#if you cant tell the spreadsheet i use to make these things has been updated. so this is now a much faster process

Explore tagged Tumblr posts

Text

89/118

H He Li Be B C N O F Ne Na _ Al Si P S Cl Ar K Ca Sc Ti V Cr _ Fe Co Ni _ _ Ga Ge As Se Br _ _ Sr Y _ _ _ Tc Ru Rh _ Ag _ In Sn Sb Te I _ _ Ba La _ Ta W Re Os Ir _ Au Hg Tl _ Bi Po At Rn Fr Ra Ac Rf Db _ _ _ Mt Ds Rg _ Nh _ _ Lv Ts Og Ce Pr Nd _ Sm Eu _ Tb Dy Ho Er Tm Yb Lu Th Pa U _ Pu Am _ _ _ Es Fm _ No Lr

S Se W Er Rf F I H - 8/118

when I was around twelve I used to sit at the family computer and send hatemail to a white french dude named Jacques who was a self proclaimed communist on Tumblr. This was back in the day when you didn't need a blog to send anon hate. I had no real beef with him but I just didn't like his tone. used to send him "SHUT UP Jacques" periodically. and he'd answer every single one of my asks like "who is this?? show your face or I'll fucking kill you" and I'd be like "now now, that doesn't make sense, jacques" all haughty and he'd get so fucking mad at me. One time he posted a selfie and I sent him an ask claiming I was a psychologist and that his hair parting suggested that he wasn't a communist at all. and he took it deliriously serious and went off on a 2,000 word rant. I can remember going to stay at my grandparents over that weekend, so I didn't even respond to the rant until I came back. I could've chosen to end it there, but when I returned, I sent him another ask which was like "psychologist here again: if you were a communist your hair parting would be in the middle. evenly distributed. All behavioural signs point to someone who doesn't take their own values seriously." and he went ballistic. really swearing at me. all caps type beat. he never turned the asks off, btw. which always made me wonder if he didn't know how to, or if he didn't want to cause he was convinced he was fighting a war, and this action would ensure he lost it. anyway this went on for weeks until one day I completely forgot about him like he was some kind of childhood imaginary friend I'd conjured up in my loneliness. but yesterday I happened to recall the whole scenario, because my buddy was like "remember when you were twelve and I came over to your house, and you showed me on the computer how you'd been terrorizing this random French guy for days on end. And you were laughing like fucking crazy. and I said it wasn't funny because he probably had problems, and you were like 'oh.' and you looked a bit guilty for a second, but then you went and got a grapefruit from the kitchen and threw it out of the second story window at my kid brother, who was playing in the street, and then you started laughing again?" Well. when she put it like that, needless to say I felt bad. so Jacques if you're out there I'm sorry I was such a little shit. you had totally normal hair, and you only wanted people to share stuff. If it's any consolation I know every day of my life that I'm probably going to hell for the sick things I have done

#50%#75%#if you cant tell the spreadsheet i use to make these things has been updated. so this is now a much faster process

112K notes

·

View notes

Text

Is your home a better investment than the stock market?

Shares 169 Ill admit it: There are times that I think everything that needs to be said about personal finance has been said already, that all of the information is out there just waiting for people to find it. The problem is solved. Perhaps this is technically true, but now and then as this morning Im reminded that teaching people about money is a never-ending process. There arent a lot of new topics to write about, thats true (this is something that even famous professional financial journalists grouse about in private), but there are tons of new people to reach, people who have never been exposed to these ideas. And, more importantly, theres a constant stream of new misinformation polluting the pool of smart advice. (Sometimes this misinformation is well-meaning; sometimes its not.) Heres an example. This morning, I read a piece at Slate by Felix Salmon called The Millionaires Mortgage. Salmons argument is simple: Paying off your house is saving for retirement. Now, I dont necessarily disagree with this basic premise. I too believe that money you pay toward your mortgage principle is, in effect, money youve saved, just as if youd put it in the bank or invested in a mutual fund. Many financial advisers say the same thing: Money you put toward debt reduction is the same as money youve invested. (Obviously, theyre not exactly the same but theyre close enough.) So, yes, paying off your home is saving for retirement. Or, more precisely, its building your net worth. But aside from a sound basic premise, the rest of Salmons article boils down to bullshit.

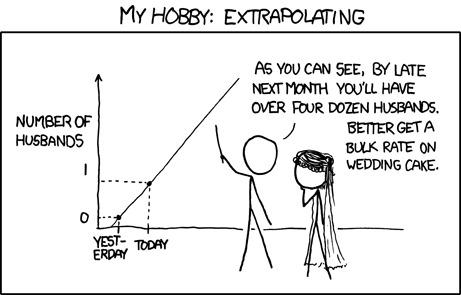

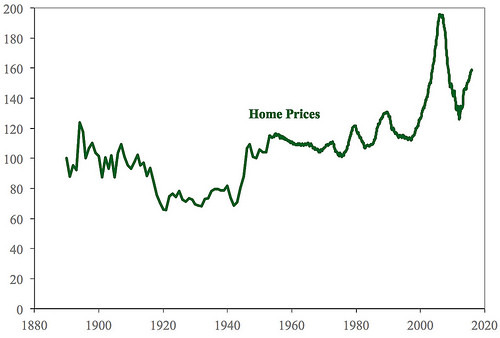

Lying with Statistics Looking past the paying off your house is saving for retirement subtitle on his piece (a subtitle that was likely added by an editor, not by Salmon), we get to his actual thesis: Making mortgage payments can, in theory, be a way to accumulate wealth almost as effectively as contributing to a retirement fund. Im glad Salmon qualified this statement with in theory and almost because this is pure unadulterated bullshit. And its dangerous bullshit. Heres how this logic works: If you buy an urban house today for $315,000 (the average price) and it appreciates at 8 percent a year for the next 15 years, you will be living in a $1 million house by the time you pay off your 15-year mortgage, and you will own it free and clear. Which is to say: Youll be a millionaire. For this to be true, heres what has to happen.: Home prices in your area have to appreciate at an average of eight percent not just this year and next year, but for fifteen years.You have to take out a 15-year mortgage instead of a 30-year mortgage.You need to stay in that house (or continue to own it) for that entire fifteen years.Once youve become a millionaire homeowner, you now have to tap that equity for it to be of use. To do that, you have to sell your home, acquire a reverse mortgage, or otherwise creatively access the value locked in your home. The real problem here, of course, are the assumptions about real estate returns. Salmon spouts huckster-level nonsense: The 8 percent appreciation rate is aggressive, but not entirely unrealistic: Its lower than the 8.3 percent appreciation rate from 2011 through 2017, and also lower than the 9 percent appreciation rate from 1996 to 2007. Thats right. Salmon cites stats from 1996 to 2007, then 2011 to 2017 and completely leaves out 2008 to 2010. WTF? This as if I ran a marathon and told you that I averaged four minutes per milebut I was only counting the miles during which I was running downhill! Or I told you that Get Rich Slowly earned $5000 per monthbut I was only giving you the numbers from April. Or I logged my alcohol consumption for thirty days and told you I averaged three drinks per weekbut left out how much I drank on weekends. This isnt how statistics work! You dont get to cherry pick the data. You cant just say, Homes in some markets appreciated 9% annually from 1996 to 2007, then 8.3% annually from 2011 to 2017. Therefor, your home should increase in value an average of eight percent per year. What about the gap years? What about the period before the (very short) 22 years youre citing? What makes you think that the boom times for housing are going to continue? Long-Term Home Price Appreciation In May, I shared a brief history of U.S. homeownership. To write that article, I spent hours reading research papers and sorting through data. One key piece of that post was the info on U.S. housing prices. Let me share that info again. For 25 years, Yale economics professor Robert Shiller has tracked U.S. home prices. He monitors current prices, yes, but hes also researched historical prices. Hes gathered all of this info into a spreadsheet, which he updates regularly and makes freely available on his website. This graph of Shillers data (through January 2016) shows how housing prices have changed over time:

