#home loans in patna housing loans in patna home loan patna home finance in patna housing finance companies in patna best home loans in patna

Text

Best Gold Loan Rate Per Gram Provider in Odisha Today - Maafin Loan

Gold Loan in Karnataka & Patna - Lowest Gold Loan Interest Rate Bihar

Lowest Interest Rate Gold Loan Odisha - Best Gold Loan Provider Bihar

Get Lowest Interest Rate Gold Loan Bhubaneswar - Manappuram Asset Finance

Used Vehicle loan Interest Rate in kerala - Maafin Vehicle Loan

Avail Gold Loan with Lowest Interest Rate in TamilNadu & Kerala

Get Housing loan at Lowest Interest Rate in Kerala - Maafin Home Loan

Best Gold Loan Provider Company - Apply for Instant Gold Loan

#Gold Loan Patna#Lowest Interest Rate Gold Loan#Gold Loan Bhubaneswar#Gold Loan Per Gram#Gold Loan Interest#Vehicle Loan#Gold Loan Rate Today#Gold Loan In Karnataka#Karnataka Gold Loan Interest Rate#Gold Loan Tamilnadu#Lowest Gold Loan Interest Rate In Tamilnadu#Gold Loan Kerala#Housing Loan Kerala#Vehicle Loan Kerala#Vehicle loan interest rate in kerala

0 notes

Text

5 Reasons Why You Should Invest In A 'Luxury' Home

What's a better time to invest in real estate than the festive season, also considered to be an auspicious time to start a new venture or buy a new property. We suggest if you've got the right budget and finances in place then invest in a 'Luxury' home of your choice. It's not just a good option for investment but also for dwelling purposes as it offers you to experience a lavish lifestyle with a plethora of amenities. Here are 5 reasons why you should invest in a 'Luxury' Home as your next asset:

1.Festive Time

Festive season comes with a great number of discounts reeled out by real estate agents on a wide range of properties. Take advantage of these offers, and if you've got the funds then invest in a property of your choice. The discounts are not just limited to property prices but banks also come up with varied offers on home loans. We highly recommend making the most of this period and buy a luxury home that too at an affordable rate from a top real estate company in Patna, Bihar.

2. A Great Investment

If you plan to buy a luxury home as an asset then we're sure you can get some wealth out of it as well. Investing in high-end real estate can be very beneficial if you buy an existing luxury property, remodel it, and resell it for profit. Another way to go about the same would be renting it out for vacations, so if you buy a luxury home in a prime location then renting out could be a great option. A luxury independent house for sale in Patna, Bihar can be a great investment, to begin with when it comes to renting.

3. If You Desire An Unparalleled Living Experience

The best part about luxury homes is that they come with an array of premium amenities and facilities to ensure that you have an ultra-modern lifestyle. The majority of properties will have plush amenities like a fully-equipped swimming pool, skywalk, yoga center, salons, in-house shopping center, multipurpose hall, lounge area, and more. The more the amenities, the more desirable it gets.

4. Technologically Advanced

From 24/7 security equipped with a 3-tier security system and CCTV surveillance to remote-controlled window shutters, solar generators to multi-level parking, lifts, escalators, home theaters, and more. Innovation goes a long way when it comes to making living experiences grander in luxury homes.

5. A Posh Neighborhood

One of the major benefits of housing one's family in a luxury home is that it comes with a great neighborhood too. High-end real estate projects are also constructed keeping a suitable environment in mind so families can socialize and dwell within an influential community. Such projects often form a society with a particular culture and education suitable for children to grow up in.

#residential building construction services patna#flats for sale in patna#villas for sale in patna#budget houses for sale in patna#independent house for sale in patna'#homes for sale in patna bihar#2 bhk flat for sale in patna#3 bhk flat for sale in patna#4 bhk flat for sale in patna#new flats for sale in patna

0 notes

Text

Why Purchasing a Flat is better in Patna?

The capital city of Bihar, Patna, has started growing vertically at an exponential rate on account of residential complex, commercial spaces, shopping malls, recreational centers, etc. Population Outburst, Limited Land and high land cost are some of the factors that have forced such growth and made many real estate developers enter the market. Previously, choosing a flat as dwelling was more a compulsion rather than a choice, but nowadays, flats are more preferred because of their facilities, amenities, security, luxury and comfort. Still now, owning an individual house may be more preferred choice, but less feasible. Let’s check the reasons why purchase a flat is smarter than buying an individual house.

Advantage of Flat or Apartments:

1. More options, more offers:

If you’re looking for a flat, you have a lot of choices and offers to choose the best one while comparing the location, facilities and price. You can purchase a luxurious flat with unmatched services and facilities at an affordable price on which you can’t even think of purchasing a plot at that location. So option of flats comes with more offers and affordable prices.

2. More Saftey and Security:

In residential complexes, you can avail of more security and safety of being within a gated community. Most of the residential complexes have their own security staff, norms and rules that provide their residents the utmost security at a shared cost. You can just lock your flat and go out without much worry. In case of personally owned house, you can’t leave it all alone relying on government security facilities. I hope, you read newspaper daily.

3. Self Sustainable:

If you choose a flat, by virtue it comes with more neighbors and households in your society that attracts a lot of local business to develop nearby. Nowadays, most of the township projects have all the utility centers on the campus itself. These make flats to create a self-sustainable community where you don’t require going to any other place for your basic market needs. While if you purchase a plot in newly proposed planning, it will take time to get developed.

4. More Amenities and Facilities:

Now apartments come with additional amenities like a swimming pool, gymnasium, clubhouse, sports complex, Spa and much more. Owning such amenities and facilities at individual house is far from the reach of the majority of the population as it’s very expensive.

5. Easy Maintenance:

Residential Complexes have many service providers like plumber, electrician, sweeper, etc. as there is more business in a shared community. It will benefit you in getting any repair or maintenance work at discounted rate. In case of individual home, you have to search and call any serviceman which is more time consuming and expensive.

