#money lender review

Explore tagged Tumblr posts

Text

Big Tech disrupted disruption

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/02/08/permanent-overlords/#republicans-want-to-defund-the-police

Before "disruption" turned into a punchline, it was a genuinely exciting idea. Using technology, we could connect people to one another and allow them to collaborate, share, and cooperate to make great things happen.

It's easy (and valid) to dismiss the "disruption" of Uber, which "disrupted" taxis and transit by losing $31b worth of Saudi royal money in a bid to collapse the world's rival transportation system, while quietly promising its investors that it would someday have pricing power as a monopoly, and would attain profit through price-gouging and wage-theft.

Uber's disruption story was wreathed in bullshit: lies about the "independence" of its drivers, about the imminence of self-driving taxis, about the impact that replacing buses and subways with millions of circling, empty cars would have on traffic congestion. There were and are plenty of problems with traditional taxis and transit, but Uber magnified these problems, under cover of "disrupting" them away.

But there are other feats of high-tech disruption that were and are genuinely transformative – Wikipedia, GNU/Linux, RSS, and more. These disruptive technologies altered the balance of power between powerful institutions and the businesses, communities and individuals they dominated, in ways that have proven both beneficial and durable.

When we speak of commercial disruption today, we usually mean a tech company disrupting a non-tech company. Tinder disrupts singles bars. Netflix disrupts Blockbuster. Airbnb disrupts Marriott.

But the history of "disruption" features far more examples of tech companies disrupting other tech companies: DEC disrupts IBM. Netscape disrupts Microsoft. Google disrupts Yahoo. Nokia disrupts Kodak, sure – but then Apple disrupts Nokia. It's only natural that the businesses most vulnerable to digital disruption are other digital businesses.

And yet…disruption is nowhere to be seen when it comes to the tech sector itself. Five giant companies have been running the show for more than a decade. A couple of these companies (Apple, Microsoft) are Gen-Xers, having been born in the 70s, then there's a couple of Millennials (Amazon, Google), and that one Gen-Z kid (Facebook). Big Tech shows no sign of being disrupted, despite the continuous enshittification of their core products and services. How can this be? Has Big Tech disrupted disruption itself?

That's the contention of "Coopting Disruption," a new paper from two law profs: Mark Lemley (Stanford) and Matthew Wansley (Yeshiva U):

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4713845

The paper opens with a review of the literature on disruption. Big companies have some major advantages: they've got people and infrastructure they can leverage to bring new products to market more cheaply than startups. They've got existing relationships with suppliers, distributors and customers. People trust them.

Diversified, monopolistic companies are also able to capture "involuntary spillovers": when Google spends money on AI for image recognition, it can improve Google Photos, YouTube, Android, Search, Maps and many other products. A startup with just one product can't capitalize on these spillovers in the same way, so it doesn't have the same incentives to spend big on R&D.

Finally, big companies have access to cheap money. They get better credit terms from lenders, they can float bonds, they can tap the public markets, or just spend their own profits on R&D. They can also afford to take a long view, because they're not tied to VCs whose funds turn over every 5-10 years. Big companies get cheap money, play a long game, pay less to innovate and get more out of innovation.

But those advantages are swamped by the disadvantages of incumbency, all the various curses of bigness. Take Arrow's "replacement effect": new companies that compete with incumbents drive down the incumbents' prices and tempt their customers away. But an incumbent that buys a disruptive new company can just shut it down, and whittle down its ideas to "sustaining innovation" (small improvements to existing products), killing "disruptive innovation" (major changes that make the existing products obsolete).

Arrow's Replacement Effect also comes into play before a new product even exists. An incumbent that allows a rival to do R&D that would eventually disrupt its product is at risk; but if the incumbent buys this pre-product, R&D-heavy startup, it can turn the research to sustaining innovation and defund any disruptive innovation.

Arrow asks us to look at the innovation question from the point of view of the company as a whole. Clayton Christensen's "Innovator's Dilemma" looks at the motivations of individual decision-makers in large, successful companies. These individuals don't want to disrupt their own business, because that will render some part of their own company obsolete (perhaps their own division!). They also don't want to radically change their customers' businesses, because those customers would also face negative effects from disruption.

A startup, by contrast, has no existing successful divisions and no giant customers to safeguard. They have nothing to lose and everything to gain from disruption. Where a large company has no way for individual employees to initiate major changes in corporate strategy, a startup has fewer hops between employees and management. What's more, a startup that rewards an employee's good idea with a stock-grant ties that employee's future finances to the outcome of that idea – while a giant corporation's stock bonuses are only incidentally tied to the ideas of any individual worker.

Big companies are where good ideas go to die. If a big company passes on its employees' cool, disruptive ideas, that's the end of the story for that idea. But even if 100 VCs pass on a startup's cool idea and only one VC funds it, the startup still gets to pursue that idea. In startup land, a good idea gets lots of chances – in a big company, it only gets one.

Given how innately disruptable tech companies are, given how hard it is for big companies to innovate, and given how little innovation we've gotten from Big Tech, how is it that the tech giants haven't been disrupted?

The authors propose a four-step program for the would-be Tech Baron hoping to defend their turf from disruption.

First, gather information about startups that might develop disruptive technologies and steer them away from competing with you, by investing in them or partnering with them.

Second, cut off any would-be competitor's supply of resources they need to develop a disruptive product that challenges your own.

Third, convince the government to pass regulations that big, established companies can comply with but that are business-killing challenges for small competitors.

Finally, buy up any company that resists your steering, succeeds despite your resource war, and escapes the compliance moats of regulation that favors incumbents.

Then: kill those companies.

The authors proceed to show that all four tactics are in play today. Big Tech companies operate their own VC funds, which means they get a look at every promising company in the field, even if they don't want to invest in them. Big Tech companies are also awash in money and their "rival" VCs know it, and so financial VCs and Big Tech collude to fund potential disruptors and then sell them to Big Tech companies as "aqui-hires" that see the disruption neutralized.

On resources, the authors focus on data, and how companies like Facebook have explicit policies of only permitting companies they don't see as potential disruptors to access Facebook data. They reproduce internal Facebook strategy memos that divide potential platform users into "existing competitors, possible future competitors, [or] developers that we have alignment with on business models." These categories allow Facebook to decide which companies are capable of developing disruptive products and which ones aren't. For example, Amazon – which doesn't compete with Facebook – is allowed to access FB data to target shoppers. But Messageme, a startup, was cut off from Facebook as soon as management perceived them as a future rival. Ironically – but unsurprisingly – Facebook spins these policies as pro-privacy, not anti-competitive.

These data policies cast a long shadow. They don't just block existing companies from accessing the data they need to pursue disruptive offerings – they also "send a message" to would-be founders and investors, letting them know that if they try to disrupt a tech giant, they will have their market oxygen cut off before they can draw breath. The only way to build a product that challenges Facebook is as Facebook's partner, under Facebook's direction, with Facebook's veto.

Next, regulation. Starting in 2019, Facebook started publishing full-page newspaper ads calling for regulation. Someone ghost-wrote a Washington Post op-ed under Zuckerberg's byline, arguing the case for more tech regulation. Google, Apple, OpenAI other tech giants have all (selectively) lobbied in favor of many regulations. These rules covered a lot of ground, but they all share a characteristic: complying with them requires huge amounts of money – money that giant tech companies can spare, but potential disruptors lack.

Finally, there's predatory acquisitions. Mark Zuckerberg, working without the benefit of a ghost writer (or in-house counsel to review his statements for actionable intent) has repeatedly confessed to buying companies like Instagram to ensure that they never grow to be competitors. As he told one colleague, "I remember your internal post about how Instagram was our threat and not Google+. You were basically right. The thing about startups though is you can often acquire them.”

All the tech giants are acquisition factories. Every successful Google product, almost without exception, is a product they bought from someone else. By contrast, Google's own internal products typically crash and burn, from G+ to Reader to Google Videos. Apple, meanwhile, buys 90 companies per year – Tim Apple brings home a new company for his shareholders more often than you bring home a bag of groceries for your family. All the Big Tech companies' AI offerings are acquisitions, and Apple has bought more AI companies than any of them.

