#moneygoal

Explore tagged Tumblr posts

Text

4 notes

·

View notes

Text

4 notes

·

View notes

Text

It’s my birthday y’all cash app me $thickchick901

2 notes

·

View notes

Text

How 'Rich Dad Poor Dad' Can Help You Transform Your Finances

Transform your financial future with Bookish Buzz's Rich Dad Poor Dad Challenge! Join us and learn how to make your money work for you with day 5 of the audiobook by Robert Kiyosaki. Check out our 7 helpful lessons from the book to apply to your own life. Don't miss out on this opportunity to gain financial freedom! #RichDadPoorDad

"Rich Dad Poor Dad" is an invaluable resource for anyone looking to take control of their finances and transform their financial future. Through its lessons on money, assets, and liabilities, financial literacy, and business ownership, readers can gain a better understanding of how to build wealth and achieve financial success. By taking action towards their financial goals and adopting a mindset of abundance, readers can begin to create a life of financial freedom and abundance.

youtube

2 notes

·

View notes

Text

💸 99% Log Paisa Waste Karte Hain – Tum Toh Nahi? Har mahine ₹5000-₹10000 ka chhupa-kharcha hota hai! 🤯 Yeh 3 expenses avoid karo aur paise bachana shuru karo. Koi aisa friend hai jo bina soche udta hai? Usko tag karo! 😂👇 #DiscoverAndRise

#MoneyMatters #SmartSpending #SaveMoney #GenZFinance #PersonalFinance #MoneyTips #FinancialFreedom #InvestWisely #MoneyManagement #IndiaFinance #SpendSmart #RichMindset #FinanceForGenZ #FrugalLiving #FinancialLiteracy #MoneyGoals #WealthBuilding #SaveSmart #BudgetingTips #StopWastingMoney #WealthCreation #MoneyHacks #SaveInvestRepeat #MinimalistLiving #MoneyWisdom #FinancialIndependence #SmartChoices #BachatTips #InvestEarly #DiscoverAndRise

#MoneyMatters#SmartSpending#SaveMoney#GenZFinance#PersonalFinance#MoneyTips#FinancialFreedom#InvestWisely#MoneyManagement#IndiaFinance#SpendSmart#RichMindset#FinanceForGenZ#FrugalLiving#FinancialLiteracy#MoneyGoals#WealthBuilding#SaveSmart#BudgetingTips#StopWastingMoney#WealthCreation#MoneyHacks#SaveInvestRepeat#MinimalistLiving#MoneyWisdom#FinancialIndependence#SmartChoices#BachatTips#InvestEarly#DiscoverAndRise

0 notes

Text

10 Life-Changing Personal Finance Tips | Master Your Money Today | Wealth Brain

youtube

Managing money wisely is key to achieving financial stability and building long-term wealth. In this video, we’ll share 10 powerful personal finance tips that can transform the way you handle your money. From tracking expenses and budgeting to investing for the future and avoiding debt, these strategies will help you take control of your finances and make smarter financial decisions.

#personalfinance#moneymanagement#financialfreedom#savemoney#budgetingtips#investing#wealthbuilding#financialsuccess#moneytips#debtfree#smartmoney#financialplanning#passiveincome#moneygoals#financehacks#Youtube

0 notes

Text

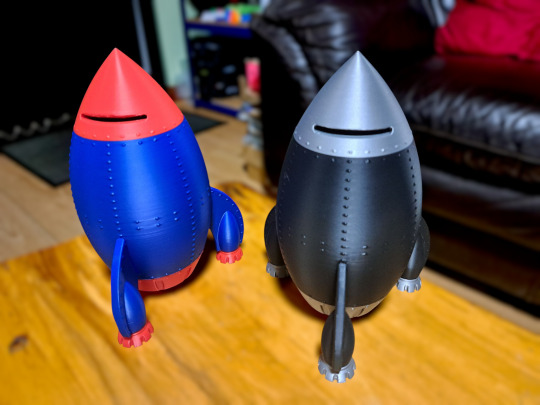

🚀 Blast Off to Smart Savings! 💰✨

Turn saving money into an adventure with this Rocket-Shaped Money Bank! 🚀💵 Whether you're saving for a dream trip, a new gadget, or just for fun, this unique piggy bank makes it exciting!

✨ Why You'll Love It: ✅ Futuristic rocket design – perfect for space lovers! ✅ Durable & lightweight – built to last. ✅ Easy access – removable base for hassle-free savings.

