#microsoft pullback

Explore tagged Tumblr posts

Text

5 big analyst AI moves: Apple downgraded; Microsoft pullback an opportunity

0 notes

Text

NVDA earnings, $183B Treasury sale may drive USD rebound

US benchmark indices ended a bumpy session on Monday, all three major indices experienced a pattern of opening high and closing low. Despite bullish investors trying to find reasons from the favourable outcomes of the Federal Reserve’s annual meeting to further push the stock market higher, the bearish forces ultimately won on Monday—the Dow Jones ended slightly higher, while the Nasdaq and S&P 500 both closed lows.

US30 Daily

This week, the two most noteworthy events for investors are NVIDIA's upcoming earnings report on Wednesday and the issuance of $183 billion in new U.S. Treasury bonds by the Treasury Department.

Regarding the earnings report, NVIDIA, as a leader in AI and semiconductors, is expected to announce its earnings after the market closes on Wednesday. The reason it has become a focal point this week is because NVIDIA’s massive market capitalization significantly affects the Nasdaq and S&P 500 indices (both are market-capitalization-weighted indices). Any large fluctuation in its stock price could influence the overall market trend.

Another reason is that NVIDIA’s operating profit has soared 2000% over the past five years, and its stock price has increased 30-fold. However, NVIDIA’s monopoly in manufacturing technology and production capacity is about to face major challenges—its three largest customers, Microsoft, Amazon, and Google, are accelerating the development of their own chips to provide more efficient and lower-cost options for their massive cloud service demands.

In other words, when investors focus on NVIDIA’s earnings report on Wednesday, they must pay attention to the company’s outlook for future profits and the impact of these factors on its future guidance.

Finally, the U.S. Treasury Department will complete the issuance of $183 billion in new Treasury bonds this week. Although a rate cut in September has become a foregone conclusion, U.S. Treasury yields still have sufficient appeal in the international market. So, if international buyers are attracted to enter the market, it is likely to push the dollar to rebound.

DXY H4

Currently, the U.S. Dollar Index (DXY) has found a rebound opportunity at the 100.357 support level. If the rebound continues, investors should pay attention to the resistance levels at 100.738 and 101.221.

XAUUSD H4

Regarding gold, XAUUSD formed a mid-term rising wedge pattern, and on Monday, it formed a short-term rising wedge. Considering the potential dollar rebound and the downward pressure of the rising wedge on the technical front, gold might face a short-term pullback, with the next support level around $2,479 per ounce.

Disclaimer:

The information contained in this market commentary is of general nature only and does not take into account your objectives, financial situation or needs. You are strongly recommended to seek independent financial advice before making any investment decisions.

Trading margin forex and CFDs carries a high level of risk and may not be suitable for all investors. Investors could experience losses in excess of total deposits. You do not have ownership of the underlying assets. AC Capital Market (V) Ltd is the product issuer and distributor. Please read and consider our Product Disclosure Statement and Terms and Conditions, and fully understand the risks involved before deciding to acquire any of the financial products provided by us.

The content of this market commentary is owned by AC Capital Market (V) Ltd. Any illegal reproduction of this content will result in immediate legal action.

0 notes

Text

5 Trade Ideas for Monday: Citigroup, Conagra, Cummins, General Dynamics and Microsoft

5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

Citigroup, Ticker: $C

Citigroup, $C, comes into the week at resistance. It has a RSI in the bullish zone with the MACD positive. Look for as push over resistance to participate…..

Conagra, Ticker: $CAG

Conagra, $CAG, comes into the week approaching resistance. It has a RSI in the bullish zone with the MACD level and positive. Look for a push over resistance to participate…..

Cummins, Ticker: $CMI

Cummins, $CMI, comes into the week approaching resistance. It has a RSI in the bullish zone with the MACD positive. Look for a push over resistance to participate…..

General Dynamics, Ticker: $GD

General Dynamics, $GD, comes into the week at resistance. It has a RSI in the bullish zone with the MACD positive. Look for a push over resistance to participate…..

Microsoft, Ticker: $MSFT

Microsoft, $MSFT, comes into the week at resistance. It has a RSI moving up from the midline with the MACD about to turn positive. Look for a push over resistance to participate…..

If you like what you see sign up for more ideas and deeper analysis using this Get Premium link.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into the May options expiration, saw equity markets showed renewed strength with a rebound from pullback.

Elsewhere look for Gold to continue pause in its uptrend while Crude Oil consolidates in the pullback. The US Dollar Index continues to pullback in the 6 month uptrend while US Treasuries continue their downtrend. The Shanghai Composite looks to continue the short term move higher while Emerging Markets flirt with a break out of a long channel to the upside.

The Volatility Index looks to remain very low and stable making the path easier for equity markets to the upside. The charts of the SPY and QQQ look strong, especially on the longer timeframe. On the shorter timeframe both the QQQ and SPY continue to move higher toward new highs as well. The IWM looks good on the shorter timeframe but the longer timeframe continues to need more time. Use this information as you prepare for the coming week and trad’em well.

