#non-fungible tokens explained

Explore tagged Tumblr posts

Text

NFTs: The Next Big Thing in the Crypto World?

NFTs: The Next Big Thing in the Crypto World? What is an NFT? NFT stands for non-fungible token. A non-fungible token is a unique digital asset that cannot be replaced by another asset. Each NFT has its own unique identifier and metadata, which makes it impossible to counterfeit or duplicate. NFTs are stored on a blockchain, which is a distributed ledger that records transactions in a secure…

View On WordPress

#buy NFT#create NFT#how NFTs work#NFT#NFT art#NFT collectibles#NFT future#NFT gaming#NFT investment#NFT marketplace#NFTs explained#non-fungible token#sell NFT#what are NFTs used for

0 notes

Note

What is nft? I have zero knowledge about this subject, tried to google but won't understand, so please could you explain like I'm five? Why is it a problem? I'm 100 % positive Jere has no idea either.

hi!! i'll give you a quick explaination and then link a video to watch

Non-fungible tokens, or N//FT's for short (censoring to avoid bots flooding to this post) are a digital asset stored on a big public online database called the blockchain. they are, in theory, completely individual and cannot be replicated as they are authenticated on the blockchain with their own unique ID - think of it like a certificate of authentication for a piece of art - except the art is on a screen and basically anyone can take a screenshot of it.

the main issues people have with them are

1) their environmental impact. the servers used to run the blockchain use huge amounts of power and energy resulting in large unnecessary co2 emissions. purchasing, transferring and holding of N//FTs is all part of this. while there are ways to lessen this, it is unclear whether the system kollekt uses utilises them - and doesnt change the fact that the best way to avoid the environmental impact of N//FTs is to not use them at all.

2) the financial impact. not totally applicable to this as it is a free raffle, but most N//FTs, at this point are basically worthless. paired with the fact that they are usually bought with cryptocurrency - which is very unregulated in many places including where I am in the UK - means that the purchasing of N//FTs is a huge financial risk.

this is a very long but very informative video that goes more in depth with most of the issues:

youtube

EDIT: the link to the raffle has been reinstated so I don't think they are looking to take it down.

27 notes

·

View notes

Text

go far enough down the memory lane and you will see pete wentz explaining what a non fungible token is and also how he's bumping lana del rey in the same sentence

4 notes

·

View notes

Text

This weekend’s episode of "Saturday Night Live" began with a skit poking fun at former President Donald Trump’s recently released, meme-worthy non-fungible token (NFT) collection.

“Seems like a scam and, in many ways, it is,” said James Austin Johnson, who played the 45th President in the show’s cold open.

While the mainstream media has eagerly picked up the story on the collection for its comedic value, the popularity of the Trump Digital Trading Cards has continued to climb since the collection dropped on Thursday, selling out within 24 hours.

According to data from OpenSea, the collection’s trading volume is 6,658 ether (ETH), or about $7.8 million at the time of publishing. Its floor price, which started at $99, has been hovering around 0.3 ETH, or $350.

The collection features 45,000 tokens in the style of baseball cards. In each collectible, Trump wears a different costume linked to rarity elements that allow users to enter a sweepstakes to win prizes like a zoom call with the former President or a cocktail hour at Mar-a-Lago.

In the wake of the project’s apparent success, internet sleuths have dug deep into the project and the parties behind the wallet addresses associated with Trump’s collectibles. Among the nuances and inconsistencies alleged on Twitter: the company that created the collectibles is hoarding a large amount of them; that the project poorly relies on stock imagery; and that most of the buyers opened new wallets without holding any cryptocurrency, sticking them with an NFT and no way to derive any future value from them.

THE STRANGE CASE OF 1,000 NFTS

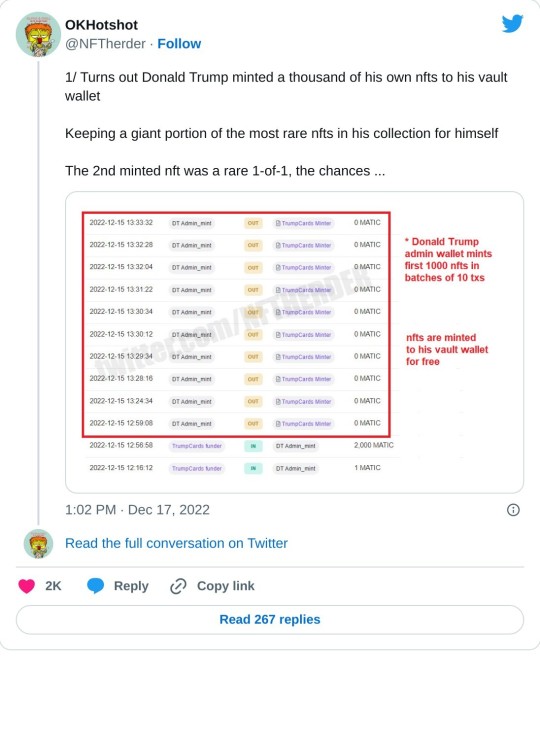

Over the weekend, Twitter user @NFTherder noticed something strange about a large number of the rarest NFTs in the collection. The user posted a thread explaining the nature of the transaction data of the contracts involved in the mint.

According to data from Polyscan, Polygon’s version of Etherscan, a “Donald Trump Admin” wallet minted 1,000 tokens to a Gnosis Safe Wallet, a multisignature smart contract wallet that requires a handful of users associated with the tokens to approve of any asset movement.

While the Collect Trump Cards site said that 44,000 of the 45,000 tokens created in the initial series would be available for users to mint, it did not specify what would happen to the remaining 1,000 tokens. Where another project might save those assets for a later date to revive demand, data suggests that the administrative wallet holds the remaining minted 1,000 tokens.

After the collapse of Three Arrows Capital, the crypto-hedge fund backed NFT collection “Starry Night” moved its tokens into a Gnosis Safe wallet, along with other valuable assets. It was likely done out of caution to hold the assets in one place to prevent any singular actor from moving these out of the wallet.

The Trump Trading Card site specified that there was a “strict limit of 100 Trump Digital Trading Cards per purchaser/household,” meaning that an individual or a group who did not have to abide by the rules for the general public was able to pick up a large swath of the NFT pool.

In addition, the mystery wallet isn’t full of second-rate NFTs. It minted 26% of the rarest 1-of-1 tokens and 28% of the autographed trading cards, according to NFTherder. These are the most valuable and expensive assets in the collection, respectively comprising 0.4% and 0.16% of the total tokens in the collection.

NFTherder told CoinDesk that not only do the wallet owners have the ability to inflate the price floor of the collection, but they also could have the ability to rig the sweepstakes and alter the competition.

