#how to buy and sell bitcoins for profit

Explore tagged Tumblr posts

Text

How to Make Money on Coinbase: A Simple Guide

Coinbase is a leading platform for buying, selling, and managing cryptocurrencies like Bitcoin and Ethereum. With millions of users worldwide, it’s a trusted choice for both beginners and experienced traders. Here’s how you can make money using Coinbase.

Why Use Coinbase?

Coinbase offers:

User-friendly interface: Ideal for newcomers.

Top-notch security: Advanced encryption and offline storage keep your assets safe.

Diverse earning methods: From trading to staking, there are plenty of ways to earn.

Ready to get started? Sign up on Coinbase now and explore all the earning opportunities.

Setting Up Your Coinbase Account

Sign up on Coinbase’s website and provide your details.

Verify your email by clicking the link sent to you.

Complete identity verification by uploading a valid ID.

Navigate the dashboard to track your portfolio, view live prices, and access the "Earn" section.

Ways to Make Money on Coinbase

1. Buying and Selling Cryptocurrencies

Start by buying popular cryptocurrencies like Bitcoin and Ethereum at a lower price and selling them when the price goes up. It’s the basic strategy for making profits through trading.

2. Staking for Passive Income

Staking allows you to earn rewards by holding certain cryptocurrencies. Coins like Ethereum and Algorand offer staking options on Coinbase. It’s a straightforward way to earn passive income.

Maximize your earnings—get started with Coinbase today and start staking your crypto.

3. Earning Interest

Coinbase lets you earn interest on some of your crypto holdings. Just hold these assets in your account, and watch your crypto grow over time.

Advanced Trading with Coinbase Pro

For those with more trading experience, Coinbase Pro provides lower fees and advanced trading tools. Learn how to trade efficiently using features like market charts, limit orders, and stop losses to enhance your profits.

Coinbase Earn: Learn and Earn

With Coinbase Earn, you can earn free cryptocurrency by learning about different projects. Watch educational videos and complete quizzes to receive crypto rewards—an easy way to diversify your holdings with no risk.

Coinbase Affiliate Program

Promote Coinbase using their affiliate program. Share your unique referral link (like this one: Earn commissions with Coinbase), and earn a commission when new users sign up and make their first trade. It’s a fantastic opportunity for bloggers, influencers, or anyone with an audience interested in crypto.

Want to boost your income? Join the Coinbase Affiliate Program now and start earning commissions.

Coinbase Referral Program

You can also invite friends to join Coinbase and both of you can earn bonuses when they complete a qualifying purchase. It’s a win-win situation that requires minimal effort.

Conclusion

Coinbase is an excellent platform for making money in the cryptocurrency world, offering various ways to earn through trading, staking, and affiliate marketing. Explore all its features to maximize your earnings.

Ready to dive in? Sign up today and start earning with Coinbase.

#coinbase#bitcoin#binance#ethereum#bitcoin news#crypto#crypto updates#blockchain#crypto news#make money on coinbase

497 notes

·

View notes

Text

mercs on the dark web headcanons

(dark!characterization below/general taboo dark web subject mater. proceed at your own discretion.)

Sniper

red room live streamer

Women fear him, the CIA want him.

Aside from profiting on the mutilation of the lives of the innocent he's a regular poacher and sells exotic/protected animals hides, meat, or sometimes live specimens.

Scout

Amphetamines manufacturer and distributer. He regularly gets high off his own supply who's gotten into run-in with the police as far back as he can remember.

Got scammed out of $10k buying a fake Alligator skin couch.

Big fan of Sniper's live streams, but doesn't have the guts to sit through the truly grizzly parts.

Pretends to know how Bitcoin works.

Spy

Hitman for hire.

Everyone hates his ass because he acts like a narc, and no one can trust him. But despite his unknown affiliations and methods, he always gets the job done.

Has seen an unfortunate amount of political figure's nudes searching through confidential documents.

Medic

Black market organ harvester and consumer.

The most likely to have Reddit threads about himself and his infamy. (maybe he would sneakily encourage this some how? he would really thrive off of that kind of attention.)

He's the only person Sniper's ever collaborated with and featured as a second party torturing a victim in a live stream.

Likely has some insane history with the human experimentation crowd.

OG member of the cannibal cafe

Pyro

She has no idea how to access the dark web, but watches a lot of "Lost Media" videos, creepypastas and pirates cartoons and anime. She assumes that's a part of what everyone else is talking about

Engie and Demo

Producing, modifying and manufacturing wildly unsafe and unregulated: firearms, explosives, chemical weapons- maybe even automobiles.

They don't do this for the rush, or the money, or the feeling of power; but rather out of an almost pure-hearted love for their craft.

Have somehow never been raided by the FBI or the DEA

Soldier

His special interest is HiddenWiki articles about terrorism and conspiracy theories.

No one understands how he managed to access the deep web in the first place.

Bulk buys his percs here.

Heavy

¯\_(ツ)_/¯ My best guess is he's buying some of the animal meat Sniper sells. He doesn't seem like someone who would care much for digital carnage.

#mdni#dead dove do not eat#also not to sound like a massive tool. but- i think 'women fear him. the cia want him' is my favorite thing i've ever written#dark!character#this au has potential alright just trust me guys

24 notes

·

View notes

Text

How buy bitcoin and make profits in stock Market?

As Example inside Forex Metatrader4 Plataform, double #BUY trade inside #BTCUSD running based in last Non Repaint Buy Signal. Official Website to have access: wWw.ForexCashpowerIndicator.com . Forex Cashpower Indicator Lifetime license one-time fee with No Lag & Non Repaint buy and sell powerful Signals with Smart algorithms that emit signals in big trades volume zones. Works in all Charts inside your Broker MT4 Plataform and all timeframes . ✅ NO Monthly Fees ✅ NON REPAINT / NON LAGGING 🔔 Sound And Popup Notifications 🔥 Powerful & Profitable AUTO-Trade Option . ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.** . ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . ✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

#forexsignals#indicatorforex#forex#forexindicator#forexprofits#cashpowerindicator#forexchartindicators#forextradesystem#forexindicators#forexvolumeindicators#bitcoin#How buy bitcoin and make profits in stock Market?#trading bitcoin#btcusd

2 notes

·

View notes

Text

How to Ride the Uptrend and Maximize Profits

Capitalizing on a market uptrend can significantly increase your investment returns. Read on for practical tips to navigate market movements and optimize your profits. Start improving your investment strategy today!

How to Predict the Uptrend?

Predicting exactly when the market will experience an uptrend is challenging. Even if experts anticipate an uptrend soon, the exact timing—whether in 2024, 2025, or beyond—remains uncertain.

The real challenge lies in avoiding premature profit-taking that could cause you to miss out on gains, while also not holding investments too long and risking losses when the market turns.

So, how can we navigate these challenges and maximize our gains during an uptrend? Here are some strategies to consider:

Focus on Your Goals

Monitoring market movements is not sufficient on its own. It’s crucial to establish clear financial goals. Attempting to buy at the absolute lowest and sell at the highest points is an impractical approach since it’s impossible to precisely predict the end of an uptrend.

Instead, set clear, achievable targets that align with your financial objectives. This approach will guide you in making well-informed decisions rather than chasing market trends.

Use the Four-Year Cycle

The four-year cycle remains a dependable framework for anticipating market movements, even though minor deviations can occur. This cycle can help guide your profit-taking strategy, allowing you to gauge the mid-phase of an uptrend.

Utilizing a dollar-cost averaging (DCA) approach, particularly from late 2024 to Q3 2025, can be beneficial. DCA involves consistently investing a fixed amount, which mitigates the risk of buying at peak prices manipulated by market whales. For those preferring a safer strategy, DCA can be an effective way to spread investment risk over time.

Stick to Your Strategy

Maintaining a well-defined and disciplined strategy is crucial. This disciplined approach helps you stay focused and avoid making emotional decisions driven by market volatility.

