#invoice generator free

Explore tagged Tumblr posts

Text

The Best Free Invoicing Generators for Freelancers and Entrepreneurs

Invoicing can often feel like a daunting task for freelancers and entrepreneurs. With deadlines to meet and clients to please, the last thing you want to worry about is how to create a professional-looking invoice. Fortunately, there are plenty of free invoicing generators available that can make this process easy and efficient. In this blog post, we'll explore the best options available, highlighting their features, benefits, and how they can help you manage your finances more effectively.

Why Use an Invoicing Generator?

Before diving into the specifics, let’s take a moment to discuss why using a free invoicing generator is beneficial for freelancers and entrepreneurs:

Professional Appearance: An invoice generator helps you create invoices that look polished and professional, which can enhance your business's image.

Time-Saving: Instead of creating invoices from scratch, an invoicing generator allows you to fill in templates quickly, saving you valuable time.

Accuracy: These tools often come with built-in calculations, reducing the chance of errors in amounts owed.

Tracking: Many invoicing tools allow you to track payments, making it easier to manage your finances.

Free Options: There are plenty of free invoicing generators that provide excellent functionality without needing a subscription.

Top 8 Free Invoicing Generators

1. Wave

Wave is one of the most popular free invoicing generators available. It’s not only user-friendly but also offers a variety of features tailored for small business owners.

Key Features:

Customizable Templates: You can personalize your invoices to reflect your brand.

Payment Tracking: Easily see which invoices have been paid and which are still outstanding.

Multiple Payment Options: Clients can pay directly through the invoice, making the process smoother.

Why It’s Great for Freelancers: Wave is particularly appealing for freelancers because it combines invoicing with accounting features, allowing you to manage all aspects of your finances in one place.

2. Zoho Invoice

Zoho Invoice offers a free plan that’s perfect for freelancers and small business owners. This tool is packed with features that simplify the invoicing process.

Key Features:

Automated Invoicing: Set up recurring invoices for ongoing projects.

Time Tracking: Keep track of hours worked and add them directly to your invoices.

Multi-Currency Support: Ideal for freelancers working with international clients.

Why It’s Great for Entrepreneurs: Zoho Invoice provides a comprehensive suite of tools that can grow with your business, making it a solid choice for entrepreneurs looking for a scalable solution.

3. Get Free Invoice

Invoice Generator is a straightforward and efficient tool for creating invoices quickly. It’s perfect for freelancers who need to send invoices on the go.

Key Features:

Quick and Easy: Create an invoice in just a few minutes.

No Sign-Up Required: You can generate an invoice without creating an account.

PDF Download: Easily download your invoice as a PDF to send to clients.

Why It’s Great for Freelancers: Its simplicity and speed make Invoice Generator an excellent choice for freelancers who need to bill clients fast without complicated processes.

4. Invoiced

Invoiced offers a free plan with robust features that cater to both freelancers and small businesses. Its user-friendly interface makes invoicing easy for everyone.

Key Features:

Recurring Billing: Set up recurring invoices for repeat clients.

Client Portal: Allow clients to view and pay their invoices online.

Automated Reminders: Send automatic reminders to clients for upcoming payments.

Why It’s Great for Entrepreneurs: The automated features save time and help ensure you get paid on time, making it an excellent choice for busy entrepreneurs.

5. PayPal Invoicing

If you’re already using PayPal for payments, their invoicing feature is a convenient option. It's straightforward and integrates well with your existing PayPal account.

Key Features:

Ease of Use: Generate and send invoices directly through your PayPal account.

Payment Tracking: Track the status of your invoices in real-time.

Multiple Payment Methods: Clients can pay using various methods, enhancing convenience.

Why It’s Great for Freelancers: If you frequently receive payments via PayPal, using their invoicing tool is a seamless option that simplifies the payment process.

6. FreshBooks

FreshBooks offers a free trial, making it a great option for freelancers who want to explore its features before committing. It’s more than just an invoicing tool; it’s a full accounting platform.

Key Features:

Mobile App: Create and send invoices on the go using the mobile app.

Time Tracking: Easily track billable hours and add them to your invoices.

Expense Tracking: Keep all your financial data in one place.

Why It’s Great for Entrepreneurs: FreshBooks offers comprehensive features that are particularly beneficial for entrepreneurs managing multiple projects and clients.

7. Square Invoices

Square is widely known for its payment processing, but its invoicing tool is just as impressive. It offers a free service for creating and sending invoices.

Key Features:

Customizable Invoices: Tailor your invoices with your business logo and colors.

Payment Tracking: Know when your invoices have been viewed and paid.

No Monthly Fees: You only pay when you receive a payment, making it budget-friendly.

Why It’s Great for Freelancers: Square Invoices is a great choice for freelancers who also need a payment processing solution, as it combines both services seamlessly.

8. Hiveage

Hiveage provides a free tier with essential features for invoicing and expense tracking. It’s designed for freelancers and small businesses looking for a comprehensive tool.

Key Features:

Time Tracking: Log billable hours and add them to invoices effortlessly.

Recurring Invoices: Set up invoices that are sent automatically on a regular basis.

Multi-Currency Support: Ideal for freelancers working with clients worldwide.

Why It’s Great for Entrepreneurs: Hiveage’s expense tracking feature makes it easier to see where your money is going, which is essential for maintaining profitability.