“If this was a 10,000 unit collection about monkeys, the whole discord would be blowing up about how this is a rug and a scam and that the team is holding one fourth of the most rare supply,” said NFTHerder.

THE CURIOUS MARKS AND MAKER OF THE ART

While people have been digging into the wallet addresses and collection sweepstakes, other Twitter users were delving into pop culture digital artist Clark Mitchell and the artwork he created for the collection.

On-Chain TV founder Morgan Sarkissian tweeted an image of one of the collectibles featuring the 45th president in a space suit that seemed to still have a visible watermark from Shutterstock.

She also uncovered an Adobe watermark in another token listed in the collection.

Other Twitter users have found inconsistencies in the artwork, with some of the creative assets used to build the collection apparently taken from stock images or Amazon costumes.

While Mitchell has worked on other projects such as artwork for Disney, Hasbro and Marvel, this isn’t his first NFT project.

Web3 researcher and Twitter user @Valuemancer uncovered that Mitchell also did the artwork for Sylvester Stallone’s SlyGuy NFT collection that never launched, according to the digital collectibles website.

The collection included similar creative assets, such as drawings of the actor paired with exclusive access to events such as the Ultimate Stallone Experience, a dinner hosted by Stallone for token holders.

Mitchell, Sarkissian, @Valuemancer and the SlyGuy NFT collection did not respond to CoinDesk by press time.

THE SHINY NEW WALLETS WITH NO CRYPTO

While NFT collections often attract a wide range of buyers with various stake in the game, Trump’s NFT collection had a large number of buyers that appear to be new to digital collectibles.

According to data from Dune Analytics, of the nearly 12,900 users that minted Trump NFTs, about 9,300 did not hold any cryptocurrency in their wallet for gas fees – the fee all users pay for a transaction on the blockchain. If a holder has no balance of either MATIC or wETH, he is "No Gas" holder. That means he can't list his NFT for sale until he get some balance into his wallet, the Dune dashboard shows.

This means that 72% of buyers were likely purchasing NFTs for the first time.

The total number of tokens held by holders with no gas is 21,420, according to Dune Analytics, which one Twitter user pointed out may be stuck due to the more advanced nature of trading on Polygon.

“It's more like a 20,000 set than 45,000,” said Tyler Warner, staff writer at Lucky Trader on Twitter, citing the data as one of the reasons why the tokens skyrocketed in trading volume.

Warner did not respond to CoinDesk by press time.

In a harsh crypto winter where NFTs are already subject to market vulnerabilities, celebrities releasing successful NFT projects or funding Web3 ventures seems like a promising sign.

However, when the project is executed before fully working its kinks out, it does not serve as a vehicle for mass adoption. Instead, it can onboard a new user base that is not familiar with cryptocurrency or the steps needed to make a sound purchase, analyze blockchain data for irregularities and fund wallet transactions.

As projects like these continue to rise in popularity, it’s important to educate holders, dig into the details and look beyond the hype.

#us politics#news#coindesk#bitcoin#nfts#non fungible tokens#donald trump#Trump Digital Trading Cards#opensea#@NFTherder#twitter#Polyscan#Polygon#Etherscan#Gnosis Safe Wallet#Collect Trump Cards#Morgan Sarkissian#On-Chain TV#Clark Mitchell#copyright infringement#@Valuemancer#sylvester stallone#celebs#SlyGuy NFT#Dune Analytics#gas fees#Tyler Warner#blockchain#Lucky Trader#2022

30 notes

·

View notes

Text

I've been seeing the "furry adopts are just like NFTs" joke ever since NFTs became a thing and I'm aware it's just a dumb joke but I find it quite annoying so I'm gonna take it at face value, assume the people making this joke genuinely don't know the difference, and explain it

What are NFTs?

NFTs stands for Non-Fungible Tokens and in very short terms they're unique data identifiers attached to something (usually an image) meant to recreate real life scarcity in the digital world. They're typically bought using cryptocurrency

What are furry adopts?

Furry adopts (or adoptables) are characters or character designs sold commonly in the furry and OCs communities

How do they differ?

In order to "mint" NFTs, an increadibly large amount of electrical power is needed. This is not needed for adopts

One of the main reasons for buying NFTs (if not the main reason altogether) is betting on the resale value. While it's become an unintended side effect in small pockets of the adopts community with popular artists' designs, it's never been the main reason for buying them - which is obtaining a character design

What you are buying with NFTs is essentially the receipt of the image, not the image itself. With adopts, you obtain the character itself which is then usually reused for storytelling and/or artwork; some adopts artists have however a stricter TOS (which is not legally enforceable and I refuse to buy characters from such people), but the intent is still to give away the character design

NFTs are mostly comprised of stolen, randomly generated, and "corporate" (as in, only profit-driven with no creative intent behind it) art, while adopts are made by individual artists. Buying adopts supports small artists, NFTs do not

Also, NFTs suck and furries are great 👍

3 notes

·

View notes

Text

What is an NFT Minting Service and How Can You Use it to Make Money?

NFT minting services are a new way to create and sell digital art.

NFTs are non-fungible tokens that are stored on a blockchain.

They are unique, digital collectibles that can be bought, sold, or traded.

NFT minting services allow artists to create NFTs and sell them to collectors.

These services also allow artists to set up their own NFT marketplace, where they can sell their NFTs directly to collectors.

In this article, we will explain what an NFT minting service is and how you can use it to make money.

youtube

We will also provide a list of the best NFT minting services that are currently available.

1. What is an NFT Minting Service?

NFT minting services are platforms that enable users to create and sell non-fungible tokens (NFTs).

NFTs are digital collectibles that are stored on a blockchain and represent unique digital items such as artwork, music, or sports cards.

Using an NFT minting service, users can create NFTs and then sell them on the platform's marketplace.

Users can also create their own NFT marketplace, where they can directly sell their NFTs to collectors.

This allows artists to have more direct control over the sale of their art.

The NFT minting service will take a small percentage of the proceeds from each sale in exchange for providing the service of minting and enabling the sale of the NFT.

This money will go towards covering the platform’s costs, such as the cost of running the blockchain, hosting the platform, and providing customer support.

2. How Can You Use an NFT Minting Service to Make Money?

Using an NFT minting service, you can make money by creating and selling your own digital artwork.

You can also use the service to promote and sell your existing artwork or other creative works.

By selling your art as an NFT, you can reach a larger market and potentially make more money.

When selling your artwork as an NFT, you will need to set a minimum selling price that covers both your commission and the cost of production.

This will allow you to make sure that you are making a profit on each sale.

When setting your selling price, it is important to be aware of the market demand for your artwork.