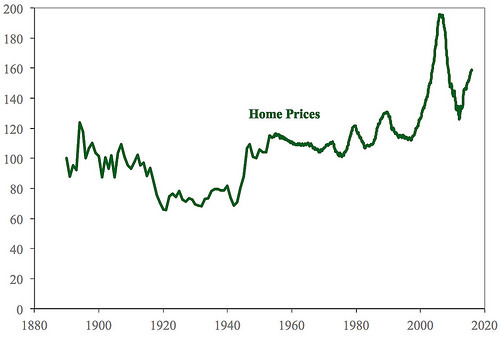

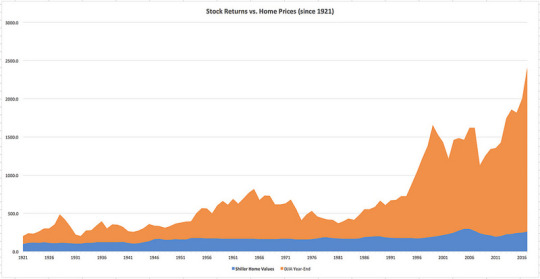

Shillers index is inflation-adjusted and based on sale prices of existing homes (not new construction). It uses 1890 as an arbitrary benchmark, which is assigned a value of 100. (To me, 110 looks like baseline normal. Maybe 1890 was a down year?) As you can see, home prices bounced around until the mid 1910s, at which point they dropped sharply. This decline was due largely to new mass-production techniques, which lowered the cost of building a home. (For thirty years, you could order your home from Sears!) Prices didnt recover until the conclusion of World War II and the coming of the G.I. Bill. From the 1950s until the mid-1990s, home prices hovered around 110 on the Shiller scale. For the past twenty years, the U.S. housing market has been a wild ride. We experienced an enormous bubble (and its aftermath) during the late 2000s. It looks very much like were at the front end of another bubble today. As of December 2017, home prices were at about 170 on the Shiller scale. (Personally, I believe that once interest rates begin to rise again, home prices will decline.) Heres the reality of residential real estate: Generally speaking, home values increase at roughly the same (or slightly more) than inflation. Ive noted in the past that gold provides a long-term real return of roughly 1%, meaning that it outpaces inflation by 1% over periods measured in decades. For myself, thats the figure I use for home values too. Crunching the Numbers Because Im a dedicated blogger (or dumb), I spent an hour building this chart for you folks. I took the afore-mentioned housing data from Robert Shillers spreadsheet and combined it with the inflation-adjusted closing value of the Dow Jones Industrial Average for each year since 1921. (I got the stock-market data here.) If youd like, you can click the graph to see a larger version.

Let me explain what youre seeing. First, I normalized everything to 1921. That means I set home values in 1921 to 100 and I set the closing Dow Jones Industrial Average to 100. From there, everything moves as normal relative to those values.Second, Im not sure why but Excel stacked the graphs. (Im not spreadsheet savvy enough to fix this.) They should both start at 100 in 1921, but instead the stock market graph starts at 200. This doesnt really make much of a difference to my point, but it bugs me. There are a few places 1932, 1947 where the line for home values should actually overtake the line for the stock market, but you cant tell that with the stacked graph. As the chart shows, the stock market has vastly outperformed the housing market over the long term. Theres no contest. The blue housing portion of my chart is equivalent to the line in Shillers chart (from 1921 on, obviously). Now, having said that, there are some things that I can see in my spreadsheet numbers that dont show up in this graph. Because Felix Salmon at Slate is using a 15-year window for his argument, I calculated 15-year changes for both home prices and stock prices. Ill admit that the results surprised me. Generally speaking, the stock market does provide better returns than homeownership. However, in 30 of the 82 fifteen-year periods since 1921, housing provided better returns. (And in 14 of 67 thirty-year periods, housing was the winner.) I didnt expect that. In each of these cases, housing outperformed stocks after a market crash. During any 15-year period starting in 1926 and ending in 1939 (except 1932), for instance, housing was the better bet. Same with 1958 to 1973. In other words, if you were to buy only when the market is declining, housing is probably the best bet if youre making a lump-sum investment and not contributing right along. Another thing the numbers show is that youre much less likely to suffer long-term declines with housing than with the stock market. Sure, there are occasional periods where home prices will drop over fifteen or thirty years, but generally homes gradually grow in value over time. The bottom line? I think its perfectly fair to call your home an investment, but its more like a store of value than a way to grow your wealth. And its nothing like investing in the U.S. stock market. For more on this subject, see Michael Bluejays excellent articles: Long-term real estate appreciation in the U.S. and Buying a home is an investment. Final Thoughts Honestly, I probably would have ignored Salmons article if it werent for the attacks he makes on saving for retirement. Take a look at this: If youre the kind of person who can max out your 401(k) every year for 30 or 40 years straight disciplined, frugal, and apparently immune to misfortune then, well, congratulations on your great good luck, and I hope youre at least a little bit embarrassed at how much of a tax break youre getting compared to people who need government support much more than you do. Holy cats! Salmon has just equated the discipline and frugality that readers like you exhibit with good luck, and simultaneously argued that you should be embarrassed for preparing for your future. He wants you to feel guilty because youre being proactive to prepare for retirement. Instead of doing that, he wants you to buy into his bullshit millionaires mortgage plan. This crosses the line from marginal advice to outright stupidity. Theres an ongoing discussion in the Early Retirement community about whether or not you should include home equity when calculating how much youve saved for retirement. There are those who argue absolutely not, you should never consider home equity. (A few of these folks dont even include home equity when computing their net worth, but that fundamentally misses the point of what net worth is.) I come down on the other side. I think its fine good, even to include home equity when making retirement calculations. But when you do, you need to be aware that the money you have in your home is only accessible if you sell or use the home as collateral on a loan. Regardless, Ive never heard anyone in the community argue that you ought to use your home as your primary source of retirement saving instead of investing in mutual funds and/or rental rental properties. You know why? Because its a bad idea! Shares 169 https://www.getrichslowly.org/home-investment/

0 notes

Text

Which car would have the highest insurance rates out of these?

"Which car would have the highest insurance rates out of these?

1. 2001 Audi TT Coupe 33,000 miles 2. 2007 Saturn Sky Convertible 8,603 miles 3. 2006 Volkswagen Jetta 31,000 miles 4. 2007 Scion tC 39,000 miles I am 16, and these are all stick shifts, and when i get one of these 4 in December, i think the one of the biggest factors for me at least comes down to insurance costs.

BEST ANSWER: Try this site where you can compare quotes: : http://averageinsurancecost.xyz/index.html?src=tumblr

RELATED QUESTIONS:

Health insurance question..?

I have bcbs of tx. My mom got it for me when I was there. I am now living in California but still have the insurance from bcbs tx. So can I still use the insurance that I have right now at the doctors office. Or I cant? If i cant, then what do I have to do in order to use my insurance..? Another thing, I am 17 years old so do I have to be with my mom if I make an appointment, or can I go by myself, Or do I need an adult to go with me. (I'm living with my uncle right now.)""

What's the best individual health insurance?

I am 27 and have no major health problems, but because all the jobs I have been getting lately are temporary gigs, none of my employers offer health insurance.""

Its cheaper to lease a new 2011 Jaguar then buy Auto Insurance?

Hey, I'm 16 (going onn 17) and I want a 1999 Mustang convertible (base, no GT or Cobra) I am a Male and my insurance is $500.00 a month... HOLY!!!!!!!!!!!!!!!!!! How do I lower it? PS: How is it possible Insurance companies judge on gender? I thought that was illegal now, I thought all our rights were equal?""

How much will auto insurance be for me?

I want to buy an eclipse,and im 20 years old. Had my license over a year. just want an average price""

Individual dental insurance for braces?

