#limited liability partnership firm registration

Explore tagged Tumblr posts

Text

Online Trademark Registration Fees, Process, Documents

Trademark registration distinguishes your brand from competitors and help in identifying your product & services as source. Trademark could be a Name, Slogan, Logo or Number which a company uses on its business name, Product or services.

Registering a trademark could be a time taking process as brand registration could take minimum 6 months to 24 months of time depending upon the result of the Examination Report, that's why Professional Utilities provides Brand Name Search Report to get a fair idea about the turnaround time for registration.

Once a Trademark application is processed with the government department, applicants can start using the TM symbol on their mark & ® when the registration certificate has been issued. The registration of the trademark is valid for ten years & can be renewed after ten years. (Read More)

NOTE: If you are a manufacturer then you should also read about EPR Registration

#india#business#earnings#startup#trademark#intellectual property#intellectual disability#private limited company registration in chennai#private limited company registration in bangalore#private limited company registration online#sole proprietorship#limited liability partnership#limited liability company#ngo#ngo donation#nidhi company registration#partnership#partnership firm registration#manage business#taxes#income tax#management#accounting#entrepreneur#import export business#import export data#industry#commerce#government#marketplace

3 notes

·

View notes

Text

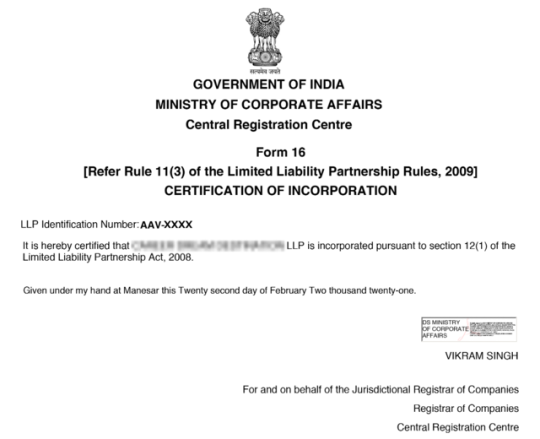

Limited Liability Partnership (LLP) Firm Registration: Benefits, Process, and Requirements | Legal Man

A Limited Liability Partnership (LLP) combines the advantages of both a company and a partnership, making it a popular choice for entrepreneurs. Here's a detailed overview of Limited Liability Partnership (LLP) Firm Registration in India:

What is LLP?

An LLP is a hybrid entity that offers the benefits of a partnership while limiting the partners' liabilities. It was introduced in India by the Limited Liability Partnership Act, 2008. Unlike traditional partnerships, LLPs protect partners from personal liability beyond their investment, making them a safer option for business owners.

Benefits of LLP

LLPs have numerous benefits, which make them a preferred choice for professionals and businesses:

Limited Liability: One of the main advantages is that the partners’ liability is limited to their capital contribution. This means that the personal assets of the partners are protected in case of losses or business debts.

Separate Legal Entity: An LLP is treated as a separate legal entity, independent of its partners. This allows the LLP to own assets, enter into contracts, and sue or be sued in its own name.

No Maximum Limit on Partners: While a traditional partnership can have a maximum of 20 partners, an LLP can have an unlimited number of partners.

No Minimum Capital Requirement: Unlike companies, there is no minimum capital required to form an LLP. This feature is attractive for startups or small businesses.

Less Compliance and Regulations: LLPs have fewer regulatory compliance requirements compared to private limited companies. For instance, they don't require annual audits unless their turnover exceeds a certain limit.

Tax Benefits: Limited Liability Partnership (LLP) Firm Registration enjoy tax advantages such as avoiding Dividend Distribution Tax (DDT), which applies to companies. Profits distributed among partners are tax-free after they pay the income tax.

Easy Transfer of Ownership: Transfer of ownership or changes in partners is simpler in an LLP as compared to a traditional partnership or company.

Steps for LLP Registration

Obtain Digital Signature Certificate (DSC): Since the registration process is online, all the designated partners of the LLP need to obtain a Digital Signature Certificate (DSC). The DSC is used to sign electronic documents.

Apply for Director Identification Number (DIN): Each designated partner of the LLP must have a Director Identification Number (DIN), which can be obtained from the Ministry of Corporate Affairs (MCA).

Name Reservation: An LLP must reserve its name through the RUN-LLP (Reserve Unique Name - Limited Liability Partnership) service provided by the MCA. It’s advisable to check name availability before submission to avoid rejections.

Filing of Incorporation Form: After the name is approved, the Form for Incorporation of LLP (FiLLiP) must be submitted. This form contains details about the LLP’s partners, registered office, and other necessary documents.

LLP Agreement: An LLP agreement defines the rights and duties of the partners and the firm. It must be filed within 30 days of LLP incorporation and can be amended as required.

Documents Required for LLP Registration

Partners’ Documents:

PAN Card of all partners (mandatory)

Address proof (Passport, Voter ID, Driver's License)

Residence proof (Bank statement, electricity bill, telephone bill)

Registered Office Documents:

Address proof of the registered office

NOC from the landlord if the office is rented

LLP Agreement: Drafting the LLP Agreement is essential, and it should include details like profit-sharing ratio, responsibilities, and roles of partners.

post-Registration Compliance

Once the Limited Liability Partnership (LLP) Firm Registration done, it is subject to annual compliance requirements such as:

Filing Annual Returns: Form 11, which contains the details of partners, must be filed annually.

Statement of Accounts & Solvency: LLPs must maintain proper financial records and file Form 8 annually, which declares solvency and financial status.

Income Tax Filing: LLPs are required to file their Income Tax Return by the prescribed date, based on their turnover and audit requirements.

