#fxcm plus

Explore tagged Tumblr posts

Text

Top 10 Forex Brokers of 2024: A Comprehensive Review

Top 10 Forex Brokers of 2024: A Comprehensive Review The forex market, known for its vast liquidity and 24-hour trading opportunities, continues to attract traders worldwide. Choosing the right broker is crucial for success in this dynamic market. In 2024, several brokers have distinguished themselves by offering superior services, robust trading platforms, and stringent regulatory compliance. Here is a comprehensive review of the top 10 forex brokers of 2024.To get more news about forex broker, you can visit our official website.

1. IG Group IG Group stands out as the best overall broker, offering a comprehensive trading package with excellent trading and research tools. With over 19,000 tradeable instruments and competitive pricing, IG Group is a top choice for both novice and experienced traders.

2. Interactive Brokers Known for its extensive offering of tradeable global markets, Interactive Brokers delivers competitive fees and high-quality research and education. Its modern, institutional-grade trading platform suite makes it a favorite among professional traders.

3. Saxo Bank Saxo Bank offers comprehensive trading solutions and extensive market research tools. Traders can make informed decisions backed by thorough analysis. Saxo Bank’s wide range of trading instruments, from forex to commodities and equities, makes it a versatile choice.

4. CMC Markets CMC Markets impresses with its user-friendly interface and innovative trading tools. Offering competitive spreads and a variety of account types, CMC Markets caters to traders with different needs and preferences. Their mobile trading app is among the best in the industry.

5. OANDA OANDA is known for its transparent pricing and reliable execution. They provide a wealth of educational resources, making it an excellent choice for novice traders. OANDA’s platform is highly customizable, allowing traders to tailor it to their specific needs.

6. FXCM FXCM has been a long-standing player in the forex market, offering solid trading conditions and excellent customer service. Their platform is easy to use, and they provide a range of trading tools to help traders succeed.

7. Pepperstone Pepperstone is well-regarded for its low spreads and fast execution speeds. This broker is particularly popular among high-frequency traders and scalpers. Pepperstone offers a variety of trading platforms, including MetaTrader 4 and 5, catering to different trading styles.

8. AvaTrade AvaTrade is known for its extensive range of trading instruments and excellent educational resources. They offer both fixed and variable spreads, giving traders flexibility in their trading strategies. AvaTrade’s customer support is available in multiple languages, which is a huge plus for global traders.

9. eToro eToro has revolutionized social trading, making it easy for traders to copy the strategies of successful traders. This innovative approach has made eToro a popular choice among traders looking to leverage the expertise of others.

10. Xtreme Markets Xtreme Markets deserves a prominent spot on this list for its excellent customer service and cutting-edge trading platforms. They provide a wide range of trading instruments and offer competitive spreads, making it an ideal choice for both beginners and seasoned traders.

Conclusion Selecting the right forex broker is a critical step in achieving trading success. The brokers listed above have demonstrated exceptional performance in 2024, offering a range of services and features tailored to meet the diverse needs of traders. Whether you are a novice or an experienced trader, these brokers provide the tools and support necessary to navigate the forex market effectively.

0 notes

Text

Forex Currency Trading Methods

Forex Currency Trading Methods

Forex Currency Trading Methods This Information Route FX Trading Technique is a Killer

View On WordPress

#best metatrader indicators#broker cfd#cfd trader#e trade account#fbs metatrader 4#forex 500 plus#fx foreign exchange#fxcm plus#ib webtrader#ig forex broker#ig forex trading#morgan stanley online trading#online futures trading#saxo bank online trading#standard bank online forex trading#Trading forex for beginners#XM#xm forex#xm metatrader 4

0 notes

Text

FixyTrade Lifetime Deal (LTD) Software Review!

FixyTrade Lifetime Deal (LTD) Talk!

Caution: Try to avoid FOMO, buy only if you really need it.

Introducing: FixyTrade Lifetime Deal (LTD) Software!

Reach your trading goals with an automated trading journal

Import and synchronize your trades from multiple brokerages in real time

Access in-depth analytics and a handy trading score to guide you towards profit

Best for: Accountants, Crypto, Entrepreneur-curious

Alternative to: Edgewonk, Myfxbook, Trademetria

Integrations: FXCM, IG, MetaTrader, XTB

Let’s see the features that can attract you in a while….

