#latency arbitrage top

Explore tagged Tumblr posts

Text

PetroSky BlueStacks VPS: Best Android Emulator for Windows VPS

In today’s fast-paced digital world, the need for seamless Android emulation on Windows VPS servers is rising—especially among developers, testers, gamers, and digital marketers. When it comes to a reliable and high-performance setup, PetroSky BlueStacks VPS stands out as one of the top solutions. It offers dedicated resources, GPU support, and full compatibility with Android emulators, making it an ideal choice for those looking to run mobile applications in a cloud-hosted environment.

What Is PetroSky BlueStacks VPS?

PetroSky BlueStacks VPS is a virtual private server specifically optimized for running the BlueStacks Android emulator on Windows. BlueStacks is one of the most popular Android emulators for Windows, allowing users to run Android apps, games, and automation tools seamlessly on a desktop or remote environment. PetroSky takes this experience to the next level by offering a VPS setup fine-tuned for performance, stability, and speed.

With GPU passthrough, high RAM, and NVMe SSDs, PetroSky ensures that users experience minimal latency and excellent frame rates, even when running graphic-intensive mobile games or automation software.

Why Use Android Emulator for Windows VPS?

Using an Android emulator for Windows VPS comes with several advantages:

Remote Access Anywhere: You can control your emulator from any device without needing a high-performance local machine.

24/7 Operations: Ideal for app testing, automation tools like bots, or running background processes.

Data Security: VPS environments are isolated and can be customized for maximum security.

Multitasking: Run multiple instances or different emulator setups without affecting your local system.

For these reasons, developers, marketers, and gamers are increasingly turning to Windows VPS solutions to emulate Android.

Key Features of PetroSky BlueStacks VPS

PetroSky VPS hosting is purpose-built to ensure that Android emulators like BlueStacks work flawlessly. Here’s what makes their offering standout:

GPU Acceleration: Full OpenGL and DirectX support with GPU passthrough allows for smooth graphics rendering.

KVM Virtualization: Uses Kernel-based Virtual Machine (KVM), ensuring high performance and isolation.

Windows Pre-Installed: Comes with Windows OS pre-installed so users can start using BlueStacks right away.

Custom Resources: Choose VPS configurations based on your need—RAM, CPU cores, storage, etc.

No Bloatware: Clean OS images without unnecessary software, ensuring optimum performance.

Full Admin Access: Install any emulator or tools you want with full administrative privileges.

24/7 Support: Their technical team offers reliable support for troubleshooting or setup queries.

Use Cases for PetroSky BlueStacks VPS

PetroSky’s VPS solution is designed for a wide variety of use cases:

App Developers: Test and debug your Android apps in multiple device environments.

Mobile Game Enthusiasts: Run games like PUBG Mobile, Free Fire, or Genshin Impact with zero lag.

Marketing Automation: Use tools like Jarvee, Followliker, or social media bots that rely on Android emulation.

eCommerce Automation: Run mobile apps for online arbitrage, stock monitoring, or customer service.

Educational Testing: Set up controlled environments for app performance testing and research.

Why Choose PetroSky Over Other VPS Providers?

While there are many VPS hosting services, PetroSky’s specialization in Android emulator hosting makes it unique. Generic VPS providers often lack the GPU support or technical knowledge to optimize for Android emulation. PetroSky’s servers are specifically tailored to run emulators like BlueStacks, LDPlayer, or Nox Player efficiently. With low latency, consistent uptime, and rapid deployment, PetroSky ensures users get the best possible experience.

Getting Started with PetroSky

Getting started is easy and user-friendly. You simply choose a plan based on your performance needs, and within minutes, you'll have access to a fully functional Windows VPS with BlueStacks compatibility. Installation guides, pre-configured emulator images, and customer support make the onboarding smooth even for beginners.

Final Thoughts

If you’re looking to run Android apps or games remotely with high performance, PetroSky BlueStacks VPS is an excellent choice. Its optimized infrastructure supports the best Android emulator for Windows VPS, giving you the power, flexibility, and reliability needed for a range of personal or professional use cases. Whether you're an app developer, a digital marketer, or just a gaming enthusiast, PetroSky ensures a seamless and efficient Android emulation experience.

0 notes

Text

Alltick API: Decoding U.S. Stock Market Rules & Empowering Real-Time Trading Decisions

In the global financial markets, the U.S. stock market remains a cornerstone due to its massive scale, diverse asset classes, and mature trading mechanisms. For both institutional investors and individual traders, the demand for real-time U.S. market data continues to surge. Alltick API, a professional-grade financial market data provider, delivers millisecond-latency global market data while empowering users to seize every trading opportunity with precision. This article explores the U.S. stock ticker system, trading rules, and how Alltick’s real-time API redefines quantitative and high-frequency trading strategies.

1. U.S. Stock Ticker Rules: Precision from Symbol to Market

The U.S. stock ticker system prioritizes simplicity and recognizability, with symbols ranging from 1 to 5 letters that reflect company abbreviations or brand identities. Examples include:

AAPL for Apple Inc.

MSFT for Microsoft

AMZN for Amazon

This coding system not only aids memorization but also reveals industry affiliations. For instance:

Financial firms often use suffixes like "B" or "F" (e.g., JPM for JPMorgan Chase).

Tech companies favor shorter codes (e.g., NVDA for NVIDIA).

Special identifiers like ST (indicating consecutive losses) or DR (post-dividend adjustments) further enhance the informational depth of ticker symbols.

2. U.S. Stock Trading Rules: Efficiency Meets Risk Management

Centered around the NYSE and NASDAQ, U.S. trading mechanisms balance liquidity and fairness:

Trading Hours:

Regular session: 9:30 AM – 4:00 PM ET.

Pre-market (4:00–9:30 AM ET) and after-hours (4:00–8:00 PM ET) trading enable flexibility but with reduced liquidity.

T+2 Settlement: Transactions settle two business days after execution, demanding robust risk management.

Circuit Breakers: Triggered when the S&P 500 drops 7%, 13%, or 20%, halting trading to curb extreme volatility.

In this environment, real-time data latency becomes a critical factor. While standard market data interfaces suffer 15-minute delays, Alltick API’s millisecond-level updates ensure strategies capture micro-movements instantaneously.

3. Alltick API’s Core Advantages: Real-Time Data Revolution

For quantitative and high-frequency strategies, data quality and speed directly determine profitability. Alltick API redefines market data standards through:

A. Zero-Latency Global Coverage

Direct Exchange Feeds: Data sourced directly from NYSE, NASDAQ, and other major exchanges, eliminating intermediaries and ensuring sub-50ms latency.

Multi-Protocol Support: Real-time streaming via WebSocket, REST API for historical data, and compatibility with Python, Java, C++, and more.

B. Comprehensive Data Granularity

Tick-by-Tick Data: Includes price, volume, bid/ask direction, and timestamps to reconstruct market microstructure.

Level 2 Market Depth: Displays top 5 bid/ask tiers, optimizing order execution for high-frequency algorithms.