Tips for Creating Effective Invoices

Using an invoicing generator is just the first step. Here are some tips to ensure your invoices are effective:

Use a Professional Template: Make sure your invoice template reflects your brand’s identity. This includes using your logo, colors, and fonts.

Include All Necessary Information: Your invoice should include your name, address, contact information, and the client’s details. Don’t forget the invoice number and date!

Be Clear and Concise: List the services provided or products sold, along with the corresponding prices. Clarity helps avoid confusion.

Set Clear Payment Terms: Clearly state when payment is due and any late fees that may apply. This encourages timely payments.

Follow Up: If you don’t receive payment by the due date, don’t hesitate to send a polite reminder.

Conclusion

Managing finances as a freelancer or entrepreneur doesn’t have to be stressful. By using one of the many free invoicing generators available, you can streamline your invoicing process, maintain professionalism, and ultimately get paid faster. Whether you choose Wave, Zoho Invoice, or any of the other tools mentioned, each one offers unique features that can cater to your specific needs.

In today’s fast-paced business environment, efficiency is key. Invest a little time in choosing the right invoicing tool, and you’ll find that managing your invoices becomes a breeze. With the right approach, you can focus more on what you do best—growing your business and serving your clients.

Related Articles

How to Choose the Best Free Receipt Generator for Your Needs

Manual vs. Automated Invoice Processing: Which is Best for Your Business?

#invoice generator#free invoice generator#invoice maker#create invoice free#free invoice maker#invoice generator free#free invoicing generator

0 notes

Text

Free Invoice Generator with Online Templates

Would you like to Generate a Free invoice?

Zozo online invoicing software and templates make it simple to create a free invoice in Australia. Online templates for pre-made invoices are available for use. You can edit many of these templates for free to add your information. Millions of people trust us as your original Invoice Generator. With our eye-catching invoice template, Invoice Generator allows you to quickly create invoices right from your web browser. Create an invoice online customized for your brand or business using a Zozo free online invoice template.

Contact Us - https://www.zozo.com.au/contact-us

Regsiter - https://www.zozo.com.au/register

Website - https://www.zozo.com.au/

Our Plans - https://www.zozo.com.au/plans

2 notes

·

View notes

Text

Rent Receipt Generator Online - Generate Free Rent Receipt Instantly

Avoid the last-minute scramble for rent receipts to claim an HRA exemption. Our free rent receipt generator is the best solution. It saves you time and money. It is efficient, easy to use, and designed to simplify your financial matters. Our Rent Receipt Generator is an easy-to-use online tool. It allows you to create receipts for the rent you have paid this year with minimal effort. These receipts follow the Income Tax Authorities' format. You can submit them to your Finance Department with assurance. Doing so will secure HRA exemption based on your rent payments this year. Whether you're new to work or a seasoned expert, you will face a request from HR for rent receipts during tax season. This can cause frantic moments. Many employees struggle to understand tax calculations. They also need rent receipts to save on taxes. You must submit a rent receipt if you rent your home and receive a House Rent Allowance (HRA). It proves your housing expenses. It allows tax deductions under India's Income Tax Act 1961. Our Rent Receipt Generator simplifies and speeds up this process for everyone. Cut tax worries. Maximize your savings while following the tax rules

#Online Rent Receipt Generator#Generate Rental Receipts#Rent Bills#Online Rent Receipt#Generate House Rent Receipts Free#Quarterly Rent Receipt#Generate Rent Receipt Online#Rent Receipt Generator#FREE Rent Receipt Generator tool#House Rent Online Generator#Rent Invoice#Rent Bill#Generate Free Rent Receipt#Rent Receipt Generator Tool

0 notes

Text

𝗛𝗼𝘄 𝘁𝗼 𝗨𝘀𝗲 𝗮 𝗙𝗿𝗲𝗲 𝗜𝗻𝘃𝗼𝗶𝗰𝗲 𝗧𝗲𝗺𝗽𝗹𝗮𝘁𝗲 𝗶𝗻 𝗚𝗼𝗼𝗴𝗹𝗲 𝗗𝗼𝗰𝘀: 𝗔 𝗦𝘁𝗲𝗽-𝗯𝘆-𝗦𝘁𝗲𝗽 𝗚𝘂𝗶𝗱𝗲 This article is a comprehensive guide on how to create professional invoices using a free Google Docs template. It walks you through every step, from customizing the template to adding client details, listing products or services, and saving the final document. Perfect for small businesses and freelancers, this guide helps you streamline your invoicing process in just minutes. Discover how easy it is to get started—read the article now!

#business#finance#entrepreneurship#startup#google docs#invoice generator#invoice maker#free invoice software#invoice management system

1 note

·

View note

Text

Benefits of Streamlining Your Invoicing Process with Invoice Generator Software in 2025

Description: Discover how invoice generator software can transform your invoicing process in 2025. This blog highlights key benefits, including time savings, reduced errors, improved cash flow, and enhanced professionalism. Learn how modern invoicing tools can simplify billing, boost efficiency, and support your business growth.

Why is Invoice Management Important?

Invoice management is important for several reasons, including:

Cash Flow Management: Invoices are a critical part of a business's cash flow. Proper invoice management helps ensure that invoices are sent out on time, payments are received on time, and any issues or discrepancies are addressed promptly. This keeps the company's cash flow in a healthy range.

