#how to buy shares in smallcase

Explore tagged Tumblr posts

Text

The Rise of Fractional Investing in India: Making Wealth Creation Accessible to All

In the rapidly evolving world of finance, one trend is quietly revolutionizing how Indians invest—fractional investing. Traditionally, wealth creation through the stock market or alternative assets was a domain dominated by high-net-worth individuals and institutional investors. But with fractional investing, that narrative is changing. Now, everyday Indians can own a piece of premium stocks, REITs, and even luxury assets like art or commercial real estate.

This shift isn’t just about convenience or access; it’s about financial empowerment. And for those looking to master the analytics behind these trends, Online Certification Courses for Financial Analytics are proving to be the perfect launchpad.

What is Fractional Investing?

Fractional investing allows investors to buy a portion of a high-value asset rather than the whole unit. For instance, instead of purchasing one share of a premium stock like MRF (which trades above ₹1 lakh per share), an investor can buy a fraction of that share for just ₹100 or ₹500.

This model isn't just limited to stocks. Fintech platforms are extending it to:

Real Estate Investment Trusts (REITs)

Gold and precious metals

Art and collectibles

Startups and private equity

Why Is It Booming in India?

Several factors are fueling the growth of fractional investing in India:

1. Rise of Fintech Platforms

Platforms like smallcase, INDmoney, and Grip Invest are making it easier than ever to invest small amounts in diversified portfolios or single assets. Seamless user experience, low entry thresholds, and transparency are driving user adoption.

2. Growing Financial Literacy

Thanks to initiatives in financial education, more young Indians understand the importance of investing early. Combine that with digital-first behavior, and you have a generation hungry for smarter investment tools.

3. Market Volatility and Diversification Needs

In a post-pandemic world, diversification is more than a buzzword. Fractional investing offers a way to spread risk across asset classes without needing a large capital outlay.

4. Regulatory Encouragement

SEBI and RBI have been pushing for inclusive and investor-friendly frameworks. While the regulatory landscape for fractional investing is still evolving, the intent is clear—broaden the base of retail participation.

Who Benefits the Most?

Young Professionals: Fresh graduates and early-career professionals can start investing with minimal capital.

Women Investors: More women are entering the investment space, and fractional investing offers a low-risk entry point.

Tier-2 and Tier-3 City Investors: With digital access improving, retail investors outside metros are exploring new ways to grow wealth.

The Analytics Behind the Magic

What makes fractional investing work isn't just tech; it’s data. Algorithms assess asset performance, diversification metrics, investor risk profiles, and predictive analytics to recommend investment bundles.

This is where Online Certification Courses for Financial Analytics come into play. These courses teach you how to:

Analyze investment portfolios

Use data to understand market trends

Make predictions using statistical tools

Understand asset allocation and risk modeling

Whether you're an aspiring analyst or a curious investor, understanding financial analytics helps you make smarter, data-backed decisions.

How Financial Analytics Powers the Future of Investing

Consider this: you're using a fractional investing app, and it recommends a curated smallcase focused on sustainable energy stocks. How did it know that aligns with your goals? The answer lies in financial analytics powered by machine learning and behavioral finance models.

With the explosion of user data, the future of investing will be deeply personalized. Financial analytics professionals will be in high demand to develop algorithms that decode market signals and align them with individual financial goals.

Getting Started: The Power of Online Certification

If you're looking to ride this wave of innovation and understand the "why" behind your investment decisions, enrolling in Online Certification Courses for Financial Analytics is a smart move. These courses are:

Flexible and accessible from anywhere

Taught by industry experts

Designed with real-world applications and case studies

Perfect for upskilling finance professionals or entering the investment field

Institutes like the Boston Institute of Analytics are offering programs that blend technical skills with practical financial knowledge, helping learners tap into new-age opportunities like fractional investing, fintech innovation, and data-driven wealth management.

Final Thoughts

Fractional investing isn’t just a buzzword—it’s a movement democratizing wealth creation. From millennials entering the job market to seasoned professionals exploring alternative assets, the Indian investment landscape is becoming more inclusive, agile, and data-driven.

To truly capitalize on this transformation, understanding financial analytics is no longer optional. It's essential. And with Online Certification Courses for Financial Analytics, you're not just learning—you’re future-proofing your financial career.

0 notes

Text

Invest in Smallcase with SEBI registered professionals

What Is Smallcase and How Does It Work?

India’s investment landscape has changed dramatically in recent years, with the introduction of digital platforms and the rise of mutual funds as popular investment vehicles.

Smallcase is a new investment platform in India that offers a unique way of investing in the stock market through theme-based portfolios. A Smallcase is a basket of stocks designed around a particular theme or sector managed by SEBI-approved fund managers. This innovative investment approach brings an element of diversification to investing in the stock market.

With low minimum investment amounts and well-rounded theme-based asset classes, Smallcases are an affordable investment option that won’t break the bank account.

Smallcases provide the services of a qualified RIA for the price of a mutual fund investment and offer the easy purchase of thematic investments. Instead of buying each company’s share one piece at a time, you can buy a theme or idea as a bundle, like investing in global tech leaders or companies benefiting from rising rural consumption. Smallcases are subject to the same clearing and settlement rules as direct stocks.

Features and Benefits of a Smallcase

Investing in the stock market has long been seen as a complex and risky endeavour that requires significant research, time, and expertise. However, a Smallcase is changing the game, providing a simple, flexible, and low-cost way for anyone to invest in the Indian stock market. Smallcase offers a unique approach to investing, providing pre-made portfolios, known as ‘smallcases’, that cater to different investment goals and risk profiles. These portfolios are curated and analysed by experts in the field, providing investors with a diversified mix of stocks and other securities that can lead to stable and consistent returns over time.

One of the critical benefits of Smallcase is risk diversification. By investing in a mix of large, mid, and small-cap stocks, investors can protect themselves from the downside of any particular stock while enjoying the upside of multiple stocks.

Smallcase is a game-changer for the Indian stock market, providing a simple, flexible, and low-cost way for investors to build a diversified portfolio and generate consistent returns over time. Whether you are a seasoned investor or a novice investor, Smallcase has something to offer.

Types of Smallcases

Founded by three graduates from IIT Kharagpur in 2015, Smallcase provides a unique way to build a long-term stock portfolio based on various themes or concepts.

The beauty of Smallcases lies in their diversity. With various themes, investors can tailor their portfolios to match their investment profile. For instance, the trend-themed Smallcases are perfect for those who want to capitalise on different trends in the market. While Beta-themed smallcases use a quantitative approach to extract a favourable rate of return on investments. Industry-themed smallcases allow investors to focus on specific industries they want to remain invested.

Smallcases are designed to offer flexibility and convenience to investors. Unlike traditional mutual funds, smallcases are stock portfolios that can be bought and sold anytime during market hours, with no lock-in period. Smallcase is revolutionising the investment industry, making it accessible to all, regardless of financial background. With its unique approach to building a portfolio, it’s no wonder that Smallcase is gaining popularity among investors.

