#groww calculator

Explore tagged Tumblr posts

Text

#fyers web#sharekhan mini#groww calculator#nifty trader option chain#upstox customer care number#groww brokerage calculator#upstox customer care#coin zerodha#upstox brokerage calculator#nifty 50 trading view#kotak 811 customer care number#upstox calculator

0 notes

Text

Trading is related to buying and dealing with securities to make silk stockings based on daily price changes. However, if you want to trade in the share request, you should have a good grasp of the fundamentals of share trading. Investing is essential these days, as more than savings is required to beat the odds and fulfill all our financial goals. Trade is a primary profitable concept involving the buying and selling supplies good and services and the compensation a buyer pays a dealer. In another case, trading can exchange goods and services between parties. For example, trade can be made between directors and consumers within a company.

Trading is related to buying and dealing with securities to make silk stockings based on daily price changes. However, if you want to trade in the share request, you should have a good grasp of the fundamentals of share trading. Investing is essential these days, as more than savings is required to beat the odds and fulfill all our financial goals. Trade is a primary profitable concept involving the buying and selling goods, supplies, and services and the compensation a buyer pays a dealer. In another case, trading can exchange goods and services between parties. For example, trade can be made between directors and consumers within a company.

Highlights of trading

1. Trade involves the exchange of goods and services substantially in return for money.

2. Trade can happen within a country or amongst trading nations. In the case of transnational trade, the proposition concerning relative advantage speculates that trade benefits all parties; however, critics contend that it leads to a position within countries in reality.

3. Economists recommend free trade among nations, but protectionism like tariffs might present itself because of political motives.

Types of Trading Platforms in India

When performing seamless stock trading without encountering the fences of time and distance, using the best trading platforms for stock trading is relatively apparent. One can do online trading through 3 virtual interfaces that are given below.

There are mainly three types of online trading platforms in India that top dealers and investors exploit.

Mobile- Based

Browser- based

Desktop- based

1. Mobile- based Mobile App

As its name represents, this type of trading platform can be suitable to use through smart phones. Over time, the rapid penetration of mobile devices in India has made this trading platform the best online platform in India 2023. The significant reasons are ease of usage, portability, and no physical barriers.

2. Browser-based/ Web

A browser-based trading platform can be on a web browser like Internet Explorer, Mozilla Firefox, and Google Chrome. This platform is suitable when smart phones and desktops aren't accessible.

For example, if you're from home without a laptop, your trading account can be entered through a web cyber surfer. However, it is usually believed that this type of trading platform is slower than a desktop-based trading platform.

3. Desktop-based

This platform can be downloaded and installed on a desktop or laptop. Though this is undoubtedly the best trading platform in India, you can use if you're between those traders and investors who desire to place quick buy/ sell orders.

The known thing about this trading platform is that consumers can use shortcut keys to carry out different activities like F1 to buy and F2 to sell etc.

Goods Fundamental characteristics of a best trading platform In India

· Quick continuous execution

· Front line and sharp innovative highlights

· Top-level security

· Simple to-utilize interface

· Simple arrangement of exchanges.

List of Best Trading Platforms in India:-

Zerodha Kite Trading Platform

ICICI Direct All-in-1 App

FYERS ONE Trading Platform

Sharekhan Trade Tiger

Angel Broking Speed Pro

Trade Station Trading Platform

Trade Eye Trading Platform

Upstox Pro Trading Platform

Trader Terminal (TT)

10. NSE Now Trading Platform

1. Zerodha Kite

Zerodha Kite is the flagship trading platform of Zerodha, a leading reduction broker in India. Known as one of the best trading platforms in India, it is connected using next-gen technology to match the different requirements of all types of investors. In addition, the platforms offer a wide assortment of features like charting tools, data widgets, integration with third-party apps, etc., to make trading simple and quick.

Pros

1. Multiple Market Watch

2. Comprehensive charting with further than 100 pointers and six map orders

3. Floating Order window

4. Progressive order types are similar as classes with detector entry and cover with limit entry

5. Unified instrument search for quick search over 90,000 stocks and F&O contracts

6. Live ticks, quotes, and order admonitions

7. Ideal integration with Quant tool for carrying out fundamental analysis using geste

8. Analytics

9. Mixing with other investment apps erected by Zerodha consorts

Cons

1. No extent for strategy backtesting

2. Separate after office with the name Zerodha Q

3. Brokerage Charges – Zero brokerage charges, RS 20 per order for intraday

4. Website – Zerodha Kite

2. ICICI Direct All-in-1 App

The ICICIDirect App is an advanced trading and investing platform designed to simplify investment and trading. The simplified UI and UX make the investment process a breeze. Get access to over 50 products and services across all product categories.

Taken as one of the best trading platforms in India among traders and investors, the operation strives to do online trading a lot easier and quicker for users.

Pros

1. Analyze your app's live data and F&O, NSE Nifty 50, & BSE Sensex charts to know your investment status.

2. Please get the latest news, movements, and trends to assess how they affect your investments.

3. Offers multiple watchlists of various investment products like shares, stocks, mutual funds & IPO to track your being and future investments.

4. Use your curated watch list to place your buy and sell orders in your chosen share request securities in seconds.

5. On the exclusive charting tool, compare various scrips, track ongoing and upcoming events, corporate actions, etc...

6. Make guided investing decisions after assessing trending, expertly curated investment ideas.

7. Generate instant limits with the shares in your DEMAT account.

8. Get instant money in your account within 5 minutes of dealing shares withe-ATM

9. Use MTF( Margin Trading Funding) to buy stocks now and pay latterly anytime within 365 days at seductive interest rates.

