#if i paid someone to go shopping for me (even just instacart) and do my laundry that'd be like a sixth of my weekend back

Explore tagged Tumblr posts

Text

i need about twice as many hours in the day and four times as much ability to focus

#thinking about this weekend and how i have errands a hangout and a covid/flu appt planned and i need to work on cleaning my closet#as a step in a chain of things i need to do over the next year to prepare for moving/just to downsize in general#But i also have been wanting to watch this movie i was recommended and i REALLY want to set aside some time to work on a drawing#but i ALSO need to keep working out and i need to clean my bathroom and i also WANT to read and watch so#me other things and Ahhhhhhh TIME!!!!!#I love so many things i want to do so much ahhhhhhh#isn't it insane how wealth lets you buy yourself more time in the day by outsourcing necessities to other people#if i paid someone to go shopping for me (even just instacart) and do my laundry that'd be like a sixth of my weekend back#if i paid someone to cook for me? lord. if i paid someone to CLEAN?????#SIGHS#i like doing these things for myself but i'd like to do other things more. oh well

3 notes

·

View notes

Text

Moving Day DID NOT Go As Planned

Last time we moved, we vowed we weren't doing it that way again. We rented a U-Haul, asked some friends for help, loaded all of our belongings into a truck, drove them to our next place, and unloaded all of our stuff. "Next time," we said, "next time we're hiring movers."

And this time, we did. We found a service called Bellhop, they had good rates. We booked our move for Friday the 23rd of July. We closed on our new house two weeks before, and we needed to be out of our rental by the 31st. That would give us a week to make sure we left the property in the same condition we found it in.

By the time the movers got there at 2:00pm on Friday, I had already emptied the basement into two separate storage units by transporting boxes in my car. I packed up the library, thousands of books, and moved all of those over to the new place myself. We packed up all our DVDs and Blu-rays, and moved all of them into storage along with the shelving we used to display them. We'd packed up most of the kitchen (the counter-tops were still full of stuff from the cabinets we emptied, we figured we had a week to pack and move the stragglers) and moved the boxes to the front room. We packed up the bedroom and the nursery, and moved most of those boxes to the front room. We left some boxes stacked in the nursery.

We bought a new couch for the new house and were getting rid of the old one. So we told them we didn't need the couch moved. We had some loose items that hadn't made it into boxes on the couch, which also, was not their concern. We showed them the front room, said we needed those boxes, the curio cabinet, computer desk, leave the couch, the desk we used as a TV stand, the TV (surround sound, 4k player, cable box had already been packed and moved), from the kitchen, just the small table, microwave, washer and dryer. No need to move the refrigerator, or the stove, they belonged in the house. Upstairs, we needed two beds, the crib, chest of drawers, computer desk, TV, a nightstand, an etagere, and two small filing cabinets moved.

By this time, a full three quarters of our belongings had already been moved into storage or into the new house. The movers were supposed to come with the expectation that they were moving a two story, two bedroom house into a three bedroom two story house. After they stepped outside and conferred amongst themselves, they came back in and said they were going to need to re-schedule the move … — Scuse, please? You don't re-schedule a fucking move. Moving day is moving day, come hell or high water. Period. Full stop. End of story.

Upon questioning, they said it was to give us more time to prepare for the move … — Scuse, please? For two months we've been spending our evenings and weekends packing and moving the majority of our belongings out of this fucking house while working full time jobs and raising a child. My entire library is already moved, all of the end tables, my massive mixed media collection … two storage units, a 10x10 and a 5x10, and a good portion of my new house was already full of my stuff that I already moved there prior to moving day. What the fuck do you want me to do, take apart all the furniture? That's kind of the point of hiring movers. I don't want to mess with that. I don't want to do it so much, that I'm willing to pay someone else to do it. That's the whole point of hiring the work out.

Anyway, they left and after we picked our jaws up off the floor at the sheer fucking audacity of what had just happened, we re-grouped and scrambled to find a U-Haul truck available at 2:00 pm on a Friday afternoon in late July. Luckily, we found a twenty-six foot truck available. I reserved it, we went and picked it up. It was jacked up. The brake light kept coming on and beeping at me. The brakes seemed fine, and if I turned the truck off and back on again, it stopped until it decided to start up with the beeping again.

I got the truck home at 4:30 pm, and we immediately started loading it as fast as we could. The goal was to get as much as we possibly could into the truck, loading our bed and Rowan's crib last, so we could get the truck to our new house, and unload the crib and bed, get them set up by a fairly reasonable time, go to sleep, and save the rest of the unloading for morning. We stopped loading and headed to our new home around 9:00 pm. We were tired, sweaty, dirty, we hurt all over. And to think — the plan had been to sit back and point at things while we watched fit, muscular men move all our stuff for us. We'd paid good money for it, after all.

I think we got to sleep around 3:00 am the next morning. Nothing went quite as planned. When we got back home with the U-Haul, we realized we didn't have any of Rowan's food, nor her milk, nor any food for us, and we didn't have Sammy's dog food. So, I left Jay to fight with getting Rowan's crib re-assembled on his own while I ran to Kroger and obtained sustenance for my family.

In the morning, I tried to secure the truck for another day. It was already booked. Every 26 foot truck in a 30 mile radius was booked. I tried to get a smaller truck, any truck, for the rest of our stuff. I kept calling all of the U-Haul locations near me. Nobody had a truck. Finally, I called the national number, and they did find a 20 foot truck. So, while Jay dropped Rowan off at his friend Linda's house, I unloaded what I could of the U-Haul. When Jay got back, we unloaded the two-man objects. We went to the U-Haul, swapped out the trucks, and drove back to our old house for round two.

Jay headed back in the car to go pick up Rowan at around 7:00 pm. I kept loading until around 8:30, then drove the second truckload of furniture and boxes back to our new home. We had no plans to unload that night. We would unload in the morning, return the truck, and bring two more carloads home that evening, my Versa and his Optima. Monday, Tuesday, and Wednesday of the next week, I drove the Versa over to the old place after work and brought home a carload. Thursday, we took both cars, we made two trips with the Versa and one with the Optima. Friday, we brought both cars again, loaded them up, and finally got everything out of the old place that we meant to take.

Saturday, July 31st, eight days after some jackasses with no work ethic told us we needed to reschedule our move, I drove to the rental office and dropped off our keys.

I think that in many ways, in some states, when executed properly, the gig economy can be a good thing. In states that have adopted the Affordable Care Act, where self-employed individuals can find affordable health care options, and sensible tax codes. I think it has the potential to be good for workers, employers, and consumers alike. I rely quite heavily on services like Instacart, Shipt, Doordash, and Amazon, all of whom employ gig workers to make deliveries, do the shopping, etc. Most of the time they do a phenomenal job. And when they don't, it's usually because the person you lucked into getting is fairly new, in over their heads, not cut out for the job, and likely won't last long before they seek out something more suitable for them.

But a moving company is not suited for gig workers at all. Moving a person's belongings with the care and respect they deserve is a learned skill that most people don't possess. Let's face it, Americans love their things. Their shiny baubles. Their found treasures. I was already nervous that the movers might just be careless and break things without a thought. I was nervous that they wouldn't show at all. I didn't imagine they'd show up and then go, "Meh, too hard."

We wanted professional movers, and they sent us college kids with no work ethic, no sense of obligation to honor an agreement, and absolutely no clue what goes into moving all of ones belongings from one house to another. Every time I think back, I think up fresh, new ways I should have berated them as they beat a hasty retreat from my rented property.

Next time we move, I swear, we're hiring professional movers.

