#globalpayments

Explore tagged Tumblr posts

Text

ERSTE-féle karácsonyi ajándék

Hogy ha van egy vállalkozásod, amelyik szeretne egy softPOS terminált üzemelteteni, hogy az ügyfelek akár kártyával is tudjanak fizetni, és abban a szerencsétlen helyzetben vagy, hogy az ERSTE ügyfeleként valamiért (lustaságból, nemtörődömségből) nem váltottál még bankot, és még mindig ennél a fostalicska banknál vezeted az ügyeidet, akkor tudod, hogy a softPOS terminált kiszervezték egy Global Payments nevű, igazi vadkapitalista karvaly szervezetnek.

Namost, ez a cég, a Global Payments meghúzta azt, hogy valamikor szeptemberben egy hírlevélbe elrejtve közölte az ügyfelekkel, hogy átszervezik a szolgáltatást, és ennek éves tagdíja 59 000 Ft lesz. De várj, a hírlevél végén, miután felsorolják a teljesen unalmas és senkit sem érdeklő részleteket, található az a sor, épp csak nem apró betűvel szedve, hogy amennyiben NEM jelzel vissza, akkor elfogadod a feltételeket, a szerződésed folytatódik az új feltételekkel.

Karácsony előtt 2 héttel pedig jön a meglepi, hogy leemelnek a számládról 59 000 Ft-ot, úgy hogy az erről szóló hírlevél 4 hónappal korábban volt, azóta se egy figyelmeztetés, se egy ügyfélkapcsolat, hogy heló, ugye tudod, hogy elfogadtad az új szerződést? SEMMI!

Mellesleg a Global Payments ügyfélszolgálatán a magyart erősen törő, nem feltétlenül jól beszélő operátorokkal tudsz beszélni.

Csak összehasonlításul: a Yettel 3-4 hetente küld SMS-ben figyelmeztető értesítést a várható változásokról, és mindig releváns információval (még 30 napja van, még 10 napja van, stb...) Ugynakkor a CIB több felületen is értesítéseket küld, a saját appján keresztül, emailben és SMS-ben is figyelmeztet. Az OTP minden lehetséges felületén ömlik kifelé a figyelmeztetés, ha a szerződésbe változást léptet életbe. Ezek a legtöbb esteben olyan változások, amik anyagilag nem, vagy nem jelentősen érintik az ügyfelet.

Ehhez képest azt hiszem, hogy egy 59 000 Ft-os tételre, amit karácsony előtt 2 héttel emelnek le a számládról, talán kevés az 1 db hírlevélben elbújtatott értesítés 4 hónappal korábban. Amúgy ki olvas manapság hírlevelet?

5 notes

·

View notes

Text

Send money internationally anytime with Zil.US. Through international wire transfers, businesses can make secure payments globally.

Learn more: https://zil.us/send-money-internationally/

Click Here for Interactive Demo: https://zilmoney.storylane.io/share/mq7rllcugf7e

0 notes

Text

0 notes

Text

Why You Should Join NodePay

NodePay is redefining the way we handle digital transactions and manage payment systems. Here’s why you should be a part of this innovative platform:

Effortless Payments: NodePay simplifies transactions, offering a user-friendly experience for seamless payment processing.

Blockchain-Powered Security: Built on cutting-edge blockchain technology, NodePay ensures transparency, security, and immutability in all transactions.

Global Reach: Operate without boundaries. NodePay supports international transactions, making it ideal for businesses and individuals.

Fast Transactions: Say goodbye to delays with NodePay’s efficient and rapid processing system.

Cost-Effective: Enjoy reduced fees compared to traditional payment gateways, maximizing value for users.

User-Centric Dashboard: A well-designed dashboard provides insights, management tools, and real-time updates to keep you in control.

Integration-Friendly: NodePay easily integrates with existing systems, ensuring smooth adoption for businesses.

