#gst on tdr

Text

GST on Real Estate Sectors

GST levy on Real Estate Sectors

Goods and Service Tax:

Apartment:

As per RERA – An “ apartment”

whether called block, chamber, dwelling unit, flat, office, showroom, shop, godown, premises, suit, tenement, unit or by any other name, means

a separate and self-contained part of any immovable property,

use such as residence, office, shop, showroom or godown or for carrying on any business,…

View On WordPress

#construction#gst on construction#gst on joint development agreement#gst on real estate#gst on tdr#transfer of development right

1 note

·

View note

Link

Reasonable and simple application of common solutions to your financial accounts. You can easily calculate,you can look and you can get information about financial investments.

1 note

·

View note

Text

11 FAQs on TDR in Real Estate under GST

In this article, we will cover about TDR supply by the landlord.

Visit Us :- https://www.mastersindia.co/gst/11-faqs-on-tdr-in-real-estate-under-gst/

0 notes

Text

GST on trading of Transferable Development Rights - Taxability

GST on trading of Transferable Development Rights – Taxability

GST on trading of Transferable Development Rights (TDR’s): State Governments across India have evolved a method of compensating the loss for acquisition of land / building for developmental purposes. Till recently, the State would pay monetary compensations to the land owner on compulsory acquisition of land / building. This methodology envisaged huge cash outflows in the hands of the State,…

View On WordPress

0 notes

Text

Property developers seek GST cut for joint development deals on TDR

Currently, GST is paid by the developer on the value of undivided share of land pertaining to unsold area of the project as on the date of receipt of occupancy certificate

https://www.thehindubusinessline.com/news/real-estate/property-developers-seek-gst-cut-for-joint-development-deals-on-tdr/article33600266.ece

0 notes

Text

GST on Real Estate Transactions involving Joint Development Agreements / Transfer of Development Rights wef 1st April 2019 (JDA/TDR)

Construction and Real Estate is a complex business with multiple stakeholders involved in it. It has been a growing sector in India, but ironically has been riddled with litigation owing to multiplicity of taxes and dual administration mechanism; thereby exposing it to the conundrums of both Central and State level complex indirect taxation levy prior to GST regime.

However, with the series of changes that have been made effective from 1st April, 2019 it can be seen as a step in the right direction, although it may not be in line with the GST principles. These changes are enumerated in GST Notification No. 03/2019 – Central Tax (Rate) dt. 29.03.2019 and Notification No. 08/2019-CTR dt. 29.03.2019.

This article is an attempt to summarize the changes made in GST Law effective from 1st April 2019, with respect to its impact on Real Estate Business, involing Joint Development Agreement/Transfer of Development Rights (JDA/TDR) where consideration is in the form of Area Sharing and / or Revenue Sharing. This article does not cover any of the provisions of GST on Real Estate applicable on or before 31st March 2019, nor any transitional provisions for Ongoing Projects as on 31st March 2019.

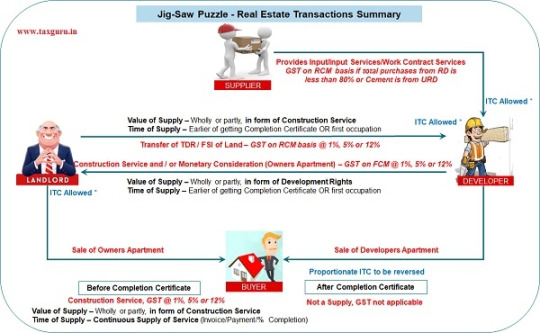

Let us now understand the various parties that could possibly be involved in a typical real estate business end-to-end and the implications of GST on transactions between them.