Adhering to your plan, even amidst market fluctuations, is key to successful profit-taking. Regularly reviewing and adjusting your strategy based on your goals and market conditions can also enhance your decision-making process.

Diversify Your Investments

Diversification is a time-tested strategy to manage risk and enhance profit potential. While applying DCA to established assets like Bitcoin, consider diversifying your portfolio by holding presale tokens such as $BUSAI or participating in airdrops.

Presale tokens are often available at lower prices, offering potential high returns with reduced initial investment. Diversification spreads your risk across various assets, reducing the impact of any single asset’s performance on your overall portfolio.

BUSAI PRESALE CASE STUDY

In today’s crowded presale landscape, distinguishing between genuine opportunities and scams is crucial. For example, the meme AI project BUSAI is gaining significant attention, but don’t let the hype cloud your judgment.

Before diving in, it's vital to thoroughly examine the whitepaper, tokenomics, and the project's backers. If your research checks out, it could be worth considering.

BUSAI stands out with its impressive ecosystem and strategic tokenomics. Its innovative features, such as the interact-and-earn and staking rewards, set it apart from typical meme tokens.

Its tokenomics emphasizing substantial presale, marketing, and liquidity allocations, the project shows strong growth potential. Additionally, BUSAI’s focus on community engagement and cutting-edge technology makes it a distinctive and promising investment in the evolving crypto arena.

By following these guidelines, you can navigate the uptrend effectively and avoid common pitfalls. Stay focused, be disciplined, and make informed decisions to achieve your financial goals.

BUSAI Official Channel: Website | Twitter | Telegram

3 notes

·

View notes

Text

10 Tips for Achieving Financial Success with Memecoin Tokens

Introduction

Memecoins have taken the cryptocurrency world by storm. Inspired by internet memes and cultural trends, these tokens have garnered a lot of attention for their potential to deliver significant financial returns. However, investing in memecoins also comes with its risks. This blog will provide you with ten essential tips to help you navigate the world of memecoins and achieve financial success.

1. Understand What Memecoins Are

Definition of Memecoins

Memecoins are cryptocurrencies that are often based on popular internet memes or trends. Unlike traditional cryptocurrencies like Bitcoin or Ethereum, memecoins usually don’t have a strong technological or utility basis. Instead, they rely on community engagement and viral marketing.

Popular Examples

Some well-known examples of memecoins include Dogecoin and Shiba Inu. These tokens started as jokes but quickly gained a massive following, demonstrating the power of community and viral content.

2. Do Your Research

Thorough Research is Crucial

Before investing in any memecoin, it’s essential to conduct thorough research. Understand the project’s goals, the team behind it, and its community engagement. Look into the tokenomics, the total supply, and how the tokens are distributed.

Reliable Sources

Use reliable sources for your research. Read whitepapers, follow official social media channels, and join community discussions on platforms like Reddit and Discord. Avoid making investment decisions based solely on hype or rumors.

3. Join the Community

Community Engagement

Memecoins thrive on community engagement. Join the community surrounding the memecoin you’re interested in. Participate in discussions, ask questions, and stay updated with the latest news and developments.

Social Media Platforms

Follow the project’s official social media accounts on Twitter, Reddit, and Discord. These platforms are excellent sources of real-time information and can provide insights into the community’s sentiment and activity.

4. Diversify Your Investments

Spread Your Risk

Diversification is a fundamental principle of investing. Don’t put all your money into a single memecoin. Spread your investments across multiple projects to mitigate risk. This way, if one investment doesn’t perform well, others might offset the losses.

Balance Your Portfolio

Balance your portfolio by including both high-risk and lower-risk investments. Consider holding traditional cryptocurrencies like Bitcoin or Ethereum alongside your memecoin investments.

5. Use Technical Analysis

Understanding Market Trends

Technical analysis involves studying price charts and market trends to make informed investment decisions. Learn how to read charts and identify patterns that might indicate future price movements.

Tools and Indicators

Use tools and indicators such as moving averages, relative strength index (RSI), and Bollinger Bands to analyze the market. These tools can help you determine the best times to buy or sell.

6. Stay Informed

Follow News and Updates

The cryptocurrency market is highly dynamic, and staying informed is crucial. Follow news and updates related to your memecoin investments. Major developments, partnerships, or regulatory changes can significantly impact prices.

Real-Time Alerts

Set up real-time alerts for significant price movements or news related to your investments. This will help you react quickly to changes in the market.

7. Have a Clear Strategy

Define Your Goals

Before investing, define your financial goals. Are you looking for short-term gains or long-term growth? Having a clear strategy will help you make informed decisions and stay focused on your objectives.

Exit Strategy

Plan your exit strategy in advance. Decide on the profit levels at which you will sell part or all of your holdings. Similarly, set stop-loss levels to minimize potential losses.

8. Use Secure Wallets

Protect Your Investments

Security is paramount in the cryptocurrency world. Use secure wallets to store your memecoins. Hardware wallets and reputable software wallets offer the best security features.

Avoid Exchange Wallets

Avoid keeping large amounts of cryptocurrency in exchange wallets for extended periods. Exchanges can be vulnerable to hacks and security breaches. Transfer your funds to a secure wallet as soon as possible.

9. Be Aware of Scams

Identify Red Flags

The popularity of memecoins has attracted scammers. Be aware of red flags such as promises of guaranteed returns, pressure to invest quickly, or requests for personal information.

Verify Legitimacy

Always verify the legitimacy of a project before investing. Check if the team is transparent and reputable, and look for audits or reviews from credible sources.

10. Stay Patient and Manage Emotions

Emotional Control

The cryptocurrency market is highly volatile, and prices can swing dramatically in a short time. Stay patient and avoid making impulsive decisions based on emotions. Stick to your investment strategy and goals.

Long-Term Perspective

Adopt a long-term perspective. While short-term gains can be tempting, long-term investments often yield better returns. Stay focused on the bigger picture and avoid getting swayed by short-term market fluctuations.

And must create your favorite memecoin tokens on solana in just less than three seconds without any progamming knowledge only on solanalauncher platform

Also they provide 4 tools like Mint tokens, Revoke Freeze authority, Revoke mint authority , Multy sender

If you need more guide about this, Feel free to ask!!

Conclusion

Investing in memecoins can be an exciting and potentially profitable venture, but it also comes with its risks. By following these ten tips — understanding what memecoins are, doing your research, joining the community, diversifying your investments, using technical analysis, staying informed, having a clear strategy, using secure wallets, being aware of scams, and managing your emotions — you can navigate the memecoin market more effectively and increase your chances of achieving financial success.

Remember, the key to success in any investment is to stay informed, stay disciplined, and stay patient. The world of memecoins is dynamic and full of opportunities, so equip yourself with the right knowledge and strategies to make the most of it. Happy investing!

4 notes

·

View notes

Text

How to Earn Money in Trading: Simple Strategies for Success

Trading has become an increasingly popular way for people to grow their wealth and achieve their financial goals. Whether you're interested in forex trading, stocks trading, or crypto trading, there are opportunities to earn money by investing wisely. However, trading is not just about luck; it requires a rich mindset, a solid strategy, and a deep understanding of the markets. In this post, we’ll explore how to earn money in trading by focusing on key principles and strategies that can set you on the path to financial success.

Understanding the Basics of Trading

Before diving into any form of trading, it's crucial to understand the basics. Trading involves buying and selling financial instruments like stocks, currencies, or cryptocurrencies with the aim of making a profit. Each type of trading—whether it's forex trading, stocks trading, or crypto trading—has its own unique characteristics and requires a different approach.

Forex Trading: It involves trading with currencies in the foreign exchange market. It’s one of the largest financial markets in the world, with trillions of dollars traded daily.

Stocks Trading: Here, you buy and sell shares of companies. The stock market can be volatile, but with careful analysis, it offers significant profit opportunities.

