#howtosetupabudgetandsave

Explore tagged Tumblr posts

Text

How To Set Up A Budget And Save

Setting up a budget can be a bit challenging, but realize, anyone can do it. Learn how to set up a budget and start saving money, and start buying those things you've always wanted. Once you get your budget created it will all start to make sense on how you can start spending money on things you want instead of only buying what you need. When people think about a budget, they usually relate it to just paying bills on time, or just tracking an expense that you can adjust for savings. But did you know, the whole point of budgeting is to spend money on what you want. That might sound backwards but that is why you have a budget. So let's look into how to set up a budget. First we will go over the basics, then we will look at easier ways to creating a budget that won't seem so technical or overwhelming.

Know Your Income

In order to set up a budget, you have to know what your income is. It's all really easy addition and subtraction, but when you look at it as your livelihood, then it seems to be a little more complicated. If you have a normal consistent income, setting up a budget isn't that hard. Knowing how to set up a budget when you have a variable income can be difficult. Let's say your income is normal and steady, then this isn't bad at all. A normal income would even include more than one job or source of income. You would just add your monthly incomes, after taxes and or any deductions, and that would be the start of your budget. You also include your spouse, or significant other, or any other contributors that are living under one roof. Don't include anyone that is on a temporary stay. Variable Income Knowing how to set up a budget on a variable income will require averaging your income sources and setting goals. People that are in sales, or have their own businesses, don't always bring in the same monthly income. So in this situation, you have to set a goal that you can align a realistic monthly figure. Let's say you sale hot dogs on a corner of a busy street. You know if you sold 50 hotdogs through the whole day at $1.40 each, you would make $70 a day. You know that is a low projection of the amount you can really sell. There have been days you have sold close to 200 hotdogs, but there were rare days you only sold 40. It would be safe to say you are always going to bring home $70 a day, so you can use that as a constant in your budget. Any extra money can go towards months that weren't so good and towards your savings. After time, you will will have an average of what you make per month based on how many hotdogs you're selling. If you had more than one location, you would need to average all of them combined to give yourself a consistent income to set up your budget. Just remember, no matter the type of income you have, your goal should always be to save at least 10% to go into savings.

Listing Your Expenses

You will have two kinds of expenses, Fixed and Variable. Fixed expenses are your bills, or what you pay out, that don't change from month to month. This would be things like, mortgage, rent, insurances, and types of loans, or services. Variable expenses will be things like your automotive fuel, electric, water, food, or any type of bill that isn't a static amount every month. Fixed Expenses You will want to make a list of all your fixed expenses, for example: Mortgage/Rent, Cable, Car Insurance, Trash Pickup. Calculating these will be pretty easy since the amounts rarely change. It would be a good idea to include your savings as an expense as well. I know that sounds funny but in order to make a good budget, you should at least add 10% of you income as a payment towards yourself. Part of knowing how to set up a budget, is understanding that the goal is to get yourself into a position to buy things you want. So include in your fixed expenses, an amount you want to save each month. Usually you want it to be 10% of your income but that can vary based on your situation. The water and electric bill can be included under a fixed expense. However, that also depends how steady or how you have your services set up. Some utility companies have a balance pay plan, also known as a Budget-Billing Plan. This is where they average your bill over a year period and charge you the same amount each month. If you have a larger family, the utility bills will fluctuate enough that it may fall under a variable expense. Variable Expenses Variable expense are those that you have control over. Rent, car payments and such are fixed and the cost is determined by the supplier. Your variable expenses can be reduced by you. For example, if you like to take an hour long shower twice a day, you can reduce your water bill by cutting the shower time back. Any expense that is effected by you, is variable. It is in this area you can start managing your budget. Make a list of all your variable expenses, such as fuel for the car, groceries, eating out, apparel, or entertainment. Electric, gas and water can be included in variables, if your utility bills fluctuate. You will be able to see where you can start making cut backs to increase your savings. Read more on "Tips On How To Save Money". Your utilities could be a variable that you don't have much control over depending on the area you live in. If you live in an area where the temperatures have extreme variances, this will make setting up a budget a little harder. However, I would suggest taking a total of what you spend per year on your utilities and get an average based on 12 months. This will at least give you a fixed number to work with.

How To Set Up A Budget On A Sheet

It is really common for people to use a spreadsheet for budgeting or many other financial or mathematical calculations. However you can just as easily use pencil, paper and calculator. Spreadsheets just seem to give a certain visualization when it comes to setting up a budget. Below are screen-shots of a very basic budget, done in an Excel spreadsheet. You can also watch the video of me running through the same steps. If you don't have Excel, you can use for FREE, Google Sheets. There is also budgeting you can use, that actually works much better than just using Excel. Setting Up Your Spreadsheet Open up a spreadsheet and make the following headings. Expense Name, Due Date, Total Balance and Monthly Payment. Your Due Date doesn't need to be a full date, just make it the day of the month. If a bill is due on the 4th of each month, then just enter "4th" in the field.

Next you will want to enter your expenses under the "Expense Name" column. To make it easier for you to track your expenses, you can color code them. You can see in this example below, that Fixed, Variable and Credit Cards have been highlighted in colors. This is not necessary but it does help.

You will now want to add a title field to the left and title it, "Total". In the same row and directly under the last entry in your "Monthly Payment" column, select the field as shown below. We are going to make this the sum of all the "Monthly Payments'.

