#magazine covers luxury goods investment apps

Explore tagged Tumblr posts

Text

Bangtan weekly report.

On the Street on first listen/MV watch did not make me warm and fuzzy. It was melancholy, it made me sad.

Watching it again and again, some of the imagery is hard to interpret, like the small sidewalk memorial off to the side with the yellow and white flowers.

But some of the other imagery was definitely obvious. The child representing Army (again). The location: Bowery Station.

The MV was not as dancey as I thought it would be. But since the moment I learned that J. Cole would be part of this I knew this was one of those full circle moments for Hobi.

He preceded the premiere of the MV with a Weverse live on the banks of the Han River in Seoul. Walking around in public doing a live... we’ve come a long way people... I bet there was at least one security guy hovering out of the shot... hiding in the tall grass... somewhere nearby.

Other developments this past week:

When I said “Instagram is going to go silent for a while unless JK wipes his feed again” I didn��t mean wipe it and then delete it, you big dork!!!! Be furrrrrrreallllll.

The estimated “value” of JK’s instagram followers was $50 million USD. All those potential partnership companies gagged and choked.

Jungkook informed fans of his withdrawal from Instagram which had as many followers as South Korea's total population: 52.4 million. It was estimated the value of one posting for Jungkook would have exceeded 1 billion won or almost $766,000 USD. His account value would have been in the tens of billions of won.

Okay, Kookie... just keep doing you. I love you anyway.

In other news (unfortunately):

So, if the Korail employee knows private information such as addresses and such (scary and mind-boggling)... Namjoon would have no choice but to reveal information before anyone else has a chance to do it and incur any more damage to his reputation or compromise the information for anyone he knows if that’s the type of info they had access to. In other words, don’t be surprised when Namjoon reveals personal info before anyone else has a chance to do it.

I hope it is plain to see why Jimin doesn’t even let us know what color his walls are or to understand why Jungkook may have left Instagram. There is too much chance of anyone figuring out information just from being able to identify objects and things in photos. Who knows what other private info of theirs is already breached and in the hands of nefarious people.

It is so concerning to me that I even question when Jungkook gives us details about the amenities at Bam’s new training place. DON’T TELL US!

The Tiffany & Co. ambassadorship... and the dollars keep rolling in for our precious little 21st Century Pop Icon who is just our goofy friend in sweatpants who loves soju.

We all noticed Jimin seemed to be “naked” when he attended the Dior menswear show back in January. When I say naked, I mean he wasn’t wearing a single piece of jewelry. We know this man loves him some bangly bangles and dangly earrings and spangly necklaces. He never goes anywhere without his signature hoop earrings on so we all felt something was missing.

And now we know he had this Tiffany deal up his sleeve. Seems like he was cleansing himself of jewelry. Starting fresh by being jewelry free in front of millions of eyes just so he could follow up with a jewelry refresh. Jimin will have Tiffany’s classic and polished pieces flying out of jewelry stores. Get ready for the Jimin effect. I hope they manufactured enough to satisfy demand. I can’t wait for the knock-offs so I can afford to wear a few look-alikes.

Busan Expo update video. Filmed last October or November?

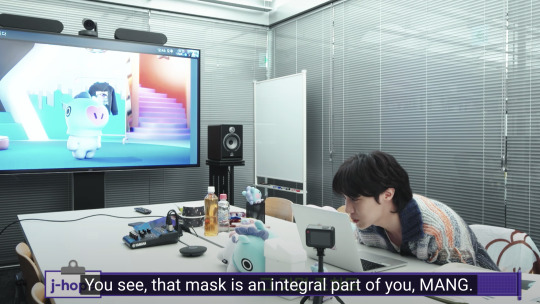

Inside Mang made me tear up. Their little virtual Mang interacting with Hobi was the sweetest thing. We will get a “real” Mang reveal soon!! Everything Hobi does is so well thought out. His attention to detail is astounding. I suppose Mang might serve a similar role that Wootteo did for Jin... (weeps).

And Jimin on Insta and Weverse trying to catch up on the member’s content HE IS JUST LIKE ME! I CAN’T KEEP UP WITH ALL THE CONTENT EITHER, JIMIN!!!

Jimin is about to slap us in the face with FACE... hold on to your asses we’re about to go for a ride on the Jimin freight train soon.

#bangtan weekly report is getting to be a thing#what happened to hiatus/not a hiatus?#kookie! you dork!#jungkook#jimin#hobi#j-hope#on the street#tiffany&co#jimin face#magazine covers luxury goods investment apps#throwing away $50 million dollars like its nothing#have mercy on us poor folk#i hope JK got his garbage disposal fixed at his rental#i hope Bam is feeling better#ok enough hashtags#bangtan weekly report

44 notes

·

View notes

Text

Ways That You Can Make Money on the Web

"Audiobooks are an increasingly common type of amusement. The convenience variable of smartphones has resulted in a market boom," advises International Living. "That is creating a need for freelancer narrators." This website has advice on figuring out how to become an audiobook narrator.

Would you understand how to do content and web development? It is possible to provide these services to anybody via internet tools which make developing amazing sites a snap. Some sources comprise WordPress, Weebly and Joomla. Proofreading is just another rewarding online livelihood. "Most agencies will cover around 25 percent of the purchase price of a translated document to a proofreader," advises International Living. "Agencies cost about $75 to the translation of a five-page standard company record. So proofing the identical record --which takes approximately an hour pays about $18 to $20." It is possible to work whole time, part-time or around-the-clock. Mediabistro--a website that provides resources for networking professionals--has hints about the best way best to be a proofreader.

Perhaps you have heard of drop-shipping? It is a technique of retail in which the vendor does not really have a physical stock. Rather, when a client makes a purchase, you buy the product from a third party, and they send it straight to the client. "This also usually means you're not need to fork over one dime to put away your merchandise or keep your stock," advises International Living. "And you're never going to need to purchase goods in bulk, expecting to sell enough to recoup your investment" This technique can be achieved with internet selling platforms such as eBay or Amazon. You will discover more about drop-shipping within this very helpful post from Shopify.

Become a Copywriter

"Podcasting does not need to be complex," says International Living. Using a microphone, notebook and completely free recording software, you are going to be ready to go. Additionally, podcasts do not have to run daily (after a week is best) and therefore are better when they are short. There are a range of methods to create money out of a podcast. The clearest is commercial sponsorship, but it is also possible to utilize it as a platform to market your own services or products. NPR has a fantastic guide to starting a podcast .

Form for Money

Become a Audiobook Narrator

"If you are a native English speaker, then you might not understand it, but you currently have the number one qualification you require to get a fun, mobile income which may give you a steady paycheck from any place on the planet," states International Living.

We have got three innovative money-making notions from the International Living listing we dream of performing when the world return to normal.

Another means to create decent money is by browsing the Web in your free time or filling out online surveys. "In case you're trying to find a way to produce an additional $1,000, $2,000 per month part time --afterward Online search is for you," advises International Living. Insert the website Qmee for your browser, and if you click on a search result, you are going to make money. You could even make money for taking Qmee polls and sharing your comments on brands. A different way to create a run of little money rewards while on the move? Together with the newest app Present, travelers may make as much as an additional $600 annually simply by listening to songs and doing a variety of tasks. Can you speak another language? Anywhere you find expat communities--where English isn't the first language--you'll get a demand for translation and translation services. You might also do interpretation and translation online. You'll discover quite a few sources for becoming a translator or an interpreter here; among the greatest is Welocalize, that ranked at the peak of the listing of the top 20 firms for distant tasks in 2020.

Produce a Money-Making Website

Produce How-To Videos

Establish a Content and Internet Development Business

Sell Your Pictures

Or proceed beyond composing an e-book and generate an entire online class with tutorials, PDF videos and downloads. It is a terrific way to produce passive income since people will pay for the advice and will go at their own speed or post questions associated with the class at a committed group. Here is 1 source for selling and creating online classes: LearnWorlds, making it possible for everyone to gain from their wisdom and expertise by producing an internet program.

