#in one of the episodes he becomes the vice president (the MC is the president)

Explore tagged Tumblr posts

Text

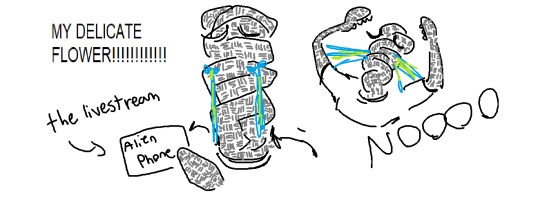

there is so much needed context to this but im posting it anyways

#vlorgnarb#project earth#OKAY CONTEXT#project earth (series about seeing into the multiverse and seeing what kind of person you could've been if you made other choices)#theres a character named tom wilson#in one of the episodes he becomes the vice president (the MC is the president)#IN THE EPISODE aliens are proven to be real#and VP tom marries one. named vlorgnarb. which is her#over there#ANYWAYS#TODAY#there was a MEETUP . and everyone was like “oh boy we're gonna see (our universe) tom wilson!”#(it's heavily implied to have not been our universe but the VP tom)#cause (he was wearing a mask) and he said something like 'oh im wearing a mask cause me and vlorgnarb were doing. things. and i didnt want#you guys to get contaminated'#and vlorgnarb Doesn't exist in our universe#at least probably not#VP tom got FUCKING KIDNAPPED ON LIVE#TWITCH DOT TV#LMFAOOOOOOOO#the context for the 'delicate flower' thing is that that was one of the things he yelled out while he was getting Kidnapped#So.#Context done

10 notes

·

View notes

Text

Passionate Leader of ENHYPEN, 양정원.

About Yang Jungwon

Stage Name: Jungwon (정원)

Birth Name: Yang Jung-won (양정원)

English Name: Johnny Yang

Position: Leader, Lead Vocalist, Lead Dancer*

Birthday: February 9, 2004

Zodiac Sign: Aquarius

Chinese Zodiac Sign: Monkey

Height: 174 cm (5’8 ½”)

Weight: N/A

Blood Type: AB

MBTI Type: ISTJ (His previous result was ESTJ)

Nationality: Korean

Solo Fandom Name: Edens

Yang Jung-won (Hangul: 양정원, Japanese: ヤン・ジョンウォン), more well known by his stage name Jungwon (Hangul: 정원, Japanese: ジョンウォン), is the leader of the South Korean boy group ENHYPEN. He was born on February 9, 2004.

I-LAND

On June 2, 2020, Jungwon, along with trainees Jay, Geonu, EJ, Kyungmin, via Twitter was revealed as an I-LAND contestant. It was also revealed he had been a trainee for three years and four months. On September 18, 2020, he ranked 1st place, becoming a part of the official lineup of ENHYPEN.

On November 30, he then debuted in ENHYPEN with the release of their first mini album Border : Day One.

Radio DJ

On February 7, 2022, it was announced that Jungwon, alongside Sunoo, would be the new radio DJs for the EBS radio show Listen. Their first episode would then be broadcasted on February 13 and will air every Sunday from 7 to 9 PM KST. However, on February 11, it was announced that Sunoo, his fellow DJ, had tested positive for COVID on the 10th after going to the hospital for fever symptoms on the 9th, and so their first broadcast will instead be postponed to February 20.

Pre Debut

In I-LAND's first episode, he performed "All I Wanna Do" by Jay Park, along with Yoonwon and Taeyong

He was a former Taekwondo athlete.

He is currently roommates with Jake and Sunoo.

His least favorite subject to study in school was math.

He is a former SM Entertainment. Jungwon was a former SM trainee before he joined Big Hit. A mom of a friend who was also a Big Hit trainee at the time, showed Jungwon’s photo to a casting director, and that was how he got recruited.

When he was still in I-LAND, he put ‘acrobatics’ as his hidden talent.

Jungwon has a sister who is 2 years older than him and he said they have very similar eyes.

He was praised by Bang PD during I-LAND for having a unique and charming voice.

Jungwon is described by his classmates as 100% pure milk, really kind, soft-spoken, and laughs a lot with his friends.

Jungwon was the class president for 5 years straight in his class followed by being the vice president in 6th grade.

He was selected to become ENHYPEN’s leader after a 40-day selection process, which included interviews with all members and test.

Hobbies & Skills

Jungwon is very well-spoken. He was formerly the MC of EBS Listen along with Sunoo, which broadcasted every Sunday at 10 pm KST.

He did taekwondo for 7 years and was a taekwondo athlete for 4 years.

He is good at table tennis. He was formerly a table tennis club member at school.

Jungwon is widely praised for unique singing skills and his dancing skills, and he is particularly good at popping

Likes & Dislikes

Jungwon loves his family dog Maeumi (he/him) who was coincidentally rescued on Jay’s birthday the same year ENHYPEN debuted in 2020.