Payment Tracking: An approach for monitoring payments and unpaid balances provided by invoice management. This helps businesses stay on top of their finances and make informed decisions about expenses, investments, and future growth.

Avoiding Errors & Disputes: Proper invoice management can help avoid errors and disputes with clients. By keeping accurate records and sending invoices on time, businesses can reduce the risk of payment delays, missed payments, and misunderstandings that can lead to disputes.

Compliance and Audit Readiness: Invoice management ensures that businesses are in compliance with financial regulations and tax laws. It also provides a system for tracking financial records, making it easier to prepare for audits or financial reporting requirements.

Better Customer Relationships: Effective invoice management can help build better relationships with customers. By sending clear, accurate, and timely invoices, businesses can demonstrate their professionalism, reliability, and commitment to quality service.

Overall, invoice management is a crucial aspect of running a successful business. It helps businesses maintain a healthy cash flow, track payments, avoid errors and disputes, stay compliant with financial regulations, and build better relationships with customers.

Here are some of the benefits of using this Invoice software:

Saves Time: Generating invoices manually is a time-consuming process. With invoice generator software, you can automate the process and generate invoices quickly and easily. This can save you a lot of time and effort that can be spent on other important business tasks.

Increases Accuracy: Manual invoicing can result in errors and inaccuracies, which can be costly for your business. With a free invoice generator online, you can ensure that your invoices are accurate and error-free, reducing the risk of disputes or payment delays.

Improves Cash Flow: By streamlining your invoicing process, you can send out invoices quickly and receive payment faster. This can help improve your cash flow and ensure that you have the funds you need to run your business smoothly.

Enhances Professionalism: Using an invoice generator software can help you create professional-looking invoices that reflect positively on your business. This can help build trust with your clients and improve your brand image.

Provides Tracking and Reporting: Invoice generator software can provide you with detailed tracking and reporting features that allow you to keep track of invoices, payments, and outstanding balances. This can help you stay on top of your invoicing and make informed business decisions.

From this, using an invoice generator software can help you streamline your invoicing process, improve your cash flow, and enhance the professionalism of your business. With these benefits, it's definitely worth considering incorporating this tool into your business operations.

AI IN INVOICE GENERATOR SOFTWARE

AI, or artificial intelligence, is becoming increasingly common in invoice generator software. Here are some of the ways AI is applied in these tools:

Automated Data Extraction: AI algorithms can be used to automatically extract data from invoices, such as the vendor's name, address, and payment terms. This can save time and reduce errors when compared to manual data entry.

Smart Invoice Matching: AI can be used to match incoming bills to purchase orders and receipts, ensuring that they are correct and valid. This reduces the likelihood of overpayments, duplicate payments, and fraud.

Predictive Invoicing: Artificial intelligence (AI) can analyze past data to anticipate when bills will be paid. This can help businesses plan their cash flow and identify potential payment delays or problems.

Intelligent Invoice Routing: AI can be used to route invoices to the appropriate department or approver using predefined rules or machine learning techniques. This can speed up the approval process and decrease bottlenecks.

Fraud Detection: AI can be used to detect fraudulent invoices by analyzing patterns and anomalies in invoice data. This can help prevent financial losses and protect businesses from scams.

Pros and Cons of Invoice Generator Software

Invoice generator software can be a useful tool for businesses, but it also has its pros and cons. Here are some of the advantages and disadvantages of using this type of software:

Pros:

Timesaving: Free invoice generator can help businesses save time by automating the invoicing process, reducing the need for manual data entry and calculation.

Accuracy: Online invoice generator can help reduce errors and inaccuracies in invoices, which can help improve cash flow and avoid disputes with customers.

Efficiency: Free invoice generator online can help businesses improve efficiency by providing a streamlined process for generating, sending, and tracking invoices.

Professionalism: Invoice generator software can help businesses create professional-looking invoices that reflect positively on their brand and image.

Accessibility: Free invoice generator online can be accessed from anywhere with an internet connection, making it convenient for businesses to generate invoices on-the-go.

Cons:

Cost: Some invoice generator online may need a fee, either as a subscription or a one-time purchase. This may not be useful for certain small enterprises with limited resources.

Learning Curve: Some invoice generator software may have a learning curve for users who are not familiar with the software, which may require additional time and effort to get up to speed.

Limited Customization: Some invoice generation software may have limited customization choices, which may not fit the unique needs or branding of some firms.

Dependence on Technology: Using invoice generation software requires reliance on technology, which is susceptible to system outages, hacking, and other difficulties that may disrupt the invoicing process.

Security Concerns: There may be concerns about the security of sensitive financial data when using invoice generator software, which may require additional precautions and measures to protect against data breaches.

Overall, the benefits of using invoice generator online can outweigh the drawbacks for many businesses. However, it's important to carefully consider the pros and cons and choose software that aligns with the specific needs and budget of the business.

0 notes

Text

Best Practices for Customizing Invoices with a Free Online Invoice Generator

Customizing invoices is essential for creating a strong brand identity and ensuring clear communication with clients. Using a free online invoice generator makes the process simple and efficient. This guide explores the best practices for tailoring invoices, including adding your logo, choosing the right format, and including essential details like payment terms and contact information. By following these tips, you can elevate your professionalism, improve client relationships, and streamline your billing process. Discover how to make the most of your invoicing tool in this detailed blog.