Who Should Register an LLP?

LLP is ideal for:

Professionals like CA, CS, doctors, or architects who want to form a firm.

Entrepreneurs and startups looking for a flexible yet protected business structure.

Businesses that plan to scale but want to avoid the compliance burden of private limited companies.

Service providers who operate with multiple partners and wish to safeguard their personal assets.

Conclusion

The LLP structure is gaining popularity due to its flexibility, low compliance burden, and limited liability protection. It’s a smart choice for small businesses, startups, and professionals. With minimal capital requirements, tax advantages, and simplified legal formalities, Limited Liability Partnership (LLP) Firm Registration has become a preferred option for many entrepreneurs in India.For more details, refer to Legal Man.

#Limited Liability Partnership (LLP) Firm Registration#private limited company registration#ROC Compliances#indian subsidiary incorporation

0 notes

Text

https://eazybahi.com/limited-liability-partnership/

A Limited Liability Partnership (LLP) is a body corporate which is a distinct legal entity separate from that of its partners. It has perpetual succession and a common seal. It enjoys the benefits of a partnership firm while having the status of a body corporate.

Get Your Limited Liability Partnership registered along with name approval, PAN, TAN and GST registration and enjoys the benefits of a partnership firm at EazyBahi.

0 notes

Text

Company Formation by MASLLP: Your Partner in Starting a Business

Starting a company is an exciting venture, but the process can be complex and time-consuming. This is where professional guidance comes in handy. MASLLP offers expert company formation services, designed to streamline the process and ensure compliance with all legal requirements. Whether you are a local entrepreneur or an international business looking to establish a presence in India, MASLLP has the expertise to assist you at every step.

Why Choose MASLLP for Company Formation? Expertise in Legal Procedures MASLLP specializes in handling the intricate legal requirements involved in setting up a company. From filing necessary documents to obtaining essential licenses, MASLLP ensures that your business is established in compliance with India's regulatory framework.

Customized Solutions Every business has unique needs, and MASLLP tailors its services to meet your specific goals. Whether you're forming a private limited company, a public limited company, or a limited liability partnership (LLP), MASLLP provides guidance based on your business model and objectives.

End-to-End Support MASLLP offers comprehensive services from the initial consultation through to post-formation compliance. This includes drafting Memorandum of Association (MOA) and Articles of Association (AOA), securing digital signatures, and helping with PAN/TAN registration.

The Company Formation Process Setting up a company in India requires a series of steps that MASLLP manages efficiently:

Choosing the Right Structure The first step is determining the right business structure—Private Limited, LLP, or a One-Person Company (OPC). MASLLP provides advice on the best structure based on liability, tax, and regulatory requirements.

Name Approval MASLLP assists in selecting a suitable name for your business and ensures it complies with the Ministry of Corporate Affairs (MCA) guidelines.

Incorporation Documentation The legal team at MASLLP helps prepare and file all necessary documents, such as the Director Identification Number (DIN), Digital Signature Certificate (DSC), and incorporation forms with the MCA.

Post-Incorporation Compliance Once your company is established, MASLLP ensures you meet all post-incorporation compliance requirements, such as obtaining necessary licenses, registering for Goods and Services Tax (GST), and maintaining statutory records.

Benefits of Company Formation with MASLLP Time Efficiency: With MASLLP managing the paperwork, you can focus on growing your business rather than worrying about legal hurdles. Compliance Assurance: Ensures that your company is set up in full compliance with Indian law. Professional Expertise: MASLLP’s team of legal and financial experts guide you through every phase of company formation. Conclusion For entrepreneurs looking to establish a company in India, MASLLP offers a seamless, efficient, and expert-driven service. Their deep understanding of the legalities involved in company formation makes them the ideal partner for anyone looking to start a business. Whether you're a startup, an established business, or an international firm, MASLLP ensures your company formation process is smooth and compliant.

#accounting & bookkeeping services in india#businessregistration#audit#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ap management services

3 notes

·

View notes

Text

Company Incorporation Consultants in Delhi by SC Bhagat & Co.

Starting a new business in Delhi can be a rewarding venture, but it also comes with its own set of legal and administrative challenges. One of the critical steps in building your business is the incorporation process, which requires careful attention to various regulations. This is where professional assistance from SC Bhagat & Co., a leading company incorporation consultant in Delhi, becomes invaluable.

Why Choose Professional Company Incorporation Consultants? Incorporating a company involves several legal procedures, such as:

Selecting the correct business structure Filing the necessary paperwork with regulatory authorities Complying with tax laws Obtaining approvals and licenses The process can be complex and time-consuming for new entrepreneurs. SC Bhagat & Co. helps streamline this procedure, ensuring compliance with all legal requirements while minimizing delays.

Services Offered by SC Bhagat & Co. As one of the top company incorporation consultants in Delhi, SC Bhagat & Co. offers a range of services that cater to startups, small businesses, and large corporations. These include:

Business Structure Advisory Choosing the right business structure is crucial for long-term success. The firm provides guidance on various business entities, including:

Private Limited Company Limited Liability Partnership (LLP) One Person Company (OPC) Public Limited Company SC Bhagat & Co. ensures that you opt for the structure best suited to your business goals and tax advantages.

Registration Services From company name reservation to filing of incorporation documents, SC Bhagat & Co. handles the entire registration process. They assist with:

Drafting Memorandum and Articles of Association (MOA/AOA) Digital signature certificates (DSC) Director Identification Number (DIN) Filing with the Ministry of Corporate Affairs (MCA) Their comprehensive approach makes the process seamless and efficient.

