#honestly all the news articles say it was about 200 people but i think thats understating by a lot

Explore tagged Tumblr posts

Text

Denver pro-Palestine protestors delayed Pride yesterday and ended up taking over the main stage, and in response, the organizers said they're "collecting community input and evaluating our sponsorships and affiliations," which is huge!!! Criticism of corporate sponsorships at pride is hardly anything new, and yet I've NEVER seen the organizers make a statement like that before. Almost all of the news coverage about the parade mentions the protest!!

I'm just so proud of my community and so hopeful for the future. <3

#im so glad i got to be there!!#there was one guy who stood next to me and was just screaming 'homophobe!' in my ear over and over#but there were really only a handful of those assholes and HUNDREDS of us#honestly all the news articles say it was about 200 people but i think thats understating by a lot#there were a ton of people gathering even early in the morning#we also got cheered on by many of the parade participants#there are more people on our side than weve been led to believe#free palestine#denver pride#palestine

31 notes

·

View notes

Text

Is your home a better investment than the stock market?

Shares 169 Ill admit it: There are times that I think everything that needs to be said about personal finance has been said already, that all of the information is out there just waiting for people to find it. The problem is solved. Perhaps this is technically true, but now and then as this morning Im reminded that teaching people about money is a never-ending process. There arent a lot of new topics to write about, thats true (this is something that even famous professional financial journalists grouse about in private), but there are tons of new people to reach, people who have never been exposed to these ideas. And, more importantly, theres a constant stream of new misinformation polluting the pool of smart advice. (Sometimes this misinformation is well-meaning; sometimes its not.) Heres an example. This morning, I read a piece at Slate by Felix Salmon called The Millionaires Mortgage. Salmons argument is simple: Paying off your house is saving for retirement. Now, I dont necessarily disagree with this basic premise. I too believe that money you pay toward your mortgage principle is, in effect, money youve saved, just as if youd put it in the bank or invested in a mutual fund. Many financial advisers say the same thing: Money you put toward debt reduction is the same as money youve invested. (Obviously, theyre not exactly the same but theyre close enough.) So, yes, paying off your home is saving for retirement. Or, more precisely, its building your net worth. But aside from a sound basic premise, the rest of Salmons article boils down to bullshit.

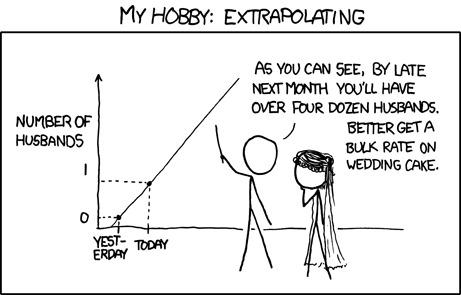

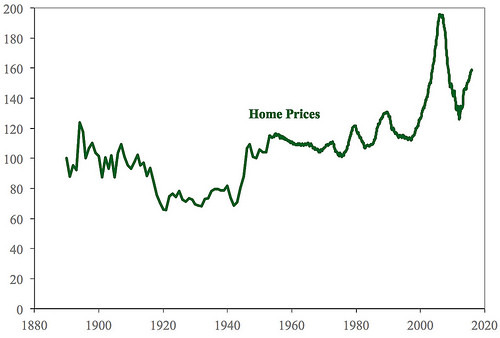

Lying with Statistics Looking past the paying off your house is saving for retirement subtitle on his piece (a subtitle that was likely added by an editor, not by Salmon), we get to his actual thesis: Making mortgage payments can, in theory, be a way to accumulate wealth almost as effectively as contributing to a retirement fund. Im glad Salmon qualified this statement with in theory and almost because this is pure unadulterated bullshit. And its dangerous bullshit. Heres how this logic works: If you buy an urban house today for $315,000 (the average price) and it appreciates at 8 percent a year for the next 15 years, you will be living in a $1 million house by the time you pay off your 15-year mortgage, and you will own it free and clear. Which is to say: Youll be a millionaire. For this to be true, heres what has to happen.: Home prices in your area have to appreciate at an average of eight percent not just this year and next year, but for fifteen years.You have to take out a 15-year mortgage instead of a 30-year mortgage.You need to stay in that house (or continue to own it) for that entire fifteen years.Once youve become a millionaire homeowner, you now have to tap that equity for it to be of use. To do that, you have to sell your home, acquire a reverse mortgage, or otherwise creatively access the value locked in your home. The real problem here, of course, are the assumptions about real estate returns. Salmon spouts huckster-level nonsense: The 8 percent appreciation rate is aggressive, but not entirely unrealistic: Its lower than the 8.3 percent appreciation rate from 2011 through 2017, and also lower than the 9 percent appreciation rate from 1996 to 2007. Thats right. Salmon cites stats from 1996 to 2007, then 2011 to 2017 and completely leaves out 2008 to 2010. WTF? This as if I ran a marathon and told you that I averaged four minutes per milebut I was only counting the miles during which I was running downhill! Or I told you that Get Rich Slowly earned $5000 per monthbut I was only giving you the numbers from April. Or I logged my alcohol consumption for thirty days and told you I averaged three drinks per weekbut left out how much I drank on weekends. This isnt how statistics work! You dont get to cherry pick the data. You cant just say, Homes in some markets appreciated 9% annually from 1996 to 2007, then 8.3% annually from 2011 to 2017. Therefor, your home should increase in value an average of eight percent per year. What about the gap years? What about the period before the (very short) 22 years youre citing? What makes you think that the boom times for housing are going to continue? Long-Term Home Price Appreciation In May, I shared a brief history of U.S. homeownership. To write that article, I spent hours reading research papers and sorting through data. One key piece of that post was the info on U.S. housing prices. Let me share that info again. For 25 years, Yale economics professor Robert Shiller has tracked U.S. home prices. He monitors current prices, yes, but hes also researched historical prices. Hes gathered all of this info into a spreadsheet, which he updates regularly and makes freely available on his website. This graph of Shillers data (through January 2016) shows how housing prices have changed over time:

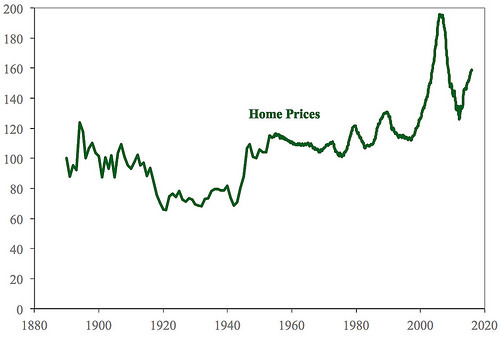

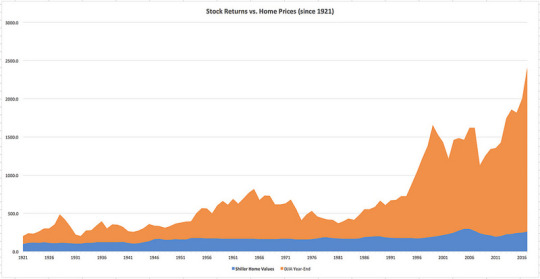

Shillers index is inflation-adjusted and based on sale prices of existing homes (not new construction). It uses 1890 as an arbitrary benchmark, which is assigned a value of 100. (To me, 110 looks like baseline normal. Maybe 1890 was a down year?) As you can see, home prices bounced around until the mid 1910s, at which point they dropped sharply. This decline was due largely to new mass-production techniques, which lowered the cost of building a home. (For thirty years, you could order your home from Sears!) Prices didnt recover until the conclusion of World War II and the coming of the G.I. Bill. From the 1950s until the mid-1990s, home prices hovered around 110 on the Shiller scale. For the past twenty years, the U.S. housing market has been a wild ride. We experienced an enormous bubble (and its aftermath) during the late 2000s. It looks very much like were at the front end of another bubble today. As of December 2017, home prices were at about 170 on the Shiller scale. (Personally, I believe that once interest rates begin to rise again, home prices will decline.) Heres the reality of residential real estate: Generally speaking, home values increase at roughly the same (or slightly more) than inflation. Ive noted in the past that gold provides a long-term real return of roughly 1%, meaning that it outpaces inflation by 1% over periods measured in decades. For myself, thats the figure I use for home values too. Crunching the Numbers Because Im a dedicated blogger (or dumb), I spent an hour building this chart for you folks. I took the afore-mentioned housing data from Robert Shillers spreadsheet and combined it with the inflation-adjusted closing value of the Dow Jones Industrial Average for each year since 1921. (I got the stock-market data here.) If youd like, you can click the graph to see a larger version.

