#legal firm automation

Explore tagged Tumblr posts

Link

Case Management is important for not only solo attorneys but also for well-settled law firms. However, some law firms face challenges in achieving perfect case management. A few are Workflow management, Adoption of Legal tech, automation software, and so on.

#legal case management#legal case management software#legal case management system#legal case management solution#law firm case management#law firm case management software#law firm case management solution#law firm case management system#attorney case management#attorney case management software#law firm#lawyers#attorneys#legal tech#law firm automation

3 notes

·

View notes

Text

Paying consumer debts is basically optional in the United States

The vast majority of America's debt collection targets $500-2,000 credit card debts. It is a filthy business, operated by lawless firms who hire unskilled workers drawn from the same economic background as their targets, who routinely and grotesquely flout the law, but only when it comes to the people with the least ability to pay.

America has fairly robust laws to protect debtors from sleazy debt-collection practices, notably the Fair Debt Collection Practices Act (FDCPA), which has been on the books since 1978. The FDCPA puts strict limits on the conduct of debt collectors, and offers real remedies to debtors when they are abused.

But for FDPCA provisions to be honored, they must be understood. The people who collect these debts are almost entirely untrained. The people they collected the debts from are likewise in the dark. The only specialized expertise debt-collection firms concern themselves with are a series of gotcha tricks and semi-automated legal shenanigans that let them take money they don't deserve from people who can't afford to pay it.

There's no better person to explain this dynamic than Patrick McKenzie, a finance and technology expert whose Bits About Money newsletter is absolutely essential reading. No one breaks down the internal operations of the finance sector like McKenzie. His latest edition, "Credit card debt collection," is a fantastic read:

https://www.bitsaboutmoney.com/archive/the-waste-stream-of-consumer-finance/

McKenzie describes how a debt collector who mistook him for a different PJ McKenzie and tried to shake him down for a couple hundred bucks, and how this launched him into a life as a volunteer advocate for debtors who were less equipped to defend themselves from collectors than he was.

McKenzie's conclusion is that "paying consumer debts is basically optional in the United States." If you stand on your rights (which requires that you know your rights), then you will quickly discover that debt collectors don't have – and can't get – the documentation needed to collect on whatever debts they think you owe (even if you really owe them).

The credit card companies are fully aware of this, and bank (literally) on the fact that "the vast majority of consumers, including those with the socioeconomic wherewithal to walk away from their debts, feel themselves morally bound and pay as agreed."

If you find yourself on the business end of a debt collector's harassment campaign, you can generally make it end simply by "carefully sending a series of letters invoking [your] rights under the FDCPA." The debt collector who receives these letters will have bought your debt at five cents on the dollar, and will simply write it off.

By contrast, the mere act of paying anything marks you out as substantially more likely to pay than nearly everyone else on their hit-list. Paying anything doesn't trigger forbearance, it invites a flood of harassing calls and letters, because you've demonstrated that you can be coerced into paying.

But while learning FDCPA rules isn't overly difficult, it's also beyond the wherewithal of the most distressed debtors (and people falsely accused of being debtors). McKenzie recounts that many of the people he helped were living under chaotic circumstances that put seemingly simple things "like writing letters and counting to 30 days" beyond their needs.

This means that the people best able to defend themselves against illegal shakedowns are less likely to be targeted. Instead, debt collectors husband their resources so they can use them "to do abusive and frequently illegal shakedowns of the people the legislation was meant to benefit."

Here's how this debt market works. If you become delinquent in meeting your credit card payments ("delinquent" has a flexible meaning that varies with each issuer), then your debt will be sold to a collector. It is packaged in part of a large spreadsheet – a CSV file – and likely sold to one of 10 large firms that control 75% of the industry.

The "mom and pops" who have the other quarter of the industry might also get your debt, but it's more likely that they'll buy it as a kind of tailings from one of the big guys, who package up the debts they couldn't collect on and sell them at even deeper discounts.

The people who make the calls are often barely better off than the people they're calling. They're minimally trained and required to work at a breakneck pace. Employee turnover is 75-100% annually: imagine the worst call center job in the world, and then make it worse, and make "success" into a moral injury, and you've got the debt-collector rank-and-file.

To improve the yield on this awful process, debt collection companies start by purging these spreadsheets of likely duds: dead people, people with very low credit-scores, and people who appear on a list of debtors who know their rights and are likely to stand on them (that's right, merely insisting on your rights can ensure that the entire debt-collection industry leaves you alone, forever).

The FDPCA gives you rights: for example, you have the right to verify the debt and see the contract you signed when you took it on. The debt collector who calls you almost certainly does not have that contract and can't get it. Your original lender might, but they stopped caring about your debt the minute they sold it to a debt-collector. Their own IT systems are baling-wire-and-spit Rube Goldberg machines that glue together the wheezing computers of all the companies they've bought over the last 25 years. Retrieving your paperwork is a nontrivial task, and the lender doesn't have any reason to perform it.

Debt collectors are bottom feeders. They are buying delinquent debts at 5 cents on the dollar and hoping to recover 8 percent of them; at 7 percent, they're losing money. They aren't "large, nationally scaled, hypercompetent operators" – they're shoestring operations that can only be viable if they hire unskilled workers and fail to train them.

They are subject to automatic damages for illegal behavior, but they still break the law all the time. As McKenzie writes, a debt collector will "commit three federal torts in a few minutes of talking to a debtor then follow up with a confirmation of the same in writing." A statement like "if you don’t pay me I will sue you and then Immigration will take notice of that and yank your green card" makes the requisite three violations: a false threat of legal action, a false statement of affiliation with a federal agency, and "a false alleged consequence for debt nonpayment not provided for in law."

If you know this, you can likely end the process right there. If you don't, buckle in. The one area that debt collectors invest heavily in is the automation that allows them to engage in high-intensity harassment. They use "predictive dialers" to make multiple calls at once, only connecting the collector to the calls that pick up. They will call you repeatedly. They'll call your family, something they're legally prohibited from doing except to get your contact info, but they'll do it anyway, betting that you'll scrape up $250 to keep them from harassing your mother.

These dialing systems are far better organized than any of the company's record keeping about what you owe. A company may sell your debt on and fail to keep track of it, with the effect that multiple collectors will call you about the same debt, and even paying off one of them will not stop the other.

Talking to these people is a bad idea, because the one area where collectors get sophisticated training is in emptying your bank account. If you consent to a "payment plan," they will use your account and routing info to start whacking your bank account, and your bank will let them do it, because the one part of your conversation they reliably record is this payment plan rigamarole. Sending a check won't help – they'll use the account info on the front of your check to undertake "demand debits" from your account, and backstop it with that recorded call.

Any agreement on your part to get on a payment plan transforms the old, low-value debt you incurred with your credit card into a brand new, high value debt that you owe to the bill collector. There's a good chance they'll sell this debt to another collector and take the lump sum – and then the new collector will commence a fresh round of harassment.

McKenzie says you should never talk to a debt collector. Make them put everything in writing. They are almost certain to lie to you and violate your rights, and a written record will help you prove it later. What's more, debt collection agencies just don't have the capacity or competence to engage in written correspondence. Tell them to put it in writing and there's a good chance they'll just give up and move on, hunting softer targets.

One other thing debt collectors due is robo-sue their targets, bulk-filing boilerplate suits against debtors, real and imaginary. If you don't show up for court (which is what usually happens), they'll get a default judgment, and with it, the legal right to raid your bank account and your paycheck. That, in turn, is an asset that, once again, the debt collector can sell to an even scummier bottom-feeder, pocketing a lump sum.

