#midcap stocks in 2022

Text

Add These 2022's 10 Biggest Dividend Paying Midcap Stocks To 2023 Watchlist

List of top ten midcap stocks which have paid the highest dividends for 2022Indian share markets are on a roller coaster ride once again. This has raised the need for stable income assets and consistent payouts, to protect against high inflation and high interest rates.For years, investors have looked at dividend-paying stocks as an answer for steady income. By providing much-needed income that other types of assets have lacked, dividend stocks have become the go-to investment.The preference for these dividend stocks intensified after the US Fed embarked on the ambitious campaign to raise interest rates to rein in inflation.With billions of dollars pouring into dividend stocks, the demand for these stocks has increased significantly.Among the many categories, midcap stocks usually have a higher growth potential to generate consistent cash flows.Keeping that in mind, we take a look at 2022's ten biggest dividend-paying midcaps. Add these to your 2023 watchlist.#1 Oracle Financial ServicesFirst on the list is Oracle Financial Services.For the financial year 2022, the company declared a final dividend of Rs 189 per share, with a dividend payout ratio of 86.8 per cent. This payout was on the back of a marginal reduction in employee retention costs.Oracle Financial Services has been a consistent dividend payer. Since 2002, the company has declared 13 dividends. We even covered an in-depth editorial on why Oracle Financial is the greatest dividend stock of all time.The five-year average dividend payout ratio stands at 75.9 per cent. The dividend yield over the past five years has averaged 4.8 per cent.Oracle Financial Services is a subsidiary of Oracle Global (Mauritius). With strong in-house R&D centers, Oracle has produced products used by banks in more than 150 countries around the world. Oracle assists in implementing artificial intelligence (AI) in the company and IT processes.The company has a healthy cash balance of Rs 69 billion as of 31 March 2022, up 3.6 per cent YoY.With its foray into the sovereign cloud regions with EU-based users, the company is looking forward to expanding its cliental base. This is expected to boost the profits, inching the cash balance higher.Oracle Financial Services' Dividend History

#2 Bayer CropScienceSecond, on the list is Bayer CropScience.The company declared a final dividend of Rs 150 per share for the financial year 2022. The dividend payout ratio of the company stands at 104.5 per cent. The 17 per cent rise in net sales was the driving factor for the payouts.Since 2001, the company has paid a total of 25 dividends.The payout ratio over the last five years stands at 54.4 per cent, while the dividend yield stands at 1.4 per cent.Bayer CropScience is an Indian subsidiary of Bayer AG, the world's largest pharmaceutical and life sciences company based out in Germany.It provides various products and services through its 3 business divisions: crop science, pharmaceutical products, and consumer healthcare.The company has a healthy cash balance of Rs 7.9 billion as of 31 March 2022, down 34 per cent YoY, due to an increase in manufacturing costs.The company strengthens its manufacturing for the financial year 2023 by setting up a new plant to increase the global production volumes.Bayer CropScience's Dividend History

#3 Bajaj Holdings and InvestmentThird on the list is Bajaj Holdings and Investments.The company has declared a final dividend of Rs 115 per share for the financial year 2022, with the dividend payout ratio coming at 31.6 per cent. The 17 per cent rise in net earnings was the driving factor for the payouts.Since 2001, the company has paid a total of 25 dividends. The payout ratio over the last five years stands at 17.5 per cent, while the dividend yield stands at 1.6 per cent. It was due to the increase in the profits.Bajaj Holdings & Investment is a non-banking finance company (NBFC). The company was formed when Bajaj Auto de-merged in 2007.The manufacturing business was transferred to Bajaj Auto (BAL), while the wind farm and financial services business was vested with Bajaj Finserv (BFS).The company has a healthy cash balance of Rs 328.9 million as of 31 March 2022, down 39 per cent YoY, due to a decrease in sales and weak markets.The company is planning to reduce the capex for 2023, due to weaker markets and planning to focus on the earnings from dividend and interest income.Bajaj Holdings and Investment Dividend History

#4 Hindustan AeronauticsFourth on the list is Hindustan Aeronautics.For the financial year 2022, the company declared a final dividend of Rs 50 per share, with a dividend payout ratio of 37 per cent. This payout was due to a 91 per cent jump in the net profit of the firm.Since 2008, the company has declared 15 dividends.The five-year average dividend payout ratio stands at 75.9 per cent. The dividend yield over the past five years has been 3.6 per cent.Hindustan Aeronautics manufactures and maintains aircraft and helicopters for the Indian Airforce, Indian Army, ISRO, Indian Navy, and Indian Coast Guard, among others. As of March 2022 quarter, it had a healthy cash balance of Rs 143 billion, up 99 per cent YoY.To increase sales, HAL signed a $716 million deal with GE Aviation for the supplies of engines.It has also set up a Rs 2.1 billion Integrated Cryogenic Engine Manufacturing Facility (ICMF) that would cater to the entire rocket engine production under one roof for ISRO. This will eventually result in higher profits for the company.Hindustan Aeronautics Dividend History

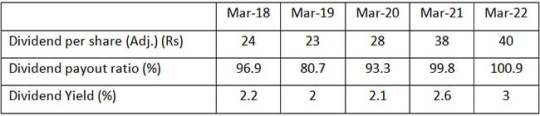

#5 ColgateFifth on the list is Colgate.Colgate declared an interim dividends of Rs 21 and a final dividend of Rs 19 per share. For the financial year 2022, the company paid Rs 40 per share, with a dividend payout of 100.9 per cent. This higher dividend payout was due to a 6 per cent increase in the sales of the company.Since 2001, the company has declared 58 dividends. The five-year average dividend payout ratio stands at 94.3 per cent. The dividend yield over the past five years has been 2.3 per cent.Colgate-Palmolive (India) is India's leading provider of scientifically proven oral care products. The range includes toothpaste, toothpowder, toothbrushes, and mouthwashes.The cash balance for the financial year 2022 stands at Rs 3.5 billion, up 37 per cent YoY. For the financial year 2023, company is focusing on increasing the free cash by increasing its sales.Colgate's Dividend History