10. Apply to the rearmost IPO in a few simple ways with the enhanced user experience and interface.

11. Build low-cost, long- term and diversified portfolios with the One Click Equity.

Cons

· Many features similar to Flash Trade and Easy options have yet to be available (Available on ICICI Direct Markets App). However, it'll be available shortly.

Brokerage Charges –0.1 for equity delivery

Website – ICICI Direct

3. FYERS One

It's the best trading platform in India for desktops and allows users to invest in stock from the comfort of their homes. It's declared Fyers the best trading software in India, with striking features that professionals and beginners can use for stock trading.

The trading software is also known for its speed and superb performance that fluently aligns with its easy and precious features.

Pros

1. Advanced charting point

2. Stock screeners

3. Offers free equity delivery trading.

4. Advanced charting with further than 65 specialized pointers

5. In- erected Live Scanner & Trend Scanner

6. Accepts UPI payments

7. Workshop on low bandwidth

Cons

1. No access to exploration reports and trading tips

2. Reliance on 3rd party merchandisers like Omnesys API and Trading View for charting

3. Brokerage Charges – Flat Rs 20 or0.03 per order

4. Website – FYERS One

4. Sharekhan Trade Tiger

Sharekhan Trade Tiger is foremost considered the best online trading platform in India. It's a terminal-based trading software that needs to be downloaded and installed on a desktop or laptop. The application allows dealers and investors to invest across various portions – Equity, Commodity, Currency, and derivations.

Pros

1. Easy access to reports, tips, and signatures by Sharekhan Research.

2. Association with 14 banks for easy online finance transfer to the trading account.

3. Admit direct share request feeds on a real-time basis across NSE, BSE, MCX, etc.

4. Various helpful calculators include Brokerage Calculator, Span Calculator, and Premium Calculator.

5. One-click order placement option.

6. Pre-loaded with over 30 trading approaches

Cons

1. No availability of 3- in- one account

2. No version for Mac notebooks

3. Collective funds aren't available

4. Brokerage Charges –0.50 or 10 paise per share for equity delivery

5. Website – Sharekhan Trade Tiger

5. Angel Broking Speed Pro

Regarding finding the best online trading platform in India, the available options will only be sufficient with the addition of Speed Pro by Angel Broking. The trading platform is known for offering its users a single-window trading experience along with perceptive trade evaluation features.

Another plus point with Speed Pro is the double-quick prosecution of orders and real-time monitoring.

Pros

1. Scrip addition points for various parts, including F&O, Commodity, and Currency

2. The combined best five – get a quick look at the top five bids for buying and selling across BSE and NSE

3. Open Live Market in Excel with an incredible refresh rate

4. Seamless access to insightful summaries and reports

5. Enables customization of the interface to a specific level

Cons

1. Not available for Mac

2. Little scope for improvement in terms of the software user interface

3. One needs a PC with an excellent configuration for the software to perform better

Brokerage Charges – Zero brokerage on delivery trading

Website – Angel One Trade

6. Trade Station

5Paisa Trade Station App is one of the most feature-loaded and high-tech trading software top dealers in India use. This one of the best trading platforms in India is designed for predominantly active dealers. Still, it isn't like that, as this software is inversely salutary for punk dealers and investors.

Pros

1. Despite being a reduction broker, Trade Station provides easy access to trading calls and recommendations to its guests.

2. This trading platform from 5Paisa updates itself generally, bringing new features every time and dealing with the bugs or problems from the former performances.

3. The trading app is set up to work indeed an introductory internet connection, which is a big plus.

4. Option to register for the rally session

5. Allows investors to trade in the equity member or stock request and joint finances and insurance orders.

Cons

1. Low internet bandwidth may delay the lading of maps

2. Only the Windows interpretation is available

3. The app isn't responsive and can be viewed best on a desktop or laptop. However, the view may need improvement on a mobile or laptop.

Brokerage Charges – Variable brokerage charges

Website – Trade Station

7. Trade Eye

Trade Eye by Wisdom Capital is an Android-grounded trading app that allows investors to trade between several segments through one app. The app is registered with BSE, NSE, MCX, MCX- SX, and NCDEX exchange. It's considered one of the best trading software in India.

Pros

1. A simple trading application that runs fluently using mobile internet

2. Erected for Android druggies along with touch features

3. Option to add multiple request watches

4. Examiner positions in the trade book and order book

5. Get access to various maps and specialized index tools

6. Installation to place aftermarket order

7. Instructional charting functionality for insightful technical stock analysis

8. Fast, secure, and flawless fund transfer

Cons

1. No support for iOS users

2. Introductory interface

Brokerage Charges – Zero brokerage charges, Trade for free

Website – Trade Eye

8. Upstox Pro

This is one of the best trading software in India by Upstox, known as RKSV. Being a responsive trading operation, there's no need to download or install the app. Also, it allows a user to directly access the trading tools through a laptop, desktop, mobile, or tablet.

Considered one of the best trading platforms in India among traders and investors, the application strives to do online trading a lot easier and quicker for users.

Pros

1. Unified search tool to discover easy and complex stocks

2. Contact predefined watch- list of Nifty 50 and other indices

3. Reach NSE cash, Futures and Options, and Currencies scrips

4. Apply 100 specialized pointers on real-time maps

5. Define unlimited price cautions for quick updates

6. Figure a total number of customized watchlists

7. Advanced charting tools that standard assiduity norms

8. Get real-time request word to stay ahead

Cons

1. The specialized support isn't over to the mark

2. Limited features in comparison to its counterparts.

3. The desktop outstation of Upstox needs high speed and stable internet connectivity.

4. Call and Trade installations are chargeable; Upstox charges Rs 20 when placing an order through the phone.

Brokerage Charges – Rs 20 or2.5 whichever is smallest for equity delivery

Website – Upstox Pro Web

9. Trader Terminal (TT)

IIFL Trader Outstations is among the best trading software in India and is also known for its intuitive interface and many features. The trading platform has many shortcut keys that let dealers and investors perform various functions quickly and smartly.

