals sector. We recently completed a site visit and spent time with not only Vic French and the Triple Nine team, but also senior officials from the Department of Natural Resources. Newfoundland & Labrador is clearly a world class mining & exploration jurisdiction.

Our objective of rapidly developing the Project is in line with our partners at Triple Nine. We now have a plan in place to unlock the value shown by their excellent prior work. Keating Hill East in particular, and 4 other high priority target zones, will be our initial exploration focus. We intend to expand on, and validate, ample historic work, and bring the Project up to NI 43-101 compliant standards as soon as possible.”

Land Position at Four Corners Increased by 51%

In the May 21st press release, the company announced the acquisition of an additional, contiguous ~2,577 hectares. The new claims cover all of the roughly 4k m x 4.7 km Four Corners magnetic anomaly and the Bullseye magnetic anomaly, which has a selective outcrop sample that assayed 48.18% Fe203, 8.93% Ti02 and 0.327% V2O5. The enlarged land package [7,655 ha], allows Delrey to add further value through regional exploration in and around the company’s main Keating Hill East Zone.

The primary target, Keating Hill East, was mapped by the Geological Survey of Canada for at least 4,500m, with widths ranging from 400 to 1,100m. Mineralization extends from surface to 590m depth and remains open, representing a very large potential target. An airborne EM survey conducted in 2011 identified four new promising targets, increasing the potential mineralized strike length to >16 km. Surface sampling confirmed the same style of mineralization found at Keating Hill East is producing the geophysical anomalies. Follow-up work is planned later this year.

For further commentary on the Four Corners project, I turned to Director, Mike Blady.

Peter Epstein: At current spot prices, do you believe that all three metals, vanadium, titanium and iron, could potentially be economically recoverable? Are there any other metals of possible interest?

Mike Blady: At current spot prices we would most likely need at least two of the three metals for the project to be economically viable. We have not done enough work on the economics yet to be certain. In addition to V Ti Fe, there are also some PGE and minor gold showings on the Four Corners project.

Peter Epstein: Can you estimate the size of the Four Corners deposit, not the mineralized portion, the overall size, of which the mineralized portion would be a subset? Is the deposit open in any directions and/or at depth?

Mike Blady: The deposit could be 10 billion tonnes on a recently expanded footprint of 7,655 hectares. It’s open in all directions. There are many other targets (mag/sampling) that could potentially increase the overall grade of a future resource.

Peter Epstein: What exploration activities are expected to be carried out at Four Corners between now and year-end?

Mike Blady: As mentioned, we plan to advance this Project at a rapid, but prudent pace. Exploration will include, geophysics, mapping, sampling (grab, chip and channel) and diamond drilling. The amount and timing of drilling depends on the results of the geophysics, mapping and sampling. Material news on the exploration/prospecting front will be announced as it is received.

Peter Epstein: Might Delrey Metals be in the position to deliver a maiden mineral resource this year? Or, is it next year’s business?

Mike Blady: Due to the consistent and homogeneous nature of the cumulate style of mineralization, Delrey could potentially deliver a maiden resource over the winter. However, this is contingent on the grade and size being in-line with what we have seen in historical drilling, and the anticipation that we would be able to incorporate additional higher grade zones.

Peter Epstein: What portion of the 7,655 hectare [recently upsized 51%] Four Corners property has been explored? By explored I mean more than just grab samples, actively explored with drilling and/or surveys.

Mike Blady: That’s a good question. Less than 10% has been targeted by drilling. However, the majority of the claims have been explored with some sort of geophysics (airborne/ground). We have a number of attractive targets to go after, we are in the process of choosing the best ones.

Phase II Exploration on Star, Porcher and Blackie Looks Good!

On May 16th, Delrey announced highlights of a recent Phase II exploration program done on its 100%-owned Star, Porcher and Blackie properties near Prince Rupert, BC, Canada. Delrey is one of the few vanadium juniors actively exploring their properties. 125 rock samples were collected from the three properties, with assays as high as 0.51% V205 (49% Fe and 4% Ti). Prospecting focused on the strongest magnetic anomalies mapped during the Phase I airborne magnetic surveys (see news release April 15th). Management is very encouraged by the consistency of V205, titanium & iron enrichment on all three properties, and has submitted five-year area-based permit applications to establish a total of up to 40 drill sites on the Blackie, Porcher and Star properties.

Blackie Highlights

Selective outcrop sample results up to 0.513% V2O5, with 5 of the 21 samples returning >0.30% V2O5. Strong V2O5 enrichment was mapped over approximately 800 m x 300 m, centered on the magnetic anomaly identified in the Phase I survey.

Porcher Highlights

Selective outcrop sample results up to 0.422% V2O5, with 11 of 61 rock samples returning >0.20% V2O5 along a strike length of 1 km. An approximately 2.8 km x 1.8 km strong magnetic anomaly remains to be ground-truthed in the southern portion of the property.

Star Highlights

Assay results at Star are highlighted by 11 of the 43 selective outcrop samples returning >47% Fe (up to 61.2%) from exposed northwest-southeast oriented semi-massive to massive magnetite outcrops along a strike length of approximately 4.7 km. V2O5 enrichment in massive magnetite samples returned as high as 0.10% V2O5. Strong vanadium in-stream sediment results of between 447 to 637 ppm V2O5 suggest that higher concentrations in bedrock may occur elsewhere on the property.

NOTE: Grab samples are selective in nature and not necessarily representative of the mineralization hosted on the properties.

