#home loan low deposit

Explore tagged Tumblr posts

Text

How to Buy Your First Home with a Low Deposit?

The landscape for first-time homebuyers in Australia has become more challenging with factors like inflation and rising living costs making it difficult to save for a 20% deposit. HAS shared equity is a practical option for those seeking low deposit mortgages, offering a way to secure their financial future in a challenging housing market. Learn more in this blog.

#2.5% deposit home loan#Australia#first home buyer#home affordability solutions#home loan low deposit#Sydney#Melbourne

1 note

·

View note

Text

I got a packet from the social security people I have to fill out and have sent back in--by mail--by the 26th. I got it on Friday. And I haven't looked at it til now, bc I was so stressed out about my dog being sick and i feel so overwhelmed. They want all my medical records from the last year, which I don't have, because I've only started keeping that stuff since I had my complete mental breakdown and she took me out of work. And there's so many pages and so much information they want. They have to nitpick my whole fucking life, before they can decide I deserve health. Being disabled in this country is a fucking nightmare. Instead of trying to hep, the just look for reasons to disqualify you. Because they don't want to help us; they just want us to go away

#america is a trashfire#i can't even leave my house alone#i literally have been in tears every time they call me#bc taking on the phone to strangers gives me that much anxiety#i can't function#i can't remember anything longer than a few seconds#i can't focus or concentrate on anything#i have to set alarms just to remind me to do things like eat or take meds#i forget to shower sometimes. others i'm too tired to bother#i literally went an entire week without showering recently. bc i didn't remember to do it#i am not well#and i just need help long enough to get well#but how am i supposed to get it? if they make you wait 200+ days just to hear if your claim is accepted#how am i supposed to survive until then?#I can't work bc i can't leave home with having panic attacks#i can't file for unemployment bc to do so you have to be actively looking for a job#and to get disability i have to prove that i can't work#i could probably work if i found a job i could do from home that payed enough to live off of#not to mention they want me to list any income from may-july#which i didn't make any working. but my brother lives me and gives me money to deposit for the bills#that are all in my name bc he hadn't established credit when we moved in. and my credit was better back then#bc i couldn't afford to leave home until i was 28. so my credit was literally based off my student loan payments#and they were pretty low bc i did the income based thing#i'm getting my parents to come help me with the paperwork#not bc i can't understand it. but bc i literally cannot remember something i read 30 seconds ago

5 notes

·

View notes

Text

How Mortgage Brokers Can Help You Secure a Low Deposit Home Loan

Buying a home in Sydney can be a challenging process, especially when it comes to securing a loan with a low deposit. Many first-time homebuyers struggle to gather the necessary funds for a deposit, which can sometimes be 20% of the property’s value. Fortunately, mortgage brokers Sydney are experts in navigating the complex landscape of home loans Sydney, and they can help you find a low deposit loan that fits your financial situation. In this blog, we’ll explore how mortgage brokers Sydney can assist you in securing a low deposit loan and why working with the best mortgage brokers in Sydney can save you time, money, and stress during your home-buying journey. Understanding Low Deposit Loans A low deposit loan typically allows homebuyers to purchase a property with less than the usual 20% deposit. This type of loan is particularly attractive to first-time buyers or those who haven't saved enough for a large deposit but are eager to enter the property market. While the idea of a low deposit may sound simple, the criteria and conditions that come with it can be complex. This is where mortgage brokers Sydney play a crucial role. They guide you through the available loan products and ensure you meet the requirements for lenders offering low deposit options. Access to Lenders Who Offer Low Deposit Loans One of the key benefits of working with mortgage brokers Sydney is that they have access to a wide variety of lenders, including those that offer low deposit loans. Instead of being limited to one or two options, mortgage brokers can help you explore a range of lenders who are willing to approve your loan with a smaller deposit. This not only broadens your choices but increases the likelihood of securing a loan that works for you. The best mortgage brokers in Sydney often have established relationships with lenders, which can give you an edge when negotiating favorable loan terms. They are familiar with each lender’s requirements, including credit scores, employment history, and income levels, ensuring that you are matched with the lender most likely to approve your loan application.

Tailoring the Loan to Your Specific Needs Every homebuyer has unique financial circumstances, and the best mortgage brokers in Sydney know how to tailor loans to suit individual needs. Whether you’re self-employed, a first-time buyer, or someone with a fluctuating income, mortgage brokers Sydney can find home loans Sydney that align with your situation. They also take into account additional costs that may come with a low deposit loan, such as Lenders Mortgage Insurance (LMI). Mortgage brokers Sydney can advise you on ways to minimize LMI costs and help structure your loan in a way that fits your long-term financial goals. Navigating the Application Process Applying for a home loan can be daunting, especially when trying to secure a low deposit loan. There are many factors to consider, including your credit score, savings, and overall financial health. Mortgage brokers Sydney simplify this process by guiding you step-by-step, ensuring you meet all the necessary requirements. From gathering your documents to liaising with lenders, mortgage brokers Sydney handle the entire process on your behalf. Their expertise ensures that your loan application is prepared correctly, reducing the chances of delays or rejections. Negotiating Competitive Interest Rates In addition to finding the right lender, mortgage brokers Sydney can also negotiate competitive interest rates on your behalf. This is particularly important with low deposit loans, as some lenders may charge higher interest rates to offset the perceived risk of a smaller deposit. The best mortgage brokers in Sydney use their knowledge of the lending market to secure favorable rates, saving you money over the life of your loan. Conclusion Securing a low deposit loan in Sydney’s competitive real estate market can be challenging, but with the help of mortgage brokers Sydney, the process becomes much more manageable. From finding the right lender to negotiating the best interest rates, mortgage brokers play a vital role in helping you achieve your dream of homeownership, even with a small deposit. For expert assistance in navigating home loans Sydney and securing a low deposit loan, reach out to Efficient Capital today. As one of the best mortgage brokers in Sydney, Efficient Capital can guide you through the entire process, ensuring you get the right loan to fit your needs. Start your home-buying journey with confidence and let Efficient Capital help you secure the perfect mortgage deal!