Best Practices for Customizing Invoices with a Free Online Invoice Generator

The impression of your business and its professionalism is often transparent in your invoices themselves. Generic invoices may be adequate for you. However, do not just leave out the small but noticeable things. Keep your head straight before your clients. And gracefully leave your lasting brand’s impression.

Competition between small business owners and freelancers is inevitable. One might quote a more impressive project budget than the other. However, the quoted amount in the well-polished invoices with a free online invoice generator does the magic. Keep your efforts simple but in an effective manner. It facilitates on-time payments. So, you can sustain yourself for longer periods than your competitors.

But how do you generate your invoices to be professional and efficient to serve your business needs? Today, we will explore convenient ways to elevate your business and attract your client with each transaction. Ready to learn more about the best invoicing practices?

1.Invoice Design: Match Your Brand Identity with a Free Online Invoice Generator

Your invoices are not just payment requests. An invoice is an immediate echo of your brand reflection. Pick a template that aligns with your business standards. Recognize the nature of your company and choose accordingly. Every free online generator expands the options for you to choose your preferred design. Users can select between minimal and more detailed designs.

Photographers and freelancers work in the creative fields. These people may prefer visually appealing and artistic invoice templates. So that they can blend with your business standards.

Professional services such as legal or accounting firms look for simple and formal designs for invoicing. They often avoid glittery elements, which will be odd for the nature of their professions.

For commercial purposes, the business owners often use the itemized invoices. Their invoices must elaborate on the product title, descriptions, quantity, price and other tax details.

Based on the above-mentioned difference, a client will immediately recognize the perception of your brand. Always validate the outlook of your invoices and keep it flexible to add more details.

2.Cover All Essential Information

To avoid confusion or late payments, you have to create your customers’ invoices precisely with the details. The key information to cover in invoices when using a free online invoice generator is client information, invoice date and number. Along with this information, you have to add the details for the list of services or products, payment terms and the due date.

Client details such as their name, residential address and contact information have to be included.

Better provide different invoice numbers for each customer. So, you can maintain track of information along with the date on when the invoice has been generated.

Give a detailed description of the items or services you have provided.

Mention the quantity, total and subtotal of the items with the applicable taxes or deductions in the total amount.

You can also include your shipping details if you are delivering your products.

Above all, do not forget to provide the payment policy. It will help your client to understand the terms for any late payment fees.

The primary purpose of an invoice is to communicate essential payment information. Accurate information in your invoices will let your consumer comprehend everything in detail. So, they can promptly complete their payment process without any delays.

3.Prioritize Clarity and Legibility

While you choose your invoice templates, do not overdo the customization. You cannot set your creativity as a form of leverage while fulfilling professional commitments. Some designs may be flashy. But it comes with the cause of poor clarity for the details entered in it.

To keep your invoice clear and legible, use enough space between each section. It will highlight the important information without any hindrance. Plan the list of items that you are going to include. Then, give enough space for segmentation. So, your client does not miss any key details.

It is a better practice to highlight or bold the quantity and total of the items. You can also do the same for the due date of the payment. Moreover, double-check your client’s name and billing details. Such petty mistakes may lead the uncertain events in your business.

Do not dump all the available customization options in one template. It will create clutter. Limit your invoice to essential details only.

Keep the template structure simple. It is the basis for all the details mentioned earlier to maintain clarity. A well-structured layout is the most efficient choice for invoicing regardless of your job nature.

Your prominent goal is to deliver readable invoices. It should be free from any distractions or misleading content. State everything brief and straightforward.

4.Incorporate Personal Notes for Better Client Interaction

Find new and innovative ideas to encourage the loyalty of your client. Your financial document is the primary opportunity to maintain a professional relationship with them. A simple message can leave a positive impression on you. It increases the value of your business before your customers. A small gesture can help you go a long way towards achieving success after success in your business.

Just include a personalized thank-you note or a message of appreciation.

- Thank you for your business! We appreciate working with you.

- Your support means a lot to us. We’re looking forward to future collaborations!

- Thank you for choosing us! Reach us for any queries.

Strengthen the relationships between you and your client. And start building a huge community following for your enterprise.

5.Simplifying Small Tasks with Automated Features

The biggest advantage of using a free online invoice generator is the ability to automate certain tasks. It can assist you to minimize the risk of making errors while generating several invoices. It is not about the biggest features. Even the smallest work, like auto-filling the details of the existing clients and automated calculations.

If you want to create an invoice for your regular customer, it is better to have the automation feature for refilling the details. Sometimes manual entry tends to miss the details. Once you have saved the required common information of your recurring clients, you can simply type their names. The automated feature will suggest to you the pre-existing details of the particular clients. You can simply select the needed one.

Most free online invoice generator comes with a built-in auto-calculation feature. Manual calculation of totals, taxes, or discounts can lead to human error. This could result in trust issues, delays in payments or even damage to your reputation. Better utilize the feature of automated calculation for summing up the total cost of the purchased products or the service provided.

For discounts, you have to enter the percentage in the specified column. The generator will finalize the total. This leaves no room for confusion. The same applies to tax compliance based on your region’s regulations.

6.Enable Diverse Payment Methods

Let me get to this straight. You are purchasing something you love the most. You immediately grab it to buy the product. The business unit only takes cash from you. But you only have the card or ready for e-payment. What will be your reaction? So, do you prefer a single payment option or various alternatives?