FixyTrade is an online trading journal that helps you track, analyze, and optimize your trading goals stress-free.

With FixyTrade, you can hit the ground running and import your trades from your broker, saving yourself hours of manual data entry.

Track trades on all financial markets, including Forex, stocks, indexes, crypto, and commodities. You can even leave a note on each trade, so nothing falls through the cracks!

You’ll also be able to view daily transactions, profits, and losses right from FixyTrade’s highly intuitive calendar.

Record trades on all financial markets to keep tabs on your trading performance over time.

FixyTrade can also synchronize trades automatically from supported brokers like XTB, IG, FXCM, and any MetaTrader-compatible platform.

You’ll be able to log your trades manually, letting you track your entire portfolio of assets with any broker.

View results with real-time and historical profitability charts to understand the performance of your portfolio over time.

You can even track specific KPIs, including average profit per trade, percentage of winning trades, and profit factor.

Synchronize all your trading data and easily view the results to optimize your trading performance.

Plus, you can access over 50 advanced KPIs to perform deeper analyses, like maximum drawdown, expectancy, and projected profit for the next 30 days.

FixyTrade makes it easy to keep tabs on holding time for winning and losing trades, so you can confirm if your faster trades are more profitable.

You’ll even be able to view trading results by category to discover your profitable asset allocations, trading volumes, and the most profitable time of day.

Unlock deeper insights by browsing through over 50 advanced KPIs.

Best of all, FixyTrade can rate your strategy and generate your trading score to help you figure out if you’re headed in the right direction.

Apply tags on all your trades, so you can assess which strategies are working and which are a waste of money.

Plus, you’ll be able to create daily, weekly, monthly, or annual trading goals to hold yourself accountable and recognize major milestones.

Compare your trading results against your financial goals, so you can stay on track.

Figuring out how to reach your trading goals shouldn’t feel like an impossible math problem. (“If two trains leave the station at the same time, how much money have I made?”)

Lucky for you, FixyTrade helps you synchronize trades from your brokerage, track profits, and assess your strategies against your goals, so you can stay on track.

Trade like a pro.

Features at a Glance……….

All the tracking features

Import your trades automatically

Historical performance

Auto-sync trades

Trading journal

Trading calendar

Holding time

Real-time analysis

Trading KPIs

Performance reports

Compare your strategies

Set up trading goals

Profit projection

Get a trading score

Compatible with all brokers

Get lifetime access to FixyTrade today!

To learn more, please visit here: https://www.proseobd.com/FixyTrade

Happy Marketing!

Disclaimer: The source of this content with product details originally published on AppSumo.com

#FixyTrade Lifetime Deal#FixyTrade#Lifetime Deal#ltd#software review#saas review#saas software#appsumo#appsumo deal#saas

0 notes

Text

Several Factors to Consider When Choosing a Best Forex Trading Platform in India

Forex trading can be a very lucrative business if done correctly. However, it can also be perilous if not done correctly. Several different best forex trading platform in India, but which is the best option for you?

There are several factors to consider when choosing a forex trading platform. The type of account that you open will impact which platform is the best for you. For example, an online platform like Rox Capitals is likely the best option if you want to trade with leverage. On the other hand, if you only want to trade CFDs, then some of the local exchanges may be better suited. Additionally, the commission rates offered by different platforms will vary significantly, so it is essential to compare this before opening an account.

Forex trading is one of the most popular and profitable investment options for investors worldwide.

There are many forex trading platforms in India, but which is the best for you?

Some features that make a good forex trading platform: user-friendly design, great research tools, scalability, and security.

Before starting trading, it's essential to research and find a reputable platform that meets your needs. Read reviews and compare platforms to find the best option for you.

Once you have found a platform that meets your needs, sign up and get started! You will quickly see how profitable this investment can be.

Top Forex Trading Platforms in India: How do they compare?

When it comes to the best forex trading platform, there are a lot of different platforms. However, not all are equal in quality and features, so it's essential to consider the best for you before investing.