https://www.efficientcapital.com.au/

0 notes

Text

How Mortgage Brokers Can Help You Secure a Low Deposit Home Loan

Buying a home in Sydney can be a challenging process, especially when it comes to securing a loan with a low deposit. Many first-time homebuyers struggle to gather the necessary funds for a deposit, which can sometimes be 20% of the property’s value. Fortunately, mortgage brokers Sydney are experts in navigating the complex landscape of home loans Sydney, and they can help you find a low deposit loan that fits your financial situation. In this blog, we’ll explore how mortgage brokers Sydney can assist you in securing a low deposit loan and why working with the best mortgage brokers in Sydney can save you time, money, and stress during your home-buying journey. Understanding Low Deposit Loans A low deposit loan typically allows homebuyers to purchase a property with less than the usual 20% deposit. This type of loan is particularly attractive to first-time buyers or those who haven't saved enough for a large deposit but are eager to enter the property market. While the idea of a low deposit may sound simple, the criteria and conditions that come with it can be complex. This is where mortgage brokers Sydney play a crucial role. They guide you through the available loan products and ensure you meet the requirements for lenders offering low deposit options. Access to Lenders Who Offer Low Deposit Loans One of the key benefits of working with mortgage brokers Sydney is that they have access to a wide variety of lenders, including those that offer low deposit loans. Instead of being limited to one or two options, mortgage brokers can help you explore a range of lenders who are willing to approve your loan with a smaller deposit. This not only broadens your choices but increases the likelihood of securing a loan that works for you. The best mortgage brokers in Sydney often have established relationships with lenders, which can give you an edge when negotiating favorable loan terms. They are familiar with each lender’s requirements, including credit scores, employment history, and income levels, ensuring that you are matched with the lender most likely to approve your loan application.

Tailoring the Loan to Your Specific Needs Every homebuyer has unique financial circumstances, and the best mortgage brokers in Sydney know how to tailor loans to suit individual needs. Whether you’re self-employed, a first-time buyer, or someone with a fluctuating income, mortgage brokers Sydney can find home loans Sydney that align with your situation. They also take into account additional costs that may come with a low deposit loan, such as Lenders Mortgage Insurance (LMI). Mortgage brokers Sydney can advise you on ways to minimize LMI costs and help structure your loan in a way that fits your long-term financial goals. Navigating the Application Process Applying for a home loan can be daunting, especially when trying to secure a low deposit loan. There are many factors to consider, including your credit score, savings, and overall financial health. Mortgage brokers Sydney simplify this process by guiding you step-by-step, ensuring you meet all the necessary requirements. From gathering your documents to liaising with lenders, mortgage brokers Sydney handle the entire process on your behalf. Their expertise ensures that your loan application is prepared correctly, reducing the chances of delays or rejections. Negotiating Competitive Interest Rates In addition to finding the right lender, mortgage brokers Sydney can also negotiate competitive interest rates on your behalf. This is particularly important with low deposit loans, as some lenders may charge higher interest rates to offset the perceived risk of a smaller deposit. The best mortgage brokers in Sydney use their knowledge of the lending market to secure favorable rates, saving you money over the life of your loan. Conclusion Securing a low deposit loan in Sydney’s competitive real estate market can be challenging, but with the help of mortgage brokers Sydney, the process becomes much more manageable. From finding the right lender to negotiating the best interest rates, mortgage brokers play a vital role in helping you achieve your dream of homeownership, even with a small deposit. For expert assistance in navigating home loans Sydney and securing a low deposit loan, reach out to Efficient Capital today. As one of the best mortgage brokers in Sydney, Efficient Capital can guide you through the entire process, ensuring you get the right loan to fit your needs. Start your home-buying journey with confidence and let Efficient Capital help you secure the perfect mortgage deal!

0 notes

Text

How Mortgage Brokers Can Help You Secure a Low Deposit Home Loan

Buying a home in Sydney can be a challenging process, especially when it comes to securing a loan with a low deposit. Many first-time homebuyers struggle to gather the necessary funds for a deposit, which can sometimes be 20% of the property’s value. Fortunately, mortgage brokers Sydney are experts in navigating the complex landscape of home loans Sydney, and they can help you find a low deposit loan that fits your financial situation. In this blog, we’ll explore how mortgage brokers Sydney can assist you in securing a low deposit loan and why working with the best mortgage brokers in Sydney can save you time, money, and stress during your home-buying journey. Understanding Low Deposit Loans A low deposit loan typically allows homebuyers to purchase a property with less than the usual 20% deposit. This type of loan is particularly attractive to first-time buyers or those who haven't saved enough for a large deposit but are eager to enter the property market. While the idea of a low deposit may sound simple, the criteria and conditions that come with it can be complex. This is where mortgage brokers Sydney play a crucial role. They guide you through the available loan products and ensure you meet the requirements for lenders offering low deposit options. Access to Lenders Who Offer Low Deposit Loans One of the key benefits of working with mortgage brokers Sydney is that they have access to a wide variety of lenders, including those that offer low deposit loans. Instead of being limited to one or two options, mortgage brokers can help you explore a range of lenders who are willing to approve your loan with a smaller deposit. This not only broadens your choices but increases the likelihood of securing a loan that works for you. The best mortgage brokers in Sydney often have established relationships with lenders, which can give you an edge when negotiating favorable loan terms. They are familiar with each lender’s requirements, including credit scores, employment history, and income levels, ensuring that you are matched with the lender most likely to approve your loan application.