He is allergic to cats but he likes to watch cat videos to relieve stress.

Jungwon’s favorite color is blue.

Jungwon enjoys watching drama series when he can to help him understand emotions and relationships better which he finds helpful for composing and writing.

Jungwon dislikes wearing socks to bed.

He also dislikes chewing food loudly.

Jungwon likes Twix the best out of chocolate candies.

Personality

Jungwon is a person who is known for keeping his promises. Thus far, he has never broken a promise he has made with Engenes. (source)

Jungwon enjoys engaging with fans, meeting fan requests, and interacting almost daily with Engenes on social media.

Jungwon is usually the first to get up in the morning, and he helps wake up the rest of the members. (source)

He is often the last to shower after his members, and He will turn the shower tap to cold before he exits because his grandmother taught him that it would conserve the utility bills.

Jungwon doesn’t usually play computer games, but he does occasionally play to get closer to the other members.

Jungwon has a caring personality, and often brings things in his bag for the benefit of the other members. For example, he carried mosquito repellant for Sunghoon for a shoot because he knew Sunghoon was allergic to mosquito bites.

Fun facts

Jungwon wrote the topline (melody & lyrics) to “Hundred Broken Hearts” on ROMANCE: UNTOLD.

Jungwon popularized the buzzword ‘Lezzugo!’ (Let’s go!) since their I-LAND days.

His favorite movie is Aladdin

The members pick him as one who works the hardest among the group

Jungwon trained for 1 year and 4 months (according to I-LAND profiles)

He is currently a student at Hanlim High School

Chinese ENGENEs often address Jungwon as ‘Yang Emperor’ (梁帝). It’s a play on word since it has the same pronunciation as 弟 (little brother) in chinese.

He is also frequently called ‘President Yang/ President Yang Jungwon’ (대통령 양정원) by Korean ENGENEs

Jungwon was Elected as the ‘President of K-pop’ in Whosfan Global Fan Vote

He was also selected as ‘Idol who is the Communication King’- He comes online almost daily with greetings like “good morning”, “have a great lunch”, and “good night”

Jungwon is the member who updates the most on their SNS accounts (Weverse and Twitter). He posts almost daily. He also does solo Vlives frequently.

Jungwon (along with Ni-Ki) were selected as Enhypen’s representatives for the first ever Mix & Match collaboration by Studio Choom.

Jungwon has three cacti: Miniwon, Injang and Garden. Injang and Garden were gifts from RM (leader of BTS) during I-land. 'Injang' passed away despite Jungwon’s efforts to revive it by repotting it.

He is also a donator to UNICEF (according to Jay on a vlive). He also supports an organization that focuses on creating jobs for older women with financial difficulties called ‘Marco Roho’.

Jungwon loves to take walks in the rain.

Jungwon and Sunoo are similar in height, as mentioned by Sunoo in one of the episode of their EBS Listen FM Radio.

Jungwon’s shoe size is 42.

Disclaimer :

Due to 𝕏’s new policy, I’m posting a disclaimer and would like to mention that I am not the real. This account is not affiliated with the real one. This is account made for rp or roleplayer purposes only.

⠀

0 notes

Text

WHY I LOVE : JUJUTSU KAISEN

A/N: Hi, yes I’m back. I’m sorry for being inactive for 60 smth days and probably going to be inactive for another 2 weeks because of exams but it’s fine. <3 I promise I binged lots of animes and I’m back with more headcanons. Also, I’m not sure if you guys would like me to do more than headcanons, but do tell if you want me to. I started this as a fun blog and hope to continue that even though I’m always inactive lol. Anyways, here you go, a jujutsu kaisen rant! Ps: these are my personal thoughts and feelings, if you don’t agree with them then fair enough! ^^

Genre: Crack/Comedy/?reviewing?

A/U(s): None.

Warnings: spoilers are put in brackets and are red! Watch out for them. :D

Trigger warnings: None.

Summary: Just me ranting. :)

UHHH REVIEW TIME! The main characters ;)

Megumi Fushiguro

Megumi is best sasuke trope boy. By far my favorite emo boy. Why? Well, it’s mostly because when animes introduce characters like Megumi they’re all emo and have to avenge their village and kill people and are ‘brocken’ or smth idk.

But jujutsu kaisen does the whole sasuke trope a big middle finger and makes Megumi a less tsundere, and broken character.

Honestly, I never expected Megumi to have this type of personality because most animes try to give his archetype the whole ‘their honest’ when in reality they are just rude and selfish. Megumi is literally honest. My guy had no problems telling Gojou that he wants Yuji to stay as his own opinion which if you asked any of the people under this archetype they would respond with ‘Ugh, just keep him alive okay?’.

