#implementing hr policies and procedures

Explore tagged Tumblr posts

Text

#list hr policies#best hr policies to implement#basic hr policies and procedures#common hr policies and procedures#hr policy to employees#global hr policies#general human resources policies and procedures#must have hr policies#hr policies you must have#policies hr should have#hr policies and procedures for small business#implementing hr policies and procedures#humanresourcemanagement#humanresource#hrm#hrprocess#future of work#new employee#probation period#hr#probation process

0 notes

Text

Are you ambitious? Is work just a paycheck? Tired of being a slacker? Want to turn that frown upside down?

Then, boy have we got the job for you!

Our recent wave of hires has begun to ebb, so we're putting you all on notice: We're hiring! See open positions below.

Bureau of Client Engagement

You're on the front lines, keeping our clients happy and developing relationships that last a life time!

-Billing -Escalations -Product Support -Quality Assurance

Bureau of Compliance

You keep us on the straight & narrow; working closely (but not too closely) with bureau leadership to perform internal audits; create, continuously refine, and enforce the policies and procedures for your assigned bureau and the company as a whole.

-Client Engagement -Facilities -Finance -Human Resources -Information and Technology -Marketing

Bureau of Facilities

Without you, we'd just be a bunch of well-dressed folks standing around in a cold, empty building. We need you to make sure everything's working as it should be and that we're always fully stocked on all the things that keep us energized and productive!

-Mechanical (Electrical, Elevators, Equipment Maintenance) -Premise (Grounds Maintenance and Real Estate Management) -Purchasing (From pushpins to pallet jacks)

Bureau of Human Resources

You are we, and we are, apparently, where the party's at; everyone and their uncle Fred wants to be in HR. Come November, it'll be your time to shine. The yearly benefits package will roll out and people will have questions, lots of questions, and we need you to answer them because we're all too busy handling other things. Please!

-Employee Benefits

Bureau of Finance

From the assets we already have to our future investments and everything in between, you're on top of the comings and goings of every §imoleon we have to our name.

-Asset Management -Travel and Accommodations -Vendor Relations

Bureau of Information & Technology

Desk phones? Softphones? Company-issued mobile devices? THE INTERNET?! That's all you, babe!

-Telecommunications

Bureau of Marketing

The copywriters and designers are often just a ball of unleashed creativity until you step in; after R&D, you're the beginning and the end of what we're slapping our logo on or putting our name behind; we can't do it without you!

-Planning and Implementation

We appreciate your interest. It's never too late to JOIN US! -HR

Tags are not 100% reliable, so be sure to drop us an ask if you want to make sure you've been queued. You can also check out the full list of bureaus and delegations here.

34 notes

·

View notes

Text

Company Setup in India by Masllp: Simplifying Business Formation

India is emerging as one of the world’s fastest-growing economies, making it a hotspot for entrepreneurs and businesses looking to expand. Setting up a company in India can be incredibly rewarding, but navigating the legal, regulatory, and procedural complexities can be daunting. This is where Masllp, a trusted name in business consultancy, comes into play.

Masllp specializes in company setup in India, offering end-to-end solutions that simplify the process, save time, and ensure compliance with all legal requirements.

Why Choose India for Your Business? Before diving into the details of setting up a company, let’s explore why India is an attractive destination for businesses:

Growing Economy: India’s economy is projected to grow rapidly, providing numerous opportunities for businesses in various sectors. Large Market: With a population of over 1.4 billion, India offers access to a vast consumer base. Favorable Policies: The Indian government has implemented pro-business policies, including tax incentives, ease of doing business reforms, and support for startups. Skilled Workforce: India boasts a highly skilled and cost-effective workforce, making it ideal for businesses in technology, manufacturing, and services. Masllp: Your Trusted Partner for Company Setup in India Masllp is a leading consultancy firm that assists businesses in establishing their presence in India. From startups to multinational corporations, Masllp offers tailored solutions to meet your specific needs.

Services Offered by Masllp Business Structure Advisory Masllp helps you choose the most suitable business structure, such as:

Private Limited Company Limited Liability Partnership (LLP) One Person Company (OPC) Branch Office, Liaison Office, or Subsidiary Company Registration Masllp handles the entire registration process, ensuring compliance with the Ministry of Corporate Affairs (MCA). Key services include:

Obtaining Digital Signature Certificates (DSC) and Director Identification Numbers (DIN) Name approval and filing of incorporation documents Issuance of Certificate of Incorporation Legal and Regulatory Compliance Setting up a company in India requires adherence to various legal requirements. Masllp ensures your business complies with:

Companies Act, 2013 Taxation laws (GST, Income Tax) Labor and employment laws Taxation and Accounting Support Masllp provides ongoing support with:

GST registration and filing Income tax filings Accounting and bookkeeping services Banking and Licensing Assistance Masllp assists in opening corporate bank accounts and obtaining necessary licenses or approvals for your business operations.

Post-Incorporation Support From drafting agreements to HR policies, Masllp provides all the support you need to ensure smooth operations after incorporation.

Benefits of Partnering with Masllp Expert Guidance: Masllp’s team of experts ensures a hassle-free setup, handling every aspect with precision. Time-Saving: With Masllp, you can focus on your core business while they take care of the formalities. Cost-Effective Solutions: Their services are designed to deliver maximum value without unnecessary expenses. Compliance Assurance: Avoid legal hassles with Masllp’s thorough knowledge of Indian laws and regulations. Steps to Set Up a Company in India with Masllp Initial Consultation: Discuss your business goals and requirements with the Masllp team. Business Structure Selection: Choose the appropriate business entity based on your objectives. Document Preparation: Masllp collects and prepares all necessary documents for registration. Company Registration: The team handles the incorporation process with the Ministry of Corporate Affairs. Compliance Setup: Get your tax registrations, bank accounts, and licenses in place. Operational Support: Start your operations with confidence, supported by Masllp’s expertise. Why Masllp is the Best Choice for Company Setup in India With a proven track record of assisting businesses across various industries, Masllp has earned its reputation as a trusted partner for company setup in India. Their personalized approach, industry knowledge, and commitment to excellence make them the ideal choice for entrepreneurs and established firms alike.

Ready to Start Your Business in India?

Let Masllp make your company setup journey seamless and efficient. From registration to compliance, their expert team ensures every detail is handled with care.

Contact Masllp today to kickstart your business in India!

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#taxation#auditor#ap management services

3 notes

·

View notes

Text

The Employer’s Playbook: Correcting Employee Misclassification

Navigating the labyrinth of labor laws, tax responsibilities, and HR best practices can sometimes feel like a full-contact sport for business owners. One of the significant challenges in this game is correctly classifying your personnel as either employees or independent contractors. Misclassification can result in dire consequences, including hefty fines and back taxes. In this detailed guide, we’ll break down why correct classification is critical, how to spot misclassification, and what to do if you find you’ve been playing on the wrong team.

What Is Employee and Independent Contractor Classification?

Before we draw battle lines, it’s essential to understand the various types of personnel at your disposal. The Internal Revenue Service (IRS) and the Department of Labor (DOL) each have their own criteria for what constitutes an employee versus an independent contractor. Employees typically work under the direction and control of an employer, whereas contractors maintain their independence, controlling when, where, and how the work is done. The distinction is vital because it affects how you pay taxes, allocate benefits, and protect your business from legal disputes.

Employers often prefer to engage workers as independent contractors because it:

Reduces administrative overhead

Eliminates the need to provide employee benefits

Allows for more flexible staffing arrangements

However, misclassification can open a Pandora’s box of unforeseen liabilities.

5 Indicators of Employee vs. Contractor Misclassification

The lines between employees and independent contractors can seem blurry, but certain indicators can clearly point one way or the other. Here are five indicators to watch for:

The Business's Degree of Control

The more control a business exercises over the work being done – including the manner and means of the work – the more likely the worker should be classified as an employee.

Financial Control

When the business controls significant aspects of a worker’s financial affairs, such as setting the pay rate or providing tools and materials, it’s a strong indication of an employer-employee relationship.

Investment in Facilities

If the worker has a significant investment in things like office space or equipment, they're more likely to be a contractor.