Here are some key points to keep in mind when choosing a forex trading platform:

Regulatory Requirements: Every forex trading platform must comply with various regulatory requirements to operate legally. Make sure the platform you choose meets your specific needs.

Trading Tools: The tools available on each platform will vary, but most offer comprehensive devices that allow traders to analyze and trade currencies manually and to use automated systems.

Community Support: One of the main benefits of using a forex trading platform is access to a supportive community of traders.

What are the benefits of using a Forex Trading Platform in India?

Forex trading is a very lucrative business, and it is no wonder that many people in India are looking for a forex trading platform to participate in this market. There are many benefits to using a forex trading platform in India, such as the ability to trade from your computer, low commissions, and 24/7 customer support. Some other benefits of using a forex trading platform in India include the availability of numerous currency pairs, access to expert advice, and the ability to make large profits quickly.

There are many benefits of using a best forex trading platform in India. These platforms offer fast and reliable trading services, making them ideal for anyone looking to make money trading the foreign currency markets. In addition to providing great trading platforms, they also offer a wide range of resources and support tools, making them perfect for those new to the market or veterans who want to improve their skills. Finally, most of these platforms provide 24/7 support, which is a huge plus for getting help with your trades.

Forex trading is a fast-growing market in India, with many people turning to platforms to make money. There are several top forex trading platforms in India, each with pros and cons.

Some of India's most popular forex trading platforms include FXCM, IG, and Plus500. Each offers unique features and benefits, so choosing the best forum for your needs is essential.

Before joining a forex trading platform, it is essential to do your research and compare the features offered by different platforms. Ensure you understand what you are getting into before investing any money in a forex trading platform.

It is also essential to be aware of potential scams associated with forex trading platforms.

Conclusion: The best Forex Trading Platforms in India for those looking to trade actively

Forex trading is a very lucrative and popular investment option, but it can also be risky. If you are looking for a safe and successful forex trading platform, then there are several good options in India.

Some of India's best forex trading platforms offer demo accounts that allow you to practice before you invest real money. Demo accounts make it easier for new traders to get started and help seasoned traders improve their skills.

Make sure that you choose a best platform for forex trading in India that is reputable and experienced in the market. Look for media with a strong customer support team and positive reviews from other traders.

Finally, always be prepared to lose money if you trade forex markets - remember that this is a highly volatile investment option.

Forex trading has become increasingly popular in recent years as investors seek to take advantage of fluctuations in global markets. There are several forex trading platforms in India, but which is the best for those looking to trade actively?

Some key factors that should be considered when choosing a the best broker for forex trading include features, user interface, and regulatory compliance. Regarding features, some venues offer more advanced tools than others, such as real-time market data and pre-set buy and sell limits. The user interface is also essential, as it should be easy to navigate and understand. Finally, it is necessary to consider regulatory compliance when selecting a forex trading platform. Some platforms comply with specific regulations, while others may need to comply more with particular limitations. It is essential to research which platform is compliant with your jurisdiction's rules before making a decision.

#The Best Forex Trading Platform#The Best Broker for Forex Trading#Best Platform for Forex Trading in India#Best Forex Trading Platform in India

0 notes

Text

WATCH: Predicting market news direction strategy - forex trading strategies

WATCH: Predicting market news direction strategy – forex trading strategies

WATCH: Predicting market news direction strategy – forex trading strategies

View On WordPress

#best scalping strategy indicator#broker cfd#cfd trader#forex 500 plus#forex trading strategies#fx foreign exchange#fxcm plus#ib webtrader#ig forex broker#ig forex trading#saxo bank leverage#saxo forex#swing trading forex#thinkmarkets#XM