McKenzie doesn't know what will fix this. But Michael Hudson, a renowned scholar of the debt practices of antiquity, has some ideas. Hudson has written eloquently and persuasively about the longstanding practice of jubilee, in which all debts were periodically wiped clean (say, whenever a new king took the throne, or once per generation):

https://pluralistic.net/2020/03/24/grandparents-optional-party/#jubilee

Hudson's core maxim is that "debt's that can't be paid won't be paid." The productive economy will have need for credit to secure the inputs to their processes. Farmers need to borrow every year for labor, seed and fertilizer. If all goes according to plan, the producer pays off the lender after the production is done and the goods are sold.

But even the most competent producer will eventually find themselves unable to pay. The best-prepared farmer can't save every harvest from blight, hailstorms or fire. When the producer can't pay the creditor, they go a little deeper into debt. That debt accumulates, getting worse with interest and with each bad beat.

Run this process long enough and the entire productive economy will be captive to lenders, who will be able to direct production for follies and fripperies. Farmers stop producing the food the people need so they can devote their land to ornamental flowers for creditors' tables. Left to themselves, credit markets produce hereditary castes of lenders and debtors, with lenders exercising ever-more power over debtors.

This is socially destabilizing; you can feel it in McKenzie's eloquent, barely controlled rage at the hopeless structural knot that produces the abusive and predatory debt industry. Hudson's claim is that the rulers of antiquity knew this – and that we forgot it. Jubilee was key to producing long term political stability. Take away Jubilee and civilizations collapse:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

Debts that can't be paid won't be paid. Debt collectors know this. It's irrefutable. The point of debt markets isn't to ensure that debts are discharged – it's to ensure that every penny the hereditary debtor class has is transferred to the creditor class, at the hands of their fellow debtors.

In her 2021 Paris Review article "America's Dead Souls," Molly McGhee gives a haunting, wrenching account of the debts her parents incurred and the harassment they endured:

https://www.theparisreview.org/blog/2021/05/17/americas-dead-souls/

After I published on it, many readers wrote in disbelief, insisting that the debt collection practices McGhee described were illegal:

https://pluralistic.net/2021/05/19/zombie-debt/#damnation

And they are illegal. But debt collection is a trade founded on lawlessness, and its core competence is to identify and target people who can't invoke the law in their own defense.

Going to Defcon this weekend? I’m giving a keynote, “An Audacious Plan to Halt the Internet’s Enshittification and Throw it Into Reverse,” today (Aug 12) at 12:30pm, followed by a book signing at the No Starch Press booth at 2:30pm!

https://info.defcon.org/event/?id=50826

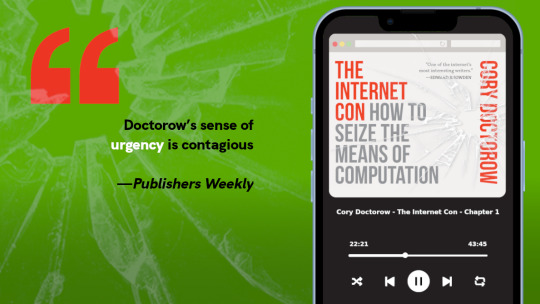

I’m kickstarting the audiobook for “The Internet Con: How To Seize the Means of Computation,” a Big Tech disassembly manual to disenshittify the web and bring back the old, good internet. It’s a DRM-free book, which means Audible won’t carry it, so this crowdfunder is essential. Back now to get the audio, Verso hardcover and ebook:

http://seizethemeansofcomputation.org

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/08/12/do-not-pay/#fair-debt-collection-practices-act

#pluralistic#jubilee#debts that cant be paid wont be paid#Patrick McKenzie#patio11#bits about money#debt#debt collection#do not pay#bottom feeders#Fair Debt Collection Practices Act#fdcpa#finance#armbreakers

11K notes

·

View notes

Link

Many software is offering best-in-class features with at least investment to make your law firm workflow automation more flexible and competitive. But opting for those solutions is the task you need to perform for your organization. Automation is a process that aims to reduce overall human effort and time. This blog will help you get a clear understanding of how automation can work wonders for your law firm.

1 note

·

View note

Text

On October 16th 1995 the Bridge to the Isle of Skye opened.

Prior to the opening of the bridge the main route to Skye was by the ferry between the 2 villages Kyle of Lochalsh and Kyleakin. The ferry service was operated by Caledonian MacBrayne the short route of about 500m took 5min, at peak times there was often queues to use the ferry.

The bridge construction started in 1992 built by the Scottish company Miller, but designed by a German engineering company DYWIDAG Systems International in collaboration with civil engineering firm Arup.

The main bridge is a concrete arch, supported by two piers. This connect Skye to the small island called Eilean Bàn, the rest of the bridge is level across to the mainland. The total distance across is 1.5 miles. The main arch is about 35m high with around 30m clearance for boats on high tide.

Eilean Bàn (White Island) is the small island upon which the main arch of the bridge rests.

The island has a 21m high lighthouse just below the bridge arch. The lighthouse keepers (before automation in the 1960s) stayed in the cottages on the Island. These cottages where then purchased by Gavin Maxwell who is best remembered for is work with otters. Maxwell did many interesting things including writing wildlife books, his most famous is called "The Ring of Bright Water”.

These days the island is a wildlife reserve being managed by the Bright Water Trust. One of the cottages is now the Maxwell museum. This is a reconstruction of Maxwell’s 40ft living room, containing original artefacts, recreated by Virginia Mckenna of the Born Free foundation.

Most people wanted the bridge, but the way in which it was funded was conversional. Rather than the UK government paying for it, the government allowed it to be privately funded. Then granted a licence for the private company to charge tolls. It was said to be the most expensive road bridge in Europe.

This clearly upset many people. Locals on Skye setup a campaign group called SKAT (Skye and Kyle Against Tolls). After years of campaigning, legal challenges and then the setup of the new Scottish parliament in 1999 the leading political parties made it a priority to have the tolls abolished.

On the 21st of December 2004 the bridge was purchased by the Scottish Government and made free to cross.

41 notes

·

View notes

Note

(Spaces after dots must be removed for the link to work)

www. tumblr. com/an-gaol-seo-ol/660216691912048640/its-not-my-email-so-i-dont-know-i-was-only?source=share

Dear Not Her Email Anon,

I am aware of that debate. It made me grin, the first time I read it. For many reasons.

I hope you are all aware that, in the UK, existing petitions 'stuck at nisi' (that expression alone should have told people it was NOT an automated response) can be resumed anytime. There is no 'expiry date' for that procedure and it is up to the person to go ahead and ask for the Decree Absolute (which will make things legally effective) or not.

You don't have to trust me, Anon. But maybe this legal opinion by a specialized UK law firm will give you pause (https://www.waldrons.co.uk/insights/does-a-divorce-petition-expire/):

Just explaining the applicable UK legislation (Family Proceedings Rules), nothing more.

I am not sure of what you are trying to do here, Anon. But if you want me to diss on @samheughanswife, this is not going to happen. For many reasons, of which integrity and being brave are not the least. She proved it over and over and over again. Without her, we'd be all stuck not 'at nisi', but with some inconclusive pics of the Sydney Kilted Kid - to mention just the most recent episode.

If SHW is a PR plant, I am Greta Garbo. Seriously. And at this particular (difficult) juncture in time, it is of no good use to revive those childish disputes over things that are completely outside of our reach and control. Sorry, but I don't think we need more divisions, in here, just because some things don't fit this or that, whatever this or that might mean.

30 notes

·

View notes

Text

This story is part of a joint investigation between Lighthouse Reports and WIRED. To read other stories from the series, click here.

Mitch Daniels is a numbers guy, a cost-cutter. In the early 2000s, he tried and failed to rein in congressional spending under then-US president George W. Bush. So when he took office as Indiana governor in 2005, Daniels was ready to argue once again for fiscal discipline. He wanted to straighten out Indiana’s state government, which he deemed rife with dysfunction. And he started with its welfare system. “That department had been rocked by a series of criminal indictments, with cheats and caseworkers colluding to steal money meant for poor people,” he later said.

