#mygreatlakes

Explore tagged Tumblr posts

Text

MyGreatLakes

Success is the biggest goal for novices, and with good reason. A strong and excellent college education is crucial for success in the fast-paced world we live in.

MyGreatLakes

1 note

·

View note

Text

MyGreatLakes Login

Advance Pardoning Projects: MyGreatLakes Login gives data and backing to different credit absolution programs. These projects are intended to assist borrowers with government understudy loans lessen or take out their credit adjusts under unambiguous conditions. Models incorporate Educator Credit Pardoning, which excuses a piece of advances for educators working in low-pay schools, and Pay Driven Reimbursement Plan absolution, which excuses the excess advance equilibrium after a specific number of qualifying installments. MyGreatLakes Login offers direction on qualification necessities, application processes, and the vital documentation for these credit pardoning programs.

Monetary Education Assets: MyGreatLakes Login is devoted to advancing monetary proficiency among borrowers. The stage offers a scope of instructive assets, including articles, guides, and intelligent devices, to assist borrowers with working on their monetary information and settle on informed choices. These assets cover points, for example, planning, saving, credit the board, and understanding advance terms. By outfitting borrowers with monetary information, MyGreatLakes Login means to enable them to pursue wise monetary decisions and construct major areas of strength for a future.

Default Anticipation and Restoration: MyGreatLakes Login underscores the significance of forestalling advance defaults and offers assets to help borrowers who are battling with credit reimbursement. The stage gives data on choices, for example, credit restoration, which permits borrowers to reestablish their credits to great remaining after a progression of back to back, reasonable installments. MyGreatLakes Login offers direction on the recovery interaction, the advantages it gives, and how borrowers can make progress toward effective credit reimbursement.

Monetary Guide Instruments: MyGreatLakes Login offers apparatuses and assets to assist understudies and families with exploring the monetary guide process. This remembers data for finishing the Free Application for Government Understudy Help (FAFSA), figuring out various sorts of monetary guide, and investigating grant amazing open doors. By giving these assets, MyGreatLakes Login plans to help understudies in getting to the monetary help they need for their schooling and settling on informed conclusions about their instructive funding.

Local area Commitment: MyGreatLakes Login effectively draws in with borrowers and the more extensive local area through different effort drives. This might incorporate facilitating online courses, studios, and occasions to give direction and backing on educational loan the board and monetary proficiency. Moreover, MyGreatLakes Login might team up with schools, universities, and different associations to convey instructive projects and assets that enable people to settle on informed monetary choices.

Keep in mind, while these subtleties give a more extensive comprehension of MyGreatLakes Login, it's dependably fitting to visit the authority MyGreatLakes site or contact their client service straightforwardly for the most dependable and cutting-edge data about the stage and its elements.

Is there something else I can help you with?

0 notes

Text

MyGreatLakes Pro

MyGreatLakes is an online portal that provides financial support to students by offering educational loans. Signup & Log in to access your federal student loan account to make payments, existing status, terms, conditions, interest rate, or available repayment plans.

https://twitter.com/Mygreatlakepro

https://www.linkedin.com/company/mygreatlakes-pro

https://form.jotform.com/233471105984054

0 notes

Text

Mygreatlakes Student Loans Registration, Login, Payment Information & Guide

Pupils taking loans up is a frequent matter, higher education isn't cheap and lots of parents and pupils take loans up to help cater to all schooling expenses. Mygreatlakes is just one of those associations offering loans to students with the very best conditions. They are considerate and have a communication system that is very effective. Let us show you how.

You have to register, to secure financing with. Make an account login either in the computer or together with an android telephone number or your own apple. The signup and logins processes are easy and so is your procedure or regaining your password in the event you forget it.

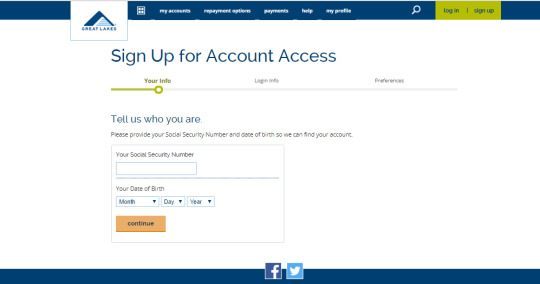

The MyGreatLakes Login signup process is as follows;

First and foremost, make sure you get a secure online connection until you make your account.

Subsequently, visit mygreatlakes.org webpage and enroll. The join button is in the top right corner of the site. On the flip side, you're able to immediately follow this link to register right; https://www.mygreatlakes.org/educate/registration/identify.html

Then input your social security number followed by your date of arrival as prompted from the fall-down menus.

Click continue button to fill the other areas giving specific information about your loan program specifications and tastes.

As soon as you're finished with filling all info, go back to the site and login into your accounts.

To handle your loan, you are able to login into a MyGreatLakes Login account anytime and anyplace. The login processes for apple telephone owners is a bit different from people utilizing android phones. The overall login process comprises;

Go to my greatlakes student loans home page by clicking on the following link: https://www.mygreatlakes.org.

At the very top left corner of this homepage is your login button, click on it as soon as you're ready to log in.

Set your ID on the area that's vacant of this login site and remember to type it properly to prevent mistakes.

Press that orange button after filling in the ID and move to fill in additional details as prompted.

MyGreatLakes Login for apple apparatus

The fantastic lake login process for apple apparatus owners is as follow

Visit iTunes and get the excellent lakes cellular program

Install the program in your own apparatus

Then sign up to this fantastic lakes bank accounts on the apparatus.

For android apparatus owners

The program for android telephones is quite simple to use. It makes it effortless for users to handle their loans. The login process is as follows;

Download the excellent lakes cellular program from google play shop

put in it on your device.

Subscribe today to get your accounts.

Forgot password, fear not to Recover your login credentials Simply by following the next steps;

Go to the greatlakes student login portal site particularly for loans.

Beneath the last key, press the"Trouble with Your Account?" A link that leads you to the password retrieval supervisor.

Supply the previous 4 amounts from your social security figure beneath the private information area.

Input the email connected with your accounts then provide the date that you have created details as prompted.

Produce on the last button to create a new password.

Manage Your Student Loan Debt Using www.MyGreatLakes.org

Seeing www.MyGreatLakes.org will provide you the base you want to step ahead on your future. A robust and superior instruction is important to your success. But paying for this instruction leaves one with a financial burden which has a lifelong effect on your credit score. Fantastic Lakes can allow you to map out a future of financial strength and construct a credit profile you will need for many years to come.

An excellent education is important to your future success. The issue is in how an instruction costs many thousands of dollars. Outside of scholarships, many students rely on loans to help cover their research. The United States government has not helped the process by enabling student loan interest rates to double without granting any aid to present debt holders. This produces the affordability of an excellent education difficult to acquire. That's the reason you require a website like Great Lakes which makes it possible to make informed decisions regarding your educational expenses.

