#gold loan rate per gram as per gold purity

Explore tagged Tumblr posts

Text

#gold loan rate#gold loan rate per gram#gold loan rate per gram as per gold purity#gold loan rates in India#best gold loan rates#SahiBandhu

0 notes

Text

[ad_1] When it comes to securing a gold loan, understanding how the gold loan per gram rate is determined is essential for borrowers. The gold loan gram rate plays a crucial role in determining the amount of money a borrower can access by pledging their gold as collateral. This rate depends on several factors, including the purity of the gold, the prevailing market rate, and the lender's policies. Keep reading to understand how these elements come together to influence the rate. Bajaj Finserv Gold Loan When it comes to securing a gold loan, understanding how the gold loan per gram rate is determined is essential for borrowers. The gold loan gram rate plays a crucial role in determining the amount of money a borrower can access by pledging their gold as collateral. This rate depends on several factors, including the purity of the gold, the prevailing market rate, and the lender's policies. With Bajaj Finserv Gold Loan, you can access competitive interest rates, high per gram value, and flexible repayment options, ensuring a seamless borrowing experience. Keep reading to understand how these elements come together to influence the rate. Factors affecting the gold loan gram rate in India Gold purity The purity of the gold being pledged significantly affects the gold loan gram rate. Lenders typically accept gold jewellery with a purity of 18 to 24 karats. The higher the purity, the higher the rate at which the gold is valued. For example, 24-karat gold, being of the highest purity, will fetch a higher loan value compared to 18-karat gold. Institutional lenders like Bajaj Finance use the most accurate and advanced karat meters to evaluate the purity of the gold, ensuring that borrowers receive the most value for their gold. Gold’s market rate The market price of gold is another critical factor in determining the gold loan gram rate. This rate fluctuates daily based on global and local market conditions. The prevailing market rate of gold in a specific location, such as Kolkata, will directly impact the loan value. For instance, if today’s gold rate in Kolkata is Rs. 7,000 per gram, the amount a borrower can access depends on the percentage of the gold's value that the lender is willing to offer, typically up to 75%. A higher market price means a higher loan amount that can be availed. Loan-to-value (LTV) ratio and lender’s policies The loan-to-value (LTV) ratio is the percentage of the gold's market value that a lender is willing to lend. Typically, lenders offer up to 75% of the gold's current market value as a loan. This ratio, along with the lender's internal policies, determines the loan amount. Understanding the factors that impact the gold loan gram rate, such as gold purity, market rates, and the LTV ratio, is essential for borrowers. Bajaj Finserv Gold Loan combines these with competitive rates and customer-centric benefits. Here are the top 5 advantages of choosing this loan option: Transparent and accurate gold valuation with competitive rates. Borrow from Rs. 5,000 to Rs. 2 crore, based on gold weight and purity. Retrieve part of your gold early by repaying a portion of the loan. Get complimentary insurance on your pledged gold, covering against theft or loss. Enjoy a convenient repayment schedule, with no prepayment or foreclosure fees. T&C Apply. About Bajaj Finance Limited Bajaj Finance Ltd. (‘BFL’, ‘Bajaj Finance’, or ‘the Company’), a subsidiary of Bajaj Finserv Ltd., is a deposit taking Non-Banking Financial Company (NBFC-D) registered with the Reserve Bank of India (RBI) and is classified as an NBFC-Investment and Credit Company (NBFC-ICC). BFL is engaged in the business of lending and acceptance of deposits. It has a diversified lending portfolio across retail, SMEs, and commercial customers with significant presence in both urban and rural India. It accepts public and corporate deposits and offers a variety of financial services products to its customers.

BFL, a thirty-five-year-old enterprise, has now become a leading player in the NBFC sector in India and on a consolidated basis, it has a franchise of 80.41 million customers. Bajaj Finance has a credit rating of AAA/Stable for its Fixed Deposit program from CRISIL and ICRA, AAA/Stable for long-term borrowing from CRISIL, India Ratings, CARE and ICRA, and A1+ for short-term borrowing from CRISIL, India Ratings and ICRA. It has a long-term issuer credit rating of BBB-/Stable and a short-term rating of A-3 by S&P Global ratings.To know more, visit www.bajajfinserv.in. !function(f,b,e,v,n,t,s) if(f.fbq)return;n=f.fbq=function()n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments); if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)(window,document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '311356416665414'); fbq('track', 'PageView'); [ad_2] Source link

0 notes

Text

Maximizing Your Gold Loan: Tips to Get the Best Per Gram Rate

Gold loans have become one of the most accessible and convenient ways to secure funds quickly. Whether you need money for personal use, a business venture, or an emergency, pledging your gold can be a quick solution. However, to ensure you’re getting the most out of your gold loan, it’s essential to understand how to maximize the per gram rate lenders offer. In this guide, we’ll walk through the factors that determine gold loan rates and offer practical tips on how you can get the best deal.

Understanding How Gold Loan Rates Are Determined

Before diving into how you can maximize your gold loan, it's important to understand how lenders determine the per gram rate for your gold. Financial institutions like banks and non-banking financial companies (NBFCs) assess multiple factors to determine how much loan value they can offer.