Daniels’ solution took the form of a $1.3 billion, 10-year contract with IBM. He had lofty ambitions for the project, which started in 2006, claiming it would improve the benefits service for Indiana residents while cracking down on fraud, ultimately saving taxpayers billions of dollars.

But the contract was a disaster. It was canceled after three years, and IBM and Indiana spent a decade locked in a legal battle about who was to blame. Daniels described IBM’s sweeping redesign and automation of the system—responsible for deciding who was eligible for everything from food stamps to medical cover—as deficient. He was adamant, though, that outsourcing a technical project to a company with expertise was the right call. “It was over-designed,” he said. “Great on paper but too complicated to work in practice.” IBM declined a request for comment.

In July 2012, Judge David Dryer of the Marion County Superior Court ruled that Indiana had failed to prove IBM had breached its contract. But he also delivered a damning verdict on the system itself, describing it as an untested experiment that replaced caseworkers with computers and phone calls. “Neither party deserves to win this case,” he said. “This story represents a ‘perfect storm’ of misguided government policy and overzealous corporate ambition.”

That might have been an early death knell for the burgeoning business of welfare state automation. Instead, the industry exploded. Today, such fraud systems form a significant part of the nebulous “govtech” industry, which revolves around companies selling governments new technologies with the promise that new IT will make public administration easier-to-use and more efficient. In 2021, that market was estimated to be worth €116 billion ($120 billion) in Europe and $440 billion globally. And it’s not only companies that expect to profit from this wave of tech. Governments also believe modernizing IT systems can deliver big savings. Back in 2014, the consultancy firm McKinsey estimated that if government digitization reached its “full potential,” it could free up $1 trillion every year.

Contractors around the world are selling governments on the promise that fraud-hunting algorithms can help them recoup public funds. But researchers who track the spread of these systems argue that these companies are often overpaid and under-supervised. The key issue, researchers say, is accountability. When complex machine learning models or simpler algorithms are developed by the private sector, the computer code that gets to define who is and isn’t accused of fraud is often classed as intellectual property. As a result, the way such systems make decisions is opaque and shielded from interrogation. And even when these algorithmic black holes are embroiled in high-stakes legal battles over alleged bias, the people demanding answers struggle to get them.

In the UK, a community group called the Greater Manchester Coalition of Disabled People is trying to determine whether a pattern of disabled people being investigated for fraud is linked to government automation projects. In France, the digital rights group La Quadrature du Net has been trying for four months to find out whether a fraud system is discriminating against people born in other countries. And in Serbia, lawyers want to understand why the introduction of a new system has resulted in hundreds of Roma families losing their benefits. “The models are always secret,” says Victoria Adelmant, director of New York University’s digital welfare state project. “If you don’t have transparency, it’s very difficult to even challenge and assess these systems.”

The rollout of automated bureaucracy has happened quickly and quietly, but it has left a trail of scandals in its wake. In Michigan, a computer system used between 2013 and 2015 falsely accused 34,000 people of welfare fraud. A similar thing happened in Australia between 2015 and 2019, but on a larger scale: The government accused 400,000 people of welfare fraud or error after its social security department started using a so-called robodebt algorithm to automatically issue fines.

Another scandal emerged in the Netherlands in 2019 when tens of thousands of families—many of them from the country’s Ghanaian community—were falsely accused of defrauding the child benefits system. These systems didn’t just contribute to agencies accusing innocent people of welfare fraud; benefits recipients were ordered to repay the money they had supposedly stolen. As a result, many of the accused were left with spiraling debt, destroyed credit ratings, and even bankruptcy.

Not all government fraud systems linked to scandals were developed with consultancies or technology companies. But civil servants are increasingly turning to the private sector to plug knowledge and personnel gaps. Companies involved in fraud detection systems range from giant consultancies—Accenture, Cap Gemini, PWC—to small tech firms like Totta Data Lab in the Netherlands and Saga in Serbia.

Experts in automation and AI are expensive to hire and less likely to be wooed by public sector salaries. When the UK surveyed its civil servants last year, confidence in the government’s ability to use technology was low, with around half of respondents blaming an inability to hire top talent. More than a third said they had few or no skills in artificial intelligence, machine learning, or automation. But it’s not just industry experience that makes the private sector so alluring to government officials. For welfare departments squeezed by budget cuts, “efficiency” has become a familiar buzzword. “Quite often, a public sector entity will say it is more efficient for us to go and bring in a group of consultants,” says Dan Sheils, head of European public service at Accenture.

The public sector lacks the expertise to create these systems and also to oversee them, says Matthias Spielkamp, cofounder of German nonprofit Algorithm Watch, which has been tracking automated decision-making in social welfare programs across Europe since 2017. In an ideal world, civil servants would be able to develop these systems themselves and have an in-depth understanding of how they work, he says. “That would be a huge difference to working with private companies, because they will sell you black-box systems—black boxes to everyone, including the public sector.”

In February 2020, a crisis broke out in the Dutch region of Walcheren as officials realized they were in the dark about how their own fraud detection system worked. At the time, a Dutch court had halted the use of another algorithm used to detect welfare fraud, known as SyRI, after finding it violated people’s right to privacy. Officials in Walcheren were not using SyRI, but in emails obtained by Lighthouse Reports and WIRED through freedom-of-information requests, government employees had raised concerns that their algorithm bore striking similarities to the one just condemned by the court.

Walcheren’s system was developed by Totta Data Lab. After signing a contract in March 2017, the Dutch startup developed an algorithm to sort through pseudonymous information, according to details obtained through a freedom-of-information request. The system analyzed details of local people claiming welfare benefits and then sent human investigators a list of those it classified as most likely to be fraudsters.

The redacted emails show local officials agonizing over whether their algorithm would be dragged into the SyRI scandal. “I don’t think it is possible to explain why our algorithm should be allowed while everyone is reading about SyRI,” one official wrote the week after the court ruling. Another wrote back with similar concerns. “We also do not get insight from Totta Data Lab into what exactly the algorithm does, and we do not have the expertise to check this.” Neither Totta nor officials in Walcheren replied to requests for comment.

When the Netherlands’ Organization for Applied Scientific Research, an independent research institute, later carried out an audit of a Totta algorithm used in South Holland, the auditors struggled to understand it. “The results of the algorithm do not appear to be reproducible,” their 2021 report reads, referring to attempts to re-create the algorithm’s risk scores. “The risks indicated by the AI algorithm are largely randomly determined,” the researchers found.

With little transparency, it often takes years—and thousands of victims—to expose technical shortcomings. But a case in Serbia provides a notable exception. In March 2022, a new law came into force which gave the government the green light to use data processing to assess individuals’ financial status and automate parts of its social protection programs. The new socijalna karta, or social card system, would help the government detect fraud while making sure welfare payments were reaching society’s most marginalized, claimed Zoran Đorđević, Serbia’s minister of social affairs in 2020.

But within months of the system’s introduction, lawyers in the capital Belgrade had started documenting how it was discriminating against the country’s Roma community, an already disenfranchised ethnic minority group.

Mr. Ahmetović, a welfare recipient who declined to share his first name out of concern that his statement could affect his ability to claim benefits in the future, says he hadn’t heard of the social card system until November 2022, when his wife and four children were turned away from a soup kitchen on the outskirts of the Serbian capital. It wasn’t unusual for the Roma family to be there, as their welfare payments entitled them to a daily meal provided by the government. But on that day, a social worker told them their welfare status had changed and that they would no longer be getting a daily meal.

The family was in shock, and Ahmetović rushed to the nearest welfare office to find out what had happened. He says he was told the new social card system had flagged him after detecting income amounting to 110,000 Serbian dinars ($1,000) in his bank account, which meant he was no longer eligible for a large chunk of the welfare he had been receiving. Ahmetović was confused. He didn’t know anything about this payment. He didn’t even have his own bank account—his wife received the family’s welfare payments into hers.