How to Select a Smallcase?/Investing in a Smallcase?

Investors are always on the lookout for new ways to grow their money. Smallcase offers curated investment baskets of stocks and ETFs based on different sectoral themes and risk appetites.

The first step in selecting the right smallcase is to identify your investment goal. Once you have identified your investment goal, you must also decide on an investment corpus. This decision must consider your risk profile, entry barriers for certain smallcases and expert fund management costs.

It is essential to read the investment methodology and the fact sheet and evaluate the risk factors involved in the smallcase.

Investing in smallcases has several benefits. Smallcase managers offer professional investment portfolio management, so you do not have to track individual stocks or keep up with market trends. In addition, investing in smallcases provides flexibility in the investment amount, making it accessible to all investors.

Which Smallcase is Best?

Smallcase offers a basket of stocks and ETFs that are thematically grouped based on a specific investment goal. For those seeking reliable capital growth or with a high-risk tolerance, investing in equities through Smallcase is an excellent option.

Once investors have determined that Smallcase investing suits them, they must consider their investment goals, expected returns, investment style, risk tolerance, and time horizon. It will help them choose the right type of smallcase investment for their portfolio. Different investment types include large-cap, small-cap, mid-cap, dividend-yielding, tech stocks, and high-growth. Each type of investment comes with its own set of risks and rewards.

Investors should ensure that the portfolio of stocks and ETFs included in the smallcase is relevant to their needs. Investors must also consider their risk profile, investment capital, and time horizon to find the right mix of investments.

In conclusion, choosing the best smallcase investment requires careful consideration of several factors. Still, investors who take the time to do their research can enjoy risk-adjusted gains while maintaining a balanced and diversified portfolio.

#smallcase portfolio#Smallcase#smallcase stocks#smallcase teji mandi#smallcase investment#smallcase managers#best smallcase managers#best smallcase to invest in 2023 india#best smallcase

0 notes

Text

Invest in smallcase with Sebi Registered professionals

What Is Smallcase and How Does It Work?

India’s investment landscape has changed dramatically in recent years, with the introduction of digital platforms and the rise of mutual funds as popular investment vehicles.

Smallcase is a new investment platform in India that offers a unique way of investing in the stock market through theme-based portfolios. A Smallcase is a basket of stocks designed around a particular theme or sector managed by SEBI-approved fund managers. This innovative investment approach brings an element of diversification to investing in the stock market.

With low minimum investment amounts and well-rounded theme-based asset classes, Smallcases are an affordable investment option that won’t break the bank account.

Smallcases provide the services of a qualified RIA for the price of a mutual fund investment and offer the easy purchase of thematic investments. Instead of buying each company’s share one piece at a time, you can buy a theme or idea as a bundle, like investing in global tech leaders or companies benefiting from rising rural consumption. Smallcases are subject to the same clearing and settlement rules as direct stocks.

Features and Benefits of a Smallcase

Investing in the stock market has long been seen as a complex and risky endeavour that requires significant research, time, and expertise. However, a Smallcase is changing the game, providing a simple, flexible, and low-cost way for anyone to invest in the Indian stock market.

Smallcase offers a unique approach to investing, providing pre-made portfolios, known as ‘smallcases’, that cater to different investment goals and risk profiles. These portfolios are curated and analysed by experts in the field, providing investors with a diversified mix of stocks and other securities that can lead to stable and consistent returns over time.

One of the critical benefits of Smallcase is risk diversification. By investing in a mix of large, mid, and small-cap stocks, investors can protect themselves from the downside of any particular stock while enjoying the upside of multiple stocks.

Smallcase is a game-changer for the Indian stock market, providing a simple, flexible, and low-cost way for investors to build a diversified portfolio and generate consistent returns over time. Whether you are a seasoned investor or a novice investor, Smallcase has something to offer.

Types of Smallcases

Founded by three graduates from IIT Kharagpur in 2015, Smallcase provides a unique way to build a long-term stock portfolio based on various themes or concepts.

The beauty of Smallcases lies in their diversity. With various themes, investors can tailor their portfolios to match their investment profile. For instance, the trend-themed Smallcases are perfect for those who want to capitalise on different trends in the market. While Beta-themed smallcases use a quantitative approach to extract a favourable rate of return on investments. Industry-themed smallcases allow investors to focus on specific industries they want to remain invested.

Smallcases are designed to offer flexibility and convenience to investors. Unlike traditional mutual funds, smallcases are stock portfolios that can be bought and sold anytime during market hours, with no lock-in period. Smallcase is revolutionising the investment industry, making it accessible to all, regardless of financial background. With its unique approach to building a portfolio, it’s no wonder that Smallcase is gaining popularity among investors.

How to Select a Smallcase?/Investing in a Smallcase?

Investors are always on the lookout for new ways to grow their money. Smallcase offers curated investment baskets of stocks and ETFs based on different sectoral themes and risk appetites.

The first step in selecting the right smallcase is to identify your investment goal. Once you have identified your investment goal, you must also decide on an investment corpus. This decision must consider your risk profile, entry barriers for certain smallcases and expert fund management costs.

It is essential to read the investment methodology and the fact sheet and evaluate the risk factors involved in the smallcase.

Investing in smallcases has several benefits. Smallcase managers offer professional investment portfolio management, so you do not have to track individual stocks or keep up with market trends. In addition, investing in smallcases provides flexibility in the investment amount, making it accessible to all investors.

Which Smallcase is Best?

Smallcase offers a basket of stocks and ETFs that are thematically grouped based on a specific investment goal. For those seeking reliable capital growth or with a high-risk tolerance, investing in equities through Smallcase is an excellent option.

Once investors have determined that Smallcase investing suits them, they must consider their investment goals, expected returns, investment style, risk tolerance, and time horizon. It will help them choose the right type of smallcase investment for their portfolio. Different investment types include large-cap, small-cap, mid-cap, dividend-yielding, tech stocks, and high-growth. Each type of investment comes with its own set of risks and rewards.

Investors should ensure that the portfolio of stocks and ETFs included in the smallcase is relevant to their needs. Investors must also consider their risk profile, investment capital, and time horizon to find the right mix of investments.

In conclusion, choosing the best smallcase investment requires careful consideration of several factors. Still, investors who take the time to do their research can enjoy risk-adjusted gains while maintaining a balanced and diversified portfolio.

Smallcase Vs Direct Stock Investments

Investing in the stock market comes with a number of options. Two of the most popular options are investing in smallcases and investing directly in stocks. But what exactly are smallcases, and how do they differ from investing in stocks directly?

Smallcases are professionally managed investment products created by bundling a selection of stocks and ETFs. They are designed to provide investors a more diversified and cost-effective way to invest in the equity markets.

On the other hand, investing directly in stocks is suited for investors who prefer a more hands-on approach. They must understand what and why they buy and how the stock performs in the market and with its peers. They may also need to try and time the investment – the entry and the exit – to capitalise on the investment to the maximum possible extent.

