#mt4 trading

Explore tagged Tumblr posts

Text

Forex MT4 Plataform, #BUY SWING TRADE #US30Cash INDEX $4.100 Profits. Official Website to have access: wWw.ForexCashpowerIndicator.com . Forex Cashpower Indicator Lifetime license one-time fee with No Lag & Non Repaint buy and sell powerful Signals with Smart algorithms that emit signals in big trades volume zones. Works in all Charts inside your Broker MT4 Plataform and all timeframes . ✅ NO Monthly Fees ✅ NON REPAINT / NON LAGGING 🔔 Sound And Popup Notifications 🔥 Powerful & Profitable AUTO-Trade Option . ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.** . ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . ✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

#US30Cash#forex index#usd30cash#us500cash#us30cash#best forex trade system#forex volume indicators#nt4 bollinger bands#mt4 fibonacci#metatrader4 fibonacci

3 notes

·

View notes

Text

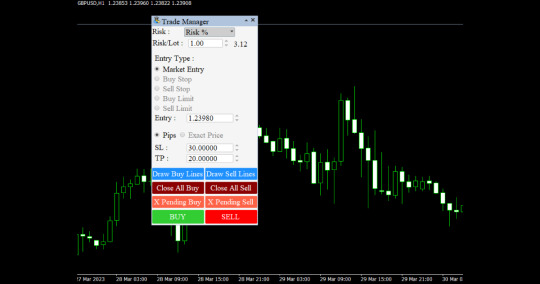

Effortless Efficiency: Automate Your Forex Trades with the Panel

In the dynamic world of forex trading, efficiency is paramount. Traders are constantly seeking ways to streamline their processes, optimize their strategies, and maximize their profits. One powerful tool that has emerged to meet these demands is the Automated Trading Panel. These panels leverage cutting-edge technology to automate trade execution, implement complex strategies, and enhance overall efficiency in forex trading. In this blog post, we'll explore the benefits, features, and potential of Automated Trading Panels in revolutionizing the way traders approach the forex market.

Understanding Automated Trading Panels: Automated Trading Panels are sophisticated software solutions designed to automate various aspects of forex trading, from trade execution to risk management and strategy implementation. These panels utilize advanced algorithms, artificial intelligence, and machine learning techniques to analyze market data, identify trading opportunities, and execute trades on behalf of traders. With their user-friendly interfaces and customizable features, Automated Trading Panels empower traders of all skill levels to automate their trading processes and achieve consistent results in the forex market.

Key Features and Functionality:

Trade Execution Automation: Automated Trading Panels enable traders to automate trade execution, eliminating the need for manual intervention. Traders can set specific parameters for trade entry, exit, and position sizing, allowing the panel to execute trades automatically based on predefined rules and criteria.

Strategy Implementation: Automated Trading Panels support the implementation of complex trading strategies, including trend-following, mean-reversion, and breakout strategies. Traders can customize their strategies by combining technical indicators, price action signals, and market sentiment analysis to suit their trading preferences and objectives.

Risk Management Tools: Automated Trading Panels offer advanced risk management tools to help traders mitigate potential losses and protect their capital. Traders can set stop-loss and take-profit levels, adjust position sizes, and implement trailing stop orders to manage risk effectively.

Backtesting and Optimization: Automated Trading Panels enable traders to backtest and optimize trading strategies using historical market data. By simulating trades under various market conditions, traders can assess the performance of their strategies and make necessary adjustments to improve profitability.

Real-time Market Analysis: Automated Trading Panels provide real-time market analysis and insights, allowing traders to stay informed about key market developments and potential trading opportunities. With access to up-to-date market data and analysis tools, traders can make informed decisions and execute trades with confidence.

Benefits of Using Automated Trading Panels:

Enhanced Efficiency: Automated Trading Panels streamline the trading process by automating repetitive tasks such as trade execution, position management, and risk assessment. By eliminating the need for manual intervention, traders can save significant time and effort. This enhanced efficiency allows traders to focus their attention on analyzing market trends, refining trading strategies, and making informed decisions, rather than getting bogged down by routine tasks.

Improved Accuracy: Automated Trading Panels leverage sophisticated algorithms and artificial intelligence to execute trades with precision and accuracy. Unlike human traders, who may be prone to emotions, biases, and cognitive errors, these panels operate based on predefined rules and criteria. By removing human involvement from the trading process, Automated Trading Panels minimize errors and enhance overall trading performance. Trades are executed consistently and objectively, without the influence of emotions such as fear, greed, or hesitation.

