#green hydrogen energy stocks

Explore tagged Tumblr posts

Text

Mukesh Ambani and Gautam Adani, two of India's biggest businessmen, are about to invest roughly $70 billion each by the end of this decade to make green hydrogen affordable, including renewable energy plants, large-scale photovoltaic cell manufacturing, electrolyzers, storage, and transportation facilities, and other components of the hydrogen ecosystem. The government declared it would cover the cost of renewable energy used to create hydrogen at a location other than the source of the power.

#green hydrogen#renewable energy#mukesh ambani#mukesh ambani green energy#mukesh ambani green hydrogen#mukesh ambani net worth#mint explains#mint#mukesh ambani completes 20 years at the helm of reliance#green hydrogen energy#green hydrogen production#hydrogen#reliance mukesh ambani#green hydrogen energy stocks#mukesh ambani news#green hydrogen explained#explained#affordable renewable energy#gautam adani#gautam adani green energy#gautam adani green hydrogen

1 note

·

View note

Text

Why Oil Companies Are Walking Back From Green Energy. (New York Times)

Excerpt from this New York Times story:

When oil and gas companies made ambitious commitments four years ago to curb emissions and transition to renewable energy, their businesses were in free fall.

Demand for the fuels was drying up as the pandemic took hold. Prices plunged. And large Western oil companies were hemorrhaging money, with losses topping $100 billion, according to the energy consulting firm Wood Mackenzie.

Renewable energy, it seemed to many companies and investors at the time, was not just cleaner — it was a better business than oil and gas.

“Investors were focused on what I would say was the prevailing narrative around it’s all moving to wind and solar,” Darren Woods, Exxon Mobil’s chief executive, said in an interview with The New York Times last week at a United Nations climate conference in Baku, Azerbaijan. “I had a lot of pressure to get into the wind and solar business,” he added.

Mr. Woods resisted, reasoning that Exxon did not have expertise in those areas. Instead, the company invested in areas like hydrogen and lithium extraction that are more akin to its traditional business.

Wall Street has rewarded the company for those bets. The company’s stock price has climbed more than 70 percent since the end of 2019, lifting its market valuation to a record of nearly $560 billion in October, though it has since fallen to about $524 billion.

The American oil giant’s performance stands in contrast with BP and Shell, oil and gas companies based in London that embraced wind, solar and other technologies like electric-vehicle charging. BP’s stock has fallen around 19 percent in that time, based on trading in London, while Shell’s has climbed about 15 percent.

The market’s renewed acceptance of fossil fuels underscores one of the core challenges of curbing global emissions: Climate change poses risks that compound over decades. Scientists say every fraction of a degree of warming caused by fossil fuels brings greater risks from deadly heat waves, wildfires, drought, storms and species extinction. But investors are focused on making money over months and years.

“If we want to combat climate change, we need to make it in the firms’ and consumers’ self-interest to produce and buy the low-carbon alternatives,” said Christopher Knittel, a professor of energy economics at the Massachusetts Institute of Technology.

The election of Donald J. Trump, who has falsely described global warming as a hoax, has led to even greater optimism about the oil and gas business.

The difference in profits that companies can make from extracting oil and gas and what they can earn from harnessing wind and solar had already swung sharply in favor of fossil fuels in recent years.

The median return on capital among some of the world’s biggest investor-owned oil companies, a key measure of profitability, topped 11 percent last year, up from negative 8 percent in 2020, according to an analysis by S&P Global Commodity Insights. The median return over that same period for the top renewable energy companies has stayed around 2 percent.

6 notes

·

View notes

Text

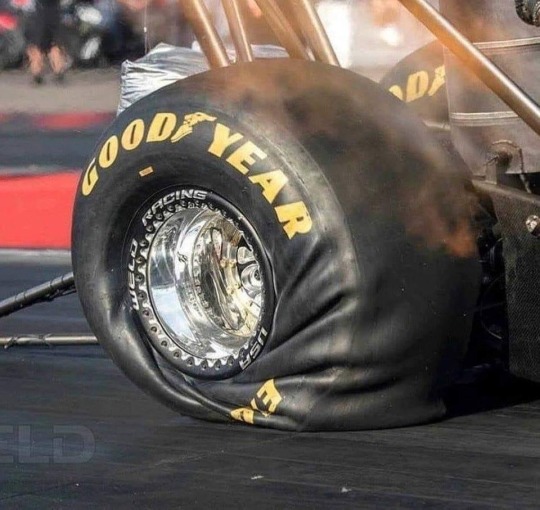

What 10,000 horsepower does to a top fuel tire at launch.

TOP FUEL ACCELERATION PUT INTO PERSPECTIVE

* One Top Fuel dragster 500 cubic-inch Hemi engine makes more horsepower (10,000 HP) than the first 5 rows at the Daytona 500.

* Under full throttle, a dragster engine consumes 1.2-1.5 gallons of nitro methane per second; a fully loaded 747 consumes jet fuel at the same rate with 25% less energy being produced.

* A stock Dodge Hemi V8 engine cannot produce enough power to merely drive the dragster's supercharger.

* With 3000 CFM of air being rammed in by the supercharger on overdrive, the fuel mixture is compressed into a near-solid form before ignition. Cylinders run on the verge of hydraulic lock at full throttle.

* At the stoichiometric 1.7:1 air/fuel mixture for nitro methane the flame front temperature measures 7050 degrees F.

* Nitromethane burns yellow. The spectacular white flame seen above the stacks at night is raw burning hydrogen, dissociated from atmospheric water vapor by the searing exhaust gases.

* Dual magnetos supply 44 amps to each spark plug.

This is the output of an arc welder in each cylinder.

* Spark plug electrodes are totally consumed during a pass. After 1/2 way, the engine is dieseling from compression plus the glow of exhaust valves at 1400 degrees F. The engine can only be shut down by cutting the fuel flow.

* If spark momentarily fails early in the run, unburned nitro builds up in the affected cylinders and then explodes with sufficient force to blow cylinder heads off the block in pieces or split the block in half.

* Dragsters reach over 300 MPH before you have completed reading this sentence.