The same thing applies to your enterprise as well. When it comes to the payment process, clients are more likely to pay instantly without experiencing any embarrassing moments. Remove this kind of inconvenience and make your service accessible even for your clients from overseas. Most of the free online invoice generator will enable you to integrate the online payment gateways. Provide the maximum convenience to your clients for smooth business operations.

7.Curate Professional Email Notifications

After making a billing receipt, you have to forward the invoice copy through mail. It sounds more proficient when it comes to business. You can send the copy directly from your invoice pre-drafted mail body. Or simply create a professional mail and send it with the attached invoice.

To write a mail professionally, the sender has to be clear with the subject line. You can use the relevant subject based on what type of invoice you want to send to your client. If it is about the due date of the particular project, mention it as “Invoice Due Date Reminders of (project name)”.

Write a mail body with simple and brief content. No one in the business sector has time to read a paragraph mail. So, keep it concise and informative. For instance, thank your customers for doing business with you. Then, mention the due date of the project invoice. In the end, attach a copy of the mentioned invoice.

The attached copy of the invoice should be in a standard PDF format. A gentle reminder just a few days before the due date of the invoice will give you a sustainable cash flow.

8.Track Your Invoice Status

It is easy to store your business-related invoices in a reputable free online invoice generator. Everything will be fine. Until you need to process an invoice immediately to them in a no-internet access region. It is the best practice to back up your invoices in your systems or other medium for efficient financial management.

Wrap Up

We can surely say this. Each invoice you create is a representation of your brand identity. Invest some time while you customize the invoice for the first time. These strategies will create a positive impact on your business and client management. Once you start to implement the tips discussed in your invoicing process, you can see tremendous growth in your business dealings. Use the best free online invoice generator for your branding. Start now by signing up with the best online invoice generator.

0 notes

Text

Best Practices for Customizing Invoices with a Free Online Invoice Generator

Competition between small business owners and freelancers is inevitable. One might quote a more impressive project budget than the other. However, the quoted amount in the well-polished invoices with a free online invoice generator does the magic. Keep your efforts simple but in an effective manner. It facilitates on-time payments. So, you can sustain yourself for longer periods than your competitors.

But how do you generate your invoices to be professional and efficient to serve your business needs? Today, we will explore convenient ways to elevate your business and attract your client with each transaction. Ready to learn more about the best invoicing practices?

1.Invoice Design: Match Your Brand Identity with a Free Online Invoice Generator

Your invoices are not just payment requests. An invoice is an immediate echo of your brand reflection. Pick a template that aligns with your business standards. Recognize the nature of your company and choose accordingly. Every free online generator expands the options for you to choose your preferred design. Users can select between minimal and more detailed designs.

Photographers and freelancers work in the creative fields. These people may prefer visually appealing and artistic invoice templates. So that they can blend with your business standards.

Professional services such as legal or accounting firms look for simple and formal designs for invoicing. They often avoid glittery elements, which will be odd for the nature of their professions.

For commercial purposes, the business owners often use the itemized invoices. Their invoices must elaborate on the product title, descriptions, quantity, price and other tax details.

Based on the above-mentioned difference, a client will immediately recognize the perception of your brand. Always validate the outlook of your invoices and keep it flexible to add more details.

2.Cover All Essential Information

To avoid confusion or late payments, you have to create your customers’ invoices precisely with the details. The key information to cover in invoices when using a free online invoice generator is client information, invoice date and number. Along with this information, you have to add the details for the list of services or products, payment terms and the due date.

Client details such as their name, residential address and contact information have to be included.

Better provide different invoice numbers for each customer. So, you can maintain track of information along with the date on when the invoice has been generated.

Give a detailed description of the items or services you have provided.

Mention the quantity, total and subtotal of the items with the applicable taxes or deductions in the total amount.

You can also include your shipping details if you are delivering your products.

Above all, do not forget to provide the payment policy. It will help your client to understand the terms for any late payment fees.

The primary purpose of an invoice is to communicate essential payment information. Accurate information in your invoices will let your consumer comprehend everything in detail. So, they can promptly complete their payment process without any delays.

3.Prioritize Clarity and Legibility

While you choose your invoice templates, do not overdo the customization. You cannot set your creativity as a form of leverage while fulfilling professional commitments. Some designs may be flashy. But it comes with the cause of poor clarity for the details entered in it.

To keep your invoice clear and legible, use enough space between each section. It will highlight the important information without any hindrance. Plan the list of items that you are going to include. Then, give enough space for segmentation. So, your client does not miss any key details.

It is a better practice to highlight or bold the quantity and total of the items. You can also do the same for the due date of the payment. Moreover, double-check your client’s name and billing details. Such petty mistakes may lead the uncertain events in your business.

Do not dump all the available customization options in one template. It will create clutter. Limit your invoice to essential details only.

Keep the template structure simple. It is the basis for all the details mentioned earlier to maintain clarity. A well-structured layout is the most efficient choice for invoicing regardless of your job nature.

Your prominent goal is to deliver readable invoices. It should be free from any distractions or misleading content. State everything brief and straightforward.

4.Incorporate Personal Notes for Better Client Interaction

Find new and innovative ideas to encourage the loyalty of your client. Your financial document is the primary opportunity to maintain a professional relationship with them. A simple message can leave a positive impression on you. It increases the value of your business before your customers. A small gesture can help you go a long way towards achieving success after success in your business.

