#investingforthefuture

Explore tagged Tumblr posts

Text

https://anthonydoty.com/wp-content/uploads/2024/08/saving-for-tomorrows-needs.jpg 💼 Smart Saving Tips for Tomorrow's Needs 💡 📊 Did you know 33% of Americans have no s... 👉 Dive deeper into financial insights on our website https://tinyurl.com/22zmcxj3. Start your journey to financial freedom today! 🌟 🚀 Don’t miss out on our free 30-minute consultation to kickstart your financial empowerment journey. Click the link in our bio to book now! 🔔 Follow us for more expert tips and join our community of empowered individuals. 💪 #FinancialFreedom #WealthBuilding #BudgetingTips #FinancialPlanning #Empowerment #Success #AnthonyDoty"

#FinancialEmpowerment#Budgetingforlongtermgoals#Buildingafinancialsafetynet#Emergencysavingsfund#Financialsecuritystrategies#Futurefinancialplanning#Investingforthefuture#Moneysavinghabits#PersonalFinanceTips#Retirementsavingsplan#WealthManagementStrategies

0 notes

Text

Learn how to make smart financial decisions with this comprehensive guide that covers budgeting, investing, debt management, and more. Empower your financial future today.

#SmartFinancialDecisions#FinancialPlanningTips#EffectiveMoneyManagement#PersonalFinanceStrategies#InvestingForTheFuture

0 notes

Text

Unlocking the Potential of Systematic Investment Plans (SIPs) for Long-Term Growth

In the realm of investment strategies, consistency is often the key to unlocking long-term financial success. One such strategy that embodies this principle is Systematic Investment Plans (SIPs). SIPs have gained popularity among investors for their ability to harness the power of consistent investing, providing a pathway to wealth accumulation and financial security over time. In this article, we delve into the essence of SIPs and explore how they offer a potent tool for achieving your financial goals.

Understanding Systematic Investment Plans (SIPs)

At its core, a Systematic Investment Plan (SIP) is a disciplined approach to investing in mutual funds. Unlike lump-sum investments, where a large amount is invested at once, SIPs involve investing a fixed amount at regular intervals, typically monthly or quarterly. This systematic approach eliminates the need for market timing, as investors contribute regardless of market fluctuations.

The Power of Consistency:

Consistency is the cornerstone of SIPs and is what sets them apart from other investment strategies. By committing to invest a fixed sum regularly, investors benefit from the power of compounding. Compounding is the snowball effect where the returns generated on investments are reinvested to generate further returns. Over time, this compounding effect can significantly boost the growth of your investment portfolio.

Mitigating Market Volatility:

One of the primary advantages of SIPs is their ability to mitigate the impact of market volatility. Since investments are spread out over time, SIP investors benefit from rupee-cost averaging. In essence, this means that when markets are down, your fixed investment amount buys more units of the mutual fund, and when markets are up, it buys fewer units. Over the long term, this helps smooth out the impact of market fluctuations and reduces the risk associated with timing the market.

Achieving Financial Goals:

SIPs are highly versatile and can be tailored to meet a wide range of financial goals. Whether you're saving for retirement, education expenses, a down payment on a house, or any other long-term objective, SIPs provide a structured approach to achieving your goals. By consistently investing over time, investors can accumulate the wealth needed to fulfill their aspirations.

Flexibility and Convenience:

Another attractive feature of SIPs is their flexibility and convenience. Investors can start with a relatively small investment amount and gradually increase it over time as their financial situation improves. Additionally, most mutual fund companies offer the convenience of automating SIP payments, allowing investors to set up a standing instruction with their bank for hassle-free investing.

Conclusion:

In today's dynamic and uncertain financial landscape, a disciplined and consistent approach to investing is more crucial than ever. Systematic Investment Plans (SIPs) offer investors a powerful tool to navigate market volatility, harness the benefits of compounding, and achieve their long-term financial goals. By committing to regular investments and staying the course, investors can unlock the full potential of SIPs and pave the way for a brighter financial future. In essence, while SIPs offer a powerful tool for consistent investing and long-term growth, the guidance of financial advisors or experts serves as a catalyst for achieving financial freedom and security. Together, with the right blend of discipline, patience, and expert guidance, investors can embark on a journey towards realizing their financial aspirations and unlocking a future of prosperity and freedom.