Big Tech claims to be innovating, but it's really just operationalizing. Any company that threatens to disrupt a tech giant is bought, its products stripped of any really innovative features, and the residue is added to existing products as a "sustaining innovation" – a dot-release feature that has all the innovative disruption of rounding the corners on a new mobile phone.

The authors present three case-studies of tech companies using this four-point strategy to forestall disruption in AI, VR and self-driving cars. I'm not excited about any of these three categories, but it's clear that the tech giants are worried about them, and the authors make a devastating case for these disruptions being disrupted by Big Tech.

What do to about it? If we like (some) disruption, and if Big Tech is enshittifying at speed without facing dethroning-by-disruption, how do we get the dynamism and innovation that gave us the best of tech?

The authors make four suggestions.

First, revive the authorities under existing antitrust law to ban executives from Big Tech companies from serving on the boards of startups. More broadly, kill interlocking boards altogether. Remember, these powers already exist in the lawbooks, so accomplishing this goal means a change in enforcement priorities, not a new act of Congress or rulemaking. What's more, interlocking boards between competing companies are illegal per se, meaning there's no expensive, difficult fact-finding needed to demonstrate that two companies are breaking the law by sharing directors.

Next: create a nondiscrimination policy that requires the largest tech companies that share data with some unaffiliated companies to offer data on the same terms to other companies, except when they are direct competitors. They argue that this rule will keep tech giants from choking off disruptive technologies that make them obsolete (rather than competing with them).

On the subject of regulation and compliance moats, they have less concrete advice. They counsel lawmakers to greet tech giants' demands to be regulated with suspicion, to proceed with caution when they do regulate, and to shape regulation so that it doesn't limit market entry, by keeping in mind the disproportionate burdens regulations put on established giants and small new companies. This is all good advice, but it's more a set of principles than any kind of specific practice, test or procedure.

Finally, they call for increased scrutiny of mergers, including mergers between very large companies and small startups. They argue that existing law (Sec 2 of the Sherman Act and Sec 7 of the Clayton Act) both empower enforcers to block these acquisitions. They admit that the case-law on this is poor, but that just means that enforcers need to start making new case-law.

I like all of these suggestions! We're certainly enjoying a more activist set of regulators, who are more interested in Big Tech, than we've seen in generations.

But they are grossly under-resourced even without giving them additional duties. As Matt Stoller points out, "the DOJ's Antitrust Division has fewer people enforcing anti-monopoly laws in a $24 trillion economy than the Smithsonian Museum has security guards."

https://www.thebignewsletter.com/p/congressional-republicans-to-defund

What's more, Republicans are trying to slash their budgets even further. The American conservative movement has finally located a police force they're eager to defund: the corporate police who defend us all from predatory monopolies.

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

#pluralistic#coopting disruption#law and political economy#law#economics#competition#big tech#tech#innovation#acquihires#predatory acquisitions#mergers and acquisitions#disruption#schumpeter#the curse of bigness#clay christensen#josef schumpeter#christensen#enshittiification#business#regulation#scholarship

291 notes

·

View notes

Text

August 12th:

My mom and I did a study date at a local coffee shop today. I got in three hours of studying specifically reviewing sections one and two. Maybe tomorrow I'll take the mini exam. I can't keep pushing it off because I can't move on until its done and I'm so far behind as it is. But I want to reread my worst modules before I take this mini exam in the hopes of doing well enough I won't have to retake it.

Today's accounting topic: Interest rate risk is the risk that interest rates increase which decreases the value of the financial instrument. Market risk is the risk a financial instrument will loose value due to fluctuations in the economy. Unsystematic risk is the risk that a financial instrument will loose value due to specific fluctuations in industry. Credit risk affects the borrower as there is a risk they will not be able to pay back what they borrowed. Default risk is the risk that a lender will not get their money back. Liquidity risk is the risk that investors will not be able to sell their securities quickly or at the price they want. Price risk is the risk that investors will have to decrease the value of their securities or portfolios due to very specific reasons.

Other activity: A new and used bookstore in my town had a sale going on and I was able to get these gorgeous Jane Austin books! They didn't have Emma or else I would have gotten that one too. I might go back tomorrow though and get Mansfield Park and Persuasion!

#CPA exam review#CPA#cpa exam#business#BEC#Business CPA#studyblr#study inspiration#study hard#study motivation#study blog#study space#studying#student#study#studyspo#heydilli#astudentslifebuoy#heyzainab#juliistudies#inky studies#lookrylie#problematicprocrastinator#mittonstudies#heystardust#notetaeker#mine#just wish I was getting more studying done#i want to be doing literally anything else

60 notes

·

View notes

Text

5 Insider Tips You Should Know That Mortgage Brokers Won't Share: Insights by CIBC Advisor

The mortgage procedure might be challenging to negotiate; mortgage brokers can assist in clarifying it. Brokers, on the other hand, may not always disclose specific insider knowledge. These suggestions will guarantee you are making educated selections, help you avoid typical errors, and save you money. Before finalising your mortgage, here are five vital truths you should know.

Credit Score Affects Mortgage Rate

Your credit score has a big effect on the interest rate you get. A little increase in your credit score might lead to a much cheaper interest rate, saving you thousands over the term of your mortgage. Brokers may not always stress how much your credit score affects your monthly expenses.

What you need to do:

Check your credit score before you apply for a mortgage. You can improve it by getting rid of debt, making payments on time, and limiting your credit card amounts. An excellent credit score will enable you to get a cheaper rate.

2. You Can Negotiate Your Mortgage Terms

Many consumers think mortgage terms are set, although this is not necessarily true. Often, from your down payment to the interest rate, there is flexibility to negotiate. Since mortgage brokers could not constantly provide the finest conditions up front, enquiring about flexibility is crucial.

What you need to do:

Enquire about improved rates, more flexible payment arrangements, or maybe other benefits. You are welcome to haggle; keep in mind that you may evaluate many lenders and brokers to locate the greatest offer for you.

3. Pre-approval Has No Guarantee.

A pre-approval for a mortgage only tells you how much you might be able to borrow. It doesn't mean you'll get the loan. Your pre-approval is based on basic requirements; the final choice will be made after a more thorough review of your finances.

What you need to do:

While waiting for final mortgage approval, avoid making significant financial changes like moving jobs or asking for new credit. Your loan application may be delayed or denied if you become ineligible.

4. Broker Fees Can Vary and Be Negotiated

There are many different fees that some mortgage providers charge for their services. Even though many agents get paid by lenders, some could be able to make your mortgage payments go up. Before deciding on a broker, one should enquire about any costs.

What you need to do:

Get everything in writing and enquire about any costs up front. Especially if their services can be acquired without additional expenses, think about haggling the price or searching for brokers who don't charge fees. Always be sure the value you are receiving justifies any costs.

5. Not All Brokers Have Access to the Same Lenders

Some brokers deal with only a small number of lenders, which might limit your choices. Even though it's not always a problem, the broker's lender list may affect mortgage proposals.

What you need to do:

Request information from brokers about their lenders and whether they can connect you to many financial institutions. Since more choices may imply better bargains, it's important to make sure your broker has broad access to lenders.

Conclusion

Selecting the appropriate mortgage brokers is critical; knowing these insider tips will enable you to choose more wisely. You may get a mortgage that helps your financial future by raising your credit score, negotiating conditions, and knowing pre-approval restrictions, broker costs, and lender access.

Being a CIBC Advisor, I will assist you in navigating the procedure and locating the ideal mortgage option. Contact me today to discuss how we can meet your homeownership goals and optimise your mortgage.