Compliance and Taxation Support Once incorporated, companies are required to meet various compliance standards, including:

GST registration and filing Annual financial statements Regulatory audits SC Bhagat & Co. offers ongoing support to ensure your business stays compliant with both state and central laws, thus avoiding penalties and legal hurdles.

Legal Advisory and Licensing Navigating the legal landscape in India can be tricky. SC Bhagat & Co. also provides assistance in obtaining the necessary business licenses and permissions, such as:

Trade license Import-export code (IEC) Professional tax registration Why SC Bhagat & Co. Stands Out With years of experience in the field, SC Bhagat & Co. has become synonymous with trust and expertise in company incorporation consulting in Delhi. Here’s why they stand out:

Expert Team: Their team consists of highly qualified professionals, including chartered accountants and legal experts. Personalized Service: They tailor their services according to the specific needs of your business. Quick Turnaround: Their efficient processes ensure timely incorporation and compliance. Post-Incorporation Support: Even after your company is set up, SC Bhagat & Co. provides continuous support for your legal and financial needs. Conclusion Incorporating a company is a significant step in the journey of entrepreneurship. With the expert guidance of SC Bhagat & Co., you can rest assured that all legal and regulatory requirements will be handled efficiently, allowing you to focus on growing your business. If you're looking for reliable company incorporation consultants in Delhi, SC Bhagat & Co. should be your first choice.

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices

2 notes

·

View notes

Text

How to start a business in Vietnam as a foreign investor?

Vietnam is one of the fastest-growing economies in Southeast Asia, with a young and dynamic population, a favorable business environment, and a strategic location. Additionally, Vietnam's government has been increasingly enacting more preferential policies to facilitate foreign investors' entry into the country to do business in Vietnam. If you are interested in starting a business in Vietnam, here are some steps you need to follow:

Step 1: Choose a business entity type

There are different types of business entities in Vietnam, such as limited liability company joint-stock company partnership, branch office, representative office, etc. Each type has its own advantages and disadvantages, depending on your business goals, capital, and legal requirements. You should consult a local law firm in Vietnam to help you decide which entity type suits your needs best.

Step 2: Register your business in Vietnam

After chosing your business entity type, you need to register your business with the relevant authorities in Vietnam. This involves submitting various documents, such as: business name, address, charter capital, shareholders, directors, tax code, etc. Depending on the type and scope of your business, you may also need to obtain additional licenses or permits from other agencies, such as the Ministry of Industry and Trade, the Ministry of Health, the Ministry of Planning and Investment, etc.

Step 3: Open a bank account in Vietnam

You need to open company’s bank account after registering your business. You will need to provide your business registration certificate, tax code certificate, and other documents to the bank. You can choose from various local or foreign banks operating in Vietnam, depending on your preferences and needs.

Step 4: Hire staff and set up your office in Vietnam

The next step is to hire staff and set up your office in Vietnam. You will need to comply with the labor laws and regulations in Vietnam, such as: minimum wage, social insurance, health insurance, working hours, etc. You will also need to find a suitable location for your office and equip it with the necessary facilities and equipment.

Step 5: Start your operations and marketing

You will need to develop a business plan and strategy that suits the local market and culture in Vietnam. You will also need to build relationships with customers, suppliers, partners, and authorities in Vietnam. You can use various channels and methods to promote your products or services, such as: social media,online platforms, events, etc.

Starting a business in Vietnam can be challenging but rewarding. By following these steps and seeking professional advice from the law firm in Vietnam when needed, you can successfully establish and grow your business in Vietnam.

ANT Lawyers is the reliable law firm in Vietnam that will always contact the authorities to obtain legal updates on issues pertaining to do business in Vietnam.

2 notes

·

View notes

Text

How to Establish a Joint-Stock Company in Vietnam?

How to Establish a Joint-Stock Company in Vietnam?

In addition to limited liability companies, partnerships, and private enterprises, joint-stock companies are recognized by Vietnamese law. When a Vietnam authority issues a Certificate of Business Registration, a joint-stock company gains legal status. Consult with corporate lawyers in Vietnam to learn about the advantages of various company formations in Vietnam for the owner's efficient management and goals.

As per the meaning of the Law on Undertakings, a business entity is a venture whose sanction capital is separated into two halves called shares. A joint-stock company can have individuals or organizations as its shareholders; the minimum number of shareholders is three. Since there is no maximum number of shareholders, the company will be able to easily expand its operations on a larger scale. In addition, shareholders will only be responsible for the company's debts and other property obligations up to the amount of capital contributed. Due to the level of risk that shareholders must bear, this is an advantage of this type of business. Specifically, business entities reserve the privilege to give offers, bonds and different protections to raise capital, which is a component that different kinds of organizations don't have.

The owner of a business in Vietnam has the option of submitting a set of documents to the Business Registration Office where the intended head office is located on their own or by authorizing another individual, organization, or law firm in Vietnam to do so. These documents include:

1.An application for enterprise registration;

2.The company’s charter;

3.List of founding shareholders and list of shareholders being foreign investors;

4.Copies of the following papers:

a) Legal papers of the individual for the legal representative of the enterprise;

b) Personal legal papers for company members, founding shareholders, shareholders being foreign investors who are individuals; Legal papers of the organization for members, founding shareholders, shareholders being foreign investors being organizations; Legal documents of individuals for authorized representatives of members, founding shareholders, shareholders being foreign investors being organizations and documents on appointment of authorized representatives.

For individuals and investors being unfamiliar associations, duplicates of lawful papers of the association should be authenticated and consularly sanctioned in Vietnam; The owner of a business in Vietnam has the option of submitting a set of documents to the Business Registration Office where the intended head office is located on their own or by authorizing another individual, organization, or law firm to do so. These documents include:

c)Investment registration certificate, in case the enterprise is established or participated in the establishment by a foreign investor or a foreign-invested economic organization in accordance with the provisions of the Investment Law and other legal documents; implementation manual.