If you set a price that is too high, your NF Tim artwork may not sell.

Price your artwork competitively to maximize your potential profits.

You can also make money by selling the rights to your artwork or other digital items.

These NFTs can represent exclusive rights to items such as artwork, music, or even virtual land.

By selling these exclusive rights, you can generate a steady stream of income.

3. What Are the Benefits of Using an NFT Minting Service?

An NFT minting service offers a number of benefits to both buyers and sellers.

First, it allows buyers to easily purchase unique digital art pieces.

This is because the buyer can be confident that the artwork they are purchasing is genuine and not fake.

The NFT minting service also provides an easy way for sellers to create and sell NFTs.

The platform will provide tools to help make the process of creating, minting, and selling NFTs easier for the seller.

In addition, the NFT minting service can provide some additional benefits for the seller such as offering payment processing, customer support, and marketing services.

This will allow the seller to focus on creating artwork, as the platform will handle all the other aspects of the sale.

4. How Can You Get Started With an NFT Minting Service?

Getting started with an NFT minting service is fairly simple.

First, you will need to select a service that offers the features that you need.

Some services offer more features than others, so you will want to find one that suits your needs.

Once you have selected a service, you will need to create an account and set up your profile.

After that, you can start creating your NFTs and putting them up for sale.

You can also connect to your other social media accounts if you want to promote your NFTs.

Finally, you will need to set a price for your NFT and decide whether you want to sell directly to buyers or set up your own marketplace for selling your NFTs.

Once your NFT is listed, you can start promoting it and making money from the sales.

5. NFT Minting Service

NFT minting services are a great way for artists and creators to make money from their art.

The services provide easy-to-use tools for creating, minting, and selling NFTs.

They also provide additional benefits such as payment processing, customer support, and marketing services.

With an NFT minting service, you can make money by creating your own digital artwork or by selling exclusive rights to existing artwork.

This can be a great way to generate a passive income stream and make money from your art.

If you are interested in creating, selling, or buying NFTs, then an NFT minting service may be the perfect platform for you.

2 notes

·

View notes

Text

What are NFTs and the Top 5 Advantages of NFTs?

we will explore what NFTs are and how it works. NFTs meaning non-fungible token is a type of digital token that can represent, as the name suggests, any number of things the most popular format of NFT is the blockchain, which acts as a public ledger updat

In this article, we will explore what NFTs are and how it works. NFTs meaning non-fungible token is a type of digital token that can represent, as the name suggests, any number of things the most popular format of NFT is the blockchain, which acts as a public ledger updating everyone on when orders for NFTs have been placed and completed. we are explaining about nfts buy, sell, advantages,…

View On WordPress

#Advantages of NFTs#Disadvantages of NFTs#How do NFTs work?#NFT#NFTs#NFTs meaning#What are NFTs#What is an NFT?

2 notes

·

View notes

Note

Okay, so to provide some context for the fans who aren't aware of NFT's, NFT's stand for "non fungible tokens" and the people who purchase NFT's purchase a block or keyfile of some sort that provides them with the "rights" to a piece of art, which in my opinion sounds incredibly exclusive. I suppose the whole point of NFT's were to ensure that digital creators have the rights to their work and are compensated appropriately but in turn, it also made digital art inaccessible.

Furthermore, the NFT's are provided with some sort of security detail within a cryptocurrency like Bitcoin or Ethereum, and again in order to certify that fraudulent transactions won't become a problem, these cryptocurrencies use a significant amount of machinery and technology which then results in an excess of carbon gas emissions.

So in short, I don't really know what the point of the band doing this was to be honest.

And also they mentioned that everyone will at some point have access to the NFT's but that defeats the whole purpose of what an NFT is and what it intends to do soooooo … idk idk man.

thank you for this explanation !! i think we are all still very confused and hopefully they just explain wtf is happening soon because i am already very tired of this :))

2 notes

·

View notes

Note

NFT's aren't really scams. Saying they are is like saying that Tumblr accounts are for scamming just because a small minority use their accounts for it. I'd recommend the (currently) most recent video by Uniquenameosaurus which covers over the NFT stuff in the beginning approx 20mins (as is explained more in-depth in a larger video)

I wonder how old this anon question is? Are they even aware of pyramid and multilevel marketing schemes? Do they even have the money to lose and come out ok if spent on non fungible tokens? Do they even know what fungible mean? Because it certainly has nothing to do with fungi.

1 note

·

View note

Text

8 Simple Steps - Tokenizing Your Bond

The financial world as we know it has changed dramatically over the last few years, thanks to the advent of blockchain technology, which has increased clarity, democratization, mobility, and liquid markets that are often a monopoly of institutional investors. Among the numerous innovations within the niche of blockchain, the most promising is certainly the prospect of bond tokenization, that is, when bonds can be represented digitally in the form of tokens that represent parts of ownership rights of a bond. Bond tokenization allows the issuers and investors of such instruments to step up their game and go out of their comfort zones, looking for things that never existed before.

If you’re interested in how to tokenize a bond, please read this manual which contains 8 steps basic principles describing the entire process from explaining what tokenization is to how to sell the tokens on a secondary exchange.

1. Understanding Tokenization and Its Benefits

The concept of tokenization will be discussed further along and so before heading to the ‘how’ phase, it will be important to note what tokenization is and its significance.

Tokenization is the conversion of any form of asset ownership (for example bond) into digital units on a blockchain. Each token is owned by many other investors who buy and sell portions of these tokens much to the amazement of everyone. In case of bonds, tokenization leads to the following:

Enhanced Liquidity: Investors can easily buy or sell his or her share in bonds and this in turn leads to speedy access to cash.

Fractional Ownership : Smaller investors are enabled access by able to buy small portions or fractions of the bonds.

Trust and Safety: Once decentralized digital currency is used to conduct any form of business the transaction is almost timelessly recorded in the blockchain.

In other words, if you decide to tokenize your bond, it helps you to attract more kinds of investors and makes such a financial instrument more liquid and flexible.

2. Choose the Right Blockchain Platform

The selection of a blockchain platform is a strategic move, since each one of them has its strong and weak points that affect the safety, the enlargement, and the cost of all transactions made.

Here are a few blockchain solutions that can be used for purposes of tokenization:

Ethereum: As a result of its inventive structure, the complex of smart contracts built on Ethereum has attracted a large number of admirers. Therefore, there are many tokenization projects utilizing this network. But transaction fees may be extremely high during certain times.

Tezos: A cheaper version of the two above, Tezos is smart contract-enabled and is designed with the possibility of future upgrades which makes it perfect for projects with longer duration.

Stellar: Stellar has good transaction speeds and charges low fees which are helpful in cases where there is a need for trading within tokenized assets and frequency.