Opportunity for Profit or Loss

Contractors typically have the potential to make a profit or suffer a financial loss, while employees are often insulated from business fluctuations.

Permanency of the Relationship

An ongoing, indefinite working relationship suggests an employer-employee relationship. Contracts that specify a defined project or time frame lean more toward independent contractor status.

By assessinging these factors, you can catch early signs of misclassification and protect your business from unnecessary risk.

How to Correct Employee Misclassification

Discovering that you’ve misclassified workers can be a daunting reality, yet there is a path to rectification. Here are the vital steps to correct the course:

Identify the Misclassified Workers

The first step to fixing a problem is recognizing its existence. Audit your workforce to determine the scope of the misclassification.

Re-Evaluate Workforce Hiring Practices

Once the misclassified workers are identified, reassess how and why they were classified as independent contractors. Ensure your classification practices adhere to legal guidelines moving forward.

Adjust for Prior Compensation and Tax Withholding Errors

Correct any erroneous payroll tax filings and ensure all relevant taxes are appropriately withheld and paid.

Communicate Changes Transparently

Notify affected workers of the status change and what it means for their compensation and benefits.

Implement Corrective Policies

Establish clear policies and procedures for future worker classification, including documentation of the basis for classification.

By following these steps, you’ll mitigate the immediate damage and establish a framework for avoiding future misclassification issues.

5 Factors to Calculate Employee Misclassification Costs

Once you’ve acknowledged misclassification, it’s time to tally the costs. Knowing what you’re up against can help you make informed decisions about how to proceed.

Back Pay and Overtime

Misclassified employees may be owed back wages and overtime pay if they were treated as contractors when they should have been deemed employees.

Unemployment and Workers Compensation

Your business may be responsible for past and future payments associated with unemployment and workers compensation benefits.

Tax Adjustments

The IRS can penalize you for failing to withhold and match taxes appropriately for employees. You’ll need to amend past returns and address any unpaid tax liabilities.

Fines and Fees

In addition to the back taxes, the IRS or DOL may levy fines for misclassifications. These penalties can be substantial and vary depending on the number of employees involved and the severity of the violation.

Legal Costs

If an employee brings a lawsuit against your business due to misclassification, you’ll also need to factor in legal fees, settlement costs, and potential damage awards.

By factoring in these costs, you’ll be better equipped to map out how to best address the misclassification with the least amount of impact.

Navigating the complexities of employee classification is not for the faint of heart. However, staying informed about the indicators of misclassification and understanding how to rectify errors can save you immeasurable headaches down the line. Compliance isn’t always simple, but it is non-negotiable. Your workforce — and your bottom line — will thank you for these proactive measures.

In the fast-paced world of business, agility and foresight are your strongest allies. Knowing how to respond to misclassification can transform a potential pitfall into a learning opportunity. By understanding the rules and diligently auditing your practices, you can ensure that your team — both on the field and off — is set up for success.

@erastaffingsolutions

#erastaffingsolutions#era#hrsolution#workfocesolution#aorservice#howtocorrectemployeemisclassification

2 notes

·

View notes

Text

Driving Success: Mastering DOT Drug Testing for Transportation Entrepreneurs

As a transportation entrepreneur, navigating the intricate landscape of DOT drug testing is not just a regulatory requirement but a crucial step in ensuring safety, reliability, and compliance within your business. In this blog, we'll explore the ins and outs of DOT drug testing, its importance, challenges, solutions, and the role of technology and service providers in simplifying compliance. Let's dive in!

Why DOT Drug Testing Matters:

DOT drug testing isn't just about following rules; it's about safeguarding lives. By ensuring a sober workforce, transportation businesses mitigate the risks of substance-related accidents, protecting employees, passengers, and the public. Compliance with DOT regulations fosters a culture of safety and responsibility, essential for maintaining trust and credibility in the industry.

Who Needs to Comply:

Understanding who falls under DOT drug testing requirements is essential. From commercial truck drivers to aviation personnel, railroad workers to mariners, employees in safety-sensitive positions across various transportation sectors must adhere to strict testing protocols to uphold integrity and reliability within the industry.

Testing Procedures and Requirements:

DOT drug testing involves screening for a range of substances, including marijuana, cocaine, opiates, amphetamines, phencyclidine, and alcohol. Testing procedures follow rigorous guidelines, from sample collection to laboratory testing, review by Medical Review Officers (MROs), and follow-up protocols in case of positive results.

When Tests Are Required:

DOT drug and alcohol tests are mandated in various situations, including pre-employment, random testing throughout the year, reasonable suspicion testing, post-accident testing, return-to-duty testing after a violation, and follow-up testing for employees undergoing substance abuse treatment.

Practical Tips for Compliance:

Staying informed about DOT regulations, educating your team, partnering with reliable testing services, implementing clear policies, and providing support for employees struggling with substance abuse are vital steps in ensuring compliance with DOT drug testing requirements.

The Importance of Compliance:

Compliance with DOT drug testing regulations isn't just about adhering to government rules; it's about cultivating a safety culture, maintaining reliability and trust, avoiding legal and financial consequences, mitigating insurance and liability risks, and promoting long-term business health.

Implementing a Drug Testing Program:

Establishing a comprehensive drug testing program involves understanding DOT regulations, selecting qualified service agents, crafting clear policies, conducting pre-employment and random testing, managing post-accident and reasonable suspicion testing, and ensuring confidentiality and record-keeping compliance.

Challenges and Solutions:

While DOT drug testing poses challenges such as managing costs, ensuring privacy, and handling positive test results, practical solutions such as negotiating discounts, maintaining confidentiality, and establishing clear policies can mitigate these challenges and ensure effective management of drug testing programs.

The Role of Technology and Service Providers:

Technology and service providers play a crucial role in simplifying DOT drug testing compliance through digital scheduling and management systems, electronic chain of custody forms, integration with HR systems, mobile apps, expert guidance, comprehensive testing services, training, legal assistance, and compliance support.

Conclusion:

Navigating DOT drug testing is a multifaceted endeavor that requires diligence, expertise, and strategic partnerships. By prioritizing safety, reliability, and compliance, transportation entrepreneurs can ensure the well-being of their workforce, passengers, and the public while maintaining a competitive edge in the industry. Embrace DOT drug testing as a cornerstone of your entrepreneurial journey, and pave the way for a safer, more responsible future in transportation.

FAQs

1. Who needs to comply with DOT drug testing regulations?

Businesses in the transportation sector, including trucking, aviation, and public transportation, among others.

2. What substances does DOT drug testing screen for?

Typically, the test screens for marijuana, cocaine, opiates, phencyclidine (PCP), and amphetamines/methamphetamines.

3. How often should DOT drug tests be conducted?

It depends on various factors, including the specific industry and whether the testing is pre-employment, random, post-accident, or other types.

4. What happens if an employee fails a DOT drug test?

The procedures can include removal from safety-sensitive duties, a mandatory evaluation by a substance abuse professional, and completion of a return-to-duty process.

5. Can small businesses afford to comply with DOT drug testing?

Yes, there are cost-effective solutions and service providers that can help small businesses manage the requirements efficiently.

2 notes

·

View notes

Text

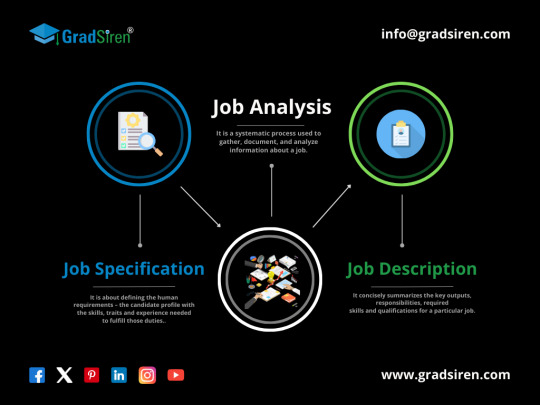

𝐉𝐨𝐛 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬, 𝐉𝐨𝐛 𝐃𝐞𝐬𝐜𝐫𝐢𝐩𝐭𝐢𝐨𝐧 𝐀𝐧𝐝 𝐉𝐨𝐛 𝐒𝐩𝐞𝐜𝐢𝐟𝐢𝐜𝐚𝐭𝐢𝐨𝐧

An organization is like a machine with many moving parts. For it to work efficiently, there must be the right people placed in the right roles.