Consistent Performance: With their disciplined approach to trade execution and risk management, Automated Trading Panels help traders achieve consistent and reliable results over time. These panels adhere strictly to predetermined trading rules and strategies, ensuring that trades are executed in a systematic and disciplined manner. By maintaining consistency in trade execution and risk management, traders can avoid impulsive decisions and erratic behavior, thereby improving their chances of long-term success in the forex market.

Accessibility and Convenience: Automated Trading Panels are accessible from any internet-enabled device, allowing traders to monitor and manage their trades on the go. Whether at home, in the office, or on vacation, traders can stay connected to the forex market and take advantage of trading opportunities anytime, anywhere. This level of accessibility and convenience enables traders to stay informed about market developments, adjust their trading strategies, and execute trades promptly, without being tied to a specific location or time zone.

Reduced Stress and Emotional Impact: Trading can be a stressful and emotionally taxing endeavor, particularly during periods of market volatility or when faced with significant losses. Automated Trading Panels help alleviate stress and emotional strain by automating the trading process and removing the need for manual intervention. Traders can trade with confidence, knowing that their trades are being executed according to predefined rules and parameters. By removing the emotional element from trading decisions, Automated Trading Panels help traders maintain a clear and rational mindset, reducing the psychological burden associated with trading and improving overall well-being.

Automated Trading Panels offer numerous benefits to traders, including enhanced efficiency, improved accuracy, consistent performance, accessibility and convenience, and reduced stress and emotional impact. By leveraging advanced technology and automation, traders can streamline their trading processes, optimize their performance, and achieve greater success in the forex market.

Conclusion:

Automated Trading Panel offer a powerful solution for automating forex trades and enhancing trading efficiency. With their advanced features, customizable settings, and user-friendly interfaces, these panels empower traders to execute trades with precision, consistency, and confidence. Whether you're a seasoned trader looking to optimize your trading strategies or a novice trader seeking to streamline your trading process, Automated Trading Panels can help you achieve your trading goals with ease. Embrace the future of forex trading with Automated Trading Panels and experience the benefits of effortless efficiency in your trading journey.

#Trade Panel#Trading Panel#Trading Panel EA#TradePanel MT4#Trade Manager#Forex Trade Manager#Best Trade Manager#Trade Management utility#Trade Management tool#Trading management#forextrading#forexmarket#forex education#forexsignals#forex#black tumblr#technical analysis#4xPip

4 notes

·

View notes

Text

First Impressions: RBNZ Monetary Policy Review

The RBNZ raised the policy rate by an unexpectedly large 50 basis points, and another 25 basis point hike appears to be scheduled for the May Monetary Policy Statement.

#forexeducation#forexbroker#forexmoney#forexmarket#forextrading#finance#crypto#bitcoin#mt4 trading platform#profit#investment#trading platform

2 notes

·

View notes

Text

The Leading MT5 White Label Solutions in the market.

Start your new MT5 White Label with ForexBrokerageSetup

Now at an extremely affordable and convenient price you can run your forex company with the most popular trading software available in the market. Add proprietary software and premium packages to the platform to grow the company even faster.

Discover Our MT5 White Label Solution’s Key Benefits:

Completely branded and optimized,

Availability of A — Book and B-book executions,

A wide range of available tools,

Low cost, price transparency,

Tools to support your business.

Get In Touch

Phone : +44 7362 055687 Email: [email protected]

#finance#trading strategy#forextrading#mt5 brokers#mt4 trading platform#mt5trading#forex#forexnews#forexbroker#forexmarket

2 notes

·

View notes

Text

#forex trading#mt4#mt5#fx#octafx#forex market#forextrading#investing#marketing#account management#accounting#stock market#business ideas#online business#business#investment#investors#management#Spotify

1 note

·

View note

Text

Master Forex Trading with AIPIPS’ Innovative Trendometer Indicator

In the dynamic world of forex trading, where markets change in seconds and decisions must be swift, having the right tools can make all the difference. At AIPIPS, we provide traders with cutting-edge solutions to stay ahead in the highly competitive forex market. Among our most powerful tools is the Trendometer Indicator—a game-changer for traders seeking clarity, precision, and confidence in their trading strategies.

The Challenges of Forex Trading

Forex trading is one of the most liquid and fast-paced markets in the financial world. With over $6 trillion traded daily, the opportunities are vast, but so are the risks. Traders face several challenges:

Volatility: Currency prices can fluctuate dramatically due to geopolitical events, economic reports, or market sentiment.