Tailoring the Loan to Your Specific Needs Every homebuyer has unique financial circumstances, and the best mortgage brokers in Sydney know how to tailor loans to suit individual needs. Whether you’re self-employed, a first-time buyer, or someone with a fluctuating income, mortgage brokers Sydney can find home loans Sydney that align with your situation. They also take into account additional costs that may come with a low deposit loan, such as Lenders Mortgage Insurance (LMI). Mortgage brokers Sydney can advise you on ways to minimize LMI costs and help structure your loan in a way that fits your long-term financial goals. Navigating the Application Process Applying for a home loan can be daunting, especially when trying to secure a low deposit loan. There are many factors to consider, including your credit score, savings, and overall financial health. Mortgage brokers Sydney simplify this process by guiding you step-by-step, ensuring you meet all the necessary requirements. From gathering your documents to liaising with lenders, mortgage brokers Sydney handle the entire process on your behalf. Their expertise ensures that your loan application is prepared correctly, reducing the chances of delays or rejections. Negotiating Competitive Interest Rates In addition to finding the right lender, mortgage brokers Sydney can also negotiate competitive interest rates on your behalf. This is particularly important with low deposit loans, as some lenders may charge higher interest rates to offset the perceived risk of a smaller deposit. The best mortgage brokers in Sydney use their knowledge of the lending market to secure favorable rates, saving you money over the life of your loan. Conclusion Securing a low deposit loan in Sydney’s competitive real estate market can be challenging, but with the help of mortgage brokers Sydney, the process becomes much more manageable. From finding the right lender to negotiating the best interest rates, mortgage brokers play a vital role in helping you achieve your dream of homeownership, even with a small deposit. For expert assistance in navigating home loans Sydney and securing a low deposit loan, reach out to Efficient Capital today. As one of the best mortgage brokers in Sydney, Efficient Capital can guide you through the entire process, ensuring you get the right loan to fit your needs. Start your home-buying journey with confidence and let Efficient Capital help you secure the perfect mortgage deal!

0 notes

Text

How Mortgage Brokers Can Help You Secure a Low Deposit Home Loan

Buying a home in Sydney can be a challenging process, especially when it comes to securing a loan with a low deposit. Many first-time homebuyers struggle to gather the necessary funds for a deposit, which can sometimes be 20% of the property’s value. Fortunately, mortgage brokers Sydney are experts in navigating the complex landscape of home loans Sydney, and they can help you find a low deposit loan that fits your financial situation. In this blog, we’ll explore how mortgage brokers Sydney can assist you in securing a low deposit loan and why working with the best mortgage brokers in Sydney can save you time, money, and stress during your home-buying journey. Understanding Low Deposit Loans A low deposit loan typically allows homebuyers to purchase a property with less than the usual 20% deposit. This type of loan is particularly attractive to first-time buyers or those who haven't saved enough for a large deposit but are eager to enter the property market. While the idea of a low deposit may sound simple, the criteria and conditions that come with it can be complex. This is where mortgage brokers Sydney play a crucial role. They guide you through the available loan products and ensure you meet the requirements for lenders offering low deposit options. Access to Lenders Who Offer Low Deposit Loans One of the key benefits of working with mortgage brokers Sydney is that they have access to a wide variety of lenders, including those that offer low deposit loans. Instead of being limited to one or two options, mortgage brokers can help you explore a range of lenders who are willing to approve your loan with a smaller deposit. This not only broadens your choices but increases the likelihood of securing a loan that works for you. The best mortgage brokers in Sydney often have established relationships with lenders, which can give you an edge when negotiating favorable loan terms. They are familiar with each lender’s requirements, including credit scores, employment history, and income levels, ensuring that you are matched with the lender most likely to approve your loan application.

Tailoring the Loan to Your Specific Needs Every homebuyer has unique financial circumstances, and the best mortgage brokers in Sydney know how to tailor loans to suit individual needs. Whether you’re self-employed, a first-time buyer, or someone with a fluctuating income, mortgage brokers Sydney can find home loans Sydney that align with your situation. They also take into account additional costs that may come with a low deposit loan, such as Lenders Mortgage Insurance (LMI). Mortgage brokers Sydney can advise you on ways to minimize LMI costs and help structure your loan in a way that fits your long-term financial goals. Navigating the Application Process Applying for a home loan can be daunting, especially when trying to secure a low deposit loan. There are many factors to consider, including your credit score, savings, and overall financial health. Mortgage brokers Sydney simplify this process by guiding you step-by-step, ensuring you meet all the necessary requirements. From gathering your documents to liaising with lenders, mortgage brokers Sydney handle the entire process on your behalf. Their expertise ensures that your loan application is prepared correctly, reducing the chances of delays or rejections. Negotiating Competitive Interest Rates In addition to finding the right lender, mortgage brokers Sydney can also negotiate competitive interest rates on your behalf. This is particularly important with low deposit loans, as some lenders may charge higher interest rates to offset the perceived risk of a smaller deposit. The best mortgage brokers in Sydney use their knowledge of the lending market to secure favorable rates, saving you money over the life of your loan. Conclusion Securing a low deposit loan in Sydney’s competitive real estate market can be challenging, but with the help of mortgage brokers Sydney, the process becomes much more manageable. From finding the right lender to negotiating the best interest rates, mortgage brokers play a vital role in helping you achieve your dream of homeownership, even with a small deposit. For expert assistance in navigating home loans Sydney and securing a low deposit loan, reach out to Efficient Capital today. As one of the best mortgage brokers in Sydney, Efficient Capital can guide you through the entire process, ensuring you get the right loan to fit your needs. Start your home-buying journey with confidence and let Efficient Capital help you secure the perfect mortgage deal!

0 notes

Text

Buying a home can be an exciting experience. But there are many options and factors to consider, including the loan type and rate, deposit amount and length of time you have to pay it off. The best way to get the best deal is by talking directly with a licensed broker - especially when there are so many variables at play.

For more information visit Kiwi Mortgages official website.

#Home Loans Auckland#Low Deposit Home Loans Auckland#Home Loan Broker Auckland#Property Development Mortgage#Borrowing for Property Development#Property Development Loans

0 notes

Text

Purchasing your first home can be an exciting but daunting experience, especially if you're a first-time homebuyer with a limited deposit.In this article, we will provide expert tips on low deposit home loans, explaining how we work and what you need to know to make an informed decision.

1 note

·

View note

Text

Private equity ghouls have a new way to steal from their investors

Private equity is quite a racket. PE managers pile up other peoples’ money — pension funds, plutes, other pools of money — and then “invest” it (buying businesses, loading them with debt, cutting wages, lowering quality and setting traps for customers). For this, they get an annual fee — 2% — of the money they manage, and a bonus for any profits they make.