What is a good individual dental insurance if I were to get braces? I have done some research and nailed it down to DeltaCare and Pacificare. So which dental insurance is better, or any other suggestions? Pacificare cost slightly less than DeltaCare as far as co-payments go. Both are HMO plans, all the PPO plans covers little to nothing for braces, so HMO seems to be the only way to go for an individual plan. DeltaCare seems to be more reliable since it's associated with Delta Dental, a little more costly also. I'm more concerned about the quality of the services as far as making claims and such. So DeltaCare, Pacificare, or ay other dental insurance/plans? Any personal experience with either of these companies? I am in San Francisco, California.""

When do I get my money back from life insurance?

I was on life insurance since I was a baby I'm 21 now but how long will it take for me to get my check?

What is a good health care insurance provider for self employed people?

What is a good health care insurance provider for self employed people?

Does anyone know of a cheap auto insurance carrier in california?

does anyone know of a cheap auto insurance carrier in california

How does a speeding ticket affect insurance costs?

My parents own the car that I drive and cover insurance fees (I pay for gas/oil/maintenance). I got a speeding ticket today for $156 for going 52 in a 35 zone (if that price is legitimate and fair in CT, I'm not sure), but I'm curious as to how that will affect insurance costs? Anyone with knowledge in the area, your responses are much appreciated.""

How can I get my insurance cheaper?

21 years old 0 claims bonus first bike : 1998 r1 (already got it) what are some ways to get my insurance down? thanks

""Im 17 i hve a 1.4 citroen saxo west coast, nd te lowst insurance ive found is 2300! cn an1 suggest a company?""

ive tried all the compairson sites and they are really expensive, can anyone suggest a cheaper insurance company? i love my car and dont want to sell it!""

""Can I drive without insurance, if the car itself is insured?""

It's my dad's car. The car is insured but i am not, as in. I use to be on the same policy as my dad, but now i am off of it due to money problems. But the car I drive is insured under my dad. Is it legal to drive it? (CA)""

I'm getting my licence next week and I was wondering how much insurance cost for teens.?

I'm getting my licence next week and I was wondering how much insurance cost for teens.?

Car Insurance Question - For A First Car?

I've just recently bought my first car which will be shared with a parent, and it is one of my parents is the policy holder, I am an additional driver who currently holds a provisional license. The insurance started on the 14th March. However, I've got my driving test on Monday, so if I pass I will then have a full UK License. What will this do to the insurance? Do I have to then amend the policy to let the insurance company know I now have a UK license, or do I not need to let the insurance company know until the current policy needs renewing. Is it illegal if it is not updated when I get my UK license, as I believe the insurance will be a lot more expensive when I move to a full license from a provisional. Thanks""

Question about car insurance for a Honda Civic Si?

Ok so I'm 16, I just got a job and I have my permit and as soon as I get my license I'm going to be buying a car. I have already chosen my car. A 2006-2010 Honda Civic Si. The question is should I get the Honda Civic Si Coupe or the Sedan? Will the insurance be any different between the two or will it be very close if not the same? Thanks for all information.""

How much would car insurance cost for a Chevrolet Corvette C6 ZR1?

-I'M using the information for a spreadsheet and to get an idea of how much it costs to insure a modern day Corvette because I'M planning to get a Corvette Some Day . -An estimate is also fine thankz

Small Business General Liability Insurance rates for premiums and audits?

The small business that I work for is currently shopping for a GL carrier and in getting quotes, questions are coming up that I just cannot find the answers for. Our current GL company basis our premium on our policy year payroll. However, one company that we are getting a quote from is basing the quote on the policy year gross income. Now, these two numbers are VASTLY different and I don't know why one is basing my premium on one item and another company on another item. Another question is Audit Rates. The audit rates between these two companies, (again based on different item dollar amounts,) differs also and I was wondering what a standard audit dollar amount would be, or maybe an average? If it makes a difference, my company does subcontract low voltage work. Thanks!""

What are some cars with easily tunable engines and low insurance?

i need a car that i can make faster but i don't wanna pay alot f insurance. specific models please

""Moving to Toronto Canada, Need Car Insurance?""

I am moving to toronto, canada and looking to see what company provides the best coverage for the lowest cost as I understand insurance is privatized in Toronto.""

2 door sports car insurance costs?

I've been seriously looking into purchasing a 06 Hyundai Tiburon or an 04 Nissan 350z. I'm 18, and everytime I mention it to my parents, they ALWAYS bring up the fact that we ...show more""

A car crash into my car on purpose when my car was parking!!??INSURANCE!?

I got 1 ticket since i was driving til now will my insurance rate go up??? thankx

How much would insurance cost around for a 2002 ford explorer for a 16 year old?

please don't tell me it depends and such...i just want a range Thanks

Best car insurance for college students?

I need to know what the cheapeast car insurance is... ....

Long term disability insurance?

I am interested in buying long term disability insurance. Anyone has a good company in mind to recommand?

Can i take out two seperate care insurances for two different cars?

im looking to insurance another car in my name, but looking i have found cheaper quotes, i was wondering if i can have two different cars, on two different insurance poilcys? many thanks.""

Which car would have the highest insurance rates out of these?

1. 2001 Audi TT Coupe 33,000 miles 2. 2007 Saturn Sky Convertible 8,603 miles 3. 2006 Volkswagen Jetta 31,000 miles 4. 2007 Scion tC 39,000 miles I am 16, and these are all stick shifts, and when i get one of these 4 in December, i think the one of the biggest factors for me at least comes down to insurance costs.

What is the cheapest car to insure for a 17-19 year old guy from the UK in 2013?

I'm 16 and will be taking my test next year and I want to know what to get for my first car?

Farmers Insurance problem when changed from CA to OR?

Hi, I've had insurance in CA for 2 years and moved to Oregon recently. I had my insurance tranferred with an useless Farmers Agent in OR. The thing is I already paid my 6 months premium in CA which is covered me until 06/2009. I paid nearly $450 for until 06/29. I've had quite a few discounts in CA but the jug-head agent in Oregon, not shifted any discounts to Oregon automatically. I got a bill for next 6 months from that agent saying that I have to pay $1000, since I haven't lived in Oregon for long enough. Jeez!!!. It's almost a $600 rise in my insurance that too I haven't had any claims or ticket in my last 5 years. I went to meet him in person but he told that's all he can do it. He didn't look my CA policy/discounts too. Then I told him, I can get $500 insurance anywhere else. But he challenges me if I could get something like that. I haven't approached any other insurers yet. Is it anything like insurance history or something like that maintained nationwide or in Oregon? Does he threaten me based on somre record? Can I get some decent insurance from someother insurers/agents? In CA I've never paid my 6 months permium more than $450. I'm the only driver for my car and the car is 8 years old. I've never claimed from any insurance till date. I neither had any speeding tickets elsewhere. Can I get some insurance for some decent rate If I shop around? My farmers insurance expects to pay the additional premium in a week else my policy with farmers expires. I dont want to meet someother farmers agents. I wanna get out of farmers and go with someone else. Can I get some decent insurance in a week?""

Got a speeding ticket. Will my insurance go up?

I am 28 years old. I have a clean driving record. I got a speeding ticket for 0-10 miles over. Seat belt on. Will my insurance company know I got this ticket and will they raise my rates. We have Geico. Should I take the defensive driving class and keep this ticket off my record? Or should I just pay it and go on?

Does you're engine being a V-8 vs a V-6 matter in what u pay for insurance?

i'm 16 and want to buy a white mustang, i'll spend the extra money for the V-8 but i don't know if it will increase my insurance costs, will it?""

Will my license get suspended if I don't have insurance?

I had a 6 month policy. It ended the 20th of this month. However my insurance was due the 28 of last month and I wasn't able to pay it. Will my license get suspended if I don't have insurance? I don't drive it, it just sits in the drive way. Am I okay as long as I'm not driving or does it not matter? If it does matter does anyone know anything I can do to keep it from getting suspended? Also does anyone know of any affordable insurance companies? I'm 20 years old, so I know it's gonna be more for me than someone over 25.""