Crypto Trading: Cryptocurrency trading involves buying and selling digital currencies like Bitcoin and Ethereum. It’s a rapidly growing market, known for its high volatility.

Setting Clear Financial Goals

To earn money in trading, it's essential to set clear financial goals—like what do you wanna achieve through trading? Are you looking to build long-term wealth, or are you interested in making quick profits? Defining your financial goals will guide your trading strategy and help you stay focused.

For example, if your goal is to create a steady income stream, you might focus on stocks trading and dividend-paying stocks. If you're aiming for high-risk, high-reward opportunities, crypto trading could be more suitable.

Developing a Rich Mindset

A rich mindset is critical for success in trading. This mindset is about being patient, disciplined, and focused on long-term success rather than short-term gains. Many new traders fail because they get caught up in the excitement of quick profits, leading to poor decisions and losses.

A rich mindset also involves continuous learning. The financial markets are constantly changing, and staying informed is key to making smart trading decisions. Whether you’re involved in forex trading, stocks trading, or crypto trading, always keep learning and adapting to new market conditions.

Choosing the Right Trading Strategy

Your trading strategy will significantly impact your ability to earn money in trading. There are various strategies you can adopt depending on your financial goals and risk tolerance.

Day Trading: This involves buying and selling financial instruments within a single trading day. It's fast-paced and requires quick decision-making.

Swing Trading: Here, you hold positions for several days or weeks, aiming to profit from short- to medium-term price movements.

Long-Term Investing: This strategy involves holding onto investments for years, betting on the overall growth of the market.

Each strategy has its pros and cons, and the best one for you will depend on your trading style, market knowledge, and financial goals.

Risk Management is Key

One of the most important aspects of earning money in trading is managing your risk. Even experienced traders face losses, but with proper risk management, you can minimize those losses and protect your capital.

Set stop-loss orders, never invest more than you can afford to lose, and always diversify your portfolio. Whether you’re engaged in forex trading, stocks trading, or crypto trading, understanding and managing risk is crucial for long-term success.

4 notes

·

View notes

Text

How to Be a Great Cryptocurrency Trader

Because the cryptocurrency market is so volatile, trading cryptocurrencies can be both extremely rewarding and extremely difficult. You need to have a disciplined mindset, create winning tactics, and comprehend the market in order to become a profitable cryptocurrency trader. In plain words, this post will walk you through the fundamentals of becoming a successful bitcoin trader.

Understanding the Cryptocurrency Market

What is Cryptocurrency?

Cryptocurrency is a type of virtual or digital money that is secured by encryption. On decentralized networks powered by blockchain technology, cryptocurrencies function differently from conventional currencies that are issued by governments. Since the creation of the first cryptocurrency, Bitcoin, in 2009, many more have been produced.

How Does Cryptocurrency Trading Work?

Buying and selling virtual currencies with the intention of turning a profit is known as cryptocurrency trading. Cryptocurrency trading is available on a number of exchanges, including Binance, Coinbase, and Kraken. The value of cryptocurrencies varies according on news about regulations, technological developments, market demand, and general economic conditions.

Steps to Becoming a Great Cryptocurrency Trader

1. Educate Yourself

Learning about the market is the first step to becoming a great bitcoin trader. Here are some crucial aspects to pay attention to:

Blockchain Technology: Recognize the foundations of blockchain technology, which underpins cryptocurrencies.

Different Cryptocurrencies: Discover the several cryptocurrencies, the applications for them, and the underlying technology.

Market Analysis: Examine both fundamental analysis—which assesses a cryptocurrency's worth and potential—and technical analysis, which makes use of charts and indicators.

Trading Platforms: Learn about the features of the various cryptocurrency exchanges.

2. Create a Trading Plan

A detailed strategy including your trading objectives, risk tolerance, and techniques is called a trading plan. Here's how to draft a successful trading strategy:

Set Clear Goals: Establish both your short- and long-term trading objectives. Do you want to invest for the long term or are you just looking for immediate returns?

Risk Management: Determine the amount of money you are ready to lose on each deal. It's customary to never risk more than 1% to 2% of your entire capital in a single transaction.

Entry and Exit Strategies: Establish the parameters by which you will enter and exit deals. This could be determined by other variables, news stories, or technical indicators.

Record Keeping: To keep track of your deals, including the reasons you entered and left each deal as well as the results, keep a trading journal.

3. Choose the Right Trading Platform

The trading platform you choose will determine how successful you are as a bitcoin trader. Here are some things to think about:

Security: Select a platform that offers strong security features to safeguard your money..

Fees:Examine and contrast the trading costs offered by various platforms.

User Interface:Seek for a platform with an interface that is easy to use and intuitive.

Liquidity: Make sure there is a lot of liquidity on the platform so you can buy and sell cryptocurrencies fast.

4. Practice with Paper Trading

It's a good idea to practice with paper trading before risking real money. Paper trading is the practice of mimicking deals with virtual currency. As a result, you may practice using the trading platform and test your trading techniques without having to worry about losing real money.

5. Start Small

When the time comes for you to start trading with real money, start modest with your funds. In this manner, you may control your risk and earn experience without having to risk a sizable amount of your money. You can progressively increase your trading capital as you gain success and confidence.

Developing Effective Trading Strategies

1. Technical Analysis

In technical analysis, price charts are examined, and indicators are used to forecast future price movements. Here are some essential instruments and ideas:

Candlestick Charts: The opening, closing, high, and low prices for a certain time period are shown in these charts. Future price fluctuations may be indicated by candlestick patterns.

Moving Averages: These average prices over a given time span might be used to spot trends. Simple Moving Averages (SMA) and Exponential Moving Averages (EMA) are the two most used varieties.

Relative Strength Index (RSI): The pace and variation of price fluctuations are measured by this momentum indicator. Overbought situations are indicated by an RSI above 70, while oversold conditions are indicated by an RSI below 30.

MACD (Moving Average Convergence Divergence): This indicator can be used to detect changes in momentum and trends by displaying the connection between two moving averages.

2. Fundamental Analysis

Evaluating a cryptocurrency's inherent worth is a component of fundamental analysis. Here are some things to think about:

Technology: Examine the underlying technologies behind cryptocurrencies. Does it tackle problems in the actual world and is it innovative?

Team: Examine the underlying technologies behind cryptocurrencies. Does it tackle problems in the actual world and is it innovative?

Adoption: Take a look at how widely used and adopted cryptocurrencies are. Are practical uses for it being made?

Partnerships: Think about the alliances and groups the initiative has brought together. Robust alliances may portend a bright future.

3. Sentiment Analysis

Evaluating investor sentiment and market sentiment are key components of sentiment analysis. Here are a few methods for performing sentiment analysis:

News and Social Media: Keep an eye on forums, social media, and news articles for conversations and viewpoints regarding cryptocurrency.

Market Sentiment Indicators: Use resources such as the Crypto Fear and Greed Index, which gauges sentiment in the market by looking at a number of different variables.

Managing Risk

1. Diversify Your Portfolio

To lower risk, diversification entails distributing your money among several cryptocurrencies. You can reduce the negative effects of a performing asset on your portfolio as a whole by diversifying.

2. Use Stop-Loss Orders

An order to sell cryptocurrency when it hits a certain price is known as a stop-loss order. If the market swings against your position, this helps to reduce your losses.

3. Don’t Invest More Than You Can Afford to Lose

Invest only funds that you are willing to lose. There is always a chance of losing money when investing in cryptocurrency markets because they may be very volatile.

4. Stay Informed

Keep yourself informed about the most recent events and advancements in the bitcoin space. This assists you in deciding wisely and adjusting to changes in the market.

Trading Psychology

1. Control Your Emotions

Fear and greed are two strong emotions that can impair judgment and cause you to make bad trading judgments. Acquire emotional self-control and follow your trading plan.

2. Be Patient

It takes patience to trade successfully. Avoid making transactions without doing the necessary research and preparation. Hold off till the appropriate moments.