0 notes

Text

Decoding the Downturn: Examining the Decline in Shares of Tech Titans Apple, Amazon, and Tesla

In the opening days of 2024, some of the world's tech behemoths, including Apple, Amazon.com, Alphabet (Google parent), Microsoft Group, Meta Platforms, Tesla, and Nvidia Corp – collectively known as the 'Magnificent 7' – are grappling with a challenging start as their shares face substantial losses on the stock market. The prolonged dip over the past four sessions constitutes their lengthiest losing streak in a month, according to a recent report by Bloomberg News.

Understanding the Slide

Shares of these tech giants, representing some of the most influential companies globally, have collectively fallen, wiping out a staggering $383 billion in market value. Apple, in particular, has led this broad-based slump, experiencing a 4.6% decline over the past four sessions. The Nasdaq 100 index has also witnessed a sharp downturn in the last four trading days.

Steve Sosnick, chief strategist at Interactive Brokers Group, attributes this pullback to a natural correction following a robust rally in calendar year 2023. He notes that the absence of year-end factors that fueled the rally suggests that the party may be winding down.

Market Dynamics and Concerns

Despite an exceptional surge of over 100% in the previous year, fueled by heightened enthusiasm for artificial intelligence, the momentum of the 'Magnificent 7' began to wane in the latter part of 2023. Investor deliberations over the Federal Reserve's ability to manage a smooth economic landing for the US, potentially resulting in fewer anticipated interest rate cuts, contributed to this slowdown.

Sosnick emphasizes the importance of a soft landing, stating that high-single-digit or double-digit earnings growth may be compromised in a less favorable scenario. However, he also notes that a soft landing may not warrant the significant cuts seen previously.

Individual Challenges and Bearish Outlooks

Some members within the 'Magnificent 7' are facing specific challenges in the early part of 2024. Apple's shares have experienced downward pressure following a recent bearish outlook. Analysts from Barclays Plc downgraded the tech giant's shares to underweight, citing expectations of weakened demand for iPhones in the future.

Tesla, despite surpassing analysts' expectations for electric vehicle deliveries in the fourth quarter, has seen a continuous decline over the past four days. This marks its longest losing streak in over four weeks, relinquishing its leading position to China's BYD Co.

Outlook for 2024

While the Bloomberg report notes that it is premature to declare the end of the tech-focused rally, it acknowledges that much of the gains in 2023 served to recover losses from the previous year. Key players like Amazon, Alphabet, Meta, and Tesla are still trading below their all-time highs, suggesting potential for further upward movement.

As we look ahead to 2024, major tech companies face significant challenges. Beyond providing innovative technology, ensuring sustained profitability will be crucial, according to Sosnick. The evolving landscape will require these giants to navigate a delicate balance between innovation and fiscal responsibility.

0 notes

Text

MSFT Stock has been on an upward trend since 2023 and has shown buying Interest. The Stock faced a hurdle near the supply range and had a pullback in the previous sessions in the last couple of weeks around the Price of $310 also the Fibo 38.20% level. MSFT’s earnings have grown by 20.8% every year for the last 5 years, as per Simply Wall St. It also has a high return on Equity (ROE) of 35.1%, where ROE means how much money it makes with its Shareholders’ money. MSFT publicized its results for the quarter ending in July on July 25th, 2023. It made $56.19 Billion in revenue and $20.08 Billion in net income. It also earned more per share ($2.69) than expected ($2.551), which was a good surprise for investors. For the next quarter ending in September 2023, MSFT expects to earn $2.633 per share and make $54.5 Billion in revenue. It will report its results on October 25th, 2023. As per the predictions and estimates by Simply Wall St., MSFT’s earnings and revenue are expected to grow faster than the US Market average in the next few years. It also expects to have a high ROE of 28.9% in 3 years. MSFT has more cash than debt. MSFT’s debt has gone down from 92.2% to 22.9% of its Equity in the last 5 years, as shown by Simply Wall St. MSFT’s debt is well covered by its cash flow. Cash flow is how much money it has left after paying its expenses. MSFT earns more Interest than it pays, so it does not have to worry about paying its debt. MSFT Stock Price was at $332.88 with an intraday decrease of 0.20%. Moreover, the intraday Trading volume of MSFT is 17.536 Million less than the 10-day aggregate volume of 20.11 Million. The Stock has bounced back after a pullback and has a Market cap of $2.473 Trillion. Analysts gave a buy rating with a yearly high target Price of $440, suggesting a growth outlook for future sessions. MSFT Stock also pays Dividends every quarter. Dividends are money that it gives to its Shareholders. The last dividend was $0.68 per share, which is to be paid on September 14th, 2023 to Shareholders who had the Stock before August 16th, 2023. The biggest shareholder of MSFT Stock is Vanguard Group Inc., which owns 8.79% of the company. The second biggest shareholder is Blackrock Inc., which owns 7.22% of the company. Some of the top people who work for MSFT have sold many of their Shares in the last three months. Kathleen Hogan, who is an executive vice president, and Bradford Smith, who is a president, together sold 76,814.6 Shares worth about $25.5 Million. Technical Analysis of MSFT Stock Price in 1-D Timeframe Source: MSFT.1D.NASDAQ by TradingView MSFT Stock has been rising since November last year. It went from $213 to $366, following the Fibonacci levels. Now it is at $332.88 (at press time). It faced some resistance and dropped to $310, but then bounced back. It might go up to $341 or $351, the next resistance level. But if it breaks below $318, the major support level, it might fall to $311 or lower. MSFT Stock is Trading above the 20 and 50-day EMA. RSI is around 56, bullish with 14 SMA support. MACD histogram gap is widening. Summary The MSFT Stock seems to be poised for a significant rise with potential Price growth in the next sessions. The Buyers are backing the Microsoft Stock’s upward movement by striving to maintain these levels. Technical parameters for MSFT Stock also support the increase in Bullish momentum. Microsoft Corporation (NASDAQ: MSFT) Stock prices are Bullish on the 1-D time frame as indicators turn Bullish. The traders and investors also suggest positive buying sentiments. Technical Levels Support levels: The nearest support levels for MSFT Price are $341 and $351. Resistance levels: The nearest resistance levels for the MSFT Stock Price are $318 and $311. In this article, the views and Opinions stated by the author, or any people named are for informational purposes only, and they don’t establish the Investment, financial, or any other advice. Trading or investing in Cryptocurrency assets comes with a risk of financial loss.