Can an insurance company drop your auto insurance any time?

I have had 3 claims in 4 years. The first two claims where while living in another state. I since moved and just put in my third claim today (first claim with this company). My insurance payment really isn't all that high, about $75 monthly. The lady told me today that it would go up 10% if the cost was over $750. (it will be) She said this didn't effect my insurability or anything, but what if I had another accident in a year?? The real question is, can an insurance company drop you for any reason at any time? Some have said no, only within the first 60 days, others say yes, absolutely any time. What's the right answer?""

Do I need car insurance to register an overdue car?

I missed my registration date for my car and it doesn't have any insurance. Do I need to get insurance before they will let me register the car? I live in Fresno, California. I want to get it registered to sell it through craigslist, if that matters.""

What is the cheapest auto insurance for a new driver?

I'm 23, female, and a new driver. I don't care about the quality of the insurance, I just need CHEAP, CHEAP, CHEAP. A potential job depends on a car I'm about to get, and I need cheap insurance ASAP.""

Can I insure my boyfriends car in my name and him as a named driver?

We are trying to get the cost of his car insurance down and realised if we insure it in my name and add him as a named driver it is much cheaper. Is this allowed even though I have my own car? currently live seperately but due to move in together in 3 weeks.

Car Insurance - How much of my premium would I get back?

Hi everyone I live in the UK and I insure my car with Direct Line. I have never had any issues with them before apart from now that I have a new car. I have several years no claims for my driving, most of which are through policies with Direct Line. However, the first 2 years I was driving I was with another insurance company and gained 2 years no claims with them. When I took out my latest policy with Direct Line after buying a new vehicle they said they needed to see proof of my no claims. I contacted my old insurance company who sent me a letter confirming these years and I sent this to Direct Line, they said they never received it so I requested another letter and sent this one also but via Recorded Delivery. It is now a month on and Direct Line are claiming they haven't received this one either although proof of postage and tracking shows it was signed for. I wish to cancel my policy with Direct Line and was wondering how much of my policy cost I would be entitled to receive back from them. Many thanks""

Looking for icn national insurance?

supposedly an insurance company

Whats your best insurance quote? (Young guys only plz!)?

Just curious, whats your best insurance quote guys? - I'm hunting for a decent deal for my tiny little 796cc car outside.. Yeah, that's right, I'm gonna boy race with my 796cc mean machine. So yeah, whats your best quotes and is it fully comp, third party only? fire and theft? So far I got a 700 quote third party fire and theft I'm quite happy with... Sorry girls, no offense but I'm kind of looking for guys answers, Your insurance is completely different :) And I'm 18 btw""

Is driving a motorcyle dangerous? and will it raise my insurance prices?

is a motorcycle more dangerous than a car what are the pros and cons. i am considering it for the good gas millage i am 18 yrs old (clean record) -- will it increase my insurance costs

What would happen if I can't afford my car insurance?

I'm 18 and just got a car and insurance. I am set to pay on the 28th of each month, starting this month. My insurance is $236 a month and it's being taken directly from my checking account. Say by this time if I was short $20 - $30, what would happen? I know I'd get a $35 overdraft fee from my bank but what happen with the car insurance company?""

How much does liability insurance cost for auto in TX?

How much does liability insurance cost for auto in TX?

Car Insurance in Northern NJ?

Hello, How much do a couple pay on an average for car insurance premiums in Northern NJ? I am insured with liberty mutual and my monthly commitment is close to $140, I have a clean driving history and no claims in the past. Culd you suggest how I cut down on my premiums? Also the best car insurance company in the tri state area.""

How much would full coverage insurance cost?

I want to get a car loan to buy this 2004 Hyundai Tiburon. I'm 18, I've been in one accident. Around how much a month?""

Hey how much will car insurance be when i start driving at 16?

ok heres the thing,ill be 16 years old when i get my dl,our insurance is mercury,and i am gonna drive a 1991 civic hatchback,or a 1992 integra any clues o how much per month""

How much car insurance should I get?

I live in California and wanted to try to save some money on my car insurance. I want to get enough coverage in case I am responsible for a major accient. Any recommendations on the following? Bodily Injury and Property Damage Uninsured/ Underinsured Motorist Uninsured Motorist Property Damage Medical Payments Thanks!

How much would insurance be on this car for a 17 year old?

Photo: http://i.imgur.com/oBPkdUi.jpg

New car for 16 year old. Insurance question?

So I'm 16 and my parents are buying me a 2009-2010 Honda Civic EX-L.

Cars to avoid for low insurance?

Im looking to buy my first car, I dont have any driving history and my licence is still provisional. Someone told me that certain cars, like 2 doors, make your insurance higher. Is this true? If so, what other car characteristics should I avoid?""

What would be a good and cheap car insurance here in TX?

What would be a good and cheap car insurance here in TX?

Do you know who offers the best insurance rates for BMWs?

We are trying to update our club policy for members.

Can I still be insured with my mother?

So, my crappy old car just broke down. In the last few months I have managed to save up some money and I have decided to purchase a used car. The car cost about 6000 dollars and I have gotten a 3000 dollar loan in my name to pay the rest of the cost. So I'm trying to get all the paper work done because everything is in my name. My mom already purchased a car so she couldn't' even help my out to get a loan. Before I could even get the car, the bank needs a binding from an insurance company. When I had my old car my mom had me under her insurance because the car was under her name. So I want to know if after I get my insurance on my new car if I will be able to switch it over with my mom. Or will I be able to transfer the old car insurance into the new one. Right now I am planning to get the same insurance she has. Will I always have to have the insurance under my name is it is my car? This is in Massachusetts""

Which car would have the highest insurance rates out of these?

1. 2001 Audi TT Coupe 33,000 miles 2. 2007 Saturn Sky Convertible 8,603 miles 3. 2006 Volkswagen Jetta 31,000 miles 4. 2007 Scion tC 39,000 miles I am 16, and these are all stick shifts, and when i get one of these 4 in December, i think the one of the biggest factors for me at least comes down to insurance costs.

Do all car insurance rates drop when you turn 25?

When I turned 25 everyone told me congrats that my car insurance rate would drop. I never heard of this. I asked around and some people said that that is not ALWAYS true. Is it? I use Esurance Auto Insurance. Do i need to call to get the discount. Is there even a discount. Do insurance companys automatically do it? Hmm.

How much would insurance be on a mistibishi lancer GT on my moms insurance? (16 yrs. old)?

We are thinking about purchasing a mistibishi but we fear the insurance would skyrocket as me being a new driver. Any help?

In a california DUI license suspension how do i get my license back?

its been a year that got a DUI in California and got my license suspended, and im just wondering how do i get my license back? do i just show up to DMV? i never got sent to court so by law the case gets dismissed after a year. so how do i go about getting my license back. ANSWER FAST!! :D""

A car crash into my car on purpose when my car was parking!!??INSURANCE!?

I got 1 ticket since i was driving til now will my insurance rate go up??? thankx

What type of Life Insurance would be best for me?

I am a 27 year old single male. I own a house that has a mortgage, and I have some outstanding debt, car, student loans, etc. I plan to be married within the next 3-4 years. I want to make sure that if something should happen to me my family, future wife and parents, are not stuck with my bills and able to continue on without a huge finacial hardship. I know there are different types of life insurance, but not sure how the different ones work. Any help would be greatly appreciated.""

Cheap car insurance for 17 year old?

Hi, I have just passed my driving test and need to insure my car. When I had a provisional licence, my insurance was 550 a year, but now the cheapest I can find is 1850 a year now I have passed! The insurance company I was with only covers learners. Anyone know where I can get cheap insurance? I have tried all the comparison sites. Should my dad insure it and put me on as a driver? Thank you.""