* In order to exceed 300 MPH in 4.5 seconds, dragsters must accelerate an average of over 4 G's. In order to reach 200 MPH well before half-track, the launch acce leration approaches 8 G's.

* Top Fuel engines turn approximately 540 revolutions from light to light!

* Including the burnout, the engine must only survive 900 revolutions under load.

* The redline is actually quite high at 9500 RPM.

* THE BOTTOM LINE: Assuming all the equipment is paid off, the crew worked for free, & for once, NOTHING BLOWS UP, each run costs an estimated $1,000 per second.

0 to 100 MPH in .8 seconds (the first 60 feet of the run)

0 to 200 MPH in 2.2 seconds (the first 350 feet of the run)

6 g-forces at the starting line (nothing accelerates faster on land)

6 negative g-forces upon deployment of twin ‘chutes at 300 MPH An NHRA Top Fuel Dragster accelerates quicker than any other land vehicle on earth . . quicker than a jet fighter plane . . . quicker than the space shuttle.

The current Top Fuel dragster elapsed time record is 4.420 seconds for the quarter-mile (2004, Doug Kalitta). The top speed record is 337.58 MPH as measured over the last 66' of the run (2005, Tony Schumacher).

Putting this all into perspective:

You are driving the average $140,000 Lingenfelter twin-turbo powered Corvette Z06. Over a mile up the road, a Top Fuel dragster is staged & ready to launch down a quarter-mile strip as you pass. You have the advantage of a flying start. You run the 'Vette hard up through the gears and blast across the starting line & pass the dragster at an honest 200 MPH. The 'tree' goes green for both of you at that moment.

The dragster launches & starts after you. You keep your foot down hard, but you hear an incredibly brutal whine that sears your eardrums & within 3 seconds the dragster catches & passes you.

He beats you to the finish line, a quarter-mile away from where you just passed him. Think about it - from a standing start, the dragster had spotted you 200 MPH & not only caught, but nearly blasted you off the road when he passed you within a mere 1320 foot long race!

That's acceleration!

5 notes

·

View notes

Text

In January, after New York-based short seller Hindenburg Research released a report accusing Adani Group of accounting fraud and stock manipulation, the Indian conglomerate defended itself by appealing to nationalism. “This is … a calculated attack on India, the independence, integrity and quality of Indian institutions, and the growth story and ambition of India,” the group said in a 413-page response refuting the allegations.

It is no surprise that Adani Group tied itself to India’s “growth story.” The industrial empire of Gautam Adani, the group’s founder, has been key to Prime Minister Narendra Modi’s vision for India, which centers on big infrastructure projects as drivers of growth. In turn, Adani’s support for Modi’s nation-building plans, from airports to green hydrogen plants, has propelled his conglomerate’s meteoric rise. From 2014 to December 2022, Adani Group’s market capitalization soared from $6.5 billion to more than $223 billion.

Hindenburg’s report triggered a sudden reversal, however. The value of Adani Group’s publicly traded stocks soon fell by more than half—a rout that has continued a month after the report’s release. Modi has chosen to remain quiet about the affair, even as it has raised serious questions about India’s economy.

If Adani Group seeks refuge from criticism by tying its success to that of India’s, then the converse must also be reckoned with: The collapse of its shares represents a stress test for India’s growth project. It has cast doubt on whether Modi’s strategy of propping up a few favored corporate titans can translate into lasting results on the ground. And, beyond that, whether Modi’s India can deliver on hopes that it could become a driver of global economic growth, as China was for the past three decades.

Modi’s rise has long been intertwined with that of Adani’s. As chief minister of Gujarat from 2001 to 2014, Modi made his name through his so-called Gujarat model of development, with its large infrastructure projects, such as dams, extensive highways, and solar power plants. Adani was critical not just to constructing many of these projects but also to bringing big business around to the idea of Modi as a potential prime minister. After Modi was elected in 2014, he flew from Gujarat to his new home of New Delhi in Adani’s private jet.

As Modi became India’s most popular leader since the republic’s first prime minister, Jawaharlal Nehru, Adani’s business interests expanded. His conglomerate partnered with the government on critical infrastructure projects within India and, increasingly, abroad. Since Modi entered office, Adani’s net worth increased by more than 5,000 percent to $150 billion in September 2022, making him Asia’s richest man before the scandal. His wealth came largely on the back of winning government contracts; expanding into strategic sectors, such as clean energy and defense; and building critical infrastructure projects. For instance, Adani Group secured seven out of the eight airports that the Indian government leased out to private companies. These kinds of contracts, in turn, led to more interest in Adani Group stock from investors.

The government has undoubtedly placed its trust in Adani, but the Hindenburg report could be a stumbling block in Modi’s plans to ensure that India remains the world’s fastest-growing major economy. After the brutal stock rout, the group called off a $2.5 billion share sale and had to delay its expansion plans. A margin call followed, leading Adani to prepay a $1.1 billion loan. Meanwhile, French energy giant TotalEnergies has put on hold a $4 billion investment in an Adani Group green hydrogen project.

Over his tenure, Modi has been unwilling or unable to push through structural reform that would allow more companies to enter new sectors without significant risk-taking. He therefore has no option but to depend on national champions, such as Adani. But even among Indian billionaires, Adani is unique. Very few businesspeople enjoy the government’s confidence, can navigate dizzying state regulation, and, most of all, are willing to risk enormous amounts of capital.

In 2015, Credit Suisse published its House of Debt report, which examined the precarious debt levels of 10 prominent Indian business groups with a significant presence in various infrastructure sectors. Out of the 10 groups, many have ended up in bankruptcy courts in recent years, while others have pursued debt consolidation plans. Only one group—the Adani conglomerate—has continued to borrow and invest at a breathtaking pace.

The Economist has estimated that the combined revenues of companies controlled by Adani and fellow tycoon Mukesh Ambani, chair of India’s Reliance Industries, are equivalent to 4 percent of India’s GDP. Firms controlled by the pair also account for nearly a quarter of the capital spending of all publicly traded non-financial firms.

While many analysts fret over whether Adani Group is too big to fail, the more pertinent question is whether Adani has been too integral to the Indian economic project to fail.

