#gold bullion price

Explore tagged Tumblr posts

Text

The Growing Popularity of Gold Bar Investments in the UAE

Investing in pamp gold has long been considered a haven for investors worldwide, offering stability and security during uncertain economic times. In the UAE, the allure of gold is particularly strong due to the region’s rich history with the precious metal and its status as a global trading hub. This blog explores why gold bar investment in the UAE is gaining traction and how investors can make informed decisions.

Why Invest in Gold Bars? 1. Stability and Security Gold is known for its ability to maintain value over time, making it a popular choice for preserving wealth. Unlike stocks or real estate, which can be subject to market volatility, buy gold bullion a stable investment that can protect against inflation and currency fluctuations.

2. Tangible Asset valcambi gold bars are a tangible asset that investors can physically hold, providing a sense of security that digital investments cannot match. This tangibility is particularly appealing in a world of unpredictable financial markets.

3. Portfolio Diversification Investing in gold bars can diversify an investment portfolio, reducing risk by offsetting potential losses in other asset classes. Gold often performs well when other markets struggle, providing a balancing effect.

The UAE Advantage 1. Tax-Free Investment One of the key benefits of investing in gold bullion bar price in the UAE is the tax-free environment. Investors can purchase gold without worrying about capital gains taxes, which can significantly impact overall returns.

2. Access to High-Quality Gold The UAE is renowned for its high-quality gold, with Dubai often referred to as the “City of Gold.” Investors can access a wide range of gold bars from reputable dealers, ensuring the authenticity and purity of their investments.

3. Strong Market Infrastructure The UAE’s robust market infrastructure supports gold trading, with numerous exchanges and platforms facilitating the buying and selling of gold bars. This accessibility makes it easier for investors to enter and exit the market as needed.

Factors to Consider Before Investing 1. Purity and Weight When purchasing gold bars, it’s essential to consider their purity and weight. Look for bars that are at least 99.5% pure, commonly known as 24-karat gold, to ensure you are getting the highest quality.

2. Reputable Dealers Choose reputable dealers with a proven track record in the gold market. Conduct thorough research and verify their credentials to avoid potential scams or counterfeit products.

3. Storage and Insurance Consider the storage and insurance of your gold bars. Secure storage is crucial to protect your investment, and insurance can provide additional peace of mind against theft or loss.

4. Market Trends Stay informed about market trends and factors influencing gold prices, such as geopolitical events, economic data, and currency fluctuations. Understanding these trends can help you make informed investment decisions.

Steps to Invest in Gold Bars in the UAE Research and Education Educate yourself about the gold market, investment strategies, and the factors influencing gold prices. Knowledge is key to making informed decisions.

Set Investment Goals Define your investment goals, whether long-term wealth preservation, short-term gains, or portfolio diversification. Clear objectives will guide your investment strategy.

Choose a Reputable Dealer Select a reputable gold dealer in the UAE with a strong market presence and positive customer reviews. Verify their credentials and ensure they offer high-quality gold bars.

Monitor Market Trends Keep an eye on market trends and economic indicators that could impact gold prices. Stay informed to make timely investment decisions.

Secure Storage and Insurance Arrange for secure storage of your gold bars and consider insurance to protect against potential risks. Proper storage is essential to safeguard your investment.

Conclusion Gold bullion price investment in the UAE offers numerous advantages, from tax-free benefits to access to high-quality gold. By considering factors such as purity, reputable dealers, and market trends, investors can make informed decisions that align with their financial goals. As the UAE continues to be a global leader in the gold market, investing in gold bars remains a viable and attractive option for preserving wealth and securing a stable financial future.

#gold bar#gold bullion#gold bars#gold#valcambi gold#gold buyer#pamp gold#Gold bullion price#gold bullion bar price#Gold Coins

2 notes

·

View notes

Text

Buy Luxury 22 Karat Gold Bullion Jewelry Online –

Buy high-end buying gold bullion online at NatusExStella. Our collection of gold bullion bracelets available for is the best option for future investing.