If you are a beginner or an experienced stock-picker who wants to buy a niche idea, smallcases can work for you. However, direct investments may be the right choice if you are comfortable understanding risk profiles and willing to take on more volatile investment climates.

Smallcase vs Mutual Fund

When it comes to investing, plenty of options are available. Two popular options for diversifying your portfolio and achieving your financial goals are mutual funds and Smallcases. But which one is the best investment option for you?

Mutual funds are a pool of money collected from multiple investors, then invested in a mix of securities. Professional fund managers choose the fund’s constituents, and investors can choose from various schemes based on their investment objectives.

On the other hand, Smallcases are portfolios of stocks or ETFs created by top-qualified and registered investment advisors in India based on a specific theme, strategy, or objective.

The investment option that is best for you will depend on your financial goals and risk appetite. If you want high control, customisation, and low cost, Smallcases could be the better option. However, mutual funds may be the better choice if you are looking for diversification and risk mitigation.

Does Many Smallcases = More Profit?

In recent years, smallcases have emerged as a popular way for retail investors in India to invest in the equity markets. These thematic investments cater to investors’ diverse investing goals and risk appetite. However, with the growing popularity of smallcases, investors need to be cautious about their investment decisions.

While smallcases offer a convenient way to diversify one’s portfolio and mitigate market volatility, over-diversification can lead to concentration risk and expensive access. Additionally, too many smallcases can make monitoring the portfolio’s performance challenging, leading to confusion and difficulty in understanding the exact details of the investments.

Choosing the right smallcases that offer a well-diversified portfolio and provide reasonable returns is crucial. Investing in a few selected smallcases that align with one’s investment goals and risk profile is a better strategy than investing in multiple smallcases.

How to use your existing Demat account to invest in Smallcase?

For novices, investing in the stock market can be a challenging and intimidating experience. With so many stocks and funds, figuring out where to start can take time. Enter Smallcases, a new and innovative way of investing that makes diversifying your portfolio a breeze.

Smallcases are baskets of equities and ETFs carefully selected by investment experts to align with specific market themes, investment strategies, or trending ideas. To invest in Smallcases, investors need a Demat account, a trading account, and a bank account, just like conventional stock trading. The trades are executed through trading accounts with a broking firm, and the stocks purchased in the basket are held in the investor’s Demat account.

How do SIPs work in a Smallcase?

Smallcases are a unique investment avenue that allows investors to invest in a basket of stocks and ETFs that follow a specific theme or investment idea. One of the significant advantages of investing in Smallcases is the ability to establish a SIP, which is a systematic investment plan.

SIPs allow investors to invest small amounts regularly, an affordable way to invest in the stock market. However, it’s important to note that Smallcases work differently than mutual funds, and investors need to purchase total units of the stocks. In most smallcases, the first investment needs to be a lump sum investment that adheres to the minimum investment requirement.

Setting a SIP in Smallcases is a great way to build a disciplined investment habit and earn better risk-adjusted returns. It’s also a great way to stay relevant in all market conditions, as SIPs do not require investors to time the market.

How to set the proper Risk Appetite in Smallcase – Explained

Investing is often a game of balancing risks and returns. And while returns may seem like the most crucial factor in selecting an investment, experienced investors know that risk is equally critical.

Smallcases offer investors a unique investment avenue that allows them to access a carefully curated portfolio of stocks and ETFs managed by professional fund managers.

However, before investing in Smallcases, investors must understand their risk appetite and tolerance. Risk appetite is an investor’s willingness to take risks, while risk tolerance is an investor’s ability to take risks. Investors must examine these two factors before making any investment decisions. Once investors have determined their risk appetite and tolerance, they can choose the Smallcases that align with their objectives.

Finally, investors should regularly examine their portfolio’s alignment with their goals and rebalance it as necessary. It can help their asset portfolio stay on track.

Read more about smallcase wikipedia

0 notes

Text

Unlocking Smallcase

What Is Smallcase and How Does It Work?

India’s investment landscape has changed dramatically in recent years, with the introduction of digital platforms and the rise of mutual funds as popular investment vehicles.

Smallcase is a new investment platform in India that offers a unique way of investing in the stock market through theme-based portfolios. A Smallcase is a basket of stocks designed around a particular theme or sector managed by SEBI-approved fund managers. This innovative investment approach brings an element of diversification to investing in the stock market.

With low minimum investment amounts and well-rounded theme-based asset classes, Smallcases are an affordable investment option that won’t break the bank account.

Smallcases provide the services of a qualified RIA for the price of a mutual fund investment and offer the easy purchase of thematic investments. Instead of buying each company’s share one piece at a time, you can buy a theme or idea as a bundle, like investing in global tech leaders or companies benefiting from rising rural consumption. Smallcases are subject to the same clearing and settlement rules as direct stocks.

Features and Benefits of a Smallcase

Investing in the stock market has long been seen as a complex and risky endeavour that requires significant research, time, and expertise. However, a Smallcase is changing the game, providing a simple, flexible, and low-cost way for anyone to invest in the Indian stock market.

Smallcase offers a unique approach to investing, providing pre-made portfolios, known as ‘smallcases’, that cater to different investment goals and risk profiles. These portfolios are curated and analysed by experts in the field, providing investors with a diversified mix of stocks and other securities that can lead to stable and consistent returns over time.

One of the critical benefits of Smallcase is risk diversification. By investing in a mix of large, mid, and small-cap stocks, investors can protect themselves from the downside of any particular stock while enjoying the upside of multiple stocks.

Smallcase is a game-changer for the Indian stock market, providing a simple, flexible, and low-cost way for investors to build a diversified portfolio and generate consistent returns over time. Whether you are a seasoned investor or a novice investor, Smallcase has something to offer.

Types of Smallcases

Founded by three graduates from IIT Kharagpur in 2015, Smallcase provides a unique way to build a long-term stock portfolio based on various themes or concepts.

The beauty of Smallcases lies in their diversity. With various themes, investors can tailor their portfolios to match their investment profile. For instance, the trend-themed Smallcases are perfect for those who want to capitalise on different trends in the market. While Beta-themed smallcases use a quantitative approach to extract a favourable rate of return on investments. Industry-themed smallcases allow investors to focus on specific industries they want to remain invested.

Smallcases are designed to offer flexibility and convenience to investors. Unlike traditional mutual funds, smallcases are stock portfolios that can be bought and sold anytime during market hours, with no lock-in period. Smallcase is revolutionising the investment industry, making it accessible to all, regardless of financial background. With its unique approach to building a portfolio, it’s no wonder that Smallcase is gaining popularity among investors.

How to Select a Smallcase?/Investing in a Smallcase?

Investors are always on the lookout for new ways to grow their money. Smallcase offers curated investment baskets of stocks and ETFs based on different sectoral themes and risk appetites.

The first step in selecting the right smallcase is to identify your investment goal. Once you have identified your investment goal, you must also decide on an investment corpus. This decision must consider your risk profile, entry barriers for certain smallcases and expert fund management costs.