3. Learn from Your Mistakes

Examine your previous trades and take note of your errors. Determine what went wrong and how your tactics might be strengthened.

4. Stay Disciplined

Trading successfully requires discipline. Adhere to your trading strategy and refrain from making snap judgments. Results are consistent when discipline is maintained.

Continuous Learning and Improvement

1. Follow Experts

Pay attention to knowledgeable traders and authorities in the bitcoin field. Take note of their tactics and insights.

2. Join Trading Communities

Participate in online trading forums and communities to exchange concepts, talk about tactics, and pick up tips from other traders.

3. Read Books and Take Courses

Invest in your education by learning about bitcoin trading through books and courses. Maintaining a competitive edge in the market requires constant learning.

4. Practice Regularly

Regular practice will help you stay sharp and refine your trading skills. Your confidence and experience will grow as you trade more.

Conclusion

It takes a combination of education, strategy, discipline, and ongoing learning to become a great bitcoin trader. You may improve your chances of success in the thrilling realm of cryptocurrency trading by comprehending the market, creating winning trading techniques, controlling risk, and keeping a disciplined mentality. Recall that trading is a journey, and the secret to long-term success is constant progress.

2 notes

·

View notes

Note

are in game currencies you can buy with real money covered under the same laws that make nfts and bitcoin taxable?

DISCLAIMER

I am not an international tax expert. Tax laws are obviously different in different jurisdictions; something that's true in the USA might not be true in the UK or Ukraine or India or Japan or Kenya or whatever. Also, the details of individual games can affect their legal standing. You may wish to consult a local tax expert before filing your return.

Disclaimers aside, probably not.

The thing about NFTs is that you can resell them. If you buy an ugly ape for etherium, you can later sell that ape for etherium and sell the etherium for cash, hopefully more than you paid in. That's what makes crypto stuff taxable; it's an investment.

Most in-game currencies cannot be exchanged for real-world money. You can't buy Fortnite VBucks at 5¢ to the buck and resell it at 7¢ to make a profit, and you can't sell anything for real-world cash. (This the main reason why gambling regulations usually don't apply to lootboxes.)

As far as the law is concerned, buying VBucks in Fortnite is no different from buying DLC on Steam.

Aside from blockchain games like the infamous Axie Infinity, the only ways I can think of for in-game currency purchases to result in taxable transactions probably violate the terms of service. Back in ye olde World of Warcraft days, people would sell their in-game gold for real-world money—profitable, despite (or because of?) being against the TOS.

Obviously, people can buy premium video game currency with their own money; that's what premium currency is for. But hypothetically, if you used that currency to buy an in-game item that you sold for real-world money, that would be a taxable transaction. The amount you sold it for minus the price initially paid for in-game currency would be taxable game.

Again, this is probably a violation of the terms of service you agreed to without reading, which would make this a breach of contract. In the US, you are required to report illegal income; however, as per the fifth amendment, you don't have to report anything that would incriminate yourself. How you report such income without self-incrimination is an exercise for any reader running a Fortnite money laundering business.

3 notes

·

View notes

Text

The fallout from the collapse of FTX just won’t stop—and now it’s threatening one of crypto’s most important institutions. On November 16, Genesis Global Capital’s lending unit suspended withdrawals due to “unprecedented market turmoil.” Now, the firm is seeking emergency funding of at least $500 million to ensure it has enough cash on hand to pay its customers. All the while, the crypto industry watches nervously.

On November 21, Genesis said it had “no plans to file for bankruptcy imminently,” but it has since appointed an external party to advise on its financial predicament. Such moves have done little to calm twitchy customers. Halting withdrawals has been the precursor to multiple previous crypto collapses this year, including at FTX and Celsius. Genesis did not respond when asked to confirm whether bankruptcy was under consideration.

If Genesis were to fold, it would deliver another gut-punch to an industry already reeling from the fall of FTX, one of its most highly regarded companies. If an institution the size and standing of Genesis is vulnerable, can trust be placed in the stability of any crypto firm? Yes, the industry is expected to survive the ordeal, but the days of minimal oversight, generous funding, and rapid expansion are over.

The impact from the potential fall of Genesis should not be underestimated. It might not be as well known as FTX and other exchanges, but it’s crucial to the day-to-day operations of the crypto world. In 2021 alone, the company issued $131 billion in loans and set up $116.5 billion in trades; the Financial Times has described it as the Goldman Sachs of crypto. To fund these loans, Genesis borrows from individuals and institutions that own large quantities of coins, also known as whales, who receive a cut of profits in return.

While the market was hot, so was Genesis. But as the price of crypto tumbles, and trust in large crypto companies bleeds away, Genesis risks becoming the latest example of a crypto giant failing to prepare for the worst. Not only might customers lose their money, but the collapse of an intermediary like Genesis threatens to “set crypto back several years,” says Brad Harrison, founder of decentralized lending protocol Venus. That’s because of how Genesis enables the flow of money between organizations—which is essential to the functioning of any industry.

When it launched in 2013, Genesis was the first over-the-counter bitcoin trading desk—somewhere traders could go to buy and sell large quantities of coins. But the company is now the largest crypto lender too, as well as the backbone for yield farming services provided by exchanges, which let customers earn interest on their holdings.

Harrison says Genesis has worked with many of the largest crypto organizations over the years, and it has wound its way into practically all corners of the cryptosphere. “It’s a household name.”

Genesis has been in trouble since July, when the hedge fund Three Arrows Capital (3AC) collapsed, taking with it $1.2 billion of the $2.36 billion it had borrowed from the firm. If someone defaults on their mortgage, the bank can seize the property to recoup the full value of the loan, but in this case Genesis didn’t have that option, because only part of the loan was secured against 3AC assets.

To ensure Genesis wasn’t hamstrung by the loss, its parent company, Digital Currency Group (DCG), bailed it out. But in the aftermath, Genesis cut 20 percent of its workforce to reduce costs and Michael Moro, its longtime CEO, stepped down.

Genesis again found itself on the wrong side of a collapse earlier this month; when FTX filed for bankruptcy on November 11, the firm lost $175 million stored with the exchange. Again, DCG intervened, providing a cash injection of $140 million.

But despite multiple DCG bailouts, Genesis has failed to escape the FTX fallout. Samson Mow, a prominent crypto pundit and ex-chief strategy officer at crypto infrastructure firm Blockstream, says the brokerage is struggling to fund a surge in the number of customers asking to redeem their crypto. This led to the suspension of withdrawals, which threatens to worsen the prevailing crisis of confidence and increase the likelihood of a rush on other lenders (say, BlockFi or Voyager Digital)—and so the contagion spreads.

But Mow says it’s important to understand that this is a liquidity problem, not a solvency problem. In other words, Genesis has enough assets to pay its debts, they’re just not readily available in cash form. For this reason, a bankruptcy “seems unlikely,” says Mow.

DCG also sought to play down the situation on Twitter, saying that the decision to suspend redemptions and stop issuing fresh loans was a “temporary action,” and that the problem is confined exclusively to the Genesis lending division, which means the trading and custody units will continue to operate as normal.

Nonetheless, the situation is serious enough for Genesis to seek additional funding, with crypto exchange Binance and private equity firm Apollo Global Management tapped as potential investors.

The attempt to secure funding has been unsuccessful thus far, reports suggest, partly due to concern over the financial relationship between Genesis and other DCG-owned entities. Of the $2.8 billion in outstanding loans on the Genesis balance sheet, roughly 30 percent are made to either DCG or its subsidiaries, but inter-company loans are being treated with particular suspicion right now because of their central role in the FTX collapse.

Barry Silbert, CEO of DCG, told investors that inter-company loans of this kind are nothing out of the ordinary. “We have weathered previous crypto winters, and while this one may feel more severe, collectively we will come out of it stronger.”

