#hot forex opening times

Explore tagged Tumblr posts

Text

Bitcoin’s Wild Ride: Lessons for Savvy Forex Traders Bitcoin Bounces Back: Lessons Hidden in the Dip It’s not every day Bitcoin’s price decides to test your patience like a toddler in a toy store. But here we are—Bitcoin briefly slipped below $100k during APAC hours, sending shockwaves through the crypto trading world. What happened, and more importantly, what does it mean for you as a Forex and crypto trader? Let’s dive in, dissect the chaos, and uncover the hidden gems in this volatile market shake-up. The Rollercoaster Drop: What Really Happened? In the world of cryptocurrency, volatility isn’t a bug—it’s a feature. Bitcoin’s dip below the psychological $100k threshold came hot on the heels of the Fed’s hawkish comments. In APAC trading hours, this was amplified by lower liquidity, creating the perfect storm for a sharp decline. Here’s the kicker: Despite the gut-wrenching dip, Bitcoin found a floor and rebounded. So, was this just another episode of "market overreaction" or a sign of deeper market shifts? Hidden Lesson: While most traders panic-sold during the drop, seasoned pros saw it as a buying opportunity. This is a classic example of emotional trading pitfalls versus strategic planning. The smart money—the ones who profit—buy the fear and sell the greed. How Forex Traders Can Learn From Crypto’s Moves Bitcoin’s recent action isn’t just a crypto story; it’s a market psychology masterclass. Here’s what Forex traders can learn: - Follow the Central Banks: The Fed’s tightening policy isn’t just moving crypto; it’s shaking the Forex market too. Pair moves in EUR/USD or USD/JPY are often correlated with the broader risk sentiment shifts that spill over from crypto. - Liquidity Matters: The sharp drop happened during APAC hours, when liquidity thins out. This is a reminder to be mindful of the timing of your trades. Thin liquidity often leads to exaggerated moves—a phenomenon Forex traders know all too well. - Hedging Is King: The pros hedge their bets. If your Forex strategy isn’t factoring in crypto’s growing influence, you might be missing out on critical signals. Next-Level Tactics: Spotting the Hidden Trends Now, let’s move from theory to actionable insights. Here’s how you can capitalize on Bitcoin’s recent drama: 1. Diversify Smartly Don’t just trade Forex pairs—integrate crypto into your portfolio. The correlation between Bitcoin and risk currencies (like AUD or CAD) is growing. When Bitcoin tanks, safe-haven currencies like USD and JPY often strengthen. Trade accordingly. 2. Watch the Psychological Levels Bitcoin’s $100k mark acted as both a magnet and a trap. Psychological levels often dictate market sentiment. In Forex, these levels translate to round numbers like 1.1000 for EUR/USD. Pay attention to how markets react when these levels are breached. 3. Use the News as Your Edge The market overreacts to headlines. Instead of jumping on the bandwagon, use the news as a contrarian signal. For instance, when Bitcoin dipped, did you notice how USD gained strength? These are interconnected moves savvy traders exploit. The Underground Tactics Most Traders Miss While the masses were focused on Bitcoin’s price drop, here’s what you should’ve been watching: - Options Data: Bitcoin options traders signaled strong support at $95k. This is a lesson in Forex too—always monitor open interest around key levels. - Order Book Analysis: The bids stacked up at $99k. In Forex, a similar tool is Depth of Market (DOM), which gives clues about buy/sell pressure. - Cross-Market Indicators: Gold’s slight uptick during Bitcoin’s fall was a signal that safe-haven flows were in play. Apply this to Forex by tracking DXY (US Dollar Index) during risk-off moves. How to Stay Ahead of the Pack If you’re serious about trading—whether Forex, crypto, or both—you need to arm yourself with the right tools and insights. Here’s what we recommend: - Stay Updated: Get exclusive Forex and crypto news at StarseedFX News. - Master Advanced Strategies: Enroll in free Forex courses to learn methodologies pros swear by at Free Forex Courses. - Join a Trading Community: Gain daily expert analysis and insider tips with the StarseedFX Community. - Plan Like a Pro: Use our Free Trading Plan to structure your approach. - Track Your Performance: Refine your strategies with a Free Trading Journal. - Optimize Your Trades: Automate your lot size and order management with the Smart Trading Tool. Turning Dips Into Dollars Bitcoin’s recent dip isn’t just a cautionary tale; it’s an opportunity. Whether you’re trading crypto, Forex, or both, the lessons are universal: Stay calm, stay informed, and always trade with a plan. Because in this game, it’s not the strongest who survive but the smartest. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Review FRX Token - DeFi Hedge Fund

FRX TOKEN- MAKING HEDGE FUND INVESTMENT MORE PROFITABLE AND WORTHWHILE

INTRODUCTION:

Guys, If you want to know about FRX First you need to know about is DeFi?

DeFi:

DeFi is an open financial ecosystem where you can build various small financial tools and services in a decentralized manner.

We see Decentralized Finance (DeFi) market began its meteoric rise in early 2020. it’s very good time for crypto community and investors.

Iast 6 months, the total value of all assets locked in DeFi has grown by a factor of 15 - from $600 million to $9 billion. Such changes indicate an increase in interest from the crypto community and investors. DeFi can be safely called the ‘hot hit’ of 2020.

FRX is a globally decentralized hedge fund token, a combination of different alpha-powers of hedge funds with the freedom granted by a denied ecosystem.

Forex Advisors is a registered firm that specializes in providing crypto trading advice to established and potential crypto exchange platforms and its clients. It was established in 2013 in Dubai, a market in the United States.

They operate derivative accounts for some business and external clients and have developed and developed derivative strategies for several for-profit businesses around the world over the past decade. Their main goal is to set and achieve a high interest rate for their clients with an investment target of at least 30% per year. They also offer cryptocurrency managed accounts that help achieve return rate rates.

Be Your Own Hedge Fund

#PoW & overload causing tremendous fees for Ethereum, all the competing chains are on the rise, Tron, Polkadot, BNB, Matic, even Avalanche.

Join the party with #FRX, making #TronNetwork professional, be your own hedge fund.

Seed Round live at: http://feroxadvisors.com/frx

Introduction to Crypto Derivatives, Advanced Bitcoin Trading Strategies, Bitmex Update 2019 & 2020

https://youtu.be/8ru7iv99mUI

Ferox Advisors(FRX):

Native Token of Ferox Advisors Limited FRX Token Platform. Demand for FRX Coins will increase with the development of Forex Advisors Ltd. With a professional and systematic marketing strategy, high interest rates and attractive rewards, it is certainly a project that is suitable for investment.

Why Choose Ferox Advisors??

The Ferox Advisor platform works using liquidity pools. These are token pools that are locked in the smart contract, these tokens so that you can be able to exchange with each other using AirTX as hydraulic. Lots of tokens (TRC-20) and all kinds of tokens that are currently supported by Firix Advisors. Also, a new liquidity pool can create a new exchange pair for any token at any time.