0 notes

Link

#djia#Dow#dowJonesChart#dowjonesChartToday#dowjoneslive#dowjoneslivechart#dowjonesnow#dowjonessupportandresistance#dowjonestechnicalanalysis#dowjonestechnicalchart#dowjonesweeklychart#Downgrades

0 notes

Text

U.S. shares closed combined on Wednesday following robust quarterly outcomes from Microsoft (MSFT) and Alphabet (GOOGL) that kicked off an enormous tech earnings bonanza this week. Traders had been additionally hit with a recent wave of concern in regards to the health of regional banks.The S&P 500 (^GSPC) closed down 0.39% as First Republic Financial institution’s (FRC) inventory sank on Wednesday. The Dow Jones Industrial Common (^DJI) dipped 0.68%. The technology-heavy Nasdaq Composite (^IXIC) was up 0.47%, paring earlier features after tech giants Microsoft and Alphabet each reported better-than-expected earnings and income for the newest quarter after the shut on Tuesday.Authorities bonds had been up. The yield on the 10-year notice ticked as much as 3.44%, whereas rate-sensitive two-year notice yield rose barely to three.93%.Microsoft rallied greater than 7% after the software program large reported fiscal third-quarter earnings that surpassed estimates on Tuesday, indicating rising power in its AI and cloud companies. Microsoft earned $2.45 a share, on income of $52.9 billion, in comparison with a revenue of $2.22 a share, on $49.4 billion for a similar interval a yr in the past.Microsoft's potential acquisition of Activision Blizzard (ATVI), nevertheless, suffered a setback Wednesday morning, as UK regulators blocked the deal over competitors fears. Activision inventory was down about 12%.Alphabet’s first-quarter earnings confirmed a 2% rise in search revenues, far beneath the corresponding quarters from the final two years. In the meantime, installations of the Bing app have quadrupled after it was augmented by AI. Shares had been down Wednesday afternoon.Meta (META) earnings are up subsequent after the bell on Wednesday, whereas Amazon (AMZN) studies Thursday.Tech shares have fueled the equities rally thus far this yr, however some analysts count on the sector might come underneath promoting strain because it loses steam. Traders stay involved that expectations for earnings progress will probably be weaker, prompting some market strategists to anticipate a pullback that has thus far not but materialized.Story continuesFILE - The Microsoft brand is pictured outdoors the headquarters in Paris, Jan. 8, 2021. (AP Picture/Thibault Camus, File)On the monetary providers entrance, PacWest Bancorp (PACW) reported earnings after Tuesday's shut that topped EPS estimates. Its inventory ended Wednesday up 7%.That wasn't sufficient to make up for the continued fallout from First Republic Financial institution’s (FRC) larger-than-expected drop in deposits when it reported earnings on Monday. The financial institution is contemplating asset gross sales, Bloomberg reported, following Silicon Valley Financial institution’s collapse and subsequent turmoil within the sector.First Republic prolonged its rout and sank almost 30% Wednesday following a CNBC report that mentioned advisors shored up potential consumers of recent inventory as a part of its rescue plan.First Republic’s drastic transfer to the draw back on Tuesday dragged down the KBW Regional Banking Index, which fell to its lowest degree since November 2020.Visa (V) reported earnings that beat top- and bottom-line expectations for its newest quarter on Tuesday that confirmed continued post-pandemic rebound in worldwide journey.Elsewhere, mortgage purposes to buy a house climbed for the second time over the previous three weeks, signaling stabilization within the housing market, in accordance with the Mortgage Bankers Affiliation weekly survey. Different knowledge out on Wednesday confirmed that US item for consumption orders obtained a bounce in March from new contracts for passenger planes, however enterprise funding dropped once more for the month.Individually, Boeing (BA) missed Wall Road estimates as soon as once more for its first quarter. Boeing earned $1.27 a share on a income of $17.9 billion, in comparison with a revenue of $2.75 on $14 billion in gross sales for a similar interval a yr in the past.

