#ifsc codes

Explore tagged Tumblr posts

Link

IFSC Code to Bank Converter

0 notes

Text

FAQs Concerning MICR and IFSC Codes

What is the IFSC's complete form? Indian Financial System Code is the full form of the acronym IFSC

Why is IFSC applied? The Reserve Bank of India uses the Indian Financial System identifier (IFSC), an 11-digit alphanumeric identifier, to identify each bank branch within the National Electronic Funds Transfer (NEFT) network individually.

How do I use my IFSC code to look for a bank's name? Using the IFSC code, locating the bank name is quite simple. In the IFSC code, the bank name appears in the first four characters. For example, the IFSC code will resemble HDFC0004053 if the bank is called HDFC.

How does a MICR code represent something? The acronym for Magnetic Ink Character Recognition is MICR. This particular ink reacts to magnetic fields. A check has it printed on the bottom. Read more

1 note

·

View note

Text

Donate today to help those in need and make a difference in their lives."

#Donate Now#Bank Account Details#Account Holder : WE FOR EDUCATION WELFARE SOCIETY#Account No. : 922020002147540#IFSC Code : UTIB0001100#https://www.weforsociety.

1 note

·

View note

Text

Locate Bank of Baroda Rajkot Main Branch and get the nearest Branch details like Address, phone no. & Branch timing with just one click.

0 notes

Text

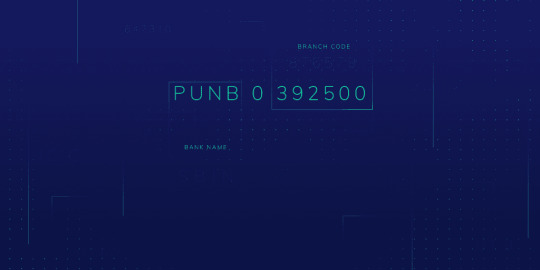

Seamless Banking In Kaimur Madhya Bihar Gramin Bank IFSC Code PUNB0MBGB06 Unveiled

Unlock the gateway to hassle-free transactions in Kaimur with Madhya Bihar Gramin Bank's IFSC Code PUNB0MBGB06. Our comprehensive guide on Urban Pincode provides you with the key details for secure and swift fund transfers.

0 notes

Text

Navigating Digital Transactions: Demystifying the ICICI Bank Limited IFSC Code

In the era of digital finance, where speed and accuracy are paramount, the ICICI Bank Limited IFSC Code emerges as a crucial element facilitating seamless online transactions. Let's delve into the intricacies of the ICICI Bank Limited IFSC Code, understand its significance, and explore how it plays a pivotal role in the digital banking landscape.

Decoding the ICICI Bank Limited IFSC Code:

The Indian Financial System Code (IFSC) is an alphanumeric code uniquely assigned to each bank branch by the Reserve Bank of India (RBI). For ICICI Bank Limited, one of India's leading private sector banks, the IFSC Code serves as a distinctive identifier, ensuring precision in electronic fund transfers and other digital transactions.

The ICICI Bank Limited IFSC Code follows a standardized structure where the first four characters represent the bank code, the fifth character is a reserved space, and the last six characters identify the specific branch. This unique code is instrumental in routing funds accurately to the intended recipient's account during online transactions.

Significance of ICICI Bank Limited IFSC Code:

Ensuring Transaction Accuracy: The primary role of the ICICI Bank Limited IFSC Code is to ensure the accuracy of online transactions. Whether customers are initiating fund transfers or engaging in digital banking activities, the correct IFSC Code is crucial for directing funds to the precise recipient's account.

Minimizing Errors: In a vast banking network with numerous branches, each having a unique IFSC Code, the potential for errors is inherent. The ICICI Bank Limited IFSC Code acts as a safeguard, minimizing the risk of errors and ensuring that funds are directed to the intended branch with precision.

Facilitating Interbank Transactions: The IFSC Code is particularly significant for interbank transactions. It enables seamless communication between banks, allowing for the swift and secure transfer of funds across different financial institutions.

Locating the ICICI Bank Limited IFSC Code:

For customers seeking the ICICI Bank Limited IFSC Code, the process is user-friendly and accessible:

Official Website: ICICI Bank provides an official online tool on its website where customers can easily locate the IFSC Code. By entering details such as the state, city, and branch name, customers can retrieve the specific code they need.

Mobile App: The ICICI Bank mobile app offers a convenient platform for customers to access the IFSC Code. It provides a seamless interface where users can input branch details and swiftly obtain the accurate code.

Online IFSC Code Finder Tools: Various online platforms offer dedicated IFSC Code Finder tools. These tools are designed to provide users with quick and accurate information by simply entering relevant details.