Car Insurance 10 pts. best answer!?

What are the parties to an insurance policy. So far i've got policyholder, and underwriter what are some other ones? thanks""

VERY EXPENSIVE CAR INSURANCE?

I can't understand this issue. I have been living in the uk since 2008. I used to pay 900 for the insurance, then it raised to 1200 and now they ask me for 2300 for the third year renewal. I never made a claim and I have a full UK license and an international license for 11 years. I am 29 years old and I am an educated with MSc in medical sciences and I never drink or smoke. Is it because I am a foreigner. My friend is a British and he only pay 490 and he just obtained his license and we live at the same building. I can't find an answer for this problem only that car insurance companies are racist toward foreigners.""

Home Content Insurance?

Hi this may be a odd question but is it possible to get insurance for one item?? I have had 2 replace my comp and it would have helped if I had insurance instead of getting anouther built! Thanks

What cheap classic car would you recommend for a 17 year old?!?

I turn 17 in October and so i have began to start looking for cars and the insurance that it will cost me. from looking on go-compare, i've found that the cheapest cars to insure are old classics like the VW beetle or Rover mini. I would really like to know if there are any other cool looking classic cars out on the market that would suit a 17 year old? they will have to have a small sized engine as well. recommendations would be great! thanks""

Student health insurance...please help?

So, I'm looking for my first health insurance since becoming independent. What is a reasonable amount for the deductible and monthly payments, coinsurance and the price per office visit? I really have no idea...thanks for any advice. i'm a full time student btw and i'm 19 female""

Help!!!! changing car insurance?

I called another company and had a quote with them and they offering me a way better price than my current insurance company... I wanna make a change.. what do I do? Do I have to call up the current insurance company and cancel the policy?

If i'm 17 and in the military can i get a discount on car insurance?

My mom has PGC insurance and with me added to it its another $1000 ever 6 months. I'm in the U.S. army. is there a way i can get a discount on car insurance?

""Could $5,000 cover the healthcare insurance premium for a family?""

If McCain's credit becomes reality, doesn't it seem logical that a major healthcare provider would put together an affordable health insurance package for the credit amount and market the heck out of it? Obviously, it won't have all the bells and whistles, but people would be covered. There is the issue of the tax on the premium, but it still seems like a good idea. This link was interesting - it describes both plans clearly: http://money.cnn.com/2008/03/10/news/economy/tully_healthcare.fortune/""

How do auto insurance providers calculate your payments?

I just got off the phone with my auto insurance to change my address. They informed me that my rate is going to be $16 more now because I moved to a different zip code. The problem is, I had previously had my insurance changed because it skyrocketed after my previous move. Which is strange because I had moved from the same city before and it went down about $20. I have since moved BACK to the SAME city I was in before and it's going up again?? This makes NO SENSE! I thought it was based off of your location (zip code). But now I just think these insurance companies are making up their own numbers and rules and we're all getting screwed!! Can someone please explain this insanity to me? My zip code is now and was before, 95608. The zip code I just moved from is 95628. Yes, I have moved back and forth 4 times within the same 2 cities if you're confused.""

List of cheap auto insurance in Georgia $40-$50 a month?

cheap auto insurance in Georgia .looking for where I can pay btw $40-$50 a month

Boss mustang & insurance?

here's the thing. im 16 and live in VA. im saving up to get my dream car, a 1971 boss mustang. ive had my permit and hopefully about to get my license next month. everything would be perfect if it wasn't for the insurance price. are there any discounts that are available that would help out a lot? and does it cost anything if i just get my license and for now not drive? if so around how much? thanks a bunch in advance""

Car insurance.......?

hey guys, i was just wondering how much car insurance would be for me. i am 20 years old and just recently starting driving and when i say recently i mean like today haha!. but anyones i DO know that to get a real SET price i would have to call and get a quote but i was hoping to here from some of yall about how much YOU pay each month, how old you are and what kind of car you drive, just to get an ideal of how much its going to be for me ya know? thanks for the help""

""I am about to quit my job, need advice about insurance?

I am quitting my job in a couple of weeks to start my own business. I am shopping around for individual health insurance plans and have found a couple that will suit my needs. The problem is that the plans are both Anthem (Blue Cross California) and that is the same insurance that my employer carries. I'm worried that contacting Anthem to start the process of getting coverage will alert my employer that I am leaving. Should I be concerned?

How much to insure a classic bus?

i'm a mild bus enthusiast, and would quite like to buy a preserved vehicle. and i was wondering how much it would cost to insure the vehicle for pleasure purposes only, and how much it would cost to run. fuel figures and what not, tax and mot. also, what are the complications in being 17, like max people to carry and whatever. cheers ;)""

Will a speeding ticket increase my liability insurance rates at allstate?

No prior tickets in 7+ years. It was 74 in a 60. Its 2 points and a license doesn't get suspended until 12 points in a 2 year period. 49 years old. Liability only. My rate is about $98 every 6 months for 100/300/100 with no uninsured motorist. If you don't know, please do not answer or guess.""

""Whats a cheap military car insurance, with low down payment?""

i know usaa, but i want options.. im in florida.. if that makes a difference""

If requiring people to have car insurance is the same as requiring them to have health insurance then why?

Wont the US government help you pay your car insurance if you cant afford it? Isn't car insurance a basic human right?

Dairyland insurance company for motorcycle?

How can they issue me registration over the phone? I'm located in Michigan and the local office has a different price then what I was quoted over the phone. Over the phone I pay $168, the office said it would be $330. I don't feel uncomfortable getting insurance over the phone but looks like I may have to. Is this okay to do and has anyone else done this before?""

Raising money for individuals with health condition?

I'm just curious about why people ask for donation and fund raising for people with health condition here in Canada. Health care is free that will cover most of the medical ...show more

Which car would have the highest insurance rates out of these?

1. 2001 Audi TT Coupe 33,000 miles 2. 2007 Saturn Sky Convertible 8,603 miles 3. 2006 Volkswagen Jetta 31,000 miles 4. 2007 Scion tC 39,000 miles I am 16, and these are all stick shifts, and when i get one of these 4 in December, i think the one of the biggest factors for me at least comes down to insurance costs.

Does anyone know where i can get car insurance?

does anyone know where a college student with bad credit can get a car insurance

I got into a car accident (my fault) without insurance. What now?

Yesterday, I hit a parked car with my boyfriends car. The car I hit has some door damage, and I thought I would be covered by my boyfriends insurance. Turns out that his insurance expired in the beginning of August so I'm not covered; I also don't have car insurance. The couple whose car I hit are now saying that they can put a warrant out for my boyfriend's arrest because he has an uninsured car (I was driving, not him!). Is this true? What happens in this situation ? I told the owner I can make payments, but I want to know my rights, as long as his. I also live in the state of CT, if that helps.""

What is the best car insurance?

I need to get insurance on my new car but don't know what company is the best insurance to get it from. I need full coverage as the car is being financed not owned yet. I currently have Geico but I think their rates are too high, but they are a pretty good insurance from what I hear. What do you have? Do you like them?""

Can my father insure my car under his name?

I'm planing on financing a car and my father will Co sign. Can he put the car under his insurance I am only 18 years old so insurance just under my name is extremely expensive or is there a way he can be a Co owner of the vehicle if so how ?

Car insurance for a 16 year old boy with a 90s camaro?

Im a 16 year old boy living in kansas and i want a 90s Camaro as my first car but my dad thinks that insurance will be super expensive, so i was wondering that if i just got liability and towing how much would it be? The cars are typically anywhere in between 2k and 5k dollars, at least thats my price range. I dont know if that affects anything but I thought I should bring it up. And do you guys think that a 90s Camaro is a good first car? thanks for answering all of my questions.""

Tips on low insurance quotes?

Tips on low insurance quotes?

""Im 17 and got a DUI, will this affect my insurance when I turn 18?""