#mortgage brokers#Mortgage advisor#Cibc mortgage advisor#Best mortgage broker#From my side#Mortgage agent near me#Best mortgage agent#Best mortgage specialist near me#Mortgage specialist near me#Cibc mortgage specialist

2 notes

·

View notes

Text

Top Tips for Choosing the Best Mortgage Broker in Dubai

Securing a home loan in Dubai can be a complex process, and choosing the right mortgage broker can make all the difference. This guide provides top tips for selecting the best mortgage broker to help you navigate the home loan process in Dubai.

Importance of a Mortgage Broker

A mortgage broker acts as a bridge between borrowers and lenders, helping you find the best mortgage deals and guiding you through the application process. Here are some benefits of using a mortgage broker:

Expert Knowledge: Brokers have extensive knowledge of the mortgage market.

Access to Multiple Lenders: They work with multiple lenders, giving you more options.

Personalized Service: Brokers offer services tailored to your financial situation and needs.

Time Savings: They handle the paperwork and negotiations, saving you time and effort.

For more information on home loans, visit home loan dubai.

Steps to Choosing the Best Mortgage Broker

Research and Recommendations: Start by asking for recommendations from friends, family, and colleagues. Check online reviews and testimonials.

Verify Credentials: Ensure the broker is licensed and regulated by the relevant authorities in Dubai.

Interview Multiple Brokers: Speak with several brokers to compare their services, fees, and expertise.

Evaluate Experience: Choose a broker with a proven track record and extensive experience in the Dubai mortgage market.

Understand Fees: Clarify the broker's fee structure and ensure there are no hidden costs.

For property purchase options, explore Buy Houses in Dubai.

Questions to Ask Potential Brokers

What types of mortgages do you offer?

Which lenders do you work with?

What is your fee structure?

Can you provide references from previous clients?

How will you help me find the best mortgage deal?

For expert mortgage advice, consider Mortgage Broker UAE.

Benefits of Using a Mortgage Broker

Access to Exclusive Deals: Brokers often have access to deals that are not available to the general public.

Expert Negotiation: They can negotiate better terms and rates with lenders.

Stress Reduction: Brokers handle the complex paperwork and administrative tasks, reducing your stress.

Comprehensive Financial Advice: They provide valuable financial advice, helping you make informed decisions.

For rental options, visit Apartments For Rent in Dubai.

Real-Life Success Story

Consider the case of Sarah, a first-time homebuyer in Dubai. With the help of a mortgage broker, she secured a favorable mortgage rate and purchased her dream home. The broker's expertise and negotiation skills saved her time and money, making the home-buying process smooth and stress-free.

For selling your apartments, visit Sell Your Apartments in Dubai.

Conclusion

Choosing the best mortgage broker in Dubai requires careful research and evaluation. By following the tips outlined in this guide, you can find a broker who will provide expert advice, access to the best mortgage deals, and personalized service. For more resources and expert advice, visit home loan dubai.

8 notes

·

View notes

Text

Short Term Loans Direct Lenders | Short Term Loans UK Direct Lender | Short Term Loans UK

As the name suggests, short-term loans are often for very small amounts of money and are paid back rapidly. These factors are taken into account when any lender reviews your application for a short term loans UK direct lender.

https://paydayquid.co.uk/

#short term loans direct lenders#short term cash loans#same day loans direct lenders#payday loans same day loans cash loans#fast cash loans online#same day payday loans#same day loans online#online personal loans#short term loans uk#short term loans uk direct lender

3 notes

·

View notes

Text

Excerpt from this New York Times story:

As the Trump administration imposes deep cuts on foreign aid and renewable energy programs, the World Bank, one of the most important financiers of energy projects in developing countries, is facing doubts over whether its biggest shareholder, the United States, will stay on board.

While the Trump administration has voiced neither support nor antipathy for the bank, it has issued an executive order promising a review of U.S. involvement in all international organizations. And Project 2025, the right-wing blueprint for overhauling the federal government, has pressed for withdrawal from the World Bank.

If the United States were to withdraw, the bank would lose its triple-A credit rating, two credit-rating companies warned in recent weeks. That could significantly reduce its ability to borrow money. Roughly 18 percent of the bank’s funding comes from the United States.

In an interview, Ajay Banga, the bank’s president, said his institution was fundamentally different from the aid agencies, such as U.S.A.I.D., that the Trump administration has been cutting. And he used some of the administration’s own talking points to argue the case: Investment in natural gas and nuclear power is good, he said, and the development projects funded by the bank can help prevent migration.

He also said that the bank makes money and shouldn’t be seen as charity from U.S. taxpayers.

“The World Bank is profitable,” he said, noting that it more than covers its own administrative costs even if most of its projects are designed to yield slim returns. “It’s not as though we take money every year from taxpayers to subsidize us and our salaries.”

The concern about the bank’s future is heightened as the second Trump administration doubles down on its repudiation of climate projects and promotes an accelerated expansion of U.S. oil and gas projects.

The United States wields enormous influence over the bank and effectively chooses its leader. David Malpass, nominated by President Trump in 2019, doubled the bank’s climate financing. But he resigned shortly after wavering during a 2023 public event at The New York Times on whether he accepted the scientific consensus that fossil fuels drive climate change.

Mr. Banga was then nominated in 2023 by President Biden. He committed to channel 45 percent of the bank’s funds on climate related projects, an increase of 10 percentage points from his predecessor.

2 notes

·

View notes

Text

Can I finance my roofing project through a roofing contractor?

When it comes to roofing projects, there’s a lot to consider. One of the biggest questions that often comes up is, “Can I finance my roofing project through a roofing contractor?” Whether your roof needs repair or replacement, it’s natural to wonder how to pay for such a large investment. After all, roofing projects can be expensive, and not everyone has the funds ready to go. The good news is that many roofing contractors, including Lastime Exteriors, offer financing options to help make the process smoother and more manageable for you.

Understanding Roofing Project Costs

Roofing projects can vary widely in price based on the materials you choose, the size of your roof, and the complexity of the installation or repair. The costs can add up quickly, whether replacing a few shingles or installing an entirely new roof. Before starting a project, you’ll want an estimate of what to expect. But, if you’re concerned about how to pay for the project, financing can provide a solution that fits your budget.

This is where your roofing contractor can help. Many contractors understand that paying for a roof upfront may not always be possible for every homeowner. That’s why they offer financing plans to spread out the payments, making it easier for people to tackle these necessary home improvements without the immediate financial burden.

Can a Roofing Contractor Offer Financing?

Yes, many roofing contractors offer financing options to help people fund their roofing projects. Financing through a contractor is convenient because you don’t have to go through a separate financial institution to secure a loan. Instead, the contractor partners with a lender to offer financing packages directly to customers.

With Lastime Exteriors, for example, you can explore various financing options tailored to meet your needs. The idea is to help you afford the project while paying over time, allowing you to maintain the safety and integrity of your home without breaking the bank.

What Are the Benefits of Financing Your Roofing Project?

Financing a roofing project has several benefits that can make your life easier, especially when the expense feels overwhelming. Here are a few key advantages to consider when working with a roofing contractor like Lastime Exteriors:

Flexible Payment Plans: You can spread out the cost of your roofing project over months or even years, depending on the terms of your financing agreement. This way, you can pay manageable amounts instead of facing a large upfront cost.

Quick Approval Process: Unlike traditional loans, many roofing contractors offer fast and simple financing approval. This can save you time and hassle compared to dealing with banks or credit unions.

Low Interest Rates: Some contractors partner with lenders who offer competitive interest rates, making financing affordable. Choosing a lower-interest plan can save you money in the long run.

Convenience: You don’t need to search for external financing options. The roofing contractor handles it all, providing one-stop shopping for your project.

No Delay on Repairs: If you need urgent repairs but don’t have the funds ready, financing can help you start the project immediately rather than waiting until you can pay in full.

What Should You Know Before Financing Through a Roofing Contractor?

Before diving into financing, remember a few things to ensure you’re making the best decision for your financial situation. When working with a roofing contractor to finance your project, here are a few factors to consider:

Interest Rates and Terms

Every financing plan has its interest rate and repayment terms. It’s important to carefully review these details to understand your monthly payments and how long it will take to pay off the project. In some cases, financing plans may offer 0% interest for a certain period, but checking the fine print is essential to avoid surprises.