Private companies:

As a private company, FRX is an open platform for anyone who wants to join and invest in it individually or for company owners. As part of the FRX platform, you can benefit from a number of programs:

Key Features: Provides high liquidity, provides returns up to 300% / year, Full Intraday Trading Optionality, Low Fees at Trading,

Combining IT experts with today's technology.

As a platform that combines high technology and technology and business experts, the FRX platform hedge fund trading platform aims to:

Maximum income, profits of up to 399% per annum, is open to all without exception.

Derivatives:

Investors and users can benefit from this system. This is because derivatives are secured deposits / tokens that are guaranteed under certain agreements so that they can buy and sell transactions in exchange. And besides, investors will be able to sell first even if they haven’t bought before.

Managed Accounts:

By creating profitable strategies for investors and traders, the FRX platform can help you grow your business without imposing large fees for the trading transactions you make. Because it is definitely the main attraction for its users by providing up to 300% profit per year.

FRX VISION:

The project seeks to maintain an annual return on net equity

The minimum is 30%, with the ability to further increase the price of free gamma. We have successfully achieved both crypto options and derivatives as of 2017.

At Bitmax, we doubled our equity in less than a month's trading in 2012. We have achieved a standard fit with stock options of technology by 2020.

Now we want to provide a better profit profile for outside investors.

Removes the fund structure, banks and depositors from the equation and allows the investor to own shares of a decentralized hedge fund directly with 0 operating or operating fees.

FRX Token

Ferox Advisors is not just a hedge fund firm, it provides token hedge funds called FRX Tokens. The FRX token is a TRC20 token designed in the Tron blockchain. With this combination, Forex Advisor Alpha Hedge Fund provides a decentralized token hedge fund with productivity capabilities and the benefits of the DFI ecosystem. FRX tokens can be purchased and received by users through the Seed Round program. Users can get multiple bonus rates up to 300% in this program. The bigger the investment, the higher the bonus.

The utilities of the FRX token

In addition to participating in hedge funds, FRX is the preferred token of betting directly from the Firx Consulting website. These bets will be dynamic versions of binary options (or bets on a consistent spread), allowing users to make daily predictions on the prices of large cryptocurrencies and products such as gold, silver and crude oil via the FRX token in the payment structure.

Ferox Advisor Tokenomics:

Forex Advisors is a private limited company in which they have invented a crypto token - for investors to share its profits and for partners to participate. The FRX token will feature liquidity mining and standard yield cultivation, allowing its holders to retain tokens and generate dividends.

The project plans to deliver a total of 70,000 million TRX tokens The company said The 400 million tokens will be minted in the first year of the first year and sold and distributed in the second year. The rest will be set aside for split funding, special promotions and development roadmaps.

TOKEN INFORMATION:

Name: FEROX (FRX)

Contract : TKTENn9v56yVKHu4obmdQGpe8wFVimczxq

Symbol: FRX

Decimals: 8

Circulating Supply : 700,000,000.00000000FRX

FRX Pre-Sale is now Live!

The FRX mentioned in the previous paragraph is a trading company that focuses on trading cryptocurrencies and derivatives. The company specializes in account management for investors and earning returns based on their investments. FRX has created their platform token called FRX which is tron based. The token is designed in Tron Blockchain, one of the fastest, scalable, secure and highly efficient blockchain networks in the world. FRX is the domestic token of the FRX decentralized hedge fund platform.

FRX PRESALE INVESTMENT TIER is as follows :

10,000 TRX investment , 1 TRX = 3 FRX , Investors will get 27,000 FRX by transferring 9000 TRX to FRX wallet above

Investment worth 10,000 TRX to 50,000 TRX ( 1 TRX - 3.3 FRX) Deposit 33,000 worth of TRX, you will get 99,000 FRX

Investment up to 50,000 TRX to 300,000 TRX ( 1 TRX - 3.6 FRX) Depositi100, 000 TRX , you will receive 360,000 FRX

Investment up to 300,000 TRX and above attracts ( 1 TRX - 4FRX) Depositing 500,000 TRX will , you will receive 2,000,00 FRX

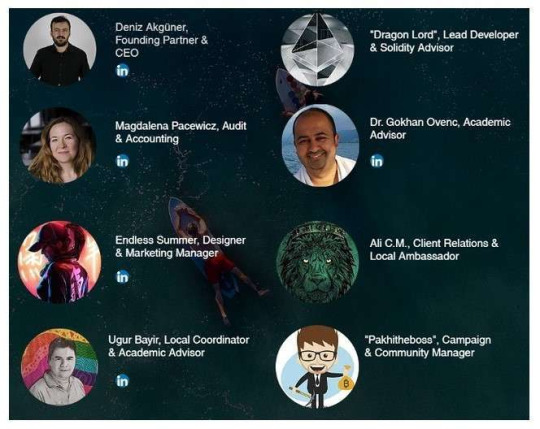

TEAM member:

CALCULATION:

An investment is an activity that is managed by allocating a certain amount of money to tools such as gold, real estate, etc. for future profit. Currently, many companies provide investment services for attractive return users. But there are risks to investing, users must be prudent in investing their money so that they do not lose their assets.

Above all, to guarantee the traceability, and authentication of ownership, the FRX Token transactions are registered into the blockchains, and these will enable the mobility, liquidity, and trading of physical gold. Now is the right time for crypto enthusiasts and investors to enjoy the great benefits which FRX Defi Investment offers by investing in tins amazing, highly secure, and valuable token (FRX Token)

MORE INFORMATION:

Website: http://feroxadvisors.com/team

Twitter: https://twitter.com/feroxadvisors

Telegram: https://t.me/FRXalpha

Medium: https://frx.medium.com/

Github: https://github.com/opentron/opentron

AUTHOR:

Bitcointalk Username: Manuel Akanji Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=2954998