C. Enterprise-Grade Reliability

Global CDN Network: 99.99% uptime guaranteed through load-balanced servers across regions.

Custom Solutions: Tailor data fields, frequencies, and storage formats to meet institutional needs.

4. Alltick API Use Cases: From Backtesting to Live Trading

High-Frequency Strategy Optimization: Build spread arbitrage or statistical models using real-time ticks to exploit microsecond opportunities.

Risk Monitoring: Detect anomalies (e.g., flash crashes) and dynamically adjust positions via real-time alerts.

Cross-Market Hedging: Synchronize U.S. equities, crypto, and forex data for global portfolio diversification.

5. Why Choose Alltick?

Alltick outperforms traditional vendors through cost efficiency and developer-centric design:

Affordable Pricing: Tiered plans and free trials replace Bloomberg Terminal’s $20k+/year fees.

Seamless Integration: Clear documentation, sample code (Python/CURL), and 5-minute setup.

Conclusion: Turn Data into Your Alpha with Alltick API

In the financial arena, where information equals wealth, Alltick API redefines market data with real-time accuracy, global coverage, and unmatched reliability. Whether refining quant models, managing risk, or optimizing trades, Alltick empowers your strategy at every step.

Visit 【Alltick API】 to start your free trial and unlock the full potential of the U.S. stock market.

Alltick — Real-Time Data, Decisive in Milliseconds.

1 note

·

View note

Text

DGQEX Expands Stablecoin Trading Channels in Response to Global Market Cap Growth

Recently, the total market capitalization of stablecoins in the cryptocurrency sector surpassed $246 billion, marking a 1.02% increase over the past week. This data not only reflects the sustained rise in demand for stablecoins but also underscores the growing importance of crypto assets in fields such as cross-border payments and DeFi (Decentralized Finance). USDT remains the market leader with a 62.25% share, further highlighting the dominance of top stablecoins. Against this backdrop, DGQEX, as a digital asset exchange, is actively responding to structural changes in the stablecoin market through technological innovation and a compliance-driven approach.

Technological Drivers and Market Logic Behind Stablecoin Market Cap Growth

The steady growth in stablecoin market capitalization is closely tied to the maturation of the global crypto ecosystem. From a technical perspective, stablecoins address the challenge of excessive price volatility in cryptocurrencies by pegging to fiat currencies or other assets, making them a core infrastructure for DeFi protocols and cross-chain transactions. For example, USDT, with its broad liquidity and on-chain compatibility, has become the benchmark trading pair on most exchanges. DGQEX recognizes this trend and has optimized its underlying trading engine to improve the efficiency of transactions between stablecoins and major crypto assets. Its proprietary distributed clearing system supports tens of thousands of stablecoin transactions per second, maintaining latency at the millisecond level to ensure users can swiftly execute arbitrage or hedging strategies during market fluctuations.

Leading Market Share of USDT: How Exchanges Balance Risk and Opportunity

The USDT market share has consistently remained above 60%, reflecting strong market recognition but also raising concerns about the risks of overreliance on a single stablecoin. Recently, regulators in some regions have imposed stricter transparency requirements on stablecoin issuers, intensifying the market demand for a diversified stablecoin ecosystem. DGQEX addresses this challenge with a multi-pronged strategy: On one hand, the platform has integrated compliant stablecoins such as USDC and BUSD, allowing users to freely switch trading pairs and reduce dependency on a single stablecoin. On the other hand, DGQEX has enhanced its on-chain tracking capabilities for stablecoin assets, collaborating with multiple blockchain analytics firms to monitor fund flows in real time and mitigate potential risks. This dual approach of “technology plus compliance” has enabled DGQEX to establish a differentiated competitive edge in stablecoin trading.

DGQEX Technological Moat and Forward-Looking Industry Positioning

Competition in the stablecoin market is fundamentally a contest of underlying technology. DGQEX leverages its proprietary “multi-chain aggregation engine” to provide seamless support for stablecoins across major blockchains such as Ethereum, TRON, and Solana. Users can complete cross-chain stablecoin swaps on DGQEX without the need for cross-platform operations, significantly reducing transaction costs. Additionally, the platform has introduced a “liquidity aggregation protocol” that uses intelligent routing algorithms to automatically match the best available prices, ensuring users experience minimal slippage in stablecoin trades. This technological advantage has been particularly evident during recent periods of stablecoin market volatility: when network congestion causes delays on one blockchain, DGQEX users can still complete transactions quickly via alternative chains, avoiding the risk of idle assets.

Beyond technology, DGQEX regards regulatory compliance as central to its stablecoin business. The platform has obtained digital asset service licenses in multiple jurisdictions and collaborates with globally recognized auditing firms to regularly disclose proof of stablecoin reserves. This transparent operational model not only enhances user trust but also lays a solid foundation for institutional client onboarding.

The continued growth of stablecoin market capitalization signals the transformation of cryptocurrencies from “speculative assets” to “practical tools.” Through deep investment in core technology and expansion of compliance boundaries, DGQEX has secured a leading position in this sector. Looking ahead, as more traditional financial institutions enter the space, the on-chain use cases for stablecoins will further diversify. DGQEX will continue to optimize the trading experience and launch innovative products such as stablecoin derivatives and lending protocols, helping users capture market opportunities. Whether for individual investors or institutional clients, DGQEX offers comprehensive end-to-end services from trading to asset management, making it a trusted partner in the stablecoin ecosystem.

0 notes

Text

How to Use a Forex Arbitrage Scanner Like a Pro

The foreign exchange market is fast-moving and highly liquid, presenting a wealth of opportunities for those equipped with the right tools and strategies. One of the most effective tools used by professional traders is the Forex Arbitrage Scanner. This powerful technology identifies and capitalizes on price differences across different brokers, enabling traders to profit from inefficiencies in real-time. In this guide, we’ll explore how to use a Forex Arbitrage Scanner like a seasoned professional, review trusted brokers that support arbitrage strategies, and provide practical advice rooted in real trading experience.

What Is a Forex Arbitrage Scanner and Why It Matters

A Forex Arbitrage Scanner is a software tool that scans the live pricing data of multiple brokers to find discrepancies in currency pair quotes. These small differences—often lasting only milliseconds—can be exploited by buying low from one broker and selling high with another. For serious traders, this method offers a low-risk, high-frequency approach to gaining consistent returns.

The success of this strategy hinges on speed, execution accuracy, and access to reliable broker feeds. A scanner helps remove the guesswork and manual effort involved, allowing traders to act quickly on arbitrage opportunities that would otherwise go unnoticed.

Mastering the Use of a Forex Arbitrage Scanner

To use a Forex Arbitrage Scanner like a pro, you must understand not just how the tool works, but also how to integrate it into a broader trading strategy. This includes:

Choosing the right brokers that offer low latency and raw spreads.

Utilizing a Virtual Private Server (VPS) to reduce execution delays.

Setting appropriate thresholds for triggering trades.

Monitoring trading rules to avoid violating broker policies.

Regularly backtesting the scanner’s performance with historical data.