5 notes

·

View notes

Text

this weekend

was definitely the closest thing i’ve had to a normal weekend since march.

we celebrated emma’s birthday on thursday, at the wine bar in clinton hill where i had my birthday party last year. it was just the three of us, me, emma, and kate, and nobody else was even there at the bar, really. just three idiots drinking three bottles of wine and impulse-buying tickets for opening weekend at the bronx zoo.

here is the thursday night look, along with my dumb little susan alexandra bag i bought last week:

friday i mostly slept off my hangover and felt horrible and anxious all day and then daniel and i watched palm springs, which i honestly had low expectations for, but it was exactly what i wanted it to be: short, aesthetically pleasing, just the right amount of cynical time-traveling andy samberg, soundtrack featuring kate bush.

on saturday kate and i made cupcakes for emma (chocolate cupcakes with a rosemary buttercream) and carried them over to golda so i could buy a bottle of wine for emma (the same wine that i paid [redacted dollar amount] for at petra at kate’s birthday in january) and overheard the co-owner of a franklin ave bar we really liked make a very unseemly comment about a Black woman walking by the bar who was saying something about BLM and police brutality. this bar, which sits on a heavily gentrified street in bed stuy, has not made any sort of public comment about the police brutality and BLM movements. we had a long discussion about how to handle what we heard—we kind of couldn’t believe that the co-owner felt so comfortable saying something like that in front of a bunch of strangers—but ultimately we decided to handle it privately, and kate ended up writing an email to the bar about it today.

emma’s park picnic for her birthday was perfect—friends all showed up, and even my sister and her roommate stopped by. we drank orange wine and pet jaz and gabe’s dog moose and absolutely did not come into close physical contact with anyone. eventually i left the park with a friend i hadn’t seen in months and we walked back towards fort greene and caught each other up on our lives, which was so nice.

i started “seeing” “someone” last month and instead of doing our usual thing of bar-hopping and getting to-go drinks and food last night when it was 300 degrees outside we hung out in his air conditioned apartment and drank two bottles of natural wine and pet his cat and ordered thai food and watched most of a full season of entourage, which is all i would want from someone during normal, non-pandemic times anyway.

today i did some work in the morning and then went to wegmans with larissa. that grocery store absolutely sucks—it’s like 65% instacart shoppers and nothing is in stock and the store is too crowded with people in a way that makes me feel so uncomfortable so everyone there, shopping for themselves or for others, are all just sort of vultures circling the charcuterie display—and it is only my wegmans brand loyalty that keeps me coming back. then i came home and napped and watched five episodes of i may destroy you, which has, appropriately, destroyed me.

it’s very hard not to have a weekend like the one that’s currently slipping through my fingers and be like “better enjoy it, this is as good as it’s going to get this year! remember this when you’re spending all day inside in december again!” i talk about this literally every week with my therapist, who assures me that she is talking about this with all of her other clients too. tomorrow i’ll go to work and stay inside all day and not get my steps in or see anyone, but i needed a weekend like this to remind me that not everything has irreversibly changed this year.

1 note

·

View note

Text

I Tried a Grocery Delivery Service and I Liked It

I have always assumed that a grocery delivery service would be prohibitively expensive for me, but like most things I assume without verifying, there eventually comes a day where I get curious enough to go check and see if I’ve been bullshitting myself. Enter Instacart. Grocery delivery is not to be confused with meal planning delivery services like Blue Apron that deliver pre-planned meal packages with a recipe. Grocery delivery is just straight up where someone else goes to the grocery store for you and drops off your groceries at your address (or carries them into your kitchen for you). If you sign up for the “Express” plan it’s $99 for the year. If you order over $35 per run (which I would easily do every time) the delivery fee is waived, which is otherwise $3.99. A 5% tip is built in and expected. I think if you don’t sign up there is a service fee with each order to incentivize you, I think it was around $5 for my $100 order before I decided to sign up and eliminate it. So here’s my math: I’m estimating our household makes about 6 grocery runs a month. At $99 a year that’s $8.25 a month for the service. We spend about $400 per month for the two of us, and groceries represent nearly all of our food budget as we both eat at home almost every night and pack our lunches for work. That comes to $20/month in tips at the 5% rate. So if I add up the monthly expenses, we get $28.25, divide by 6 to calculate the cost of each run and we land at $4.70. So for our household it only costs me $4.70 to send someone else to do the shopping. That means no drive, no grocery store, no carrying in the groceries and I can make my little list and order on my laptop from the couch. They show up in a few hours, usually only 2 if you order at a non-busy time and I think there is a paid option to rush delivery. $4.70!!! And I don’t have to spend the 1-1.5 hours traveling, shopping, and unloading. They let you try it for 2 weeks without paying the $99 so you can calculate the fees for yourself if it’s hard to picture here with just what I’ve written. Just make sure to unsubscribe before the trial is up or they will sign you up and charge your card for it. Or you can not sign up and just use as needed with the service charge on each order. Alternatively, you can just save this link for a rainy day. With it you get $10 off your first order and that knocks out all the fees and tip if your order is between $35 and $100, even if you don’t subscribe for the year or use the 14 day trial, so basically you can get one grocery delivery for free. I am stoked to share this with my fellow spoonies because I think we all have the “can’t go to store because of symptoms, need groceries” emergency at least once. Full disclosure: the referral link gets me $10 on my account also, but I would not recommend this if I wasn’t really impressed with it. I’ve only made one order, and I will update if something goes screwy but so far, a godsend.

64 notes

·

View notes

Text

Cheap spoon savers

Let’s talk about chores—or more specifically, not doing them. Laundry, cooking, dishes, and shopping are incredibly hard for me, even just from the ADHD angle. Add in the fatigue, dizziness, joint problems, and hand issues, and these things take up my entire weekend. I finally decided to outsource some of the work, and it was WAY more affordable than I expected.

Obviously, I’ve been using disposable kitchenware whenever possible for a long time. The majority of my food is mostly pre-prepared in some way (pre-chopped and/or frozen veggies, fully cooked bacon, etc.). But I was getting really sick every time I went to the laundromat or grocery store, so I tried paying for their extra services.

Laundry service: $1 per pound, min. $10. (I spent $10 + optional tip for an entire week’s worth of clothes, a set of sheets, and some cardigans. Note: I would have paid at least $6 to wash and dry that amount of laundry.)

Bring some hangers for hangables and they’ll hang them up for you. Everything else was nicely folded. They pulled out the non-dryables even though I said it was fine to just dry everything because I didn’t have spoons to sort it. They provided all the detergent, softener, dryer sheets, etc. (As a bonus, apparently using this service really helps small local laundromats! Also, if you can’t get your laundry down your stairs, some places even offer pickup/dropoff at your house for an added fee.)

Clicklist at Kroger: $5 per order (free this time for me, unsure why; Walmart has a similar service but I haven’t tried it yet. I don’t go grocery shopping every week so this is extremely affordable!)

With Clicklist, I went through the Kroger site and picked out what I wanted, applied any coupons, then placed my order. It was so much easier to grocery shop from bed! I made way better decisions and could see the coupons as I shopped. In a few hours, I’ll drive to Kroger, and they’ll bring me my groceries, ready to go. Amazing! (Also, if you’re not even able to drive/uber to the store or get groceries up your front stairs, Instacart is a slightly more expensive option you can check out.)

Bottom line: It’s worth it—for me. Both services cost, at most, a combined extra $5-10 per week. I would absolutely pay someone $30 a month to do my laundry and grocery shopping for me! I would also pay a $30 a month co-pay for medicine that reduced the extreme effects the grocery store and laundromat have on my symptoms. There was a time not long ago when I couldn’t have afforded even that much per month, but thankfully I can afford it now.

Hope this helps someone! I was really struggling and expected it to be a lot more expensive.

5 notes

·

View notes

Text

Target’s Delivery App Workers Describe a Culture of Retaliation and Fear

In late October, Ashley Johnson, a single mom and seasoned gig worker in a quiet Seattle suburb, tweeted about the decline of lucrative work on Shipt, the Target-owned grocery delivery app.

“Shipt has taken the […] model of hiring so many shoppers per area that those of us who have given our blood, sweat, and tears can no longer even get orders unless we pre schedule shifts. I haven't had an order in WEEKS. WEEKS. I'm hungry, shipt,” Johnson wrote. “I went from making $200 a week with shipt to making $0-25.”