#22 karat gold jewelry#22 karat gold jewelry online#22 karat jewelry#gold jewelry#high end gold jewelry#luxury gold jewelry#luxury jewelry#22k gold bullion#bullion gold#buy gold bullion#gold bullion jewelry#gold bullion jewellery#buying gold bullion online#buying gold online#gold bullion bracelets#gold bullion for sale#gold bullion price#gold jewelry bullion#bullion jewelry#invest in gold#gold future investing

2 notes

·

View notes

Text

Navigating Inflation: Is Gold or Cryptocurrency Your Best Defense?

Looking for effective ways to safeguard your wealth against inflation? 24 Gold Group Ltd examines the strengths of Gold And Cryptocurrencies As Investment options. Gold has a long history of stability and reliability during economic uncertainty, while cryptocurrencies offer innovative potential and high volatility. Understanding the unique benefits and risks associated with each asset is essential for informed decision-making. For more information, contact us or visit our website!

2 notes

·

View notes

Text

Looking for the mother lode. ☠️🥇⛏🟡(silkscreen on paper)💰🏆

#gold#cash for gold#gold price#golden#golden nugget#gold nugget#gold necklace#gold bars#gold mining#gold mine#gold miner#oro#ghost town#skull and crossbones#treasure hunting#treasure hunter#tombstone#printmaking#printmaker#monoprint#silkscreen#silkscreen print#golden jewelry#gold bullion#basquiat#poster art#hand lettering#poster design#folk art#dynamite

2 notes

·

View notes

Text

Gold bullion price Dubai:- ROYAL STAR Jewelers is your go-to destination for diamond necklace prices and engagement rings in Dubai. Trust us for expert diamond jewelry repair services with a smile. https://royalstarjewellery.com/gold-bullion/

0 notes

Text

https://bullionmartt.com/

Buy Gold Bullion Bars at Wholesale Price – Trusted Supplier | Bullion Mart

Bullion Mart is a leading supplier of 99.9% pure gold, offering investors and businesses the opportunity to Buy Gold Bullion Bars at Wholesale Price with the highest standards of quality, security, and transparency. With headquarters in Melbourne and a branch in Dubai, we operate in the world’s safest and most regulated markets, ensuring a seamless buying experience and reliable global delivery. Whether you're an investor or a reseller, our competitive pricing and premium gold bullion make us the preferred choice for gold buyers worldwide.

1 note

·

View note

Text

Kota Mandi Bhav : कोटा मंडी भाव 5 जनवरी 2025; कृषि जिंसों और सर्राफा बाजार में उतार-चढ़ाव

Kota Mandi Bhav 5 January 2025 : शुक्रवार को भामाशाह मंडी में विभिन्न कृषि जिंसों की आवक करीब 1,40,000 कट्टे रही। धान और लहसुन में गिरावट देखी गई, जबकि सर्राफा बाजार में चांदी और सोने के भाव तेज रहे। मंडी में प्रमुख जिंसों के भाव (प्रति क्विंटल) फसल न्यूनतम मूल्य (₹) अधिकतम मूल्य (₹) गेहूं 2,850 3,091 धान (सुगंधा) 2,300 2,521 धान (1509) 2,600 2,821 धान…

#Agro Commodity#Bhamashah Mandi Kota#bullion market#gold silver price#Kota Mandi Bhav#Kota Mandi Bhav 5 January 2025#kota mandi news#Kota news#mustard price high#paddy#soybean | Kota News | News

0 notes

Text

Purchase Silver Bars with Confidence from Baird & Co. - UK's Trusted Refiners

Investing in precious metals is a time-tested way to secure financial stability, and purchase silver bars is a top choice for both seasoned and new investors. As the UK’s largest independent gold trader, Baird & Co. offers a trustworthy, streamlined process for acquiring high-quality silver bars and other precious group metals.