Factors Affecting Gold Loan Per Gram Rates

Gold Purity: The purity of your gold significantly impacts the per gram rate you will receive. Higher purity gold, such as 22K or 24K, is more valuable and will fetch a better rate than lower purity gold.

Market Gold Price: The global and national gold market prices play a crucial role. When market prices are high, lenders typically offer higher loan amounts per gram.

Lender’s Margin: Financial institutions add a margin to account for fluctuations in gold prices, and this margin reduces the actual loan value offered.

Loan-to-Value (LTV) Ratio: Regulatory bodies like the Reserve Bank of India (RBI) set a maximum LTV ratio, which determines the percentage of the gold’s value that can be offered as a loan.

Tips to Maximize Your Gold Loan Per Gram Rate

Once you understand how lenders determine the rate, you can start applying strategies to ensure you get the highest value for your gold.

Compare Offers from Different Lenders

One of the most effective ways to get a good deal is to compare loan rates from different lenders. Banks, NBFCs, and cooperative banks each offer different loan-to-value ratios and interest rates. Online comparison tools can help you easily compare the rates different institutions offer, ensuring you choose the best one for your needs.

Monitor Gold Prices

Gold prices fluctuate based on market conditions, so it's important to time your loan carefully. If you can pledge your gold when market prices are high, you’ll get a better per gram rate. Use online tools to track gold prices and consider waiting for a spike in value if your loan isn't urgent.

Choose High-Purity Gold

To get the best per gram rate, it’s crucial to pledge high-purity gold, such as 22K or 24K. Jewelry with a lower purity level will fetch a lower loan value, as lenders base their rates on the percentage of pure gold. Additionally, avoid pledging gold with stones or other materials, as the lender will exclude these from the total weight when calculating your loan.

Negotiate Interest Rates and Fees

Although lenders often have standard loan terms, there’s always room for negotiation, especially if you have a strong relationship with your bank or lender. Lowering the interest rate or negotiating processing fees can effectively increase the value you receive per gram of gold.

The Role of Loan-to-Value (LTV) in Gold Loans

The Loan-to-Value ratio (LTV) plays a crucial role in determining the maximum loan amount you can receive against your gold. Most lenders offer up to 75% of the gold’s market value, as per the RBI guidelines. However, some lenders may offer lower LTV ratios with the benefit of a lower interest rate.

A higher LTV means a higher loan amount, but often at the cost of a higher interest rate. On the other hand, a lower LTV may lead to a more favorable repayment structure, allowing you to manage the loan more easily.

Understanding Gold Purity and Its Impact on Loan Rates

The purity and weight of your gold are key determinants in the loan amount you’ll be offered.

How Gold Purity Affects Valuation

Lenders assess the purity of gold before deciding the per gram rate. The purer the gold (22K or 24K), the higher the loan amount you can expect. If your gold contains other elements like stones or mixed metals, the lender will deduct these from the total weight, reducing the value.

The Impact of Gold Weight on Loan Amount

While gold purity is essential, the weight of your gold also directly impacts the loan amount. More gold pledged means a larger loan, but it’s important to ensure that the gold is assessed for its pure weight, without any extraneous materials attached.

The Importance of Gold Loan Interest Rates

Interest rates are a significant factor in determining the overall value you receive from your gold loan. Even if you secure a high per gram rate, a high-interest rate can reduce the effective value of your loan. That’s why it’s crucial to negotiate for a lower interest rate and pay close attention to the loan terms before signing an agreement.

Key Considerations When Choosing a Lender

Not all lenders are created equal, and it’s important to weigh the pros and cons of different financial institutions:

Banks: Nationalized and private banks typically offer more stability and lower interest rates, but the loan processing may take longer.

NBFCs: Non-banking financial companies (NBFCs) offer quicker processing times and often provide higher LTV ratios, but they may charge higher interest rates.

Cooperative Banks: These institutions may offer favorable interest rates and lower fees, but the processing time could be slower.

Each lender has different offerings, and the right choice depends on how urgent the loan is and your preferred terms.

Conclusion

Maximizing the per gram rate for your gold loan requires careful planning and strategic decision-making. By comparing offers, monitoring gold prices, choosing high-purity gold, and negotiating loan terms, you can ensure that you get the best possible value for your gold. Whether you choose a bank, NBFC, or cooperative society, making informed decisions will help you get the most out of your gold loan.

0 notes

Text

Guide to check the value of your gold

If you have gold jewellery lying idle, it can be very beneficial to cover any short-term cash needs. You can use a gold loan to start or expand your dream business, for higher education, a marriage in the family or a holiday trip.

We offer gold loans from home, so you can get a gold loan from the convenience of your home. But how would you check how much loan amount you can get against your gold jewellery? Here's a helpful guide to get you started:

The karat value of your gold jewellery

The first determining factor is the purity of your gold jewellery. It is stated in Karat, which is 1/24 portion of the gold metal contained in it. 24 karat, which is 99.9% pure, is very soft gold and can't be used for jewellery making. Gold jewellery is made by adding metals like Zinc, Nickel etc., to pure gold. 22 karat, which is 91.67% in purity, is the best Karat rating for ornaments. As the Karat value increases, the percentage of gold in the jewellery also increases. Any gold jewellery you have usually has a Karat rating.