Typically, any real estate transaction starts with Developer acquiring land for constructing a building (Residential/Commercial) upon it. Land is either purchased outright from the Landowner, or the Developer enters in to “Joint Development Agreement” (JDA) with the Landowner, whereby

The Developer Acquires the Development Rights from Landowner with respect to the Land

The Development rights entitles the Developer to obtain various types of licenses and approvals from the Government authorities and construct a complex, building, civil structure on the land, either by himself, by acqiring material and labour from Suppliers or getting work done through Works Contractors

In return for the transfer of development rights by landowner, the Developer gives the Landowner consideration in the form of Cash (Revenue Sharing) or Construction Service for certain agreed number of apartments/offices/shops (Area Sharing) allotted to Landwoer (hereinafter referred to as “Owners Apartment”) or both

The remaining apartments/Offices/Shops (hereinafter referred to as “Developers Apartment”) are retained by Developer and sold to other Buyers

Landowner may also sell Owners Apartment independently to Buyers or decide to retain it for own use

So in a nutshell, there are 5 parties typically involved in a Real Estate transaction, which has an impact of GST – Landowner, Developer, Supplier, Works Contractor and Buyer.

Various Transactions in a JDA type of agreement and its GST Impact: Flowchart 1

For ease of reading, we have divided this article into 2 sections as below:

1. Definitions

2. Type of transactions and its taxability

1. Definitions and Terms used in this article

Supply – As per para 5(b) of Schedule II of CGST Act, the following is ‘supply of service“:

..(b) Construction of a complex, building, civil structure or a part thereof, including a complex or building intended for sale to a buyer, wholly or partly, except where the entire consideration has been received after issuance of completion certificate, where required, by the competent authority or after its first occupation, whichever is earlier

As per para 6(a) of Schedule II of CGST Act, the following composite supplies shall be treated as a supply of services, namely:

..(a) works contract as defined in clause (119) of section 2

RREP – Residential Real Estate Project (RREP) means a Real Estate Project in which the carpet area of the commercial apartments is not more than 15 % of the total carpet area of all the apartments in the project.

REP – Real Estate Project (REP) means any project other than RREP.

RCM – Reverse charge (RCM) means the liability to pay tax by the recipient of supply of goods or services or both instead of the supplier of such goods or services or both under sub-section (3) or sub-section (4) of section 9, or under sub-section (3) or sub-section (4) of section 5 of the Integrated Goods and Services Tax Act

FCM – Forward Charge (FCM) means the liability to pay tax by the supplier of such goods or services

ITC – Input Tax Credit (ITC) means credit of Input Tax

2. Type of transactions and its taxability

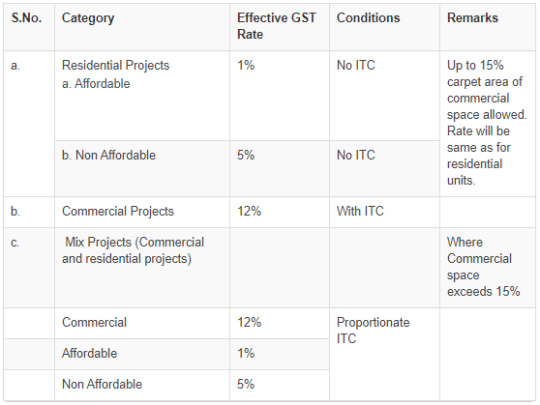

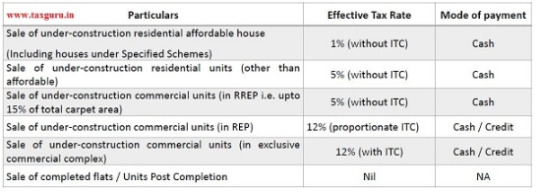

2.1 Sale of units by Developer/Landowner to Buyer – Outward Supply for Ongoing Projects (option not exercised for old rates) and New Projects (01.04.2019 onwards)

In this transaction, either the Developer and/or Landowner sells apartments/shops/offices to the Buyer. This is a simple transaction with the Buyer and GST would be leviable as below, if unit is sold before receipt of Completion Certificate or before its first occupation:

Table 1:

If the entire consideration for the property is received after receipt of Completion Certificate or after its first occupation, whichever is earlier, then it is not considered as a Supply and hence GST is not applicable in such transaction. ITC proportionate to the unsold units as on the date of Completion of the project should be reversed upon completion of the project.