On top of this, private equity bosses get to use the carried interest tax loophole, a scam that lets them treat this ordinary income as a capital gain, so they can pay half the taxes that a working stiff would pay on a regular salary. If you don’t know much about carried interest, you might think it has to do with “interest” on a loan or a deposit, but it’s way weirder. “Carried interest” is a tax regime designed for 16th century sea captains and their “interest” in the cargo they “carried”:

https://pluralistic.net/2021/04/29/writers-must-be-paid/#carried-interest

Private equity is a cancer. Its profits come from buying productive firms, loading them with debt, abusing their suppliers, workers and customers, and driving them into ground, stiffing all of them — and the company’s creditors. The mafia have a name for this. They call it a “bust out”:

https://pluralistic.net/2023/06/02/plunderers/#farben

Private equity destroyed Toys R Us, Sears, Bed, Bath and Beyond, and many more companies beloved of Main Street, bled dry for Wall Street:

https://prospect.org/culture/books/2023-06-02-days-of-plunder-morgenson-rosner-ballou-review/

And they’re coming for more. PE funds are “rolling up” thousands of Boomer-owned business as their owners retire. There’s a good chance that every funeral home, pet groomer and urgent care clinic within an hour’s drive of you is owned by a single PE firm. There’s 2.9m more Boomer-owned businesses going up for sale in the coming years, with 32m employees, and PE is set to buy ’em all:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

PE funds get their money from “institutional investors.” It shouldn’t surprise you to learn they treat their investors no better than their creditors, nor the customers, employees or suppliers of the businesses they buy.

Pension funds, in particular, are the perennial suckers at the poker table. My parent’s pension fund, the Ontario Teachers’ Fund, are every grifter’s favorite patsy, losing $90m to Sam Bankman-Fried’s cryptocurrency scam:

https://www.otpp.com/en-ca/about-us/news-and-insights/2022/ontario-teachers--statement-on-ftx/

Pension funds are neck-deep in private equity, paying steep fees for shitty returns. Imagine knowing that the reason you can’t afford your apartment anymore is your pension fund gambled with the private equity firm that bought your building and jacked up the rent — and still lost money:

https://pluralistic.net/2020/02/25/pluralistic-your-daily-link-dose-25-feb-2020/

But there’s no depth too low for PE looters to sink to. They’ve found an exciting new way to steal from their investors, a scam called a “continuation fund.” Writing in his latest newsletter, the great Matt Levine breaks it down:

https://news.bloomberglaw.com/mergers-and-acquisitions/matt-levines-money-stuff-buyout-funds-buy-from-themselves

Here’s the deal: say you’re a PE guy who’s raised a $1b fund. That entitles you to a 2% annual “carry” on the fund: $20,000,000/year. But you’ve managed to buy and asset strip so many productive businesses that it’s now worth $5b. Your carry doesn’t go up fivefold. You could sell the company and collect your 20% commission — $800m — but you stop collecting that annual carry.

But what if you do both? Here’s how: you create a “continuation fund” — a fund that buys your old fund’s portfolio. Now you’ve got $5b under management and your carry quintuples, to $100m/year. Levine dryly notes that the FT calls this “a controversial type of transaction”:

https://www.ft.com/content/11549c33-b97d-468b-8990-e6fd64294f85

These deals “look like a pyramid scheme” — one fund flips its assets to another fund, with the same manager running both funds. It’s a way to make the pie bigger, but to decrease the share (in both real and proportional terms) going to the pension funds and other institutional investors who backed the fund.

A PE boss is supposed to be a fiduciary, with a legal requirement to do what’s best for their investors. But when the same PE manager is the buyer and the seller, and when the sale takes place without inviting any outside bidders, how can they possibly resolve their conflict of interest?

They can’t: 42% of continuation fund deals involve a sale at a value lower than the one that the PE fund told their investors the assets were worth. Now, this may sound weird — if a PE boss wants to set a high initial value for their fund in order to maximize their carry, why would they sell its assets to the new fund at a discount?

Here’s Levine’s theory: if you’re a PE guy going back to your investors for money to put in a new fund, you’re more likely to succeed if you can show that their getting a bargain. So you raise $1b, build it up to $5b, and then tell your investors they can buy the new fund for only $3b. Sure, they can get out — and lose big. Or they can take the deal, get the new fund at a 40% discount — and the PE boss gets $60m/year for the next ten years, instead of the $20m they were getting before the continuation fund deal.

PE is devouring the productive economy and making the world’s richest people even richer. The one bright light? The FTC and DoJ Antitrust Division just published new merger guidelines that would make the PE acquire/debt-load/asset-strip model illegal:

https://www.ftc.gov/news-events/news/press-releases/2023/07/ftc-doj-seek-comment-draft-merger-guidelines

The bad news is that some sneaky fuck just slipped a 20% FTC budget cut — $50m/year — into the new appropriations bill:

https://twitter.com/matthewstoller/status/1681830706488438785

They’re scared, and they’re fighting dirty.

I’m at San Diego Comic-Con!

Today (Jul 20) 16h: Signing, Tor Books booth #2802 (free advance copies of The Lost Cause — Nov 2023 — to the first 50 people!)

Tomorrow (Jul 21):

1030h: Wish They All Could be CA MCs, room 24ABC (panel)

12h: Signing, AA09

Sat, Jul 22 15h: The Worlds We Return To, room 23ABC (panel)

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/07/20/continuation-fraud/#buyout-groups

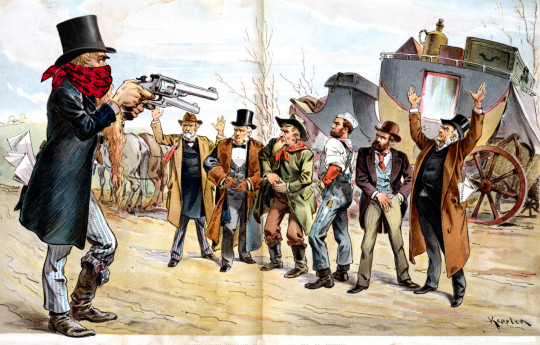

[Image ID: An old Punch editorial cartoon depicting a bank-robber sticking up a group of businesspeople and workers. He wears a bandanna emblazoned with dollar-signs and a top-hat.]