6. Easy Loans and Finance:

Getting loans or Finance for an apartment is much easier than for an individual house. Most developers have direct contact with loan or finance providers that make availing finance much easier while if you choose to construct a home, you will only get a part of total cost for construction that also after a laborious process.

7. Better Complain Redressal:

As apartment resident associations have a large number of members that makes their voice to be heard more speedily by civil agencies in case of any issue. Also, complaint redressal is speedy and responsibly. In the case of individual complains, it may happen that you haven’t get heard that fast.

8. More Appreciation:

Selling or buying an apartment or flat is much quicker than an individual home. Moreover, the appreciation amount in the value is commensurate with the initial investment that one makes. Apartments/Flats have a higher return on investment.

I hope, these reasons are convincing to opt for a flat than an individual home. If you are looking for home, consider Saakaar Aquacity – the most luxurious, affordable and modern township of Patna by Saakaar Constructions – the leading construction company of India.

0 notes

Link

DHFL is one of the best housing finance companies in Patna. It provides best home loans at attractive & affordable interest rates with flexible repayment options which are tailored to best suit your needs.

0 notes

Link

DHFL provides best home loans in Patna at attractive & affordable interest rates with flexible repayment options which are tailored to best suit your needs.

0 notes

Link

DHFL provides various types of home loans in Patna with flexible repayment options & affordable rate of interest.

0 notes

Link

DHFL provides a number of attractive home loan types in Patna with approachable customer care unit, flexible repayment option & affordable home loan rates.

0 notes

Link

DHFL provides various types of home loans in Patna with flexible repayment options & affordable rate of interest.

0 notes

Link

DHFL provides various types of home loan in Patna to fulfil your dream of having own house with flexible repayment options & affordable rate of interest.

0 notes

Text

Best Gold Loan Rate Per Gram Provider in Odisha Today - Maafin Loan

Gold Loan in Karnataka & Patna - Lowest Gold Loan Interest Rate Bihar

Lowest Interest Rate Gold Loan Odisha - Best Gold Loan Provider Bihar

Get Lowest Interest Rate Gold Loan Bhubaneswar - Manappuram Asset Finance

Used Vehicle loan Interest Rate in kerala - Maafin Vehicle Loan

Avail Gold Loan with Lowest Interest Rate in TamilNadu & Kerala

Get Housing loan at Lowest Interest Rate in Kerala - Maafin Home Loan

Best Gold Loan Provider Company - Apply for Instant Gold Loan

#Gold Loan Patna#Lowest Interest Rate Gold Loan#Gold Loan Bhubaneswar#Gold Loan Per Gram#Gold Loan Interest#Vehicle Loan#Gold Loan Rate Today#Gold Loan In Karnataka#Karnataka Gold Loan Interest Rate#Gold Loan Tamilnadu#Lowest Gold Loan Interest Rate In Tamilnadu#Gold Loan Kerala#Housing Loan Kerala#Vehicle Loan Kerala#Vehicle loan interest rate in kerala

0 notes

Text

Stock Broker

Investment is about wealth preservation, while trading is about wealth creation. We help you in making both of these, possible

Most likely, you came to this page in search of cheapest brokerage, or low-cost brokerage or in search of a firm that gives you best rates in futures, options, commodity or equity trading…but have you ever considered to search for the most trusted brokerage firm, a firm with the most successful and successful performance in futures, options, commodity or equity trading?

An online share trading platform that can open you a demat account within the time It takes to make yourself a cup of coffee? A stock broker that is THE BEST when it comes to Research? If your answer is YES to All…You’ve come to the right place.

Importance and Advantages of having a full-service Stock Broker

A Full-service broker brings you the best of wealth-making experience and research advisory, and through their insights, helps a trader and investor device the best trading and investing practices. At Swastika, we offer personalised services to our patrons and investors, irrespective of whether they are an HNI (High Net-Worth Investors) or Early stage/beginner investor.

We offer the investors and traders have stock advisory, access to various IPO, share market, industry and sector reports that will help you understand the share market and generate handsome returns.

With a one-window stock broker like Swastika, you gain access to our full suite of investment options such as mutual fund, FPO, IPO, loans products, debt instruments, in futures, options, commodity or equity trading and insurances. Our dedicated relationship manager ensures personalized service to you and guide you at every step of their financial journey.

Our seasoned investors and traders who trade in higher volume and need a higher margin, we never hesitate and offer him appropriately high margins, unmatched among the leading brokerage houses.

Swastika Investmart is the top stock broking & Trading Company. We are Offering Online Share Brokers, Demat account, lowest brokerage account, Mutual Fund, IPO, & NBFC. We offer Stock Brokers for Shares & securities trading at lowest stock brokerage rates. As specialized stockbroker, also called a Registered Representative, investment advisor or simply, broker, we have an expert team of professionals & individuals who execute, buy and sell orders for stocks and other securities through a stock market at lowest stock brokerage rates. Partner with Swastika Investmart, one of the Best Stock Brokers in Indore, Madhya Pradesh and India that’s offering valuable insights on share market and commodity trading. We provide Top Online Share Brokers, Best brokers to trade and Special Promotion and offers for ProStocks.

Swastika Investmart Ltd is Providing best Online Trading system for stock trading in NSE BSE MCX NCDEX Mutual Funds and safely invest in shares. Online account opening available. Click Here to Open a Demat Account. We work as discount broker offering the lowest, cheapest brokerage rates in the industry. We offer option trading, commodity brokerage, futures trading, brokerage services in India.