Time of Supply – Continuous supply as per %Completion/Invoicing/Payments received

Input Tax Credit:

Landowner

Entitled to ITC of GST levied by developer on construction of owner’s apartment (refer Flowchart 1) subject to cap of output tax payable on residential apartments sold under construction. For e.g. If the developer charges GST of Rs. 1 lakh to the Landowner, the Landowner should pay at least Rs. 1 lakh as output GST on supply of such apartment to his buyer.

However, if developer pays tax on Construction service for apartments allotted to Landlord (on FCM basis), only on completion of the project, Landowner will not be in a position to avail or utilise ITC, since Landowner cannot charge output GST on further sale of Owners apartment to buyers after completion of project in terms of Schedule III to the Act. Thereby, it seems that even though the landowner is eligible for the credit, its utilisation is doubtful. Whether developer can raise invoice earlier and pay GST before the date of completion of project or first occupation, so that the Landowber can claim ITC, is a question which needs to be considered and clarified by CBIC.

Developer

Not entitled to any ITC in respect of sale of under construction/completed residential units (in any project) and under construction/completed commercial units (in RREP).

ITC can be claimed only on inputs and input services used (see Flowchart 1 above):

for sale of under-construction commercial units (in exclusive commercial complex), or

for sale of under-construction commercial units (in REP), where proportionate ITC can be availed only for the commercial units based on ratio of carpet area of commercial units sold to total carpet area of residential and commercial units

Computation & Reporting of ineligible ITC

ITC not availed should be reported every month by reporting the same as ineligible credit in Form GSTR-3B.

On the final computation done for the financial year, the final adjustment (excess/short) needs to be carried out in Form GSTR-3B or through Form GST DRC-03 in the month not later than the month of September following the end of financial year in which the cut-off date occurs (ie Project is completed), as follows

Excess ITC availed: Such excess need to be reversed along with interest @18% from 1st of April of such financial year till the date of reversal.

Short ITC availed: Same can be claimed as credit in the return filed not later than September following the financial year in which the cut-off date occurs (ie Project is completed).

Mode of Payment of Output Tax:

80% Condition:

The new lower GST rates on construction of residential housing or commercial units in RREP is subject to procurement of 80% of inputs and input services (other than capital goods, TDR/ JDA, FSI, long term lease premiums)) from registered persons.

However, the value of the following services used in the construction of residential apartments are excluded for this calculation:

Grant of developmental rights

Long term lease of land

Floor space index

Value of electricity

Value of high-speed diesel

Motor spirit and natural gas

Salary to employees (neither a good nor a service as per clause 1 of the Schedule III of CGST Act, 2017)

Land value (as per Schedule III, Entry No 5, of CGST Act, sale of land is not a supply)

On shortfall of purchases from the 80 percent from registered dealers, builder shall be required to pay tax under reverse charge (RCM) at 18 percent, provided that on procurement of cement from unregistered dealers the rate shall be 28 percent rate and procurement of capital goods from unregistered dealers shall be liable to the applicable rate of tax. The tax liability on the shortfall of inward supplies from unregistered person would be added to his output tax liability in the month not later than the month of June following the end of the

financial year in which inputs/input services were purchased.

2.2 Transfer of DR/TDR/FSI for Construction of Residential apartments / Residential part of Mixed Project (having both Residential and Commercial Apartments)

Transfer of development rights by Landowner to Developer is treated as Supply in which Development Rights are transferred in return for consideration in kind, by way of wholly or partly, in the form of Construction Service of Complex, Building or Civil Structure (Owners apartment) and/or monetary Consideration from the Developer to the Landowner (refer Flowchart 1 above)

Taxability:

Transfer of DR/ TDR/ FSI used for sale of under construction residential units is exempt

Taxable to the extent of unsold residential apartments on the date of issuance of completion certificate or first occupation, whichever is earlier

Person liable to pay Tax: Promoter – Developer (to be paid under RCM)