A professional trader doesn’t just rely on software automation; they fine-tune their system to match changing market conditions. This level of insight separates beginners from advanced users.

Real-Life Success Story: Maria’s Journey with Eightcap

Maria Hernandez, a full-time trader from Madrid, began her forex journey with minimal experience but a strong background in mathematics. After encountering inconsistent results with traditional strategies, she turned her attention to arbitrage. She selected Eightcap due to its fast execution speeds and reputation for transparency.

Maria paired her Forex Arbitrage Scanner with a VPS hosted near Eightcap’s servers, drastically reducing latency. Within her first three months, she transformed a $7,500 account into $18,000 by consistently exploiting minor price differences between Eightcap and another broker she monitored.

What set Maria apart was her meticulous logging of each trade and continuous optimization of her scanner’s parameters. Her story highlights how combining technical tools with discipline and analysis can lead to long-term success in forex trading.

Click Now

Top Brokers That Support Arbitrage Trading

Eightcap

Eightcap offers institutional-grade liquidity and ultra-low spreads, making it ideal for arbitrage strategies. The broker’s infrastructure is built around Equinix servers, which reduce latency and ensure rapid execution. It supports MetaTrader 4 and 5 and is known for its reliability and competitive pricing structure.

FP Markets

FP Markets is favored by experienced traders for its true ECN environment and access to deep liquidity pools. The platform supports high-frequency trading and offers access to VPS services. FP Markets also integrates well with most arbitrage scanners, making it a strong choice for automated strategies.

FBS

FBS is a regulated broker with a user-friendly platform that appeals to new traders. While it doesn’t offer the same low latency as some competitors, its consistent pricing and transparency make it a viable secondary broker for arbitrage setups. FBS provides MT4 and MT5 platforms, and supports API trading.

XM

XM stands out for its zero-requotes policy and fast trade execution. It provides access to more than 1,000 trading instruments, offering plenty of arbitrage opportunities across different assets. The broker maintains strong regulatory credentials and offers negative balance protection to safeguard traders.

IC Markets

IC Markets is a top choice for professionals due to its lightning-fast execution, raw spreads starting from 0.0 pips, and high-capacity server infrastructure. It supports algorithmic trading and arbitrage strategies, and its consistent performance has earned it a strong reputation in the trading community.

How to Evaluate Broker Security and Platform Reliability

When engaging in arbitrage trading, trust in your broker is crucial. Traders must ensure that their chosen platform is both secure and reliable. Key factors to examine include:

Regulatory Oversight: A reputable broker will be licensed by authorities such as ASIC, FCA, or CySEC. These bodies enforce strict rules to protect traders.

Website Encryption: Check for HTTPS in the URL and the presence of SSL encryption. These protect your data from being intercepted.

Client Fund Segregation: Brokers that keep client funds separate from their operational accounts offer greater safety in the event of financial issues.

Two-Factor Authentication (2FA): This adds a vital layer of account protection, especially when trading at scale.

Reputation and Transparency: Reliable brokers are open about their fee structure, trading conditions, and have a solid history of performance.

Frequently Asked Questions (FAQs)

What does a Forex Arbitrage Scanner do? It scans real-time quotes from multiple brokers to find pricing discrepancies and identifies opportunities for low-risk, fast-execution trades.

Is arbitrage trading allowed by all brokers? No, some brokers place restrictions on high-frequency or latency arbitrage strategies. Always review the terms of service before trading.

Can a beginner use a Forex Arbitrage Scanner? Yes, but it is highly recommended that beginners start with demo accounts to practice and understand the technical and strategic requirements of arbitrage trading.

Do I need a VPS for arbitrage trading? While not mandatory, using a VPS significantly reduces latency, increasing the likelihood of successful arbitrage trades.

Which broker is best for arbitrage trading? Brokers like IC Markets and Eightcap are favored for their fast execution speeds, raw spreads, and compatibility with arbitrage systems.

Final Thoughts

Trading forex with a Forex Arbitrage Scanner is not just about having the right tool—it’s about using it with precision, patience, and the right partners. Brokers such as Eightcap, FP Markets, FBS, XM, and IC Markets offer the infrastructure necessary for successful arbitrage trading. By investing time in understanding how scanners work, optimizing their parameters, and choosing secure brokers, traders can turn small pricing differences into substantial profits. For those committed to mastering this strategy, the rewards can be well worth the effort.

0 notes

Text

Tick Data at Your Fingertips! Alltick Stock API Gives Your Trading Strategy the Edge

In today's rapidly evolving financial markets, speed and data quality determine trading success. High-frequency trading, algorithmic strategies, and quantitative analysis—once exclusive "weapons" of institutional investors—are now gradually becoming accessible to individual traders and small-to-medium-sized teams. The Alltick Stock API is the key that unlocks this door.

Why is Tick Data So Important?

Tick data (trade-by-trade data) records detailed information for every transaction in the market, including execution price, volume, and timestamp (accurate to milliseconds or even microseconds). Compared to traditional candlestick data, tick data provides a truer reflection of market microstructure, helping traders capture:

Instantaneous price movements

Order flow dynamics

Liquidity distribution

✔ High-Frequency Trading (HFT): Relies on tick data to identify microsecond arbitrage opportunities. ✔ Algorithmic Trading: Optimizes order execution to reduce slippage costs. ✔ Quantitative Research: Backtests strategies using historical tick data for higher accuracy.

However, for years, high-quality tick data has been monopolized by a handful of institutions, making it difficult for ordinary investors to access. Alltick breaks down this barrier, making tick data truly "freely accessible" to every trader.

Alltick Stock API: Blazing Fast, Stable & Easy to Use

1. Ultra-Low Latency, Direct Exchange Connectivity

Alltick’s optimized network architecture connects directly to major global exchanges, ensuring millisecond-level latency—giving your strategies a speed advantage.

2. Full Market Coverage, One-Stop Access

Supports A-shares, HK stocks, US equities, futures, forex, and more—no need to integrate multiple data sources. A single API meets all your needs.

3. Multi-Language SDKs, Quick Integration

Provides Python, C++, Java, Go, and other mainstream language SDKs, with clear documentation and rich examples for rapid onboarding.

4. Rock-Solid Reliability, Institutional-Grade Service

99.9% uptime guarantee, supports high-concurrency requests, and meets the demands of HFT and real-time risk management.

How Alltick Empowers Your Trading

🔹 HFT Traders: Use real-time tick data to capture bid-ask spreads and execute lightning-fast orders via low-latency APIs. 🔹 Quant Teams: Backtest strategies with complete historical tick data, optimize parameters, and improve win rates. 🔹 Retail Traders: Move beyond rough candlestick data—uncover hidden trading signals with tick-level precision.

Start Now, Stay Ahead of the Market

Whether you're a professional institution or an independent trader, Alltick provides institutional-grade tick data and ultra-fast APIs, giving your strategies the same competitive edge as top quant teams.

Register for Alltick and unlock the full potential of tick data—truly "stay one step ahead" in your trading strategies!