Why Choose Silver Bars for Investment?

Silver bars are a versatile and practical investment. Here’s why they’re an excellent choice:

Affordability Compared to gold, silver is more accessible for investors with smaller budgets, making it a great entry point into the precious metals market.

Tangible Wealth Owning silver bars provides a sense of security as they represent a physical, tangible asset that retains value over time.

Hedge Against Inflation Silver’s intrinsic value helps protect your portfolio against inflation and economic downturns.

High Liquidity Silver bars are widely recognized and easily tradable, ensuring liquidity when you need it most.

Why Baird & Co. Is Your Trusted Partner

Baird & Co. stands out as the UK’s premier supplier of silver bars and other precious metals. Here's what makes them exceptional:

1. LBMA Approved Refiners

Baird & Co. is a member of the London Bullion Market Association (LBMA), a globally recognized authority in the precious metals industry. This accreditation guarantees the purity and authenticity of their products.

2. End-to-End Refining Process

As the UK’s only company managing the entire refining process under one roof, Baird & Co. ensures unmatched quality control. From refining raw materials to manufacturing bullion bars and coins, every step is conducted with precision.

3. Comprehensive Product Range

Whether you're looking for silver bars, gold bullion, or legal tender coins, Baird & Co. offers a wide selection to suit varying investment needs.

4. Competitive Pricing

With no middlemen involved, Baird & Co. offers competitive pricing on all their products, giving you the best value for your investment.

5. Global Reputation

Trusted by investors worldwide, Baird & Co. has earned its place as a leader in the global precious metals market.

How to Purchase Silver Bars from Baird & Co.

Buying silver bars from Baird & Co. is a straightforward process. Follow these simple steps:

1. Browse Their Extensive Catalog

Visit BairdMint.com to explore their collection of silver bars, bullion coins, and other investment options.

2. Select Your Desired Product

Choose the silver bar that fits your investment strategy. Baird & Co. offers various sizes and weights to cater to all budgets.

3. Secure Payment Options

Make your purchase with confidence through their secure and user-friendly payment platform.

4. Delivery or Secure Storage

Opt for insured delivery to your doorstep or take advantage of Baird & Co.’s secure storage facilities for peace of mind.

Top Silver Bar Options Available

Baird & Co. offers an array of premium silver bars to suit all investment levels. Here are some popular choices:

1 oz Silver Bar – Ideal for beginners, offering affordability and convenience.

100 g Silver Bar – A step up for more significant investments while remaining accessible.

1 kg Silver Bar – A robust option for serious investors looking to diversify their portfolios.

Each silver bar is stamped with its weight, purity, and the Baird & Co. hallmark, ensuring authenticity.

Why Now Is the Best Time to Invest in Silver Bars

The demand for silver continues to rise due to its critical role in various industries, including electronics and renewable energy. With supply constraints and increasing global interest, silver’s value is expected to grow steadily.

By investing in silver bars today, you’re not just securing your wealth but also positioning yourself to benefit from future market trends.

Customer Testimonials

"Baird & Co. made my first silver bar purchase seamless. Their quality and service exceeded my expectations." – Sarah T., London

"I trust Baird & Co. for all my precious metal investments. Their LBMA accreditation and transparent process give me complete peace of mind." – Mark R., Manchester

Conclusion

When it comes to purchasing silver bars, choosing a trusted partner like Baird & Co. is essential. With their LBMA accreditation, end-to-end refining process, and unmatched industry reputation, they make investing in silver bars simple, secure, and rewarding.

Visit BairdMint.com today and take the first step toward securing your financial future with high-quality silver bars from the UK’s most trusted precious metals trader.