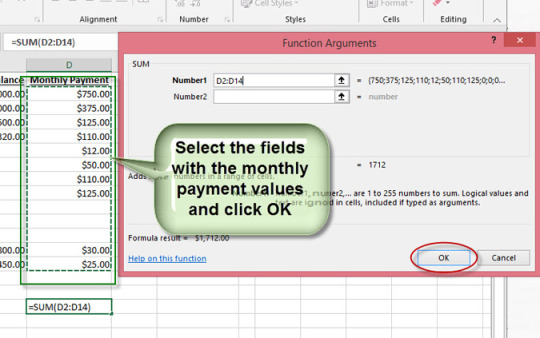

There are several ways to create a sun in a field, this is just one of them. With your field selected, click on the Function icon to the left side of the formula bar. An "Insert Function" window will open. Select "SUM" and click on OK.

Highlight all the cells with a monthly payment in them and again click OK.

Now your "Total" field has a sum of all you monthly payments. This is what you are paying out each month.

In the row directly underneath "Total", create a Title called, "Monthly Income". In the Cell directly below the actual "Monthly Total", enter your exact monthly take-home income. This would be what you bring home after taxes, with-holdings and any benefits. Drop down a couple of rows and in the "Expense Name" column, create a title called "Net". In the same row, under your "Monthly Income" value, click on that cell. In the selected cell, type an "=" sign in the field. Then select the cell with your monthly income value.

Then type the "minus" symbol. Click on the cell above "Monthly Income", this would be the cell with your "Monthly Total" in it. Now press the enter key, you have just said, "Monthly Income", subtract "Monthly Payment Total".

In this example you can see that you have $954.67 left over each month based of these expenses. Now that your savings have been identified, you can now decide how much savings you would like to enter in the "Savings" payment. This is usually 10% of your income. In this scenario, this person's income is $32,000 a year, so 10% of that is $3200, divide by 12 months, makes it $267 a month.

Examples On How To Set Up A Budget Video

Summary

As you can see in the above examples, you can start identifying expenses. For example, "Savings". If you noticed, I didn't include a value for savings in my budget set up. The reason is because at that point, I didn't know if I would have any money left over for savings. My goal for the savings expense value, was to at least have 10% of my take-home income. Now, I can see that I have more than my 10%, so now I can use that money to start paying off debts. Notice the credit card balances, now I know I can start increasing monthly payments to get these paid off and still keep my 10% towards savings. 50/30/20 System There is the 50/30/20 System you can use as a guide. This isn't the always the best method to use, but it does work for people that don't have the time or patients to track every expense detail or set up a budget. This system means, you spend 50% of your net income on bills, 30% on wants, and 20% on savings or paying off debt. The system allows you to focus more on the big picture, and really, if you do not have many monthly expenses, this can work quite well. However if you have a goo list of monthly expenses, I highly recommend keeping a more detailed budget. The drawback to this 50/30/20 method is, you may not make enough money that 50% of your earning will cover all your bills. Yo may live in an area that the cost of living is high, and again, it is going to take more than 50% of your total monthly income to pay your bills. You can however, adjust the 30% and the 20% on wants and savings to go toward bills. Although then it starts confusion and more than likely constant adjustments. Budgeting Tips Variable Income If you work in some form of sales, or a job that you live more off tips, this means your income is not fixed. You should consider your income as variable and this is where you will need to start making averages. A budget is very useful for this type situation. It identifies what your income has to be to pay bills and have savings. Averaging your income works best if you can get at least six months of numbers to work with. Average what you made, at least over the past six months, and then reduce the amount between 5% to 10%. By doing this, you are working on a minimum income and this will reduce risk of not being able to pay a bill in the future. Credit Cards Once your budget has been created, it will help you identify expenses that may need to be cleaned up. Credit Cards are the biggest among them all. Credit Card balances will be exposed and since they charge interest, these need to be reduced as soon as possible. As long as you pay the minimum amount, the balance will never go down, in fact, it will keep rising even if you are no longer charging on them. Savings Expense In the above example, you saw that there was way more than 10% of savings for each month. As I have mentioned, the savings expense should be at least 10% of you net income. If your situation is similar to the above example, you may be tempted to spend all of that monthly savings on paying off your credit cards, but don't. Still take out the 10% of your earnings as an expense and enter that in your Savings field for the following months. The savings expense is money put back so that you can buy what you want. But keep in mind, there are always emergency expenses. Things break and have to be fixed or replaced, so use this money for a cushion as well. I do recommend getting those credit card balances paid off as quick as you can, but never put yourself in a situation where you have no savings. All good things take time, be patient.

In Conclusion

No matter how much your income is, having a detailed budget is the best plan on saving money and buying the things you want. The whole goal to a budget is to put yourself in a position to where you can start buying the things you want. I know it takes time and some thought to sit down and work out a budget but in the end, you will be glad you did. Even in the above example, I was just throwing numbers right out of my head without knowing what the outcome would be. And as you can see, it turned up a good amount of savings each month. It then made those credit card bills stick out just screaming, "Pay Me Off"!!!. As mentioned above, you do not have to use a spreadsheet, you can simply just write this down on paper. I do however highly recommend a spreadsheet or using a budgeting software. Software's have more technology behind them with systems built in them to do more than just put numbers on a page. Usually they ask for more information than you may thing to enter on a sheet. Something to consider, but it does depend on your situation and how tight of an income you live on. Site Index Read the full article

#budgetsoftware#budgetingtips#creatingabudget#followingabudget#householdbudgeting#howtobudget#howtobudgetandsavemoney#howtobudgetmoney#howtobudgetyourmoney#howtocreateabudget#howtomakeabudget#howtopaybillsontime#howtosetupabudget#howtosetupabudgetandsave#personalbudgetsoftware#reducebills#reducedebt#settingabudget

0 notes