Yet, for all its conviction, Silbert’s rallying cry has not halted speculation. Burned recently by false assurances from FTX founder Sam Bankman-Fried—who tweeted “FTX is fine” on November 7, just days before the firm collapsed—crypto investors are bracing for a bankruptcy at Genesis, too.

One of the consequences of a potential collapse is already playing out. After withdrawals were halted, crypto exchange Gemini, whose yield farming product sits on top of Genesis, announced its Earn customers would no longer be able to access their funds.

On November 22, the exchange explained it was working to “find a solution,” but until then, $700 million worth of customer funds would remain locked up. If Genesis were to go bankrupt, some of these funds may never be returned, just like at FTX—and it's possible that customers of other Genesis-linked exchanges might suffer the same fate.

The silver lining is that Genesis deals predominantly with institutional customers: family offices, high-net worth individuals, hedge funds, and the like. So in the event of a bankruptcy, although confidence in the industry may be torn to shreds and knock-on effects may put other businesses in financial distress, the immediate impact on regular people would not be as severe as with FTX.

Max Galka, founder of blockchain analytics company Elementus, says that blockchain data suggests the company is also "an order of magnitude less intertwined than FTX” with large industry players. Although there will be “ripples,” a collapse is unlikely to have the same cascading effects.

The potential collapse of Genesis wouldn’t be “nearly as broad,” says Joe Flanagan, cofounder of the decentralized lending protocol Maple, because the financial shortfall is much smaller than at FTX. He also says bankruptcy proceedings would likely be more straightforward as a result of the clear demarcation between internal divisions at Genesis, which means the troubled lending division could be splintered off.

The greatest impact is likely to be felt in the crypto lending market itself; in the same way the collapse of FTX has drawn attention to the advantages of decentralized exchanges, the Genesis situation has the potential to drive people towards decentralized lenders.

Instead of relying on an intermediary to lend out their cryptocurrency in a responsible way and to keep enough cash on hand to meet withdrawals, decentralized alternatives let customers see exactly what’s happening to their crypto. This is an example of what’s known as decentralized finance, or DeFi.

Most decentralized lenders also exclusively support overcollateralized loans—that’s to say, borrowers are required to lock up assets with a greater value than those they are borrowing—so the chance of default is low. Genesis, by contrast, is reported to offer riskier, unsecured loans, which might have contributed to its current financial difficulties.

Harrison describes lenders like Genesis as “black boxes” that offer none of the transparency of the DeFi approach. He says there are two potential outcomes to the current situation: Either the “DeFi ethos” around transparency and collateralization will have to be adopted by centralized lenders, or decentralized lenders will begin to steal customers away. Galka goes as far as to say that “crypto lending by centralized services is essentially done,” as a result of what’s happened to lenders like Genesis.

Meanwhile, the FTX fallout continues. Although the effects on Genesis and other companies tied up with FTX (like BlockFi and Voyager Digital) are beginning to take shape, it’s possible that many more are quietly sitting on significant losses, Galka says. “It may take a year or more for things to shake out before we really know just how far the contagion has spread.”

12 notes

·

View notes

Text

How to Buy Mining Machines for Bitcoin Miners?

China is the world's largest producer of mining machines, designing, manufacturing, and supplying over 95% of the global mining machine market. Looking for and purchasing mining machines from the country of origin, China, has significant advantages in various aspects.

Generally, when deciding to purchase mining machines, factors to consider include coin price, machine price, payback period, the development prospects of the coin, current mining difficulty, spot or futures, and machine condition.

Before purchasing mining machines, you need to select the coins you believe have potential. Although most people invest in Bitcoin, every bull market brings forth a multitude of coins that can increase in value by hundreds of times. Therefore, when choosing which coin to invest in, factors such as risk coefficient, application scenarios, and future prospects should be considered.

Once you have identified the coin you want to invest in, you can proceed to choose the machine. Generally, machines with higher unit computing power prices have higher energy efficiency. This factor is not particularly important when the market is in a bull phase because high coin prices make almost all machines profitable. However, during a bear market, this factor becomes crucial. Many machines generate daily earnings that are insufficient to cover electricity costs, resulting in the need to shut down or idle the machines. In some cases, machines may even become damaged due to prolonged inactivity. For example, for machines mining Bitcoin, according to the price index on AsicFinder.com, the Whatsminer M53 248Th/s has a current unit computing power price as high as 19.40$ per TH/s

In addition to computing power prices, coin prices are another significant factor affecting mining return periods. Although the payback period may seem very short during a bull market, the fluctuation in coin prices often makes it difficult to achieve the ideal expected return period, resulting in holding positions at high prices.

Be cautious when it comes to new, small, and lesser-known coins. Newcomers to the market often fall into the trap of being blinded by current earnings, leading to massive investments and subsequent huge losses. Due to their small market capitalization and limited attention from mining machine manufacturers, newly emerging coins often have machines with relatively low computing power. Once a large number of machines with higher computing power enter the market, the entire market will be reshuffled, and the previously purchased low computing power machines will be completely eliminated by more advanced high computing power machines, resulting in significant losses for buyers.

The type of inventory, whether the mining machines are in stock or futures, is also a crucial factor. Purchasing futures, especially long-term futures, may appear cheaper. However, there is a possibility of a decrease in machine profitability before the machines are delivered. Additionally, for a mining machine with disruptive high computing power in the market, many manufacturers intentionally sell futures to collect down payments. When the machines are finally shipped, the sudden influx of high computing power machines in the market will render your seemingly considerable computing power earnings insignificant, resulting in significant losses.

Machine condition, although not a factor affecting the return period, is undoubtedly important. Machines with newer conditions and warranties can prevent you from spending a significant amount of time sending them back for repairs, which can affect mining earnings. This is especially true during a bull market, where the loss of one week of mining due to machine downtime can be staggering.

Machine price: For some experienced buyers or participants in the mining community, purchasing mining machines is not a difficult task. However, due to the relatively closed nature of the mining community and the lack of price transparency, if you do not conduct in-depth research on prices when purchasing mining machines, you may fall victim to scams. It is highly recommended to compare prices from multiple sources, even up to ten, to avoid falling into traps. You can also refer to the price index on AsicFinder.com, which is based on big data analysis of quotes from numerous mining machine suppliers in China. It provides a relatively accurate reference for prices.

Conclusion: When purchasing mining machines, it is essential to conduct thorough research and due diligence to ensure a successful mining investment. Factors such as selecting promising coins, considering machine efficiency and coin price fluctuations, being cautious with new coins, evaluating inventory types, machine condition, and comparing prices are crucial for making informed decisions. By following these guidelines, Bitcoin miners can increase their chances of success in the mining industry.

2 notes

·

View notes

Text

PHEMEX Exchange

Founded by former executives of Morgan Stanley in 2019, Phemex stands as a leading cryptocurrency futures exchange, facilitating the trading of diverse digital assets such as Bitcoin, Ethereum, Solana, Avalanche, Shiba Inu, and over 250 others. With a commitment to serving both professional and retail traders, Phemex offers an intuitive interface, competitive fees, tight spreads, and lightning-fast execution speeds.

Unleash the power of Phemex, the visionary platform that empowers traders worldwide. Trade a vast array of digital assets, including renowned cryptocurrencies like Bitcoin, Ethereum, and Ripple. Phemex caters to both spot and margin trading, ensuring that even the most seasoned traders have access to advanced tools and features. Experience the advantage of Phemex’s minimal fees, enabling you to maximize your profits. Available in over 180 countries, Phemex welcomes traders from around the globe to embark on an exciting journey towards financial success.

PHEMEX: Secure and Reliable?

Phemex assures safety as a regulated cryptocurrency exchange, duly registered with the US Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC). This regulatory oversight mandates stringent financial compliance, including robust anti-money laundering (AML) and countering-the-financing-of-terrorism (CFT) measures.