Launch your savings journey today! 🚀💰

🛒 Available now – grab yours before liftoff!

https://fredbox3d.etsy.com/ie/listing/1879618879

#RocketBank#PiggyBank#SaveMoney#MoneyGoals#3DPrinted#SpaceLover#RocketDesign#CoolGadgets#EtsyFinds#HandmadeShop#FutureSavings#AstronautLife#SpaceDecor#GiftIdeas#BudgetingTips#STEMGift#3d printed#3d printing#kids room decor#gaming room#etsy finds#etsyshop#etsy store#etsy#etsyseller#etsystore#artists on etsy#handmade#smallbusinessowner#smallbusinesslove

0 notes

Text

Your dreams are big. Your investments should be bigger! 🔥 Start your journey with InvestKraft today!

#Investing#WealthGrowth#SmartInvestments#FinancialFreedom#StockMarket#MoneyMatters#InvestmentStrategy#PassiveIncome#FinancialPlanning#GrowYourWealth#MoneyGoals#WealthBuilding#FinancialSuccess#MoneyManagement#InvestmentTips

0 notes

Text

#SuccessMindset #LawOfAttraction #MoneyGoals #AbundanceMindset #DreamBig #MindsetShift #ManifestYourDreams

#moringa magic#moringa magic official website#buy moringa magic#moringa magic tea#Moringa tea benefits#moringa magic reviews#moringa magic supplement#blood pressure support#SuccessMindset#LawOfAttraction#MoneyGoals#AbundanceMindset#DreamBig#MindsetShift#ManifestYourDreams

0 notes

Text

Stop the Money Mystery! 🕵️♀️💸 Expense Tracking with Budgeting Apps (For People Who Hate Math)

Hey Tumblr Fam!

Okay, let's be real: dealing with money can be a total drag. 😩 But what if I told you there's a way to make it less awful and maybe even...dare I say...kinda fun? 🤔

I'm talking about expense tracking with budgeting apps! I know, I know, it sounds super boring, but trust me, it's a game-changer. Think of it as becoming a detective for your own wallet! 🕵️♀️

Why You Need to Become a Money Detective (aka, Stop Letting Your Cash Disappear):

Ever wonder where all your money goes? One minute you're feeling flush, the next you're wondering how you're gonna afford ramen for the rest of the month. 🍜 That's where expense tracking comes in! It helps you:

Uncover your spending secrets (like that secret addiction to online shopping 👀)

Find hidden money leaks (those subscriptions you totally forgot about 🙈)

Take control of your finances (and finally achieve your goals! ✨)

Making Expense Tracking Less Painful (aka, Tips for the Math-Averse):

Okay, so how do you actually do it? Here are some tips to make expense tracking with budgeting apps less of a chore:

Choose an App You Actually Like: There are tons of budgeting apps out there, so find one that's visually appealing and easy to use.

Automate Everything: Connect your bank accounts and let the app automatically import your transactions (if you're comfortable with that!).

Categorize Like a Pro: Create custom categories that fit your lifestyle. "Treat Yo' Self" is a perfectly valid category, BTW. 😉

Track Everything (Even the Small Stuff): Every dollar counts!

Make It a Habit: Set aside a few minutes each week to review your expenses.

Turning Your Data into $ (aka, Actually Saving Money):

Okay, so you're tracking your expenses. Now what? Here's how to turn that data into real savings:

Identify Your Biggest Spending Categories: Where is most of your money going?

Find Areas to Cut Back: What can you live without?

Set Realistic Goals: What are you saving for?

Automate Your Savings: Set up automatic transfers to your savings account.

Conclusion:

Expense tracking with budgeting apps doesn't have to be a drag. By making it a fun and engaging process, you can take control of your finances and achieve your goals. So go forth, become a money detective, and unlock your financial potential! You got this! 💪

Ready to stop the money mystery and become a budgeting pro? Check out my comprehensive guide to expense tracking with budgeting apps and start your financial journey today!

