#home equity loans ontario

Explore tagged Tumblr posts

Text

Unlock Your Home's Equity with Devon Jones

Devon Jones provides homeowners in Ontario with home equity loans, offering a practical financial solution. These loans come with competitive rates and terms, allowing you to utilize your home's equity for various purposes like home renovations, debt consolidation, and significant expenses. Rely on Devon Jones to assist you in tapping into your Ontario home's equity to achieve your financial objectives. Explore further details on their website.

0 notes

Text

Everything About Home Equity Loans

Home equity loans in Ontario allow homeowners to borrow money using the equity they have built up in their property. Equity is the difference between the current value of the property and the outstanding mortgage balance. Home equity loans can be used for various purposes.

0 notes

Text

Debt consolidation services in Ontario offer strategic solutions to combine multiple debts into a single manageable payment. Through personalized debt management plans and negotiation with creditors, these services help individuals regain financial stability and reduce the burden of high-interest debts, providing a pathway to long-term financial health.

#Debt consolidation Services in Ontario#Home Improvement Loans in Ontario#Home Renovation Loans Ontario#Home Equity Loan in Ontario Canada#Ontario Private First Mortgage Services

0 notes

Text

Things You Need To Know Before Taking Any Loans Or Mortgage!

A loan is an agreement between a lender and borrower that involves the exchange of money in return for interest payments over some time. The lender will typically issue the loan, which can be used to purchase goods, and services, or to cover other debts. The borrower will then repay the loan with interest over the predetermined amount of time, which is usually determined by the lender. Mortgage A mortgage is similar to a loan in that it involves the exchange of money in return for interest payments over some time. However, unlike a standard loan, a mortgage is usually taken out to purchase real estate or other property. Mortgages are secured by the property being purchased and typically require a much larger sum of money to be borrowed than a standard loan. The length of a mortgage will depend on the type and amount being borrowed. What is a private mortgage? A private mortgage involves borrowing money from an individual or private lender rather than from an institutional lender such as a bank or credit union. Unlike traditional lending institutions, private mortgage lenders Ontario is not subject to government regulations and may offer more flexible terms regarding repayment plans and interest rates. Private mortgages are usually taken out when borrowers have difficulty qualifying for traditional financing such as when they have poor credit scores or little equity in their home. Why taking private mortgages is better? Private mortgage lenders offer borrowers an alternative financing option when they are unable to qualify for traditional financing through banks or credit unions. Private lenders often offer more flexible terms and interest rates compared to traditional lenders due to less strict government regulations. Additionally, private lenders may provide quicker turnaround times, and better cash flow optimization when approving loans. Three things to keep in mind when taking out a loan such as a Home Equity Loan: When taking out any type of loan, some key things you should keep in mind: Budgeting Budgeting means estimating how much money will be needed and ensuring that it can be repaid without any future financial hardship. Terms and conditions Understanding the terms and conditions of the home equity loan Ontario itself means identifying potential fees, scrutinizing all terms regarding repayment schedules and interest rates, and confirming that there are no hidden fees or charges associated with the loan. To learn more, visit https://braydenhoopermortgages.com/ Original Source: https://bityl.co/L1zQ

0 notes

Text

Unlock the Potential of Your Business with a Commercial Mortgage: A Comprehensive Guide

Are you an ambitious business owner seeking to expand or secure financing for your company’s growth? Have you considered the benefits of a commercial mortgage? While it may appear daunting at first, a commercial mortgage can provide advantages for businesses of all sizes and industries. In this extensive exploration, we delve into the intricacies of commercial mortgages and shed light on why they may be the perfect solution for your business. Discover how a commercial mortgage can propel your enterprise to new heights, offering lower interest rates and long-term stability.

An Introduction to Commercial Mortgages A commercial mortgage serves as a loan specifically designed to finance the purchase of commercial properties, such as office buildings, retail spaces, or industrial warehouses. These mortgages differ significantly from residential loans, both in terms and conditions.

Types of Available Commercial Mortgages Various types of commercial mortgages exist, each with its unique terms and conditions. The standard variable-rate mortgage is the most prevalent commercial mortgage, ranging from 5 to 30 years. Additionally, other types include:

1. Fixed-Rate Mortgages: These mortgages feature a fixed interest rate for the entire loan duration, making them ideal for businesses seeking property purchase or refinancing at a lower interest rate.

2. Balloon Mortgages: With a shorter term than standard variable-rate mortgages (usually 5 to 7 years), balloon mortgages require a substantial balloon payment at the loan’s end. They can benefit businesses anticipating a significant cash inflow, such as through property sales.

3. Cache Mortgages: Specifically tailored for businesses dealing with commodities, such as agricultural or natural resource-based enterprises, cache mortgages are short-term loans (1 to 5 years) utilized to finance the purchase or development of commodity-based assets.

Advantages of a Commercial Mortgage Suppose you intend to secure a commercial mortgage to acquire property for your business. In that case, several crucial factors must be considered. First, like any mortgage, ensuring affordability of monthly payments is vital. However, commercial mortgages typically bear higher interest rates than residential mortgages, necessitating careful budgeting.

Another crucial consideration is the loan-to-value ratio (LTV), representing the percentage of the property’s value being borrowed. The LTV affects both the interest rate and the required down payment. Higher LTV ratios pose greater risk to lenders, resulting in higher interest rates or larger down payment requirements.