Modi now faces a difficult dilemma. On the one hand, he relies heavily on large infrastructure development delivered by India’s billionaires. For example, Adani plans to develop massive renewable energy projects—and without them, India would find it challenging to fulfill its commitment to meet 50 percent of its energy requirements with renewables by 2030.

On the other hand, if Modi continues to protect Adani—as India’s opposition has alleged—by not addressing Hindenburg’s allegations, he runs the risk of undermining the credibility of India’s corporate governance and, by extension, its growth narrative.

Although India’s financial regulatory institutions are far from perfect, India has an established history of investigating and punishing financial fraud. The Adani Group scandal, however, has cast doubt on the ability of these institutions—such as the Securities and Exchange Board of India (SEBI), the country’s capital markets regulator—to operate independently.

It’s worth asking whether the Adani saga could have been anticipated, investigated, and defused long before Hindenburg came along if watchdogs had done their job.

Consider, for instance, a puzzling question that Hindenburg has sought to address: What explains the mind-boggling rise in the price of many Adani Group stocks? The price-to-earnings ratio of Adani Enterprises, the conglomerate’s flagship entity, went from 37.6 to 343.9 in just two years. But as experts have pointed out, growth of that nature is typically seen in companies in the technology sector, not brick-and-mortar industries.

There could be innocuous explanations, but the fact that the company’s board of directors didn’t examine the issue publicly opened the door for worrying allegations put forth by Hindenburg. In particular, the short seller has alleged that Adani Group’s stocks are being inflated by the conglomerate itself through secretive offshore entities.

This brings us to the question of what India’s stock market and banking regulators were doing. Long before Hindenburg came along, news outlets had pointed to the existence of three Mauritius-based funds that appeared to only invest in Adani Group companies and whose ultimate ownership was opaque. Why weren’t these funds forced to furnish details of their ownership structure at any point in the last few years and nip allegations of “round-tripping” in the bud?

In addition, SEBI continued to sign off on the conglomerate’s fundraising proposals even though the Indian government disclosed in Parliament in 2021 that SEBI had begun a probe to investigate some Adani Group companies over “non-compliance of rules.” It’s unclear what the scope of the SEBI investigation was and whether it has concluded.

For years, India’s beleaguered political opposition has accused regulatory authorities of corruption and raised allegations of crony capitalism, specifically pointing to Adani. But given the opposition’s lack of specific allegations made against SEBI, it seems more likely that the economy and stock market’s overseers are simply indifferent and plagued by inertia. Regardless, these accusations, and the Adani Group controversy, have not hurt Modi’s popularity, thanks in part to his administration’s tight control over the mainstream media.

Yet there may be consequences that stem from outside of India’s borders. It’s possible that global investors will become less bullish on India if they think that Indian business empires won’t be able to build necessary infrastructure or be reined in by domestic regulatory systems. Overseas partnerships and joint ventures could face headwinds as well, just as the Adani-TotalEnergies partnership has.

A fair, independent, and transparent probe into the allegations against Adani Group could ease these fears. Modi has so far ignored demands for one made by opposition political parties. But continuing to do so could very well be damaging to the long-term economic interests of India, and the world, even if it does not hurt Modi politically in the short term.

3 notes

·

View notes

Text

Sustainability in TMT Bar Manufacturing: The Future of Green Construction

As the world shifts toward more environmentally responsible practices, the construction industry is no exception. Among the key contributors to eco-friendly construction is the sustainable manufacturing of TMT bars (Thermo Mechanically Treated bars), which form the backbone of modern infrastructure. Companies like A One Steel Group are leading the charge in adopting innovative and sustainable methods to produce high-quality metal bars, essential for green construction practices.

Eco-Friendly Manufacturing of TMT Bars

The manufacturing of TMT bars involves significant energy use, raw material extraction, and carbon emissions. However, advancements in technology have made it possible to reduce the environmental footprint of this process. Modern steel plants utilize energy-efficient furnaces, waste heat recovery systems, and water recycling processes to minimize waste and resource usage. By focusing on these measures, manufacturers are able to produce mild steel bars and steel reinforcement products while reducing greenhouse gas emissions.

Recycling Steel for a Greener Future

Steel is one of the most recyclable materials on the planet. Today, an increasing portion of flat steel bar, stainless steel square bar, and mild steel flat bar comes from recycled scrap metal. Recycling steel significantly reduces the need for mining iron ore, conserving natural resources, and reducing energy consumption. For example, recycled steel requires about 60% less energy to produce compared to virgin steel. This practice not only aligns with sustainable goals but also ensures that the tmt rate today remains competitive and stable for the end consumer.

Durability and Longevity of TMT Bars

The use of high-quality steel reinforcement materials such as stainless steel flat stock and flat stock steel contributes to the durability and longevity of buildings. Sustainable construction practices prioritize materials that extend the lifecycle of structures, reducing the need for frequent repairs or replacements. This approach minimizes construction waste and conserves resources over time.

Innovations in Steel Manufacturing

Emerging technologies like electric arc furnaces (EAF) and green hydrogen-based steel production are revolutionizing how stainless flat bars and other steel products are manufactured. These methods replace traditional coal-based processes with cleaner, renewable energy sources. Additionally, manufacturers are incorporating advanced carbon capture technologies to offset emissions from production facilities.

The Role of Mild Steel and Flat Steel in Sustainable Construction

Mild steel bars and mild steel flat bars are versatile, cost-effective materials widely used in construction. Their high recyclability and adaptability make them integral to green building projects. Similarly, flat steel and steel round bars are favored for their strength and sustainability, supporting the creation of energy-efficient structures.

Why Sustainability Matters

Adopting sustainable practices in TMT bar manufacturing is crucial for building a greener future. It aligns with global efforts to combat climate change, reduce resource depletion, and minimize environmental pollution. Moreover, as demand for eco-friendly materials grows, companies that prioritize sustainability in producing metal bars, steel reinforcement, and other essential products are better positioned to meet market expectations.