Just include a personalized thank-you note or a message of appreciation.

- Thank you for your business! We appreciate working with you.

- Your support means a lot to us. We’re looking forward to future collaborations!

- Thank you for choosing us! Reach us for any queries.

Strengthen the relationships between you and your client. And start building a huge community following for your enterprise.

5.Simplifying Small Tasks with Automated Features

The biggest advantage of using a free online invoice generator is the ability to automate certain tasks. It can assist you to minimize the risk of making errors while generating several invoices. It is not about the biggest features. Even the smallest work, like auto-filling the details of the existing clients and automated calculations.

If you want to create an invoice for your regular customer, it is better to have the automation feature for refilling the details. Sometimes manual entry tends to miss the details. Once you have saved the required common information of your recurring clients, you can simply type their names. The automated feature will suggest to you the pre-existing details of the particular clients. You can simply select the needed one.

Most free online invoice generator comes with a built-in auto-calculation feature. Manual calculation of totals, taxes, or discounts can lead to human error. This could result in trust issues, delays in payments or even damage to your reputation. Better utilize the feature of automated calculation for summing up the total cost of the purchased products or the service provided.

For discounts, you have to enter the percentage in the specified column. The generator will finalize the total. This leaves no room for confusion. The same applies to tax compliance based on your region’s regulations.

6.Enable Diverse Payment Methods

Let me get to this straight. You are purchasing something you love the most. You immediately grab it to buy the product. The business unit only takes cash from you. But you only have the card or ready for e-payment. What will be your reaction? So, do you prefer a single payment option or various alternatives?

The same thing applies to your enterprise as well. When it comes to the payment process, clients are more likely to pay instantly without experiencing any embarrassing moments. Remove this kind of inconvenience and make your service accessible even for your clients from overseas. Most of the free online invoice generator will enable you to integrate the online payment gateways. Provide the maximum convenience to your clients for smooth business operations.

7.Curate Professional Email Notifications

After making a billing receipt, you have to forward the invoice copy through mail. It sounds more proficient when it comes to business. You can send the copy directly from your invoice pre-drafted mail body. Or simply create a professional mail and send it with the attached invoice.

To write a mail professionally, the sender has to be clear with the subject line. You can use the relevant subject based on what type of invoice you want to send to your client. If it is about the due date of the particular project, mention it as “Invoice Due Date Reminders of (project name)”.

Write a mail body with simple and brief content. No one in the business sector has time to read a paragraph mail. So, keep it concise and informative. For instance, thank your customers for doing business with you. Then, mention the due date of the project invoice. In the end, attach a copy of the mentioned invoice.

The attached copy of the invoice should be in a standard PDF format. A gentle reminder just a few days before the due date of the invoice will give you a sustainable cash flow.

8.Track Your Invoice Status

It is easy to store your business-related invoices in a reputable free online invoice generator. Everything will be fine. Until you need to process an invoice immediately to them in a no-internet access region. It is the best practice to back up your invoices in your systems or other medium for efficient financial management.

Wrap Up

We can surely say this. Each invoice you create is a representation of your brand identity. Invest some time while you customize the invoice for the first time. These strategies will create a positive impact on your business and client management. Once you start to implement the tips discussed in your invoicing process, you can see tremendous growth in your business dealings. Use the best free online invoice generator for your branding. Start now by signing up with the best online invoice generator.

0 notes

Text

Manage your financial and accounting operations with Billing Applications

Automate daily tasks for your finance team with Tecnolynx billing software. Our powerful application allows you to create professional invoices, generate payment reminders, and maintain accurate accounting records. With Tecnolynx, you can easily track the products and services used by your clients, produce and send invoices, and efficiently collect payments. Streamline your financial processes and enhance productivity with our advanced billing solution.

#Billing applications#Invoice software#Billing solutions#Invoice management#Billing system#Invoice generation#Billing software#Invoice processing#Business invoicing#Free demo

0 notes

Text

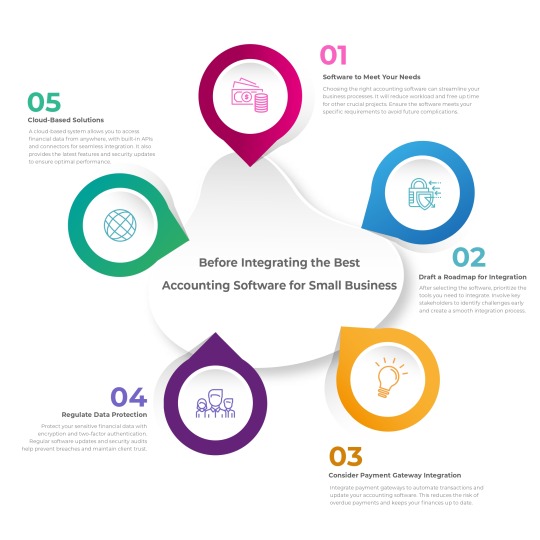

Handling numerous software is a weary task. Understandably, integrating accounting software can be complex and often confusing when juggling multiple tasks. However, it can revolutionize the efficiency of your company’s operations. To help you achieve a seamless integration process, we've outlined key tips for precise planning and execution of your business needs.

Before diving into our tips, take a moment to assess your current setup and identify the areas that will benefit most from integration. This step is crucial for maximizing the impact of your new accounting software.