It is worth noting that commercial mortgages usually have shorter terms compared to residential mortgages. While this entails higher monthly payments, it also means the loan will be paid off sooner. This can be advantageous if you anticipate business growth and the ability to refinance at a lower rate in the coming years.

Essential Considerations Before Applying for a Commercial Mortgage If you are contemplating applying for a commercial mortgage, several key considerations should be evaluated. Here’s an overview of what you need to know before proceeding:

1. Understand the Distinction Between Commercial and Residential Mortgages: Recognize the fundamental differences between commercial and residential mortgages. Commercial mortgages finance properties utilized for business purposes, while residential mortgages finance homes for personal dwelling.

2. Evaluate the Type of Property Being Financed: When considering a commercial mortgage, carefully assess the property you aim to finance. Different properties carry varying risks and rewards, making it crucial to select a property that aligns with your business objectives. Factors such as location and condition are significant when financing office buildings, for instance.

3. Assess Your Financial Situation: Thoroughly evaluate your financial standing before applying for a commercial mortgage. This involves considering your credit score, debt-to-income ratio, and overall financial health. Lenders utilize this information to determine your loan eligibility and the interest rate offered.

Selecting the Right Commercial Mortgage Lender When seeking a commercial mortgage lender, several factors warrant attention. Firstly, ensure the lender possesses experience in financing properties similar to the one you intend to purchase. For instance, if acquiring an office building, opt for a lender well-versed in financing such properties.

Additionally, compare interest rates and fees among lenders, as some may charge higher fees than others. Pay close attention to the loan-to-value ratio (LTV), as a higher LTV entails increased lender risk and potentially higher interest rates.

Before signing any loan agreement, thoroughly comprehend all the terms and conditions, including prepayment penalties and balloon payments. If you have any uncertainties, seek clarification from the lender to ensure a clear understanding.

Why Choose Right Choice Mortgages for Commercial Mortgage Solutions A commercial mortgage presents an excellent opportunity to fulfill your business’s financial requirements. However, it is crucial to carefully consider the available options and their alignment with your short-term and long-term financial goals. Once you have determined that a commercial mortgage is the right fit for your business, it’s time to find a reputable lender offering competitive rates and favorable terms to suit your needs and budget.

If you are seeking a commercial property mortgage in Toronto, Right Choice Mortgage offers numerous compelling reasons to consider their services. As a leading provider of commercial mortgages, we possess the experience and expertise necessary to secure the best possible deal for your loan.

We work closely with you to understand your unique needs, enabling us to identify the most suitable loan for your business. With a diverse range of loan options available, we are confident in finding the perfect match. Moreover, we offer competitive rates and flexible repayment terms to ensure optimal affordability.

Recognizing that obtaining a loan entails significant decision-making, we take the time to explain all aspects and answer any queries you may have. Our goal is to instill confidence in your decision-making process, ensuring that you make the right choice for your business.

Contact us today to learn more about our commercial mortgage options. We are eager to assist you in finding the ideal loan solution for your business’s specific requirements.

#commercialproject#commercialmortgage#mortgage professional ontario#mortgage brokers#mortgages#financial services#mortgage broker toronto#mortgage agent toronto#home equity loans

0 notes

Text

Working with a Mortgage broker in Canada

Mortgage brokers in Canada are licensed professionals who work with multiple lenders to help you find a mortgage that meets your needs. They can save you time and money by shopping around on your behalf and finding the best mortgage rates and terms available.

Here are some of the benefits of working with a mortgage broker in Canada:

More Options: Mortgage brokers have access to multiple lenders, including banks, credit unions, and private lenders. This gives you more options and a better chance of finding a mortgage that meets your needs.

Expert Advice: Mortgage brokers are knowledgeable about the mortgage industry and can provide you with expert advice on your options. They can help you understand the different types of mortgages, interest rates, and terms, and help you choose the best option for your situation.

Save Time: Instead of contacting multiple lenders yourself, a mortgage broker can do the legwork for you. They will gather quotes and provide you with a list of options, saving you time and effort.

Save Money: Mortgage brokers can help you find the best rates and terms available, potentially saving you money over the life of your mortgage.

Personalized Service: Mortgage brokers work with you to understand your unique financial situation and goals. They can provide personalized service and help you find a mortgage that meets your specific needs.

If you're interested in working with a mortgage broker in Canada, be sure to do your research and choose a licensed and experienced professional.

#self employment mortgage#home equity loan ontario#mortgage for home buyer#quick equity loan#best mortgage broker mississauga

1 note

·

View note

Text

Private equity ghouls have a new way to steal from their investors

Private equity is quite a racket. PE managers pile up other peoples’ money — pension funds, plutes, other pools of money — and then “invest” it (buying businesses, loading them with debt, cutting wages, lowering quality and setting traps for customers). For this, they get an annual fee — 2% — of the money they manage, and a bonus for any profits they make.