We provide wealth management services to help investors find the best stock broker. Hassle Free Investment · Paperless Account opening · Simplified Equity Trading | Types: Online Trading A/C, Trade in Stocks, Mutual Funds, Currency Trading, SIP, Trade in Shares. We provide Investment Banking, Wealth Management, Investment service shares, Corporate Finance, Equities, news, and analysis on equity / stock markets, sensex, nifty etc. We are the leading online stock/share broking and trading company in India in Stock Market (BSE and NSE of India) offers buying & selling of stocks/shares, equity broking, investing in IPO's & mutual funds and all market updates on SENSEX, BSE, NSE, Nifty, commodities, derivatives, and much more. Start trading online in Indian Share Market with Swastika Investmart - A leading brokerage firm in India; get live updates on stock prices, news & research reports. For the best stock broker services, Try Swastika Investmart Ltd to manage your Wealth Profile. Click here to open an account or feel free to Contact Us

Swastika offers live online share/stock market trading account, demat account, IPO, SIPs, mutual fund recommendations, tips, updates in India. Open trading account today and check our detailed analysis with a simplified online trading system. Invest in equities, derivatives, mutual funds, derivatives and many more under one roof. Trade with us today! Stay on top of the stock market, trade in shares and derivatives, create multiple personalised market watch and also invest in Mutual Funds & do DIYSIP in shares & ETF in couple of minutes.

A person willing to trade in stock markets needs to have a trading account. A trading account is a way to do buy and sell transactions in stocks. Swastika is India's leading stock broker firm which offering online share trading at lowest brokerage rates. Swastika Investmart Ltd is an online stocks and shares market trading company in India. Here you can buy shares online and trading on the equity share capital. Swastika Investmart Ltd online stocks and shares market trading company in India. Here you can buy shares online and trading on the equity share capital.

Swastika helps its clients in trading in share and equity market to gain huge profits with minimizing the risk factors in Share trading in India. Swastika Investmart Ltd has clients all over India and in cities like Mumbai, New Delhi, Hyderabad, Bangalore, Chennai, Ahmedabad, Patna, Kolkata etc. Our Stock market trading advisors are committed for best stock market technical analysis and provide training course on shatr market trading in India.

We at Swastika Investmart Ltd help our clients gain the extraordinary growth of their investments by giving them Quality premium stock option tips, Future stock tips, Intraday call-put option tips, Nifty Tips and commodity tips as per our clients requirements in India. Our professional and experienced equity / stock market tips provider advisors provide training on stock market technical analysis, online technical analysis course for beginners and experienced share market trading people in India.

Trading in stock market in India involves huge risk and people often are unaware of these risks which causes the loss of their hard-earned money. Swastika Investmart Ltd provides the smarter way to trade in stock market. We have designed the course and tips which comprises of stock tips for today, stock tips for tomorrow, intraday stock tips, future stock tips, daily stock tips, nse stock tips etc. Try Swastika Investmart Ltd to manage your Wealth Profile. Click here to open an account

Online Trading in Share Markets is simple with Swastika Investmart Ltd. Trade Online in Stocks, Commodities, Futures, Currencies & Options online with Online Trading by opening a Demat Account (Click here to Open a DEMAT ACCOUNT). Buy & sell Stocks, Commodities, Futures, Currencies & Options with Online Trading by Swastika Investmart.

Online Trading with Swastika enables you to trade in Equity, Derivatives and Currency Derivatives with the best Financial Experts and Research Firm in India. Trade online on your own schedule with Online Trading in Stocks, Commodities, Futures, Currencies, Equity, Derivatives and Currency Derivatives. Start online trading & get prices of stocks listed in the Indian share markets BSE & NSE. Open your trading account at Swastika Investmart Today.

Get online trading share/stock market trading account, demat account, IPO, SIPs, mutual fund recommendations, tips, updates in India with Swastika Investmart. Open online trading account today and check our detailed analysis with a simplified online trading system. Experience the best online trading platform for stocks, IPOs, mutual fund in India. Open your online trading account with Swastika and start investing in share market today! Investors who trade through an online brokerage firm are provided with a online trading platform.

The online trading platform acts as the hub, allowing investors to purchase and sell such securities as fixed income, equities/stock, options, and mutual funds. Open an Online Trading Account with India's Best Brokerage House, Swastika Investmart Ltd. Get instant access to latest stock trading tips & updates on Stock Prices. Online trading is easy and quick. You can educate yourself on your investment options, place orders to buy and sell, and possibly make a considerable amount of money without ever leaving the comfort of your home. On opening Online Trading accounts, our executives will guide in your investment process.

They will even provide you with an online trading platform through which you can monitor and trade your investments with the ease of your home.

Subscribe to Online Trading Account with Swastika Investmart Ltd to manage your Wealth Profile. Click here to open an account or feel free to Contact Us

0 notes

Text

15 Measures to Revive Economy, Big Takeaways For MSMEs, NBFCs

Union Finance Minister Nirmala Sitharaman has come out with 15 new and some enhanced measures to revive businesses, and support workers via fiscal incentives and regulatory easing under the mega stimulus package — Self-Reliant India Movement — which was announced by Prime Minister Narendra Modi on Tuesday evening.

Accordingly, on Wednesday, Sitharaman announced the slew of fiscal and regulatory measures for MSMEs, real estate, NBFCs, power distribution and general businesses and workers.

She attempted to decrease the regulatory burden on companies while increasing the take-home pay of employees via these measures.

In terms of takeaways, the biggest was for the MSME sector which is considered to be the backbone of economic activity.

As a major reform measure for the sector, the Centre has decided to give a new definition to MSMEs.

This will denote the type of companies that will be included in the sector. Specifications wise, the investment limit for defining MSMEs has been revised upwards.

Besides, she highlighted that additional criteria such as turnover have been considered for defining MSMEs.

In terms of fiscal measures, the Minister announced that Rs 3 lakh crore “Collateral-free Automatic Loans” for businesses, including MSMEs, will be provided to meet operational liabilities built up, buy raw material and restart the business.