Last year, Shipt flooded its markets with new workers and began rolling out an algorithmic pay model in certain cities, like Seattle, that many workers say has left them scrambling to piece together gigs and took a chunk out of their paychecks, as Gizmodo reported.

An hour after tweeting, Johnson received an email from Shipt telling her that she had been “deactivated” and was not “eligible to reapply” for her job, according to an email reviewed by Motherboard. The letter provided no explanation for her removal from the app. (On gig economy apps like Uber and the like, “deactivation” is the same thing as getting fired.)

We don't know why Shipt deactivated Johnson's account, but the company has a track record of censoring and retaliating against workers for asking basic questions about their working conditions or expressing dissent. In particular, on its official national Facebook group, known as the Shipt Shopper Lounge, which has more than 100,000 members, Shipt moderators selected by the company frequently censor and remove posts, turn off comments sections, and ban workers who speak out about their working conditions, according to screenshots, interviews, and other documentation provided to Motherboard. The same is true on local Facebook groups, which Shipt also monitors closely, according to workers.

Motherboard spoke to seven current Shipt workers, each of whom described a culture of retaliation, fear, and censorship online. They told Motherboard that posts asking for advice on getting higher tips and how to avoid liabilities on the job never get approved by moderators.

According to the Facebook group’s “About” page, the shopper lounge, is intended to be a “helpful community for all Shipt shoppers.” But workers lament censorship online and joke about their First Amendment rights. “The last post I commented on got deleted…I’m not even from the U.S. but I know we all have freedom of speech here, right?,” one worker wrote in a non-company controlled Facebook group where workers complained about censorship.

One of these workers, who lives in a Midwestern city, and asked to remain anonymous due to fear they would be retaliated against, said they were deactivated in early February after writing a comment on a post announcing the new corporate logo, a green shopping bag.

“No one actually knows what gets you deactivated. They never tell you. It’s like you’re always walking on eggshells.”

They had criticized the new design, and later that day received two emails within 15 minutes of each other. One was from a Shipt social media specialist informing them they had been suspended from the Facebook group; another, also from Shipt, said they had been deactivated.

After the worker shot off a series of emails to Shipt and threatened a lawsuit, they said, the company followed up to tell them that their deactivation had been a mistake: Signing off as “Shopper Success,” a representative for the company said it wrongly took their post to be “inappropriate” and “discriminatory,” and would reverse its decision. But the worker was still shaken. “What they did was wrong. They can’t go around firing people,” the Shipt worker told Motherboard.

According to workers and emails reviewed by Motherboard, Shipt never provides explanations for why workers are deactivated.

“No one actually knows what gets you deactivated. They never tell you,” Willy Solis, a Shipt worker in the Dallas area, said. “It’s like you’re always walking on eggshells.”

“If something rubs people the wrong way, it gets deleted,” Michael, another Shipt worker who works as a security guard by day on the Gulf Coast and asked to use his first name only because he feared retaliation, told Motherboard. “The Facebook group is supposed to be a resource of information to help workers. But if you say something, someone doesn’t like—a Shipt moderator just removes the thread, or removes you from the lounge.”

He said he was kicked out of his local Facebook group, also moderated by Shipt, for arguing with a moderator about a comment he made about the demise of good paying gigs on the app. “I got honest and made some comments about not working the regular schedule anymore, and then me and one of the moderators got into a pissing match,” Michael said. “It took me a couple days to realize I had been banned from the group.”

“Shipt’s official social channels exist as a supportive online community and shoppers are asked not to post inflammatory, rude, insulting, attacking, trolling or threatening posts or comments," a Shipt spokesperson told Motherboard when asked about censorship and deactivations on social media. "Shipt, however, does not make deactivation decisions based on shopper feedback consistent with those guidelines. We do have written agreements with all shoppers that outline possible causes for deactivation including consistent performance issues resulting in a poor customer experience or unlawful behavior.”

Shipt, a major rival of the grocery delivery platform Instacart, was founded in Birmingham, Alabama. The app launched in 2014 and got its foothold smaller cities in the South and Midwest before spreading to coastal metro areas like Seattle and Washington DC. (Because of Instacart’s hold on San Francisco, the app is not popular in Silicon Valley.)

When Target bought the company for $550 million in 2017, Shipt rapidly expanded its same-day delivery to half of its stores. Today, Shipt has more than 100,000 gig workers, according to the company. The company has tripled its geographic reach since 2017.

Shipt workers told Motherboard that customers who order from Target often seem surprised when independent contractors in plain clothes driving their personal cars show up at their homes with massive deliveries from Target. Because Shipt classifies its workers as contractors, not employees, workers pay for all of their expenses—including gas, wear and tear on their cars, and accidents—out of pocket. They say the tips on large orders from Target, sometimes with hundreds of items, can be meager.

Workers say Shipt customers often live in gated and upscale communities and that the app encourages workers to tack on gifts like thank you cards, hot cocoa, flowers, and balloons onto orders (paid for out of their own pocket) and to offer to walk customer’s dogs and take out their trash, as a courtesy. Shipt calls this kind of service “Bringing the Magic,” which can improve workers’ ratings from customers that factor into the algorithm that determines who gets offered the most lucrative orders.

“If you say you want to create a post [on the Facebook group], it has to be approved by a moderator and they never approve anything except for the super syrupy stuff,” said Solis, the Shipt shopper in the Dallas area. “People show off giving customers balloons. A lot of over the top things. It creates a false sense of what to expect. It sets up other shoppers to look bad if they don’t do those things, and we’re not even employees.”

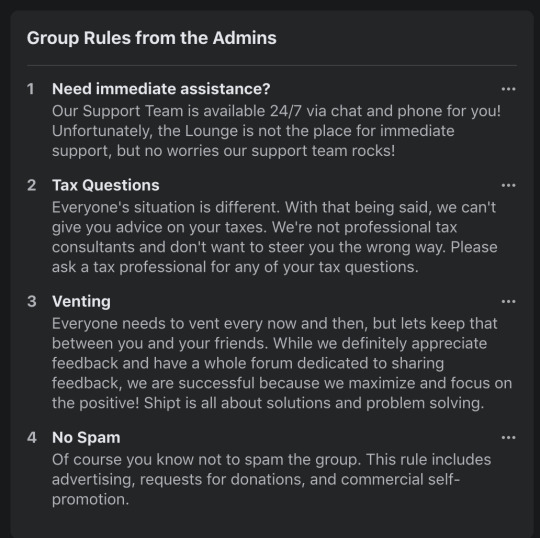

One of the four rules on the Facebook group is to avoid “venting”: “Everyone needs to vent every now and then, but let’s keep that between you and your friends. While we definitely appreciate feedback and have a whole forum dedicated to sharing feedback, we are successful because we maximize and focus on the positive!”

“Any time people say things that are important, they are shut down,” said Solis. “You have to make Shipt look good and say all the happy things.” Solis told Motherboard that his comment was removed from the national Facebook group when he commented on a photo of a worker walking a customer’s dog, saying doing so as an independent contractor could present a liability to the worker.

In February, other workers also posted complaints about Shipt’s new logo announcement on the Facebook group. One worker commented: “I don’t think no one cares about the new logo no offense. What’s going on with the pay system and tips?” Shortly thereafter, a Shipt moderator shut down the comments section, according to a screenshot Motherboard obtained.

One of the biggest causes for concern among workers, as of late, has been the switch from a clear, commission-based pay model ($5 plus a 7.5 percent commission on all orders) to a new model that “take estimated shop time, substitutions, street traffic, and estimated travel time into consideration,” according to emails provided to Motherboard. But, similar to other gig economy apps like Instacart, Shipt does not tell workers how each of these factors is weighted, causing concern that Shipt could tinker with pay whenever it wants, resulting in significantly lower earnings over time. Workers in some markets say their pay has already dropped by 40 to 50 percent, according to Gizmodo.

In Kalamazoo, Michigan, one of the markets where the new pay model rolled out in January, shoppers say their pay has dropped significantly.