The exterior of becoming one of the top servicers of student loans, Great Lakes will supply you with quality advice that raises your financial IQ. You have to learn more than interest rates and present principal balances. You need to discover how to repay your student loan payment and debt plans which are presently offered. It's very important to find out more about the tax consequences associated with a student loan and which kind of applications the government provides. There are lots of taxable deductions accessible if you're at present in a repayment plan. You have to learn how student loans affect your credit rating and your ability to acquire any sort of financing today and later on. This sort of information is the thing that contributes to a solid financial IQ.

You have to construct a route to repaying your student loan debt. The debt won't ever go off, and new legislation makes student loans exempt from any kind of insolvency protection. The kind of loan that you get along with the lending institution is crucial elements in your ability to pay back your student loans. That's the reason you have to know who your lender is and just how much they're charging in points and fees. Banks charge interest, particularly if the loan has been accessed through a private establishment. In the event the loan isn't secured by the USA authorities, the creditor may charge five to six percent in penalties based on the original principal balance. The creditor can adjust the rate of interest depending on the current prime rate. They can earn this kind of modification because the loan doesn't fall under any kind of government guidelines. A route to repaying your student loan on time and keeping your budget under control starts with understanding who your lender is and also the details of the loan.

The practice of obtaining or repaying your student loan may seem overwhelming. You will feel like there's not any respectable place to begin, or you can't trust the info which you obtain from any site. But, accounts with fantastic Lakes will provide you the head start you will need for any kind of loan repayment info. The tools available include the best way to make your payments in time together with a budget that helps with your everyday finances. Learn about the variety of repayment options which are accessible, for example, ways to unite your personal student loan into a government-backed program. This will help save you tens of thousands of dollars over the life span of your loan and avoid the hidden costs related to private lenders. The most significant part regaining your student loan is to construct a repayment plan that fits your requirements. This begins by learning the fundamentals behind your loan, beginning with how much interest and principal the lender is presently charging.

Student loan debt should not be a burden, particularly if you're attempting to acquire an excellent education. The key to success is handling your debt, and finding out just who's giving you cash. Rather than wasting precious time on the telephone, utilize www.MyGreatLakes.org as a 1 stop source for each your student loan requirements. The info is free of charge, and the tools available will make your student loan debt a whole lot less difficult to handle.

1 note

·

View note

Text

www.mygreatlakes.org : Great Lakes Students Loans Information & Guide

Lots of people nowadays are currently questioning concerning the genuineness of My Great Lakes. The ceremony is being quoted by some. But is that My Great Lakes is a student loan support that is registered.

The authorities issue federal loans to aid a pupil access credit in a rate with flexible payment choices. Good kindergarten student loan support isn't a hoax. Being a company with tens of thousands of collaborations, My Great Lakes can be reliable for almost any quantity of student loan. As the Federal Government offers the loans, one must not be worried about prices as in the instance of loans.

Great Lakes Student Loans could be availed if a person needs to research without worrying about strict repayment schedules and high-interest prices. As the rates of interest on Federal student loans have been determined by the Congress, there's a prospect of an exorbitant increase.

As the rates of interest aren't predicated on any credit rating and therefore are fixed throughout the tenure, an individual can stay free of concerns associated with the shift in interest rates because of the markets that are dwindling.

Developing a Great Lakes Student Loans login account on the My Great Lakes Website If a student would like to keep a tab on every detail associated with his/her student loan, then My Great Lakes provides a handy facility for the same. A pupil can easily make My Great Lakes accounts on the website and may get information anytime, anywhere readily.

mygreatlakes student loan accounts help a student to view repayment choices, assess outstanding balance, establish a schedule for routine payments, compute the entire price of the loan in a couple of clicks. To make a student loan accounts, one just must visit the website mygreatlakes.org and click on the signup button at the top.

By inputting the social security number and date of arrival and moving farther with excellent lakes login info and preferences, an individual can make an account.

After a pupil creates My Great Lakes Login accounts, he/she could easily maintain a check on their own fiscal responsibilities and cover loan without any hassle.

The way to get Great Lakes student loans client services?

If you would like to clear your doubts about Great Lakes Loans or have some queries concerning the authenticity of My Great Lakes, you could always contact Great Lakes student loans client services. It is possible to telephone on +1 800-236-4300 from 7:00 am to 9:00 pm on any day from Monday to Friday to clean your doubts.

You could drop an email by filling the complaint form from the contact us part of the website. My Great Lakes agents will be happy to solve all of the questions.

Being a real organization, My Great Lakes has assisted tens of thousands of students in fulfilling their academic dreams. The Majority of the pupils speak to support and the firm has a number of positive testimonials like below:

"I had been very concerned about the management of pupil loan. Because I'm a naïve to this loan item, I did not have the slightest thought about the way the whole education loan item functioned, Great Lakes assisted me a fantastic deal in efficiently handling my student loan to my own graduation and helped me to handle my rate of interest."

Rather than listening to everybody, be certain that you do your research if you're searching for a student loan that is inexpensive. My Great Lakes provides a fantastic opportunity for pupils to avail loans in a pace that is low-interest. And as the business has been assisting students for decades, there isn't any question of a scam.

My Great Lakes believes in doing what is right by providing services and helps pupils. Broaden your outlook towards pupil loan facilitators and make the move that is perfect in choosing your career. Fantastic Lakes Higher Education Corporation is just one of the Largest services of student loans and guarantors from the United States of America.

According to Madison, Wisconsin, it had been intercepted from the year 1967 and takes pride in being the finest support of national loans to pupils. In cooperation with 1100 creditors and about 6000 colleges, it is a support of loans to countless pupils

History of Great Lakes at www.mygreatlakes.org

Therefore, in the event that you don't know about the fantastic lakes student that's official website will be www.mygreatlakes.org. You may read the history of lakes on the website but we supply some stage. Fantastic Lakes created in 1967 that is excellent education loans firm. Fantastic lakes business collaborate with over 1100 creditors and 6000 schools. And today their times you will find lot's of pupil accomplished his analysis with the support of Student Loans that are excellent.

Fact isn't known by them and individuals believe the Great Lakes Student Loans is Scam although now there are several pupils. So friends here we let you know that the truth of student loans that are fantastic. Fantastic Student Loans isn't the scam since lakes enrolled with Federal Student Loans service that provides by authorities at prices with fixable payment. Since lakes are genies don't about the scam of lakes that are great and operate with authorities.

Great Lakes Student Loans Requirement

There is a necessity but here we supply the requirement. So, friends, you want to read below tips and then you'll receive loans. And should you accomplished those points along with following you handle your obligations?

In Great Lakes Student Loans you discover the ideal repayment plan for your financial plan.

Up o date with advice with your student loans.

Monitoring your college registration & Status while you are in college.

Consistently keeping your schooling documents.

Consistently chose repayment strategies predicated on your budget.

Constantly read terms and condition prior to take Great Lakes Student Loans as well as some other loans.

You've got to be US Citizen. Because Great Lakes offer student loans in the USA.

So friends all over the requirement. Therefore, if you realized above these demand to choose great lake student loans.