Factors like transaction fees, risk mitigation, service availability scale, and availability of developers should inform your decision. For example, popularity of Ethereum assures users of great community assistance but the settlement processes has different fees, while Stellar is affordable and quicker but rigid.

3. Decide on the Token Standard

To represent your Bond and assigning it a representation on the blockchain, it is imperative that you identify the most appropriate token type. There are different standards of tokens, but the following tend to be the most common;

ERC-20: This standard applies to fungible tokens – where each token is the same with the other. If your bond tokens are interchangeable like traditional shares, then ERC-20 is appropriate.

ERC-721 (NFT): Non fungible tokens are non interchangeable tokens whose assets are unique. Although they are largely used for artwork and similar items, if ever a token would represent a unique claim or bond each with specific details, then usage of ERC-721 can be considered.

Most bond tokenization projects often opt for ERC-20 token, given that each token embodies an equal right over the bond value of the underlying. Nevertheless, should your bond framework illustrate complexities or embodies various bonds, consider looking up for ERC 721 or any other standard.

4. Consult with Legal and Regulatory Experts

Although the process of tokenization of bonds is not straightforward as it appears, it brings legal and regulatory issues. Just like any tokenized securities, bond tokens also fall under regulatory restrictions. Therefore, since issuance of bond tokens involves selling securities, it is the responsibility of the issuer to follow the appropriate laws and regulations governing securities business. It is very important to engage in-house and external lawyers who have a specialization in this field.

Here are the issues that should be dealt with:

Geo Limits: Look into the policies within each nation where you intend to make your tokens available. Understand that law is not the same everywhere.

Offering Memorandum: Certain jurisdictions will expect an investor or a prospectus to be provided for investment. Ensure that your answer is without omissions and all the facts required are stated.

KYC & Anti-Money Laundering Policies in Place: Ullage and KYC regulation are almost always compulsory. The names of your investors will have to be collected and checked.

Securing legal counsel from the outset will assist in managing these issues and help prevent breaches of regulations in the future.

Ready to Transform Your Bond? Start Your Tokenization Journey Today!"

Get Started Now

5. Set Up Smart Contracts

Smart contract that has been coded and placed on the blockchain. Its significance is paramount in tokenization projects. For one such bond wherein tokens will be issued to every bondholder, this means that smart contracts will perform the tasks of generating and allocating tokens, paying dividends or coupons, and ensuring that the issued bond adheres to the country legislation.

Thus, when developing a smart cod, the following notes should be taken into consideration:

Token Issuance: State how many tokens will be generated, how these tokens will be allocated and to what privileges will the owning members have.

Compliance and Restrictions: Smart contracts could be programmed to automatically restrict token transfer e.g. to verified investors only.

Interest Payments and Redemptions: Bonds normally offer interest payments to the bond owners and have a fixed time of expiration. These smart contracts will assist in managing the payment of coupon and the redemption of the fractional ownership tokens at the end of the maturity period.

While the risks can be handled by an internal team, it is advisable to engage qualified external blockchain developers. Further, ensure that potential weak points found in smart contracts are corrected by engaging the services of independent computer security experts.

Check out us : Bond tokenization services

6. Mint and Issue the Tokens

The only thing that remains is to mint program eligibility tokens after all the smart contracts have been developed. Minting refers to the creation of tokens on the blockchain, which will act as a share of your bond.

The process of token issuance by the issuer can be broken down into the following parts:

Smart Contract Initialization: Introduce the smart contract to the blockchain that has been completed.

Token Provisioning at the Beginning: Tokens will be minted, with respect to the bond’s value.

Distribute The Tokens To Your Address: At the start, the tokens will be kept by the issuer in their wallet, waiting to be issued to the investors.

Plan the sale of the newly created tokens: Establish in what manner the investors will acquire the tokens: by means of direct sale, a tokens offering or listing on the exchange.

Tokens can then be issued to initial investors, meaning that they will have fractional digital ownership in the bond.

7. Distribute Tokens to Investors

Once the tokens are created at the primary level, the subsequent action is to allocate them to the investors. At this level, the regulatory aspect becomes very essential as you will have to do the following:

Establish Procedures to Validate Investor Identities: Every single investor must be KYC and AML compliant to the required regulatory level.

Implement a Fair Process: State the specifics pertaining to the bond to be offered to the investors, even where the tokens come with certain restrictions.

Enforce Regulations: All token movements must be regulated to curb issuance of tokens without proper authorization especially if the bond is only meant for accredited investors.

In this case, you may opt for a token sale platform or an exchange dealing with security tokens, and the process will be conducted in an orderly and compliant manner.

8. List Tokens on a Secondary Market for Liquidity

In the end, if you want your bond to be fully liquid, you will have to list your tokens on a secondary market. This allows the investors to conduct buy and sell transactions on the tokens to their full extent in real time.

Some options to consider include:

Decentralized Exchanges (DEXs): Exchanges such as Uniswap allow users to trade tokens directly through the blockchain without a third party.

Security Token Exchanges: Some SIC exchanges like INX or tZERO are constructed with the purpose of security token compliant trading.

Market Makers and Brokers: For more significant bond token offerings, issuers may engage broker-dealers that may include market makers to enhance liquidity through buying and selling the tokens.

Do not forget that once your token is listed on a secondary market, it not only offers liquidity to the token but also increases the token’s exposure and may entice additional investors.

Conclusion: Embrace the Future of Finance

Bond tokenization is not just a cognitive process. Instead, it is a means of modifying a conventional financial instrument into a more digital, dynamic, and available resource. Within the 8 steps detailed in the guide, anyone can execute the process of bond tokenization and access a global market based on the blockchain technology. This brings about improved liquidity, lower costs of transacting, and a wider investor base accessible.

Similarly, With the evolution of the finance sector towards more digitalization, the idea of tokenized bonds provides an interesting avenue for both issuers and investors to engage with tomorrow’s finance.

0 notes

Text

How Cal Evans Gresham is Pioneering Blockchain Gaming Regulations

In the rapidly evolving world of blockchain and digital assets, the gaming industry has emerged as one of the most innovative and promising areas of growth. With blockchain technology enabling unique features like decentralized ownership, tokenized in-game assets, and enhanced security, blockchain gaming has captured the attention of players and developers alike. However, this technological shift also introduces complex legal challenges that require a thoughtful approach to regulation. Cal Evans Gresham, a leading authority on blockchain law and founder of Cal Evans Gresham International, has become a central figure in shaping the regulatory frameworks needed to support blockchain gaming’s growth while ensuring compliance and user protection.