On top of this, private equity bosses get to use the carried interest tax loophole, a scam that lets them treat this ordinary income as a capital gain, so they can pay half the taxes that a working stiff would pay on a regular salary. If you don’t know much about carried interest, you might think it has to do with “interest” on a loan or a deposit, but it’s way weirder. “Carried interest” is a tax regime designed for 16th century sea captains and their “interest” in the cargo they “carried”:

https://pluralistic.net/2021/04/29/writers-must-be-paid/#carried-interest

Private equity is a cancer. Its profits come from buying productive firms, loading them with debt, abusing their suppliers, workers and customers, and driving them into ground, stiffing all of them — and the company’s creditors. The mafia have a name for this. They call it a “bust out”:

https://pluralistic.net/2023/06/02/plunderers/#farben

Private equity destroyed Toys R Us, Sears, Bed, Bath and Beyond, and many more companies beloved of Main Street, bled dry for Wall Street:

https://prospect.org/culture/books/2023-06-02-days-of-plunder-morgenson-rosner-ballou-review/

And they’re coming for more. PE funds are “rolling up” thousands of Boomer-owned business as their owners retire. There’s a good chance that every funeral home, pet groomer and urgent care clinic within an hour’s drive of you is owned by a single PE firm. There’s 2.9m more Boomer-owned businesses going up for sale in the coming years, with 32m employees, and PE is set to buy ’em all:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

PE funds get their money from “institutional investors.” It shouldn’t surprise you to learn they treat their investors no better than their creditors, nor the customers, employees or suppliers of the businesses they buy.

Pension funds, in particular, are the perennial suckers at the poker table. My parent’s pension fund, the Ontario Teachers’ Fund, are every grifter’s favorite patsy, losing $90m to Sam Bankman-Fried’s cryptocurrency scam:

https://www.otpp.com/en-ca/about-us/news-and-insights/2022/ontario-teachers--statement-on-ftx/

Pension funds are neck-deep in private equity, paying steep fees for shitty returns. Imagine knowing that the reason you can’t afford your apartment anymore is your pension fund gambled with the private equity firm that bought your building and jacked up the rent — and still lost money:

https://pluralistic.net/2020/02/25/pluralistic-your-daily-link-dose-25-feb-2020/

But there’s no depth too low for PE looters to sink to. They’ve found an exciting new way to steal from their investors, a scam called a “continuation fund.” Writing in his latest newsletter, the great Matt Levine breaks it down:

https://news.bloomberglaw.com/mergers-and-acquisitions/matt-levines-money-stuff-buyout-funds-buy-from-themselves

Here’s the deal: say you’re a PE guy who’s raised a $1b fund. That entitles you to a 2% annual “carry” on the fund: $20,000,000/year. But you’ve managed to buy and asset strip so many productive businesses that it’s now worth $5b. Your carry doesn’t go up fivefold. You could sell the company and collect your 20% commission — $800m — but you stop collecting that annual carry.

But what if you do both? Here’s how: you create a “continuation fund” — a fund that buys your old fund’s portfolio. Now you’ve got $5b under management and your carry quintuples, to $100m/year. Levine dryly notes that the FT calls this “a controversial type of transaction”:

https://www.ft.com/content/11549c33-b97d-468b-8990-e6fd64294f85

These deals “look like a pyramid scheme” — one fund flips its assets to another fund, with the same manager running both funds. It’s a way to make the pie bigger, but to decrease the share (in both real and proportional terms) going to the pension funds and other institutional investors who backed the fund.

A PE boss is supposed to be a fiduciary, with a legal requirement to do what’s best for their investors. But when the same PE manager is the buyer and the seller, and when the sale takes place without inviting any outside bidders, how can they possibly resolve their conflict of interest?

They can’t: 42% of continuation fund deals involve a sale at a value lower than the one that the PE fund told their investors the assets were worth. Now, this may sound weird — if a PE boss wants to set a high initial value for their fund in order to maximize their carry, why would they sell its assets to the new fund at a discount?

Here’s Levine’s theory: if you’re a PE guy going back to your investors for money to put in a new fund, you’re more likely to succeed if you can show that their getting a bargain. So you raise $1b, build it up to $5b, and then tell your investors they can buy the new fund for only $3b. Sure, they can get out — and lose big. Or they can take the deal, get the new fund at a 40% discount — and the PE boss gets $60m/year for the next ten years, instead of the $20m they were getting before the continuation fund deal.

PE is devouring the productive economy and making the world’s richest people even richer. The one bright light? The FTC and DoJ Antitrust Division just published new merger guidelines that would make the PE acquire/debt-load/asset-strip model illegal:

https://www.ftc.gov/news-events/news/press-releases/2023/07/ftc-doj-seek-comment-draft-merger-guidelines

The bad news is that some sneaky fuck just slipped a 20% FTC budget cut — $50m/year — into the new appropriations bill:

https://twitter.com/matthewstoller/status/1681830706488438785

They’re scared, and they’re fighting dirty.

I’m at San Diego Comic-Con!

Today (Jul 20) 16h: Signing, Tor Books booth #2802 (free advance copies of The Lost Cause — Nov 2023 — to the first 50 people!)

Tomorrow (Jul 21):

1030h: Wish They All Could be CA MCs, room 24ABC (panel)

12h: Signing, AA09

Sat, Jul 22 15h: The Worlds We Return To, room 23ABC (panel)

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/07/20/continuation-fraud/#buyout-groups

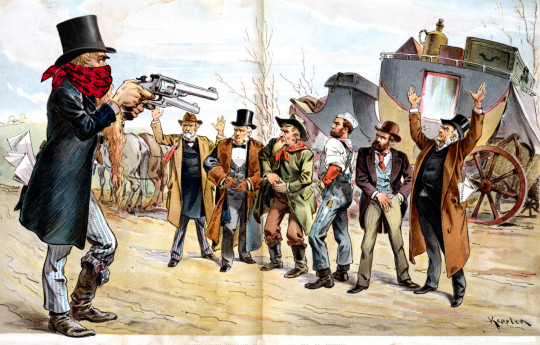

[Image ID: An old Punch editorial cartoon depicting a bank-robber sticking up a group of businesspeople and workers. He wears a bandanna emblazoned with dollar-signs and a top-hat.]