It is essential to read the investment methodology and the fact sheet and evaluate the risk factors involved in the smallcase.

Investing in smallcases has several benefits. Smallcase managers offer professional investment portfolio management, so you do not have to track individual stocks or keep up with market trends. In addition, investing in smallcases provides flexibility in the investment amount, making it accessible to all investors.

Which Smallcase is Best?

Smallcase offers a basket of stocks and ETFs that are thematically grouped based on a specific investment goal. For those seeking reliable capital growth or with a high-risk tolerance, investing in equities through Smallcase is an excellent option.

Once investors have determined that Smallcase investing suits them, they must consider their investment goals, expected returns, investment style, risk tolerance, and time horizon. It will help them choose the right type of smallcase investment for their portfolio. Different investment types include large-cap, small-cap, mid-cap, dividend-yielding, tech stocks, and high-growth. Each type of investment comes with its own set of risks and rewards.

Investors should ensure that the portfolio of stocks and ETFs included in the smallcase is relevant to their needs. Investors must also consider their risk profile, investment capital, and time horizon to find the right mix of investments.

In conclusion, choosing the best smallcase investment requires careful consideration of several factors. Still, investors who take the time to do their research can enjoy risk-adjusted gains while maintaining a balanced and diversified portfolio.

Smallcase Vs Direct Stock Investments

Investing in the stock market comes with a number of options. Two of the most popular options are investing in smallcases and investing directly in stocks. But what exactly are smallcases, and how do they differ from investing in stocks directly?

Smallcases are professionally managed investment products created by bundling a selection of stocks and ETFs. They are designed to provide investors a more diversified and cost-effective way to invest in the equity markets.

On the other hand, investing directly in stocks is suited for investors who prefer a more hands-on approach. They must understand what and why they buy and how the stock performs in the market and with its peers. They may also need to try and time the investment – the entry and the exit – to capitalise on the investment to the maximum possible extent.

If you are a beginner or an experienced stock-picker who wants to buy a niche idea, smallcases can work for you. However, direct investments may be the right choice if you are comfortable understanding risk profiles and willing to take on more volatile investment climates.

Smallcase vs Mutual Fund

When it comes to investing, plenty of options are available. Two popular options for diversifying your portfolio and achieving your financial goals are mutual funds and Smallcases. But which one is the best investment option for you?

Mutual funds are a pool of money collected from multiple investors, then invested in a mix of securities. Professional fund managers choose the fund’s constituents, and investors can choose from various schemes based on their investment objectives.

On the other hand, Smallcases are portfolios of stocks or ETFs created by top-qualified and registered investment advisors in India based on a specific theme, strategy, or objective.

The investment option that is best for you will depend on your financial goals and risk appetite. If you want high control, customisation, and low cost, Smallcases could be the better option. However, mutual funds may be the better choice if you are looking for diversification and risk mitigation.

Does Many Smallcases = More Profit?

In recent years, smallcases have emerged as a popular way for retail investors in India to invest in the equity markets. These thematic investments cater to investors’ diverse investing goals and risk appetite. However, with the growing popularity of smallcases, investors need to be cautious about their investment decisions.

While smallcases offer a convenient way to diversify one’s portfolio and mitigate market volatility, over-diversification can lead to concentration risk and expensive access. Additionally, too many smallcases can make monitoring the portfolio’s performance challenging, leading to confusion and difficulty in understanding the exact details of the investments.

Choosing the right smallcases that offer a well-diversified portfolio and provide reasonable returns is crucial. Investing in a few selected smallcases that align with one’s investment goals and risk profile is a better strategy than investing in multiple smallcases.

How to use your existing Demat account to invest in Smallcase?

For novices, investing in the stock market can be a challenging and intimidating experience. With so many stocks and funds, figuring out where to start can take time. Enter Smallcases, a new and innovative way of investing that makes diversifying your portfolio a breeze.

Smallcases are baskets of equities and ETFs carefully selected by investment experts to align with specific market themes, investment strategies, or trending ideas. To invest in Smallcases, investors need a Demat account, a trading account, and a bank account, just like conventional stock trading. The trades are executed through trading accounts with a broking firm, and the stocks purchased in the basket are held in the investor’s Demat account.

How do SIPs work in a Smallcase?

Smallcases are a unique investment avenue that allows investors to invest in a basket of stocks and ETFs that follow a specific theme or investment idea. One of the significant advantages of investing in Smallcases is the ability to establish a SIP, which is a systematic investment plan.

SIPs allow investors to invest small amounts regularly, an affordable way to invest in the stock market. However, it’s important to note that Smallcases work differently than mutual funds, and investors need to purchase total units of the stocks. In most smallcases, the first investment needs to be a lump sum investment that adheres to the minimum investment requirement.

Setting a SIP in Smallcases is a great way to build a disciplined investment habit and earn better risk-adjusted returns. It’s also a great way to stay relevant in all market conditions, as SIPs do not require investors to time the market.

How to set the proper Risk Appetite in Smallcase – Explained

Investing is often a game of balancing risks and returns. And while returns may seem like the most crucial factor in selecting an investment, experienced investors know that risk is equally critical.

Smallcases offer investors a unique investment avenue that allows them to access a carefully curated portfolio of stocks and ETFs managed by professional fund managers.

However, before investing in Smallcases, investors must understand their risk appetite and tolerance. Risk appetite is an investor’s willingness to take risks, while risk tolerance is an investor’s ability to take risks. Investors must examine these two factors before making any investment decisions. Once investors have determined their risk appetite and tolerance, they can choose the Smallcases that align with their objectives.

Finally, investors should regularly examine their portfolio’s alignment with their goals and rebalance it as necessary. It can help their asset portfolio stay on track.

Know More About Smallcase

0 notes

Text

How Do I Buy/Sell Shares in Smallcases?

With smallcase, an investor can buy, sell and manage their portfolio seamlessly in seconds. All they have to do is follow these steps to learn how to buy and sell shares in smallcase.

Investing in ready-made strategies

Many a time, while choosing a stock, there is utter confusion as to which company should be chosen for investing. Should one go for a startup or an already established company? Well, smallcase eases this confusion with ready-made portfolio options.

Customised portfolio-based investing

The option to invest as a risk-averse or risk-taking investor doesn’t end here. With the help of SEBI Registered Financial Experts, they can get a customised portfolio. For instance, if an investor wants a set return but also a scope of earning higher returns, they can get their portfolio customised with such shares and stocks. The best part about smallcase is that it’s easy, convenient, and tailored according to the investor’s needs and aspirations from the market trends.

How To Buy And Sell Shares In Smallcase?

One of the biggest problems an investor faces is analysis; a lot of effort and time has to be spent on smart investing before buying any stocks. However, all this time and money can be saved in smallcase, where SEBI registered financial partners and researchers help with buying and selling decisions.