Like he is honestly sweet and even when trying to force Yuji and Nobara to leave it WASNT for his own well-being it was for theirs. Literally is the opposite of Ray, Sasuke, and any type of character that is emo and rude. Also he is one of the few characters that deserves to be as powerful as he is because he didn’t get his powers because of ‘his burning rage for the person who killed his village as he tries to avenge them.’ And he also has a bad background but is quite an average character. I just appreciate him. :)

Nobara Kugisaki

AMAZING-

Honestly though, she’s amazing. My favorite character since she literally is a girly girl yet is powerful (nothing wrong with that, it’s just wow.), which hear me out.

Most shounen anime girls fall under 3 categories of female characters.

The useless damsel in distress that is a tsundere.

‘Another Naruto reference? Seriously Mochi?’ I’m so sorry my lovely reader, but Naruto is one of the founding fathers of all Shounen anime stereotypes. So yes, another Naruto reference.

First of all, I don’t hate this characters, I actually don’t dislike them either. That being said I don’t like them. I get this neutral emotion whenever someone like idk Sakura I guess is on screen next to Aiura Mikoto (Who btw, is another underrated female character that deserves love even though the anime is crack-y.). I guess it’s because throughout all of the Arc’s and episodes, Sakura hasn’t changed or developed or even learned from past mistakes. It sucks seeing character that could’ve had potential, being boring and just bad. Also she’s ungrateful for her parents for no reason, and that just says a lot about her persona. To be honest, most Naruto female characters are like this, and I don’t want to hear crap about Hinata’s character because she barely got screen time and the only times we see her is when the creator pushes her to be next to Naruto more often or if the whole gang is together. (I watched a bit of Naruto so I could be wrong about this whole thing but this is again, my opinion.)

The dimwit and clumsy/tsundere/strong female fan service

Oh look, it’s everyone’s ‘favorite’ Erza Scarlet from Fairytail. But whoops, her whole character is just her having cleavage. Or everyone’s favorite crime Taboo Tattoo (I didn’t watch it but most fans have come together and agreed that it would’ve been a decent anime without all of the fan service.) Or maybe the stereotypical dimwit character that is clumsy?

Yeah, you know who I’m talking about right?

I feel like some animes, that are 23 minutes long, would be reduced to around 15 minutes without all the fan service (not counting the Opening or ending)

(Also all the dumb jokes, but that’s for another time.)

Looking at how many creators complain they can’t go too in-depth with their OC’s, because they don’t have much time, but they somehow can fit in a whole scene of people literally having their clothes ripped off because of how ‘delicious’ it is. Yes, I’m coming after you Food Wars. Even though I am a big fan, that doesn’t mean I can ignore the flaws. I am fair and will admit that, as far as characters go, Food Wars is shallow.

Personally, mha is also another crime with lots of fan service of 15-16 year old girls. 😀

I don’t want to get into the heated Hero Hei debate wether this doesn’t count because they’re ‘fictional’ or if it does. So moving on.

Can I mention how much Momo Yaoyorozu could’ve been an amazing character with amazing development and a cool quirk? I mean personally, I hate how Momo is now just fanservice. This queen has an amazing quirk, went in through recommendations, smart, helpful, is class Vice President, heroic, tall, thoughtful, rich but doesn’t brag about it and is humble, and just a cool character that could be delved deeper on?

Haha nope. Boobs.

avegsjhsowhaGEJEGOA

W h a t

This literal queen could carry this series on her back yet they have the audacity to make her have zero personality and just a background character? Like excuse me, I don’t think you understand, but Principle Nezu has more screen time than her. Literally her and Koda (Creati and Anima) could be so cool but no one ever acknowledges them. :(

Anyways let’s move on.

And finally, the love interest.

Ochako Uraraka. That’s it.

Ochako really deserves more, honestly. I was hyped up in the sports fest. because she just showed off that she isn’t backing down, and now she’s just a mindless love interest.

Honestly, I don’t like talking about this topic the most because A, it’s controversial for some reason. And B, it sucks seeing these amazing characters being watered down to just a love interest.

OH BUT NOBARA? NOBARA?

SHE DOESN’T NEED ANYONE!

She’s fine on her own, thank you very much.

I mean best scene was when she was fighting Sabrina the witch and didn’t seem to care much about scars and she just debunked all of those things and I just UGGGHHHH- <33333

Like animes try so hard to have a feminist role model by making her tomboyish and mean and a tsundere and calls anyone that looks at her a pervert.

But Nobara isn’t any of that. Nobara is fashionable and powerful. She loves shopping. She loves eating expensive. She loves Luxuries. She loves proving people she’s strong. She isn’t easily scared. She protects, and I just love her. She isn’t your stereotypical tomboy or at least she doesn’t fall into the smurfette effect or smth.

Tbh, I was worried when she joined them. I said either she’s a tomboy who’s a tsundere or a soft spoken damsel in distress, but now that I’ve seen her, I know that Nobara is Nobara. And that you all should appreciate her also.

Okay enough of that rant lol, moving on to Yuji!