#pluralistic#buyout groups#continuation fraud#pe#pyramid schemes#the sucker at the table#pension plans#continuation funds#matt levine#fiduciaries#finance#private equity#mark to market#ripoffs

310 notes

·

View notes

Text

Gabon's debts will be reduced by $450 million thanks to an innovative debt-for-nature mechanism. Piloted on Gabon's behalf by Bank of America (BofA), the debt-for-nature mechanism enables developing countries to reduce their external debt in return for funding for their biodiversity. In return, Gabon is protecting part of its marine ecosystem. This is the second case in Africa after the Seychelles.

...Gabon is paying for its biodiversity through the debt-for-nature mechanism. The operation, for which tenders were launched on the London Stock Exchange on 25 July 2023, will enable Gabon to reduce its external debt by up to 450 million dollars (267.1 billion CFA francs). In return, the country is committed to protecting its marine environment, with the support of the US-based non-governmental organisation (NGO) The Nature Conservancy.

Financially, the operation is being led by Bank of America (BofA), the second largest US bank in terms of deposits. A debt-for-nature swap is a debt relief technique for developing countries. It involves extending payment terms, reducing interest rates, granting new loans at low rates and writing off debts. This technique, invented by the American biologist Thomas Lovejoy, considered to be the godfather of biodiversity, involves exchanging part of the foreign debt for local investment in environmental protection measures.

The largest network of marine reserves in Africa

As part of Gabon’s debt-for-nature operation, the choice to protect marine biodiversity is not an insignificant one. Over the years, the Central African country has built up the largest network of rich and diverse marine reserves in Africa. Stretching over 53,000 km2, or 26% of the country’s territorial waters, this environment comprises 20 marine parks and aquatic reserves. It is home to countless threatened marine species, including the largest breeding populations of leatherback and olive ridley turtles, as well as 20 species of dolphins and whales.

Gabon thus becomes the second African country, after the Seychelles, to benefit from the debt-for-nature swap. It’s a swap that should spread throughout Africa... explains Hamouda Chekir, a member of Lazard’s Government Advisory team.

The French bank has just assisted Ecuador with a financial package that benefits both nature and the country’s economy. In concrete terms, Ecuador has swapped its current debt of $1.63 billion for a debt of $656 million, a transaction corresponding to 3% of the South American country’s total external debt, i.e. $48.129 billion in February 2023."

-via Afrik21 (via FutureCrunch), August 1, 2023

#conservation#biodiversity#debt for nature#debt relief#debt#gabon#africa#ecuador#seychelles#marine life#marine park#good news#hope#united states#france#bank of america

89 notes

·

View notes

Text

No Deposit Loans Pros, Cons and the Truth

It’s hard for first home buyers to save for an upfront deposit, when paying rent, meeting bills and maybe starting a family.

This is frustrating, when you have a good rental record and know you could meet your mortgage repayments.

As the Reserve Bank of Australia found in 2022, first home buyers are no more likely than other types of owner-occupiers to report financial stress over the loan life or be in arrears or negative equity.

If you’re in this situation, you might be wondering about no deposit loans. Here are the pros and cons of these loans, and some alternatives.

Is buying a home with no deposit possible?

Buying a home with no deposit sounds like a great idea, doesn’t it?

You get onto the property ladder now, without the stress of finding that big lump sum.

Not many Australian lenders offer no deposit home loans, although there are options out there if you look hard enough.

Like any type of home loan, there are advantages and drawbacks to think about before you go ahead.

Pros of no deposit loans

Get a home without having to save for a deposit.

Get your own property sooner rather than later.

Set aside savings for other contingencies, like renovations or emergencies, when you don’t have to save for a deposit.

Invest in an area of the market that offers fast appreciation. Less of your own money is tied up in your home with a 100% lend.

Potentially get tax benefits on interest paid on 100% mortgage.

Cons of no deposit loans

Banks set very high interest rates on 100% loans, due to greater risk.

Pay costly LMI (Lender’s Mortgage Insurance), potentially adding tens of thousands to your loan.

Not many lenders offer 100% loans in Australia.

Increased risk of over-borrowing or negative equity.

More difficult to refinance or sell the property.

Hard to qualify, with banks requiring perfect credit report and high income.

Banks set hidden higher closing costs in return for no deposit.

There are also some alternatives to no deposit home loans to consider.

5% home loans in Australia

The First Home Guarantee is essentially a 5% home loan in Australia. This federal government program allows first-time buyers to purchase a property using a 5% deposit, without the need for LMI.

The government underwrites the loan and acts as a guarantor.

New places on the scheme are released at the start of each financial year. Places are limited though, and strict eligibility criteria applies.

There are also caps on how much applicants can spend on a property, depending on location.

While the scheme can provide first-time buyers with a low deposit way forward, a shared equity loan may be a more accessible option.

Shared equity home loans

With shared equity home loans, you can:

Deposit as little as 2.5%

Shared equity provides the remaining 17.5% to bring the deposit to 20%. With full ownership shared equity, where you are solely on the title, you can reduce the 2.5% further by adding in any government grants you may be eligible for.

Avoid LMI

Because the remaining 80% of the loan sits with the bank, you avoid costly LMI, saving between $10,000 and $40,000 on an average mortgage.

Get low fixed interest for five years

Pay 3.25% fixed interest on your loan’s shared equity portion for the first five years with HAS. The first three years of monthly payments on the shared equity facility are funded, which means you’re only making monthly mortgage payments on the 80% loan during this time.

What is the best option for you?

All these loan types can help you get onto the property ladder.

At HAS, naturally we think shared equity loans offer the best of both worlds! Buy property with a 2.5% micro deposit, without having to pay LMI. For the first three years, you only make monthly repayments on the 80% of the loan held by the bank.

However, it’s important to talk to your financial advisor about your individual circumstances before you decide on the best path forward. Consider your longer term goals, your current housing conditions, and your individual financial position before making a decision on the right loan for you.