With smallcase, an investor can buy, sell and manage their portfolio seamlessly in seconds. All they have to do is follow these steps to learn how to buy and sell shares in smallcase:

Step 1: Select the stocks you want to invest in, whether 1 or 50. You have the allowance to choose upto 50 stocks with smallcase.

Step 2: Assign weights to stocks. The choice differs according to needs. Hence, the investor can assign individual weights to the theme their portfolio is based on. The minimum weighted amount ensures they buy stocks with the weights allocated.

Step 3: Performance management. The investor can check the prior movement of their portfolio and assign weights to new stocks accordingly. With respect to performance, they can buy stocks in clicks from the smallcase portal.

Changing the stock investing pattern and outlook, smallcase is on the mission to make the process seamless and easy. Teji Mandi is a means to access quality Smallcases – we have 2 portfolios on offer for now – Flagship and Multiplier – that cater to your goal-based needs. Gain access to “Affordable PMS” – Start with as low as Rs149/month and embark on your investment journey today.

0 notes

Text

Investing In Smallcase Can Make You Rich

The ordinary investor knows the advantages of holding a diverse portfolio. The advised method for investing in securities is to keep a range of businesses depending on market segments and sector caps (mid-cap, large-cap, and small-cap). By spreading their risk over several equities, an investor is safe as their portfolio won't be negatively impacted if one stock in a niche sector fails.

What Is Smallcase?

For small investors, a smallcase is a brand-new product that is equipped with built-in portfolio diversity. The smallcases are skillfully crafted investments of stocks or exchange-traded funds (ETFs) that represent an investment strategy, concept, or purpose. Smallcase Solutions, an investing platform established in Bengaluru, India, offers Smallcases. On this platform, organizations like brokers, financial planners, and asset managers conduct in-depth analyses to build results considerable for investors.

Smallcase Investment

Many complex asset allocation mechanisms and solutions are emerging as financial innovation approaches a crescendo on a global scale. Smallcase investment, a packaged product made up of stocks and ETFs, is one example of such a tool. Financial super minds with years of experience pool securities together based on predetermined themes or concepts.

Everyone who invests wishes to understand how to oversee their stocks successfully, but fewer people have the knowledge to locate reliable advisors, follow their recommendations, or have the financial means to hire a firm to carry out certain aspects of the investment decision on their behalf. And smallcase delivers precisely that.

Advantages of Investing In Smallcases

Purchasing smallcases has several advantages.

1. Simple

The convenience of acquiring and disposing of assets is unmatched for most new investors. With the press of a button, investors can buy and sell positions on the Smallcase marketplace. When it relates to the ease of trading, other financial structures like equity funds and index funds fall considerably short.

2. Visible

Smallcase investors may instantaneously and continuously track the results of their investments, enabling them to base their decisions on current financial information. Investors can also monitor price changes and modify their stocks as necessary.

3. Liability

Since the prototype strategies for the best-performing smallcases have a defined structure, smallcase shareholders can hold their asset managers responsible for their activities.Many portfolio managers actively participate in the beginning and administration of the strategy, and they frequently provide alerts that explain why they are buying and selling particular securities. It is certain that stakeholders comprehend the reasoning behind the actions and allows them to make wise choices within the Smallcase ecology.

4. Access Charges

While the profit margin for most equity funds is, at worst, less than 2% of the overall budget value, the production cost for Smallcases is determined by the asset manager that developed the technique.On an initial investment of between Rs 50,000 and Rs 1,00,000, several Smallcases cost around 2-5% of the investment capital. Smallcases may ultimately become inappropriate for small investors, quick investing, or sometimes both as a result of these costs, which may raise the bar for a significant amount.

Although these profits are not assured, smallcases might have the ability to generate greater yields than equity mutual funds and exchange-traded funds. Smallcases aren't any different from other stock market investments in that they carry a risk. Because the stock-picking strategy is based on specific domain expertise, Small cases are best suited as a financial asset for traders who have a better understanding of the share market than the typical person.

#best smallcases#best smallcases stocks#best small case to buy#smallcase in stock market#smallcase in share market#best performing small cases

1 note

·

View note

Text

Invest in smallcase with sebi registered professionals

What Is Smallcase and How Does It Work?

India’s investment landscape has changed dramatically in recent years, with the introduction of digital platforms and the rise of mutual funds as popular investment vehicles.

Smallcase is a new investment platform in India that offers a unique way of investing in the stock market through theme-based portfolios. A Smallcase is a basket of stocks designed around a particular theme or sector managed by SEBI-approved fund managers. This innovative investment approach brings an element of diversification to investing in the stock market.

With low minimum investment amounts and well-rounded theme-based asset classes, Smallcases are an affordable investment option that won’t break the bank account.

Smallcases provide the services of a qualified RIA for the price of a mutual fund investment and offer the easy purchase of thematic investments. Instead of buying each company’s share one piece at a time, you can buy a theme or idea as a bundle, like investing in global tech leaders or companies benefiting from rising rural consumption. Smallcases are subject to the same clearing and settlement rules as direct stocks.

Features and Benefits of a Smallcase

Investing in the stock market has long been seen as a complex and risky endeavour that requires significant research, time, and expertise. However, a Smallcase is changing the game, providing a simple, flexible, and low-cost way for anyone to invest in the Indian stock market.

Smallcase offers a unique approach to investing, providing pre-made portfolios, known as ‘smallcases’, that cater to different investment goals and risk profiles. These portfolios are curated and analysed by experts in the field, providing investors with a diversified mix of stocks and other securities that can lead to stable and consistent returns over time.

One of the critical benefits of Smallcase is risk diversification. By investing in a mix of large, mid, and small-cap stocks, investors can protect themselves from the downside of any particular stock while enjoying the upside of multiple stocks.

Smallcase is a game-changer for the Indian stock market, providing a simple, flexible, and low-cost way for investors to build a diversified portfolio and generate consistent returns over time. Whether you are a seasoned investor or a novice investor, Smallcase has something to offer.

Types of Smallcases

Founded by three graduates from IIT Kharagpur in 2015, Smallcase provides a unique way to build a long-term stock portfolio based on various themes or concepts.

The beauty of Smallcases lies in their diversity. With various themes, investors can tailor their portfolios to match their investment profile. For instance, the trend-themed Smallcases are perfect for those who want to capitalise on different trends in the market. While Beta-themed smallcases use a quantitative approach to extract a favourable rate of return on investments. Industry-themed smallcases allow investors to focus on specific industries they want to remain invested.

Smallcases are designed to offer flexibility and convenience to investors. Unlike traditional mutual funds, smallcases are stock portfolios that can be bought and sold anytime during market hours, with no lock-in period. Smallcase is revolutionising the investment industry, making it accessible to all, regardless of financial background. With its unique approach to building a portfolio, it’s no wonder that Smallcase is gaining popularity among investors.

How to Select a Smallcase?/Investing in a Smallcase?

Investors are always on the lookout for new ways to grow their money. Smallcase offers curated investment baskets of stocks and ETFs based on different sectoral themes and risk appetites.