#purchase silver bars#buy gold#purchase gold coins#gold storage#gold coin sale#gold bars for sale#invest in gold coins#500g of silver price#buy silver bullion#buy silver coin

0 notes

Text

A Blooming Investment.🌸 The Flower Gold Bar from Rizan Jewellery is an elegant symbol of growth and prosperity. Customize it to add a personal touch to your financial bloom.✨

Visit: www.rizanjewellery.com Contact: +971 58 936 6018

#gold bullion#bullion dealers dubai#bullion shop dubai#bullion shop in dubai#best bullion shop in Dubai#gold bullion Dubai#gold traders in dubai#gold dealers in dubai#bullion dealers UAE#best bullion traders in Dubai#best bullion dealers in Dubai#Dubai gold dealers#gold bullion dealers in Dubai#best bullion traders in UAE#Dubai bullion dealers#buying gold in Dubai#where to buy gold in dubai#gold bullion dubai#best place to buy gold in dubai#best place to buy gold bars in dubai#best place to buy gold bullion#24k gold bullion price#where to buy gold bullion#bullion traders dubai#buy gold bars#where to buy gold bars for investment in dubai#where to buy gold bars#where can i buy gold bars in Dubai#where to buy gold bars for tourists#gold trading dubai

0 notes

Text

Gold Silver Price Today; आज फिर गिरे सोना-चांदी के भाव, जानें सर्राफा बाजार का हाल

Gold Silver Price Today: सप्ताह के पहले दिन यानि रक्षाबंधन के दिन सोने की कीमतों में गिरावट आई थी। उसके बाद सोने में उछाल देखने को मिली। आज गुरुवार को (21 अगस्त) सोना-चांदी की कीमतों में गिरावट देखी जा रही है। मल्टी कमोडिटी एक्सचेंज (MCX) पर इस समय सोना (Gold Price) 0.29 फीसदी गिरावट के साथ 71,620 रुपए प्रति 10 ग्राम पर कारोबार कर रहा है। जबकि चांदी (Silver Price) 0.27 फीसदी फिसलकर 84,630 रुपए…

0 notes

Text

How to buy Gold in Africa

How to buy Gold in Africa

With the property and stock market stocks going down, people are now looking for how to buy Gold in Africa. You might ask why Africa?

Chinese investors and households have been buying gold as a refuge from local property and stock market mayhem, helping to support record prices for the haven asset.

China was the principal bright spot globally for gold jewelry and investment flows in 2023, according to industry group the World Gold Council’s quarterly report, as local property, equity, and currency markets disappointed following the country’s exit from COVID-19 lockdowns.

Africa’s Gold market

Africa’s Gold market is highly unregulated and this means you can get it very cheap. The mining done in Africa is mostly artisanal and the individual miners decide on the prices. This sometimes means they sell well below the gold market price. Buying Gold in Africa with the right connections can make you a lot of money.

There are many people who have created local cooperatives for miners, providing equipment to miners and also healthcare facilities. In turn, these miners sell only to them. Lives in the mines is not easy and with all the gold, the people still live on under $1 per day.

At BSLMGOLD-GOV.NET Bertoua Savanna Local Miners Cameroon, we give information on where you can successfully buy gold in Africa without any hassles. There are a lot of scammers online and even in the mines looking to take advantage of unsuspecting individuals. Our job is to make sure investors are able to come into the country, improve the lives of the miners, and buy gold without getting scammed.

Why buy Gold in Africa?

As a businessman, your first priority is making a profit. If you are looking to make huge profits by buying and selling Gold, then Africa is your number one destination. Do not be fooled by what you see on social media, it is relatively safe and you can do business without any problems.

The first reason you should buy Gold in Africa is the price. In the world market, a troy ounce of Gold costs $2000 while in Africa it costs $1150 imagine the difference and the profit you can make buying up to a kilogram. However, getting to these miners is not easy. They do not have a website, they do not even have a Social media presence. You have to come to their country and deal with them directly.