"Life coaching is a thought-provoking and innovative process which helps individuals focus on both professional and personal objectives," advises International Living. "Individuals use life training to conquer anxieties, enhance their self-confidence, develop targets and enhance success-oriented habits" You will find thousands of internet training programs about the way to become a life coach, and lots of certification programs supply an whole site installation after training is finished. If traveling is the field of expertise, you may become a traveling trainer. Continue reading this story about a traveling writer who turned into a traveling trainer.

Do you've got photo abilities or reside in a region where pictures are in demand? "Stock photography sites are enormous repositories of photos, covering virtually every possible topic you can imagine," advises International Living. Just just how does this function? Participants can upload their pictures into any of a range of enormous databases, permitting magazine editors, designers or some other organization with a site to purchase them. Along with the attractiveness of stock sites: Photographs can be marketed any number of occasions --so you may continue to earn money with no effort.

Tutor

"In the past few decades, YouTube has grown to the go-to resource for all manner of movie classes and guides," says International Living. "Teachers can decorate their movies by charging a subscription fee or password protecting material for paying clients only." This report shares some hints from one property agent who earned $100,000 in 1 month on YouTube. Another bit of information in International Living: Get to know the phrases that people seek out. To discover possible search phrases, begin typing "the way to [your subject ]" to YouTube's search bar and detect what phrases are created in the auto-fill dropdown. Be certain that you use the very same key words when you compose your movie name, description, and tags.

The e-book company is a fantastic way to make money online. You may produce your own (Kindle has a manual for how to get it done ). Or locate a book that has been published in print and also permit it to print online. You are able to cover the writer 8-15% royalties based on net revenue or a one-time fee to the internet publishing rights.

Establish an Online Course

"Placing your tutoring service may be a profitable business which supplies you with a comfortable and adaptable way of life," advises International Living. "The best aspect of all, you may establish a tutoring company in just about any nation on the planet." A tip: Give discounts to customers who promote your organization. "Word-of-mouth promotion is still among the most valuable marketing tools that you can have when beginning," advises International Living. The website Tutors.com includes a listing of the very best internet tutoring tasks, and you may also apply for a mentor at Tutorme.com.

Are you currently a quick typist? Transcribing is easy: Listen to a sound file through cans and sort it out. "As a transcriber, your cover is directly linked to how quickly you type," advises International Living. "Transcription tasks are compensated by the sound hour (the amount of the sound file), instead of by the hour . The time spent on a transcript is affected by the sound quality, background sound, the emphasis of the speaker and also the rate at which people talk." The ordinary transcriber--typing between 75 and 100 words a second --will finish one sound hour four hours . Think about the firm Rev.com, which hires freelancer transcribers. Teach English

Become a Life Coach (or Possibly a Traveling Coach)

Try out Drop-shipping

Wish to make a fantastic income wherever you live--a home by the sea from Latin America, an early European town or perhaps in a Greek island? Copywriting could be great for you. In accordance with International Living, "copywriting is a mega-industry, blessed with opportunity. And longing for those that may fuel it with new advertising messages and among the greatest benefits of this freelancer's lifestyle is that you are able to get paid in U.S. bucks...nevertheless live virtually anywhere on the planet." Express Writers has hints about the best way best to be a copywriter and can be a source for jobs.

Can you have a place of expertise? Share your information on a website. If traveling is the field of experience, think of what you need to provide: Are you an expert in luxury travel or financial traveling? Would you discuss information about particular activities like shopping or hiking? "The more specific you get, the easier it'll be to entice an engaged audience and also to make money with your website," advises International Living. The websites Squarespace and Wix have advice about the best way best to create blogs and may also sponsor them.

#money#make money online#online money making#online money#earn money online#earn online#make money#earn money

0 notes

Text

14 Valentine’s Date Ideas That Aren’t Takeout or a Prix-Fixe Meal

Valentine’s Day is a lot like New Year’s Eve. You make grand plans, set high expectations, and then get rushed through your overpriced set menu at a restaurant that’s overcapacity and wish you’d just stayed home in bed. As long as you’re smooching someone you love when the clock hits midnight, you should be happy at both holidays—but that doesn’t mean you can’t do your best to avoid all the decidedly disappointing clichés. From psychic readings to steamy audiobooks, here are 14 date ideas to inspire your February 14th plans.

Image courtesy of Hotel X Toronto

Splurge on an OTT Romantic Staycation

From February 8th to 24th, Hotel X Toronto is transforming their 27th floor nook into The Love Nest, a space for Instagram photos and sweet talking, complete with twinkly lights, rose gold balloons, fresh roses and a view of the skyline. For $499 per couple, you’ll receive a chilled bottle of bubbly, a fondue assortment to gently feed your S.O. and 90 minutes of one-on-one time in the Love Nest. Then, choose between a night stay in a luxury room or a 3-course candlelit dinner for two.

To keep turning up the heat, get in touch with the the hotel’s dedicated Romance Concierge, who will help you book a personalized photo shoot, a romantic film in the private screening room, a couple’s massage, private yoga or an in-suite musical accompaniment. If you’re after an evening of private intimacy, you aren’t going to find anything more luxurious than this.

Download a Steamy AudioBook

What sets the mood better than smooth jazz? Birthday Suit, the latest audiobook from New York Times bestselling romance novelist, Lauren Blakely. It has a shirtless man on the cover, it’s set in a chocolate shop, and when the female protagonist describes the hunky object of her affection, she says, “If Leo were chocolate, I’d easily add up the ingredients that comprised him. With a touch of pepper and a dash of spice, he’d be a strong, full-bodied dark chocolate, bordering on bittersweet. You’d pair him with a rich red wine and enjoy him by the fireplace.”

Organize a Themed At-Home Meal & Movie

Example: Watch Ratatouille and make ratatouille, watch Roma and try your hand at tortas de tamales, or watch Julie and Julia, and cook a couple of courses from Julia Child’s catalogue of Provencal recipes. If you’re interested in really committing, you could watch A Quiet Place and do your best to prepare a meal in complete silence—or watch Bird Box and eat blindfolded.

Photography via Instagram/@ripleysaquaca

Drink & Dine Under the Sea

Seafood is an aphrodisiac, after all. Both Toronto and Vancouver aquariums are hosting Valentine’s Day events this year: Toronto’s Ripley’s Aquarium of Canada has a three-course dinner (bottle of wine included) by Daniel and Daniel for $275 per couple, and the Vancouver Aquarium is hosting an After Hours Valentine’s Affair that, for $35 per person, lets you explore the galleries with a drink in hand.

Serenade Your Sweetie at Private Karaoke

Book a room at your local karaoke lounge and sing the night away with bottles of Soju. Or, invest in a Rose Gold Wireless Bluetooth Karaoke Microphone for an at-home-sing-along session. (It’s $36 and available on Amazon Prime.)

Attend the World’s Longest Valentine’s Day Party

Bumble, the female-focused dating app all your single friends are obsessed with, is bringing their digital experience offline and into real life. They’re taking over Toronto’s Bangarang Bar on February 14 from 9PM to late as part of their global Valentine’s Day party. The festivities start in New Zealand, and will travel through Australia, India, Europe and the Americas. There will be complimentary snacks, drinks, games and a top Toronto DJ—and the only thing you need to get in is your Bumble app.

Image via Pinterest

Build a Pillow Fort & Camp Inside

Collect some sheets, a couple of chairs, all of pillows in your house—and set to work re-creating the basement forts you constructed as a kid. A string of lights will make the space especially Pinterest-worthy, but a few carefully placed candles will do just the trick. Then, bring the camping vibes inside with s’mores made over a gas stove and a steaming mug of mulled wine or hot chocolate. You could even crack a window to create a chilly, outdoor adventure environment.