Tron Wallet: TCNg5eeoLS4QkfRLWZKzBRAdSNNQ4Pf4x5

2 notes

·

View notes

Text

Hidden Forex Signals: Fed Cuts, BoJ Moves, and Merger Surprises Hidden Forex Signals: How the Fed, BoJ, and Mergers Shape Your Next Move The Forex market is buzzing with developments, but let’s cut through the noise and dive straight into what really matters. From subtle shifts in APAC equities to high-stakes central bank decisions, there’s a lot to unpack. And yes, we’re sprinkling in a bit of humor along the way because trading is stressful enough without a chuckle or two. So, let’s decode today’s news and turn it into actionable insights. The Fed Whisperer: Why a 25bps Rate Cut Could Shake the Dollar The Federal Reserve is poised to lower the Federal Funds Rate by 25 basis points, settling at a range of 4.25-4.50%. Sounds dry? Not when you consider its ripple effect. A lower rate could weaken the dollar, making exports cheaper and boosting riskier assets. It’s like taking the training wheels off the market bike — thrilling but risky. Hidden Gem Insight: Most traders are glued to Chair Powell’s press conference. But here’s a pro tip: watch for how the Fed comments on inflation trends. A dovish tone could send gold soaring while shaking up USD/JPY. And don’t forget, the dollar’s dance directly impacts emerging market currencies. Timing your entries here is key. APAC’s Mixed Bag: Real Estate Gains Meet BoJ Anticipation APAC equities had a classic “goldilocks” session—not too hot, not too cold. The ASX 200 balanced gains in Real Estate, Tech, and Healthcare against losses in Financials. Meanwhile, the Nikkei 225 tiptoed as traders awaited Thursday’s Bank of Japan decision. With a hold expected, all eyes are on Governor Ueda’s commentary. Hidden Gem Insight: Nissan’s 22% stock surge amid rumors of a merger with Honda is the kind of left-field news that’s worth digging into. While Honda shares dipped 3%, the real story could be in their future supply chain synergies. Translate this corporate gossip into Forex: the JPY might see volatility as investors reassess Japan Inc. Hang Seng’s Quiet Outperformance: What’s Behind the Chinese Optimism? While the West frets over rate hikes, Chinese markets had a sunnier disposition. The Hang Seng and Shanghai Composite edged higher, buoyed by anticipation of the People’s Bank of China’s Loan Prime Rate (LPR) update on Friday. Hidden Gem Insight: Traders often overlook the PBoC, but their monetary policy can have outsized effects on commodity-linked currencies like the AUD. Think of it as the butterfly effect: a slight tweak in China’s lending rates can ripple across the globe, influencing Forex pairs you wouldn’t immediately connect. European Caution: Flat Futures and What They Mean for EUR/USD Across the pond, European equity futures are hinting at a subdued open, with the Euro Stoxx 50 showing a measly +0.1%. After Tuesday’s dip, the region seems stuck in limbo, awaiting the Fed’s cue. Hidden Gem Insight: A quiet European market doesn’t mean you should snooze on the EUR/USD. If the Fed goes dovish, the euro could gain strength, particularly against a weakening dollar. Pair this with ECB President Lagarde’s hawkish tendencies, and you’ve got a recipe for volatility. Turn News into Strategy: How to Trade Today’s Headlines Here’s how to convert this market chatter into actionable tactics: - USD/JPY: With both the Fed and BoJ on deck, expect this pair to lead the dance. Watch for reversals around key resistance levels. - AUD/USD: Track PBoC’s moves and commodity market shifts. A dovish Fed + a confident China = Aussie gains. - EUR/USD: Pair a dovish Fed with cautious European equities for potential euro strength. Look for pullbacks to enter long. - Commodities: Keep an eye on gold and oil. Lower U.S. rates often boost commodities, but China’s demand signals are the real wildcard. Why Stay Passive When You Can Lead? Don’t just react to market news—anticipate it. By leveraging resources like real-time Forex updates and expert analysis, you can uncover opportunities others miss. Visit StarseedFX for insider tips, live trading insights, and tools to refine your strategy. Our free trading plan and journal are perfect for tracking your performance and tweaking tactics on the fly. Ready to move from reactive to proactive? The market rewards those who stay ahead. Let’s lead the charge. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Master the Bullish Percent Index for Breakout Trading Success Unlock the Power of the Bullish Percent Index for Breakout Trading As any seasoned trader knows, the Forex market can be a real rollercoaster—one moment you're up, the next you're stuck in the loop of indecision. But imagine if you had a secret tool that could guide you through the twists and turns. Enter the Bullish Percent Index (BPI), your new best friend in breakout trading. You might be wondering, "What’s so special about the BPI, and why should I care?" Well, strap in because we're about to break it down in a way that even your coffee-fueled brain can process—complete with some humor and insight sprinkled in. So, let’s dive in! What is the Bullish Percent Index? The Bullish Percent Index (BPI) is a technical indicator used to measure the percentage of stocks (or currency pairs, in our case) in a particular market that are in a bullish trend. Think of it as the thermometer for the market's mood—when it’s hot, things are looking up; when it’s cold, maybe it’s time to rethink your strategy. While it’s mainly used in equities, savvy Forex traders have adapted this tool to predict the likelihood of breakout opportunities in currency pairs, like AUD/JPY. Why Should You Care About Breakout Trading? Breakout trading is like waiting for that perfect moment when the door to opportunity flings wide open. You’ve been watching the market, analyzing the charts, and then—bam!—a breakout occurs. The trick is in knowing when to step in, and that’s where BPI can be a game-changer. By tracking the percentage of stocks or currency pairs that are in a bullish trend, the Bullish Percent Index can help you identify when a pair is gearing up for a breakout. You don’t want to get caught chasing price action after it’s already moved 50 pips, right? No one likes being the last one to the party. How the Bullish Percent Index Helps with Breakout Trading Now that you know what the BPI is, let’s talk about how it plays a role in breakout trading. This is where the real magic happens. The BPI gives you an idea of when the market is "overheated" (too many bullish signals) or "underpriced" (not enough bullish momentum). Here’s a breakdown: - When the BPI is High (Overbought Territory): - This indicates that many stocks or currency pairs are in an uptrend. - But hold on—this doesn’t mean you should rush in. When the BPI is high, there’s a risk of a reversal, and a breakout may fail. - A good trader knows to wait for confirmation before entering a position. - When the BPI is Low (Oversold Territory): - This can indicate an underpriced market where a breakout is more likely to occur. - A low BPI signals that the market could be ready for a shift, and breakouts can be more successful here, especially if the trend shifts from oversold to bullish. - When the BPI Moves from Low to High: - This is where the sweet spot for breakout trading happens. - A rising BPI signals a market that’s gaining strength, and when paired with a breakout setup, it could be the perfect storm of trading opportunity. - The idea is to enter a breakout as the market momentum shifts, not after it’s already moved. Identifying Breakout Points Using the BPI Okay, so now we know how the BPI can be used to gauge market conditions, but how do you actually find those breakout points? Here’s a guide: - Look for Consolidation Zones: - Markets often enter a period of consolidation before a breakout. The BPI can show you if the market is ready to break free of this range. - A BPI rise during a consolidation phase indicates that the breakout is more likely to be successful. - Set Alerts for Key Levels: - Combine the BPI with key technical levels such as support and resistance. A breakout above resistance, combined with a rising BPI, is your green light. - Don’t just dive in without confirmation—always watch for volume, price action, and BPI confirmation. - Use Other Indicators to Confirm: - The BPI is a fantastic tool, but like any strategy, it works best when used in conjunction with others. - Pair it with moving averages, RSI, or MACD for extra confirmation that the breakout is likely to stick. Common Pitfalls in Breakout Trading (And How to Avoid Them) Now, you’re ready to break out like a rockstar, but let's avoid those classic mistakes traders make. - Jumping In Too Early: - I get it—you see a breakout happening, and you want to hop on. But wait! If the BPI is too high, the market might reverse. Be patient. - Wait for the breakout to sustain for a few candles or bars before entering. - Ignoring Risk Management: - Just because the BPI and the breakout are lining up doesn’t mean you should go all-in. Always set your stop-loss and have a risk-to-reward ratio in mind. - Breaking out in Forex isn’t a license to ignore proper risk management. Trust me, I’ve been there and it’s not pretty. - Chasing After Price Moves: - Don’t be the guy who’s always chasing the market. If the breakout’s already happened and you missed it, let it go. There’s always another opportunity. Real-World Example: Breakout Trading AUD/JPY Let’s wrap this up with a real-world example: AUD/JPY. If you’re looking for a breakout trade, using the BPI can tell you if this pair is primed for a breakout. Imagine that AUD/JPY has been in a tight range for a while, and the BPI starts moving from oversold levels to bullish. You’re seeing the pair break resistance at the same time, and your BPI indicator is confirming strength. This is your cue to step in, but only after confirmation from your other indicators—maybe a break above a trendline or a MACD cross. So there you have it: using the Bullish Percent Index for breakout trading is like having a backstage pass to the concert that is the Forex market. It helps you time your entries better, understand market sentiment, and avoid some classic pitfalls. To recap: - Use the BPI to gauge whether the market is ripe for a breakout. - Pair it with technical levels, volume, and other indicators for confirmation. - Avoid chasing price, and always manage your risk. And, most importantly, keep the humor rolling. After all, the market’s unpredictable—but with the right tools (and a little laughter), you can keep your trading in check. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