The LTV of your gold loan

The second factor is LTV or Loan-to-Value, which is the ratio of the loan amount to the market value of the pledged gold jewellery. Our gold loans from home offer the maximum LTV under a gold loan in the market without any hidden charges. You can get a gold loan of up to 75% or more of the market value of gold from the comfort of your home. The market value and purity of the collateral gold decide your maximum eligible loan amount.

The weight of gems

When you buy gold jewellery from a retail outlet, the final price includes the karat value of gold, making charges, price of stones or gems, hallmark charges and applicable taxes. If you are pledging ornaments with precious stones, the actual weight eligible for a gold loan is calculated by deducting the stone weight from the gold weight.

You can use our online gold loan calculator to evaluate the loan you are eligible for against your gold jewellery.

How to use the gold loan eligibility calculator?

Our gold loan calculator will help you evaluate the monetary value of gold and the customized repayment plans. You can access the gold loan eligibility calculator by following these simple steps.

Log on to www.onemuthoot.com and scroll down to the Gold Loan Amount Calculator.

Enter the loan amount or gold weight to be pledged and "get the value." If you enter the amount you wish to loan, it will display the weight of gold in grams that needs to be pledged and if you enter the weight of gold in grams you have, it will show the loan amount you are eligible for.

You will also find a variety of schemes based on the loan amount on the right-hand side. The information includes the monthly interest rate, gold loan eligibility per gram, loan value range, tenure, annual interest, and a schedule of the interest rate for different terms.

Choose a scheme suitable for your budget and click "avail this scheme." You will be directed to schedule a call to set up an appointment.

Once the home visit appointment is set up, one of our loan managers will visit your place to evaluate the purity and weight of your ornaments. The eligible weight is calculated by deducting the stone weight from the gold weight. After gold evaluation and approval, we will quickly transfer the loan amount to your account*.

You can also get a top-up loan on your existing gold loan

If you have not taken the maximum amount that is permissible for the collateral ornaments, you can avail the residual amount at a later time. This feature is known as gold loan top-up.

As our existing customer, you are eligible for a gold loan top-up if you have not availed the full amount at the time you pledge gold jewellery or if the market value of gold has increased since pledging.*

With our gold loan from home, you can get a gold loan of up to 75% or more of the market value of gold from the comfort of your home. Head to our website www.onemuthoot.com to learn more about gold loan top-up benefits and book an appointment for a gold loan from home.

*T&C Apply.

0 notes

Text

Why Is Investing in Gold Coins a Good Investment Option?

Gold, in whichever form, has been used as a better investment option and retains much of its value even in difficult economic times. It is considered a low-risk investment with a high return on value. Gold coins are similarly comforting in times of need as gold jewellery has been.

In India, gold coins are manufactured and are much better to invest in. They are available in a range of shapes, weights, and degrees of purity, as compared to gold jewellery or bars. If you are planning to invest in gold, here are the reasons why you should opt to invest in gold coins.

No Making charges

Gold coins are more widely available and more reasonably priced since they generally need less work and workmanship. Gold coins offer a better value than gold jewellery of a similar purity because, unlike gold jewellery, they can be purchased in their purest state with little to no making fees.

Easy Monetisation

Selling gold jewellery or gold bars may result in additional expenses because all gold tangibles must be examined for purity, melted, and reshaped. Gold coins are the purest form of metal, making it simpler for investors to acquire, sell, or obtain a loan against them.

Investment Flexibility

One significant benefit of buying gold coins is that you can invest as per your financial capacity, as banks and financial corporations sell them in varying volumes. You can invest in a 24-carat 2-gram gold coin and go as high as 5 and 8 grams, or you can start with a 1-gram gold coin.

Transparent Price

In India, gold coin rates are regulated by MMTC, which is a government entity. It ensures transparent pricing with equal resale value and the purity of the gold coin at the same time.

Quick Liquidity

Compared to other gold goods, gold coins have better liquidity. The investor does not have to wait to sell them off, unlike jewellery, because they are widely accepted.

In addition to the benefits mentioned above, gold coins are conveniently sold in both physical and online stores. Thus, it still remains one of the better gold investment options.

0 notes

Text

Myths that you might have heard about gold loan

Gold loan is a phenomenal service that allows you to borrow the money you need for any special occasion. However, there are some myths about gold loans that you might have heard about. Read on to find out more about these myths and learn the truth. In the case of a gold loan, the borrower pledges gold ornaments as security for the loan. The interest of gold loans is usually lower than that of a personal loan or credit card. Gold loans can be used for a variety of purposes, including funding a business, paying for medical expenses, or other emergency requirements.

There are many misconceptions about gold loans, so let's clear some of them. A gold loan does not mean that you are selling your gold. You are only using your gold as collateral for the loan and will get it back once you have repaid the loan in full. The interest of gold loans is usually lower than that of a personal loan or credit card because the lender is taking less risk. Gold loans can be used for a variety of purposes. If you are considering taking out a gold loan, do your research and make sure you understand the terms and conditions of the loan before signing anything.

Interest rates will make me poor

When it comes to taking out a loan, many people believe that the interest of gold loans will make them poor. However, this is not always the case. Depending on the type of loan you opt for, the interest of gold loans can actually help you save money in the long run. For example, if you take out a gold loan with a low interest rate, you can use the money you save on interest to pay off your debt faster. In addition, if you invest the money you borrowed wisely, you can make a profit that more than covers the cost of your loan.

