#malta law firm

Explore tagged Tumblr posts

Text

The Malta Permanent Residence Programme

By virtue of Legal Notice 121 of 2021, the Malta Permanent Residence Programme Regulations were implemented, introducing a new residence programme for Non-EU/EEA/Swiss nationals. Residency Malta Agency has been recently set up to administer and process applications under these Regulations. Get More Info: https://www.emd.com.mt/the-malta-permanent-residence-programme/

#Malta Employment Law#iGaming Malta#Consumer Law Malta#malta law firm#set up malta company#malta residence#malta company

1 note

·

View note

Text

The wealthy are building these “passport portfolios” — collections of second, and even third or fourth, citizenships — in case they need to flee their home country. Henley & Partners, a law firm that specializes in high-net-worth citizenships, said Americans now outnumber every other nationality when it comes to securing alternative residences or added citizenships.

“The U.S. is still a great country, it’s still an amazing passport,” said Dominic Volek, group head of private clients at Henley & Partners. “But if I’m wealthy, I would like to hedge against levels of volatility and uncertainty. The idea of diversification is well understood by wealthy individuals around what they invest. It makes no sense to have one country of citizenship and residence when I have the ability to actually diversify that aspect of my life as well.”

#long reads#as a trends article this isn't super worthwhile but...#the reasoning on display is.... interesting

23 notes

·

View notes

Text

Ireland's privacy regulator is a gamekeeper-turned-poacher

This Saturday (May 20), I’ll be at the GAITHERSBURG Book Festival with my novel Red Team Blues; then on May 22, I’m keynoting Public Knowledge’s Emerging Tech conference in DC.

On May 23, I’ll be in TORONTO for a book launch that’s part of WEPFest, a benefit for the West End Phoenix, onstage with Dave Bidini (The Rheostatics), Ron Diebert (Citizen Lab) and the whistleblower Dr Nancy Olivieri.

When the EU passed its landmark General Data Protection Regulation (GDPR), it seemed like a privacy miracle. Despite the most aggressive lobbying Europe had ever seen, 500 million Europeans were now guaranteed a digital private life. Could this really be?

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/15/finnegans-snooze/#dirty-old-town

Well, yes…and no. Despite flaws (Right to Be Forgotten), the GDPR has strong, well-crafted, badly needed privacy protections. But to get those protections, Europeans need their privacy regulators to enforce the rules.

That’s where the GDPR miracle founders. Europe includes several tax-havens — Malta, Cyprus, the Netherlands, Luxembourg, Ireland — that compete to offer the most favorable terms to international corporations and other criminals. For these havens, paying little to no tax is just table-stakes. As these countries vie to sell themselves out to giant companies, they compete to offer a favorable regulatory environment, insulating companies from lawsuits over corruption, labor abuses and other crimes.

All of this is made possible — and even encouraged — by the design of European federalism, which lets companies easily shift which flag of convenience they fly. Once a company re-homes in a country, it can force Europeans across the union to seek justice in that country’s courts, under the looming threat that the company will up sticks for another haven if the law doesn’t bend over backwards to protect corporate citizens from the grievances of flesh-and-blood humans.

Big Tech’s most aggressive privacy invaders have long flown Irish flags. Ireland is “headquarters” to Google, Meta, Tinder, Apple, Airbnb, Yahoo and many other tech companies. In exchange for locating a handful of jobs to Ireland, these companies are allowed to maintain the pretense that their global earnings are afloat in the Irish Sea, in a state of perfect, untaxable grace.

That cozy relationship meant that the US tech giants were well-situated to sabotage Ireland’s privacy regulator, who would be the first port of call for Europeans whose privacy had been violated by American firms. For many years, it’s been obvious that the Irish Data Protection Commission was a sleeping watchdog, with infinite tolerance for the companies that pretend to make Ireland their homes. 87% of Irish data protection claims involve just eight giant US companies (that pretend to be Irish).

But among for hardened GDPR warriors, the real extent of the Data Protection Commissioner’s uselessness is genuinely shocking. A new report from the Irish Council for Civil Liberties reveals that the DPC isn’t merely tolerant of privacy crimes, they’re gamekeepers turned poachers, active collaborators in privacy abuse:

https://www.iccl.ie/wp-content/uploads/2023/05/5-years-GDPR-crisis.pdf

The report’s headline figure really tells the story: the European Data Protection Board — which oversees Ireland’s DPC — overturns the Irish regulator’s judgments 75% of the time. It’s actually worse than it appears: that figure only includes appeals of the DPC’s enforcement actions, where the DPC bestirred itself to put on trousers and show up for work to investigate a privacy claim, only to find that the corporation was utterly blameless.

But the DPC almost never takes enforcement actions. Instead, the regulator remains in its pajamas, watching cartoons and eating breakfast cereal, and offers an “amicable resolution” (that is, a settlement) to the accused company. 83% of the cases brought before the DPC are settled with an “amicable resolution.”

Corporations can bargain for multiple, consecutive amicable resolutions, allowing them to repeatedly break the law and treat the fines — which they negotiate themselves — as part of the price of doing business.

This is illegal. European law demands that cases that involve repeat offenders, or that are likely to affect many people, must be fully investigated.

Ireland’s government has stonewalled on calls for an independent review of the DPC. The DPC continues to abet lawlessness, allowing corporations to use privacy invasive techniques for surveillance, discrimination and manipulation. In 2022, the DPC concluded 64% of its cases with mere reprimands — not even a slap on the wrist.

Meanwhile, the DPC trails the EU in issuing “compliance orders” — which directly regulate the conduct of privacy-invading companies — only issuing 49 such orders in the past 4.5 years. The DPC has only issues 28 of the GDPR’s “one-stop-shop” fines.

The EU has 26 other national privacy regulators, but under the GDPR, they aren’t allowed to act until the DPC delivers its draft decisions. The DPC is lavishly funded, with a budget in the EU’s top five, but all that money gets pissed up against a wall, with inaction ruling the day.

Despite the collusion between the tech giants and the Irish state, time is running out for America’s surveillance-crazed tech monopolists. The GDPR does allow Europeans to challenge the DPR’s do-nothing rulings in European court, after a long, meandering process. That process is finally bearing fruit: in 2021, Johnny Ryan and the Irish Council for Civil Liberties brought a case in Germany against the ad-tech lobby group IAB:

https://pluralistic.net/2021/06/16/inside-the-clock-tower/#inference

And the activist Max Schrems and the group NOYB brought a case against Google in Austria:

https://pluralistic.net/2020/05/15/out-here-everything-hurts/#noyb

But Europeans should not have to drag tech giants out of Ireland to get justice. It’s long past time for the EU to force Ireland to clean up its act. The EU Commission is set to publish a proposal on how to reform Ireland’s DPA, but more muscular action is needed. In the new report, the Irish Council For Civil Liberties calls on the European Commissioner for Justice, Didier Reynders, to treat this issue with the urgency and seriousness that it warrants. As the ICCL says, “the EU can not be a regulatory superpower unless it enforces its own laws.”