Yuji Itadori

I LOVE THIS MC!

Are we going to use stereotypes again? Yes we are!

Usually shounen MCs have the worst personality either being too bland (mf MC from re-zero) or just too much of a coward/weakling/pervert/happy-go-lucky character.

I mean, if we are going to have a strong character he has to be a pervert for some reason.

A respectful character is a crybaby/weakling.

And a happy character has a dark secret side and ‘OmG lOoK hE’s SoO sc a Ry!1!1!’.

And tbh Yuji falls in the rare category.

The category that isn’t a crybaby, perverted, 11 year old that looks like he’s at least 20.

That category is what I’d like to call. The Saiki K. category.

I love MC’s like this because they aren’t too shallow, but not the whole story is about THEM and THEM ONLY.

It’s amazing to see how they still have the same personality but somehow have went through a bigger character development than all those other MC’s.

(Not disrespecting your faves, once again this is a personal opinion-)

And the way he isn’t OP and actually has trouble and the way (Slight spoilers!) that we can see that when he asks Sukuna to heal yoshino and the way Sukuna just laughs and I just like how they didn’t make Yuji just ‘become OP through the power of friendship’ and just they accepted he was dead or how his hand was cut off and he accepted it but how when he was dying he actually cried saying how he didn’t want to die showing us hey, it’s okay to cry but please don’t cry when you win a prize or competition or something. (End of spoilers!)

Ugh I just love Yuji being an MC. Again, he is one of those few rare MC’s with interesting character design, and personality without overwhelming it or just underwhelm it.

AND FINALLY YES ITS HIS TIME

Satoru Gojo

I DIDNT EXPECT HIM TO BE THIS GOOFY LMAO-

Honestly most surprising character.

DHEUIWOWV should I make a separate post for the plot, story and Gojo? It’s getting late where I am sooo this gonna get a continuation! I’m Mochi and see you guys next time, Bye-Bye! (。- u -。)

#jujutsu kaisen#jujutsu sorcerer#jujutsu#kaisen#kk#kugisaki nobara#Kugisaki#Nobara#megumi fushiguro#Megumi#Fushiguro#yuji itadori#Yuji#Itadori#gojo saturo#Gojo#Saturo#review#RGKSUEOS IM SORRY FOR CUTTING IT SHORT-#sorry for being inactive#hey 😏😩😩

12 notes

·

View notes

Text

The Wall Street bankers who feast during recessions say there's a 'smell in the air' and it's starting to feel like 2007 (MC, HLI, GHL)

New Post has been published on http://foursprout.com/wealth/the-wall-street-bankers-who-feast-during-recessions-say-theres-a-smell-in-the-air-and-its-starting-to-feel-like-2007-mc-hli-ghl/

The Wall Street bankers who feast during recessions say there's a 'smell in the air' and it's starting to feel like 2007 (MC, HLI, GHL)

The global economy is growing and corporate defaults are low and projected to drop even further.

Yet the Wall Street investment bankers who feast during recessions are optimistic about their business, and some say it’s starting to feel like it did just before the financial crisis.

Top restructuring firms have been filling out their rosters of talent to be prepared in case of an economic recession.

Restructuring bankers told Business Insider that a massive amount high-yield debt issued in recent years could produce defaults and keep them busy even without a recession.

Another source of optimism: The restructuring business has changed since the last financial crisis, with firms finding year-round work across the globe by providing solutions to companies before they get to bankruptcy court.

At an earnings call in April, an analyst pressed bank CEO Ken Moelis on his rosy outlook for his firm’s restructuring business — the corner of Wall Street known for advising companies with messy books veering toward bankruptcy.

For a healthy chunk of his opening commentary, the namesake founder and CEO of independent investment bank Moelis & Co. touted his firm’s “market-leading restructuring business” for supplying meaningful activity.

“Your comments were surprisingly positive,” said Ken Worthington, a senior equity analyst with JPMorgan Chase. “Is this sort of steady state for you in a lousy environment? Can things only get better from here?”

On the surface, market conditions are showing few signs of distress. The economies in the US and throughout the developed world are growing, the stock market has been upbeat despite fits of volatility, and corporate default rates remain low and are projected to fall further in 2018 and beyond.

So why was Moelis so optimistic about his restructuring team?

“Look, it could get worse. I guess nobody could default,” Moelis said. (Keep in mind that “worse” from the perspective of a restructuring banker, who feasts during recessions, means “better” for most of the rest of the world). “But I think between 1% and 0% defaults and 1% and 5% defaults, I would bet we hit 5% before we hit 0%.”

The billionaire dealmaker isn’t alone in his sentiment. Many on Wall Street are scrutinizing cracks in the economy’s glossy veneer.

JPMorgan copresident and investmen banking head Daniel Pinto told Business Insider in March that a 40% correction, triggered by inflation and rising interest rates, could be looming on the horizon.