Others have taken this advantage to create small cooperative communities for them thereby actively participating in their activities. This means they will sell directly to you and no one else. By investing just $500 in a miner, you can get as much as $120,000 profit in 2 months.

Buying Gold from Africa is also very good because you do not need much documentation. Other countries require a lot just to be able to buy gold but in Africa, you do not need all that. The most difficult thing is meeting a local artisanal miner. Once you do that, you can easily buy gold bars and dust without any problems.

Difficulties

The difficulties involved in buying Gold in Africa are not many. The first is finding a good supplier due to the presence of many scammers. We explained in the post how to buy Gold and avoid scam.

Another problem is reaching the mines. The areas where the mines are situated are very difficult to get to. The roads are terrible with many highway robbers and crook law officials wanting bribes. You need to move with a national who is an expert to be able to succeed.

If you are ever in Africa and looking to buy Gold in the following Countries; Cameroon, Kenya, Tanzania, Ghana, Uganda and Togo, do not hesitate to contact us.

#cemac permit#buyer's permit license#cemac license#license for cemac#license for cemac permit#gold permit#gold license#buyer's permit gold#gold buyer#gold bar#Bertoua savanna local miners#buy gold bars from bank#Buy Gold In Cameroon#cam rural mines corporation#cameroon gold price#cameroon mining company sarl#gold bars for sale#Gold Buyers Cameroon#Gold Companies in Cameroon#gold for sale near me#How to Order Gold from Cameroon#liberty local miners ltd#list of mining companies in cameroon#mining in cameroon#ounce of gold for sale#Where can I buy gold in Cameroon#Where To Sell Gold Bullion For Sale#Best place to buy gold in 2024#Best Raw Gold Bar#BSLMGOLD-GOVNET

0 notes

Text

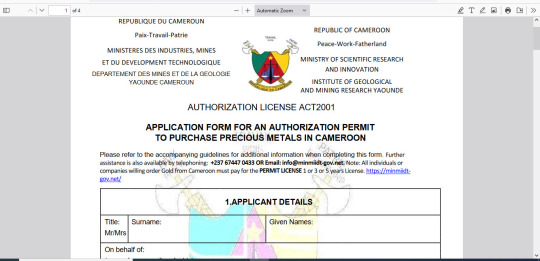

Cemac permit downloaded application form

Cemac permit downloaded application form

How to obtain a Cemac permit application form with the downloaded version from the official Ministry of Mines In Cameroon minmiidt-gov.net.

How to Apply for Cemac Permit Authorization Buyer’s Gold License? You must visit Minmiidt-gov.net to buy the Cemac permit Gold License.

Cemac Buyers Permit License: Cemac permit application form

Any application for the grant of a mining title, authorization, Cemac permit application form shall be addressed to the Minister in charge of mines in Cameroon. including one original stamp at the rate in force. The following documents shall be appended to the application

You can also order Cemac buyer’s Permit for Gold from Minmiidt-gov.net with brinks shipping to your location. Is the CEMAC Buyer’s Permit Real or a scam? Cemac buyers permit is real and also a scam depending on who you decide to purchase from.

Get an EXIT Buyer’s Permit

Since Cameroon is an EXIT Member State, an EXIT Buyer’s Permit is required for the purchase of gold and many other precious stones. The process of getting the permit is easy. Simply go to the MINMIIDT official website, visit the permit download page, and download the EXIT Buyer’s Permit application form.

Gold Seller License

To obtain this license, you must meet the following requirements:

You must be a resident of Cemac permit application form for at least 12 months.

You must have a certificate that shows you have completed an apprenticeship program in gold selling.

You must have proof of insurance for $2 million from a company that is approved by CEMAC.

Invest in Gold

Are you looking for How to Invest in Gold in Cameroon? BSLMGOLD is the best place to invest in Gold in Africa without getting scammed . How to obtain a Cemac permit application form with the downloaded version from the official Ministry of Mines In Cameroon minmiidt-gov.net.