Great Lakes Student Loans Registration in www.mygreatlakes.org

As you realize that MyGreatLakes is one loan accomplished their higher education. My Great Lakes Student Loans functioning with 1100 Lenders and 6000 Faculties. And should you would like to apply for this particular loans and need to accept this particular loans then you have to create accounts on the official website of Great Lakes is www.mygreatlakes.org. So friends in case you don't have any advice about you follow the aforementioned steps.

To begin with, you get a digital device with an appropriate internet connection.

visit the official website of Great Lakes Student Loans In case you do not have an official website like then you may click on this hyperlink www.mygreatlakes.org.

Now Open the Account Login Page. After you start Account Login Page you then visit Sign UP and you click on such a webpage"register"

You may the Great Lakes Registration Page.

Now input the data that you ask on this page such as Name, Social Security Number, month, day and year of your date of arrival.

Click Continue and complete registration for myGreatLakes Loan Login Account.

come back to the main site of Mygreatlakes.org official website.

Click on login and you then find the login page. Now place the Account ID and Password and you're able to get my amazing lakes website.

In case you don't have a password you have legal Account ID you then click forget the password and then reset your password. Where you have to fill some info and you also have an email or SMS for reset your password.

So, friends, should you obey the above steps you then certainly registration on the mygreatlakes.org website. And you can log in and get the official website.

Great Lakes Student Loans Contact

Telephone number: 800-236-4300, staffed weekdays from 7 a.m. to 9 p.m. Central period

you might also contact fantastic Lakes on its website, Facebook and Twitter

Mail: [email protected], or even submit a web form here.

Fax: Toll-free -LRB-800-RRB- 375-5288, or -LRB-608-RRB- 246-1608 to get local/international faxes

Mail: General correspondence address is below. If you are mailing in a payment, then you will need to Find the Appropriate mailing address, which you can get on your internet account. Great Lakes PO Box 7860 Madison, WI 53707-7860

So friends within this guide we discuss on Great Lakes Student Loans that's official website www.mygreatlakes.org and inform us about how to Register on Great Lakes Official website. So friends when you have any sort of question-related this informative article you comment and then I will provide you answer. If you enjoy this article you want to share this informative article on Whatsapp, Facebook

and

Twitter.

0 notes

Text

www.Mygreatlakes.org - best student loans website

As an understudy credit borrower, you may have an affection/detest association with your advance servicer. All things being equal, it’s critical to work with them keeping in mind the end goal to pay off your understudy credits.

Your credit servicer is a critical delegate amongst you and your loan specialist. Your servicer causes you deal with your advances, and on the off chance that you are ever in a tough situation, they can examine diverse reimbursement choices with you.

One government advance servicer is the Great Lakes Higher Education Corporation, usually alluded to as just “Incredible Lakes.”

In the event that you have Great Lakes understudy credits, read on to figure out how you can take full favorable position of the advantages you servicer offers and pay off your advances ASAP.

About Great Lakes

In 2018, understudy credit organization Nelnet declared that it had obtained Great Lakes. At the season of the buy, Great Lakes was adjusting over $224 billion in government understudy credits.

In spite of the obtaining, Nelnet and Great Lakes work as two unmistakable brands, as opposed to only one organization. Be that as it may, they are cooperating to make another overhauling stage for government-claimed understudy credits. The objective of the new stage is to disentangle the client experience and upgrade security.

What does Great Lakes do as a credit servicer?

As an understudy credit servicer, Great Lakes helps set up borrowers for effective advance reimbursement.

“It is our obligation to enable understudy to advance borrowers begin on the way to reimbursement,” said Renola Swoboda, web-based social networking pro at Great Lakes. “We perceive that understudy advances can be befuddling, overpowering, and terrifying for a few borrowers. We help make it more sensible by noting their inquiries and concerns, and joining any criticism we get from them.”

Influencing understudy to advance installments to Great Lakes

On the off chance that you have Great Lakes understudy advances, the simplest method to make installments is through their online entry. Begin by making a record on the web; you’ll have to share your Social Security number and date of birth so you can recover your advance data. At that point, you’ll make a username and secret key keeping in mind the end goal to sign in to make installments.

On the off chance that you need to put your installments on autopilot and spare some cash on premium, you can agree to accept auto-pay, which naturally pulls back you installments from your ledger every month.

Awesome Lakes understudy advance reimbursement choices

On the off chance that you don’t have any significant bearing for an elective reimbursement design, Great Lakes will consequently enlist you in the Standard Repayment Plan, which offers settled installments throughout 10 years. This choice is great on the off chance that you can bear the cost of it since you’ll spare cash on premium contrasted with different plans with longer reimbursement terms.

In the event that your understudy advances feel overpowering and you have a constrained wage, you might need to consider a wage driven (IDR) plan to make installments more reasonable. Under an IDR design, the credit servicer expands your reimbursement term and tops your regularly scheduled installments at a level of your optional wage.

“At times, we can bring down an installment to $0 every month,” said Swoboda. “Borrowers’ qualification for each arrangement shifts in view of their credit compose and particular monetary circumstance. They should reapply every year to qualify, and may have decreased regularly scheduled installments for up to 25 years.”

Simply know that pay driven reimbursement designs will cost you more in enthusiasm after some time in light of the fact that the length of the advance is expanded great lakes student loans.

Expert tips from Great Lakes

Before we start you know these tow things we talking about mygreatlakes and www.mygreatlakes.org

I talked with Great Lakes about the best tips for overseeing understudy advances that borrowers may not think about:

1. Reimbursement Planner. In the wake of signing into their online record, the Great Lakes Repayment Planner enables borrowers to play around with various installment designs.

The Repayment Planner demonstrates to them the impact a reimbursement design will have on their adjust and length of reimbursement. The best part is it demonstrates breakthroughs amid reimbursement, helping borrowers set short-and long haul reimbursement objectives.

2. Online networking support. Numerous Great Lakes understudy advance borrowers know they can connect by means of telephone and email, yet numerous still don’t have the foggiest idea about that they can likewise get help through web-based social networking.

The Great Lakes Facebook and Twitter pages are superb approaches to make an inquiry. They reply with general data that everybody can gain from. On the off chance that an inquiry moves toward becoming record particular, the inquiry is then tended to off of online networking via telephone or through email.

3. Make installments while still in school. While understudies aren’t required to make installments in school, intrigue keeps on accrueing on most advance composes. Any installment cuts down the intrigue that is developing. Awesome Lakes acknowledges installments while borrowers are still in school, as low as $10. Intrigue is promoted, or added to the important adjust, when the borrower enters reimbursement.

Early installment spares cash in two ways. To start with, the borrower has less to pay back when reimbursement starts. Second, less intrigue accumulates for the life of the advance on the grounds that the adjust is brought down.

0 notes

Text

MygreatLakes Top 10 List of Student Loan Payment Application Criteria for College Students In 2020 (Review and Guide)

MygreatLakes Student Loan Review and Guide: What You Should Know

Mygreatlakes - Higher Education Corporation is one of the student loan providers in the United States. This guide is to help point you in the right direction when it comes to college funds. Mygreatlakes is a great option, however, we'll let you be the judge of that. Hence our list of the 12 things to watch out for before you embark on that college loan application. It is already a known fact that paying student loans can be such a daunting task for any college student today, especially given the limited availability of student loans, and student opportunities to meet increasing expenses.