1 note

·

View note

Text

How to Build a Solana Trading Bot: A Complete Guide

Introduction

In today’s rapidly evolving crypto landscape, algorithmic trading is no longer just for hedge funds—it’s becoming the norm for savvy traders and developers. Trading bots are revolutionizing how people interact with decentralized exchanges (DEXs), allowing for 24/7 trading, instant decision-making, and optimized strategies.

If you're planning to build a crypto trading bot, Solana blockchain is a compelling platform. With blazing-fast transaction speeds, negligible fees, and a thriving DeFi ecosystem, Solana provides the ideal environment for high-frequency, scalable trading bots.

In this blog, we'll walk you through the complete guide to building a Solana trading bot, including tools, strategies, architecture, and integration with Solana DEXs like Serum and Raydium.

Why Choose Solana for Building a Trading Bot?

Solana has quickly emerged as one of the top platforms for DeFi and trading applications. Here’s why:

🚀 Speed: Handles over 65,000 transactions per second (TPS)

💸 Low Fees: Average transaction cost is less than $0.001

⚡ Fast Finality: Block confirmation in just 400 milliseconds

🌐 DeFi Ecosystem: Includes DEXs like Serum, Orca, and Raydium

🔧 Developer Support: Toolkits like Anchor, Web3.js, and robust SDKs

These characteristics make Solana ideal for real-time, high-frequency trading bots that require low latency and cost-efficiency.

Prerequisites Before You Start

To build a Solana trading bot, you’ll need:

🔧 Technical Knowledge

Blockchain basics

JavaScript or Rust programming

Understanding of smart contracts and crypto wallets

🛠️ Tools & Tech Stack

Solana CLI – For local blockchain setup

Anchor Framework – If using Rust

Solana Web3.js – For JS-based interactions

Phantom/Sollet Wallet – To sign transactions

DeFi Protocols – Serum, Raydium, Orca

APIs – RPC providers, Pyth Network for price feeds

Set up a wallet on Solana Devnet or Testnet before moving to mainnet.

Step-by-Step: How to Build a Solana Trading Bot

Step 1: Define Your Strategy

Choose a trading strategy:

Market Making: Providing liquidity by placing buy/sell orders

Arbitrage: Exploiting price differences across DEXs

Scalping: Taking advantage of small price changes

Momentum/Trend Trading: Based on technical indicators

You can backtest your strategy using historical price data to refine its effectiveness.

Step 2: Set Up Development Environment

Install the essentials:

Solana CLI & Rust (or Node.js)

Anchor framework (for smart contract development)

Connect your wallet to Solana devnet

Install Serum/Orca SDKs for DEX interaction

Step 3: Integrate with Solana DeFi Protocols

Serum DEX: For order-book-based trading

Raydium & Orca: For AMM (Automated Market Maker) trading

Connect your bot to fetch token pair information, price feeds, and liquidity data.

Step 4: Build the Trading Logic

Fetch real-time price data using Pyth Network

Apply your chosen trading algorithm (e.g., RSI, MACD, moving averages)

Trigger buy/sell actions based on signals

Handle different order types (limit, market)

Step 5: Wallet and Token Management

Use SPL token standards

Manage balances, sign and send transactions

Secure private keys using wallet software or hardware wallets

Step 6: Testing Phase

Test everything on Solana Devnet

Simulate market conditions

Debug issues like slippage, front-running, or network latency

Step 7: Deploy to Mainnet

Move to mainnet after successful tests

Monitor performance using tools like Solana Explorer or Solscan

Add dashboards or alerts for better visibility

Key Features to Add

For a production-ready Solana trading bot, include:

✅ Stop-loss and take-profit functionality

📈 Real-time logging and analytics dashboard

🔄 Auto-reconnect and restart scripts

🔐 Secure environment variables for keys and APIs

🛠️ Configurable trading parameters

Security & Risk Management

Security is critical, especially when handling real assets:

Limit API calls to prevent bans

Secure private keys with hardware or encrypted vaults

Add kill-switches for extreme volatility

Use rate limits and retries to handle API downtime

Consider smart contract audits for critical logic

Tools & Frameworks to Consider

Anchor – Solana smart contract framework (Rust)

Solana Web3.js – JS-based blockchain interaction

Serum JS SDK – Interface with Serum’s order books

Pyth Network – Live, accurate on-chain price feeds

Solscan/Solana Explorer – Track transactions and wallet activity

Real-World Use Cases

Here are examples of Solana trading bots in action:

Arbitrage Bots: Profiting from price differences between Raydium and Orca

Liquidity Bots: Maintaining order books on Serum

Oracle-Driven Bots: Reacting to real-time data via Pyth or Chainlink

These bots are typically used by trading firms, DAOs, or DeFi protocols.

Challenges to Be Aware Of

❗ Network congestion during high demand

🧩 Rapid updates in SDKs and APIs

📉 Slippage and liquidity issues

🔄 DeFi protocol changes requiring frequent bot updates

Conclusion

Building a trading bot on Solana blockchain is a rewarding venture—especially for developers and crypto traders looking for speed, cost-efficiency, and innovation. While there are challenges, Solana's robust ecosystem, coupled with developer support and toolkits, makes it one of the best choices for automated DeFi solutions.

If you're looking to take it a step further, consider working with a Solana blockchain development company to ensure your bot is scalable, secure, and production-ready.

#solana trading bot#solana blockchain#solana development company#solana blockchain development#how to build a solana trading bot#solana defi#serum dex#solana web3.js#anchor framework#solana crypto bot#solana trading automation#solana blockchain development company#solana smart contracts#build trading bot solana#solana bot tutorial#solana development services#defi trading bot

0 notes

Text

Bitcoin Price API × Forex Data Interface: Deep Dive into Alltick's Quantitative Trading Data Engine

Industry Pain Points: Why 90% of Quant Strategies Suffer from Data Flaws

Latency Trap

Free APIs typically exhibit >500ms delays (Yahoo Finance latency reaches 1.8 seconds)

Case study: A statistical arbitrage strategy lost 42% annualized returns due to 300ms latency

Data Distortionpython*# Simulating common free API issues* def check_data_quality(tick): if tick['timestamp'].endswith(':00'): # Second-level alignment print("⚠️ Data normalization detected - microstructure information lost!")

Incomplete Coverage

Bitcoin-Forex correlation trading requires cross-market data, but 83% of APIs fail to provide synchronized feeds

2. Alltick's Solution: Trifecta Data Network

Technical Architecture

Industry Pain Points: Why 90% of Quant Strategies Suffer from Data Flaws

Latency Trap

Free APIs typically exhibit >500ms delays (Yahoo Financ latency reaches 1.8 seconds)

Case study: A statistical arbitrage strategy lost 42% annualized returns due to 300ms latency

Data Distortionpython*# Simulating common free API issues* def check_data_quality(tick): if tick['timestamp'].endswith(':00'): # Second-level alignment print("⚠️ Data normalization detected - microstructure information lost!")