Innovative Ecosystem: Be part of a forward-thinking community that’s shaping the future of digital payments.

Join NodePay to embrace secure, fast, and global transactions, and take control of your financial interactions like never before!

#NodePay#DigitalPayments#BlockchainTechnology#SecureTransactions#GlobalPayments#FastProcessing#CostEffective#UserFriendly#PaymentGateway#InnovativeEcosystem#SeamlessIntegration#FinancialManagement#InternationalTransactions

0 notes

Text

#Revolut#Fintech#DigitalBanking#CryptoTrading#TravelMoney#MoneyManagement#FinancialApp#GlobalPayments#SpendSmart#InstantTransfers#BancaDigital#TradingDeCripto#DineroDeViaje#GestiónFinanciera#AplicaciónFinanciera#PagosGlobales#GastaInteligente#TransferenciasInstantáneas

1 note

·

View note

Text

How (APM) Alternative Payment Methods Can Ease Your Customer Checkout Page

Expand your reach with Payment Clarity’s alternative payment methods. We provide innovative solutions that make cross-border transactions simple and secure. Whether you’re targeting customers in Europe, Asia, or beyond, our payment systems help you engage with a wider audience while maintaining trust and compliance. Let’s make global payments work for your business!

0 notes

Text

What are virtual IBAN accounts, and what are the pros and cons of having one?

Hey there! Capri Payment is here to simplify your global payments with our virtual IBAN accounts. Handle multiple currencies with ease, reduce your international banking fees, and stay in control of your cash flow. Ready to go global without the headache? Get in touch with Capri Payment!

0 notes

Text

RemitAnalyst - Send money to Tunisia from South Africa. Get the best exchange rate and check live rates & analysis. Fast and secure money transfer from South Africa to Tunisia.

0 notes

Text

Understanding Payment Orchestration: Revolutionizing Payment Processing

In today’s fast-paced digital economy, businesses face numerous challenges in managing payments across various platforms, gateways, and regions. As customer expectations for seamless payment experiences continue to grow, the need for a unified, efficient solution has become paramount. This is where payment orchestration comes in—a comprehensive approach that optimizes and simplifies payment processes for businesses of all sizes.

What is Payment Orchestration?

At its core, payment orchestration refers to the coordination of different payment services, gateways, and methods under a single platform. Instead of managing multiple payment providers individually, payment orchestration platforms act as a central hub, automatically routing transactions through the best possible gateways. This creates a seamless payment experience, improving both transaction success rates and overall efficiency.

How Payment Orchestration Works

A payment orchestration platform connects a business to various payment gateways, acquiring banks, and alternative payment methods. It acts as an intermediary, evaluating each transaction in real time and determining the most suitable payment route based on factors like transaction type, geographic location, and gateway performance. The system may consider aspects such as:

Payment gateway availability: If a specific gateway is down, the system reroutes the payment to another.

Transaction cost: Some gateways offer lower fees for certain regions or transaction types.

Success rates: The system prioritizes gateways with higher success rates to minimize payment failures.

This intelligent routing not only increases the likelihood of a successful payment but also reduces costs by selecting the most efficient gateway for each transaction.

Key Benefits of Payment Orchestration

Higher Transaction Success Rates One of the primary advantages of payment orchestration is the improvement in transaction success rates. By automatically selecting the best-performing gateway, businesses can reduce payment declines and errors, ensuring more customers complete their purchases without frustration.

Reduced Costs Since payment orchestration platforms can evaluate transaction fees across multiple gateways, they help businesses save on processing costs. By routing payments through the lowest-cost option, companies can significantly reduce their payment expenses.

Scalability and Flexibility As businesses grow and expand into new markets, payment orchestration offers the flexibility to integrate new payment methods and gateways easily. This makes it easier for businesses to operate globally without the need to establish new contracts or relationships with individual payment providers.