iq Option and ask before you test whatever new.

Now, take note that leverage is risky. In truth, the forex market is unstable, in addition to quite a lot all iq Option other markets. While it's miles proper that nobody can actually inform what the interest price at the 3-months LIBOR is going to be in three months, it is also flawlessly proper that no person sincerely knows at which rate the EURUSD (euro versus US dollar) is going to alternate in three months. Before you begin buying and selling the forex, recognize your dangers and ensure you have a solid trading method that includes as a minimum a few signs and other analysis techniques.

A exact way to practice and complex your foreign exchange strategy is to use a free demo account. Don't worry; top forex agents provide this carrier without cost. It permits you to alternate fictive money before entering into the market for actual. You will even see if the dealer fits your wishes and if the platform it makes use of gives an interface which you like.

Remember that ultimately, there aren't any first-rate foreign exchange agents. You can check which ones are the most used and which of them provide the lowest spreads, highest leverage, and many others. Some web sites offer a score for each broking. Hot the Forex market comes first maximum of the time, in case you need to be in short iq Option resumed on these scores. In the cease, the choice is yours in any case. The first time I study about the Forex market changed into returned in the 90s and it become nothing however some thing like a recreation. I just watch the charts and are expecting with my naked eye where this pair will go subsequent. Did I have any achievement the use of this approach? I tripled my money inside the first three days. Then I hit Margin Call.

Margin Call: Point this is reached while your account has no sufficient finances to open a role of any size.

I commenced to study all along and thought that Forex is something greater than a moving chart.

The first thing I did became to search for the Best the Forex market Broker.

With Best Forex Broker, I mean the subsequent tick list:

1 note

·

View note

Text

Forex Insights You Can’t Afford to Miss The Hidden Gems of Forex News: Turning Market Whispers into Trading Gold In the ever-volatile world of Forex, sometimes the best opportunities are hiding in plain sight—or perhaps just behind the noise of major headlines. Today’s market movement might not have obvious catalysts, but that’s where the magic lies. Let’s break down what’s happening, what it means, and how you can turn it into actionable trading insights—with a dash of humor to keep things interesting. USD: Calm Before the Storm? The USD is holding steady after an early hiccup, leaving traders scratching their heads. No clear catalyst? Welcome to Forex, where the market loves a good mystery. With the DXY bouncing within a tight 106.26-80 range, the real action might kick off with upcoming PPI metrics. Think of it like waiting for your favorite band’s encore—you know it’s coming, and it’ll probably be epic. Key Takeaway: This consolidation phase offers a prime opportunity for scalpers to pounce. Keep an eye on PPI data for the next big USD move. EUR/USD: Treading Water Before the ECB’s Big Reveal The EUR/USD pair is nervously clinging to the 1.05 mark, with traders bracing for today’s ECB rate decision. The consensus? A 25bps rate cut. But whispers of a deeper 50bps cut add an extra layer of intrigue. It’s like watching a thriller where you’re not quite sure who the villain is—but you’re hooked. Hidden Gem: If the ECB surprises with a larger cut, expect EUR/USD to test the lower bounds of its 1.0480-1.0539 range. This could create a lucrative breakout or fake-out scenario—perfect for range traders with tight stop-losses. USD/JPY: Jitters Ahead of the BoJ’s Next Move The yen had a rollercoaster session in APAC trading, briefly showing strength before fizzling out. Reports suggest the BoJ might hold rates steady next week, but with no internal consensus, it’s anyone’s guess. The USD/JPY currently flirts with the 152.86 resistance, making it a hot ticket for those watching for trend exhaustion. Pro Tip: Use Fibonacci retracement levels to identify potential reversal zones. A dip below 151.50 could signal a bearish correction. GBP: Playing It Safe The pound is behaving itself, trading within a modest range as UK-specific drivers remain scarce. Tomorrow’s GDP report is unlikely to shake things up, but Cable’s recent peak at 1.2787 might tempt breakout hunters. Advanced Strategy: If you’re a fan of options trading, this quiet phase could be a great time to consider a straddle strategy, capitalizing on any unexpected volatility post-GDP. AUD: Surprise Star of the Show Who saw this coming? The Aussie dollar is flexing its muscles after an impressive jobs report. Employment figures smashed expectations, and the unemployment rate defied predictions by dropping to 3.9%. AUD/USD reclaimed the 0.64 handle, leaving traders wondering if this rally has legs. Insider Insight: Look for pullbacks to key support levels around 0.6380 as potential entry points for long positions. CHF: Shock and Awe from the SNB The Swiss National Bank sent shockwaves through the market with a surprise 50bps rate cut. With inflation forecasts trimmed for 2024 and 2025, the SNB’s dovish tone opens the door for further interventions. CHF traders, take note: volatility is your playground. Tactical Play: The deeper rate cut could fuel further CHF weakness. Watch for EUR/CHF to breach key resistance levels around 0.98. The Bottom Line: Find Your Edge Forex is a game of inches, where even the smallest edges can make the biggest difference. By staying ahead of the curve with insights like these, you’re not just trading—you’re trading smarter. Dive deeper into the nuances of today’s market, and don’t forget to keep refining your strategies with tools like StarseedFX’s free trading plan and smart trading tools. Ready to level up? The market is waiting. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

What is trading212 Markets?

What is trading212 Markets? Read More http://fxasker.com/question/62025396f49a00a1/ FXAsker

#activtrades web platform#admiral markets sri lanka#ads securities sign up#alpari timezone#APSEC#avatrade instruments#citypoint gym#comments on synergy fx#deltastock metatrader 4#etx capital trailing stop#EXNESS#exness contest#fxpro ecn minimum deposit#fxtm copytrade#hot forex opening times#iforex jpn com#iforex limassol#kawase trading#nordfx indicators#online commodity trading#orbex cysec#tradenext news#TRADING212#windsor homes#windsor police#Futures Trading Brokers

0 notes

Text

Futures Trading - Why Is It For You?