Empower your financial journey with a FREE consultation today. Your future starts now. 💯

🔗 To know more, visit - www.fintlivest.com

📞 Contact us – 8951741819 / 9637778041

👉 Follow for daily financial tips and strategies: @fintlivest

#InvestingForTheFuture #FinancialFreedom #SIPInvesting #LongTermGrowth #WealthBuilding #FinancialPlanning #SmartInvesting #WealthManagement #InvestmentStrategies #SIPforSuccess #SecureYourFuture #InvestmentGoals #SIPBenefits #SteadyReturns #FinancialWellness #InvestmentOpportunity

Get FREE financial advice from our experts to plan your investment with Fintlivest!

To know more, visit - www.fintlivest.com

Contact us – 8951741819 / 9637778041

https://www.instagram.com/fintlivest

https://www.facebook.com/Fintlivest

https://www.youtube.com/@Fintlivest

https://in.pinterest.com/fintlivestservices/

#investment#insurance#personalfinance#finance#wealthmanagement#InvestingForTheFuture#FinancialFreedom#SIPInvesting#LongTermGrowth#wealthbuilding#FinancialPlanning#SmartInvesting#financialwellness#SIPBenefits

1 note

·

View note

Text

When you realize, you are the only one, Who has not started your SIP yet. 🤔

Start Your SIP Today...

For more details call me +91 7276518999

https://dreamfunds.in/

#StartYourSIPToday#SIPTheSmartWay#FinancialGoalsMatter#GrowYourWealthWithSIP#InvestingForTheFuture#AskMeAboutSIP#SIPLateBloomer#fomoinvestor#BetterLateThanNeverSIP#mutualfundsahihai#financialadvisor#dreamfunds#sip#mutualfundssahihai#wealthplanner

0 notes

Text

8 Secrets for Long-Term Financial Success

Read More- https://www.goldenbulls.co.in/8-secrets-for-long-term.../

#WealthBuilding#SmartMoneyMoves#LongTermFinancialGoals#FinancialFreedom#Investment#MoneyMindset#StrategicSavings#InvestingForTheFuture#FinancialServces#Investing#InvestmentStrategy#Goldenbulls

0 notes

Text

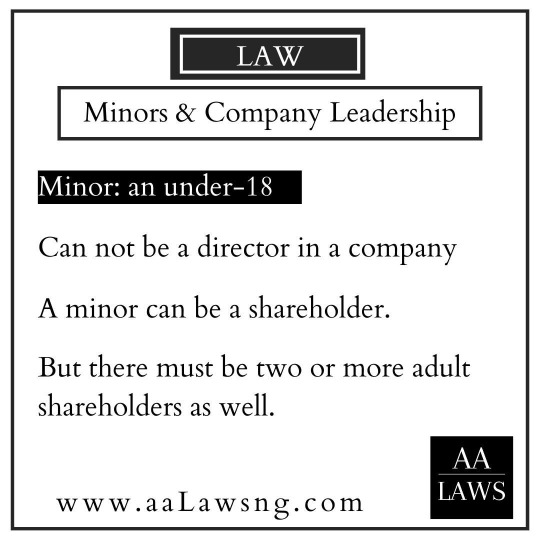

Did you know that minors cannot be directors in a company in Nigeria, but they can still be shareholders? With two or more adult shareholders, they can still have a stake in the business world at a young age

#MinorShareholders #BusinessWorld #YoungEntrepreneur #InvestingForTheFuture #ShareholderRights #BusinessOwnership #InvestingForTheFuture #ShareholderRights #Directorship #BusinessDecisionMaking #FinancialIndependence #YoungEntrepreneurship #ShareholderCollaboration #EntrepreneurshipJourney #InvestingForTheFuture #NextGenerationLeaders #BusinessDecisionMaking #StartYoung #minor

2 notes

·

View notes

Video

youtube

Beware of Black Friday So-Called Bargains and Invest Your Money Instead

Black Friday is marketed as the ultimate shopping event, but are those deals truly worth it? Many so-called bargains are just clever marketing tricks, with retailers inflating prices beforehand or offering discounts on items you don’t really need. Falling into the Black Friday trap can drain your wallet and delay your financial goals.