Enhanced Security and Compliance Payment orchestration platforms often come with built-in fraud detection and compliance tools, ensuring that transactions are secure and meet industry standards. This not only protects customer data but also helps businesses stay compliant with local regulations, reducing the risk of penalties.

Streamlined Operations Managing multiple payment gateways can be a complex, time-consuming process. Payment orchestration simplifies this by providing a single, unified dashboard for monitoring and managing all payment activities. This centralization reduces administrative burdens and makes it easier to track performance, reconcile payments, and resolve issues.

Use Cases for Payment Orchestration

E-commerce: Online retailers can benefit from payment orchestration by providing customers with a wide range of payment options, ensuring smooth transactions even during peak shopping times.

Subscription Services: Businesses offering recurring payments can reduce churn by increasing the success rate of subscription renewals through automated payment retries and intelligent routing.

Global Enterprises: Companies operating across multiple countries can use payment orchestration to handle international transactions more efficiently, accommodating regional payment preferences and currencies.

#PaymentOrchestration#Businesses#PaymentGateways#Scalability#Ecommerce#SubscriptionServices#CustomerExperience#FraudPrevention#GlobalPayments#PaymentInnovation

0 notes

Text

0 notes

Text

0 notes

Text

Simplify Global Workforce Management with Pay Anytime, Any Team

In the rapidly evolving global business landscape, managing a diverse workforce spread across multiple countries can be a daunting task. The complexities of different currencies, varying compliance regulations, and the sheer logistical challenges of timely payments can bog down even the most efficient HR departments. However, with the introduction of the Pay Anytime, Any Team initiative, businesses can now streamline their payroll processes, allowing them to focus on what truly matters: driving profits and growth.

The Challenges of Global Workforce Management

As companies expand their operations internationally, they face several challenges in managing a global workforce:

Currency Conversion: Paying employees in their local currencies can be complicated and costly.

Compliance: Each country has its own set of labor laws and tax regulations, making compliance a significant concern.

Timeliness: Ensuring that payments are made on time, regardless of time zones, is crucial for maintaining employee satisfaction and morale.

Administrative Burden: Managing payroll manually or with outdated systems can be time-consuming and error-prone.

Introducing Pay Anytime, Any Team

Pay Anytime, Any Team is designed to address these challenges head-on. This innovative payroll solution provides businesses with the tools they need to manage their global workforce efficiently and effectively. Here’s how:

1. Flexibility

With Pay Anytime, Any Team, businesses can manage payments anytime, anywhere. This flexibility ensures that all employees, no matter where they are located, receive their payments on time. The system supports multiple currencies, making it easier to handle international transactions without the hassle of currency conversion issues.

2. Efficiency

By automating the payroll process, Pay Anytime, Any Team significantly reduces the administrative burden on HR departments. This automation not only saves time but also minimizes the risk of errors that can occur with manual data entry. Streamlined operations mean that businesses can focus their resources on strategic initiatives rather than getting bogged down by payroll logistics.

3. Security

Ensuring the security of financial transactions is paramount, especially when dealing with a global workforce. Pay Anytime, Any Team employs advanced encryption and security measures to protect sensitive data and ensure that all transactions are safe and secure. This level of security builds trust with employees, knowing that their payments are handled with the utmost care.

4. Cost-Effectiveness

Traditional payroll methods often come with hidden fees and high transaction costs. Pay Anytime, Any Team offers transparent pricing, helping businesses save money. These cost savings can be redirected towards other critical areas of the business, such as product development, marketing, or expanding into new markets.

Focus on Profits, Not Payroll

One of the most significant benefits of adopting a modern payroll system like Pay Anytime, Any Team is the ability to shift focus from administrative tasks to profit-driving activities. Here’s how:

Strategic Planning: With payroll processes streamlined, management can devote more time to strategic planning and decision-making.

Employee Satisfaction: Timely and accurate payments enhance employee satisfaction and retention, reducing turnover costs.

