#linkusd

Explore tagged Tumblr posts

Text

Amid the turbulent crypto bear market, Chainlink whales are continuing to show their hand by refusing to back down. This has led to a rapid rise in not only the holdings of these Chainlink whales but the number of whale addresses associated with the altcoin as well. Chainlink Whale Addresses Rise By 6% In a report posted on X (formerly Twitter), on-chain data tracker Santiment revealed what Chainlink whales have been up to over the last month. Apparently, while most of the market has been freaking out over declining prices, these whales have taken it as a sign to continue to buy more tokens. The report showed a considerable amount of accumulation among large LINK wallets which hold between 1 million and 10 million tokens. However, this was not the only holder cohort that was taking advantage of the lower prices. Another cohort featuring wallets holding between 100,000 and 1 million tokens had been buying up as many coins. This buying spree saw a good number of wallets move from this cohort into the higher echelon and the rest has been a 6% increase in the number of wallets holding 1 million and 10 million LINK tokens. LINK whale addresses rise rapidly | Source: Santiment on X In the same vein, accumulation among smaller wallets also saw the number of wallets in the 100,000 and 1 million tokens cohort rise as well. With 27 more wallets added to the lineup, the number of wallets in this cohort went up by 5.8%. LINK Price Enjoys The Spoils Of Accumulation As evidenced by the movement of the altcoin on the charts, the LINK price has benefitted from these large accounts choosing to buy instead of sell. On Wednesday, October 11, the Chainlink price went from a low of $7.12 to a high of $7.4. Even more interesting is the fact that this was happening while the rest of the market bled, as Santiment notes. “#Chainlink’s market value sits at $7.31, trading ahead of most of #crypto over the past 12 hours,” the tracker explained in the post. However, it seems that LINK is beginning to run out of steam as of Thursday morning when the price began to reverse. LINK’s decline during this time has seen its price fall around 3%. This could signal some profit-taking following Wednesday’s price increase. At the time of writing, the Chainlink price is at $7.24, down 6.21% on the weekly chart. Currently, the bears and the bulls are locked in a fierce battle over turning the $7.2 mark to either support or resistance. LINK price retraces from Wednesday's gains | Source: LINKUSD on Tradingview.com

0 notes

Photo

Chainlink (LINK) Eyes Another Record Peak as Bitcoin Gets Choppier

2 notes

·

View notes

Text

Chainlink Fiyat Analizi: 18 Şubat

Chainlink Fiyat Analizi: 18 Şubat % 176'lık YTD iadeleri ile, şüphe yoktur ki Chainlink , son birkaç hafta içinde olağanüstü performans gösteren ve daha da yükseklerin geleceği tahminleriyle birlikte büyük hacimli paralardan biridir. Aslında, LINK 36 dolara yakın yerel bir yüksekliğe tırmanırken, daha sonra fiyat listelerinde değerinin bir kısmını düşürdü. Dahası, LINK için 32 dolarlık destek seviyesi bir kez daha yükselirken, son birkaç saatin satışına karşı durması muhtemel. Chainlink 30 dakikalık grafik Kaynak: Read the full article

#Chainlink#chainlinkkaçlira#CryptoCurrency#Fiyatanalizi#koinanaliz#koinkoine#Kripto#kriptoparahaber#kriptopara#linkusd

0 notes

Text

Charted: Chainlink (LINK) Steadies above $24, Fresh Increase To $27 Likely

Charted: Chainlink (LINK) Steadies above $24, Fresh Increase To $27 Likely

Chainlink (LINK) traded to a new yearly high near $27.00 before correcting lower, similar to bitcoin and Ethereum. The price is now holding a major support at $24.00 and the 100 SMA (H4). Chainlink token price started a downside correction from the $27.03 high against the US dollar. The price is well bid above the $24.00 level and the 100 simple moving average (4-hours). There is a key bullish…

View On WordPress

0 notes

Text

LINK/USD Blasts New All-Time Highs But This Rising Wedge Pattern Spells Doom

LINK/USD Blasts New All-Time Highs But This Rising Wedge Pattern Spells Doom

[ad_1]

advertisement

Chainlink has ascended to new all-time highs around $17.00 in the push for gains eyeing $20.00.

LINK/USD is trading within a rising wedge pattern spells doom with a possibility for breakdown to $15.00.