Total Cost

When financing a project, you’ll want to consider the total cost, including interest. While financing can make your project more affordable upfront, you may pay more over time due to interest charges. However, some roofing contractors may offer promotional deals, such as deferred payments or low-interest options, which can help minimize additional costs.

Your Budget

Think about how the monthly payments will fit into your budget. While financing can make a large project feel more manageable, it’s still important to ensure you can handle the monthly payments without stretching your finances too thin.

Contractor’s Financing Partner

Many roofing contractors work with third-party lenders to offer financing. Be sure to ask about the lender’s reputation and any terms and conditions associated with their loans. Working with a trustworthy contractor like Lastime Exteriors ensures that you’ll be connected to reputable lenders who offer transparent and fair financing options.

Steps to Finance Your Roofing Project

The process is straightforward if you want to finance your roofing project through a contractor. Here’s how you can get started:

Get an Estimate: First, contact a contractor like Lastime Exteriors to schedule a consultation and get an estimate for your project. This will give you an idea of the project's cost and help you determine how much financing you need.

Explore Financing Options: Once you estimate, discuss financing options with the contractor. Lastime Exteriors offers various plans designed to meet the needs of homeowners like you. The contractor will walk you through the plans, interest rates, and payment terms.

Apply for Financing: After choosing the right financing plan, you must complete an application. This process is typically quick and easy. The contractor will work with the lender to get your application processed, and you can expect a response in a short period.

Approval and Project Start: The contractor can begin the project once your financing is approved. This allows you to start the necessary work on your roof without waiting for additional funds.

Make Payments: As the project progresses, you’ll start making your monthly payments according to the terms of your financing agreement. With the convenience of financing, you can enjoy your new or repaired roof without the immediate stress of paying in full.

Why Work With Lastime Exteriors?

Working with a reputable and experienced contractor is essential when financing your roofing project. Lastime Exteriors provides high-quality roofing services and financing options that make it easier for people to manage their costs. Here are a few reasons why Lastime Exteriors should be your go-to choice for financing your next roofing project:

Trusted Reputation: With years of experience in the roofing industry, Lastime Exteriors has built a solid reputation for providing excellent craftsmanship and customer service. You can trust them to do the job while offering fair and transparent financing options.

Variety of Financing Plans: Whether you need a short-term payment plan or a longer-term option, Lastime Exteriors offers a range of financing solutions that can be customized to fit your budget.

Knowledgeable Team: The team at Lastime Exteriors will guide you through the entire process, from selecting the right materials to understanding your financing options. You’ll feel supported every step of the way.

Convenience and Efficiency: Financing your roofing project through Lastime Exteriors is simple and convenient. Their team handles everything, so you can focus on what matters most – your home.

Financing Your Roof Through a Roofing Contractor

When you need roofing work done but the cost feels overwhelming, financing through a roofing contractor can be a practical solution. With flexible payment plans, quick approval processes, and competitive interest rates, financing can help you start your project without needing immediate full payment.

Lastime Exteriors offers a variety of financing options designed to make your roofing project more affordable. Whether you need repairs or a full roof replacement, their team can guide you through the process and help you find the right financing plan for your needs.

If you’re considering financing your roofing project, don’t hesitate to contact Lastime Exteriors. Visit Lastime Exteriors today for more information, or call (402) 330-0911 with any questions. You can also email [email protected] for a free estimate and to discuss your financing options. Your new roof is well within reach with the right contractor and financing plan!

4 notes

·

View notes

Text

How to Protect Yourself from Personal Loan Phishing Scams

In today’s digital world, personal loans have become more accessible, allowing borrowers to apply online and receive funds quickly. However, this convenience has also led to a rise in phishing scams, where fraudsters attempt to steal your personal and financial information by posing as legitimate lenders. These scams can result in identity theft, financial loss, and fraudulent loan applications in your name.

If you’re planning to apply for a personal loan, it is essential to understand how phishing scams work, the warning signs to look for, and the best ways to protect yourself.

1. What Are Personal Loan Phishing Scams?

A phishing scam is a fraudulent attempt to trick individuals into providing sensitive information such as bank details, Aadhaar number, PAN card, OTPs, or login credentials. Scammers typically impersonate banks, NBFCs, or online lending platforms and contact borrowers via emails, phone calls, SMS, or fake websites.

Once they obtain your information, they can:

Steal money from your bank account

Take a loan in your name

Misuse your identity for financial fraud

Access and sell your personal data on the dark web

2. Common Types of Personal Loan Phishing Scams

2.1 Fake Loan Approval Emails & SMS

Fraudsters send emails or SMS messages claiming that your loan has been pre-approved or that you qualify for a low-interest personal loan. These messages often contain links leading to fake lender websites designed to steal your personal information.

2.2 Fake Loan Websites & Apps

Scammers create websites and mobile apps that look like real financial institutions. They trick users into entering personal and banking details, which are then used for fraudulent activities.

2.3 Fraudulent Customer Service Calls

You may receive a phone call from a scammer pretending to be a bank representative. They claim you must provide your OTP, Aadhaar, PAN, or bank details to complete your loan application. Once you share these details, scammers can withdraw money or take loans in your name.

2.4 Loan Processing Fee Scams

Fraudsters promise quick loan disbursal with no documentation but demand advance processing fees or a loan insurance fee. Once the fee is paid, the scammer disappears, and no loan is disbursed.

2.5 Social Media Loan Scams

Some scammers advertise fake loans on Facebook, Instagram, or WhatsApp and ask potential borrowers to contact them privately. Once engaged, they request confidential details, leading to identity theft.

3. Red Flags to Identify Loan Phishing Scams

3.1 Offers That Sound Too Good to Be True

If you receive an offer promising guaranteed loan approval with no credit check, zero documentation, or extremely low-interest rates, it’s likely a scam.

3.2 Unsolicited Loan Messages

Legitimate lenders do not send random SMS, WhatsApp messages, or emails offering personal loans. Be cautious if you receive messages from unknown numbers or email addresses.

3.3 Fake Loan Websites

Before applying for a loan online, always verify the website’s domain name. Scammers often create fake websites with slightly modified spellings of real lenders to trick borrowers.

3.4 Requests for Upfront Payments

No genuine lender will ask for advance processing fees before loan approval. If a lender insists on upfront payments via UPI, Paytm, or Google Pay, it’s a scam.

3.5 Pressure to Act Immediately

Scammers create urgency by saying things like, "Limited offer – Apply now!" or "Your loan will be canceled if you don’t act fast." A real lender will give you time to review the terms.

3.6 Request for Personal Information Over the Phone

A legitimate bank or NBFC will never ask you for OTPs, passwords, or CVVs over the phone. If someone does, hang up immediately.

4. How to Protect Yourself from Loan Phishing Scams

4.1 Apply for Loans Only from Trusted Lenders

Always apply for a personal loan through registered banks, NBFCs, or reputed online lenders. Here are some safe options:

🔗 IDFC First Bank Personal Loan 🔗 Bajaj Finserv Personal Loan 🔗 Tata Capital Personal Loan 🔗 Axis Finance Personal Loan 🔗 Axis Bank Personal Loan 🔗 InCred Personal Loan

4.2 Verify the Lender’s Website

Check if the website URL starts with "https://" (secure site).

Look for official lender details on the RBI website or lender’s official website.

Avoid websites with poor design, spelling errors, or unusual domain names (e.g., "axisbankloans.xyz" instead of "axisbank.com").

4.3 Never Click on Suspicious Links

Do not click on links in unsolicited emails or messages claiming to be from a bank or NBFC. Instead, visit the official website by typing the URL manually.

4.4 Avoid Sharing Personal Information Online

Scammers may ask for your Aadhaar, PAN, or bank details via email, phone, or WhatsApp. Never share sensitive information with unknown sources.