This requires properly defining and documenting different jobs in the organization through job analysis, job descriptions and job specifications.

These tools form the foundation of key HR functions like recruitment, compensation, performance management and employee development.

In this article, we’ll provide an in-depth overview of what job analysis, descriptions and specifications are, why they matter. We’ll also discuss how to create them accurately for hiring and managing talent effectively.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐉𝐨𝐛 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬?

Job analysis is a systematic process of gathering, documenting and analyzing information about the responsibilities, tasks, skills, abilities, knowledge area, and work context associated with a

particular job. It forms the basis for defining the right requirements for successfully performing that job.

The key objectives of job analysis are to:

● Identify the core duties and responsibilities that a job entails

● Determine the specialized skills, credentials or competencies needed for the job

● Recognize the key performance indicators to measure outcomes for the job

● Understand the environmental/cultural context and physical demands of the job

● Identify machines, tools, equipment, and technologies used in the job

Information for job analysis is gathered in several ways – employee surveys, questionnaires, interviews with job incumbents, observation of workers, and review of policies and procedures.

Specialized jobs may also require analyzing industry standards.

The deliverable from job analysis is documentation that comprehensively describes the job – this is called job description.

𝐄𝐥𝐞𝐦𝐞𝐧𝐭𝐬 𝐨𝐟 𝐚 𝐉𝐨𝐛 𝐃𝐞𝐬𝐜𝐫𝐢𝐩𝐭𝐢𝐨𝐧

An effective job description concisely summarizes the key outputs, responsibilities, required skills and qualifications for a particular job. It serves as a guiding document for recruiting, onboarding, training and performance management.

Key elements that a job description includes are:

● Job title and department

● Overall purpose/objective of the job (summary statement)

● The scope of role and position in org structure

● Key duties and responsibilities

● Interactions with other jobs/departments

● Educational qualifications and specialized certification

● Technical/software skills needed

● Soft skills or behavioral competencies required

● Physical or sensory abilities required

A well-written job description is detailed yet easy to grasp for both job seekers and employees. It should describe both day-to-day activities as well as rare responsibilities that the role may

entail. The language used should be clear and use common industry terminology.

Here’s an example snippet from a job description:

Job Title: Sales Manager

Department: Sales

Summary Statement: Responsible for building and leading high-performing sales teams to drive sustainable business growth and achieve revenue targets for the organization’s products/services. Reports to the Head of Sales.

Roles and Responsibilities:

● Develop and implement strategic sales plans to achieve growth targets

● Manage end-to-end sales cycle for major accounts/partnerships

● Coach and mentor junior sales team members to build capabilities

● Work closely with marketing to generate quality sales leads

● Monitor competition landscape and market trends to identify opportunities

Notice how the summary provides an overview while the responsibilities dive into details of core duties.

𝐉𝐨𝐛 𝐒𝐩𝐞𝐜𝐢𝐟𝐢𝐜𝐚𝐭𝐢𝐨𝐧

Job specification is about defining the human requirements – the candidate profile with the skills, traits and experience needed to fulfill those duties.

Job specification details:

● Minimum or required educational qualifications

● Job-related certifications needed

● Hard skills and soft skills required

● Physical attributes like stamina if applicable

● Minimum years and type of experience desired

● Specialized knowledge needed

As part of job specification, you can also indicate “preferred but not required” qualifications to find candidates who may exceed expectations for the role.

The aim is to outline an optimal candidate profile that increases the chances of identifying the right people for long-term success in the job. Paired with the job description, the spec allows for informed hiring decisions based on merit rather than subjective impressions alone.

For example, part of a job spec for a sales manager role could be:

Required Qualification and Experience:

● Bachelor’s degree in Business Administration or relevant field

● Proven experience of 5+ years successfully managing corporate sales teams

● Demonstrated ability to coach and mentor junior sales resources

● Strong track record of achieving revenue targets in past roles

● Subject matter expertise and network in the technology industry

Preferred Qualifications:

● Master’s degree in Business or relevant certification

● Background working with partners/alliances programs

● International sales experience

𝟖 𝐁𝐞𝐬𝐭 𝐏𝐫𝐚𝐜𝐭𝐢𝐜𝐞𝐬 𝐟𝐨𝐫 𝐉𝐨𝐛 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬, 𝐃𝐞𝐬𝐜𝐫𝐢𝐩𝐭𝐢𝐨𝐧 𝐚𝐧𝐝 𝐒𝐩𝐞𝐜𝐢𝐟𝐢𝐜𝐚𝐭𝐢𝐨𝐧

Here are some key best practices to create accurate and impactful job analysis documentation:

1. Get input from diverse stakeholders: Speak with not just incumbents but their managers and internal customers to get a balanced perspective on the job.

2. Focus on the job, not person: Document only the role itself rather than capabilities of the current person in the job which could be subjective.

3. Use clear, concise language: Write descriptions suited not just for internal HR but also external candidates. Use common industry terminology.

4. Standardize key elements: Use consistent sections and structure across job docs for different roles to enable comparison.

5. Review and update regularly: Revisit docs as business needs evolve to ensure relevance. You can also build review cadence.

6. Collaborate with the compensation team: Align job analysis with pay scale considerations for competitive and fair compensation.

7. Leverage software tools: Use online templates and organizational collaboration tools to easily create, review and update descriptions.

8. Incorporate compliance needs: Ensure job documentation meets all the mandatory and other regulatory requirements.

𝐓𝐡𝐞 𝐈𝐦𝐩𝐨𝐫𝐭𝐚𝐧𝐜𝐞 𝐨𝐟 𝐀𝐜𝐜𝐮𝐫𝐚𝐭𝐞 𝐉𝐨𝐛 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬 𝐚𝐧𝐝 𝐃𝐞𝐬𝐜𝐫𝐢𝐩𝐭𝐢𝐨𝐧

Getting job analysis right has far-reaching impact across the employee lifecycle:

● Strategic workforce planning: The details help assess workforce capacity and identify skill gaps.

● Candidate screening: Job specs enable assessing if applicants have the required credentials and experience to shortlist.

● Interviewing and selection: Structured, standardized questions can be based on requirements in description.

● Onboarding/training: New hires understand role expectations right from day one. Learning is aligned to needs.

● Performance reviews: Measurable evaluation relies on key outputs and metrics captured in description.

● Succession planning: Required qualifications help identify and develop suitable internal candidates to fill critical roles.

● Compensation management: Job analysis enables pay to be competitive based on “going rate” for matching skill-sets and demands.

However, it is also important to choose the right platform to find experienced or fresher jobs. GradSiren is your destination if you are looking for IT jobs in India. The platform also provides you numerous opportunities for IT jobs in USA that fits your requirements.

𝐂𝐨𝐧𝐜𝐥𝐮𝐬𝐢𝐨𝐧

Job analysis, descriptions and specifications provide the strong informational backbone for managing your human capital in alignment with organizational goals. Getting it right does demand diligence and collaboration across teams, but pays off manifold in building a productive, thriving workforce.

As per best practices, incorporate input from diverse stakeholders, use clear and concise language, integrate regular reviews and ensure consistency across roles. By laying this robust groundwork, organizations can make smart, ethical decisions in acquiring and supporting talent.

3 notes

·

View notes

Text

Looking for POSH compliance in India

Introduction: In the dynamic landscape of Indian workplaces, ensuring a safe and inclusive environment is paramount. For organizations seeking to uphold the Prevention of Sexual Harassment (POSH) compliance, Brooks Payroll emerges as a trusted partner. Let's delve into the essential aspects of POSH compliance in India and how Brooks Payroll leads the way.