The Business Registration Office will process the application within three working days of receiving it.

ANT Lawyers could assist you in establishing a joint-stock company in Vietnam with their highly skilled staff and extensive experience in foreign investment.

2 notes

·

View notes

Text

Get Your LLP Firm Registered Easily With Registration Mitra

Looking for a trustworthy and reliable LLP registration consultant? Look no further than Registration Mitra! We are experts in helping businesses register as Limited Liability Partnerships. Our team of professionals will guide you through the entire process, ensuring that it is quick and easy. Contact us today to get started!

2 notes

·

View notes

Text

Start – up India – A Campaign to Boost the Business in India

Introduction

Startup India is a drive initiated by the Government of India to build a strong eco-system for nurturing the innovation and Startups in the Country so as to take India a Step forward in becoming a developed Country. This shall be able to generate more employment opportunities alongwith the economic growth of the Country. It has given opportunity to many unemployed persons to come with their innovative ideas and designs.

Setting up Process

Startup definition for the purpose of Government Schemes, means an entity, incorporated or registered in India not prior to five years, with an annual turnover not exceeding INR 25 Crores in any preceding financial year, working towards innovation, development, deployment or commercialization of new products, processes or services driven by technology or intellectual property. Provided that such entity is not formed by splitting up or reconstruction, of a business already in existence.

Further the entity shall lose its existence of Startup if in any preceding financial years it has achieved the turnover of INR 25 Crores or it has completed 5 years from the date of incorporation/registration.

The Startup entity can be incorporated in either of the following form:

- Partnership firm [ a duly registered partnership deed under the Partnership Act, 1932]

- Limited Liability Partnership [LLP] firm duly incorporated under the Limited Liability Act, 2008

- Private Limited Company incorporated under the Companies Act, 2013.

A proprietorship or public limited company is not eligible as Startup, whereas the One Person Company, being a Private Limited Company is entitled to be a Startup.

A business is deemed to be recognized as Startup only if it aims to develop and commercialize — a new product or service or process or a significantly improved existing product or service or process that will create or add value for customers or workflow.

For the ease of registration and other details regarding Startups the Government of India has launched the Startup India portal and mobile app w.e.f. 1st April, 2016, wherein the Action plan as to how startups have to go about doing business is completely provided.

Further to ease out the queries of the various startups the Government of India, Department of Industrial Policy & Promotion (DIPP) has release the Frequently Asked Questions (FAQs). The Government from every possible way is trying to reach out to the Startups to come up with their innovation and ideas.

The Government in order to do the proper hand holding for the startups have provided a complete action plan to the startups so that they can easily start their own ventures after duly fulfilling all the requirements.

In this regard The Ministry of Human Resource Development and the Department of Science and Technology have agreed to partner in an initiative to set up over 75 such startup support hubs in the National Institutes of Technology (NITs), the Indian Institutes of Information Technology (IIITs), the Indian Institutes of Science Education and Research (IISERs) and National Institutes of Pharmaceutical Education and Research (NIPERs).The Reserve Bank of India said it will take steps to help improve the ‘ease of doing business’ in the country and contribute to an ecosystem that is conducive for the growth of start-up businesses.

Startups Eligible for Startup India Tax Exemptions & Incentives

As reproduced before that a business is considered a Startup under the Startup India Action Plan if it aims to develop and commercialize new products or services…

Read More: https://www.acquisory.com/ArticleDetails/9/Start-%E2%80%93-up-India-%E2%80%93-A-Campaign-to-Boost-the-Business-in-India

#startups in india#startup business in india#startup india action plan#startup india tax#financial consulting services#startup tax relief

0 notes

Text

LLP Registration in India — Online Procedure, Documents Required, Cost

Limited Liability Partnership, commonly known as “LLP”, is a newer form of business in India with limited liability benefits of a private limited company and the flexibility of a partnership firm. The concept of the LLP was introduced in India in 2008 and is regulated by the Limited Liability Partnership Act, 2008.

The maintenance cost and compliances are less in LLP; hence, it has become a preferred form of business organization among entrepreneurs. This form of business structure is ideal for small and medium-sized businesses.

Benefits of LLP Registration

Separate legal entity

Limited liability

Lower cost

No minimum capital required

Minimal compliances

Checklist for LLP registration

Minimum two partners

At least one partner should be a resident of India

DSC for all designated partners

DPIN for all designated partners

Unique name of the LLP that is not similar to any existing LLP or company or trademark

Capital contribution by the partners of LLP

LLP agreement between the partners

Address proof for the office of LLP

Documents required for LLP registration

Documents of both the partners and LLP have to be submitted for incorporating a Limited Liability Partnership:

—Documents of partners

ID proof of partners

Address proof of partners

Residence proof of partners

Passport size photograph

Passport (in case of foreign nationals / NRI)

—Documents of LLP

Proof of registered office address

Digital Signature Certificate

Documents you’ll get after LLP incorporation

To know more (click here)

#llp registration#nidhi company registration#limited liability company#private limited company registration online#private limited company registration in bangalore#private limited company registration in chennai#partnership firm registration#firm#organisation#india

0 notes

Text

How can an NRI start an immigration business if he/she moves back to India? Is it profitable? Where does one start from?

Starting an immigration business in India as an NRI can be a fulfilling and profitable endeavor, given the increasing demand for global mobility services. Here's how to begin, along with real-world insights and futuristic strategies.