Let me explain what youre seeing. First, I normalized everything to 1921. That means I set home values in 1921 to 100 and I set the closing Dow Jones Industrial Average to 100. From there, everything moves as normal relative to those values.Second, Im not sure why but Excel stacked the graphs. (Im not spreadsheet savvy enough to fix this.) They should both start at 100 in 1921, but instead the stock market graph starts at 200. This doesnt really make much of a difference to my point, but it bugs me. There are a few places 1932, 1947 where the line for home values should actually overtake the line for the stock market, but you cant tell that with the stacked graph. As the chart shows, the stock market has vastly outperformed the housing market over the long term. Theres no contest. The blue housing portion of my chart is equivalent to the line in Shillers chart (from 1921 on, obviously). Now, having said that, there are some things that I can see in my spreadsheet numbers that dont show up in this graph. Because Felix Salmon at Slate is using a 15-year window for his argument, I calculated 15-year changes for both home prices and stock prices. Ill admit that the results surprised me. Generally speaking, the stock market does provide better returns than homeownership. However, in 30 of the 82 fifteen-year periods since 1921, housing provided better returns. (And in 14 of 67 thirty-year periods, housing was the winner.) I didnt expect that. In each of these cases, housing outperformed stocks after a market crash. During any 15-year period starting in 1926 and ending in 1939 (except 1932), for instance, housing was the better bet. Same with 1958 to 1973. In other words, if you were to buy only when the market is declining, housing is probably the best bet if youre making a lump-sum investment and not contributing right along. Another thing the numbers show is that youre much less likely to suffer long-term declines with housing than with the stock market. Sure, there are occasional periods where home prices will drop over fifteen or thirty years, but generally homes gradually grow in value over time. The bottom line? I think its perfectly fair to call your home an investment, but its more like a store of value than a way to grow your wealth. And its nothing like investing in the U.S. stock market. For more on this subject, see Michael Bluejays excellent articles: Long-term real estate appreciation in the U.S. and Buying a home is an investment. Final Thoughts Honestly, I probably would have ignored Salmons article if it werent for the attacks he makes on saving for retirement. Take a look at this: If youre the kind of person who can max out your 401(k) every year for 30 or 40 years straight disciplined, frugal, and apparently immune to misfortune then, well, congratulations on your great good luck, and I hope youre at least a little bit embarrassed at how much of a tax break youre getting compared to people who need government support much more than you do. Holy cats! Salmon has just equated the discipline and frugality that readers like you exhibit with good luck, and simultaneously argued that you should be embarrassed for preparing for your future. He wants you to feel guilty because youre being proactive to prepare for retirement. Instead of doing that, he wants you to buy into his bullshit millionaires mortgage plan. This crosses the line from marginal advice to outright stupidity. Theres an ongoing discussion in the Early Retirement community about whether or not you should include home equity when calculating how much youve saved for retirement. There are those who argue absolutely not, you should never consider home equity. (A few of these folks dont even include home equity when computing their net worth, but that fundamentally misses the point of what net worth is.) I come down on the other side. I think its fine good, even to include home equity when making retirement calculations. But when you do, you need to be aware that the money you have in your home is only accessible if you sell or use the home as collateral on a loan. Regardless, Ive never heard anyone in the community argue that you ought to use your home as your primary source of retirement saving instead of investing in mutual funds and/or rental rental properties. You know why? Because its a bad idea! Shares 169 https://www.getrichslowly.org/home-investment/

0 notes

Text

Fort Worth Texas Cheap car insurance quotes zip 76112

"Fort Worth Texas Cheap car insurance quotes zip 76112

Fort Worth Texas Cheap car insurance quotes zip 76112

BEST ANSWER: Try this site where you can compare quotes: : http://financeandcreditsolution.xyz/index.html?src=tumblr

RELATED QUESTIONS:

""What is the best Health insurance, with good maternity coverage?""

I would like to get insurance before I get pregnant because I know they won't give it to you when you're pregnant. So I would like to know who has the best coverage, hospital, pre-natal....etc! Would really like to hear from mothers, and there experience with the providers!!!! Thanks in advance""

Best value car/insurance for a new driver (teenager)?

Hey Ive just started taking driving lessons (im 17), and am hopefuly gonna buy my first car soon. I'll probaly just get a second hand one from the paper, but, is there that much difference in the insurance cost with the different cars (like, if i buy a Vauxhall Cora will it be more expensive in insurance than if I get a Ford Focus etc etc). Also, how much will I be looking to pay for for insuance? Im hoping its no higher than 500 a year, as I dont have a ton of money. Thanks""

The minimum amount your auto insurance must cover per accident is?

The minimum amount your auto insurance must cover per accident is in california?? A. $15,000; 30,000; 5,000 B. $10,000; $25,000; $5,000 C. $20,000; $25,000; $15,000 D. $5,000; $15,000; $10,000""

Are insurance rates higher if you have a lien on the auto?

I heard they charge more if you have a lien on your car and was wondering if this is true?

Cheap insurance for a sixteen year old girl on suzuki 124cc maurder?

living in limerick ireland

Switching car insurance from old to new car?

Forgive me if this is a stupid question.. I currently have insurance coverage on a 2004 car and just purchased a 2013 car. I am going today to switch over my insurance (if possible) and would like to know what to expect before I go. I automatically assumed my insurance would go up because of the year difference, but a friend of mine recently switched her policy over from a 2000 to a 2007 and her policy did not go up, so now i'm questioning if mine would go up and what would cause it to vary. Thanks!""

Car insurance help?

Ok so im about to turn 16. my parents said they would get me a car, but only if i paid my own insurance. can u please tell me how much it would be a month. and what company would be the lowest price. i dont know if u need this info but. im 16. white ( someone told me it matters?), i live in florida (palm beach county), and the car will probably be an audi a4. can u please give me an average amount a month so i know what my goal to save up is.""

What is the cheapest company for a 17 year Old's car insurance in the UK?

I am 17 and looking around on sites the car insurance is around 2500 but this is too expensive for me, if I was to get car insurance I would probably drive a ford fiesta or something like that.""

How will the Affordable Care Act impact part-time and full-time employees?

So I get that employees working 30+ hours, and where there are 50+ employees, have to be offered health insurance, lest the company get a fine, but I'm not sure how that will work ...show more""

What car is the lowest cost for insurance for a 18 year old male driver (2 years Driving)?

Just curious what is the least expensive to cover for those of you in the insurance industry

What is deal with the new obamacare insurance plans?