Instead of splurging on unnecessary items, consider investing your money for long-term growth. Here’s why:

Avoid Impulse Buying: Emotional spending during sales leads to regret later. Channel that money into investments that work for you over time.

Build Wealth: Small amounts saved during Black Friday can grow into significant wealth when invested in stocks, index funds, or property.

Achieve Financial Freedom: Every pound you invest brings you closer to financial independence and security.

Smart Alternatives to Black Friday Spending:

Increase contributions to your pension or ISA.

Buy shares in companies instead of their discounted gadgets.

Save for a deposit on a property.

This Black Friday, break free from the consumerist cycle and focus on your financial future. Investing, rather than spending, puts your money to work and sets you on the path to lasting wealth.

#BlackFriday #MoneyTips #SmartSpending #FinancialFreedom #InvestingForTheFuture #WealthBuilding #StockMarketInvesting #SaveNotSpend #CharlesKellyMoneyTips #PersonalFinance

0 notes

Video

youtube

🌱🔋Unleashing the Power Battery Storage Technology Drives Sustainability🌱 🔋

"The future depends on what we do in the present." - Mahatma Gandhi

📰🔋 Get ready for an electrifying revelation in our latest issue of Sustainable Investing Digest! We are thrilled to shine the spotlight on the booming battery storage market and its crucial role in shaping a sustainable future! 💚🚀

According to Bloomberg New Energy Finance, battery storage investment worldwide doubled in 2020, surpassing $100 billion, and brace yourself for this mind-blowing projection - it's set to jump by nearly 80% to over $250 billion in 2023! 🤯💸

📈 Harnessing the Power of Technology Discover how batteries are transforming the energy landscape, ensuring grid reliability, and empowering the integration of renewable energy. Countries like India and Indonesia are gearing up for exponential growth, with massive investments planned in battery manufacturing. 💰🔌

👉 Making Sustainable Energy Affordable Over the past decade, the cost of lithium-ion batteries has plummeted by nearly 90%, thanks to groundbreaking technology improvements and large-scale manufacturing. This dramatic reduction in costs has made battery storage increasingly cost-competitive for large-scale energy needs. 💡🔋

🙌 Join the Energy Transition! Goldman Sachs proclaims, "Battery storage is a key enabling technology for the broader energy transition." The 10-year outlook for battery storage growth is incredibly strong, with technology advancements, cost reductions, and the growing need for grid flexibility and reliability driving the charge. 🚀🌟

🌎 Embrace the Future with Sustainable Investing Digest! The future of energy is green, and the time for action is NOW! Don't miss out on this opportunity to invest in innovative companies leading the charge toward a cleaner, greener world. The power is in your hands to shape the future you want to see. 💚⚡️

💪😍 Subscribe to Sustainable Investing Digest today and be part of the sustainable investment movement! Click this link to subscribe: https://lnkd.in/evwmY7wG

#sustainableinvesting #greenfinance #renewableenergy #battery #storage #climatechange #cleanenergy #investingforthefuture #gogreen #ecofriendly 🌱🌿

0 notes

Photo

Always looking for unique items to add to my collection. When it comes to things like watches and such, I’m more of a silver person, but when investing... a little gold doesn’t hurt. 🤙🏼 . #apmex #gold #goldnote #€500notereplica #notereplica #goldaurum #24k #thakman #kennethirwinii #indieauthor #indieartist #photographer #videographer #xtheboundaries #investingforthefuture #pdx #nyc #la #worldwide #uk #euro #europe #photooftheday (at Portland, Oregon) https://www.instagram.com/p/B-AW2B-gufJ/?igshid=ykt039msz4fg

#apmex#gold#goldnote#notereplica#goldaurum#24k#thakman#kennethirwinii#indieauthor#indieartist#photographer#videographer#xtheboundaries#investingforthefuture#pdx#nyc#la#worldwide#uk#euro#europe#photooftheday

0 notes

Text

Top 10 financial mistakes to avoid in your 20’s and 30’s

Navigating your 20s and 30s can be a financial minefield. Many individuals in these age groups face significant life changes and decisions that can impact their long-term financial health. Here are the top 10 financial mistakes to avoid during these critical decades:

1. Not Budgeting: Failing to create and stick to a budget is one of the most common financial mistakes. Without a budget, it’s easy to overspend and lose track of where your money goes. A budget helps you manage your income, control your expenses, and plan for savings and investments.