I can’t get a gold loan because I don't have a collateral

You may have heard that you need collateral to get a loan, but that’s not always the case. Depending on the lender, you may be able to get a gold loan without putting up any collateral. Some lenders may require you to have a regular source of income or other assets, but it’s possible to get a loan without using your home or car as a collateral.

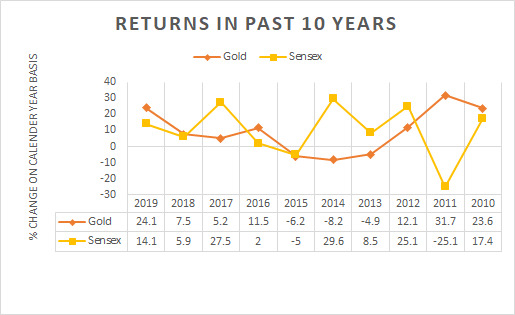

Gold is risky and too volatile

Gold is often seen as a volatile investment, but this isn't necessarily the case. While the price of gold can fluctuate in the short-term, it has actually been one of the most stable investments over the long term. In fact, gold's volatility has been declining in recent years. From 2011 to 2016, gold's annual volatility averaged 14.3%. But from 2017 to 2020, it declined to just 10.4%. What's more, gold prices have tended to rise during periods of economic uncertainty and market volatility. So, if you're looking for a safe haven investment, gold could be a good option.

I will lose money if the price of gold drops

One of the most common myths about gold loans is that borrowers will lose money if the price of gold drops. This is simply not true. Gold loans are collateralized loans, which means that the lender only has a claim on the gold itself, not on the cash value of the gold. Therefore, if the price of gold does drop, borrowers will not be required to repay any more than the amount they originally borrowed. But the gold loan rate per gram does not have the same procedure. The gold loan rate per gram is calculated by considering the entire weight of the jewelry supplied, the degree of purity, the average price of 22-carat gold over the last month, and the loan to value provided by the bank or the finance that you use. 0.75% of the total amount is considered as the processing fee for the gold loan.

The loan application process is too cumbersome

Gold credit is a simple and dependable source of funding. It helps you get your money back in a reasonable length of time. To apply for a gold loan online, all you have to do is go to the Gold Loan website. It is a hassle-free process as there is no waiting time or any other processes. There is another process called doorstep gold loan, where we can avail all the gold loan services from the comfort of our home.

Probabilities of jewelry loss or theft are high

If you have chosen us or a respectable NBFC or bank, this is quite improbable. Additionally, while they are kept in the vault, your gold ornaments are covered by insurance against theft and accidental damage. Gold loan is a type of loan that is given against the security of gold. The borrower can keep the gold with him and only has to pay the interest on the loan amount. There are many myths associated with gold loans, which often prevents people from availing this facility. Some of these myths are that gold loans are expensive, that they have a lot of hidden charges, and that they are difficult to repay. However, none of these claims are true. Gold loans are actually very affordable and come with flexible repayment options. So, if you're in need of quick cash, don't let these myths stop you from considering a gold loan.

0 notes

Text

Guide to check the value of your gold

The karat value of your gold jewelleryHow to use the gold loan eligibility calculator?You can also get a top-up loan on your existing gold loanWith our gold loan from home, you can get a gold loan of up to 75% or more of the market value of gold from the comfort of your home. Head to our website www.onemuthoot.com to learn more about gold loan top-up benefits and book an appointment for a gold loan from home.

If you have gold jewellery lying idle, it can be very beneficial to cover any short-term cash needs. You can use a gold loan to start or expand your dream business, for higher education, a marriage in the family or a holiday trip.

We offer gold loans from home, so you can get a gold loan from the convenience of your home. But how would you check how much loan amount you can get against your gold jewellery? Here's a helpful guide to get you started:

The first determining factor is the purity of your gold jewellery. It is stated in Karat, which is 1/24 portion of the gold metal contained in it. 24 karat, which is 99.9% pure, is very soft gold and can't be used for jewellery making. Gold jewellery is made by adding metals like Zinc, Nickel etc., to pure gold. 22 karat, which is 91.67% in purity, is the best Karat rating for ornaments. As the Karat value increases, the percentage of gold in the jewellery also increases. Any gold jewellery you have usually has a Karat rating.

The LTV of your gold loan

The second factor is LTV or Loan-to-Value, which is the ratio of the loan amount to the market value of the pledged gold jewellery. Our gold loans from home offer the maximum LTV under a gold loan in the market without any hidden charges. You can get a gold loan of up to 75% or more of the market value of gold from the comfort of your home. The market value and purity of the collateral gold decide your maximum eligible loan amount.

The weight of gems

When you buy gold jewellery from a retail outlet, the final price includes the karat value of gold, making charges, price of stones or gems, hallmark charges and applicable taxes. If you are pledging ornaments with precious stones, the actual weight eligible for a gold loan is calculated by deducting the stone weight from the gold weight.

You can use our online gold loan calculator to evaluate the loan you are eligible for against your gold jewellery.