Nonetheless, the inventory ticked up Wednesday.Dani Romero is a reporter for Yahoo Finance. Observe her on Twitter @daniromerotvClick on right here for the most recent inventory market information and in-depth evaluation, together with occasions that transfer sharesLearn the most recent monetary and business news from Yahoo FinanceObtain the Yahoo Finance app for Apple or AndroidObserve Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, Linkedin, and YouTube https://guesthype.co.uk/?p=4029&feed_id=9054&cld=64499d112f03f

0 notes

Text

[ad_1] The stock market rally had another big week, with the Nasdaq running higher amid major news from the latest Fed outlook to the jobs report to massive earnings from Apple (AAPL), Meta Platforms (META) and more. Dow Jones futures will open on Sunday evening, along with S&P 500 futures and Nasdaq futures. X Don't be surprised to see a market pullback after the big gains in recent weeks, with Tesla (TSLA) and Apple stock up strongly yet again. Friday may have been the start of a pullback, with Amazon.com (AMZN) plunging on its weak earnings and outlook. But with the uptrend showing more signs that it's more than a bear market rally, investors can continue to gradually add exposure over time. Dow Jones giant Microsoft (MSFT), lithium and fertilizer giant SQM (SQM), auto parts maker Autoliv (ALV), Pure Storage (PSTG) and Freeport-McMoRan (FCX) are stocks near buy points. Microsoft, Autoliv and FCX stock already have earnings out of the way, while SQM and PSTG stock aren't due for several weeks. MSFT stock is on IBD Long-Term Leaders. Onsemi (ON), formerly ON Semiconductor, reports early Monday. The EV-focused chipmaker surged 9.8% this past week, breaking out of a cup base to a new high. But ON stock is now extended. The video embedded in this article reviewed the strong market action and analyzed Regeneron Pharmaceuticals (REGN), Microsoft and ALV stock. Dow Jones Futures Today Dow Jones futures open at 6 p.m. ET on Sunday, along with S&P 500 futures and Nasdaq 100 futures. Remember that overnight action in Dow futures and elsewhere doesn't necessarily translate into actual trading in the next regular stock market session. Join IBD experts as they analyze actionable stocks in the stock market rally on IBD Live Stock Market Rally The stock market rally shook off a weak Monday for a generally strong week. The Dow Jones Industrial Average dipped 0.2% in last week's stock market trading. The S&P 500 index rose 1.6%. The Nasdaq composite jumped 3.3%. The small-cap Russell 2000 sprinted 3.9% higher. Apple stock, a Dow Jones, S&P 500 and Nasdaq component, leapt 5.9% for the week, vaulting above its 200-day line. Shares reversed higher on Friday despite weak Apple earnings and revenue. AMZN stock plunged 8.4% on Friday, back below its 200-day moving average, though it did close up 1.1% for the week. Late Thursday, Amazon reported a 98% EPS decline for Q4. While revenue slightly beat, Amazon guided low on Q1 revenue, with the high-margin Amazon Web Services a key reason. The 10-year Treasury yield rose 1 basis point to 3.53% for the week, with the yield jumping 13 basis points Friday on the hot jobs report. Intraday Thursday, the yield fell to 3.33%, the lowest since Sept. 13. U.S. crude oil futures plunged 7.9% to $73.39 a barrel last week, with gasoline down 10.5% and natural gas off 12.9%. ETFs Among growth ETFs, the Innovator IBD 50 ETF (FFTY) rose 1.25% last week, while the Innovator IBD Breakout Opportunities ETF (BOUT) climbed 1.9%. The iShares Expanded Tech-Software Sector ETF (IGV) popped 2.4%, with Microsoft stock a major holding. The VanEck Vectors Semiconductor ETF (SMH) jumped just over 4%, with ON stock a modest holding. SPDR S&P Metals & Mining ETF (XME) advanced 1.45% last week. The Global X U.S. Infrastructure Development ETF (PAVE) soared 4%, clearing a 13-month consolidation to hit a record high. U.S. Global Jets ETF (JETS) ascended 2.2%. SPDR S&P Homebuilders ETF (XHB) stepped up just over 6%. The Energy Select SPDR ETF (XLE) slumped 5.7%, wiping out several weeks of slim gains. The Financial Select SPDR ETF (XLF) climbed 1%. The Health Care Select Sector SPDR Fund (XLV) slipped 0.1%, its sixth straight modest weekly decline. Reflecting more-speculative story stocks, ARK Innovation ETF (ARKK) jumped 6.1% last week and ARK Genomics ETF (ARKG) popped 3.7%, continuing their strong performance to start 2023. Tesla stock is a major holding across Ark Invest's ETFs. Five Best Chinese Stocks To Watch Now