With no warning, their welfare payments were slashed by 30 percent, from around 70,000 dinars ($630) per month to 40,000 dinars ($360). The family had been claiming a range of benefits since 2012, including financial social assistance, as their son’s epilepsy and unilateral paralysis means neither parent is able to work. The drop in support meant the Ahmetovićs had to cut back on groceries and couldn’t afford to pay all their bills. Their debt ballooned to over 1 million dinars ($9,000).

The algorithm’s impact on Serbia’s Roma community has been dramatic. Ahmetović says his sister has also had her welfare payments cut since the system was introduced, as have several of his neighbors. “Almost all people living in Roma settlements in some municipalities lost their benefits,” says Danilo Ćurčić, program coordinator of A11, a Serbian nonprofit that provides legal aid. A11 is trying to help the Ahmetovićs and more than 100 other Roma families reclaim their benefits.

But first, Ćurčić needs to know how the system works. So far, the government has denied his requests to share the source code on intellectual property grounds, claiming it would violate the contract they signed with the company who actually built the system, he says. According to Ćurčić and a government contract, a Serbian company called Saga, which specializes in automation, was involved in building the social card system. Neither Saga nor Serbia’s Ministry of Social Affairs responded to WIRED’s requests for comment.

As the govtech sector has grown, so has the number of companies selling systems to detect fraud. And not all of them are local startups like Saga. Accenture—Ireland’s biggest public company, which employs more than half a million people worldwide—has worked on fraud systems across Europe. In 2017, Accenture helped the Dutch city of Rotterdam develop a system that calculates risk scores for every welfare recipient. A company document describing the original project, obtained by Lighthouse Reports and WIRED, references an Accenture-built machine learning system that combed through data on thousands of people to judge how likely each of them was to commit welfare fraud. “The city could then sort welfare recipients in order of risk of illegitimacy, so that highest risk individuals can be investigated first,” the document says.

Officials in Rotterdam have said Accenture’s system was used until 2018, when a team at Rotterdam’s Research and Business Intelligence Department took over the algorithm’s development. When Lighthouse Reports and WIRED analyzed a 2021 version of Rotterdam’s fraud algorithm, it became clear that the system discriminates on the basis of race and gender. And around 70 percent of the variables in the 2021 system—information categories such as gender, spoken language, and mental health history that the algorithm used to calculate how likely a person was to commit welfare fraud—appeared to be the same as those in Accenture’s version.

When asked about the similarities, Accenture spokesperson Chinedu Udezue said the company’s “start-up model” was transferred to the city in 2018 when the contract ended. Rotterdam stopped using the algorithm in 2021, after auditors found that the data it used risked creating biased results.

Consultancies generally implement predictive analytics models and then leave after six or eight months, says Sheils, Accenture’s European head of public service. He says his team helps governments avoid what he describes as the industry’s curse: “false positives,” Sheils’ term for life-ruining occurrences of an algorithm incorrectly flagging an innocent person for investigation. “That may seem like a very clinical way of looking at it, but technically speaking, that's all they are.” Sheils claims that Accenture mitigates this by encouraging clients to use AI or machine learning to improve, rather than replace, decision-making humans. “That means ensuring that citizens don’t experience significantly adverse consequences purely on the basis of an AI decision.”

However, social workers who are asked to investigate people flagged by these systems before making a final decision aren’t necessarily exercising independent judgment, says Eva Blum-Dumontet, a tech policy consultant who researched algorithms in the UK welfare system for campaign group Privacy International. “This human is still going to be influenced by the decision of the AI,” she says. “Having a human in the loop doesn’t mean that the human has the time, the training, or the capacity to question the decision.”

Despite the scandals and repeated allegations of bias, the industry building these systems shows no sign of slowing. And neither does government appetite for buying or building such systems. Last summer, Italy’s Ministry of Economy and Finance adopted a decree authorizing the launch of an algorithm that searches for discrepancies in tax filings, earnings, property records, and bank accounts to identify people at risk of not paying their taxes.

But as more governments adopt these systems, the number of people erroneously flagged for fraud is growing. And once someone is caught up in the tangle of data, it can take years to break free. In the Netherlands’ child benefits scandal, people lost their cars and homes, and couples described how the stress drove them to divorce. “The financial misery is huge,” says Orlando Kadir, a lawyer representing more than 1,000 affected families. After a public inquiry, the Dutch government agreed in 2020 to pay the families around €30,000 ($32,000) in compensation. But debt balloons over time. And that amount is not enough, says Kadir, who claims some families are now €250,000 in debt.

In Belgrade, Ahmetović is still fighting to get his family’s full benefits reinstated. “I don’t understand what happened or why,” he says. “It’s hard to compete against the computer and prove this was a mistake.” But he says he’s also wondering whether he’ll ever be compensated for the financial damage the social card system has caused him. He’s yet another person caught up in an opaque system whose inner workings are guarded by the companies and governments who make and operate them. Ćurčić, though, is clear on what needs to change. “We don’t care who made the algorithm,” he says. “The algorithm just has to be made public.”

Additional reporting by Gabriel Geiger and Justin-Casimir Braun.

161 notes

·

View notes

Text

Everything You Need to Know About Cosmolex Accounting Software

In today’s fast-paced business world, having the right accounting software is essential for smooth financial management. CosmoLex has emerged as a leading choice for businesses, particularly in the legal and professional services industries, offering comprehensive accounting solutions tailored to specific needs.

This guide will explore why CosmoLex stands out as the best accounting software, detailing its features, benefits, and unique selling points. We will also address common questions to help you understand if CosmoLex is the right tool for your business.

What is CosmoLex?

CosmoLex is a cloud-based accounting software solution designed with professionals in mind, especially those in the legal industry, such as law firms and solo practitioners. With an all-in-one platform, CosmoLex combines essential accounting functions with specialized features that cater to the unique needs of legal professionals. Unlike traditional accounting software, CosmoLex streamlines financial management while also addressing compliance and trust accounting requirements.

With features that extend beyond basic bookkeeping, CosmoLex helps firms manage time tracking, billing, client management, and compliance, all in one integrated system. The software's easy-to-use interface and powerful functionality have made it a go-to solution for professionals looking for efficiency and accuracy in their financial operations.

Key Features of CosmoLex

1. Trust Accounting Compliance

One of CosmoLex’s standout features is its trust accounting capabilities, specifically designed to meet the strict regulations of the legal industry. Trust accounts require meticulous record-keeping to ensure that client funds are handled appropriately. CosmoLex automates the process of tracking client trust balances, generating trust account reconciliations, and ensuring compliance with local bar association rules.

2. Integrated Time Tracking and Billing

CosmoLex combines time tracking and billing into one seamless process, making it easy for law firms to log billable hours and create invoices directly from the platform. This feature helps streamline the billing process, improves accuracy, and ensures that no billable time goes unaccounted for. Whether you need to track time spent on client meetings or specific case tasks, CosmoLex offers a user-friendly interface that simplifies time tracking and invoicing.

3. Comprehensive Financial Management

Beyond its specialized tools, CosmoLex provides full-service accounting capabilities, including accounts payable/receivable management, general ledger, and financial reporting. It allows businesses to manage their financial data accurately, create financial statements, and generate customizable reports that provide insights into their financial health.

4. Automated Bank Reconciliation

CosmoLex automates the process of bank reconciliation, which is crucial for maintaining accurate financial records. By connecting your bank accounting software, transactions are automatically imported, matched, and reconciled. This reduces the manual effort needed for reconciliation and minimizes the risk of human error.

5. Client and Matter Management

CosmoLex offers integrated client and matter management tools that allow you to organize client files, manage documents, and maintain case notes within the same system. This helps legal professionals keep track of all case-related information in one place, ensuring that critical documents are easily accessible when needed.

6. Billing Customization and Payment Processing

The software supports customizable invoice templates and allows you to set payment terms and accept online payments through integrated payment gateways. This feature not only streamlines the billing process but also provides clients with convenient payment options, thereby improving cash flow for the business.