Input Tax Credit of tax paid under RCM by Developer – ITC not eligible

Time of Supply / Payment of Tax (In area sharing, revenue sharing or outright purchase of DR/TDR/FSI):

Earlier of

Issuance of Completion certificate; or

First occupation of project

Value of Supply (Value of DR/TDR/FSI):

Area sharing: value of similar apartments charged by promoter from independent buyers nearest to the date of transfer of DR/TDR/FSI;

Revenue sharing: monetary consideration paid to the Landowner as revenue share;

Outright purchase: value of monetary consideration paid for outright purchase

GST Tax to be Paid:

Lower of

18% on Value of DR/TDR/FSI in proportion to carpet area of such unsold residential apartments & all commercial apartments to total carpet area of residential apartments & commercial apartments; or

1% / 5% of Value of such unsold apartments & all commercial apartments. Value of unsold apartments is deemed to be equal to value of similar apartments charged by the promoter nearest to the date of completion certificate or first occupation, whichever is earlier

2.3 Transfer of DR/TDR/FSI for Construction of Commercial apartments

Transfer of development rights by Landowner to Developer is treated as Supply in which Development Rights are transferred in return for consideration in kind, by way of wholly or partly, in the form of Construction Service of Complex, Building or Civil Structure (Owners apartment) and/or monetary Consideration from the Developer to the Landowner (refer Flowchart 1 above)

Taxability: Fully taxable

Person liable to pay Tax: Promoter – Developer (to be paid under RCM)

Input Tax Credit of tax paid under RCM by Developer:

For RREP (with Commercial portion less than 15%) – ITC not eligible

For REP – ITC attributable to Commercial portion can be claimed

For Commercial projects – ITC is eligible

Time of Supply / Payment of Tax (In area sharing, revenue sharing or outright purchase of DR/TDR/FSI):

Area Sharing:

Earlier of:

Issuance of Completion certificate; or

First occupation of project

Revenue Sharing:

SRA Projects (continuous supply of service) – Periodical release of FSI;

JDA projects – Date of transfer of DR/FSI irrevocably

Outright purchase – Date of transfer of DR/TDR/FSISRA Projects (continuous supply of service) – Periodical release of FSI;JDA projects – Date of transfer of DR/FSI irrevocably

Value of Supply (Value of DR/TDR/FSI):

Area sharing: value of similar apartments charged by promoter from independent buyers nearest to the date of transfer of DR/TDR/FSI;

Revenue sharing: monetary consideration paid to the Landowner as revenue share;

Outright purchase: value of monetary consideration paid for outright purchase

GST Tax to be Paid:

18% on Value of DR/TDR/FSI

2.4 Construction Service for Owner’s Apartment (aplicable only in case of Area Sharing agreement)

Developer provides Construction service to Landowner over a period. The Developer hands over the ownership rights of certain percentage of the developed area ie. Super Structures like complex, building or civil structure or apartments to the landowner (in Area Sharing JDA), referred to as Owner’s Apartment in Flowchart 1 above.

Taxability: Fully taxable

Person liable to pay Tax: Promoter – Developer (to be paid under FCM)

Input Tax Credit to Landowner (for tax paid under FCM by Developer):

Landowner would be eligible to take credit of taxes paid by him to the developer and can be availed for paying the taxes on sale of the owners apartment to his buyers before issuance of completion certificate or first occupation, whichever is earlier, sold by the Landowner independently.

However, as discussed before, if developer pays tax on Construction service for apartments allotted to Landlord (on FCM basis), only on completion of the project, Landowner will not be in a position to avail or utilise ITC, since Landowner cannot charge output GST on further sale of Owners apartment to buyers after completion of project in terms of Schedule III to the Act. Thereby, it seems that even though the landowner is eligible for the credit, its utilisation is doubtful. Whether developer can raise invoice earlier and pay GST before the date of completion of project or first occupation, so that the Landowber can claim ITC, is a question which needs to be considered and clarified by CBIC.