You may wonder, how exactly does student loans work? This is a great place to begin before we delve deeper into the financial intricacies of a funding college education. There is no gain-saying in the fact that this can be quite stressful for parents and students to navigate the complexities of the student loan world, and finding ways to understand how student loans work. Here's a list of important questions to ask before getting that loan: Do you qualify for scholarships, grants or other free funds?What program are you pursuing?What special talent or skill do you possess?How can you leverage other options?What can you comfortably afford?

The Truth About My Great Lakes

1. My Great Lakes Background Information My Great Lakes was founded in the United States, with its headquarters in Madison, WI. My Great Lakes is established within college funders in the United States, and as such, has earned a place in our review for college loan service providers for the 2020 school year. The financial backing of the My Great Lakes has a strong foundation, with over 7 million customers, and over $75 billion in loans, grants, and other student fundings. An employer of over 2,000 employees within the midwest region of the United States. My Great Lakes has made it quite easy to apply on their platform to get a student loan. Since 2011, The Great Lakes has sustained its position as a highly competitive college funding company in the United States. The confidence that comes with all of these accomplishments have made them the ideal candidate for our end of the year college funders review.

How Loans Work on MyGreatLakes

Signing up on My Great Lakes is easy. The loan application is very easy, and we have compiled a list of what to watch out for to enable you to process your application successfully. You begin by entering your SSN and DOBThen your e-mail addressThe next page requires you choose a pinThen you set your identity image and catchphraseThen you fill out the rest of the information requested

t is important to note here that the website uses high SSL security to check your IP address to ensure that you are signing up from within the United States. If you are currently visiting friends and family, on a vacation, abroad or working abroad, or officially posted outside the United States, it is advisable that you wait until you return home before you start the application. We know tuition, housing, food, books and other necessities that today's students need to be able to function at their best in school are increasingly rising. As such, parents and students alike are constantly on the lookout to find other options to help cover their college expenses. 2. Ideas to Consider Before Loans with MyGreatLakes Some of these options range from volunteering opportunities to student jobs to looking outside the box, which could mean having to bring out those items that you have locked up in your garage for years and never bothered to take a second look at.

3. How to Approach Student Loans After you have considered all of these other options, there is indeed a better way of approaching student loans would be to borrow the least amount as possible. For a lot of students, the idea of student loans can be quite promising, and a lot of people lose focus because of that. You should approach loans with care. Knowing that though this loan is readily available to you, that is if you are a U.S. student, permanent resident and other special cases, however, learning to responsibly borrow will save you lots of troubles in the future. 4. Covering your Bases Before the Loans Knowing that you have covered your bases is important, that way you are not overwhelmed after completion of your program, and the reality of college loan payment hits. By borrowing the least amount you can, your payment options are relatively flexible in terms of your purchasing power, and your mindset of knowing that you did not go on a spending spree.

5. Involve Family Members When You Can This is another important area that you should know about, which is ensuring that you involve family members from your parents, to friends and siblings. This is because you may need them when that time comes. Learning to build those vital relationships comes quite handy, as this can determine such factors as choosing to stay home or go out of state or farther for college, especially during your college days, and even after. So finding ways to stay in touch, and connect with family remains very important. 6. Focus on College and Your Purpose

One thing that students forget to do is to focus on their college program, and not give in to distractions. This is very important especially because it is easy to spend way too much on frivolities, and not actually get much done. The endless college parties, drinking and fun times can come with a huge price tag, but when you do not find yourself in such situations, you could as well save that money you would have spent on partying and investing it. A lot of people are of the opinion that you cannot go through college without having to go through these other sides too, which is the parties, the drinking, and all of the fun stuff. However, just like everything else in life, this requires a high degree of moderation, not just because of finances, but also because of your goals and purpose for being in college. 7. You Still Should Have a Little Fun If you choose to go the fun, party route, have a backup plan. Ensure that you put all the things you plan to do on a list, and then try to evaluate it using your budget for the semester. This will give you a good guide as to how to go about spending or not spending too much for the night. This is not to say that you still should not have a little fun in college, however, the focus is on saving money using MyGreatLakes, therefore, the focus should be on how you can cut your spendings. Some other fun stuff you can consider that would not break the bank, are listed below: Hang out with a friend in their roomCreate a fun playlist togetherMap out some nice after graduation plansRecount some memorable times in collegeInvite others to yours for a change 8. Borrow Books Instead of Buying

In most cases, you can borrow books for the semester. There are a ton of websites that provides the service. Amazon has a dedicated textbook system for students at any given semester. You can also extend the time needed if you need more time for your work or you decide to retake the class for any reason whatsoever for the term. It is also quite possible that your school already has this service, where you would go borrow the assigned texts for the semester and return them at the end of the program, or however long you borrow them for. You can also use my MyGreatLakes loan to cover for books amongst other expenses. 9. Spending on Food, Clothing & Others

It is important to be smart with your spending as this will help you with saving up some more money, and not leaving yourself to chance for when that "need" that always do arise usually, from nowhere arises. It is also important to watch the cost of your grooming and other miscellaneous costs that tend to take out from the little you have. You should look at finding tools that can help you save on things you already spend money on weekly-biweekly or monthly as the case may be. You can save money on hair expenses, for instance, by using tools that can help you find discounts, promos and more on hair salons near you for college students. Other students may very much be into sports, soccer, basketball, badminton, running, hiking and the likes, that may not necessarily take money out of your pocket, but finding ways that can help you maximize your loan from MyGreatLakes would naturally mean a great win for your any time, any day. 10. Creating a Budget and Using It College budgeting and saving money is very important. You can definitely make a huge difference in the way you plan your finances, and how you hope to keep at it. This is one area that many college students take for granted. However, if you are able to get this process going, it definitely will make that huge difference that you are hoping for in your finances. Planning your money is a big part of the goal. You may not get first-hand money management, credit building or repair education in that program you are enrolled in. However, you can choose to learn about this essential information by going online and researching for yourself. This will keep you informed and in a better position to make an informed decision.

How Do You Proceed With The Information You Have

The information provided here is to serve as your guide on how to proceed with caution when it comes to getting student loans. It is important knowing that MyGreatLakes may have its many benefits, however, a loan is still a loan, and you are required to make payment when the time comes for the payment. So what you should bear in mind is to see ways to ensure that you do not get overwhelmed when the time for repayment comes. Use the information provided as a guideCalculate and budget every dollar spentDo a weekly review of your spendingsLook for bargains and deals to take advantage ofHave a backup plan to make more money

The information we provide here would be very helpful if the tips are followed. Using this article as a guide, you would be able to stand the chance of creating a balance between your spendings, your income, and savings. You do not want to be stuck in college without funds, especially if you have things such as books, college supplies to take care of. Finding options to ensure that you are not left all by yourself when the time comes to actually make money is very vital. For a lot of people, they try and reach out to their neighbors, friends and family members offering them some form of manual labor for money. Mowing, lifting, moving, and other different services that a student is able to provide is a great way to make money. for college students.