The first step in selecting the right smallcase is to identify your investment goal. Once you have identified your investment goal, you must also decide on an investment corpus. This decision must consider your risk profile, entry barriers for certain smallcases and expert fund management costs.

It is essential to read the investment methodology and the fact sheet and evaluate the risk factors involved in the smallcase.

Investing in smallcases has several benefits. Smallcase managers offer professional investment portfolio management, so you do not have to track individual stocks or keep up with market trends. In addition, investing in smallcases provides flexibility in the investment amount, making it accessible to all investors. Read more about smallcase

0 notes

Text

How Do I Buy and Sell Shares in Smallcases?

For a variety of reasons, we make stock market investments. For a better investment in the future or an additional source of income. However, the core is still the same. Investment. How may smallcase assist you in investing, and how can smallcase be purchased?

Smallcase offers the investor a selection of stocks that correspond to their idea, theme, and outlook. With the aid of financounselorsllors and specialists that evaluate, pick, and direct investors through portfolio choices, it offers a straightforward, practical, yet exciting way to go about investing hard-earned money.

How To Buy And Sell Shares In Smallcase?

The analysis is one of the major challenges for investors; before purchasing any stocks, careful investing requires a lot of time and work. All of this time and money can be saved, though, in modest cases when financial partners who have registered with SEBI and researchers assist in making purchasing and selling judgments.

An investor may buy, sell, and manage their portfolio quickly and easily with smallcase. To learn how to buy and sell shares in smallcase, all people have to do is adhere to the following steps:

Step 1: Select the stocks you want to invest in, whether 1 or 50. You have the allowance to choose up to 50 stocks with smallcase.

Step 2: Assign weights to stocks. The choice differs according to needs. Hence, the investor can assign individual weights to the theme their portfolio is based on. The minimum weighted amount ensures they buy stocks with the weights allocated.

Step 3: Performance management. The investor can check the prior movement of their portfolio and assign weights to new stocks accordingly. With respect to performance, they can buy stocks in clicks from the smallcase portal.

Read more about

how to sell shares in smallcase

0 notes

Text

How Do I Buy and Sell Shares in Smallcases?

With smallcase, an investor can buy, sell and manage their portfolio seamlessly in seconds. All they have to do is follow these steps to learn how to buy and sell shares in smallcase.

What is a Smallcase?

We invest in the stock market for a variety of reasons. It can be for a better future investment or an extra set of income. However, the essence remains the same. Investment. So how can smallcase help you in investing, and how to buy smallcase?

Smallcase provides the investor with a basket of stocks that reflects their idea, theme, and mindset. It gives a simple, convenient yet intriguing way to go about investing hard-earned money with the help of financial advisors and experts who analyse, choose and guide investors through portfolio choices.

Investing in ready-made strategies

Many a time, while choosing a stock, there is utter confusion as to which company should be chosen for investing. Should one go for a startup or an already established company? Well, smallcase eases this confusion with ready-made portfolio options.

Tracking news and trends of 10-15 stocks is often a task and takes a lot of time. This is where a ready-made theme and idea help in investing. For instance, if an investor wants to play it safe, they can choose a theme with safer stock options and bets and a set return. But in case they want to play with the market trends and earn higher with the risks associated, they can invest in a theme that plays around with startups and new companies.

Customised portfolio-based investing

The option to invest as a risk-averse or risk-taking investor doesn’t end here. With the help of SEBI Registered Financial Experts, they can get a customised portfolio. For instance, if an investor wants a set return but also a scope of earning higher returns, they can get their portfolio customised with such shares and stocks. The best part about smallcase is that it’s easy, convenient, and tailored according to the investor’s needs and aspirations from the market trends.

How To Buy And Sell Shares In Smallcase?

One of the biggest problems an investor faces is analysis; a lot of effort and time has to be spent on smart investing before buying any stocks. However, all this time and money can be saved in smallcase, where SEBI registered financial partners and researchers help with buying and selling decisions. Read more about how to buy smallcase

0 notes

Text

Invest in smallcase with sebi registered professionals- Teji Mandi

What is Smallcase?

Smallcases incorporate a portfolio-driven approach to investing. After you make a purchase, individual stock units are deposited to your Demat account. Contrary to a mutual fund, you only have access to the aggregated fund, not the underlying companies.

This also implies that when you invest in a smallcase, you automatically own a portion of each stock in the chosen smallcase and are entitled to dividends and other shareholder rights.

According to the RIA (Registered Investment Advisor) managing the portfolio, different smallcases have varied fee rates, and investing in them may cost about the same as investing in mutual funds. Exit loads aren’t imposed on smallcase redemptions, though. The same fees that apply to stock trading also apply to smallcases.

Smallcases have no concept of lock-in periods, making them similar to liquid stock. They are a type of investing that provides more flexibility and variety while remaining liquid. Investors can withdraw at any moment without losing their entire investment if things don’t turn out as expected because there are no lock-in periods. Getting the services of a qualified RIA for the fees of a mutual fund investment is another significant benefit of smallcases.

Smallcases make it simple to purchase thematic investments; rather than buying each company’s share individually, you may invest in a topic or idea as a package, such as investing in IT, pharmacy or businesses gaining from expanding rural consumerism.

For those who wish to diversify their finances without taking on too much risk, smallcases are the ideal choice. They offer reasonable investment solutions that won’t burn a hole in your pocket, with minimum investment amounts and broad theme-based asset classes!

Why Invest with Teji Mandi

Invest in Expert Managed Portfolios

Regular Review of the Portfolio

Regular Portfolio Rebalance Update

Affordable Advisory Fees Start From 99/- Month

How to Invest with Teji Mandi

Invest in tailor-made portfolio

Teji Mandi experts will create a portfolio just for you based on your risk level

Execute regular rebalance

Get rebalance update on teji mandi app and approve and execute the actions

Invest regularly with SIP or LumpSum

Keep investing and watch your wealth grow. Its that easy.

Read More about smallcase

0 notes

Text

Invest in smallcase with Sebi registered professionals- Teji Mandi

Build long-term wealth in the right manner curated by SEBI-registered professionals.

What is Smallcase?

Smallcases incorporate a portfolio-driven approach to investing. After you make a purchase, individual stock units are deposited to your Demat account. Contrary to a mutual fund, you only have access to the aggregated fund, not the underlying companies.

This also implies that when you invest in a smallcase, you automatically own a portion of each stock in the chosen smallcase and are entitled to dividends and other shareholder rights.

According to the RIA (Registered Investment Advisor) managing the portfolio, different smallcases have varied fee rates, and investing in them may cost about the same as investing in mutual funds. Exit loads are not imposed on smallcase redemptions, though. The same fees that apply to stock trading also apply to smallcases.

Smallcases have no concept of lock-in periods, making them similar to liquid stock. They are a type of investing that provides more flexibility and variety while remaining liquid. Investors can withdraw at any moment without losing their entire investment if things do not turn out as expected because there are no lock-in periods. Getting the services of a qualified RIA for the fees of a mutual fund investment is another significant benefit of smallcases.