Scalability: As the business grows, Pay Anytime, Any Team scales with it, ensuring that payroll management remains efficient and effective regardless of the company’s size.

Managing a global workforce doesn't have to be a logistical nightmare. With Pay Anytime, Any Team, businesses can simplify their payroll processes, ensuring compliance, security, and efficiency. This streamlined approach allows companies to focus on their core objectives, driving profits and growth.

Adopting a modern payroll solution is not just about managing payments; it's about empowering your business to thrive in a competitive global market. By choosing Pay Anytime, Any Team, you're not just improving your payroll system—you're investing in your business's future success.

Ready to transform your payroll process and focus on what truly matters? Book a demo to discover the benefits of Pay Anytime, Any Team today and take the first step towards seamless global workforce management.

0 notes

Text

A New Era of International Finance: Zero Forex Markup Solutions

Introduction:

In today's interconnected world, international transactions have become a common occurrence. However, hidden fees associated with currency conversion can often leave a dent in our wallets. Enter zero forex markup cards, the unsung heroes of hassle-free international spending.

Understanding Forex Markup:

Forex markup is the sneaky fee applied by traditional credit/debit cards when making transactions in foreign currencies. These markups may seem insignificant at first glance but can accumulate into substantial amounts over time, especially for frequent travelers and online shoppers.

Introducing Zero Forex Markup Cards:

Zero forex markup cards, as the name suggests, eliminate these additional fees, offering a transparent and cost-effective solution for international transactions. Imagine being able to spend freely without worrying about unexpected charges eating into your budget – that's the beauty of zero forex markup cards.

Benefits of Zero Forex Markup Cards:

Cost Savings: By waving goodbye to forex markups, users can save a significant amount on transaction fees, making every penny count.

Transparency: Zero forex markup cards provide clarity in pricing, ensuring that users are fully aware of the costs associated with their transactions.

Convenience: With a zero forex markup card in hand, travelers and shoppers can enjoy the convenience of seamless international spending, without the hassle of calculating conversion fees.

Factors to Consider When Choosing a Zero Forex Markup Card:

Annual Fees: While some cards may boast zero forex markups, it's essential to consider any associated annual fees and weigh them against the potential savings.

Additional Perks: Look out for cards that offer additional benefits such as travel insurance, rewards programs, or exclusive discounts.

Acceptance: Ensure that the card is widely accepted globally, allowing you to make transactions with ease wherever you go.

Conclusion:

Zero forex markup cards are a game-changer in the world of international finance, offering users the freedom to spend without boundaries. Whether you're a globetrotter or an avid online shopper, consider harnessing the power of zero forex markup cards for a seamless and cost-effective experience.

Join the conversation by sharing your experiences with zero forex markup cards or ask any questions you may have. Let's make international spending a breeze together!

#InternationalFinance#ForexMarkup#CurrencyConversion#ZeroMarkup#FinancialInnovation#GlobalPayments#TransparentTransactions#FintechRevolution#TravelMoney#CostSavings

0 notes

Text

Why Forex Trading Business Needs a Forex Merchant Account

At Payment Clarity, we provide top-tier Forex Merchant Account solutions tailored to your business needs. Whether you're trading in different currencies or managing high-volume transactions, we’ve got you covered. Trust us to deliver clarity and efficiency in every payment.

0 notes

Text

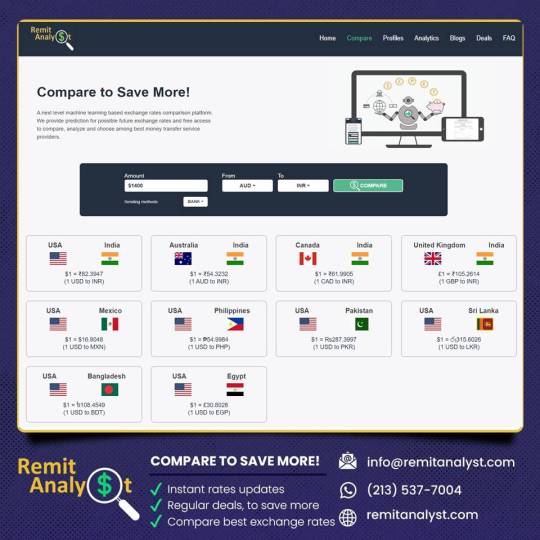

RemitAnalyst: Compare to Save More on Money Transfers!