The Unique Legal Landscape of Blockchain Gaming

Blockchain gaming represents a fusion of technology, finance, and entertainment, creating a new type of gaming experience where players can own, trade, and monetize digital assets. Unlike traditional games, which restrict the ownership and transferability of in-game items, blockchain gaming allows players to truly own assets through the use of non-fungible tokens (NFTs). These tokens enable players to buy, sell, and trade items on blockchain networks, creating real-world value within virtual environments.

However, the rise of blockchain gaming has introduced unprecedented legal challenges, from issues of ownership and intellectual property to compliance with regulatory standards. Cal Evans Gresham understands that this complex landscape demands regulatory clarity to protect both developers and players, while fostering innovation. As a well-respected Cal Evans lawyer with deep expertise in blockchain and digital assets, he is uniquely positioned to lead efforts in creating sensible regulatory frameworks for blockchain gaming.

Cal Evans Gresham International: A Commitment to Blockchain Regulation

At Cal Evans Gresham International, the team is committed to building regulatory frameworks that support blockchain gaming companies as they navigate the evolving legal landscape. Cal Evans, with his extensive background in blockchain law, provides invaluable guidance to developers, investors, and companies operating within the space. His approach emphasizes compliance, transparency, and the protection of user rights.

One of the primary goals of Cal Evans Gresham International is to ensure that companies involved in blockchain gaming adhere to regulatory standards in each jurisdiction in which they operate. Since blockchain gaming is global in nature, companies often find themselves facing a patchwork of regulations that vary by region. Cal Evans offers tailored legal strategies that help these companies achieve compliance while remaining agile in a competitive market.

Protecting Intellectual Property in Blockchain Gaming

Intellectual property (IP) rights have long been a cornerstone of the gaming industry, protecting developers and creators from unauthorized use of their designs, code, and assets. However, blockchain gaming introduces new challenges related to IP protection, as in-game assets are often represented as NFTs that can be traded on open markets. This shift raises questions about ownership, licensing, and the rights of creators versus players.

Cal Evans Gresham recognizes the importance of protecting intellectual property in blockchain gaming. His firm advises clients on how to secure and enforce IP rights for digital assets, including character designs, game mechanics, and NFTs. "Blockchain gaming has expanded the concept of ownership, but this also requires robust IP protection to safeguard creators," explains Cal Evans. By implementing licensing agreements and establishing clear terms of ownership, Cal Evans Gresham International helps companies protect their valuable assets within a decentralized environment.

Regulatory Compliance for NFTs and Digital Assets

NFTs have become integral to blockchain gaming, allowing players to buy, sell, and trade unique digital items. However, the rise of NFTs has attracted the attention of regulators worldwide, who are concerned about issues like fraud, money laundering, and investor protection. Cal Evans Gresham International takes a proactive approach to NFT regulation, helping clients comply with anti-money laundering (AML) and know your customer (KYC) requirements to reduce the risk of illegal activities.

Cal Evans Gresham has developed a reputation as a trusted advisor for companies seeking to navigate the regulatory challenges associated with NFTs. By guiding clients through compliance with these standards, he ensures that their platforms are not only legally compliant but also positioned to attract a wider audience. His emphasis on ethical practices and transparent transactions has helped blockchain gaming companies build trust with their users and regulators alike.

Drafting and Enforcing Smart Contracts

Smart contracts, self-executing agreements embedded in code, are a fundamental part of blockchain gaming, allowing for automated transactions and secure trades of digital assets. While smart contracts provide significant advantages, they also introduce new legal complexities, particularly in terms of enforceability and compliance with existing laws.

As a Cal Evans lawyer with in-depth knowledge of blockchain technology, Cal Evans works closely with developers to draft smart contracts that are both legally sound and functional. "Smart contracts are transforming the gaming industry, but they must be carefully structured to avoid legal pitfalls," says Cal Evans. His approach ensures that these contracts are clear, enforceable, and aligned with relevant regulations, protecting all parties involved in a transaction.

The Future of Blockchain Gaming Regulations

As blockchain gaming continues to evolve, the need for effective regulatory frameworks will only increase. Cal Evans Gresham remains at the forefront of this movement, advocating for balanced regulations that protect users without stifling innovation. He believes that regulation should foster trust in blockchain gaming, encouraging more players and developers to participate in this exciting new industry.

Through his work at Cal Evans Gresham International, Cal Evans is not only helping individual companies achieve compliance but also influencing broader industry standards. By collaborating with policymakers, industry leaders, and technology experts, he is actively shaping the future of blockchain gaming regulation. "The goal is to create a regulatory environment that supports growth while addressing the unique challenges of blockchain gaming," says Cal Evans. His vision emphasizes the importance of cooperation between stakeholders, with the aim of building a secure, transparent, and accessible blockchain gaming ecosystem.

Conclusion

In a rapidly changing digital world, Cal Evans Gresham has established himself as a pioneer in blockchain gaming regulation. Through Cal Evans Gresham International, he is helping to build the legal infrastructure that will support the growth of this revolutionary industry. His focus on regulatory compliance, intellectual property protection, and ethical practices has made him a trusted advisor to blockchain gaming companies around the world.

As the industry matures, the contributions of experts like Cal Evans Gresham will be crucial in ensuring that blockchain gaming reaches its full potential. With a commitment to innovation and a forward-thinking approach to regulation, he is helping to lay the foundation for a new era of gaming—one that combines technology, creativity, and responsible governance.

0 notes

Text

Crypto Venture: Your Ultimate Hub for Crypto, AI, and NFT News

In a world where digital currencies and technologies are constantly evolving, staying ahead of the curve is essential. Crypto Venture is designed to be your one-stop platform for real-time updates and expert insights into cryptocurrency, artificial intelligence (AI), and non-fungible tokens (NFTs). As the world's first video news platform for crypto-related content, we focus on providing the latest updates with in-depth analysis, ensuring that you're always in the know.

Why Crypto Venture?

Crypto Venture’s mission is to simplify complex topics related to the digital world. While traditional news outlets may cover cryptocurrency sporadically, Crypto Venture delivers comprehensive, up-to-date video news focused on Bitcoin, cryptocurrency coins, and AI developments. We make it easy for investors, tech enthusiasts, and everyday users to access real-time updates, curated by industry experts.

Crypto Coin News Today: What You Need to Know

The world of cryptocurrency is fast-paced, and new developments happen almost daily. Our platform covers the latest crypto coin news today, ensuring you’re aware of major market shifts and emerging opportunities. From price changes to technology advancements, we simplify complex information, helping both beginners and seasoned investors stay informed.