She announced another scheme worth Rs 20,000 crore for “Subordinate Debt for Stressed MSMEs”.

A Rs 50,000 crore “Fund of Funds” for MEMEs which face a severe shortage of equity was also announced.

The Centre has also decided not to go in for global bidding for government procurement for tenders up to Rs 200 crore, thereby, promoting the participation of MSMEs, she said.

Furthermore, e-market linkage for MSMEs will be provided and that the CPSEs will pay all receivables to MSMEs within 45 days.

Besides MSMEs, a Rs 30,000 crore special liquidity scheme for non-banking finance companies (NBFCs), housing finance companies (HFCs) and micro-finance institutions (MFIs) was announced.

This scheme will provide investments in both primary and secondary market transactions in “investment grade debt paper of these institutions”.

The minister said the scheme will support the previous initiatives of the government and the central bank to boost liquidity.

The securities under the scheme will be fully guaranteed by the Central government. Further, the FM has also announced Rs 45,000 crore partial credit guarantee scheme for NBFCs.

Under this measure, the first 20 per cent loss will be borne by the Centre, and even unrated papers will be eligible for investment, enabling NBFCs to reach out even to MSMEs in far-flung areas.

Additionally, a Rs 90,000 crore liquidity injection plan was announced for the financially stressed power distribution companies.

This plan will allow these entities to clear their dues towards power generation companies.

As per the plan, the liquidity window for discoms was essential as its revenue has plummeted and they are in the midst of unprecedented cash flow problem accentuated by demand reduction during the current lockdown.

The scheme will allow power sector financiers — PFC and REC to infuse liquidity of Rs 90,000 crore to discoms against receivables.

Loans will be extended against State guarantees for the exclusive purpose of discharging liabilities of discoms to gencos.

Apart from discoms, relief steps for the real estate industry were also announced.

The Minister stated that Union Ministry for Housing and Urban Affairs will issue advisory to states and union territories to declare the Covid-19 situation as a ‘force majeure’ under the Real Estate (Regulation and Development) Act.

With this move, the government has allowed the suo-moto extension of the registration and completion date by six months for all registered project expiring on or after March 25, 2020, without individual applications.

Simultaneously, to give regulatory relief to businesses Sitharaman announced a six-month extension of contracts for contractors by all central agencies and departments including railways, the Central Public Works Department, and Ministry of Road Transport & Highways.

The extension would not come with any cost for the contractors, she said. This scheme covers construction works and goods and services contracts.

It also applies on obligations like completion of work, intermediate milestones and extension of concession period in public-private partnership contracts.

The minister also announced that government agencies will partially release bank guarantees, to the extent contracts are partially completed, to ease cash flows.

Finally to provide more money into the taxpayers’ hands, Centre decided to reduce the TDS (tax deduction at source) rates for non-salaried specified payments made to residents, and the TCS (tax collection at source) rates by 25 per cent for the specified receipts.

Sitharaman said the move would release Rs 50,000 crore liquidity.

As per the announcement, the reduced TDS rate will be applicable to the payment for a contract, professional fees, interest, rent, dividend, commission and brokerage. It will be applicable for the remaining part of FY21 — from May 14 to March 31, 2021.

Speaking to the media, Finance Minister pointed out the due date of all income tax returns for FY 2019-20 will be extended from July 31, 2020, October 31, 2020, to November 30, 2020, and tax audit from September 30, 2020, to October 31, 2020.

The government has also extended the date of assessments getting barred on September 30, 2020, to December 31, 2020, and those getting barred on March 31, 2021, to September 30, 2021.

In another major move for businesses and charitable trusts, Sitharaman announced that all pending refunds to charitable trusts and non-corporate businesses and professions, including proprietorship, partnership, LLP and co-operatives, shall be issued immediately.

In addition, she announced a further extension of the deadline for settling tax disputes under the Vivid se Vishwaas scheme without paying any interest and penalty to December 31, 2020, from June 30, 2020.

“The sectors covered in the initial phase are clearly the ones that required the highest policy attention at this juncture, including MSME, power, and construction and real estate. The impact of the package totalling Rs 20 lakh crore to be unveiled in the next few days would add to spending power and bring relief to millions of enterprises that employ huge numbers of workers. We expect the stimulus measure to impart stability and growth to the economy,” said Vikram Kirloskar, President, Confederation of Indian Industry.

According to Ficci’s President Sangita Reddy: “The greatest takeaway from today’s announcement was the clear focus on getting liquidity flowing into the system.”

“Besides liquidity, we need to give equal focus on generating consumption demand and propping up investments. We hope that in the next set of announcements, these areas will be taken up in a comprehensive manner as well.”

On its part, Assocham’s Secretary General Deepak Sood said: “The Rs 3 lakh crore collateral-free loans for the MSMEs on a guarantee from the government would have a big-time multiplier impact and would generate economic activity of at least up to Rs 10 lakh crore, not only retaining the jobs but also creating additional employment.”

He further said, treating COVID-19 as an ‘act of God’ and allowing the real estate developers extra six months for completion of projects would help both the developers and the consumers as it would make the sector viable.

Sood listed reduction in the TDS by 25 percentage points as a demand-boosting measure along with a cut in the EPFO deductions from 12 to 10 per cent.

Industry body PHD Chamber’s President D.K. Aggarwal said the liquidity injection of Rs 90,000 crore for DISCOMs will significantly help the power sector in mitigating the impact of demand deduction amid pandemic COVID-19 scenario.

Source: Trusted Online News Portals in India

Bihar News Patna | Latest Jharkhand News in Hindi | Entertainment News India | Top Environment News |

0 notes

Text

Coronavirus Outbreak LIVE Updates: Delhi district court employee tests positive for COVID-19; global toll exceeds 280,000

08:38 (IST)

Coronavirus Outbreak in US Latest Update

Mike Pence not in quarantine, to be at White House even after aide tests positive

Vice President Mike Pence is not in quarantine and plans to be at the White House on Monday, a spokesman said on Sunday, despite media reports that Pence was self-isolating after a staffer tested positive for the novel coronavirus.