Complex Analysis: Analyzing charts, trends, and patterns requires significant time, expertise, and experience.

Emotional Decisions: Fear and greed often lead traders to make impulsive decisions that result in losses.

To overcome these challenges, traders need tools that offer clear insights, reliable data, and actionable information. That’s where the Trendometer Indicator comes in. Read More

#trendometer#forex trading#bots#forex indicators#mt4#cryptocurreny trading#forextrading#ai#forexsignals

0 notes

Text

Master Candle Indicator for MT4: A Key Tool for Analyzing Price Action Patterns

For traders wishing to strengthen their analysis and improve their trading techniques, the Master Candle indicator for MT4 offers a valuable tool to identify certain candlestick patterns and price action settings. Candlestick patterns are among the most extensively used approaches in technical analysis, and the master candle is one of the most successful patterns to identify prospective price changes. The Master Candle indicator streamlines the process of detecting these patterns, saving traders important time and helping them make more informed trading decisions. Whether you're new to trading or a seasoned expert, understanding how to use this indicator will help you pinpoint important entry and exit opportunities with greater accuracy.

What Is the Master Candle Pattern? The master candle is a sort of candlestick pattern that happens when a huge candle engulfs the previous few smaller candles, forming a consolidation or pause in price action before a potential breakout. The range of the master candle—meaning the space between its greatest and lowest points—typically contains the price movement of multiple preceding candles. This makes it a critical pattern for traders attempting to predict consolidation phases in the market that are likely to lead to a big price move. Traders typically perceive the master candle as a signal that the market is preparing for a breakout in one direction. The breakout could happen when price swings past the high or low of the master candle, delivering a strong signal of market direction. It is often seen as a valuable price action instrument since it can imply either a continuation of a current trend or a potential reversal. The Master Candle indicator for MT4 automatically finds these patterns on charts, making it easier for traders to spot and act upon them without having to actively seek for them. This is especially helpful for traders who want to focus more on establishing their techniques and executing their trades rather than spending time examining every candlestick pattern. How the Master Candle Indicator Works The Master Candle indicator is designed to recognize the pattern based on established criteria: a giant candlestick that includes the price range of the previous smaller candles. When this pattern develops, the indicator indicates the master candle on the chart, making it easy for traders to detect it and take action. In MT4, the Master Candle indicator works by calculating the size of the candlesticks and recognizing those that have a greater body and range than the surrounding candles. When the master candle is spotted, it is highlighted visibly on the chart. Traders can then focus on the peak and low of the master candle as crucial levels for potential breakout points. Key Features of the Master Candle Pattern

To use the Master Candle indicator for MT4 effectively, it’s important to understand the key features of the master candle pattern. Here are some characteristics to look for when analyzing this pattern:

Large Body: The master candle is larger than the surrounding candles, both in body and range. This large candle generally indicates significant price movement or volatility, suggesting that the market is preparing for a strong move.

Engulfing Previous Candles: The range of the master candle often fully engulfs the range of the preceding candles. This is a critical feature, as it shows that price action has expanded and may indicate the end of a consolidation phase.

Consolidation Before a Breakout: The master candle typically follows a period of consolidation, where price action has been moving sideways or within a narrow range. The breakout from the high or low of the master candle can signal the resumption of a trend or the start of a new one.

Clear Entry and Exit Points: Traders can use the high and low of the master candle as important levels for entering and exiting trades. A breakout above the high of the master candle suggests a bullish signal, while a breakout below the low points to a bearish movement.

How to Use the Master Candle Indicator for MT4

The Master Candle indicator for MT4 is a valuable tool for identifying key price action patterns in the market. To get the most out of it, follow these steps to apply the indicator and interpret the signals:

Step 1: Install the Indicator

Before you can use the Master Candle indicator in MT4, you need to install it on your trading platform. To do this:

Download the Master Candle indicator from a trusted source.

Open your MT4 platform and navigate to File > Open Data Folder.

Inside the Data Folder, open the MQL4 folder, then the Indicators folder.

Copy the downloaded indicator file (usually an .ex4 or .mq4 file) into the Indicators folder.

Restart your MT4 platform, and the Master Candle indicator will appear in the Navigator window under Custom Indicators.

Step 2: Apply the Indicator to a Chart

Once the indicator is installed, applying it to a chart is simple:

Open the chart of the asset or currency pair you wish to analyze.

In the Navigator window, find the Master Candle indicator.

Drag the indicator onto the chart, and it will automatically start identifying and marking master candle patterns.