4.5 Enable Two-Factor Authentication (2FA)

Use 2FA on your banking and email accounts to protect against unauthorized access. This adds an extra layer of security if your password is compromised.

4.6 Check Reviews & Ratings Before Downloading Loan Apps

Before installing a loan app, check:

App permissions (Avoid apps that ask for access to contacts, photos, and messages).

Reviews and ratings on Google Play or App Store.

If the app is registered with an RBI-approved lender.

4.7 Monitor Your Bank & Credit Report Regularly

Check your credit report and bank statements for unauthorized loan applications or suspicious transactions. If you spot any fraudulent activity, report it immediately.

5. What to Do If You Are a Victim of Loan Phishing?

If you have fallen victim to a loan phishing scam, take these steps:

1️⃣ Contact Your Bank Immediately – Report any unauthorized transactions and request to block your account if necessary. 2️⃣ Change Your Passwords – Update your internet banking, email, and loan account passwords immediately. 3️⃣ File a Cyber Crime Complaint – Report the fraud to the Cyber Crime Portal (www.cybercrime.gov.in) or call the National Cyber Crime Helpline (1930). 4️⃣ Report to RBI & Consumer Forum – If you have been tricked into a fake loan scheme, report it to the RBI and National Consumer Helpline (1800-11-4000). 5️⃣ Monitor Your Credit Report – Check for unauthorized loans taken in your name and dispute them with credit bureaus like CIBIL and Experian.

Stay Alert & Borrow Safely

Personal loan phishing scams are on the rise, but you can stay protected by being vigilant. Always verify loan offers, apply only through trusted lenders, and avoid clicking on suspicious links.

For safe and secure personal loan options, apply here: 👉 Compare & Apply for a Personal Loan

By staying cautious and informed, you can protect yourself from loan fraud and ensure a safe borrowing experience.

#nbfc personal loan#bank#loan services#personal loans#fincrif#personal loan#personal laon#loan apps#personal loan online#finance#fincrif india#Personal loan phishing scams#Loan fraud protection#How to avoid loan scams#Safe personal loan application#Phishing scams in personal loans#Fake loan offers#Online loan scams#Fraudulent loan websites#Personal loan safety tips#How to identify loan scams#Signs of a loan scam#Avoiding personal loan fraud#Phishing emails from loan providers#Loan application fraud prevention#How scammers trick loan applicants#Secure loan application process#Fake personal loan SMS and calls#Online loan phishing protection#Tips to protect against loan fraud

3 notes

·

View notes

Text

In Kenya, people took to the streets to protest tax hikes to pay for foreign debt. In Sri Lanka, a takeover of the presidential palace was followed by the election of a new government aiming to renegotiate Sri Lanka’s International Monetary Fund (IMF) loan. In Argentina, there’s been a record increase in poverty and hunger as the government pursues austerity to free up cash and pay off debt to the IMF. These are three of almost 80 countries currently in or at risk of debt distress, and most of them are highly climate-vulnerable. In the context of a simultaneous climate and development crisis, high debt payments are a direct obstacle to countries’ abilities to fund essential public services, tackle climate change, and invest in sustainable development. External shocks such as the U.S. Federal Reserve’s 2022-2023 interest rate hikes, combined with a slow recovery from the COVID-19 crisis, have exacerbated debt burdens around the world. And one global institution is absolutely crucial to making debt relief viable in the short term: the IMF.

Atop the international monetary hierarchy, the IMF is the head of the creditors’ cartel. Not only is it a gatekeeper for other supranational lenders; it also functions as a seal of approval for countries to gain access to capital markets. Created to rebalance countries’ balance-of-payments crises, it can even issue a type of international money called Special Drawing Rights (SDRs). Without counting this, it has a trillion dollars of lending power, plus a quarter-trillion-dollars’ worth of gold reserves. In recent years, though, the IMF has diverged from its obligation to support countries in need. Though it has increasingly relied on fees from its more distressed borrowers, over the last 12 months it made a record-breaking $6.8 billion in earnings.

As the fund’s yearly fall meetings are about to begin on Oct. 21, we propose five quick fixes for the IMF, all of which require minimal paperwork and will help get effective relief and climate funds to developing countries. Despite important strides over the last few years, the IMF is still stuck in old ways of austerity and conditionality. The institution is out of sync with the climate emergency and needs to change.

1. Immediate debt relief through the elimination of surcharges

Just as with hidden fees charged by credit cards, dozens of countries have due to surcharges paid the IMF much higher interest rates than those advertised. The institution’s own historical precedents show that bold moves, such as removing these fees, are possible. After prolonged pressure from economists, policymakers and civil society groups, the Fund recently reformed the policy to lower the fees—but didn’t go far enough. Had the IMF board scrapped surcharges, the developing world would have seen up to $13 billion in additional relief over the next decade. Highly indebted countries will continue to face an unnecessary burden and obstacle to development.

The Fund argues these surcharges are a disincentive for large and prolonged borrowing. Some rich countries’ board members opposed full elimination of the policy because they claimed the income derived from these extra fees could pay for concessional rates for loans mainly issued to low-income African and small island states. Beyond the fact that, decades ago, rich countries committed to subsidizing these loans’ low interest rates, the IMF does not need the extra income to fund this subsidy. Boasting a trillion dollars of lending capacity, the powerful IMF can cover this subsidy by freeing up cash from its retained earnings as well as conducting a partial accounting revaluation of its gold reserves. In short, the IMF is solvent enough to forego surcharge income and provide full relief from surcharges to its debt-distressed members before the next review.

2. A new issuance of SDRs

The IMF has a special unit attached to it called the Special Drawing Rights Department. It has its own balance sheet, and with the mandate from its members, it can issue and allocate international currency. American legislation allows the U.S. Treasury to vote at the IMF for an expedited issuance worth up to $650 billion. This issuance would not cost the United States—or any government, for that matter—a single penny. It is a zero-tax, deficit-free, debt-free, and conditionality-free way to support countries in distress without the lengthy political delays of budget appropriations.

The main use for foreign exchange is to pay for international transactions, primarily imports of goods and services. While 41 rich countries and China would get two-thirds of SDRs and generally would not use them, over 150 developing countries would get around $200 billion worth of SDRs, and most of them would certainly use them to pay for imports. This would boost international trade and stimulate U.S. exports. A recent study shows that hundreds of thousands of export-related jobs in the United States can be preserved or created from an SDR issuance of this magnitude.

Together with this issuance, the United Nations can decide that all UN agencies’ statistics, reports, and accounting are denominated in XDR—the international standard symbol for the SDR, the currency of the IMF, which is, let’s not forget, a UN institution. This will promote the use of SDRs and will incentivize countries to donate them for climate purposes.

3. Invest the IMF’s portfolios in African and Latin American green bonds

The IMF has unused cash on hand for about $405 billion. It has an additional $42 billion invested in the stock market, mainly in rich countries’ blue chip stocks, corporate bonds, and sovereigns. Why not have the IMF increase its portfolio and invest it in top-rated green bonds issued by regional development banks such as the African Development Bank and the Development Bank of Latin America? The usual argument is that the IMF has to follow legacy risk models biased in favor of rich-country markets, but this is shortsighted as it is a globally systemic institution—it doesn’t have to follow markets; it has to make them. This is an opportunity for unused cash at the IMF to instead be put to productive use through climate-oriented, real-life projects.

4. Fix the IMF’s new climate fund

The IMF’s managing director, Kristalina Georgieva, is an environmental economist. She was successful in creating a trust fund at the IMF that is the closest thing to an IMF climate fund: the Resilience and Sustainability Trust. However, old habits die hard, and its framework was problematic from the start. While its 20-year loans are at lower rates than the conventional 10-year IMF loans, they are full of counterproductive conditionalities linked to regular austerity-filled IMF programs and are arbitrarily capped at $1.3 billion per country. The IMF can quickly fix this by tweaking its inertial habits: scrapping the harmful conditionality, delinking it from conventional IMF loans, and removing the arbitrary cap.