7. Compliance and Security

CosmoLex prioritizes data security with encryption, secure cloud storage, and multi-factor authentication. Compliance is also a key focus, especially for law firms that must adhere to various legal and financial regulations. The platform ensures that all data is protected and compliant with the necessary guidelines for trust accounting.

Benefits of Using CosmoLex

1. All-in-One Solution

One of the major advantages of CosmoLex is that it combines various essential tools into a single platform. This eliminates the need for separate software solutions for accounting, time tracking, billing, and client management, streamlining workflow and reducing administrative overhead.

2. Enhanced Efficiency

CosmoLex’s user-friendly design and automated features help businesses save time on routine tasks. The time tracking, billing, and reconciliation automation allow professionals to focus on their core activities rather than spend valuable time on manual bookkeeping.

3. Accurate and Transparent Reporting

With real-time financial reporting capabilities, CosmoLex helps businesses keep a clear picture of their financial status. Customized financial reports can be generated for better insights, aiding in more informed decision-making and strategic planning.

4. Improved Cash Flow

By enabling easy online payment processing and accurate invoicing, CosmoLex helps businesses improve their cash flow. Clients can pay invoices directly through integrated payment gateways, which helps speed up the collection process.

5. Legal-Specific Features

CosmoLex is specifically designed for legal professionals, so it includes features that cater to the needs of law firms that other generic accounting software might not offer. This includes trust accounting compliance, case management, and billing features tailored for legal services.

How Does CosmoLex Compare to Other Accounting Software?

1. CosmoLex vs. QuickBooks

QuickBooks is one of the most widely used accounting platforms for small to medium-sized businesses. While it offers strong accounting capabilities, it does not provide specialized features tailored for legal professionals, such as trust accounting compliance and integrated client matter management. CosmoLex excels in this area by combining industry-specific tools with general accounting features.

2. CosmoLex vs. Clio

Clio is a popular practice management software for law firms that includes billing, case management, and document storage. However, while Clio does provide some financial features, it lacks full-service accounting capabilities such as automated bank reconciliation and comprehensive financial reporting that CosmoLex offers. CosmoLex integrates these features into one platform, making it an all-in-one solution.

3. CosmoLex vs. Xero

Xero is a well-known accounting software designed for a broad range of businesses. While it offers great financial management tools, it lacks the legal-specific features that CosmoLex has, such as trust accounting compliance and client matter management. For law firms needing specialized accounting and practice management, CosmoLex is the more comprehensive option.

Pros and Cons of Using CosmoLex

Pros:

All-in-One Platform: Combines accounting, time tracking, and client management.

Trust Accounting Compliance: Ideal for law firms that need to manage client trust accounts.

User-Friendly Interface: Easy to navigate, even for those without an accounting background.

Seamless Integration: Works well with payment gateways and other third-party tools.

Automated Features: Time-saving automation for bank reconciliation, billing, and reporting.

Cons:

Cost: CosmoLex can be more expensive compared to simpler, non-specialized accounting software.

Learning Curve: While the interface is user-friendly, new users may still need time to familiarize themselves with all the features.

Not Ideal for Non-Legal Firms: The software is best suited for law firms and may not provide enough value for businesses in other industries.

Final Thoughts

CosmoLex has established itself as one of the best accounting software solutions for legal professionals due to its comprehensive, all-in-one approach. From trust accounting compliance to integrated time tracking and billing, CosmoLex provides the tools needed to manage the financial and operational aspects of a law firm effectively. While it may come at a higher cost compared to simpler accounting software, its specialized features and time-saving automation make it a worthwhile investment for law firms and professional service providers. By choosing CosmoLex, businesses can enhance efficiency, ensure compliance, and focus on delivering excellent services to their clients.

FAQs

What Industries Benefit the most from CosmoLex?

CosmoLex is designed primarily for legal professionals and firms. It is best suited for law firms, solo practitioners, and accounting firms that handle legal trust accounting and billing.

How does CosmoLex Handle Data Security?

CosmoLex employs strong data security measures such as encryption, cloud storage, and multi-factor authentication to protect user data and ensure compliance with industry regulations.

Can I try CosmoLex before Purchasing?

Yes, CosmoLex offers a free trial for potential customers to test out the platform and determine if it fits their business needs.

Does CosmoLex Integrate with other Software?

CosmoLex integrates with popular tools and platforms like Xero, QuickBooks, and payment gateways, ensuring a seamless workflow for users who may need to use additional software for their operations.

Is CosmoLex Suitable for Solo Practitioners?

Yes, #CosmoLex is an excellent choice for solo practitioners who need a comprehensive accounting and practice management solution. Its user-friendly design and specialized features make it ideal for professionals who manage their own practices.

2 notes

·

View notes

Text

Consultation Audit Services in Delhi: A Pathway to Financial Precision

Delhi, the capital city of India, is not just the heart of the nation but also a bustling hub of business activity. From startups to established enterprises, organizations in the Delhi area are increasingly relying on consultation audit services to ensure financial transparency, regulatory compliance, and optimized operations. Here’s an in-depth look at why consultation audit services are essential and how they can benefit businesses in the region.

Understanding Consultation Audit Services

Consultation audit services go beyond traditional financial audits. They encompass a comprehensive review of a company’s financial records, operational processes, and compliance frameworks to provide actionable insights for improvement. These services can include:

Statutory Audits – Ensuring compliance with legal and financial reporting requirements.

Internal Audits – Evaluating operational efficiency and risk management practices.

Tax Audits – Verifying compliance with taxation laws and optimizing tax strategies.

Process Audits – Reviewing and enhancing workflows for better productivity and cost-efficiency.

Management Audits – Assessing the effectiveness of leadership and decision-making processes.

Why Businesses in Delhi Need Consultation Audit Services

Regulatory Environment Delhi is home to numerous businesses operating under stringent local, national, and international regulations. Regular audits ensure compliance with laws like the Companies Act, GST laws, and various sector-specific regulations.

Competitive Advantage A thorough audit helps identify inefficiencies, reduce costs, and optimize resource allocation. These insights allow businesses to remain competitive in Delhi’s vibrant market.

Investor Confidence For businesses seeking funding, robust audit practices reassure investors of financial integrity and sound management.

Risk Mitigation With businesses in Delhi facing challenges such as cyber threats, fraud, and fluctuating market conditions, audits provide a safeguard by identifying and addressing vulnerabilities early.

Key Benefits of Consultation Audit Services

Enhanced Compliance: Avoid penalties by adhering to legal and regulatory standards.

Financial Accuracy: Ensure error-free records and improved budgeting.

Strategic Decision-Making: Leverage insights to make informed business decisions.

Improved Credibility: Build trust with stakeholders, including customers and investors.

Cost Efficiency: Streamline processes to save time and resources.

Choosing the Right Consultation Audit Firm in Delhi

The effectiveness of an audit depends largely on the expertise of the auditing firm. Here are key factors to consider:

Experience and Specialization: Choose a firm with a proven track record and expertise in your industry.

Local Knowledge: Firms familiar with Delhi’s regulatory landscape can provide tailored solutions.

Comprehensive Services: Opt for firms offering end-to-end audit and consultation services.

Technology Adoption: Modern tools like AI-powered audit software can enhance precision and efficiency.

Leading Consultation Audit Trends in Delhi

Digital Auditing Tools: With the rise of digitization, automated tools are transforming traditional audit practices.

Sustainability Audits: As businesses focus on ESG (Environmental, Social, Governance) compliance, sustainability audits are gaining prominence.

Risk-Based Auditing: A shift towards identifying high-risk areas to prioritize during audits.

Conclusion-

In a dynamic business environment like Delhi, consultation audit services are not a luxury but a necessity. By partnering with the right audit firm, businesses can navigate the complexities of compliance, improve financial health, and unlock growth opportunities.