Incomplete Coverage

Bitcoin-Forex correlation trading requires cross-market data, but 83% of APIs fail to provide synchronized feeds

2. Alltick's Solution: Trifecta Data Network

Technical Architecture

Direct Exchange Feeds

FPGA Hardware Acceleration

Global Atomic Clock Sync

Multi-Protocol API Gateway

Client Terminal

Key Metrics ComparisonMetricIndustry AvgAlltickLatency200-500ms<50msTimestamp PrecisionSecondsMicroseconds (μs)Data Completeness90%99.99%Concurrent Connections10500+

3. Case Study: Cross-Market Statistical Arbitrage Strategy

Strategy Logic

Monitor Bitcoin futures (BTC/USD) and USD/JPY forex pairs in real-time

Trigger trades when correlation coefficient breaches thresholds

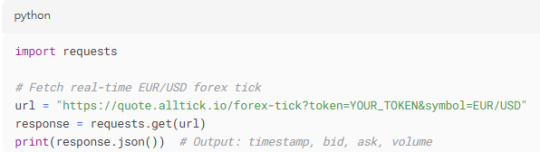

Python Implementation

pythonimport numpy as np from alltick import WebSocketClient class ArbitrageBot: def __init__(self): self.btc_buffer = [] self.fx_buffer = [] async def on_btc_tick(self, tick): self.btc_buffer.append(tick['mid']) if len(self.btc_buffer) > 1000: self.btc_buffer.pop(0) async def on_fx_tick(self, tick): self.fx_buffer.append(tick['mid']) if len(self.fx_buffer) > 1000: self.fx_buffer.pop(0) self.check_correlation() def check_correlation(self): corr = np.corrcoef(self.btc_buffer, self.fx_buffer)[0,1] if abs(corr) > 0.7: self.execute_hedge() # Initialize connection ws = WebSocketClient( symbols=['BTC/USD', 'USD/JPY'], handlers={'BTC/USD': on_btc_tick, 'USD/JPY': on_fx_tick} )

4. Client Success: Top Hedge Fund Results

Alpha Capital Case Study

Performance improvement after Alltick integration:

Annualized returns: 18% → 27%

Max drawdown: 15% → 9%

Execution latency: 120ms → 28ms

Key Optimizations

Backtest reconstruction using raw tick data

FIX 4.4 protocol for direct exchange connectivity

Dynamic order type (IOC/FOK) adjustment based on real-time liquidity

Take Action Now 【AllTick API】

0 notes

Text

Ultra-Low Latency Provider In India

Estee Advisors, a leading ultra-low latency provider in India, has been revolutionizing algorithmic trading since 2008. With cutting-edge infrastructure and high-speed execution, Estee ensures minimal delays for superior trading performance. Trusted by top financial institutions, we deliver seamless, high-frequency trading solutions.

0 notes

Text

Is Algo Trading Profitable? A Deep Dive into Automated Trading

Algo trading, has gained significant traction among traders looking to enhance efficiency and accuracy in financial markets. With its ability to execute trades at high speeds and reduce emotional bias, many investors ask: Is algo trading profitable? In this article, we’ll explore the profitability of algorithmic trading, key strategies, challenges, and how traders can maximize returns.

Understanding Algo Trading

Algo trading leverages computer programs and pre-defined algorithms to execute trades automatically. These programs analyze real-time market data, trends, and technical indicators to make precise trading decisions without human intervention. Institutions, hedge funds, and retail traders widely use algorithmic trading to stay competitive.

Is Algo Trading Profitable?

The profitability of algo trading depends on multiple factors, including strategy selection, market conditions, and risk management. Below are essential elements that influence its success:

1. Speed and Precision

Algo trading executes trades within milliseconds, capitalizing on opportunities that human traders might miss. The ability to analyze massive amounts of data quickly provides a competitive advantage, especially in volatile markets.

2. Elimination of Emotional Bias

Emotions such as fear and greed often lead to irrational trading decisions. Algorithmic trading follows pre-set rules, ensuring disciplined execution and reducing impulsive trades.

3. Backtesting and Optimization

A major advantage of algo trading is the ability to backtest strategies using historical data before live deployment. This helps traders refine algorithms and eliminate weaknesses, improving profitability potential.

4. Market Conditions and Strategy Adaptability

No single strategy works across all market conditions. While trend-following strategies perform well in directional markets, mean-reversion strategies excel in range-bound conditions. Successful algo traders continuously adapt strategies to evolving market trends.

5. Costs and Execution Risks

Despite its advantages, algo trading comes with execution costs, including brokerage fees, slippage, and potential technical glitches. Poor execution and latency issues can negatively impact profitability.

Top Algo Trading Strategies for Profitability

Traders use various algo strategies to optimize profitability, including:

Trend Following Strategies – Based on moving averages and momentum indicators.

Mean Reversion Strategies – Identifies assets deviating from their historical average.

Arbitrage Strategies – Exploits price differences across markets or exchanges.

Market-Making Strategies – Places simultaneous buy and sell orders to provide liquidity.

High-Frequency Trading (HFT) – Executes thousands of trades per second for small profit margins.

Maximizing Profitability in Algo Trading

Choose Reliable Trading Platforms – Platforms like Tradetron offer seamless algo trading with low latency.

Implement Robust Risk Management – Utilize stop-loss mechanisms and position sizing to protect capital.

Regular Monitoring & Optimization – Continuously tweak algorithms to align with changing market conditions.

Diversify Trading Strategies – A mix of different algo strategies minimizes risks and enhances consistency.

Final Verdict: Is Algo Trading Worth It?

Yes, algo trading can be highly profitable when executed with a well-structured strategy, rigorous risk management, and continuous optimization. However, traders must be mindful of market shifts, technical risks, and associated costs. Utilizing platforms like Tradetron can further enhance efficiency and profitability by automating strategies and minimizing human error.

Bookmark Descriptions for "Is Algo Trading Profitable?"

Is Algo Trading Profitable? – Learn how algorithmic trading works and discover its potential profitability in today's markets.

Maximize Algo Trading Profits – Explore expert-recommended algo trading strategies that can increase your earnings.

Algo Trading Explained – Understand the mechanics of algorithmic trading, key strategies, and how to enhance returns.

Best Algo Trading Strategies – Find out which algorithmic trading strategies offer the best potential for profitability.

Algo Trading vs. Manual Trading – Compare automated and manual trading to determine which method yields better profits and risk control.