Bitcoin News: Stay Updated on the Market Leader

Bitcoin, often seen as the gold standard of cryptocurrencies, remains a critical focus for anyone involved in the digital currency market. On Crypto Venture, we provide real-time updates on Bitcoin news, including key developments in the network, price fluctuations, and market forecasts.

What is the Bitcoin Price Today?

Bitcoin’s price is known for its volatility, making it critical for investors to stay updated. At Crypto Venture, we offer Bitcoin price today insights, with live updates and expert analysis on what might be influencing the current value. Whether you’re tracking the market daily or looking for long-term trends, our platform keeps you informed.

Shiba Inu Coin: Rising Star in the Crypto World

In recent years, Shiba Inu has gained significant attention. Often regarded as a meme coin, its value and community-driven projects have turned it into a serious contender in the crypto space. Shiba Inu coin news covers everything from price updates to development news, helping you understand its trajectory and investment potential.

Breaking Down Crypto Currency News Today

Keeping up with crypto currency news today can feel overwhelming, given the market's complexity and rapid pace. Crypto Venture simplifies it by delivering real-time news that’s easy to digest. Whether it's regulation updates, technological advancements, or market trends, our team ensures that you receive the most relevant and crucial information.

Coins in the Market: Identifying Opportunities

The cryptocurrency market is vast, with thousands of coins circulating. Keeping track of the most promising coins in the market can be daunting. Crypto Venture highlights the top performers and potential opportunities through detailed analysis and trend tracking, ensuring that you can make informed investment choices.

Cryptocoin News: In-Depth Analysis and Real-Time Updates

Cryptocurrencies continue to evolve at a rapid pace, and keeping up with cryptocoin news is essential for anyone involved in digital investments. At Crypto Venture, we deliver expert-driven updates, focusing on both well-known and emerging coins. Our insights help you make smarter decisions based on real-time data and in-depth analysis.

Navigating the Volatility of Bitcoin

Bitcoin’s price can be unpredictable, swinging drastically within hours. Keeping tabs on the Bitcoin price today can help you react quickly to market shifts. Crypto Venture provides real-time updates, accompanied by expert analysis that explains the driving factors behind Bitcoin’s highs and lows.

The Shiba Inu Phenomenon: What’s Next?

The rise of Shiba Inu coin has been nothing short of remarkable. Its passionate community and innovative projects have pushed it into the spotlight. At Crypto Venture, we explore Shiba Inu coin news, providing detailed coverage of its market performance, upcoming developments, and what experts predict for the coin’s future.

Simplifying Crypto Currency News for Investors

The cryptocurrency market can be complicated, especially with the influx of new technologies and regulations. Crypto Venture simplifies crypto currency news by offering expert insights and easy-to-understand explanations. Whether you’re a new investor or a seasoned trader, our platform ensures you stay ahead of the game.

Exploring the Most Popular Coins in the Market

Are you curious about which coins in the market are worth your attention? Crypto Venture tracks the most popular and promising cryptocurrencies, offering insights on their potential growth and market performance. Our expert analysis helps you navigate the ever-changing crypto landscape.

Tracking Emerging Cryptocoins

New cryptocurrencies are constantly entering the market, offering fresh opportunities for investors. Staying updated on cryptocoin news ensures you don’t miss out on the next big thing. At Crypto Venture, we provide real-time updates on the newest coins and analyze their potential for long-term success.

Bitcoin Price Today: Understanding Market Trends

The Bitcoin price today can fluctuate due to various factors, from global economic changes to technological updates within the blockchain. Crypto Venture provides not just price updates, but also expert analysis that helps you understand why the market is moving in a particular direction.

Shiba Inu Coin News: The Latest Developments

If you’re following Shiba Inu coin news, you know it’s more than just a meme coin. From new project launches to market trends, Crypto Venture delivers the latest updates on Shiba Inu. We help you stay informed on how this cryptocurrency is evolving and what its future might hold.

Stay Ahead with Real-Time Crypto News

With new developments happening every day, keeping up with crypto news is crucial for making informed decisions. Crypto Venture delivers real-time updates on all major cryptocurrencies, AI advancements, and NFTs, ensuring you’re always one step ahead in the digital space.

Coins in the Market: What’s Trending?

Not sure which coins in the market are gaining traction? Crypto Venture keeps you informed about trending coins, providing real-time data and in-depth analysis to help you make smarter investment choices. Our platform is designed to bring clarity to the often confusing world of crypto.

Cryptocoin News: Expert Opinions and Market Trends

Crypto Venture not only provides updates on cryptocoin news but also dives deep into market trends, regulatory changes, and technological advancements. We offer expert opinions to help you make sense of the rapidly changing crypto environment, ensuring you’re equipped with the knowledge to make better investment decisions.

Bitcoin’s Price Movements Explained

Tracking the Bitcoin price today is more than just looking at numbers. Understanding why Bitcoin’s price changes and what external factors influence these shifts can help you anticipate market trends. Crypto Venture delivers in-depth insights that go beyond surface-level updates.

Shiba Inu Coin: What’s Driving Its Popularity?

If you’re wondering what’s behind the meteoric rise of Shiba Inu, Crypto Venture provides all the answers. Our platform tracks the latest Shiba Inu coin news, from market performance to community-driven projects, helping you stay updated on its current and future potential.

Bitcoin Price Today: Real-Time Insights

The Bitcoin price today is influenced by a myriad of factors, including global events, market sentiment, and technological changes. Crypto Venture delivers real-time insights, helping you understand the broader context of Bitcoin’s price movements and what to expect next.

Shiba Inu Coin: A Deep Dive into Its Growth

The Shiba Inu coin is more than just hype—it’s a growing force in the cryptocurrency world. At Crypto Venture, we provide in-depth analysis of Shiba Inu’s market performance, future potential, and key developments, helping you stay on top of this trending coin.

Conclusion: Stay Informed with Crypto Venture

The digital world is constantly changing, and staying updated on crypto coin news today, Bitcoin price today, and Shiba Inu coin news is critical for making informed decisions. At Crypto Venture, we simplify complex topics, offer real-time updates, and provide expert insights to keep you ahead in the world of digital assets, AI, and NFTs.

1 note

·

View note

Text

The Need for Quality Crypto Content

As the blockchain and crypto industry continues to expand, accurate and insightful content is essential to educate new users, attract investors, and explain complex technologies like decentralized finance (DeFi), non-fungible tokens (NFTs), and smart contracts. Many blockchain companies struggle to find writers who understand the intricacies of these technologies and can explain them clearly. WriterOx

solves this problem by providing a pool of vetted writers skilled in the crypto space.

What is WriterOx?