“Vice President Pence will continue to follow the advice of the White House Medical Unit and is not in quarantine,” spokesman Devin O’Malley said in a statement.

“Additionally, Vice President Pence has tested negative every single day and plans to be at the White House tomorrow,” the statement added.

08:31 (IST)

Coronavirus Outbreak in India Latest Update

Special train with 1200 people departs from Gujarat for Uttarakhand

A special train carrying 1200 passengers departed from Surat for Kathgodam in Uttarakhand at 4 am on Monday, informed chief minister's office (CMO) Uttarakhand. The train is expected to reach Kathgodam by tomorrow. Special trains are being run as the Ministry of Home Affairs allows people stranded in other regions to reach their native states.

A special train carrying 1200 passengers departed from Surat (Gujarat) for Kathgodam in Uttarakhand at 4 am: Uttarakhand Chief Minister's Office pic.twitter.com/QaGYva7KUD

— ANI (@ANI) May 11, 2020

08:25 (IST)

Coronavirus Outbreak in India Latest Update

Nirmala Sitharaman to meet public sector banks chiefs today; to review credit flow

Finance Minister Nirmala Sitharaman will hold a review meeting with CEOs of public sector banks (PSBs) on Monday to discuss various issues, including credit offtake, as part of efforts to prop up the economy hit by the COVID-19 crisis.

The meeting, to be held via video-conferencing, will also take stock of interest rate transmission to borrowers by banks and progress on moratorium on loan repayments, sources told PTI.

08:18 (IST)

Coronavirus Outbreak in Haryana Latest Update

Haryana Roadways buses with 267 migrant labourers head towards UP from Ambala

Seven buses of Haryana Roadways carrying 267 migrant labourers from Ambala departed for Uttar Pradesh yesterday, amid #CoronavirusLockdown. pic.twitter.com/A5i3m2Rn2f

— ANI (@ANI) May 10, 2020

08:11 (IST)

Coronavirus Outbreak in Bihar Latest Update

Sushil Modi writes to Nirmala Sitharaman, seeks grants for Bihar

In view of declining state revenue amid the coronavirus outbreak, Bihar Deputy Chief Minister Sushil Kuamr Modi has written to Union Finance Minister Nirmala Sitharaman, requesting her to release Rs 7,434 crore grants, recommended by the 15th Finance Commission, within this quarter of the current fiscal.

He requested her to release Rs 5, 018 crore for Panchayati raj institutions and Rs 2,416 crore for urban local bodies for the financial year 2020-21, as per the recommendation of the Finance Commission.

If the amount is released in the first quarter of the fiscal, it will be helpful for the government to implement the piped drinking water project and drainage scheme, the state finance minister said in his letter.

08:04 (IST)

Coronavirus Outbreak Latest Update

Global COVID-19 number of deaths exceeds 2,80,000

The number of deaths globally from COVID-19 has surpassed 280,000, according to the database compiled by Johns Hopkins University.

There are currently 280,507 fatalities worldwide. The United States, the United Kingdom, and Italy have the highest numbers of deaths among countries, 78,932, 31,930, and 30,560, respectively.

The total number of cases is currently over 4,067,112, while the number of recoveries is at 1,392,359.

07:57 (IST)

Coronavirus Outbreak in India Latest Update

National Security Guard staff member tests positive for coronavirus

One of the members of the National Security Guard (NSG) has tested positive of coronavirus, reports ANI.

"We've one COVID-19 positive case. The individual is a non-combatant support staff in our Composite Hospital. He is stable with mild symptoms," said AK Singh, Director General of NSG.

Singh further said that the report of their member getting infected with coronavirus hasn't impacted the preparedness and availability of any of their combat formations.

07:48 (IST)

Coronavirus Outbreak in India Latest Update

First AI flight with 225 stranded Indians from US lands in Mumbai

First Air India special flight, which took off from San Francisco with 225 Indians on board, landed in Mumbai on Monday. The passengers departed from San Francisco International Airport on Saturday (local time) under the Government of India's Vande Bharat mission on Sunday.

Air India is operating in San Francisco sector after 50 days as India had imposed restrictions due to COVID-19 spread.

Amidst the coronavirus pandemic, India is conducting 'Vande Bharat' Mission — its biggest ever repatriation exercise since independence — to bring back stranded Indians from abroad, including from the US, the UAE, and the UK.

First AI spl flight from US brings in 225 Indians from San Francisco to Mumbai.

Thank @airindiain @MoCA_GoI and Maharashtra Govt for support and coordination.

Great work by CG Sanjay Panda and Team @CGISFO.@SandhuTaranjitS #VandeBharatMission

— Dr. S. Jaishankar (@DrSJaishankar) May 11, 2020

07:41 (IST)

Coronavirus Outbreak in Delhi Latest Update

Saket court employee tests positive for COVID-19

A Saket district court employee has tested positive for coronavirus infection, District Judge Neena Bansal Krishna said on Sunday.

According to a circular issued by the district judge, the wife of a junior judicial assistant of the court informed telephonically that her husband was found infected with coronavirus on Saturday evening.

The court staff had last visited the office on May 4 due to some official work and come in contact with a court's stenographer, the circular said.

Therefore the stenographer has been asked to remain in self-quarantine for 14 days from 4 May to 17 May and take necessary precautions, it said.

07:36 (IST)

Coronavirus Outbreak in West Bengal Latest Update

14 more die of COVID-19 in Bengal, toll crosses 100-mark

The toll from COVID-19 climbed to 113 in West Bengal on Sunday with 14 more people succumbing to the infection in the last 24 hours, a state government bulletin said.