5. Fast-track congressional approval for a quota increase

The U.S. government hosts the IMF in Washington and with veto power it is the most important voice at the IMF. The role of the United States is crucial in getting these quick fixes underway. For this next fix, congressional approval will be required.

The IMF’s solvency depends on its members’ quotas, its yearly profits and borrowing agreements with rich countries. The IMF had approved a quota-funding round from its members in 2010, but it was concluded only in 2016—mainly because of a slow U.S. Congress that resisted a small change in voting power. Voting power is defined according to a formula that largely rewards economic size. Per the latest round approved in 2023, the distribution of voting power will remain the same, but countries are required to proportionally increase their quotas to the IMF. In order to comply with the latest round, it is estimated that rich countries will provide around $225 billion, but mostly in their own currencies. Meanwhile, developing countries will have to seek $25 billion in U.S. dollars, with the difference in local currency promises. U.S. congressional approval for the new funding round should be accelerated.

However, for a subsequent round, it is imperative that the IMF opens a discussion on the formula. Economic power shouldn’t go unchecked by climate responsibilities but should include a climate variable that can interact with economic size. We propose including countries’ historic greenhouse gas emissions in the denominator of that formula.

Out of all these measures, only the increase in quotas requires congressional approval. Everything else can be done quickly and for free, with the voting power and influence of the U.S. Treasury representative at the IMF. It is preferable for the United States to lead these reforms, which will realign the fund with its foundational principles and purpose—especially in the context of the climate emergency and a necessary green transition.

4 notes

·

View notes

Text

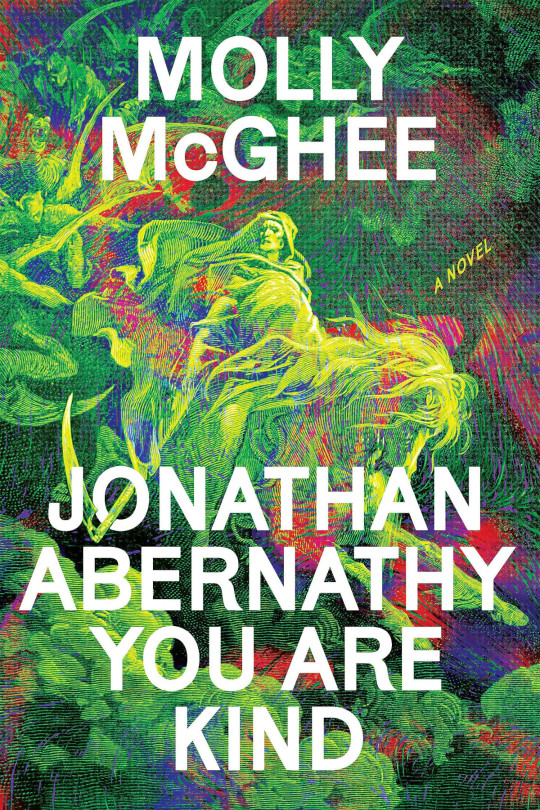

Molly McGhee’s “Jonathan Abernathy You Are Kind”

Jonathan Abernathy You Are Kind is Molly McGhee's debut novel: a dreamlike tale of a public-private partnership that hires the terminally endebted to invade the dreams of white-collar professionals and harvest the anxieties that prevent them from being fully productive members of the American corporate workforce:

https://www.penguinrandomhouse.com/books/734829/jonathan-abernathy-you-are-kind-by-molly-mcghee/

Though this is McGhee's first novel, she's already well known in literary circles. Her career has included stints at McSweeney's, where she worked on my book Information Doesn't Want To Be Free:

https://store.mcsweeneys.net/products/information-doesn-t-want-to-be-free

And then at Tor Books, where she worked on my book Attack Surface:

https://us.macmillan.com/books/9781250757531/attacksurface

But though McGhee is a shrewd and skilled editor, I think of her first and foremost as a writer, thanks to stunning essays like "America's Dead Souls," a 2021 Paris Review piece that described the experience of multigenerational debt in America in incandescent, pitiless prose:

https://www.theparisreview.org/blog/2021/05/17/americas-dead-souls/

McGhee's piece struck at the heart of something profoundly wrong in American society – the dual nature of debt, which represents a source of freedom for the wealthy, and bondage for workers:

https://pluralistic.net/2021/05/19/zombie-debt/#damnation

When billionaire mass-murderers like the Sacklers amass tens of billions of liabilities stemming from their role in deliberately starting the opioid crisis, the courts step in to relieve them of their obligations, allowing them to keep their blood-money:

https://pluralistic.net/2023/08/11/justice-delayed/#justice-redeemed

And when Silicon Valley Bank collapses due to mismanagement by ultra-wealthy financiers, the public purse yawns open and billions flow out to ensure that the wealthiest investors in the country stay whole:

https://pluralistic.net/2023/03/18/2-billion-here-2-billion-there/#socialism-for-the-rich

When predatory payday lenders target working people and force them into bankruptcy with four-digit APRs, the government intervenes…to save the lenders and keep workers on the hook:

https://pluralistic.net/2022/01/29/planned-obsolescence/#academic-fraud

"Debtor vs creditor" is the oldest class division we have. The Bronze Age custom of jubilee – the periodic cancellation of all debts – wasn't some weird peccadillo. It was essential public policy, and without jubilee, the hereditary creditor class became the arbiter of all social priorities, destabilizing great nations and even empires by directing production to suit their parochial needs. Societies that didn't practice jubilee (or halted it) collapsed:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

Today's workers are debt burdened at scales and in ways that defy comprehension, the numbers are so brain-breakingly large. Students who take out modest loans and pay them off several times over remain indebted decades later, with outstanding balances that vastly outstrip the principle:

https://pluralistic.net/2020/12/04/kawaski-trawick/#strike-debt

Workers who quit dead-end jobs are billed for five-figure "training repayment" bills that haunt them to the end of days:

https://pluralistic.net/2022/08/04/its-a-trap/#a-little-on-the-nose

Hospitals sue indigent patients at scale, siccing debt-collectors on people who can't pay – and were entitled to free care to begin with:

https://armandalegshow.com/episode/when-hospitals-sue-patients-part-2/

And debt collectors are drawn from the same social ranks as the debtors, barely trained and unsupervised, engaging in lawless, constant harassment of the debtor class:

https://pluralistic.net/2023/08/12/do-not-pay/#fair-debt-collection-practices-act

McGhee's "American Dead Souls" crystallized all of this vast injustice into a single, beautiful essay – and then McGhee crystallized things further by posting a public resignation letter enumerating the poor pay and working conditions in New York publishing, triggering mass, industry-wide resignations by similarly situated junior editorial staff:

https://electricliterature.com/molly-mcghee-jonathan-abernathy-you-are-kind-interview-debut-novel-book-debt/

Thus we arrive at McGhee's debut: a novel written by someone with a track record for gorgeous, brutally insightful prose; incisive analysis of the class war raging in the embers of capitalism's American Dream; and consequential labor organizing against the precarity and exploitation of young workers. As you might expect, it's fantastic.

Jonathan Abernathy is a 25 year old, debt haunted, desperately lonely man. An orphan with a mountain of college debt, Abernathy lives in a terrible basement apartment whose rent is just beyond his means. The only thing that propels him out of bed and into the world are his affirmations:

Jonathan Abernathy you are kind

You are well respected and valued by your community

People, including your family, love you

That these are all easily discerned lies is beside the point. Whatever gets you through the night.

We meet Jonathan as he is applying for a job that he was recruited for in a dream. As instructed in his dream, he presents himself at a shabby strip-mall office where an acerbic functionary behind scratched plexiglass takes his application and informs him that he is up for a gig run jointly by the US State Department and a consortium of large corporate employers. If he is accepted, all of his student debt repayments will be paused and he will no longer face wage garnishment. What's more, he'll be doing the job in his sleep, which means he'll be able to get a day job and pull a double income – what's not to like?