For more detailed insights on this topic, check out our blog post on integrating accounting software.

1 note

·

View note

Text

Boost your business with the best billing software for small business

If you take your business quite seriously, then you should definitely need the best billing software for small business. After opting for billing software, you need not worry about billing because free GST invoice generator software covers all business types and sizes because it is especially designed to meet the demands of customers by managing the billing processes seamlessly. With the world shifting towards digital payments and towards digital India, there has been an increase in the usage of the best invoice software free.

The importance of the best invoice software free

The best billing software for small business like Eazybills, plays a crucial role in financial management.

Streamlined Automation and Efficiency: It automates the creation of invoices, reducing errors and saving time. This includes managing recurring billing, sending payment reminders, and tracking expenses, thereby enhancing overall operational efficiency.

Compliance: Automated calculations ensure accurate billing, minimize discrepancies, and assist businesses in adhering to tax and financial regulations. This reduces compliance risks significantly.

Easy Cash Flow Management: By facilitating prompt invoicing and efficient payment processing, billing software helps businesses maintain a healthy cash flow. Features such as integrated payment gateways and automated reminders encourage timely payments, thereby reducing outstanding balances.

Enhanced Customer Experience: Professional-looking invoices and seamless payment options contribute to a positive customer experience. Transparency and convenience in payment processes strengthen client relationships.

Cost Efficiency: Despite initial investment costs, billing software reduces expenses associated with manual invoicing, billing inaccuracies, and late payments. This optimization of resources boosts productivity and operational savings over time.

Support and Service Excellence: Reputable GST invoice software free offer strong customer support, assisting with implementation, training, and troubleshooting. This ensures seamless software operation and enhances user satisfaction.

How to select the best free GST invoice generator software

Choosing the best billing software for small business is important because your business's reputation depends on it. Selecting GST invoice software free requires considering the following factors:

Specify your requirements: Start the selection process for free GST invoice generator software by outlining the essential features you need, like invoicing, expense tracking, inventory management, reporting, and tax calculations.

Budgetary constraints: After that, determine your budget for GST invoice software free considering various options from free solutions to monthly or annual subscriptions.

Scalability: Check whether the best invoice software free can expand alongside the expansion of business to avoid the difficulties of frequent system changes.

User-Friendliness: Prioritize free GST invoice generator software that is user-friendly and easy to operate, not one with complicated navigation.

Integration Capability: Check whether the GST invoice software free integrates smoothly with the other tools or not. It is important that your selected billing software work smoothly alongside accounting software, CRM systems, and payment gateways.

Security Features: Make sure that the GST invoice software free complies with data protection regulations and has strong security measures, particularly those essential for handling sensitive customer information.

Customer Support Services: Look for the best invoice software free that provides reliable customer support services, ideally with options for direct assistance through phone, email, or live chat with the team.

Reputation and Feedback: Research user reviews and testimonials to learn about the reliability, scalability, performance, and accuracy of the GST invoice software free.

Customization Options: Consider whether your selected billing software allows customization options to adapt to your specific business requirements and branding needs.

By carefully evaluating the above-mentioned factors, you can easily select the best billing software for small businesses that aligns precisely with your business-specific billing demands, optimizing your invoicing operations effectively. Check out Eazybills for all your business billing requirements.

#best billing software for small business#free gst invoice generator software#best invoice software free#gst invoice software free#free billing software#billing software free#gst billing software free#gst software free

0 notes

Text

How to Use Your Last Paystub to File Taxes

Filing taxes can be a daunting task, but understanding how to use your last paystub can simplify the process. Whether you're an employee or a freelancer, your paystub contains crucial information needed to complete your tax return. In this blog, we'll walk you through the steps of using your last paystub to file taxes and highlight some useful tools like a paystub generator, 1099 MISC Form, and more.

Understanding Your Paystub

A paystub provides a detailed breakdown of your earnings and deductions. Key components include:

Gross Earnings: Total income before any deductions.

Net Earnings: Income after deductions.

Federal and State Taxes: Amounts withheld for tax purposes.

Social Security and Medicare: Deductions for social security and Medicare contributions.

Other Deductions: Any other deductions such as health insurance or retirement contributions.

Steps to File Taxes Using Your Last Paystub

1. Gather Your Paystub and Relevant Forms

Before you begin, ensure you have your last paystub of the year. You may also need other documents such as the 1099 MISC Form if you're a freelancer or independent contractor.

2. Review Your Paystub

Check that all information is correct, including your gross and net earnings, tax withholdings, and any other deductions. If you notice any discrepancies, contact your employer or use a paystub generator to create a corrected version.

3. Calculate Your Total Income

Use the gross earnings listed on your last paystub to calculate your total income for the year. If you have multiple jobs, add the gross earnings from all your paystubs.

4. Enter Information into Tax Forms

Transfer the information from your paystub to the appropriate tax forms. For employees, this is usually the W-2 form. Freelancers will use the 1099 MISC Form.

5. Deductions and Credits

Review any deductions or credits you may be eligible for, such as educational credits, retirement contributions, or health savings accounts. Ensure these are accurately reflected in your tax return.

6. File Your Taxes

You can file your taxes online or via mail. If you’re using a tax software, it will guide you through the process, ensuring all information from your paystub is correctly entered.