The market’s biggest money managers are already positioning as if a major economic downturn is near, according to research this month from Bank of America Merrill Lynch.

And while they’re quick to note that no one can predict the next collapse, Wall Street’s top restructuring bankers are also joining in the chorus cautioning that the economic boom may be on its last legs.

“I do think we’re all feeling like where we were back in 2007,” Bill Derrough, the cohead of recapitalization and restructuring at Moelis & Co., told Business Insider. “There was sort of a smell in the air; there were some crazy deals getting done. You just knew it was a matter of time.”

Business Insider spoke with several top restructuring bankers who were all buoyant on the outlook for their industry, in part because of disconcerting trends facing debt-burdened companies but also because of how the business has changed since the last financial crisis.

Massive debt, rising interest rates, flimsy covenants

The global default rate for weak companies is indeed very low; it climbed in March to 3.9% on the struggles of a handful of retail and oil and gas firms, but it ticked back down to 3% in April and is expected to dip to 1.2% a year from now, according to Moody’s.

But as Moelis alluded to in his investor call, the amount of high-yield corporate debt — bonds and loans issued to riskier companies — doled out in the US in recent years is at levels far exceeding precrisis highs.

Historically, large volumes of high-yield issuance “has led, after a period of time, to an increased level of restructuring,” according to Steve Zelin, head of the restructuring in the Americas at PJT Partners.

Four of the past five years have seen both high-yield bond and leveraged loan issuance that exceeded 2007’s precrisis levels. Further, 2017 was the highest year on record for US leveraged lending, with volume of $1.4 trillion nearly 25% more than the previous high point, in 2013, according to Thomson Reuters data.

“Even if there is not a recession or credit correction, with the sheer volume of issuance there are going to be defaults that take place,” said Neil Augustine, cohead of the restructuring practice at Greenhill & Co.

Granted, the glut of debt is in no small part attributable to the super-low-interest-rate environment imposed by the Federal Reserve following the crisis. Many companies took advantage and refinanced their debt before 2015 when a large swath was set to mature, kicking the can several years down the road.

But going forward “there’s going to be refinancing at significantly higher rates,” Zelin said, given the Fed in March hiked interest rates to the highest level since 2008 and is expected to unleash at least two more hikes in 2018.

Refinancing at higher rates will further shrink the margin of error for troubled companies, as they’ll have to dedicate additional cash flow to cover more expensive interest payments.

“When you have highly leveraged companies and even a modest rise in interest rates, that can result in an increase in restructuring activity,” Irwin Gold, executive chairman at Houlihan Lokey and cofounder of the firm’s restructuring group, said.

And as some bankers said, with investors stretching for yield amid low interest rates, covenant packages on debt deals have grown increasingly flimsy.

But another reason for optimism has to do with how restructuring has changed since the financial crisis. For top firms, it’s become all-weather business in which bankers can earn fees by solving problems and cleaning up balance sheets before a company is teetering upon financial ruin.

“The way restructuring used to work, it was more of an episodic business associated primarily with a spike in default rates,” Gold said. “When you get an environment like 2009, 2010, you’re obviously swimming in opportunities, but we’re quite busy right now and we have been for the last couple of years. We’re always prepared. We’re going after opportunities all the time.”

Part of Moelis & Co.’s strategy involves working with clients before they ever end up in bankruptcy court — arranging debt buybacks and using exchange offers to lessen the debt load and capture discounts. About 50% of its restructuring mandates are completed out of court, according to the firm.

‘There will be a massive amount of work to do’

Still, some firms have been filling out their rosters with talent to be prepared should the economy take a turn for the worse.

“The restructuring business is a good business during normal times and an excellent business during a recessionary environment,” Augustine said. “Ultimately, when a recession or credit correction does happen, there will be a massive amount of work to do on the restructuring side”

Greenhill hired Augustine from Rothschild in March to cohead its restructuring practice. The firm also hired George Mack from Barclays last summer to cohead restructuring. The duo, along with Greenhill vet and fellow cohead Eric Mendelsohn, are building out the firm’s team from a six-person operation to 25 bankers.

Evercore Partners in May hired Gregory Berube, formerly the head of Americas restructuring at Goldman Sachs, as a senior managing director. The firm also poached Roopesh Shah, formerly the chief of Goldman Sachs’ restructuring business, to join its restructuring business in early 2017.

“It feels awfully toppy, so people are looking around and saying, ‘If I need to build a business, we need to go out and hire some talent,'” one headhunter with restructuring expertise told Business Insider.

It’s not exactly a war for talent at this point, though. Firms are primarily adding for junior and mid-level positions, according to the recruiter, who’s noticed job advertisements online and in trade publications for restructuring positions from several large firms.

“Places that don’t traditionally need to advertise in trade rags are popping up,” the recruiter said. Evercore, for instance, has job postings online for restructuring analysts, associates, and vice presidents.