Trade NAIRA

Wikipedia's Reply is: A Futures Market is a monetary market where people can exchange Forex Contracts.Well, what's a Futures Contract?

Trade NAIRA

It's important to Highlight the term Contract. The primary difference between the Forex Market and, say, the stock exchange is the Futures Market transactions contracts, not stocks of inventory. You aren't buying and buying a talk (or part ) of a provider.

It Is fairly straightforward to determine how commodities do the job. An airline, as an instance, agrees to buy 100,000 gallons of gasoline for their airplanes in the present market price, but doesn't take delivery until sometime later on.

Of fuel was 140/barrel along with other airlines had none whatsoever. They'd negotiated Futures Contracts with different oil companies years before when the amount of petroleum was less costly, and waited for delivery before 2007-2008. After the amount of oil is cheap , they will be purchasing Futures Contracts for shipping in 2011/2012.

For Every Futures Contract, there's a level of danger. Futures Contracts leverage threat against the value of their underlying asset.

Southwest Obtained risk. If the purchase price of crude dropped below the cost they paid, they paid more than they ever needed to. Simultaneously, they decreased danger since they believed that the purchase price of oil could go higher compared to price cost. In their situation, the leverage has been rewarding.

Now Examine the oil firms. They decreased danger, believing crude petroleum prices would fall under the price price they negotiated with Southwest. They obtained danger because the purchase price of oil climbed higher than the contract (consequently losing extra earnings they might have earned). In cases like this, their leverage wasn't like it could have been.

Here is Where you stop and say,'' I am not Southwest Airlines. I am a single day dealer. I really don't wish to purchase 100,000 gallons of crude. How do I trade ?

Vast majority of foreign exchange contracts are exchanged, recognized that traders wish to trade foreign exchange exactly like major associations; individual traders would like to leverage their danger too. They also realize that small investors won't risk countless dollars on gallons of gasoline contracts or a lot of wheat. Hence, the CME chose to make an investment environment which would tempt individual investors to exchange currencies.

Bear in Mind, as little investor, you've got a Great Deal of exchanges Available to you for your own trading day. To lure investors to trade foreign exchange, the CME made a market that created other trades moderate in comparison.

First The CME generated emini Futures made specifically for traders. The e in emini means they are traded electronically. You will have a trading platform directly on your desktop computer wherever your transactions visit the CME. The miniature means that the contract is a more compact variant of the specific same contract which the bigger institutions transaction.

The Hottest CME emini is your S&P500. This arrangement is based upon the S&P500 indicator which reflects the top 500 stocks at the NYSE. The S&P500 indicator is price-weighted, therefore a number of those stocks have significantly more weight or"significance" than many others. (bigger businesses can proceed the significance of the indicator lower or higher ).

And you thought trading Futures was only for commodities such as wheat, corn, wheat, crude oil.

Imagine For a minute you could trade each of the top 500 stocks in precisely the exact same moment. That would leverage danger. If one or even two shares didn't function well that day, you'd still have 498 additional shares to trade. It's not necessary to choose any particular stock. Why? Since you're trading all of these. Obviously, it might cost a fortune to have the ability to exchange 500 stocks at the same time.

How

1) The S&P500 emini contract is quite liquid, meaning it has plenty of quantity, and a great deal of action. A great deal of volume means that you may enter and depart immediately, in as little as 1 minute. These days, it isn't unusual to see 3-4 million contracts every day.

2) This type of a Completely digital environment. The CME doesn't have Market Producers who might refuse to meet with your transaction such as the NYSE. The CME publication is FIFO, first initially.

3) Commission to get emini Futures relies upon a Round Trip rather than in-and-out.

4) The S&P500 transactions at 25 cent increments. Pay attention is a little different... in case you gain 1 sign on your commerce, the payoff is $12.50, together with 4 ticks = $50. Evaluate a 1 re - Bid / Request difference without Market Producers with trading NYSE securities where the gap between the Bid and request could be important, particularly when quoted by a Market Maker that makes his living to the spread gap )

5) Trading Emini's way that you're simply seeing 1 graph, the exact same chart, daily, day in and day out. Wouldn't you turn into an extremely hot trader in the event that you just had to see 1 graph? Stock traders typically see a basket of shares simultaneously, flipping graphs forth and back for fear of overlooking any cost action.

6) Fundamentally, There's no research to perform every evening. Bear in mind, you're trading all of"500 stocks" in exactly the exact same moment.

7) Choice traders must be able to properly trade 4 Option traders could be correct and lose on their commerce because time wasn't their buddy and also the option expired worthless until they could earn a profit. Forex traders are just worried about two states: an advancing marketplace or even a declining market. Time decay isn't troublesome for traders.

8) Margin rates are beneficial to traders. To exchange stocks, at the very least you would have to obtain a good deal of 100 stocks. A mean inventory is $25/share$2500 to get from the doorway. Following is a significant difference. The SEC defines a daily commerce for a trade that closed and opened within precisely the exact same trading day. A"pattern day trader" isn't any dealer who implements 4 or more transactions over a 5 day interval. Day trading Futures doesn't have such limitations. A broker account requires much less capital. Most Forex agents permit you to start an account with only $2,500. This opens the trading Marketplace to small investors.

And exchange them"extended" (anticipating the contracts to move up). However, you can exchange futures short (anticipating the contracts to return ). Why? As a day trader, you would like to take complete benefit of the Marketplace's volatility. If you can't brief, then half of trading has been missing to you. In case you need to wait before the Marketplace swings back up so as to go into a trade, then on the trading times once the current market is down 200 points, then that may be a lengthy wait.

10) If You're Trading using an IRA or 401k account, even once you exit a transaction, you do not need to await the transaction to"settle" until you use the exact same money for another transaction. 1 second after you depart your present Futures trade, the exact same cash is available for you for another transaction. With stock trading, even when you exit a trade, you might wait as long as 3 weeks to the cash to repay until you are able to trade with this money .

11) Since this really is Futures trading, rules initially meant for commodities also use to e-mini Futures. Compare this to shares. . .hold a inventory less than 1 year, it's a short-term trade. You have to hold the stock for more than a year to meet the requirements for long-term capital gains. With Forex Currency, your trading has been broken down from the 60/40 rule, even though your ordinary commerce is two minutes or less. In the conclusion of the calendar year, your Forex agent sends you a 1099-b, a 1 liner, a web number of your entire trading, not every individual transaction. The 1099-b will reveal $50,000, that's . Doing your taxes is indeed much simpler as well. Your agent provides you the net entrance, not every transaction. You make only 1 entry in your tax return. Should you trade stocks, then you need to enter each transaction. If you're a day trader and exchange multiple shares, it might take hours to input each of the trades. With Futures trading, then you're finished in a snap.

12) Forex commerce just about Daily, round The single day you can't trade Futures is Saturday.

13) Unlike shares which trade across multiple Exchanges and also have distinct Bid/Ask prices, there's only 1 exchange/1 cost for e-mini Futures and that's about the CME. Meaning for e-mini Futures contracts, there's just 1 cost the posted cost.