Jonathan's job is to enter the dreams of sleeping middle-management types in America's largest firms – but not just any dreams, their nightmares. Once he has entered their nightmare, Jonathan is charged with identifying the source of their anxiety and summoning a more senior operative who will suck up and whisk away that nagging spectre, thus rendering the worker a more productive component of their corporate structure.

But of course, there's more to it. As Jonathan works through his sleeping hours, he is deprived of his own dreams. Then there's the question of where those captive anxieties are ending up, and how they're being processed, and what new products can be made from refined nightmares. While Jonathan himself is pulling ever so slightly out of his economic quagmire, the people around him are still struggling.

McGhee braids together three strands: the palpable misery of being Jonathan (a proxy for all of us), the rising terror of the true nature of his employment, and beautifully turned absurdist touches that are laugh-aloud funny. This could be a mere novel of ennui and misery but it's not – it's a novel of hilarity and fear and misery, all mixed together in a glorious and terrible concoction that is not like anything else you've ever read.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/01/08/capitalist-surrealism/#productivity-hacks

#pluralistic#books#reviews#science fiction#molly mcghee#debt#graeber#capitalist realism#capitalist surrealism#dreams#gift guide

78 notes

·

View notes

Text

How To Buy Real-Estate Using No Money Only Contracts

How To Buy Real Estate Using No Money, Only Contracts

Investing in real estate without upfront cash might sound too good to be true, but it’s possible through strategies like creative financing, contract assignments, and lease options. These methods have been used by savvy investors to acquire properties without needing significant capital or credit. In this post, we’ll walk you through step-by-step methods for buying real estate with no money, only contracts.

1. Understand Contract-Based Real Estate Investing

Contracts play a vital role in real estate transactions. When used creatively, they allow you to control property and generate profits without owning it outright. Here are a few strategies to buy real estate using contracts alone:

• Wholesaling

• Lease Option (Rent-to-Own) Agreements

• Subject-To Financing

• Seller Financing

2. Wholesaling Real Estate: Assigning Contracts for Profit

In wholesaling, you find distressed properties under market value, secure them with a purchase agreement, and assign that contract to an end buyer for a fee. The key here is control—without ever buying the property yourself.

How it works:

1. Identify a motivated seller and negotiate a low purchase price.

2. Sign a contract with the seller to buy the property.

3. Find an investor willing to buy at a higher price.

4. Assign the contract to the investor, collecting a fee (your profit) at closing.

This method requires excellent networking and negotiation skills but no large upfront cash investments.

3. Lease Options: Control the Property Now, Buy Later

A lease option allows you to lease a property with the option to buy it later. This strategy is popular because you control the property without committing to a mortgage right away.

How it works:

1. Sign a lease agreement with the seller, including an option-to-purchase clause.

2. Pay a small “option fee” (sometimes negotiated to zero).

3. Rent the property, with part of the rent going towards the purchase price.

4. Buy the property later at an agreed-upon price if you choose.

This approach gives you control over the property and time to save for the final purchase or find other financing.

4. Subject-To Financing: Take Over the Seller’s Loan

In a subject-to deal, you take over the existing mortgage payments from the seller without formally assuming the loan. The property title transfers to you, but the original loan remains in the seller’s name.

How it works:

1. Negotiate a “subject-to” deal with a motivated seller.

2. Sign a purchase contract and take control of the property.

3. Continue making mortgage payments to the lender on the seller’s behalf.

This strategy works best with sellers facing foreclosure or those wanting to move quickly.

5. Seller Financing: Skip the Bank, Deal Directly with the Seller

Seller financing eliminates banks from the equation. The seller agrees to act as the lender and finances the sale for you through a promissory note.

How it works:

1. Negotiate terms with the seller (interest rate, down payment, etc.).

2. Sign a purchase agreement and promissory note.

3. Make payments directly to the seller according to agreed terms.

With this method, credit checks are usually less strict, and down payments are often negotiable.

6. Important Tips for Success

1. Build a Network: Success in real estate depends heavily on networking with agents, investors, and motivated sellers.

2. Learn the Laws: Different states have different rules around real estate contracts—be sure to understand local regulations.

3. Negotiate Wisely: In these strategies, your negotiation skills will determine your profit margins.

4. Use an Attorney: To protect yourself, have an attorney review contracts before signing.

5. Start Small: Test these strategies on smaller deals before jumping into larger properties.

7. Conclusion: You Can Buy Real Estate Without Cash

Buying real estate with no money down may sound unconventional, but these strategies prove it’s possible to succeed with the right contracts. Whether you use wholesaling, lease options, subject-to financing, or seller financing, these methods rely on creativity and negotiation rather than large sums of cash.

By understanding these contract-based strategies, you can unlock new opportunities in real estate and build a portfolio even without upfront capital. With time and experience, you can scale these strategies and generate significant profits.

Are you ready to dive into creative real estate investing? Let us know in the comments below if you’ve tried these methods or if you have any questions!

youtube

#real-estate-buying-and-selling#real-estate-buying#real-estate-buying-in-canada#real-estate-buying-in-spain#real-estate-buyers-agent#real-estate-buyers-commission#real-estate-buyers#real-estate-buyers-guide#real-estate-buyers-agreement#real-estate-buy-box#real-estate-buyers-agent-lawsuit#real-estate-buyers-agent-commission#real-estate-buyers-market#real-estate-buyers-list#real-estate-buy-brisbane#real-estate---buying

2 notes

·

View notes

Text

A Comprehensive Guide to Working with a Mortgage Broker in Dubai

Introduction to Home Loans in Dubai

Working with a mortgage broker in Dubai can simplify the mortgage process and help you secure the best deals. This comprehensive guide provides insights into the benefits of using a mortgage broker and how to effectively work with one.

The Role of a Mortgage Broker

A mortgage broker acts as an intermediary between borrowers and lenders, helping you find the best mortgage deals and guiding you through the application process. Here are some benefits of using a mortgage broker:

Expert Knowledge: Brokers have extensive knowledge of the mortgage market.

Access to Multiple Lenders: They work with multiple lenders, giving you more options.

Personalized Service: Brokers offer services tailored to your financial situation and needs.

Time Savings: They handle the paperwork and negotiations, saving you time and effort.

For more information on home loans, visit home loan dubai.

Steps to Working with a Mortgage Broker

Initial Consultation: The process begins with an initial consultation where the broker assesses your financial situation and mortgage needs.

Pre-Approval: The broker helps you get pre-approved for a mortgage, giving you an idea of your borrowing capacity and interest rate.

Property Search: With pre-approval in hand, you can start searching for properties within your budget. For listings, visit Buy Commercial Properties in Dubai.

Application Submission: Once you find a property, the broker submits your mortgage application to multiple lenders.

Offer and Negotiation: The broker reviews offers from lenders and negotiates the best terms on your behalf.

Final Approval and Closing: After selecting the best offer, the broker assists with the final approval and closing process, ensuring all documentation is complete.

For expert mortgage advice, consider Mortgage Financing in Dubai.

Key Considerations When Choosing a Mortgage Broker

Experience and Expertise: Choose a broker with extensive experience in the Dubai mortgage market. An experienced broker will have a deep understanding of market dynamics and lender requirements.

Fee Structure: Understand the broker's fee structure. Some brokers charge a flat fee, while others earn a commission from the lender. Ensure you are comfortable with their fees and services.

Customer Reviews: Read customer reviews and testimonials to gauge the broker's reputation and track record. Positive reviews can indicate a reliable and effective broker.

Personal Connection: Choose a broker who you feel comfortable working with and who understands your needs and goals.

Specialization: Some brokers specialize in specific types of mortgages or property transactions. Find a broker whose expertise aligns with your needs.

For rental options, visit Apartments For Rent in Dubai.

Benefits of Using a Mortgage Broker

Access to Exclusive Deals: Brokers often have access to deals that are not available to the general public.

Expert Negotiation: They can negotiate better terms and rates with lenders.

Stress Reduction: Brokers handle the complex paperwork and administrative tasks, reducing your stress.

