#lpwa

Explore tagged Tumblr posts

Text

Oh Reggie... will I ever get over my crush on you? Probably not. Guess I'll watch another match!

41 notes

·

View notes

Photo

PEGGY LEE (aka Peggy Lee Leather & Lady X) 1959-2023

4 notes

·

View notes

Text

Grappling With Tragedy: Jean 'Black Venus' Kirkland

Grappling With Tragedy: Jean 'Black Venus' Kirkland

Brian Damage Grappling with Tragedy is a series of articles that deal with unfortunate, tragic incidents that have occurred throughout the history of professional wrestling. It is unlike the ‘Wrestling with Sin’ series that deals more with the seedier side of wrestling like arrests, murders and suicides. Grappling looks more at particular tragic incidents that have in some instances altered pro…

View On WordPress

#All Japan Women#Black Venus#Deaths in Wrestling#Grappling With Tragedy#Jean Kirkland#LPWA#pro wrestling deaths#WCW#Wrestler deaths#Wrestling Deaths#WWE#WWF

0 notes

Text

Qualcomm attempts to revive its IoT fortunes with Aware, a powerful device-to-cloud platform

Overview Of the Qualcomm Aware platform

Qualcomm announced the launch of its Aware platform- an API-rich, device-to-cloud technology platform to enable industrial digital transformation. A key strength of the Aware platform is energy-efficient real-time location services, which is a great fit with asset visibility applications such as asset tracking and condition monitoring.

The Qualcomm Aware platform integrates Qualcomm’s hardware with location technology assets from Skyhook (#cellular+Wi-Fi+#GNSS) and PoLTE (cellular: #4G & #5G) acquired in May 2022 and February 2023 respectively. Through these acquisitions, Qualcomm Aware platform enables energy-efficient location tracking for battery-operated sensor devices used in supply chain visibility applications. Along with the location services, The Qualcomm Aware platform also offers additional software capabilities such as connectivity management, end-to-end security and feature-rich open #API tools for solution developers and system integrators to seamlessly integrate with ERP and cloud systems across vertical industries.

Softening demand, market fragmentation and supply chain complexities underpin Qualcomm #SaaS move

As the semiconductor market increasingly faces stiff competition, as the cost of radio chipsets and modems continues to depreciate annually. Demand for #IoThardware has also dwindled as enterprise IoT adoption is disrupted due to various global market uncertainties triggered by the #US-China trade wars, the #COVID-19 pandemic, and more recently Russia-Ukraine war. These market uncertainties have also exposed vulnerabilities in the industrial supply chain due to the lack of visibility in global value chains and the concentration of production in a few countries. IoT IC chipset market growth has suffered in the last few years across all regions except for #China which accounts for a large majority of the IoT chipset/module sales driven by smart meter(enerygy and water) and smart city applications.

The above market conditions have accelerated communication chipset and module vendors need to strengthen their hardware portfolio with value-added software and to move up the value chain and ensure a larger share of revenues from enterprise #digital #transformation. With the Aware platform, #Qualcommis creating a one-stop-shop for device-to-cloud solutions by strategically partnering with device OEMs such as #ikotec and #Sodaq.

Qualcomm Aware platform attempts to address the technology market fragmentation and complexities of device-to-cloud data management, and low-power, low-cost location tracking, a key criterion for battery-operated sensor devices. The Aware platform will play a significant role in enabling supply chain visibility in enterprises that are undertaking digital transformation of their operations by implementing sensor networks. These sensor networks will allow enterprises to gather new data streams that offer real-time actionable insights to continuously improve operational visibility and control.

The Qualcomm Aware platform helps simplify the provisioning and commissioning of connected field devices when implemented, using multiple wireless connectivity technologies at scale across geographical locations and environments. The platform’s positioning technology will help field technicians automatically tag the location of devices during the installation process. Device location data is not only important for tracking mobile assets but also is an essential data point when installing stationary assets. In vertical IoT applications like smart meters, #streetlights, power transformers, industrial containers, feed silos, etc, tagging the precise location of field assets is an essential data requirement while provisioning the connected assets. The location data of fixed assets are integrated into enterprises' #GIS and subsequently used for periodic maintenance and other field service operations.

Skyhook and PoLTE location technology merged into a powerful device-to-cloud platform

Founded in 2007, Skyhook is a Boston, US-based location software that offers positioning technology using #WiFi, cellular, and #GNSS signals, or a combination of these wireless technologies to calculate device geo-location in the cloud. The accuracy and precision of the geolocation vary depending on the environment and wireless network technology.

PoLTE based in Dallas, Texas, is a location technology company founded in 2005. PoLTE, #proprietary #Cloud #location over cellular (C-LOC) technology leverages carriers' terrestrial LTE and 5G networks to offer real-time location services.

Both these cloud-based location technologies require a small firmware upgrade in device hardware to install a software agent that analyses signals from already deployed networks (Wi-Fi, cellular, and GNSS). This data is transmitted to the cloud to calculate near real-time geolocation of the device.

PoLTE and Skyhook achieve this using powerful cloud solvers leveraging either cellular and/or short-range wireless (Wi-Fi & #BLE) network scan data to compute accurate location data in the cloud. For example, a Wi-Fi-enabled device uses network scan information (eg. signal strength) from multiple Wi-Fi access points to compute the location of the device. Similarly, in the case of cellular networks, the device location is computed using measurement data obtained from cellular radio towers. The devices transmit network characteristics with an accurate time stamp to the cloud where powerful algorithms use data points either from a single network or in the case of hybrid solvers using multiple networks to compute the location with accuracy varying from a few centimetres to 10’s of meters.