Taking Care of Your Health In College

It is important that you remember to "breathe" and unwind in college. There have been increasing cases of mental health challenges in colleges in recent years. However, the good thing is you can find ways to get the needed support that can help you scale through in hard times., and know that you are not alone.

Finding a network of support, and people who have been through the same things, who can share their story to encourage would do you lots of good. Therefore, ensure that you keep and maintain valuable friendships. These are people who are going to help you pull through when you need a shoulder to lean on, a hand to hold, or an ear to listen. MyGreatLakes may pay your tuition, books, rent, and your other school expenses, however, some things are needed that are beyond financial matters. College grounds come with its many challenges, but finding ways to navigate these complexities can make the needed difference that you need to stay healthy and rejuvenated.

In Conclusion

With all being said, our conclusion remains: plan ahead and stick to it. If you plan ahead, you would be in the position of taking care of yourself, your academics, your expenses and even your fun times. However, if you decide to just go with the "flow" and not plan for what you need, it just may not work as you anticipate, and this can create its own unique challenges. The many benefits of taking advantage of the loan provided by MyGreatLakes abound, but finding ways to ensure that you do not throw away the opportunity at will is where the work will show just how much you really want that college education. By and large, it all boils down to what you think is your reason for being in college. A lot of people go to college for many reasons, and the reasons are unique to each person, depending on what their driving force and motivation are. To find better jobsTo have the flexibility of revenueTo be better educatedTo have bragging rightsTo set an example, or listen to the wish of parents and guardians Your reasons may be outside of what has been provided, however, they still amount to your motivating factors. When the going gets tough, remember the reason you are in college in the first place, and let that reason drive you to accomplish great things in college and beyond. Keep an open mind, and take those opportunities as they come because you would look back and wish you did someday after all is said and done. So now you know just what you need to be prepared. Do not let anyone or anything outside what you have agreed upon to define you. College can be fun and rewarding, but you have to do the work. Getting your loan approved from MyGreatLakes is just one of the many things that you would have to do to get on the path to paying for college. Find balance in all of what you do is very important to your success. To find balance. As you go out to the class, with friends and family, have your eyes on the "prize", which is the reason you are in college in the first place anyways. So make sure you keep your purpose alive, ensure that you get sufficient rest, and above all stay motivated, stay driven, stay you.

Read the full article

0 notes

Photo

🔹⚓️🔹 A fresh perspective on our #freshwater gem 💎 #Repost @lakeerieliving ・・・ #beautiful #lakeerie #art #lakeerieliving #Repost @toledomuseum with @repostapp ・・・ March's last #5womenartists #ArtMinute is a sculpture by Maya Lin. In the age of Google Maps, we often take for granted our ability to see Earth's features from a height of miles. Geographical mapping and topography play a large role in this sculpture by Maya Lin. For 'Silver Erie,' Ohio native Lin removes the contours of Lake Erie and the Maumee River (the lake is about six miles from the Museum, the river less than a mile away) by first mapping the shape and surface of their boundaries, then casting the result in reclaimed silver. By isolating these bodies of water, Lin reminds us of their ethereal beauty and essential role within our natural habitat. Maya Lin (American, born 1959), Silver Erie. Recycled silver, cast, 2012. H: 24 3/4 in.; W: 54 in.; Depth: 1/2 in. Gift of Mr. & Mrs. William E. Levis, by exchange, 2012.103. Gallery 2A (The Wolfe Gallery) #womenshistorymonth #mygreatlake #greatlakesproud #ohioexplored #lakeerie #mayalin #maumeeriver

#freshwater#repost#art#maumeeriver#lakeerie#womenshistorymonth#ohioexplored#mygreatlake#5womenartists#lakeerieliving#beautiful#greatlakesproud#artminute#mayalin

0 notes

Link

CNO Financial Group Inc Review 2019: CNO Financial Group Inc. is a financial service holding company. Its insurance subsidiaries provide life insurance, annuity, and health insurance products to more than four million customers.

CNO financial group has more than 50 operational subsidiaries. These subsidiaries are operational throughout the United States of America. CNO has received many recognitions from multiple business analyzers.

CNO Financial Group Inc Review 2019

Bankers Life – This is one of the top three subsidiaries of CNO, Bankers Life offers options in health and life insurance for people who are nearing retirement. The company was established in 1879. The company has a large agent force and offers home delivery of their products, i.e. people do not need to leave the comforts of their home to buy insurance.

Colonial Penn – A major subsidiary of CNO, Colonial Penn also functions in providing insurance to older people. Compared to Bankers Life, this is a young company, dating back only 60 years. Colonial Penn concentrates on Term and Whole insurance and does not deal in health insurance.

Washington National – Washington national is another major subsidiary of CNO Financial Group. This company also deals with insurance but has a major part in providing saving for education. They provide annuities, life insurance, and supplemental health insurance. The Company was founded in 1923.

Growth and performance – At the end of 2018 CNO reported the following: 4.3 Billion in revenue including 301 million dollars operating income. 1.02 dollars earning per share (diluted). The return to Shareholders over the past five years was 183%. And strong liquidity, in case of market stress. This is a very strong position to have in the insurance industry.

History – The company was originally named Conseco. It was incorporated in 1979 in Indiana. The company began operations in 1983 and went public in 1985. In 1986 they acquired Lincoln Life insurance Company. They also acquired Bankers National insurance the same year.

Bankruptcy – Conseco’s declaration of bankruptcy was USA’s third-largest bankruptcy at the time. The company went through 9 months of reorganization and decided to divest from Greentree and concentrate solely on insurance. After this incident, CNO has recovered well and treads carefully.

Awards and recognitions – CNO were recognized as the world’s best employers by Forbes in 2018. They also won America’s best employers in the 1000 to 5000 section. CNO was recognized as one of the healthiest workplaces in America as well.

High credit rating – All of CNO’s major subsidiaries are rated between A- to BBB+, these are high credit ratings and are used to describe financially sound organizations. Moody’s investor index also rates CNO at A3. This is a high rating overall and Investors are happy with the performance over the last decade.

Read More – MyGreatLakes

Conclusion

CNO Financial Group Inc. is a very stable company in today’s date. The company is one of the largest insurance companies in America. They have been recognized by Forbes and rank 608th in the fortune 1000 list. Overall CNO is a great company to invest in. CNO also has a good client service record. CNO is expected to grow at a decent pace in the coming years. (CNO Financial Group Inc Review 2019)

The post CNO Financial Group Inc Review 2019 [Scam or Legit? Let’s Find Out] appeared first on My Great Lakes Loans.

0 notes

Text

MyGreatLakes Login

Online Installment Choices: MyGreatLakes Login offers helpful web-based installment choices for borrowers. Through the stage, borrowers can make one-time installments or set up programmed repeating installments. This component works on the installment interaction, guaranteeing ideal and bother free credit reimbursements. Borrowers can look over different installment techniques, including bank moves or charge/Mastercard installments.