Is it really mandatory for one to purchase an insurance plan? And does it really cost about 20k? I read an article from a website that has some interesting articles... http://www.naturalnews.com/038905_Obamacare_health_insurance_mandate.html There are a lot of things I dislike about this country and this just really set me off... Not specially things you would expect... More like what is allowed on food, in food, medical prescriptions taking over preventive care, the idiotic media like honey boo boo, ignorance and how people explain our government needs to change in a way to be like a backwards theocracy and such and I could go on for quite a while... I would like to move away from this country if not I'll seriously live in isolation somewhere away from this society... I really need opinions and your comments my just prove or disprove my thoughts even more.""

How do I find health insurance if I have been told we are uninsurable?

I am asking this question for my m-in-law. Retired early, had extensive back surgery, f-in-law has diabetes and possible heart issues. Going to be coming off of COBRA in California, and are looking for health insurance. Aren't there health insurances like Medicaid/Care that cover hard to insure people that are in > 50yr age group?? What if they change their residency from Calif. to Texas?? Does it matter??""

Where can I find information about a career in Insurance Sales ?

Where can I find information about a career in Insurance Sales ? Which of the three fields ( life, health, or property ) would be compatible with working from my home office ? How difficult is the California State exam to get licensed ? Is it possible to earn residual income in all 3 fields ? Thank you for your help.""

What will happen if I don't have health insurance?

What will happen if I don't have health insurance?

Are VW Passats affordable cars to insure?

By affordable I mean are they good in crash tests and other factors like that which effect insurance?

How much will it cost to add a 17 year old female to my insurance plan as a driver with the car in my name?

I'm supposed to be added on my 38 year old sister's insurance with Nationwide tuesday. I have to pay for my part, I hope its not over 150 but definitely not 200.""

Where to find cheap auto insurance in florida?

We are relocating to port richey florida and I am trying to find a cheap auto insurance company

Do you have health insurance?

if so, how much is it per month? How old are you? what kind of deuctable do you have? feel free to answer also if you do not have insurance.""

How much would an insurance be a month for a 01 lexus Is300 for a guy thats 18 and first time driver..average?

How much would an insurance be a month for a 01 lexus Is300 for a guy thats 18 and first time driver..average?

Are car insurance quotes free?

i just want to know

Can I be insured on my mums car insurance if I don't live with her?

Hi I moved out 3 months ago and I have been put on my mums insurance while I have my provisional licence I will be getting my own car soon and i was wondering if I can still be on her insurance if I still won't be living there ? Thanks Billie x

How can I price/estimate what my car insurance payment will be if I don't currently have a car?

I live in New Jersey. I haven't EVER had my own car insurance although when I was in high school I was on my parents' insurance. I am a 28 year old female. Thanks all!!!

How much is motorcycle insurance in california?

Im 19 years and im planning on buying a 2012 yamaha r6 as my first bike (no experience) I am going to take a MSF course. Anyways how much would motorcycle insurance cost me?

Help looking for health insurance for college student in California?

I'm a 20 year old living in California and I'm trying to get health insurance. My previous one in PCIP is dissolved and I'm trying to get enrolled into Covered California, but I got locked out and can't reach anyone there due to high call volumes. I'm looking for an alternative but I have no idea where else to search. I'm looking into Kaiser, Blue Cross etc. but I'm not sure what to do.. Can someone please help me?""

Car Insurance increased? what to do next?

My car insurance company had increase my insurance by 2 folds (103%) increase. I contacted the company, enquired about this increase. But they said they cant do anything about it, If I want I can raise this with the customer service chief and chief executive. I wrote them a letter stating it was ridiculous amount of money, they asking me to pay. Also clearly brought to their notice, that I have a clean history, no claim, paid insurance on time, no accidents, and I have no claim discount of 7 years in total. The companies chief executive has replied me in a letter stating, unfortunately, the post code where is stay is subjected to recent increase and personal injury claims from post code area has gone up. So nothing he could do. But I replied him saying, I lived in the same place for more than 5 years. But still no good. Regards to this, I email Watch Dog, explaining the same a month ago. Still no reply or correspondence from them. Now I am stuck, I do not what to do. Honestly, I only brought this care for 500 in very good condition and it is still the same. But my insurance is more twice the value of my car. Please somebody tell , what can I do next. This is really ridiculous amount and unacceptable whatsoever. Thanks in advance.""

Fort Worth Texas Cheap car insurance quotes zip 76112

Fort Worth Texas Cheap car insurance quotes zip 76112

16 year old car insurance?

Im a 16 year old boy and am looking to buy my first car. How much more will insurance cost on average if i buy a 2 door car as opposed to a 4 door? I am thinking of buying a 1997 Toyota Celica or a 96-01 Acura integra either 2 door or 4. I am going to take drivers ed too because i know that lowers your rates. I also have 4 A's and 3 B's in school.

How much would my car insurance on Porsche?

Hey I am 21 and passed my test last week. I am thinking of either buying a BMW Z4 or a Porsche Boxster [yes i know they are expensive] It will be a new one. I did not know but people were telling me it would cost thousands...really???? Considering that aren't that big. If my dad has a car i can't get on his policy but drive a different car???? Help...how do i make this cheaper.. I am not worried so much right now if it costs thousands but its going to be with me for atleast a few years and i will not know my position then.

Buying health insurance for the first time?

I'm looking to buy health insurance, but not sure what type to get. I'm very healthy and have no children so it would be just for myself. Should I do a co-pay plan? HMO or PPO? Not sure.""

""In California, are you required to have health insurance for your child if your job offers family insurance?""

1. In California, are you required to have health insurance for your child if your job offers family health insurance (medical, dental and vision) for you and your child? 2. does the court require you to sign up your child through your workplace's health insurance (family plan)? note: I am a noncustodial parent""

Can i pay Car Insurance with cash without using bank account? (or any other methods?)?

I am hoping to purchase car in a few days, im a new driver. Unfortuantley my account has been closed due to overdraft, i have bad credit. other than a pay as you go credit card.., is there any other methods of payments possible excluding a bank account (in the uk)? Thanks""

""Where are some companies in Memphis,Tn I can find cheap auto insurance?""

Where are some companies in Memphis,Tn I can find cheap auto insurance?""

How much would an insurance premium rise if you has 2 speeding tickets?

Now, I am considering adding myself to my husbands policy(for his car). I went 15 years without a single ticket, and then this past year I recieved two speeding tickets within 6 months. I was only going 5 mph over on one, and 7 mph on the other. Will the agent factor this in, or is speeding, speeding no matter how fast..It was NOT fast enough to be consdered wreckless driving. Neither of us have ever had an accident...(thank you lord!) Alos- How long does it take for tickets to come off your record? And are they also basing premiums off credit? I have good credit, so could that help the speeding issue?""

Car Insurance HELP? which would be cheaper?

im not asking for a PRICE,but which out of these 3 cars do you THINK would be cheaper on insurance for me. I am a new driver,I have good grades ( good student discount ) and Im going under my moms insurance. -2004 pontiac grand prix -2006 chevrolet impala -2006 pontiac G6 I dont need any websites to find cheap car insurance i just need opinions on which you think will be cheaper and why thanks! = )""

What does full auto insurance cover?

hi, i bought a 2005 saturn on sat. i am tryng to get insurance quotes, so what i need to know what exactly does full coverage include? details please!! NO RUDE ANSWERS!!!""

Where i can find the cheapest car insurance rates for my 18 year old daughter? What I've seen so far is 2 $$$$

Where i can find the cheapest car insurance rates for my 18 year old daughter? What I've seen so far is 2 $$$$

Collision claim - will your insurance go up?