Morgan Good, Delrey president & CEO, stated,

“The Delrey team is very pleased with our Phase II results as the assays not only show excellent continuity with the Phase I geophysical anomalies, but include some impressive vanadium, iron & titanium grades. A systematic approach to exploration at Blackie, Porcher and Star has allowed us to put the second piece of the puzzle into place on our BC assets. We’re optimistic we will be in a position to initiate our Phase III work program consisting of diamond drilling this summer on all 3 properties, further enhancing the value of Delrey for its shareholders.”

Latest Press Releases.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University’s Stern School of Business.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Delrey Metals, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Delrey Metals are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned no shares of Delrey Metals and the Company was an advertiser on [ER].

Readers should consider me biased in favor of the Company and understand & agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure: 1) Peter Epstein’s disclosures are listed above. 2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

( Companies Mentioned: DLRY:CSE; DLRYF:OTCPK; 1OZ:FSE, )

from The Gold Report – Streetwise Exclusive Articles Full Text http://bit.ly/2QeX9TG

from WordPress http://bit.ly/30zpKHX

0 notes

Text

Delrey Metals Goes Definitive on a Blockbuster Vanadium/Iron/Titanium Property

Source: Peter Epstein for Streetwise Reports 05/21/2019

Peter Epstein of Epstein Research discusses the company's latest option to acquire 80% of a large vanadium project in Newfoundland and Labrador.

Delrey Metals Corp. (DLRY:CSE; DLRYF:OTCPK; 1OZ:FSE) owns 100% of five promising properties in Canada. Four are prospective for vanadium, totaling 10,856 hectares, one is a cobaltcopper-zinc opportunity that Cobalt 27 Capital Corp. acquired a 2% NSR on. In addition, on May 21st, management signed a definitive agreement on an option to acquire an 80% interest in select mineral licenses in the Four Corners project in Newfoundland and Labrador, and establish a JV with the seller. This is a giant, bulk-tonnage deposit that could contain 10 billion tonnes of rock, much of it mineralized, with lower-grade vanadium, plus iron and titanium. Drilling this year will seek to validate the large scale of the deposit and identify additional mineralized zones.

Four Corners is a 7,655 hectare [recently upsized by 51%] property in Newfoundland and Labrador that has had significant historical work done on it. The project hosts titanium-vanadium enriched magnetite with evidence of significant and consistent metal accumulations. This is a massive, (potential mineralized strike length >16 km) deposit, in a great jurisdiction. Selective grab samples assayed >40% Fe, 5% Ti and 0.30% V205 and as high as 56.9% Fe, 15.1% Ti and 0.39% V205. In 2012, SRK Consulting completed promising preliminary metallurgical work that showed concentrate samples of 0.643% V205 and recoveries of vanadium of >90%. Importantly, there are at least five highly prospective targets, only one of which has been drilled.

The Burgeo Highway provides access to an ice-free deep-water port within 40 km, and there's a commercial airport and industrial service center in the nearby town of Stephenville, (a potential brownfield site for primary and secondary processing). Low exploration and development costs are anticipated as there's no need for helicopter or camp support, and there's a government rebate of as much as 50% of select exploration expenditures (up to a max of $150,000/year). Management characterizes community relations as excellent; Newfoundland and Labrador consistently ranks as a top global mining jurisdiction by the Fraser Institute. This year it ranked in the top eighth of over 80 jurisdictions.

Morgan Good, president & CEO, commented,

"Finalizing the Definitive Agreement with Triple Nine Resources on The Four Corners project, and substantially increasing the property size, cements Delrey's positioning within the energy metals sector. We recently completed a site visit and spent time with not only Vic French and the Triple Nine team, but also senior officials from the Department of Natural Resources. Newfoundland & Labrador is clearly a world class mining & exploration jurisdiction.

Our objective of rapidly developing the Project is in line with our partners at Triple Nine. We now have a plan in place to unlock the value shown by their excellent prior work. Keating Hill East in particular, and 4 other high priority target zones, will be our initial exploration focus. We intend to expand on, and validate, ample historic work, and bring the Project up to NI 43-101 compliant standards as soon as possible."

Land Position at Four Corners Increased by 51%

In the May 21st press release, the company announced the acquisition of an additional, contiguous ~2,577 hectares. The new claims cover all of the roughly 4k m x 4.7 km Four Corners magnetic anomaly and the Bullseye magnetic anomaly, which has a selective outcrop sample that assayed 48.18% Fe203, 8.93% Ti02 and 0.327% V2O5. The enlarged land package [7,655 ha], allows Delrey to add further value through regional exploration in and around the company's main Keating Hill East Zone.

The primary target, Keating Hill East, was mapped by the Geological Survey of Canada for at least 4,500m, with widths ranging from 400 to 1,100m. Mineralization extends from surface to 590m depth and remains open, representing a very large potential target. An airborne EM survey conducted in 2011 identified four new promising targets, increasing the potential mineralized strike length to >16 km. Surface sampling confirmed the same style of mineralization found at Keating Hill East is producing the geophysical anomalies. Follow-up work is planned later this year.

For further commentary on the Four Corners project, I turned to Director, Mike Blady.

Peter Epstein: At current spot prices, do you believe that all three metals, vanadium, titanium and iron, could potentially be economically recoverable? Are there any other metals of possible interest?

Mike Blady: At current spot prices we would most likely need at least two of the three metals for the project to be economically viable. We have not done enough work on the economics yet to be certain. In addition to V Ti Fe, there are also some PGE and minor gold showings on the Four Corners project.

Peter Epstein: Can you estimate the size of the Four Corners deposit, not the mineralized portion, the overall size, of which the mineralized portion would be a subset? Is the deposit open in any directions and/or at depth?

Mike Blady: The deposit could be 10 billion tonnes on a recently expanded footprint of 7,655 hectares. It's open in all directions. There are many other targets (mag/sampling) that could potentially increase the overall grade of a future resource.