#pluralistic#buyout groups#continuation fraud#pe#pyramid schemes#the sucker at the table#pension plans#continuation funds#matt levine#fiduciaries#finance#private equity#mark to market#ripoffs

310 notes

·

View notes

Text

Get Fast Cash in Toronto with Car Title Loans from Snap Car Cash

Need fast cash in Toronto? Snap Car Cash offers reliable car title loans in Toronto, Ontario to help you borrow against your vehicle's value. With loans on vehicle title, you can access the money you need without the hassle of traditional credit checks. Our loans using car titles allow you to keep your car while securing the funds you need for urgent expenses. Whether it's for medical bills, home repairs, or any emergency, we make it easy to get a loan against vehicle titles. Get started with Snap Car Cash today and unlock your car’s equity!

#Car Title Loans Toronto#Car Title Loans in Toronto#Car Title Loans#loans against vehicle titles#vehicle title loans in canada#loan against vehicle title#loans on cars titles#loans using car titles

0 notes

Text

HOW TO GET PRIVATE MORTGAGES IN ONTARIO 2025

Navigating the world of mortgages can be tricky, especially when traditional lenders like banks aren’t meeting your needs. That’s where Private Mortgages in Ontario come in. Private mortgages are an alternative financing option that can provide flexible solutions when mainstream lenders say no.

In this blog, we’ll explore everything you need to know about getting a private mortgage in Ontario in 2025, step-by-step. By the end, you’ll feel confident in understanding how to work with private lenders and why it might be the right choice for you.

What Are Private Mortgages?

Private mortgages are loans provided by private lenders instead of traditional banks or credit unions. These lenders can be individuals, small groups, or companies who are willing to offer financing based on flexible criteria.

Unlike banks, private lenders don’t focus heavily on your credit score or financial history. Instead, they look at the value of the property you’re buying or refinancing. This makes private mortgages a great option for people who:

Have a low credit score.

Are self-employed with non-traditional income.

Need a fast approval process.

Have been declined by traditional lenders.

Why Consider Private Mortgages in Ontario?

The Ontario real estate market is unique and constantly evolving. With high property values and competitive bidding, securing financing quickly is critical. Here’s why private mortgages are increasingly popular in Ontario:

Flexible Approval Criteria: Private lenders are more lenient with credit scores and income verification.

Fast Approval Process: You can often get approval within days—perfect for time-sensitive deals.

Customized Terms: Lenders may tailor repayment terms to suit your needs.

Refinancing Options: If you need cash for renovations or debt consolidation, private lenders are an option.

How to Qualify for a Private Mortgage in Ontario

Qualifying for a private mortgage is much simpler than dealing with a traditional bank. Here’s how the process works:

1. Understand Your Needs

First, figure out why you need a private mortgage. Is it because of poor credit? Do you need a short-term loan for a quick property purchase? Knowing your reasons will help you approach the right lenders.

2. Check Your Property Value

Private lenders focus on the loan-to-value ratio (LTV) of your property. The LTV compares the loan amount to the property’s appraised value. Most private lenders in Ontario prefer an LTV of 75% or less, meaning you’ll need at least 25% equity or down payment.

3. Prepare Your Documents

While private lenders aren’t as strict as banks, they still need some paperwork. These typically include:

Proof of property value (like an appraisal report).

Proof of income or alternative sources of income.

Identification documents.

Details about your debt and financial obligations.

4. Find the Right Private Lender

Private lenders range from individuals to larger companies specializing in private mortgages. Working with a mortgage broker experienced in private mortgages in Ontario can save you time and connect you with the right lender.

Types of Private Mortgages

Private lenders offer different types of mortgages to suit various needs. Here are the most common ones:

First Mortgage: If you don’t qualify for a traditional mortgage, private lenders can provide the main loan for your home purchase.

Second Mortgage: Already have a mortgage? A private lender can offer a second loan to tap into your home equity.

Bridge Financing: Need temporary funds while transitioning between homes? Private lenders specialize in quick and short-term solutions.

Construction Loans: For those building or renovating properties, private lenders can provide customized financing.

Pros and Cons of Private Mortgages in Ontario

Before jumping into a private mortgage, it’s essential to weigh the advantages and disadvantages:

Pros:

Fast Approval: Ideal for urgent needs.

Flexible Terms: You can negotiate terms based on your situation.

Less Strict Requirements: Suitable for people with poor credit or self-employed individuals.

Cons:

Higher Interest Rates: Private mortgages often come with higher rates than traditional lenders.

Shorter Terms: Most private mortgages are short-term (6 months to 3 years).

Fees: You might pay additional fees for brokers, appraisals, or lender setup costs.

How to Choose the Right Private Lender

Not all private lenders are created equal. Choosing the right one is crucial for a successful mortgage experience. Here’s what to consider:

Reputation: Look for lenders with positive reviews and a solid track record.

Interest Rates: Compare rates across multiple lenders to get the best deal.

Terms and Conditions: Read the fine print to understand repayment terms and any penalties.

Transparency: The lender should clearly explain fees and charges upfront

Steps to Get a Private Mortgage in Ontario

Now that you understand the basics, here’s a step-by-step guide to getting a private mortgage:

Step 1: Evaluate Your Options

Decide whether a private mortgage is right for you. Consult a mortgage broker who specializes in private mortgages in Ontario for advice.