#6 Balkrishna IndustriesSixth on the list is Balkrishna Industries.Balkrishna Industries, for the financial year 2022, declared two interim dividends of Rs 4 per share, a special dividend of Rs 12 per share and a final dividend of Rs 4 per share each. The company paid a total of Rs 28 per share, with a dividend payout ratio of 37.7 per cent.The company declared a special dividend on the occasion of the diamond jubilee year. Since 2002, the company has declared 48 dividends. The five-year average dividend payout ratio stands at 29.3 per cent. The dividend yield over the past five years has been 1.3 per cent.Balkrishna Industries is engaged in the business of manufacturing and selling of Off-Highway Tyres (OHT). In the specialist segments such as agricultural industrial, construction earthmovers, and port mining.The cash balance for the financial year 2022 stands at Rs 317 million, down 34 per cent YoY.The company has planned a capex investment of Rs 17 billion to ramp up production over 2-3 years. It is due to an increase in demand for tyers, further boosting sales.Balkrishna Industries Dividend History

#7 Supreme IndustriesSeventh on the list is Supreme Industries.For the financial year 2022, Supreme Industries declared an interim dividend of Rs 6 per share and a final dividend of Rs 18 per share. The company paid a total of Rs 24 per share, with a dividend payout ratio of 39.9 per cent. The high payout was due to a decrease in the finance cost and an increase in sales.Since 2000, the company has declared 39 dividends. The five-year average dividend payout ratio stands at 38.1 per cent. The dividend yield over the past five years has been 1.2 per cent.Supreme Industries is a leader in India's plastic industry. It is engaged in the production of plastic products and operates in various product categories like plastic piping systems, Cross laminated film and many more.The cash balance for the financial year 2022 stands at Rs 5.3 billion, down 31 per cent YoY. It was due to higher raw material prices.For the financial year 2023, to upscale the production, it has planned a capital expenditure of Rs 7 billion across the various segments, including bath fittings, composite LPG cylinders and many more.Supreme Industries' Dividend History

#8 Cummins IndiaEight on the list is Cummins India.Cummins declared an interim dividend of Rs 8 per share and a final dividend of Rs 10.5 per share.The company paid a total of Rs 18.5 per share, with a dividend payout ratio of 60.9 per cent. The sales for the company rose by 41 per cent, leading to an increase in dividend payout.Since 2001, the company has declared 44 dividends. The five-year average dividend payout ratio stands at 69.2 per cent, with a dividend yield of 2.4 per cent.Cummins designs, manufactures, and sells diesel and alternative fuel engines, generators, and related accessories. It also provides after-sale services.The company has a strong domestic presence. Being a part of Cummins USA, it also has a global presence. With robust sales, the company's cash balance saw a growth of 47 per cent YoY to Rs 14.3 billion.Going forward, the company plans to increase its presence in the fishing boat segment to further boost sales.Cummins India's Dividend History

#9 CRISIL Ninth on the list is CRISIL.For the financial year 2022, the company has declared a final dividend of Rs 15 per share, with the dividend payout standing at 72 per cent. The increase in payout was due to the reduction in sales tax and higher sales.Since 2001, the company has declared 69 dividends. The five-year average dividend payout ratio stands at 66.5 per cent, with a dividend yield of 1.7 per cent.CRSIL is one of the leading rating agencies in India. It also provides research and risk advisory services.The company's rating services span an entire range of debt instruments for over 8,000 companies. It has a presence across the globe and draws most of its revenue from North America, India, and Europe.Due to the higher demand for research reports due to the prevailing volatile market, the cash balance saw a growth of 5.6 per cent YoY.Going forward, CRISIL plans to leverage its parent company's brand (S&P Global) to expand in the international market to boost sales.CRISIL's Dividend History

#10 EmamiLast on the list is Emami.For the financial year 2022, the company has declared a final dividend of Rs 8 per share, with the dividend payout standing at 41.5 per cent. The acquisition of Dermicool and other brands witnessed a 30 per cent growth boosting the dividend payouts.Since 2000, the company has declared 29 dividends. The five-year average dividend payout ratio stands at 27.8 per cent, with a dividend yield of 1.5 per cent.Emami is one of India's leading FMCG companies engaged in manufacturing & marketing personal care & healthcare products. Emami is the flagship company of the diversified Emami Group.For the March 2022 quarter, the cash balance of the company stands at Rs 1.2 billion, down by 67 per cent due to acquisition expenses. Going forward, the company is eyeing expansion in the ayurvedic market to increase its presence.Emami's Dividend History

To concludeMidcap stocks are often overlooked from a dividend investing perspective.Midcap stocks act faster in the changing market dynamics and can produce better returns. Due to this higher growth potential trait, they generate consistent free cash flows.They also tend to enjoy greater diversification, better access to capital, and more proven management teams compared to small-cap companies. With increasing free cashflows and larger payouts, they are considered a good buffer during times of market volatility.Due to the tussle between the bears and bulls, midcap dividend stocks are among the best bargain on the board. However, not all have created wealth equally.If you are investing in dividend stocks, you should investigate the company's history of dividend payments and whether they could continue to make higher payouts.Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. This article is syndicated from Equitymaster.com.(Except for the headline, this story has not been edited by NDTV staff and is published from a syndicated feed.)