Elevating Digital Banking with ICICI Bank Limited IFSC Code

In the realm of digital transactions, the ICICI Bank Limited IFSC Code stands as a pillar of accuracy and security. It not only facilitates smooth fund transfers but also reflects ICICI Bank's commitment to providing customers with a robust and reliable digital banking experience. As customers navigate the digital financial landscape, the ICICI Bank Limited IFSC Code becomes their trusted companion, ensuring that each transaction is executed with precision and integrity.

0 notes

Text

An IFSC Code Meaning is a unique identification code that is used to identify the bank and branch of any particular bank account and is used in bank transfer systems like NEFT, RTGS, and IMPS. IFSC stands for ‘Indian Financial System Code’ and forms an essential part of the Indian banking infrastructure.

0 notes

Text

What is IFSC Code - An IFSC code is a unique identification code that is used to identify the bank and branch of any particular bank account and is used in bank transfer systems like NEFT, RTGS, and IMPS. IFSC stands for ‘Indian Financial System Code’ and forms an essential part of the Indian banking infrastructure.

0 notes

Text

"Donate today to help those in need and make a difference in their lives."

Donate Now

Bank Account Details

Account Holder : WE FOR EDUCATION WELFARE SOCIETY

Account No.: 922020002147540

IFSC Code: UTIB0001100

instagram

4 notes

·

View notes

Text

The Importance of IFSC Codes in Indian Banking

The Indian Financial System Code, commonly referred to as IFSC or Indian Financial System Code, is an eleven-character alphanumeric number that uniquely identifies bank branches and their associated NEFT or RTGS codes. This system was created by the Reserve Bank of India (RBI).

These IFSC codes are essential for Indian banking as they enable all online transactions such as the National Electronic Funds Transfer (NEFT), Real Time Gross Settlement (RTGS) and Immediate Payment Service (IMPS). Not only do these IFSC codes prevent errors from occurring but they make transfers quicker and smoother too.

Identifying a Bank Branch

The Importance of IFSC Codes in Indian Banking

The Indian Financial System Code (IFSC) is an 11-character alphanumeric code used by banks to identify their branches across India. This unique system ensures funds are directed correctly to the right bank branch within each nation.

IFSC codes are essential for many reasons, such as speed and efficiency, enhanced security, and nationwide coverage. Furthermore, they make online money transfers simpler which benefits both parties involved in the transaction.

The IFSC (International Financial System Code) is an eleven-character alphanumeric code that uniquely identifies each bank branch. This code is utilized by NEFT, RTGS and IMPS systems to guarantee funds transfer to their intended destination. Furthermore, IFSC codes enable tracking transactions which helps reduce errors and fraudulence.

Identifying a Beneficiary Account

Bank IFSC codes are 11-character identification numbers which uniquely identify every bank branch in India participating in the NEFT, RTGS and IMPS payment systems. These help banks settle and validate transactions quickly between branches by expediting settlement processes.

IFSC codes simplify paperwork and enable individuals and organizations to transfer funds online without visiting a branch, saving banks valuable time, effort, and manpower.

If you need to look up an IFSC code, there are various resources such as the Reserve Bank of India website that can be utilized. Nevertheless, it's wise to double-check its accuracy with the relevant bank before transferring funds elsewhere.

Indian banking relies heavily on IFSC codes. They guarantee your money is transferred to its intended beneficiary promptly and efficiently, making IFSC codes essential when doing online transfers or using services like net banking.

Identifying a Bank Account

The IFSC code is a unique identification that's needed when transferring funds online through various methods such as National Electronic Fund Transfer (NEFT), Real Time Gross Settlements (RTGS), Immediate Payment System (IMPS) and Unified Payment Interfaces (UPI). Additionally, this helps identify a beneficiary account by providing their bank details.

It is essential to comprehend that an IFSC code consists of eleven alphanumeric characters, consisting of letters, numbers and symbols. The first four characters represent a bank name while the last six are either numbers or letters representing branch codes.

Indian banking relies heavily on IFSC codes, which are used to uniquely identify each bank branch. You may find IFSC codes on various documents like cheque books and account statements.

Online Fund Transfer

IFSC codes are an integral component of modern banking when transferring funds online. They identify the bank branch where your account is registered for NEFT, RTGS and IMPS transactions.

When sending money overseas or within India, the recipient's IFSC code is essential for smooth processing. To locate this number, check their cheque book or passbook.

An IFSC code is an 11-digit number issued by the Reserve Bank of India to all Indian banks and their branches. The initial four characters identify the bank, while the following six correspond to a particular branch.

5 notes

·

View notes

Link

Bank to IFSC Code Converter

0 notes

Text

Benefits of an Import Export Code (IEC) to Your Business

Today, no business is strictly a domestic concern. With e-commerce and international trade on the rise, more companies are expanding their horizons through imports and exports. In India, businesses cannot legally export or import unless they have obtained an Import Export Code (IEC). This unique 10-digit code, issued by the Directorate General of Foreign Trade (DGFT), is essential for any business involved in international trade. In this blog, we’ll explore the benefits of having an IEC, how to apply for it, the documents required, its validity.