Smallcases make it simple to purchase thematic investments; rather than buying each company’s share individually, you may invest in a topic or idea as a package, such as investing in IT, pharmacy or businesses gaining from expanding rural consumerism.

Why Invest with Teji Mandi

1-Invest in Expert Managed Portfolios

2-Regular Review of the Portfolio

3-Regular Portfolio Rebalance Update

4-Affordable Advisory Fees Start from 99/- Month

How to Invest with Teji Mandi

1- Invest in tailor-made portfolio: - Teji Mandi experts will create a portfolio just for you based on your risk level

2- Execute regular rebalance: - Get rebalance update on teji mandi app and approve and execute the actions

3- Invest regularly with SIP or Lump Sum: - Keep investing and watch your wealth grow. It is that easy.

0 notes

Text

Invest in Smallcase with Teji Mandi

What is Smallcase?

Smallcases incorporate a portfolio-driven approach to investing. After you make a purchase, individual stock units are deposited to your Demat account. Contrary to a mutual fund, you only have access to the aggregated fund, not the underlying companies.

This also implies that when you invest in a smallcase, you automatically own a portion of each stock in the chosen smallcase and are entitled to dividends and other shareholder rights.

According to the RIA (Registered Investment Advisor) managing the portfolio, different smallcases have varied fee rates, and investing in them may cost about the same as investing in mutual funds. Exit loads are not imposed on smallcase redemptions, though. The same fees that apply to stock trading also apply to smallcases.

Smallcases have no concept of lock-in periods, making them similar to liquid stock. They are a type of investing that provides more flexibility and variety while remaining liquid. Investors can withdraw at any moment without losing their entire investment if things do not turn out as expected because there are no lock-in periods. Getting the services of a qualified RIA for the fees of a mutual fund investment is another significant benefit of smallcases.

Smallcases make it simple to purchase thematic investments; rather than buying each company’s share individually, you may invest in a topic or idea as a package, such as investing in IT, pharmacy or businesses gaining from expanding rural consumerism.

For those who wish to diversify their finances without taking on too much risk, smallcases are the ideal choice. They offer reasonable investment solutions that will not burn a hole in your pocket, with minimum investment amounts and broad theme-based asset classes!

Why Invest with Teji Mandi

Invest in Expert Managed Portfolios

Regular Review of the Portfolio

Regular Portfolio Rebalance Update

Affordable Advisory Fees Start From 99/- Month

How to Invest with Teji Mandi

Invest in tailor-made portfolio- Teji Mandi experts will create a portfolio just for you based on your risk level

Execute regular rebalance- Get rebalance update on teji mandi app and approve and execute the actions

Invest regularly with SIP or LumpSum- Keep investing and watch your wealth grow. It’s that easy.

Read More about teji mandi smallcase

0 notes

Text

Invest in smallcase with sebi-registered professionals- Teji Mandi

What is Smallcase?

Smallcases incorporate a portfolio-driven approach to investing. After you make a purchase, individual stock units are deposited to your Demat account. Contrary to a mutual fund, you only have access to the aggregated fund, not the underlying companies.

This also implies that when you invest in a smallcase, you automatically own a portion of each stock in the chosen smallcase and are entitled to dividends and other shareholder rights.

According to the RIA (Registered Investment Advisor) managing the portfolio, different smallcases have varied fee rates, and investing in them may cost about the same as investing in mutual funds. Exit loads are not imposed on smallcase redemptions, though. The same fees that apply to stock trading also apply to smallcases.

Smallcases have no concept of lock-in periods, making them similar to liquid stock. They are a type of investing that provides more flexibility and variety while remaining liquid. Investors can withdraw at any moment without losing their entire investment if things do not turn out as expected because there are no lock-in periods. Getting the services of a qualified RIA for the fees of a mutual fund investment is another significant benefit of smallcases.

Smallcases make it simple to purchase thematic investments; rather than buying each company’s share individually, you may invest in a topic or idea as a package, such as investing in IT, pharmacy or businesses gaining from expanding rural consumerism.

For those who wish to diversify their finances without taking on too much risk, smallcases are the ideal choice. They offer reasonable investment solutions that won’t burn a hole in your pocket, with minimum investment amounts and broad theme-based asset classes!

Why Invest with Teji Mandi

Invest in Expert Managed Portfolios

Regular Review of the Portfolio

Regular Portfolio Rebalance Update

Affordable Advisory Fees Start From 99/- Month

How to Invest with Teji Mandi

1- Invest in tailor-made portfolio - Teji Mandi experts will create a portfolio just for you based on your risk level

2- Execute regular rebalance- Get rebalance update on teji mandi app and approve and execute the actions

3- Invest regularly with SIP or LumpSum- Keep investing and watch your wealth grow. Its that easy.

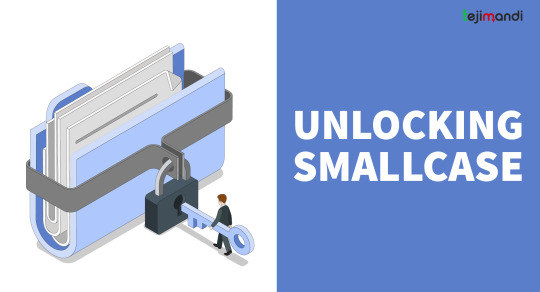

Build your long term portfolio with Teji Mandi smallcases

Teji Mandi Flagship – Invest Now

Teji Mandi Multiplier- Invest Now

Read More About Teji Mandi Smallcase

0 notes

Text

What Is Smallcase and How Does It Work?

Smallcases infuse a portfolio-driven approach to investing; individual stock units will be credited to your Demat account once you make a purchase. This is not the case with respect to a mutual fund, where you gain access to the aggregated fund alone and not the underlying companies.

For a long time, finance was an idea, like art. It then became a commodity accessible only to a privileged few. Beyond dinner-time conversations about the rising (or plunging, as the case may be) Nifty and hush-hush tips about companies that may rule the markets of India’s ballooning middle-class, investments, and investing ideas were often approached with an air of mystique. But that was then; 2020-2021 has ushered in a new era of financial literacy and everyone is interested! The pandemic changed the rules of the game and made everyone sit up and take notice of their savings and the need to invest. This is fortified by the record number of Demat accounts opened, even at the peak of the pandemic, when the economy was distressed, and the stock markets diverged and rebounded. Indian investors opened a record 14.2 million new Demat accounts in FY21, nearly three times that of the previous fiscal year, and the Nifty shot up from around 8500 at the end of FY20 to above 14600 by the end of FY21.

Whether it’s direct stocks or commodities, mutual funds or cryptocurrency, everyone is now putting a lot of time and effort into figuring out how to save and build wealth for the future. As the investment landscape heats up and finances as a subject become more accessible to the masses (at last), new and innovative ideas have cropped up and disrupted the industry.