Source link

Read the full article

#2022s#add#Biggest#Dividend#dividendgrowthstocks#dividendstocks2022#highdividendstocks#highdividendyieldstocks#listofdividend-payingstocks#Midcap#midcapdividendstocks#midcapstocks#Paying#Stocks#Stocksanalysis#Watchlist

0 notes

Text

British Assets Climb, Mid-Cap Stocks Lead Following Labour Election Win

British domestic-focused mid-cap stocks were the biggest gainers on Friday after the centre-left Labour Party achieved a decisive win in the parliamentary election. This resulted in gains for blue chip stocks, government bond prices, and the pound.

Hopes for economic stability under the new government, following 14 years of Conservative Party rule, boosted the FTSE 250 midcap index by as much as 1.8% in early trading to its highest level since April 2022. The blue-chip FTSE 100 index rose by 0.2%, and the yield on 10-year British government bonds, or gilts, dropped 3 basis points to 4.17%, slightly better than other European markets. Bond yields move inversely to prices.

Labour secured a massive majority in the 650-seat parliament, while Rishi Sunak's Conservatives faced the worst defeat in the party's history, attributed to voter dissatisfaction over the cost of living crisis, failing public services, and various scandals.

"A landslide victory provides the sort of clarity and stability that equity markets need in an increasingly volatile world," said Ben Ritchie, head of developed market equities at abrdn. He noted that businesses with significant exposure to the UK economy, especially those in the FTSE 250 and FTSE Small Cap, stand to benefit.

British home builders were particularly strong, with an index tracking their shares up 2.3%. Aruna Karunathilake, portfolio manager at Fidelity, believes a Labour-majority government will positively impact housebuilders and construction materials by reinstating housebuilding targets and investing in local planning departments to alleviate planning bottlenecks.

Analysts at Goldman Sachs noted that Labour's policies imply relatively limited changes to fiscal policy but would modestly boost demand in the near term, leading them to raise their forecasts for British GDP growth by 0.1 percentage points for both 2025 and 2026.

British government bonds, or gilts, will be closely watched, especially given the memory of the market chaos triggered by former Prime Minister Liz Truss' "mini budget" in September 2022. Truss lost her parliamentary seat in Thursday's election. The new government will need to maintain investor trust while addressing numerous economic challenges, although the stability brought by the election result is seen as a positive for the gilt market.

James Lynch, fixed income manager at Aegon Asset Management, remarked that the election result reduces one of the sources of volatility in the gilt market, providing stability for the coming years. The premium that investors demand for holding gilts over top-rated German 10-year bonds has remained stable this year at around 160 basis points, down from 230 basis points during the mini-budget crisis of 2022.

The focus for bond investors will now turn to the Bank of England, which is expected to lower interest rates either in August or September. The pound rose nearly 0.13% against the dollar to $1.2775 and remained steady against the euro at around 84.72 pence. The British currency has been edging up since Sunak called the election in late May and is the strongest-performing major currency this year, up 0.3% against the dollar. On a trade-weighted basis, the pound is back to its level at the time of the Brexit vote in 2016, reflecting trader and investor optimism that a period of intense market volatility under the Conservatives may be coming to an end.

Read the full article

0 notes

Text

10 Best Mutual Funds for Next 10 Years

One of the best ways to create wealth is to invest in mutual fund schemes. In the medium to long term, these can fetch good returns. However, investors should consider selecting funds based on their financial goals, risk appetite and tenure of the investment. In this article we would provide the list of 10 Best Mutual Funds for Next 10 years to invest in India.

Why to invest in Mutual Funds?

Before getting into the specific list of mutual funds to invest for next 10 years, let us understand the fundamentals of mutual funds. While there are several investment options, mutual funds has been gaining prominence in the last few years. Some of the mutual funds have generated 10x to 12x returns in the last 10 years. Mutual Funds pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities, managed by professional fund managers.

What are the benefits of investing in mutual funds?

- Diversification: Mutual Funds does not invest in single stock or bond. They spread the investment across various assets which helps to reduce the risk.

- Professional Management: Expert fund managers make informed investment decisions on your behalf.

- Liquidity: Investors can buy and sell mutual fund units based on NAV (Net Asset Value) at any given point of time except where there is lock-in period.

- Transparency: Fund houses keeps providing updates on the portfolio.

- Affordability: Investors can invest as low as Rs 500 in mutual funds. In some funds they can invest even as low as Rs 100.

What is the Economic Outlook for India?

Before identifying the best mutual funds for the next 10 years, let's assess the economic landscape of India and key factors shaping its growth.

- Demographic Dividend: With a young and dynamic population, India enjoys a significant demographic advantage, fueling consumption and economic growth.

- Infrastructure Development: Government initiatives and investments in infrastructure projects aim to enhance connectivity, spur economic activity, and attract investments. Our recommended Infrastructure mutual funds in 2022 have doubled in the last 2 years.

- Digital Transformation: The rapid adoption of digital technologies is revolutionizing various sectors, boosting efficiency and innovation.

- Emerging Sectors: Industries such as renewable energy, healthcare, and e-commerce present lucrative opportunities for investors, driven by evolving consumer preferences and technological advancements.

Best Mutual Funds for Next 10 Years to Invest in India:

Now, let's explore the top 10 mutual funds to invest for next decade, considering factors such as historical performance, fund management expertise, and investment strategy. We have provided 2 table, one based on annualized returns and second based on SIP returns. One can use them like a model mutual fund portfolio for investments.