2. Accumulating High-Interest Debt: Credit card debt and other high-interest loans can quickly become unmanageable. Avoid carrying a balance on your credit cards and prioritize paying off any high-interest debt as soon as possible to prevent it from scrolling out of control.

3. Neglecting Emergency Savings: Life is unpredictable, and not having an emergency fund can lead to financial disaster. Aim to save three to six months' worth of living expenses in an easily accessible account to cover unexpected costs like medical emergencies or car repairs.

4. Living Beyond Your Means: It’s tempting to keep up with peers who might be earning more or spending lavishly. However, living beyond your means can lead to significant financial stress and debt. Focus on living within your income and avoiding unnecessary expenses.

5. Not Investing Early: The earlier you start investing, the more you can benefit from compound interest. Delaying investments can cost you significantly in potential growth. Start with small, consistent investments in retirement accounts like a 401(k) or IRA.

6. Ignoring Retirement Savings: Retirement might seem far away, but it’s crucial to start saving early. Take advantage of employer-sponsored retirement plans, especially if your employer offers matching contributions. Even small contributions can grow significantly over time.

7. Not Having Insurance: Skipping essential insurance, such as health, renters, or auto insurance, can lead to massive out-of-pocket expenses if something goes wrong. Ensure you have adequate coverage to protect yourself from unforeseen financial burdens.

8. Overlooking Financial Education: Many people neglect to educate themselves about personal finance. Understanding basic financial principles can help you make informed decisions about budgeting, saving, investing, and managing debt. Consider taking courses or reading books on personal finance.

9. Impulsive Spending: Impulse buying can derail your financial goals. Whether it’s shopping for clothes, gadgets, or dining out frequently, it’s essential to be mindful of your spending habits and avoid unnecessary purchases.

10. Not Planning for Big Expense: Failing to plan for significant expenses such as buying a house, starting a family, or furthering your education can lead to financial strain. Create a savings plan for these big-ticket items to avoid taking on excessive debt.

Conclusion

Your 20s and 30s are crucial decades for building a solid financial foundation. By avoiding these common financial mistakes and making smart money decisions, you can set yourself up for long-term financial success and stability. Remember, the key is to start early, stay informed, and be proactive about managing your finances.

For more detailed financial advice and tips, consider visiting reputable financial education websites such as Fintlivest or seeking guidance from a financial advisor.

Invest in your peace of mind. Schedule your FREE financial consultation today! 💯

🔗 To know more, visit - www.fintlivest.com

📞 Contact us – 8951741819 / 9637778041

👉 Follow for daily financial tips and strategies: @fintlivest

#InvestingForTheFuture #FinancialFreedom #SIPInvesting #LongTermGrowth #WealthBuilding #FinancialPlanning #SmartInvesting #WealthManagement #InvestmentStrategies #SIPforSuccess #SecureYourFuture #InvestmentGoals #SIPBenefits #SteadyReturns #FinancialWellness #InvestmentOpportunity

Get FREE financial advice from our experts to plan your investment with Fintlivest!

To know more, visit - www.fintlivest.com

Contact us – 8951741819 / 9637778041

https://www.instagram.com/fintlivest

https://www.facebook.com/Fintlivest

https://www.youtube.com/@Fintlivest

https://in.pinterest.com/fintlivestservices/

#investment#insurance#budgeting#personalfinance#wealthmanagement#financialplanning#investmentstrategy#smartinvesting#money#financialfreedom

1 note

·

View note

Video

(via https://www.youtube.com/watch?v=7C6B57Rpylc)

0 notes

Text

Building Wealth Brick by Brick: The Art of Investment

Are you ready to embark on a journey towards financial empowerment and prosperity? 💰💼

Investing is like constructing a financial fortress, one brick at a time. Each investment you make is a building block, adding strength and resilience to your wealth portfolio. Here's why the art of investment is your path to a brighter financial future:

🏗️ Start Small, Dream Big: Just like a grand skyscraper begins with a solid foundation, your investment journey can start with small amounts. Don't underestimate the power of consistent, modest investments over time.