Step 2: Get Your Property Appraised

Hire a certified appraiser to determine your property’s value. This is a key factor for private lenders.

Step 3: Shop Around for Lenders

Don’t settle for the first lender you find. Compare multiple options, considering their terms, rates, and reputations.

Step 4: Submit Your Application

Provide the necessary documents and discuss your needs with the lender. Be honest about your financial situation to avoid complications later.

Step 5: Close the Deal

Once approved, review the mortgage agreement carefully. Ensure you understand all terms before signing.

Working with Sure Loan For You

If you’re exploring private mortgages in Ontario, Sure Loan For You can help. We specialize in connecting clients with reliable private lenders who offer flexible and affordable solutions. Whether you need a first mortgage, second mortgage, or bridge financing, our team is here to guide you every step of the way.

With Sure Loan For You, you can expect:

Personalized Service: We take the time to understand your unique needs.

Quick Approvals: Our streamlined process ensures you get financing fast.

Expert Advice: Our experienced team can help you navigate the private lending market.

CONCLUSION

Private mortgages in Ontario are an excellent option for those who need flexibility, quick approval, or alternative lending solutions. Whether you’re dealing with bad credit, are self-employed, or simply need a fast turnaround, private lenders can provide the financing you need to achieve your goals.

If you’re ready to take the next step, Sure Loan For You is here to help. Contact us today to learn how we can connect you with trusted private lenders and secure the best mortgage for your needs.Don’t wait—let’s make your real estate dreams a reality in 2025!

0 notes

Text

First-Time Home Buyer Mortgages in Ontario: A Complete Guide

Embarking on the homeownership journey is one of life's most exciting milestones. For many, this adventure begins with finding the right mortgage lender for your first-time home buyer. With so many mortgage options available, it's essential to understand the landscape, especially in Ontario, where specific programs and incentives can help make your first home more attainable. This complete guide will explore the ins and outs of first-time home buyer mortgages in Ontario, providing you with the knowledge you need to make informed decisions.

Understanding First-Time Home Buyer Mortgages in Ontario

Ontario's first-time homebuyer financing targets first-time homebuyers. These mortgages often come with benefits that make the process less daunting. First-time homebuyers usually have access to favourable mortgage rates, lower down payment requirements, and several government programs designed to help new homeowners.

Key Features of First-Time Home Buyer Mortgages

Lower Down Payment Options: In Ontario, first-time homebuyers can more effectively join the market by securing a mortgage with as little as 5% down.

Flexible Credit Requirements: It is easier for those with less-than-ideal credit histories to get approved because many lenders have more lenient credit standards for first-time buyers.

Government Assistance Programs: A number of programs are available to assist first-time homebuyers in navigating the challenges of financing their new residences. Being aware of these possibilities can substantially improve your financial path.

Government Programs Supporting First-Time Home Buyers

In Ontario, several significant programs can assist first-time homebuyers in achieving their dream of homeownership. A few notable projects are as follows:

First-Time Home Buyer Incentive (FTHBI): Through this program, you can lower your monthly mortgage payments without increasing your down payment by taking up a shared-equity mortgage with the Canadian government. For instance, you could make more manageable payments if the government co-invested in your house.

Land Transfer Tax Refund: Qualified first-time homeowners can receive refunds of up to $4,000 in land transfer tax, significantly reducing closing costs.

RRSP Home Buyers' Plan (HBP): You can withdraw up to $35,000 tax-free from your Registered Retirement Savings Plan (RRSP) toward your down payment. It is a fantastic way to leverage your savings to help secure your first home.

First-Time Home Buyers' Tax Credit: This federal tax credit helps first-time homebuyers offset some of their home's expenses by providing up to $750 in tax relief.

When taken as a whole, these initiatives give Ontario's first-time homebuyers a strong support network that simplifies navigating the financial side of home ownership.

Qualifying for a First-Time Home Buyer Mortgage

To secure a first-time home buyer mortgage, you'll need to meet specific criteria set by lenders and government programs:

Credit Score: Having a high credit score is crucial. Most lenders require a score of at least 650 to be eligible for advantageous mortgage rates. You can increase your chances of approval by reviewing your credit report and handling any problems in advance.

Down Payment: As previously stated, for properties up to $500,000, you can obtain a mortgage with a down payment as low as 5%. A more significant down payment is required for properties over this amount.

Debt-to-Income Ratio: Your debt-to-income ratio, which contrasts your monthly debt payments with your gross monthly income, will be assessed by lenders. Ideally, your total loan payments shouldn't be more than 35% of your income.

Employment Stability: A consistent employment history of at least two years can bolster your application. Lenders prefer candidates with stable jobs, as this indicates reliable income.

The Importance of Getting Pre-Approved

Before starting your house search, you must obtain a mortgage pre-approval. Pre-approval can help you know exactly how much you can afford, which may make your home search easier. Furthermore, pre-approval strengthens your negotiation by raising the possibility that sellers may consider your offer.

To get pre-approved, you must provide documents to your lender about your income, assets, debts, and credit history. Getting started early is best because this process can take several days to a week.

Navigating the Mortgage Types

When exploring mortgage options, you'll encounter various types of loans, each with its benefits:

Fixed-Rate Mortgages: These mortgages offer regular monthly payments and keep the interest rate constant for the loan. For people who prefer budget consistency, this is the best choice.

Mortgages with variable rates: These mortgages' interest rates fluctuate based on market conditions. Their initial rates may be lower, but as interest rates rise, your payments and expenses may change.