Best Mutual Funds for Next 10 Years – Annualised Returns

Category

Mutual Fund Name

3 Yrs

5 Yrs

10 Yrs

Index / Largecap

UTI Nifty 50 Index Fund

16.2%

14.8%

13.8%

Index / Largecap

UTI Nifty Next 50 Index Fund

23.2%

19.0%

NA

Index / Largecap

Nippon India Largecap Fund

26.8%

18.8%

18.4%

Index / Largecap

Baroda BNP Paribas Large Cap Fund

19.8%

18.0%

16.2%

Midcap / Smallcap

Quant Mid Cap Fund

38.3%

35.3%

21.9%

Midcap / Smallcap

SBI Small Cap Fund

25.4%

26.8%

27.2%

Flexicap

Parag Parikh Flexi Cap fund

22.7%

24.5%

20.0%

Flexicap

Quant Flexicap fund

32.5%

32.0%

24.3%

Hybrid

ICICI Prudential Equity & Debt Fund

26.2%

26.0%

19.8%

International

Motilal Oswal Nasdaq 100 FoF

12.0%

21.8%

NA

Best Mutual Funds for Next 10 Years – SIP Returns

Category

Mutual Fund Name

3 Yrs

5 Yrs

10 Yrs

Index / Largecap

UTI Nifty Index Fund

15.8%

18.0%

14.3%

Index / Largecap

UTI Nifty Next 50 Index Fund

30.5%

25.7%

NA

Index / Largecap

Nippon India Largecap Fund

28.0%

26.7%

18.3%

Index / Largecap

Baroda BNP Paribas Large Cap Fund

24.4%

22.8%

17.0%

Midcap / Smallcap

Quant Mid Cap Fund

42.2%

42.6%

26.5%

Midcap / Smallcap

SBI Small Cap Fund

25.8%

30.1%

23.6%

Flexicap

Parag Parikh Flexi Cap fund

24.7%

26.8%

20.9%

Flexicap

Quant Flexicap fund

34.0%

38.0%

25.4%

Hybrid

ICICI Prudential Equity & Debt Fund

26.2%

26.8%

19.1%

International

Motilal Oswal Nasdaq 100 FoF

19.2%

19.9%

NA

Investment Strategies for Long-Term Growth:

While selecting mutual funds for the next 10 years, it's crucial to adopt a disciplined investment strategy aligned with your financial goals and risk tolerance.

- Asset Allocation: Diversify your portfolio across asset classes to mitigate risk and enhance returns.

- Systematic Investment Plan (SIP): Invest regularly through SIPs to benefit from rupee cost averaging and harness the power of compounding. One can easily make out 1 Crore with 5,000 per month SIP investments.

- Stay Informed: Keep an eye on market developments, economic indicators, and fund performance to make informed investment decisions.

- Review and Rebalance: Periodically review your investment portfolio and rebalance it to maintain optimal asset allocation and adapt to changing market conditions.

FAQs (Frequently Asked Questions):

To address common queries regarding mutual fund investments, here are some frequently asked questions along with detailed answers:

1. What are the key factors to consider when selecting mutual funds for long-term investment?

First step is to consider financial goal, risk appetite and tenure of investment. As a second step, when selecting mutual funds for long-term investment, consider factors such as historical performance, fund manager expertise, investment strategy, expense ratio, and risk-adjusted returns.

2. How can I assess the risk associated with mutual fund investments?

You can assess the risk associated with mutual fund investments by analyzing factors such as the fund's investment objective, asset allocation, portfolio diversification, and historical volatility.

3. Is it advisable to invest in sector-specific mutual funds for long-term growth?

Investing in sector-specific mutual funds can be risky as it exposes your portfolio to concentration risk. It's advisable to opt for diversified equity funds with exposure to multiple sectors for long-term growth.

4. What role does inflation play in mutual fund investments?

Inflation erodes the purchasing power of money over time, affecting the real returns on your investments. It's essential to choose mutual funds that offer returns exceeding the inflation rate to preserve and grow your wealth. Investors should periodically check and should not end up in investing in bad funds which we indicated in our Worst Performing Mutual Funds in the last 10 year.

5. How often should I review my mutual fund investments?

It's recommended to review your mutual fund investments periodically, typically every six months to a year, to ensure they remain aligned with your financial goals and risk tolerance. Make adjustments as necessary based on changes in market conditions or your investment objectives.

6. Can mutual funds help me achieve my long-term financial goals such as retirement planning?

Yes, mutual funds can play a crucial role in helping you achieve long-term financial goals such as retirement planning by offering the potential for capital appreciation and regular income through systematic investments over time. They should also build strategy and opt for Two Bucket Strategy of Investment which can help them to get maximum benefit.

Conclusion: In conclusion, selecting the best mutual funds for the next 10 years requires careful consideration of various factors, including economic outlook, fund performance, and investment strategy. By diversifying your portfolio across equity funds, adhering to a disciplined investment approach, and staying informed about market trends, you can build a robust investment portfolio geared towards long-term growth and wealth creation.

Read the full article

#10MutualFundsforNext10Years#MutualFunds#MutualFundstoinvestfornextdecade#TopMutualFundsfornext10years

0 notes

Text

WPP Plc (LON: WPP) is a listed company on the London Stock Exchange. It specializes in creative transformations and communication services, operating through Global Integrated Agencies, Public Relations, and Specialist Agencies segments. It is a midcap company with a market capitalization of £8.2 Billion.

Financial snapshot of the recent year

Financially, the company is bouncing back from its negative revenue growth. The sales growth has been substantially relevant with a CAGR of 6.17% since 2021. The company reported a revenue of £14.4 Billion to a net profit of £682 Million in 2022. It created an Earning per share of £0.62.

The company is making an operating margin of 11.6% and is left with a net profit margin of 4.7%. However, despite the low margins, the firm has consistently been net profit positive over the years. It has helped generate an average return on equity of 15% over the years.

The dividend structure of the company is also very interesting to the investors as it regularly pays dividends. In 2022, the management accounted for a dividend payout of 58%, which created a dividend per share (DPS) of £0.39.

Technical Analysis and Prediction of WPP Stock Price

The WPP stock price has been declining since the start of 2023. It has come down from a level of £1089 in February to the current market price of £761, which is a decline of over 30%.