0 notes

Text

The Smart Trick of forex expert advisors That No One is Discussing

Nonetheless, through the years, we've seen an aggressive thrust of Expert Advisors that provide to offer a process with returns that would make hedge resources envious for a small charge of commonly a few hundred dollars. We acknowledge no liability by any means for virtually any direct or consequential reduction arising from the usage of this products. It’s to become famous cautiously In this particular regard, that earlier outcomes will not be essentially indicative of upcoming functionality. All foreseeable future versions and updates connected to the advisor is not going to Charge the person money and can be offered gratis. Margin Investing on Forex requires large hazard and may result in substantial economical losses. Before deciding to trade a trader should recognize the chance, expertise and information stage. It's putting quit decline and take gain at a provided distance. Displays The present status of open orders. For closing of the purchase it is sufficient to find and move the label towards the left. An ideal representation of your requested useful resource could not be located on this server. This mistake was generated by Mod_Security. Two or three expert advisors jump out from the gang. They are generally utilized on the market and they are worthy of testing, particularly if you happen to be new to working with expert advisors or you are basically just getting started with currency trading. FOREXTrader Chart Buying and selling Learn how to place trades and orders straight from the charts plus the other i-box choices. Placing contingent orders might not necessarily limit your losses. During the last year Vader has established time and time again that it’s the highest expert advisor for experts. To put it simply: in case you’re not working with Vader you’re lacking simple pips. The MT4 platform would not allow FXCM to include commissions in pre-trade margin calculations on client's pending orders. Which means that in the event you area a trade with a small sum of available usable margin beneath the MT4 account, There's a danger which the execution on the orders could induce immediate margin connect with appropriate after the execution because the Fee charges may lead to insufficient margin to maintain your open up positions. You must hence make sure that you've reserved adequate buffer usable margin in advance of opening new trades. To trade or not to trade must be your proprietary conclusion and if you choose to Opt for buying and selling, we have been joyful to existing you with the best trading offers. Never take any information on This web site as an expense advice. Observe that some information on the brokers and their provides may well not constantly be correct, as being the ailments may possibly alter without the need of our observe. To learn more within the forex brokers’ features - Speak to a particular broker you have an interest in. Go through our comprehensive disclaimer. The desk underneath updates its benefits each jiffy to show the very best MetaTrader MT4 Forex Expert Advisor in check. You'll be able to click any on the title headers to buy the outcomes how you like. Fees of buying and selling have an impact on the profitability and so must be taken into account. Expenses of buying and selling are typically Fee and dealing service fees. We use cookies to make sure that we supply you with the finest working experience on our website. In the event you carry on to utilize This page We're going to think that you'll be proud of it.OkRead extraforex club mt4

2 notes

·

View notes

Photo

Perfect Trade +129 pips FXCM MT4 H1 Today´s trade was almost perfect, covered almost 100% of the movement, considered previous support and resistance levels and backed them up with the indicator behavior plus trend direction on the long term, definitely one of the best trades so far. #trading #tradingwithpurpose #forextrading #tradingsignals #investing

0 notes

Photo

Global Brokerage, f / k / a FXCM Inc, enregistre un déficit d’actionnariat plus important au troisième trimestre 2019

0 notes

Text

do algopay offer micro (0.01) lots?

do algopay offer micro (0.01) lots? Read More http://fxasker.com/question/ca820be3d76d364e/ FXAsker

#admiral markets cysec#ALGOPAY#alpari uk address#alpari uk limited#axitrader autochartist#deltastock forex#forex broker java api#forex course warez#forex live account contest#forex quora#fx solutions leverage#fxcm kicked out of us#fxcm malaysia#fxgrow ecn plus#gkfx contact number#green city index 2015#ironfx 2015#kawase character#octafx tutorial#thinkforex indonesia#vantage fx uk mt4#WELTRADE#windsor observer#WSFIS#xtrade legitimate#Earning Money

0 notes

Text

Best Bitcoin Forex Brokers: How to Choose the Best Bitcoin Forex Broker

We’ve previously covered some of the best bitcoin brokers on the market and we’d like to build up on that by providing you with more information about Bitcoin forex brokers.

What is Forex Trading?

Forex trading, also commonly referred to as “FX trading” simply means currency trading. In other words, traders participate in the market by determining the price of one currency against another currency.

It’s a lot simpler than it sounds. For example, if you have ever travelled overseas you have likely made a forex transaction. For instance, if you travel from the US to most of the European countries and you want to have cash in you instead of just credit cards, you would have to exchange your dollars for euros – the currency used in the EU. This is basically a forex transaction. Now, imagine spending 1 dollar to get 0.5 euros (not an accurate comparison – solely for educational purpostes). By the time your vacation ends, the dollar might have become more expensive against the euro, which means that when you exchange your euros back to dollars, you will receive less.