Qualcomm Aware platform embeds these two powerful #geolocationtechnologies in PoLTE and Skyhook to their Qualcomm IoT modem chipsets. Integration of PoLTE and Skyhook technologies brings together their strengths in cellular and WiFi network geolocation to the Aware platform. This enables Qualcomm to offer #energy-efficient geolocation services, by transferring the location processing workload from the device to the cloud. This is a crucial requirement for battery-operated sensor devices that need to operate autonomously in the field for several years to create a strong business case and a positive return on investment (ROI) for various digital transformation projects.

One-Stop-Shop device to cloud platform will help reduce solution time to market

Vendors offering digital supply chain solutions using Qualcomm chipsets will gain the most value as they can quickly integrate Qualcomm’s Aware platform as an off-the-shelf solution to its asset visibility solution stack. This will help IoT device OEMs, system integrators and solution providers to accelerate their solution time to market. The platform's capabilities reduce complexities in device provisioning and commissioning, connectivity management, and security of IoT devices at scale.

Qualcomm Aware will potentially help reduce fragmentation and offers enterprises an end-to-end solution. The Aware platform is a device-to-cloud service that comes with integrated devices, global data connectivity, device management, tracking and sensing #modules, and developer-friendly cloud APIs.

As part of the Aware platform launch, Qualcomm has also announced a developer device, the Qualcomm QT S110 tracker which uses the #MDM9205 modem. The device is designed for global multi-modal supply chain visibility needs and comes pre-integrated with Aware Cloud. Qualcomm plans to add three new deviceswhich include:

Aware Thin Tracker, a credit card-sized tracker for shipment logistics.

Aware Cellular Label, a smart label for tracking parcels.

Aware Sensor, a low-cost inclinometer for pole tilt monitoring.

Analyst view: Opportunity in Enterprise Supply chain visibility-“You cannot improve what you don’t measure”

To improve industrial supply chains, enterprises are increasingly demanding near real-time visibility in the form of geolocation and condition of field assets. Furthermore, supply chain visibility will play a crucial role for industries to transition from existing linear to more #sustainable and #circular supply chains. The need for reliable and real-time data on assets and processes has become a critical requirement to plan, strategise and execute the necessary changes. Qualcomm aware platform has identified six asset-intensive industry verticals- construction, energy & utilities, healthcare, logistics, manufacturing, and retail. However, over time the demand for digital tools that help transition to circular/sustainable supply chains will be felt across all industries.

Broader market segmentation for potential opportunities in enterprise asset visibility can be briefly summarised as follows.

A) Indoor/Campus Asset Visibility

Visibility (location and condition) of assets within the premises of a building or a campus. This includes tracking movement and condition of assets/goods within building facilities such as factories, warehouses, hospitals, retail shops, transportation hubs, construction sites, educational institutions etc. The requirement for asset visibility in indoor environments are as follows-

Have a higher density of assets in indoor environments with location tracking and condition-monitoring at the item level and/or aggregate level (pallets, containers, Re-usable transport units).

Indoor asset visibility solutions today are dominated by short-range wireless connectivity technologies deployed as campus networks. Over the years, #RFID and to some extent BLE have gained mainstream adoption across key industry verticals such as Retail & apparel, logistics, manufacturing, and health care.

Location accuracy requirements for of indoor asset tracking can vary from a few centimetres to meters.

Short-range wireless connectivity technologies such as RFID, #UWB, Wi-Fi, and BLE are popular technology choices for enabling asset visibility indoors,

Cellular network technologies such as #NBIoT, #LTEM and 5G and non-cellular LPWAN LoRaWAN are increasingly gaining indoor coverage, especially through the deployment of private networks.

Qualcomm Aware platform fit- Low: Qualcomm Aware platform currently does not support RFID and BLE 2 dominant connectivity technologies used in indoor asset visibility. Native support of the RFID, BLE and UWB on the Aware platform would help enterprises with legacy asset visibility systems benefit from cloud applications and expand their indoor asset visibility use cases enabled by new capabilities enabled by technologies such as Wi-Fi-6, UWB and 5G.

B) Outdoor Asset Visibility

The demand for Asset visibility in outdoor environments is often for high-value assets or assets transported in the aggregate form in pallets, boxes or containers. The requirement of asset visibility for outdoor environments are as follows-

Item-level tracking of assets is mostly implemented through an edge gateway (parent) embedded with cellular and GNSS connectivity that is linked to multiple trackers (child) used to monitor either individual items or at aggregate levels when assets are being transported.

Location accuracy for outdoor asset visibility typically varies from a few 10’s of meters to hundreds of meters with the data transmission frequency of a few times a day. Sensors such as temperature sensors, vibration sensors, level sensors, humidity/moisture sensors, and pressure sensors are typically used to monitor the condition of goods while in transit.

Devices use public connectivity network infrastructure and require reliable regional coverage and/or even multi-regional coverage for use cases such as multi-modal container tracking.

Low-cost asset tracker devices use RFID, BLE and #Zigbee to track at the item level.

Asset trackers using #LPWA network technologies such as 5G (LTE-M, NB-IoT) and LoRa and Sigfox have emerged as popular technology choices to offer simple, low-cost outdoor tracking solutions at the item and/or aggregate level without the need for gateways devices.