14) Your fills are ensured. If you're in a transaction and the e-mini cost goes through your supply, you become filled. This is sometimes an issue for smaller Forex dealers. You might be in a commerce waiting to depart with an offer to market. The Forex contract goes by your cost and you do not get filled. You then examine in fine print in your Forex Brokers contract they don't guarantee matches.

Contract, futures contracts don't expire worthless. You roll your Cash over to the contract, unlike choices that expire worthless

1 note

·

View note

Text

Tips On How To Make Money With Clickbank Explained

Would you like to earn money from Clickbank internet affiliate marketing, with or without a website, Don't panic it's not going to set you back alot on the other hand must warn you when affiliate marketing or Internet guru that desires heading to $1000 with clickbank you have to be willing to place in some effort and strategy that works... Discover my awesome little secret of earning cash clickbank basic.. How to earn more With Clickbank Nigeria, Clickbank Online marketing Programme Clickbank affiliate marketing online works in each and every country and areas of continent that is certainly available to internet that allows you as a possible affiliate to earn money with clickbank promoting many.

Clickbank Nigeria Does clickbank accepts nigerians? Or perhaps is it an online affiliate marketing network generated for a certain gang of experts in affiliate industry? These questions continues to be asked often by crowd that wishes to generate or open account with clickbank in Nigeria. Practical Steps Regarding how to Create And Open Click Checking account In Nigeria Have an internet connection oral appliance proceed by these steps:

The first step: visit Clickbank.com and go through the menu button entirely on clickbank homepage, Step two: Click create account or login on your clickbank account if you have any account together before, Step 3: Complete your account registration by submitting your clickbank account creation details which can include:

• Country • Name • Number • Current email address etc........ Step # 4: Complete the three account creation stage when making or becoming a member of your clickbank account...

1. Information that is personal This is actually the first stage of clickbank affiliate account subscribe that get information regarding you: Eg: Name & Address, Telephone number, Country, Postal code, Age etc.. 2. Banking Information This can be the second stage of making a clickbank affiliate account and yes it contains information regarding: Ways you can get paid, Payment Method, Payment Address etc.... 3. Username and passwords This is the final stage of developing a forex account with clickbank because it requires providing your Clickbank Username, Password so much. When you complete the data, submit and loose time waiting for confirmation and approval on your clickbank affiliate account. So what is now, you've finish creating and subscribing to your Clickbank affiliate account, Lets go making money using clickbank Program Earn money From Clickbank If you wish to make money from Clickbank affiliate easily, listed here is a procedure to look at and work out,

1. Navigate to your clickbank account dashboard ( where every tracking link for the affiliate offers are been recorded ).

2. Select the offer or affiliate network that you might want to advertise from Clickbank ( this maybe travel affiliate products and programs, sports affiliate programs, health affiliate programs, tech and others... Etc ) 3. Proceed by permitting your affiliate link for your product, it is a tiny link which will come in html, when promoting clickbank products always occurs affiliate products link to recieve commission... 6 ways to Promote To make Cash with Clickbank 1. Heating up Products From Clickbank How do you discover a hot products from Clickbank? There's a simple option to finding out hot buyer keyword from Clickbank and one of which is by Market and keyword research...... Utilize Semrush.com and use this method to identify a keyword Employing Semrush To discover Buyer Keyword On Clickbank 1: Get your affiliate programs name on clickbank and visit Semrush.com, Input the product or service name and search to the buyer keyword...... Get Keywords around the affiliate products and programs using the highest amount of searches... Utilization of SEO To generate income With Clickbank Affiliate Products SEO referred to as search engine optimization is a very great way of making money from any online business available, From sales of affiliate products and programs, Surge in ads revenue plus much more.... So, How to Make money using Clickbank Through SEO? Once you've got the keyword with good search volume from semrush, go and write a long Quality contents throughout the keyword and embed your affiliate link for the post.... Take advantage of Seoclerks To rate it on google, should you not know how Seoclerks works, Read My Complete review on Seoclerks. When the keyword appears online first page, you might be surely to acquire affiliate sales and earn some commission..... Earn money With Clickbank With out a Website You can find faster method for you to earn money with internet affiliate marketing the other of these is rolling out the affiliate products and programs with out a website. Here's a simple guide I illustrated on How To Promote Making Money using Affiliate programs With out a Website...... Best Hack To Bank $1000 From Clickbank Or Any Affiliate Marketing Program Have you heard of E-mail marketing and Pinterest Traffic, when two combined the give unimaginable results, Allow me to explain how it really works....... Financial resources are inside the list right? Well you will find heard let me explain further, Email marketing is gradually taking over the net as it's now viewed as among the best method of generating massive income online, • From Getting High Paying Clients • Getting Affiliate Sales Anytime, • And a whole lot via your list...... How will you Earn money from List With Clickbank Starting point is to find a contact marketing strategy called Sendio. Make use of Sendio Marketing via email unit and pay a single time payment gain access to it which lets you send unlimited email in your list.......... The sendio Marketing with email tool also has a 3 pack • Email • Text & • Facebook Messenger in a single dashboard... With Sendio, market in your social media friends and work out great commission through email, text and facebook marketing.... Get Sendio Marketing with email Tool Here Trying to sell Clickbank Using Pinterest Traffic Discover using Pinterest to operate a vehicle traffic to your affiliate link and offers i have to warn you you are missing alot... Pinterest is usually a social media marketing handle that has daily million viewers every day sufficient reason for Pinterest Marketing strategy which may drive plenty of traffic to your web site, surge in affiliate sales and revenue.. Read From this level About Pinterest Marketing device..... Wrapping Up On Making Money With Clickbank Step one is usually to join a clickbank affiliate account, Step 2: Buy the right product by doing keyphrase research for the product using Semrush. 3. Utilize Seo Traffic From Seoclerks and supercharge your affiliate site to 1st page of Google..... 4. Employ Sendio And Pinterest Marketing Tool to get traffic and commission, 5. Keep making steady cash with this process online.... Making money with Clickbank Online marketing requires Product + Traffic = Commission... To read more about How To Make Money online web site: this site.

1 note

·

View note

Text

How To Text women - Deadly Text Message Seduction

When you meet a new girl, you need to begin with an interesting text. You ask her a question, you might feel bad when she doesn't resolve. Think of a single statement that lets her know you remembered her from preceding. You can send her a simple text for "I stood a great time tonight." Another potential text is "Hope you wine basket home right." When you send the text, property owner add your business at the final. If she doesn't have your number the actual world phone, she might neglect the text because she doesn't know the sender. After several dates, it is best to continue trying new things to learn how you can impress a gal on the phone by messaging. Send her texts with flirty messages. If you've already taken your relationship to a sexual level, you deliver your texting to that level of cla as in fact. Make her miss you and prepare her for a hot date by adding sexual but playful innuendoes in your texts be certain that you're great way how to text a girl.Even though texting is really a good way how to impress a girl on the phone, you can apply several texting mistakes that men make when message. Because seo you send her a text that involves her positive emotions (humor, teasing, role reversals, role plays, etc) she will anchor those emotions for you and be conditioned to think about positive emotions towards you (refer to Pavlov's theory). To acquire most from your very own investments, focus on ones with longterm savings. There's no such thing for a foolproof amass wealth strategy, and investments assure fast benefits also carry great problems. A longterm investment will help you arrange in the future, discover gives you peace of mind recognizing which you is only going to be how2txther review rewarded inside long managed. You begin trading in forex from as few as USD200. Even if you is depending on the broker you are opening a new account with. Diane puttman is hoping due on the leverage an angel investor can obtain from the broker makes it possible for such low how2txther. Ask with regards to their return policy, is it fair? levo magazine in your articles receive a lead the money contact information is wrong, buyer cannot be contacted, you may for a good credit rating prospects and receive prospects with 400 credit scores and no income, than you should receive a refund or credit to your account. Can you are this holiday happen? Very either an easy yes or no. Harmless to use it likely that you can travel to Egypt your current resources and events?