Stocks Near Buy Points Autoliv stock fell 2.7% this past week to 90.27, consolidating after gapping up 9% on Jan. 27 following strong earnings. ALV stock is in buy range from an 89.98 bottoming base. But investors could view the recent pause as a handle on a base going back to November 2021. The cup-with-handle buy point is 93.88. Many other auto parts stocks are showing strength in 2023. Pure Storage stock jumped 5.7% for the week to 29.91, decisively rising from key moving averages. PSTG stock has a 31.33 double-bottom buy point, but is already actionable from clearing a downward-sloping trendline in that base on Wednesday. Volume has been strong as Pure Storage has bounced back in the past two weeks. The relative strength line is lackluster at best, reflecting sideways action over the past year. But while PSTG stock hasn't rebounded as fast as some growth plays, it didn't plunge in 2022 either. SPECIAL REPORT: Best Online Brokers 2023 FCX stock fell 3.7% to 43.16 last week, closing just below the 21-day line as copper prices retreated. FCX stock has a three-weeks-tight pattern with a 46.83 buy point. Investors could also use that as a handle or alternate handle on a 10-month base. Microsoft stock jumped 4.1% to 258.35 last week, even with Friday's 2.4% pullback. Shares broke out of a bottoming base that formed below the 200-day line. But Thursday's breakout cleared the 200-day line and a yearlong trendline. Investors could treat the move as a place to enter MSFT stock as a Long-Term Leader. SQM stock has retaken key moving averages and is working on a double-bottom base with a 112.45 buy point, according to MarketSmith analysis. Shares rose 2.6% to 97.09 last week. It's possible that SQM stock could carve out a handle or some form of early entry. SQM stock likely won't report until March, but lithium peers Albemarle (ALB) and Livent (LTHM) release earnings in less than two weeks. Albemarle already reported strong preliminary Q4 results and gave a generally bullish outlook. SQM stock and Albemarle are notable holdings in the Global X Lithium & Battery Tech ETF (LIT). Tesla stock and China EV and battery giant BYD (BYDDF) also are significant holdings, along with China and other Asian battery makers. The LIT ETF is finding support at its 200-day line, just below a double-bottom base. Tesla Vs. BYD: EV Giants Vie For Crown, But Which Is The Better Buy? Market Rally Analysis The stock market rally had another impressive week. After skidding on Monday, the Nasdaq, S&P 500 and Russell 2000 had strong weekly gains, decisively above their 200-day lines and their late 2022 highs. The Dow Jones is lagging, but found support and isn't far from its recent highs. Some top sectors or groups faltered, but generally leading stocks broke out, flashed buy signals, set up or simply extended big recent gains. All of this is happening amid economic data and earnings reports that are often mixed at best. The late August highs are the next test for the market rally, with the Russell 2000 almost there and the S&P 500 not far away. Still, evidence is growing that the market uptrend has real legs, and is not just another bear market rally. Perhaps the biggest complaint about the current market rally is that it's too strong. The Nasdaq has run up for five straight weeks. Perhaps Friday's retreat was the start of a much-needed pause or pullback for the major indexes. That would let stocks forge handles or pull back to key support levels. A lot of interesting stocks are looking significantly extended. One question is whether Tesla, Roku (ROKU) and other ARK-type speculative growth names continue to surge or settle down. The U.S. dollar hit its lowest levels in several months on Wednesday following the Fed meeting, but then roared back on Thursday-Friday for a solid weekly gain. The dollar's sharp downtrend in recent months has been a major factor in the stock market's reviving fortunes. After Friday's jobs report, markets are now leaning toward two more quarter-point Fed rate hikes.

Time The Market With IBD's ETF Market Strategy What To Do Now With the market rally running up for several weeks, most breakouts and buying opportunities have been working. So investors should have been taking advantage. But do so prudently. Add exposure gradually, so you're not caught out in a pullback. It's possible that new buys will briefly dry up if the market pauses, but that could pave the way for a lot more entries. Don't get too concentrated in a particular stock or sector. Cut losses short. Spend time working on watchlists this weekend, making sure you're looking at quality stocks from a variety of sectors. Identify your prime targets, and do some more analysis on these potential buys. After a brutal 2022, the new year is off to a great start. So stay engaged and ready to act. Read The Big Picture every day to stay in sync with the market direction and leading stocks and sectors. Please follow Ed Carson on Twitter at @IBD_ECarson for stock market updates and more. YOU MIGHT ALSO LIKE: Want To Get Quick Profits And Avoid Big Losses? Try SwingTrader Best Growth Stocks To Buy And Watch IBD Digital: Unlock IBD's Premium Stock Lists, Tools And Analysis Today 4 Red-Hot Semiconductor Stocks Highlight Earnings Calendar [ad_2] Source link

0 notes

Text

Is Microsoft Stock A Buy Before Software Giant's December-Quarter Report?

Is Microsoft Stock A Buy Before Software Giant’s December-Quarter Report?

software giant Microsoft (MSFT) has earned plaudits for its successful pivot from desktop computing to cloud computing. And MSFT stock has risen as a result. But after a recent pullback, many investors may be wondering: Is Microsoft stock a buy right now? x Bill Gates and Paul Allen started Microsoft in 1975 at the dawn of the personal computer era to make PC operating system software. The…

View On WordPress

0 notes

Text

Microsoft turns on

Hardware makers bristled when Microsoft (MSFT) introduced its Surface line of computers in 2012. The Redmond software giant seemed to be biting the hand that fed it.

At the Consumer Electronics Show this year, Microsoft’s long-range plan came to light. Lenovo announced a game-changing Surface-like computer with constant connectivity and long battery life.

The future of mobile computing is not smartphones. It is ACPCs – always-connected PCs. And they run Microsoft software.

In 2009, iPhone changed everything. Its touchscreen, ease of use, and constant connectivity were liberating. Almost a decade later, screens are larger and software more intuitive -- but let's be honest, actual computing is still much more comfortable on a desktop or laptop.

chart courtesy StockCharts.com

There is a good reason for that. Microsoft controls the productivity software people want. Office is a robust ecosystem with broad network effects. Good luck exchanging files if you are not running Word or Excel. To make matters worse, Microsoft has been unwilling to duplicate the most compelling features on smartphones.