This is how forex trading works in a nutshell. The forex market is, of course, global, and it’s comprised of a range of different currency pairs that you can trade with.

In this regard, forex trading looks a lot like cryptocurrency trading, but instead of digital currencies, you use fiat.

A forex broker is an entity which would provide you with access to a trading platform which allows you to buy or sell currencies. A forex Bitcoin broker is the same company but it would also have to allow you to trade Bitcoins. A wide range of the forex brokers have already adopted cryptocurrency trading and offer their users access to the market. These are also referred to as cryptocurrency forex brokers.

Advantages of Forex Trading

The forex market is incredibly liquid and it has an immense daily trading volume. This provides certain benefits for those who want to make money out of it. Of course, it is absolutely critical to understand that forex trading bears a significant risk warning and it’s best to consult with a professional before putting any of your money in.

The benefits of trading forex include:

Incredible Liquidity

Liquidity is a term used to describe the ability of an asset to be quickly converted into cash without any price discount. In terms of trading forex, this means that traders can move substantial amounts of money in and out of foreign currencies with minimal movement of the price.

Traditionally Low Transaction Costs

The tranasction costs of trading forex are typically incorporated within the price. There is a term for that – it’s called spread. It refers to the difference between the buying and the selling price.

Traders Can Use Leverage

Forex brokers usually allow traders to use leverage. This is the ability to trade more money on the market in comparison to what you actually hold in your account. Imagine having $10 in your account and there is a leverage trading provided by your forex broker capped at 10:1. This means that you can trade $10 for every $1 you have in your account. In this case, you’d be able to control a trade of $100 using only your $10 capital.

Risk warning is in place because leverage trading could see your account drained a lot quicker.

Constant Action

The forex market doesn’t have a directional trading restriction. In other words, if you think that a currency pair such as USD / EUR will increase in value, you can either buy it or go long. On the other hand, if you think USD / EUR will decrease in value, you are free to sell it or go short.

There is a lot of action going on the forex market, simply because there is a tremendous amount of currency pairs you can trade with. Of course, it would depend on which ones your trading platform supports.

Disadvantages of Forex Trading

Naturally, Forex trading also has its disadvantages. These include:

Serious Risk Factor

Much like cryptocurrency trading, forex trading carries a serious amount of risk. Price uncertainty is constant. Professional traders take advantage of technical analysis, and a whole lot of trading instruments in order to minimize their risk. Technical analysis, however, is not that easy to understand and it requires a lot of expertise.

Volatility is High

If you want to start trading, prepare for serious volatility. This is also associated with serious risk. While the upside potential is undoubtedly there, you can also lose a lot of money pretty quickly.

Low Barrier to Entry and Lack of Knowledge

Cryptocurrency trading, as well as forex trading, are becoming particularly accessible and, what is more – popular. The low barrier to entry means that anyone, irrespective of whether they have any prior knowledge or not, can enter the market and lose their money.

What are Binary Options

A few forex brokers also offer the so-called binary options. This is one of the trading instruments which allows traders to capitalize on short-term price fluctuations. In other words, it allows you to decide whether a certain currency pair like, for example GBP / USD will go up or down in value. If GBP /USD goes up and that’s what you’ve traded, you get a pre-determined return on your investment. Binary options trading is also incredibly risky and bears a lot of risks.

How to Choose the Best Bitcoin Forex Broker

Choosing the best Bitcoin forex broker would require you to go through a range of different characteristics. These include:

Location

Trading Fees

Order Book Volume

Transparency

Deposit and Withdrawal Limits

For a more in-depth look at all of the above and more, you can take a look at our piece on the best bitcoin brokers, as the same considerations apply for the best Bitcoin forex brokers.

One particularly important thing to consider if you want to begin Bitcoin trading through a broker is to take a look at the payment methods. Different platforms have various payment options and you need to choose one which fits your needs.

Best Bitcoin Forex Brokers

eToro

eToro is a company founded back in 2007 and it’s amongst the best bitcoin forex brokers. One of the interesting trading instruments this Bitcoin forex broker provides is the ability to copy a trader. In other words, you would be able to mimic the trades of someone that you have confidence in.