Open versus Closed Mortgages: With an open mortgage, there are no penalties if you decide to pay off your debt at any time. A closed mortgage, on the other hand, typically has a lower interest rate but prohibits additional payments.

Tips for First-Time Home Buyers in Ontario

Here are some valuable pointers to have in mind as you get ready to enter the home market:

Start Saving Early: Begin saving for your down payment and other expenses, such as closing and moving costs, well in advance. The more you save, the better off you'll be.

Start Saving Early: Begin saving for your down payment and other expenses, such as closing and moving costs, well in advance. The more you save, the better off you'll be.

Set a Realistic Budget: Calculate how much you can comfortably pay by taking stock of your financial status. Consider the mortgage payment and extra expenses like upkeep, insurance, and property taxes.

Speak with Experts: You might want to work with a real estate agent and mortgage broker who can guide you through the process and provide wise counsel.

Conclusion

Becoming a first-time homeowner in Ontario is a thrilling journey full of opportunities. You may go through this process with confidence if you are well-prepared, have a solid understanding of Ontario's first-time home buyer mortgage market, and investigate the available government programs. Remember that being informed and ready is the key to a successful home-buying experience. With the correct strategy and tools, you can locate and turn your ideal home into a reality! If you have any questions or need assistance, contact us today to get started on your path to homeownership!

0 notes

Text

Buying a Foreclosure Homes in Canada a Smart Investment?

Buying a foreclosure home in Canada offers a unique opportunity for investors and buyers to acquire properties at below-market prices. Foreclosed homes are properties that lenders sell after the previous owners fail to pay their mortgages. Though less common, these sales provide buyers with a chance to purchase properties at a discounted rate. With recent increases in mortgage interest rates, some Canadian homeowners have struggled with payments, potentially leading to more foreclosures and opportunities for savvy buyers.

Understanding Foreclosures in Canada

When a Canadian homeowner can’t make their loan payments, the lender has the right to take back and sell the property to recover their losses. This process, known as foreclosure, can begin as soon as a payment is missed. However, it’s not an immediate sale. The lender first issues a notice of default, giving the homeowner time to resolve the issue or sell the property themselves. If the homeowner fails to take action, the lender may proceed to sell the home, often through an auction.

It’s important to note that foreclosures are less frequent in Canada compared to the United States, making them a niche opportunity in the Canadian housing market.

Types of Foreclosures in Canada

There are two primary foreclosure methods used in Canada:

Judicial Sale: In provinces like British Columbia, Quebec, Alberta, Saskatchewan, and Nova Scotia, lenders must go through the courts to gain permission to sell the property. This method can be time-consuming and expensive, often taking several months or even up to a year. The court involvement ensures a fair process, but it also means the lender incurs legal costs, which they recover from the sale proceeds.

Power of Sale: In provinces such as Ontario, Prince Edward Island, New Brunswick, and Newfoundland and Labrador, lenders can sell the property without going through the courts. After the sale, they pay off the mortgage debt and any related fees. If the sale amount exceeds the debt, the remaining funds go to the borrower. However, if the sale falls short, the borrower remains responsible for the outstanding balance. This method is typically quicker and less costly than the judicial sale process.

Things to Know About Foreclosure Sales

Pre-Foreclosure Sales: Sometimes, homeowners attempt to sell their property before the lender takes control. This can present opportunities for buyers to purchase at a discounted price before the foreclosure process is finalized.

Auctions: Banks may sell foreclosed homes through auctions, either in person or online. It’s essential to understand the rules and costs associated with these auctions, as inspections are often only allowed after purchase.

Is Buying a Foreclosure Right for You?

Investing in a foreclosure property can be a great opportunity, but it also comes with risks. It’s essential to assess your financial situation, experience level, and comfort with potential challenges.

Benefits of Buying a Foreclosed Home:

Lower Price: Lenders often aim to sell quickly, which can result in discounted prices.

Investment Potential: Foreclosures can be an affordable entry point for those looking to buy, renovate, and rent or resell properties.

Clean Title: Lenders usually clear old debts or unpaid taxes before selling, simplifying the purchase process.

Renovation Opportunities: Purchasing below market value allows buyers to invest in improvements that could increase the property’s value and equity.

Buying a foreclosed home is often faster than a standard property purchase. Banks and homeowners eager to sell may offer better deals and expedited transactions, appealing to both investors and first-time buyers.

Challenges of Buying a Foreclosed Home

Despite the advantages, buying a foreclosed home has its downsides:

Competitive Market: Not all foreclosures are discounted significantly. In a competitive market, desirable properties may sell quickly, pushing prices higher.

“As-Is” Sales: Foreclosed homes are sold “as-is,” meaning buyers take on any necessary repairs and may need to remove belongings left behind.

Complex Legal and Financial Processes: Purchasing a foreclosed home often involves more stringent procedures, which can be complicated and time-consuming.

Liabilities and Taxes: Mortgage contracts may release lenders from any responsibility for property issues. Buyers may also face land transfer taxes, especially in Ontario, where rates range from 1% to 3% based on the property value.

Steps to Buying a Foreclosed Home in Canada

If you decide to pursue a foreclosure purchase, follow these steps:

Hire a Realtor: A professional REALTOR® with foreclosure experience is crucial. They can guide you through the complexities of buying a distressed property and answer any specific questions you may have.

Inspection and Appraisal: Conduct a thorough property inspection and appraisal to ensure you’re getting a fair deal and to understand the home’s true condition.