#BudgetingApps#PersonalFinance#MoneyTips#YoungAdults#FinancialLiteracy#MoneyHacks#SaveMoney#Adulting#FinancialFreedom#MoneyGoals#BudgetingForBeginners#ExpenseTracking#DollarWisely#Tumblr#AdultingIsHard

0 notes

Text

Don’t live your life regretting yesterday. Live your life so tomorrow you won’t regret today. – Catherine Pulsifer

3 notes

·

View notes

Text

Your brain needs reminder!😊

#moneymotivation#moneygoals#change is coming#game changer#accept challenges that defines you#makemoneyonline#money business#moneymindset#legacy challenge

3 notes

·

View notes

Text

Can someone cash app me $100 please $thickchick901

13 notes

·

View notes

Text

Best Savings Accounts for Nonprofits in 2025: Low Fees & High Interest

Why Nonprofits Need a Specialized Savings Account What to Look for in a Nonprofit Savings Account? Top 5 Best Savings Accounts for Nonprofits in 2025 Nonprofit Checking vs. Nonprofit Savings: What’s the Difference? How to Open a Nonprofit Savings Account Frequently Asked Questions (FAQ)

Why Nonprofits Need a Specialized Savings Account

Nonprofits operate differently from regular businesses, meaning their banking needs are unique. Unlike personal or commercial accounts, nonprofit savings accounts often come with lower fees, higher interest rates, and additional benefits such as donation management and grant assistance. In this guide, we'll compare the best savings accounts for nonprofits in 2025, covering essential features like minimum balances, APY rates, transaction limits, and special perks tailored for charitable organizations.

What to Look for in a Nonprofit Savings Account?

Before opening a savings account for your nonprofit, consider the following factors: 1. Low or Zero Monthly Fees Nonprofits often manage limited financial resources. A good nonprofit savings account should have no monthly maintenance fees or very low fees to ensure more funds stay within the organization. 2. Competitive Interest Rates (APY) To maximize funds, look for accounts offering a high Annual Percentage Yield (APY). Even a slightly higher interest rate can make a big difference in long-term savings. 3. High Transaction Limits Since nonprofits receive donations and issue payments frequently, the best savings accounts should allow a high number of transactions per month without penalties. 4. Online & Mobile Banking Access Managing donations and expenses on the go is crucial. The ideal savings account should offer robust online banking tools, mobile access, and integration with accounting software. 5. Additional Perks for Nonprofits Some banks offer free financial consultations, grant assistance, or donor management tools as part of their nonprofit banking services.

Top 5 Best Savings Accounts for Nonprofits in 2025

1. Axos Bank Nonprofit Savings Account APY: 0.80% Monthly Fees: None Minimum Balance: $0 Perks: No overdraft fees, unlimited deposits, and access to financial planning tools. Axos Bank offers one of the best high-yield savings accounts for nonprofits, with no monthly fees and a competitive interest rate. Their online banking platform is easy to use, making it a great option for organizations that prefer digital banking. 2. Bank of America Nonprofit Financial Solutions APY: 0.50% Monthly Fees: $10 (waived if balance remains above $5,000) Minimum Balance: $5,000 Perks: Grant assistance, fundraising tools, dedicated nonprofit advisors. Bank of America’s nonprofit savings account is an excellent choice for larger organizations managing significant funds. They offer grant assistance and fundraising tools, which can be valuable for growing charities. 3. Wells Fargo Nonprofit Checking & Savings Package APY: 0.40% Monthly Fees: $5 (waived with $1,000 balance) Minimum Balance: $1,000 Perks: Fraud protection, financial coaching, integration with QuickBooks. Wells Fargo’s nonprofit account is designed for organizations that need strong fraud protection and easy integration with accounting software. 4. PNC Bank Nonprofit Savings Account APY: 0.60% Monthly Fees: None Minimum Balance: $500 Perks: No transaction limits, free nonprofit resources, community grants. PNC Bank is a solid choice for nonprofits that want unlimited transactions and access to community grants and nonprofit-focused financial education. 5. Chase Business Total Savings for Nonprofits APY: 0.35% Monthly Fees: $10 (waived with $500 balance) Minimum Balance: $500 Perks: Fundraising support, automatic transfers, donor tracking tools. Chase provides useful tools for managing donations, including donor tracking software and automatic transfers, making it easier to manage multiple revenue streams.

Nonprofit Checking vs. Nonprofit Savings: What’s the Difference?

While savings accounts help nonprofits store and grow funds, checking accounts are better for daily transactions. Many banks offer nonprofit checking and savings accounts as a package, allowing seamless fund transfers between the two. Best Banks Offering Nonprofit Checking & Savings Bundles Chase Business Banking – Includes donor tracking tools. Bank of America Nonprofit Solutions – Provides access to financial advisors. PNC Bank – Offers unlimited transactions.