Related Article: DG Paystub

Useful Tools and Resources

Paystub Generators

If you need to create or correct a paystub, a paystub generator or paystub creator can be invaluable. These tools allow you to enter your earnings and deductions to generate a professional paystub.

1099 MISC Form

Freelancers and independent contractors must report their income using the 1099 MISC Form. Ensure you have all necessary 1099 forms from each client.

Additional Resources

Balance Sheet Sample: Useful for freelancers to track their financial health throughout the year.

Employee Handbook: Review your company's employee handbook for any additional financial benefits or deductions you may be eligible for.

Personal Financial Statement: Helps in organizing your finances and preparing for tax season.

NDA Generator: If you need to protect sensitive information while sharing financial data with accountants or tax preparers.

Invoice Generator: For freelancers, maintaining accurate invoices ensures all income is reported correctly.

Conclusion

Using your last paystub to file taxes can be straightforward if you follow these steps and utilize the right tools. Paystub generators, financial statements, and proper documentation are key to ensuring your tax return is accurate and complete. By staying organized and informed, you can simplify the tax filing process and avoid any last-minute stress.

Remember, always double-check your information and consult a tax professional if you have any doubts or complex financial situations. Happy filing!

#How to Use Your Last Paystub to File Taxes#paystub generator#paystub creator#free paystub generator#paystub generator free#pay stub generator#1099 MISC Form#Balance Sheet Sample#Employee Handbook#Personal Financial Statement#nda generator#Invoice generator

0 notes

Text

Start Using our Free Invoice Generator Today

Welcome to Get Free Invoice, your go-to solution for generating professional invoices quickly and easily! With our free invoice generator, you can create detailed, professional invoices in just a few clicks. Whether you're a freelancer, small business owner, or service provider, our platform allows you to create invoices free of charge, helping you manage your finances efficiently. At Get Free Invoice, we also offer a user-friendly invoice maker that simplifies your billing process. Just enter your details, and let our tool do the work. Start using our free invoice generator today and streamline your invoicing!

#invoice generator#free invoice generator#invoice maker#create invoice free#free invoice maker#how to make an invoice#create free invoice#invoice generator free#free invoice#receipt generator#create invoice#invoice builder#free invoicing generator#create an invoice#how to create invoice#invoice creator#create an invoice free#online invoice generator

1 note

·

View note

Text

Gbooks offers unparalleled efficiency with its invoicing software, revolutionizing the way businesses manage their finances. With intuitive features and customizable templates, generating professional invoices becomes a breeze. Seamlessly integrate with your accounting systems for real-time tracking of payments and expenses. Enjoy automated reminders for overdue payments, ensuring steady cash flow. The user-friendly interface simplifies the invoicing process, saving you time and reducing errors. Plus, with secure cloud storage, access your financial data anytime, anywhere. Trust Gbooks to optimize your invoicing workflow and elevate your business to new heights of productivity and profitability.

#best invoicing software#free invoice generator#invoicing software for small business#legal billing software#free invoice software#billing software for small business#online invoicing software#free billing software#online billing software#best billing software#online invoice creator#invoice billing software

0 notes

Text

#Online Rent Receipt Generator#Generate Rental Receipts#Rent Bills#Online Rent Receipt#Generate House Rent Receipts Free#Quarterly Rent Receipt#Generate Rent Receipt Online#Rent Receipt Generator#FREE Rent Receipt Generator tool#House Rent Online Generator#Rent Invoice#Rent Bill#Generate Free Rent Receipt#Rent Receipt Generator Tool

1 note

·

View note

Text

𝟭𝟮 𝗘𝘀𝘀𝗲𝗻𝘁𝗶𝗮𝗹 𝗜𝗻𝘃𝗼𝗶𝗰𝗲 𝗣𝗮𝘆𝗺𝗲𝗻𝘁 𝗧𝗲𝗿𝗺𝘀 𝗘𝘃𝗲𝗿𝘆 𝗕𝘂𝘀𝗶𝗻𝗲𝘀𝘀 𝗦𝗵𝗼𝘂𝗹𝗱 𝗞𝗻𝗼𝘄 Understanding invoice payment terms is crucial for smooth business operations and timely cash flow management. This article outlines 12 essential payment terms that every business owner and entrepreneur should be familiar with. From "Net 30" to "Payment in Advance," these terms help establish clear expectations between you and your clients, ensuring transparency and efficiency. Ready to streamline your invoicing process and avoid payment delays? Dive into the full guide here!

#entrepreneurship#finance#business#startup#invoice#free invoice software#invoice maker#invoice management system#invoxa#invoice generator#invoice template#payments#payment systems

1 note

·

View note

Text

HR Software Info

Human Resource (HR) software has become an indispensable tool for modern organizations, revolutionizing the way businesses manage their workforce. From recruitment to retirement, HR software streamlines processes, enhances efficiency, and improves employee satisfaction. This article explores the key features, benefits, and considerations of HR software. Features: Recruitment and Applicant…

View On WordPress

#accounting software#best inventory management software#free inventory management software#free invoice generator#free project management software#freeware inventory management software#hr software#hr software< payroll software#inventory management#inventory management software#inventory management software for small business#Inventory Management Software for Small Businesses#Inventory Management Software for Small Businesses: capcutsoftware#inventory management software free#inventory management software small business#it inventory management software#pos system#project management software#quickbooks payroll#quickbooks time#retail inventory management software#warehouse inventory management software

0 notes