Rest easy knowing that Phemex provides a secure haven for buying, selling, and trading digital assets. As a testament to its credibility, the platform boasts support from industry giants like Galaxy Digital and BitMEX, cementing its position as a trusted choice in the cryptocurrency landscape. Embrace the peace of mind that comes with Phemex’s commitment to safety and the backing of renowned investors.

PHEMEX Trading Fees

Phemex stands out as the most cost-effective exchange globally, offering an unprecedented 0.025% rebate on market maker orders. Here’s how it works: when you place a limit order on Phemex and it successfully matches with another trade, Phemex will reward you with a 0.025% rebate.

Moreover, for standard market orders, Phemex imposes a mere 0.075% taker fee per trade. Take advantage of these exceptional rates and maximize your trading potential on Phemex, the ultimate destination for affordable cryptocurrency transactions. Unleash the power of low fees and embrace a rewarding trading experience with Phemex.

PHEMEX KYC Verification

Currently, Phemex sets itself apart by not mandating KYC verification for trading on their platform. This unique feature allows users to swiftly engage in cryptocurrency trading without the hassle of submitting identity verification documents. Phemex stands out as one of the few derivatives exchanges that still provide this convenience.

However, for traders dealing with substantial sums exceeding $100,000 USD, the completion of Phemex Premium membership verification becomes necessary to facilitate seamless transfers to and from their bank accounts. This added verification step ensures smooth transactions and meets the needs of large-scale traders.

Join Phemex, where trading freedom and convenience converge. Enjoy the ease of trading cryptocurrencies without the burden of KYC verification. Explore the possibilities, and if you’re a high-volume trader, unlock the full potential of Phemex by undergoing Premium membership verification. Experience a platform that caters to both small-scale and large-scale traders with efficiency and flexibility.

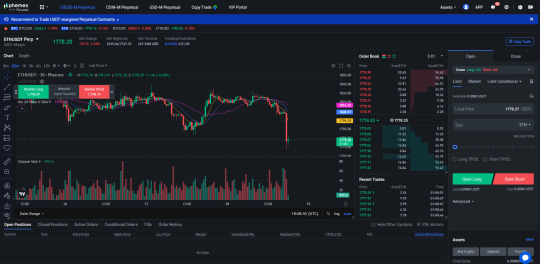

Futures and Derivatives Trading on PHEMEX

Trading ETH/USD derivatives on Phemex Futures.

Available Cryptocurrencies on PHEMEX

Phemex presents an extensive selection of top cryptocurrencies, akin to those found on renowned exchanges such as Binance or FTX. With a diverse range of over 200 digital assets, Phemex keeps pace with the ever-evolving market by promptly listing trending coins like ApeCoin (APE) or Decentraland (MANA). Discover the thrill of trading with an array of exciting options on Phemex’s platform, where opportunities abound and innovation thrives. Unleash your trading potential and explore the world of cryptocurrencies with Phemex.

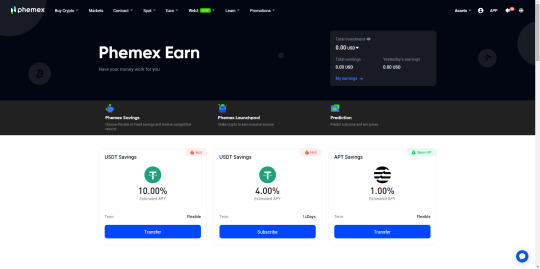

PHEMEX Earn

PHEMEX Conclusion

Discover the thriving world of Phemex, a user-friendly cryptocurrency exchange that is rapidly gaining momentum. With an impressive array of over 250 assets available for spot and futures trading, Phemex eliminates the hassle of KYC verification. Embrace the allure of low fees, abundant liquidity, and a platform tailored for both seasoned traders and beginners alike. Rest assured, Phemex prioritizes your safety, being registered with the CFTC and SEC. Unlock the potential of passive income through Phemex Earn, where staking opens doors to enticing opportunities. Join now through the provided link and seize the exclusive $180 Crypto Bonus. Don’t let this exhilarating journey pass you by.

2 notes

·

View notes

Text

INVESTING IN BITCOIN IS IT RIGHT?

Investing means buying an asset that actually creates products and services and cashflow for an extended period of time. Like a piece of a profitable business or a rentable piece of real estate. An investment is something that has intrinsic value – that is, it would be worth owning from a financial perspective, even if you could never sell it.

Now, with that moral sermon out of the way, we might as well talk about why Bitcoin has become such a big thing, so we can separate the usefulness of the underlying technology called ���Blockchain”, from the mania about how people have turned Bitcoin it into a big dumb lottery.

if you truly need it to buy stuff, and thus you need to buy coins from some other person in order to conduct important bits of world commerce that you can’t do any other way. Right now, the only people driving up the price are other speculators. The bitcoin price isn’t rising because people are buying the coins to conduct real business. It’s rising because people are buying it up, hoping someone else will buy it at an even higher price later. It’s only valuable when you cash it out to a real currency again, like the US dollar, and use it to buy something useful like a nice house or a business. When the supply of foolish speculators dries up, the value evaporates – often very quickly.

soource: https://gogostraightblog.com/investing-in-bitcoin-is-it-right/

#online buisness#buissnes#small buisness#moneytips#make money for free#make money today#finance#financial freedom#bitcoin#bitcoin latest news#crypto#crypto latest news

2 notes

·

View notes

Text

usdt and aras bit

USDT (Tether) and Arasbit are two prominent names in the cryptocurrency industry that are closely related to each other. In this article, we will delve into the details of both USDT and Arasbit and how they interact with each other.

USDT, also known as Tether, is a stablecoin that is pegged to the US dollar, meaning each USDT token is backed by a corresponding US dollar held in reserve. This provides stability to the cryptocurrency market, as USDT can be used as a safe haven for traders during periods of market volatility. USDT is widely used in the crypto market and is accepted by a growing number of exchanges and platforms.

Arasbit cryptocurrency exchange that provides a platform for users to buy, sell, and trade cryptocurrencies, including USDT. Arasbit offers a wide range of cryptocurrencies, including Bitcoin, Ethereum, and other altcoins. The platform has a user-friendly interface and provides 24/7 customer support to ensure a smooth and secure trading experience for its users.

Arasbit supports USDT, allowing users to trade this stablecoin along with other cryptocurrencies on the platform. This allows traders to benefit from the stability of USDT while also having the ability to trade other cryptocurrencies as they see fit. With the support of USDT, Arasbit becomes a more attractive platform for both new and experienced traders, as they can use USDT as a means of reducing risk while still participating in the cryptocurrency market.

In conclusion, USDT and Arasbit are two important players in the cryptocurrency industry that interact with each other in various ways. While USDT provides stability to the cryptocurrency market, Arasbit provides a platform for traders to exchange USDT with other cryptocurrencies, making it a valuable resource for traders looking to reduce risk and maximize their profits. It is important to thoroughly research both USDT and Arasbit before making any trades, and to understand the risks associated with cryptocurrency trading.

2 notes

·

View notes

Text

What is Ethereum and How It’s Leading the Digital Art Revolution Through NFTs

In recent years, the art world has undergone a significant transformation, with digital art now reaching mainstream popularity. At the heart of this digital shift are NFTs, or Non-Fungible Tokens, and the blockchain technology that makes them possible. But what is Ethereum, and why has it become the foundation for this exciting new frontier in digital art?

What is Ethereum?

Ethereum is a decentralized, open-source blockchain system that allows developers to create and run smart contracts and decentralized applications (DApps). Unlike Bitcoin, which focuses primarily on digital currency transactions, Ethereum serves as a platform for building and deploying a wide range of blockchain-based applications. Ethereum’s cryptocurrency, Ether (ETH), fuels the network, incentivizing developers and users to participate in and maintain the system.