Introduction: Welcome to RemitAnalyst, your one-stop destination for comparing and choosing the best money transfer service providers. With our free access and real-time exchange rate information, you can make informed decisions and save more on your international money transfers. Say goodbye to hidden fees and unnecessary expenses - let's dive in and discover how RemitAnalyst can empower you to transfer money wisely!

Why Compare Money Transfer Services? When it comes to sending money overseas, finding the right money transfer service is crucial. Exchange rates and fees can vary significantly between providers, impacting the total amount your recipient receives. RemitAnalyst is here to simplify this process by offering an intuitive platform that allows you to compare different service providers effortlessly.

Real-Time Exchange Rate Information: Our platform provides up-to-date exchange rate data from various sources, ensuring you get the most accurate information when making your decision. Knowing the current rates allows you to seize the best opportunities to transfer money when the rates are favorable, maximizing the value of your transfers.

Transparent Fee Structures: RemitAnalyst believes in transparency. We understand that hidden fees can be frustrating and impact your overall savings. That's why we display comprehensive fee information for each service provider, allowing you to see the complete picture before making a decision. With us, you'll never encounter unpleasant surprises when it comes to fees.

Secure and Reliable Service Providers: Your trust and security are our top priorities. We partner with reputable and trustworthy money transfer service providers that adhere to the highest industry standards. You can rest assured that your hard-earned money will reach its destination securely and efficiently.

User-Friendly Comparison Tools: Navigating through various money transfer options can be overwhelming, but not with RemitAnalyst! Our user-friendly comparison tools help you filter and sort the options based on your preferences. Whether you prioritize speed, cost-effectiveness, or destination, we've got you covered.

How to Use RemitAnalyst:

Using RemitAnalyst is a breeze! Follow these simple steps to find the best money transfer service for your needs:

Enter Your Transfer Details: Start by specifying the amount you wish to send and the destination country. Our platform will automatically generate a list of available service providers.

Compare Providers: Explore the list of service providers along with their exchange rates and fees. You can also check out customer reviews and ratings to gain insights into their reputation.

Choose Wisely: Based on your analysis, select the money transfer service that aligns best with your requirements and budget.

Initiate the Transfer: With a few clicks, you can initiate the transfer directly through RemitAnalyst, saving you time and effort.

Conclusion: Make the most out of your international money transfers with RemitAnalyst! Our user-friendly platform, real-time exchange rate information, and transparent fee structures empower you to compare and save. Don't settle for less; choose the best money transfer service for your needs with RemitAnalyst by your side. Start comparing now and unlock a world of possibilities for hassle-free money transfers!

0 notes

Text

Level up your banking experience with Monay, A Global Payment Solution from Tilli Software.

Level up your banking experience with Monay, A Global Payment Solution from Tilli Software.

At Monay, we're all about empowering you with fully functional and scalable financial products that cater to your unique needs. Our Global Payment System ensures faster and smoother transactions and empowers you to accept ACH and wire transfers effortlessly.

Curious to learn about Monay, just drop a “YES” in the comments below, and our team will reach out to you in a jiffy!

For more information visit → https://tilli.pro/monay/banking

#utility industry#gps#globalpayments#paymentsolutions#application#software#crm#banking#money#finance#business#payments#ecommerce#merchantservices#paymentprocessing#utility#bills#banks#baas#SendMonay#receive money#app#entrepreneur

0 notes