Catch me on tour with Red Team Blues in Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/15/finnegans-snooze/#dirty-old-town

[Image ID: A toddler playing with toy cars. The cars are Irish police cars. The toddler's head has been replaced with the menacing, glowing red eye of HAL9000 from Stanley Kubrick's '2001: A Space Odyssey.' The toddler's knit cap is decorated with the logos for Apple, Google, Facebook and Tinder.]

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

#pluralistic#made towns#EDPB#gamekeeper turned poacher#ireland#alphabet#eire#erin go bragh#big tech#corruption#data protection#facebook#tax havens#google#meta#tiktok#microsoft#msft#micros~1#gdpr#privacy#european federalism#eu#european union#European Data Protection Board#airbnb#tinder#forum-shopping apple#federalism

58 notes

·

View notes

Text

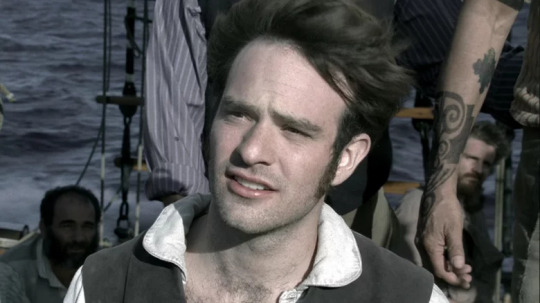

William Hurt's Stunt Double Saved Charlie Cox From Drowning On The Set Of Moby Dick

By Witney Seibold Dec.12, 2022 (X)

In Herman Melville's original 1851 novel "Moby-Dick," not much was known about the vengeful Capt. Ahab beyond his obsession with finding the story's titular whale. In Mike Barker's 2011 miniseries, Ahab (William Hurt) interacts with his on-screen wife Elizabeth (Gillian Anderson). Ethan Hawke plays Starbuck, Raoul Trujillo plays Queequeg, and Charlie Cox plays the stalwart narrator Ishmael. Cox has recently been getting a great deal of attention from Marvel fans for his performance as the superhero Daredevil in his own show, and for guest spots on "She Hulk: Attorney at Law" and in "Spider-Man: No Way Home." This author first noticed Cox for his performance as Lorenzo in Michael Radford's 2004 adaptation of "The Merchant of Venice." His appearance in "Moby Dick" would immediately be followed by 23 episode of the hit show "Boardwalk Empire," putting the actor on the map.

Filming on "Moby Dick" took place in Malta in 2009. As its story demands, the miniseries features many scenes at sea. There are many moments when multiple characters are gathered in small rowboats. Then — again, as the story demands — many characters are thrown out of said rowboats and into the ocean. In the December 2022 issue of Total Film Magazine, Cox was interviewed about his worst on-screen experience, and he revealed that filming "Moby Dick" included a moment that might have killed him. Those cursed rowboats, it seems, almost offered Cox the same fate as many members of the Pequod.

Luckily, William Hurt's unnamed stunt double — unnamed, but most likely uncredited industry veteran Tomas Ereminas — was there to rescue Cox.

Thwarting death

Charlie Cox was lucky when the day came to shoot the rowboat scene. William Hurt, it seems, did not want to get into the rowboat with his co-stars. Cox cited Hurt's age at the reason for refusing — Hurt was 61 at the time — although it could be just as likely that the star sensed danger that day. Or he simply wasn't in the mood. Regardless, one of Hurt's stunt doubles stepped in. When asked what his worst day of shooting was, Cox recalled:

"I had a stunt go wrong on the TV show 'Moby Dick.' Nobody's fault. I was meant to be on the rowboat with William Hurt but he had said he didn't want to do it. In his place was a stunt double. Anyway, we got pulled, the boat flipped, and my leg was stuck underneath one of the benches. This stunt guy got me out. With all due respect to the late, great Bill Hurt, being the age he was and not being a stuntman, I don't think he would have thought to do that. So this stunt guy potentially saved my life."

The benches Cox referred to are called, in nautical lingo, thwarts. They are ordinarily removable, but in this case, seemed to be locked firm.

The 2011 "Moby Dick" miniseries aired on August 1 and 2 of that same year, and was met with positive reviews, despite its notable changes to the novel's story. Herman Melville's novel, incidentally, has been adapted to film and TV multiple times since its first cinematic iteration in 1926. The 2011 version was the most recent direct filmed adaptation, but both the 2014 miniseries "The Whale" and Ron Howard's 2015 film "In the Heart of the Sea" adapted real-life events that served as inspiration for "Moby-Dick."

~*~

#ACK!! A huge thank you to the stunt man who rescued Charlie!! 😰#charlie cox#ishmael#moby dick 2011#interview#article

58 notes

·

View notes

Text

The Kamal's Secret Connection To The Largest Election Tech Firm

The government is so out of control. It is so bloated and infested with fraud and deceit and corruption and abuse of power. Ted Nugent

I weep for the liberty of my country when I see at this early day of its successful experiment that corruption has been imputed to many members of the House of Representatives, and the rights of the people have been bartered for promises of office. Andrew Jackson, 7 th president of the United States

Our country is now taking so steady a course as to show by what road it will pass to destruction, to wit: by consolidation of power first, and then corruption, its necessary consequence. Thomas Jefferson

Politicians are a lot like diapers. They should be changed frequently, and for the same reasons. Mark Twain

The following meme popped into my email this morning...

"Kamala Harris failed to disclose her relationship to Sir Nigel G. Knowles, her husband Douglas C. Emhoff's former boss at DLA Piper PLC of London, UK.

"Sir Nigel is co-director of SGO Smartmatic with Lord George Mark Malloch-Brown who controls Nevada, Wisconsin, Pennsylvania, Georgia, Michigan and Wisconsin voting machines from Dominion, Smartmatic, ES&S, Sequoia, Premier, Diebold and Optech machines responsible for the alleged 2020 voting fraud."

Shocking? Yes! I decided to check it out.

And surprisingly, Bloomberg is reporting that Harris' lawyer husband, Doug Emhoff, faces election quandary as Vice President's spouse.