Understanding POSH Compliance: The Prevention of Sexual Harassment (POSH) Act in India is a legislative framework designed to create a safe and harassment-free workplace for all employees. Compliance with POSH is not just a legal requirement; it's a commitment to fostering a work culture that values dignity and respect. Brooks Payroll's Expertise in Workplace Compliance: Brooks Payroll, a name synonymous with excellence in payroll and HR services, extends its expertise to workplace compliance, including POSH. With a team of seasoned professionals, Brooks Payroll ensures that organizations navigate the intricate nuances of POSH regulations seamlessly. Comprehensive POSH Compliance Services: Policy Drafting and Implementation: Brooks Payroll assists organizations in drafting and implementing robust POSH policies tailored to their specific work environment. This includes defining the process for reporting and redressal. Employee Training Programs: The key to successful compliance lies in awareness. Brooks Payroll conducts engaging and informative training programs to educate employees about their rights, the POSH framework, and the importance of maintaining a harassment-free workplace. Internal Committee Support: The POSH Act mandates the formation of Internal Committees to address complaints. Brooks Payroll provides support in establishing and structuring these committees, ensuring they are well-equipped to handle complaints impartially. Compliance Audits: Regular audits are essential to ensure ongoing compliance. Brooks Payroll conducts comprehensive audits to assess the effectiveness of POSH policies and procedures, identifying areas for improvement. Why Choose Brooks Payroll for POSH Compliance: Expert Guidance: Benefit from the expertise of professionals well-versed in Indian labor laws and compliance requirements. Tailored Solutions: Brooks Payroll understands that each organization is unique. Their POSH compliance services are tailored to align with the specific needs and nuances of your workplace. Timely Updates: Stay abreast of any amendments or updates in POSH regulations. Brooks Payroll ensures that your organization remains in compliance with the latest legal requirements. Conclusion: In the pursuit of a harmonious and legally compliant workplace, POSH compliance is non-negotiable. Brooks Payroll stands as a reliable ally, guiding organizations through the intricacies of POSH regulations with finesse. Choose Brooks Payroll for a comprehensive, tailored, and expert-led approach to POSH compliance in India. Uphold the principles of respect and dignity—partner with Brooks Payroll today.

#top eor providers in india#best payroll services provider in delhi & ncr#consultant payroll services in india#posh training in india

2 notes

·

View notes

Text

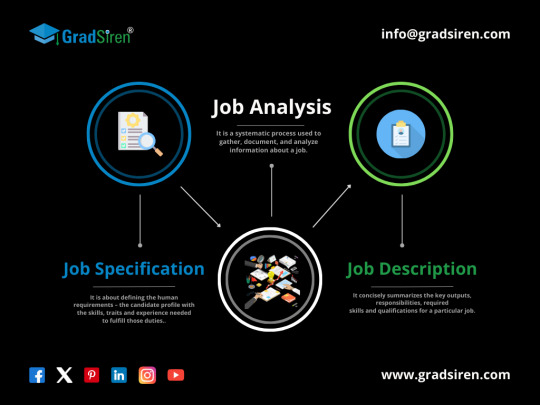

𝐉𝐨𝐛 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬, 𝐉𝐨𝐛 𝐃𝐞𝐬𝐜𝐫𝐢𝐩𝐭𝐢𝐨𝐧 𝐀𝐧𝐝 𝐉𝐨𝐛 𝐒𝐩𝐞𝐜𝐢𝐟𝐢𝐜𝐚𝐭𝐢𝐨𝐧

An organization is like a machine with many moving parts. For it to work efficiently, there must be the right people placed in the right roles.

This requires properly defining and documenting different jobs in the organization through job analysis, job descriptions and job specifications.

These tools form the foundation of key HR functions like recruitment, compensation, performance management and employee development.

In this article, we’ll provide an in-depth overview of what job analysis, descriptions and specifications are, why they matter. We’ll also discuss how to create them accurately for hiring and managing talent effectively.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐉𝐨𝐛 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬?

Job analysis is a systematic process of gathering, documenting and analyzing information about the responsibilities, tasks, skills, abilities, knowledge area, and work context associated with a

particular job. It forms the basis for defining the right requirements for successfully performing that job.

The key objectives of job analysis are to:

● Identify the core duties and responsibilities that a job entails

● Determine the specialized skills, credentials or competencies needed for the job

● Recognize the key performance indicators to measure outcomes for the job

● Understand the environmental/cultural context and physical demands of the job

● Identify machines, tools, equipment, and technologies used in the job

Information for job analysis is gathered in several ways – employee surveys, questionnaires, interviews with job incumbents, observation of workers, and review of policies and procedures.

Specialized jobs may also require analyzing industry standards.

The deliverable from job analysis is documentation that comprehensively describes the job – this is called job description.

𝐄𝐥𝐞𝐦𝐞𝐧𝐭𝐬 𝐨𝐟 𝐚 𝐉𝐨𝐛 𝐃𝐞𝐬𝐜𝐫𝐢𝐩𝐭𝐢𝐨𝐧

An effective job description concisely summarizes the key outputs, responsibilities, required skills and qualifications for a particular job. It serves as a guiding document for recruiting, onboarding, training and performance management.

Key elements that a job description includes are:

● Job title and department

● Overall purpose/objective of the job (summary statement)

● The scope of role and position in org structure

● Key duties and responsibilities

● Interactions with other jobs/departments

● Educational qualifications and specialized certification

● Technical/software skills needed

● Soft skills or behavioral competencies required

● Physical or sensory abilities required

A well-written job description is detailed yet easy to grasp for both job seekers and employees. It should describe both day-to-day activities as well as rare responsibilities that the role may

entail. The language used should be clear and use common industry terminology.

Here’s an example snippet from a job description:

Job Title: Sales Manager

Department: Sales

Summary Statement: Responsible for building and leading high-performing sales teams to drive sustainable business growth and achieve revenue targets for the organization’s products/services. Reports to the Head of Sales.

Roles and Responsibilities:

● Develop and implement strategic sales plans to achieve growth targets

● Manage end-to-end sales cycle for major accounts/partnerships

● Coach and mentor junior sales team members to build capabilities

● Work closely with marketing to generate quality sales leads

● Monitor competition landscape and market trends to identify opportunities

Notice how the summary provides an overview while the responsibilities dive into details of core duties.

𝐉𝐨𝐛 𝐒𝐩𝐞𝐜𝐢𝐟𝐢𝐜𝐚𝐭𝐢𝐨𝐧

Job specification is about defining the human requirements – the candidate profile with the skills, traits and experience needed to fulfill those duties.

Job specification details:

● Minimum or required educational qualifications

● Job-related certifications needed

● Hard skills and soft skills required

● Physical attributes like stamina if applicable

● Minimum years and type of experience desired

● Specialized knowledge needed

As part of job specification, you can also indicate “preferred but not required” qualifications to find candidates who may exceed expectations for the role.

The aim is to outline an optimal candidate profile that increases the chances of identifying the right people for long-term success in the job. Paired with the job description, the spec allows for informed hiring decisions based on merit rather than subjective impressions alone.

For example, part of a job spec for a sales manager role could be:

Required Qualification and Experience:

● Bachelor’s degree in Business Administration or relevant field

● Proven experience of 5+ years successfully managing corporate sales teams

● Demonstrated ability to coach and mentor junior sales resources

● Strong track record of achieving revenue targets in past roles

● Subject matter expertise and network in the technology industry

Preferred Qualifications:

● Master’s degree in Business or relevant certification

● Background working with partners/alliances programs

● International sales experience

𝟖 𝐁𝐞𝐬𝐭 𝐏𝐫𝐚𝐜𝐭𝐢𝐜𝐞𝐬 𝐟𝐨𝐫 𝐉𝐨𝐛 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬, 𝐃𝐞𝐬𝐜𝐫𝐢𝐩𝐭𝐢𝐨𝐧 𝐚𝐧𝐝 𝐒𝐩𝐞𝐜𝐢𝐟𝐢𝐜𝐚𝐭𝐢𝐨𝐧

Here are some key best practices to create accurate and impactful job analysis documentation:

1. Get input from diverse stakeholders: Speak with not just incumbents but their managers and internal customers to get a balanced perspective on the job.

2. Focus on the job, not person: Document only the role itself rather than capabilities of the current person in the job which could be subjective.

3. Use clear, concise language: Write descriptions suited not just for internal HR but also external candidates. Use common industry terminology.