Peter Epstein: What exploration activities are expected to be carried out at Four Corners between now and year-end?

Mike Blady: As mentioned, we plan to advance this Project at a rapid, but prudent pace. Exploration will include, geophysics, mapping, sampling (grab, chip and channel) and diamond drilling. The amount and timing of drilling depends on the results of the geophysics, mapping and sampling. Material news on the exploration/prospecting front will be announced as it is received.

Peter Epstein: Might Delrey Metals be in the position to deliver a maiden mineral resource this year? Or, is it next year's business?

Mike Blady: Due to the consistent and homogeneous nature of the cumulate style of mineralization, Delrey could potentially deliver a maiden resource over the winter. However, this is contingent on the grade and size being in-line with what we have seen in historical drilling, and the anticipation that we would be able to incorporate additional higher grade zones.

Peter Epstein: What portion of the 7,655 hectare [recently upsized 51%] Four Corners property has been explored? By explored I mean more than just grab samples, actively explored with drilling and/or surveys.

Mike Blady: That's a good question. Less than 10% has been targeted by drilling. However, the majority of the claims have been explored with some sort of geophysics (airborne/ground). We have a number of attractive targets to go after, we are in the process of choosing the best ones.

Phase II Exploration on Star, Porcher and Blackie Looks Good!

On May 16th, Delrey announced highlights of a recent Phase II exploration program done on its 100%-owned Star, Porcher and Blackie properties near Prince Rupert, BC, Canada. Delrey is one of the few vanadium juniors actively exploring their properties. 125 rock samples were collected from the three properties, with assays as high as 0.51% V205 (49% Fe and 4% Ti). Prospecting focused on the strongest magnetic anomalies mapped during the Phase I airborne magnetic surveys (see news release April 15th). Management is very encouraged by the consistency of V205, titanium & iron enrichment on all three properties, and has submitted five-year area-based permit applications to establish a total of up to 40 drill sites on the Blackie, Porcher and Star properties.

Blackie Highlights

Selective outcrop sample results up to 0.513% V2O5, with 5 of the 21 samples returning >0.30% V2O5. Strong V2O5 enrichment was mapped over approximately 800 m x 300 m, centered on the magnetic anomaly identified in the Phase I survey.

Porcher Highlights

Selective outcrop sample results up to 0.422% V2O5, with 11 of 61 rock samples returning >0.20% V2O5 along a strike length of 1 km. An approximately 2.8 km x 1.8 km strong magnetic anomaly remains to be ground-truthed in the southern portion of the property.

Star Highlights

Assay results at Star are highlighted by 11 of the 43 selective outcrop samples returning >47% Fe (up to 61.2%) from exposed northwest-southeast oriented semi-massive to massive magnetite outcrops along a strike length of approximately 4.7 km. V2O5 enrichment in massive magnetite samples returned as high as 0.10% V2O5. Strong vanadium in-stream sediment results of between 447 to 637 ppm V2O5 suggest that higher concentrations in bedrock may occur elsewhere on the property.

NOTE: Grab samples are selective in nature and not necessarily representative of the mineralization hosted on the properties.

Morgan Good, Delrey president & CEO, stated,

"The Delrey team is very pleased with our Phase II results as the assays not only show excellent continuity with the Phase I geophysical anomalies, but include some impressive vanadium, iron & titanium grades. A systematic approach to exploration at Blackie, Porcher and Star has allowed us to put the second piece of the puzzle into place on our BC assets. We're optimistic we will be in a position to initiate our Phase III work program consisting of diamond drilling this summer on all 3 properties, further enhancing the value of Delrey for its shareholders."

Latest Press Releases.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Delrey Metals, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Delrey Metals are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned no shares of Delrey Metals and the Company was an advertiser on [ER].

Readers should consider me biased in favor of the Company and understand & agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure: 1) Peter Epstein's disclosures are listed above. 2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

( Companies Mentioned: DLRY:CSE; DLRYF:OTCPK; 1OZ:FSE, )

from https://www.streetwisereports.com/article/2019/05/21/delrey-metals-goes-definitive-on-a-blockbuster-vanadium-iron-titanium-property.html

0 notes

Text

Xscape Illusion Inset Cold Shoulder Jersey Gown (Plus Size)

Find the low prices on prom dresses Compare ratings and read through reviews on Clothing stores to find best deals and discount offers At: . There are many deals onprom dresses in the Shops online, so research before you buy. Whether you are searching for prom dresses, Can help you save money with online discounts and coupon codes on affordable selections : find a prom dresses that is best for you.

Rerate Posts

Sexy Dresses

Workday Dresses

Prom Dresses

Vacation Dresses

Wedding Guest Dresses

Missoni Metallic Knit Dress

Maggy London Faux Wrap Dress

1.STATE Drop Waist Shift Dress

Diane von Furstenberg Stretch Wool Midi Sheath Dress

Theory Eulia Tidle Suede Front Mock Neck Dress

Eliza J Off the Shoulder Maxi Dress (Plus Size)

Adrianna Papell Sequin Mesh Blouson Dress

Komarov Floral Charmeuse & Chiffon A-Line Dress (Plus Size)

ECI Stripe Maxi Dress

Catherine Catherine Malandrino Candace Keyhole Detail Knit Fit & Flare Dress

Eliza J Stripe Stretch Knit Fit & Flare Dress (Regular & Petite)

Catherine Catherine Malandrino Jonni Pleat Jersey Fit & Flare Dress

BB Dakota Kindall Crepe Sheath Dress

Dress the Population Julie Sequin Lace Sheath Dress

London Times Pleat Lace & Taffeta Sheath Dress (Plus Size)