The indicator will highlight the master candle patterns with specific markers, allowing you to quickly identify them without having to manually scan the chart.

Step 3: Analyze the Market Context

After the Master Candle indicator marks the pattern on your chart, it’s essential to analyze the broader market context. The pattern by itself may not always lead to a successful trade, so consider the following factors:

Trend Direction: Look at the overall market trend. If the trend is bullish, a master candle pattern signaling a breakout above the high of the candle may indicate a continuation of that trend. Conversely, in a bearish market, a breakout below the master candle’s low may signal a downward price move.

Support and Resistance: The high and low of the master candle are critical levels. Traders can place buy orders above the high or sell orders below the low of the master candle, using these points as entry signals. These levels also act as key support or resistance zones.

Volume: While the Master Candle indicator focuses on price action, volume can also play a significant role in confirming the strength of the breakout. A breakout with higher volume often signals a stronger and more reliable move.

Step 4: Place Trades Based on Breakout

Once you’ve identified the master candle and analyzed the market conditions, you can proceed to place your trade. Here are a few guidelines for entering trades based on the master candle pattern:

Buy Entry: If the price breaks above the high of the master candle, it may be a signal to go long (buy).

Sell Entry: If the price breaks below the low of the master candle, it could be a signal to sell.

Stop-Loss: A good practice is to place a stop-loss just below the low of the master candle for a buy trade, or just above the high for a sell trade. This helps limit potential losses in case the breakout fails.

Advantages of Using the Master Candle Indicator

There are several advantages to using the Master Candle indicator for MT4 as part of your trading strategy:

Time Efficiency: The indicator automatically detects the master candle pattern, saving traders the time of manually scanning for such setups.

Clarity: The visual markers on the chart make it easy to identify the master candle and potential breakout points, improving trading clarity.

Price Action Focus: Since the master candle is a price action pattern, it allows traders to make decisions based on pure price movements, without relying on lagging indicators.

Better Risk Management: By using the high and low of the master candle as entry points, traders can more effectively manage risk and place their stop-loss orders at logical levels.

Combining the Master Candle with Other Strategies While the Master Candle indication for MT4 is a great tool on its own, it works even better when paired with other technical analysis tools. Traders commonly employ support and resistance levels, trend lines, moving averages, and other indicators to validate signals and develop their methods. By combining the master candle with these extra features, traders can boost the reliability of their trade setups. The outcome The Master Candle indicator for MT4 provides traders with an automatic tool to detect major price action situations, helping them pinpoint potential breakout chances in the market. By knowing the features of the master candle and employing the indicator correctly, traders may make more educated decisions and boost their chances of success. Whether you're trading forex, equities, or other assets, the master candle is a crucial pattern to integrate into your trading toolset.

For more info please click here

1 note

·

View note

Text

Introducing Hola Prime's Price Transparency Report!

In a decentralized forex market, we are proud to be the first and only prop firm to publish complete tick-by-tick data alongside its comparison with market prices. Our commitment to transparency ensures you have all the information you need to make informed trading decisions.

Why is this important?

- Full Transparency: Get a clear, detailed view of every market movement.

- Informed Decisions: Make smarter trades with precise data at your fingertips.

- Trustworthy Trading: Build confidence with our unmatched data transparency.

Join the revolution in transparent trading with Hola Prime.

#proprietary trading#ctrader#trading prop firms#what is a prop firm#meta trader 5#trader mt4#best prop trading firms#prop trading companies#prop trading firm#proprietary trading firm#propfirm#what is a pip in trading#prop traders#funded prop firms#trader funding#whats skrill#best prop firms forex#prop firms forex

0 notes

Text

1 note

·

View note

Video

youtube

Cashpower Indicator 100% No Repaint || NZDUSD

#youtube#forex#forex trading#forex accurate indicator#accurate buy sell signal indicator mt4#forex accurate indicatoraccurate buy sell signal indicator mt4accurate non repaint indicatoraccurate indicator for scalping accurate buy sel

2 notes

·

View notes

Text

#Xmaster Formula Forex Indicator#Best Forex indicators 2024#Xmaster Formula MT4 download#How to use Xmaster Formula#Forex indicators for beginners#Xmaster Formula trading strategy#Xmaster Formula buy/sell signals#Accurate Forex indicators for MT4#Xmaster Formula indicator settings#Xmaster Formula reviews

0 notes

Text

Trading Indicators: A Comprehensive Guide

In the trading world, the excitement to gain potential profit and the fear of loss can overpower the trader's judgment, resulting in poor trading conditions. Fortunately, understanding the intricacies of the market and preparing effective strategies using trading indicators can empower them to make more informed decisions. In this comprehensive guide, we will delve into the different types of trading indicators, their applications, and how traders can incorporate them into their trading toolkit.