What is an Import Export Code (IEC)?

The Import Export Code (IEC), also known as the IEC number or IEC code, is a mandatory requirement for businesses engaged in importing or exporting goods and services. It serves as a primary identifier for businesses in international trade and is used for customs clearance, shipping, and other trade-related activities. Whether you’re a small business owner or a large corporation, having an IEC is crucial for seamless cross-border transactions.

How to Get an IEC Code

Obtaining an IEC code is relatively simple; however, help from tax consultants or a tax advisor can definitely make a difference. Here is the step-by-step process:

1. Apply Online: Go to the DGFT website and fill out the application form for an IEC code. Fill in all the details carefully, as they have to be the same in your business documents.

2. Documents Needed:

PAN card of the business or individual

Aadhaar card (for individuals) or incorporation certificate (for companies)

Bank certificate or cancelled cheque with the business's name, account number, and IFSC code

Passport-sized photograph of the applicant

Proof of address (electricity bill, rent agreement, etc.)

3. Fee for IEC Code: The IEC code fees are minimal, around INR 500. The payment can be done online through the DGFT portal.

4. Submission and Issuance: After submitting the application and the documents, the IEC is issued within 2-3 working days. The process is entirely online and is very fast and hassle-free.

Validity of the IEC Code

One of the main benefits of an IEC number is that it holds lifetime validity. Once issued, the IEC code does not need to be renewed, so it's a one-time investment for your business. This eliminates periodic renewal hassle and ensures your business is ready to engage in international trade always.

Benefits of Having an Import Export Code

An IEC code provides many advantages to businesses, especially those trading with a GST company. The following are the most important benefits:

1. Compliance with Laws: An IEC is an essential requirement to import or export goods and services. Without this, customs will not clear shipments, and that will lead to delays and penalties.

2. Seamless Customs Clearance: The IEC code is mandatory for customs clearance, which will ensure that your goods can be imported or exported without any legal hurdles.

3. Access to Global Markets: With an IEC, your business can tap into international markets, expand the customer base, and increase revenue potential.

4. GST Compliance: For businesses registered under GST, an IEC code is vital to receive ITC on imports made. A GST company or tax advisor can guide you through the challenging worlds of GST and IEC compliance.

5. Banking Transactions: An IEC is required to process all international payments, including remittances and foreign currency transactions. Banks will not process such a transaction without a valid IEC.

6. Government Benefits: Businesses with an IEC code are eligible for various government schemes and incentives aimed at promoting exports, such as duty drawbacks and export subsidies.

7. Enhanced Credibility: Having an IEC code adds credibility to your business, making it easier to establish trust with international buyers and suppliers.

8. No Renewal Required: You know that IEC code validity is lifetime; hence, there is no effort and time needed in the long run.

Why Choose Tax Consultants or a Tax Advisor?

Though getting an IEC code is pretty simple, firms often get perplexed about the legal and tax implications of international trade. That's where the tax consultants or a tax advisor can help you.

Ensure compliance with GST and other tax regulations.

Understand complexities in customs duty and tariffs.

Optimise your tax liability and benefit from government incentives.

Simplify the process for getting your IEC code.

With professionals at work, you can focus on business growth, leaving the rest of the legalese and tax-related matters to the professionals.

In a world where international trade is becoming increasingly accessible, having an Import Export Code (IEC) is no longer optional—it's a necessity. From legal compliance and seamless customs clearance to accessing global markets and government benefits, the advantages of an IEC code are undeniable. With its lifetime validity and nominal IEC code fees, it's a small investment that can yield significant returns for your business.

Whether you are a startup or an established enterprise, getting an IEC code should be on top of your list. And if you are unsure about the process or need help with GST compliance, don't hesitate to consult tax consultants or a tax advisor. They can guide you through every step, ensuring that your business is well-positioned to thrive in the global marketplace.So, if you’re ready to take your business to the next level, apply for your IEC number today and unlock the doors to international trade!

0 notes

Text

Find My Ifsc Code

Find My IFSC Code" is a crucial tool for individuals navigating the complexities of online banking and financial transactions. The IFSC (Indian Financial System Code) is a unique alphanumeric code assigned to each bank branch in India. This online service simplifies the process of locating this essential code by offering a user-friendly interface. Users can effortlessly search for their bank's IFSC code, enabling seamless electronic fund transfers, NEFT, RTGS, and other banking transactions. By providing accurate and up-to-date information, "Find My IFSC Code" empowers users to ensure the precision and security of their financial dealings, enhancing the overall efficiency of online banking experiences.

0 notes

Text

Seamless Banking In Kaimur Madhya Bihar Gramin Bank IFSC Code PUNB0MBGB06 Unveiled

Unlock the gateway to hassle-free transactions in Kaimur with Madhya Bihar Gramin Bank's IFSC Code PUNB0MBGB06. Our comprehensive guide on Urban Pincode provides you with the key details for secure and swift fund transfers.

0 notes