Ethereum was developed by Vitalik Buterin and launched in 2015. Its unique ability to host DApps and smart contracts has made it incredibly popular, especially in the art and entertainment industries. Ethereum’s blockchain is transparent, secure, and decentralized, ensuring trust and reliability for digital assets like NFTs.

What are NFTs?

NFTs are unique digital assets that represent ownership of a specific item or piece of content, such as artwork, music, or even tweets. Unlike cryptocurrencies like Bitcoin or Ethereum, which are interchangeable, NFTs are unique and cannot be duplicated. Each NFT is recorded on the blockchain, making it easy to verify authenticity and ownership.

The value of NFTs lies in their rarity and the ability to prove that a specific digital item is authentic. This has allowed artists to monetize digital creations in a way that was not possible before.

Why Ethereum Powers the NFT Revolution

Ethereum’s role in the NFT movement is crucial, primarily because it was one of the first blockchains to introduce smart contracts. Here’s how Ethereum powers the NFT revolution:

Smart Contracts: NFTs are created, bought, and sold through smart contracts, which are self-executing contracts with the terms of the agreement written directly into code. These contracts eliminate intermediaries, allowing artists to sell directly to buyers and retain more profits.

ERC-721 and ERC-1155 Standards: Ethereum’s ERC-721 standard defines how NFTs are created on the blockchain, ensuring consistency, interoperability, and security. Meanwhile, the ERC-1155 standard allows for the creation of both fungible and non-fungible tokens, making it easier for developers to build applications with both types of assets.

Transparency and Security: Ethereum’s decentralized nature ensures that all transactions are transparent and traceable. This makes it possible to verify the authenticity of digital art pieces, protecting buyers from counterfeits.

Growing Ecosystem: Ethereum has a vast and active developer community, which has led to a wide range of NFT marketplaces, tools, and DApps. Popular platforms like OpenSea, Rarible, and SuperRare are built on Ethereum, making it the go-to choice for artists and collectors.

How NFTs Are Changing the Art World

NFTs have empowered artists by providing a direct link to their audience, bypassing traditional galleries and auction houses. Digital artists now have control over their work, setting prices, earning royalties on future sales, and reaching global audiences without needing physical displays.

Ownership and Provenance: One of the most revolutionary aspects of NFTs is that ownership is stored on the blockchain. This provides proof of authenticity and provenance, which is crucial in the art world. Art collectors can be sure they’re buying a legitimate piece, and artists can maintain a clear record of their work’s origin.

Royalties: Many NFTs are coded with royalties, meaning that artists can earn a percentage every time their work is resold. This creates an ongoing revenue stream for artists, which is rarely possible with traditional art sales.

Community Building and Engagement: NFTs have led to a new way for artists to engage with their audiences. Many artists build communities around their work, creating experiences, limited releases, and interactions that make owning their art a social experience.

Challenges and Criticisms

While Ethereum and NFTs have opened up a world of possibilities for digital artists, they’re not without challenges. One of the main criticisms is the environmental impact of Ethereum’s proof-of-work mechanism. However, Ethereum’s transition to Ethereum 2.0, a proof-of-stake system, aims to significantly reduce its energy consumption.

Another challenge is the speculative nature of NFTs, as prices can fluctuate dramatically, leading some to question the long-term sustainability of this new digital art economy.

Conclusion: What’s Next for Ethereum and NFTs?

The answer to "what is Ethereum" is no longer confined to technical explanations; it's now a story of empowerment, decentralization, and creativity. As the world continues to digitize, Ethereum and NFTs are leading the charge, creating new possibilities for artists, collectors, and fans alike.

Whether you’re a digital artist looking to enter the NFT space, an art collector seeking new investment opportunities, or simply an Ethereum enthusiast, it’s clear that we’re witnessing the beginning of a digital art revolution. And as Ethereum continues to evolve, we can expect even more exciting developments in the future.

0 notes

Text

Leveraging Binance Futures to Maximize Returns

Leveraging Binance Futures to Maximize Returns

Futures trading on Binance offers opportunities for high returns, but it also carries significant risks. Leveraging allows you to amplify potential profits with relatively low capital, making futures a popular choice for experienced traders. This guide provides an overview of futures trading, explains the risks involved, and offers tips for managing leverage effectively.

1. What is Futures Trading?

Futures trading involves agreeing to buy or sell an asset at a predetermined price on a specified date in the future. Unlike spot trading, where you own the asset immediately, futures contracts let you bet on the price movement of an asset without actually owning it. This means you can profit (or lose) based on the price movement of assets like Bitcoin (BTC), Ethereum (ETH), or other cryptocurrencies.

Binance Futures offers various contract types:

USDT-Margined Contracts: These are settled in stablecoins like USDT, making it easy to calculate your profits and losses.

Coin-Margined Contracts: These are settled in the base cryptocurrency, such as BTC or ETH, making them popular for those looking to increase their crypto holdings.

With Binance Futures, you can also trade on both sides of the market:

Long Position: You buy the contract if you think the price will increase.

Short Position: You sell the contract if you believe the price will decrease.

2. How Leverage Works in Futures Trading

Leverage is a key component of futures trading, allowing you to control a larger position with a smaller amount of capital. Binance offers leverage of up to 125x for some contracts, which means you can control a position 125 times greater than your initial capital.

For example:

If you have $100 and use 10x leverage, you can open a position worth $1,000.

If the market moves 1% in your favor, your profit will be $10 (10% of your initial capital).

However, if the market moves 1% against you, your loss will also be $10.

Leverage amplifies both potential gains and losses, so while it can increase your returns, it also increases your risk of losing capital quickly. A higher leverage ratio can lead to higher profits, but it can also cause a position to be liquidated (closed by the exchange) if the market moves unfavorably.

3. Getting Started with Binance Futures

To begin trading futures on Binance, follow these steps:

Create a Binance Account and Complete KYC Verification: If you haven’t already, register and verify your identity. Futures trading may require a separate wallet, so ensure you understand the basics of funding and using your account.

Transfer Funds to Your Futures Wallet: Go to your wallet, select “Futures Wallet,” and transfer funds from your spot wallet. Remember to only transfer funds you’re willing to risk.

Navigate to the Futures Trading Interface:

Under the “Derivatives” tab, select “USDⓈ-M Futures” or “COIN-M Futures,” depending on your preferred contract type.

The interface allows you to view price charts, order book data, and key market statistics. Binance also offers both Classic and Advanced interfaces for different levels of trading expertise.

Choose Your Leverage: By default, Binance Futures may offer a low leverage ratio, which you can adjust by clicking on the leverage ratio in the top left corner of the interface. Choose a leverage level you’re comfortable with, keeping in mind that higher leverage increases both risk and reward.

Place an Order:

Market Order: This executes immediately at the current market price.

Limit Order: You set a price you want to buy or sell at, and the order will execute only when the price reaches your specified level.

Stop-Limit and Stop-Market Orders: These help manage risk by triggering trades at certain price levels to protect against adverse price movements.

Manage Your Position: Once your position is open, you’ll see it under “Positions.” From here, you can monitor profits or losses and close the position whenever you choose.

4. Risks Involved in Binance Futures Trading

While Binance Futures offers lucrative opportunities, it’s essential to understand the associated risks:

High Volatility: Cryptocurrency markets are highly volatile, which can result in significant price fluctuations within minutes. Leverage amplifies these fluctuations, making risk management crucial.

Liquidation Risk: If your position moves against you, and you don’t have enough margin (collateral) to cover potential losses, your position will be liquidated by Binance to prevent further losses. Liquidation can result in losing your entire investment in that position.

Leverage Multiplying Losses: While leverage boosts potential profits, it also magnifies losses. For instance, with 20x leverage, a 5% unfavorable price movement results in a 100% loss of your initial capital.

Funding Fees: In Binance Futures, open positions incur funding fees. These fees fluctuate based on the market, and they are paid periodically. Understanding these fees is essential, especially for long-term positions.