I hit a pole the other day with the side of my truck. There were no other cars involved and there are just a few scratches and one big dent. If my insurance company (Allstate) pays to fix it under my collision coverage will my rates go up? I know I have to pay the deductable - just wondering if my monthly payments will be higher.

Responsible Insurance company won't pay up.?

Long story short. Not my fault. The guy backed into my car. It was parked to sell it. So no insurance policy on it. My BF and I were sitting in the car out of the rain writting out a new for sale sign. The car vibrated like crazy when we drove it to move it back to my place. The guys insurance company didn't even check the alignment or add it to the estimate. The other estimates don't even include the alignment. There could be more damage. I decided to get cash to another car. I have not signed anything yet or recived the check. My car is worth about 2K. It wouldn't be worth it to fix it. Insurance Company $1013.76 Auto Body Shop $1162.00 Ford Dealership $1284.90 Les Schwab Alignment $90.00 361.14 difference. I asked to raise their quote. The Insurance company said no. If I had go to an auto body repair shop of my choice with 1013.76 they would call and ask for them to kick down more money. I am going to notify the insurance company that in writting that I am taking them to small claims court. Any ideas on the letter that I submitt? My BF and I were injured. The medical people are refusing to bill the insurance company responsible. They wanted me to pay up front and get rembursed later or have some other insurance cover it. I didn't want to wait. I used my work health insurance. So they are getting the bill. Any way I can get the Car insurance company billed?

Insurance for people who do not have a car?

Are there any insurance for people who do not have a car?

So I'm looking into buying a Honda Element but I want to know how much insurance n gas n all that would be?

Help please lol and if overall if its worth it

Motorcycle insurance?

Anyone have any idea on the cost on motorcylce insurance.. I'm 26 clean record..Thinking about getting a new yamaha cruiser 600-700cc

Car insurance__________________?

How much do you pay for car insurance? (in a year), mine is going to expire in november (november, 30) when I am supposed to go to the agency to renew it? Can I go for example on november 1st?""

Would I need car insurance before purchasing a used car from a private dealer?

I'm 18, I'll be 19 by the time I purchase my first car & I was wondering do I need car insurance before I buy the vehicle. I've never done this before so I have no idea how this works.""

Is there anyone who insures motorcycles just for theft? dont need other coverage...?

Hey I have my 08 r6 being insured for 166 every 6 months but it doesnt cover theft. I got various quotes and nobody will do theft without doing full coverage. the difference is literally 10 times the cost. They want $320 a year without but with full coverage (aka theft) it is $3200 which is absolutely ridiculous. I was wondering if there was any insurance agencies out there who offer bike insurance (being only theft insurance)

Will the premium for my car insurance go up ? =(?

Hi, I live in Connecticut and I just began having insurance under my name about 4 months ago. Recently a guy hit me and damaged my car but when I tried to get his insurance to pay for it he lied about the whole thing and the police report stated both our stories so I was denied liability. Now my insurance company has to pay for the damages which come out to around 2400 dollars. I was wondering if my premium will go up next time I renew... I already pay $2700 a year and am worried =(""

Roughly how much is insurance for a 17 year old female?

Just wondering how much it would cost per month for a 17 year old girl with a very cheap car?

What are the pros and cons of cancer insurance?

Please help I'm am writting a research paper nd I need help for cancer insurance ..

""If you crash a car whilst test driving it, is it covered by insurance?""

If you're buying a second hand car from a private owner and you already have comprehensive insurance from another car, or if the owner has comprehensive insurance but isn't driving, would either policy cover this? And what if the driver doesn't have any insurance at all because if they buy it this will be their first car?""

How do you know how much insurance to take when you buy car insurance?

How do you know how much insurance to take when you buy car insurance?

17 year old male car insurance?

I am due to take my practical driving test in the near future and have been doing some research, hopefully (fingers crossed) i pass my test and all goes well there and i obtain my full uk license, but on websites like gocompare etc i pretended i had passed my test already to see what the quotes would be like, so i used a 1995 clapped out renault clio (1.2) and used my dads details as the proposer including his maximum amount of No Claims Bonuses with me as the 1 extra named driver, and it came up as 3500+!!!!!! so i took me out and it would only cost my dad 200 a year, and plenty of my friends drive around in flashy cars on their parents policies so they say, i mean how the f*** does anybody afford to insure anything?! Im just wandering if there is any point now because it seems a waste of money if i wont have a car. Many thanks for your answers :)""

Im a 29 single mother of 4 I was wondering should I get whole life insurance or term?

I dont know which one is the better choice at my age

Fort Worth Texas Cheap car insurance quotes zip 76112

Fort Worth Texas Cheap car insurance quotes zip 76112

Looking for cheap health insurance website for students?

Hello there! I'm a student and I need some suggestions, I'm looking for an affordable college student health insurance plan. There are many sites but I'm scared because I think some of them are scams. I'm looking for a cheap price. Please tell me a good one.""

Cheapest place to insure a peugeot 106 1.1 or a peugeot 106 quiksilver?

Im getting pissed off with the prices of inurance for my car the cheapest i can get it is 3200 fully comp (third party is more money for some reason?!?) and ive tryed all these compare websites and they are utter bollocks i might aswell not have passed my bastard driving test with these prices, i may have to wait another year for my insurance to go down. Btw im 19 year old and have been passed 4 month, can anyone help me im sick of ******* looking at insurance websites, thanks""

I bought a car week ago and i get insurance from AIG it costs me $850 for 6 months(full coverage)?

does anybody know cheaper one i am first time driver and my car new toyota scion XA 2006 thanks i really need cheaper one

How much cheaper is health insurance in Texas?

Does anyone have data, did Tort reform lower health insurance costs? I mean isn't texas having a surplus or perhaps a surge of doctors since passing such law? Let's prove to the liberals this works by using the facts for a change.""

Where can i find cheap car insurance?

Im 18 and male and all the quotes i've looked at are coming back from 3000 to 7000, does anyone know where i can get it under 3000?""

What are 3 reasons why insurance rates are higher for driver's under the age of 25?

What are 3 reasons why insurance rates are higher for driver's under the age of 25?

How can I convince my dad that leasing a cheap car would be a good decision given my circumstances?

Ok. So I'm about to be 18 and have about $1,400 saved up towards a car, should be getting a few hundred more after graduation and from a few other things, so I expect to have around $2,000 in the summer. This is what I was planning on spending on a down payment on a cheap used car. For the monthly note and insurance, my parents said that they'll help at least some until I get a job. The thing is, it's seriously impossible to get a job in my town. I've been trying for a couple years and just nothing. Most other people I know - not just teenagers - are having the same problem. Because of this, my parents are worried that having to pay for so much and me pay for basically just the down payment would be too much on them. They're struggling very hard financially and haven't bought a car themselves in 13 years. So I was looking at some car websites the other day and noticed that some of them had really appealing lease deals. The ones that most caught my attention were $0 down, and then a monthly payment of around $200 or less per month for three years. What really interested me about that deal is the no down payment, because if there's no down payment and they pay for the monthly note, then that's the only thing they have to pay, at least for quite a while. That leaves me with around $2,000 still in pocket to spend over time on insurance, gas, various maintenance costs, etc., plus if there are too many hidden fees, etc. in the lease. (My dad got me an insurance quote and it was a lot lower than I expected btw, about $560/yr.) That seems so much better than having to start back at $0 after buying the car having paid all the rest on the down payment. I just don't wanna spend that much down because then I'm left with nothing, if I can't get a job then I have no way to pay for everything, again my parents don't think they can pay too much. If they only have to pay the monthly note, then I still have quite a while to get a job and start making money before that couple thousand runs out and if I do eventually get a job (hopefully it'll be easier in another city, but I need a car in order to move), I can even help them with the monthly payments or pay all of them. But all they can say is, Why lease a car when you can buy one, you'll just be stuck in the same spot in three years. But this is completely missing the point. The problem here is that if I spend everything down, then I have nothing left to maintain the car with, and therefore can't have a car at all. I have no steady source of income and can't make a steady source of income without a car. But if I can afford to maintain a car for at least several months with money I already had and can later get a job in a bigger city, I at least have some car, regardless of whether not I own it or it's the best and wisest financial decision in the long run. Once I have a car I can move to a bigger city and hopefully go to college and then get a better job, I'm sure I can get another car later. So basically, if I want a car now (which I need one in order to advance my life and go to college and such) the only possible way is if I lease instead of buy, unless I suddenly come into a bunch of money or can find a car for sale with no down payment. I need to just do whatever I have to do to have a car and get by at the moment, but my parents won't let me. They're so stuck in their stubborn ways that leasing cars is always a waste of money (I agree that it'a a waste of money, but again that's not the point here, the point is that I need a car) when in this situation it would work much better for me. But they refuse to let me.""