Time of Supply / Payment of Tax:

Earlier of:

Issuance of Completion certificate; or

First occupation of project

Value of Supply (Value of Construction service for Owners Apartments):

Value of similar apartments charged by promoter from independent buyers nearest to the date of transfer of DR/TDR/FSI;

GST Tax to be Paid:

Developer shall pay tax on owner’s area at the time of completion certificate or first occupation, whichever is earlier. Rate of tax will be either 1%, 5% or 12% depending on whether the owners apartment is affordable Residential, Residential or Commercial unit (see Table 1 above)

Conclusion

Time will tell whether the reduced GST rates for under-construction properties will give the necessary fillip to the real estate sector which is currently witnessing adversities. The concern regarding the reduced rate of 5% and 1% is that it is offered without the ability for developers to take input tax credit, which could actually lead to an escalation of costs.

In addition, more clarity from CBIC needs to be provided on how the Landowner can avail input tax credit in respect of the GST on construction service for Owners apartment charged by the Developer, as discussed in earlier sections, as this could also have a significant impact on price point of the apartment sold to ultimate buyers.

Disclaimer: The views, opinions and arguments presented in this article are those of the author and may not necessarily reflect legal standing. While every effort has been taken to provide correct information, the author will not be liable for any loss, expense, liability, detriment or deprivation suffered arising out of any action based on the information provided above. The readers are expected to cross-check the facts and information with government circulars and notification.

Author: CA Rahul Jain can be reached at [email protected]. More details on http://rahuljainassociates.in

0 notes

Photo

New Update!! Sec. 206AB effective from 1st July 2021!! TDS would be deducted at higher rate if: -The deductee has not filed ITR for last 2FYs & -Aggregate of TDS/TCS is 50,000 or more in each of these 2 FYs. Note: TDS u/s 192, 192A, 194B, 194BB, 194LBC or 194N are excluded. . . . . . #newupdate #newalert #alert #tax #tds #taxrefund #itr #tdr #incometax #gst #gstreturn #accountant #tax #cpa #accounting #accountants #taxes #accountinglife #business #taxseason #accountingservices #entrepreneur #ca #consulting #marketing #finance #startup #incometax #manishanilgupta (at Delhi, India) https://www.instagram.com/p/CQQHwAqrGnZ/?utm_medium=tumblr

#newupdate#newalert#alert#tax#tds#taxrefund#itr#tdr#incometax#gst#gstreturn#accountant#cpa#accounting#accountants#taxes#accountinglife#business#taxseason#accountingservices#entrepreneur#ca#consulting#marketing#finance#startup#manishanilgupta

0 notes

Link

A partnership firm is an organization which is formed with two or more persons to run a business with a view to earn profit. Each member of such a group is known as partner and collectively known as partnership firm. These firms are governed by the Indian Partnership Act, 1932. Following are the characteristics of Partnership Firm.

0 notes

Link

For those post April 1, promoter is liable to pay GST (on reverse charge basis) on units sold after project completion in case of residential projects..

0 notes

Text

Decisions taken by the GST Council in the 34th meeting regarding GST rate on real estate sector

GST Council in the 34th meeting held on 19th March, 2019 at New Delhi discussed the operational details for implementation of the recommendations made by the council in its 33rd meeting for lower effective GST rate of 1% in case of affordable houses and 5% on construction of houses other than affordable house.

The council decided the modalities of the transition as follows.

Option in respect of ongoing projects:

2. The promoters shall be given a one -time option to continue to pay tax at the old rates (effective rate of 8% or 12% with ITC) on ongoing projects (buildings where construction and actual booking have both started before 01.04.2019) which have not been completed by 31.03.2019.

3. The option shall be exercised once within a prescribed time frame and where the option is not exercised within the prescribed time limit, new rates shall apply.

New tax rates:

4. The new tax rates which shall be applicable to new projects or ongoing projects which have exercised the above option to pay tax in the new regime are as follows.