CONCLUSION:

Sustainability in TMT bar manufacturing is no longer an option but a necessity for the future of green construction. By embracing recycling, energy-efficient processes, and innovative technologies, companies like A One Steel Group are setting new benchmarks in producing eco-friendly steel round bars, stainless steel square bars, and other key products. This shift toward sustainable steel production ensures a harmonious balance between industrial growth and environmental preservation, paving the way for a more resilient and eco-conscious construction industry.

0 notes

Text

📈 Monday’s Must-Watch: 5 Canadian Small-Cap Stocks to Keep on Your Radar! 🚀

1. Illumin Holdings (TSX: ILLM) — AI Ad-Tech on the Rise

Stock Price: CAD 1.80

Why Watch: Illumin is making waves with its AI-driven ad-tech platform, boasting a 13.92% year-over-year revenue increase!

Key Highlight: Recent partnerships with leading agencies fuel expansion into the U.S. and Europe.

Watch For: Growth in a competitive digital ad market.

2. Lithium Ionic (TSXV: LTH) — Powering the EV Revolution ⚡

Stock Price: CAD 0.88

Why Watch: With strong exploration results in Brazil, Lithium Ionic is capturing investor interest in the lithium market for EVs.

Key Highlight: Secured CAD 20 million in funding for project expansion.

Watch For: Potential partnerships with battery and EV manufacturers.

3. Perimeter Medical Imaging AI (TSXV: PINK) — Transforming Healthcare with AI 💡

Stock Price: CAD 0.53

Why Watch: Innovative cancer imaging technology aims to boost surgical accuracy, leading healthcare AI growth.

Key Highlight: Positive clinical trials have increased momentum in the AI-driven healthcare sector.

Watch For: Commercialization pace and healthcare AI competition.

4. Coveo Solutions (TSX: CVO) — Leading with AI-Driven Cloud Solutions ☁️

Stock Price: CAD 5.62

Why Watch: Coveo’s cloud platform accelerates business operations with tailored AI solutions.

Key Highlight: Rapid customer growth as demand for enterprise SaaS solutions surges.

Watch For: New AI integrations and customer expansions.

5. Ballard Power Systems (TSX: BLDP) — Fueling the Hydrogen Economy 🔋

Stock Price: CAD 2.32

Why Watch: Ballard’s focus on hydrogen fuel cells positions it well in the clean energy shift.

Key Highlight: Global interest in hydrogen infrastructure and government support for clean energy.

Watch For: New advancements in fuel cell tech and government-backed green initiatives.

Investors, these stocks are buzzing! Dive in and see where the market’s trending next! 📊

Visit - https://skrillnetwork.com/mondays-mustwatch-5-canadian-smallcap-stocks-you-need-to-watch-on-october-7th

0 notes

Text

Green Hydrogen Stocks In India: Opportunities And Leading Players

What is Green Hydrogen? Green hydrogen refers to hydrogen produced through the electrolysis of water, using renewable energy sources such as wind and solar power. This process generates hydrogen and oxygen without releasing greenhouse gases, making it an environmentally friendly and sustainable fuel option. Green hydrogen stands in stark contrast to grey hydrogen, which is derived from fossil…

View On WordPress

0 notes

Text

IREDA Share Price Target 2025

The Indian Renewable Energy Development Agency (IREDA) plays a pivotal role in financing renewable energy projects in India, driving the country's transition toward a cleaner energy future. As global concerns over climate change and sustainability grow, so does the potential for renewable energy companies like IREDA to thrive. With this increasing demand for green financing and government support for sustainable energy, many investors are looking into IREDA's stock as a strong long-term opportunity.

This article aims to analyze IREDA share price target 2024, 2025, and 2030, based on the company’s trajectory in the renewable energy market and its strategic importance in financing the sector.

IREDA Share Price Target 2024

In the short term, 2024 is expected to be an essential year for IREDA. The company is uniquely positioned to benefit from India’s ambitious renewable energy goals. As India pushes to increase its renewable energy capacity, IREDA, as a key financing partner, is expected to see significant growth in its project portfolio. The government has announced various plans to boost solar and wind energy production, which will likely lead to greater financing needs for infrastructure projects, solar parks, and wind farms.

Considering these growth prospects, market experts predict the IREDA share price target 2024 could range between INR 109-290. This estimate is based on anticipated project financing growth, new investment opportunities, and ongoing support from Indian policymakers. While external factors such as market volatility and changes in government priorities could influence this forecast, the overall outlook remains positive for the company in the near term.

IREDA Share Price Target 2025

By 2025, IREDA’s influence on India’s renewable energy landscape will likely expand even further. This period will be crucial for India’s renewable energy roadmap, as the country will aim to achieve substantial targets in renewable capacity installations. During this time, IREDA’s role in financing renewable energy projects will become more pronounced, with the potential for partnerships with global renewable energy firms.

The expected IREDA share price target 2025 is projected to be between INR 280-430, driven by both domestic and international developments. If India continues to make progress toward its renewable energy goals, particularly through solar and wind power, IREDA is likely to benefit from increased demand for project funding. Additionally, the government's focus on increasing energy efficiency and lowering carbon emissions will provide further opportunities for IREDA to finance innovative technologies, such as energy storage systems and electric vehicle (EV) infrastructure projects.

This forecast assumes favorable conditions for the sector, including regulatory incentives and continuous investments from private and public stakeholders. It is also expected that IREDA will continue to strengthen its financial position, thus boosting investor confidence.

IREDA Share Price Target 2030

The long-term outlook for IREDA looks very promising. As India marches toward achieving 500 GW of renewable energy capacity by 2030, IREDA is expected to remain a critical player in financing this massive energy transition. The government has already set aggressive goals for renewable energy adoption, and IREDA’s extensive experience in financing renewable projects will be instrumental in achieving these targets.

The IREDA share price target 2030 is anticipated to range from INR 1200-1750, given the expected scale of renewable energy expansion in India by the end of the decade. With the global focus on decarbonization, green energy technologies such as solar, wind, and hydrogen are predicted to play a major role in IREDA's business growth. IREDA’s strong focus on financing these clean energy projects, coupled with technological advancements, should enhance its profitability and market position.