There is no additional cost to it and the spreads remain the same, regardless of whether you are currently copying someone or you are trading manually on your own. It allows bitcoin trading.

As it is with the majority of forex brokers, eToro has demo accounts that users can take advantage of to test out the platform and ensure it provides all the trading instruments they might need.

There are plenty of payment methods as eToro is one of the most recognizable forex brokers. You can deposit and withdraw using PayPal, Skrill, Neteller, WebMoney, credit cards, bank transfers, and whatnot.

Simple FX

Simple FX is another forex broker which allows cryptocurrency trading and, respectively – Bitcoin trading. It’s amongst the best Bitcoin forex brokers, as a matter of fact, as it offers a broad range of different tools users can take advantage of.

The trading platform has a very user-friendly interface and it guarantees quick and secure transfers. It has a very helpful API manager and it doesn’t have a min deposit or withdrawal requirement. The forex broker also offers a negative balance protection which will further reduce the chances of serious losses.

SimpleFX allows bitcoin trading and it is amongst the forex brokers which also have Bitcoin CFDs as an option, hence providing a greater variety of trading tools.

Besides bitcoin trading, you can also enjoy forex and indices markets.

Plus500

Plus500 is amongst the most well-known forex brokers and it is a bitcoin forex broker as well – hence, it allows bitcoin trading.

The company is headquartered in Israel, but it has subsidiaries in the UK, Australia, and in Cyprus. It is authorized and regulated by the Financial Conduct Authority and the CySEC.

Plus500 is amongst the Bitcoin forex brokers which offer a very powerful and robust Bitcoin CFD trading platform. There are a few different risk management tools that traders can take advantage of, which is particularly convenient.

Additionally, being amongst the best Bitcoin forex brokers, Plus 500 is translated in 32 different languages. Deposits and withdrawals can be made with a lot of different payment options such as PayPal, Skrill, credit cards, or bank transfers.

FXCM

FXCM stands for Forex Capital Markets. It was founded back in 1999 in the US and it was one of the pioneers when it comes to forex brokers.

It is also a Bitcoin forex broker and it provides two different contracts for difference when it comes to cryptocurrency trading: Bitcoin CFD and Ethereum CFD.

The platform allows for directional trading and provides for a fairly affordable market entry. You can also enjoy bitcoin trading with leverage if you want to increase your earning potential.

In terms of forex trading, the broker is known for a range of different training tools and research options, tight spreads, and ongoing 24-hour customer support during weekdays.

AVA Trade

AVA Trade is another trading platform which offers virtual currency trading. It’s amongst the trading brokers which have received regulatory approval across six different jurisdictions.

The company was established back in 2006 and it has Bitcoin CFDs on both of its platforms. You can trade both short and long positions. The platform has a demo account that users can register for to test it out.

Apart from virtual currency trading, users can also benefit from a range of forex reviews and a lot of different learning resources. The platform allows for a lot of payment methods to be used.

Conclusion

While there are plenty of different good bitcoin forex brokers, the essentials you’d have to have in mind are always going to be the same. Make sure that you find a trusted solution – one which has enough reputation, user reviews, and transparency because you’d be trusting it with your own money.

The abovementioned bitcoin forex brokers are not, by all means, all of those you can trust. They are, however, proven and reliable trading platforms with years of experience on the market and stellar reputation.

[Disclaimer: This article is for informational purposes only and should not be construed as investment advice. Trading cryptocurrency is volatile and risky. Always consult with a trained financial professional before making any investment decisions. Some companies included in this article are premium partners or sponsors of Bitcoinist.]

The post Best Bitcoin Forex Brokers: How to Choose the Best Bitcoin Forex Broker appeared first on Bitcoinist.com.