Enrol in a Couples Cooking Class

Couples cooking class events pop up in all major cities on February 14. Why? Pop culture has made kitchens out to be a very romantic space. Usually, they aren’t—but when you don’t have the do the planning, food prep or dishes, maybe cooking together can be flirty and fun. St. Lawrence Market is hosting a cinema and craft beer themed culinary evening that costs $275 per couple, and will have you making Hand Made Ramen Noodles with Lobster Lemongrass Broth.

Take a Trip to Your Friendly Neighbourhood Psychic

Do the stars line up in your romantic relationship? There’s only one way to find out.

Photography via Instagram/@trafiqmain

Embark on an Ultra-Specific Food Crawl

Pick your poison: tacos, oysters, dumplings, desserts. Find something you love to eat, then travel around the city indulging in it at multiple locations. If you live on the West Coast, take advantage of the Vancouver Hot Chocolate Festival, which has the city’s best chocolatiers, pastry shops, bakeries, cafes and ice cream makers coming together to serve their take on the humble hot chocolate.

Participate in a Murder Mystery

Solving a murder might not be what you had in mind for V-Day but why not give it a shot? Toronto’s interactive entertainment troop Mysteriously Yours is hosting a dinner event at the Chelsea Hotel that will set you back $119 per person, and at Fort Calgary there’s a Death by Chocolate themed evening that’s almost a little too frightening for the holiday.

Get Stoned & Paint Something

It’s both the activity and the gift. You can DIY this date at home, or, purchase a $70 per couple ticket to this Toronto event where music, beverages, snacks and a paint brush will be provided.

Photography courtesy of TORA

Seek Out a Creative Dining Experience

Futuristic laneway sushi? Head to Toronto’s recently opened TORA. Dinner with a side of indoor surfing? Head to Montreal’s Oasis Surf. A speakeasy with magicians and a secret burlesque room? Head to Toronto’s Coffee Oysters Champagne, where you’ll find the 1920’s inside a champagne cellar. Search the Internet for something unique, and give it a try.

Revisit Your Youth & Go to Prom

Vancouver’s annual People’s Prom is described as “the prom you never had in high school: it’s a community-oriented, anti-capitalist, queer, cross-dressing, gender-bending, bike loving, slow dancing, big dress wearing, good time.” Since 2000, the event has been raising money for radical resistance, using their proceeds to “support projects that are often unable to obtain mainstream sources of funding.”

The post 14 Valentine’s Date Ideas That Aren’t Takeout or a Prix-Fixe Meal appeared first on FASHION Magazine.

14 Valentine’s Date Ideas That Aren’t Takeout or a Prix-Fixe Meal published first on https://borboletabags.tumblr.com/

0 notes

Text

10 Essential Money Tips for New LGBT Grads

Here’s the good news, freshly minted graduates: You’re not as financially inept as the media portrays you.

Stash, the beginner investment app, asked grads like you what they plan to do with their graduation money, and the results are comforting. The largest percentage, 23.8% of those polled, plan to put the haul directly into savings, while 21% will pay rent or other expenses. An impressive 19.2% plan to invest their grad cash, and a near equal number, 18.7%, said they’ll pay down student loans with the money.

That’s a great start. But there’s plenty more to learn about savvy spending and saving, now that you’re out in the real world. Here are 10 essential tips to help you hit the ground running.

Commit to independence.

No more asking for help. Sorry! One month after you land your first decent job is when you need to make a clean financial break from the welfare providers you call parents. That gives you enough time to get your proverbial ducks in a row — and collect your first paycheck — so you can really start adulting.

Mobile bill, car payment and insurance, gas, utilities, internet, groceries, rent — all that good stuff — should now be your responsibility if you have a job. And no hitting up mom and pop for extra cash because you spent all your disposable income buying Fireball shots for a future one-night stand. For starters, that swill is poison, and two, he probably would have gone home with you $30 ago.

Stop wasting money on stupid things.

Millennials and lazy people around the world (along with their enablers) lost their ever-loving hive minds last year when the “avocado-toast guy” (as he will be forever known) suggested in the pages of GQ that just maybe they should stop spending money on overpriced food trends and other luxuries if they ever want to afford a home.

Certainly there are prevailing factors preventing young people in a variety of demographics from becoming homeowners, but I happen to agree with that GQ writer on this particular point.

So, here’s my advice to curb that practice: If you want to get ahead, especially if you’re on a tight budget, it’s critical to have self-control, say no to all the shiny things, and concentrate more on making extra cash instead of spending what little you have.

You’re not entitled to anything you didn’t earn, and the world doesn’t owe you anything. The faster you learn that, the happier your heart (and wallet) will be.

Make a budget — and stick to it — as if your life depends on it.

If you’re new to managing your own money, the best place to begin is with a budget. There’s a wealth of resources online to help you get started. The concept is simple: In one column list your income; in the other, keep track of your expenses; and then crunch a few numbers to make sure everything balances out or, if you’re lucky, results in a surplus. Negative numbers in a budget are no bueno, but you already know that, degree holder. Sounds like a hassle, but only if you like being broke all the time.

Become a coupon and cash-back queen.

Along with clipping coupons for groceries and other purchases, tap into cash-back savings on apps like Ibotta, Checkout 51, and SPENT, which offers up to 25-percent cash back on your favorite brands; use in-store apps like Target’s Cartwheel; cut costs on activities with daily deals; identify days and nights that offer the best discounts on whatever you plan to buy (like buy-one-get-one free meals at restaurants, for example); and plan clothes-shopping trips around major sales — paired with loyalty points and discounts.

I often pay pennies on the dollar because of my dedication to saving money, and you can too if you make it part of your routine.

Avoid carrying credit card balances.

When you know how to use them responsibly, credit cards can be your friend. They’ll help you build a respectable credit score when you swipe and then pay on time (preferably more than the minimum payment; ideally, paying the entire balance each month), but they also can rip you a new one if you’re regularly spending more than you can repay within a month.

“Many people get into a bad habit of using credit to buy things, or to maintain a lifestyle,” says Jeff White, finance writer at FitSmallBusiness.com. “In many cases, these habits are created soon after graduation because of the credit card offers out there for new grads that have secured jobs. While having credit accounts can benefit your borrowing position and total credit score, keeping balances on them will not help you. Use credit cards, but make sure you’re using them as part of your budget, and pay them off each month.”

Refinance those student loans.

Most new grads have student loans. They’ll be more manageable — and seem like less of a burden — if you refinance as soon as possible.

��Refinancing your loans is one of the best options to pay off your student loans faster and more cost-efficiently,” says Carla Dearing, CEO of SUM180, an online financial wellness service designed to make financial planning simple and affordable. “When you refinance your student loans, you’ll have one consolidated loan with a single monthly payment and a lower interest rate, which is important, as more of each payment goes toward paying down the balanced owed. Companies like SocialFinance (sofi.com) have a strong refinancing offering.”

For more ideas, check out “The Ultimate Guide to Paying Off Student Loans Faster” at StudentLoanHero.com.

Keep your health care covered.

You should not forgo health insurance for any reason. One little trip to the hospital can leave you deep in debt.

Fortunately, those monster bills can be avoided — if you’re insured. Right now you’re probably covered under your parents’ family plan until your 26th birthday. That works for some recent grads but not all. If you’re planning to live in a city that’s beyond the provider network for your parents’ plan, it may make sense to buy your own coverage to keep costs down.

eHealth, a leading, private, online health insurance exchange, provides tips to help you navigate this tricky fact of life, including information on how to enroll in health insurance, short-term health coverage, and financial assistance resources that may be available to you.

Create a savings plan that makes sense for your current situation.

Try to save wherever you can (including putting money into an emergency fund), but when you’re on a tight budget, it’s important to focus on the present. Pay your monthly student loan bill first, then stash a little away.