Key developments, such as the establishment of more solar parks, offshore wind farms, and the deployment of cutting-edge renewable technologies, are likely to boost IREDA's revenue streams. Furthermore, global and domestic investors are expected to increase their stake in India’s green energy sector, giving IREDA ample room to grow and diversify its portfolio.

Key Drivers for IREDA's Growth

Several key factors will likely influence IREDA’s future performance and its stock price:

Government Initiatives: Policies supporting renewable energy financing and subsidies for green energy projects are crucial to IREDA’s continued growth. The National Solar Mission, wind energy initiatives, and green hydrogen projects are expected to provide significant opportunities for IREDA.

Global Trends in Green Energy: The shift towards sustainable energy solutions on a global scale, coupled with international climate commitments, will boost IREDA's financing of large-scale renewable projects.

Technological Innovation: Advances in renewable energy technologies, such as better solar panel efficiency and cost-effective wind turbines, will encourage more investments in the sector, opening doors for IREDA’s project financing.

Investor Sentiment: There is growing interest from institutional and retail investors in renewable energy stocks. IREDA, with its central role in financing the sector, stands to benefit from this sentiment, driving its stock price higher.

Conclusion

The future looks bright for IREDA as the renewable energy sector is poised for substantial growth in the coming years. The IREDA share price targets for 2024, 2025, and 2030 reflect the company’s potential to capitalize on India’s clean energy push and the growing global demand for sustainable energy solutions.

While external factors like policy shifts and market conditions could impact short-term fluctuations, IREDA’s long-term outlook remains robust. Investors interested in the renewable energy sector should consider IREDA as a potential high-growth stock, especially given the company's strategic importance in financing green projects. However, as always, thorough due diligence and professional financial advice are essential before making any investment decisions.

0 notes

Text

Best Green Hydrogen Stocks in India

Discover the best green hydrogen stocks to invest in India. Explore the factors driving the green hydrogen industry's growth, top players, and expert analysis. Make informed investment decisions with this comprehensive guide. Uncover the potential of green hydrogen stocks in India. Learn about key trends, factors influencing performance, and top-performing companies. Make informed investment decisions with data-driven insights and expert analysis.

#best stock advisor in india#best stock broker in india#investing stocks#best stocks to buy#best stock market advisor#investment#bse#investsmart#GreenHydrogenStocks hashtag#IndianEconomy hashtag#InvestmentTips hashtag#IndiaInvestment hashtag#renewableenergyisthefuture

0 notes

Text

Gensol Engineering Secures Landmark Bio-Hydrogen Project, Bolstering India’s Green Energy Mission

In a significant development for India’s renewable energy sector, Gensol Engineering Limited has successfully emerged as the lowest bidder for the country’s first bio-hydrogen project. The project, which will be undertaken in collaboration with Matrix Gas & Renewables, represents a pivotal step in advancing India’s National Green Hydrogen Mission and signals a new era in sustainable energy generation.

Gensol Engineering, a prominent player in the renewable energy industry, witnessed a 3 percent surge in its stock price on September 3, 2024, reaching ₹971 per share. This increase in stock value comes on the heels of the company securing this groundbreaking project. The bio-hydrogen project is not only a first for India but also marks a significant milestone for Gensol Engineering as it continues to expand its influence in the green energy sector.

The Gensol-Matrix consortium is tasked with the development of a facility capable of converting 25 tonnes of bio-waste into 1 tonne of green hydrogen each day. This ambitious project is valued at ₹164 crore and is scheduled for completion within 18 months. The project’s scope includes the establishment of a processing facility that will utilize the advanced Pre-Gasification Plasma Induced Radiant Energy-Based Gasification System (GH2-PREGS) technology. This cutting-edge technology is designed to efficiently convert bio-waste into hydrogen, offering a sustainable solution to some of the pressing environmental challenges faced by the country.

Gensol Engineering’s participation in this project is a testament to the company’s unwavering commitment to innovation and excellence within the renewable energy sector. By converting bio-waste into hydrogen, the company is not only contributing to the nation’s energy transition but also addressing critical environmental issues. This project aligns seamlessly with India’s National Green Hydrogen Mission, which aims to position the country as a global leader in green hydrogen production and consumption.

Anmol Singh Jaggi, Chairman and Managing Director of Gensol Engineering, expressed his enthusiasm for the project, emphasizing the consortium's commitment to executing the project with the highest standards of quality and efficiency. He highlighted that the collaboration with Matrix Gas & Renewables underscores their shared vision of becoming a turnkey solution provider in the renewable energy sector, particularly in the production of green hydrogen and its derivatives.

The bio-hydrogen project is not the first collaboration between Gensol and Matrix. Both companies, promoted by common stakeholders, have a history of working together in the green energy sector. They have expressed their intent to continue their partnership in the future, exploring opportunities in the production of green steel, green ammonia, and other renewable energy derivatives. The unique skill sets of both entities, combined with their shared commitment to sustainability, make this consortium a formidable force in the green hydrogen sector.

Gensol Engineering, established in 2012, has built a reputation as a leading provider of engineering, procurement, and construction (EPC) services in the solar power sector. The company has also made significant strides in electric mobility solutions, further solidifying its position as a key player in India’s renewable energy landscape. The successful bid for the bio-hydrogen project represents another significant achievement for Gensol, reinforcing its role as a pioneer in the country’s transition to sustainable energy sources.

Despite the recent 11 percent rise in Gensol Engineering’s stock price this year, the company has underperformed compared to the benchmark Nifty 50, which has risen by 16 percent. However, the acquisition of this landmark project is likely to boost investor confidence and potentially drive further stock price appreciation as the company continues to deliver on its ambitious growth plans.

As India continues to push forward with its National Green Hydrogen Mission, projects like the one undertaken by Gensol Engineering and Matrix Gas & Renewables will play a crucial role in achieving the country’s sustainability goals. The successful execution of this bio-hydrogen project will not only set a precedent for future green hydrogen initiatives but also position Gensol Engineering as a leader in the renewable energy sector.