Qualcomm Aware platform fit- High: Provides strong value proposition in this segment as the Aware platform offers an Off-the-shelf solution that will help enterprises transition from legacy outdoor asset visibility solutions using cellular technologies such as 2G/3G networks that are expected to be sunset soon to more energy efficient technologies such as #CAT1, LTE-M and NB-IoT. The simplicity and TCO benefits from low-power, low-cost, outdoor asset trackers will also help replace existing complex point-to-point tracking systems and also stimulate new demand for asset visibility.

C) Seamless Indoor and Outdoor Asset visibility

End-to-end supply chain visibility requires seamless tracking of goods or assets as it moves through factory floors to warehouses to end-customer locations and in some cases returned back.

Changing environments present several challenges as no single location tracking technology is suitable for seamless indoor and outdoor tracking. Asset visibility application requirements also vary depending on the environment.

Relatively more complex solution designs to address application and business use-case requirements.

Leverages a combination of private/campus networks and public network infrastructure for device connectivity.

To enable seamless indoor and outdoor tracking capability use multi-radio connectivity hardware using a combination of short-range wireless technologies such as RFID, Wi-Fi, BLE and UWB for indoor environments and WAN technologies for cellular, GNSS and non-cellular LPWA for outdoor environments to mitigate connectivity network coverage limitations.

Qualcomm Aware platform fit- Medium: In this segment, connectivity technology limitations contribute to solution design challenges that have a direct impact on device/solution complexity from multi-radio hardware, cost, implementation complexity, data silos, integration challenges etc that directly impacts enterprise adoption. The Qualcomm Aware platform’s growth in this segment will depend on indoor network coverage of cellular (4G/5G) and Wi-Fi to drive adoption or the platform will require plug-ins, and integrations with indoor asset visibility solution providers to offer end-to-end supply chain visibility.

Conclusion and Recommendations:

As briefly explained above, application requirements for location technologies vary depending on the industrial supply chain process, interoperability with existing systems, location/environment, the total cost of ownership, ease of implementation and several other factors. Qualcomm’s Aware platform currently supports Wi-Fi, Cellular and GNSS network technologies and does not include BLE and RFID two popular location technologies used in indoor location services. The platform also does not support emerging location technologies such as UWB and LoRaWAN. These limitations can be potentially addressed by leveraging the open APIs to integrate data generated from connectivity technologies currently not supported by the platform.

Qualcomm’s acquisition of Skyhook and PoLTE and its integration into the Qualcomm Aware platform also validate the value and demand for cloud-based location technologies. However, Qualcomm through this strategic acquisition has also created problems for several of its competitors. Over the years, Skyhook and PoLTE had developed strategic partnerships with several chipset vendors including #Mediatek, #Unisoc, #Altair Semi, #Nordic Semiconductor, and #Sequans Communications that have embedded their location technology in their chipsets to offer similar geolocation services. it’s unclear after the acquisition of PoLTE and Skyhook, how these chipset vendors will mitigate the impact on its continuity of geolocation service. In the short term, the affected chipset vendors can potentially switch to other cloud-based location software technology providers such as #Google, #Here, #unwired labs, and #Ubudu, which offer similar indoor and outdoor geolocation solutions.

The Qualcomm Aware platform will directly compete with connectivity platforms and solutions from large telecom operators such as #AT&T, #Verizon, #Vodafone, #DeutscheTelekom, #Orange Etc that offer similar enterprise asset visibility solutions. That said, the Qualcomm Aware platform also helps other regional telecom operators with similar ambitions to offer end-to-end solutions will be able to quickly develop their asset visibility offerings and significantly reduce their solution time to market.

Finally, the acquisition of Skyhook and PoLTE by Qualcomm highlights the need for the industry to collaborate on an open-source, standards-based low-power location technology for sensor devices that are agnostic of connectivity technology and radio-chipset vendor. Such an open-source standards-based solution will foster a multi-vendor cloud-based location technology supplier and chipset supplier ecosystem, enabling interoperability and reducing the risks of vendor lock-in for end customers.

#IoT#digitaltransformation#supplychain#visibility#LPWA#technology#assettracking#strategy#GTM#assetvisibility#qualcomm

1 note

·

View note

Text

4 notes

·

View notes

Text

0 notes

Text

0 notes

Text

Low-Power-Wide-Area (LPWA) Market

The Low-Power-Wide-Area (LPWA) Market size was valued at USD 6.50 billion in 2023 and is predicted to reach USD 48.10 billion by 2030 with a CAGR of 33.10% from 2024-2030.

Access full report: https://www.nextmsc.com/report/lpwa-market

0 notes

Video

youtube

LPWA Wrestling: Bambi & Malia Hosaka vs. Candi Devine & Rusty Thomas

4 notes

·

View notes

Text

What is the difference between LoRa and LoRaWAN?

Introduction:

LoRaWAN serves as the communication protocol connecting the LoRa signal (which carries sensor data) to the respective application(s). To simplify, think of LoRa as the radio signal transporting the data, while LoRaWAN acts as the governing framework that dictates how this data travels and communicates within the network.

What is LoRa?