Whether you’re a small business owner or a large enterprise, investing in consultation audit services can set you on the path to financial precision and long-term success.

Looking for Consultation Audit Services in Delhi? Contact our team of experts to get tailored solutions for your business needs. Let us help you achieve financial clarity and compliance excellence!

#ConsultationAuditServices#AuditSolutions#DelhiBusinesses#FinancialTransparency#RegulatoryCompliance#InternalAudit#TaxAudit#RiskManagement#BusinessGrowth#DelhiStartups#AuditExperts#CorporateCompliance#ProcessOptimization#InvestorConfidence#StatutoryAudits#BusinessSuccess#AuditingTrends#SustainabilityAudits#FinancialClarity#BusinessConsultation

2 notes

·

View notes

Text

How BoardRoomAI is Revolutionizing Corporate Governance in the Legal Industry

In a sector where regulatory compliance, transparency, and effective governance are paramount, Tagbin’s BoardRoomAI is transforming how legal firms operate. The legal industry, known for its intricate paperwork and strict adherence to guidelines, is now embracing advanced technology to streamline processes, enhance decision-making, and maintain a competitive edge. BoardRoomAI on legal industry is paving the way for smarter, faster, and more efficient governance—setting a new benchmark for compliance and boardroom operations.

Understanding BoardRoomAI and Its Relevance to the Legal Industry

BoardRoomAI is an AI-powered boardroom management tool developed by Tagbin to automate, streamline, and optimize the functions of corporate governance, compliance, and decision-making. Designed with robust features tailored for legal professionals, this platform is uniquely positioned to address the challenges that law firms and corporate legal teams face, especially in maintaining strict compliance and regulatory standards.

Key Features of BoardRoomAI

Automated Document ManagementThe legal sector generates a massive amount of documentation daily. BoardRoomAI leverages automation to organize, store, and manage these documents seamlessly. This eliminates manual work, reduces human error, and ensures easy access to critical documents when needed.

Real-Time Compliance MonitoringCompliance is the backbone of the legal industry. BoardRoomAI’s real-time monitoring ensures that all activities and documents meet regulatory standards, thus reducing compliance risks and safeguarding the firm from potential legal complications.

Enhanced Data SecurityData confidentiality is critical in the legal world. BoardRoomAI provides advanced encryption, multi-level access controls, and secure data storage, making it a reliable tool for safeguarding sensitive client and firm data.

Streamlined Decision-MakingBoardRoomAI facilitates faster and more accurate decision-making through AI-driven insights and analytics, enabling board members to make well-informed choices based on real-time data.

Improved Collaboration and CommunicationWith built-in collaboration tools, BoardRoomAI allows seamless interaction between board members and legal teams, even across geographies, ensuring efficient and transparent communication.

Why the Legal Industry Needs BoardRoomAI

The complexities of the legal field demand high levels of accuracy, efficiency, and compliance. Traditional methods of document handling and governance not only slow down operations but also increase the risk of errors. Here’s why BoardRoomAI on legal industry is a game-changer:

Increasing Regulatory RequirementsWith global regulatory landscapes constantly evolving, legal firms face the challenge of adapting quickly. BoardRoomAI offers real-time updates on regulatory changes and ensures that governance practices comply with the latest standards.

Mitigating Legal RisksLegal risk mitigation is paramount. BoardRoomAI’s monitoring tools identify compliance gaps early, alerting firms to potential risks before they escalate, thus protecting the firm’s reputation and avoiding costly penalties.

Optimizing Workflow EfficiencyLaw firms often struggle with lengthy approval processes and back-and-forth document exchanges. BoardRoomAI automates these workflows, cutting down on time-consuming tasks and allowing lawyers to focus on more strategic activities.

Data-Driven Decision-MakingThe legal sector thrives on data accuracy and analysis. With BoardRoomAI, legal teams can access real-time data insights, allowing them to make informed decisions that align with the firm’s objectives and regulatory requirements.

How BoardRoomAI Impacts Corporate Governance in Legal Firms

Corporate governance in the legal industry entails rigorous adherence to ethical standards, board accountability, and decision transparency. BoardRoomAI introduces a layer of intelligence and automation to these processes, which benefits law firms and corporate legal departments in several ways:

1. Transparency and Accountability

BoardRoomAI records every boardroom activity and decision, creating a clear audit trail. This not only helps in maintaining transparency but also holds board members accountable for their actions. With a history of all decisions readily available, legal teams can review past actions and improve future governance practices.

2. Streamlined Board Meetings

Board meetings are critical for making high-level decisions. BoardRoomAI simplifies the organization of board meetings by automating the scheduling, agenda setting, and sharing of necessary documents. Legal professionals can participate in these meetings with minimal prep time, as all essential information is readily accessible.

3. Enhanced Compliance and Risk Management

With its compliance tracking and risk assessment features, BoardRoomAI helps legal firms stay proactive. Instead of merely reacting to issues, legal professionals can take preventive measures against potential risks. Automated compliance reports keep legal teams well-informed about any regulatory updates, making compliance an integral part of governance.

4. Improved Client Confidence

In the legal world, trust and credibility are vital. By adopting BoardRoomAI, law firms showcase their commitment to using modern, secure, and transparent governance methods. Clients gain confidence knowing that their legal advisors are well-equipped to handle their needs in a compliant and secure manner.

Case Study: BoardRoomAI’s Success in a Leading Law Firm

Consider the example of a prominent law firm that implemented BoardRoomAI to streamline its boardroom operations and compliance tracking. The firm faced challenges with document management and lengthy decision-making processes, often leading to delays and potential compliance risks.

After adopting BoardRoomAI, the firm achieved the following:

70% Reduction in Document Handling Time: Automated document sorting and retrieval led to faster turnaround times.

Enhanced Compliance Monitoring: Real-time alerts helped the firm stay ahead of regulatory changes, reducing the likelihood of compliance breaches.

Improved Decision-Making Accuracy: AI-driven insights empowered board members to make data-backed decisions.

This transformation not only improved the firm’s internal efficiency but also elevated its reputation in the industry as a tech-savvy, client-focused organization.

The Future of BoardRoomAI in the Legal Sector

The potential for BoardRoomAI on legal industry is immense. As artificial intelligence advances, we can expect even more sophisticated features tailored to meet evolving legal needs. Here are some trends and future developments:

AI-Powered Predictive Analytics: BoardRoomAI could soon incorporate predictive analytics to forecast compliance issues, client concerns, and market shifts, giving legal professionals a proactive edge.

Enhanced AI-Driven Decision Support: Advanced algorithms will improve decision support, offering even more precise recommendations for board members based on historical data and current market trends.

Integration with Other Legal Tech Tools: As legal tech ecosystems grow, integrating BoardRoomAI with e-discovery tools, case management systems, and contract management software will provide an even more seamless experience.

Conclusion: BoardRoomAI as a Catalyst for Change in Legal Governance

As the legal industry undergoes digital transformation, Tagbin’s BoardRoomAI stands out as a vital tool for enhancing corporate governance and compliance. By automating processes, increasing transparency, and reducing legal risks, BoardRoomAI allows legal professionals to focus on what matters most—delivering exceptional service and safeguarding their firm’s reputation.

The adoption of BoardRoomAI on legal industry is not just a trend; it’s a necessity for firms aiming to stay competitive and maintain their regulatory compliance. Embracing this technology-driven shift opens up new possibilities for smarter, more efficient governance, setting a new standard for how legal firms operate in an increasingly complex world.

CONTENT SOURCE-( https://tagbininsights.blogspot.com/2024/11/how-boardroomai-is-revolutionizing.html )

2 notes

·

View notes

Text

How to Sell Your eCommerce Business in 2024 | Imagency Media

The eCommerce landscape in 2024 is more competitive and dynamic than ever. As a business owner, you may have decided that now is the right time to sell your eCommerce business and capitalize on your hard work. Whether you're looking to pursue new ventures, retire, or simply cash in on your investment, selling your eCommerce business can be a lucrative opportunity. However, it requires careful planning and execution. In this guide, Imagency Media will walk you through the key steps to successfully sell your eCommerce business in 2024.