0 notes

Text

Sustainable Logistics: Eco-Friendly Practices in Modern Supply Chains

In the evolving world of logistics, sustainability has become a crucial focus. Companies are increasingly recognizing the need to integrate eco-friendly practices into their supply chains to minimize environmental impact and enhance operational efficiency. This shift towards sustainable logistics is not just a trend but a vital strategy to address global environmental challenges while maintaining competitive advantage logistic institute in kochi

The Need for Sustainable Logistics

The logistics industry, a major player in global trade, is also a significant contributor to environmental issues. From greenhouse gas emissions to excessive waste and resource depletion, the traditional logistics model has had a considerable ecological footprint. As consumers and businesses alike become more environmentally conscious, there is a growing demand for greener logistics solutions. Adopting sustainable practices not only helps in reducing environmental impact but also offers economic benefits and aligns with corporate social responsibility goals.

Key Eco-Friendly Practices in Modern Supply Chains

Energy-Efficient Transportation

One of the most impactful ways to reduce the environmental footprint of logistics is through energy-efficient transportation. This includes investing in fuel-efficient vehicles, adopting alternative fuels such as electric or hydrogen-powered trucks, and optimizing transportation routes. Companies can use advanced analytics and route planning software to minimize fuel consumption and reduce emissions. Additionally, transitioning to electric delivery vans and trucks is becoming increasingly viable as technology advances and charging infrastructure expands.

Green Warehousing

Warehousing operations can significantly impact the environment, from energy consumption to waste generation. Sustainable warehousing practices include using energy-efficient lighting and HVAC systems, implementing solar panels, and adopting green building certifications such as LEED (Leadership in Energy and Environmental Design). Warehouses can also focus on reducing waste through recycling programs and utilizing eco-friendly packaging materials. Innovations in warehouse design and technology, such as automated systems and robotics, can also enhance efficiency and reduce environmental impact.

Optimizing Supply Chain Management

Efficient supply chain management plays a crucial role in sustainability. By improving supply chain visibility and collaboration, companies can better coordinate inventory levels, reduce excess stock, and minimize transportation needs. This not only cuts down on waste and emissions but also lowers costs. Implementing real-time tracking systems and data analytics helps in making informed decisions and optimizing the entire supply chain process.

Sustainable Packaging

Packaging is a significant component of logistics that affects the environment. Eco-friendly packaging solutions, such as biodegradable materials, reusable containers, and minimalistic designs, can reduce waste and lower the environmental impact of packaging. Companies are increasingly exploring innovative packaging technologies that are both functional and environmentally responsible. Adopting sustainable packaging practices can also improve brand image and appeal to environmentally conscious consumers.

Reverse Logistics

Reverse logistics, which involves the management of product returns, recycling, and disposal, is a critical aspect of sustainable logistics. Efficient reverse logistics processes help in minimizing waste and ensuring that products are reused or recycled appropriately. Companies can establish take-back programs, repair and refurbishment initiatives, and recycling partnerships to manage end-of-life products in an environmentally friendly manner.

Green Logistics Technologies

The adoption of green technologies is pivotal in transforming logistics practices. Innovations such as electric vehicles, renewable energy sources, and energy-efficient infrastructure contribute to reducing the carbon footprint of logistics operations. Additionally, technologies like IoT (Internet of Things) and AI (Artificial Intelligence) enable real-time monitoring and optimization of logistics processes, further enhancing sustainability efforts.

Collaborative Logistics

Collaborative logistics involves partnering with other businesses to share resources and optimize transportation. This can include co-loading shipments, sharing warehousing facilities, or collaborating on last-mile delivery solutions. By pooling resources and leveraging collective efficiencies, companies can reduce overall environmental impact and lower costs.

Carbon Footprint Measurement

Measuring and monitoring the carbon footprint of logistics operations is essential for setting and achieving sustainability goals. Companies can use carbon footprint calculators and reporting tools to assess their environmental impact and identify areas for improvement. Setting targets for reducing carbon emissions and regularly reviewing progress helps in driving continuous improvement and accountability.

Regenerative Practices

Beyond minimizing environmental harm, some companies are adopting regenerative practices that aim to restore and enhance environmental conditions. This can include initiatives like reforestation projects, supporting biodiversity, and investing in sustainable agriculture. Regenerative practices contribute to a positive environmental impact and help in building a resilient supply chain.

Employee Training and Engagement

Sustainability efforts are most effective when employees are engaged and informed. Providing training on sustainable practices, encouraging employee participation in green initiatives, and fostering a culture of environmental responsibility can drive significant improvements in logistics operations. Employees play a crucial role in implementing and maintaining eco-friendly practices, making their involvement essential for success.

Sustainable logistics is no longer an option but a necessity for modern supply chains. By adopting eco-friendly practices and leveraging innovative technologies, companies can reduce their environmental impact, enhance operational efficiency, and meet the growing demands of environmentally conscious consumers. Embracing sustainability not only contributes to a healthier planet but also offers long-term economic benefits and strengthens brand reputation. As the logistics industry continues to evolve, the integration of sustainable practices will be key to achieving a greener and more efficient future logistics courses in kochi

0 notes

Text

Invest in India's Green Hydrogen Revolution

You know Green hydrogen stocks in India are buzzing! This clean energy revolution is picking up speed, and investing now means getting in early on a game-changer. Imagine powering the future with zero emissions! With the government's push for sustainable energy, these stocks are set to soar. Don't miss out on this exciting opportunity—invest in green hydrogen and watch your portfolio grow green and strong!

0 notes

Text

The mix of flavors is surprisingly delightful - BUTTERELA Chocolate Peanut Butter

The Many Uses of Chocolate Peanut Butter

Chocolate peanut butter isn't just a spread; it's a versatile ingredient that you can use in many creative ways. Imagine starting your day with a tasty breakfast – spread chocolate peanut butter on your pancakes or waffles for a sweet and satisfying meal. You can also swirl it into your morning oatmeal for extra flavor.

Tasty Lunch Ideas

For lunch, try a peanut butter chocolate flavor and jelly sandwich. This fun twist on the classic sandwich adds a chocolatey flavor that pairs perfectly with the sweetness of jelly or jam. It's a quick and easy meal that's both tasty and filling.