LoRa, short for Long Range, is a wireless technology known for its extended range and energy-efficient characteristics. It operates within unlicensed wireless frequencies, similar to how Wi-Fi utilizes the unregulated 2.4 GHz and 5 GHz bands. The specific frequency employed by LoRa varies depending on the geographic location of the deployment. For instance, in North America, LoRa operates in the 915 MHz band, while in Europe, it utilizes the 868 MHz band and in India it is 865 MHz to 867 MHz.

It is crucial to be aware of the legally permitted frequencies for LoRa deployments in each respective location. In terms of its communication range, LoRa can transmit data up to a distance of 10 kilometers in ideal conditions with a clear line of sight.

Low Power Wide Area (LPWA) technology can be categorized into two main types. On one hand, there's cellular LPWA, which utilizes mobile networks. Examples of cellular LPWA technologies include Narrowband IoT (NB-IoT) and Long Term Machine Type Communications (LTE-M). On the other hand, there's non-cellular LPWA like LoRa, which disseminates data by dividing it into encoded packets and transmitting them across various frequency channels and data rates.

What is LoRaWAN?

LoRaWAN is a network protocol that serves as the bridge between the LoRa signal, which carries sensor data, and the applications that use this data. In simpler terms, LoRa represents the radio signal responsible for transmitting the data, while LoRaWAN is the communication protocol that manages and defines how this data is transmitted across the network.

LoRaWAN offers several valuable advantages, including low power consumption, extensive coverage range, and cost-effective connectivity for devices that don't require high data transfer speeds. It's an excellent choice when cellular connectivity is too expensive or Wi-Fi coverage is unavailable. Some of the most compelling use cases for LoRaWAN include:

Agriculture: LoRaWAN's long-range capabilities provide reliable connectivity for rural applications where high data transfer rates are not necessary, making it ideal for agricultural applications. LoRaWAN sensors for agriculture are used for cattle management, soli monitoring, and temperature monitoring.

Asset Tracking and Logistics: LoRaWAN supports cost-effective location tracking of assets, with optimized battery life, making it a practical choice for asset management and logistics.

Smart Metering: LoRaWAN's sensors have the ability to reach even in underground utility locations makes it a suitable choice for smart metering applications.

Smart Homes: LoRaWAN can penetrate obstacles like walls and supports battery-powered devices with low data consumption, making it an attractive connectivity option for smart home applications.LoRaWAN sensors for smart homes are used for Air quality monitoring, water quality monitoring, and temperature & humidity monitoring.

Healthcare: The low power consumption, affordability, and reliability of LoRa technology make it suitable for connected health applications. IoT solutions based on LoRa hardware can monitor high-risk patients or systems around the clock, ensuring comprehensive health and medical safety management.LoRaWAN Gateways and sensors enhance production practices, enable efficient tracking and monitoring of shipments, and facilitate the development of cutting-edge medications.

Industrial Applications: LoRa-enabled devices and sensors play a crucial role in the transformation of industrial IoT operations like mentioned above. They digitize legacy processes and equipment, leading to increased profits, lower costs, and enhanced efficiency. These devices provide real-time data for predictive maintenance, machine health monitoring, reduced downtime, and more.

3 notes

·

View notes

Text

Public Safety LTE Market Size, Share, Trends Key Companies & Competitive Landscape by 2032

The global Public Safety LTE Market is set to gain momentum from the increasing usage of land mobile radio by military and police services for mobile communication. Fortune Business Insights™ provided this information in an upcoming report, titled, “Public Safety LTE Market Size, Share & Industry Analysis, By Infrastructure (E-UTRAN, EPC), By Services (Consulting, Integration), By Deployment Model (Private, Hybrid), By Application (Law Enforcement, Firefighting Services) and Regional Forecast, 2024-2032.” The report further states that the implementation of public safety LTE network is providing a rising support to both critical mission and voice data services.

Informational Source:

https://www.fortunebusinessinsights.com/public-safety-lte-market-102603

The outbreak of the COVID-19 pandemic has taken a toll on the global economy. Most of the companies have started cutting off their employees because of a decline in production and sales. The worldwide lockdown has created major disruptions in the supply chain, thereby obstructing the transportation of raw material. Our reports are providing elaborate analysis of the current situation and its effects on every market.

Fortune Business Insights™ lists out the names of all the public safety LTE manufacturers present in the global market. They are as follows:

Airbus SE (Netherland)

AT&T, Inc. (The U.S.)

Bittium Corporation (Finland)

General Dynamics Corporation (The U.S.)

Harris Corporation (The U.S.)

Huawei Technologies Co. Ltd. (South Korea)

Hytera Communications Corporations (China)

KT Corporation (South Korea)

Samsung Electronics Co. Ltd. (South Korea)

ZTE Corporations (China)

This Report Answers the Following Questions:

What are the challenges and opportunities in the global market?

Which segment is set to dominate the market in terms of share?

What are the growth drivers, dynamics, and obstacles?

Which region is expected to lead the market in terms of revenue?

Drivers & Restraints-

High Demand for Seamless Data Connectivity to Accelerate Growth

The demand for seamless data connectivity is one of the major drivers for the public safety LTE market growth. It is being demanded increasingly from applications in unmanned aerial vehicles (UAVs). Apart from that, high qualities of voice communication services and data safety are being provided by public safety LTE networks. Coupled with this, the adoption of a low power wide area (LPWA), as well as the usage of emergency service to develop internet protocol (IP) would contribute to the market growth positively. However, budget constraints for maintaining and developing a dedicated public safety LTE network may hinder growth.