4. Standardize key elements: Use consistent sections and structure across job docs for different roles to enable comparison.

5. Review and update regularly: Revisit docs as business needs evolve to ensure relevance. You can also build review cadence.

6. Collaborate with the compensation team: Align job analysis with pay scale considerations for competitive and fair compensation.

7. Leverage software tools: Use online templates and organizational collaboration tools to easily create, review and update descriptions.

8. Incorporate compliance needs: Ensure job documentation meets all the mandatory and other regulatory requirements.

𝐓𝐡𝐞 𝐈𝐦𝐩𝐨𝐫𝐭𝐚𝐧𝐜𝐞 𝐨𝐟 𝐀𝐜𝐜𝐮𝐫𝐚𝐭𝐞 𝐉𝐨𝐛 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬 𝐚𝐧𝐝 𝐃𝐞𝐬𝐜𝐫𝐢𝐩𝐭𝐢𝐨𝐧

Getting job analysis right has far-reaching impact across the employee lifecycle:

● Strategic workforce planning: The details help assess workforce capacity and identify skill gaps.

● Candidate screening: Job specs enable assessing if applicants have the required credentials and experience to shortlist.

● Interviewing and selection: Structured, standardized questions can be based on requirements in description.

● Onboarding/training: New hires understand role expectations right from day one. Learning is aligned to needs.

● Performance reviews: Measurable evaluation relies on key outputs and metrics captured in description.

● Succession planning: Required qualifications help identify and develop suitable internal candidates to fill critical roles.

● Compensation management: Job analysis enables pay to be competitive based on “going rate” for matching skill-sets and demands.

However, it is also important to choose the right platform to find experienced or fresher jobs. GradSiren is your destination if you are looking for IT jobs in India. The platform also provides you numerous opportunities for IT jobs in USA that fits your requirements.

𝐂𝐨𝐧𝐜𝐥𝐮𝐬𝐢𝐨𝐧

Job analysis, descriptions and specifications provide the strong informational backbone for managing your human capital in alignment with organizational goals. Getting it right does demand diligence and collaboration across teams, but pays off manifold in building a productive, thriving workforce.

As per best practices, incorporate input from diverse stakeholders, use clear and concise language, integrate regular reviews and ensure consistency across roles. By laying this robust groundwork, organizations can make smart, ethical decisions in acquiring and supporting talent.

2 notes

·

View notes

Text

Technology and the POSH Act: Enhancing Compliance Through Digital Solutions.

The digital era has transformed how organizations approach compliance with the Prevention of Sexual Harassment (POSH) Act, 2013. Technology-driven solutions are making it easier for companies to educate employees, track compliance, and streamline reporting mechanisms, ultimately creating safer and more transparent workplaces. How Technology is Revolutionizing POSH Compliance Organizations are increasingly leveraging digital tools to enhance their POSH Act implementation. Some key advancements include:

E-Learning and Virtual Training – Online modules and AI-driven simulations make POSH training more engaging and accessible to employees across different locations.

AI-Powered Complaint Management Systems – Automated reporting systems ensure confidentiality, provide step-by-step guidance, and help track case progress efficiently.

Secure Digital Reporting Platforms – Web-based portals and mobile apps enable employees to report harassment incidents anonymously and securely.

Compliance Tracking Dashboards – Advanced analytics and dashboards help HR teams monitor compliance levels, identify trends, and address potential gaps in implementation.

Chatbots for Instant Assistance – AI-driven chatbots provide employees with instant answers to common queries related to POSH policies and procedures. Benefits of Using Technology for POSH Compliance The integration of technology in POSH compliance offers several advantages: • Increased Accessibility – Employees can access training materials and reporting systems anytime, from anywhere. • Enhanced Confidentiality and Trust – Digital tools help ensure secure complaint handling, reducing fear of retaliation. • Efficiency and Accuracy – AI-driven analytics provide insights into workplace trends, helping organizations take proactive measures. • Automated Record-Keeping – Digital documentation helps maintain proper records for audits and legal requirements. Challenges in Implementing Tech-Based POSH Solutions While technology enhances compliance, some challenges remain: • Resistance to Digital Adoption – Employees and management may be hesitant to rely on digital platforms for sensitive issues. • Cybersecurity Risks – Ensuring data security and confidentiality in online complaint systems is crucial. • Customization and Localization – POSH compliance solutions must be tailored to organizational structures and regional legal requirements. The Future of POSH Compliance: A Tech-Driven Approach To maximize the potential of technology in workplace safety, organizations should: • Invest in AI-Based Learning and Support Tools – Interactive training modules and AI-driven assistants can improve employee awareness. • Ensure Data Privacy and Security Measures – Strong encryption and compliance with data protection laws will enhance trust in digital platforms. • Adopt a Hybrid Approach – Combining digital solutions with human oversight ensures a balanced and effective POSH implementation strategy. Conclusion Technology is revolutionizing POSH Act compliance by making reporting, training, and monitoring more efficient and accessible. By embracing digital solutions, organizations can build a workplace culture that prioritizes safety, accountability, and transparency.

#posh training in india#posh act 2013#best posh lawyers in india#posh lawyers in india#posh law services in india#posh at workplace#posh act

0 notes

Text

Trauma-Informed Care Training: Safeguarding Your Organization from Legal Risks

In today’s workplace, fostering a culture of safety and empathy isn’t just a moral imperative—it’s a legal necessity. Trauma-informed care (TIC) training has emerged as a critical tool for organizations aiming to protect both their employees and their bottom line.

By integrating trauma-informed practices, businesses can reduce legal risks, enhance employee well-being, and build resilient teams. In this article, we’ll explore how trauma-informed care training shields organizations from litigation, the key components of effective programs, and actionable steps to implement these strategies.

Why Trauma-Informed Care Matters in Modern Workplaces

Trauma-informed care is an approach rooted in understanding how trauma impacts behavior, decision-making, and workplace dynamics. With 70% of adults experiencing at least one traumatic event in their lifetime (CDC), workplaces are increasingly recognizing that unaddressed trauma can lead to conflicts, absenteeism, and even lawsuits.

For example, employees who feel misunderstood or retraumatized by workplace policies may file discrimination or hostile work environment claims.

By adopting trauma-informed practices, organizations demonstrate a commitment to psychological safety—a factor courts increasingly consider in employment disputes.

Training staff to recognize trauma responses (e.g., withdrawal, hypervigilance) helps de-escalate conflicts before they escalate into formal complaints.

The Legal Risks of Ignoring Trauma in the Workplace

Organizations that overlook trauma’s role in workplace interactions face several legal pitfalls:

Discrimination Claims: Employees with trauma histories may qualify for accommodations under the ADA. Failure to provide these can lead to costly lawsuits.

Hostile Work Environment Allegations: Insensitive management of trauma-related behaviors (e.g., penalizing an employee for panic attacks) may violate workplace safety laws.

Reputational Damage: Publicized incidents of mishandled trauma can harm recruitment and customer trust.

A landmark 2022 case involved a healthcare provider fined $1.2 million after failing to accommodate an employee with PTSD, highlighting the stakes for unprepared organizations.

How Trauma-Informed Training Reduces Legal Exposure

Effective trauma-informed care training addresses legal risks by:

Promoting Compliance: Educating leaders on ADA requirements and anti-discrimination laws.

Improving Communication: Teaching de-escalation techniques to prevent misunderstandings.

Strengthening Policies: Ensuring HR protocols account for trauma-related needs.

For example, managers trained in TIC learn to approach performance issues with curiosity (“What’s happening here?”) rather than punishment, reducing the likelihood of retaliation claims.

Rebecca Sposita, a leading expert in trauma-informed organizational strategies, emphasizes that “proactive training transforms workplace culture from reactive to supportive, which is your first line of defense against litigation.”

Key Components of Effective Trauma-Informed Care Training

Not all training programs are created equal. Look for these elements:

Leadership Buy-In: Workshops for executives on the ROI of trauma-informed practices.

Scenario-Based Learning: Role-playing responses to trauma-related challenges.

Policy Integration: Aligning HR protocols with TIC principles (e.g., flexible leave policies).

Ongoing Support: Resources like peer support groups or access to mental health professionals.