The smart investor has always considered gold to be an integral part of a well-balanced portfolio. This is because of its role as a diversifier, due to its low correlation to most other asset classes. Gold is the ultimate wealth preservation tool; considered not only a hedge against inflation but also acts as a currency hedge, in particular against the dollar.

#Bertoua savanna local miners#buy gold bars from bank#Buy Gold In Cameroon#cam rural mines corporation#cameroon gold price#cameroon mining company sarl#gold bars for sale#Gold Buyers Cameroon#Gold Companies in Cameroon#gold for sale near me#How to Order Gold from Cameroon#liberty local miners ltd#list of mining companies in cameroon#mining in cameroon#ounce of gold for sale#Where can I buy gold in Cameroon#Where To Sell Gold Bullion For Sale#Best place to buy gold in 2024#Best Raw Gold Bar#BSLMGOLD-GOVNET#buy Gold bars#buy Gold bars from Africa online#buy Gold in 2024#Buying Gold in Africa#Buying the permit#Exit Permit#Gold to the Buyers Refinery#Minmiidt-govnet#Raw Gold Barspot Shipment fee#Where Can I Buy Gold

0 notes

Text

Natusexstella Luxury Jewelry Elevates Your Style –

Natusexstella believes elegance is in the details. Our jewelry is handcrafted with 22k gold bullion and precious gemstones. Opulent and charming pieces arise from meticulous consideration of every detail. Beautiful diamond necklaces and complex bracelets showcase unmatched craftsmanship and beauty.

#22 karat gold jewelry#22 karat gold jewelry online#22 karat jewelry#gold jewelry#high end gold jewelry#luxury gold jewelry#luxury jewelry#22k gold bullion#bullion gold#buy gold bullion#gold bullion jewelry#gold bullion jewellery#buying gold bullion online#buying gold online#gold bullion bracelets#gold bullion for sale#gold bullion price#gold jewelry bullion#bullion jewelry#invest in gold#gold future investing

2 notes

·

View notes

Text

Inflation Hedge Showdown: Gold Bars or Cryptocurrencies?

In times of economic uncertainty, savvy investors look for assets that can protect their wealth from the eroding effects of inflation. Two of the most popular options for hedging against inflation today are traditional gold bars and the more modern asset class of cryptocurrencies. Both have their proponents, but how do they stack up when it comes to offering stability and security? At 24 Gold Group Ltd., a leading gold and silver dealer in Toronto, Canada, we believe that while cryptocurrencies may be gaining attention, gold bars remain the time-tested choice for inflation protection. Let’s explore the comparison between gold vs. cryptocurrencies, with a focus on why gold continues to shine.

Why Gold Bars Have Stood the Test of Time

Gold has been a trusted store of value for thousands of years. From ancient civilizations to modern economies, gold has remained a universal symbol of wealth and security. When inflation rises and the purchasing power of fiat currency diminishes, gold tends to hold or even increase in value, making it a reliable hedge.

Here are several reasons why gold bars stand out as an inflation hedge:

1. Tangible and Real Value

One of the primary advantages of gold bars is their intrinsic value. Gold is a physical asset that you can hold in your hand, and its worth isn’t tied to any government or financial system. During times of inflation or economic instability, fiat currencies can lose value rapidly, but gold’s rarity and universal recognition make it a safe harbor for investors. Unlike cryptocurrencies, which are digital and can be prone to extreme volatility, gold is solid and proven.

2. Stable Long-Term Investment

Gold’s track record as a stable store of value spans millennia, offering a sense of security that cryptocurrencies, still relatively new, cannot yet match. While the prices of both gold and cryptocurrencies can fluctuate, gold’s long-term trend is one of steady appreciation, especially during inflationary periods. Investors who are seeking long-term wealth preservation often prefer the consistent reliability of gold bars.