Regional Analysis-

Increasing Demand from Police Service to Favor Growth in Europe

Regionally, North America is anticipated to generate the highest public safety LTE market revenue in the near future. This growth is attributable to the presence of several industry giants, such as Harris Corporation and General Dynamics Corporation in the region. Europe is expected to retain the second position owing to the rising adoption of LTE networks in police service. Asia Pacific, on the other hand, is likely to showcase a considerable growth fueled by the rising demand for public safety LTE networks from India, Japan, and China. At present, China is developing unique 5G enabled LTE networks to refine the voice communication service across its borders.

Competitive Landscape-

Key Companies Aim to Sign Contracts to Gain a Competitive Edge

The market consists of a large number of companies across the globe. Most of them are trying to gain a competitive edge by signing contracts with the other start-ups. Some of them are also striving to bag new orders.

Below are two of the key industry developments:

February 2020: The U.K. Home Office Emergency Services Network (ESN) signed a contract with APD Communications. It would enable APD to connect emergency services for ESN by using the LTE network.

November 2017: The U.K Home Office Emergency Services Network (ESN) and Samsung Electronics Co. Ltd. signed a contract to supply the former with 250,000 smartphones and accessories. The total deal is worth USD 280 million.

0 notes

Text

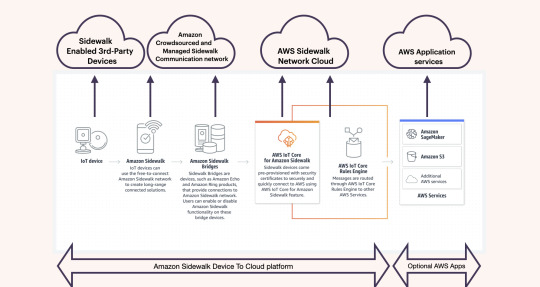

Amazon opens up the Sidewalk network to developers for free in the US to galvanise the IoT market

On 28th of March 2023, Amazon announced its Sidewalk network project launched in early 2020, now covers 90% of the US population and is open to developers to test, build and create new IoT applications. AWS also announced Sidewalk networks integration with AWS IoT core, enabling Sidewalk-enabled partner devices to easily provision, onboard, and monitor Sidewalk devices at scale. The service is currently available only in the US and developers can use the AWS IoT core for Amazon Sidewalk for free using the AWS Free Tier(details here)

A few companies working with Amazon have also announced the launch of sidewalk-enabled devices which includes:

New Cosmos: Natural gas alarm

Primax: Woody, a smart door lock

Netvox: environmental sensor

Meshify’s: Moisture sensor

Browan: Motion and carbon monoxide sensor

OnAsset Intelligence: Sentinel 200 Asset tracker

Is Amazon Sidewalk just a connectivity network platform?

Amazon Sidewalk communication network is one of the 3 core components of the Sidewalk Device-To-Cloud (DTC) platform which includes:

Sidewalk connectivity network: The Sidewalk network is built and operated by crowdsourcing participating customers who enable the Sidewalk network using consumer bridge devices such as the Amazon Echo and Ring devices.

Sidewalk end-devices: Includes Amazon Ring devices and third-party end-devices that are embedded with Sidewalk radio chipsets running the proprietary network protocol and security certificates required to communicate on the Sidewalk network.

Sidewalk Network Server: The Sidewalk network server verifies and routes the data packets from end devices to the application servers.

The #Sidewalk platform is a Device-to-Cloud platform that is built on a crowdsourced, shared #IoT network that connects Sidewalk end devices with enterprise applications using the #AWS IoT Core. The AWS IoT core also offers developers application-level services and security among other functionalities. The application servers hosting the end devices and applications can either use AWS or third-party cloud application services.

How does Amazon monetise the Sidewalk platform when the Sidewalk network Is free?

By integrating the Sidewalk connectivity network, with the AWS cloud services, Amazon monetizes the data sent by Sidewalk-enabled devices to the AWS cloud. As enterprises use the crowd-sourced network to connect their devices, enterprise customers are charged a small fee every time a Sidewalk device transmits data to the sidewalk network server located in the AWS IoT core. In the near term, the revenues from data alone will be negligible as most of the Sidewalk end devices at the most transmit data a dozen times per day adding to a few Kbs of data per month.

However, over time as sidewalk-enabled devices generate millions of data packets that are routed via the AWS IoT core rules engine, this will help grow its opportunity pipeline for its cloud application services. Amazon Sidewalk will help drive enterprise demand and adoption of its cloud applications especially to manage (sort and query) through large volumes of small data packets sent by end devices. AWS will gain the most value as enterprises start to build applications to leverage its consumer and industrial IoT analytics services, especially advanced analytics services (machine learning and AI services) generating new revenue streams.

Overview of the Amazon Sidewalk network technology

Amazon Sidewalk Network is a Multi-Radio Access Network(#MRAN) wireless connectivity platform used to build a crowd-sourced, community-owned, Neighbourhood Area Network (NAN). The network is powered by mostly consumer Sidewalk bridge devices that use a small fraction of the customer's internet bandwidth (~80Kbps) and share it with other sidewalk customers to create a low-bandwidth, low-power #NAN.