In 2014, Smartmatic's CEO, Antonio Mugica and British Lord Mark Malloch-Brown announced the launching of the SGO Corporation Limited , a holding company based in London whose primary asset is the election technology and voting machine manufacturer. Malloch-Brown became the chairman of the board of directors of SGO since it's foundation . Antonio Mugica remains as CEO of the new venture. They were joined on SGO's board by Sir Nigel Knowles , Global CEO of DLA Piper , and Douglas Emhoff's former boss before his wife was named as Democrat candidate for President of the United States. Emhoff has since left his job as partner at DLA Piper.

Nigel Knowles did not take his father's name; he took his mother's. His father was connected to Cecil Rhodes, Ruskin and others, all early communists.

SGO Smartmatic that controls all election systems, including Dominion, worldwide - the various company names (Smartmatic, Hart InterCivic, Sequoia, Premier, Diebold, ES&S) and all have common Optech software.

SGO is the largest elections tech firm .

The aim of SGO according to its CEO was to continue to make investments in its core business of election technology, as well as rolling out a series of new ventures which should make us extremely wary. Those ventures include biometrics , online identity verification , internet voting and citizen participation, e-governance and pollution control . Can you imagine the possibilities?

As an aside, Peter Comey, the brother of former FBI Director James Comey, is a Senior Director of Real Estate Operations for the law firm DLA Piper. Birds of a feather.

Here is a timeline on Sir Nigel Graham Knowles, as well as his family tree . Knowles appears to be the king of "K" Street, the home of lobbyists and Non-Governmental Organizations in DC. He is the lead Trustee of The Prince's Trust , a United Kingdom-based charity founded in 1976 by King Charles III to help vulnerable young people get their lives on track. It supports 11-to-30-year-olds who are unemployed or struggling at school and at risk of exclusion.

DLA Piper is most likely the primary law firm for the British Crown.

The Prince's Trust

In 1990, Knowles founded the Prince's Trust International at the Knights of Malta. Then they incorporated in the United States as Prince's Trust America. Another British connection is the fact that Kamala Harris' father was a Jamaican citizen and Jamaica was also a British holding. Jamaica was granted independence in 1962.

Major donors to the Prince's Trust are BAE Systems, BlackRock, CDW UK, Garfield Weston Foundation, HSBC UK, LDC, Marks & Spencer Group plc, and NatWest. Here is a list of Prince's Trust patrons , which includes Barclay's Bank, Dell, Apple, Google, HSBC, Accenture, Capgemini, JPMorgan Chase, Morgan Stanley, Marriott, BAE, Clear Channel, Ricoh, American Airlines, Allianz, Amazon, AT&T, Baillie Gifford, Bloomberg, Boeing, DLA Piper, Facebook, HP, Joules (John Podesta), NBC, Qualcomm, NTT Data, Oracle, Rolls Royce, RBC, TikTok and Worldpay.

Basically, it appears as though Harris may be taking orders from the mother ship, The Prince's Trust of Great Britain.

The Pilgrim's Society

The Pilgrim's Society is the mother lode, operating from the London office of the Privy Council. Those names include the English-Speaking Society, Royal Over-Seas League, Atlantic Council, Club of Rome, Bilderberg Group, Davos World Economic Forum, Trilateral Commission, Aspen Institute, United Nations, Council on Foreign Relations among them.

Knowles is also a member of the British Pilgrims Society and apparent handler for Biden and Harris. The Society was founded in July of 1901 allegedly to bring peace and harmony between America and Great Britain. However, there definitely seems to be ulterior motives behind the society when one examines former members such as Allen and John Foster Dulles, Alexander Haig, John D. and David Rockefeller, Henry Kissinger, General George Marshall, Averall Harriman, Henry Luce, King Charles III and more.

Sir Nigel-directed companies include DLA Piper (auditor: Deloitte), SERCO/SGO Smartmatic (auditor: KPMG), Prince's Trust America/QintetiQ (auditor: Price Waterhouse Coopers), Wellcome Trust/DLA Piper (auditor: Deloitte), Investec (auditor: Ernst & Young, director Lord Mark Malloch-Brown).

The Pilgrims of Great Britain and the Pilgrims of the United States have reciprocal membership. These two groups are the two oldest and most prestigious Anglo- American organizations on both sides of the Atlantic.

British Colonialism in India

Britain controlled India from 1757 through the East India Company which was initially created in 1600 to serve as a trading body for English merchants, specifically to participate in the East Indian spice trade, and it later added items such as cotton, silk, tea, and opium.

From 1858 onward, the British government directly ruled India and it became known as the British Raj. It had a negative impact on people living in India as many suffered from extreme poverty and famines during British rule. The government as well as British individuals gained a lot of wealth from trade with India which they used in part to fund the industrial revolution.

India gained independence from British rule on August 15, 1947, after decades of nonviolent resistance led by Mohandas Gandhi and Jawaharlal Nehru. The Indian Independence Act of 1947 created two independent nations, India and Pakistan, ending 200 years of British rule.

DLA Piper has international trade and customs in India . Why is this history important? Because we have two natives of India in both parties campaigning for president, Kamala Harris and Usha Vance, wife of JD Vance. And that's not to mention two other South Asian Republican candidates who vowed for the top slot, Nikki Haley and Vivek Ramaswamy, the latter a first cousin of Usha Vance.

Usha Vance

JD Vance's wife, Usha is also a member of the Pilgrim's Society. Usha has worked for law firms associated with the Clinton Foundation and Bill and Hillary. She was at Cambridge University as a scholar of the Bill and Melinda Gates Foundation. Bill and Melinda are 2005 knighted members of the British Pilgrims Society who funded with Britain's Pirbright Institute (UK), who is testing new coronavirus vaccines on animals to help combat Covid-19. Usha was on the board of directors at Gates Cambridge, a Bill Gates enterprise. (The Pirbright Institute is a national center that works to contain, control, and eliminate viral diseases of animals through its fundamental and applied research programmes.)

JD and Usha both worked at Sidley Austin law firm, a firm that employed the Obamas and others of their standing.

Usha received both a BA and JD from Yale—classical CIA grooming venues notoriously controlled by secret societies like Skull and Bones. It was business associate and Bilderberg globalist elite Peter Thiel who introduced JD Vance to Donald Trump. The Pilgrim Society strikes again. Some 40 or 50 years ago, Phyllis Schlafly wrote that every vice president is chosen by the Bilderbergers.

The British Connection

Kamala Harris and Usha Vance both have South Asian heritage. The bigger interconnection however, is Great Britain, The Pilgrim Society and The Prince's Trust.

Add all the pieces together...