WriterOx is a specialized content marketplace designed to meet the growing demand for blockchain and crypto-focused writing. The platform connects crypto writers with projects, businesses, and startups within the blockchain ecosystem that require articles, whitepapers, blogs, and technical documentation. WriterOx bridges the gap between content creators and the booming world of decentralized technology by offering a marketplace where both novice and seasoned writers can find opportunities that match their expertise.

0 notes

Text

What Is the Difference Between Ethereum and Bitcoin? A Deep Dive into the World of Cryptocurrencies

Cryptocurrencies have captured global attention, with Bitcoin and Ethereum standing out as two of the most prominent and popular assets. As a trader with a decade of experience in the field, I frequently encounter questions about how these two digital currencies differ. In this article, I will explain what distinguishes Bitcoin from Ethereum and highlight the unique features of each cryptocurrency.

The Basics of Bitcoin and Ethereum Bitcoin was introduced in 2009 by Satoshi Nakamoto as a decentralized digital currency designed for peer-to-peer transactions without the need for intermediaries like banks. Its primary purpose is to act as a medium of exchange and store of value, similar to gold. Bitcoin has a maximum supply limit of 21 million coins, making it a scarce asset and contributing to its value.

Ethereum, launched in 2015 by Vitalik Buterin, is a platform that enables the creation and execution of smart contracts. These contracts are self-executing agreements with terms written directly into code. Ethereum is not just a cryptocurrency but also a platform for developing decentralized applications (dApps), which extends its use beyond simple transactions.

Goals and Functions Bitcoin is focused on being the digital equivalent of gold. Its main objective is to provide a stable, secure, and reliable store of value and medium of exchange. Bitcoin aims to become "digital gold," serving as an alternative to traditional currencies and assets.

Ethereum, on the other hand, functions as a platform for creating decentralized applications. Its standout feature is smart contracts, which facilitate the automatic execution and verification of agreements without the need for intermediaries. This capability makes Ethereum not only a cryptocurrency but also a foundation for a wide range of applications and services.

Technology and Architecture Bitcoin operates on a proof-of-work (PoW) consensus mechanism, which requires miners to solve complex mathematical problems to validate transactions and add them to the blockchain. This process ensures security and decentralization but is energy-intensive and can lead to slower transaction times.

Ethereum, originally using a similar PoW mechanism, is transitioning to a proof-of-stake (PoS) system with its Ethereum 2.0 upgrade. PoS aims to improve scalability and reduce energy consumption by allowing validators to create new blocks based on the number of coins they hold and are willing to "stake" as collateral.

Use Cases and Applications Bitcoin is primarily used as a store of value and a medium of exchange. It is often referred to as "digital gold" due to its scarcity and role as a hedge against inflation and economic instability. Bitcoin is widely accepted by merchants and is frequently used as an investment vehicle.

Ethereum supports a broader range of use cases beyond simple transactions. Its smart contract functionality enables the development of decentralized finance (DeFi) applications, non-fungible tokens (NFTs), and other innovative solutions. Ethereum's platform is used for creating decentralized autonomous organizations (DAOs), gaming applications, and various other projects that leverage blockchain technology.

Market Perception and Value Bitcoin is widely recognized as the first and most well-known cryptocurrency, often seen as a safe-haven asset in the digital world. Its market capitalization and adoption levels make it a dominant player in the crypto space, and it is often compared to gold as a store of value.

Ethereum, while also holding a significant position in the cryptocurrency market, is valued for its versatility and potential for innovation. Its role as a platform for decentralized applications and smart contracts contributes to its market value, and it is frequently viewed as the backbone of the decentralized internet.

Community and Development Bitcoin has a strong and dedicated community focused on maintaining its security and stability. The development process is relatively conservative, with changes and upgrades being carefully considered and implemented to ensure the integrity of the network.

Ethereum has a vibrant and active development community that continuously works on improving the platform and expanding its capabilities. The Ethereum network regularly undergoes upgrades and enhancements to address scalability issues, improve performance, and introduce new features.

Conclusion In summary, while Bitcoin and Ethereum share some similarities as cryptocurrencies, they serve different purposes and have distinct features. Bitcoin focuses on being a decentralized digital currency and store of value, akin to gold. Ethereum, with its smart contract functionality and dApp platform, extends the possibilities of blockchain technology beyond mere transactions.

Understanding these differences can help investors and users make informed decisions about how to engage with these cryptocurrencies. Whether you're interested in Bitcoin's stability and value proposition or Ethereum's innovative potential, both offer unique opportunities in the evolving landscape of digital finance. https://best-cryptocurrency-exchange-2024.blogspot.com/

0 notes

Text

OpenSea receives SEC Wells notice, monthly NFT sales fall below $400M: Nifty Newsletter

In this week’s newsletter, find out how former United States president Donald Trump’s fourth non-fungible token (NFT) collection performed, and read about the US Securities and Exchange Commission sending a Wells notice to NFT marketplace OpenSea. Take a look at how crypto advocates reacted to the notice, and check out Cointelegraph’s interview with a Web3 executive explaining how NFTs could…

0 notes

Text

How Can You Effectively Market a Crypto Project in 2024?

The rapid evolution of the cryptocurrency landscape has introduced both new opportunities and challenges for crypto marketers. As the industry matures, marketing strategies must also adapt to the changing environment. With the surge in competition and increased regulatory scrutiny, effectively Crypto Marketing a crypto project in 2024 requires a comprehensive approach that combines traditional marketing techniques with innovative, crypto-specific tactics.

1. Understanding the Crypto Market in 2024

Before diving into marketing strategies, it’s crucial to understand the current state of the crypto market. In 2024, the market is more saturated than ever, with thousands of projects vying for attention. The rise of decentralized finance (DeFi), non-fungible tokens (NFTs), and blockchain-based applications has created a crowded space, making it challenging for new projects to stand out.

However, this saturation also indicates a growing interest in the industry, with more investors and users looking to participate in crypto. To effectively market your crypto project, you must first understand your target audience, their pain points, and what sets your project apart from the competition.

2. Building a Strong Brand Identity

A strong brand identity is the foundation of any successful marketing campaign. In the crypto space, where trust and credibility are paramount, a well-defined brand can make or break your project.

Define Your Mission and Vision: Clearly articulate what your project aims to achieve and how it intends to solve a specific problem in the crypto space. Your mission and vision should resonate with your target audience and reflect your project's core values.

Create a Memorable Logo and Visual Identity: Your logo and visual elements should be distinctive and instantly recognizable. Consistency in design across all platforms will reinforce your brand's identity.

Develop a Compelling Narrative: Storytelling is a powerful tool in marketing. Craft a narrative that explains your project’s journey, its purpose, and the impact it aims to have on the industry. This narrative should be authentic and relatable, helping to build an emotional connection with your audience.