2 notes

·

View notes

Text

European Markets Rally Amid US Tech Hangover - Hidden Insights Revealed The Hidden Optimism Driving the Forex Market and What it Means for You Picture this: European markets start the day as flat as a pancake, but somehow, after a few sips of optimism-infused coffee, they begin their climb upwards. That’s how the trading day kicked off in Europe today. It was as if the bourses needed a gentle push from Wall Street’s success yesterday, and suddenly, we were back on track. And honestly, isn't that just trading in a nutshell—waiting for that spark, that nudge, to finally make a move? Despite an initial slow start, European sectors opened with what we’ll call a "mild positive bias." You know, the kind of optimism that’s not quite a cheer, but more of a knowing nod, like a trader who’s just seen a promising chart pattern that they’re not quite ready to bet the farm on—yet. Before long, that sentiment spread, and the markets got a bit of an upward groove on. It’s like a dancer finding their rhythm just after the DJ drops the beat. Suddenly, everyone wants to join in. And here’s where it gets spicy. President Macron and his government survived a vote of no confidence—an event that came and went with all the drama of a canceled soap opera. Traders shrugged, the CAC 40 moved on, and Macron’s team decided they’d rather replace a cabinet member than have the whole country revisit the ballot boxes. Honestly, you can almost picture Macron looking at the situation like someone trying to decide between rewatching a favorite series or doing a full-on Netflix binge with something new. Spoiler alert: he’s rewatching. Across the pond, US equity futures weren't feeling as upbeat. The S&P 500 and Nasdaq futures were nursing a mild hangover from Wall Street’s previous rally—a rally that saw US stocks print fresh record highs, led by those overachieving tech names. You know, the Teslas and Googles of the world, always striving for the top spot like a student who insists on finishing every assignment a week early. Nasdaq’s tech-heavy swagger seems to be leaving a little tension in its wake, as traders nervously keep one eye on tech and the other on their economic calendars. Meanwhile, Foxconn reported a 3.47% year-over-year increase in November revenue. Sure, it’s not the 8.59% they boasted in October, but let’s face it, Foxconn is still growing, and it's hinting that Q4 will be a strong one. It’s kind of like someone who’s been eating super healthy all week, had a cheat day, but knows they're still on track to smash their fitness goals by the end of the month. Good vibes all around. In other noteworthy developments, European antitrust chief Margrethe Vestager has brought up the idea of breaking up Google—again. You’ve got to give it to her: persistence is key. It’s like that friend who keeps trying to fix their ancient laptop rather than buying a new one. In Vestager's world, that fix is splitting up Google, and this time she’s making sure everyone knows it’s still on the table. And if that’s not enough for your "underground news fix," let’s talk about TSMC and Nvidia. The whispers on the street say they’re talking about making Blackwell chips at TSMC’s new Arizona plant. It’s like two big-shot friends planning to open a boutique coffee shop in a trendy neighborhood. Arizona just might be the next Silicon Valley—or at least a pretty hot spot for chip production. For those looking for an edge in Forex, these tech moves are important—because where tech goes, often the broader market follows. The Hidden Patterns in Today’s Market So, what does all of this tell us, really? Beyond the headlines and the superficial noise, there are undercurrents in these movements. Let’s break it down. - Market Sentiment is a Game of Influence: Just like that push from Wall Street gains this morning, sentiment is highly contagious in trading. A small move on one major market can ripple across others, much like an influencer’s trending post that makes everyone else jump on the bandwagon. Don’t underestimate how important it is to keep a finger on the pulse of the big movers. - Contrarian Opportunity? Look Beyond Tech Hype: Nasdaq leading gains might make tech look like the only game in town, but contrarian traders know that when the spotlight’s on one area, there are hidden opportunities elsewhere. Financials, energy, or even utilities—all are worth a second glance right now, particularly if tech falters. - Regulatory Headwinds Are Real: When the EU talks about breaking up tech giants, it’s not just for dramatic effect. Regulatory risk is an ever-present, slow-moving shadow over big tech. Traders need to take this into account, especially when weighing long-term exposure. Where's the Real Edge? You might be wondering, what does all this mean for a trader looking for the next edge? The truth is, it’s all about reading between the lines. Whether it's Foxconn showing resilience amid a broader slowdown, Macron’s attempts at political damage control, or Google’s potential future as a smaller conglomerate, each piece contributes to the bigger puzzle. The key is to see what others miss—those seemingly minor details can provide serious strategic advantages. As always, don’t get caught up in the noise. Look for the hidden trends, the shifts that others overlook, and stay ahead of the game. And if you want exclusive insights and some of those underground trading tactics, you know where to find them. (Hint: Scroll up to those links—we’ve got the tools and community to help you level up.) —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Beverage Filling Tools

They also supply a excessive stage of comfort for purchasers as they are simply available with a wide range of selections in terms volumetric filler machine of greens, fruits and dressings. Therefore, in case you are in a hurry, opening up a bag of leafy greens and pouring a delicious dressing could be the method in which to go.

These are all common clear tools design ideas which are good to bear in mind. However, the filler’s level of hygiene will be dictated by the precise wants of the filling product. Increasing the final sanitary design features of fillers continues to be one other area of improvement. More equipment is incorporating sloped surfaces for elevated drainage and avoiding usage of hollow bodies, which might facilitate product buildup. For merchandise that need particular consideration paid to minimizing microorganisms and making certain meals safety, similar to juices, hot-fill expertise for hygienic bottles shall be wanted. This was the case when Coca-Cola Canners in South Africa started bottling iced tea, sports drinks and juices with and without fruit chunks.

Our self-motivated ardour for perfumes and flavours has led us to invent sensory perceptions and progressive merchandise extra rapidly and repeatedly for our prospects. Options for insulated or steam jacketed tank for warm crammed products, product agitator, and so on. He prides himself in his capability to mobilize synergistic teams via honest communication and empowering his group members to work autonomously. When requested about what clients might anticipate from Jeremy, he responded, My handshake is my forex. I method my purchasers as pals and assure that our interactions will be honest and transparent. N most instances, a tabletop piston or peristaltic filler and accompanying tabletop labeling equipment will pay for themselves within the first a hundred and eighty days of use.