This gives us a clearer picture of the breadth and complexity of transatlantic thought from the 19 th and 20 th centuries to present day. Behind the scenes, the stealth of the British crown and her hierarchal organizations have wormed their way into America's governmental administrations with their utopian hopes of once again controlling the "colonies."

#blacklivesmatter#blackvotersmatters#donald trump#joe biden#naacp#blackmediamatters#blackvotersmatter#news#ados#youtube

0 notes

Text

Efficiency and Expertise Federal Outsourcing Solutions for Malta Work Permits

Efficiency and expertise are the keys to federal outsourcing solutions for obtaining work permits in Malta. By leveraging specialized services, applicants can navigate the complex visa application process with ease and confidence. Federal outsourcing firms offer comprehensive assistance, guiding individuals through each step, from document preparation to submission and follow-up. Their deep understanding of Maltese immigration laws and regulations ensures that applications are accurate, complete, and compliant, minimizing the risk of delays or rejections.

Moreover, these outsourcing solutions smooth the entire process, saving applicants valuable time and resources. With dedicated experts handling administrative tasks and liaising with relevant authorities on behalf of the applicant, individuals can focus on their professional endeavors or other aspects of their relocation to Malta. Whether it's obtaining work permits for employment, entrepreneurship, or investment purposes, federal outsourcing solutions provide the best approach to meet the unique needs and goals of each applicant, moving a smoother transition and a more efficient visa acquisition process.

Visit: https://federaloutsourcing.com/blog-details/your-ultimate-guide-to-getting-a-work-permit-visa-for-malta

#best immigration consultant#immigration#immigration consultant#federal outsourcing#best immigration consultant in delhi#malta visa#Malta Work Permit Visa

0 notes

Text

What Are the Benefits of CE Mark Certification in Malta?

What Are the Advantages of CE Mark Certification in Malta?

In the global market, notably inside the European Economic Area (EEA), the CE mark is an emblem that represents compliance with critical wellness, safety, and environmental management requirements. Obtaining CE mark certification is critical for Malta-based firms seeking to enter the EEA market and manufacture high-quality, secure products. This article discusses the benefits of CE mark certification in Malta, including its impact on trade, customer trust, and regulatory compliance.

Market Gain Access and Professional Assistance:

One of the key advantages of CE mark certification in Malta is unfettered access to the EEA, a substantial financial zone that encompasses over 30 countries. With CE marking, Maltese businesses can freely sell their goods and services in this vast market without encountering additional technological barriers. This broadens market reach and increases competitiveness for Maltese products in the European phase.

Legal Compliance and Consumer Safety:

CE marking is a regulatory requirement for particular items in the European Economic Area (EEA), which includes Malta. It demonstrates that an item complies with European Union (EU) wellness, security, and environmental protection laws. By getting CE mark certification, Maltese enterprises ensure that their products meet these stringent criteria, demonstrating a dedication to customer safety. This protects consumers and businesses from legal consequences and liabilities associated with noncompliance.

Improved Consumer Dependability and Self-confidence:

The CE mark is widely acknowledged as an indicator of high quality and safety. Customers in the EEA, including Malta, are concerned about connecting the CE mark to items that meet high standards. As a result, for Maltese enterprises, having the CE mark on their products increases consumer trust and confidence. This trust is crucial in establishing brand credibility and fostering long-term relationships with local and international clients.

Competitive advantages in the global market:

While CE marking is generally associated with the EEA, it also serves as a quality indicator in the international marketplace. Products with CE certification are usually perceived as satisfying stringent requirements, making them more appealing to consumers worldwide. By gaining CE mark certification, Maltese enterprises have a competitive edge not just within the EEA but also in countries outside of Europe, thereby expanding their global presence.

Streamlined Regulatory Compliance:

CE mark certification ensures that items adhere to EU policies, easing the process of reviewing various national standards within the EEA. This implies an organized approach of regulatory compliance for Maltese merchants, since they can adhere to a single set of requirements specified across the entire EEA. This simplification decreases the procedural barriers associated with exporting to other EU member states, allowing for simpler and more successful cross-border trade.

Promotes technological and product advancements:

CE states that Malta's businesses are encouraged to develop and manufacture products that meet or exceed European standards. The certification process thoroughly assesses a product's design, procedures, and documentation. This scrutiny generates a culture of continuous improvement, encouraging businesses to spend in R&D to stay ahead of technological breakthroughs and market trends.

Supply Chain Cooperation:

CE mark certification frequently necessitates collaboration with multiple stakeholders in the supply chain. This collaborative technique ensures compliance and fosters closer relationships among manufacturers, providers, and representatives. Maltese businesses may build a long-lasting and dependable supply chain that satisfies the demands of the EEA market by collaborating to meet CE marking regulations.

Threat Reduction and Responsibility Decrease:

CE marking is much than simply an emblem; it represents a commitment to quality and security. Maltese enterprises reduce the risks connected with producing poor or unsafe products by adhering to CE standards. This, in turn, reduces the likelihood of item recalls, legal disputes, and damage to the brand's credibility. CE mark certification is an aggressive method that allows firms to demonstrate their due care and commitment to supplying risk-free and compliant products to consumers.

Conclusion:

Finally, the benefits of CE mark certification for services in Malta are numerous. CE marking plays an important role in the growth and development of Maltese businesses, from facilitating market access in the EEA to ensuring legal compliance, increasing consumer trust funds, and gaining a competitive advantage around the world. As the global industry becomes more interconnected, acquiring CE mark certification is no longer just a regulatory obligation, but a tactical necessity for businesses seeking to prosper in a competitive and quality-driven world.

Why did Malta CE MARK Certification choose to accredit with Factocert?

Our CE MARK Professionals in Malta consistently deliver excellent results. To ensure that the organisation can function without them, each device head develops a cellular phone name on a continuous basis. However, that is not exactly how all techniques have begun and ended.

Factocert, Malta's leading authority in CE MARK Certification, provides choices for remarkable, detailed, and necessary businesses in Valletta, Mdina, Birgu, and Sliema. To oversee all enterprises that obtain licenses through preliminary cost modification mechanisms in Malta. They also provide a wide range of services at significantly lower costs, including software applications, training and investigations, documents, audits, enrollment, and bogus checks.

The CE MARK can be used to adorn Malta's financial instruments as a valuable service undertaking. We offer a free quote for the Certification fee rate.