The Lenovo Miix 360 is a crazy thin and light 2-in-1. The tablet/PC hybrid is ARM-based, promises 20 hours of battery life, and can surf the Internet at speeds greater than most home WiFi connections, thanks to always-on LTE. Better still, it runs the entire Windows software stack, past and present. For most computer users, it is the best of all worlds.

It eliminates worries about battery life, connectivity, and compatibility. It is not the first time down this road for Microsoft. The original Surface RT, an ARM-based 2-in-1, was a $900 million flop. The machines were underpowered and unloved by developers and hardware partners. This time, Microsoft put in the hard work. The new Windows S software works. And Hewlett Packard (HPQ), Asus and others have announced new machines coming before the end of the year.

Two years ago Apple reimagined the computer with the iPad Pro. The big idea was corporate users would flock to the bigger form factor because they loved their iPhones. Beefed-up second-generation Surface computers were also selling very well. The 2-in-1 format became a legitimate category with widespread demand.

The latest course change at Microsoft leverages Surface’s compatibility strengths, and adds always-on connectivity and better battery life, thanks to ARM-based architecture and mobile system-on-a-chip processors. At 20 hours, ACPC’s will achieve battery life 50% greater than iPad Pros.

It’s ironic. As Apple is embracing Intel (INTC) and moving away from Qualcomm(QCOM) silicon, Microsoft is going the other way.

That is why ACPC is so important. It could help Microsoft make a surprise takeover of mind share in mobile computing software, with a legitimate competitive advantage.

Microsoft stock has been shooting higher after an important upside breakout at $85. That level is now support. It's a buy for those of you who like large-tech on pullbacks; I'm on the lookout for a spot.

Click here to sign up for my free VIP newsletter on the intersection of business, technology and culture

3 notes

·

View notes

Text

Bull Market On!

Image Source: Mike Cohen.

By Brian Nelson, CFA

It’s very hard not to be bullish on the stock market these days. The prudence exercised by many of the largest companies in the S&P 500 remains unprecedented, in our view. Some of the best companies out there have tremendous balance sheets, as evidenced by huge net cash positions. Perhaps two of our favorite companies, Microsoft (MSFT) and Facebook (FB) are the best examples of this, but Apple (AAPL) still retains quite the large net cash hoard as it works to net-cash breakeven.

As we look at the next couple years, most investors will continue to focus on the Fed. We’ve seen this song and dance following the Great Financial Crisis (GFC) that wreaked havoc on the markets between 2007-2009. Many believed that the markets would have a Fed-induced crisis that would obliterate stocks after the GFC as they tapered and withdrew stimulus, but the Fed executed flawlessly. The bears seized on a municipal bond crisis, and a European debt crisis, but we still had one of the strongest bull markets in history following the Great Financial Crisis -- a bull market that ran through the onset of the COVID-19 outbreak.

Here we are just 16-18 months after the first case of COVID-19 was announced in the United States, and we are not just at new highs in the stock market--but we’ve already made many of them! The “old school” analysis with respect to drawdowns and withdrawals no longer holds in this hyper-intensive, information-driven economy, in our view, where 3-4 years’ worth of price behavior is experienced in 3-4 months. Those pursuing annual withdrawals in retirement in January, for example, didn’t experience any impact from the market meltdown, as January 2021 saw a market much higher than January 2020, despite the most abrupt fall in market history. Bear markets in the future may be even shorter than the 11.3 month historical average, too. The COVID-19 bear market was just 1.1 months.

We crunched the numbers, and a 60/40 stock/bond indexed and rebalanced portfolio has now trailed active stock selection, as measured by the S&P 500 Sector SPDR (SPY) as the midpoint, by 130 percentage points the past 10 years. The 60/40 stock/bond indexed and rebalanced portfolio failed at what it was supposed to do, too. During the worst of the COVID-19 stock market swoon, the 60/40 stock/bond indexed and rebalanced portfolio saved just 8 percentage points versus a full allocation to the largest U.S. equities. From our perspective, it has become hard to justify the 60/40 stock/bond indexed and rebalanced portfolio given its high correlation to equities, the vast underperformance during lengthy bull markets, and the short duration of bear markets when it comes to periodic withdrawals.

The arguments against active stock selection have vanished, in our view. The vast underperformance of the 60/40 stock/bond portfolio over a 10-year and even 30-year stretch relative to a diversified S&P 500 portfolio may be the biggest reason. Not only has modern portfolio theory (MPT) failed in this respect, but quant finance has also dropped the ball in other areas. The huge underperformance of the small value factor during the past decade has shown that it is a fool’s errand to believe that past performance is prologue. The entire basis of quant research can be readily dismissed by the most common disclaimer in this industry warning about past analysis not being prologue, and yet, many continue to fall for the nonsense. Stay away from quant conclusions until they start factoring forward-looking expectations into their processes.

The best of times with respect to cryptocurrency may very well be behind us as well. The alternative asset market isn’t as strong as it was in the beginning of this year, and Bitcoin (GBTC) and other cryptocurrencies have followed suit. A few cryptocurrencies have even zeroed out, and this is the true risk faced by anybody seeking the merits of modern portfolio theory with a small crypto allocation. An asset must have intrinsic value and go up in the long run for MPT to hold merit, meaning that you need a better model than just mashing historically uncorrelated assets together. The model we use at Valuentum is the discounted cash flow model, or enterprise valuation. We then seek to diversify among the most undervalued assets that have strong market backing via technical and momentum indicators.