Our gold loan calculator will help you evaluate the monetary value of gold and the customized repayment plans. You can access the gold loan eligibility calculator by following these simple steps.

Log on to www.onemuthoot.com and scroll down to the Gold Loan Amount Calculator.

Enter the loan amount or gold weight to be pledged and "get the value." If you enter the amount you wish to loan, it will display the weight of gold in grams that needs to be pledged and if you enter the weight of gold in grams you have, it will show the loan amount you are eligible for.

You will also find a variety of schemes based on the loan amount on the right-hand side. The information includes the monthly interest rate, gold loan eligibility per gram, loan value range, tenure, annual interest, and a schedule of the interest rate for different terms.

Choose a scheme suitable for your budget and click "avail this scheme." You will be directed to schedule a call to set up an appointment.

Once the home visit appointment is set up, one of our loan managers will visit your place to evaluate the purity and weight of your ornaments. The eligible weight is calculated by deducting the stone weight from the gold weight. After gold evaluation and approval, we will quickly transfer the loan amount to your account*.

If you have not taken the maximum amount that is permissible for the collateral ornaments, you can avail the residual amount at a later time. This feature is known as gold loan top-up.

As our existing customer, you are eligible for a gold loan top-up if you have not availed the full amount at the time you pledge gold jewellery or if the market value of gold has increased since pledging.*

0 notes

Text

How Much Interest Do You Have To Pay For Gold Loan

Gold loan is a kind of secured loan.it is an easy way of getting funds for one’s financial needs. It is a good credit option due to the cheap gold loan interest rate. Log on to your preferred online portal offering a gold loan interest calculator. The highest gold loan per gram is calculated based on the pledged gold’s purity.

Also Read:- https://wowmagzine.com/how-much-interest-do-you-have-to-pay-for-gold-loan/

0 notes

Text

All That Glitter is Not Gold They Could Be Gold ETFs. In many cultures, gold is a representation of the sun, and the sun represents new hope. In this uncertain fast-changing world, investors are once again pinning their hopes on the yellow metal. For many decades investment in gold meant buying jewellery, bars, and coins, however, with the influx of modern schemes, gold has become one of the top preferences for big and small investors.

Gold Exchange Traded Funds (Gold ETFs) are catching the fancy of even those who are otherwise wary of trading in digital schemes. They are easy to understand and trade. They allow the investors to invest in physical gold without the complication of holding physical gold. Gold ETFs also enhance the investment portfolio by building wealth and reducing the risk when other assets are experiencing volatility. According to a report by the Association of Mutual Fund Industry (AMFI), gold ETF folios have gone up from 4.23 lakh to 32.09 lakh between December 2019 and December 2021.

Insight into Gold ETFs scheme

When you purchase Gold ETFs, you purchase gold in its digital form. Since it tracks the domestic physical gold price, it offers complete transparency. Trading in gold ETFs is like trading in stocks. One Gold ETF unit equals 1 gram of physical gold and supports the metal in its purity of 99.5% or 99.9%. Furthermore, ETFs are cost-effective in comparison with physical gold investments.

Who can invest in Gold ETFs?

Any investor, who wishes to invest in gold but without going through the inconvenience in procuring physical gold and spending on making charges, can invest in gold ETFs. As the unit price of gold ETF is almost like gold's market price, an investor can sell his/her units on the stock exchange without any fuss.

Moreover, for investors who want to invest a smaller amount, gold ETFs are a perfect option. Though a lot depends on the price of 1 gram of gold at the time of investment.

How to trade in Gold ETFs?

Gold ETFs are traded on the National Stock Exchange of India (NSE) and Bombay Stock Exchange Ltd. (BSE) like the stocks of any other company. Contrary to gold jewellery, gold ETFs can be traded at the same price across India. Here are the steps to follow for trading in gold ETFs: -

• Compare the returns offered by ETFs of different companies

• Contact an authorized and trustworthy broker

• Open a Demat and trading accounts to trade in gold ETFs – This will require your PAN, address, and identity proof

• Choose the quantity of ETFs you want to invest in

• Regularly monitor the National Stock Exchange of India (NSE) and Bombay Stock Exchange Ltd (BSE) to understand the performance of your ETFs

How to redeem Gold ETFs?

You can sell your gold ETFs at the stock exchange using Demat and a trading account. However, on redeeming Gold ETF, you don't get physical gold but receive cash equivalent. You can also convert your ETF into physical gold but for that minimum 1-kilogram gold unit is required as that is the standard size of one gold bar.

Taxation on gold ETFs

There are three factors that determine the tax rates for gold ETFs – the trader, the country, and the holding period. Taxes on the profit earned on the sale of gold ETF are equated with the sale of physical gold. While short-term capital gains before the three-year holding period are added to your income and taxed as per the existing slab rate, the long-term capital gains after three years of holding are subject to 20.8% cess.

Benefits & risks of investing in gold ETFs:

Benefits

1. Gold ETFs are easy to trade and safe unlike physical gold when kept in a large quantity at home.

2. They are the hedge against inflation

3. There's a guarantee of gold's purity

4. There's no wealth tax, no security transaction tax, and no sales tax on gold ETFs. Furthermore, the GST charged to consumers is GST is charged to consumers is finally reimbursed.