How to Open a Nonprofit Savings Account

Opening a nonprofit savings account requires careful planning and documentation. Follow these steps to ensure a smooth process: Step 1: Gather Required Documents Banks require specific documentation to verify your nonprofit status. Typical requirements include: IRS Determination Letter verifying 501(c)(3) tax-exempt status. Articles of Incorporation to prove the legal formation of your nonprofit. Employer Identification Number (EIN) provided by the IRS. Board of Directors Resolution approving the account opening. Organization Bylaws outlining governance and financial policies. Step 2: Research and Compare Banking Options Evaluate multiple banks to find an account that best suits your nonprofit's needs. Consider: Interest rates and fees – Choose accounts with minimal fees and competitive APY. Transaction limits – Ensure the account allows sufficient transactions per month. Additional services – Look for donor management, financial advisory, and grant assistance. Step 3: Visit a Local Branch or Apply Online Some banks let nonprofits apply for an account online, while others may ask for an in-person visit. Provide all necessary documentation. Confirm eligibility for fee waivers or promotional benefits. Ask about integration with nonprofit accounting software. Step 4: Set Up Online Banking & Fund Transfers Once your account is open, maximize its efficiency by: Enabling online banking for easy access to account details and transactions. Setting up automatic transfers between checking and savings accounts. Utilizing financial tools such as donor tracking, reporting, and fraud protection. Step 5: Maintain Compliance and Optimize Savings To ensure long-term success: Monitor transaction limits and maintain required balances. Keep records updated with the bank to prevent compliance issues. Explore additional banking services such as business credit lines or investment accounts for surplus funds. Explore More: Types of Financial Institutions: Traditional Banks, Credit Unions, and Neobanks

Frequently Asked Questions (FAQ)

1. What are the best bank accounts for nonprofit organizations? The best bank accounts for nonprofits include those from Axos Bank, Bank of America, Wells Fargo, PNC Bank, and Chase, offering low fees and nonprofit-specific perks. 2. Which banks offer the best bank accounts for nonprofits? Some of the best banks for nonprofits include Chase, Bank of America, Axos Bank, Wells Fargo, and PNC Bank, offering specialized nonprofit banking solutions. 3. What are the best savings accounts for nonprofits? Top savings accounts for nonprofits include Axos Bank Nonprofit Savings, Bank of America Nonprofit Financial Solutions, and PNC Bank Nonprofit Savings. 4. Which type of savings account is best for nonprofits? A high-yield savings account with low fees and high transaction limits is best for nonprofits. Accounts with APY benefits, grant assistance, and fraud protection are ideal. 5. Which nonprofits are the best? The best nonprofits vary by cause. Some globally recognized nonprofits include The Red Cross, UNICEF, World Wildlife Fund (WWF), and Doctors Without Borders. 6. Which nonprofits give the most? Nonprofits with the highest charitable giving include The Bill & Melinda Gates Foundation, United Way Worldwide, Feeding America, and The Salvation Army. Read the full article

#FinanceTips#MoneyGoals#RichMindset#WealthyLife#SideHustleSuccess#MakeMoneyOnline#Investment101#DebtFreeJourney#SmartInvesting#MillionaireMindset

0 notes

Text

Credit Card vs. Debit Card - Which One is Better?

💳 Credit Card ya Debit Card? Ek sahi choice, ek galat decision! Samjho paison ka game aur bano financial pro! 💰🔥

#CreditVsDebit#SmartSpending#FinancialLiteracy#MoneyMatters#PersonalFinance#MoneyTips#GenZFinance#DebtFree#SaveMore#FinancialFreedom#InvestSmart#WealthMindset#MoneyGoals#CreditCardTips#Budgeting#FrugalLiving#MoneySavvy#IndianFinance#FinanceTips#DiscoverAndRise

0 notes

Text

youtube

#IndianBudget#IndiaTax#FinanceIndia#BudgetNews#TaxPayers#CA#InvestIndia#IncomeTaxIndia#ViralVideo#TrendingNow#LatestNews#BreakingNews#FinancialEducation#PersonalFinance#FinanceTips#InvestSmart#MoneyMatters#WealthBuilding#StockMarket#FinancialFreedom#MoneyGoals#SmartInvesting#Budget2025#IncomeTax#TaxSaving#Finance#TaxPlanning#MoneyTips#SaveMoney#TaxExemptions

0 notes