Credit Overhauling Data: Inside the MyGreatLakes entry, borrowers can get to itemized data about their advance servicer. This incorporates contact data and assets intended for their advance servicer, permitting borrowers to handily connect for help or ask about their credit subtleties.

Credit Combination Data: MyGreatLakes Login gives assets and data about advance union. Borrowers can investigate the choice of uniting their government understudy loans into a solitary credit, possibly working on the reimbursement interaction. The stage offers direction on the advantages, contemplations, and steps engaged with the credit union interaction.

Advance Reimbursement History: MyGreatLakes Login permits borrowers to get to their credit reimbursement history. This component gives an extensive record of past installments made, including the date, sum, and status of every installment. Approaching this data can be useful for following advancement, checking installments, and keeping an unmistakable outline of the credit reimbursement venture.

Client service Assets: MyGreatLakes Login offers a scope of client care assets to help borrowers. The stage gives admittance to every now and again clarified some pressing issues (FAQs), guides, and instructional exercises that address normal requests and concerns. Moreover, borrowers can find contact data for client care delegates, permitting them to look for customized help when required.

Protection and Safety efforts: MyGreatLakes Login focuses on the security and security of borrower data. The stage utilizes progressed safety efforts to defend individual and monetary information. These actions incorporate encryption, firewalls, and customary security reviews to guarantee that borrower data stays shielded from unapproved access.

Advance Leave Directing: For borrowers who are approaching the finish of their examinations or getting ready to leave school, MyGreatLakes Login offers assets and direction on credit leave advising. Leave guiding assists borrowers with understanding their limitations as they change out of school and enter the advance reimbursement stage. The stage gives admittance to online leave guiding meetings and applicable materials to guarantee borrowers are all around informed about their credit commitments.

Updates and Notices: MyGreatLakes Login keeps borrowers informed about significant updates and warnings connected with their credits. These updates can remember changes for advance terms, loan costs, or installment cutoff times. By remaining associated through the stage, borrowers can keep awake to date with any significant changes or advancements.

Keep in mind, the particular elements and administrations presented by MyGreatLakes Login might develop over the long haul, so it's generally smart to visit the authority MyGreatLakes site or contact their client care for the most exceptional and exact data.

1 note

·

View note

Text

1 note

·

View note

Text

Applied for A Loan? Get myGreatLakes Loan Account As Well!

Applied for A Loan? Get myGreatLakes Loan Account As Well!

Great Lakes Loans is a federal based student loan service company. When we say federal based loan company, we mean that the loans given by Great Lakes Loans are funded by the government of United States of America. The best characteristic of the Great Lakes Loans is that these student loans come at a very low interest rate. Along with that, your repayment methods and options are made fairly…

View On WordPress

0 notes

Text

The Complete Overview Of Mygreatlakes - Great Lakes Student Loans

The organization has one thing identified as a repayment planner, which can enable borrowers to select which repayment application will function ideally with their one of a kind wants.

Great Lakes Student Loans Information & Guide-

By partaking in the best level of philanthropic collaboration, we are pursuing greater scale and effect than we'd realize alone. We will probably be soliciting investments from national, regional and Group funders to even more bolster the initiative.

The personnel was unable to assist in any way and although they supplied an apology they did nothing to repair the situation. If your financial loan is sold to mygreatlakes, I like to recommend that you just refinance with a far more trustworthy establishment.

If they depart high school, students and their households are likely to depart behind the assistance of your counselors who assisted them to acquire admission and make an application for economic help. They are on their own, typically for the first time, equally as they attain the ultimate hurdles on just how into higher education.

I had some freakout moments but the issues had been settled in a couple of days. I knock on wood I don't have any difficulties Sooner or later seeking to pay these off way early but as of right this moment I just advocate you all get accustomed to obtaining nothing from them... Do the function, log in online each day due to the fact you have to police the account oneself.

I am dealing with these people for years now. They will lie and say you only owe a certain small volume in forbearance in the event you Join it after which you can you should have ten occasions the amount of cash they mentioned you should owe. It's absurd. They are a complete scam. If you are attempting for getting offended over the cell phone with them then they will get angry back. The customer just isn't generally proper of their eyes.

For most very low-money students, a surprising motor vehicle mend or a health care bill can necessarily mean the top of their college hopes. Although ordinarily not large expenditures, they can be plenty of to put these students in a serious bind: remain in higher education or pay out the bill.

On sure events, Great Lakes borrowers could have difficulties accessing their student loans account. Within our expertise, Now we have determined that the most common dilemma linked to a failed login attempt is really a mistyped User ID.

Right after clicking on one particular of those backlinks, you may be redirected to an alternate password Restoration strategy. To complete the process, in this article’s That which you’ll have to do:

It can be crucial to keep up contact with your mortgage servicer. If your conditions transform Anytime through your repayment interval, your financial loan servicer can support.

When you've got any troubles accessing your account, you need to know which you can remedy all of them with the assistance on the My Great Lakes student loans login web page. Go through this Guidance to Recuperate or reset you are My Great Lakes student loans login credentials:

Moreover, the Great Lakes has actually been accredited considering that July six, 2012 by the Better Company Bureau (BBB). The BBB has the dedication of Assembly the corporate’s accreditation requirements such as a powerful motivation that may resolve grievances by The customer and difficulties encountered through the borrower with the personal loan.

A financial loan servicer is a firm that handles the billing along with other providers in your federal student mortgage. The personal loan servicer will do the job with you on repayment strategies and financial loan consolidation and can help you with other duties connected with your federal student mortgage.

They may enable students to reap the benefits of probable tax Rewards, also to submit an application for bank loan consolidation applications. Great Lakes’ full assistance extends to tutorials on budgeting for student funds, creating a strong credit history historical past great lakes student loans though in higher education, and protecting oneself from id theft.

0 notes

Text

MyGreatLakes.org Student Loans Vs FAFSA Student Loan Review + The Ultimate Guide to Getting Approved for Student Loans with Bad Credit in 2020

MyGreatLakes.com Complete Step by Step Review

Student Loan Review by ScholarshipAffairs.com Are you looking for options for student loans? Look no further. Mygreatlakes student loans is where to go. Every now and then students are facing the difficulty of coming up with fees to pay for education. This has left many students stranded and in some cases, they are deprived of progressing with their academics. In this guide, we have broken down all the vital information that you need to help you navigate the complexities of applying for student loans with mygreatlakes.com In today's world, colleges and other companies offer different loan options and other opportunities for loans, such as entering scholarships, internships, contests and more to help student pay for college.