For a roadmap to developing policies that align with legal standards, explore Rebecca Sposita’s guide to trauma-informed workplace policies and litigation prevention.

Case Study: How TIC Training Prevented a Costly Lawsuit

A mid-sized tech company faced rising turnover and employee complaints. After implementing TIC training:

Managers learned to recognize signs of burnout linked to past trauma.

HR revised disciplinary procedures to include trauma assessments.

Within a year, employee grievances dropped by 40%, avoiding potential litigation costs exceeding $500,000.

Implementing Trauma-Informed Care in 4 Steps

Assess Needs: Survey employees anonymously to identify trauma-related challenges.

Partner with Experts: Collaborate with specialists like Rebecca Sposita to design customized training.

Revise Policies: Update handbooks to reflect trauma-informed language and procedures.

Measure Impact: Track reductions in complaints, absenteeism, and turnover post-training.

Conclusion: Protect Your Organization Proactively

Trauma-informed care training isn’t just about empathy—it’s a strategic safeguard against legal and financial risks. By prioritizing psychological safety, organizations foster loyalty, productivity, and compliance.

Ready to take the next step? Dive deeper into trauma-informed strategies with Rebecca Sposita’s resources, including her comprehensive guide to litigation prevention. Investing in TIC today could save your organization millions tomorrow.

#Trauma-Informed Care Training#Trauma Care Training#Trauma-Informed Care#Trauma-Informed Training#Trauma Training

0 notes

Text

EEOC Guidelines: Valuable Fundamentals You Need to Know

In today’s competitive and diverse workforce, following EEOC guidelines isn’t just a legal requirement—it’s a cornerstone of ethical, inclusive business practices. These guidelines not only help businesses comply with federal regulations but also create workplaces that foster diversity, equality, and fairness. From EEO-1 Reporting to enhancing employee retention, understanding these fundamentals can significantly impact your organization’s success and reputation.

Let’s explore what the Equal Employment Opportunity Commission (EEOC) guidelines mean for your business and how to implement them effectively.

What Are EEOC Guidelines?

The EEOC guidelines are a set of federal standards established to prevent discrimination in the workplace. The Equal Employment Opportunity Commission enforces laws that prohibit job discrimination based on:

Race

Color

Religion

Sex (including pregnancy, sexual orientation, and gender identity)

National origin

Age (40 or older)

Disability

Genetic information

These rules apply to all aspects of employment, including hiring, firing, promotions, wages, training, benefits, and workplace harassment.

Why EEOC Guidelines Matter

Following EEOC guidelines ensures your company:

Complies with federal laws

Avoids costly lawsuits

Promotes diversity and inclusion

Builds a stronger, more loyal workforce

Enhances your company’s public image

Beyond compliance, businesses that embrace EEOC standards are often more attractive to top-tier talent and maintain better employee retention rates.

Key Elements of EEOC Compliance

To fully comply with EEOC guidelines, employers should implement practices that ensure fairness and consistency. Here are some foundational elements:

1. Non-Discriminatory Hiring Practices

Develop job descriptions and interview questions that focus on skills and qualifications—not personal characteristics.

2. Fair Compensation Structures

Wages should be consistent across gender, race, and other protected categories. Conduct pay equity audits regularly.

3. Equal Access to Promotions and Training

All employees should have the opportunity to grow within the organization. Transparent evaluation systems help prevent bias.

4. Handling Workplace Harassment

Implement clear policies, reporting systems, and disciplinary procedures to prevent and respond to harassment claims.

Understanding EEO-1 Reporting

EEO-1 Reporting is a critical component of EEOC compliance. It’s an annual federal survey that collects workforce data categorized by race, ethnicity, sex, and job category.

Who Must File?

Private employers with 100 or more employees

Federal contractors with 50 or more employees and contracts of $50,000 or more

Why It’s Important:

Helps identify employment patterns and possible discrimination

Serves as a baseline for audits or investigations

Reflects your company’s commitment to transparency and diversity

Accurate EEO-1 Reporting also supports better strategic planning and internal DEI (Diversity, Equity, and Inclusion) initiatives.

How EEOC Compliance Affects Employee Retention

Companies that follow EEOC guidelines create more inclusive, respectful environments—directly impacting employee retention. Employees are more likely to stay when they feel:

Valued and fairly treated

Safe from harassment or discrimination

Supported in their career development

Strategies That Boost Retention Through EEOC Compliance:

Conduct regular training on anti-discrimination laws

Establish anonymous reporting systems

Celebrate diversity and foster an inclusive culture

Track progress and address disparities revealed through EEO-1 Reporting

A reputation for fairness helps attract and keep talent, especially among younger, values-driven professionals.

Training and Education: Building an Inclusive Culture

Educating your staff on EEOC guidelines is one of the most effective ways to ensure long-term compliance. Consider:

Mandatory annual training for managers and HR teams

Onboarding programs that include workplace rights and policies

Diversity and sensitivity training to foster mutual respect

Regular refreshers and real-world case studies help solidify the importance of equal opportunity and make the rules easier to apply day-to-day.

EEOC Audits: What Employers Should Know

The EEOC may investigate your workplace if a complaint is filed or if your EEO-1 Reporting indicates a potential issue. To prepare:

Maintain accurate employee records and documentation

Keep your policies updated and easily accessible

Ensure all employment decisions are well-documented and justifiable

Being proactive reduces risk and builds trust with your workforce.

EEOC Best Practices for Employers

To fully align with EEOC guidelines, employers should implement these best practices:

Create a DEI task force: Monitor internal practices and suggest improvements.

Conduct regular internal audits: Ensure hiring, pay, and promotion practices are bias-free.

Use HR software: Automate and track data for accurate EEO-1 Reporting.

Stay informed: Monitor changes in laws and attend compliance training sessions.

Conclusion: More Than Compliance—It’s Culture

Adhering to EEOC guidelines is more than just a legal necessity—it’s a smart, strategic investment in your organization’s future. It leads to stronger employee retention, improved workplace morale, and a company culture rooted in fairness and equity. With consistent training, accurate EEO-1 Reporting, and ongoing commitment to diversity, your business can thrive ethically and operationally in today’s workforce.

0 notes

Text

Top 5 Business Litigation Mistakes Seattle Companies Make (And How to Avoid Them)

Business litigation can be a costly and disruptive experience, especially for companies that aren't legally prepared. In Seattle’s competitive and fast-paced business environment, even small oversights can lead to lawsuits that drain resources, damage reputations, and halt growth.

Whether you’re running a startup or managing a well-established company, understanding common legal pitfalls—and knowing how to avoid them—can protect your business from unnecessary litigation. Working with a skilled attorney in Seattle Washington can make all the difference.

Here are the top 5 business litigation mistakes Seattle companies make, and tips on how to prevent them.

1. Poorly Drafted Contracts

The Mistake: Relying on generic templates or handshake agreements without clearly defined terms.

Why It Matters: Vague or incomplete contracts often lead to disputes over deliverables, payments, and responsibilities.

How to Avoid It: Always have a professional attorney in Washington draft or review your business contracts. Custom legal agreements ensure clarity and enforceability, protecting all parties involved.

2. Ignoring Employment Law Requirements

The Mistake: Failing to comply with wage laws, employee classification rules, and anti-discrimination policies.

Why It Matters: Seattle businesses face strict local and state employment regulations. Misclassifying employees or mishandling workplace complaints can lead to legal action and hefty penalties.

How to Avoid It: Partner with an attorney in Seattle Washington who is familiar with both Washington State and federal employment laws. They can help you create compliant policies and provide regular HR audits.

3. Inadequate Record Keeping

The Mistake: Not documenting communications, transactions, or internal decisions properly.

Why It Matters: In legal disputes, the burden of proof often falls on the business. Without thorough documentation, defending your company becomes much more difficult.

How to Avoid It: Implement consistent internal procedures for record keeping and documentation. Consult a legal advisor to ensure your practices align with industry standards.

4. Failing to Address Disputes Early

The Mistake: Waiting too long to handle a brewing conflict or assuming it will resolve on its own.

Why It Matters: Delayed responses often escalate into full-blown lawsuits, costing time and money.