Chainlink is arguably the best performing cryptocurrency in the market this August. It is giving major assets such as Bitcoin, Ethereum and Ripple a run for their…

View On WordPress

0 notes

Photo

#xbtusd#btcusd#btcusdt#ethusd#ethusdt#xrpusd#xrpusdt#linkusd#linkusdt#linkbtc#ethbtc#xrpbtc#btc#bitcoin

0 notes

Text

This Top Crypto’s Grim Pattern Shows a Massive Decline May Be Imminent

Chainlink’s immense bullishness seen throughout 2019 spilled into 2020, with the market-wide uptrend in January and February sending the crypto to fresh all-time highs. Even in the face of intense bearishness over the past few weeks, LINK has been able to incur some parabolic momentum.This momentum, however, may not last too long, as the cryptocurrency is currently flashing some signs of weakness…

View On WordPress

0 notes

Text

In a recent interview, Chainlink’s co-founder, Sergey Nazarov, said the collapse of the banking industry will drive crypto mass adoption. Chainlink’s Co-Founder Predicts Crypto And Blockchain Prospects Over The Next Decade Sergey Nazarov believes that the collapse of the banking industry will favor crypto adoption and growth in the next decade. Nazarov believes the crypto industry and its technological innovations might maintain the same slow growth pace. However, the industry player cited two possible crypto and blockchain adoption scenarios in the next ten years. First, the Chainlink co-founder proposed a fast-case scenario where the collapse of the traditional finance system puts individuals in pain. This pain will force individuals to “acknowledge the relevance” of cryptographic financial systems. Further, Nazarov noted that the continued collapse of banks like Silicon Valley Bank could fast-track crypto adoption. Secondly, based on the first theory, the collapse of traditional finance systems will lead to political tension and international problems. Nazarov believes investors will favor crypto for financial operations if the pain of suffering losses becomes unbearable. Therefore, Nazarov insists that even in the slow case, the crypto market is likely on its way to a $10 trillion market cap. LINK’s price currently hovers at $7.63 in the daily chart. | Source: LINKUSD price chart from TradingView.com Chainlink’s Adoption By ANZ Banking Group Supports Nazarov’s Growth Theory According to a new industry report, ANZ Bank has adopted Chainlink’s CCIP for cross-chain tokenized asset settlement. CCIP solution helps to transfer data and tokenized assets across blockchains in a decentralized and secure way, according to the crypto founder. Notably, ANZ Bank is one of the world’s largest banks, with over $1 trillion in total assets managed. Sergey Nazarov noted that Chainlink’s adoption by ANZ shows how large companies are now adopting Chainlink’s CCIP. Also, the co-founder stated that building on a global internet needs secure connectivity between private bank chains and public chains. The CCIP is an upgrade on the Chainlink Network that functions as a global Internet of Contracts. This upgrade aims to create the world’s largest liquidity layer across various regions and markets. Remarkably, Nazarov stated that CCIP can create a higher level of cross-chain security. It achieves this extra security with multiple layers of decentralization and advanced risk management techniques. Moreover, most cryptocurrencies offer users fast and secure cross-border transactions cheaply. However, some critics still insist that cryptocurrencies are unreliable based on their volatility and crisis in the sector. With innovations like the CCIP of Chainlink, more banks may integrate crypto and blockchain-based solutions. This drives crypto to mainstream adoption, increasing the market cap to $10 trillion, as Nazarov predicts. Meanwhile, the collapse of banks such as Silicon Valley Bank (SVB) in 2023 has strained the global finance economy. If another banking crisis occurs, cryptocurrencies might become the preferred option for most investors based on their rising utility.

0 notes

Photo

Charted: Chainlink (LINK) Holding Uptrend Support, Why It Could Rally Again

1 note

·

View note

Video

youtube

Contact: [email protected] Twitter: https://twitter.com/justanalysis1 Site: https://www.itsjustanalysis.com/ https://www.patreon.com/justanalysis ******** The trade idea from March 17th triggered and is currently active. No new trade ideas were identified. ******** Trade-Ideas ******** ($1.00/3-box P&F Chart) - March 17th Buy Stop @ $16 Stop Loss @ $12 Profit Target @ $32 ******** Dollar-Cost Average - Update Oct 20th ******** Buy Limit @ $11 Buy Limit @ $9 #Chainlink #LINK #Crypto #altcoins #LINKUSDT #LINKUSD $LINK $LINK #cryptocurrencies #Crypto #blockchain #DeFi #Crypto #CryptoNews #cryptotrading #defi #metaverse #yieldfarming #ALTSEASON

0 notes

Text

New Grayscale trust filings spin rumour mill into overdrive for Cardano, Polkadot, Cosmos and more

New Grayscale trust filings spin rumour mill into overdrive for Cardano, Polkadot, Cosmos and more

Crypto asset manager Grayscale Investments filed new trusts for Aave, Cardano, Cosmos, Monero, and Polkadot in the Delaware corporate registry. As expected, each respective community is bullish over the news. However, filings do not necessarily mean Grayscale will follow through with them. The firm commented on the matter by saying filings relate to preparation for possible trust launches. But…