Visit for added Information: CE Mark Certification in Malta

RELATED LINKS:

ISO 21001 Certification in Malta

ISO 22301 Certification in Malta

ISO 37001 Certification in Malta

ISO 27701 Certification in Malta

ISO 26000 Certification in Malta

ISO 20000-1 Certification in Malta

ISO 50001 Certification in Malta

CE Mark Certification in Malta

0 notes

Text

Amidst crypto regulation developments in the EU, Cyprus is amending its “Prevention and Suppression of Money Laundering Law” to enforce fines on illegal crypto service providers, aiming to regulate the cryptocurrency industry better.Amending and Enforcing LawBy enforcing severe fines on crypto service providers (CSPs) who operate illegally, Cyprus is attempting to regulate the cryptocurrency industry better. The “Prevention and Suppression of Money Laundering Law” is being amended, according to the government. The Financial Action Task Force (FATF) international standards and the recommendations made in the MONEYVAL report will both be complied with by Cyprus due to this change.Mandatory Registration with Cysec for CSPsThe proposed amendment mandates that crypto asset trading firms, or CSPs, register with Cyprus Securities and Exchange Commission (CySEC), the nation’s financial authority. Serious repercussions, such as fines of up to €350,000 and imprisonment for a maximum of five years, or both, may occur if this rule is not followed. Given the development of new technology, the government has defended these sanctions as essential steps in reducing the risks of money laundering and terrorism financing. Cyprus is not the only country implementing strict regulations against CSPs without a license. Malta has additionally imposed fines of up to €15 million for infringement of cryptocurrency regulations and punishments of up to six years in prison. In contrast, nations like France and Ireland have also implemented a variety of penalties for comparable infractions, including imprisonment and hefty fines.Cyprus Bar Association Raises ConcernsThe Cyprus Bar Association has expressed concern about the potential impact of these strict regulations on the country’s reputation as a business-friendly jurisdiction. They argue that while it is essential to combat money laundering and terrorism financing, the penalties imposed should be proportionate and not discourage legitimate businesses from operating in Cyprus. The Cyprus Bar Association has voiced opposition to the draft amendment. The association has voiced concerns regarding the law’s breadth and questioned the need for CSPs registered in other EU member states to additionally register in Cyprus, given that they are already subject to the jurisdiction of their home state. What is the ‘Travel Rule’?The “Travel Rule,” which obliges CSPs to exchange customer and transaction information with authorities, was also suggested by the association. The Finance Ministry responded by claiming that the rule aligns with how the EU’s single market operates. They stress that, despite their registration in other EU member states, CySEC has jurisdiction over CSPs offering services in Cyprus. Furthermore, they guaranteed that the necessary amendments to Cyprus’ current legal framework would allow for the prompt implementation of the “Travel Rule. The Parliamentary Committee on Legal Affairs is currently reviewing this proposed change, which is expected to be approved soon. Once passed, implementing the “Travel Rule” will enhance the regulatory framework for CSPs in Cyprus, ensuring greater transparency and accountability in financial transactions. This aligns with the EU’s efforts to combat money laundering and terrorist financing across member states. !function(f,b,e,v,n,t,s) if(f.fbq)return;n=f.fbq=function()n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments); if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)(window,document,'script', ' fbq('init', '887971145773722'); fbq('track', 'PageView');

0 notes

Text

IPint, Malta's Leading Crypto Payment Gateway, Eases Crypto Transactions

Cryptocurrencies are a new innovation in the digital era that could completely alter the way we do business financially. As cryptocurrency's popularity skyrockets, so does the need for reliable payment processors. IPint, a well-known Maltese firm, has risen to prominence as a premier crypto payment gateway provider, meeting the needs of consumers and merchants alike with an easy-to-use and trustworthy service.

The popularity of Bitcoin, Ethereum, and Litecoin, among others, has skyrocketed over the past decade, making them a viable alternative to traditional digital currencies. They remove the need for centralized intermediaries like banks by providing a decentralized and secure system for making and receiving payments. The increasing popularity of cryptocurrency has heightened the importance of safe and simple payment processing systems.

The Inception of IPint: Headquartered in the burgeoning fintech hotspot of crypto Payment Gateway malta, IPint saw the promise of cryptocurrencies early on and set out to address the difficulties of incorporating them into traditional payment networks. IPint, founded by a group of blockchain technology and financial specialists, provides a full suite of services that facilitate the easy acceptance and processing of cryptocurrency payments by businesses.

IPint's crypto payment gateway offers a number of useful features and benefits, including the following.

IPint is compatible with several different digital currencies, including Bitcoin, Ethereum, Ripple, and many more. This kind of backing guarantees that companies can serve a diverse customer base and adjust to the ever-changing crypto market.

IPint places a premium on security and uses state-of-the-art encryption standards to keep all financial dealings and client information safe. IPint ensures that businesses and customers can confidently engage in crypto transactions by complying to high security standards.

Instant Settlements: Transactions processed through conventional payment gateways are often delayed. IPint solves this problem by facilitating quick settlements, which speed up the payment process and protect businesses against chargebacks.

d. Simple Integration: IPint's payment gateway can be easily integrated with most popular e-commerce platforms, allowing merchants to accept cryptocurrency payments with little to no additional programming or IT support. This straightforward method improves the onboarding process for businesses, making it easier for them to start using cryptocurrencies.

Operating from Malta, IPint follows the rigorous regulatory framework set by the Malta Financial Services Authority (MFSA). e. Regulatory Compliance. IPint's platform for cryptocurrency transactions is trustworthy and lawful because it abides by the aforementioned standards.

IPint is at the forefront of facilitating cryptocurrency transactions as their popularity and use continue to grow around the world. Businesses looking to accept cryptocurrency payments may rely on the company as a reliable partner thanks to its dedication to technological advancement and client satisfaction.

Conclusion:

IPint's rise to prominence as Malta's go-to crypto payment gateway is indicative of the market need for more dependable services in the cryptocurrency sector. IPint has established itself as a frontrunner in the field of crypto transaction simplification thanks to its extensive feature set, stringent security protocols, and flexible integration options. IPint's dedication to innovation and client satisfaction ensures it will play a crucial role in determining the future of crypto payments as cryptocurrencies acquire wider mainstream recognition.

#crypto Payment Gateway malta#Doge Payment Gateway malta#Ltc Payment Gateway malta#bitcoin payment gateway malta#Defi payment gateway malta#Payment Gateway In Malta

0 notes

Text

Malta Green Card

Malta, an enchanting Mediterranean archipelago, has become a popular destination for expatriates seeking a high quality of life, favorable tax regimes, and a thriving economy. One of the most attractive ways to live and work in Malta is by obtaining the Malta Green Card. EMD Advocates, a leading law firm in Malta, offers expert guidance to navigate the process seamlessly. In this blog, we will explore the benefits of the Malta Green Card, the eligibility criteria, and how EMD Advocates can assist you in making Malta your new home.