Comprehensive Financial Advice: They provide valuable financial advice, helping you make informed decisions.

Customized Solutions: Brokers offer solutions tailored to your specific needs and financial situation.

For villa listings, visit Villas For Sale in Dubai.

Real-Life Success Story

Consider the case of Emma, a first-time homebuyer in Dubai. With the help of a mortgage broker, she secured a favorable mortgage rate and purchased her dream apartment in Dubai Marina. The broker's expertise and negotiation skills saved her time and money, making the home-buying process smooth and stress-free.

Conclusion

Working with a mortgage broker in Dubai can simplify the mortgage process and help you secure the best deals. By leveraging the broker's expertise, relationships with lenders, and negotiation skills, you can achieve your homeownership goals more efficiently. For more resources and expert advice, visit Mortgage Financing in Dubai.

3 notes

·

View notes

Text

Expert Tips for Choosing a Mortgage Consultant in Dubai

Choosing the right mortgage consultant in Dubai is crucial for securing the best mortgage deal and ensuring a smooth property purchase process. This blog provides expert tips to help you choose the best mortgage consultant for your needs.

For more information on home loans, visit Home Loans in Dubai.

Understanding the Role of a Mortgage Consultant

A mortgage consultant acts as an intermediary between borrowers and lenders, helping clients find the best mortgage deals, negotiate terms, and complete the necessary paperwork. Their expertise and connections in the industry can save you time, money, and stress.

Expert Tips for Choosing a Mortgage Consultant

Research and Referrals: Start by researching mortgage consultants online and asking for referrals from friends, family, and colleagues who have recently purchased property in Dubai.

Check Credentials: Ensure that the consultant is licensed and has a good reputation in the industry. Check for certifications and memberships in professional organizations.

Interview Multiple Consultants: Schedule consultations with several mortgage consultants to compare their services, fees, and approach.

Evaluate Experience: Choose a consultant with extensive experience in the Dubai mortgage market and a track record of successful transactions.

Assess Communication Skills: Ensure that the consultant communicates clearly and promptly, and is willing to answer all your questions.

Review Testimonials and Reviews: Read client testimonials and online reviews to gauge the consultant’s reliability and customer satisfaction.

Understand Fees and Charges: Be clear about the consultant’s fees and charges upfront to avoid any surprises later on.

Check Availability: Ensure that the consultant is available and willing to provide ongoing support throughout the mortgage process.

For property purchase options, explore Buy Apartments in Dubai.

Real-Life Success Story

Consider the case of Ahmed, an expatriate in Dubai looking to buy his first home. Ahmed was initially overwhelmed by the mortgage options and the complexities of the application process. He decided to seek the help of a mortgage consultant based on recommendations from colleagues. The consultant assessed Ahmed’s financial situation, explained the different mortgage products available, and helped him choose the best one for his needs.

Throughout the process, the consultant handled all the paperwork, negotiated with lenders to secure a competitive rate, and kept Ahmed informed at every step. This personalized service made a significant difference, reducing Ahmed’s stress and ensuring a smooth and successful home purchase.

For mortgage consulting services, consider Mortgage Broker Dubai.

Common Challenges and How to Overcome Them

Navigating the mortgage market in Dubai comes with its own set of challenges. Here are some common challenges and how to overcome them:

Understanding Complex Terms: The mortgage market is filled with complex terms and jargon that can be confusing. A mortgage consultant can break down these terms and explain them in simple language.

Comparing Different Products: With numerous mortgage products available, comparing them can be overwhelming. A mortgage consultant can provide a clear comparison of different products, highlighting the pros and cons of each.

Handling Documentation: The mortgage application process requires extensive documentation. A mortgage consultant can help you gather and organize the necessary documents, ensuring that everything is in order.

Dealing with Rejections: If your mortgage application is rejected, a mortgage consultant can help you understand the reasons and provide guidance on improving your financial profile for future applications.

Securing the Best Rates: Negotiating with lenders to secure the best rates can be challenging. A mortgage consultant, with their industry connections and expertise, can negotiate on your behalf to get the most favorable terms.

For rental property management services, visit Rent Your Property in Dubai.

Future Trends in Mortgage Consulting

The mortgage consulting landscape in Dubai is continuously evolving, with new trends shaping the market. Here are some future trends to watch out for:

Increased Use of Technology: The integration of technology in the mortgage process is expected to increase, making applications and approvals more seamless.

Sustainability: There is a growing focus on sustainable and energy-efficient properties. Mortgages for green buildings and eco-friendly homes are likely to become more popular.

Flexible Mortgage Products: Lenders are expected to offer more flexible mortgage products to cater to the diverse needs of borrowers.

Regulatory Changes: Ongoing regulatory changes may impact the mortgage market, and staying informed will be crucial for borrowers.

Market Adaptation: The mortgage market will continue to adapt to economic conditions, including interest rate fluctuations and property market trends.

For more resources and expert advice, visit Home Loans in Dubai.

Conclusion

Choosing the right mortgage consultant in Dubai is crucial for securing the best mortgage deal and ensuring a smooth property purchase process. By researching, checking credentials, interviewing multiple consultants, evaluating experience, and assessing communication skills, you can choose a reliable consultant who will guide you through the mortgage process. For more resources and expert advice, visit Home Loans in Dubai.

6 notes

·

View notes

Text

I forgot Hypothecation when I "Hypothesis" yesterday

Hypothecation is the pledging of an asset as collateral for a loan, without transferring the property's title to the lender. In a mortgage, the property purchased is used to secure the loan, but the lender holds the title.

Hypothecation means "Hypothetically, I own this [thing]". But in the cases of mortgages and liens, the bank (or carpenter or automotive mechanic) can take ownership of the [thing] when they have evidence of inability to pay. (Or they feel like; if the local jurisdiction is particularly slothful or biased.)

This is a two way street. Hypothetically, the bank owns the asset, hypothetically the borrower owns the asset. And so the asset can be present in both the lender and borrowers financial portfolio. Because, hypothetically, they own it.

Hypothecation and "Hypothetical assets" aren't only Houses and Cars. Hypothecation, can include stocks, shorts, and Burts Beeswax Lip Balm.

They can include cash, loans, or any other tool known to man.

Re-Hypothecation is the tool where a financial entity uses a hypothetical asset as leverage in another dealing. "Hypothetically I own this asset, so Hypothetically, I can take a loan against it. (Mortgage/Lien) this is how an entity can get a pay day loan for an asset, they might not own.

This ties into CDOs because it's what most of them are made of. They sell their paychecks tomorrow, for a pay day loan today. But since financial institutions are selling them all to each other, nobody actually knows who owns what for how much.

And the individual can be held liable for a forgotten lien or mortgage they paid off a decade ago, when a financial institution needs money and reviews their books and sees an "asset" without being able to trace it completely through this financial web. Or, the individual can lose assets they're owed because the bank assumes them. (Like it assumes risk.)

These are hypothetical worst case scenarios that have not been addressed as of yet.

8 notes

·

View notes

Text

CASH FLOW: The Bloodline of Business

See Into Your Financial Future

In the dynamic world of entrepreneurship, success hinges not only on brilliant ideas and strategic planning but also on mastering the art of cash flow management. Cash flow, often referred to as the lifeblood of a business, is the movement of money in and out of your business, and understanding its importance is paramount for new entrepreneurs.

The Importance of Cash Flow

Cash flow is the heartbeat of your business, fueling its daily operations, growth initiatives, and long-term sustainability. Here's why it's crucial for new entrepreneurs:

Survival and Stability: Positive cash flow ensures your business can cover its day-to-day expenses, such as rent, utilities, payroll, and inventory. Without sufficient cash flow, even the most promising ventures can falter and fail.

Opportunity and Growth: Healthy cash flow provides the flexibility to seize opportunities for expansion, innovation, and investment. Whether it's launching new products, entering new markets, or scaling operations, a robust cash flow empowers entrepreneurs to pursue growth with confidence.