KENDALL + KYLIE Illusion Body-Con Dress

Band of Gypsies Floral Print Swing Dress

CeCe Elise Floral Dress (Regular & Petite)

Diane von Furstenberg Georgie Popover Dress

Ella Moss Gioannia One-Shoulder Dress

French Connection Kantha Sheath Dress

Brianna Illusion Sleeve Corded Lace Cocktail Dress (Plus Size)

Self-Portrait Lace Minidress

Donna Morgan Asymmetrical Sheath Dress

Dress the Population Larissa Sequin Minidress

Tart 'Dinah' Print Sleeveless Sheath Dress (Plus Size)

Michael Stars Ruffle Bodice Strapless Gauze Dress

Equipment Natalia Print Silk Shift Dress

Leith Mock Neck Shift Dress

Maggy London Lace Detail Crepe Sheath Dress (Regular & Petite)

Etro Ribbon Print Cap Sleeve Dress

Fraiche by J Stripe Short Sleeve Romper

ASTR the Label Paulina Halter Dress

Laundry by Shelli Segal Stretch Gown

Ella Moss Lover Tapestry Midi Dress

ATM Anthony Thomas Melillo Stripe Mercerized Jersey Dress

NSR Floral Lace Slipdress

Adelyn Rae Pleated Romper

N°21 Tie Neck Print Silk Shirtdress

Donna Morgan Floral Fit & Flare Dress (Regular & Petite)

Sanctuary Romy Print Flounce Hem Shift Dress

Tahari Flame Print Jersey Sheath Dress (Plus Size)

Show Me Your Mumu Hacienda Convertible Off the Shoulder A-Line Gown

Topshop Cutout Crushed Velvet Dress

Stella McCartney Landscape Print Dress

Brianna Sequin Fit & Flare Dress (Plus Size)

French Connection Stayton Off the Shoulder Dress

City Chic Mono Print Maxi Dress (Plus Size)

ECI Wrap Dress

Opening Ceremony Tiered Stripe Cotton Dress

Tahari Flame Print Jersey Sheath Dress (Regular & Petite)

Vince Camuto Embellished Jersey Gown

St. John Collection Luxe Sculpture Knit Cold Shoulder Dress

Herve Leger V-neck Jumpsuit

Fraiche by J Cold Shoulder Maxi Dress

3.1 Phillip Lim Ruffle Dress

Maggy London Leaf Wrap Dress (Regular & Petite)

Lauren Ralph Lauren Polka Dot Jersey Sheath Dress (Plus Size)

SALONI Elodie Pleated Print Silk Dress

Raga Endless Love Cold Shoulder Tunic Dress

Tahari Piqué Knit Sheath Dress (Regular & Petite)

Tahari Flocked Dot Shift Dress (Plus Size)

Dress the Population Cori Stretch Body-Con Dress

Fraiche by J 'Nadia' Ruffle Blouson Dress

Rebecca Taylor Off the Shoulder Midi Dress

Adrianna Papell Floral Mikado Party Dress (Plus Size)

Bailey 44 Floral Print Midi Dress

Dress the Population 'Alexa' Metallic Two-Piece Dress

kate spade new york paillette dress

Chaus Floral Border Print Midi Dress

Dress the Population 'Lisa' Mock Neck Body-Con Minidress

London Times Crystal Trim Shift Dress (Plus Size)

L'AGENCE Silk Maxi Shirtdress

Mac Duggal Floral A-Line Ballgown (Plus Size)

Milly Liz Palm Print Sheath Dress

City Chic Fair Lady Convertible Maxi Dress (Plus Size)

O'Neill Shawn Cotton Swing Dress

Dress the Population Larissa Sequin Minidress

Vince Camuto Stripe Scuba Sheath Dress

Tadashi Shoji V-Neck Lace Gown (Plus Size)

Charles Henry Cold Shoulder Shift Dress

Veronica Beard Stella Tie Waist Print Dress

Ted Baker London Layli Sheath Dress

Topshop Strappy Ribbed Body-Con Dress

Lilly Pulitzer® Kenzi Midi Dress

Volcom Solo Trip Romper

McQ Alexander McQueen Floral Print Shift Dress

Lauren Ralph Lauren Georgette Tier Sheath Dress (Plus Size)

Topshop Ruffle Floral Tea Dress (Regular & Petite)

Ellen Tracy Embellished Jersey Gown

Adrianna Papell Floral Sheath Dress

Topshop Ruffle Floral Tea Dress (Regular & Petite)

Ieena for Mac Duggal Floral Strapless Bustier Ballgown

kate spade new york lantern print scoop neck dress

Vera Wang Strappy Jersey Gown

Adrianna Papell Ruched A-Line Dress

Misha Collection Gabrielle Midi Dress (Nordstrom Exclusive)

Tadashi Shoji Floral Print Sheath Dress

Eliza J Pintuck Lace Fit & Flare Dress (Plus Size)

Milly Nicole Minidress

0 notes

Text

Dolce&Gabbana Lace Dress with Pink Lining Reviews

Find the low prices on womens cocktail dresses Compare ratings and go through reviews on Clothing stores to find best deals plus discount offers At: . There are many deals onwomens cocktail dresses in the Shops online, so research before you buy. Whether you are searching for womens cocktail dresses, Can help you save money with online discounts and discount coupons on affordable selections -- find a womens cocktail dresses that is right for you.