Snack Time Delights

Snack time can be exciting with chocolate flavor peanut butter. Spread it on crackers or rice cakes for a quick snack, or dip pretzels into it for a salty-sweet treat. For a healthier option, try dipping carrot sticks or cucumber slices into chocolate peanut butter. The mix of flavors is surprisingly delightful.

Baking with Chocolate Peanut Butter

One of the best things about chocolate peanut butter is how you can use it in baking. From cookies to cakes and even muffins, adding chocolate peanut butter to your baked goods makes them extra special. You can make high protein peanut butter cupcakes with creamy frosting from the same jar, ensuring every bite is rich and indulgent.

Energy Boost for Active Lifestyles

If you lead an active lifestyle, BUTTERELA chocolate peanut butter can be a fantastic addition to your diet. It's a great source of energy, thanks to its protein and healthy fats. After a workout, a spoonful of chocolate peanut butter can help replenish your energy and aid in muscle recovery. You can also make energy balls by mixing chocolate peanut butter with oats, honey, and your favorite nuts and seeds. These are perfect for a quick snack on the go.

Chocolate Peanut Butter Smoothies

Smoothies are another excellent way to incorporate chocolate peanut butter into your diet. Blend it with bananas, milk (or a dairy-free alternative), and a handful of spinach for a nutritious and delicious smoothie. The chocolate and peanut butter mask the taste of the spinach, making it a great option for adding more greens to your diet without sacrificing flavor.

Homemade Ice Cream and More

If you love ice cream, you can make your own peanut chocolate butter version at home. Simply mix some chocolate peanut butter into your favorite vanilla ice cream and refreeze it for a few hours. You'll have a creamy, chocolatey treat perfect for hot days.

Decadent Desserts

High protein peanut butter can also be used to make decadent desserts like chocolate peanut butter pie or cheesecake. The possibilities are endless when you have a 1kg jar at your disposal.

Healthy Choice

Even though chocolate and peanut butter is indulgent, it can still be part of a healthy diet. Choose brands that use natural ingredients without added sugars or hydrogenated oils. This way, you can enjoy the rich flavors while still getting the nutritional benefits of peanuts and cocoa.

Perfect for Sharing

Peanut Butter Chocolate Flavor is perfect for sharing. Whether you're hosting a party or just having a few friends over, it can be a fun addition to your spread. Set up a snack bar with various dippable items like fruits, crackers, and pretzels, and let everyone enjoy the chocolate peanut butter as they like. It's sure to be a hit and a talking point among your guests.

Chocolate Peanut Butter: A Pantry Essential

In conclusion, BUTTERELA Chocolate Flavor Peanut Butter is more than just a spread; it's a versatile, delicious, and nutritious addition to your kitchen. With a 1kg jar, you'll have plenty to experiment with, from breakfast to dessert and everything in between. It's a perfect choice for families, fitness enthusiasts, and anyone who loves the combination of chocolate and peanut butter. So, stock up and start exploring all the wonderful ways you can enjoy this delightful treat.

#chocolate peanut butter#peanut butter chocolate flavor#chocolate flavor peanut butter#peanut chocolate butter#butterela#peanut butter

0 notes

Text

Snack time can be exciting with BUTTERELA Chocolate Peanut Butter.

Chocolate peanut butter is not just a spread; it’s a versatile ingredient that can be used in numerous creative ways. Imagine starting your day with a delicious breakfast – spread chocolate peanut butter on your pancakes or waffles for a sweet and satisfying meal. It can also be swirled into your morning oatmeal for an extra burst of flavor.

For lunch, a peanut butter chocolate flavor and jelly sandwich is a fun twist on the classic. It adds a chocolatey flavor that pairs wonderfully with the sweetness of jelly or jam. This combination makes for a tasty and filling meal that’s quick and easy to prepare.

Snack Time Delights

Snack time can be exciting with chocolate flavor peanut butter. Spread it on crackers or rice cakes for a quick snack, or dip pretzels into it for a salty-sweet treat. For a healthier option, try dipping carrot sticks or cucumber slices into chocolate peanut butter. The contrast of flavors is surprisingly delightful.

One of the best things about peanut chocolate butter is how it can be used in baking. From cookies to cakes and even muffins, adding chocolate peanut butter to your baked goods will make them extra special. You can create chocolate peanut butter cupcakes with a creamy frosting made from the same jar, ensuring every bite is rich and indulgent.

Energy Boost for Active Lifestyles

If you lead an active lifestyle, BUTTERELA chocolate peanut butter can be a fantastic addition to your diet. It’s a great source of energy, thanks to its protein and healthy fats. After a workout, a spoonful of chocolate peanut butter can help replenish your energy levels and aid in muscle recovery. You can also make energy balls by mixing chocolate peanut butter with oats, honey, and your favorite nuts and seeds. These are perfect for a quick snack on the go.

Chocolate Peanut Butter Smoothies

Smoothies are another excellent way to incorporate peanut butter chocolate flavor into your diet. Blend it with bananas, milk (or a dairy-free alternative), and a handful of spinach for a nutritious and delicious smoothie. The chocolate and peanut butter mask the taste of the spinach, making it a great option for those who want to add more greens to their diet without sacrificing flavor.

Homemade Ice Cream and More

If you’re a fan of ice cream, you can make your own chocolate peanut butter version at home. Simply mix some chocolate flavor peanut butter into your favorite vanilla ice cream and refreeze it for a few hours. You’ll have a creamy, chocolatey treat that’s perfect for hot days.

BUTTERELA Chocolate peanut butter can also be used to make decadent desserts like chocolate peanut butter pie or cheesecake. The possibilities are endless when you have a 1kg jar at your disposal.

Healthy Choice

Even though chocolate peanut butter is indulgent, it can still be part of a healthy diet. Choose brands that use natural ingredients without added sugars or hydrogenated oils. This way, you can enjoy the rich flavors while still getting the nutritional benefits of peanuts and cocoa.

Perfect for Sharing

Peanut Chocolate Butter is perfect for sharing. Whether you’re hosting a party or just having a few friends over, it can be a fun addition to your spread. Set up a snack bar with various dippable items like fruits, crackers, and pretzels, and let everyone enjoy the chocolate peanut butter as they like. It’s sure to be a hit and a talking point among your guests.