General Helpful Information on MyGreatLakes.com

MyGreatLakes student loans, a financial service provider in the form of loans has been in the system for quite some time now with the goal of helping students who are otherwise not able to afford money to pursue their academics. With the induction of this good initiative, students no longer have to worry about tuition fees, accommodation, and other expenses. This company has been in existence for some years now. My Great lakes have a good track record of providing loans to millions of students and parents alike. They have been doing this in the past years with the goal of reducing the hardships students go through in times of paying for education. Interestingly, the mode of payment is made flexible to aid students in paying back their loans swiftly thereby helping students build up a credit report. The purpose of making this article available to you is that we want to clear the air concerning the legitimacy of My Great Lakes, in the following paragraphs, we are going to take you through almost all that you need to know about My Great Lakes. Do stay with us as we explore this company.

Why My Great Lakes?

What exactly is My Great Lakes? MyGreatLakes.org How Can I Make Monthly Payments at Great Lakes? o Online payment o Pay by check o Autopay Signing up and logging in to MyGreatlakes Account Interest Rates for Great Lakes Students Loan? The authenticity of My Greatlakes legit or Scam? MyGreatlakes Reviews 2019 Reviews from MyGreatLakes Website How can I reach the Great Lakes student loans customer service? How to avoid student loan scams MyGreatLake Loan Repayment How payments applied to student loans Mygreatlakes.org Student Loan FAQs In Conclusion

Is MyGreatLakes Student Loans Legit?

What exactly is My Great Lakes? Great Lakes, a nonprofit loan company designed to help students overcome the burden of paying for college, is a higher educational Corporation in the USA. The Scheme was founded in 1967. It is headquartered in Madison, Wisconsin. It is one of the most prestigious nonprofit student loan companies. This company has more than 1,100 lenders and 6,000 schools, students at prestigious universities with access to federal credit can study what is a stepping-stone to their bright future. Great Lakes link lenders to borrowers and since higher education is an expensive business, families, and students no longer have to be perturbed by expenses. The company can, therefore, grant its student clients access to Companies $244 billion through scholarships, grants, and more. With over 8 million Customers, Great Lake holds the Guarantees on almost 75 billion in Loans for the Federal Family Education Loan Program. Thus far, the Company has invested almost $260 Million in Students grant. Other outlets of Great Lakes include Indiana, Minnesota, South Dakota, Texas, and Connecticut. The provision of labor jobs to job seekers near the various outlets is another achievement made by Great Lakes in their quest to promote national growth. Throughout the United States of America, Great Lake employs more than 2,000 People. From the US Department of Education Quarterly survey, participants regard Great Lakes as the number one Student Loan Servicer, since 2011.

MyGreatLakes Philosophy and Service Delivery

The motto of Great Lakes is: “Do what’s right!” MyGreatLakes.org Potential borrowers can use Great Lakes website and mobile application to effect transactions that ease the effort in accessing loan information. This tech-driven service has reduced traffic on the number of people trooping into the company for loan deals. How Can I Make Monthly Payments at Great Lakes? Online payment Payment of loan can be made online if you are a federal borrower and have named Great Lakes as your service provider. First, you will have to create an account that will make you eligible to access the online information concerning payment modes. You will need to create an account on the online portal and sign up for mygreatlakes.org.

How to Start with MyGreatLakes

Biodata/personal details such as name, date of birth, social security number, etc. will be asked to facilitate the processing of your loan information. A username and a password will be created to aid in logging in into your account at mygreatlakes.org. A debit card is required when making payments. Pay by check You could equally pay using a check or money order. This mode of payment usually takes time. You can also choose to use an automated approach in which your bank account will be linked to your loan information. In this way, you benefit from a 0.25% interest rate cut on all direct loans that you repay. This system ensures you do not miss payments and you are not always caught up with paying fine in the long run. You can easily change the amount debited from your account by signing up

Signing Up and Logging In to Your MyGreatLakes Account

Account This is a simple to use platform which considers the interests and concerns of its clients. If a student at some point feels the need to solicit or access information about their student loan, they can easily do so through the official MyGreatLakes website. To create an account, a student is supposed to visit my Great Lakes website (mygreatlakes.org). It is a stepwise approach involving several options. The student just has to click on the registration option in the top right corner of the page to create an account on mygreatlakes.org (the Great Lakes Student Loan website) and become a member of Great Lakes Student Loans online. Program. Creating an account does not take a lot of time. Details such as social security number, date of birth are a few of the things you will be providing. You can enter a user ID, email address and password. At the end of the Signup, There will be a green screen saying your account is successful. After getting this notification, kindly sign in to your Gmail account to complete the setup process. To be able to login in, students are required to enter their valid username and password. Issues with logging in can also be resolved. After successfully creating the account, Great Lakes' credentials and settings must be verified. The transaction can be completed and the financial information displayed in a few clicks. The account comes with various options to aid students to overcome financial issues such as repayment options, checking outstanding credit, setting up a payment plan or even calculating the total amount of the loan costs.

Interest Rates for Great Lakes Students Loan?

Interests on student loans are not fixed. They vary depending on the type of federal loan. In fact, the United States government through Congress decides annually on the interest rates on student loans of the federal government on the basis of the financial situation of the market. Federal student loans are always fixed and remain constant for the duration of the loan, i.e. for the duration of the student loan. Interest loans do not depend on the capacity of the borrower to repay, but rather, it depends on whether a student loan is subsidized or not. It does not also depend on the creditworthiness or ability of the borrower to repay the money or not. The interest rates depend only on whether the person’s loan is subsidized or not.

The Authenticity of My Greatlakes?

First, most people have doubts about the Great Lakes student loan and there is a myth that it is a Scam. However, other people have regarded Great Lakes as a legit company. The following information throw more light on substantiating the legitimacy and authenticity of My Great Lakes. People need to understand that, this is a registered financial and educational company in the United States by the federal government. The company works with federal loans to provide students with moderate and comfortable payment plans that are in line with their needs. Therefore, people have to disregard the rumor that Great Lakes student loan is misleading and unreliable. This great institution does well in the student loan sector. They offer loans to the federal government without fear of high-interest rates. The fact that it maintains its customers with federal loans, where the interest rates are set by the Congress itself, thus promises to reduce or even eliminate the possibility of an excessive interest rate. Credit ratings limit the credibility of a person to borrow money, and thus their options. The interest rates for my Great Lakes, however, do not depend on the credit rating. In fact, credit scores are predetermined throughout the period. This effectively relieves the customers of My Great Lakes. I will Work you through some Reviews of MyGreatLakes Students Loan Servicer. If you are a Nigerian Student and you need a loan, you can go for Smart Credit Education Loan.