Amazon customers who had already set up a sidewalk gateway device (Echo Or Ring devices) at the time of the launch in early 2020, an over-the-air (#OTA) update automatically connected the edge gateway to the network. Echo or Ring customers have the option to turn off the Sidewalk network feature at any time. This OTA update route to create the Sidewalk network without customers’ prior consent is unlikely to be used in European countries with strict laws protecting customer privacy.

In return for the customer's participation, Amazon manages the network to create a city-wide network which end-users can use for free to connect their third-party sidewalk-enabled devices. The Sidewalk network is available for free to other enterprises to offer consumer and enterprise IoT solutions using Sidewalk-enabled 3rd party devices.

The Sidewalk network is built through the integration of 3 wireless connectivity technologies-

Long Range Communication: Proprietary Sub-Ghz (915 MHz ISM band) LPWAN developed on Chirp spread spectrum (CSS/LoRa) radio PHY. The LoRa Phy technology is also used in the LoRaWAN protocol, the #LPWANtechnology managed by the #LoRa Alliance. The LoRa technology is the bearer technology used for long-range communication.

Medium Range Communication: Sub-Ghz(902-928 MHz) Frequency Shift Keying (FSK) technology. This is a legacy wireless technology used in various smart home security applications such as motions sensors, contact sensors and garage door openers.

Short Range Communication: Frequency Hopping Spread Spectrum Phy(Bluetooth Low Energy or #BLE) operates in the 2.4 GHz ISM band.

Identifying potential growth opportunities for the Sidewalk platform

Anchored on the Sidewalk communication network, the key strength of the Sidewalk platform is the complete integrated device-to-cloud stack. The Sidewalk platform helps enterprises easily onboard Sidewalk devices at scale and the low-cost pricing of AWS cloud services helps solution vendors reduce the overall solution TCO. A glance at the AWS IoT core price calculator will provide an indication of the cost of running devices using the Sidewalk platform.

Growth Prospects for Sidewalk Network: The Sidewalk network is currently available in the US only and covers over 90% of the population coverage. Amazon has made public its plans to expand its network footprint to other regions worldwide in the coming years. However, the success of the Sidewalk network in the US will set the pace of its network footprint growth in other regions.

Since the Sidewalk network relies on Amazon #Echo and #Ring customers, One of the recurring challenges for Amazon will be to ensure Amazon Echo and Ring customers participating in the Sidewalk programme remain high and to reduce churn.

Amazon will also need to ensure customer participation in the Sidewalk network programme remains high to ensure sufficient network redundancies are in place, in case some customers decide to turn off their Sidewalk feature from their devices. The only way Amazon can ensure the Sidewalk network continues to thrive is by ensuring participating Echo and Ring customers see immediate and recurring value in the form of new digital devices and services.

In early 2022, to address potential opportunities in the enterprise IoT market, Amazon Ring announced its #Sidewalk Bridge Pro, a ruggedised outdoor gateway. The weatherproof, enterprise-grade gateway will help Amazon expand its network coverage to public spaces such as parks, city centres, universities, businesses, and other places which are not covered by consumer echo and ring bridge devices. The Sidewalk Bridge Pro is designed to be deployed by businesses and municipalities to complement the residential network coverage.

The Sidewalk Bridge Pro will help expand the Sidewalk network by enabling:

On-demand network availability for enterprises that have an immediate demand for campus networks and are willing to host the network infrastructure.

Will help expand network coverage from existing population coverage to wider regional coverage.

The outdoor gateway devices will also help add necessary network redundancies in residential places where Amazon Ring and Echo customer participation is low or the network requires densification.

The success of the Sidewalk network will depend on the growth in the device and solution ecosystem in the US before it launches the service in other regions. The future regional network roll-out will also depend on regional privacy laws and the residential penetration of Amazon Echo and Ring bridge devices used to build the network. The Sidewalks regional network which includes LoRa and FSK technologies will operate on different sub-GHz frequency bands

Based on Amazon’s Sidewalk bridge shipment data, regional network footprint growth will likely be as follows.

Rest of North America: Canada

Europe: Western Europe followed by Eastern Europe

APAC: India, East Asia and the rest of South East Asia. No presence in China.

Rest of the world: Latin America and MEA.

As the Amazon Sidewalk network operates as a single network, when regional networks outside of the US are rolled out, Amazon can offer a roaming-free global network as long as the device's radio hardware is capable of switching to regional Sub-GHz frequency bands.

Growth Prospects for Amazon Sidewalk Devices and Applications

Amazon's Sidewalk platform strategy is focused on driving device makers’ adoption of the platform to develop sidewalk-enabled devices for enterprises and consumer applications. Amazon has announced its partnership with hardware communication module vendors including #Nordic Semiconductor, #Silicon Labs, #Semtech, Texas Instruments and #Quectel.

As the Sidewalk radio hardware matures, one of the developments to watch out for will be a single SKU global radio hardware that enterprises can embed in their devices. This would help global device OEMs and solution providers drastically reduce their design costs of having to modify their devices to operate in each region. This would also have value for enabling application verticals such as asset tracking that requires seamless connectivity across different regions.

The Sidewalk platform operates on 3 business models to target consumer and enterprise markets:

Business to consumer: Consumer IoT(Smart Home)

Ring acquired by Amazon in 2018 provides consumer home security and smart home devices. The sidewalk network supports Amazon Echo and Ring customers to connect Ring devices including doorbells, outdoor cameras, outdoor lights, and Alarm systems that are beyond the range of the home Wi-Fi network and other Personal Area Networks (PANs). The Sidewalk network's extended range capabilities will also help Ring offer new consumer devices such as pet trackers, asset trackers, outdoor irrigation systems, motion sensors and other connected devices.