What Are Trading Indicators?

Trading indicators are mathematical calculations based on the price, volume, or open interest of a security. These calculations provide valuable insights to traders, allowing them to make more informed decisions. With the help of these indicators, traders can interpret market trends, identify potential entry and exit points, and check market sentiment.

Types of Trading Indicators

There are different types of trading indicators that fall into several categories. Each one of them serves a distinct purpose. Trading platforms like the mt4 trading platform offer a range of built-in indicators that can help traders to understand the current market trends. These are explained below-

Trend Indicators

These are the indicators designed to identify the direction of the market. They help traders to determine whether a market is bullish (upward trend), bearish (downward trend) or moving sideways (consolidation). Some of the popular trend indicators include:

Moving Averages (MA): These smooth out price data to create a trend-following indicator. It helps traders identify potential support and resistance levels. The Simple Moving Average (SMA) and the Exponential Moving Average (EMA) are the two most common types of moving averages.

Average Directional Index (ADX): It measures the strength of a trend, regardless of its direction. A rising ADX indicates a strong trend, while a falling ADX indicates a weak trend.

Momentum Indicators

Momentum indicators help traders check the speed and strength of price movements. They can indicate potential reversals and confirm trends. These indicators are essential for forex day trading.

The critical momentum indicators include:

Relative Strength Index (RSI): The RSI measures the speed and change of price movements, typically on a scale from 0 to 100. An RSI above 70 indicates an overbought condition, while an RSI below 30 suggests an oversold condition.

Stochastic Oscillator: This indicator compares a security's closing price to its price range over a specific period. Values above 80 indicate overbought conditions, while values below 20 indicate oversold conditions.

Volatility Indicators

Volatility indicators measure the rate of price fluctuations in a security. High volatility may indicate potential opportunities to trade, while low volatility may signal a lack of interest. Some of the notable volatility indicators include the following:

Bollinger Bands: These consist of a middle band (SMA) and two outer bands representing standard deviations away from the SMA. When prices approach the outer bands, it can indicate overbought or oversold conditions.

Average True Range (ATR): This indicator measures market volatility by calculating the average range between the high and low prices over a specified period. A rising ATR suggests increasing volatility, while a falling ATR indicates decreasing volatility.

Volume Indicators

Volume indicators are trading indicators that provide insights into the strength or weakness of a price move by analyzing the trading volume. A higher volume often confirms the validity of a price movement, while a lower trading volume may suggest uncertainty.

The key volume indicators that a trader must use while analysing the market include:

On-Balance Volume (OBV): This indicator uses volume flow to predict changes in stock price. An increasing OBV suggests that buyers are willing to step in, while a decreasing OBV indicates that sellers are taking control.

Chaikin Money Flow (CMF): The CMF combines price and volume to show the buying and selling pressure over a specific period. If a CMF is positive, it indicates buying pressure, while a negative CMF indicates selling pressure.

How to use Trading Indicators effectively?

To incorporate trading indicators into your forex trading strategies, you need to carefully consider and practice. Here are some tips to help you use them effectively:

Combine Indicators: It is important to combine different indicators to analyse the market condition. Relying on a single indicator may lead to misleading signals. Thus, use a combination of indicators from different categories to confirm your analysis. For instance, you can pair a trend indicator with a momentum indicator, as it can provide a clearer picture of market conditions.

Understand the Market Context: Do not use the trading indicators in isolation. Always consider the broader market context, which includes news events, economic data, and geopolitical developments. All these factors can significantly influence market behaviour and, thus, should be considered important.

Backtest Your Strategy: Before implementing your strategy in live trading, it is important to backtest it using historical data. Backtesting the strategy will help you understand how your chosen indicators perform under various market conditions. Based on the observation, you can refine your approach.

Practice Risk Management: No matter how reliable your indicators may seem, it is always essential to implement risk management strategies. Set stop-loss and take-profit levels to protect your capital and minimize the impact of potential losses.

Stay Disciplined: Trading can evoke strong emotions, especially when you are a beginner. Thus, it is one of the necessities to maintain discipline. Create a personalised trading plan, stick with it, and trust your analysis, even when faced with market volatility.