“Our best estimate is that payouts are now 30 percent less, and up to 50 percent on orders,” one Shipt worker in Kalamazoo with two years under her belt, who wished to remain anonymous for fear of retaliation, told Motherboard. “I fluctuate between extreme anger and despair. It’s been three weeks since this has been implemented, and one of my good friends told me that she’s down the equivalent of a car payment.”

“I fluctuate between extreme anger and despair. It’s been three weeks since this has been implemented, and one of my good friends told me that she’s down the equivalent of a car payment.”

Another Shipt worker in Palm Springs, California provided Motherboard with receipts for a 181-item order that included six Snapple cases, five La Croix cases, and 12 packs of soda. They had to wheel three shopping carts out of a Ralph’s grocery store and deliver them —and earned $12.68 for the job. The customer did not tip. (Under the older, more transparent pay model, they would have earned $44.19.) “That’s a real slap in the face,” they told Motherboard.

When asked about the new pay model, a spokesperson for Shipt told Motherboard that it could not go into detail about the specific markets where the changes had been rolled out, but claimed that pay was constant if not higher in these new markets.

“Our goal is to maximize our shoppers' earning potential and ensure they get the best value for their time,” the spokesperson said. “We are testing a new pay structure in select markets to better account for the time it takes to complete and deliver an order, including regional factors like drive time.”

Many Shipt shoppers say they were initially drawn to the app because of its friendly marketing and commission-based pay. But with the new lack of transparency, many are realizing that working for the app is no longer worth it.

Do you work for Shipt or another gig economy app? We'd love to hear from you. You can email Lauren at [email protected], or connect securely on Signal 201-897-2109.

“I was actually quite a cheerleader for Shipt for a while compared to Instacart. It puts on a happier face,” said Johnson, the worker who was deactivated after tweeting about her working conditions. “But my deactivation felt really petty. It was really frustrating to work super hard for them, filling 200-pound orders across three cities and getting good ratings, and then have this happen. If they’re going to pay low, that’s what they’re going to do. I just wish they’d be more transparent about it.”

“I used to tell my friends and family members that Shipt was so great,” said Solis, the Dallas worker. “But I can’t rely on the platform anymore. They stamp out resistance by flooding the market with new workers […] and they’re actively monitoring all the social media groups. That’s why everyone wants to be anonymous. We’re going to be deactivated if we speak out.”

Correction: This article originally said that Willy Solis was removed from the national Shipt Facebook group. Solis' comment was removed, but he was not removed from the group. Motherboard regrets the error.

Target’s Delivery App Workers Describe a Culture of Retaliation and Fear syndicated from https://triviaqaweb.wordpress.com/feed/

0 notes

Text

Eliminating the Human

We are beset by—and immersed in—apps and devices that are quietly reducing the amount of meaningful interaction we have with each other.

by

David Byrne

Aug 15, 2017

I have a theory that much recent tech development and innovation over the last decade or so has an unspoken overarching agenda. It has been about creating the possibility of a world with less human interaction. This tendency is, I suspect, not a bug—it’s a feature. We might think Amazon was about making books available to us that we couldn’t find locally—and it was, and what a brilliant idea—but maybe it was also just as much about eliminating human contact.

The consumer technology I am talking about doesn’t claim or acknowledge that eliminating the need to deal with humans directly is its primary goal, but it is the outcome in a surprising number of cases. I’m sort of thinking maybe it is the primary goal, even if it was not aimed at consciously. Judging by the evidence, that conclusion seems inescapable.

This then, is the new norm. Most of the tech news we get barraged with is about algorithms, AI, robots, and self-driving cars, all of which fit this pattern. I am not saying that such developments are not efficient and convenient; this is not a judgment. I am simply noticing a pattern and wondering if, in recognizing that pattern, we might realize that it is only one trajectory of many. There are other possible roads we could be going down, and the one we’re on is not inevitable or the only one; it has been (possibly unconsciously) chosen.

I realize I’m making some wild and crazy assumptions and generalizations with this proposal—but I can claim to be, or to have been, in the camp that would identify with the unacknowledged desire to limit human interaction. I grew up happy but also found many social interactions extremely uncomfortable. I often asked myself if there were rules somewhere that I hadn’t been told, rules that would explain it all to me. I still sometimes have social niceties “explained” to me. I’m often happy going to a restaurant alone and reading. I wouldn’t want to have to do that all the time, but I have no problem with it—though I am sometimes aware of looks that say “Poor man, he has no friends.” So I believe I can claim some insight into where this unspoken urge might come from.

Human interaction is often perceived, from an engineer’s mind-set, as complicated, inefficient, noisy, and slow. Part of making something “frictionless” is getting the human part out of the way. The point is not that making a world to accommodate this mind-set is bad, but that when one has as much power over the rest of the world as the tech sector does over folks who might not share that worldview, there is the risk of a strange imbalance. The tech world is predominantly male—very much so. Testosterone combined with a drive to eliminate as much interaction with real humans as possible for the sake of “simplicity and efficiency”—do the math, and there’s the future.

The evidence

Here are some examples of fairly ubiquitous consumer technologies that allow for less human interaction.

Online ordering and home delivery: Online ordering is hugely convenient. Amazon, FreshDirect, Instacart, etc. have not just cut out interactions at bookstores and checkout lines; they have eliminated all human interaction from these transactions, barring the (often paid) online recommendations.

Digital music: Downloads and streaming—there is no physical store, of course, so there are no snobby, know-it-all clerks to deal with. Whew, you might say. Some services offer algorithmic recommendations, so you don’t even have to discuss music with your friends to know what they like. The service knows what they like, and you can know, too, without actually talking to them. Is the function of music as a kind of social glue and lubricant also being eliminated?

Ride-hailing apps: There is minimal interaction—one doesn’t have to tell the driver the address or the preferred route, or interact at all if one doesn’t want to.

Driverless cars: In one sense, if you’re out with your friends, not having one of you drive means more time to chat. Or drink. Very nice. But driverless tech is also very much aimed at eliminating taxi drivers, truck drivers, delivery drivers, and many others. There are huge advantages to eliminating humans here—theoretically, machines should drive more safely than humans, so there might be fewer accidents and fatalities. The disadvantages include massive job loss. But that’s another subject. What I’m seeing here is the consistent “eliminating the human” pattern.

Automated checkout:Eatsa is a new version of the Automat, a once-popular “restaurant” with no visible staff. My local CVS has been training staff to help us learn to use the checkout machines that will replace them. At the same time, they are training their customers to do the work of the cashiers.

Amazon has been testing stores—even grocery stores!—with automated shopping. They’re called Amazon Go. The idea is that sensors will know what you’ve picked up. You can simply walk out with purchases that will be charged to your account, without any human contact.

AI: AI is often (though not always) better at decision-making than humans. In some areas, we might expect this. For example, AI will suggest the fastest route on a map, accounting for traffic and distance, while we as humans would be prone to taking our tried-and-true route. But some less-expected areas where AI is better than humans are also opening up. It is getting better at spotting melanomas than many doctors, for example. Much routine legal work will soon be done by computer programs, and financial assessments are now being done by machines.

Robot workforce: Factories increasingly have fewer and fewer human workers, which means no personalities to deal with, no agitating for overtime, and no illnesses. Using robots avoids an employer’s need to think about worker’s comp, health care, Social Security, Medicare taxes, and unemployment benefits.

Personal assistants: With improved speech recognition, one can increasingly talk to a machine like Google Home or Amazon Echo rather than a person. Amusing stories abound as the bugs get worked out. A child says, “Alexa, I want a dollhouse” … and lo and behold, the parents find one in their cart.

Big data: Improvements and innovations in crunching massive amounts of data mean that patterns can be recognized in our behavior where they weren’t seen previously. Data seems objective, so we tend to trust it, and we may very well come to trust the gleanings from data crunching more than we do ourselves and our human colleagues and friends.