How to Avoid It: At the first sign of a legal issue, consult with a trusted attorney in Washington. Early intervention can help you resolve issues through negotiation or mediation before they turn litigious.

5. Overlooking Intellectual Property Protection

The Mistake: Not securing trademarks, copyrights, or patents for your original work.

Why It Matters: Competitors may copy your branding, products, or content, resulting in lost market share and legal headaches.

How to Avoid It: Register your intellectual property with the help of a qualified attorney in Seattle Washington. They’ll guide you through the process and ensure your business assets are legally protected.

Final Thoughts

Every business—large or small—faces legal risks. But the companies that thrive in Seattle’s dynamic market are the ones that take a proactive approach to legal compliance and protection. Avoiding these five common mistakes is a powerful first step.

Working closely with an experienced attorney in Washington ensures your business is legally sound and ready to handle any challenge that may arise.

0 notes

Text

5 Key Trends of GRC and Its Future

Introduction:

Governance, Risk, and Compliance (GRC) have become critical components of Australian businesses, ensuring organisations adhere to regulations, manage risks effectively, and maintain ethical governance. With evolving workplace regulations in Australia, businesses must stay ahead of compliance changes to avoid penalties and reputational impacts.

What is GRC and Why Does It Matter?

GRC refers to a centralised strategy that helps businesses manage risks, adhere to regulations, and fulfil governance standards. It ensures that organisations operate ethically, minimise legal liabilities, and create a transparent business environment.

A strong GRC framework allows businesses to proactively address regulatory changes, ensuring they stay compliant while reducing operational risks. With evolving workplace laws in Australia, companies must adopt a comprehensive GRC strategy to avoid legal complications and maintain business continuity.

For Australian businesses, prioritising GRC means building a resilient and well-governed organisation. Effective GRC practices improve decision-making, raise risk visibility, and create a compliance-driven workplace culture.

Key Benefits of an Effective GRC Framework:

Regulatory Compliance Ensures businesses adhere to evolving workplace laws and industry regulations, reducing legal risks and avoiding penalties. Companies that comply with regulations avoid fines, legal disputes, and reputational damage, ensuring sustainable operations.

Risk Mitigation Identifies potential threats early, allowing organisations to take proactive steps to prevent disruptions. By analysing historical data and current trends, businesses can anticipate risks and implement strategies to minimize their impact.

Operational Efficiency Automates compliance processes, streamlining workflows and reducing the administrative burden on employees. Digital GRC tools enhance productivity by ensuring policies and procedures are updated in real time.

Corporate Transparency Enhances accountability by promoting ethical governance and clear reporting standards. An effective GRC system provides real-time insights into compliance status, ensuring all stakeholders are informed.

Reputation Protection Safeguards brand credibility by ensuring consistent compliance with ethical and legal obligations. Businesses that prioritise governance and risk management gain stakeholder trust and maintain a strong market reputation.

Top 5 Key Trends in GRC and Its Future:

1. AI and Automation Reshaping GRC 2. Integrating GRC with HR for Workforce Compliance 3. Moving from Reactive to Proactive Compliance 4. Strengthening Cybersecurity and Data Privacy 5. ESG Compliance as a Business Imperative

Conclusion:

As GRC advances, businesses must embrace modern strategies to remain compliant and competitive. AI-driven automation, HR and compliance integration, proactive risk management, and effective cybersecurity protocols are important for handling regulatory complexities. Organisations that stay ahead of these trends can build stronger governance frameworks and mitigate compliance risks properly.

Sentrient provides Australian businesses with a complete GRC solution suited to their compliance needs. With automated compliance tracking, risk assessment tools, and seamless HR integration, our platform ensures regulatory alignment without disrupting operations.

Learn more how Sentrient’s GRC solutions can keep your organisation secure and compliant. Get started today!

This blog post was originally published here:

5 Key Trends of GRC and Its Future

0 notes

Text

Behind the Scenes of Success: Premier Business Administration Firms in Mountain View, CA

Mountain View, California, is widely recognized as a global tech hub, but behind every groundbreaking startup and innovative enterprise lies a network of business administration firms quietly powering growth and stability. These firms offer crucial services that keep operations running smoothly, from managing finances and HR functions to streamlining day-to-day tasks that allow business leaders to focus on big-picture goals.

In a region known for rapid change and relentless innovation, administrative support is not just about keeping up—it’s about staying ahead. The leading firms in Mountain View understand this, offering tailored solutions that combine strategic thinking with practical execution.

Supporting Vision with Operational Excellence

Founders and executives in Mountain View often come from technical or creative backgrounds, so many turn to business administration firms to handle the foundational aspects of running a company. These firms bring structure and consistency to business operations, ensuring that everything from internal reporting to compliance processes is managed efficiently.

They don’t just implement processes—they design them to align with each company’s goals and growth stage. By identifying bottlenecks, organizing workflows, and standardizing internal procedures, these firms help businesses lay a solid operational foundation. This frees up leadership to focus on scaling innovation, entering new markets, or refining their product without being weighed down by administrative distractions.

Adapting Technology for Smarter Business Operations

It’s no surprise that administrative firms in Mountain View are fluent in technology. They utilize many modern tools to automate and optimize tasks like payroll processing, financial reporting, inventory management, etc. This commitment to using the best available technology ensures that clients benefit from faster turnaround times, greater accuracy, and better data insights.

Automation doesn’t replace the human touch—it enhances it. These firms use tech platforms as tools to support human decision-making, providing real-time dashboards, performance tracking, and automated alerts that help businesses respond quickly to changes. Their ability to seamlessly integrate digital solutions into business operations gives clients a crucial edge in a tech-savvy market.

Financial Oversight with a Strategic Focus

One of the core offerings of top business administration firms is financial oversight. These services go beyond basic accounting; they include long-term financial planning, fundraising support, and scenario forecasting. This level of economic strategy is invaluable for companies in Mountain View preparing for growth rounds or mergers.

With deep experience in budgeting, cost analysis, and performance metrics, these firms guide clients toward financial decisions that promote sustainability. They provide regular insights on profitability, burn rates, and capital requirements, helping leadership stay informed and ready to act. This expertise is indispensable in a climate where financial agility can make or break a business.

People-Centered Solutions for Workforce Management

Business success depends on people, and the leading administrative firms in Mountain View understand the importance of human capital. They provide a full suite of HR services, including hiring support, benefits administration, employee onboarding, and policy development. These offerings help companies build strong, compliant, and inclusive workplaces.

Their HR expertise is especially beneficial in navigating California’s complex labor laws and evolving workplace expectations. Maintaining up-to-date practices and advising on culture-building initiatives, these firms help businesses foster productive teams while avoiding legal and administrative pitfalls. This attention to compliance and culture creates a strong foundation for long-term growth.

Versatility That Serves Every Industry

Mountain View has a diverse business landscape, ranging from early-stage startups and SaaS companies to biotech firms and nonprofit organizations. Business administration firms in the area are skilled at adapting to this variety, offering customized support tailored to different industries and company sizes.

Whether a company needs ongoing virtual CFO services or just temporary help with restructuring, these firms provide solutions that fit. Their ability to shift gears and adapt to client-specific challenges makes them valuable partners during transition periods, whether a product launch, a leadership change, or an IPO. Their flexibility ensures businesses get exactly what they need when needed.

Rooted in Mountain View, Connected Globally

Though based in Mountain View, these firms often work with clients worldwide. Many have experience handling international payroll, foreign compliance issues, and cross-border tax planning. Their global perspective makes them ideal partners for businesses with international ambitions or remote teams across time zones.

At the same time, they remain deeply embedded in the local business community. Their relationships with attorneys, venture capitalists, incubators, and other service providers in the area allow them to offer referrals and connections that help clients grow faster—being local means more than location—understanding the ecosystem and contributing to its success.

Choosing a Partner That Moves with You

The right business administration firm isn’t just a vendor—it’s a partner. Mountain View’s premier firms take pride in building lasting relationships with their clients, growing with them from early development to significant milestones. They provide a steady hand in a fast-changing environment, ensuring businesses stay grounded while aiming high.