Steps to Start an Immigration Business

Conduct Market ResearchIdentify your target audience—students, skilled professionals, or families. Understand the demand for specific services such as student visas, work permits, or permanent residency applications in your chosen area.

Develop a Business PlanOutline your objectives, services, pricing model, and operational strategies. A detailed plan will serve as your blueprint and help secure financing if needed.

Legal Framework

Registration: Register your firm under the Companies Act, 2013, or as a Limited Liability Partnership (LLP).

Licenses: Obtain country-specific certifications like ICCRC for Canada or MARA for Australia to build credibility.

Compliance: Adhere to India’s local laws, such as the FEMA regulations for NRIs.

Office and InfrastructureSet up a client-friendly office with basic amenities like computers, internet, and software for visa application tracking. Initially, you can work remotely to minimize costs.

Hiring and Training StaffRecruit a team with expertise in immigration law, documentation, and client communication. Ensure regular training to keep them updated on evolving regulations.

Marketing and NetworkingUse social media, local advertisements, and partnerships with educational institutions or placement agencies to market your services. Build relationships with international consultants for cross-border referrals.

Profitability

The global immigration consulting market is expected to grow from $15.01 billion in 2023 to $24.94 billion by 2032, with a CAGR of 5.73%. In India, demand for immigration services, particularly for student and skilled worker visas, is surging due to the increasing number of people seeking opportunities abroad. With an initial investment in infrastructure and licenses, you can expect profitability within 1-2 years, depending on your niche.

Examples

Success Story: An NRI who returned from the UAE started an immigration consultancy in Bangalore, focusing on Canadian PR and student visas. By collaborating with local IELTS coaching centers and offering virtual consultations, their client base grew by 40% within two years.

Challenges: A consultant without the necessary MARA accreditation faced penalties and reputational damage while handling Australian visa cases, underscoring the importance of licensing.

Futuristic Steps

Adopt TechnologyLeverage AI tools for document verification and case tracking. Use CRM software for seamless client management.

Expand ServicesDiversify into relocation assistance, language training, or financial planning for emigrants to increase revenue streams.

Stay UpdatedMonitor changes in immigration policies and conduct regular workshops to educate your team and clients.

Virtual ServicesOffer online consultations and application filing services to cater to clients beyond your local area.

Starting an immigration consultancy as an NRI not only taps into a growing market but also offers the chance to make a meaningful impact on people’s lives. By combining expertise with the right resources, you can build a profitable and sustainable business.

For expert legal guidance and seamless solutions in starting your immigration business in India, LawCrust Legal Consulting is your trusted partner. With in-depth knowledge of immigration laws, business registration, and compliance, they ensure your venture runs smoothly and successfully. To get premium legal service in India, LawCrust is the name that stands out. Visit https://lawcrust.com/ or call +91 8097842911 for expert legal assistance.

0 notes

Text

Startup Registration in India: A Comprehensive Guide by MAS LLP

Starting a business in India has become increasingly attractive due to the country’s growing economy and supportive government policies. However, navigating the complexities of startup registration can be challenging. MAS LLP, a leading consultancy firm, offers expert guidance to streamline this process. In this blog, we’ll walk you through the essential steps for startup registration in India and how MAS LLP can assist you in launching your venture efficiently.

Why Register Your Startup in India? Registering your startup is a crucial step that provides legal recognition and several benefits, including: Access to Funding: Registered startups are more likely to attract investors and secure funding. Legal Protection: It ensures your business name and intellectual property are protected. Tax Benefits: The Indian government offers various tax exemptions and incentives for registered startups under the Startup India initiative. Credibility: Registration enhances your brand’s credibility, making it easier to build trust with customers and partners.

Types of Business Structures for Startups in India Choosing the right business structure is vital for your startup's success. The most common types of business entities in India are: Private Limited Company: Ideal for startups looking for scalability, limited liability, and ease of raising capital. Limited Liability Partnership (LLP): Combines the benefits of a partnership and a company, offering flexibility and limited liability. Sole Proprietorship: Suitable for small businesses with a single owner, but with no separate legal entity. Partnership Firm: A simple structure for businesses with multiple owners, but with unlimited liability. MAS LLP can help you choose the best structure based on your business goals and future plans.

Step-by-Step Process of Startup Registration in India Here’s a simplified guide to the startup registration process in India: Step 1: Name Reservation: Choose a unique name for your startup and reserve it with the Ministry of Corporate Affairs (MCA). Step 2: Digital Signature Certificate (DSC): Obtain DSCs for the directors or partners of your startup, as they are required for filing electronic documents. Step 3: Director Identification Number (DIN): Apply for DIN for all directors of the company. Step 4: Incorporation: File the incorporation documents with the MCA, including the Memorandum of Association (MoA) and Articles of Association (AoA). Step 5: PAN and TAN Registration: Apply for your startup’s Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN). Step 6: GST Registration: If your startup’s turnover exceeds the threshold limit, you must register for Goods and Services Tax (GST). Step 7: Startup India Registration: Register your startup under the Startup India initiative to avail of various government benefits. MAS LLP provides end-to-end assistance throughout this process, ensuring that your startup is registered correctly and without delays.

Benefits of Partnering with MAS LLP MAS LLP offers several advantages to entrepreneurs seeking startup registration in India: Expert Guidance: With years of experience, MAS LLP’s professionals guide you through each step, ensuring compliance with all legal requirements. Customized Solutions: They provide tailored solutions based on your specific business needs and goals. Time Efficiency: MAS LLP handles all the paperwork and formalities, allowing you to focus on building your business. Post-Registration Support: Beyond registration, MAS LLP offers ongoing support for legal, financial, and compliance matters.