If you’re already stretched thin, that 401k your company offers may have to wait a bit. You’ll get there eventually, but you don’t want to dig a deeper debt hole by having 401k deductions leave you with so little take-home pay that you’re missing loan and credit-card payments and racking up late fees.

Learn the difference between good debt and bad debt.

Various debts you carry have different implications. TopCashback’s personal finance expert Natasha Rachel Smith explains.

“Good debt is an investment that has the potential to grow in value or can generate long-term income,” she says. “Well-negotiated car loans/payments, mortgages, and low-rate student loans are considered good debt. It is perfectly OK to accrue debt when it is good debt. Bad debt involves purchases that quickly lose their value or do not generate income. High-rate debts, frivolous spending, and credit cards with high-interest rates are bad debt. You want to avoid accruing bad debt, as it could severely impact your credit score. Focus on paying your long-term good debt and minimize your bad debt.”

Stop trying to keep up with the Joneses on social media.

To those who are independent and work hard for whatever they have, life doesn’t come easy. With that in mind, you’re doing yourself a huge disservice by comparing your life to that of others.

Keep dreaming and setting goals for yourself — whatever they may be — but don’t let your success depend on what you have or don’t have, especially when you don’t have it. Beating yourself up about a financial situation that you can’t snap your fingers to improve will only stress you out while crushing your motivation to keep climbing.

from Hotspots! Magazine https://hotspotsmagazine.com/2018/05/30/10-essential-money-tips-for-new-lgbt-grads/ from Hot Spots Magazine https://hotspotsmagazine.tumblr.com/post/174412384805

0 notes

Text

10 Essential Money Tips for New LGBT Grads

Here’s the good news, freshly minted graduates: You’re not as financially inept as the media portrays you.

Stash, the beginner investment app, asked grads like you what they plan to do with their graduation money, and the results are comforting. The largest percentage, 23.8% of those polled, plan to put the haul directly into savings, while 21% will pay rent or other expenses. An impressive 19.2% plan to invest their grad cash, and a near equal number, 18.7%, said they’ll pay down student loans with the money.

That’s a great start. But there’s plenty more to learn about savvy spending and saving, now that you’re out in the real world. Here are 10 essential tips to help you hit the ground running.

Commit to independence.

No more asking for help. Sorry! One month after you land your first decent job is when you need to make a clean financial break from the welfare providers you call parents. That gives you enough time to get your proverbial ducks in a row — and collect your first paycheck — so you can really start adulting.

Mobile bill, car payment and insurance, gas, utilities, internet, groceries, rent — all that good stuff — should now be your responsibility if you have a job. And no hitting up mom and pop for extra cash because you spent all your disposable income buying Fireball shots for a future one-night stand. For starters, that swill is poison, and two, he probably would have gone home with you $30 ago.

Stop wasting money on stupid things.

Millennials and lazy people around the world (along with their enablers) lost their ever-loving hive minds last year when the “avocado-toast guy” (as he will be forever known) suggested in the pages of GQ that just maybe they should stop spending money on overpriced food trends and other luxuries if they ever want to afford a home.

Certainly there are prevailing factors preventing young people in a variety of demographics from becoming homeowners, but I happen to agree with that GQ writer on this particular point.

So, here’s my advice to curb that practice: If you want to get ahead, especially if you’re on a tight budget, it’s critical to have self-control, say no to all the shiny things, and concentrate more on making extra cash instead of spending what little you have.

You’re not entitled to anything you didn’t earn, and the world doesn’t owe you anything. The faster you learn that, the happier your heart (and wallet) will be.

Make a budget — and stick to it — as if your life depends on it.

If you’re new to managing your own money, the best place to begin is with a budget. There’s a wealth of resources online to help you get started. The concept is simple: In one column list your income; in the other, keep track of your expenses; and then crunch a few numbers to make sure everything balances out or, if you’re lucky, results in a surplus. Negative numbers in a budget are no bueno, but you already know that, degree holder. Sounds like a hassle, but only if you like being broke all the time.

Become a coupon and cash-back queen.

Along with clipping coupons for groceries and other purchases, tap into cash-back savings on apps like Ibotta, Checkout 51, and SPENT, which offers up to 25-percent cash back on your favorite brands; use in-store apps like Target’s Cartwheel; cut costs on activities with daily deals; identify days and nights that offer the best discounts on whatever you plan to buy (like buy-one-get-one free meals at restaurants, for example); and plan clothes-shopping trips around major sales — paired with loyalty points and discounts.

I often pay pennies on the dollar because of my dedication to saving money, and you can too if you make it part of your routine.

Avoid carrying credit card balances.

When you know how to use them responsibly, credit cards can be your friend. They’ll help you build a respectable credit score when you swipe and then pay on time (preferably more than the minimum payment; ideally, paying the entire balance each month), but they also can rip you a new one if you’re regularly spending more than you can repay within a month.

“Many people get into a bad habit of using credit to buy things, or to maintain a lifestyle,” says Jeff White, finance writer at FitSmallBusiness.com. “In many cases, these habits are created soon after graduation because of the credit card offers out there for new grads that have secured jobs. While having credit accounts can benefit your borrowing position and total credit score, keeping balances on them will not help you. Use credit cards, but make sure you’re using them as part of your budget, and pay them off each month.”

Refinance those student loans.

Most new grads have student loans. They’ll be more manageable — and seem like less of a burden — if you refinance as soon as possible.

“Refinancing your loans is one of the best options to pay off your student loans faster and more cost-efficiently,” says Carla Dearing, CEO of SUM180, an online financial wellness service designed to make financial planning simple and affordable. “When you refinance your student loans, you’ll have one consolidated loan with a single monthly payment and a lower interest rate, which is important, as more of each payment goes toward paying down the balanced owed. Companies like SocialFinance (sofi.com) have a strong refinancing offering.”

For more ideas, check out “The Ultimate Guide to Paying Off Student Loans Faster” at StudentLoanHero.com.

Keep your health care covered.

You should not forgo health insurance for any reason. One little trip to the hospital can leave you deep in debt.

Fortunately, those monster bills can be avoided — if you’re insured. Right now you’re probably covered under your parents’ family plan until your 26th birthday. That works for some recent grads but not all. If you’re planning to live in a city that’s beyond the provider network for your parents’ plan, it may make sense to buy your own coverage to keep costs down.

eHealth, a leading, private, online health insurance exchange, provides tips to help you navigate this tricky fact of life, including information on how to enroll in health insurance, short-term health coverage, and financial assistance resources that may be available to you.

Create a savings plan that makes sense for your current situation.

Try to save wherever you can (including putting money into an emergency fund), but when you’re on a tight budget, it’s important to focus on the present. Pay your monthly student loan bill first, then stash a little away.

If you’re already stretched thin, that 401k your company offers may have to wait a bit. You’ll get there eventually, but you don’t want to dig a deeper debt hole by having 401k deductions leave you with so little take-home pay that you’re missing loan and credit-card payments and racking up late fees.

Learn the difference between good debt and bad debt.

Various debts you carry have different implications. TopCashback’s personal finance expert Natasha Rachel Smith explains.

“Good debt is an investment that has the potential to grow in value or can generate long-term income,” she says. “Well-negotiated car loans/payments, mortgages, and low-rate student loans are considered good debt. It is perfectly OK to accrue debt when it is good debt. Bad debt involves purchases that quickly lose their value or do not generate income. High-rate debts, frivolous spending, and credit cards with high-interest rates are bad debt. You want to avoid accruing bad debt, as it could severely impact your credit score. Focus on paying your long-term good debt and minimize your bad debt.”

Stop trying to keep up with the Joneses on social media.

To those who are independent and work hard for whatever they have, life doesn’t come easy. With that in mind, you’re doing yourself a huge disservice by comparing your life to that of others.