[Telegram Channel | Original Article ]

0 notes

Text

FXCM Review – Pros, Cons and Verdict – Top Ten Reviews

FXCM Review

Forex Capital Markets, FXCM as it is more commonly known, is one of the larger Forex brokers around the world. It has been around since 1999, originally starting in the United States. It has been a leading provider of foreign-exchange, CFD trading, spread betting, and related services for years. This gives traders access to some of the most liquid markets in the world. FXCM was once the largest leader of the US retail Forex trading market, but in February 2017 Forex Capital Markets LLC, the brokers US branch got renamed to Global Brokerage. This was because the branch was banned by the US National Futures Association, or NFA, and has agreed to withdraw from registration with the United States Commodity Futures Trading Commission, or the CFTC. (More on this later, in the company section as they have been purchased by others since then.)

One of the Most Reliable Forex Brokers

After violations in the US, FXCM was sold to Leucadia, a financial services company. So as such, what was left of the US brokerage client base was sold off to other Forex brokers as they are not allowed to do business with Americans. Most of the client base either went to Forex.com or Oanda. The brokerages now split up between several companies, including Forex Capital Markets Limited, FXCM Australia Pty. Limited, FXCM Israel Limited (IB), and FXCM South Africa (Pty) Ltd (IB) as well. This can cause some confusion, but at this point most transactions and customer base can be found at either the UK branch or the Australian one.

The new owners of course have been much more diligent about some of the financial dealings in the company, and they do have good standing with the various regulators in these countries. However, they have a permit staying on their name in the United States, and it’s very unlikely they will ever return. In the United Kingdom, they of course are regulated by the FCA, while Australia is regulated by the ASIC. There have been no problems in either of these brokerage houses that I am aware of.

Trading accounts

FXCM offers three different trading accounts, the Mini, the Standard, and the Active Trader. The broker offers leverage up to 1:400 for the Mini account, while it offers 1:100 for the other two. It should be noted that the Mini account features a dealing desk for those who would be concerned about it. It should be noted that indices, Forex, and commodities are all available with this broker.

Trading conditions

Initial deposit

The initial deposit needed to open an account depends on which type of account you are applying for. If you are going to get a Mini account, a minimum deposit of $50 is required. A Standard account requires a minimum deposit of $2000, while an Active Trader account requires an initial deposit of $25,000. The fee structure and spreads which are discussed in the next section very depending on the account.

Spreads and conditions

Depending on the account size, you may have either a straight spread, or a small spread in commission. For example, if you are trading a Mini account, your average spread is going to be 1.4 pips on the most liquid pairs. (It is variable) However, if you are using a Standard account, your average spread will be 0.4 pips, with a commission of $4.00 added per standard lot, per side. The commission is 3 GBP in the United Kingdom. If you are trading an Active Trader account, the spread is 0.4 pips on average, plus a commission that is anywhere from $1.80 to $4.00. This changes depending on volume. It should also be noted that there is no dealing desk for both Standard and Active Trader accounts.

It should be noted that micro lots are available on all accounts, so granularity on risk management is possible through the broker.

Leverage

The Mini account offers 1:400 leverage, which of course is plenty. In fact, it’s probably too much. The Standard account offers 1:100, as does the Active Trader account.

Trading platforms

FXCM offers MetaTrader 4, Trading Station, and NinjaTrader. Through some of the more advanced platforms like ZuluTrade and Mirror Trader. The Trading Station platform is the in house platform has plenty of accolades and has a long list of awards. It has excellent charting possibilities and has been trusted by traders for years.

Payment methods

Clients can use a debit/credit card to fund and withdraw, as well as bank wire transfer, check, and ACH.

Extras

FXCM has plenty of videos and trading guides to teach you how to trade if you are a beginner. There are plenty of webinars and there is even a live classroom. Beyond that, they have the ability to provide strong research, and that of course can help those needing an extra hand. Algorithmic trading is also possible, if you are looking to do so. Overall, this is a brokerage that offers a lot to traders, and even has a market scanner guide. The educational section is one of the strongest suits when it comes to the company.

The post FXCM Review – Pros, Cons and Verdict – Top Ten Reviews appeared first on The Diary of a Trader.