What is the Malta Green Card?

The Malta Green Card, officially known as the Malta Permanent Residence Programme (MPRP), allows non-EU nationals to reside, work, and establish a business in Malta. It provides a pathway to permanent residency, offering a range of benefits that make Malta an attractive destination for individuals and families alike.

Benefits of the Malta Green Card

1. Permanent Residency

The Malta Green Card grants permanent residency, allowing holders to live in Malta indefinitely. This status also provides access to the Schengen Zone, enabling travel to 26 European countries without additional visas.

2. Work and Business Opportunities

Permanent residents can work in Malta without requiring a separate work permit. Additionally, Malta's robust economy and strategic location make it an ideal place for establishing and running a business.

3. Favorable Tax Regime

Malta offers an attractive tax system, particularly for high-net-worth individuals and entrepreneurs. There is no inheritance tax, wealth tax, or property tax, making it a tax-efficient destination.

4. High Quality of Life

Malta boasts a Mediterranean climate, rich cultural heritage, and excellent healthcare and education systems. The island's safe environment and welcoming community make it a perfect place for families.

Eligibility Criteria

To qualify for the Malta Green Card, applicants must meet specific requirements:

1. Financial Stability

Applicants must demonstrate financial stability, ensuring they can support themselves and their dependents without relying on Malta's social welfare system.

2. Investment in Property

Applicants must invest in property in Malta. This can be through purchasing or renting property that meets the minimum value thresholds set by the government.

3. Health Insurance

Comprehensive health insurance covering all risks in Malta is required for the applicant and their dependents.

4. Clean Criminal Record

Applicants must have a clean criminal record and be of good character.

How EMD Advocates Can Assist

EMD Advocates is a premier law firm in Malta with extensive experience in immigration law. They provide comprehensive services to help clients obtain the Malta Green Card, ensuring a smooth and hassle-free process.

1. Expert Guidance

EMD Advocates offers personalized advice on the eligibility criteria and required documentation, helping clients understand the process and prepare their applications accurately.

2. Property Investment Assistance

The firm provides guidance on meeting the property investment requirements, whether through purchasing or renting property. They also offer assistance in finding suitable properties that meet the government's criteria.

3. Application Preparation and Submission

EMD Advocates meticulously prepares and submits the application on behalf of the client, ensuring all necessary documents are in order. Their expertise minimizes the risk of application rejection due to incomplete or incorrect submissions.

4. Post-Approval Support

Once the Malta Green Card is approved, EMD Advocates continues to offer support, including assistance with residency renewals and any other legal matters that may arise.

Conclusion

The Malta Green Card opens the door to a wealth of opportunities in one of the Mediterranean's most desirable locations. With the guidance of EMD Advocates, the process of obtaining permanent residency in Malta can be straightforward and stress-free. If you are considering relocating to Malta, contact EMD Advocates today to start your journey towards a new life in this beautiful island nation.

0 notes

Text

Italian Regulator Suspends Crypto Investment Firm Behind Liracoin

Italian securities regulators have shut down the activities of a cryptocurrency investment firm and its corresponding cryptocurrency, in the latest enforcement action against companies operating in the sector.

La Commissione Nazionale per le Società e la Borsa (CONSOB) issued a notice of suspension to investment firm Tessline, covering its own activities as well as the promotion of its associated cryptocurrency, liracoin.

The notice, which covers several organizations linked to the firm, demanded the company terminates its violations of Italy’s Consolidated Law of Finance. In particular, CONSOB referenced Article 18, which sets out statutory obligations on finance companies under the direction of the regulator and Italy’s central bank.

The notice says that the regulator has formally suspended all activities involved in the offer and promotion of liracoin for the next 90 days, as well as removing the firm’s ability to promote investment products.

CONSOB has form for this kind of suspension, after serving up similar bans to two firms allegedly involved in cryptocurrency fraud. This came at the same time as the regulator was forced to issue a joint statement with the Financial Services Authority in Malta over the operation of unlicensed crypto exchanges in both territories.

The regulator has been sending cease and desist notices since November to a number of firms suspected of being involved in providing unlicensed investment services, with as many as three firms thought to have been caught in that round of enforcement action.

The move shows CONSOB tackling suspected abuse in the cryptocurrency sector head-on, at a time when regulators worldwide are tackling ever-rising levels of crypto-related fraud.

From unlicensed exchanges and unregistered securities to outright fraud and theft, CONSOB counterparts elsewhere in the world have faced similar challenges in reducing levels of criminality.

Tessline has previously been flagged by regulators for breaching compliance rules, including in Ireland, where the Central Bank of Ireland issued warnings about the unauthorized firm back in February.

The development further strengthens the case for more robust regulation and licensing in the cryptocurrency sector, with scammers finding it far too easy to defraud investors.

0 notes

Text

Alleged cryptocurrency scams flood the National Court

The alleged cryptocurrency scams like bitcoin or Ethereum, have stormed into Spanish courts, where complaints and complaints from thousands of affected people accumulate that have seen hundreds of millions of euros evaporate through pyramid schemes.

Cryptocurrencies or cryptocurrencies They are virtual currencies that are based on encrypted security codes to certify electronic transactions for the purchase and sale of goods and services, and of these there are already about 5,000, although only 40 of them have liquidity within the market.

In September 2020, the total capitalization of this market was 336,000 million dollars. At the moment, in Spain The largest alleged fraud by volume defrauded is that of Algorithms Group, London-based bitcoin investment firm that could have defrauded more than 280 million euros to about 3,000 investors and is already investigating the National audience.

The complaint, presented by Zaballos Abogados, lists a series of alleged crimes such as fraud, intrusion, money laundering, corporate crimes, misappropriation and illicit association, and he goes against Javier Biosca -in search and capture since last May 10-, his wife Paloma Gallardo, and his son Javier.

The lawyer Emilia Zaballos, president of the Association of People Affected by Investments in Bitcoins, advocates for the creation of specialized courts in these operations, and regrets the laziness that, in his opinion, the National Securities Market Commission has shown (CNMV) as the Bank of Spain, which warn about these financial bars but do not prevent them from operating.

Pyramid scam

Below the volume allegedly defrauded by Algorithms is Nimbus, which according to a forensic report by the Civil Guard would have cheated about 136 million euros. After a complaint in a court in Huelva by the Aranguez Abogados law firm, the National Court must rule on its jurisdiction, after the court was inhibited.