5. ETFs are pledged as security against loans.

Risks

1. They are subject to market risks

2. They are affected by the SEBI Mutual Funds Regulations

1 note

·

View note

Text

Learn the key factors influencing the per gram rate of gold loans, including market trends, gold purity, and loan tenure.

#gold loan#sahibandhu#sahibandhu gold loan#instant gold loan#best gold loan rates#gold loan interest rate#gold loan rate#gold loan rate per gram

0 notes

Text

This Akshaya Tritiya think beyond Gold | GoldenPi

Digital Gold | Gold ETF | Sovereign Gold Bonds | Bonds

Indians love gold. The gold produced in India cannot meet the demand. Hence India imports tons of gold every year. In the FY 2019, 983,000kg of gold. This precious metal is irreplaceable. Rather than consumption, if you want to buy gold for investment purposes, then here are few gold investment options.

Gold Investment Options in India

Digital Gold

It is a digital form of gold issued by Minerals Trading Corporation of India.The investor can buy or sell digital gold via an agent on an online platform. Investors can convert the digital gold into physical gold and receive the delivery. You can buy digital gold via mobile apps such as Google Pay, Paytm, and PhonePe.

You can start investing in digital gold with Rs. 1 also. And that is why people go for digital gold. If you have to buy physical gold, you need to buy at least one gram of it. One gram of gold charges around Rs. 5000. They can be brought and sold easily online. Maintenance cost and GST together will charge you 6%. Hence effective returns will be less by 6% than gold returns. Most digital apps allow you to hold digital gold for a limited number of years (mostly 7 years). After that, you need to take physical delivery of the digital gold or sell the units. The more significant concern here is that there is no regulatory body to control the digital gold business.

How can one make money by investing in Bonds?

Gold ETFs:

Gold ETFs are commodity-based securities that invest in gold companies or gold refineries. They follow the gold index on the National Stock Exchange. These are low-risk investments present in both dematerialized and paper form. Every one unit of Gold ETF represents one gram of 24 carat gold. Gold ETFs are listed on the NSE, and Asset Management Company takes the responsibility of trading them online.

In the case of Gold ETFs, the minimum investment is the price of one gram of gold. The maintenance cost is 0.5-0.1%. SEBI regulates them, and the physical gold brought is also audited regularly by the statutory bodies. The risk here is the volatility of the gold price. There is redemption, but you can sell them in the stock market at the current market price. And gains are taxable as per the tax slab.

Gold MF:

Gold MFs are funds that invest in multiple Gold ETFs. They are also called Fund of Funds. They are similar to Gold ETFs, but a professional fund manager manages Gold MFs.

The minimum investment amount is Rs. 100. They are readily available, and they are liquid in nature. The maintenance cost double the cost involved in gold ETFs. The maintenance charge is around 1.5 – 2.5 %. The effective gold returns from Gold MFs are 2.5 % lesser than the returns from physical gold. The gains from Gold MFs are taxable.

Sovereign Gold Bonds Schemes

SGBs are denominated in grams of gold. SGBs are derivative instruments issued by the RBI, where investors will own gold in a certificate format. They are available periodically. SGBs are issued by RBI once in a month or two. You can buy them from Stock Echange, selected banks, and Stock Holding Corporation of India. As the GOI backs them, they are safe to invest in, and they are insured. SGBs offer a fixed rate of interest of 2.5%. SGBs are tax-free if they hold them till maturity, i.e., eight years else, you will be taxed as per your tax slab. You cant redeem these bonds before five years. After the completion of 5 years, you can save them whenever RBI opens a window. RBI opens a redemption window twice a year. The dematerialized form of SGBs can be sold in secondary markets. SGBs are not very thriving in the secondary market; hence, the seller has to offer a good discount to sell these SGBs. SGBs are usually sold at the discount of 2% – 6%. You can take a loan on SGBs, and the loan amount varies from bank to bank.

Is physical gold safe?

Risks involved in physical gold are-

Making and designing charges

Storage expenses

GST of 3%

These charges may come up to 10%. And if you wish to sell physical, you need to produce origination and purity certificates. Else you need to sell at a discount.

Equity and gold prices both are volatile.

Digital Gold

Gold ETFs

Gold MF

SGBs

Bonds

Availability

Available Available Available Periodically Available Available

Liquidity

High Liquidity Medium Liquidity High LiquidityLow Liquidity Moderate Liquidity

Cost

3%0.5 – 0.1%1.5 – 2.5%NANA

Tax

3% GST Capital Gain Tax Capital Gain Tax Tax-free & early redemption taxable No TDS only Capital Gain Tax

Risk

No regulatory body Gold Price volatility Gold Price volatility No risk Low risk

Returns

Not fixed Linked to the gold price Not fixed Linked to the gold price Not fixed Linked to the gold price Fixed: Gold returns + 2.5%8-12% P.A.

(AAA rated)

Gold and equity both are volatile. Gold investments such as digital gold, Gold-ETFs, and Gold MFs attract the cost of maintenance, exit loads, and taxes. SGBs are profitable if you are determined to hold them for the whole eight years. In case you are looking for fixed income instruments that are liquid in nature. Then you can think of Bonds.

To know the perks of investing in Bonds, click here.