Estimate for Auto Insurance on a 18 year old Living in GA driving a Mitsubishi Lancer GTS 20k?

In Janurary of 08 i am going to get a New Mitsubishi Lancer GTS. I already know how much my monthlly payments are going to be the car is 20 grand. I Live in GA and was wanting to know around how much would insurance be if im 18 years old driving a new car. It would have to be full coverage and right now my family has Allstate. Can anyone give me a reasonable Estimate? Thank You.

Insurance for my mom & me?

so say if my mom goes to get her permit could she get a insurance policy then list me as the main driver on it ? i have my licenses but i am only 17 and i can take out my own policy so could this happen ? i live in ny and since i am not 18 could this work for my mom to get her permit & get car insurance policy since she is old ?

Question about delaying the individual mandate portion of the Affordable Healthcare act.?

Since the Affordable Healthcare Act is based primarily on the individual mandate, if the mandate is delayed by 1 year, what happens to those who have already lost their current health ...show more""

How much was your insurance co-pay for your hospital stay to deliver a baby?

...assuming you have good health insurance.

How much did your car AND insurance cost?!?

I need to do an independent survey for my maths GCSE and i need to know how much your car cost and how much it cost to insure it. Need aout 50 answers overall. 30 at least. Please answer, thankyou!""

How does a wrecked car loan payoff (by insurance company) affect credit score?

I have a car that I have a loan on that has been wrecked. Since the bank owns the car, I have full coverage & insurance is writing it off. They are going to cut a check to the bank for the balance due on the car. I have so far paid this loan on time; it has been rebuilding my credit. When the loan is paid off by insurance, will I get more points to my score since the loan was technically paid off early? Or will I only gain based on my status as paid ontime at this point?""

I have already asked if i can get car insurance without license someone said put it in my name is that the car

put car in my name or insurance in my name?

How much do you think my car insurance would be/added on to my mother's insurance?

I'm 18 and just now getting my license. My car is a 2001 Ford Focus ZX5 that I bought for $2500. My mom is going to add me to her insurance which is $50 per month (I know that is outrageously cheap I'm so jealous lol). I just want a loose loose estimate because I'm also in college so I'm only working 15 hours a week at minimum wage.

How much would yearly insurance cost for a 16 year-old dirver with a mitsubishi eclipse?

How much would yearly insurance cost for a 16 year-old dirver with a mitsubishi eclipse?

Republicans: If your wife or mother died of breast cancer due to Blue Cross terminating her insurance on a?

flimsy excuse, how would you react? This is exactly what happened in California and several women died due to lack of treatment. As a Republican, would you Glad Hand the exectutive responsible for increasing profits, just take the court settlement and start your life over, or would you hunt down the exectutive responsible for her death and avenge it?""

Can you recommend a cheap insurance company?

I'm seventeen and currently learning to drive. (I'll hopefully be getting a Peugeot 206 or Renault Clio etc) Can anyone recommend somewhere that has CHEAP car insurance? Most places are quoting me 2000!!!! AHHHH On a price comparison site the cheapest quote was from Quinn Direct (700-800). Is this a good company or can you suggest other companys. (PS I live in N Ireland so local places please) Thanks in advance for answering :)

How much does insurance cost for Top gear?

I need to find out how much Top Gear have to pay for there insurance for driving fast cars etc. Or how much will Jeremy Clarksons Insurance be? Hope you can help :)

Named non owner insurance- Florida?

It is possible to get a named non owner car insurance in Florida with damage and collision? We usually rent cars in Florida, and we pay a lot of money for CDW and liability, we are looking this kind of solution.""

Anyone in pennsylvania know of an affordable dental plan that covers everything?

Does anyone have good dental insurance for a fair monthly price? I need something that covers crowns root canals check ups fillings and xrays. I don't really know where to start. ...show more

The best insurance company to work for?

I'm looking for a job in the insurance industry and curious what company offers the best potential for a good income? over six figures the first year is my target and looking to pursue sales.

I got a no insurance ticket so I bought insurance less then an hour after.?

The date on the ticket is the same date my insurance started. Anybody know what the outcome might be?

Car insurance for a 16 year old?

I am getting my g2 (I'm in Ontario) soon, and would like to purchase my own car. I can go through my parents insurance, but I couldn't be a secondary driver as there would be 3 cars in the house. Could I put it under my grandfathers name and be a secondary driver? Or just get insurance by myself? How much should I expect to pay? I have done drivers ed if that helps. Thanks !""

What's the average insurance coast monthly for a Lambo convertible?

What's the average insurance coast monthly for a Lambo convertible?

Fort Worth Texas Cheap car insurance quotes zip 76112

Fort Worth Texas Cheap car insurance quotes zip 76112

Ok I don't udersrtand why for car insurance!?

I add my own details on car insurance, no accidemts etc and my quote is 190. i add my partner as an extra driver with a speeding fine and it goes down to 152""

Health insurance for a pregnant college student?

Okay, so my baby is due in August, and that will be in between semesters. so the only way that my parents insurance will cover me is if I am still considered a full time student, which means I'd have to be enrolled in the next fall semester. By then my baby would only be a month old, and my university is 4 hours away from my mom. so my question is: what other ways could i get health insurance? is there a good online school that i could do, and would i be considered a full time student if i took online classes? and/or what companies offer health insurance benefits and what do you have to do to be eligible? thanks!""

""Insurance,if I buy a car and get my dad to registered keeper and owner and he insures it wi me as main driver?""

Is this legal their is a space on go compare ask n who the main driver would be ive got dr10 ins10 twice lc20 All from 2008 so cheapest quote is 5k. My dad also has his car too with 8 yrs no claims so idea is to insure my car registered in his name with the 8 yrs no claim s wi me as main driver and insure his car without no claims bonus got a quote on go compare 1000 for my car wr dad as registered keeper me as main driver and he would have to pay on his own car with no claims bonus not on should still b cheaper than , ,5k help!""

Where can I get pit bull insurance in Ohio??? What does it cost??

Where can I get pit bull insurance in Ohio??? What does it cost??

Ticket for no proof of insurance?

in california best friend got a ticket for no proof of insurance at the time of accident, he doesnt have insurance i know everyones gonna write about that but how can he fix the ticket? he didnt know that his insurance was canceled his dad who lives out of state pays. ive read other questions on YA and one said u can take proof of insurance to the clerk before the court date (the judge) and they will disregard the ticket? if the insurance card says that hes covered from 6/30/09-6/30/10 would the clerk check to see if hes paid?""