Business to Business to Consumer :Consumer IoT(Smart home, asset track and trace)

The sidewalk platform is open to other enterprises that want to develop IoT devices and services for end consumers. Some examples of enterprises using the Sidewalk platform to offer consumer IoT services are as follows.

Tile, a leading consumer track and trace solution provider is one of the early adopters of the Sidewalk platform.

Speciality insurer HSB has also announced its IoT subsidiary, Meshify will connect its proprietary water leak sensors for homeowners through the Amazon Sidewalk platform.

Careband, a wearable device for elderly care, has announced plans to test the Sidewalk platform to offer services to its CareBand customers.

Amazon announced the Fetch pet tracker in early 2020 and has since been developing its cloud-geolocation service to enable more consumer asset track and trace use cases.

Business to Business: Enterprise IoT: (Smart City, Industrial IoT, Asset visibility)

Amazon Sidewalk offers system integrators and solution providers a fully integrated DTC platform to cost-efficiently test, build and operate enterprise IoT applications and services. Utilities and city municipalities deploying smart city applications such as streetlights, water meters, parking sensors, air quality sensors, and other environmental monitoring sensors will benefit from an integrated DTC platform service in reducing its solution time to market and cost. Enterprises benefit from Amazon’s vast partner network which includes software partners, hardware partners, service and consulting partners, system integrators, and distributor partners. The AWS Partner Network has more than 100,000 partners from more than 150 countries, with almost 1/3rd or 30,000 partners based in the US.

In 2022, Amazon announced a collaboration with Arizona state university and Thingy to connect environmental sensors such as sunlight sensors, air quality indicators, and moisture sensors in places like commercial centres, parks, and wilderness areas.

Asset Visibility(Location tracking and condition monitoring): Asset track and trace applications have been a key vertical use case for the sidewalk network. Amazon has been partnering with solution vendors to develop its platform capabilities to offer more seamless and accurate geolocation services. In November 2022, Semtech announced a strategic agreement with AWS to license its LoRa cloud geolocation services to help AWS IoT core offer indoor and outdoor geolocation capability.

On March 28, 2023, Amazon announced its Sidewalk solution partner, #OnAssetintelligence, introduce its Sentinel 200, a Sidewalk-enabled asset tracker for logistics use cases. The Sentinel 200, is a multi-year battery life device with temperature, humidity, light, shock and motion sensors that provide timely and granular data on the location, status and chain-of-custody of shipments and assets moving through the global supply chain.

The sidewalk platform in its current form lacks several key network requirements to succeed in the B2B segment. One of the key network capabilities missing today is the Sidewalk Networks ability to guarantee network quality of service (QoS). However, The Sidewalk platform with its free communication network offers enterprises an opportunity to test proofs-of-concept at a minimal cost and examine the financial feasibility of digital transformation programmes.

Analyst view: “A rising tide lifts all boats…but those unable to change and adapt will fail”

With Sidewalk, Amazon integrates device-to-cloud data management capabilities with a communication network to offer simplicity to the enterprise's digital transformation programs. Device-to-cloud platforms that integrate multi-RAN technologies is a solution to reduce technology complexity. That said, the success of the Sidewalk platform will depend on how quickly the technology's adopted by device makers and enterprises to develop innovative new applications and services.

A cautionary tale: Sigfox, an early pioneer of the low-cost Device to Cloud platform using a proprietary LPWA network technology.

To give credit where it's due, #Sigfox was an early pioneer and strong advocate of a low-cost device-to-cloud (DTC) platform to address the market demand for massive IoT applications. Sigfox believed for enterprises to adopt massive IoT applications which may require deploying 100sK or millions of battery-operated sensor devices, it's crucial to drastically simplify the process and cost of transporting data from the device to the cloud. Sigfox was an advocate of the need for very low network TCO to encourage enterprise digital transformation.

To achieve this, Sigfox built its own DTC platform from the ground up based on its proprietary LPWA network also called Sigfox. Sigfox built and operated its cloud services located in Toulouse, France and only in 2021 had migrated its Sigfox network server to Google IoT core(which also shut down in 2022).

Sigfox launched its device-to-cloud platform services at around $1-$7 per annum per device. The cost varied depending on the volume of end-point connections but included regional sigfox connectivity service and sigfox cloud services. Sigfox as a disruptive technology faced severe criticism for its extremely low device-to-cloud connectivity pricing strategy and lack of financial viability to continue operating several of its large nationwide and citywide networks in Europe and the US respectively.

Sigfox witnessed some early success in smart home, smart metering and asset tracking use cases connecting almost 20 million end-points on its network within a span of 5 years. However, due several factors including financial difficulties due to slow revenue growth and the fallout from the Covid-19 pandemic led to Sigfox filing for bankruptcy in early 2022.

Sigfox assets were subsequently acquired by Unabiz, a Sigfox network operator and system integrator. Unabiz in collaboration with over 60 Sigfox network operators is managing the sigfox technology and developing integrated solutions for enterprise Digital transformation.

Amazon Sidewalk in many ways has a similar business model to Sigfox. Similar to Sigfox, the Amazon sidewalk platform offers very low-cost device-to-cloud connectivity, but with several strengths to ensure longer-term sustainability of the business.