The state also reported 153 fresh COVID-19 cases, the highest in a day so far. Of the 14 deaths, Kolkata alone accounted for 10 while two each were from North 24 Parganas and Howrah districts. There have been 72 deaths due to comorbidities where COVID-19 was incidental, the bulletin said.

07:31 (IST)

Coronavirus Outbreak in India Latest Update

Railways to gradually restart passenger train operations from 12 May; online ticket booking will begin at 4 pm today

The Indian Railways will gradually restart passenger train operations from 12 May, initially with 15 pairs of trains, the national transporter said Sunday.

These trains will be run as special trains from New Delhi station connecting Dibrugarh, Agartala, Howrah, Patna, Bilaspur, Ranchi, Bhubaneswar, Secunderabad, Bengaluru, Chennai, Thiruvananthapuram, Madgaon, Mumbai Central, Ahmedabad and Jammu Tawi.

Booking for reservation in these trains will start at 4 pm on 11 May and will be available only on the IRCTC website (https://ift.tt/IFbjHR). Ticket booking counters at railway stations will remain closed and no counter tickets (including platform tickets) will be issued, it said.

07:26 (IST)

Coronavirus Outbreak in India Latest Update

India has reported total of 62,939 cases, says health ministry

India has reported a total of 62,939 COVID-19 cases till Sunday, with Maharashtra alone reporting 20,228 of these infections, a report by the Union health ministry has stated.

However, the report said that India's mortality rate is 3.35 percent, as compared to the global average of 6.9 percent.

The number of active COVID-19 cases stood at 41,472, while 19,357 people have recovered and one patient has migrated, the ministry said. The recovery rate stands at about 30.75 percent.

07:26 (IST)

Coronavirus Outbreak in India Latest Update

India has reported total of 62,939 cases, says health ministry

India has reported a total of 62,939 COVID-19 cases till Sunday, with Maharashtra alone reporting 20,228 of these infections, a report by the Union health ministry has stated.

However, the report said that India's mortality rate is 3.35 percent, as compared to the global average of 6.9 percent.

The number of active COVID-19 cases stood at 41,472, while 19,357 people have recovered and one patient has migrated, the ministry said. The recovery rate stands at about 30.75 percent.

Coronavirus Outbreak LATEST Updates: A Saket district court employee has tested positive for coronavirus infection, District Judge Neena Bansal Krishna said on Sunday. Meanwhile, the number of deaths globally from COVID-19 has surpassed 280,000, according to the database compiled by Johns Hopkins University.

First Air India special flight, which took off from San Francisco with 225 Indians on board, landed in Mumbai on Monday. The passengers departed from San Francisco International Airport on Saturday (local time) under the Government of India's Vande Bharat mission on Sunday.

India has reported a total of 62,939 COVID-19 cases till Sunday, with Maharashtra alone reporting 20,228 of these infections, a report by the Union health ministry has stated.

However, the report said that India's mortality rate is 3.35 percent, as compared to the global average of 6.9 percent.

The number of active COVID-19 cases stood at 41,472, while 19,357 people have recovered and one patient has migrated, the ministry said. The recovery rate stands at about 30.75 percent.

Meanwhile, in what can be seen as a step towards easing the nationwide lockdown, an official release said that the Railways plans to gradually restart passenger trains from 12 May.

State-wise cases and deaths

A total 128 deaths were reported in the country since Saturday morning — 48 in Maharashtra, 23 in Gujarat, 15 in Madhya Pradesh, 11 in West Bengal, eight in Uttar Pradesh, five each in Rajasthan and Delhi, four in Tamil Nadu, three in Andhra Pradesh, two in Punjab and one each in Telangana, Haryana, Chandigarh and Assam.

Of the 2,109 fatalities, Maharashtra tops the tally with 779 deaths. Gujarat comes second with 472 deaths, followed by Madhya Pradesh at 215, West Bengal at 171, Rajasthan at 106, Uttar Pradesh at 74, Delhi at 73, and Andhra Pradesh and Tamil Nadu at 44.

The death toll is 31 in Punjab, 30 each in Karnataka and Telangana. Jammu and Kashmir and Haryana each have registered nine COVID-19 deaths, Bihar five and Kerala four.

Jharkhand has recorded three COVID-19 fatalities. Odisha, Chandigarh, Assam and Himachal Pradesh have reported two deaths each.

Meghalaya and Uttarakhand have reported one fatality each.

According to the health ministry data updated in the morning, the highest number of confirmed COVID-19 cases in the country are from Maharashtra at 20,228,followed by Gujarat at 7,796, Delhi at 6,542, Tamil Nadu at 6,535, Rajasthan at 3,708, Madhya Pradesh at 3,614 and Uttar Pradesh at 3,373.

The number of coronavirus cases has gone up to 1,930 in Andhra Pradesh, 1,786 in West Bengal and 1,762 in Punjab.

They have risen to 1,163 in Telangana, 836 in Jammu and Kashmir, 794 in Karnataka, 675 in Haryana and 591 in Bihar.

Kerala has reported 505 coronavirus cases so far, while Odisha has 294 cases. A total of 169 people have been infected with the virus in Chandigarh and 156 in Jharkhand.

Tripura has reported 134 cases, Uttarakhand has 67 cases, Assam 63 and Chhattisgarh 59. Himachal Pradesh has 50 and Ladakh has registered 42 cases so far.

Thirty-three COVID-19 cases have been reported from the Andaman and Nicobar Islands.

Meghalaya has registered 13 cases, Puducherry has nine, while Goa has seven COVID-19 cases. Manipur has two cases. Mizoram, Arunachal Pradesh and Dadar and Nagar Haveli have reported a case each.