Keep dreaming and setting goals for yourself — whatever they may be — but don’t let your success depend on what you have or don’t have, especially when you don’t have it. Beating yourself up about a financial situation that you can’t snap your fingers to improve will only stress you out while crushing your motivation to keep climbing.

from Hotspots! Magazine https://hotspotsmagazine.com/2018/05/30/10-essential-money-tips-for-new-lgbt-grads/

0 notes

Text

Post-Mortem of Top 20 failed start-ups - Lesson for Young Entrepreneurs

New Post has been published on http://www.betacompression.com/top-20-failed-start-ups-lesson-for-young-entrepreneurs/

Post-Mortem of Top 20 failed start-ups - Lesson for Young Entrepreneurs

They are not kidding when they say there is too much careful consideration needed when involved with a start-up company. When you are looking forward to running a start-up business, you are in for a gamble. If you are not smart enough then you will end up with the many failures – failed startups.

The root cause of failure can be from financial fraud to just running out money. There has been much of failure on the brain recently; it is partly because there is a good counterbalance to the typical survivorship bias-laden stories. Also; because understanding failure is critical to the algorithms underlying our product.

But, today we provide with this information, as the last thing we want is our young entrepreneurs to make the same mistake. Presenting you with post mortem reports of 20 failed startups lessons, so that you not make the same mistake.

List of Top Failed Startups

CueCat

The CueCat was invested by Belo Corp, General Electric, RadioShack, and The Coca-Cola Company, listed in top failed startups. The scanned printed bar codes and directed, the user’s Web browser to a page chosen by whoever published the code.

CueCat was the brainchild of J. Jovan Philyaw, who sold several big-time companies on the prospects for CueCat and its parent company, Digital Convergence Corp. Philyaw, a former infomercial producer, raised a sum total of $185 million from investors including Radio Shack, Coca-Cola, NBC, and Belo.

$6.50 was the cost of the scanners, and they were distributed for free to magazine subscribers and electronics store customers. What happened is there was a poor response from the customers, no one bought it and Digital Convergence fired has to fire most of their staff.

Read Also: 5 Hidden Costs Associated With Running a Business

ChaCha

The investors for this company were Qualcomm Ventures, Rho Ventures, Vantage Point Capital Partners, and Bezos Expeditions. Advertising revenue was declined sharply in 2016, for ChaCha, which left the company with no means to serve the debt.

The secured lender emptied ChaCha’s bank accounts. Scott Jones, the companies over has shared the fact that they sold their assets to cover their obligations, but it was not sufficient to cover it all. Which led Jones, debt holders and shareholders of the company to, unfortunately, write off their investment and listed in top failed startups

Sun Edison

The company’s core is Construction Company, the company wanted to venture out as a technology company. The company was well trusted by its institutional investors by managing risks. The company now faces lawsuits, for misappropriate use of paying off the loan instead of solar development projects.

Quirky

Quirky was an invention platform, where people were given a chance to vote on ideas which they liked. The hit ideas were later turned into products. Due to the almost non-existent margins of Quirky did not work in their favor. They were reportedly investing more in a development and selling minimally.

One of the products they invested in were they spent nearly $400,000 on a developing a Bluetooth speaker that only sold 28 units. The start-up ran out of money and filed for bankruptcy, which even affected their Wink unit. The business eventually sold its Wink smart home business for $15 million.

Homejoy

Homejoy, one of the failed startups provided on-demand home cleaning services, it was a low-cost cleaning service. CEO Adora Cheung blamed the worker for misclassification while the company faced lawsuits. As the company failed to raise enough funding to grow the company as big as they wanted. The company faced struggled to keep their customers when they later raised the price to meet their financial goals.

Read Also: 8 Deadly Mistakes Should Avoid That Kill Startups

Zirtual

Zirtual were providers of virtual assistants. They have full-time employees. Each assistant would work multiple accounts, depending on the workload, making it cheaper for corporate clients. The company apparently over-staffed without having matched the demands. When the funding failed to come through they laid off their 400 employees in the middle of the night via an e-mail.

Secret

The secret was an anonymous app that allowed for anonymous posting of snippets of text. It was often used to address rumors or confessions, which were shared with people. But the Secret app failed to meet the expectation of CEO David Byttow. He stated that the company did not represent his visions and therefore Byttow then noted to return the investors $35 million dollars.

Grooveshark

The music streaming service was a platform that let the users upload their music for others to listen to it. The service from immediately ran into legal problems due to the concerns about copyright violations. Despite their best intentions, the company failed to secure licenses from right holders for the vast amount of music on their service.

Rdio

Rdio was another music streaming site launched in 2010, it was done in competition with the Spotify. It was launched by the founder of Skype and Kazaa. Rdio was based on a subscription streaming model, unlike Grooveshark.

The company had struggled to compete against Spotify as the foreign music service entered when they market and offered a better free version. People, therefore, preferred Spotify where they paid less and then paid up for premium. Which only resulted in a failure of Rdio due to them not gaining any subscriptions.

Leap Transit

Leap Transit was supposedly a luxury commuter bus, this came into existence hoping to make streets less crowded due to cars. The start-up [now one of the failed startups] was suspended of its services due to disagreement with regulators. The receipt of a cease-and-desist letter put the services on a temporary hiatus. It became a permanent one and the buses were put up for auction. Leap Transit filed for bankruptcy after generating only $20,748 in gross income for the year.

Read Also: Why Every Small and Medium Business Need a Business Website

Powa Technologies

Powa Technologies was an e-commerce operation whose flagship product, was called PowaTag. It was a mobile payment app that allowed the customers to make purchases directly from their smartphone.

But the downfall of Powa Technologies was swift, as it had been found that Wagner alongside the company made false claims about their relationship with the Chinese company that was driving the value of the company. The many investors, which made the Powa Technologies look like such a promising company and a priced possession, did not invest in reality.

Zenefits

A company founded by Parker Conrad named Zenefits that aimed to provide human resource services to small businesses. The company’s downfall took place as Conrad could not fix the disorganization within the company.

He failed to overlook the positions such as office manager, IT workers, and even a receptionist. The internal problems at Zenefits led to both the illegal selling of insurance by the company and Zenefits falling short of its revenue goals.

com

At the end of the day, it ends up to get a new client for business. As the increase in the frequency of transactions and transaction sizes is growth in the business. Without those, there is no possibility of a successful start-up.

Mode Media

Mismanagement of finances by Mode Media, had them labeled as the most unprofessional. As for their clients, partners and employee base, it was an unethical experience imaginable. Thus the with the shutdown announcement, the manager receives emails from headquarters requesting immediate transfer of all funds and assets.

KiOR

Khosla Ventures, Alberta Investment Management Corporation, and Artis Capital Management invested in KiOR. The poor hiring decisions resulted in a predominance of lab researchers with Ph.Ds.’ That brought the downfall of KiOR was the lack of people with real operational experience. As unfortunate events such as scarcity of technical people with enough knowledge of carrying operational experience running energy facilities.

Lilliputian Systems

With investors such as Kleiner Perkins, Atlas Venture, and Intel Capital, The Nectar system decided to set its roots at MIT’s Microsystems Technology Lab. The system saw the downfall simply because they left the lab much earlier than they should have.

OnLive

Lauder Partners and Time Warner Investments invested in OnLive. They started off pretty well no doubt at that because of their ability to deliver a lag-free experience. Though the further studies show that the business indeed had some troubles which dragged them to bankruptcy. Which was later followed by big layoffs and a buyout.

Coraid

The Coraid operations failed to raise new funding, among other reasons which could have caused the end of the business. The company which was invested by Azure Capital Partners and Menlo Ventures closed up for good and filed for bankruptcy.

Cereva Networks

Cereva Networks was a victim of swiftly shrinking corporate IT budgets. The company failed to meet the demand for a start-up large-scale, storage systems. Resulted in abruptly shutting down and laid off 140 employees.