Rerate Posts

Wedding Guest Dresses

Womens Bridesmaid Dresses

Womens Vacation Dresses

Womens Cocktail Dresses

Womens Night Out Club Sexy Dresses

Bardot 'Gemma' Halter Lace Sheath Dress

City Chic 'Romantic Dance' Lace & Chiffon Gown (Plus Size)

Band of Gypsies Burnout Velvet Midi Dress

Adrianna Papell Lace Yoke Drape Gown

Adrianna Papell Illusion Bodice Lace Sheath Dress

Public School Asymmetrical Dress

NSR Tie Cold Shoulder Midi Dress

Rebecca Minkoff Dev Chambray Off the Shoulder Trapeze Dress

Julia Jordan Bateau Shift Dress

Felicity & Coco Print Jersey A-Line Maxi Dress (Regular & Petite) (Nordstrom Exclusive)

Taylor Dresses Scuba Fit & Flare Dress

JVN by Jovani Two-Tone Mermaid Gown

Ali & Jay Bell Sleeve Floral Sheath Dress

nouvelle AMSALE Poppy Ruffle Gown

Dress the Population Harper Mermaid Gown

Foxcroft Stripe Knit Dress (Regular & Petite)

Charles Henry Cold Shoulder Dress

Likely 'Park' V-Neck Sheath Midi Dress

Chetta B Sequin Lace Sheath Dress

Rebecca Minkoff Dexter Minidress

BCBGMAXAZRIA Smitry Colorblock Jumpsuit

Topshop Embroidered Midi Dress

Eliza J Stripe Knit Flared Dress

Milly 'Selena' Off the Shoulder Midi Dress

Dress the Population Maya Woven Fit & Flare Dress

Topshop Moto Velvet Jumpsuit

Free People Embroidered Minidress

Lush Ribbed Skater Dress

Tahari Asymmetrical A-Line Dress (Regular & Petite)

La Femme Embellished Lace Two-Piece Gown

Taylor Dresses Lace Sheath Dress

Dress the Population Larissa Sequin Minidress

Fraiche by J Jersey Maxi Dress

cupcakes and cashmere Holly Off the Shoulder Minidress

BB Dakota 'Renley' Lace Fit & Flare Dress (Plus Size)

Alex Evenings Metallic Lace Fit & Flare Gown (Plus Size)

Cynthia Steffe Claire Lace Fit & Flare Dress

Proenza Schouler Cotton & Silk Fil Coupé Dress

Bony Levy Flower Diamond Stackable Ring (Nordstrom Exclusive)

Lilly Pulitzer® Suzette Shift Dress

Fabiana Filippi Side Pleat Dress

JVN by Jovani Mermaid Gown

Fraiche by J Surplice Jersey Maxi Dress

Fuzzi Off-the-Shoulder Batik Maxi Dress

Cynthia Steffe Ava Print Sheath Dress

Morgan & Co. Lace Halter Gown

Rebecca Taylor 'Taylor' V-Neck Fit & Flare Dress

Adrianna Papell Embellished Mesh Gown

Dress the Population Marcella Midi Dress

BCBGMAXAZRIA Cailean Lace Gown

ASTR Embroidered Tie Front Dress

nouvelle AMSALE 'Dani' Ruffle Neck V-Neck Halter Gown

devlin Peggy Blouson Dress

JS Collections Stretch Crepe Gown

Ellen Tracy Seam Detail Elbow Sleeve Ponte Sheath Dress (Plus Size)

Carmen Marc Valvo Couture Floral Appliqué Sleeveless Organza Dress

Lulus Cross Neck A-Line Chiffon Gown

Alex Evenings Illusion Sleeve Cocktail Dress (Plus Size)

Donna Morgan Lace-Up Fit & Flare Dress (Regular & Petite)

rag & bone Hart Dress

La Femme Fashions Embroidered Beaded Lace & Satin Mermaid Gown

Adrianna Papell Stripe Fit & Flare Dress

Lush Lace Dress

Dress the Population Tabitha Sequin Minidress

Vince Camuto Beaded Sheath Dress (Regular & Petite)

Xscape Banded Mermaid Gown

Milly Hexagon Knit Fit & Flare Dress

Xscape Embellished Taffeta Gown (Regular & Petite)

Eliza J Print Jersey Shift Dress

Vera Wang Tie Back Gown

Alex Evenings Off the Shoulder A-Line Gown (Plus Size)

Shoshanna Florentine Guipere Lace Sheath Dress

BP. Polka Dot Popover Romper

JS Collections Illusion Lace Gown

ASTR Drew Lace Slipdress

Adrianna Papell Embellished Tulle Gown

Tart Camellia Maxi Dress (Plus Size)

Ellen Tracy Lace & Jersey Gown

Fraiche by J Lace Body-Con Dress

Theia Lace & Crepe Gown

Carolina Herrera Draped V-Back Gown

Eileen Fisher Midi Shift Dress (Regular & Petite)

CeCe 'Kate' Ruffle Hem Shift Dress (Regular & Petite)

Trixxi Cold-Shoulder Shift Dress

Kobi Halperin Paulina Lace Trim A-Line Dress

Bardot Bella Satin Maxi Dress

Adrianna Papell Lace Overlay Sheath Dress (Regular & Petite)

Alex Evenings Embellished Cuff Faux Wrap Jersey Gown (Plus Size)

Sequin Hearts Mermaid Gown

Lauren Ralph Lauren Fit & Flare Gown (Regular & Petite)

Loveappella V-Neck Jersey Maxi Dress (Regular & Petite)

French Connection 'Whisper Light' Cutout Midi Dress

ASTR Embroidered Off the Shoulder Minidress

French Connection Lula Sheath Dress

3.1 Phillip Lim Ruffle Dress

cupcakes and cashmere Goddess Jumpsuit

10 Crosby Derek Lam Tie Waist Shirtdress

JS Collections Lace Sheath Dress

Speechless Lace Shift Dress

Aidan Mattox Embellished Mesh Gown

0 notes

Text

Missguided Pleat Wrap Maxi Dress

Find the low prices on Night Out Dresses Compare ratings and study reviews on Clothing stores to find best deals plus discount offers At: . There are many deals onNight Out Dresses in the Shops online, therefore research before you buy. Whether you are searching for Night Out Dresses, Can help you save money with online discounts and vouchers on affordable selections -- find a Night Out Dresses that is right for you.