Bonds and Debentures

Bonds are debt securities issued by government bodies or corporates. The issuer can raise capital via bonds. The capital raised can be utilized for business operations or expansion. The bonds offer fixed interest paid regularly. And the investor gets the principal;l amount back on the maturity.

The advantages of the bonds are – As they are low-risk securities, they are relatively safer

They offer fixed income that can meet the financial requirements of the investors

They can be sold or brought at any point of time at the current market price without any exit load.

TDS is not deducted on bond gains.

To avail the Akshaya Tritiya offer. Invest today and earn a special yield.

0 notes

Text

Sovereign Gold Bonds vs Physical Gold: which is better for you?

Investors can choose to invest in gold through Sovereign gold bonds (SGBs), exchange-traded funds (ETFs), and the good old physical gold. The efficiency, ease of keeping the investment, and protection of sovereign gold bonds (SGBs) and gold ETFs and funds are higher. Experts say that an investor should carefully choose between these choices as they come with unique characteristics and disadvantages.

Physical Gold

The most preferred form of gold investment in India is gold in physical form. It can be purchased in the form of gold jewellery or biscuits of gold, gold coins, etc. Unlike other gold types, actual gold is one of the few properties that can be kept secret and fully private.

Getting gold in one's portfolio assists in diversification, and financial advisors often advise it. Investors should have about 20 percent of gold in their portfolio. The yellow metal is used in an investor's portfolio as a hedging tool rather than a wealth-creating instrument. During market instability, gold is a comparatively stable investment and helps investors combat the effects of inflation and economic uncertainty.

Since gold is widely recognized as money worldwide, one can always sell their gold biscuits/bricks, gold coins in case of an emergency to get instant cash. While there is no cap to the purchasing of physical gold, investors should always hold evidence of their gold investments (a tax invoice provided by the jeweller in the case of jewellery) for income tax purposes. Investors will benefit from long-term capital gains (LTCG) and take advantage of gold's tax advantages if the gold is kept for more than three years.

One of the most significant drawbacks is that jewellery's resale value is considerably lower than other gold types.

Sovereign Gold Bonds

Sovereign Gold Bonds (SGB) is government security bonds issued on behalf of India's government by the Reserve Bank of India (RBI). SGBs are published on an exchange and traded in multiples of one gram of gold. These bonds may also be used, similar to physical gold, as security for taking out loans. That said, the risk of robbery is low with gold bonds, unlike physical gold. Besides, gold bonds' prices are related to the cost of 999 pure gold (24 carats) released by the India Bullion and Jewellers Association (IBJA), so there is no question about purity.

A fixed guaranteed interest rate of 2.5% per annum on the issue price, which is charged on a half-yearly basis, is provided by the government. The last installment is paid along with the principal on maturity.

For Sovereign Gold Bonds, the interest is not subject to TDS. According to an RBI notice, the capital gains tax on redemption has also been exempted for individuals. In the case of an LTCG emerging from an investor, indexation advantages would be given to transfer bonds.

Liquidity may be a concern for these bonds. That's because the bonds come with an eight-year tenor and a five-year lock-in period. Only from the 5th year on the date from which the interest is payable will an investor withdraw money.

0 notes

Text

Guide to check the value of your gold

If you have gold jewellery lying idle, it can be very beneficial to cover any short-term cash needs. You can use a gold loan to start or expand your dream business, for higher education, a marriage in the family or a holiday trip.

We offer gold loans from home, so you can get a gold loan from the convenience of your home. But how would you check how much loan amount you can get against your gold jewellery? Here's a helpful guide to get you started:

The karat value of your gold jewellery

The first determining factor is the purity of your gold jewellery. It is stated in Karat, which is 1/24 portion of the gold metal contained in it. 24 karat, which is 99.9% pure, is very soft gold and can't be used for jewellery making. Gold jewellery is made by adding metals like Zinc, Nickel etc., to pure gold. 22 karat, which is 91.67% in purity, is the best Karat rating for ornaments. As the Karat value increases, the percentage of gold in the jewellery also increases. Any gold jewellery you have usually has a Karat rating.

The LTV of your gold loan

The second factor is LTV or Loan-to-Value, which is the ratio of the loan amount to the market value of the pledged gold jewellery. Our gold loans from home offer the maximum LTV under a gold loan in the market without any hidden charges. You can get a gold loan of up to 75% or more of the market value of gold from the comfort of your home. The market value and purity of the collateral gold decide your maximum eligible loan amount.

The weight of gems

When you buy gold jewellery from a retail outlet, the final price includes the karat value of gold, making charges, price of stones or gems, hallmark charges and applicable taxes. If you are pledging ornaments with precious stones, the actual weight eligible for a gold loan is calculated by deducting the stone weight from the gold weight.

You can use our online gold loan calculator to evaluate the loan you are eligible for against your gold jewellery.

How to use the gold loan eligibility calculator?

Our gold loan calculator will help you evaluate the monetary value of gold and the customized repayment plans. You can access the gold loan eligibility calculator by following these simple steps.

Log on to www.onemuthoot.com and scroll down to the Gold Loan Amount Calculator.