Case in Point: Smallcase

The term ‘Smallcase’ is synonymous with the company of the same name, founded in 2015 by Anugrah Shrivastava, Vasant Kamath, and Rohan Gupta to bring theme-based investments to non-institutional investors. To put it simply, Smallcases are modeled around legacy portfolio management strategies that had so far been reserved for large investors (read HNIs & HNWIs). A smallcase fund or simply ‘Smallcase’ refers to a collection of a group of stocks based on a certain sector, technology or theme that is managed by SEBI-Approved Fund Managers. This is, in a way, a tangible method to invest money into multiple companies’ shares when trying out strategies the fund managers believe could work well together at some point down the road; it introduces an element of diversification instead of cherry-picking ‘industry stalwarts’ among laggards.

Let’s see this with an example:

Suppose you feel very positive about high-growth tech stocks in the long term. You want to invest in them, but are unable to hand-pick the best bets – or you simply don’t have the knowledge or the time to research. In this case, buying a specific Smallcase that invests in the theme will be ideal, instead of buying a random stock from the sector based on a large-cap or small-cap categorization.

Smallcases typically help investors walk the middle path between mutual funds and direct investments in stocks.

What are Smallcases?

Smallcases infuse a Portfolio-Driven Approach To Investing; individual stock units will be credited to your Demat account once you make a purchase. This is not the case with respect to a mutual fund, where you gain access to the aggregated fund alone and not the underlying companies.

What this also means is that when you Invest In A Smallcase, you become a part-owner in every stock that is in the portfolio of your chosen Smallcase, and you are eligible for dividends and other rights assured to shareholders.

The cost of investing in Smallcases may be comparable to investing in mutual funds, and different Smallcases have different expense ratios as per the RIA (Registered Investment Advisor) Handling The Portfolio. However, no exit load was applied on Smallcase redemptions. Every charge applicable to stock trading is applicable to Smallcases too. Read more about how does smallcase work

0 notes

Text

Teji Mandi:Stock/ETF Portfolio

Investing in the stock market doesn't have to be as complicated as fine print. Teji Mandi cuts through the noise and simplifies stock market investing. Join our simplified investing platform, trusted by 10000+ subscribers. Diversify your portfolio with 15-20 quality stocks hand-picked from over 5000 listed companies.

Make Teji Mandi your personal investment advisor and get a seamless investment experience accessible right at your fingertips. Regardless of your level of stock investing experience, we’ll help you by suggesting which stocks to buy, why to buy them and the right time to sell them for a profit.

With SEBI-registered research analyst and investment advisor, like Teji Mandi, build a diversified all-weather stock portfolio for the long-term

💼 Invest

Got your own demat account? Integrate your existing demat account effortlessly with Teji Mandi App. New to the stock market? We’ll help you set up a new demat account within minutes

🧺 Diverse Stocks

Create a stock portfolio based on your financial goals and risk profile.

👤 Stock Advisors

Don’t know where to start? Skip the guesswork and invest with confidence in professionally built stock portfolios.

📈 Track

Check your portfolio performance through a simple dashboard, with just a click.

💌 Language

Prefer Hindi over English? Set your preferred language for investment communications.

📋 Strategies

Get tactfully prepared and research-based strategies to increase your portfolio’s performance.

🏄 Simplified Buying & Selling

Buy and sell multiple stocks in just one click.

☝ One-click Rebalance

Update your portfolio through one-click rebalance updates

💸 Pocket-friendly

Invest in small quantities in a disciplined manner through SIP

📲 Learn-on-the-go

Get bite-sized nuggets of insights from the share market news, and learn stock investing and trading anywhere, anytime.

Here’s how we help you pick the best stocks:

1. Liquid Stocks: We pick stocks from the Nifty 500 so that you always have enough liquidity available.

2. Focused Stock Picking: We take tactful decisions on your behalf to add long-term winning stocks to your portfolio.

3. Disciplined Rebalancing: We help you double down on winning stocks to ensure you have enough capital protection.

4. Tailor-made Portfolio: We curate your portfolio based on your risk appetite.

Download Teji Mandi APP here

Teji Mandi integrates with 13 brokers and growing:

1. Zerodha

2. 5paisa

3. Upstox

4. Angel Broking

5. Axis Direct

6. Edelweiss

7. HDFC Securities

8. IIFL

9. Trustline

10. Alice Blue

11. Groww

12. Kotak Securities

13. ICICI Direct

14. Dhan

15. Fundzbazar

We are also listed on Smallcase – https://tejimandi.smallcase.com/

What sets us apart?

Teji Mandi is a SEBI-registered investment advisor - Reg no. INA000015303

No hidden charges or commissions. Just a low-cost flat subscription fee.

Backed by Motilal Oswal Financial Services.

A team of seasoned financial experts to identify potential winning stock ideas through various market cycles.

Download the app for the simplest stock investing experience. For more information, head to our website: https://tejimandi.com/

0 notes

Text

How Do I Buy/Sell Shares in Smallcases?

With smallcase, an investor can buy, sell and manage their portfolio seamlessly in seconds. All they have to do is follow these steps to learn how to buy and sell shares in smallcase.

Smallcase provides the investor with a basket of stocks that reflects their idea, theme, and mindset. It gives a simple, convenient yet intriguing way to go about investing hard-earned money with the help of financial advisors and experts who analyse, choose and guide investors through portfolio choices.

Investing in ready-made strategies

Many a time, while choosing a stock, there is utter confusion as to which company should be chosen for investing. Should one go for a startup or an already established company? Well, smallcase eases this confusion with ready-made portfolio options.

Tracking news and trends of 10-15 stocks is often a task and takes a lot of time. This is where a ready-made theme and idea help in investing. For instance, if an investor wants to play it safe, they can choose a theme with safer stock options and bets and a set return. But in case they want to play with the market trends and earn higher with the risks associated, they can invest in a theme that plays around with startups and new companies.

Customised portfolio-based investing

The option to invest as a risk-averse or risk-taking investor doesn’t end here. With the help of SEBI registered financial experts, they can get a customised portfolio. For instance, if an investor wants a set return but also a scope of earning higher returns, they can get their portfolio customised with such shares and stocks. The best part about smallcase is that it’s easy, convenient, and tailored according to the investor’s needs and aspirations from the market trends.

How To Buy And Sell Shares In Smallcase?

One of the biggest problems an investor faces is analysis; a lot of effort and time has to be spent on smart investing before buying any stocks. However, all this time and money can be saved in smallcase, where SEBI registered financial partners and researchers help with buying and selling decisions.

With smallcase, an investor can buy, sell and manage their portfolio seamlessly in seconds. All they have to do is follow these steps to learn how to buy and sell shares in smallcase:

Step 1: Select the stocks you want to invest in, whether 1 or 50. You have the allowance to choose upto 50 stocks with smallcase.

Step 2: Assign weights to stocks. The choice differs according to needs. Hence, the investor can assign individual weights to the theme their portfolio is based on. The minimum weighted amount ensures they buy stocks with the weights allocated. Read More about unboxing smallcase

0 notes