Inflation is the talk of Wall Street the past few months, but we’ve seen a pullback in some of the prices that have surged. The housing market remains resilient, but lumber prices have come in quite a bit. The auto industry is working past the semiconductor shortage, and the huge ramp in used car sales may now be behind us. Crude oil and gasoline prices have increased materially, but the abundance of shale oil should keep a tight lid on long-term crude oil price expansion. Unlike OPEC, the U.S. government can’t limit production in a free economy, and the invisible hand will act as the counterbalance to high energy prices in time. We like stocks in an inflationary environment, and we love big cap tech and large cap growth in any environment.

Many are expecting net-cash rich corporates to start funneling some of their huge cash positions into the equity markets, and we don’t think they’ll be getting too complicated with their strategies. Share buybacks will be one avenue that they’ll use to deploy the capital, but many will also seek to allocate capital to the broader S&P 500, in our view. Money market funds have surged as a result of government stimulus since the COVID-19 meltdown (there is over $4.5 trillion just sitting in money market funds according to Bloomberg, more than at the peak of the GFC), and there may be hundreds of billions of dollars ready to enter the stock market in the next 6 months alone. Corporations are cash rich, and bond yields are paltry.

Buying demand for equities could set off a huge advance in stock prices, in our view, and the Fed may be fine with this as they were during the 10-year period following the GFC. We hardly experienced any meaningful inflation after the GFC either, but stock prices soared. In many ways, we’re expecting a replay of the 2010s (last decade) in the 2020s (this decade), and the next 10 years may very well be a replay of the Roarin’ 20s, a theme we have repeated before. We expect advisors and asset allocators to buy equities at almost every market dip, and we believe the Fed will support the markets in the event of even modest price weakness. These are unprecedented times, and that means the Fed will remain vigilant in support of equity prices.

Our favorite ideas remain in the newsletter portfolios, and as we noted before, Alphabet and Facebook have been lights-out with their relative price performance so far in 2021. The Valuentum Buying Index (VBI) has also showed its efficacy of late, with Facebook and Korn Ferry (KFY), two of the top ratings on the VBI, soaring. Facebook was a huge gift a couple years ago (in 2018) when it dipped below $150 per share. The market couldn’t have been more wrong on shares, and the stock has now more than doubled since then, trading north of $340 per share of late. Facebook has registered more 10s on the VBI than any other company in our coverage.

Though the meme-stock frenzy has been annoying and reveals the fragility of market structure as it relates to price-agnostic trading, the bias to the markets remains upward, in our view. Meme stock traders are long, advisors and asset allocators are pumping their clients’ money into the stock market on every dip, the short sellers have their backs against the wall, the Fed and Treasury aren’t going to go away, and more stimulus in the form of an infrastructure bill may serve to pad the bottom line of many in the energy and industrial sectors--the weakest sectors in recent years. The markets could go up for a long time yet, and we remain very bullish.

In the Dividend Growth Newsletter portfolio, we’re adding a 5-7% weight in ExxonMobil (XOM) and a 4-6% weighting in Chevron (CVX). In the Best Ideas Newsletter portfolio, we’re adding a 4-6% weighting in ExxonMobil and a 3-5% weighting in Chevron. We like their respective dividend yields, and the strengthening energy markets have only made their future free cash flow prospects better. See here. These changes will be reflected in the next editions of the newsletters, the July edition of the Dividend Growth Newsletter to be released Thursday, July 1, and the July edition of the Best Ideas Newsletter to be released July 15. Due to the July 4th holiday weekend, the July edition of the Exclusive publication will be released Saturday, July 10.

The Best Ideas Newsletter portfolio >>

The Dividend Growth Newsletter portfolio >>

-----

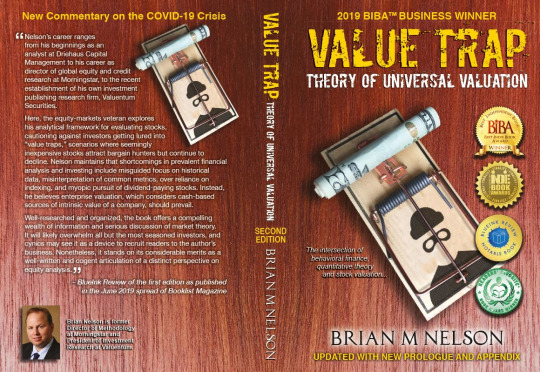

It's Here! The Second Edition of Value Trap!

Order today!

-----

Image Source: Value Trap

----------

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, and IWM. Brian Nelson's household owns shares in HON, DIS, HAS. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

-------------------------------------------------

The High Yield Dividend Newsletter, Best Ideas Newsletter, Dividend Growth Newsletter, Valuentum Exclusive publication, and any reports and content found on this website are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of its newsletters, reports, commentary, or publications and accepts no liability for how readers may choose to utilize the content. Valuentum is not a money manager, is not a registered investment advisor, and does not offer brokerage or investment banking services. The sources of the data used on this website and reports are believed by Valuentum to be reliable, but the data’s accuracy, completeness or interpretation cannot be guaranteed. Valuentum, its employees, and independent contractors may have long, short or derivative positions in the securities mentioned on this website. The High Yield Dividend Newsletter portfolio, Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio are not real money portfolios. Performance, including that in the Valuentum Exclusive publication and additional options commentary feature, is hypothetical and does not represent actual trading. Actual results may differ from simulated information, results, or performance being presented. For more information about Valuentum and the products and services it offers, please contact us at [email protected].