1. Prepare Your Business for Sale

Before you put your eCommerce business on the market, it's crucial to ensure it's in the best possible shape. Buyers are looking for profitable, well-managed businesses with growth potential. Here's how to prepare:

Financials: Make sure your financial records are up-to-date, accurate, and easy to understand. Buyers will scrutinize your profit margins, revenue trends, and expenses. Consider working with an accountant to organize your financials and identify any areas for improvement.

Operations: Streamline your operations to make your business more appealing. This includes optimizing your supply chain, automating processes where possible, and ensuring that your inventory management is efficient. A well-run business is more attractive to potential buyers.

Brand Strength: Evaluate your brand's online presence. This includes your website, social media, and customer reviews. A strong, reputable brand can significantly increase your business's value. Consider investing in professional web design and branding services to enhance your business's appeal.

Legal Documentation: Ensure all your legal documents, such as business licenses, contracts, and intellectual property rights, are in order. Potential buyers will conduct due diligence, and any legal discrepancies could derail the sale.

2. Determine the Value of Your Business

Valuing an eCommerce business is a complex process that involves multiple factors. The most common valuation method is a multiple of your annual net profit, but other factors can influence the final price:

Revenue and Profit: Consistent and growing revenue, along with healthy profit margins, are key indicators of value.

Customer Base: A large, loyal customer base with low churn rates adds significant value to your business.

Market Position: How well does your business stand out in its niche? A strong market position with potential for growth can attract higher offers.

Growth Potential: Buyers are interested in the future potential of your business. Demonstrating a clear path for growth, such as expanding product lines or entering new markets, can increase your valuation.

Consider hiring a professional business broker or valuation expert to help you determine a realistic asking price.

3. Find the Right Buyer

Finding the right buyer is critical to the success of the sale. There are several types of buyers to consider:

Strategic Buyers: These are companies or individuals in your industry looking to expand their market share or acquire new capabilities. They may pay a premium for businesses that complement their existing operations.

Financial Buyers: Private equity firms or investors looking for profitable businesses with growth potential fall into this category. They typically focus on the financial performance of your business.

Individual Buyers: These are entrepreneurs or aspiring business owners who see value in taking over an established business.

To find potential buyers, consider listing your business on online marketplaces, reaching out to your industry network, or working with a business broker who can connect you with qualified buyers.

4. Negotiate the Sale

Once you’ve found a potential buyer, the negotiation process begins. This phase is crucial, as it will determine the final terms of the sale. Key aspects to negotiate include:

Purchase Price: This is the most obvious point of negotiation, but it’s not the only one. Be prepared to justify your asking price based on your business’s financials and growth potential.

Payment Terms: You may receive the full payment upfront, or the buyer might propose an installment plan. Consider the tax implications and risks associated with different payment structures.

Transition Period: Many buyers will request a transition period where you stay on to help manage the business during the handover. Define the duration and scope of your involvement during this period.

Non-Compete Agreement: Buyers may ask you to sign a non-compete agreement, which would prevent you from starting a similar business in the same industry. Ensure the terms are reasonable and won’t limit your future opportunities.

5. Close the Deal

Once all the terms are agreed upon, it's time to finalize the sale. This involves:

Drafting the Purchase Agreement: Work with a lawyer to draft a purchase agreement that outlines all the terms of the sale, including the purchase price, payment terms, and any contingencies.

Due Diligence: The buyer will conduct a thorough review of your business, including financials, operations, and legal documentation. Be prepared to provide all requested information promptly.

Transfer of Ownership: After due diligence is complete and both parties are satisfied, the final step is the transfer of ownership. This includes transferring all business assets, such as inventory, intellectual property, and customer data, to the buyer.

Post-Sale Transition: If a transition period was agreed upon, ensure a smooth handover by providing the necessary training and support to the new owner.

6. Celebrate Your Success

Selling your eCommerce business is a significant achievement. Take the time to celebrate your success and reflect on the journey that brought you here. Whether you're moving on to a new venture or enjoying the fruits of your labor, you’ve accomplished something remarkable.

Conclusion

Selling your eCommerce business in 2024 requires careful planning, strategic thinking, and a clear understanding of the market. By following these steps, you can maximize the value of your business and ensure a successful sale. At Imagency Media, we understand the importance of a well-executed exit strategy. If you're considering selling your business and need assistance with branding, web design, or preparing your business for sale, we're here to help.

Take the next step today. Contact Imagency Media to learn how we can support you in maximizing the value of your eCommerce business and ensuring a successful sale.

This article serves as a valuable resource for eCommerce business owners looking to navigate the complexities of selling their business in 2024. By following these guidelines, sellers can approach the process with confidence and increase their chances of securing a profitable and smooth transaction.

2 notes

·

View notes

Text

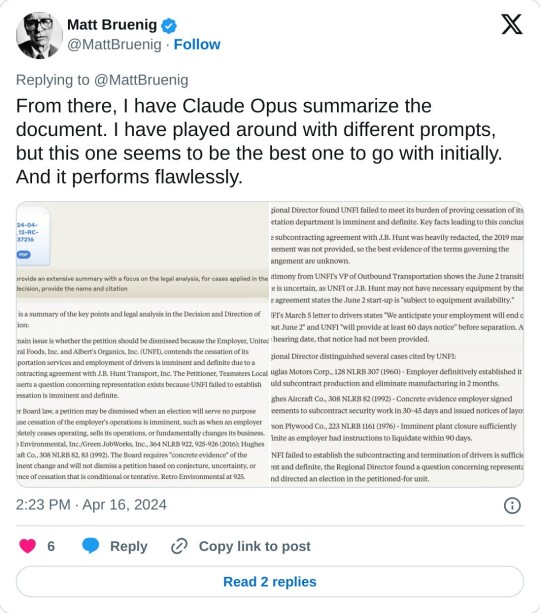

I've heard it observed that synthetic media generation is poised to replace entry level jobs, making it ever more difficult for new workers to break into an industry. This thread seems to support the argument. What Matt is describing here is essentially the automation of entry level legal work. I'm sure it works for him, but if this individual has figured it out, so will large firms. When the senior partners at major firms all do this to prepare research instead of paying a new generation of clerks and paralegals, how does the next generation learn the ropes and develop the skills necessary to become a "legal practitioner"?

4 notes

·

View notes

Text

Covid and The Naked Sun

Isaac Asimov had a particular talent for making the setting part of the story; in his murder mystery portion of the Robots series, the detective work involves not just solving the case, but understanding new and strange worlds with deep cultural differences and political infrastructures. When Elijah Bailey sets foot on Solaria in The Naked Sun, he experiences the titular ball of flame in the sky, so alien from the Caves of Steel (the titular environment in the first novel of the series) he was used to. And he encounters a society where robots outnumber humans by a factor of ten thousand, and with an entire human population of twenty thousand: people are scattered and isolated across the planet.

Stepping into this new world is not so dissimilar to the world that we inhabited just a few years ago. Reading The Naked Sun in the post-Covid era, the similarities are striking (speaking once more to the brilliance of Asimov’s foresight). Bailey, moving from a densely populated, comparatively disease-ridden Earth, finds the shift in social norms confusing and strange. No one wants to come within ten feet of him; they all wear nose plugs and gloves in his presence (if they can bear to be in his presence at all). We found ourselves as Solarians in those months and years from 2020; we wore masks and gloves, came not within six feet of one another; how alien we became to ourselves. Had someone in 2019 jumped forward in time a year, they would have been like Bailey stepping foot on a new planet.