As of this writing, the WPP stock price has taken a rebound as the bears have reclaimed the immediate resistance level of £779. The bulls may either try for a breakout or they may rest until the WPP stock price goes to its immediate support level of £737.

MACD and RSI levels

Through these support and resistance levels, indicators like MACD are showing a bullish trend. It occurred when the MACD line made a bullish crossover with its EMA back on the 29th of August. At present, both lines are trying to get past the neutral level of Zero. The MACD and EMA are at -6.1 and -8.6 respectively.

The RSI graph is showing a similar trend to that of MACD. The RSI line has made a recovery from its oversold zone of 30 and it is currently at a neutral zone of 46. If the bulls will come over the immediate resistance, The RSI will rise toward the 70th level.

Conclusion

WPP Plc (LON: WPP) has been listed on the London Stock Exchange. It specializes in creative transformations and communication services. This firm has been performing well for the last two years and is giving regular dividends. However, the WPP stock price is down from the beginning of 2023. A glimmer of hope is arriving as the bulls are making a comeback.

Technical levels

Support: £737 and £674

Resistance: £779 and £858

Source

0 notes

Text

ETFs

There are a variety of tax-advantaged saving plans for U.S. investors to save for retirement. These include 401(k) accounts, individual retirement accounts (IRAs), and Roth IRAs. Many investors favor a Roth IRA because, while they are funded with after-tax dollars, the money can be withdrawn on a tax-free basis provided that certain conditions are met.1

Like other retirement accounts, Roth IRAs are used largely for long-term buy-and-hold investing. A primary reason for this approach is that retirement accounts are designed to accumulate wealth over the long term for retirement. Thus, people investing in a Roth IRA typically have a similar long-term time horizon.

ETFs

Given this approach, Roth IRA investors may be best off by selecting a small number of inexpensive core funds to provide broad exposure to multiple asset classes. Three categories that together offer this type of broad exposure are U.S. stocks, bonds, and global investing. One way for investors to gain exposure to these three categories is exchange-traded funds (ETFs), which are a type of pooled investment security that operates much like a mutual fund. But unlike mutual funds, ETFs can be purchased or sold on a stock exchange the same way that a stock can.

For this story, we will look at the best ETFs in each of these categories. ETFs are especially appropriate investment vehicles to consider for Roth IRAs because these funds are typically designed to be low-cost and diverse.

KEY TAKEAWAYS

Roth individual retirement accounts (Roth IRAs) are tax-advantaged retirement accounts appropriate for long-term investment strategies.

Three categories that together offer Roth IRA investors broad exposure are U.S. stocks, bonds, and global investing. Exchange-traded funds (ETFs) are a good way for investors to gain exposure to these three categories.

The best U.S. stock ETFs for Roth IRAs are funds in a seven-way tie: IVV, VOO, SPLG, SPTM, ITOT, VTI, and BKLC.

The best bond ETF for Roth IRAs is BKAG.

The best global investing ETF for Roth IRAs is SPDW.

Investopedia’s methodology for selecting the best ETFs for Roth IRAs was based on a search of ETF Database for funds that trade in the United States, and then for funds tracking major market indexes for each of three categories: U.S. stocks, bonds, and global investing. All data below are as of March 13, 2022, except where indicated.

Best U.S. Stock ETF(s) for Roth IRAs: Multi-Way Tie

Best S&P 500 ETFs: iShares Core S&P 500 ETF (IVV), Vanguard S&P 500 ETF (VOO), SPDR Portfolio S&P 500 ETF (SPLG)

Best total market ETFs: SPDR Portfolio S&P 1500 Composite Stock Market ETF (SPTM), iShares Core S&P Total U.S. Stock Market ETF (ITOT), Vanguard Total Stock Market ETF (VTI)

Morningstar U.S. Large Cap ETF: BNY Mellon U.S. Large Cap Core Equity ETF (BKLC)

The funds listed above represent some of the best U.S. stock ETFs across subcategories that include the S&P 500 Index and total market exposure. All of the funds listed above have an expense ratio of 0.03%, except for BKLC, which has an expense ratio of 0.00%.2345678

In recent years, common index fund providers have engaged in a major price war to entice customers. This means that investors luckily have access to a large number of extremely inexpensive ETFs. In addition to offering similarly low prices, the stock funds listed above are in a seven-way tie because the general options that they offer investors are similar. This means that an investor’s choice may come down to which of these funds is most easily available based on their preferred broker.

As mentioned, some of the funds above track slightly different indexes across subcategories. Investors should decide if they want to track the S&P 500, which is exclusively large-cap stocks, or a total or broad market index, which offers more exposure to small-cap and midcap stocks.9 The latter may bring a bit more volatility to portfolios but also adds diversification.

The final fund listed above, BKLC, is notable because it is a zero-cost fund. It tracks a significantly smaller index of large-cap stocks, with just under 229 holdings compared to more than 500 for the S&P 500. Still, those roughly 200 stocks make up about 70% of available market capitalization, whereas the S&P 500 makes up about 80%. As a result, the difference in exposure is not as large as it may appear to be. Still, investors have reason to be cautious about BKLC. It launched in 2020, meaning that it is largely untested, and it is unclear how this relatively smaller portfolio will perform over a longer term.98

Best Bond ETF for Roth IRAs: BKAG

Expense Ratio: 0.00%

Assets Under Management: $256.5 million

One-Year Trailing Total Return: -2.35%10

12-Month Trailing (TTM) Yield: 1.61% (as of March 11, 2022)