5. Tips for Managing Leverage and Reducing Risks

Success in Binance Futures trading requires effective risk management. Here are some tips to help you manage leverage responsibly and reduce the risk of losses:

Start with Lower Leverage: Higher leverage is tempting, but it increases risk. Beginners should start with lower leverage, such as 2x or 5x, and only increase leverage after gaining experience and confidence in the market.

Use Stop-Loss Orders: Set stop-loss orders for every trade to limit potential losses. A stop-loss order closes your position automatically if the market moves unfavorably, helping you protect your capital.

Define Profit and Loss Levels: Before entering a trade, define your target profit and acceptable loss levels. Having pre-set exit points helps you stick to a trading plan rather than making impulsive decisions.

Monitor the Market: Stay updated on market trends, news, and events that could impact cryptocurrency prices. Global economic news, regulatory updates, and high-profile cryptocurrency events can all influence the market.

Avoid Overtrading: Avoid opening multiple high-leverage positions at once, as this can amplify potential losses. Choose trades carefully and focus on quality over quantity.

Practice with Binance Futures Testnet: Binance offers a testnet (a simulated environment) where you can practice futures trading without real money. It’s a great way to learn without risk and to test different strategies.

6. Advanced Strategies for Binance Futures

As you gain more experience with futures trading, you may consider exploring more advanced strategies:

Hedging: You can hedge against potential losses in spot trading by opening an opposite position in futures. For instance, if you hold BTC in your spot wallet and fear a price drop, you could open a short position in futures to offset losses.

Scalping: Scalping involves making multiple quick trades to profit from small price changes. This strategy requires a keen eye on the market and fast execution, and it works well in high-volatility markets.

Swing Trading: This approach aims to capture larger price movements over days or weeks, allowing you to profit from market trends. Swing trading requires patience and a solid understanding of technical analysis.

7. Final Thoughts: Is Binance Futures Right for You?

Binance Futures can be a powerful tool for maximizing returns, but it’s best suited for traders with a strong understanding of cryptocurrency markets and risk management. Leverage offers a way to increase profits but also demands a disciplined approach. If you’re a beginner, start slowly, learn with smaller trades, and consider practicing on the Binance Futures Testnet before trading with real capital.

Ultimately, the keys to success in Binance Futures are careful planning, disciplined risk management, and continuous learning. As you grow more comfortable with futures trading, you’ll find it’s an exciting and potentially profitable way to participate in the fast-paced world of cryptocurrency. Remember that each trade is a learning experience, and the best traders continually adapt and refine their strategies.

Happy trading, and approach each trade with caution and strategy!

#president trump#crypto#make money online#kamala harris#harris walz 2024#cryptid#earn money online#money#old money

0 notes

Text

How to Profit from Crypto: A Complete Guide to Crypto Investment, Trading, and Strategy

Cryptocurrency has emerged as one of the most exciting and lucrative investment opportunities of the modern era. With the potential for high returns and increased global adoption, many investors are eager to capitalize on the volatility of the crypto market. But how exactly can you profit from crypto? Whether you're new to the world of digital assets or an experienced investor, understanding how to craft a solid crypto investment strategy is key to maximizing your returns. In this guide, we’ll cover essential topics, including building a crypto portfolio, understanding market trends like the Crypto Fear and Greed Index, determining when to exit on a crypto bull run, and utilizing automated trading systems.

Building a Profitable Crypto Portfolio

If you are new to crypto then you can check these premade crypto portfolios. A well-structured crypto portfolio is essential for managing risk and ensuring long-term profitability. Diversification is key in the volatile world of cryptocurrency, as different coins and tokens react differently to market conditions. Here are some steps to follow when building your crypto portfolio:

Choose a Mix of Assets: Invest in a combination of well-established cryptocurrencies (like Bitcoin and Ethereum) along with promising altcoins that may have higher growth potential.

Conduct Research: Always do your homework on the projects you're investing in. Look at their technology, use case, team, and community support to make informed decisions.

Risk Management: Crypto investments can be risky, and some tokens may be more volatile than others. Determine your risk tolerance and balance higher-risk assets with more stable ones.

Long-term vs Short-term: Decide whether you're investing for the long-term (holding assets for several years) or short-term (actively trading for quick profits). This will influence your choice of assets and trading strategy.

For further guidance on how to effectively manage your crypto portfolio, you can check out detailed resources and advice from experts in the field.

Understanding the Crypto Fear and Greed Index

The Crypto Fear and Greed Index is a valuable tool for crypto investors to gauge market sentiment. This index analyzes factors like volatility, market momentum, and social media sentiment to provide a numerical score between 0 and 100, indicating whether the market is driven by fear or greed.

When the index is low (below 25), it indicates that the market is fearful, which often presents buying opportunities for savvy investors.

When the index is high (above 75), it suggests a market driven by greed, signaling that it might be a good time to sell or reduce your exposure.

By monitoring the Crypto Fear and Greed Index, you can make more informed decisions about when to buy, hold, or sell based on the prevailing market emotions. Many successful traders use this index as part of their crypto trading strategy to time their investments more effectively.

When to Exit on a Crypto Bull Run

Timing your exit during a crypto bull run is crucial to securing profits. Bull markets, where prices rise sharply, can tempt investors to hold on for even greater gains, but they can also be risky. Knowing when to exit can prevent you from losing profits as the market reverses.

Here are some guidelines to help you determine when to exit on a crypto bull run:

Set Profit Targets: Before entering a position, set specific profit targets. These targets should be based on your financial goals and market analysis. Once the asset reaches those targets, consider selling a portion of your holdings.

Watch for Market Sentiment Shifts: Keep an eye on the Crypto Fear and Greed Index and broader market conditions. A sudden shift from greed to fear could signal a market correction, and it might be time to exit.

Use Trailing Stop Loss Orders: A trailing stop loss order automatically adjusts as the price increases, protecting profits while allowing for potential gains if the market continues to rise. This strategy can help you lock in profits while keeping some exposure to potential upside.

Don’t Get Greedy: It can be tempting to hold on during a bull run, but remember that markets can turn quickly. Having a clear exit strategy helps you avoid losing the gains you've made.

Automated Trading Systems for Crypto

One of the most effective ways to profit from crypto is by leveraging automated trading systems. These systems allow you to trade 24/7, taking advantage of market opportunities around the clock without the need for constant monitoring.

Benefits of Automated Trading Systems

Efficiency: Automated systems can execute trades much faster than human traders, ensuring you don’t miss out on opportunities.

Emotion-Free Trading: By relying on algorithms rather than emotional decisions, automated trading systems help you avoid the common mistakes that come from panic or greed.

Backtesting: Many automated trading platforms allow you to backtest strategies using historical data, which can give you more confidence in your trading plan.

How to Set Up an Automated Trading System

Choose a Platform: There are several platforms that offer automated crypto trading, such as Binance, Kraken, and CryptoHopper. Choose one based on your needs and trading style.

Set Your Parameters: Define your risk tolerance, trading strategy, and the types of assets you want to trade. You can also set stop-loss and take-profit levels to manage your trades effectively.

Monitor Performance: While automated systems are designed to run independently, it’s important to regularly monitor their performance and make adjustments as needed.

Conclusion: Making Profits from Crypto Investing and Trading

Profitably navigating the world of cryptocurrency requires a combination of strategic planning, market awareness, and the right tools. By focusing on building a well-diversified crypto portfolio, keeping an eye on the Crypto Fear and Greed Index, knowing when to exit on a crypto bull run, and utilizing automated trading systems, you can increase your chances of success in the crypto markets.

If you're new to crypto investing or looking to refine your crypto trading strategy, start with small investments, educate yourself regularly, and stay informed about market trends. Over time, you’ll gain the experience and insight needed to maximize your crypto profits.

For more in-depth analysis, tips, and resources, explore guides on building the perfect crypto portfolio and advanced crypto trading strategies to ensure you’re always one step ahead in the fast-paced world of digital assets.

0 notes