Chocolate Peanut Butter: A Pantry Essential

In conclusion, BUTTERELA Chocolate Peanut Butter is more than just a spread; it’s a versatile, delicious, and nutritious addition to your kitchen. With a 1kg jar, you’ll have plenty to experiment with, from breakfast to dessert and everything in between. It’s a perfect choice for families, fitness enthusiasts, and anyone who loves the combination of chocolate and peanut butter. So, stock up and start exploring all the wonderful ways you can enjoy this delightful treat.

#chocolate peanut butter#peanut butter chocolate flavor#chocolate flavor peanut butter#peanut chocolate butter#butterela#peanut butter

0 notes

Text

Best Investments for 2024

Best Investments for 2024

In 2024, several investment avenues stand out for their potential to generate robust returns and withstand market volatility:

Technology Stocks: Companies at the forefront of artificial intelligence, cloud computing, and cybersecurity continue to offer promising growth opportunities.

Green Energy: With increasing focus on sustainability, investments in solar, wind, and hydrogen energy sectors are expected to thrive.

Healthcare and Biotechnology: Aging populations and technological advancements make healthcare and biotech firms attractive investment options.

Cryptocurrencies and Blockchain: Despite volatility, cryptocurrencies and blockchain technology represent innovative investments with significant growth potential.

Real Estate Investment Trusts (REITs): Industrial and residential REITs offer stable returns amidst growing demand in the real estate market.

Emerging Markets: Asia, Latin America, and Africa present exciting growth prospects for investors seeking geographical diversification.

ESG Investments: Environmental, Social, and Governance-focused investments align with sustainable principles while offering competitive returns.

Dividend Stocks: Companies with consistent dividend payouts provide steady income streams for investors in uncertain economic times.

Commodities: Gold, silver, and agricultural products serve as valuable hedges against inflation and economic downturns.

Index Funds and ETFs: These offer diversified exposure to various asset classes and sectors, ideal for passive investors seeking long-term growth.

By considering these "Best Investments for 2024," investors can build resilient portfolios poised for success in the evolving market landscape.

0 notes

Text

Today, FuelCell Energy, Bloom, and Clean Energy Fuels all saw a rise in their stock prices. This increase could be attributed to the growing demand for clean energy solutions in the Market. FuelCell Energy, Bloom, and Clean Energy Fuels are all leading providers of environmentally friendly power options, making them attractive investments for those looking to support sustainable energy sources. Click to Claim Latest Airdrop for FREE Claim in 15 seconds Scroll Down to End of This Post const downloadBtn = document.getElementById('download-btn'); const timerBtn = document.getElementById('timer-btn'); const downloadLinkBtn = document.getElementById('download-link-btn'); downloadBtn.addEventListener('click', () => downloadBtn.style.display = 'none'; timerBtn.style.display = 'block'; let timeLeft = 15; const timerInterval = setInterval(() => if (timeLeft === 0) clearInterval(timerInterval); timerBtn.style.display = 'none'; downloadLinkBtn.style.display = 'inline-block'; // Add your download functionality here console.log('Download started!'); else timerBtn.textContent = `Claim in $timeLeft seconds`; timeLeft--; , 1000); ); Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_1] The renewable energy sector saw a significant boost in the stock Market on Tuesday, thanks to Plug Power's announcement of receiving a $1.66 billion loan guarantee from the U.S. Department of Energy. This news led to a surge in shares of green energy companies like FuelCell Energy, Bloom Energy, and Clean Energy Fuels. Investors are optimistic about the potential for these companies to receive similar federal assistance in the future. Plug Power's plans involve developing up to six green hydrogen production facilities with the help of the loan guarantee. This initiative is part of the government's commitment to advancing large-scale hydrogen production and supporting decarbonization efforts across various industries. While the news has sparked enthusiasm among investors, it's crucial to note that profitability has been a challenge for companies like Plug Power, Bloom Energy, FuelCell Energy, and Clean Energy Fuels. Despite ongoing investments in fuel cell technology, these companies have struggled to turn a profit. Government subsidies may offer some relief, but long-term profitability remains uncertain. For investors considering buying stock in FuelCell Energy or other similar companies, it's essential to weigh the risks and rewards carefully. The Motley Fool's Stock Advisor team recently identified the 10 best stocks for investors to buy now, with FuelCell Energy not making the list. It's essential to conduct thorough research and consider expert recommendations before making investment decisions. In conclusion, while government support may provide a temporary boost for renewable energy stocks, long-term success will depend on the companies' ability to achieve profitability. Investors should proceed with caution and seek guidance from reputable sources before making investment choices in this volatile sector. Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_2] 1. Why did FuelCell Energy, Bloom, and Clean Energy Fuels rise today? - These companies rose today due to positive news or developments in the clean energy sector. 2. What caused the increase in stock prices for FuelCell Energy, Bloom, and Clean Energy Fuels? - The increase in stock prices could be attributed to increased demand for clean energy solutions and potential growth opportunities. 3. Are FuelCell Energy, Bloom, and Clean Energy Fuels good investment options? - It depends on individual investment goals and risk tolerance, but these companies are in the growing clean energy sector which could be promising for long-term growth. 4. Should I consider investing in FuelCell Energy, Bloom, and Clean Energy Fuels based on today's performance?

- It is important to conduct thorough research and consider factors beyond just one day's performance before making any investment decisions. 5. What sets FuelCell Energy, Bloom, and Clean Energy Fuels apart from other clean energy companies? - Each company may have its unique technology, Market position, and growth strategy that differentiate them from competitors in the clean energy industry. Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_1] Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators Claim Airdrop now Searching FREE Airdrops 20 seconds Sorry There is No FREE Airdrops Available now. Please visit Later function claimAirdrop() document.getElementById('claim-button').style.display = 'none'; document.getElementById('timer-container').style.display = 'block'; let countdownTimer = 20; const countdownInterval = setInterval(function() document.getElementById('countdown').textContent = countdownTimer; countdownTimer--; if (countdownTimer < 0) clearInterval(countdownInterval); document.getElementById('timer-container').style.display = 'none'; document.getElementById('sorry-button').style.display = 'block'; , 1000);

0 notes