Inception Date: April 22, 20201112

The BNY Mellon Core Bond ETF (BKAG) aims to track the performance of the Bloomberg Barclays US Aggregate Total Return Index, which offers broad exposure to the overall U.S. bond market. The passive ETF’s primary portfolio managers are Gregory Lee and Nancy Rogers, who have managed the fund since it was founded in 2020.11

As of Feb. 28, 2022, BKAG has roughly 2,112 holdings with a weighted average maturity of 8.69 years. Broken down by industry as defined by BNY Mellon, about 40.31% of the portfolio is Treasurys, followed by 27.79% agency fixed rate, with the remaining third in banking, consumer noncyclical, communications, tech, and other areas. All of the ETF’s bonds are investment grade, including 72.71% rated AAA and 14.72% BBB, with the remainder of the portfolio made up of AA and A debt.11

Bonds and stocks work together in a portfolio to manage risk, with bonds generally considered to be less risky than stocks. The proportion of each will depend on factors that include how far an investor is from retirement and how risk-averse that investor is. The traditional investing approach has been to build a portfolio with 60% stocks/40% bonds. But many investors recently have advised allocating a larger percentage of a portfolio to stocks. The thought is that a higher percentage of stocks will increase performance while only slightly increasing risk for most of an investor’s career, unless that investor is quite close to retirement. For this reason, many investors allocate only 10% or less of a portfolio to bonds while young, and even only 10% to 20% into middle age.

Best Global Investing ETF: SPDW

Expense Ratio: 0.04%

Assets Under Management: $12.0 billion

One-Year Trailing Total Return: 1.84%13

12-Month Trailing (TTM) Yield: 3.24%14

Inception Date: April 20, 200715

The SPDR Portfolio Developed World ex-US ETF (SPDW) aims to track the S&P Developed Ex-U.S. BMI Index, an index composed of publicly traded companies domiciled in developed countries outside of the U.S. As of March 13, 2022, the fund has 2,409 holdings. Among the invested funds, 17.47% are allocated to financials stocks, followed by 16.07% to industrials and 10.79% to consumer discretionary names. Japan-based stocks make up 21.6% of the fund’s portfolio, by far the largest share, followed by the United Kingdom, Canada, France, and Switzerland.15

Global investing funds help to diversify a portfolio so that an investor need not rely exclusively on the U.S. economy. If the U.S. is not doing well, investing in other countries that are growing can help a portfolio to better weather the volatility.

SPDW was tied with the BNY Mellon International Equity ETF (BKIE), according to Investopedia’s methodology. However, SPDW has significantly better liquidity, meaning that trading costs are potentially lower. However, BKIE still may have enough liquidity for most small investors. So if your preferred broker offers that fund instead of SPDW, it may be one option worth considering. Both funds are limited to developed markets, which are generally less risky and volatile than emerging market stocks. If you are looking for a global investing fund that includes both developed and emerging markets around the world, the cheapest option is the Vanguard Total World Stock ETF (VT).161517

The Bottom Line

U.S. stock and bond ETFs provide a balance of risk and stability to a Roth IRA portfolio, while global investing funds diversify a portfolio beyond the U.S. in case of U.S. economic turmoil. ETFs, which trade like stocks and are generally low cost, are an efficient way for investors to access these large investment categories. Regarding stock ETFs, there are seven equities funds that are tied as being the best choice for a Roth IRA. The best bond ETF for Roth IRAs is BKAG, while the best global investing ETF is SPDW. Buying one fund from these three categories will enable Roth IRA investors to maximize returns over the long term while limiting risk.

Trade on the Go. Anywhere, Anytime

One of the world's largest crypto-asset exchanges is ready for you. Enjoy competitive fees and dedicated customer support while trading securely. You'll also have access to Binance tools that make it easier than ever to view your trade history, manage auto-investments, view price charts, and make conversions with zero fees. Make an account for free and join millions of traders and investors on the global crypto market.

0 notes

Text

Build Your Portfolio by Investing in the Best Smallcases of 2022

The best smallcase is like finding a needle in a haystack. You must consider the theme, strategy, volatility, minimum amount, free or premium (fee-based), etc. before you finalize the smallcase.

What are smallcases?

Smallcases are baskets of stocks or ETFs (exchange-traded funds) based on the investment plan, theme, idea, and strategy. Through a Demat and trading account from one of the many brokerage houses, investors can analyze Various Smallcases and invest in the basket of funds that best suits their needs.

Who manages smallcases?

Smallcases are structured by SEBI Registered Professionals who curate and shortlist components in every basket based on rigorous proprietary filters. With over 250 smallcases available, finding the best smallcase is like finding a needle in a haystack. You must consider the theme, strategy, volatility, minimum amount, free or premium (fee-based), etc. before you finalize the smallcase.

For premium smallcases, a Fee Is Charged by managers to view constituents of the basket and invest in them. These smallcases are actively managed, with the approach to beat the market and generate great returns. Investors can still access and invest in free access smallcases without any charges. However, the returns generated remain moderate.

Considering all the factors, here are some of the best smallcases of 2022 for investors to consider:

Free Smallcases:

Top 100 stocks: This basket captures India’s powerful companies, offering better stability. It includes large-cap companies with lesser volatility and is the best choice for long-term wealth creation. In the past three years, the smallcase has given a 21.45% annual return on a minimum investment of Rs. 1,227.

All-weather investing: This smallcase is best for investors who prefer steady returns, no matter whether the market is up or down. Investment is divided into three asset classes: equity, debt, and gold, periodically rebalanced depending on the market situation. The basket has given 13.59% annually in three years with a minimum investment of Rs. 3,451.

Premium Smallcases:

Teji Mandi Flagship : This smallcase is known to provide index-beating premium stock advisory and education to its investors. The stocks are shortlisted from NIFTY 500, which provide adequate liquidity and combine short-term and long-term investment views. The portfolio is structured to give investors benefits from stocks in a 12–18-month timeframe. Teji Mandi has strong investment values and usually exit their stakes in stocks if:

Company or industry fundamentals start changing.