Delivered standard… PLC controls with colour contact screen allow the person to adjust settings similar to velocity, charge time and multi-drop. Loud sounds, ambiguous sounds, moist sounds, all set the player’s imagination working. The creaking of strained metallic, the echoing bang of pipes, and the roar of machinery come together to make the Ishimura a very unsettling place to discover.

Traditionally, blow molding and filling have been two separate manufacturing steps, utilizing compressed air to kind plastic containers. Recently developed LiquiForm know-how combines these processes into one by utilizing volumetric filler machine pressurized liquid to type a inflexible plastic container. Some equipment suppliers have been specializing in configuring machines with one standard HMI system.

Even we're offering Complete Packaging automation line and Tailor made equipment. We are counted amongst the leading names, dealing within the area of technically advanced vary of Rotary Bottle Washing Machines. These machines are acknowledged for correct dimensions and diversified application particular designs. Our machines effectively eradicate germs & dust from the bottles and operate on the rotary precept.

Industries similar to Distilled Spirits must adjust to the strictest laws which makes the volumetric fillers perfectly suited to their industry. These more capable machines are sometimes custom-made by a group of engineers who will work with you to know your calls for and contemplate a selection of factors which we talk about volumetric filler machine throughout the remainder of this article. Naturally, the time and materials required to design and fabricate totally customized filling options comes at a price and it isn't unusual to take a position six figures in a extremely personalized fully automated filling line. Lakewood’s volumetric clamshell fillers are filled by volume versus being filled by weight.

Another even more well-liked system is arranged in a circle with a common dump funnel. This means larger speeds can be achieved or as in the shrimp instance half of the scales can be set to slightly under, and the opposite half for precisely half. The system then scans to see which of the two scales has essentially the most accurate complete weight when combined. In order to hurry up the process of filling we've the stress filling machine. Pressure fillers have a tank on the again of the machine with a valve to maintain the tank full both by a easy float valve or by switching a pump on and off. The tank flood feeds a pump which then feeds to a manifold where a quantity of special overflow filling heads decrease down into the bottle as the pump switches on forcing liquid into the bottles at a speedy price.

1 note

·

View note

Text

Searching for Cross Country Moving Companies Dallas, TX?

Prime 10 Best Dallas TX Piano Movers

MY Pick: Kyle Juszczyk: Kyle had a formidable cross catching efficiency and played a monstrous amount of offensive snaps, which exhibits the value of his run and go blocking. MY Decide: Cam Heyward. You choose what you want and we'll take care of the remainder. Moonchild60— Thanks. I hope your sister is around when i need her. I would not be so afraid to develop previous in this country (which I plan on doing slowly and gracefully), if there could be more people like my sister around. Plan your move to keep away from rush hour. WFAA first reported the potential transfer in March. First Knowledge minimize its full-yr earnings forecast, because of the unfavourable influence of forex fluctuations. After the primary play I instantly needed to play once more and I’m excited to see the completed product after Kickstarter. So in the present day I’m sharing with you my Top 10 video games the I played for the first time at the convention. The advantageous people at BoardGameGeek present a library of games including a number of copies of the latest hot titles from Essen, arduous to search out games that have been lengthy out of print, and pretty much every part in between.

Anyway. It seems very very similar to we're getting the coveted Positional Heroes promo, and based on the teaser and Kraelo's response to the teaser, we're getting them on Friday morning. Wildcat Moving Company has been servicing the greater Dallas Metro since opening our doorways in 2012. Wildcat Movers in Dallas, Texas are specialists in condo, home, office, and storage moving companies. Our clients typically ask themselves “Where can I discover the best Piano Shifting Companies near me? And we never require you to buy additional services to your move. This sadly turned out to be a foul move because most of the original employees wouldn't move to Texas and this finally led to poor design and quality selections by the new employees. Our moving labor will have the ability to rise to the challenge of any move within the Dallas space, and also you won’t should ask your friends to give up their spare time that can assist you with this project. Might it be so we won't cling to the vanities of youth?

Eight years ago from Houston, Texas

Ask friends who have recently moved or submit a request in your social networks

cheap apartment movers dallas

eight years ago from Dallas, TX and Sampran, Thailand

9 years in the past from Washington, USA

Free Shrink Wrap & Padding For All your Furnishings

7 years in the past from upstate, NY

BBB score, that may pack and unpack your furniture and belongings, then contact EkoMovers right now! Robert Bowers, the man accused of killing 11 worshippers in a Pittsburgh synagogue, is expected to seem in a federal courtroom today. Call Wildcat Movers In the present day to get more particulars on our service and pricing. “We don’t get the extent of sponsorships or cash or these issues that we see other chefs get access to,” Patrick says. “I can get a direct flight to London, be in New York or Miami in lower than two hours, and take a weekend journey to Charleston from Nashville,” Epstein said. We still have two prospects playing in their respective CHL convention championship series, and I'll keep you up to date on them, however over the subsequent few months I will be posting write-ups about draft-eligible gamers. 89 to rent 32 cardboard boxes for up to 2 months. After calling back not less than four extra instances (and speaking with not less than three totally different individuals) I was advised there was "no such dimension" packing containers to offer a quote regardless that they had been boxes from Atlas. The biggest catch is if you happen to attempt to gather, say, 6 oranges and there are solely 5 in the provision, all the oranges from all gamers are returned and you then acquire yours.

So what I need to do right here is give a fast breakdown of the prospects at every place, and I'll try to again it up with stats when i can. It isn't that we want anybody to suffer. Most individuals don't desire to consider their coming decrepitude. Just think of the what could possibly be executed with that further money. I look back to when I used to be 50. I didn't think about ten years from then and the way my life may be. Almost ten years in the past an Occasion Planner in Dallas asked my colleague to generate a conference event with a philanthropic factor. New residents in Phoenix, Dallas and San Diego are principally from Los Angeles; Portland’s and Austin’s new residents are largely from San Francisco. The old are on their last hurrah and I think there is much information they'll switch to these before them as they strategy the doorway to heaven!

In India, we glance after our elderly and this isnt much an issue! Thanks for taking the time to be taught more about our moving companies, and we sit up for serving to you transition into your new Dallas dwelling! The fashionable metropolis sits in north Texas and is house to the NFL group Dallas Cowboys. Dodd is a native of East Texas who recently moved to varsity Station but was a prominent name in Dallas for years, working in elite kitchens ranging from The Crescent to Screen Door. The PGA of America's membership is made up of the almost 29,000 PGA professionals who run golf clubs across the nation. Additionally round this time, Pete Townshend from The Who bought a Schecter guitar from his guitar tech and instantly preferred it. The most effective Dallas Moving Company, Full House Shifting, On What To Avoid When Selecting A Moving Company. Every flip you solely have three potential actions—auction a new share of a company, place new train routes, or enhance a tile to increase the worth of companies that run by that tile.

Should you liked this information along with you want to receive more info with regards to best movers dallas kindly go to the website.

1 note

·

View note