Pros

1. IIFL Call feature – that provides intraday tips to place intraday orders

2. Allows the placement of AMOs (After request orders), which can get reused the coming business day

3. Access LIVE television which includes ET Now

4. Access to a daily report by the name "Weekly Wrap."

5. Easy fund transfer with top banks like ICICI, HDFC, Axis Bank, Citi Bank, UTI, etc.

Cons

1. Not available for iOS users

2. For those who are in need to trade in the F&O member, a written application needs to be submitted along with income proofs.

Brokerage Charges – Rs 20 per trade for delivery

Website – Trade Terminal

10. NSE Now

Contrary to other trading platforms developed by corresponding stockbrokers, this trading platform – Here and Now (Neat on Web), has been considered by the National Stock Exchange of India( NSE). It's one of the most stylish trading platforms in India.

This trading app allows investors to trade across various parts, including Equity, derivations, and currency.

Pros

1. Customized alerts and notifications as defined by the users

2. Request watch to chase stocks, cover trends, sectors, and indicators

3. 15 maps with over 80 specialized pointers

4. Easy fund transfer to several leading banks

5. Diurnal stock tips

Cons

1. Comparatively tough to understand

2. Many stockbrokers levy operation charges for NSE NOW

3. A PC needs to have an excellent configuration for the operation to perform well

Brokerage Charges – Flat Rs 20 for intraday and F&O

Website – NSE Now

FAQs about Best Trading Platform in India

Ques- Which trading platform is best for India?

Answer- Zerodha Vampire is India's best online trading platform, presently operating in the stock broking script. Zerodha continuously pushes invention in its products and provides dealers with the needed products and services. Zerodha's, besides the lowest brokerage rates, boasts of a full-fledged magazine of trade products and confederated services.

Ques: Which trading platform offers the best advisory and stock tips installation?

Answer: IIFL, an acronym for India Infoline, is accepted by traders as the best trading platform that offers the best advisory and free tips facility. This fact is strengthened by the company's accurate stock predictions in the past.

Ques: Which trading is most profitable?

Answer: According to trade experts, Intraday trading is the most profitable because you can buy and vend stocks on the same day. It reduces threat as stocks price don't go up or down so far in a single day, and you should always use the safest and best online trading platform for intraday trading.

Ques: Which factors make a stock broking establishment the best in India?

Answer-numerous stock broking companies try to deliver top-notch trading and stock advisory services to the guests, but only a many of them are suitable to stand- out impeccably. We see low brokerages, an easy-to-use interface, and varied platform presence as essential features of an excellent stock broking establishment.

Source - Choose the best Trading Platform in India 2023

#best forex trading platform in india#best trading platform in india#best online trading platform in india#paytm share price#zerodha kite#kite zerodha#groww#angel broking#zerodha kite login#sharekhan login#zerodha brokerage calculator#zerodha margin calculator#edelweiss share price#kotak securities login#iifl share price#angel broking share price#no brokerage#upstox brokerage calculator#groww brokerage calculator

5 notes

·

View notes

Text

Use the Groww Brokerage Calculator to estimate brokerage fees and other charges for your trades in 2025. Plan your investments with clarity.

0 notes

Text

#groww#groww brokerage calculator 2024#groww brokerage charges calculator#calculate groww brokerage charges

0 notes

Text

Groww Brokerage Calculator: A Complete Insight About Brokerage Calculator

The Groww Brokerage Calculator is a powerful tool that helps traders estimate the costs associated with their trades. It provides a detailed breakdown of charges, including brokerage fees, stamp duty, transaction fees, SEBI turnover fee, GST, and Securities Transaction Tax (STT). Visit: https://shorturl.at/hjwP8

0 notes

Text

Groww App Se Paise Kaise Kamaye 2023: 4 आसान तरीके

वर्तमान समय में बढ़ती महंगाई और अधिक खर्चे से सभी चाहते हैं कि कोई ऐसा रास्ता निकले जिससे हम कम समय, ज्यादा मेहनत न करके घर बैठै पैसे कमाने का कोई काम मिल जाये जिससे अधिक पैसा कमा सके बहुत से लोगों के मन में ऐसे सवाल जरूर आते हैं कि ऐसा कौन सा काम हो सकता है जिसे करके घर बैठे पैसा कमा सकते हैं , कुछ लोगों को यह झूठ लगेगा लेकिन यह बिल्कुल सही है दुनिया भर में ऐसे बहुत से लोग है जो घर बैठे…

View On WordPress

#Fixed Deposit (FD)#Groww app charge#Groww App Se Paise Kaise Kamaye#Groww App Sip Calculator#How to Downlode Groww app#How to Withdraw money from groww app#Mutual Fund#share buy and sell charge#Stock Market

0 notes

Text

Groww स्टॉक ट्रेडिंग, डीमॅट, ब्रोकरेज आणि पुनरावलोकने 2023

Groww एक बंगलोर स्थित ब्रोकर आहे जो ऑनलाइन ऑफर करतो फ्लॅट फी सवलत ब्रोकरेज इक्विटी, IPO, आणि मध्ये गुंतवणूक करण्यासाठी सेवा डायरेक्ट म्युच्युअल फंड. Groww हे नेक्स्टबिलियन टेक्नॉलॉजी प्रायव्हेट लिमिटेडचे ब्रँड नाव आहे जे SEBI नोंदणीकृत स्टॉक ब्रोकर आणि NSE आणि BSE चे सदस्य आहेत.