Car Insurance Calculator?

Im looking for a car insurance calculator so i can see how much this car would cost to insure should i end up getting it. Im only 17 so calling a car insurance company i would rather stay away from and idk what company my parents are even with But is there a calculator that doesnt require a ton of steps and just lets me put in what car i have and some basic questions about stuff that affects a 17 year old. Calculators i have been looking at ask for like house payments and monthly income ect and im 17. I dont have any of that. So any good and easy calculators to see if this car is too expensive to buy?

Will my disbalitiy insurance through medicaid get shut off if i get married?

Will my disbalitiy insurance through medicaid get shut off if i get married?

Do you pay insurance on a lease car in the UK?

im 18 and looking to get my first car would a lease car be a cheaper option for me as i have been told in unsureness that its all included in the price but would i still have to pay separate insurance on the car? if so what would be the cheapest option? a lease car or buying a cheap car? thanks

Where can i get the cheapest car insurance in marion ohio?

Where can i get the cheapest car insurance in marion ohio?

How much is auto insurance ?

i live in Edmonton Alberta and i am getting my license in 5 weeks and my car in 6 so i was just wondering how much is average auto insurance

How can i insure my car for 1?

just read somewhere on this site that you can insure a car for 1 surely this is a load of uncle tom cobbler? would be very impressed if someone can answer this question... seeing as my car is only worth 500 why should i be expected to pay almost that in insurance? it would get written off any way should i ever claim. cos being an olde banger insurance cost for parts and availability not as easy and quick to get.

How much should we expect from her insurance?

a friend and i had an accident on Thursday, we were going on two different motorcycles and a woman never saw us and she cut our way and we ended up hitting her pretty bad, the motorcycles are totaled. one of us had a dislocated shoulder and a strained knee, the other one was hospitalized for three days, he ended up having a broken rip, blood in the skull, and damaged spine. this accident was the woman's fault so my question is how much should each of us expect from her insurance? should we hire a lawyer?""

How much would insurance be for sports car?

ill be 17 soon so im looking for a car and i loveeee this purple sports car but i heard it makes your insurance even higher... about how much do you think it would it be?

Can I cancel my auto insurance because I am leaving the country for 3 months?

I am leaving the USA for 3 months so I was wondering if it would be possible to cancel my auto insurance for these months and not pay the monthly premium. I will not be driving the ...show more

""Hi, this is my first time getting contact lenses, i just wanna know where can I find an affordable price?""

I have called a few optometry clinics already but the price is just not satisfying; it was around $350.00 for a year (including eye exam). I would like to know if there is any other place that would do it for cheaper. By the way, I live around San Gabriel, CA. Please recommend optometry clinics located around me(less than 20mins drive), I would appreciate it.""

How much is car insurance for a first time teenage driver?

How much is car insurance for a first time teenage driver?

Whe will liberals admit the affordable health care act has made health care and health insurance?

More expensive already?

Does anyone know the cost of insurance on a classic beetle? 1972 for an 18 year old girl.?

Im 18, ive got a 1972 1303 Classic Beetle Does anyone know how much it would be for me to get insured on it as a legal driver? Im a girl btw, or would it be cheaper on my dads insurance? or would i not be fully comp??""

""California Life and Health Insurance, How can i Lower my Insurance rates?""

California Life and Health Insurance, How can i Lower my Insurance rates?""

""When it comes to your car insurance, when is it cheaper to let your kids get their licences?

is it smarter to wait until they are 18; if they get their licence before they are 18 do your rates go up higher or lower then if they waited until they're 18.

What is mortgage insurance?

When having somebody co-sign for a morgage with no $$$ down, how does mortgage insurance work? 1) Is it required? 2) Is it permanent? 3) Is it like a car insurance policy - where the money is paid, and if the insurance is never 'claimed' then the money is gone? 3.5) Does a mortgage insurance payment go towards the principle price of the house?""

Affordable insurance for children in Texas?

Does any one know of any insurance for children living in Texas? I had medicaid for my children; but, got disqualified because of a vehicle that we recently purchased. Our income really stinks. But, we never thought that it would affect us. But the resources count against us.""

Do i need car insurance?

i am turning 16 soon and i am wanting to buy a cheap truck that's about $1500. I wont be able to afford insurance since i will have to be on my own insurance plan and it would be about $200 a month. since i wont care about the truck if it gets damaged and since its so cheap i didn't know if their is a way i could just get like liability or something? also I live in missouri. Thanks

Help me about my car insurance please?

I havnt paid my car insurance for 4 months but I have enough money to pay it in a few days. I just got the letter that they cancelled myinsurance . I'm wondering if I pay the remaining balance, could i stay at the car insurance company?""

I heard of Homeowners insurance being called...?

fire insurance and hazard insurance. are they the same?? or how are they different?

Fort Worth Texas Cheap car insurance quotes zip 76112

Fort Worth Texas Cheap car insurance quotes zip 76112

https://www.linkedin.com/pulse/how-much-would-insurance-2012-porsche-carrera-4s-anthony-sweet/"

0 notes

Text

Is your home a better investment than the stock market?

Shares 169 Ill admit it: There are times that I think everything that needs to be said about personal finance has been said already, that all of the information is out there just waiting for people to find it. The problem is solved. Perhaps this is technically true, but now and then as this morning Im reminded that teaching people about money is a never-ending process. There arent a lot of new topics to write about, thats true (this is something that even famous professional financial journalists grouse about in private), but there are tons of new people to reach, people who have never been exposed to these ideas. And, more importantly, theres a constant stream of new misinformation polluting the pool of smart advice. (Sometimes this misinformation is well-meaning; sometimes its not.) Heres an example. This morning, I read a piece at Slate by Felix Salmon called The Millionaires Mortgage. Salmons argument is simple: Paying off your house is saving for retirement. Now, I dont necessarily disagree with this basic premise. I too believe that money you pay toward your mortgage principle is, in effect, money youve saved, just as if youd put it in the bank or invested in a mutual fund. Many financial advisers say the same thing: Money you put toward debt reduction is the same as money youve invested. (Obviously, theyre not exactly the same but theyre close enough.) So, yes, paying off your home is saving for retirement. Or, more precisely, its building your net worth. But aside from a sound basic premise, the rest of Salmons article boils down to bullshit.