Video games (and virtual reality): Yes, some online games are interactive. But most are played in a room by one person jacked into the game. The interaction is virtual.

Automated high-speed stock buying and selling: A machine crunching huge amounts of data can spot trends and patterns quickly and act on them faster than a person can.

MOOCS: Online education with no direct teacher interaction.

“Social” media: This is social interaction that isn’t really social. While Facebook and others frequently claim to offer connection, and do offer the appearance of it, the fact is a lot of social media is a simulation of real connection.

What are the effects of less interaction?

Minimizing interaction has some knock-on effects—some of them good, some not. The externalities of efficiency, one might say.

For us as a society, less contact and interaction—real interaction—would seem to lead to less tolerance and understanding of difference, as well as more envy and antagonism. As has been in evidence recently, social media actually increases divisions by amplifying echo effects and allowing us to live in cognitive bubbles. We are fed what we already like or what our similarly inclined friends like (or, more likely now, what someone has paid for us to see in an ad that mimics content). In this way, we actually become less connected—except to those in our group.

Social networks are also a source of unhappiness. A study earlier this year by two social scientists, Holly Shakya at UC San Diego and Nicholas Christakis at Yale, showed that the more people use Facebook, the worse they feel about their lives. While these technologies claim to connect us, then, the surely unintended effect is that they also drive us apart and make us sad and envious.

I’m not saying that many of these tools, apps, and other technologies are not hugely convenient, clever, and efficient. I use many of them myself. But in a sense, they run counter to who we are as human beings.

We have evolved as social creatures, and our ability to cooperate is one of the big factors in our success. I would argue that social interaction and cooperation, the kind that makes us who we are, is something our tools can augment but not replace.

When interaction becomes a strange and unfamiliar thing, then we will have changed who and what we are as a species. Often our rational thinking convinces us that much of our interaction can be reduced to a series of logical decisions—but we are not even aware of many of the layers and subtleties of those interactions. As behavioral economists will tell us, we don’t behave rationally, even though we think we do. And Bayesians will tell us that interaction is how we revise our picture of what is going on and what will happen next.

I’d argue there is a danger to democracy as well. Less interaction, even casual interaction, means one can live in a tribal bubble—and we know where that leads.

Is it possible that less human interaction might save us?

Humans are capricious, erratic, emotional, irrational, and biased in what sometimes seem like counterproductive ways. It often seems that our quick-thinking and selfish nature will be our downfall. There are, it would seem, lots of reasons why getting humans out of the equation in many aspects of life might be a good thing.

But I’d argue that while our various irrational tendencies might seem like liabilities, many of those attributes actually work in our favor. Many of our emotional responses have evolved over millennia, and they are based on the probability that they will, more likely than not, offer the best way to deal with a situation.

What are we?

Antonio Damasio, a neuroscientist at USC wrote about a patient he called Elliot, who had damage to his frontal lobe that made him unemotional. In all other respects he was fine—intelligent, healthy—but emotionally he was Spock. Elliot couldn’t make decisions. He’d waffle endlessly over details. Damasio concluded that although we think decision-making is rational and machinelike, it’s our emotions that enable us to actually decide.

With humans being somewhat unpredictable (well, until an algorithm completely removes that illusion), we get the benefit of surprises, happy accidents, and unexpected connections and intuitions. Interaction, cooperation, and collaboration with others multiplies those opportunities.

We’re a social species—we benefit from passing discoveries on, and we benefit from our tendency to cooperate to achieve what we cannot alone. In his book Sapiens, Yuval Harari claims this is what allowed us to be so successful. He also claims that this cooperation was often facilitated by an ability to believe in “fictions” such as nations, money, religions, and legal institutions. Machines don’t believe in fictions—or not yet, anyway. That’s not to say they won’t surpass us, but if machines are designed to be mainly self-interested, they may hit a roadblock. And in the meantime, if less human interaction enables us to forget how to cooperate, then we lose our advantage.

Our random accidents and odd behaviors are fun—they make life enjoyable. I’m wondering what we’re left with when there are fewer and fewer human interactions. Remove humans from the equation, and we are less complete as people and as a society.

“We” do not exist as isolated individuals. We, as individuals, are inhabitants of networks; we are relationships. That is how we prosper and thrive.

David Byrne is a musician and artist who lives in New York City. His most recent book is called How Music Works. A version of this piece originally appeared on his website, davidbyrne.com.

0 notes

Text

Best Apps to Make Money Online

Note from Mr. SR: Especially during the working and investing stage of life (“Step 1” in the Semi-Retire Plan), a little extra money can go a long way. But, if you want to make money online or using a phone app, the number of options can feel overwhelming.

I’m excited to share this post today by my friend Bob from The Frugal Fellow. Bob outlines a bunch of great mobile phone apps to make money on the side, so you can tell which options are the best fit for your preferences.

There’s no shortage of apps to make money these days. And given that 96% of Americans now own smartphones, you are primed and ready to start doing just that! But despite all the money-making methods out there, some are decidedly better than others.

So how do you know what are the best money making apps? That’s what we’ll cover in this article. In most cases, you probably can’t make a full-time living using apps, but you can ease the financial burden in a variety of ways.

There are also a variety of different types of apps to make money, such as:

Cash-back/discount apps

Task completion apps

Taking surveys

…and countless more. In reality, we could probably go on all day listing different apps/app categories, but these are the main ones.

What’s the catch?

If you’re thinking this sounds too good to be true, it isn’t. You are providing something of value, so it only makes sense to be compensated. With surveys, in particular, you are providing valuable input about market trends.

Brands can’t read your mind, after all. They need to know what their potential customers want so that they can make better products. Anyone who has an audience knows that understanding those folks is the most critical element of business success.

Because if you don’t know your audience, how can you succeed? Well, you really can’t.

Don’t be fooled by money-making scams

Something I feel is important to call out in regard to apps to make money is the potential for scams. In many cases (especially with survey sites), you will be redirected to a partner site to complete the survey.

While these surveys are usually legitimate, there are some unscrupulous ones. The biggest red flag to look out for is a survey asking for your contact information. A survey should never need that info beyond maybe your country of residence. Anything more specific than that is cause for concern.

In general, survey companies might need to know things like your gender, household income, the industry in which you work – but your name and contact information should never be necessary.

Why use apps to make money?

If you’ve never used an app to make money, you might ask yourself, “What’s the point? Wouldn’t it be better to just get a second job or something?”

In a way, your logic is sound. These apps probably aren’t going to make you rich and you can most likely earn more with a second job. But that’s looking at it the wrong way.

See, a lot of these apps can be partially (or totally) automated, then they simply reward you for doing the things you were already doing. In general, the less time you spend doing something, the better.

And, of course, that applies to a lot of things in life – not just apps to make money. Being more efficient means getting more things done, and you can easily do that with a lot of these.

So, what are these apps, and what makes them stand out? Let’s find out.

Survey apps

Survey apps have been a popular way to make money online for years now. Simply give your opinion on certain products and services and be paid in exchange.

Each survey has different requirements though, so you won’t be eligible for every survey. Some surveys can be especially lucrative, such as research studies – though these are more difficult to come by.

Swagbucks

Swagbucks is always a favorite of anyone looking for apps to make money. Undoubtedly, the reason Swagbucks is so popular is that it offers a wide variety of ways to make money.

In reality, Swagbucks is more than just a survey app. Here are some of the main ways you can earn money on Swagbucks:

Completing surveys

Making purchases (cash back)

Special offers

Watching videos

Completing web searches

Basically you can spend a ton of time on Swagbucks and quite possibly not even run out of things to do.

Swagbucks claims their surveys can pay as much as $50 each:

But you’ll notice they also say that most pay 40 cents to $2. Again, it may not be much, but the surveys don’t take long to complete. Plus, after you’ve completed a few, you’ll have enough to buy yourself a coffee at the local coffee shop (or whatever your daily fix is).

Once you’ve earned enough points, you’re able to redeem them for gift cards from popular stores like Amazon, iTunes, and Starbucks. Or, if you prefer, you can just cash out via PayPal.