Budget for Costs: Foreclosures come with additional expenses, such as:

Reconnecting utilities

Renovations

Changing locks

Land transfer taxes

Administrative fees and permits for modifications

New appliances and repairs

Improve Your Finances: Boost your credit score, save for a substantial down payment, and pay off any existing debts to increase your chances of mortgage approval.

Make an Offer: Once you’ve done your research and decided to move forward, work with your realtor to make a competitive offer.

How to Find Foreclosure Homes in Canada

If you’re interested in exploring foreclosure options, here’s where to look:

Online Listings: Many real estate websites have foreclosure sections or filters to help you locate these properties.

Bank Websites: Some Canadian banks list foreclosed properties under “real estate owned” or “foreclosure” sections.

Real Estate Agents: Agents specializing in foreclosures can help you find and secure properties.

Government Websites: Occasionally, government listings include foreclosures, particularly those related to tax defaults.

Urban Team: Your Trusted Partner in Foreclosure Home Buying

With over 15 years of experience in the Canadian real estate market, Urban Team Homes is your trusted partner in buying foreclosure homes. Whether you’re searching for a primary residence or an investment opportunity, our expert team offers personalized support throughout the entire process, from property search to market analysis and negotiation. We ensure a smooth and successful transaction, making your investment in a foreclosure home a smart and rewarding decision.

Frequently Asked Questions (FAQs)

1. Can you buy foreclosure homes in Canada?

Yes, foreclosure homes are available in Canada, typically listed on the Multiple Listing Service (MLS) or through specialized real estate agents.

2. Why buy a foreclosure home?

They are often sold below market value, offering investment opportunities and quicker closing times.

3. What are the risks?

Risks include unexpected repairs, unpaid taxes, and legal complications. Proper research, inspections, and professional guidance are essential.

4. Where can I find foreclosure listings?

You can search on MLS, bank websites, or government platforms and work with real estate agents specializing in foreclosures.

5. Is buying a foreclosure home right for me?

It depends on your finances, investment goals, and willingness to navigate the complexities of foreclosure purchases. Professional advice is recommended to make an informed decision.

Considering buying a foreclosure? Contact Urban Team Homes for expert guidance and support in finding the best opportunities in the Canadian real estate market.

1 note

·

View note

Text

Top 5 mistakes when getting home equity

Author Loans For Ontario Published September 23, 2011 Word count 545 Rates have historically never been better, so nowadays the temptation to borrow against your home equity is very strong. However, many homeowners unknowingly make costly mistakes. Here are the top 5 mistakes people make when applying for a home equity loan. Mistake #1 – Not Knowing The Difference between a Home Equity Loan…

0 notes

Text

Why Refinancing Could Be the Best Financial Decision for You in 2025

Refinancing a mortgage can open doors you might not have otherwise thought of. It presents an opportunity to reorganize your money to fit your objectives. Changing economic times and interest rates mean that 2025 offers a different scene for homeowners looking for more financial control. Whether by reduced payments or access to home equity, investigating private mortgage lenders Ontario could open the path for a more flexible and safe future. Click here to know more.

Changing to Fit Financial Requirements

Homeowners have changing financial needs; refinancing offers a customized answer. It lets you reinterpret the terms of your current mortgage to fit your circumstances. Refinancing provides an approach when your goals are to lower monthly expenses or stretch loan terms. Refinancing is for everyone looking for better budget management, not only for those in crisis.

Reduced Interest Rates Will Save More for You

Many times, the possibility of reduced interest rates attracts individuals to refinancing. Market swings over time present chances for large savings. Getting a better rate means you will pay less generally. You can save thousands with a small drop in interest. Competitive rates could allow homeowners to make calculated decisions in 2025. Now, locking in a good rate could protect you from uncertainty ahead.

Using Home Equity for Major Projects

Mortgage agent Oakville lets you use the equity in your house. As loans are repaid or property values climb, equity increases. Getting that value lets you pay off debt, cover renovations, or invest in other businesses. Using this money without selling your house is easy with refinancing. This adaptability helps homeowners to keep ownership while addressing urgent financial needs. Visit here for more details.

Consolidating Debt for simpler budgets

Refinancing helps combine high-interest debt as well. Homeowners can roll credit card debt or personal loans into a mortgage. Often, doing this results in smaller payments generally. Simplifying debt helps one better manage their money. Refinancing can be a lifeline for people trying to sort out complicated financial obligations.

The timing is ideal for homeowners looking at choices that would help their financial situation. Look at the several refinancing options right now.

About Brayden Hooper Mortgages:

Brayden Hooper Mortgages provides one of the best private mortgage solutions in Ontario. It helps homeowners access up to 90% of their home equity. The company specializes in refinancing first and second mortgages, debt consolidation Oakville, and personalized financial options. Its experts assist with all credit types, including those with poor credit or bankruptcy.

For more information, visit https://braydenhoopermortgages.com/

Original source: https://bit.ly/42nXVF8

0 notes

Text

Understanding Second Mortgages: What Homeowners Need to Know

A second mortgage Ontario can be a smart financial move for homeowners who need access to additional funds. However, as with any major financial decision, it is important to fully understand the details, benefits, and risks of a second mortgage before making your final mortgage decision. In this article, we will cover the basics of second mortgages, their benefits, and important considerations for homeowners.

What is a Second Mortgage?

A second mortgage , like a first mortgage, is a loan that uses your home as collateral. The term "secondary" refers to the fact that this loan is subordinate to your primary mortgage, meaning that in the event of default, payments are made first to your primary mortgage lender and then to your secondary mortgage lender.