Aereo

Aereo users were assigned with a mini broadcast TV antenna, this infrastructure drove its online service. FirstMark Capital and Highland Capital Partners invested in Aereo. The service was no different than sticking a pair of bunny ears on your television, was said by the providers.

It was a technique by which, Aereo could avoid paying retransmission fees for broadcasters’ content. But unfortunately for Aereo, the broadcasters never bought this argument and neither did the law. Thus listed in top failed startups.

It is highly suggested for our future entrepreneurs to see through the cases of these unfortunate start-ups which met the downfall. Whether it be a case of wrong investment or not the exact visionary idea, you can definitely learn from the mistakes the above start-ups did. An advice to always research the depth of business you are looking to invest in.

Author Bio:

Lewis Khan is a freelance content writer, currently associated with the firm Limetree Marketing (http://www.limetreemarketing.com/). He is a writer by passion and a sports person by heart. He enjoys regular swimming and jogging. He even opts to teach swimming to kids. He has a puppy named Max and prefers to spend his weekends at home playing with it and catching up on current affairs in the world. Reading is his passion and he prefers staying updated with current news.

0 notes

Text

Meeting the Russians Who Hope to Strike It Rich on ICOs

“7… 00… 9… 0… 183.” I type in the secret code as printed on the flyer that I found at the Blockchain & Bitcoin Conference in Saint Petersburg the day prior. But to no avail. The steel gate to the inner-city courtyard won’t open, and the buttons I’m pressing seem like some kind of doorbell system rather than a lock anyway.

As I’m about to give it a second try — against my better judgement — two more guys show up. They want to enter too and apparently actually know how to do it. Pressing the right buttons, one of them unlocks the gate and lets me in as well. “Are you going to the Crypto Friends ICO Meetup?” I ask. The guys nod.

I try some small talk as we move our way into the courtyard.

“So, what brings you guys here. Are you investing in ICOs?”

One of them answers. His Russian accent is thick, but his English is good. He says he actually works at a company that helps businesses set up ICOs. His job is to get the message out about a new ICO, as far and wide as possible via forums, chat groups, news sites, whatever it takes. PR, basically.

“The return on investment in these ICOs is insane,” he enthuses. “Put in $10,000, and you can end up a millionaire.”

The two lead me around a corner to an inconspicuous door with another lock. Here they type in the code on the flyer: 70090183. The door opens, and we step into a small, somber hallway. A doorman sort of guy is sitting in an even smaller room to the left of us. He doesn’t look up. An elevator waits on the opposite side of the hall. We get in, and one of my companions presses the button with a five on it. It takes us to the top floor.

“Have you heard of EOS?” the other guy now asks me. I have but don’t know much about it. I tell him I know that the founder is supposed to be controversial; but I don’t know the details.

“I think it could be the next big thing,” he tells me. I nod, noncommittally. I don’t usually put money in these things.

On the top floor is another hallway. I notice that the green rubber floor is covered with arrow-shaped stickers. “Crypto friends meetup,” they read. Seems like we made it to the right place indeed. The stickers bring us to the next door. One of the guys knocks, the door opens.

A bit to my surprise, we now step into a luxurious restaurant. The light-filled rooms with big windows are decorated with antique furniture, and large framed paintings hang on the walls. The restaurant itself is relatively empty, but people have gathered in a bar area in the corner.

The Deal With ICOs

In case you are that one person who hasn’t heard of the phenomenon yet: ICOs — short for Initial Coin Offerings — have been the crypto-rage for most of 2017. They are essentially tradable digital tokens, sold as some type of company stock, but issued on a blockchain. And without most of the legal guarantees that actual company stock provides — assuming these coins can even be considered company stock at all. Maybe they’re more like gift vouchers… or something. Often, no one really knows.

Either way, companies have been issuing these ICOs to raise funds for their venture. Lots of funds. ICOs have become somewhat notorious for selling tens of millions of dollars worth of tokens within minutes, earning startups — often with little more than a whitepaper to show for themselves �� valuations more appropriate for C-series funding rounds.

The phenomenon has been catching on in Russia as much as anywhere else. Some of the most successful ICO projects are being developed by Russians — although they are often officially based abroad to avoid legal trouble. MobileGo is one of them, the mobile gaming platform that raised over $50 million. Another is Waves, itself a platform for ICO tokens, which raised over $16 million. It’s Waves, founded by Moscow-based Sasha Ivanov, that is sponsoring today’s event.

Crypto Friends

Mild electronic music fills the bar area, and small groups of people — perhaps two dozen in total — stand scattered throughout, chatting. Most have a drink in their hands: beer, wine and, in particular, cocktails.

I take a seat at one of the two tables that seems reserved for the event. One other fellow is sitting at the table. He’s wearing a hoodie and shorts, even though the Saint Petersburg summer is not all that warm. He has his laptop open, his eyes focused on the screen. He looks up after a couple of minutes, so I once again try to make some small talk. He tells me he works in fintech. “Real fintech,” he emphasizes. He develops trading apps for investing.

“What we’re seeing here is a mania,” he says when I ask him about ICOs. “There is no underlying value in any of these projects. They better resemble multi-level marketing schemes than proper investments.”

He’s clearly not a fan. So I ask him why he showed up at all.

“Maybe in five months or so, it could develop into something useful,” he says. “The concept has potential, but it needs to grow into something more serious. It could potentially be an interesting mix between crowdfunding and Initial Public Offerings. Eventually.”

Another guy joins the table but doesn’t sit down. He seems to be in his thirties, casually dressed as most people are: a landscape architect, he tells me when I ask him. “I invest but only a little. To make some money on the side,” he says. “Mostly in mobile platforms or apps.” His English is a bit shaky. As a friend of his shows up, he bids me goodbye.

I watch the two of them walk away, and it’s only now that I realize that in the back of the bar area, hidden behind curtains next to the bar itself, is another doorway.

The Actual Crypto Friends

Probably at least a hundred people sit around on sofas throughout this next large, round room, filled with the fruity smoke odor of water pipes. The glass ceiling is covered with cloth to keep some of the light out, and Russian finger food is laid out on coffee tables. The walls around us are covered with paintings, books and even some handcrafted art.

Apparently the bar was just for drinks. This is where the actual meetup is. I take a seat on one of the sofas.

There’s no stage. Instead, a guy with a neat, buttoned-up shirt is standing in the middle of the room with a microphone. He’s giving what seems to be an elevator pitch. Within five minutes, the next speaker is up. And the next one some ten minutes after that.

The unofficial MC of the night has a spot on a comfortable chair in the middle of the room. Three others are sitting close him: a sort of literal inner circle. They lead the charge in asking questions after each talk. I don’t understand any of it; it’s all in Russian, of course.

During the smoke break — we’re back in the courtyard — I walk up to the MC, and ask him if he’s the organizer. He quickly turns me over to Daria, a dark-haired girl in her twenties. I had noticed her pacing around the meetup area during the talks. I learn that she has put together today’s event.

“The speakers today cover just about anything there is to know about ICOs,” she explains, when I ask her what the purpose of the meetup is. “The potential, the risks, the legal aspect of it.”

“So why are people here?” I try. “What do you think, if you’re being honest? Is it just to make a quick buck?”

“It differs,” she says. “The crowd is diverse. We’ve got programmers, professional investors, hobbyists and more.”

Though, she clearly agrees that at least some people are here just to make some easy money.

“Sure, some projects are more valid than others. And yes, there’s lots of hype. But it’s a bit like the early days of Kickstarter. Over time the hype will calm down, and this method of fundraising will prove valuable.”

Anton

As the smoke break ends, Daria and the others head back to the big round room. I decide to stick to the bar area this time. At least in there I can chat a bit.

Having bought a beer for some $7— surprisingly expensive by Russian standards — I’m killing some time on my phone when a blond man joins me at the bar. His name is Anton. He has a British accent, picked up from his studies in the U.K., he says.