And, like the Solarians, in our isolation we became reliant on our technology. The pandemic was a boon for tech firms like Zoom, whose share prices rose (and later fell) dramatically. Like in Solaria, whose main form of communication was 'tridimensional viewing’, an advanced form of holographic communication where the person viewed was almost convincingly present, we found ourselves using video calling and video conferencing, even to the point of fatigue. Though our technology is not so advanced as that of the Solarians, we still experienced joining with others virtually (and still do), on our phones, laptops, and TVs.

Underpinning both our societies was a fear of contamination. So obsessed were we, like the Solarians, with avoiding disease that we remained distant and isolated. Unlike the Solarians, we have been quick to recognise the harm that this has on our personal relationships. Social interaction via Zoom can only satiate the need for human contact so much. Yet Solarian society, in a warning to us all, became entrenched in such isolation. Gladia, a native of Solaria with whom the protagonist forms a relationship, is only one of few to recognise the damage this is causing her.

Indeed, on Solaria this separation is politicised, legally entrenched; in our world, there were fears, many legitimate, some extreme, that government imposition of lockdowns, travel restrictions, and quarantine would give those in power a taste of authoritarianism. That they would, in turn, create a society like Solaria. Such a thing might not be unthinkable: the reliance of Solarians on robotics and automated labour is a key reason of their isolation; automation of labour in our world could be a similar lever of control. Indeed, new technology and automated production has, since the 1970s, undermined collective bargaining and weakened unions, contributing to stagnant wage growth and worsening inequality. In Solaria, the small population are the landed gentry, the robots their serfs. What happened to the human working class?

And yet we have evaded and escaped from much of the Covid restrictions, which have proved, for the most part, temporary. As humans we were able to adapt to our limited conditions in the short term, and we have been resilient enough in the long term to revert back to our old ways. But when we visit a new world and come home, a part of that world stays with us. When Bailey returns to Earth, he does something he never would have done before: he leaves the City, his Cave of Steel, and starts a movement; he goes outside and stands beneath the Naked Sun.

#reading#writers#book recommendations#book review#bookish#booklover#booklr#books#Isaac Asimov#Robots series#The Naked Sun#science fiction#murder mystery#technology#pandemic#COVID-19#social distancing#isolation#authoritarianism#automation#labour#inequality#resilience

5 notes

·

View notes

Text

Revolutionizing Financial Stability: Legalari's Cutting-Edge Accounting Services in Delhi

The Essence of Accounting Services in Delhi

In a city teeming with businesses of all sizes and industries, the significance of robust accounting services in Delhi cannot be overstated. From startups to established corporations, every entity requires efficient financial management to thrive in today’s competitive market. Accounting services encompass a wide array of functions, including bookkeeping, tax preparation, auditing, and financial analysis. These services serve as the cornerstone of sound financial decision-making, enabling businesses to streamline operations, mitigate risks, and achieve sustainable growth.

Legalari: Redefining Standards in Accounting Services

Enter Legalari, a visionary firm committed to revolutionizing the landscape of accounting services in Delhi. With a team of seasoned professionals and cutting-edge technology at its disposal, Legalari sets itself apart through its unwavering dedication to client satisfaction and innovation. Unlike traditional accounting firms, Legalari adopts a proactive approach, providing strategic insights and personalized solutions to address the unique challenges faced by each client.

Tailored Solutions for Every Business Need

At Legalari, we understand that one size does not fit all when it comes to accounting services in Delhi. Recognizing the diverse needs and objectives of our clients, we offer a comprehensive suite of services designed to cater to businesses of all sizes and industries. Whether it’s managing day-to-day finances, navigating complex tax regulations, or conducting thorough audits, Legalari’s experts are equipped with the expertise and resources to deliver results that exceed expectations.

Harnessing Technology for Efficiency and Accuracy

In an era defined by digital transformation, Legalari harnesses the power of technology to enhance efficiency and accuracy in accounting processes. Through the integration of advanced software and automation tools, we streamline mundane tasks, minimize errors, and empower our clients with real-time insights into their financial performance. By leveraging technology, we not only optimize resource utilization but also enable our clients to make informed decisions with confidence.

Commitment to Compliance and Ethical Standards

At Legalari, integrity and transparency serve as the cornerstones of our operations. We adhere to the highest ethical standards and regulatory requirements, ensuring full compliance with applicable laws and guidelines. Our team undergoes rigorous training and continuous professional development to stay abreast of industry trends and best practices, guaranteeing the utmost reliability and accuracy in all our endeavors.

Driving Growth Through Strategic Partnerships

In an increasingly interconnected business landscape, Legalari recognizes the value of strategic partnerships in driving mutual growth and success. We collaborate with a network of industry experts, legal advisors, and financial institutions to provide holistic solutions that address the multifaceted needs of our clients. Through strategic alliances, we empower businesses to overcome challenges, capitalize on opportunities, and achieve their long-term objectives.

Empowering Businesses for a Brighter Future

As we look ahead, Legalari remains steadfast in its commitment to empowering businesses for a brighter future. Through our innovative approach, unwavering integrity, and dedication to excellence, we aspire to be the catalyst for positive change in the realm of accounting services in Delhi and beyond. Together with our clients, we embark on a journey towards financial stability, resilience, and prosperity.

In conclusion, Legalari emerges as a pioneering force in the realm of accounting services in Delhi, redefining industry standards through innovation, integrity, and excellence. As businesses navigate the complexities of today’s economic landscape, Legalari stands as a trusted partner, offering tailored solutions to drive growth, mitigate risks, and achieve lasting success. In the vibrant city of Delhi, Legalari’s commitment to revolutionizing financial stability serves as a beacon of hope for businesses striving to thrive in an ever-changing world.

#AccountingServices#DelhiBusiness#FinancialManagement#Legalari#InnovationInAccounting#BusinessSolutions#FinancialStability#TechnologyInFinance#ComplianceMatters#StrategicPartnerships#BusinessGrowth#EthicalStandards#FutureOfFinance#AccountingTechnology#ProfessionalServices

2 notes

·

View notes

Text

Yet another case where Google is enshittifying the internet.

For those of you unaware, Relic Castle, a fan site for Pokémon that allows users to share fan games and developers of those same games to create resources to help in making them, was given a takedown notice by a legal firm hired by The Pokémon Company. The current understanding is that the order for this takedown did not directly come from TPC, but because the law firm does work for them, the takedown does need to be treated as legit.

So, as someone trying to make a fangame and who would regularly peruse the developer resources section - I was literally in the middle of downloading alternate summary screens when the takedown hit - I was looking for alternative sites. I think I googled literally "relic castle replacements".

One of the results was "The controversy surrounding the Relic Castle takedown". Which, as displayed on the Google page, was not quite what I was looking for, but still something that might be an interesting read.

So I click on it, and the actual website is called "V*r*is*fy: The controversy surrounding the Relic Castle takedown". Which immediately sets me off. See, the word that starts with V, is a YouTuber whose whole schtick is "Anyone who is better than me at the game must be cheating, and I can prove it because look at how many shiny Pokémon they have. Trading anyone a hacked Pokémon is just as bad as giving someone an STD and should be punishable by death". Absolutely no nuance. Most other PokeTubers hate him because he steals their content, and then when they make a video showing why they dislike him and what content they had stolen, he responds with "they just hate me because I'm a furry" and the other person has to spend the next month or so with all their videos getting hate-bombed by his viewers - I've actively censored his name because it's likely some of his viewers are on here just to harass others. But he's also the most well-known PokeTuber because he does actually know how to do the content grind - he actually releases 10+ videos a day, all around the right length for the algorithm, so he does flood out the competition. He knows how to optimize for the search engine, so you'd think that a company writing an article about his (really bad) video about the takedowns would want to include his name in order to get more algorithm optimization.

Anywho, I back out to Google in order to see if it was my mistake, and nope! The search result is actually called "The controversy surrounding the Relic Castle takedown", no mention of the YouTuber in question. And I think "I could maybe fix this" and decide to report the search result.