A second mortgage allows you to borrow against the equity in your home, which is the difference between your home's current market value and your mortgage balance. For example, if your home is worth $500,000 and you owe $300,000 on your mortgage, your equity would be $200,000. You can take out a second mortgage to access some of this equity.

Types of Second Mortgages

There are two main types of second mortgages:

Home Equity Loan: This is a fixed-amount loan that lets you borrow a fixed amount, usually at a fixed interest rate, and repay it over a set period of time. Home equity loans are often used for large one-time expenses like home improvements, debt consolidation, and medical bills.

Home Equity Line of Credit (HELOC): A HELOC works like a credit card. Instead of getting a lump sum, you're approved for a line of credit that you can use as needed. You pay only interest on the amount you borrow; after you pay it off, you can borrow again up to your limit. HELOCs often have variable interest rates, so your payments can fluctuate over time.

Benefits of a Second Mortgage

Access to funds: A second mortgage gives you access to a large amount of money that can be used for various purposes, such as financing home improvements, consolidating high-interest debt, covering college tuition, or investing in a business.

Low interest rates: Because your home secures second mortgages, they generally have lower rates than personal loans or credit cards. This can make them an attractive option for consolidating debt or covering significant expenses.

Tax benefits: In some cases, interest paid on a second mortgage may be tax-deductible, mainly if the funds are used for home improvements. However, tax laws vary, so it's essential to consult a tax advisor to understand the potential benefits. Flexible repayment terms: Second mortgages offer a variety of repayment options. Home equity loans usually have fixed monthly payments, while HELOCs are more flexible and can be borrowed and repaid multiple times over the payoff period.

Risks and Considerations

While second mortgages have advantages, they also come with significant risks and considerations that homeowners must consider carefully.

Foreclosure risk: Because a second mortgage uses your home as collateral, you could lose your home if you can't make payments. This is the most critical risk before taking out a second mortgage. Higher interest rates: Second mortgages have lower interest rates than unsecured loans but often have higher interest rates than first mortgages. The second mortgage lender takes on more risk since they are second in line to the recipient in case of default.

Additional debt: A second mortgage increases your total debt. Before proceeding, consider whether you can afford the extra payments on top of your existing mortgage and other financial obligations.

Closing costs and fees: Like first mortgages, second mortgages have closing costs and fees. These may include appraisal fees, attorney's fees, and administrative fees. These costs can add up, so it's essential to consider them.

Equity impact: Taking out a second mortgage reduces the equity in your home. This can significantly affect your future financial flexibility if the real estate market slows down and homes fall in value.

When Does a Second Mortgage Make Sense?

While a second mortgage can be a good financial tool in certain situations, it's not the right choice for everyone. Here are some scenarios in which taking out a second mortgage may make sense:

Home renovations: If you are planning major home renovations to increase the value of your property, a second mortgage can be a cost-effective way to finance the project.

Debt consolidation: If you have high-interest debts, such as credit card balances, a second mortgage can help you consolidate these debts at a lower interest rate and save you money on interest payments over time.

Emergency expenses: A second mortgage can be used for emergencies such as B. To have ready access to cash needed for medical expenses or significant repairs.

Investment opportunities: Some homeowners use second mortgages to invest in other real estate, businesses, or education. However, this risky strategy should only be undertaken after thorough financial planning.

How to Qualify for a Second Mortgage

Qualifying for a second mortgage is similar to qualifying for a primary mortgage. Lenders will evaluate your credit score, income, debt-to-income ratio, and the equity you have in your home. Generally, you'll need:

Good credit score: Lenders usually require a credit score of at least 620, but the higher your credit score, the better your interest rate.

Sufficient equity: Most lenders will allow you to loan up to 80% to 85% of the price of your home minus the balance of your first mortgage.

Stable income: Lenders want to see that you have a stable income and can repay a second mortgage on top of your existing financial obligations. Diploma

Conclusion

A second mortgage can be a valuable financial resource for homeowners wanting to access their home equity for significant expenses or to consolidate debt. However, weighing the risks, costs, and capacity to handle the added debt is essential. By understanding how second mortgages function and assessing your financial situation, you can make a well-informed decision that aligns with your needs. Suppose you're thinking about taking out a second mortgage. In that case, it's wise to consult a financial advisor or mortgage broker to explore your options and choose the best solution. Contact us for more information.

0 notes

Text

Home equity loans in Ontario, Canada, offer accessible financing options leveraging property assets. With competitive rates and convenient terms, these loans enable homeowners to access funds for various purposes, including debt consolidation, investments, or major expenses, providing a valuable financial resource for achieving personal and financial goals.

#home improvement loans in ontario#debt consolidation services in ontario#home renovation loans ontario#private second mortgage ontario

0 notes

Text

Sunlite Mortgage Broker: Your Partner in Home Equity Loans

If you’re looking for a Home Equity Loan Mortgage broker in Ontario M3C 3N6, Canada, Sunlite Mortgage is the best choice. Since 1998, Sunlite Mortgage has offered homeowners non-traditional mortgage options. Whether you're purchasing a home, refinancing, or seeking access to funds, Sunlite Mortgage provides first and second mortgage options, as well as home equity loans. With fixed-term loans and HELOCs, you can choose the best method for your needs. Their streamlined process focuses on your home’s value, not a lengthy list of documents. For more information, call (877) 385-6267 and unlock the equity in your home today.

0 notes