“In our world, people are just anticipating that it’s coming. People are trying to position their teams to be ready for it,” Derrough said. “That was the lesson from last cycle: Better to invest early and have a cohesive team that can do the work right away and maybe be a little bit overstaffed early, so that you can execute for your clients when the music ultimately stops.”

It’s anybody’s guess when that day will come, as nobody has a crystal ball, aside from Ken Moelis, who is said to keep one on a stand in his office that he picked up at a flea market in Paris.

Join the conversation about this story »

NOW WATCH: Millennials are driving a shift in investing — here’s how to meet your financial and social impact goals

1 note

·

View note

Text

The Wall Street bankers who feast during recessions say there's a 'smell in the air' and it's starting to feel like 2007 (MC, HLI, GHL)

New Post has been published on http://foursprout.com/wealth/the-wall-street-bankers-who-feast-during-recessions-say-theres-a-smell-in-the-air-and-its-starting-to-feel-like-2007-mc-hli-ghl/

The Wall Street bankers who feast during recessions say there's a 'smell in the air' and it's starting to feel like 2007 (MC, HLI, GHL)

The global economy is growing and corporate defaults are low and projected to drop even further.

Yet the Wall Street investment bankers who feast during recessions are optimistic about their business, and some say it’s starting to feel like it did just before the financial crisis.

Top restructuring firms have been filling out their rosters of talent to be prepared in case of an economic recession.

Restructuring bankers told Business Insider that a massive amount high-yield debt issued in recent years could produce defaults and keep them busy even without a recession.

Another source of optimism: The restructuring business has changed since the last financial crisis, with firms finding year-round work across the globe by providing solutions to companies before they get to bankruptcy court.

At an earnings call in April, an analyst pressed bank CEO Ken Moelis on his rosy outlook for his firm’s restructuring business — the corner of Wall Street known for advising companies with messy books veering toward bankruptcy.

For a healthy chunk of his opening commentary, the namesake founder and CEO of independent investment bank Moelis & Co. touted his firm’s “market-leading restructuring business” for supplying meaningful activity.

“Your comments were surprisingly positive,” said Ken Worthington, a senior equity analyst with JPMorgan Chase. “Is this sort of steady state for you in a lousy environment? Can things only get better from here?”

On the surface, market conditions are showing few signs of distress. The economies in the US and throughout the developed world are growing, the stock market has been upbeat despite fits of volatility, and corporate default rates remain low and are projected to fall further in 2018 and beyond.

So why was Moelis so optimistic about his restructuring team?

“Look, it could get worse. I guess nobody could default,” Moelis said. (Keep in mind that “worse” from the perspective of a restructuring banker, who feasts during recessions, means “better” for most of the rest of the world). “But I think between 1% and 0% defaults and 1% and 5% defaults, I would bet we hit 5% before we hit 0%.”

The billionaire dealmaker isn’t alone in his sentiment. Many on Wall Street are scrutinizing cracks in the economy’s glossy veneer.

JPMorgan copresident and investmen banking head Daniel Pinto told Business Insider in March that a 40% correction, triggered by inflation and rising interest rates, could be looming on the horizon.

The market’s biggest money managers are already positioning as if a major economic downturn is near, according to research this month from Bank of America Merrill Lynch.

And while they’re quick to note that no one can predict the next collapse, Wall Street’s top restructuring bankers are also joining in the chorus cautioning that the economic boom may be on its last legs.

“I do think we’re all feeling like where we were back in 2007,” Bill Derrough, the cohead of recapitalization and restructuring at Moelis & Co., told Business Insider. “There was sort of a smell in the air; there were some crazy deals getting done. You just knew it was a matter of time.”

Business Insider spoke with several top restructuring bankers who were all buoyant on the outlook for their industry, in part because of disconcerting trends facing debt-burdened companies but also because of how the business has changed since the last financial crisis.

Massive debt, rising interest rates, flimsy covenants

The global default rate for weak companies is indeed very low; it climbed in March to 3.9% on the struggles of a handful of retail and oil and gas firms, but it ticked back down to 3% in April and is expected to dip to 1.2% a year from now, according to Moody’s.

But as Moelis alluded to in his investor call, the amount of high-yield corporate debt — bonds and loans issued to riskier companies — doled out in the US in recent years is at levels far exceeding precrisis highs.

Historically, large volumes of high-yield issuance “has led, after a period of time, to an increased level of restructuring,” according to Steve Zelin, head of the restructuring in the Americas at PJT Partners.

Four of the past five years have seen both high-yield bond and leveraged loan issuance that exceeded 2007’s precrisis levels. Further, 2017 was the highest year on record for US leveraged lending, with volume of $1.4 trillion nearly 25% more than the previous high point, in 2013, according to Thomson Reuters data.