Conclusion

To conclude, trading indicators can be a powerful tool in your trading journey. It provides insights that can help traders navigate the complexities of the market. By understanding the various types of indicators and incorporating them into a well-rounded strategy, traders can boost their confidence as well as improve their decision-making.

0 notes

Text

INDICADOR SNIPER GRATÍS - USANDO ELE NA TRYDPROBROKER, MUITO ASSERTIVO!

youtube

#2024 indicador gratis opções#opções binárias ao vivo#estrategia quotex#carlostrader#trydprobrocker#2024 indicador opções gratis#criptomoedas 2024#trydprobroker#trydpro#corretora trydpro#opcoes binarias#iqoption#acoes#investimento#forex#mercado financeiro#day trade#jose trader#tryd pro#corretora de valores#banco inter#maior investidor#jovens investidores#nubank#investing#money#mt4#mt5#Youtube

0 notes

Text

Which is the best between MetaTrader 4 and MetaTrader 5?

When it comes to Forex trading, MetaTrader stands out as the industry standard, with its two leading versions—MT4 and MT5—both offering unique advantages. But as the trading world evolves, the question arises: which version is better suited for 2024?

MetaTrader 4 (MT4): The Classic Choice

MetaTrader 4 is a widely popular multi-functional online trading platform. It launched in 2005, MetaTrader 4 quickly became a favorite among traders. Its reliability and user-friendly interface have earned it a lasting place in the Forex community. With over 10 million downloads and a stellar rating, MT4 continues to be a go-to platform for many.

Pros:

User-friendly interface ideal for beginners

Robust community support

High stability and security

Supports automated trading through Expert Advisors (EAs)

Multi-language support and real-time market data

Cons:

Slower compared to MT5

Fewer trading tools and options

Outdated user interface

Limited customization capabilities

MetaTrader 5 (MT5): The Modern Powerhouse

Introduced in 2010, MetaTrader 5 represents the evolution of trading platforms. While it maintains a resemblance to MT4, MT5 offers enhanced features and broader market access. It's designed for traders looking for a more advanced and versatile trading experience.

Pros:

Modern and customizable user interface

Access to over 500 financial markets, including stocks and cryptocurrencies

Faster execution speed

More charting tools and technical indicators

Cons:

Smaller support ecosystem compared to MT4

Can be complex for users due to additional features

Less broker support

Head-to-Head Comparison:

User Interface: MT4 is straightforward and easy to navigate, making it perfect for beginners. MT5 offers a more sophisticated interface with advanced features for experienced traders.

Time Frames: MT4 provides 9 timeframes, while MT5 offers an impressive 21, allowing for more detailed analysis.

Charting Tools: MT5 enhances charting capabilities with additional tools and chart types, surpassing MT4.

Indicators: MT4 includes 30 built-in indicators, but MT5 expands this to 38, offering more analytical options.

Programming Language: MT4 uses MQL4, known for its simplicity, whereas MT5 uses MQL5, offering advanced programming capabilities.

Which Should You Choose in 2024?

For traders who prioritize a reliable and straightforward platform, MT4 remains an excellent choice, especially if you’re focused primarily on Forex trading. However, if you’re seeking a platform with broader market access and enhanced features, MT5 is the clear winner.

Conclusion:

Both MetaTrader 4 and MetaTrader 5 have their strengths, and the choice between them depends on your trading needs and preferences. As you step into 2024, consider what features are most important for your trading strategy and choose the platform that aligns best with your goals. Happy trading!

#Forex Trading#Telegram Signal Copier#TSC#MetaTrader 4#MetaTrader 5#MT4#MT5#MT4 vs MT5#forex market#forextrading#forex education

1 note

·

View note

Text

Convert Trading Experience with Smart Automation(Algo)!

Ever thought about making your trading routine smoother and more efficient? With advanced tools like SureShotFX Algo, you can automate many aspects of your trading strategy, allowing you to focus on what matters most—growing your portfolio.

Here’s how it works:

Sharp Entry Strategy: Makes high-probability trades.

Adaptive Stop-Loss Modes: Balances risk and reward effortlessly.

Flexible Lot Management: Customizes trades to fit your strategy.

Auto Close Partial: Secures profits without constant monitoring.

Multi-Platform Support: Works with MT4, MT5, and cTrader.

Forex News Filter: Avoids unexpected market changes.

Free VPS: Guarantees 24/7 uninterrupted trading.

Performance Tracking: Keeps you informed with real-time indicators.

I believe that integrating such technology into my trading can be a significant shift. It simplifies the process, reduces manual errors, and helps to make smarter decisions.

1 note

·

View note