I realize this was the dumbest decision me and my buddy have made in our lives. Trust me I dont want to be near a vehicle for a while. I have lost my license for only 90 days, the cops were very respectable about, and did not criminally charge me, although they were good at scaring the **** out of me. It will also cost me 500$ to get my license back after the 90 days, and my car has been impounded for 30 :(. I live in British Columbia, Canada and the car I was in is my parents and I am registered under them. Again, I feel ******* terrible about it and glad I didnt injure anyone, especially someone not in my vehicle. - The drinking age is 19, he didnt charge me for under age thankfully. - Im not considered an adult until I turn 18, you sure this will stick with me?""

Coop Young Drivers Insurance. Where do they install the smart box?

Where do they install the smart box? My car has got two 6x9's on the parcel shelf and they won't insure a car with modified sound, I'm thinking of removing the parcel shelf and hiding the wires leading to it when the engineer comes around. Would they notice?""

Car Insurance lower or higher if you lease it instead of financing it?

Hello, I would like to know if car insurance is lower or higher if you lease it instead of financing it?""

""I'm 17, I want a vauxhall corsa sxi or a fiat 500 abrath, how much will each of these cost on insurance?""

I'm 17, I want a vauxhall corsa sxi or a fiat 500 abrath, how much will each of these cost on insurance?""

I want to save money and am looking for cheapest car insurance in uk?

can any one tell me where to get an insurance say third party only or fire and theft at the most for less than 500 pounds a year online

Can someone help me find car insurance for my dad?

my dad is looking for a car insurance company that insures anyone who drives his car, ie. his children. is this possible? what insurance companies offer this type of insurance?""

What does depreciation cost mean when it comes to home insurance?

filed a claim to replace my floors.getting a check in 5-7 business days.it says i have 180 days to replace the floors,to cover depriciation cost.what does that mean exactly?""

""I wrecked my new car , insurance is liability?

i wrecked my car . my car was new 2009 car and my insurance was liabilty. police decided that was my fault. And also i am still paying monthly payment on that car. Does anybody know what should i do next . i been using that car to work now i am unemployee . should i just bankrufcy

Does anyone have either Geico or Progressive car insurance.? Or any of the smaller national companies?

I need to change from State Farm. They are charging me an arm and a leg after 10+ yrs as a customer, and a good driving record. But the past year I have been 'dinged' several times. Which has cost me a very considerable raise- 75%- in premiums. I am getting good rates from Geico and Progressive. But I do not know of anyone in my family or circle of friends who have either of the 'new guys'. I would like some feedback. Thanks""

Will auto insurance find out about my ticket?

I got 2 tickets carless driving and 62 in a 40. My truck has insurance in my grandpas name. the cop asked for my insurance but i lied and said i didnt have it so he didnt even see a insurance card. do you think that progressive will find out? they did last time when i got pulled over but i gave the cop insurance

Need to switch car insurance?

i am 18 and a female, i have a car under my parents name along with the insurance. last year i was in a car accident, and this year my insurance went up to $2000 a year with statefarm. i have to come up with $400 for the renewal period now. we've looked for insurance to something cheaper but cant find anything...can anybody help me find a cheaper insurance or where to look for one. thank you so much""

What do i do if I have breast cancer and no insurance?

I am 42 and won't go to the doctor because I have no insurance, I can't pay the $250 for a check up, plus lab fees, just to find out, not to mention the other tests and the referrals I'd get if there was an issue...I'm scared to go to the doctor, and scared not to go. any advice?""

Best car for gas and insurance for a 16 year old male?

Hi im a 16 year old male and need a older car because apparently there better on insurance? old as in from 1996-2002 what would be my best bet for gas/insurance?

What is the Cheapest Homeowners Insurance for Senior Citizen?

My elderly neighbor has had her homeowners insurance cancelled because she couldnt afford to pay it. She is on a fixed income and her children do not help in any way. She owns her home but is having a hard time with paying the large payments. her mortage company says that if she doesnt take out her own insurance then they will purchase it for her at a cost of 2100.00 per year. This is way too much for a Senior citizen. i got a quote for her from progressive for 2600.00. Are there any cheaper alternatives?

How much would insurance cost for a yamaha r6?

I'm 16, male, and I live in va. And the insurer would be gieco. Thanks""

What is an Average Home insurance rate of a 2 story house?

4.5 baths 5 beds 3000 sq feet finished basement 3 decks 1 fenced in gorund pool Please, just and average for 1 month home insurace. No super valuables or anything. (It's for a project) I just can't find anything that won't just give me a chart or some thing. In class we had to make up an imaginary house and get all this different stuff for it. I've found everything,but home insurance rate without having to put in my personal info.""

Car insurance cost for a 17 year old male?

My son is fixing to get his drivers licence and I've been told by people that it is very exspensive for him to have insurance. Can anyone tell me the average a young new driver has to pay ?

Cheap Car Insurance for my first car?

My dad owns it but hes giving it to me technically he wants me to pay insurance and I want something cheap, the majority of insurances say im underage to be reliable for it. I'm 17, is there a cheap insurance for my little chevorlate cavalier car?""

Which car insurance company fit what I want?

Hi, I recently cancelled my car insurance from State Farm because they were over-charging on my bill. I am 19 years old, and have a new car (Honda Accord Coupe) which is a 2 door which is considered a sport's car. Because I'm a young driver, and it's a new car, and it's a sports car my insurance was off the roof. I want to find another car insurance that will have fair coverage and is affordable for me. I live in PA if that helps as well...""

Which car would have the highest insurance rates out of these?

1. 2001 Audi TT Coupe 33,000 miles 2. 2007 Saturn Sky Convertible 8,603 miles 3. 2006 Volkswagen Jetta 31,000 miles 4. 2007 Scion tC 39,000 miles I am 16, and these are all stick shifts, and when i get one of these 4 in December, i think the one of the biggest factors for me at least comes down to insurance costs.

https://www.linkedin.com/post/edit/6309235307707457536"

0 notes

Text

Is your home a better investment than the stock market?

Shares 169 Ill admit it: There are times that I think everything that needs to be said about personal finance has been said already, that all of the information is out there just waiting for people to find it. The problem is solved. Perhaps this is technically true, but now and then as this morning Im reminded that teaching people about money is a never-ending process. There arent a lot of new topics to write about, thats true (this is something that even famous professional financial journalists grouse about in private), but there are tons of new people to reach, people who have never been exposed to these ideas. And, more importantly, theres a constant stream of new misinformation polluting the pool of smart advice. (Sometimes this misinformation is well-meaning; sometimes its not.) Heres an example. This morning, I read a piece at Slate by Felix Salmon called The Millionaires Mortgage. Salmons argument is simple: Paying off your house is saving for retirement. Now, I dont necessarily disagree with this basic premise. I too believe that money you pay toward your mortgage principle is, in effect, money youve saved, just as if youd put it in the bank or invested in a mutual fund. Many financial advisers say the same thing: Money you put toward debt reduction is the same as money youve invested. (Obviously, theyre not exactly the same but theyre close enough.) So, yes, paying off your home is saving for retirement. Or, more precisely, its building your net worth. But aside from a sound basic premise, the rest of Salmons article boils down to bullshit.