“Even if there is not a recession or credit correction, with the sheer volume of issuance there are going to be defaults that take place,” said Neil Augustine, cohead of the restructuring practice at Greenhill & Co.

Granted, the glut of debt is in no small part attributable to the super-low-interest-rate environment imposed by the Federal Reserve following the crisis. Many companies took advantage and refinanced their debt before 2015 when a large swath was set to mature, kicking the can several years down the road.

But going forward “there’s going to be refinancing at significantly higher rates,” Zelin said, given the Fed in March hiked interest rates to the highest level since 2008 and is expected to unleash at least two more hikes in 2018.

Refinancing at higher rates will further shrink the margin of error for troubled companies, as they’ll have to dedicate additional cash flow to cover more expensive interest payments.

“When you have highly leveraged companies and even a modest rise in interest rates, that can result in an increase in restructuring activity,” Irwin Gold, executive chairman at Houlihan Lokey and cofounder of the firm’s restructuring group, said.

And as some bankers said, with investors stretching for yield amid low interest rates, covenant packages on debt deals have grown increasingly flimsy.

But another reason for optimism has to do with how restructuring has changed since the financial crisis. For top firms, it’s become all-weather business in which bankers can earn fees by solving problems and cleaning up balance sheets before a company is teetering upon financial ruin.

“The way restructuring used to work, it was more of an episodic business associated primarily with a spike in default rates,” Gold said. “When you get an environment like 2009, 2010, you’re obviously swimming in opportunities, but we’re quite busy right now and we have been for the last couple of years. We’re always prepared. We’re going after opportunities all the time.”

Part of Moelis & Co.’s strategy involves working with clients before they ever end up in bankruptcy court — arranging debt buybacks and using exchange offers to lessen the debt load and capture discounts. About 50% of its restructuring mandates are completed out of court, according to the firm.

‘There will be a massive amount of work to do’

Still, some firms have been filling out their rosters with talent to be prepared should the economy take a turn for the worse.

“The restructuring business is a good business during normal times and an excellent business during a recessionary environment,” Augustine said. “Ultimately, when a recession or credit correction does happen, there will be a massive amount of work to do on the restructuring side”

Greenhill hired Augustine from Rothschild in March to cohead its restructuring practice. The firm also hired George Mack from Barclays last summer to cohead restructuring. The duo, along with Greenhill vet and fellow cohead Eric Mendelsohn, are building out the firm’s team from a six-person operation to 25 bankers.

Evercore Partners in May hired Gregory Berube, formerly the head of Americas restructuring at Goldman Sachs, as a senior managing director. The firm also poached Roopesh Shah, formerly the chief of Goldman Sachs’ restructuring business, to join its restructuring business in early 2017.

“It feels awfully toppy, so people are looking around and saying, ‘If I need to build a business, we need to go out and hire some talent,'” one headhunter with restructuring expertise told Business Insider.

It’s not exactly a war for talent at this point, though. Firms are primarily adding for junior and mid-level positions, according to the recruiter, who’s noticed job advertisements online and in trade publications for restructuring positions from several large firms.

“Places that don’t traditionally need to advertise in trade rags are popping up,” the recruiter said. Evercore, for instance, has job postings online for restructuring analysts, associates, and vice presidents.

“In our world, people are just anticipating that it’s coming. People are trying to position their teams to be ready for it,” Derrough said. “That was the lesson from last cycle: Better to invest early and have a cohesive team that can do the work right away and maybe be a little bit overstaffed early, so that you can execute for your clients when the music ultimately stops.”

It’s anybody’s guess when that day will come, as nobody has a crystal ball, aside from Ken Moelis, who is said to keep one on a stand in his office that he picked up at a flea market in Paris.

Join the conversation about this story »

NOW WATCH: Millennials are driving a shift in investing — here’s how to meet your financial and social impact goals

1 note

·

View note

Text

Pararelationships and Media Fandom: Good or Bad?

In this particular post, the subject matter will revolve around pararelationships we develop through fictional narratives on television shows and media fandom. To be more specific, I will be discussing my own personal pararelationship that I had with the cast from the FX original series, Sons of Anarchy, and the positive and negative effects caused by its fandom.

Going to high school in North Las Vegas was a humbling experience for me. At the age of fourteen, being a mixed race teenager with no direction in life, I found myself to be a bit of a loner, just trying to fit in anywhere I could. Now, because I didn’t have a lot of true friends around, I usually would try to drown out the emptiness by listening to music or watching television. Before I knew it, 2008 roll around with one of the most ground breaking hit crime dramas in FX network history, Sons of Anarchy. The series revolves around the vice president of an outlaw motorcycle club that deals in running illegal firearms out of their fictional central California town called “Charming”, who learns though the finding of a manuscript written by his father and founder of the club that he never wanted the direction of the MC to go the way it did, and now wants to change it for the better.