📚 Knowledge is Your Blueprint: Before laying the first brick, equip yourself with knowledge. Learn about different investment vehicles, from stocks and bonds to real estate and mutual funds. The more you know, the stronger your financial structure.

📈 Diversify Your Portfolio: Don't put all your bricks in one place. Diversify your investments to spread risk and enhance potential returns. A diversified portfolio can weather economic storms more effectively.

🚀 Compound Interest: Your Building Material: Compound interest is the magic cement that holds your financial edifice together. It allows your investments to grow exponentially over time, creating wealth at an accelerating pace.

💡 Long-Term Vision: Rome wasn't built in a day, and neither is wealth. Adopt a long-term perspective, and resist the urge to make impulsive changes. Patience can be your most valuable asset.

🏛️ Seek Professional Advice: Just as architects consult engineers, it's wise to seek advice from financial experts. They can help you design an investment strategy that aligns with your goals and risk tolerance.

��� Global Perspective: Consider expanding your investment horizon beyond your local market. With the digital age, you have access to global opportunities, which can further fortify your wealth-building efforts.

🔐 Protect Your Fortress: Safeguard your investments with prudent risk management and insurance. A strong defense ensures that unforeseen events won't crumble your financial foundation.

🌟 Celebrate Milestones: Just as builders mark milestones with ceremonies, celebrate your financial achievements along the way. Whether it's reaching a certain investment goal or seeing your dividends grow, acknowledge your progress.

🌆 Enjoy the View: As your wealth fortress rises, take time to enjoy the view. Wealth isn't just about accumulating money; it's about gaining the freedom to pursue your dreams and passions.

Remember, your journey to wealth is uniquely yours, and every brick you lay brings you closer to your financial aspirations. So, are you ready to start building your wealth, one investment at a time? 🏰💸✨

1 note

·

View note

Photo

Have already started mine, what about you. The link in bio will help you, just check it out and you will never regret it www.abidarkoh1.wakeupnow.com #investingforthefuture#wakeupnow

0 notes

Video

youtube

"The future depends on what we do in the present." - Mahatma Gandhi

📰🔋 Get ready for an electrifying revelation in our latest issue of Sustainable Investing Digest! We are thrilled to shine the spotlight on the booming battery storage market and its crucial role in shaping a sustainable future! 💚🚀

According to Bloomberg New Energy Finance, battery storage investment worldwide doubled in 2020, surpassing $100 billion, and brace yourself for this mind-blowing projection - it's set to jump by nearly 80% to over $250 billion in 2023! 🤯💸

📈 Harnessing the Power of Technology Discover how batteries are transforming the energy landscape, ensuring grid reliability, and empowering the integration of renewable energy. Countries like India and Indonesia are gearing up for exponential growth, with massive investments planned in battery manufacturing. 💰🔌

👉 Making Sustainable Energy Affordable Over the past decade, the cost of lithium-ion batteries has plummeted by nearly 90%, thanks to groundbreaking technology improvements and large-scale manufacturing. This dramatic reduction in costs has made battery storage increasingly cost-competitive for large-scale energy needs. 💡🔋

🙌 Join the Energy Transition! Goldman Sachs proclaims, "Battery storage is a key enabling technology for the broader energy transition." The 10-year outlook for battery storage growth is incredibly strong, with technology advancements, cost reductions, and the growing need for grid flexibility and reliability driving the charge. 🚀🌟

🌎 Embrace the Future with Sustainable Investing Digest! The future of energy is green, and the time for action is NOW! Don't miss out on this opportunity to invest in innovative companies leading the charge toward a cleaner, greener world. The power is in your hands to shape the future you want to see. 💚⚡️

💪😍 Subscribe to Sustainable Investing Digest today and be part of the sustainable investment movement! Click this link to subscribe: https://lnkd.in/evwmY7wG

#sustainableinvesting #greenfinance #renewableenergy #battery #storage #climatechange #cleanenergy #investingforthefuture #gogreen #ecofriendly 🌱🌿

0 notes

Photo

These arrived today!!!! Super kaduper happy!!!! Woooot! Excited to read and learn so much more! #investingforthefuture #selfdevelopment #youcantgivewhatyoudonthave (at Ateneoville, Nangka)

0 notes