0 notes

Text

The cryptocurrency world is evolving rapidly and to remain on top, it becomes essential for the traders or crypto holders to consider each factor while making a trade. One such factor to consider is latency which relates to the time consumed by data to travel across different platforms. This factor has a significant impact on the trader’s performance. Let’s uncover the value of latency in the crypto marketplace. What is Latency in Cryptocurrency? Latency is the lag in the amount of time it consumes for data to move from one point to another in the trading system. In simple terms, it refers to how rapidly data can travel across different platforms and has a major influence on how traders place their buying and selling orders. Latency has the potential to influence the trader’s capacity to carry out orders and needs to be reduced as much as feasible at all phases of trading. The increased demand for executing numerous trades in a short time period made it essential to reduce latency. Some traders don’t consider latency as a major factor in trading but it is still significant to carry out the best transaction execution. Before knowing the importance of latency in crypto trading, let’s explore a bit about the types of latency. Hardware latency, software latency, data latency, network latency, and order execution latency are the main types of latency in cryptocurrency. All these types relate to different types of latency. For example, Data latency relates to delay in market data delivery whereas software latency relates to the processing time required by the software to execute a particular program or algorithm. Now, you are a bit aware of latency and its role in cryptocurrency exchange. Let’s explore the value of latency in crypto trading. What Value Does Latency Hold in Crypto? Cryptocurrency is a digital asset and can easily be affected by the rapid technological evolution. High market volatility due to technological advancement makes latency a crucial factor in the crypto landscape as volatility changes the value of cryptocurrency within milliseconds. With low latency, data can be sent more quickly and vice versa. Low latency is considered crucial for online systems that wish to submit the order as soon as they click the submit button. More delays in order confirmation may decline the value of the asset, resulting in heavy losses. The major impact of latency is observed on execution speed, algorithmic strategy, risk management, and arbitrage opportunities. Want to achieve low latency? Minimizing the physical distance traveled by the data, using effective algorithmic trading strategies on the software front, negotiating regulatory issues, and using low-latency order routing can help you achieve low latency. Conclusion Latency is a concept accountable for the time consumed by the data to travel from one system to another to complete a trade. The factor mainly affects the trading in different ways. Low latency on the other side helps in executing the transaction more quickly.

0 notes

Text

1 note

·

View note

Text

PLC Ultima - The Gateway to Financial Inclusion

PLC Ultima is an ambitious project to provide hundreds of millions worldwide with access to digital financial infrastructure and instant payments. It does so by building secure and reliable bridge networks which anyone with an internet connection can access. Through its network of decentralized exchanges, users can access a wide range of financial services and products, from stablecoins to cryptocurrency mining, meme coin tokens, tokenomics, and more. Moreover, PLC Ultima is also developing a user-friendly platform that enables users to manage their funds and investments in a secure environment.

It has built an innovative platform that combines the benefits of blockchain technology with traditional banking services, making it easier for users to access financial products and services. The end goal of PLC Ultima is to provide greater financial inclusion and to empower individuals who have been left out of traditional banking systems by giving them access to a global economic infrastructure and instant payments. It strives to create an accessible and user-friendly platform that will make it easier for people to get involved in the digital currency revolution. In doing so, PLC Ultima hopes to give its users more control over their financial destinies and create a fairer and more equitable future for everyone.

The team behind PLC Ultima is dedicated to creating a world where everyone can access the financial services and products they need. With its mission of financial inclusion, PLC Ultima aims to provide users with an easy and secure platform to manage their finances, investments, and digital assets. It is well on its way to providing a safe, efficient, and inclusive financial infrastructure. PLC Ultima is opening the doors to a global financial ecosystem.

Users can access various financial services and products through its platform, such as cryptocurrency mining, tokenomics, meme coin tokens, stablecoins, and more. This allows users to make payments across borders efficiently and securely easily. Furthermore, PLC Ultima is developing a user-friendly platform that makes it easier for users to manage their funds and investments. The open nature of the PLC Ultima platform also allows developers to build applications on top of its infrastructure.

This opens up various possibilities, such as dApps and smart contracts, allowing users to access a much more extensive range of financial products and services. These tools enable users to make more secure transactions and benefit from various arbitrage opportunities. Ultimately, PLC Ultima is providing the gateway to a global financial infrastructure that is more open, equitable, and accessible than ever before.

PLC Ultima is creating a better future for all its users by leveraging blockchain technology and traditional banking services.

With access to a secure and reliable financial platform, individuals can gain control over their finances and benefit from the global economy. Through its mission of financial inclusion, PLC Ultima is achieving its goal of providing hundreds of millions of people worldwide with access to a secure, efficient, and inclusive economic infrastructure.

PLC Ultima is making it easier and more secure for individuals to send and receive payments worldwide. Users can access various financial products and services through its platforms, such as crypto mining, tokenomics, meme coin tokens, stablecoins, and more.

The platform also supports instant payments, allowing users to make quick and secure transactions with minimal fees. The PLC Ultima infrastructure is designed with scalability in mind, allowing it to support millions of transactions with minimal latency. This makes it the perfect platform for individuals and businesses looking for a cost-effective and efficient way to send money across borders. In addition to providing instant payments, PLC Ultima provides users access to a global financial infrastructure. This allows users to easily invest in various assets, such as cryptocurrencies and traditional stocks.

Furthermore, with its intuitive user interface and secure infrastructure, PLC Ultima makes it easier than ever for users to manage their finances. PLC Ultima makes it easy for users to access the global financial infrastructure. Its intuitive user interface lets users quickly set up and manage their accounts and funds with just a few clicks. Furthermore, users can also access a wide range of financial services and products, such as cryptocurrency mining, tokenomics, meme coin tokens, stablecoins, and more.

This makes it easier for users to make payments across borders and benefit from global financial opportunities. The platform also allows developers to build applications on its infrastructure, such as dApps and smart contracts. PLC Ultima makes it easy for users to send money across borders affordably and transparently. By leveraging the power of blockchain technology, users can make payments with minimal fees and enjoy a secure transaction experience.

Furthermore, the platform provides users access to real-time market data, allowing them to make informed decisions regarding their finances. With its secure infrastructure, PLC Ultima provides users with a reliable and safe platform to manage their finances. Moreover, the platform also features advanced security protocols, such as multi-signature wallets and two-factor authentication. These security protocols ensure that users' data is kept safe and secure.

PLC Ultima is making it easier and faster for individuals to access a global financial infrastructure. PLC Ultima is creating a better future for all its users by providing instant payments worldwide, access to a wide range of financial services and products, and a secure and reliable platform. Furthermore, with its mission of financial inclusion, the platform ensures that hundreds of millions of people worldwide can benefit from a global economic infrastructure. These features make PLC Ultima an ideal platform for individuals and businesses looking for an efficient and cost-effective way to access the global financial infrastructure.

Furthermore, its mission of financial inclusion allows it to provide access to those deprived of traditional fintech services. With its cutting-edge technology and intuitive user interface, PLC Ultima transforms how people access financial services worldwide.

0 notes

Text

Unlock Real-Time Forex & Stock Data for Professional-Grade Quantitative Trading

——Free API + High-Frequency Market Feeds to Seize Millisecond-Level Opportunities

I. The Core Challenge of Quantitative Trading: Data Quality Determines Strategy Success

In the competitive world of financial markets, the success of quantitative trading hinges on real-time availability, completeness, and accuracy of data. Traditional data sources often face three critical limitations:

High Latency: Minute-level delayed data fails to capture micro market movements, missing high-frequency arbitrage opportunities.

Limited Coverage: Narrow asset classes or regional restrictions hinder cross-market strategies.

Unreliable Stability: Data outages or duplicate records distort backtesting results and increase execution risks.