Cashing out is easy as long as you have a bank account and your routing number handy.

InboxDollars

InboxDollars will draw you in with its $5 signup credit, but is it worth doing after getting that crisp Lincoln? It depends upon how you approach it.

The primary way to make money with InboxDollars is by completing surveys. Bear in mind though, the payouts from InboxDollars surveys do tend to be a bit low. As a result, it may not be the best survey site to try first.

However, it’s common with surveys that you won’t meet one or more criteria for completing the survey. If you find yourself striking out everywhere else, this might be a decent fallback.

Once you reach $30 in your account, you can cash out via PayPal or by check.

Task apps

The apps in this section will pay you for completing specific tasks. These apps fall into what is often called the “gig” economy or sharing economy.

In a lot of ways, these apps have started to redefine what it means to have a “job,” giving people more flexible work hours and work arrangements in general.

Uber

Chances are you’ve already heard of Uber, but I wanted to quickly mention it because it is one of the original task apps. All you need is a car (that fits Uber’s requirements) and you’ll be able to start accepting rides.

Sweatcoin

Sweatcoin is an app that literally pays you to walk. I say that because there isn’t anything else you have to do. Just download the app, fire it up, and start walking. When you do, you’ll earn Sweatcoins (SWC) which you can then redeem for rewards.

Those rewards include valuable things like Amazon gift cards, cashing out via PayPal, and other cool stuff.

However, keep in mind that the app can sometimes have issues. I downloaded it myself and found that I wasn’t earning SWC. I had a lot of steps, but none of them were counting as “Sweatcoin steps.” Some Reddit users have said the same, so be sure you are in fact earning Sweatcoins if you decide to give this one a try.

Rover

Rover is a personal favorite of mine, and honestly, I’m surprised I don’t see it mentioned on more of these lists. If you’re a dog lover like I am, you are going to love Rover! This app allows dog (and cat) owners to find someone to sit, walk, board, or do drop-ins for their pets.

This is yet another gig economy app. For those who aren’t familiar with it, I like it to call it “the Uber of dog walking.” There’s one key difference between how Rover works and how Uber, works, though: when you use Uber, the app automatically finds a driver for you. With Rover, though, pet owners must manually search in their area to find someone who looks like a good fit.

If you’re a sitter, Rover says it will automatically adjust your rates for pet care based on your reviews and similar rates in your area. I’ve been on the app for months, have earned several positive reviews, and my rates haven’t changed. Nevertheless, this is a great way to earn a few extra bucks, and I’ve been loving it.

Instacart

Instacart is one of the highest-rated apps on iTunes, scoring a 4.8 with over 460,000 reviews. If you aren’t familiar with Instacart, it’s one of the many gig economy jobs. As its name implies, this one is a shopping app.

The concept is simple: go grocery shopping for people on the app who need it and get paid in the process. There are many reasons people might need help with grocery shopping, and this app helps fill that need.

Users reported earning between $7 and $17 per hour for an average of $13. Not great, especially if you live in an HCOL area, but it may be worth considering if you enjoy shopping.

Discount/rebate apps

With these apps, you shop at stores where you would be shopping anyway, then earn cashback in the process. You’ll then be able to cash out for real money, typically through PayPal.

Ibotta

It almost seems like everyone knows about Ibotta by now, but it’s worth mentioning just in case. This apps makes grocery shopping cheaper.

All you have to do is scan your receipts into the app, then you’ll get cashback on your purchases. The great thing is you don’t have to mess around with points or anything like that. Not every store is supported, but Ibotta claims 500,000 locations are, which is quite a few.

It’s worth trying, especially since you’ll be grocery shopping anyway. Minimum payout is $20.

Rakuten/Ebates

No list like this would be complete without mentioning Ebates. Ebates is now known as Rakuten. The app formerly known as Ebates is another one that works by helping you earn cash back.

The way it works is quite simple: just sign up, shop as you normally would (through their portal), and you’ll earn cashback on every purchase. They work with a ton of stores, including popular ones such as Amazon, Walgreens, and Target.

If you’re going to buy stuff through these stores anyway, why not do so through Rakuten and save money in the process? It just makes sense. You can cash out once you have at least $5.

Dosh

Spot me a few quid, will ya? If you aren’t familiar, “dosh” is British slang for cash (a “quid” is a one-pound coin). But despite the origins of its name, this is an American company based in Austin, Texas.

So how does the Dosh app work? It’s another cash-back (or should I say dosh-back) app. The way it works is sort of similar to Ebates/Rakuten. However, it’s much more convenient: rather than having to shop directly in their portal, you just link your credit card to Dosh.

Once you link your card, you’ll earn points for shopping at participating stores. Once you’ve earned at least $25 worth of points, you can cash out via PayPal or direct deposit. Pretty sweet deal.

Drop

Because you need yet another cash-back app. Don’t lie – I heard you say it.

Drop is a cash-back/rebate app that works in a way similar to Dosh, with some slight differences. What’s similar is that all you have to do is link your credit card to the app, then earn points for shopping at those stores.

The biggest difference is that you also choose five stores that are your favorite places to shop. Strangely, you can’t change these once you select them, so be sure they’re your favorite. Those stores will occasionally receive special offers you won’t get with the others.

Once you have enough points – at least 5,000 – you can redeem them for gift cards at popular stores, such as Amazon. 5,000 points are worth $5.

Other apps to make money

The remainder of the apps on this list don’t necessarily fit neatly into any of the other categories, but they are worth mentioning. They’ll help you in a variety of ways including simplifying your life and investing for the long haul.

Acorns

Acorns is a little different than other apps mentioned on this list. Whereas most of them either pay you for completing tasks or give you rebates, Acorns is more of an investment app.

What’s unique about Acorns is that it’s both an investment app and sort of a psychological one as well. I say this because its main feature is that it rounds up your purchases to whole dollar amounts and then invests your “spare change.” That way, you get lots of nice numbers on your bank statements while constantly investing more money.

You must have at least $5 in your account before the money is invested – hardly a high minimum. Once that happens, Rover claims it will invest your money in over 7,000 stocks and bonds with automatic rebalancing.

This is definitely a great way to grow your money!

M1 Finance

M1 Finance takes more of an active approach to investing than Acorns. Whereas the latter handles all of the investing for you, M1 Finance allows you to create a customized investment portfolio. That makes it ideal for the more advanced investor.

What’s especially nice about M1 Finance is that it allows you to buy partial shares of stock. Some stocks and ETFs have shared valued at over $1,000, so buying partial shares means you could invest in that stock with even as little as $5.

You can do the same with ETFs, making this a great app for both beginner investors and advanced investors alike.

Robinhood

Robinhood and M1 finance are two similar apps to make money. In other words, both are apps that allow you to invest in things like stocks and ETFs.

There is no account minimum (M1 has a $100 minimum) and no commission fees for trades. However, one drawback of Robinhood compared to M1 is you can’t buy fractional shares. For the beginner investor, this can be a pretty big drawback.

Still, the app is worth comparing to M1 before you decide to go all-in on one or the other.

Decluttr

Got lots of stuff, but wish you had less stuff? And make money in the process? Then you should probably take a look at Decluttr.

You can’t quite sell everything on Decluttr, but it still accepts some popular items – and there’s a good chance you have quite a few of them lying around. For example, you can sell:

CDs

DVDs

Games

Books

Cell phones

Electronics

So, dust off that CD from The Offspring; unearth iPhone 4 and let’s see what you can get for them! Okay, so they probably have to be newer items to be worth much, but you get the idea.

Just pack your items in a box, bring them to a UPS location, then get paid for them. Payment options include direct deposit, PayPal, check, or even donating to your favorite charity.

Apps to make money: the bottom line

There are dozens, if not hundreds of apps to make money out there. Just remember the basics of building wealth first. Then, use these apps to boost your money-making potential.

Most of them are legitimate opportunities, but it’s unlikely you’ll be able to quit your job if this is your only source of income.