“I see this as Russia’s chance to take on a leadership role in the technology sector. We’ve been trailing the U.S. and Europe too much,” he tells me, after I ask him my by-now standard question: Why are you here?

Anton is very clearly speaking from a place of passion. He stands close to me, speaking a bit too loudly. He believes in what he says.

“But we’re not just here to make money, man,” he emphasizes after I tell him I work for Bitcoin Magazine. “I don’t want you to see it like that. Blockchains are about much more than that. We’re here to transform society. And that’s important to remember.”

Anton tells me about the potential of blockchains. The typical buzzwords. Transparent. Immutable. Censorship resistant.

I feel almost nostalgic, listening to the way Anton explains himself. I remember a similar vibe from back in 2013, when I visited my first Bitcoin meetups. The air was filled with excitement. Andreas Antonopoulos’ talks were going viral for the first time. Bitcoin was gonna change the world in every imaginable way.

“Blockchain technology has the potential to make an end to corruption,” Anton says. “It can make votes impossible to forge, for example.” He says he believes the Russian political system has been rigged for decades. “Now, we can have provably fair elections.”

It makes me slightly uneasy to watch Anton’s enthusiasm, with the ICO bubble that I’ve witnessed being built up.

The Bubble… and the Potential

And it is a bubble. The valuation of many of these projects is far beyond reason, and the evidence that many of the investors have no idea what they’re putting money into is abundant. And that’s without even getting into some of the outright fraudulent claims.

In addition to that, the legal status of this whole concept is unclear. There are good arguments to be made that ICOs are really just unlicensed securities, specifically designed to skirt existing regulation. As such, regulators are bound to step in at some point — else they may as well close shop and find new careers. And when they do step in, it could mean that the ICO party is over very quickly.

At the same time, some of the genuine enthusiasm I encounter in Saint Petersburg makes me wonder if I’ve just grown cynical over the past couple of years. The cryptocurrency and blockchain space has been exhausted by scams, failures and toxicity. It’s had a bit of a disheartening effect on many, including myself.

But perhaps there’s more to this phenomenon than just scams. Who knows? Maybe the ICO strategy can break down barriers, allowing the common man to access investment markets more easily. Perhaps projects can better raise funds without caring about international borders, restrictions and regulations.

Indeed, perhaps ICOs could at one point be a fruitful “mixture between Kickstarter and IPOs.” If nothing else, the phenomenal valuations suggest that there may be untapped liquidity markets.

“In Russia we have the developers, we have good ideas, and we have the talent,” as one of the meetup attendees tried to explain. “It’s money, funding that’s hard to come by. ICOs are a chance to realize that part of the puzzle.”

Note: Some names have been changed to protect privacy and anonymity.

Source link

Source: http://bitcoinswiz.com/meeting-the-russians-who-hope-to-strike-it-rich-on-icos/

0 notes

Text

How To Prepare for Your Summer Holiday – 10 Top Tips

With Summer holidays fast approaching, it’s exciting to imagine yourself by a pool with a refreshing drink in hand. Take some time for a little advance planning, to make your trip even more enjoyable. We’ve rounded up a checklist to help you prepare for your Summer holiday, so that you’ll love your holiday even more.

1 – Plan where to go

Deciding where to go is one of the most fun parts of travel planning. It can be hard to choose somewhere that suits everyone, so villa holidays are a good compromise where people can do their own thing and come together at mealtimes. To help with travel planning, I like to read blog reviews, and Pinterest is a great source of inspiration. Villa Plus, whom we’ve teamed up with to bring you this guide, have some great destination suggestions on their site and 30 years experience of providing handpicked villas across Europe as well as bilingual in-resort staff. I’m particularly drawn to their villas in Corfu, Kefalonia and Menorca – the nearby beaches and tavernas look so tempting! Their villas with gated pools would provide real peace of mind to families with young children.

2 – Get your travel documents in order

Check that your passport is up to date – for some countries such as Kenya your passport should be valid for a minimum of 6 months from the date of entry and you need two blank pages in your passport. UK nationals can check travel requirements for each country at Gov.UK and also apply for a free European Health Card, aka the EHIC on the NHS website. Beware of unofficial sites as some charge illegal application fees for this complimentary card. If necessary, renew your travel insurance. You may need extra cover if you are going to participate in activities such as canyoning, scuba diving or jet skiing, so always check the small-print. Make photocopies of all your paperwork and leave one copy at home, taking the other with you or save an electronic copy to your phone.

3 – Look after your health

Check which vaccines or medication are needed, several months in advance, at the Travel Health Pro website. If you take medication, make sure that you have a sufficient supply for the duration of your stay. However, some countries have a list of controlled medicines such as painkillers, so it’s wise to consult the embassy website of the destination, to keep any medicine in the original packaging and bring a copy of the prescription. Consider packing a small first aid kit, together with mosquito and insect repellent depending on your destination.

4 – Get shopping

Now for the fun part! Stock up on sunscreen and other items that are likely to be pricey or hard to find in your destination. For your hand-luggage, travel-sized toiletries are essential, or invest in travel-sized containers under 100ml and decant your favourite products into them. It’s also worth buying your own clear plastic toiletry bag, no larger than 20cm x 20cm. It’s worth purchasing any items that might be hard to find in your destination, like contact lens solutions and soap free shampoos. Make your holiday feel more luxurious by investing in comfortable noise-cancelling headphones if you have a long flight ahead.

5 – Prepare your tech kit

It’s worth taking a universal adapter, and an e-reader is a good alternative to heavy books and magazines. It’s essential to charge up laptops, tablets and phones before you go as if you carry them in your hand luggage, you may be asked to switch them on when going through security and you’ll need the phone charged for your e-ticket. Check your data roaming package before you travel and consider purchasing an add-on to keep costs to a minimum. For cameras and phones, clear some space for new photos in advance by downloading your existing photos and videos to your computer or an external hard drive. It’s easy to forget and you don’t want the time-consuming task I was faced with on a recent trip, deleting phone videos just so that I could take new photos and send emails!

6 – Pick up currency in advance

It’s generally a lot cheaper than buying in the destination so find the best rates online. Many will deliver currency to you, or you could consider a prepaid card loaded with currency, or a credit card designed for overseas travel. On a side note, let your bank know that you will be away, so that they don’t query your overseas transactions, thinking that fraud is being committed on your account!

7 – Check the weather forecast

Look at websites such as World Weather Information Service or Wunderground, available online and as a phone app. Just be aware that the temperature forecast on any site won’t necessarily give you the whole picture. For example, you might be travelling to a tropical country during monsoon season, so look at sunshine hours to get a full impression.

8 – Get packing

Make a packing list or use an online template for your destination. Light layers are key, as it may get cold in the evening in Mediterranean countries, as well as a hat and sunglasses. Don’t forget to pack walking shoes or sandals if you have an active holiday in mind. Remember that all hand-luggage toiletries must fit into a clear plastic bag, not exceeding 20cm x 20cm. Check your luggage allowance online, and buy a small digital luggage scale to weigh your case at home. That way you can make sure that you’re within your allowance, rather than taking the risk at the airport. If you do need extra luggage, it’s generally much cheaper to book it in advance online than at the airport.

9 – Work out your route to the airport

If parking at the airport, make sure to pre-book your space online. Allow extra journey time, in case of any traffic jams. Have a look at how to get from your arrival airport to your holiday destination and book car hire or airport transfers in advance.

10 – Ensure peace of mind

Set up an out of office reply on your emails, and compile a list of useful numbers in case of any issues, such as your bank and phone provider. Consider a house sitter to look after your home while you are away. Organise pet care. If going away for a long time, redirect your mail or ask a neighbour to pick it up and pay bills that will be due. Finally, turn off any heating, set your alarm system and light timers and lock your doors and windows securely.

We hope you’ve found this checklist useful to prepare for your Summer holiday, and wish you a relaxing trip! Do you have any tips that you would suggest to those preparing for their holidays?