(i) New rate of 1% without input tax credit (ITC) on construction of affordable houses shall be available for,

(a) all houses which meet the definition of affordable houses as decided by GSTC (area 60 sqm in metros / 90 sqm in non- metros and value upto RS. 45 lakhs), and

(b) affordable houses being constructed in ongoing projects under the existing central and state housing schemes presently eligible for concessional rate of 8% GST (after 1/3rd land abatement).

(ii) New rate of 5% without input tax creditshall be applicable on construction of,-

(a) all houses other than affordable houses in ongoing projects whether booked prior to or after 01.04.2019. In case of houses booked prior to 01.04.2019, new rate shall be available on instalments payable on or after 01.04.2019.

(b) all houses other than affordable houses in new projects.

(c) commercial apartments such as shops, offices etc. in a residential real estate project (RREP) in which the carpet area of commercial apartments is not more than 15% of total carpet area of all apartments.

Conditions for the new tax rates:

5. The new tax rates of 1% (on construction of affordable) and 5% (on other than affordable houses) shall be available subject to following conditions,-

(a) Input tax credit shall not be available,

(b) 80% of inputs and input services (other than capital goods, TDR/ JDA, FSI, long term lease (premiums)) shall be purchased from registered persons. On shortfall of purchases from 80%, tax shall be paid by the builder @ 18% on RCM basis. However, Tax on cement purchased from unregistered person shall be paid @ 28% under RCM, and on capital goods under RCM at applicable rates.

Transition for ongoing projects opting for the new tax rate:

6.1 Ongoing projects (buildings where construction and booking both had started before 01.04.2019) and have not been completed by 31.03.2019 opting for new tax rates shall transition the ITC as per the prescribed method.

6.2 The transition formula approved by the GST Council, for residential projects (refer to para 4(ii)) extrapolates ITC taken for percentage completion of construction as on 01.04.2019 to arrive at ITC for the entire project. Then based on percentage booking of flats and percentage invoicing, ITC eligibility is determined. Thus, transition would thus be on pro-rata basis based on a simple formula such that credit in proportion to booking of the flat and invoicing done for the booked flat is available subject to a few safeguards.

6.3 For a mixed project transition shall also allow ITC on pro-rata basis in proportion to carpet area of the commercial portion in the ongoing projects (on which tax will be payable @ 12% with ITC even after 1.4.2019) to the total carpet area of the project.

Treatment of TDR/ FSI and Long term lease for projects commencing after 01.04.2019

7. The following treatment shall apply to TDR/ FSI and Long term lease for projects commencing after 01.04.2019.

7.1 Supply of TDR, FSI, long term lease (premium) of land by a landowner to a developer shall be exempted subject to the condition that the constructed flats are sold before issuance of completion certificate and tax is paid on them. Exemption of TDR, FSI, long term lease (premium) shall be withdrawn in case of flats sold after issue of completion certificate, but such withdrawal shall be limited to 1% of value in case of affordable houses and 5% of value in case of other than affordable houses. This will achieve a fair degree of taxation parity between under construction and ready to move property.

7.2 The liability to pay tax on TDR, FSI, long term lease (premium) shall be shifted from land owner to builder under the reverse charge mechanism (RCM).

7.3 The date on which builder shall be liable to pay tax on TDR, FSI, long term lease (premium) of land under RCM in respect of flats sold after completion certificate is being shifted to date of issue of completion certificate.

7.4 The liability of builder to pay tax on construction of houses given to land owner in a JDA is also being shifted to the date of completion. Decisions from para 7.1 to 7.4 are expected to address the problem of cash flow in the sector.

Amendment to ITC rules:

8. ITC rules shall be amended to bring greater clarity on monthly and final determination of ITC and reversal thereof in real estate projects. The change would clearly provide procedure for availing input tax credit in relation to commercial units as such units would continue to be eligible for input tax credit in a mixed project.

9. The decisions of the GST Council have been presented in this note in simple language for easy understanding. The same would be given effect to through Gazette notifications/ circulars which alone shall have force of law.