And if you are interested in a shared equity home loan, contact us. We’d love to show you how these loans can be a game-changer for you and your family. By boosting your micro deposit, we can help you increase your serviceability and open up a world of home-buying opportunities.

Content Source: https://yourhas.com.au/no-deposit-loans-pros-cons-and-the-truth/

#low deposit loans#home loans#no deposit home loans#home affordability solutions#your has#first home buyer#shared equity

0 notes

Text

Cash Advance in Quebec: Fast Financial Relief for Short-Term Needs

For Quebec residents needing quick cash to cover unexpected expenses, a cash advance can offer fast access to funds. This short-term financial solution is designed to help manage urgent costs like medical bills, car repairs, or utility bills, providing you with immediate cash when you need it most.

Here’s what you need to know about cash advances in Quebec, including how they work, requirements, benefits, and some important considerations before you apply.

What Is a Cash Advance?

A cash advance is a short-term loan that provides immediate funds, usually repaid on your next payday or within a few weeks. In Quebec, cash advances are often offered by payday lenders and online loan providers, making them accessible and convenient for those facing temporary cash flow issues.

How Does a Cash Advance Work?

Application: You can apply online or at a cash advance location in Quebec. The application typically requires basic information like your ID, proof of income, and bank details.

Approval Process: Cash advances don’t usually require a credit check, so approvals are quick, often within minutes.

Funding: Once approved, the funds are sent to your bank account, sometimes within hours through e-Transfer or direct deposit.

Repayment: The loan amount plus any fees is usually due on your next payday. Some lenders may offer flexible repayment options for a slightly longer term.

Benefits of Cash Advances in Quebec

Quick Access to Funds: Cash advances are ideal for emergencies, as they provide immediate funds without lengthy approval times.

No Credit Check Needed: Most cash advance providers don’t perform a credit check, making them accessible to people with low credit scores.

Flexible Usage: You can use a cash advance for a wide range of expenses, from car repairs to last-minute travel.

Easy Online Applications: Many Quebec lenders offer online applications, allowing you to apply from the comfort of your home.

Requirements for Getting a Cash Advance in Quebec

To qualify for a cash advance, lenders generally require:

Proof of Income: Regular income, such as employment income, government benefits, or pension funds.

Canadian Bank Account: A bank account for direct deposit and repayments.

Government-Issued ID: Proof of identity and Quebec residency.

Contact Information: A valid phone number and email address.

Things to Consider Before Taking a Cash Advance

While cash advances provide immediate financial relief, there are a few important considerations:

High Fees and Interest: Cash advances often come with high fees. In Quebec, payday lenders can charge up to $15 per $100 borrowed, which can add up quickly.

Short Repayment Period: Repayment is typically due on your next payday, which can be challenging if you don’t have enough cash flow to cover the loan.

Risk of a Debt Cycle: Repeatedly relying on cash advances may lead to a cycle of debt. Borrow only what you need and plan to repay on time.

Tips for Using a Cash Advance Responsibly

Borrow Only When Necessary: Use a cash advance only for urgent expenses that can’t be postponed.

Budget for Repayment: Make sure you’ll have sufficient funds to repay the loan on time to avoid additional fees.

Explore Other Options First: If possible, consider alternatives like personal loans, borrowing from family or friends, or using a credit card cash advance if it’s more affordable.

Understand the Terms: Be clear on the fees, interest rate, and repayment schedule before agreeing to the loan.

Alternatives to Cash Advances in Quebec

Credit Union Loans: Many credit unions in Quebec offer short-term loans at lower interest rates than payday lenders.

Installment Loans: These loans allow for longer repayment periods and may offer better terms than cash advances for those who qualify.

Credit Card Cash Advance: While credit card cash advances have high interest, they might still be cheaper than payday loans if paid off quickly.

Community Assistance Programs: For essential expenses, check if any local resources or assistance programs in Quebec can help.

Frequently Asked Questions (FAQs)

1. Can I get a cash advance with no credit check in Quebec?Yes, most cash advance lenders don’t require a credit check, focusing instead on your income and ability to repay.

2. How much can I borrow with a cash advance?Cash advance amounts typically range from $100 to $1,500, depending on your income and the lender’s policies.

3. How quickly can I receive the funds?Many lenders offer same-day or next-day funding, particularly if you apply online.

4. Are cash advances expensive?Yes, cash advances come with high fees due to their short-term nature. In Quebec, the maximum fee allowed is $15 per $100 borrowed.

5. What happens if I can’t repay my cash advance on time?If you’re unable to repay on time, contact your lender. Many lenders offer extensions, but they usually come with additional fees. Avoid defaulting, as it could negatively impact your financial situation.

Cash advances in Quebec provide a quick financial solution for short-term needs, but they come at a cost. While they can help in emergencies, it’s essential to borrow responsibly, considering both the repayment terms and potential alternatives. By planning carefully, a cash advance can provide the immediate relief you need without compromising your financial stability.

2 notes

·

View notes

Text

i am buying a house, and (maybe) you can too!

so... you want to buy a house, but you don't make a lot of money and you have no way to save up the recommended 10% recommended downpayment on a mortgage, which means you're basically going to be stuck renting forever, right?

well... actually, maybe not!

this post is going to be very US-centric, so i cannot speak to the homebuying experience in other countries, but if you live in the united states... you might be able to buy a house for much less up front than you might think!

this is gonna get long, but the main things you'll need are:

a credit score in the low- to mid-600s. this can vary by program, but most down payment assistance programs require somewhere between a 620 and 660. (i might make a second post at some point about credit scores bc fixing my credit score was a long and arduous process.)

enough in savings to cover a few up-front expenses. there are a couple of things that the down payment assistance programs won't cover. for me, we ended up having to pay ~$1500 up front total, which - to put it in perspective - is less than the deposit and move-in fees were going to be at most apartments in our area.

that's basically it! if you can do those two things, you might be able to buy a house!

let's talk about the details.