Rerate Posts

Prom Dresses

Work Dresses

Cocktail Party Dresses

Bridesmaid Dresses

Formal Dresses

MICHAEL Michael Kors Dressage Shirtdress

Lauren Ralph Lauren Cutout Back Sequin Sheath Dress

Carmen Marc Valvo Infusion Ballgown

Adrianna Papell Embellished Mesh Gown

Marina Sequin Stretch Lace Sheath Dress (Plus Size)

Aidan Mattox Embroidered Bodice Mesh Ballgown

NSR Body-Con Sweater Dress

Lilly Pulitzer® Havana A-Line Dress

City Chic 'Miss Shady' Stripe Strapless Fit & Flare Party Dress (Plus Size)

T Tahari Colorblock Sheath Dress

Fraiche by J Lace Trim Crepe Romper

Pamella Roland Signature Sequin Cap Sleeve Cocktail Dress

La Femme Mixed Media Gown

Adrianna Papell Embellished Chiffon Sheath Dress

ASTR Rib Knit Wrap Dress

Pamella, Pamella Roland Beaded Mesh & Crepe Gown

BCBGMAXAZRIA 'Clio' Ruched Jersey Body-Con Dress

Catherine Catherine Malandrino Noreen Pleated Knit Dress

Erdem Valentina Floral Print Jersey Gown

Pisarro Nights Beaded Mesh Dress (Regular & Petite)

Adrianna Papell T-Back Beaded Mesh Gown

Tracy Reese Yarn Dye Check Lace Bodice Dress

Adrianna Papell Floral Border Print Scuba Sheath Dress

Dress the Population 'Mia' Sequin Skater Dress

JS Collections Embellished Fit & Flare Dress

Eliza J Top & Skirt

Felicity & Coco Woven Minidress (Nordstrom Exclusive)

Sea Exploded Eyelet Stripe Shift Dress

Lafayette 148 New York Ruched Front Zip Dress

4SI3NNA Lace Body-Con Dress

Vince Camuto Beaded Waist Jersey Gown

Vince Camuto Crepe A-Line Dress (Regular & Petite)

Erdem Valentina Floral Print Jersey Gown

Adrianna Papell Lace Sheath Dress (Regular & Petite)

Morgan and Co. Lace Mermaid Gown

Aidan Mattox Lace Gown

nouvelle AMSALE 'Bea' One-Shoulder Chiffon Gown

Show Me Your Mumu Aimee Ruffle Bodice Chiffon Halter Gown

Alfred Sung High/Low Hem Sateen Twill Open Back Gown

Xscape Lace Sides Jersey Gown (Plus Size)

Marina Beaded A-Line Jersey Gown (Plus Size)

Dress the Population Embroidered Lace Fit & Flare Dress

Tahari Sleeveless A-Line Dress (Petite)

Aidan Mattox Embroidered Beaded Gown

Oscar de la Renta Floral Print Silk & Cotton Mikado Dress

Ellen Tracy Print Jersey Sheath Dress (Regular & Petite)

Ali & Jay Lace Sheath Dress

French Connection 'High Line Lula' Ponte Sheath Dress

Alex Evenings Beaded Twist Front Sheath Dress (Plus Size)

Eliza J Embroidered Fit & Flare Dress (Regular & Petite)

Vera Wang Illusion Yoke Woven Fit & Flare Gown

Everly Floral Velvet Cutout Dress

Vera Wang Jersey Pleated Fit & Flare Gown

Ted Baker London 'Cealine' Belted Texture Fit & Flare Dress

Jill Jill Stuart Strapless Midi Dress

Tracy Reese Flounced T Cold Shoulder Dress

Cushnie et Ochs Lace-Up Silk Pencil Dress

Pamella, Pamella Roland Mikado Mermaid Gown

Ali & Jay Mixed Media Maxi Dress

Jill Jill Stuart Strapless Midi Dress

London Times Lace Panel Gown (Plus Size)

Caslon® Cotton Terry Shift Dress (Regular & Petite)

Jenny Yoo 'Cassie' Flutter Sleeve Chiffon A-Line Gown

Ten Sixty Sherman Lace Trim Velvet Slipdress

St. John Collection Jeweled Shimmer Knit Dress

ATM Anthony Thomas Melillo Mock Neck Drape Velvet Dress

Eliza J Lace & Faille Dress (Regular & Petite)

Adrianna Papell Velvet & Taffeta Fit & Flare Dress

Adrianna Papell Cold Shoulder Draped Shift Dress

Tomas Maier Riviera Cotton Utility Dress

Marina Sequin Lace V-Neck Sheath Dress (Plus Size)

Stella McCartney Lace Trim Plissé Satin Dress

Dress the Population 'Alex' Strappy Sequin Midi Dress

Ellen Tracy Print Shantung Sheath Dress

Eliza J Metallic Jacquard Fit & Flare Dress (Regular & Petite)

Ted Baker London Feay Belted Lace Embellished Dress

Soft Joie Arryn B Dress

Charles Henry Print Smocked Midi Dress

Alexander McQueen Intarsia Knit Fit & Flare Dress

Soprano High Neck Shift Dress

Topshop Boutique Polka Dot Deconstructed Dress

French Connection 'Summer Sudan' Knit Sheath Dress

Joie Dashalynn Plaid Tie Waist Shirtdress

Vince Camuto Side Ruched Jersey Midi Dress (Plus Size) (Nordstrom Exclusive)