Too much negativity surrounds a company.

An extreme macroeconomic/market situation occurs.

In some instances, they exit volatile markets and hold some percentage of the portfolio in stable liquid ETFs such as ‘liquid bees’. Teji Mandi Flagship has given 80.36% CAGR in the past year with a minimum investment of Rs. 23,259.

Teji Mandi Multiplier: This is a concentrated yet well-diversified portfolio of midcap and small-cap stocks. The basket is ideal for investors who want to generate significant wealth over a long horizon. Benefits of this portfolio are:

Allocation of capital: Teji Mandi invests in companies that have a great track record of capital allocation, excellent corporate governance, and strong, sustainable competitive advantage.

Read More about best smallcase to invest in 2022 in india

0 notes

Text

Is IDEXX Laboratories (IDXX) a High-Growth Stock?

New Post has been published on https://petn.ws/Wj0Y9

Is IDEXX Laboratories (IDXX) a High-Growth Stock?

Baron Funds, an investment management company, released its “Baron Asset Fund” fourth quarter 2022 investor letter. A copy of the same can be downloaded here. The fund increased by 12.21% in the fourth quarter, outperforming the Russell Midcap Growth Index which returned 6.90%. Stock selection and underexposure to stocks with high measures of Residual Volatility and […]

See full article at https://petn.ws/Wj0Y9

#PetFinancialNews

0 notes

Text

Will Mid-cap Stocks Rule the Roost in 2023?

Indian securities markets continued to shine bright all throughout 2022 when other global equities collapsed over ongoing Covid-19 and Russia-Ukraine war concerns. In fact, the Indian equity market became the world’s 5th largest stock market, keeping aside the UK, Canada, and Saudi Arabia.

This massive growth was a culmination of increased interest displayed by domestic investors, who were further empowered by the influx of a hoard of stock trading apps. Not only did these stock trading apps provide investors with the convenience to trade ‘anytime, anywhere’ but also advanced financial literacy by providing requisite information about various securities and trading strategies.

Midcaps in 2022

While Indian securities did showcase colossal growth in 2022, most of it was large-cap driven. Indeed, NIFTY50 gained 5.7% versus only 3.9% for NIFTY Midcap 150 in 2022. These trends suggest that midcaps did not bring top-of-the-chart returns for their investors, but at least they did outperform the small-cap index, which slipped 13% in 2022.

However, when analysed over a 3-year period (since investors generally stay invested in equities for at least 3 years), NIFTY Midcap 100 has outperformed the NIFTY 100. The former soared 73.59% with the large-cap index falling short at 46.44%. Even the small-cap indices posted substantial gains over the same duration, far outstripping the benchmark index.

Midcaps Outlook

Past trends indicate that the performance of mid-cap stocks follows a cyclical pattern compared to large-cap stocks. So, with mid-caps outdoing large-caps over the 3-year duration may not exactly spell a boom for its investors this year.

However, considering the evolving economic outlook, mid-cap stocks may still stand in good stead. With expectations of a significant infrastructure push in the budget, property cycle revival on the anvil, and with RBI set to decelerate its pace of interest rate hikes, these stocks may well see some growth offshoots.

Additionally, the credit quality has improved meaningfully in the economy, thus boding well for mid-cap banking stocks. Even the pharma companies may see a reversal in their fortunes in 2023 on account of new drug launches.

But concerns remain with the US being in a tight spot over inflation and recessionary concerns, which may domino through emerging markets over fewer exports. Also, commodity price fluctuations and tight money policy may well restrain profit-making for some mid-caps.

What Should Investors Do?

The way things stand today, sectors like banking and financial services (BFIS), manufacturing, and engineering appear well-positioned for solid gains in 2023. But sectors, such as consumer staples, IT, and automobiles may face some setbacks, especially IT considering the massive layoffs.

If cherry-picking sectors is not your forte, then it’s best to stick to diversified funds. Multi-cap or Flexi-cap funds that hold stocks in a variety of sectors, spread across different market caps are an ideal way to ride this turbulent period while ensuring wealth generation.

Are you looking for an easy-to-use, safe, and secure stock trading app to kick-start your trading journey? Try Angel One’s super stock trading app today for a swift and frictionless experience.

0 notes

Text

firstsource solutions stock price: Chart Check: This midcap offers attractive risk-reward post 40% fall from highs; contra buy?

, part of the IT Services industry, has fallen by about 40% from its February 2022 high but recent consolidation at lower levels suggests buying demand near support.

High risk traders can look to buy the stock for a long term target above Rs 200 in the next 5-6 quarters, suggest experts.

The stock hit a 52-week high of Rs 168 on 2nd February 2022 but it failed to hold on to the momentum. The…

View On WordPress

0 notes

Text

10 Most Undervalued Midcap Stocks To Watch In 2023

10 Most Undervalued Midcap Stocks To Watch In 2023

10 most undervalued midcap stocks to watch out for as 2023 begins

The Indian stock market hit a record high in November 2022 and the momentum continued in December as well. However, things have changed in the past few days.

Markets have fallen amid concerns over rising Covid cases globally. Moreover, apprehensions ahead of Reserve Bank of India’s latest policy meet and key macroeconomic data…

View On WordPress

0 notes

Video

youtube

*AXISBANK – Example of When Broken a Resistance becomes a Support & a Support becomes a Resistance*

In this video I discuss the Chart of AXISBANK. This stock was analyzed on 8 Dec 2022, now in this video I review the current price action as can be seen on the day end chart.