2 notes

·

View notes

Text

NASDAQ 100 Forecast: Touches 50-Day EMA

NASDAQ 100 Forecast: Touches 50-Day EMA

The NASDAQ 100 rallied a bit during the trading session on Tuesday to touch the 50-Day EMA. Perhaps people are trying to front run the earnings calls from both Microsoft and Google after the bell on Wednesday, but I think they are going to be disappointed. The 50-Day EMA is of course a technical indicator that a lot of people pay close attention to, so it is worth noting that the market pullback…

View On WordPress

0 notes

Text

NASDAQ 100 Forecast: Touches 50-Day EMA

NASDAQ 100 Forecast: Touches 50-Day EMA

The NASDAQ 100 rallied a bit during the trading session on Tuesday to touch the 50-Day EMA. Perhaps people are trying to front run the earnings calls from both Microsoft and Google after the bell on Wednesday, but I think they are going to be disappointed. The 50-Day EMA is of course a technical indicator that a lot of people pay close attention to, so it is worth noting that the market pullback…

View On WordPress

0 notes

Text

S&P 500 Stages Big Turnaround Despite Microsoft & Alphabet Carnage, US GDP Eyed

S&P 500 Stages Big Turnaround Despite Microsoft & Alphabet Carnage, US GDP Eyed

US STOCK MARKET OUTLOOK: The S&P 500 rebounds after at sharp sell-off at the market open Alphabet and Microsoft shares tumble on disappointing quarterly results, but bearish sentiment is offset by a steep pullback in Treasury yields All eyes will be on the U.S. third quarter GDP report and earnings from Amazon and Apple on Thursday Trade Smarter – Sign up for the DailyFX Newsletter Receive…

View On WordPress

0 notes

Text

Large Tech tumbles as outcomes set off alarm bells By Reuters

2/2 © Reuters. FILE PHOTO: Smartphone is seen in entrance of Microsoft brand displayed on this illustration taken, July 26, 2021. REUTERS/Dado Ruvic/Illustration 2/2 (Reuters) – Gloomy outcomes from Alphabet (NASDAQ:) and Microsoft (NASDAQ:) stoked fears of a worldwide financial downturn and derailed an earnings-led surge in inventory markets on Wednesday, whereas setting the tone for outcomes from different megacap expertise giants. The Nasdaq tumbled almost 2% because the outcomes underscored the fallout of robust greenback and weak demand on the tech sector in opposition to the backdrop of excessive inflation and rising borrowing prices. Shares of the Google-parent and Microsoft fell about 8% in early buying and selling. Meta Platforms Inc, which can report after markets shut, was down 4%, whereas Amazon.com Inc (NASDAQ:) misplaced 4% and Apple Inc (NASDAQ:) 1% within the run-up to their outcomes on Thursday. Heavyweights Netflix (NASDAQ:), Meta, Amazon, Microsoft, Alphabet and Apple have already misplaced a mixed market worth of greater than $2.5 trillion up to now this yr and had been set to shed one other $330 billion on Wednesday. “The outcomes of the massive expertise companies had been seen as a key figuring out consider market sentiment going into the U.S. third quarter reporting season and each Microsoft and Alphabet have given traders motive to fret,” mentioned Laith Khalaf, head of funding evaluation at AJ Bell. Alphabet missed Wall Avenue’s goal for income development within the third quarter as advert gross sales remained weak, whereas inflation and a robust greenback led Microsoft to report its slowest topline development in 5 years. GRAPHIC – Microsoft, Alphabet revenues develop slower as recession fears loom https://graphics.reuters.com/ALPHABET-STOCKS/dwvkdgebnpm/chart.png At the least 21 analysts minimize their worth goal on Alphabet, reducing it by as a lot as $36, whereas 17 of them introduced down their targets on Microsoft. With analysts predicting a pullback in budgets for promoting attributable to rising costs, traders concern that Meta’s enterprise too may come below strain because it income depends closely on adverts. “Traders will likely be bracing for Meta’s outcomes with some trepidation, with a typical thought being that if Google’s struggling, the remainder of the tech pack faces a marathon climb,” mentioned Sophie Lund-Yates, an analyst at Hargreaves Lansdown. For Meta, Google Search’s tender outcomes are worrisome whereas YouTube and Snap (NYSE:) weak point counsel that macro and advert concentrating on challenges continued within the third quarter, JMP Securities analyst Andrew Boone wrote. In the meantime, a slowdown in development at Azure, Microsoft’s cloud platform and considered one of its most profitable companies, raised worries round Amazon’s cloud enterprise. Whereas most Large Tech shares have edged larger previously few weeks, total it has been a bleak yr for the sector that has misplaced roughly 15% to 60% of their worth. Wednesday’s selloff additionally hit Europe’s tech index, falling 2.3% to steer sectoral losses within the area. Originally published at Irvine News HQ

0 notes