2016 मध्ये स्थापित, Groww ने सुरुवातीला थेट म्युच्युअल फंड गुंतवणूक प्लॅटफॉर्म म्हणून सुरुवात केली. 2020 च्या मध्यात, Groww ने इक्विटी ट्रेडिंग समाविष्ट करण्यासाठी आपल्या उत्पादन ऑफरचा विस्तार केला. कंपनी आपल्या ग्राहकांसाठी इतर गुंतवणूक पर्याय म्हणून डिजिटल सोने, यूएस स्टॉक्स आणि मुदत ठेव देखील ऑफर करते.

Groww review 2023

Groww शुल्क 20 रुपये किंवा 0.05% प्रति निष्पादित ट्रेड कमी. तुम्ही ऑर्डरसाठी ब्रोकरेज म्हणून जास्तीत जास्त 20 रुपये द्याल, कोणतीही रक्कम किंवा रक्कम विचारात न घेता. Groww म्युच्युअल फंडाची गुंतवणूक किंवा पूर्तता करण्यासाठी कोणतेही ��ुल्क न घेता मोफत म्युच्युअल फंड सेवा देते.

Groww चे Groww (वेब आणि मोबाईल ट्रेडिंग अॅप) नावाचे स्वतःचे ट्रेडिंग प्लॅटफॉर्म आहे जे त्याच्या गुंतवणूकदारांना अखंड ट्रेडिंग अनुभव देते. हे 128-बिट एन्क्रिप्शनसह सुरक्षित आणि सुरक्षित अॅप आहे. नोव्हेंबर 2020 पर्यंत 90+ लाख वापरकर्त्यांचा भक्कम ग्राहक आधार असलेले Groww हे भारतातील सर्वात जलद-वाढणार्या प्लॅटफॉर्मपैकी एक आहे. हे Google Play Store आणि App Store मधील सर्वोच्च रेट केलेले (4.5+) अॅप देखील आहे.

Groww एक ऑनलाइन ब्रोकर आहे. विपरीत पूर्ण-सेवा दलाल, ते कोणत्याही टिपा, शिफारसी आणि संशोधन सेवा देत नाही. Groww कडे विनामूल्य ईपुस्तके, माहितीपूर्ण आणि शैक्षणिक ब्लॉग आणि गुंतवणूकदार/नवशिक्यांना शेअर बाजारातील व्यापार आणि गुंतवणूकीची मूलभूत माहिती शिकण्यास मदत करण्यासाठी संसाधने आहेत जी त्यांना माहितीपूर्ण गुंतवणूक निर्णय घेण्यास मदत करू शकतात.

0 notes

Text

Top Mutual Fund Company in India with Stock Market Investment in India

India’s financial landscape is evolving rapidly, with millions of individuals turning toward structured investment plans to build long-term wealth. Whether it’s through mutual funds, direct stock market investments, or using cutting-edge trading apps, the Indian investor has more tools and opportunities than ever before.

In this article, we explore some of the best mutual fund companies, trading platforms, SIP calculators, and investment strategies suited for every type of investor — from beginners to seasoned traders.

📊 Top Mutual Fund Companies in India

Mutual funds remain one of the most popular and accessible investment options in India. These funds pool money from various investors and invest in diversified asset classes such as equities, debt, and hybrid instruments.

Here are some of the top mutual fund companies in India:

SBI Mutual Fund – One of India’s oldest and most trusted AMCs.

HDFC Mutual Fund – Offers a wide range of schemes for all investor profiles.

ICICI Prudential Mutual Fund – Known for hybrid and balanced advantage funds.

Nippon India Mutual Fund – Popular for its tax-saving and small-cap funds.

Axis Mutual Fund – Offers performance-driven equity and debt schemes.

These AMCs are regulated by SEBI and cater to different mutual fund plan in india financial goals such as retirement, education, wealth creation, and tax saving.

📱 Best Trading App in India

In the digital era, trading apps have revolutionized stock market access, especially for young and first-time investors. The best apps offer real-time market data, low brokerage, fast execution, and user-friendly interfaces.

Here are some of the best trading apps in India:

Zerodha Kite – The most popular discount broker app with advanced charting.

Upstox – Offers fast trading and high-quality research tools.

Groww – Ideal for beginners looking to invest in mutual funds and stocks.

Angel One – A full-service broker with AI-powered recommendations.

5Paisa – Affordable trading with portfolio analysis tools.

These apps offer seamless KYC and integration with UPI for quick fund transfers, making investing more convenient than ever.

📅 Mutual Fund Investment Plans and SIP Calculators

Mutual Fund Investment Plans (MFIPs) allow investors to choose from various schemes based on risk appetite, goals, and investment horizon. The most popular method of investing in mutual funds is through Systematic Investment Plans (SIPs).

Why SIPs?

Helps in rupee cost averaging

Encourages disciplined investing

Ideal for long-term wealth creation

Use SIP Investment Plan Calculators

Before starting an SIP, use a SIP calculator to estimate:

Future value of your investment

Monthly contribution best trading app in india required for a goal

Time required to reach a financial target

For example, an investment of ₹5,000/month for 10 years at an average 12% return can grow to around ₹11.6 lakhs.