*Watch Full Video On This Link* : https://youtu.be/sELe_OYQeL8

*To Join the MJ Stock App* - https://play.google.com/store/apps/details?id=com.ionic.Precision

#axisbank #mandarjamsandekar #precisiontechnicals #nifty #banknifty #dow #intradaystrategy #positonalstrategy #LONGTERMTRADE #longtermtrendchange #longtermresistancetrendlinebreakout #shorttermtrade #STOCKSIP #MULTIBAGGER #optionwriting #weeklyexpiry #weeklyexpirytrading #intradaystrategy #RUSSIAUKRAINE #DOWJONES #investor #positionaltrader #crudeoil #pricecorrection #timecorrection #technicalanalysis #runningpricestagnantprice #intraday #askmandar #strategy #identifybreakout #tradeexitstrategy #longtermresistance #supportandresistance #learnwithmandar #swingtrading #intradaystrategy #smallcap #midcap

0 notes

Text

AMFI stock category rejig: Paytm, Bandhan Bank can get downgraded to midcap

AMFI stock category rejig: Paytm, Bandhan Bank can get downgraded to midcap

In its upcoming semi-annual list of stocks, Association of Mutual Funds in India (AMFI) is highly likely to downgrade and One 97 Communication (Paytm) from largecap to midcap category, according to a report by .

The AMFI rejig will mostly be classified by size, taking into account data from July to December 2022. This period saw rising valuations as the Indian equity market rose by over 5% with…

View On WordPress

0 notes

Text

5 Midcap Stocks Under Rs 100 to Add to Your Watchlist

5 Midcap Stocks Under Rs 100 to Add to Your Watchlist

Top 5 midcap multibagger stocks under Rs 100 in India

As large-cap stocks and sectorial indices are gaining bullish momentum, the Nifty Midcap index is on the verge of breaking out of its consolidation zone.

It could join hands with the benchmark indices to surpass its previous high.

During the September 2022 rally, the midcap index outperformed Nifty and hit a new high, indicating a trend…

View On WordPress

0 notes

Text

These midcap stocks are loved by analysts, including one name expected to double

These midcap stocks are loved by analysts, including one name expected to double

Investors scrambling to find a home for their money amid this year’s market turmoil may want to look at midcap stocks. The S & P Midcap 400 is down 15% year to date, outperforming the large cap S & P 500’s 20% drop in that time. The Russell 2000 , which is made up of small cap stocks, is also lagging the midcap index, losing 19% in 2022. Midcap stocks are also outpacing the large- and small-cap…

View On WordPress

0 notes

Text

FTSE 100 falls for fifth session, eyes on BoE moves to stem bond rout

New Post has been published on https://medianwire.com/ftse-100-falls-for-fifth-session-eyes-on-boe-moves-to-stem-bond-rout/

FTSE 100 falls for fifth session, eyes on BoE moves to stem bond rout

Banks, insurers among the biggest decliners

Marston’s climbs on upbeat results

FTSE 100 down 1.1%, FTSE 250 off 1.3%

Oct 11 (Reuters) – Britain’s main stock indexes fell on Tuesday, as geopolitical risks and the prospect of higher interest rates hit global markets, with investors focussing on fresh measures by the Bank of England (BoE) to try to stem the rout in government bonds.

The central bank, battling to stabilise Britain’s 2.1 trillion pound ($2.3 trillion) bond market, said it would buy up to 5 billion pounds of inflation-linked debt per day, starting Tuesday, until the end of this week. read more read more

The pound reversed course and gained 0.8%, weighing on the export-heavy FTSE 100 index.

Data showed Britain’s unemployment rate fell to 3.5% in the three months to August, the lowest since 1974. read more

The blue-chip FTSE 100 (.FTSE) fell 1.1%, its fifth consecutive day of losses, with financial stocks dragging the index lower.

Shares of pension providers such as Legal & General (LGEN.L), Prudential (PRU.L) and Aviva (AV.L) fell between 4.2% and 5.2%.

“The stocks that are getting impacted the most are stocks that are priced off the bond market … the real estate companies, asset backed companies, where it’s clear that the cost of capital is going to go up,” said Roger Jones, head of equities at London & Capital.

Britain’s banking index (.FTNMX301010) was down 2.0% at a one-week low, despite prospects of a large rate hike by the BoE next month.

“We are heading into earnings season, we get a number of banks giving us their update on Friday,” said Danni Hewson, analyst at AJ Bell.

“There’s concern about how they’ve fared and whether or not their profits will have fallen because there’s just not been the same level of deal-making which helps big banks see fantastic profits and investment banking activity has really been curtailed.”

However, the internationally focussed FTSE 100 has outperformed Britain’s domestically exposed FTSE 250 (.FTMC) this year, as a weakening pound and strength in commodity prices boosted the former.

The FTSE 100 has shed 6.8% so far in 2022, while the midcap index has lost about 28% – set for its worst annual performance since 2008.

Marston’s (MARS.L) gained 5.8% after the pub operator said annual total retail sales came in higher than 2019 numbers, as people continued to splurge on drinks and food. read more

Reporting by Sruthi Shankar and Bansari Mayur Kamdar in Bengaluru; Editing by Neha Arora and Mark Potter

Our Standards: The Thomson Reuters Trust Principles.

Read the full article here

0 notes

Text

Is IDEXX Laboratories (IDXX) a High-Growth Stock?

New Post has been published on https://petn.ws/omscP

Is IDEXX Laboratories (IDXX) a High-Growth Stock?

Baron Funds, an investment management company, released its “Baron Asset Fund” fourth quarter 2022 investor letter. A copy of the same can be downloaded here. The fund increased by 12.21% in the fourth quarter, outperforming the Russell Midcap Growth Index which returned 6.90%. Stock selection and underexposure to stocks with high measures of Residual Volatility and […]

See full article at https://petn.ws/omscP

#PetFinancialNews

0 notes