Lying with Statistics Looking past the paying off your house is saving for retirement subtitle on his piece (a subtitle that was likely added by an editor, not by Salmon), we get to his actual thesis: Making mortgage payments can, in theory, be a way to accumulate wealth almost as effectively as contributing to a retirement fund. Im glad Salmon qualified this statement with in theory and almost because this is pure unadulterated bullshit. And its dangerous bullshit. Heres how this logic works: If you buy an urban house today for $315,000 (the average price) and it appreciates at 8 percent a year for the next 15 years, you will be living in a $1 million house by the time you pay off your 15-year mortgage, and you will own it free and clear. Which is to say: Youll be a millionaire. For this to be true, heres what has to happen.: Home prices in your area have to appreciate at an average of eight percent not just this year and next year, but for fifteen years.You have to take out a 15-year mortgage instead of a 30-year mortgage.You need to stay in that house (or continue to own it) for that entire fifteen years.Once youve become a millionaire homeowner, you now have to tap that equity for it to be of use. To do that, you have to sell your home, acquire a reverse mortgage, or otherwise creatively access the value locked in your home. The real problem here, of course, are the assumptions about real estate returns. Salmon spouts huckster-level nonsense: The 8 percent appreciation rate is aggressive, but not entirely unrealistic: Its lower than the 8.3 percent appreciation rate from 2011 through 2017, and also lower than the 9 percent appreciation rate from 1996 to 2007. Thats right. Salmon cites stats from 1996 to 2007, then 2011 to 2017 and completely leaves out 2008 to 2010. WTF? This as if I ran a marathon and told you that I averaged four minutes per milebut I was only counting the miles during which I was running downhill! Or I told you that Get Rich Slowly earned $5000 per monthbut I was only giving you the numbers from April. Or I logged my alcohol consumption for thirty days and told you I averaged three drinks per weekbut left out how much I drank on weekends. This isnt how statistics work! You dont get to cherry pick the data. You cant just say, Homes in some markets appreciated 9% annually from 1996 to 2007, then 8.3% annually from 2011 to 2017. Therefor, your home should increase in value an average of eight percent per year. What about the gap years? What about the period before the (very short) 22 years youre citing? What makes you think that the boom times for housing are going to continue? Long-Term Home Price Appreciation In May, I shared a brief history of U.S. homeownership. To write that article, I spent hours reading research papers and sorting through data. One key piece of that post was the info on U.S. housing prices. Let me share that info again. For 25 years, Yale economics professor Robert Shiller has tracked U.S. home prices. He monitors current prices, yes, but hes also researched historical prices. Hes gathered all of this info into a spreadsheet, which he updates regularly and makes freely available on his website. This graph of Shillers data (through January 2016) shows how housing prices have changed over time:

Shillers index is inflation-adjusted and based on sale prices of existing homes (not new construction). It uses 1890 as an arbitrary benchmark, which is assigned a value of 100. (To me, 110 looks like baseline normal. Maybe 1890 was a down year?) As you can see, home prices bounced around until the mid 1910s, at which point they dropped sharply. This decline was due largely to new mass-production techniques, which lowered the cost of building a home. (For thirty years, you could order your home from Sears!) Prices didnt recover until the conclusion of World War II and the coming of the G.I. Bill. From the 1950s until the mid-1990s, home prices hovered around 110 on the Shiller scale. For the past twenty years, the U.S. housing market has been a wild ride. We experienced an enormous bubble (and its aftermath) during the late 2000s. It looks very much like were at the front end of another bubble today. As of December 2017, home prices were at about 170 on the Shiller scale. (Personally, I believe that once interest rates begin to rise again, home prices will decline.) Heres the reality of residential real estate: Generally speaking, home values increase at roughly the same (or slightly more) than inflation. Ive noted in the past that gold provides a long-term real return of roughly 1%, meaning that it outpaces inflation by 1% over periods measured in decades. For myself, thats the figure I use for home values too. Crunching the Numbers Because Im a dedicated blogger (or dumb), I spent an hour building this chart for you folks. I took the afore-mentioned housing data from Robert Shillers spreadsheet and combined it with the inflation-adjusted closing value of the Dow Jones Industrial Average for each year since 1921. (I got the stock-market data here.) If youd like, you can click the graph to see a larger version.

Let me explain what youre seeing. First, I normalized everything to 1921. That means I set home values in 1921 to 100 and I set the closing Dow Jones Industrial Average to 100. From there, everything moves as normal relative to those values.Second, Im not sure why but Excel stacked the graphs. (Im not spreadsheet savvy enough to fix this.) They should both start at 100 in 1921, but instead the stock market graph starts at 200. This doesnt really make much of a difference to my point, but it bugs me. There are a few places 1932, 1947 where the line for home values should actually overtake the line for the stock market, but you cant tell that with the stacked graph. As the chart shows, the stock market has vastly outperformed the housing market over the long term. Theres no contest. The blue housing portion of my chart is equivalent to the line in Shillers chart (from 1921 on, obviously). Now, having said that, there are some things that I can see in my spreadsheet numbers that dont show up in this graph. Because Felix Salmon at Slate is using a 15-year window for his argument, I calculated 15-year changes for both home prices and stock prices. Ill admit that the results surprised me. Generally speaking, the stock market does provide better returns than homeownership. However, in 30 of the 82 fifteen-year periods since 1921, housing provided better returns. (And in 14 of 67 thirty-year periods, housing was the winner.) I didnt expect that. In each of these cases, housing outperformed stocks after a market crash. During any 15-year period starting in 1926 and ending in 1939 (except 1932), for instance, housing was the better bet. Same with 1958 to 1973. In other words, if you were to buy only when the market is declining, housing is probably the best bet if youre making a lump-sum investment and not contributing right along. Another thing the numbers show is that youre much less likely to suffer long-term declines with housing than with the stock market. Sure, there are occasional periods where home prices will drop over fifteen or thirty years, but generally homes gradually grow in value over time. The bottom line? I think its perfectly fair to call your home an investment, but its more like a store of value than a way to grow your wealth. And its nothing like investing in the U.S. stock market. For more on this subject, see Michael Bluejays excellent articles: Long-term real estate appreciation in the U.S. and Buying a home is an investment. Final Thoughts Honestly, I probably would have ignored Salmons article if it werent for the attacks he makes on saving for retirement. Take a look at this: If youre the kind of person who can max out your 401(k) every year for 30 or 40 years straight disciplined, frugal, and apparently immune to misfortune then, well, congratulations on your great good luck, and I hope youre at least a little bit embarrassed at how much of a tax break youre getting compared to people who need government support much more than you do. Holy cats! Salmon has just equated the discipline and frugality that readers like you exhibit with good luck, and simultaneously argued that you should be embarrassed for preparing for your future. He wants you to feel guilty because youre being proactive to prepare for retirement. Instead of doing that, he wants you to buy into his bullshit millionaires mortgage plan. This crosses the line from marginal advice to outright stupidity. Theres an ongoing discussion in the Early Retirement community about whether or not you should include home equity when calculating how much youve saved for retirement. There are those who argue absolutely not, you should never consider home equity. (A few of these folks dont even include home equity when computing their net worth, but that fundamentally misses the point of what net worth is.) I come down on the other side. I think its fine good, even to include home equity when making retirement calculations. But when you do, you need to be aware that the money you have in your home is only accessible if you sell or use the home as collateral on a loan. Regardless, Ive never heard anyone in the community argue that you ought to use your home as your primary source of retirement saving instead of investing in mutual funds and/or rental rental properties. You know why? Because its a bad idea! Shares 169 https://www.getrichslowly.org/home-investment/

0 notes

Text

Is your home a better investment than the stock market?

Ill admit it: There are times that I think everything that needs to be said about personal finance has been said already, that all of the information is out there just waiting for people to find it. The problem is solved. Perhaps this is technically true, but now and then as this morning Im reminded that teaching people about money is a never-ending process. There arent a lot of new topics to write about, thats true (this is something that even famous professional financial journalists grouse about in private), but there are tons of new people to reach, people who have never been exposed to these ideas. And, more importantly, theres a constant stream of new misinformation polluting the pool of smart advice. (Sometimes this misinformation is well-meaning; sometimes its not.) Heres an example. This morning, I read a piece at Slate by Felix Salmon called The Millionaires Mortgage. Salmons argument is simple: Paying off your house is saving for retirement. Now, I dont necessarily disagree with this basic premise. I too believe that money you pay toward your mortgage principle is, in effect, money youve saved, just as if youd put it in the bank or invested in a mutual fund. Many financial advisers say the same thing: Money you put toward debt reduction is the same as money youve invested. (Obviously, theyre not exactly the same but theyre close enough.) So, yes, paying off your home is saving for retirement. Or, more precisely, its building your net worth. But aside from a sound basic premise, the rest of Salmons article boils down to bullshit.