Free SIP calculators are available on:

💡 Best Investment Plan in India

The best investment plan depends on your risk profile and financial goals. Here’s a breakdown:

Investor Type

Investment Plan

Conservative

PPF, FDs, Debt Mutual Funds

Balanced

Hybrid Mutual Funds, ULIPs

Aggressive

Equity Mutual Funds, Direct Stocks

Other smart investment avenues:

NPS (National Pension Scheme) – Retirement-focused with tax benefits

ELSS (Equity Linked Saving Scheme) – Short lock-in with tax deductions

Index Funds – Passive investing in large-cap indices

Diversifying across these instruments helps manage risk while optimizing returns.

📈 Share Market & Stock Market Investment in India

Investing in the share market involves buying equity shares of listed companies. It can be done through:

IPO (Initial Public Offering) via primary market

Secondary Market via stock exchanges like NSE & BSE

Key Steps to Invest in the Stock Market:

Open a Demat & Trading Account

Complete eKYC process

Link your bank account

Start trading or investing sip investment plan calculator via an app

Always do proper research or follow expert recommendations before making any investment.

Primary Market vs. Secondary Market:

Primary Market: Where companies issue new shares (IPOs).

Secondary Market: Where existing shares are traded between investors.

For instance, when a company like LIC launches an IPO, it's through the primary market. Once listed, you can trade those shares in the secondary market.

🇮🇳 The Future of Stock Market in India

India’s stock market is growing exponentially, driven by:

Rising financial literacy

Digital access via mobile apps

Government support for retail investors

SEBI regulations ensuring transparency

With over 12 crore demat accounts in India (as of 2025), the democratization of stock market investing is in full swing. Moreover, fintech platforms now offer AI-driven financial advice, robo-advisory services, and goal-based investing, bringing sophistication to the masses.

Final Thoughts

Whether you're a student planning your first SIP or an experienced investor exploring primary market IPOs, India offers a wide range of investment options tailored to share market investment in india every need. With reliable mutual fund companies, efficient trading apps, and intelligent planning tools like SIP calculators, wealth creation is no longer limited to finance professionals.

Start small, stay consistent, and let time do the magic. The Indian stock market and digital investment platforms have made it easier than ever to achieve your financial goals.

0 notes

Text

Loan Against Mutual Funds Charges: Processing Fees, Interest & More Explained

Have you ever needed urgent funds but didn’t want to break your mutual fund investments?

You’re not alone. In 2025, with inflation, unexpected medical emergencies, education costs, and business needs rising, many investors are turning towards Loan Against Mutual Funds (LAMF) — a smart way to unlock liquidity without redeeming your assets.

If you’ve ever searched “what is LAS or LAMF,” or wondered about “loan against mutual funds interest rate,” or “who can apply for loan against mutual funds” — then this article is your one-stop guide.

What Is Loan Against Mutual Funds (LAMF)?

A Loan Against Mutual Funds is a type of Loan Against Securities (LAS) where you pledge your mutual fund units to a bank or NBFC in exchange for a loan. You don’t sell your investment—you simply borrow against it.

This helps retain your long-term financial goals while giving you immediate liquidity.

Why Consider a Loan Against Mutual Funds?

Here’s what makes LAMF an attractive option:

No need to redeem mutual funds

Lower interest rate than personal loans or credit cards

Instant digital processing in many cases

Flexible repayment options

Continue earning capital gains/dividends on mutual funds

Loan Against Mutual Funds vs. Loan Against Shares: A Quick Comparison

Minimum Balance Requirements – What You Should Know

Many banks have their own policies regarding minimum balance or value of mutual fund portfolio before approving the loan.

Here’s what you typically need:

A minimum of ₹25,000 to ₹50,000 in mutual funds (varies by lender)

Approved mutual fund types (Equity, Hybrid, or Debt)

Portfolio with consistent returns or stable value

For example:

HDFC Bank may require ₹50,000+ in approved mutual funds.

ICICI Bank offers loans starting from ₹10,000 if it’s processed digitally.

Tip: Always check with your bank or NBFC for the latest minimum NAV requirement.

Charges Involved in LAMF

Understanding the charges is crucial before you proceed:

Looking for the lowest interest rate of loan against mutual fund in India? Always compare loan against securities interest rates online before choosing.

Digital Loan Against Mutual Funds: Fast & Paperless

Gone are the days of branch visits and heavy paperwork. With digital loan against mutual fund services by ICICI, HDFC, Axis, and fintechs like Paytm and Groww:

Instant eligibility check via PAN + mobile

e-KYC + e-Sign

Loan disbursed in a few hours

Manage everything via app

Many even show you the digital loan against mutual funds interest rate transparently before applying.

Documents Needed

You usually don’t need many documents. If applying digitally:

PAN Card

Aadhaar (linked to mobile)

Mutual fund folio details

Bank account proof

If applying offline or for higher amounts, income proof and address proof may be needed.

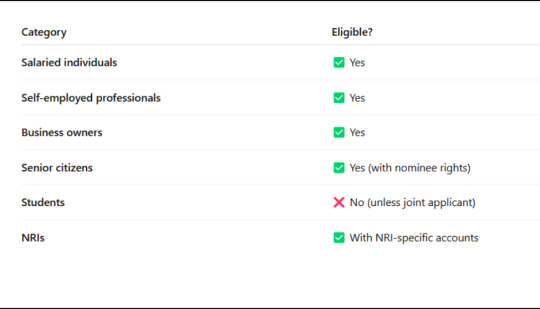

Who Can Apply for Loan Against Mutual Funds?

If you've been wondering who can apply for loan against mutual funds, here's the answer:

Things to Keep in Mind Before Applying

Loan tenure: Usually up to 36 months. Choose based on your repayment capacity.

Prepayment options: Check if there are charges.

Mutual Fund Type: Some lenders only accept debt or equity-oriented funds.