There are surveys, cash-back apps, task apps, and even investing apps. Just watch out for apps that seem to be getting a little too personal in terms of collecting information about you.

The great thing about apps to make money is that they will often cash out via PayPal – meaning you get cold, hard cash. Some only let you redeem gift cards, but those are useful, too.

Hopefully, you have found this article helpful and are now ready to start making money!

This article was written by Bob from The Frugal Fellow and originally appeared on The Money Mix. It is republished here with permission.

The post Best Apps to Make Money Online appeared first on Semi-Retire Plan.

from Semi-Retire Plan https://ift.tt/330naM8 via IFTTT

0 notes

Text

13 Top Apps To Make Money For Passive Income

13 Top Apps To Make Money For Passive Income

Best Apps To Make Money For An Easy Financial Boost

[Editor’s Note: Today’s article is a guest post from Bob, The Frugal Fellow, who is a freelance personal finance writer and blogger. After paying off nearly six figures in student loan debt, he decided to not only take control of his own finances, but to help others do the same.]

There’s no shortage of apps to make money these days. And given that 96% of Americans now own smartphones, you are primed and ready to start doing just that! But despite all the money-making methods out there, some are decidedly better than others.

So how do you know what are the best money making apps? That’s what we’ll cover in this article. In most cases, you probably can’t make a full-time living using apps, but you can ease the financial burden in a variety of ways.

There are also a variety of different types of apps to make money, such as:

Cash-back/discount apps

Task completion apps

Taking surveys

…and countless more. In reality, we could probably go on all day listing different apps/app categories, but these are the main ones.

What’s the Catch?

If you’re thinking this sounds too good to be true, it isn’t. You are providing something of value, so it only makes sense to be compensated. With surveys, in particular, you are providing valuable input about market trends.

Brands can’t read your mind, after all. They need to know what their potential customers want so that they can make better products. Anyone who has an audience knows that understanding those folks is the most critical element of business success.

Because if you don’t know your audience, how can you succeed? Well, you really can’t.

Don’t Be Fooled By Money Making Scams

Something I feel is important to call out in regard to apps to make money is the potential for scams. In many cases (especially with survey sites), you will be redirected to a partner site to complete the survey.

While these surveys are usually legitimate, there are some unscrupulous ones. The biggest red flag to look out for is a survey asking for your contact information. A survey should never need that info beyond maybe your country of residence. Anything more specific than that is cause for concern.

In general, survey companies might need to know things like your gender, household income, the industry in which you work – but your name and contact information should never be necessary.

Why Use Apps To Make Money?

If you’ve never used an app to make money, you might ask yourself, “What’s the point? Wouldn’t it be better to just get a second job or something?”

In a way, your logic is sound. These apps probably aren’t going to make you rich and you can most likely earn more with a second job. But that’s looking at it the wrong way.

See, a lot of these apps can be partially (or totally) automated, then they simply reward you for doing the things you were already doing. In general, the less time you spend doing something, the better.

And, of course, that applies to a lot of things in life – not just apps to make money. Being more efficient means getting more things done, and you can easily do that with a lot of these.

So, what are these apps, and what makes them stand out? Let’s find out.

Survey Apps

Survey apps have been a popular way to make money online for years now. Simply give your opinion on certain products and services and be paid in exchange.

Each survey has different requirements though, so you won’t be eligible for every survey. Some surveys can be especially lucrative, such as research studies – though these are more difficult to come by.

Swagbucks

Swagbucks is always a favorite of anyone looking for apps to make money. Undoubtedly, the reason Swagbucks is so popular is that it offers a wide variety of ways to make money.

In reality, Swagbucks is more than just a survey app. Here are some of the main ways you can earn money on Swagbucks:

Completing surveys

Making purchases (cash back)

Special offers

Watching videos

Completing web searches

Basically you can spend a ton of time on Swagbucks and quite possibly not even run out of things to do.

Swagbucks claims their surveys can pay as much as $50 each:

But you’ll notice they also say that most pay 40 cents to $2. Again, it may not be much, but the surveys don’t take long to complete. Plus, after you’ve completed a few, you’ll have enough to buy yourself a coffee at the local coffee shop (or whatever your daily fix is).

Once you’ve earned enough points, you’re able to redeem them for gift cards from popular stores like Amazon, iTunes, and Starbucks. Or, if you prefer, you can just cash out via PayPal.

Cashing out is easy as long as you have a bank account and your routing number handy.

InboxDollars

InboxDollars will draw you in with its $5 signup credit, but is it worth doing after getting that crisp Lincoln? It depends upon how you approach it.

The primary way to make money with InboxDollars is by completing surveys. Bear in mind though, the payouts from InboxDollars surveys do tend to be a bit low. As a result, it may not be the best survey site to try first.

However, it’s common with surveys that you won’t meet one or more criteria for completing the survey. If you find yourself striking out everywhere else, this might be a decent fallback.

Once you reach $30 in your account, you can cash out via PayPal or by check.

Task Apps

The apps in this section will pay you for completing specific tasks. These apps fall into what is often called the “gig” economy or sharing economy.

In a lot of ways, these apps have started to redefine what it means to have a “job,” giving people more flexible work hours and work arrangements in general.

Uber

Chances are you’ve already heard of Uber, but I wanted to quickly mention it because it is one of the original task apps. All you need is a car (that fits Uber’s requirements) and you’ll be able to start accepting rides.

Sweatcoin

Sweatcoin is an app that literally pays you to walk. I say that because there isn’t anything else you have to do. Just download the app, fire it up, and start walking. When you do, you’ll earn Sweatcoins (SWC) which you can then redeem for rewards.

Those rewards include valuable things like Amazon gift cards, cashing out via PayPal, and other cool stuff.

However, keep in mind that the app can sometimes have issues. I downloaded it myself and found that I wasn’t earning SWC. I had a lot of steps, but none of them were counting as “Sweatcoin steps.” Some Reddit users have said the same, so be sure you are in fact earning Sweatcoins if you decide to give this one a try.

Rover

Rover is a personal favorite of mine, and honestly, I’m surprised I don’t see it mentioned on more of these lists. If you’re a dog lover like I am, you are going to love Rover! This app allows dog (and cat) owners to find someone to sit, walk, board, or do drop-ins for their pets.

This is yet another gig economy app. For those who aren’t familiar with it, I like it to call it “the Uber of dog walking.” There’s one key difference between how Rover works and how Uber, works, though: when you use Uber, the app automatically finds a driver for you. With Rover, though, pet owners must manually search in their area to find someone who looks like a good fit.

If you’re a sitter, Rover says it will automatically adjust your rates for pet care based on your reviews and similar rates in your area. I’ve been on the app for months, have earned several positive reviews, and my rates haven’t changed. Nevertheless, this is a great way to earn a few extra bucks, and I’ve been loving it.

Instacart

Instacart is one of the highest-rated apps on iTunes, scoring a 4.8 with over 460,000 reviews. If you aren’t familiar with Instacart, it’s one of the many gig economy jobs. As its name implies, this one is a shopping app.

The concept is simple: go grocery shopping for people on the app who need it and get paid in the process. There are many reasons people might need help with grocery shopping, and this app helps fill that need.

Users reported earning between $7 and $17 per hour for an average of $13. Not great, especially if you live in an HCOL area, but it may be worth considering if you enjoy shopping.

Discount/Rebate Apps

With these apps, you shop at stores where you would be shopping anyway, then earn cashback in the process. You’ll then be able to cash out for real money, typically through PayPal.

Ibotta

It almost seems like everyone knows about Ibotta by now, but it’s worth mentioning just in case. This apps makes grocery shopping cheaper.

All you have to do is scan your receipts into the app, then you’ll get cashback on your purchases. The great thing is you don’t have to mess around with points or anything like that. Not every store is supported, but Ibotta claims 500,000 locations are, which is quite a few.

It’s worth trying, especially since you’ll be grocery shopping anyway. Minimum payout is $20.