Enter the loan amount or gold weight to be pledged and "get the value." If you enter the amount you wish to loan, it will display the weight of gold in grams that needs to be pledged and if you enter the weight of gold in grams you have, it will show the loan amount you are eligible for.

You will also find a variety of schemes based on the loan amount on the right-hand side. The information includes the monthly interest rate, gold loan eligibility per gram, loan value range, tenure, annual interest, and a schedule of the interest rate for different terms.

Choose a scheme suitable for your budget and click "avail this scheme." You will be directed to schedule a call to set up an appointment.

Once the home visit appointment is set up, one of our loan managers will visit your place to evaluate the purity and weight of your ornaments. The eligible weight is calculated by deducting the stone weight from the gold weight. After gold evaluation and approval, we will quickly transfer the loan amount to your account*.

You can also get a top-up loan on your existing gold loan

If you have not taken the maximum amount that is permissible for the collateral ornaments, you can avail the residual amount at a later time. This feature is known as gold loan top-up.

As our existing customer, you are eligible for a gold loan top-up if you have not availed the full amount at the time you pledge gold jewellery or if the market value of gold has increased since pledging.*

With our gold loan from home, you can get a gold loan of up to 75% or more of the market value of gold from the comfort of your home. Head to our website www.onemuthoot.com to learn more about gold loan top-up benefits and book an appointment for a gold loan from home.

*T&C Apply.

0 notes

Text

Flexible Repayment on Gold Loans

youtube

Which is the most celebrated and precious metal in India? The answer is obvious; gold! The oldest tradition of Indian culture is buying and gifting gold. Nowadays, people have put this precious metal to good use by pledging it and ending financial troubles in their lives. Getting a gold loan is as simple as purchasing it. Gold loan is for salaried or self-employed professionals, traders, or any kind of businessmen. Any person between the ages of 18 to 75 years is eligible to apply for a gold loan process. Only KYC documents are required to acquire a simple gold loan against your gold. Gold Loan Process A gold loan can be acquired from a bank or a gold financing company with low interest rates, minimum paperwork against gold ornaments. The quality and the quantity of the gold pledged against the gold loan are duly verified by the financer. If there are any gold appraiser charges applicable, they are paid by the applicant at the time of gold loan processing. Every gold loan provider has a minimum to a maximum loan amount limit set as per their own processing requirements. Benefits of Gold Loan Acquisition You can make the most out of your idle gold lying at home, by acquiring a gold loan. The charges are transparent, minimum documentation is required and you get your gold loan within an hour of application! 1. Gold loans are instant financial options. 2. The gold loan highest rate per gram 3. The gold pledged is handled with care and secured by the gold loan financers. 4. Identification and address proof are the only 2 documents required for a gold loan. 5. The borrower can apply for a non-EMI gold loan, wherein he pays the entire loan and interest amount at the end of the year. 6. The gold items pledged by the customer are not melted but safely kept in the same state. Gold Loan Calculator The gold loan rate per gram varies with the purity, whether it is 24 carat, 20 carat or 18 carat gold. The loan amount varies from INR 1000 to INR 1 Crore. Before, pledging your gold, always check your eligibility and compare the best offered interest rates on gold loans by multiple financers. When the loan amount is high, the interest rates charged on the gold loan are low. When you need a loan for a relatively short period of time, on an urgent basis, take a gold loan from Rupeek and free yourself off financial worries. Rupeek is a company that has been offering gold loans for around five years now and has successfully catered to the needs of all those that need finances for different purposes. The best thing about taking easy gold loan from Rupeek is that you get the loan amount in your bank within 30 minutes to 60 minutes of your application. You do not have to move out of your home as the company representatives complete all formalities in your home.

0 notes

Photo

BEST GOLD LOAN WITH MINIMUM INTEREST

Gokula gold provides the best gold loan opportunities with minimum interest.

Gokula gold provides gold loan up to 1 Crore, depending on the purity of gold ornaments.

Draw instant Cash by pledging your Gold Ornaments and Jewelry.

Higher loan amounts, depending on purity, net weight of the gold.

Gold Loan is the quickest way to get funds for personal or business requirements. The funds from gold Loan can be used for weddings, education, business expansion, hospital expenses or any other similar purpose. With minimal documentation and secure storage, our gold Loan is a simple funding option to meet your needs.

Benefits of Gold loan with Gokula Gold:

Gold loan is now being preferred by customers due to a variety of reasons including,

Quick loan approvals and disbursal, with minimal documentation and formalities

Most convenient loan to be availed in case of emergency

Easily available asset with most of the households

The multitude of loan options with a higher LTV(Loan-to-Value) ratios.

Greater accessibility due to better penetration.

Lesser formalities allow a large section of customers to be served.

Convenient hours of operation.

Flexibility: Provision of very small and very large loan amounts.

Instant sanction and hassle-free processing.

Low rates of interest.

Minimal Paperwork and quick disbursement.

Convenient repayment and flexible tenure.

Higher Per Gram Rates.

No Hidden Charges Security for the loan will be pledge of 22 ct. gold ornaments.

Get funds instantly against your gold, and repay at your own convenience.

Low Interest Rates.

Gokula Gold Loan comes with competitive interest rates on Term Loan, Overdraft and EMI prepay your loan in easy lower EMIs, over a tenor of your choice.

0 notes