The mastermind of the plot is Andrea Zanon, who between 2009 and 2016 was responsible for the Middle East risk area of the World Bank; In 2020 it created Nimbus in Malta, and in October of that year the company already stopped facing commitments to its investors, around 4,000.

As stated in the complaint, Nimbus followed a pyramid scheme or Ponzi scheme, whereby instead of buying and selling crypto assets, itIn reality, it did not carry out any type of financial activity but limited itself to paying the interests of the first investors with the capital offered by the following ones. The Nimbus operation, which guaranteed returns from between 7% and 15% monthly, it could be constitutive of the crimes of fraud, money laundering and criminal organization.

Money laundering and criminal organization

Another of the cases that the National Court is already investigating is that of Arbistar 2.0, whose economic damage currently exceeds 41 million euros but could amount up to 100 million. The head of the Central Court of Instruction number 4, José Luis Calama, accepted the inhibition of a court in Tenerife on understanding that those investigated, led by Santiago Fuentes Jover, could have incurred in alleged aggravated fraud, criminal organization and a continuing crime of falsification of a commercial document.

Arbistar allegedly concocted a fraud scheme promising investors returns of between 8% and 15% monthly, paying them weekly -always on Saturdays- and giving them the option of adding it to the initial amounts invested or opting for the reimbursement. As in the case of Nimbus, what allegedly happened was that they used a part of the money obtained from investors to deliver it to previous investors in payment of the high interest agreed, says the judge.

Also in the National Court, the support judge of the central investigating court No. 6, Elías Gadea, opened proceedings at the end of April after a complaint filed against the Kuailian cryptocurrency platform, founded in September 2018 by Cristian Carmona, David Ruiz de León, Javier Hermosilla and Miguel Tello. According to the judge's order, investors exchanged euros for Ethereum through a virtual wallet with a 1,000-day contract. The judge has indications that, in addition to the pyramidal operation with cryptocurrencies, Kuailian could have committed tax fraud, being domiciled in Estonia although it operates in Spain, as well as money laundering, although it has not yet quantified the volume of the alleged swindle.

1 note

·

View note

Text

We are hiring freelance Business Development Manager

We are currently seeking a Business Development Manager/Specialist to join our team and help us further develop our business and support foreign investors in Vietnam. #jobsforyou #gbs #BusinessDevelopmentManager #vietnam

GBS is a reputable business and legal services firm with a strong presence in Vietnam, South East Asia, Middle East, Japan, Hong Kong, Malta, and Poland. Our firm specializes in assisting foreign investors in Vietnam with market entry services, company registration services, corporate and commercial law, employment and labor law, dispute resolution and more. With over 13 years of experience, we…

View On WordPress

0 notes

Text

Silvergate Under Fire For Collaborating With Huobi Global Despite KYC Concerns

Despite prior evidence of Huobi Global's lax KYC enforcement, public company investigator Aurelius Capital Value criticized Silvergate for working with the exchange. To argue that Silvergate's screening procedure was inadequate, Aurelius cited Huobi's purported history of aiding money laundering and a 2020 experiment showing how simple it is to create phony accounts. Did Justin Sun Affect Huobi's KYC Process? Following a 2020 experiment by forensics company Cipherblade, Aurelius raised concerns about Silvergate's collaboration with Huobi Global on Twitter. In addition, the experiment showed how simple it is to create false accounts by using manipulated images of famous people as ID photos. Authorities in Thailand and China busted a $124 million money-laundering conspiracy in 2021 that had taken advantage of Huobi's inadequate security measures. Silvergate Bank, chosen by 1600 major crypto firms, Silvergate Exchange Network, specializes in converting crypto and fiat. Researchers found connections between Huobi and darknet marketplace Hydra and discrepancies in Silvergate's due diligence and Huobi's onboarding process. Justin Sun, a member of Huobi's international advisory board, is a significant character. Aurelius claims Sun partnered with Silvergate Bank to launch TRON stablecoin, criticized for lacking technical foundation and value. Through TRON's coin in 2017, Sun raised $58 million. Chinese media alleged that Sun committed insider trading, money laundering, and other financial crimes in 2019. According to The Verge, Sun authorized the Poloniex exchange to onboard new users via a phony KYC mechanism. Furthermore, A former Poloniex employee suggested creating a new account using a picture of the animated character Daffy Duck. As per the sun fiercely refuted the charges and threatened to sue anyone who made false accusations for defamation. If any entity spreads misleading information, we reserve the right to seek legal redress. He confirmed that Harder LLP, our legal counsel, is in charge of representing us. Identity Theft Risk From Weak Controls Financial service providers must abide by KYC regulations to gather and validate customer data and stop criminals from opening accounts. In addition, the procedure must recognize sanctioned people and stop them from opening accounts without authorization. Lax controls can result from various factors, including how strictly different jurisdictions enforce KYC and anti-money laundering laws. Bad actors may also get inside through inept compliance officers' ocular examinations of identifiable information. Sometimes cryptocurrency exchanges relocate to areas with less demanding rules, like Malta, which might cause additional customer issues. According to Aurelius, Huobi clients could only contact the exchange through a mailbox in Seychelles, as the deal had no physical presence in that location. Furthermore, Lax KYC rules on exchanges make it easier for thieves to convert stolen cryptocurrency to money, as businesses are commonly used for trading fiat and cryptocurrencies. Related Reading | Kraken Exits Japanese Market In 2023: Is This The End Of Crypto In Japan? Moreover, the gang in the Chinese money laundering bust got people's personal information by posting false employment adverts. After that, they opened many accounts on exchanges using these details to serve as conduits for illicit money. Read the full article

0 notes

Text

How to Get Started ISO 26000 Certification in Malta for Corporate Social Obligation?

How to Begin ISO 26000 Certification in Malta for Corporate Social Responsibility?

ISO 26000 Certification in Malta for Corporate Social Responsibility (CSR) covers a number of critical steps to ensure successful implementation and compliance. ISO 26000 provides guidance for social responsibility, assisting organizations in incorporating social, environmental, moral, and administrative concerns into their operations and strategies. Here's a full explanation in 1,000 words to help you navigate the procedure effectively:

Step 1: Understand ISO 26000

Before going into the certification process, it is critical to understand the principles and requirements outlined in ISO 26000. This fundamental focuses on seven key ideas of social responsibility:

Liability

Openness

Moral deeds.

Respect for stakeholders' passions.

Respect for laws and international norms of behavior.

Respect for Human Rights

ISO 26000 also provides guidance on how firms should address various social responsibility issues, including as human rights, labor practices, environmental sustainability, fair operating procedures, consumer issues, and community participation.