[Press Release dt. 19-03-2019]

Central Board of Indirect Taxes and Customs

Tweet

The post Decisions taken by the GST Council in the 34th meeting regarding GST rate on real estate sector appeared first on SCC Blog.

Decisions taken by the GST Council in the 34th meeting regarding GST rate on real estate sector published first on https://sanantoniolegal.tumblr.com/

0 notes

Text

Impact of GST on Real Estate

At a monetary arranging workshop in Delhi, a home purchaser had a correlated question: "In spite of the fact that GST may help the developers to stay away from twofold or triple tax collection and lessen their cost of development and operation, in what manner will it help me when purchasing a house or when looking for apartments for sale in Kolkata? Paying VAT of 5% on development material and 3.5% administration duty, may even now be lower than what is being proposed in the GST – at least 18% assessment."

This disarray, over the effect of the proposed Goods and Services Tax (GST), is being reverberated by home purchasers, and the land brotherhood. Many are notwithstanding addressing whether the double model of GST, as proposed by the engaged panel, will rearrange and diminish the taxation rate or further entangle the circumstance. Under this double model, there will be a Central GST (collected by the focal government, alongside extract obligation, additional charge, cess, benefit assess, and so on.) and a State GST (demanded by the state government, alongside VAT, stimulation impose, extravagance charge, impose on lottery, section assess, cess, additional charge and others). The way of land business, is with the end goal that both, the Central GST and State GST will fall into its ambit.

Appropriateness

While it is normal that the offer of resolute property after its culmination, would keep on being outside the domain of GST and be appropriate just on stamp obligations, the proposed move to GST does not appear to be clear of vulnerabilities. In addition, there is no clearness over key issues, for example, the exchange of advancement rights (TDR) ashore, assessable incentive for products and enterprises, taxability of joint improvement assertions, and so on. Specialists, thus, address how GST will improve the circuitous tax assessment in the land area.

Benefit expense and VAT are the two primary requires on land, today. By the by, there are consistent question on the rate of expense and the base on which it must be charged, given the various choices accessible for release of assessments crosswise over states. This has brought about assorted works on being trailed by engineers, crosswise over states and even inside the same smaller scale markets.

Effect on costs

Charge specialist, Rikki Sahni, feels that costs may increment imperceptibly, if any rate more than 15% is connected for materials and administrations. "Be that as it may, the realty business, which contributes essentially to the Indian GDP, will profit by GST over the long haul, as it will make homogeneity and institutionalization. There are two distinct perspectives that affect engineers. A noteworthy issue is the manner by which land is esteemed. A considerable measure will rely on upon the deductibility of land in GST estimations. In addition, if CENVAT credit is offered in the development division, it might profit designers of business properties. A considerable measure of clearness is as yet required," Sahni clarifies.

As indicated by Nikhil Hawelia, overseeing chief of the Hawelia Group, the GST administration will help the part over the long haul. In any case, its prompt effect on home purchasers stays misty. "For the designers, the aggregate quantum of assessment might possibly increment, contingent upon whether the buy of land is measured as a noteworthy wellspring of info cost. Regardless of the possibility that charges increment a bit, it will in any event bring clearness, when contrasted with the current different layers of tax collection. Home purchasers who are looking for property for sale in Kolkata, in any case, may wind up paying more duties," says Hawelia. Money related experts generally concur that GST may expand the costs of homes, regardless of the possibility that it is not specifically charged from home purchasers, as designers will pass on the extra taxation rate to purchasers.

0 notes

Text

Housing market to thrive in 2017: Irfan Razack, Prestige Group

Housing market to thrive in 2017: Irfan Razack, Prestige Group

By: Irfan Razack, CMD, Prestige Group & Chairman, CREDAI National

As far as the industry is concerned, we have been facing certain challenges like the new TDR regulations. There’s also the RERA bill, which is likely to get notified very soon. The GST lawswill get notified in the next few months as well. So the industry is looking at a series of new laws that need to be complied with. Apart from…

View On WordPress

0 notes