Ownership: Joint holding mutual funds may need consent of all holders.

Interest Calculation: It’s usually daily reducing balance.

5 Frequently Asked Questions (FAQ)

1. Can I apply for a loan against SIP mutual funds?

Yes, if your SIP investments have accumulated to a minimum NAV (₹25K to ₹50K). The loan is based on NAV, not just SIP frequency.

2. How much loan can I get against my mutual fund?

Typically, up to 75% of your NAV (Net Asset Value). Some equity funds allow up to 50–60%.

3. Will my mutual funds get sold during the loan?

No. They are pledged, not sold. You still own them unless you default.

4. Is loan against mutual funds better than a personal loan?

Yes, it’s cheaper and quicker if you have an MF portfolio. You save on interest and still retain your investment benefits.

5. Are there any tax benefits on LAMF?

No direct tax benefits, but since it’s not an income, it doesn’t increase your taxable income like some withdrawals might.

Final Thoughts: Should You Go for LAMF?

If you’re looking for an instant loan with lower interest rates, don’t want to disturb your long-term financial goals, and want flexibility—Loan Against Mutual Funds (LAMF) is a smart choice.

Especially with digital loan against mutual fund options and competitive loan against mutual funds interest rates offered by top banks and NBFCs, it’s now easier than ever to get the funds you need without hassle.

Pro Tip: Always compare loan against shares interest rates, loan against securities interest rates, and LAMF offers to pick the one that suits you best.

#Loan Against Securities (LAS)#Loan Against Mutual Funds#Loan Against Mutual Funds Interest Rate#Loan Against Securities Interest Rates#Loan Against Shares#loan against shares interest rates#LAMF#digital loan against mutual funds interest rate#digital loan against mutual fund#who can apply for loan against mutual funds

0 notes

Text

#nse option chain#delhivery share price#कैलकुलेटर#brokerage calculator#ncl research share price#mpokket#kotak share price#zerodha customer care#calculator price#upstox brokerage calculator#groww brokerage calculator#ccl points table

0 notes

Text

What is Step-Up SIP? Meaning, Benefits & How It Works?

Keywords: step up SIP, what is step up SIP, benefits of step up SIP, SIP in mutual funds, mutual fund investment, step-up SIP calculator

✅ Introduction

If you're investing in mutual funds through SIPs (Systematic Investment Plans), there's a smarter way to grow your wealth — it's called a Step-Up SIP.

A Step-Up SIP allows you to automatically increase your SIP amount at regular intervals. This simple strategy can make a huge difference in your long-term wealth creation.

In this blog, we’ll explain what Step-Up SIP means, how it works, and why it's an ideal option for salaried investors and long-term planners.

📌 What is a Step-Up SIP?

A Step-Up SIP (also known as Top-Up SIP) is a type of SIP where you increase your monthly investment amount periodically, such as every year.

For example:

You start with ₹5,000/month

After one year, it automatically increases to ₹6,000/month

Next year: ₹7,000/month — and so on

You can set the step-up amount (like ₹1,000) or step-up percentage (like 10%) based on your comfort.

💡 Why Choose a Step-Up SIP?

Here’s why Step-Up SIPs are smart:

1. 🌱 Grow With Your Income

As your salary increases, your SIP also increases — automatically. It aligns with your earning potential.

2. 📈 Faster Wealth Accumulation

A step-up SIP helps you invest more over time and build a bigger corpus — thanks to power of compounding.

3. ⏰ Beat Inflation

Increasing your SIP helps your investment stay ahead of inflation and rising expenses.

4. 🧠 Discipline Without Effort

Once set, it runs automatically. You don’t need to remember to increase your SIP manually.

📊 Example of Step-Up SIP in Action

Let’s say you start a SIP of ₹5,000/month for 15 years.

Type

Final Value (@12% return)

Normal SIP

₹25.3 Lakhs

Step-Up SIP (+₹1,000/year)

₹34.8 Lakhs

👉 That’s ₹9.5 Lakhs extra — just by increasing ₹1,000/year!

Use any Step-Up SIP Calculator online to estimate your returns.

🛠️ How to Start a Step-Up SIP?

You can easily start a Step-Up SIP through:

Zerodha Coin

Groww

Paytm Money

Kuvera

Direct AMCs (like SBI MF, HDFC MF, etc.)

During SIP setup, choose “Top-Up” or “Step-Up” and set the amount/percentage + frequency (usually yearly).

🚀 Best Funds for Step-Up SIP (Examples)

Here are some popular mutual fund categories to consider:

Equity Mutual Funds

Index Funds

Hybrid/Balanced Funds

ELSS Funds (for tax saving)

💡 Pro Tip: Always match the fund to your risk appetite and goals.

🔁 Final Thoughts

A Step-Up SIP is one of the smartest ways to build long-term wealth with minimal effort. It’s ideal for:

Young investors

Salaried professionals

Long-term goal planners

Start small, increase gradually, and let compounding work its magic! 🚀

0 notes

Text

Want to Understand Loans Better? Start Reading These Finance Blogs

Loans have become a common part of life in India. Whether it’s for education, business, home, or even a new phone, most people have taken or are planning to take a loan. But the problem is, many jump into it without proper knowledge.

What’s the interest rate? Is there a processing fee? What about hidden charges? How does CIBIL score matter?

If these questions confuse you, the best place to start learning is through finance blogs covering loans in India.

Why Finance Blogs Matter

Let’s be real—not everyone has the time or patience to talk to bank managers or read through complicated RBI guidelines. That’s where blogs come in. Good finance blogs explain these concepts in simple language, using real examples.