Conclusion Registering your startup in India is a critical step toward building a successful business. With the expert assistance of MAS LLP, you can navigate the complexities of the registration process with ease. Whether you’re a first-time entrepreneur or an experienced business owner, MAS LLP ensures that your startup is registered efficiently and in compliance with Indian laws. Get in touch with MAS LLP today to kickstart your entrepreneurial journey in India!

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ap management services#ajsh

5 notes

·

View notes

Text

LLC vs. Corporation: Which Business Structure Is Right for You?

When starting a new business, one of the most important decisions you’ll make is choosing the right legal structure. Limited Liability Companies (LLCs) and Corporations (C-Corps or Private Limited Companies) are two popular options, each with its advantages and disadvantages. Here, we’ll help you understand the key differences between an LLC and a Corporation so you can make an informed choice.

What is an LLC?

An LLC, or Limited Liability Company, is a flexible business structure that combines some benefits of corporations and partnerships. The main advantage of an LLC is limited liability for its owners (known as members), which means personal assets are typically protected from business debts and liabilities.

Pros of an LLC:

Simpler setup and fewer formalities than corporations.

Pass-through taxation (members report business income on personal tax returns).

Flexible management structure with fewer compliance requirements.

Cons of an LLC:

Limited growth potential as LLCs can’t issue stock.

Not as favorable for raising large capital.

Can be subject to self-employment taxes.

For those interested in learning more about setting up an LLC, check out our detailed LLP Firm Formation Guide.

What is a Corporation?

A Corporation (often referred to as a Private Limited Company in some regions) is a more complex structure designed for businesses that intend to grow significantly. It offers limited liability to shareholders and has a more rigid management and operational structure than an LLC. Corporations can also issue stock, which is advantageous for raising capital.

Pros of a Corporation:

Ability to raise capital by issuing stock.

Greater credibility with investors and partners.

Limited liability protection for shareholders.

Cons of a Corporation:

Double taxation (taxed at the corporate and personal level).

More formalities, reporting requirements, and costs.

Rigid management structure that may require a board of directors.

Interested in starting a Private Limited Company? Our Private Limited Company Registration Guide provides a comprehensive breakdown of the steps involved.

Key Differences Between an LLC and a Corporation

Liability Protection: Both LLCs and Corporations offer limited liability protection, meaning owners or shareholders are generally not personally liable for the business’s debts.

Management Structure: An LLC has a flexible management structure, allowing owners to manage the business directly. In contrast, a Corporation has a more formal structure, with a board of directors overseeing business operations.

Taxation: LLCs benefit from pass-through taxation, where business income is reported on the owners’ personal tax returns. Corporations, however, face double taxation, meaning the business itself is taxed on its income, and shareholders are taxed on dividends received.

Ease of Formation: LLCs are generally easier to form due to fewer formalities and requirements, while Corporations are more complex and involve more paperwork.

Raising Capital: LLCs have limited options for raising capital, as they cannot issue stock. Corporations can issue stock, making it easier to attract investors and raise funds.

Regulatory Requirements: LLCs typically face lower regulatory burdens, whereas Corporations must comply with stricter regulations, including more reporting and filing requirements.

These factors will help guide your decision depending on your business goals and needs.

Which Business Structure is Right for You?

Choosing between an LLC and a Corporation depends on your business goals. If you’re looking for simplicity, flexibility, and lower taxes, an LLC might be a better fit. But if you have plans to raise significant capital and expand, the structure of a Corporation could be more advantageous.

If you’re still unsure which structure is best, check out our Business Registration Overview to explore the full range of registration services and options available.

Next Steps

Once you decide on a structure, the registration process is crucial. Whether you’re looking to start an LLC or a Corporation, our experts can help you navigate the process smoothly. For those exploring various company structures, take a look at our guide on Limited Company Registration for more insights.

Setting up a business is an exciting journey, and choosing the right structure can set you up for future success. Reach out today to start your business registration process with confidence!

#tax consulting services#LLC registration#Corporation registration#Private limited company registration#Company registration process#Incorporating a business#Business incorporation

0 notes

Text

Company formation in Vietnam- How to proceed?

Company Formation in Vietnam?

Foreign investors may put resources into the type of 100 % funding to set up company in Vietnam, being joint stock company, limited liability company, partnership company. In recent years, the openness policy of the Vietnamese government has made company formation in Vietnam easier.

To receive investment registration certificates, first-time foreign investors in Vietnam must have investment projects and complete investment registration or examination procedures at state investment agencies.

Business registration certificates shall concurrently be investment certificates. Company with 100% foreign capital has established and operated from the date of issuance of the business registration certificates

Vietnam company formation dossiers

-Registration/Request for issuance of Investment Certificate;

-A report on financial capability of the investor;

-Draft of the company’s charter;

-List of members of company;

-Copy of the people’s identity card, passport or other lawful personal certification, for individual members;

-Copy of the business registration certificate or establishment decision, or other equivalent document, for member organizations;

-Copies of the people’s identity card, passport, the authorization document, or other lawful personal certification, for authorized representatives.

-Within three months of the date of submission of the business registration dossier, copies of the foreign member organizations' business registration certificates must be authenticated by the organizations' registered agencies;

-Written authorization of the investor in case investor is organization and valid copy of the legitimate individual affirmation of the approved delegate. Documents in foreign languages must be converted into Vietnamese, authenticated and legalized;

-The Business Cooperation Contract (BCC) or the joint-venture contract

-Other documents required by Vietnam law

Vietnam company formation would take anywhere from 30 days. If the investment area is conditional or the State government must examine the investment project, additional time may be required.

Special licenses, minimum capital or other conditions might be required in certain investment projects.

How a law firm in Vietnam would help with company formation in Vietnam?