Alltick API delivers professional-grade financial data services, offering developers, traders, and institutions a free API key and ultra-low-latency market feeds (avg. 170ms) across 100,000+ instruments including stocks, forex, and cryptocurrencies. It powers quantitative systems as the ultimate "data engine".

II. Core Advantages of Alltick API: Free Tier + High-Frequency Data

1. Zero-Cost Entry: Free API for Rapid Prototyping

Instant Registration: Create an account via our website or GitHub examples in 5 minutes.

Full Basic Features: Free tier includes 10 instrument queries, 1 WebSocket connection, and 1-year historical data for strategy validation.

2. Millisecond-Level Forex Data, Direct from Top Liquidity Sources

100+ Currency Pairs: Covering majors (EUR/USD, USD/JPY) and emerging pairs (AUD/CAD), sourced directly from global banks and exchanges.

Tick-by-Tick Updates: Receive real-time bid/ask prices and volumes via WebSocket for high-frequency decision-making.

3. Global Stock Market Coverage: HK, US, and A-Shares

30,000+ Equities: Full coverage of Hong Kong (3,000+), US (11,000+), and China A-shares (5,000+) with order book and trade-by-trade data.

Multi-Timeframe OHLC: Flexible intervals from 1-minute to monthly charts for diverse strategies.

4. Enterprise-Grade Reliability & Scalability

99.95% SLA Guarantee: Less than 5 hours annual downtime ensures uninterrupted trading.

Multi-Protocol Support: REST API, WebSocket, and FIX protocols for low-latency to high-frequency needs.

III. Four Key Use Cases for Alltick API

1. High-Frequency Trading (HFT)

Example Strategy: Capture forex arbitrage opportunities using tick-level spread analysis.

Implementation: Subscribe to EUR/USD real-time quotes via WebSocket, trigger orders based on order book patterns.

2. Multi-Asset Portfolio Management

Data Integration: Monitor US tech stocks, gold futures, and Bitcoin simultaneously for risk diversification.

3. Machine Learning Model Training

Historical Data: Train models with 5+ years of tick-level data to reduce overfitting risks.

4. Institutional Risk Management

Real-Time Alerts: Track currency fluctuations via API to minimize cross-border settlement slippage.

IV. Three Steps to Integrate Alltick API

1. Register & Get API Key

Visit Alltick Official Site, sign up via email or Gmail, and generate your token instantly.

2. Run Sample Code (Python)

3. Scale with Premium Plans

Upgrade for 1,200+ requests/minute, full-market data, and multi-WebSocket connections.

V. Client Success Stories: Data-Driven Profit Growth

Hong Kong Quant Fund: Boosted annual returns by 15% using Alltick’s HK stock tick data.

Cross-Border Payment Platform: Reduced settlement slippage by 70%, saving $50k+ daily.

Act Now!

Whether you’re an individual developer, startup, or financial institution, Alltick API combines zero-barrier free access with institutional-grade data to accelerate your strategy deployment.

Visit [Alltick API] now!!!

1 note

·

View note

Text

Tick Data × Stock API: The Precision Engine for High-Frequency Trading Strategies

In financial markets, every millisecond of delay can mean a difference of millions in profits. While traditional investors still rely on the "outlines" of candlestick charts, top traders have already combined tick data and stock APIs to build a "super-sensing capability" that captures the pulse of the market. This ability is not just about speed—it’s about transforming vast amounts of data into a precise decision-making engine. And at the core of this lies the perfect fusion of technology and tools.

Tick Data: Decoding the Market’s Microstructure

Tick data is the "atomic-level" record of financial markets, containing every transaction’s price, volume, timestamp, and trade direction. Unlike aggregated candlestick data, tick data preserves the market’s raw rhythm, enabling traders to:

Capture hidden liquidity shifts: Identify institutional actions like iceberg orders or large-order splitting through continuous tick data.

Anticipate short-term breakouts: Analyze tick distributions in high-volume zones to gauge the true strength of support/resistance levels.

Quantify market sentiment: Measure real-time shifts in bullish/bearish momentum based on tick direction ratios.

However, the value of tick data doesn’t reveal itself automatically—without an efficient toolchain, it becomes an overwhelming flood of information.

Stock API: Transforming Data into Strategy Fuel

The high-frequency nature of tick data imposes strict demands on technical infrastructure: even millisecond-level delays can cripple strategies, while data interruptions may trigger risk control failures. A professional stock API is the critical solution to these challenges:

1. Real-Time Performance: Syncing with the Market’s Heartbeat

Top-tier APIs ensure near-zero latency in delivering tick data from exchanges to strategy engines. For example:

WebSocket streaming replaces traditional HTTP polling to eliminate waiting gaps.

Multi-exchange parallel feeds prevent congestion in single data channels.

2. Flexibility: Custom Data Flows for Every Need

High-frequency strategies may require specific tick data types:

Raw ticks: Full transaction details for microstructure analysis.

Incremental updates: Only changed order book entries to reduce bandwidth load.

Smart aggregation: Time/volume-based pre-processing to lower system strain.

3. Stability: The Lifeline of High-Frequency Trading

API reliability directly determines strategy survival rates:

Auto-reconnect ensures uninterrupted data flow during network volatility.

Sequence validation timestamps prevent misaligned or lost packets from distorting signals.

Disaster recovery combines local caching with cloud backups to guarantee historical data integrity.

Case Studies: How Tick Data Powers Strategies

Strategy 1: Liquidity Arbitrage

Monitor cross-exchange price gaps via tick data. When large orders deplete liquidity on one platform, instantly execute counter-trades on another to capture convergence opportunities.

Strategy 2: Order Book Momentum

Analyze tick-level bid/ask imbalances—persistent large unfilled bids may signal imminent breakouts, triggering rapid position entries via API.

Strategy 3: Event-Driven Plays

During earnings announcements, API-captured tick anomalies reveal sentiment shifts hundreds of milliseconds ahead of news alerts, enabling preemptive positioning.

Why Alltick is the Ultimate Tick Data × API Solution?

Among data providers, Alltick stands out with three core advantages for high-frequency traders:

1. Speed Engine: Outpacing the Market

Global edge nodes in NYC, London, and Tokyo minimize physical latency.

Binary protocol slashes 70% payload size vs. JSON.

Adaptive compression reduces bandwidth costs without data loss.

2. End-to-End Integration: Seamless Data-to-Trade Pipeline

Unified API covers tick feeds, backtesting, risk controls, and execution.

Multi-language SDKs (Python/C++/Java) enable 30-minute integration.

Sandbox environment simulates live trading with historical ticks.

3. Institutional-Grade Safeguards

Data lineage tracking with exchange-native timestamps for compliance.

Rate-limiting prevents API bans during abnormal strategy spikes.

Dark pool masking obscures large-order ticks to prevent signal leakage.

Choose Alltick to Supercharge Your Trading

With the advantages of stable data quality, fast transmission efficiency and professional technical support, Alltick is committed to providing traders with stable and reliable Tick data services to help you accurately grasp every market opportunity.