West Bengal reports highest mortality rate, says Union health ministry

According to the health ministry, the highest mortality rate was recorded in West Bengal at 9.57 percent, where 1,786 cases and 171 deaths have been reported. On 5 May, the Inter-Ministerial Central Team (IMCT) sent to the state had said that the mortality rate in West Bengal was 12.8 percent. This figure stood lower in Maharashtra, where the mortality rate was 3.85 percent, higher than the national average. Of the 128 new COVID-19 deaths in India, 48 were recorded in India's financial capital.

With 7,796 infections, Gujarat reported a mortality rate of 6.05 percent. The figure in Delhi, which has the third highest number of cases in the country, stood at 1.12 percent.

India carried out 86,000 tests for COVID-19 on Saturday and India''s testing capacity now stands at 95,000 samples per day, Union health minister Harsh Vardhan told reporters after inspecting a COVID-19 care centre in the Mandoli area in the national capital.

India had started from one laboratory and now there are 472 laboratories testing for COVID-19, he said.

There are 4362 corona care centres across the country where 3,46,856 patients with mild or very mild symptoms can be kept, he said.

"We are moving fast on path of success in the fight against COVID-19. The doubling rate for the last three days is 12 (days). The recovery rate has crossed 30 per cent. Out of around 60,000 COVID-19 patients, about 20,000 have recovered and gone home," Vardhan said.

"Our mortality rate is still at 3.3 percent.... In the last 24 hours, there has been no case in 10 states and Union territories. There are four states or Union territories where there has not been a single case till now," Vardhan said.

Three migrant workers die near Maharashtra-MP border

Three migrant workers who were on their way to Uttar Pradesh from Maharashtra, mostly walking, died in Barwani district of Madhya Pradesh on Saturday, officials said.

The trio were among thousands of migrant workers who have set out on foot for their home states from Maharashtra in the last few weeks amid lockdown on account for coronavirus.

While autopsy reports were yet to be available, doctors said the possible cause of deaths was fatigue and dehydration in peak summer heat.

The deceased, who were traveling separately, were identified as Lalluram (55), resident of village Chhudiya in Prayagraj district, Prem Bahadur (50), resident of Siddharth Nagar and Anees Ahmed (42) of Hardas Girja village of Fatehpur.

Railways to partially resume passenger train operations from 12 May

The Indian Railways will resume passenger train operations from 12 May nearly after two months when services were stopped due to the coronavirus-induced nationwide lockdown.

Initially, the Railways will run 15 pairs of trains and the booking for reservation for these trains will start at 4 pm on 11 May.

An official press release on Sunday said: "Indian Railways plans to gradually restart passenger train operations from 12 May, initially with 15 pairs of trains (30 return journeys)."

"These trains will be run as special trains from New Delhi station connecting Dibrugarh, Agartala, Howrah, Patna, Bilaspur, Ranchi, Bhubaneswar, Secunderabad, Bengaluru, Chennai, Thiruvananthapuram, Madgaon, Mumbai Central, Ahmedabad, and Jammu Tawi," added the release.

"Thereafter, Indian Railways shall start more special services on new routes, based on the available coaches after reserving 20,000 coaches for COVID-19 care centres and an adequate number of coaches being reserved to enable operation of up to 300 trains every day as 'Shramik Special' for stranded migrants," said the release.

Only online bookings are allowed and ticket booking counters at the railway stations shall remain closed.

As per the release, the booking for reservation for these trains will start at 4 pm on 11th May and will be available only on the IRCTC website (https://ift.tt/IFbjHR). Ticket booking counters at the railway stations shall remain closed and no counter tickets including platform tickets shall be issued.

Only the passengers with valid confirmed tickets will be allowed to enter the railway stations.

"Only passengers with valid confirmed tickets will be allowed to enter the railway stations. It will be mandatory for the passengers to wear face cover and undergo screening at departure and only asymptomatic passengers will be allowed to board the train. Further details including train schedule will be issued separately in due course," added the press release issued by the PIB.

With inputs from agencies

via Blogger https://ift.tt/2ztY5z2

0 notes

Text

66.6% Indians are open to taking loans reports study | Home Credit India

- Focussing on service and trust, the campaign showcases Home Credit's role in helping customers to be financial literate & to avail safe loans

- Family aspirations and upgrading lifestyle is the primary reason for seeking loans by 46% Indians

- 33% of Indians are likely to purchase Consumer durables such as smartphones, refrigerators, TV etc. on EMIs to be able to upgrade lifestyle

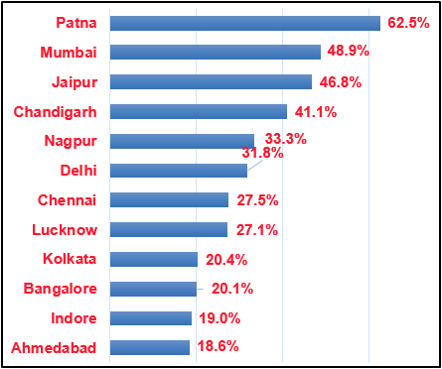

- Loan culture penetrating deep in non-metro cities. Cities like Jaipur, Patna, Lucknow and Nagpur are driving this trend

The unique survey from across 12 cities of India across regions revealed that almost 67% of Indians were not opposed to taking loans especially if it fulfils their family's desire or upgrades their lifestyle. The survey reveals other key aspects of borrowing patterns as well.

This report was commissioned by Home Credit India, a local arm of the international consumer finance provider with operations spanning over Europe and Asia and committed to drive financial inclusion in India. This report has released a fresh new perspective on India's borrowing habits. This study conducted by research agency Absolutdata has been commissioned across 12 cities and 2,571 respondents have been evaluated to provide a near to accurate pattern of savings, spending and borrowing behavior in the country.