Rakuten/Ebates

No list like this would be complete without mentioning Ebates. Ebates is now known as Rakuten. The app formerly known as Ebates is another one that works by helping you earn cash back.

The way it works is quite simple: just sign up, shop as you normally would (through their portal), and you’ll earn cashback on every purchase. They work with a ton of stores, including popular ones such as Amazon, Walgreens, and Target.

If you’re going to buy stuff through these stores anyway, why not do so through Rakuten and save money in the process? It just makes sense. You can cash out once you have at least $5.

Dosh

Spot me a few quid, will ya? If you aren’t familiar, “dosh” is British slang for cash (a “quid” is a one-pound coin). But despite the origins of its name, this is an American company based in Austin, Texas.

So how does the Dosh app work? It’s another cash-back (or should I say dosh-back) app. The way it works is sort of similar to Ebates/Rakuten. However, it’s much more convenient: rather than having to shop directly in their portal, you just link your credit card to Dosh.

Once you link your card, you’ll earn points for shopping at participating stores. Once you’ve earned at least $25 worth of points, you can cash out via PayPal or direct deposit. Pretty sweet deal.

Drop

Drop is a cash-back/rebate app that works in a way similar to Dosh, with some slight differences. What’s similar is that all you have to do is link your credit card to the app, then earn points for shopping at those stores.

The biggest difference is that you also choose five stores that are your favorite places to shop. Strangely, you can’t change these once you select them, so be sure they’re your favorite. Those stores will occasionally receive special offers you won’t get with the others.

Once you have enough points – at least 5,000 – you can redeem them for gift cards at popular stores, such as Amazon. 5,000 points are worth $5.

Other Apps to Make Money

The remainder of the apps on this list don’t necessarily fit neatly into any of the other categories, but they are worth mentioning. They’ll help you in a variety of ways including simplifying your life and investing for the long haul.

Acorns

Acorns is a little different than other apps mentioned on this list. Whereas most of them either pay you for completing tasks or give you rebates, Acorns is more of an investment app.

What’s unique about Acorns is that it’s both an investment app and sort of a psychological one as well. I say this because its main feature is that it rounds up your purchases to whole dollar amounts and then invests your “spare change.” That way, you get lots of nice numbers on your bank statements while constantly investing more money.

You must have at least $5 in your account before the money is invested – hardly a high minimum. Once that happens, Rover claims it will invest your money in over 7,000 stocks and bonds with automatic rebalancing.

This is definitely a great way to grow your money!

M1 Finance

M1 Finance takes more of an active approach to investing than Acorns. Whereas the latter handles all of the investing for you, M1 Finance allows you to create a customized investment portfolio. That makes it ideal for the more advanced investor.

What’s especially nice about M1 Finance is that it allows you to buy partial shares of stock. Some stocks and ETFs have shared valued at over $1,000, so buying partial shares means you could invest in that stock with even as little as $5.

You can do the same with ETFs, making this a great app for both beginner investors and advanced investors alike.

Robinhood

Robinhood and M1 finance are two similar apps to make money. In other words, both are apps that allow you to invest in things like stocks and ETFs.

There is no account minimum (M1 has a $100 minimum) and no commission fees for trades. However, one drawback of Robinhood compared to M1 is you can’t buy fractional shares. For the beginner investor, this can be a pretty big drawback.

Still, the app is worth comparing to M1 before you decide to go all-in on one or the other.

Decluttr

Got lots of stuff, but wish you had less stuff? And make money in the process? Then you should probably take a look at Decluttr.

You can’t quite sell everything on Decluttr, but it still accepts some popular items – and there’s a good chance you have quite a few of them lying around. For example, you can sell:

CDs

DVDs

Games

Books

Cell phones

Electronics

So, dust off that CD from The Offspring; unearth iPhone 4 and let’s see what you can get for them! Okay, so they probably have to be newer items to be worth much, but you get the idea.

Just pack your items in a box, bring them to a UPS location, then get paid for them. Payment options include direct deposit, PayPal, check, or even donating to your favorite charity.

Apps to Make Money: The Bottom Line

There are dozens, if not hundreds of apps to make money out there. Just remember the basics of building wealth first. Then, use these apps to boost your money-making potential.

Most of them are legitimate opportunities, but it’s unlikely you’ll be able to quit your job if this is your only source of income.

There are surveys, cash-back apps, task apps, and even investing apps. Just watch out for apps that seem to be getting a little too personal in terms of collecting information about you.

The great thing about apps to make money is that they will often cash out via PayPal – meaning you get cold, hard cash. Some only let you redeem gift cards, but those are useful, too.

Hopefully, you have found this article helpful and are now ready to start making money!

The post 13 Top Apps To Make Money For Passive Income appeared first on Debt Free Dr..

from Debt Free Dr. https://ift.tt/2JxM7GO via IFTTT

0 notes

Text

Nine Reasons Why You Never Have Enough Money

I hear the same complaint all the time: “I never have enough money.”

Truth is, we’ve all been there, but while some of us choose to confront the situation head on to get out of that rut, others continue the paycheck-to-paycheck lifestyle for a number of reasons. What are they? Find out where you fit in here.

1. You’re Not Budgeting Properly.

The sole purpose of budgeting is so you can keep track of exactly how much money is coming into, and going out of, your bank account every month. For this system to work, you must track your finances accurately. Otherwise, it becomes a messy situation. For instance, your take-home pay generally stays the same, but that’s not always the case for your expenses (i.e., your bills) — your electricity bill especially fluctuates month to month, as does your phone bill, probably.

It’s important to follow those variable expenses to the cent so you can decide where to make changes, such as cutting back on recreational activities, picking up a part-time job, or other adjustments to ensure that you have enough money (and a little excess) in your budget every month.

2. You’re Shopping Frivolously.

It’s easy to go overboard when shopping, especially if you’re susceptible to impulse buying, so it’s important to keep your wallet in check when you go out. If you know you can’t afford anything extra this month, don’t tempt yourself by going shopping (or “browsing”). Find something more productive to do with your time — like thinking of ways to make extra money (imagine that!) — so you don’t fall prey to spending money you don’t have.

3. You’re Neglecting Your Savings Account.

I treat my savings account as a reserve that should only be touched in extreme emergencies. I funnel money to that account consistently, after all my monthly expenses have first been paid. I do include a bit of extra money in my budget to do things I like, like go to the movies or hang out with friends on the weekends. But after bills and regular expenses are paid, most of my leftover earnings go to savings.

If you’re in such a financial bind that you have neither funds in your checking account nor your savings, you need to reevaluate your priorities before you’re faced with a major expense that could put you deeply in debt for years to come.

4. You’re Being Lazy.

This may sound harsh, but I believe laziness is one of the most common problems among people who complain they don’t have enough money. Now, before you start sending nastygrams my way, I’m not talking about the hard-working Americans in unfortunate circumstances who can barely make ends meet; those folks know how real the struggle is, and they’re constantly working to correct the situation in most cases.

Instead, I’m referring to perfectly middle and lower-middle class folks who have just enough money to cover their expenses and more time than they know what to do with, which, coincidentally, is anything but work harder.

I have no sympathy and very little tolerance for these people. Personally, I try to make an extra buck everywhere I can, so I can enjoy the life I have. That means having lots of little side gigs: taking on additional writing work, renting out my homes on Airbnb, dog sitting via Rover.com, and shopping and delivering groceries using Instacart. These are things that almost anyone can do. To be in the red financially because you’re being lazy is no one’s fault but your own and — dare I say it? — probably well deserved.

5. You Have Too Many Costly Commitments in Your Life.

If you have a lot of friends and family, you’re probably inundated with invitations to weddings, birthday parties, baby showers, and more — and these events can be costly. There are times, of course, when you can’t get out of it (like when your sister is getting married), but if you’re tight on cash already and it’s not essential that you attend the party, you’re allowed to politely decline. There’s no shame in citing financial hardship either; most reasonable and caring people will totally understand your plight.