While the process of company formation in Vietnam is straight forward more often than not, there are numerous circumstances which it would be better that the client draws in a law firm in Vietnam to help with record planning, legitimate interpretation, legally approbation, and verification of utilization dossiers.

1 note

·

View note

Text

ASC Group Provide India market entry registration

India is among the countries that is growing at a rapid rate providing lucrative opportunities to foreign entrepreneurs and investors. Being able to navigate the Indian market for foreigners is a strategic process and requires compliance to local regulations. This article outlines the most important actions to set up a profitable firm in India and offers insight into the India application process for entry.

Understanding India Entry Services

In order to begin business for business in India Foreign companies must be in compliance with the regulatory frameworks. India Entry business registration includes assistance in incorporation, taxation licensing, registration, and legal compliance. They simplify the procedure for foreign investors and guarantee an easy entry into the market and smooth the smooth running of business.

Business Incorporation in India for Foreigners

Foreign investors have many choices to establish their business into India which include:

Private Limited Company The most popular form of company that caters to foreign business owners, with lower liability and a simpler scalability.

Liaison Office It is ideal to explore the market prior to fully-fledged operation.

Branch Office Perfect for businesses looking to conduct export/import transactions or for professional consultation.

The international business registration India procedure requires required approval from the regulatory authorities like authorities like the Ministry of Corporate Affairs (MCA) as well as the Reserve Bank of India (RBI).

Licensing Requirements for Foreign Nationals

Establishing a company in India typically requires licenses according to the type of business. As an example, firms operating in areas such as food manufacturing, pharmaceuticals and food require specialized permits. Making sure that they comply with these licensing prerequisites is essential for smooth business operations. Affording India Business licensing for non-Indians is vital to reduce legal issues.

Partnership Opportunities for Foreign Nationals

Foreigners are also able to form partnership with Indian companies. For registration, the partner registration for foreigners for India process involves the drafting of partnerships deeds, getting a an PAN (Permanent Account Number) as well as signing the partnership agreement with the local authorities. This method is perfect for individuals who want partnership agreements or partnerships that involve local counterparts. Also, check out this blog: Grow Your Business through a virtual CFO Advisor from India

Key Benefits of India Market Entry

Potential to speak to a wider amount of customers within the same division A stable political environment and a favorable policy of the government regarding imports from foreign countries Affordable workplace competition, and low cost savings to a varied customer base

Supportive government policies encouraging foreign investments

A competitive workforce and cost-savings

Foreigners who want to do businesses on the Indian market can benefit from assistance from professionals when seeking entry. Respecting local regulations is essential to have the best chance of success within the Indian market.

Conclusion

Establishing an enterprise within India is an open and wide-ranging opportunity to investors in various nations. From the time of registration for India Market admission...

getting permits, numerous aspects of the environment which govern the process must be comprehended. Employ experts to better understand and to ensure smooth operation to start a businesses in India.

#India entry registration#India entry services#Foreign business registration in india#Business incorporation india for foreigners#Establish business in india#foreign national business entry#Indian Business for Licencing for Foreigners

0 notes

Text

Ultimate Guide to Startup Registration in India: Step-by-Step Process & Benefits

Although it entails overcoming a number of regulatory hurdles, starting a business in India may be a lucrative endeavor. By registering as a startup, you can access a wealth of advantages and expansion prospects, providing your business with a strong platform on which to expand. This tutorial will explain how Bizsimpl can help you at every stage of the Startup Registration in India process, as well as its main advantages.

What is Startup Registration in India?

In India, registering your company as a startup with the Department for Promotion of Industry and Internal Trade (DPIIT) is a government-approved procedure. Any new company in the cutthroat Indian market needs to register in order to get legal credibility and access to a host of advantages, including tax breaks, simpler financing alternatives, and support for intellectual property rights.

Why Register Your Startup?

In India, registering as a startup provides special advantages that help young companies expand and remain stable:

Tax Exemptions: During a seven-year period, qualified startups are eligible to seek tax exemptions for three of those years. Fundraising Made Easier: A well-known legal framework makes it easier for startups to raise money from investors. Facilitation of Trademarks and Patents: Startups are given preference when submitting trademark and patent applications. Opportunities for Networking: The government provides venues for new businesses to connect and expand. With these important advantages, registering a startup in India is an essential first step for any business owner.

A Comprehensive Guide to Indian Startup Registration This comprehensive guide will help you register a startup in India and get your firm off to a good start:

Step 1: Establish Your Company Your company must first be incorporated as a Private Limited Company, Partnership Firm, or Limited Liability Partnership (LLP) in order to begin Startup Registration in India. For private limited companies, you must abide by the Companies Act of 2013, and for partnership firms and limited liability partnerships, you must abide by the Partnership Act of 1932.

Required documents:Digital Signature Certificates (DSC) PAN Number Certificate of Incorporation/Partnership Deed By assisting customers in selecting the best business structure and assembling all required paperwork to expedite Startup Registration in India, Bizsimpl streamlines this process.

Step 2:Register with Startup India . Make an account by going to the Startup India website (https://www.startupindia.gov.in/). Enter information about your startup, such as its type, sector, and stage of development, after registering.

Note: Your startup needs to have a clear business plan and be innovative and scalable, among other requirements.

Step 3:Obtain a DPIIT Certificate Applying for recognition from the Department for Promotion of Industry and Internal Trade (DPIIT) is the next stage in the Indian startup registration process. To receive benefits including tax exemptions, capital gain exemptions, and reduced patent fees, this certificate is necessary.

Documents needed:A synopsis of your company and its objectives Information about any grants obtained Certificates of incorporation or partnership Here, Bizsimpl may help by handling paperwork, guaranteeing correctness, and promoting a seamless DPIIT registration procedure.