3. Leveraging Social Media and Community Engagement

Social media remains one of the most effective channels for crypto marketing. Platforms like Twitter, Telegram, Discord, and Reddit are particularly popular in the crypto community. Engaging with these platforms allows you to reach a large audience and foster a strong community around your project.

Regular Updates and Content Sharing: Keep your audience informed with regular updates about your project’s progress, upcoming milestones, and any important announcements. Sharing educational content about your project and the broader crypto industry can also position you as a thought leader in the space.

Engage with Your Community: Building a loyal community is crucial in the crypto world. Actively engage with your followers, respond to their questions, and participate in discussions. Hosting AMA (Ask Me Anything) sessions, webinars, and live streams can help you connect with your audience on a deeper level.

Influencer Partnerships: Collaborating with influencers who have a strong following in the crypto community can significantly boost your project’s visibility. Ensure that the influencers you choose align with your brand values and have a genuine interest in your project.

4. Content Marketing and SEO Optimization

Content marketing is essential for establishing your project’s authority and driving organic traffic to your website. In 2024, content marketing goes beyond just blogging—it includes videos, podcasts, infographics, and more.

High-Quality Blog Posts: Regularly publishing well-researched blog posts on your website can help you rank higher on search engines and provide valuable information to your audience. Topics can range from technical explanations of your project to broader discussions about trends in the crypto industry.

SEO Optimization: To ensure your content reaches the right audience, it’s important to optimize it for search engines. Use relevant keywords, optimize meta tags, and ensure your website is mobile-friendly. In the crypto space, where competition is fierce, SEO can give you a crucial edge.

Video Content: Video content is becoming increasingly popular, especially on platforms like YouTube and TikTok. Creating explainer videos, tutorials, and interviews with industry experts can help you reach a wider audience and provide a more engaging way to showcase your project.

5. Paid Advertising and PPC Campaigns

While organic reach is important, paid advertising can accelerate your project’s growth by targeting specific audiences. Pay-per-click (PPC) campaigns on platforms like Google Ads, Facebook, and Twitter can drive targeted traffic to your website.

Targeted Campaigns: Use audience segmentation to target your ads based on demographics, interests, and behavior. This ensures that your ads are shown to users who are most likely to be interested in your project.

Retargeting: Retargeting campaigns can help you reach users who have previously interacted with your project but haven’t yet taken the desired action. By reminding them of your project, you can increase the chances of conversion.

Compliance and Transparency: In the crypto space, advertising regulations are becoming stricter. Ensure that your ads comply with platform policies and are transparent about what your project offers. Misleading or exaggerated claims can damage your reputation and lead to penalties.

6. Partnerships and Collaborations

Forming strategic partnerships with other projects, platforms, or influencers can help you expand your reach and gain credibility in the crypto space.

Industry Partnerships: Collaborate with other projects or companies that complement your offerings. For example, if your project is focused on DeFi, partnering with a popular wallet provider or exchange can give you access to a larger audience.

Cross-Promotions: Cross-promotions with other projects can be mutually beneficial. For instance, you can co-host events, webinars, or giveaways, allowing both projects to tap into each other’s audiences.

Integration with Existing Platforms: Integrating your project with popular platforms or protocols can enhance its utility and make it more appealing to users. For example, integrating with a widely used blockchain can provide added security and interoperability.

7. Building Trust Through Transparency and Security

In the crypto world, trust is everything. With numerous scams and fraudulent projects, users are understandably cautious. Building trust through transparency and robust security measures is essential for the success of your project.

Transparent Communication: Be open and honest with your community about your project’s progress, challenges, and any changes in direction. Regularly update your community on the status of your project, and don’t shy away from discussing setbacks or delays.

Audit and Security Measures: Ensure that your project undergoes regular security audits by reputable firms. Publish the results of these audits to demonstrate your commitment to security. Additionally, implement strong security measures, such as multi-signature wallets and secure coding practices, to protect user funds and data.

Regulatory Compliance: Staying compliant with regulations in the jurisdictions where you operate is crucial. As regulations evolve, ensure that your project adheres to the latest legal requirements. This not only protects your project but also builds trust with your users and investors.

8. Utilizing Blockchain and DeFi Marketing Techniques

Given that your project is within the crypto space, leveraging blockchain and decentralized finance (DeFi) marketing techniques can be highly effective.

Token Airdrops: Airdrops involve distributing free tokens to users, often in exchange for completing specific tasks like following your social media accounts or joining your Telegram group. Airdrops can generate buzz and increase user engagement.

Yield Farming and Staking: If your project involves a DeFi component, offering yield farming or staking opportunities can attract users. These incentives encourage users to lock their tokens in your platform, which can increase liquidity and drive long-term engagement.

Decentralized Governance: Implementing decentralized governance allows users to participate in decision-making processes related to your project. This can foster a sense of ownership and community involvement, leading to higher user retention.

9. Engaging in Community-Based Events and Networking

Participating in and hosting community-based events, both online and offline, can help you connect with potential users, investors, and partners.

Crypto Conferences and Meetups: Attending or sponsoring crypto conferences, meetups, and hackathons can give your project visibility among industry professionals and enthusiasts. Networking at these events can lead to valuable partnerships and collaborations.

Online Webinars and Panels: Hosting or participating in online webinars and panels allows you to share your expertise and discuss your project with a broader audience. These events can also serve as a platform for launching new features or products.

Community Challenges and Contests: Engaging your community through challenges, contests, or bounties can generate excitement and encourage user participation. For example, you could host a meme contest or a coding challenge related to your project.

10. Tracking and Analyzing Performance

To ensure that your marketing efforts are effective, it’s important to track and analyze the performance of your campaigns. Use analytics tools to monitor key metrics such as website traffic, conversion rates, and social media engagement.

A/B Testing: Experiment with different marketing strategies and messages to see what resonates best with your audience. A/B testing allows you to compare the performance of two versions of a campaign to determine which one is more effective.

Adjusting Strategies Based on Data: Regularly review your analytics and make data-driven decisions to optimize your marketing efforts. If a particular strategy isn’t delivering the desired results, be willing to pivot and try something new.

Reporting and Transparency: Share your progress with your community through regular reports. Transparency in your marketing efforts can build trust and demonstrate that you are committed to your project’s success.

Conclusion

Marketing a crypto project in 2024 requires a multifaceted approach that combines traditional marketing techniques with innovative, crypto-specific strategies. By understanding the current market, building a strong brand, engaging with your community, and leveraging the unique aspects of blockchain technology, you can effectively promote your project and stand out in the competitive crypto landscape.

As the industry continues to evolve, staying agile and adapting to new trends will be key to maintaining your project's visibility and success.

0 notes