View On WordPress

0 notes

Text

The Markets

Hello, Hello, Hello, We were right on track once again with what was to come, we are officially long LINKUSD and BCHUSD. We did buy a couple of days again and the charts are starting to mature. Others charts are also starting to look really well such as Zoom, and even some currency pairs. Wanna see the charts come back tomorrow! lol

View On WordPress

3 notes

·

View notes

Text

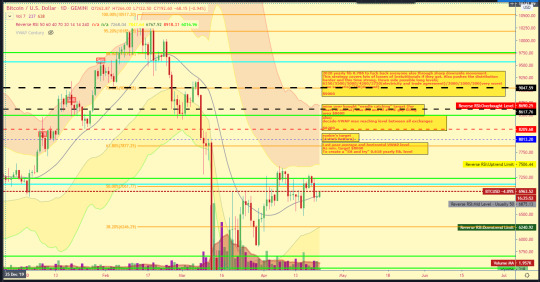

Is #link making another run at greatness? #LINKUSD #crypto @CoinbasePro #coinbase @Trading_Tech #cryptocurrencies https://t.co/Cz9yp9pZdK

Is #link making another run at greatness? #LINKUSD #crypto @CoinbasePro #coinbase @Trading_Tech #cryptocurrencies pic.twitter.com/Cz9yp9pZdK

— Patrick Rooney (@patrickrooney) December 10, 2019

https://platform.twitter.com/widgets.js from Twitter https://twitter.com/patrickrooney

View On WordPress

1 note

·

View note

Text

An on-chain signal that preceded crashes of at least 34% for Chainlink in the past has once again formed for the cryptocurrency. Chainlink 30-Day MVRV Ratio Recently Hit The 20% Mark As explained by an analyst in a post on X, the last two times the 30-day MVRV ratio broke above the 19% level, the price of LINK registered a sharp decline. The “Market Value to Realized Value (MVRV) ratio” is an indicator that measures the ratio between the Chainlink market cap and the realized cap. The “realized cap” here refers to the total amount of capital that holders of the cryptocurrency have invested into it. As the MVRV ratio compares the spot valuation (the market cap) with the amount that the investors bought the asset with, its value can provide hints about whether the holders as a whole are in profits or not. When the metric has a value greater than 1, it means that the market cap is more than the realized cap, and hence, the average investor is in profit right now. The more the holders get into profit, however, the more likely they become to sell, so high values of the MVRV ratio can suggest the asset is becoming overpriced and a correction may be due. On the other hand, values under the threshold suggest the cryptocurrency may be undervalued currently as the overall market is holding some net unrealized losses. Now, here is a chart that shows the trend in the 30-day version of the Chainlink MVRV ratio, which looks at the profitability of only the investors who bought within the past month: The value of the metric seems to have sharply surged in recent days | Source: @ali_charts on X In the above graph, the value of the 30-day MVRV ratio is represented as a percentage relative to the break-even level. As is visible, this indicator has observed some sharp uptrend recently as Chainlink has enjoyed its rally. During this latest rapid growth, the metric had managed to hit a peak of 20%, which means that the market cap had become 20% more than the realized cap of the 30-day investors. The analyst has pointed out an interesting trend that LINK has followed during the past couple of years. It would appear that whenever the 30-day MVRV ratio has broken above the 19% mark, the cryptocurrency has followed up with a steep drawdown. This has happened two times in the period of the chart and coincidentally, Chainlink’s decline was about 34.5% in both of these instances (although the time the drawdown was spread out over was different in the two cases). Since the 30-day MVRV has once again surged above this apparently significant level, it’s possible that LINK may also register a similar drop in the coming days or weeks. LINK Price Chainlink has observed some sharp uptrend over the past month, as its price is currently trading just under the $8 level, having gone up almost 34% in the period. If the MVRV ratio is anything to go by, though, this impressive run may finally be coming to an end. Looks like LINK has sharply surged recently | Source: LINKUSD on TradingView

0 notes

Photo

Chainlink Hits $30 as Grayscale Adds 115,570 LINK to Its Reserves

0 notes

Video

youtube

Contact: [email protected] Twitter: https://twitter.com/justanalysis1 Site: https://www.itsjustanalysis.com/ https://www.patreon.com/justanalysis ******** The trade idea from March 17th triggered and is currently active. No new trade ideas were identified. ******** Trade-Ideas ******** ($1.00/3-box P&F Chart) - March 17th Buy Stop @ $16 Stop Loss @ $12 Profit Target @ $32 ******** Dollar-Cost Average - Update Oct 20th ******** Buy Limit @ $11 Buy Limit @ $9 #Chainlink #LINK #Crypto #altcoins #LINKUSDT #LINKUSD $LINK $LINK #cryptocurrencies #Crypto #blockchain #DeFi #Crypto #CryptoNews #cryptotrading #defi #metaverse #yieldfarming

0 notes