Cotton Emporium Turtleneck Sweater Dress

Adrianna Papell Lace Sheath Dress

Billabong Scenic Roads Off the Shoulder Dress

ECI Keyhole Neck Midi Sheath Dress

Alex Evenings Beaded Lace A-Line Gown & Jacket (Plus Size)

Tadashi Shoji Sequin Tulle Neoprene Sheath Dress (Plus Size)

Alex Evenings Embellished Stretch Gown (Regular & Petite)

Laundry by Shelli Segal Embellished Shift Dress

Adrianna Papell Beaded Sheath Dress

Somedays Lovin Shadow Play Open Back Skater Dress

Cinq à Sept Ela Midi Dress

Xscape Lace & Knit Sheath Dress

Zero + Maria Cornejo Tasi Drift Dress

St. John Collection Metallic Dégradé Peekaboo Gown

Needle & Thread Embroidered Fit & Flare Dress

Lauren Ralph Lauren Metallic Sheath <p></p><p> <a

Blog Roll

cherokeecounty-nc.gov

senate.ca.gov

newportbeachca.gov

noaa.gov

noaa.gov

0 notes

Text

Delrey Metals Goes Definitive on a Blockbuster Vanadium/Iron/Titanium Property

Source: Peter Epstein for Streetwise Reports 05/21/2019

Peter Epstein of Epstein Research discusses the company's latest option to acquire 80% of a large vanadium project in Newfoundland and Labrador.

Delrey Metals Corp. (DLRY:CSE; DLRYF:OTCPK; 1OZ:FSE) owns 100% of five promising properties in Canada. Four are prospective for vanadium, totaling 10,856 hectares, one is a cobaltcopper-zinc opportunity that Cobalt 27 Capital Corp. acquired a 2% NSR on. In addition, on May 21st, management signed a definitive agreement on an option to acquire an 80% interest in select mineral licenses in the Four Corners project in Newfoundland and Labrador, and establish a JV with the seller. This is a giant, bulk-tonnage deposit that could contain 10 billion tonnes of rock, much of it mineralized, with lower-grade vanadium, plus iron and titanium. Drilling this year will seek to validate the large scale of the deposit and identify additional mineralized zones.

Four Corners is a 7,655 hectare [recently upsized by 51%] property in Newfoundland and Labrador that has had significant historical work done on it. The project hosts titanium-vanadium enriched magnetite with evidence of significant and consistent metal accumulations. This is a massive, (potential mineralized strike length >16 km) deposit, in a great jurisdiction. Selective grab samples assayed >40% Fe, 5% Ti and 0.30% V205 and as high as 56.9% Fe, 15.1% Ti and 0.39% V205. In 2012, SRK Consulting completed promising preliminary metallurgical work that showed concentrate samples of 0.643% V205 and recoveries of vanadium of >90%. Importantly, there are at least five highly prospective targets, only one of which has been drilled.

The Burgeo Highway provides access to an ice-free deep-water port within 40 km, and there's a commercial airport and industrial service center in the nearby town of Stephenville, (a potential brownfield site for primary and secondary processing). Low exploration and development costs are anticipated as there's no need for helicopter or camp support, and there's a government rebate of as much as 50% of select exploration expenditures (up to a max of $150,000/year). Management characterizes community relations as excellent; Newfoundland and Labrador consistently ranks as a top global mining jurisdiction by the Fraser Institute. This year it ranked in the top eighth of over 80 jurisdictions.

Morgan Good, president & CEO, commented,

"Finalizing the Definitive Agreement with Triple Nine Resources on The Four Corners project, and substantially increasing the property size, cements Delrey's positioning within the energy metals sector. We recently completed a site visit and spent time with not only Vic French and the Triple Nine team, but also senior officials from the Department of Natural Resources. Newfoundland & Labrador is clearly a world class mining & exploration jurisdiction.

Our objective of rapidly developing the Project is in line with our partners at Triple Nine. We now have a plan in place to unlock the value shown by their excellent prior work. Keating Hill East in particular, and 4 other high priority target zones, will be our initial exploration focus. We intend to expand on, and validate, ample historic work, and bring the Project up to NI 43-101 compliant standards as soon as possible."

Land Position at Four Corners Increased by 51%

In the May 21st press release, the company announced the acquisition of an additional, contiguous ~2,577 hectares. The new claims cover all of the roughly 4k m x 4.7 km Four Corners magnetic anomaly and the Bullseye magnetic anomaly, which has a selective outcrop sample that assayed 48.18% Fe203, 8.93% Ti02 and 0.327% V2O5. The enlarged land package [7,655 ha], allows Delrey to add further value through regional exploration in and around the company's main Keating Hill East Zone.

The primary target, Keating Hill East, was mapped by the Geological Survey of Canada for at least 4,500m, with widths ranging from 400 to 1,100m. Mineralization extends from surface to 590m depth and remains open, representing a very large potential target. An airborne EM survey conducted in 2011 identified four new promising targets, increasing the potential mineralized strike length to >16 km. Surface sampling confirmed the same style of mineralization found at Keating Hill East is producing the geophysical anomalies. Follow-up work is planned later this year.

For further commentary on the Four Corners project, I turned to Director, Mike Blady.

Peter Epstein: At current spot prices, do you believe that all three metals, vanadium, titanium and iron, could potentially be economically recoverable? Are there any other metals of possible interest?