It's for the family! The desire to fulfil the needs and the wishes of the family tops the reasons for taking a loan in the future: So while lifestyle is important, respondents have revealed that fulfilling family needs and their wishes constitutes the single topmost reason for people wanting to take a new loan at an average of 46% nationally. Family orientation and needs is highest among people in Patna (61%) followed by Lucknow (58%), Nagpur (56%) and Jaipur (54%).

The second reason why most Indians are willing to take a loan is to Upgrade Their Lifestyle. The survey revealed that 33% of Indians are willing to take a loan for a consumer durable item such as- Mobile Phone, Television, Refrigerator etc. The other vastly popular loan categories are the two wheelers (23.3%) and personal expenses (20.3%). This is followed by is for purchase of Cars (12.5%), House (12%) and Gold (10.5%). When asked about the future, 33% of the respondents are likely to take it for consumer durables while personal loans are the next high interest segment at 28% followed by two wheelers at 22.8. Agriculture loans (0.7%), credit card EMI (1.1%), Travel loans (1.5%) and Medical loans (3.7%) are the lowest ranked categories of loans.

City-Wise Breakup: 33% Indians believe that loans are important to enhance their lifestyle highest being in cities like Mumbai (49%), Jaipur (47%) and Chandigarh (41%). On the converse, lifestyle consideration is the least among people in Ahmedabad (19%) followed by Indore (19%), Bangalore (20%) and Kolkata (20%).

Friends and Family not only feature at the top of the survey for fulfilling needs, they also play the most important role in the decision making process of the loan. 34% Indians rely on friends for advice while taking loans followed by family at 31.8% and colleagues at 25.4%. A financial advisor comes second at 22.4% as the source of advice followed by sales representative of a loan provider at 21.8%; 20.9% people take a self-decision while availing loan, and do not consult anyone.

People in Mumbai and Delhi are the most evolved in terms of consulting a financial advisor before taking at loan at 44.2% and 38.8% respectively; For other cities it is the non-formal sources for advice. The people of Nagpur are the most self-assured when it comes to taking a loan and do not consult anyone, taking their own decision to avail a loan at 50.8%. This is followed by people of Kolkata at 32.3% and Ahmedabad (22.2%) respectively.

While the country is very positive towards loans, a section of the respondents have also not been positively drawn towards the concept of lending and borrowing and therefore have never taken a loan before. The study identifies Key Behavioral Challenges that this section faces. 35% of the respondents say that "Having a loan is a stressful feeling". The second reason for loan aversion is that 32% of respondents 'believe in saving and spending'. The fear of not being able to repay is the third reason why people do not take loans, said 32% respondents. The burden of documentation and hassle at 31% is another reason why people do not prefer loans; so, they usually end up borrowing from friends and family, said 28% of the respondents. In fact, among the least important reasons for not taking a loan is that the employer provides with advance salary, if needed (20%), the process is rigorous and time consuming (25%) and the fear of repercussion in case of a default (26%). Another reason cited for not taking a loan is the lack of awareness of different types of loans (27%).

However, what stands out as a median reason for not taking a loan before, is that 28% of the respondents indicated the take the loans from their friends and family. The study also shows that a staggering 57.3% of respondents have never availed a loan before which means that cash is still king, Three-fourth of the people are most comfortable in using cash. This is followed by debit cards which are being used by 80% people, half of them using them at least once a week or more. Only 26% people use credit cards and 40% use net-banking, pointing that digitization of banking services is the road ahead.

Home Credit has been working aggressively in India and has been able to establish itself as a leading financial products and services provider. Gathering intel with knowledge partners to have a deeper understanding of the market trends, consumer behavior patterns is a continuous process at Home Credit across each market. This enables a focused, targeted customer centric proposition across all its product offerings. Almost 50% of Home Credit's customers are the First Time Borrower (FTB) who have no borrowing and repayment history with credit rating agencies. The company has strong underwriting capabilities, risk assessment, new market entry and customer focused approach have ensured that the company has made the right disbursements of loans in a responsible manner as well as has been able to advise and help customers plan their finances better. All this has helped to build Home Credit as a lender of choice and help the company retain its differentiated position in the market. The company is committed to driving credit penetration and broadening financial inclusion through responsible lending. This, the company aims to do through offering financial solutions that are simple, transparent and accessible to all, backed by trained financial advisers who are able to drive understanding of credit, assess the borrower and help them to ascertain the right borrowing.

Supporting quote: Marko Carevic, Chief Marketing & Customer Experience Officer, Home Credit India: "We've made concerted efforts to broaden the ambit of financial inclusion across the world and India is a key market for us by virtue of the potential it offers. After China and Russia, India is now showing signs of a new resurgence and we have seen the evolution of the customers since our entry in 2012. The survey is yet another attempt to understand our customers so that we can customize our product offering to the need. We continue to build on the collective market intelligence coupled with our proprietary methods and technologies to evaluate all borrowers. As a company propagating responsible borrowing, we also effect responsible lending. We are committed to enhancing the quality of life through our financial products and services for our customers."

Source: 66.6% Indians are open to taking loans reports study : Home Credit India

#loans#avail a loan#types of loans#credit card EMI#consumer durables loan#smartphones on EMIs#refrigerators on EMIs#TV on EMIs#Home Credit India#HomeCreditIndia#loans study

0 notes

Link

Patna is the capital city of Bihar. It is one of the fastest growing city of the country with the GDP of around 7.29%. Its GDP is increasing with every year and is prepared to perform better. The economy of the city is fast moving consumer goods industry, trade, and agricultural products. The medium and small enterprises are growing rapidly as a result of which the demand for home loans is also at its peak. To fulfill the housing finance needs of the people, some of the top banks like SBI and DHFL are providing affordable housing loans in Patna. Check out the details of the interest rates on a housing loan and the nearest branch address to apply now.

0 notes

Link

DHFL is one of the best housing finance companies in Patna. It provides housing loans at affordable interest rates with flexible repayment options and comes up with a tailored transperant approach.

0 notes