“When you’ve watched an actor laugh, cry, and share secrets through the media, it makes sense that you feel you know that person.” (Dill, p.53) From the very first episode I was intensely drawn in as if I were there riding in the pack along side these men, one of the main reasons being because no matter what they seemed to get themselves into, they always had each other to lean on. A brotherhood if you will, which, I had never experienced before. “We might daydream about Jon Stewart of the Daily Show laughing at our jokes, or secretly fantasize that our attraction to Johnny Depp or Gwyneth Paltrow might someday be returned.” (Dill, p.53). Later on in life, when I was able to break out of my shell, this became one of the main aspects I look for in friendships. And so far it has served me pretty well. None the less, even though I am able to point out the positives, there are still some negative effects that lie ahead. When reading through Karen Dill’s book, How Fantasy Becomes Reality, I learned that “in many ways, we learn how we should act from watching social interactions on television”. (Dill, p.52). This links to a term called, “Vicarious Reinforcement”, which is something I’ll get more in-depth with in a later post. The majority of the social interactions seen on this show display a lot of graphic and sometime gory violence from bar-room brawls to contract killings. That and plenty of sexual content that a young man like myself just could not look away from. During this time in which I was obsessed with this show, I realize that I would get into more physical confrontations than ever before, which, in hindsight was not the best way for me to act seeing how I am actually not as tough as I look. Not to mention my attitude towards authority figures and law enforcement could only be described as absolutely defiant which led me to nothing but trouble down the road. Unfortunately, this is what I was subjected to at a young age. “The end result is (sometimes unintended) learning to value more extreme behaviors because we are exposed to them more often, and they therefore become more normal to us.” (Dill, p.53).

youtube

However, I was not the only one who gained pararelationships with these gritty characters. Not by along shot. In no time, people started to catch on, band together on social media, and before we knew it, the show created a “fandom” like never before. “This refers to a subculture of fans of a particular film or TV series and can often be seen through the creation of fan-generated content that either responds to the TV series or Film, such as, artwork, videos, and social media pages.

“The Sons of Anarchy fandom creates this style of converging content and in turn a subculture of die hard fans that create Facebook sites that have over 6 million likes” (sonsinsideandout.wordpress.com, 2014). I told you I wasn’t the only one!

youtube

Is the fandom really doing as much good as its seems? I honestly believe it has in the way that it started a world-wide motorcycle craze that got a lot of people riding bikes again which I am completely for because I grew up riding dirt bikes in this crazy desert and is so much fun to do. It gave a lot of talented actors and writers the break they need to make their careers take off into the stars. The only thing I could really take into the negative side is the fan clothing they started to make. Not all of it though. There’s nothing wrong with the t-shirts, hats, and other cool swag they have to offer. It is the leather vests with the SOA patches on the back that a lot of super fans of the show wear in public. Now I know Sons of Anarchy is a fictional club, but it is the actual real life outlaw MC’s that take issue with this, and take it as a sign of disrespect. Some of these super-fans on the street seen wearing these vests have been subject to beatings and even having the vest removed and taken away. The steps one must go through vary from club to club, but according to One Percenter Bikers (onepercenterbikers.com, sec.8), these are the lengthy phases you must go through in order to become a full fledged member of an outlaw motorcycle club,

1. Hang-around: You literally just hang out and go to club events, 3 year process. You have to be invited by a club member.

2. Associate: Go to more events and meet more members. 3 more years ending with an evaluation/vote to start the stage of

3. Prospect: You attend more events and are allowed to attend some meetings. This part can also last up to 2 years.

4. Full Patch Membership: This occurs only after a unanimous vote from all members.

Like I said it is a very long and hard process of evaluation and most men don’t even make it in, so I could definitely see why outlaw bikers find it disrespectful and make a huge deal about it. To wrap this up, I would say media fandom is an amazing and beautiful thing for a television show or movie franchise to gain, for the reason that it can really help its success, but some subcultures like the 1%er community just do not respond to it very well to it. On the other hand, pararelationships are can definitely be a positive thing, but can also leave some lingering negative effects lying around.

Dill, K. (2009). How Fantasy Becomes Reality: Seeing Through Media Influence (p. 53). New York, NY: Oxford University Press.

Dill, K. (2009). How Fantasy Becomes Reality: Seeing Through Media Influence (p. 52). New York, NY: Oxford University Press.

Dill, K. (2009). How Fantasy Becomes Reality: Seeing Through Media Influence (p. 53, para 1). New York, NY: Oxford University Press.

The Convergence Culture of the Sons of Anarchy Fan Sites (2014, May 5). In SOA Inside and Out . Retrieved April 3, 2017, from https://sonsinsideandout.wordpress.com/2014/05/05/the-convergence-culture-of-the-sons-of-anarchy-fan-sites/

Hells Angels Membership Requirements (2017). In One Percenter Bikers. Retrieved April 7, 2017, from http://www.onepercenterbikers.com/hells-angels-membership-requirements/

0 notes