Lying with Statistics Looking past the paying off your house is saving for retirement subtitle on his piece (a subtitle that was likely added by an editor, not by Salmon), we get to his actual thesis: Making mortgage payments can, in theory, be a way to accumulate wealth almost as effectively as contributing to a retirement fund. Im glad Salmon qualified this statement with in theory and almost because this is pure unadulterated bullshit. And its dangerous bullshit. Heres how this logic works: If you buy an urban house today for $315,000 (the average price) and it appreciates at 8 percent a year for the next 15 years, you will be living in a $1 million house by the time you pay off your 15-year mortgage, and you will own it free and clear. Which is to say: Youll be a millionaire. For this to be true, heres what has to happen.: Home prices in your area have to appreciate at an average of eight percent not just this year and next year, but for fifteen years.You have to take out a 15-year mortgage instead of a 30-year mortgage.You need to stay in that house (or continue to own it) for that entire fifteen years.Once youve become a millionaire homeowner, you now have to tap that equity for it to be of use. To do that, you have to sell your home, acquire a reverse mortgage, or otherwise creatively access the value locked in your home. The real problem here, of course, are the assumptions about real estate returns. Salmon spouts huckster-level nonsense: The 8 percent appreciation rate is aggressive, but not entirely unrealistic: Its lower than the 8.3 percent appreciation rate from 2011 through 2017, and also lower than the 9 percent appreciation rate from 1996 to 2007. Thats right. Salmon cites stats from 1996 to 2007, then 2011 to 2017 and completely leaves out 2008 to 2010. WTF? This as if I ran a marathon and told you that I averaged four minutes per milebut I was only counting the miles during which I was running downhill! Or I told you that Get Rich Slowly earned $5000 per monthbut I was only giving you the numbers from April. Or I logged my alcohol consumption for thirty days and told you I averaged three drinks per weekbut left out how much I drank on weekends. This isnt how statistics work! You dont get to cherry pick the data. You cant just say, Homes in some markets appreciated 9% annually from 1996 to 2007, then 8.3% annually from 2011 to 2017. Therefor, your home should increase in value an average of eight percent per year. What about the gap years? What about the period before the (very short) 22 years youre citing? What makes you think that the boom times for housing are going to continue? Long-Term Home Price Appreciation In May, I shared a brief history of U.S. homeownership. To write that article, I spent hours reading research papers and sorting through data. One key piece of that post was the info on U.S. housing prices. Let me share that info again. For 25 years, Yale economics professor Robert Shiller has tracked U.S. home prices. He monitors current prices, yes, but hes also researched historical prices. Hes gathered all of this info into a spreadsheet, which he updates regularly and makes freely available on his website. This graph of Shillers data (through January 2016) shows how housing prices have changed over time:

Shillers index is inflation-adjusted and based on sale prices of existing homes (not new construction). It uses 1890 as an arbitrary benchmark, which is assigned a value of 100. (To me, 110 looks like baseline normal. Maybe 1890 was a down year?) As you can see, home prices bounced around until the mid 1910s, at which point they dropped sharply. This decline was due largely to new mass-production techniques, which lowered the cost of building a home. (For thirty years, you could order your home from Sears!) Prices didnt recover until the conclusion of World War II and the coming of the G.I. Bill. From the 1950s until the mid-1990s, home prices hovered around 110 on the Shiller scale. For the past twenty years, the U.S. housing market has been a wild ride. We experienced an enormous bubble (and its aftermath) during the late 2000s. It looks very much like were at the front end of another bubble today. As of December 2017, home prices were at about 170 on the Shiller scale. (Personally, I believe that once interest rates begin to rise again, home prices will decline.) Heres the reality of residential real estate: Generally speaking, home values increase at roughly the same (or slightly more) than inflation. Ive noted in the past that gold provides a long-term real return of roughly 1%, meaning that it outpaces inflation by 1% over periods measured in decades. For myself, thats the figure I use for home values too. Crunching the Numbers Because Im a dedicated blogger (or dumb), I spent an hour building this chart for you folks. I took the afore-mentioned housing data from Robert Shillers spreadsheet and combined it with the inflation-adjusted closing value of the Dow Jones Industrial Average for each year since 1921. (I got the stock-market data here.) If youd like, you can click the graph to see a larger version.

Let me explain what youre seeing. First, I normalized everything to 1921. That means I set home values in 1921 to 100 and I set the closing Dow Jones Industrial Average to 100. From there, everything moves as normal relative to those values.Second, Im not sure why but Excel stacked the graphs. (Im not spreadsheet savvy enough to fix this.) They should both start at 100 in 1921, but instead the stock market graph starts at 200. This doesnt really make much of a difference to my point, but it bugs me. There are a few places 1932, 1947 where the line for home values should actually overtake the line for the stock market, but you cant tell that with the stacked graph. As the chart shows, the stock market has vastly outperformed the housing market over the long term. Theres no contest. The blue housing portion of my chart is equivalent to the line in Shillers chart (from 1921 on, obviously). Now, having said that, there are some things that I can see in my spreadsheet numbers that dont show up in this graph. Because Felix Salmon at Slate is using a 15-year window for his argument, I calculated 15-year changes for both home prices and stock prices. Ill admit that the results surprised me. Generally speaking, the stock market does provide better returns than homeownership. However, in 30 of the 82 fifteen-year periods since 1921, housing provided better returns. (And in 14 of 67 thirty-year periods, housing was the winner.) I didnt expect that. In each of these cases, housing outperformed stocks after a market crash. During any 15-year period starting in 1926 and ending in 1939 (except 1932), for instance, housing was the better bet. Same with 1958 to 1973. In other words, if you were to buy only when the market is declining, housing is probably the best bet if youre making a lump-sum investment and not contributing right along. Another thing the numbers show is that youre much less likely to suffer long-term declines with housing than with the stock market. Sure, there are occasional periods where home prices will drop over fifteen or thirty years, but generally homes gradually grow in value over time. The bottom line? I think its perfectly fair to call your home an investment, but its more like a store of value than a way to grow your wealth. And its nothing like investing in the U.S. stock market. For more on this subject, see Michael Bluejays excellent articles: Long-term real estate appreciation in the U.S. and Buying a home is an investment. Final Thoughts Honestly, I probably would have ignored Salmons article if it werent for the attacks he makes on saving for retirement. Take a look at this: If youre the kind of person who can max out your 401(k) every year for 30 or 40 years straight disciplined, frugal, and apparently immune to misfortune then, well, congratulations on your great good luck, and I hope youre at least a little bit embarrassed at how much of a tax break youre getting compared to people who need government support much more than you do. Holy cats! Salmon has just equated the discipline and frugality that readers like you exhibit with good luck, and simultaneously argued that you should be embarrassed for preparing for your future. He wants you to feel guilty because youre being proactive to prepare for retirement. Instead of doing that, he wants you to buy into his bullshit millionaires mortgage plan. This crosses the line from marginal advice to outright stupidity. Theres an ongoing discussion in the Early Retirement community about whether or not you should include home equity when calculating how much youve saved for retirement. There are those who argue absolutely not, you should never consider home equity. (A few of these folks dont even include home equity when computing their net worth, but that fundamentally misses the point of what net worth is.) I come down on the other side. I think its fine good, even to include home equity when making retirement calculations. But when you do, you need to be aware that the money you have in your home is only accessible if you sell or use the home as collateral on a loan. Regardless, Ive never heard anyone in the community argue that you ought to use your home as your primary source of retirement saving instead of investing in mutual funds and/or rental rental properties. You know why? Because its a bad idea! Shares 169 https://www.getrichslowly.org/home-investment/

0 notes

Text

Is your home a better investment than the stock market?

Ill admit it: There are times that I think everything that needs to be said about personal finance has been said already, that all of the information is out there just waiting for people to find it. The problem is solved. Perhaps this is technically true, but now and then as this morning Im reminded that teaching people about money is a never-ending process. There arent a lot of new topics to write about, thats true (this is something that even famous professional financial journalists grouse about in private), but there are tons of new people to reach, people who have never been exposed to these ideas. And, more importantly, theres a constant stream of new misinformation polluting the pool of smart advice. (Sometimes this misinformation is well-meaning; sometimes its not.) Heres an example. This morning, I read a piece at Slate by Felix Salmon called The Millionaires Mortgage. Salmons argument is simple: Paying off your house is saving for retirement. Now, I dont necessarily disagree with this basic premise. I too believe that money you pay toward your mortgage principle is, in effect, money youve saved, just as if youd put it in the bank or invested in a mutual fund. Many financial advisers say the same thing: Money you put toward debt reduction is the same as money youve invested. (Obviously, theyre not exactly the same but theyre close enough.) So, yes, paying off your home is saving for retirement. Or, more precisely, its building your net worth. But aside from a sound basic premise, the rest of Salmons article boils down to bullshit.