In association with Villa Plus, the leading provider of quality European holiday villas

The post How To Prepare for Your Summer Holiday – 10 Top Tips appeared first on Luxury Columnist.

How To Prepare for Your Summer Holiday – 10 Top Tips published first on http://ift.tt/2pewpEF

0 notes

Text

Don’t Be Fooled by the Illusion of What Your Life Should Look Like

“There’s definitely this illusion of what our lives should look like. Whether its advertising or your Instagram or facebook feed, it’s this illusion that our live should be perfect” — Shannon Whitehead, Minimalism: A Documentary About the Important Things

Every single day we are exposed to a perpetual illusion of what we think life should look like that is portrayed through Instagram feeds, status updates, and all of the other media we consume

Perfect portraits, selfies with scenic backdrops, and laptops with beaches in the background

Magazine covers where people are dressed to the 9’s

Gadgets, gear, gizmos and luxury goods

Daily advertisements that litter our social feeds with something we think we want but don’t have

All of these are layers upon layers of social programming in the matrix. Not only that we all contribute, participate and add to the programming. And this illusion creates a perpetual state of dissatisfaction that keeps us buying shit we don’t need to impress people we don’t like. Our default is to feed a voracious and insatiable appetite for more. Buy, eat, download, and acquire more

The illusion is an imagined reality and social construct. But with enough consumption, it becomes quite easy for us to confuse this illusion with objective reality. When we an envy a life that someone has thoroughly curated, edited and uploaded we have bought into the illusion of what we think our lives should look like and overlook that what we’re experiencing is a filtered reality.

The illusion of what your life should look like is the ultimate marketing tool and a form of propaganda. Refuse to question it at your own peril.

The American Dream Isn’t Dead. It’s Just Changed

A few months ago I was on the elliptical machine at the gym, and I kept seeing a news story with the tagline “is the American dream dead?” It isn’t dead. It’s just being drastically reinvented. Courtney Martin has written a beautiful book about this called The New Better Off: Reinventing The American Dream. I believe it’s the most thought-provoking and meaningful book that I read in 2016. It’s a message that needs to spread, and it’s truly soulful exploration of living a life meaning, purpose, and fulfillment.

1. A Significant Cultural Value Shift

For decades we valued the notions of security and safety. A good life meant a good job with a steady paycheck. But when an entire generation watches the one that came before them lose their retirement funds, get let go by corporate behemoths like Microsoft and unicorns like Twitter, it’s not surprising that they don’t place much value on security.

Some have called millennials an entitled generation because they do things like write open letters to the CEO’s of their companies. But what’s happening is not just entitlement, but a significant cultural value shift. Meaning and significance of work and life have become a higher priority than safety and security. There’s so much more to all of us than can possibly be expressed through bullet points in a job description or a job title. And for work to be truly fulfilling that expression can’t be stifled.

2. A Greater Need than Ever for Community

If you asked me why any website, app, or creative project is a success, my answer would be that it satisfies our need for our community our need to belong to something.

The success that people like Joel Gascoigne have had with Buffer goes far beyond having a created a great product and hiring great people. They’ve built a community around their brand., Even if you don’t use Buffer, their blog is one of the most useful things you’ll ever read. It creates a sense of community. I don’t know even know that I’ve met Joel, but I’ve met Leo and I’ve always felt they have a profound understanding of what it means to connect.

In the early days of Yelp, they used to throw parties for their elite members. I was fortunate enough to become friends with people like Michael Ernst (who is now my roommate). And looking back what I realize is that they were building community. In fact, if anybody deserves credit for making the idea of meeting people that you only knew on the internet less creepy, it’s Yelp. They bridged a gap that so many before them had failed the bridge.

In a world where everyone is just a Facebook message or skype chat away, people are craving conferences. Hence the reason things like TED, The Summit Series and more have been such big success.

In Courtney’s book, she writes about a concept called co-housing. And it’s likely we’ll see more of it, not just for financial reasons, but because it provides people with a sense of community.

But, the world we live in paradoxically has made us more connected than we’ve ever been and at the same time even lonelier than we’ve ever been. In the words of Sherry Turtle, we’re alone together.

2. An Education System In Need of Serious Reform

When a college that has been around for 100 years has to close its doors, you have to begin to question whether the system at large is working. And there’s little incentive to change it because the people within the system benefit from its current structure. And I’m saying this as the son of a college professor with both a graduate and undergraduate degree.

Right now it’s a one sized fit all solution. We would never sell everyone the same size shoes and expect them to walk, but we seem to have no issues doing it with education and expecting them to thrive. In Zero to One, Peter Thiel described it as follows

Elite students climb confidently until they reach a level of competition sufficiently intense to beat their dreams out of them. Higher education is the place where people who had big plans in high school get stuck in fierce rivalries with equally smart peers over conventional careers like management consulting and investment banking. For the privilege of being turned into conformists, students (or their families) pay hundreds of thousands of dollars in skyrocketing tuition that continues to outpace inflation. Why are we doing this to ourselves?”

That about sums up my experience of going to Berkeley in a nutshell. A few of my friends are the investment bankers and management consultants he speaks of.

In a conversation with creative live founder Chase Jarvis, he said the following to me:

We throw around words like creativity, innovation and forward thinking and yet we don’t have an education system that is actually capable of producing that. Usually, people or ideas that come out of those things, come out of them in spite of all that programming, not because of it. There’s a lot of strong economic theory that a stagnating or lukewarm economy has student debt as its basis because the students are hamstrung with college debt.

If people are going to have five jobs at the same time, the way we are currently educating them is preparing them for a future that doesn’t exist. Something has to change. There’s only so long student loan vendors can keep lending out money that people are unable to pay back because they don’t have jobs until the roof caves in. As Seth Godin so eloquently put it, maybe it’s time for us to “stop stealing dreams.”

3. A Future of Exponential Change

I asked my business partner Brian’s 4-year old niece where she lived. She said, “I don’t know.” When I asked her how she got home, she said: “there’s a map on the phone.”

Between my conversations with people like Kevin Kelly and Salim Ismail, one thing is very clear. The amount of change we’re going to experience in the next 10 years will likely be greater than the change most of us have seen in the entirety of our lives. Self-driving cars, drone delivery, and AI are in so any ways the tip of the iceberg. If you’re not subscribed to Peter Diamandis’ Abundance Insider Newsletter, do yourself a favor and sign up. You’ll be amazed by some of the change that’s coming.

So where does this leave all of us? The pessimist would look at it and see the world as going to hell in a handbag. The optimist would see abundance and a significant amount of opportunity for improving the state of humanity. The illusion of what your life should look like contains one gem. It’s an illusion which means it can be shaped and molded to your own liking far beyond the imagined realities that we live in today.

Before you go…

Like the article?Follow Me on :

Facebook : @Best.Self.Awareness

Twitter : @My_Awareness

Pinterest : BestAwareness

Website : www.BestSelfAwareness.com

0 notes

Text

still matters...

the Nuremberg Trials? "thank you's"? truth and credibility in a post-truth environment? poetry? what it means to be British? female “firsts”? pedigree of a thoroughbred racehorse? a man’s height? expert critics, now that everyone’ s a tastemaker? caste for mate selection? handwriting? formal language? ideological cleavages? (text)books? elaborate holiday window displays in NY department stores? Heidegger and postmodern ethics? albums in the Pakistani music scene? The Blur: TV or movie? password “strength” beauty in art? grades if you have good litigation experience? states in an era of globalisation? Judy Garland? 9/11? web safe colours? paper vs screen? keywords? your job title? parents, in relation to adolescent drinking? student-to-faculty-ratio? talking to humans? reading literature? trading partners for Nigeria? political sex scandals? meta descriptions? the “little things”? learning assembly language? ‘Sesame Street’? corporate nationality? Shakespeare?

do* * still matter