For companies ready to take their operations to the next level, they offer the support and insight needed to thrive. In a city known for creating the future, Mountain View’s top business administration firms ensure the future is built on a solid foundation.

0 notes

Text

The Role of Compliance Audits in Medical Practice Assessments

In today’s complex healthcare environment, maintaining regulatory compliance is a critical component of running a successful medical practice. Compliance audits play an essential role in assessing medical practices, ensuring adherence to federal and state regulations, preventing legal complications, and optimizing operational efficiency. As regulatory frameworks continue to evolve, medical practices must conduct regular compliance audits to mitigate risks and enhance their overall practice management strategies.

Understanding Compliance Audits in Medical Practices

A compliance audit is a systematic review of a medical practice’s policies, procedures, and documentation to ensure they align with legal and regulatory standards. These audits typically evaluate adherence to healthcare laws such as the Health Insurance Portability and Accountability Act (HIPAA), the Stark Law, the Anti-Kickback Statute, and billing compliance under the Centers for Medicare & Medicaid Services (CMS) guidelines. By conducting these audits, medical practices can identify areas of risk, implement corrective actions, and maintain a culture of compliance.

Compliance audits serve multiple purposes in Medical Practice Assessments. They help prevent fraud, abuse, and financial penalties, ensuring that billing and coding practices are accurate and in accordance with federal regulations. Additionally, they promote transparency and accountability, which are crucial for sustaining patient trust and operational efficiency.

Key Components of a Compliance Audit

A thorough compliance audit evaluates various aspects of a medical practice. These include:

Billing and Coding Compliance – Auditors review claims submissions, billing records, and coding practices to ensure accuracy and prevent fraudulent claims. Errors in documentation can lead to significant financial losses or legal consequences.

HIPAA Compliance – Patient privacy and data security are paramount in healthcare. Compliance audits assess whether a practice’s electronic health record (EHR) systems, data storage, and staff training align with HIPAA regulations.

Physician Financial Management Services – Effective financial management is essential for maintaining a sustainable practice. Compliance audits analyze revenue cycle management, reimbursement models, and financial policies to ensure ethical and legal financial operations.

Physician Compensation Models – Audits assess whether physician compensation structures comply with regulatory standards, including Stark Law provisions, to prevent conflicts of interest and illegal financial arrangements.

Employment and HR Policies – Audits examine employment contracts, staff training, and workplace policies to ensure compliance with labor laws and anti-discrimination regulations.

Risk Management and Quality Assurance – Compliance audits assess risk mitigation strategies, patient safety protocols, and adherence to best practices to enhance the quality of care.

The Importance of Regular Compliance Audits

Medical practices operate in an industry that is highly regulated and subject to frequent changes in policies. Regular compliance audits help practices stay ahead of regulatory shifts and avoid costly penalties. Here are some of the primary benefits of conducting routine compliance audits:

Risk Reduction: Compliance audits help identify and mitigate legal, financial, and operational risks before they become serious issues.

Financial Integrity: Audits ensure that billing and reimbursement processes align with ethical and legal standards, preventing financial mismanagement.

Improved Patient Trust: Patients are more likely to trust healthcare providers who demonstrate a commitment to compliance and ethical practices.

Operational Efficiency: Identifying inefficiencies and implementing best practices can improve workflow and resource utilization within a medical practice.

Implementing a Compliance Audit Program

For a compliance audit program to be effective, it should be well-structured and regularly updated to address new regulatory requirements. Here’s how medical practices can implement a successful audit program:

Develop a Compliance Plan – Establish a comprehensive compliance plan that outlines policies, procedures, and accountability measures.

Appoint a Compliance Officer – Designate a compliance officer or team responsible for overseeing audits, identifying risks, and enforcing corrective measures.

Conduct Periodic Audits – Schedule routine audits, either internally or with the help of third-party compliance experts, to assess ongoing compliance efforts.

Employee Training and Education – Educate staff on compliance requirements and provide continuous training to keep them informed about regulatory updates.

Address Audit Findings Promptly – If an audit uncovers compliance issues, implement corrective actions immediately to prevent regulatory violations and financial penalties.

Stay Updated on Regulatory Changes – Continuously monitor changes in healthcare laws and regulations to ensure ongoing compliance.

Conclusion

Compliance audits are a fundamental aspect of medical practice assessments, ensuring adherence to regulatory standards, financial integrity, and operational efficiency. By conducting routine audits, medical practices can mitigate risks, enhance patient trust, and create a culture of transparency and accountability. Given the ever-changing nature of healthcare regulations, proactive compliance auditing is not just a best practice—it is a necessity for maintaining a sustainable and legally compliant medical practice.

0 notes

Text

HR Compliance: Ensuring Your Business Stays on Track

HR compliance is a critical aspect of managing a business, ensuring that all employment practices align with legal and regulatory standards. From hiring and payroll to workplace policies and termination procedures, businesses must comply with federal, state, and local laws to avoid legal penalties and maintain a fair work environment.

Failing to meet HR compliance requirements can result in lawsuits, fines, and reputational damage. Whether you’re a small business or a large corporation, having a solid HR compliance strategy is essential for long-term success.

Why HR Compliance Matters

Avoiding Legal Issues Labor laws and employment regulations change frequently, and non-compliance can lead to costly lawsuits or fines. Staying updated on HR compliance helps businesses protect themselves from legal risks and ensures they meet all required labor laws.

Protecting Employees and the Workplace Compliance with workplace safety regulations, anti-discrimination laws, and fair labor standards creates a safe, respectful, and equitable work environment for employees. Following HR compliance guidelines helps foster a positive company culture and improves employee satisfaction.

Improving Business Efficiency Well-structured HR compliance policies streamline business operations, from recruitment to payroll processing. Companies that implement effective compliance strategies reduce the risk of errors and maintain smooth HR functions, leading to higher efficiency and productivity.

Enhancing Employer Reputation Businesses that prioritize HR compliance build trust with employees, clients, and stakeholders. Demonstrating a commitment to ethical business practices and fair employment policies enhances a company’s reputation, making it more attractive to top talent and customers.

Key Areas of HR Compliance

Employment Laws and Regulations HR compliance starts with understanding and adhering to federal, state, and local employment laws. These include:

Fair Labor Standards Act (FLSA) for wage and hour regulations

Equal Employment Opportunity (EEO) laws to prevent discrimination

Family and Medical Leave Act (FMLA) for employee leave policies

Americans with Disabilities Act (ADA) for workplace accessibility

Workplace Policies and Employee Handbook A well-documented employee handbook outlining company policies, workplace conduct, and compliance requirements ensures that employees understand their rights and responsibilities. Clear policies on harassment prevention, code of conduct, and grievance procedures help maintain a compliant workplace.

Payroll and Benefits Compliance HR compliance extends to payroll management, tax withholdings, and employee benefits administration. Businesses must ensure accurate payroll processing, adhere to minimum wage laws, and properly classify employees as exempt or non-exempt. Additionally, companies must comply with health insurance regulations under the Affordable Care Act (ACA).

Health and Safety Regulations Employers must follow Occupational Safety and Health Administration (OSHA) guidelines to maintain workplace safety and reduce the risk of accidents. Providing proper training, protective equipment, and safety policies is essential for HR compliance in workplace health and safety.

Hiring and Termination Procedures HR compliance covers fair hiring practices, including non-discriminatory recruitment and adherence to background check regulations. Similarly, when terminating employees, businesses must follow proper procedures to avoid wrongful termination claims and ensure compliance with severance policies.

Data Privacy and Confidentiality Protecting employee data is a crucial aspect of HR compliance. Companies must comply with data protection laws such as the General Data Protection Regulation (GDPR) and ensure secure handling of employee records, Social Security numbers, and personal information.

How to Strengthen HR Compliance

Regular Compliance Audits Conducting HR compliance audits helps identify gaps and areas for improvement. Regular reviews of policies, payroll systems, and employee records ensure compliance with labor laws and minimize risks.

Training for HR and Employees Providing HR compliance training for managers and employees ensures that everyone understands workplace policies, anti-discrimination laws, and safety protocols. Keeping employees informed reduces the risk of violations and legal disputes.