They help you:

Understand loan types (secured, unsecured, personal, education, etc.)

Know how interest rates work

Learn the meaning of terms like EMI, tenure, foreclosure

Avoid scams and fake loan apps

Stay updated with the latest government schemes like Mudra, PMEGP, etc.

Reading finance blogs covering loans in India can literally save you from taking the wrong loan and falling into a debt trap.

What to Look for in a Good Finance Blog?

Not all blogs are worth your time. Some are just promoting credit cards or selling leads to loan companies. Here’s what a useful blog will offer:

✅ Honest and unbiased content ✅ Clear language (not full of jargon) ✅ Real-life loan comparisons ✅ Tips to improve CIBIL score ✅ Updates on RBI rules and loan schemes ✅ Warnings against frauds and scams

A good finance blog feels like a friend explaining things—not a salesman trying to sell you a product.

Some Topics You’ll Commonly Find

On finance blogs covering loans in India, you’ll usually find articles on:

“Best banks for personal loans in 2025”

“How to check if your loan app is fake”

“Should you prepay your loan early?”

“How to apply for Mudra loan step-by-step”

“Hidden charges banks don’t talk about”

These blogs also often review loan apps and online calculators—helping you decide what’s trustworthy and what’s not.

Where to Find These Blogs?

Some popular platforms that consistently put out solid content include:

BankBazaar Blog

Paisabazaar Blog

MoneyControl

ClearTax

Groww

Finshots (for general finance awareness)

You can also follow independent finance creators on Instagram and YouTube—they often link to their blogs in the bio.

Final Tip

Knowledge is power, especially in the world of loans. One small mistake while applying, and you could be paying more than you planned for years.

So before signing any loan document, make it a habit to read a couple of finance blogs covering loans in India. You’ll feel more confident, more aware, and way more in control of your financial decisions.

0 notes

Text

Brokerage Calculator - Calculate and Compare Brokerage Charges Online

The benefits of using a Groww brokerage calculator are manifold. It provides transparency by giving investors a clear understanding of all costs associated with their trades.

Furthermore, by comparing different brokerages using this tool before making any transactions can help you choose wisely among multiple brokers available in the market today. Visit us : https://shorturl.at/dENPX

0 notes

Text

What is XIRR? The Right Way to Track Your SIP Returns

When you invest in mutual funds through SIP (Systematic Investment Plan), you're investing a fixed amount regularly—usually monthly. Over time, as market values fluctuate, your investments grow. But how do you measure the true return from this scattered and systematic investment? The answer lies in XIRR.

Let’s understand what XIRR is, and why it is the most accurate way to track your mutual fund SIP returns.

What is XIRR?

XIRR (Extended Internal Rate of Return) is a financial metric used to calculate the annualized return on investments where there are multiple cash flows at different intervals. It takes into account each investment date, amount, and the final redemption amount to give you a true picture of your investment performance.

In simple terms: XIRR shows the average yearly return you earned across all your SIPs—even if they were made on different dates and amounts.

Why XIRR is Ideal for SIPs?

In SIPs, you're investing the same amount every month, but at different NAVs (Net Asset Values). This means:

Each investment is made on a different date

Each amount is compounded differently

Market fluctuations affect every SIP installment uniquely

Using a simple average return won’t capture this complexity. That’s where XIRR shines.

How Does XIRR Work?

XIRR calculates the return based on:

Each investment amount and date

The final redemption amount and date

The time period each investment was held

It uses a formula that estimates the rate at which your total inflows and outflows break even over time.

Example:

Let’s say you invested ₹5,000 monthly from Jan 2022 to Dec 2024 (total ₹1.8 lakh). On 1st Jan 2025, the value of your mutual fund is ₹2.1 lakh.

The XIRR formula will calculate how much return (in %) per year you earned on your SIPs from start to end.

Benefits of Using XIRR

Gives accurate annualized return on irregular cash flows

Helps compare different investment options

Reflects actual performance of SIP-based investments

Can be used to track partial withdrawals or top-ups

How to Calculate XIRR?

You don’t need to do complex math. Just use:

In Excel or Google Sheets:

List all SIP amounts as negative values (outflows)

Add the current value or redemption as positive value (inflow)

Add corresponding dates

Use the formula: =XIRR(values, dates)

It will instantly show the annualized return percentage.

Tools That Automatically Show XIRR:

Most mutual fund platforms (NJ Wealth, CAMS, Zerodha Coin, Groww, etc.)

Mutual fund account statements

Portfolio tracking apps like Kuvera, Paytm Money, and ET Money

Final Thoughts

XIRR is the most reliable way to track your SIP returns. Unlike simple returns or CAGR, XIRR adjusts for the timing and flow of your investments—giving you a real-world view of how your mutual fund is performing.

So, next time you check your portfolio, don’t just look at the current value—check the XIRR to know how well your money is truly working for you.

0 notes

Text

Stock Market Trading with Brokerage Calculators in India

Stock market trading has become increasingly popular in India, thanks to the rise of digital platforms and growing awareness about financial investments. From seasoned investors to first-time traders, the Indian stock market offers a wide array of opportunities for wealth creation. Whether it’s equities, derivatives, or intraday trades, having the right tools at your disposal is essential to maximize profits and minimize trading costs.

The Rise of Stock Market Applications in India

With the boom in fintech, stock market applications in India have revolutionized the way people invest. These apps provide real-time stock prices, easy fund transfers, portfolio tracking, and instant order execution, all in the palm of your hand. Popular trading apps like Zerodha, Upstox, Groww, and TradFlow have made stock market participation more accessible than ever before. For traders who want a streamlined experience with advanced tools, these platforms are game-changers.