programs vary by state, but most states have down payment assistance programs of one kind or another. there's also a federal USDA loan program which is $0 down as well, but is only available in rural areas.

these programs WILL usually require you to have a certain credit score, usually somewhere in the 600s. (the particular program my housemates and i are using requires a minimum 640, but some require a higher or lower credit score than that.)

usually your first step is speak to a mortgage lender. the mortgage lender i'm working with is only available in the state of tennessee and not all mortgage companies accept all down payment assistance options, so i would research options in your state and then check to see if the programs have a list of preferred lenders and/or loan officers.

this sounds scary, but my loan officer has been a life-saver during this process. generally your loan officer wants to help you succeed, particularly when they know you're a first time home owner. tell your loan officer that you're going to be a first time home owner and you're interested in a $0 down payment program. they can run the numbers and see if you qualify, and if so, how much you can qualify for.

you can have multiple people on the mortgage with you, but everyone on the mortgage has to meet the credit score requirement.

if you do qualify, also talk to your loan officer about how much you can pay per month for a mortgage, too, since this might also impact what price range you're shopping in.

you'll also want a real estate agent. (trust me on this. you want a real estate agent.) my loan officer recommended a real estate agent to me and we quite literally could not have done this without him. your real estate agent does a lot more than just help you find houses to look at. they will also point out things that you might not know to look for and will also help negotiate with the seller for you.

when you talk to your real estate agent, tell them you are using a down payment assistance program and that you will need the seller to cover your closing costs. closing costs, for reference, are a bunch of small expenses that are paid when you officially sign the mortgage. typically both the buyer and the seller have separate closing costs, but it's fairly normal for buyers to ask the seller to pay for their closing costs for them in the current market. your real estate agent can then negotiate for this for you.

if the seller covers your closing costs and you can get approved for down payment assistance, there are only three things you will probably have to pay for out of pocket:

"earnest money." this is a small sum of money you pay to hold the house after the seller accepts your bid. (in our case, we paid $500 for our earnest money.)

the home inspection. our home inspection was also about $500, though the price of this could vary based on where you live.

the home appraisal. for us this was also about $500, though again, this could vary based on where you live.

and that's basically it! obviously talk with your loan officer and real estate agent about the cost of these things bc they might not be the same cost for you as they were for me, but for us, this ended up actually being cheaper than moving into a new apartment!

#i might try to write up some tips on improving your credit at some point too?#obviously i'm not a professional and this is just information based on my experience#but also six months ago we had NO IDEA that buying a home was even an option#and we were looking at trying to rent a house#and honestly... the credit score requirement on the mortgage was about the same as the credit score requirement for most of the rentals her#i don't know what to tag this as lmao#briar.txt

5 notes

·

View notes

Text

How Mortgage Brokers Can Help You Secure a Low Deposit Home Loan

Buying a home in Sydney can be a challenging process, especially when it comes to securing a loan with a low deposit. Many first-time homebuyers struggle to gather the necessary funds for a deposit, which can sometimes be 20% of the property’s value. Fortunately, mortgage brokers Sydney are experts in navigating the complex landscape of home loans Sydney, and they can help you find a low deposit loan that fits your financial situation. In this blog, we’ll explore how mortgage brokers Sydney can assist you in securing a low deposit loan and why working with the best mortgage brokers in Sydney can save you time, money, and stress during your home-buying journey. Understanding Low Deposit Loans A low deposit loan typically allows homebuyers to purchase a property with less than the usual 20% deposit. This type of loan is particularly attractive to first-time buyers or those who haven't saved enough for a large deposit but are eager to enter the property market. While the idea of a low deposit may sound simple, the criteria and conditions that come with it can be complex. This is where mortgage brokers Sydney play a crucial role. They guide you through the available loan products and ensure you meet the requirements for lenders offering low deposit options. Access to Lenders Who Offer Low Deposit Loans One of the key benefits of working with mortgage brokers Sydney is that they have access to a wide variety of lenders, including those that offer low deposit loans. Instead of being limited to one or two options, mortgage brokers can help you explore a range of lenders who are willing to approve your loan with a smaller deposit. This not only broadens your choices but increases the likelihood of securing a loan that works for you. The best mortgage brokers in Sydney often have established relationships with lenders, which can give you an edge when negotiating favorable loan terms. They are familiar with each lender’s requirements, including credit scores, employment history, and income levels, ensuring that you are matched with the lender most likely to approve your loan application.

Tailoring the Loan to Your Specific Needs Every homebuyer has unique financial circumstances, and the best mortgage brokers in Sydney know how to tailor loans to suit individual needs. Whether you’re self-employed, a first-time buyer, or someone with a fluctuating income, mortgage brokers Sydney can find home loans Sydney that align with your situation. They also take into account additional costs that may come with a low deposit loan, such as Lenders Mortgage Insurance (LMI). Mortgage brokers Sydney can advise you on ways to minimize LMI costs and help structure your loan in a way that fits your long-term financial goals. Navigating the Application Process Applying for a home loan can be daunting, especially when trying to secure a low deposit loan. There are many factors to consider, including your credit score, savings, and overall financial health. Mortgage brokers Sydney simplify this process by guiding you step-by-step, ensuring you meet all the necessary requirements. From gathering your documents to liaising with lenders, mortgage brokers Sydney handle the entire process on your behalf. Their expertise ensures that your loan application is prepared correctly, reducing the chances of delays or rejections. Negotiating Competitive Interest Rates In addition to finding the right lender, mortgage brokers Sydney can also negotiate competitive interest rates on your behalf. This is particularly important with low deposit loans, as some lenders may charge higher interest rates to offset the perceived risk of a smaller deposit. The best mortgage brokers in Sydney use their knowledge of the lending market to secure favorable rates, saving you money over the life of your loan. Conclusion Securing a low deposit loan in Sydney’s competitive real estate market can be challenging, but with the help of mortgage brokers Sydney, the process becomes much more manageable. From finding the right lender to negotiating the best interest rates, mortgage brokers play a vital role in helping you achieve your dream of homeownership, even with a small deposit. For expert assistance in navigating home loans Sydney and securing a low deposit loan, reach out to Efficient Capital today. As one of the best mortgage brokers in Sydney, Efficient Capital can guide you through the entire process, ensuring you get the right loan to fit your needs. Start your home-buying journey with confidence and let Efficient Capital help you secure the perfect mortgage deal!

https://www.efficientcapital.com.au/

0 notes

Text

Debt at the heart of the growth paradigm

Before industrialization, much of the world’s population lived in a society with very low per capita economic growth rates. In the 1930’s with the invention of econometrics, economic growth became a symbol of a modern state, and an aspirational goal of the nation to demonstrate progress in comparison to other nations.