Step 2: Conduct a Space Analysis

Conduct a complete gap analysis to compare your organization's current practices and policies to the requirements of ISO 26000. Determine where your organization now stands in terms of needs, as well as areas that need to be improved or new procedures implemented.

Step 3: Organizing a CSR Committee

Form a CSR committee or appoint a group to oversee the ISO 26000 certification process. This group should comprise representatives from several divisions within your firm to ensure an alternate strategy for CSR application.

Step 4: Create a CSR Policy

Create a thorough CSR strategy that reflects your organization's commitment to social responsibility and is consistent with the concepts outlined in ISO 26000. Your company's CSR plan must clearly describe its goals, responsibilities, and strategies for addressing social, environmental, and moral issues.

Step 5: Stakeholder Engagement.

Involve stakeholders in your CSR initiatives, including as employees, customers, providers, neighborhood areas, and other relevant events, to get feedback and replies. Stakeholder involvement is critical for identifying expectations and difficulties, as well as building trust and integrity.

Step 6: Implementing CSR Practices.

Implement CSR approaches throughout your organization, focusing on areas such as:

Civil rights: Make sure your organization respects and promotes human rights throughout its operations and supplier chain.

Labor methods: Encourage reasonable labor practices, such as nondiscrimination, fair salaries, and safe working conditions for employees.

Ecological sustainability: Reduce your company's environmental impact by reducing waste, conserving resources, and implementing long-term solutions.

Fair running procedures promote honesty, transparency, and moral behavior in company operations and relationships.

Customer issues: Prioritize customer security, contentment, and education, and address any item or service-related concerns.

Community participation entails working with neighboring communities through charitable activities, offerings, and collaborations to address social needs and contribute to long-term development.

Step 7: Tracking and Dimension.

Create systems for monitoring and evaluating the impact of your CSR efforts against set goals and performance indicators. To ensure continual improvement, check your progress on a regular basis and make changes as appropriate.

Step 8: Paperwork and Records.

Maintain detailed documentation of your CSR operations, including plans, procedures, application plans, monitoring results, and stakeholder contact activities. Documentation is critical for demonstrating conformity with ISO 26000 requirements and promoting the certification process.

Step 9: Interior Audit.

Conduct frequent internal audits to assess the efficiency of your CSR management system and identify areas for improvement. Internal audits provide continuous compliance with ISO 26000 requirements and prepare your firm for external certification audits.

Step 10: Certification Audit.

Once you have implemented and embedded CSR policies in your company's society and operations, you can begin the ISO 26000 certification audit. Choose a reputable certification authority that is authorized to license enterprises under ISO 26000.

During the certification audit, the Certification Body will compare your company's CSR management system to the requirements of ISO 26000. This approach often includes written examination, discussions with key personnel, and on-site inspections to ensure compliance.

Step 11: Certification Upkeep

After successfully completing ISO 26000 certification, your organization should maintain compliance with the requirement through regular security audits conducted by the Certification authority. These audits ensure that your firm remains committed to CSR and continuously improves its efficiency.

Conclusion

ISO 26000 Certification demonstrates your organization's commitment to social responsibility and sustainability, enhancing your online reputation, dependability, and competitiveness in the marketplace. By following these procedures and incorporating CSR concepts into your service technique, you may effectively implement ISO 26000 in Malta and contribute to a long-lasting and honest future.

Why did Malta's ISO 26000 Certification choose to employ Factocert for certification?

Often, our ISO 26000 professionals in Malta produce remarkable results. Given that each device head consistently displays a cellular phone call image, the organization can function without them. However, this is not how all techniques have begun to be completed.

Factocert, Malta's leading professional in ISO 26000 Certification, provides Valletta, Mdina, Birgu, and Sliema with unique, original, and crucial solutions. To assist all businesses in becoming licensed under extraordinary control devices in Malta, they also provide software application programs, education and learning, papers, hole evaluation, registration, audit, and design solutions at a greatly reduced cost.

The use of ISO may help improve Malta's monetary systems as a vital supplier. To be honest, we are providing an unfastened quote of the CertificationF rate's worth.

Visit this site for more information on ISO 26000 Certification in Malta.

RELATED LINKS:

ISO 21001 Certification in Malta

ISO 22301 Certification in Malta

ISO 37001 Certification in Malta

ISO 27701 Certification in Malta

ISO 26000 Certification in Malta

ISO 20000-1 Certification in Malta

ISO 50001 Certification in Malta

CE Mark Certification in Malta

0 notes

Text

Cyprus is taking steps to enhance its regulation of the cryptocurrency sector by imposing harsh penalties on crypto service providers (CSPs) who operate without proper registration. The government has introduced a proposed amendment to the “Prevention and Suppression of Money Laundering Law.” This amendment aims to align Cyprus with international standards outlined by the Financial Action Task Force (FATF) and in accordance with the recommendations put forth in the MONEYVAL report. Registration With Cysec Mandatory for CSPs According to the proposed amendment, crypto asset dealing companies known as CSPs must register with the Cyprus Securities and Exchange Commission (CySEC), which serves as the country’s financial regulator. Failure to comply with this requirement can result in severe consequences, including fines up to €350,000 and imprisonment for a maximum of five years, or both. Read Also: T1Markets: CySEC-Regulated Online Broker Offering Up To 500X Leverage! The government has justified these penalties as crucial measures in combating money laundering and terrorism financing risks, particularly considering advancements in new technologies. Cyprus is not alone in implementing stringent measures against unlicensed CSPs. Malta has also imposed penalties of up to six years’ imprisonment and fines reaching €15 million for violations of cryptocurrency regulations. Similarly, countries like France and Ireland have also enacted various sanctions ranging from imprisonment to substantial fines for similar offenses. Cyprus Bar Association Raises Concerns The draft amendment has faced criticism from the Cyprus Bar Association. The association has expressed concerns about the law’s scope and questioned why CSPs registered in other EU member states should also register in Cyprus, considering they are already under their home state’s supervision. Additionally, the association suggested including the “Travel Rule,” which requires CSPs to share customer and transaction information with each other and authorities. Read Also: UK Crypto Firms Now Mandated to Follow Travel Rule In response, the Finance Ministry stated that the law aligns with the single market functioning within the EU. They emphasize that CySEC holds authority over CSPs providing services in Cyprus, irrespective of their registration in other EU states. Moreover, they assured that necessary modifications to Cyprus’ existing legislation would enable the timely implementation of the “Travel Rule.” A Parliamentary Committee on Legal Affairs is reviewing this draft amendment, which is expected to be passed soon.

0 notes