3. Less Volatility

Cryptocurrencies, including popular ones like Bitcoin, are known for their price volatility. Sudden market fluctuations can lead to large gains but can also result in significant losses. For those looking to hedge against inflation, this level of unpredictability can be unnerving. In contrast, gold’s value typically moves at a steadier pace, making it a safer choice for investors focused on wealth protection rather than speculative gains.

At 24 Gold Group Ltd., we offer a wide range of gold bars that can provide investors with a secure and tangible way to protect their assets, particularly during periods of rising inflation.

Cryptocurrencies: The New Contender

Cryptocurrencies have emerged as a disruptive force in the world of finance, with many viewing them as a modern hedge against inflation. Cryptocurrencies like Bitcoin are decentralized, meaning they are not controlled by any central authority, which proponents argue makes them immune to inflationary pressures associated with traditional currencies.

However, while the idea of cryptocurrencies as a hedge against inflation has gained traction, there are several reasons to approach this asset class with caution.

1. Extreme Volatility

As mentioned earlier, cryptocurrencies are notorious for their extreme price swings. While gold prices move in a more stable manner, Bitcoin and other cryptocurrencies can experience daily fluctuations of 10% or more. This volatility makes cryptocurrencies more suited for speculative investors rather than those looking for a safe inflation hedge.

2. Uncertain Regulatory Environment

Another factor that adds risk to cryptocurrencies is the uncertain regulatory landscape. Governments around the world are still figuring out how to regulate these digital assets, and future regulations could impact their value. On the other hand, gold has a well-established market with clear regulatory frameworks, making it a more predictable and secure investment option.

3. Lack of Tangibility

Unlike gold bars, cryptocurrencies are purely digital. While some investors appreciate the convenience of digital assets, the lack of physical presence can be a downside for those who prefer to have a tangible asset they can hold or store securely. Gold provides that peace of mind in a way that cryptocurrencies simply cannot.

Gold vs. Cryptocurrencies: Which Is the Better Inflation Hedge?

When comparing gold vs. cryptocurrencies as inflation hedges, it becomes clear that both have their merits, but they appeal to different types of investors. Cryptocurrencies offer high-risk, high-reward potential and can be an exciting part of a speculative investment portfolio. However, they lack the long-standing history, stability, and tangible nature that gold provides.

For investors looking for a proven inflation hedge, gold bars remain the superior choice. Gold has weathered countless economic storms and has consistently protected wealth through times of inflation, deflation, and market turbulence. Cryptocurrencies may have a place in modern portfolios, but gold’s role as a reliable store of value is hard to beat.

Why Choose Gold Bars from 24 Gold Group Ltd.?

At 24 Gold Group Ltd., we have built our reputation as one of Toronto's leading dealers in gold and silver. If you’re looking to buy gold in Canada to hedge against inflation, we offer a range of high-quality gold bars that are ideal for long-term investment. Our team is dedicated to providing trusted service, competitive pricing, and expert guidance to help you make the best choices for your financial future.

0 notes

Video

youtube

How To Benefit From Rising Gold Prices Without Buying Gold

Special presentation that Everyone should watch - A huge gold nugget is dropped during the livestream! Yes - you can benefit from Gold without buying gold! Plus entry into our silver contest expires at midnight tonight!

Information to get started today https://sandgsolutions.org/silvertoday

#youtube#silver#gold#gold nugget#silver contest#how to benefit from rising gold prices#silver and gold solutions#silver bullion#gold bullion

1 note

·

View note

Text

Gold snaps RECORD highs now, heads for fourth weekly gain

Gold prices surged to a historic peak fueled by central bank purchases amid geopolitical tensions, reaching $2,395.29 per ounce. ACY Securities analyst Luca Santos attributed this rise to global conflicts, emphasizing commodities’ status as a safe haven. Social Media Links Follow us on: Instagram Threads Facebook Twitter YouTube DailyMotion Read More News #latestmalaysia Gold record…

View On WordPress

0 notes