However, sustained economic growth comes with an immense social and ecological cost. There is little doubt that increasing pollution and waste generated by the growth economies threaten the well-being of future generations. Likewise, the overuse of the world’s natural resources is eliminating the possibility of people in the majority world achieving the same levels of income as people in high-income countries.

Photo by Alexander Grey on Unsplash

If the problems of the hegemony of growth are obvious, what is creating a “growth trap” so hard to escape?

In today’s economy money is primarily created through the issuance of loans by the private banking sector. Most of the money circulating in the economy is created by private banks. When a person gets a mortgage to buy a new home, the bank creates a deposit account with an equivalent amount of money in the ledger (no new money is printed). However, this deposit is equivalent to other types of money, in fact over 99% of total transactions by value in the UK are bank deposits! Only a fraction of the money is physical cash created by the state.

The problem with this type of money production is that we need to maintain a high level of loans to have money circulating in the economy. Understanding how money is created in the modern economy, and the role of debt in the process of money creation, helps to understand one of the key obstacles to escaping the hegemony of growth.

At the individual level, dept economy means that people must constantly work more than they consume, to be able to pay back their loans. Having a shorter working week, and earning less, is not an option if one needs to pay back a home mortgage or student loan. It is difficult to reduce private debt in the absence of growth.

Likewise, in the non-growing economy, the country governments struggle to pay down their public debt and may need to cut spending on education, health care or other social services. Particularly low and middle-income countries, with large debts issued in foreign currency, are often unable to invest in public infrastructure without taking more loans.

In the worst case to manage their loan payments to international creditors, they must resort to privatising the state assets such as electricity production or drinking water, exposing these “public goods” under speculation of private markets, and making them too expensive to most of the people in the country.

If all loans would be paid back, there would not be money in the economy.

Dept drives growth, which in turn is necessary to avoid financial crises. High levels of public debt mean that growth is the only option to manage the loan without hurting the people living in the country. Likewise, high levels of private debt mean that people have no option other than to continue to contribute their labour to the growth economy.

However, in the current financial system, private banks continue to issue new loans for profit, without any consideration of whether these loans contribute to the economy operating within planetary boundaries or advance equality and social justice.

And while banks and asset mangers cash in profits, the circle of more debt and demands for more growth goes on and on and on….

References

Escaping Growth Dependency – Why reforming money will reduce the need to pursue economic growth at any cost to the environment by PositiveMoney

https://positivemoney.org/publications/escaping-growth-dependency/

Sovereign Money - An Introduction by Ben Dyson, Graham Hodgson and Frank van Lerven

https://www.insearchofsteadystate.org/downloads/Sovereign-Money,-An-Introduction-Dyson-Positive-Money-2016.pdf

18 notes

·

View notes

Text

If you want to be a home owner please look into local assistance for first time home buyers.

In the US there are special loans for first time home buyers as well as assistance if you want to live in a rural area ( FHA and USDA loans). Special loans are more flexible with minimum down payment and credit score minimums as well as don't have some requirements that Conventional Loans have.

Ie one thing that helped us is Conventional loans require you to work full time consistently in the same field for 2 years. FHA only requires 6 months of employment and a letter explaining your history and to have an income that can afford the loan. I didn't have the work history needed for a Convention Loan.

The Loans, Grants, and Assistance vary state to state and you may have other options if you live in a major city. (Our second grant was only for our area.)

There also may be government backed housing assistance agencies which will help you with going through the process for free or a low payment (our state requires you to do some education with them for the FHA loan, and it was free).

My partner and I recently bought a house with a FHA Loan/Grant and a First Homeowners Grant from our lender (which has the qualifications of being a low income area, low income, as well as first homeowners). We were able to forgo any down payment or closing costs and will be paying less monthly costs then the rentals we were considering month to month.

We still had to pay some things. We paid for inspection, appraisal, insurance upfront, refundable deposit and 1000 dollars at closing.

FHA loans also have the added cost of loan insurance for month to month costs, but overall is still cheaper then renting so 🤷 I am not complaining.

Another thing to expect as a lower income buyer is you likely will only be able to afford fixer uppers so expect to have a lot of initial repair costs as well as maintaining your home over time. There is assistance for those things as well but be careful of loan scams when looking for those.

If you do consider going this route, make sure to be thorough with inspections and negotiate with what you find. It is a lot of upfront costs for something you may not go with, but can save you thousands in the long run. We needed to change out knob and tube in our house and since we found it in the inspection we were able to negotiate 12k from the sellers to fix it rather than paying that out of our pockets later. We also saved over a thousand by getting them to service the neglected HVAC. You're not likely to get a seller to fix everything, but you can save a lot with negotiating.

More homeowners can stabilize communities and help rent to not skyrocket uncontrollably. Especially if the homeowners arent nimbys who only care about their property values and instead actually care about their renting neighbors. Homeowners also have more power in your local politics, so taking advantage of these programs and getting more power to disadvantaged people and communities is so important.

#new homeowner#my partner and o have been yapping about this to everyone who will listen because fuck landlords and our city is gentrifying at a terrifyin#pace and the more homeowners the better#low income homeowners#not rich ppl moving in and buying the shiny new luxury housing that was built on demolished 100 yr old rowhomes#i want my neighbors to be safe from eviction and have the equity for retirement#for full disclosure i make 15.50 and my partner makes 17 an hr in a major city#we have good credit but it took a bit of a hit when applying to rentals#i dont know abt this stuff internationally#but theres likely simular stuff

3 notes

·

View notes