By crowd-sourcing the network, majority of the network infrastructure costs required to build and operate the Sidewalk network (except for the Sidewalk Network server) are borne by its Amazon Echo and Ring customers.

The sidewalk network integrates 3 established network technologies ie. LoRa, FSK and BLE. These technologies are backed by a global ecosystem of hardware and solution vendors.

The sidewalk platform has a strong anchor business use case in its successful smart home business. Amazon Ring uses the Sidewalk network to expand its connectivity coverage for security sensors, lights, cameras and other sensor devices in the periphery of the customer's home and beyond.

The total cost of ownership (TCO) for solutions built on the Sidewalk platform will be a fraction of similar existing solutions using cellular or other LPWAN solutions in the market. The cost of BLE and LoRa connectivity hardware is sub $1 at scale. With free connectivity and the cost of the device to cloud platform service at a few 10s of US$ cents per device per annum, the Sidewalk platform drastically helps reduce the TCO for digital products and services.

AWS partner network consists of over 100,000 partners globally consisting of solution developers, system integrators, hardware partners, consultants and distributors.

The Sidewalk platform is integrated with the AWS IoT core which has over 200 services including machine learning and advanced analytics services.

Will Sidewalk complement or compete with other LoraWAN operators in the US?

There are several existing LoRaWAN service providers in the US including:

Public network operators: #Comcast #MachineQ, Senet and more recently Everynet.

Community networks: LoRiot, Things network and #Helium.

Private networks: #Senet, Comcast, Link Labs, and other enterprise customers.

Senet and Everynet two established LoRaWAN operators have deployed regional network infrastructure and offer it to enterprises in a Network as a Service (NaaS) model. Amazon Sidewalk network will compete with public network service providers but will potentially complement system integrators, solution vendors and other enterprise private networks. As the Sidewalk network footprint grows, it will become difficult for these public network operators to justify their connectivity costs compared to a free network. That said, Amazon Sidewalk which uses LoRa for long-range connectivity could benefit from partnering with LoRaWAN-managed network operators such as Senet and Everynet to densify its city-wide network and expand its geographical network footprint, especially in rural and industrial areas.

Nova Labs, Helium Network is one of the largest community-owned LoRaWAN networks in the US(coverage map-https://explorer.helium.com/iot/cities) and will directly compete with Amazon's Sidewalk Network. The Helium network has nearly a million hotspots running the LoRaWAN and is available in over 163 countries. Helium operates its LoRaWAN by rewarding its hotspot owners with blockchain-powered tokens that are generated for transferring device data to the cloud. Today Helium network has nearly 100 device makers and solution providers using the Helium network to offer IoT solutions.

System integrators such as Comcast MachineQ will benefit from leveraging the Sidewalk network by minimizing its network infrastructure costs and using its resources to develop vertical IoT applications and services for end customers.

Will Amazon Sidewalk complement or compete with Telcos Cellular LPWAN services in the US?

AT&T, #Verizon and #tmobile : Cellular LPWA network (#LTEM & #NBIoT) with nationwide coverage since early 2018. Teclos in the US has been monetizing its NB-IoT and LTE-M networks by offering connectivity services and several end-to-end solutions for enterprise customers. Today, Telcos cellular LPWAN connectivity services vary from $12-$36/device/annum and are calculated based on the end device’s data usage. Telcos have struggled to monetize their LPWA network infrastructure with connectivity service alone and have developed a three-pronged monetization strategy. Telcos in the US today offer enterprises a choice of IoT connectivity and/or software platform and/or end-to-end IoT solutions built through an ecosystem of hardware and solution partners.

Amazon Sidewalk will directly compete with telcos’ LTE-M and NB-IoT networks and their consumer smart home(B2C and B2B2C) offerings with the Sidewalk network. Furthermore, with Sidewalk Bridge Pro, Amazon will also be able to target enterprise IoT(B2B) applications such as smart buildings, smart parking, environmental monitoring etc where telcos offer connectivity services and/or end-to-end solutions.

That said, a heterogeneous network architecture that integrates cellular networks and the Sidewalk network will further augment the Sidewalk platform in addressing a broad range of enterprise IoT solution requirements. Cellular LPWA network's nationwide coverage will also help the sidewalk platform address applications such as outdoor asset-tracking requiring broader geographical coverage, lower latency and frequent data transmissions.

Will Amazon Sidewalk complement or compete with Mesh networking technologies used in smart city applications in the US?

Mesh networking technologies based on IEEE 802.15.4(#Zigbee, #Thread) and #Zwave are two dominant connectivity technologies used in smart home applications. Proprietary LPWAN technologies such as LoRa and Sigfox are more energy efficient and hence have gained market share in the smart home market replacing mesh technologies to connect battery-operated sensor devices. The extended range of capabilities of LPWAN technologies has an advantage over Wi-Fi and mesh network technologies that require additional gateway or bridge devices to extend the network range to basements or the periphery of the homes.

Mesh networking technologies also have a growing market share in several smart city applications such as smart metering, parking and smart street lighting. These applications’ network requirements are currently addressed through the deployment of private networks. The sidewalk network is likely to have little to no impact in these segments until it can guarantee network QoS which is a critical application and business requirement

#amazon#sidewalk#LPWA.#LoRa#IoT#technology#lorawan#devicetocloud#assetvisbility#geolocation#crowdsource#free

0 notes

Text

0 notes