The Ultimate Guide MyGreatlakes Reviews 2020

Yes! Many people have said a lot about Great Lakes Student Loan Servicer. The Government too has rated their activities thus far and we are here to give you a bit of that rundown. Below is a comment made by a student who signed up for the College Investor Forum thread in 2016. This is what he has to say. Comment : "The last 2 years I’ve had to take out loans to pay for school. However last semester I took the semester off as I was contemplating changing my major and I had several life issues I needed to take care of. I just started going back to school (the semester started this week). I did not receive financial aid for this semester due to a mix of scholarships and saved up the money of my own. Over the past year, I’ve been receiving numerous spam calls a day. Most are obvious scams but some have seemed legit until I further researched them. One number that has been calling me is with mygreatlakes.org. They tell me I have student loans due and refuse to give me any information until I give them my SSN. When I tell them I do not feel comfortable doing so unless I receive proof from them that they’re legit they get rude and refuse saying I need to act quickly before going into default. I have not received any official piece of mail or anything stating such claims and when I bring this up I’m pretty much told that they don’t have to send such notice and that they’ll send me an email showing my statement and how to pay. The number I’ve talked to is from Great Lakes (according to mygreatlakes.org anyway). My questions are 1. Is this a scam? 2. What happens to my student loans if I’m still in school but no longer using loans? 3. Will I receive an official letter in the mail when or if my loans are due now? 4. If this is true, what can I do if I cannot afford to pay these loans yet? And here is a Humble Reply from the College Investor Admin. This also gave rise to another response to the earlier message from a College student. 1. Possibly. Read this post: https://thecollegeinvestor.com/16429/is-your-student-loanrepayment-company-a-scam/ 2. Your Federal student loans will go back into deferment if you are enrolled at least half time. Sometimes your school will notify your lender, but more likely you will need to notify your lender about your status change. 3. Yes – just make sure your lender has your correct address. A lot of times people move and don’t update their address, so that could delay you getting a letter. 4. Well, you make no payments in deferment. If you’re not in school, and can’t afford your Federal loans, switch to an income-based repayment plan, which will make your loan payment no more than 10-15% of your discretionary income. The biggest thing to take away – all correspondence from your lender that matters will be sent as a letter unless you signed up for eStatements, which they will then be delivered via secure email. You might also find this valuable: Great Lakes Student Loan Servicing Problems Here is a Review from another Student in the Chat Thread. I think one is a very honest one each gives big credit to the GreatLakes.org Student Loan System. You can check them out in College Investor’s thread. Other Ratings Include the Following: BBB Rating: A+ (BBB Accredited since 7/6/2012) Consumer Affairs Rating: 1.2 stars (out of 5) Yelp Rating: 1.5 stars (out of 5) Reviews from MyGreatLakes Website Millions of satisfied customers have written great reviews and enjoy My Great Lakes. Customers leave opinions like: I was really worried about student loan management because I was naive about all this kind of loan and did not even know how the Education Loan works, Great Lakes helped me to effectively manage my student loan for my degree and set my interest rate to manage. This is another customer, who was satisfied with his experience with student loan My Great Lakes. This is what he has to say: My first reaction when I learned that my loans could be transferred to another loan officer was:” Oh no!!! No one cares about me like her! Great Lakes has been taking out my loans for almost five years and has always been helpful and very nice with all the changes I am constantly making in my work. The customer representatives (telephone) are patient and explain every step and every option in detail so I can get the best one. “ How can I reach the Great Lakes student loans customer service? Great Lakes Student Loans Customer Service is happy to answer any questions you may have about the Legitimacy of My Great Lakes. To attend to all customers, the team works 24/7. This is to make sure that there are misunderstandings of any kind with regard to the My Great Lakes student loan. There are many ways to contact My Great Lakes customer service for student loans. A person can interact with their customer service team in one of the following ways: You can call either the + 1800-236-4300 phone number, between 9 am and 7 pm, exactly 14 hours. Customer service is available from Monday to Friday throughout the week. Another means is to Contact Customer service online. Simply fill out the complaint form in the Contact section of the website. For people who find it easier to get in touch by email, this seems very convenient. The response rate of the MyGreatLakes customer service team has been quick and efficient. This is because MyGreatLake's core values are providing the best student loan options in financial difficulty. Regardless of what an individual has heard from the masses, it is imperative to do their own research on this topic and to determine for yourself which student loan suits his needs and which loan would be most advantageous, affordable and viable for you. How to avoid student loan scams Now for those other Scam mailings that you receive regularly. Some Student Loan companies will do everything in their power to get your money, including suggesting you do things that you could do yourself (such as signing a refund based on income) or make stupid promises to clear your student debt. If you do not know if an e-mail you received is a scam, you should ask the following questions. Does the company want your money? Do you charge application fees for the consolidation of your loans or a monthly payment for the termination of your loan? Stop there. Do they make unrealistic promises? For example, do they tell you that they can give your loan? The federal government has set up programs for the allocation of student loans, which, however, all meet very stringent qualification requirements and their development can take decades. Do they want your personal data? Do they demand your account number, your FSA number or even a power of attorney? Your trusted lender already has all the information they need. Do not share your information with scammers. If Great Lakes is your loan officer, you can quickly find it by going to My Federal Student Aid or the NSLDS database, or by calling them. If you know your loan service provider, you know which emails to open and which emails need to be discarded. Are you still snacking on this student loan? See how much you can save by refinancing.

What You Need to Know About MyGreatLake Loan Repayment

With all the complicated calculations and considerations, it can be difficult to determine the correct repayment plan for you. The Great Lakes repayment planner, which you can access through your mygreatlakes signup account, allows you to view and list all available credit and repayment options. MyGreatLakes Student Loan Scheme is Legit from all Indication. Don’t fear to borrow from the system. I will leave you with a choice. Kindly Communicate how you feel about this post in the comment box below and get rewarded with more details. However, you can change the date of your payment. Just log in to mygreatlakes.org, if you haven’t already, and select a new payment due date for your eligible Great Lakes loans once your payment is not due yet. If your account is past due, contact the site for more information. How payments applied to student loans How payments are applied to student loans revolves around a number of factors. In most cases, payments are applied first to any accrued interest and fees, then to your principal balance. Check out How Payments Are Applied for different scenarios that may apply to your situation.

In Conclusion

There you have it! MyGreatLakes.com is a legit student loan provider that you indeed can utilize to help pay for college. Payments must be applied first to interest and fees, then to loan unpaid balance. This means that only the amount that exceeds interest and fees owed is applied to the unpaid balance. There are common situations in which all, or most, of your payments will be applied to interest and fees. For example, when you’re on a Graduated repayment plan if you’ve missed or skipped a few payments and then make a payment, if you’re on an income-driven repayment plan, or if you don’t make a payment within 30 days of entering repayment. Find out more about how payments are applied. Your student loan interest information is available on mygreatlakes.org. Your 1098-E statement for the previous tax year is first available in January. Select My Accounts > Tax Filing Statements to access it. You can reach Great Lakes for general correspondence through their post office box: Great Lakes PO Box 7860 Madison, WI 53707-7860 Or call the representative on (800) 236-4300 to get more information. And you can also communicate directly with Great Lakes online by emailing them at [email protected]. You’ll also receive an email notification when new student loan interest information is available. Read the full article

0 notes

Text

I'm trying to get my life together but I keep having to deal with websites (mygreatlakes and american family insurance) that are 0% user friendly!!!! Like there is no intuition in how they're set up, and the things I want to do or access aren't even available to me. Like, HORRIBLE website designs are probably my biggest pet peeve I'm so annoyed

#rant#if you're on tumblr: fuck mygreat lakes!#fuck american family insurance!#fuck bad web design!!!

0 notes