Activate Alltick now, and let the professional data service provide a solid backing for your trading strategy.

1 note

·

View note

Text

Styles of Investing

Know who you're betting against. Be aware of how other people are trading.

Macro-investing: Top-down approach Form views and predictions on large scale and global events in political and economic landscape

Strategy involves both long and short positions in various instruments.

Need to understand that Macro investors have a shit load of capital, hence they can swing the market based on their views so its important to understand their positions and views

Activist Investing (trending areas) Buy large stakes in underperforming companies and try to get seats on the board with the goal of affecting major changes.

Profit comes from implementing changes that make the company more valuable. Changes can range from the dividend payout policy, cost cutting, divestment from particular projects, or even firing the CEO. Based on forcing the CEO into doing what they want to do. Make their positions clear. (buying over 5% of a company makes your trade public to everyone)

Cost cutting popular.

"Poison pill" a defense from Activist investors. Basically booby trapping an Activist investor. For example a clause that if you fire the CEO he gets a $75mil payout - very expensive. Basically disincentives to change the way the company is operating.

Price moves due to them buying capital but also the market reaction. What stops them from just buying in and out is their reputation. If they continue to pull shit people will catch on. SCC etc.

Creates volatility which is good.

Small Activist hedgefund in NZ? Market isn't really big enough but could work on a smaller scale.

Pure Arbitrage:

Takes advantage if pricing inefficiences across securities, currencies and its derivatives to make a guaranteed, risk free profit.

Funds use computers to rapidly identify and execute trades because arbitrage opportunities only last for fractions of a second. (ETF?)

Example:

Stock XYZ listed on NYSE at US$100 and on the TSX at CA$130

Exchange rate is $US! - CA$1.31

XYZ should theoretically be $CA131

Therefore make instant $1 profit by buying XYZ from TSX for CA$130, selling on NYSE for US$100, then converting the US$100 into CA$131

People who win have the fastest computers and best algorithms. Don't need to worry about it as an equity investors.

Statistical Arbitrage:

Makes an expected profit Risk arbitrage carries some degree of risk and profits are made when the price converges to the theoretical price.

Far more opportunities to find.

Fundamental Long Only: (Buffet) Buy when underpriced and sells when they are overpriced. Doesn't use short selling Makes decisions by placing bets on market expectations, also use leverage, derivatives and alternative assets. (2:1, 3:1 leverage)

Fundamental Long/Short Equity: Similar to fundamental long but also allows for the use of short selling

Many of these funds focus on equities.

Allows for hedging, can have an overall bear view or bull view.

Most have a net exposure of 30%. 200-300% leverage.

High Frequency Trading: Automated trading using powerful computers that use quantitative models to identify opportunities and transact a large number of trades at extremely high speeds.

Positions are held for very short periods on time.

Relies on receiving and processing information faster than anyone else.

Profits come from:

Pure Arbitrage and statistical arbitrage

News-based trading

Latency arbitrage.

Special Situations (Event-driven trading)

Announcement of news with an uncertain probability of a particular result, differences can appear between the market's expectations and reality.

You want to adjust your positions as the market starts adjusting to your bet.

Merger Arbitrage: Type of special situation where the fund manager believes the probability of an M&A deal going through, or the probability of a higher counteroffer price announcement by the acquirer, is different to what the market expects.

Fund of Funds: Invest in other funds and ETF's. Investing in managers. Not that great unless you have a large sum of capital Highly diversified but suffer from two layers of management and performance fees.

Active Strategy fund of funds:

Makes macroeconomic bets by shifting funds into geography or industry specific funds. Actively shifts funds around between different hedgefunds etc.

Passive strategy

Creates an efficient portfolio across asset classes to maximize return for a given level of risk, rebalancing the portfolio routinely

13 notes

·

View notes

Text

Tick Data: Unveiling the “Genetic Blueprint” of Market Microstructure, Capturing Every Trade’s Details

The Era of Data-Driven Trading

In today’s financial markets, data has become one of the most critical assets. Whether you’re an individual investor or a professional institution, the ability to access market information faster and more accurately can provide a substantial competitive edge. The gap between retail investors and professional institutions often lies in the speed and quality of data access. While retail investors might rely on traditional market data delayed by 15 minutes, high-frequency quantitative funds are already leveraging millisecond-level Tick data to capture excess returns.

The Problem

While traditional candlestick (K-line) data provides a basic overview of market trends, it has significant limitations:

High latency:

A delay of 15 minutes or more can render trading signals entirely ineffective.

Low granularity:

K-line data only provides the open, close, high, and low prices over a time period, failing to capture changes in market microstructure.

Inability to meet high-frequency trading needs:

In high-frequency trading, price changes every second, or even every millisecond, can lead to substantial gains or losses. Traditional data is simply inadequate.

The Solution

Breaking the “15-minute delay curse” requires the introduction of more granular, real-time data — Tick-level data — combined with a robust real-time stock API.

Tick data records precise details of every price change, including price, volume, and order book depth, enabling investors to capture micro-level market changes. Real-time stock APIs act as a bridge, delivering this data quickly and reliably to investors’ trading systems, empowering smarter and more efficient trading strategies.

Why Are Tick Data and APIs So Important?

1.Real-time updates:

Tick data updates in milliseconds, ensuring investors are the first to access market dynamics.

2.Precision:

Every trade’s details are recorded, helping investors analyze market behavior more accurately.

3.Diversity:

Beyond price and volume, Tick data includes order book depth and capital flow information, offering more dimensions for strategy development.

Case Study Insight

The CTO of a top 10 global quantitative fund once stated: “After integrating the Alltick stock API, our algorithm’s profitability during Nasdaq’s opening auction improved by 2.7x, translating to an additional $8 million in annual alpha returns.” This is a testament to the immense value brought by the combination of Tick data and real-time APIs.

Tick Data: The “Genetic Blueprint” of Market Microstructure

1.What is Tick Data?

Definition:

Tick data records every price change in detail, including price, volume, and order book depth.

-Comparison to traditional K-line data:

Higher frequency, greater detail, and more real-time information.

2.The Value of Tick Data:

Captures changes in market microstructure, identifying order book anomalies and block trade patterns.

Enhances the accuracy of algorithmic models — studies show improvements of over 300%.

Three Applications of Tick Data

1.High-Frequency Order Flow Analysis

Monitor large-order splitting patterns and trigger follow-up orders 0.3 seconds earlier.

Case: A private fund’s test showed that intraday trading win rates increased from 58% to 82%.

2.Dynamic Spread Arbitrage

Real-time calculation of Tick-level spread distribution across markets to capture arbitrage opportunities.

Case: Cryptocurrency arbitrage across exchanges, with an average of 47 effective opportunities captured daily.

3.Liquidity Crisis Warning

Predict liquidity exhaustion points in advance based on instantaneous order book slope changes.

Case: During the 2023 U.S. stock market flash crash, risks were cleared 4 seconds in advance.

Try Alltick Today

Alltick offers dedicated customer and technical support to ensure seamless integration for users.

0 notes