Step 4: Submit a Tax Exemption Application The opportunity to apply for a tax break is among the most alluring features of startup registration in India. Within a seven-year period, eligible startups may petition for an income tax exemption for three consecutive fiscal years.

Step 5: Safeguard Your Intellectual Property You can get special prices on patents, trademarks, and copyrights when you register as a startup in India. Startups are eligible for a 50% trademark fee refund and an 80% patent cost refund. To help safeguard creative ideas, the government provides registered startups with a rapid and easy IP facilitation process.

By offering advice on safeguarding intellectual property, Bizsimpl makes sure your startup is legally shielded from exploitation.

Step 6: Take Advantage of Government Grants and Benefits You will be able to access a variety of government initiatives for startups, such as incubator programs, loan support, and seed fund schemes, after successfully registering your business in India.

Bizsimpl helps businesses apply for and take advantage of the newest programs by making sure registered startups are informed about pertinent grants and opportunities.

Advantages of Indian Startup Registration

More than just a legal necessity, startup registration has real advantages that can help your company grow. What is unlocked by Startup Registration in India is as follows:

Acknowledgment and Credibility: Obtaining official DPIIT recognition gives your company legitimacy, which facilitates luring in customers, investors, and talent. Financial incentives: Startups can achieve financial growth thanks to tax exemptions, capital gain tax incentives, and simpler access to government funding and loans. Support for Patents and Trademarks: Registering your startup gives you priority treatment during the IP registration procedure, which makes it simpler to safeguard your creative concepts. Access to Mentoring and Networking: Startup India offers webinars, networking events, and mentoring opportunities, all of which are accessible through Startup Registration in India. Ease of Doing Business: Startup Registration in India eases the administrative load and allows entrepreneurs to concentrate on growing their businesses by streamlining compliance procedures. How Bizsimpl Can Assist You in India with Startup Registration For business owners who wish to easily register their startups in India, Bizsimpl is a one-stop shop. From forming your company to obtaining DPIIT accreditation and beyond, Bizsimpl guarantees a seamless registration process with its skilled experts and individualized services. Here’s how Bizsimpl streamlines and simplifies startup registration in India:

Professional Advice on Business Structure: Selecting the appropriate structure is essential. Bizsimpl assists customers in weighing the advantages and disadvantages of every structure so they can make the best decision. Extensive Documentation Support: A number of documents are needed for startup registration, and errors could cause the process to drag on. All documentation is managed by Bizsimpl, which guarantees correctness and compliance with legal requirements. DPIIT Certification and Tax Exemption Application: To guarantee that entrepreneurs get the most out of Startup Registration in India, Bizsimpl manages applications for DPIIT certification and tax exemptions. Access to Grants and Plans: The staff at Bizsimpl keeps abreast of government programs and financial assistance alternatives, helping customers apply for grants and facilitating financing access. Intellectual Property Support: Bizsimpl provides continuing assistance for intellectual property management and assists new businesses in submitting applications for patents, trademarks, and copyrights. End-to-End Support: Bizsimpl offers a smooth experience that enables you to effectively manage the complexity of Startup Registration in India, whether you’re incorporating your company, requesting tax exemptions, or obtaining government perks. Selecting Bizsimpl allows business owners to concentrate on what really counts—developing their startup—while Bizsimpl manages the registration procedure.

Conclusion

In India, registering a startup is a crucial first step in building a well-established, tax-exempt, and legally recognized company. The benefits of startup registration in India can have a big impact on your growth and long-term success, from credibility and networking to cash gains and intellectual property protection.

You may optimize the advantages provided by the Indian government and expedite the registration process with Bizsimpl. Get started on the path to a more promising business future right now by visiting Bizsimpl and allowing their professionals to assist you with every stage of Indian startup registration.

Register your startup and discover how Startup Registration in India will improve your business journey if you’re prepared to turn your entrepreneurial aspirations into a reality. Allow the knowledgeable staff at Bizsimpl to assist you throughout the process, making sure your company is established on a strong basis right away.

Maybe You Like

November 13, 2024

Ultimate Guide to Startup Registration in India: Step-by-Step Process & Benefits

Share Post : Ultimate Guide to Startup Registration in India: Step-by-Step Process & Benefits Although it entails overcoming a number of regulatory hurdles, starting a business in India may be a lucrative endeavor. By registering as a startup, you can access a wealth of advantages and expansion prospects, providing your business with a strong platform […]

November 11, 2024

Startup Incorporation in India: Essential Steps and Benefits for New Entrepreneurs

Share Post : Startup Incorporation in India: Essential Steps and Benefits for New Entrepreneurs India has quickly developed into a center for new businesses and entrepreneurial endeavors. For prospective business owners, startup incorporation in India offers an exciting and lucrative opportunity due to the country’s expanding ecosystem, benevolent government regulations, and extensive market reach. But […]

November 11, 2024

Understanding Private Limited Company in India: Benefits, Requirements, and Setup Guide

Share Post : Understanding Private Limited Company in India:Benefits, Requirements, and Setup Guide Many entrepreneurs and small business owners are thinking about establishing a Private Limited Company in India as a result of the country’s thriving business climate. Because of its special advantages and legal advantages, a Private Limited Company (PLC) is one of the […]

November 9, 2024

Startup Registration in India Simplified: Your Pathway to Launching a Successful Business

Share Post : Startup Registration in India Simplified: Your Pathway to Launching a Successful Business Making sure you are properly registered as a startup in India is one of the most important first stages in the exciting but complicated process of starting a business. In addition to gaining reputation, a solid legal foun

0 notes