Lying with Statistics Looking past the paying off your house is saving for retirement subtitle on his piece (a subtitle that was likely added by an editor, not by Salmon), we get to his actual thesis: Making mortgage payments can, in theory, be a way to accumulate wealth almost as effectively as contributing to a retirement fund. Im glad Salmon qualified this statement with in theory and almost because this is pure unadulterated bullshit. And its dangerous bullshit. Heres how this logic works: If you buy an urban house today for $315,000 (the average price) and it appreciates at 8 percent a year for the next 15 years, you will be living in a $1 million house by the time you pay off your 15-year mortgage, and you will own it free and clear. Which is to say: Youll be a millionaire. For this to be true, heres what has to happen.: Home prices in your area have to appreciate at an average of eight percent not just this year and next year, but for fifteen years.You have to take out a 15-year mortgage instead of a 30-year mortgage.You need to stay in that house (or continue to own it) for that entire fifteen years.Once youve become a millionaire homeowner, you now have to tap that equity for it to be of use. To do that, you have to sell your home, acquire a reverse mortgage, or otherwise creatively access the value locked in your home. The real problem here, of course, are the assumptions about real estate returns. Salmon spouts huckster-level nonsense: The 8 percent appreciation rate is aggressive, but not entirely unrealistic: Its lower than the 8.3 percent appreciation rate from 2011 through 2017, and also lower than the 9 percent appreciation rate from 1996 to 2007. Thats right. Salmon cites stats from 1996 to 2007, then 2011 to 2017 and completely leaves out 2008 to 2010. WTF? This as if I ran a marathon and told you that I averaged four minutes per milebut I was only counting the miles during which I was running downhill! Or I told you that Get Rich Slowly earned $5000 per monthbut I was only giving you the numbers from April. Or I logged my alcohol consumption for thirty days and told you I averaged three drinks per weekbut left out how much I drank on weekends. This isnt how statistics work! You dont get to cherry pick the data. You cant just say, Homes in some markets appreciated 9% annually from 1996 to 2007, then 8.3% annually from 2011 to 2017. Therefor, your home should increase in value an average of eight percent per year. What about the gap years? What about the period before the (very short) 22 years youre citing? What makes you think that the boom times for housing are going to continue? Long-Term Home Price Appreciation In May, I shared a brief history of U.S. homeownership. To write that article, I spent hours reading research papers and sorting through data. One key piece of that post was the info on U.S. housing prices. Let me share that info again. For 25 years, Yale economics professor Robert Shiller has tracked U.S. home prices. He monitors current prices, yes, but hes also researched historical prices. Hes gathered all of this info into a spreadsheet, which he updates regularly and makes freely available on his website. This graph of Shillers data (through January 2016) shows how housing prices have changed over time:

Shillers index is inflation-adjusted and based on sale prices of existing homes (not new construction). It uses 1890 as an arbitrary benchmark, which is assigned a value of 100. (To me, 110 looks like baseline normal. Maybe 1890 was a down year?) As you can see, home prices bounced around until the mid 1910s, at which point they dropped sharply. This decline was due largely to new mass-production techniques, which lowered the cost of building a home. (For thirty years, you could order your home from Sears!) Prices didnt recover until the conclusion of World War II and the coming of the G.I. Bill. From the 1950s until the mid-1990s, home prices hovered around 110 on the Shiller scale. For the past twenty years, the U.S. housing market has been a wild ride. We experienced an enormous bubble (and its aftermath) during the late 2000s. It looks very much like were at the front end of another bubble today. As of December 2017, home prices were at about 170 on the Shiller scale. (Personally, I believe that once interest rates begin to rise again, home prices will decline.) Heres the reality of residential real estate: Generally speaking, home values increase at roughly the same (or slightly more) than inflation. Ive noted in the past that gold provides a long-term real return of roughly 1%, meaning that it outpaces inflation by 1% over periods measured in decades. For myself, thats the figure I use for home values too. Crunching the Numbers Because Im a dedicated blogger (or dumb), I spent an hour building this chart for you folks. I took the afore-mentioned housing data from Robert Shillers spreadsheet and combined it with the inflation-adjusted closing value of the Down Jones Industrial Average for each year since 1921. (I got the stock-market data here.) If youd like, you can click the graph to see a larger version.

Let me explain what youre seeing. First, I normalized everything to 1921. That means I set home values in 1921 to 100 and I set the closing Down Jones Industrial Average to 100. From there, everything moves as normal relative to those values.Second, Im not sure why but Excel stacked the graphs. (Im not spreadsheet savvy enough to fix this.) They should both start at 100 in 1921, but instead the stock market graph starts at 200. This doesnt really make much of a difference to my point, but it bugs me. There are a few places 1932, 1947 where the line for home values should actually overtake the line for the stock market, but you cant tell that with the stacked graph. As the chart shows, the stock market has vastly outperformed the housing market over the long term. Theres no contest. The blue housing portion of my chart is equivalent to the line in Shillers chart (from 1921 on, obviously). Now, having said that, there are some things that I can see in my spreadsheet numbers that dont show up in this graph. Because Felix Salmon at Slate is using a 15-year window for his argument, I calculated 15-year changes for both home prices and stock prices. Ill admit that the results surprised me. Generally speaking, the stock market does provide better returns than homeownership. However, in 30 of the 82 fifteen-year periods since 1921, housing provided better returns. (And in 14 of 67 thirty-year periods, housing was the winner.) I didnt expect that. In each of these cases, housing outperformed stocks after a market crash. During any 15-year period starting in 1926 and ending in 1939 (except 1932), for instance, housing was the better bet. Same with 1958 to 1973. In other words, if you were to buy only when the market is declining, housing is probably the best bet if youre making a lump-sum investment and not contributing right along. Another thing the numbers show is that youre much less likely to suffer long-term declines with housing than with the stock market. Sure, there are occasional periods where home prices will drop over fifteen or thirty years, but generally homes gradually grow in value over time. The bottom line? I think its perfectly fair to call your home an investment, but its more like a store of value than a way to grow your wealth. And its nothing like investing in the U.S. stock market. For more on this subject, see Michael Bluejays excellent articles: Long-term real estate appreciation in the U.S. and Buying a home is an investment. Final Thoughts Honestly, I probably would have ignored Salmons article if it werent for the attacks he makes on saving for retirement. Take a look at this: If youre the kind of person who can max out your 401(k) every year for 30 or 40 years straight disciplined, frugal, and apparently immune to misfortune then, well, congratulations on your great good luck, and I hope youre at least a little bit embarrassed at how much of a tax break youre getting compared to people who need government support much more than you do. Holy cats! Salmon has just equated the discipline and frugality that readers like you exhibit with good luck, and simultaneously argued that you should be embarrassed for preparing for your future. He wants you to feel guilty because youre being proactive to prepare for retirement. Instead of doing that, he wants you to buy into his bullshit millionaires mortgage plan. This crosses the line from marginal advice to outright stupidity. Theres an ongoing discussion in the Early Retirement community about whether or not you should include home equity when calculating how much youve saved for retirement. There are those who argue absolutely not, you should never consider home equity. (A few of these folks dont even include home equity when computing their net worth, but that fundamentally misses the point of what net worth is.) I come down on the other side. I think its fine good, even to include home equity when making retirement calculations. But when you do, you need to be aware that the money you have in your home is only accessible if you sell or use the home as collateral on a loan. Regardless, Ive never heard anyone in the community argue that you ought to use your home as your primary source of retirement saving instead of investing in mutual funds and/or rental rental properties. You know why? Because its a bad idea! https://www.getrichslowly.org/home-investment/

0 notes