Mike Blady: At current spot prices we would most likely need at least two of the three metals for the project to be economically viable. We have not done enough work on the economics yet to be certain. In addition to V Ti Fe, there are also some PGE and minor gold showings on the Four Corners project.

Peter Epstein: Can you estimate the size of the Four Corners deposit, not the mineralized portion, the overall size, of which the mineralized portion would be a subset? Is the deposit open in any directions and/or at depth?

Mike Blady: The deposit could be 10 billion tonnes on a recently expanded footprint of 7,655 hectares. It's open in all directions. There are many other targets (mag/sampling) that could potentially increase the overall grade of a future resource.

Peter Epstein: What exploration activities are expected to be carried out at Four Corners between now and year-end?

Mike Blady: As mentioned, we plan to advance this Project at a rapid, but prudent pace. Exploration will include, geophysics, mapping, sampling (grab, chip and channel) and diamond drilling. The amount and timing of drilling depends on the results of the geophysics, mapping and sampling. Material news on the exploration/prospecting front will be announced as it is received.

Peter Epstein: Might Delrey Metals be in the position to deliver a maiden mineral resource this year? Or, is it next year's business?

Mike Blady: Due to the consistent and homogeneous nature of the cumulate style of mineralization, Delrey could potentially deliver a maiden resource over the winter. However, this is contingent on the grade and size being in-line with what we have seen in historical drilling, and the anticipation that we would be able to incorporate additional higher grade zones.

Peter Epstein: What portion of the 7,655 hectare [recently upsized 51%] Four Corners property has been explored? By explored I mean more than just grab samples, actively explored with drilling and/or surveys.

Mike Blady: That's a good question. Less than 10% has been targeted by drilling. However, the majority of the claims have been explored with some sort of geophysics (airborne/ground). We have a number of attractive targets to go after, we are in the process of choosing the best ones.

Phase II Exploration on Star, Porcher and Blackie Looks Good!

On May 16th, Delrey announced highlights of a recent Phase II exploration program done on its 100%-owned Star, Porcher and Blackie properties near Prince Rupert, BC, Canada. Delrey is one of the few vanadium juniors actively exploring their properties. 125 rock samples were collected from the three properties, with assays as high as 0.51% V205 (49% Fe and 4% Ti). Prospecting focused on the strongest magnetic anomalies mapped during the Phase I airborne magnetic surveys (see news release April 15th). Management is very encouraged by the consistency of V205, titanium & iron enrichment on all three properties, and has submitted five-year area-based permit applications to establish a total of up to 40 drill sites on the Blackie, Porcher and Star properties.

Blackie Highlights

Selective outcrop sample results up to 0.513% V2O5, with 5 of the 21 samples returning >0.30% V2O5. Strong V2O5 enrichment was mapped over approximately 800 m x 300 m, centered on the magnetic anomaly identified in the Phase I survey.

Porcher Highlights

Selective outcrop sample results up to 0.422% V2O5, with 11 of 61 rock samples returning >0.20% V2O5 along a strike length of 1 km. An approximately 2.8 km x 1.8 km strong magnetic anomaly remains to be ground-truthed in the southern portion of the property.

Star Highlights

Assay results at Star are highlighted by 11 of the 43 selective outcrop samples returning >47% Fe (up to 61.2%) from exposed northwest-southeast oriented semi-massive to massive magnetite outcrops along a strike length of approximately 4.7 km. V2O5 enrichment in massive magnetite samples returned as high as 0.10% V2O5. Strong vanadium in-stream sediment results of between 447 to 637 ppm V2O5 suggest that higher concentrations in bedrock may occur elsewhere on the property.

NOTE: Grab samples are selective in nature and not necessarily representative of the mineralization hosted on the properties.

Morgan Good, Delrey president & CEO, stated,

"The Delrey team is very pleased with our Phase II results as the assays not only show excellent continuity with the Phase I geophysical anomalies, but include some impressive vanadium, iron & titanium grades. A systematic approach to exploration at Blackie, Porcher and Star has allowed us to put the second piece of the puzzle into place on our BC assets. We're optimistic we will be in a position to initiate our Phase III work program consisting of diamond drilling this summer on all 3 properties, further enhancing the value of Delrey for its shareholders."

Latest Press Releases.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Delrey Metals, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Delrey Metals are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned no shares of Delrey Metals and the Company was an advertiser on [ER].

Readers should consider me biased in favor of the Company and understand & agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure: 1) Peter Epstein's disclosures are listed above. 2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

( Companies Mentioned: DLRY:CSE; DLRYF:OTCPK; 1OZ:FSE, )

from The Gold Report - Streetwise Exclusive Articles Full Text http://bit.ly/2QeX9TG

0 notes

Text

Delrey Metals Announces Positive Airborne Geophysics, Discovers New Magnetic Anomalies

Source: Peter Epstein for Streetwise Reports 04/16/2019

Peter Epstein of Epstein Research provides an update on a company exploring its Canadian properties for vanadium and other energy metals.

Delrey Metals Corp. (DLRY:CSE; DLRYF:OTCPK; 1OZ:FSE) has acquired five promising properties in Canada. Four are prospective for vanadium, for a total of 10,856 hectares, and one is a cobalt-copper-zinc opportunity that Cobalt 27 Capital Corp. acquired a 2% NSR on. Management recently signed a non-binding term sheet to acquire an 80% interest in select mineral licenses in the Four Corners Project and to establish a JV with the seller.

On Delrey’s website it says the project “conservatively represents a potential target of over 2 billion tonnes.” That’s based on known dimensions and an estimated specific gravity. To be clear, these figures are historical in nature and not compliant with current NI 43-101 standards. Drilling this year will seek to validate the potential large scale of the deposit.