Lying with Statistics Looking past the paying off your house is saving for retirement subtitle on his piece (a subtitle that was likely added by an editor, not by Salmon), we get to his actual thesis: Making mortgage payments can, in theory, be a way to accumulate wealth almost as effectively as contributing to a retirement fund. Im glad Salmon qualified this statement with in theory and almost because this is pure unadulterated bullshit. And its dangerous bullshit. Heres how this logic works: If you buy an urban house today for $315,000 (the average price) and it appreciates at 8 percent a year for the next 15 years, you will be living in a $1 million house by the time you pay off your 15-year mortgage, and you will own it free and clear. Which is to say: Youll be a millionaire. For this to be true, heres what has to happen.: Home prices in your area have to appreciate at an average of eight percent not just this year and next year, but for fifteen years.You have to take out a 15-year mortgage instead of a 30-year mortgage.You need to stay in that house (or continue to own it) for that entire fifteen years.Once youve become a millionaire homeowner, you now have to tap that equity for it to be of use. To do that, you have to sell your home, acquire a reverse mortgage, or otherwise creatively access the value locked in your home. The real problem here, of course, are the assumptions about real estate returns. Salmon spouts huckster-level nonsense: The 8 percent appreciation rate is aggressive, but not entirely unrealistic: Its lower than the 8.3 percent appreciation rate from 2011 through 2017, and also lower than the 9 percent appreciation rate from 1996 to 2007. Thats right. Salmon cites stats from 1996 to 2007, then 2011 to 2017 and completely leaves out 2008 to 2010. WTF? This as if I ran a marathon and told you that I averaged four minutes per milebut I was only counting the miles during which I was running downhill! Or I told you that Get Rich Slowly earned $5000 per monthbut I was only giving you the numbers from April. Or I logged my alcohol consumption for thirty days and told you I averaged three drinks per weekbut left out how much I drank on weekends. This isnt how statistics work! You dont get to cherry pick the data. You cant just say, Homes in some markets appreciated 9% annually from 1996 to 2007, then 8.3% annually from 2011 to 2017. Therefor, your home should increase in value an average of eight percent per year. What about the gap years? What about the period before the (very short) 22 years youre citing? What makes you think that the boom times for housing are going to continue? Long-Term Home Price Appreciation In May, I shared a brief history of U.S. homeownership. To write that article, I spent hours reading research papers and sorting through data. One key piece of that post was the info on U.S. housing prices. Let me share that info again. For 25 years, Yale economics professor Robert Shiller has tracked U.S. home prices. He monitors current prices, yes, but hes also researched historical prices. Hes gathered all of this info into a spreadsheet, which he updates regularly and makes freely available on his website. This graph of Shillers data (through January 2016) shows how housing prices have changed over time:

Shillers index is inflation-adjusted and based on sale prices of existing homes (not new construction). It uses 1890 as an arbitrary benchmark, which is assigned a value of 100. (To me, 110 looks like baseline normal. Maybe 1890 was a down year?) As you can see, home prices bounced around until the mid 1910s, at which point they dropped sharply. This decline was due largely to new mass-production techniques, which lowered the cost of building a home. (For thirty years, you could order your home from Sears!) Prices didnt recover until the conclusion of World War II and the coming of the G.I. Bill. From the 1950s until the mid-1990s, home prices hovered around 110 on the Shiller scale. For the past twenty years, the U.S. housing market has been a wild ride. We experienced an enormous bubble (and its aftermath) during the late 2000s. It looks very much like were at the front end of another bubble today. As of December 2017, home prices were at about 170 on the Shiller scale. (Personally, I believe that once interest rates begin to rise again, home prices will decline.) Heres the reality of residential real estate: Generally speaking, home values increase at roughly the same (or slightly more) than inflation. Ive noted in the past that gold provides a long-term real return of roughly 1%, meaning that it outpaces inflation by 1% over periods measured in decades. For myself, thats the figure I use for home values too. Crunching the Numbers Because Im a dedicated blogger (or dumb), I spent an hour building this chart for you folks. I took the afore-mentioned housing data from Robert Shillers spreadsheet and combined it with the inflation-adjusted closing value of the Down Jones Industrial Average for each year since 1921. (I got the stock-market data here.) If youd like, you can click the graph to see a larger version.

Let me explain what youre seeing. First, I normalized everything to 1921. That means I set home values in 1921 to 100 and I set the closing Down Jones Industrial Average to 100. From there, everything moves as normal relative to those values.Second, Im not sure why but Excel stacked the graphs. (Im not spreadsheet savvy enough to fix this.) They should both start at 100 in 1921, but instead the stock market graph starts at 200. This doesnt really make much of a difference to my point, but it bugs me. There are a few places 1932, 1947 where the line for home values should actually overtake the line for the stock market, but you cant tell that with the stacked graph. As the chart shows, the stock market has vastly outperformed the housing market over the long term. Theres no contest. The blue housing portion of my chart is equivalent to the line in Shillers chart (from 1921 on, obviously). Now, having said that, there are some things that I can see in my spreadsheet numbers that dont show up in this graph. Because Felix Salmon at Slate is using a 15-year window for his argument, I calculated 15-year changes for both home prices and stock prices. Ill admit that the results surprised me. Generally speaking, the stock market does provide better returns than homeownership. However, in 30 of the 82 fifteen-year periods since 1921, housing provided better returns. (And in 14 of 67 thirty-year periods, housing was the winner.) I didnt expect that. In each of these cases, housing outperformed stocks after a market crash. During any 15-year period starting in 1926 and ending in 1939 (except 1932), for instance, housing was the better bet. Same with 1958 to 1973. In other words, if you were to buy only when the market is declining, housing is probably the best bet if youre making a lump-sum investment and not contributing right along. Another thing the numbers show is that youre much less likely to suffer long-term declines with housing than with the stock market. Sure, there are occasional periods where home prices will drop over fifteen or thirty years, but generally homes gradually grow in value over time. The bottom line? I think its perfectly fair to call your home an investment, but its more like a store of value than a way to grow your wealth. And its nothing like investing in the U.S. stock market. For more on this subject, see Michael Bluejays excellent articles: Long-term real estate appreciation in the U.S. and Buying a home is an investment. Final Thoughts Honestly, I probably would have ignored Salmons article if it werent for the attacks he makes on saving for retirement. Take a look at this: If youre the kind of person who can max out your 401(k) every year for 30 or 40 years straight disciplined, frugal, and apparently immune to misfortune then, well, congratulations on your great good luck, and I hope youre at least a little bit embarrassed at how much of a tax break youre getting compared to people who need government support much more than you do. Holy cats! Salmon has just equated the discipline and frugality that readers like you exhibit with good luck, and simultaneously argued that you should be embarrassed for preparing for your future. He wants you to feel guilty because youre being proactive to prepare for retirement. Instead of doing that, he wants you to buy into his bullshit millionaires mortgage plan. This crosses the line from marginal advice to outright stupidity. Theres an ongoing discussion in the Early Retirement community about whether or not you should include home equity when calculating how much youve saved for retirement. There are those who argue absolutely not, you should never consider home equity. (A few of these folks dont even include home equity when computing their net worth, but that fundamentally misses the point of what net worth is.) I come down on the other side. I think its fine good, even to include home equity when making retirement calculations. But when you do, you need to be aware that the money you have in your home is only accessible if you sell or use the home as collateral on a loan. Regardless, Ive never heard anyone in the community argue that you ought to use your home as your primary source of retirement saving instead of investing in mutual funds and/or rental rental properties. You know why? Because its a bad idea! https://www.getrichslowly.org/home-investment/

0 notes