The Importance of a Brokerage Calculator in India

One of the most essential tools for a trader is the brokerage calculator in India. It helps investors determine the exact cost involved in placing a trade. Since brokerage charges can vary based on the type of trade (intraday, delivery, futures, or options), it’s important to use a reliable calculator to avoid unexpected fees. Brokerage calculators take into account all applicable charges including GST, SEBI charges, stamp duty, exchange transaction charges, and more.

Stock Trading Charges Calculator: Why You Need It

A stock trading charges calculator allows traders to know their break-even point by showing all deductions upfront. This is especially useful for active traders who execute multiple trades in a single day. Knowing the total charges can help plan better and avoid overtrading. It also enables a fair comparison between different brokers based on fee structure.

Intraday Brokerage Charges in India

Intraday trading involves buying and selling shares within the same trading day. Because of its short-term nature, intraday trading usually comes with lower brokerage fees compared to delivery trades. However, stock trading charges calculator these charges can still add up quickly. That’s why checking intraday brokerage charges in India using a calculator is vital for day traders to assess their actual profit margins.

Delivery Brokerage Calculator in Delhi

For investors who prefer long-term investments, delivery trading is a common strategy. These trades are settled after two business days and usually incur slightly higher brokerage charges. A delivery brokerage calculator in Delhi or any other region helps estimate the charges for such trades, including all applicable state stamp duties which vary regionally.

Calculate Brokerage Online with Ease

The ability to calculate brokerage online saves time and removes guesswork from the investment process. Most modern stock trading platforms integrate these calculators directly into their interface. Traders can enter basic trade details such as buy/sell price, quantity, and type of order to instantly view the applicable charges.

Equity Brokerage Calculator in Delhi

When it comes to equity trading, charges differ from broker to broker. An equity brokerage calculator in Delhi is especially useful for investors operating in this region, where stamp duty and taxes might vary. Whether financial company in india trading in NSE or BSE, regional calculators ensure greater accuracy in cost estimation.

Understanding Options Trading Charges

Options trading is a popular strategy for hedging or speculating in the stock market. However, it comes with its own set of charges, including brokerage, premium, and transaction fees. Using a calculator to determine options trading charges helps traders set realistic expectations and better manage their capital.

Futures Brokerage Calculator in India

Futures contracts also attract specific charges and taxes. A futures brokerage calculator in India can help traders evaluate total costs involved, including margin requirements and settlement fees. These calculators are crucial for anyone dealing with derivative instruments, ensuring they don’t overlook hidden expenses.

Trading Cost Calculator in India: A Must-Have Tool

A comprehensive trading cost calculator in India covers all asset classes and trade types, giving traders a 360-degree view of their cost structure. These calculators promote transparency and smarter trading stock market in india decisions, allowing investors to optimize their strategies based on real cost analysis.

Conclusion

Whether you’re an active trader or a long-term investor, understanding the total cost of trading is crucial for financial success. With the help of stock market applications and advanced tools like brokerage and trading cost calculators, investing in the Indian stock market has become smarter, simpler, and more transparent. Use these tools to your advantage and stay ahead in the ever-evolving world of stock market trading.

0 notes

Text

SIP and Lumpsum Calculator: The Most Accurate and Precise Calculation

In today's era, financial planning is a crucial step, where SIP and Lumpsum investment play a vital role. If you are considering investing in mutual funds or any other investment scheme, then dpank.in's SIP and Lumpsum Calculator is an excellent tool for you. This calculator performs precise compounding calculations and provides more accurate results than the Groww app.

What is SIP and Lumpsum Calculator?

The SIP and Lumpsum calculator is a digital tool that allows you to estimate your investment returns. By simply entering your investment amount, interest rate, and duration (years), you can determine how much your money will grow in the future. This calculator accurately computes your investment growth using the compound interest formula.

Why is dpank.in's Calculator the Most Accurate?

Precise Compounding Calculation – This calculator follows the compound interest principles to provide an accurate estimate of your future value.

More Accurate Than Groww App – Our advanced algorithm delivers results that are even more precise than those from leading platforms like Groww.

Simple and User-Friendly Interface – Just enter your investment amount, interest rate, and time duration, and get instant, accurate results.

Useful for Both SIP and Lumpsum Investments – Whether you are investing through SIP or making a one-time lump sum investment, this tool helps in both cases.

Real-Time Calculation – Our calculator provides immediate real-time results without any delays.

How Does SIP and Lumpsum Work?

SIP Calculator Formula:

In SIP, investments are made monthly, and it follows the compound interest formula: FV=P×((1+r)n−1r)×(1+r)FV = P \times \left(\frac{(1 + r)^n - 1}{r}\right) \times (1 + r)

Where,

FV = Future Value

P = Monthly SIP Amount

r = Monthly Interest Rate (Annual Rate / 12 / 100)

n = Total Months

Lumpsum Calculator Formula:

A lump sum investment is made once, and it follows the simple compound interest principle: FV=P×(1+r)nFV = P \times (1 + r)^n

Where,

P = Initial Investment Amount

r = Annual Interest Rate / 100

n = Investment Duration (Years)

How to Use dpank.in's SIP and Lumpsum Calculator?

Enter Investment Amount – Specify the amount you want to invest.

Set Interest Rate – Define the expected return rate.

Choose Time Period – Select the number of years you wish to invest for.

Click Calculate Button – Instantly view the estimated future value.

Conclusion

If you want to enhance your financial journey, dpank.in's SIP and Lumpsum Calculator is the best choice. It delivers more accurate results than the Groww app and performs precise compound interest calculations. Start planning your investments today and secure your financial future!

0 notes