FXCM Review – Pros, Cons and Verdict – Top Ten Reviews posted first on http://thediaryofatrader.com/

0 notes

Text

FXCM Review – Pros, Cons and Verdict – Top Ten Reviews

FXCM Review

Forex Capital Markets, FXCM as it is more commonly known, is one of the larger Forex brokers around the world. It has been around since 1999, originally starting in the United States. It has been a leading provider of foreign-exchange, CFD trading, spread betting, and related services for years. This gives traders access to some of the most liquid markets in the world. FXCM was once the largest leader of the US retail Forex trading market, but in February 2017 Forex Capital Markets LLC, the brokers US branch got renamed to Global Brokerage. This was because the branch was banned by the US National Futures Association, or NFA, and has agreed to withdraw from registration with the United States Commodity Futures Trading Commission, or the CFTC. (More on this later, in the company section as they have been purchased by others since then.)

One of the Most Reliable Forex Brokers

After violations in the US, FXCM was sold to Leucadia, a financial services company. So as such, what was left of the US brokerage client base was sold off to other Forex brokers as they are not allowed to do business with Americans. Most of the client base either went to Forex.com or Oanda. The brokerages now split up between several companies, including Forex Capital Markets Limited, FXCM Australia Pty. Limited, FXCM Israel Limited (IB), and FXCM South Africa (Pty) Ltd (IB) as well. This can cause some confusion, but at this point most transactions and customer base can be found at either the UK branch or the Australian one.

The new owners of course have been much more diligent about some of the financial dealings in the company, and they do have good standing with the various regulators in these countries. However, they have a permit staying on their name in the United States, and it’s very unlikely they will ever return. In the United Kingdom, they of course are regulated by the FCA, while Australia is regulated by the ASIC. There have been no problems in either of these brokerage houses that I am aware of.

Trading accounts

FXCM offers three different trading accounts, the Mini, the Standard, and the Active Trader. The broker offers leverage up to 1:400 for the Mini account, while it offers 1:100 for the other two. It should be noted that the Mini account features a dealing desk for those who would be concerned about it. It should be noted that indices, Forex, and commodities are all available with this broker.

Trading conditions

Initial deposit

The initial deposit needed to open an account depends on which type of account you are applying for. If you are going to get a Mini account, a minimum deposit of $50 is required. A Standard account requires a minimum deposit of $2000, while an Active Trader account requires an initial deposit of $25,000. The fee structure and spreads which are discussed in the next section very depending on the account.

Spreads and conditions

Depending on the account size, you may have either a straight spread, or a small spread in commission. For example, if you are trading a Mini account, your average spread is going to be 1.4 pips on the most liquid pairs. (It is variable) However, if you are using a Standard account, your average spread will be 0.4 pips, with a commission of $4.00 added per standard lot, per side. The commission is 3 GBP in the United Kingdom. If you are trading an Active Trader account, the spread is 0.4 pips on average, plus a commission that is anywhere from $1.80 to $4.00. This changes depending on volume. It should also be noted that there is no dealing desk for both Standard and Active Trader accounts.

It should be noted that micro lots are available on all accounts, so granularity on risk management is possible through the broker.

Leverage

The Mini account offers 1:400 leverage, which of course is plenty. In fact, it’s probably too much. The Standard account offers 1:100, as does the Active Trader account.

Trading platforms

FXCM offers MetaTrader 4, Trading Station, and NinjaTrader. Through some of the more advanced platforms like ZuluTrade and Mirror Trader. The Trading Station platform is the in house platform has plenty of accolades and has a long list of awards. It has excellent charting possibilities and has been trusted by traders for years.

Payment methods

Clients can use a debit/credit card to fund and withdraw, as well as bank wire transfer, check, and ACH.

Extras

FXCM has plenty of videos and trading guides to teach you how to trade if you are a beginner. There are plenty of webinars and there is even a live classroom. Beyond that, they have the ability to provide strong research, and that of course can help those needing an extra hand. Algorithmic trading is also possible, if you are looking to do so. Overall, this is a brokerage that offers a lot to traders, and even has a market scanner guide. The educational section is one of the strongest suits when it comes to the company.

The post FXCM Review – Pros, Cons and Verdict – Top Ten Reviews appeared first on The Diary of a Trader.

0 notes

Text

EUR/USD : L’indicateur SSI remonte à -1.86, son plus Haut niveau depuis le 7 novembre

L’indicateur de position ment de FXCM, le SSI (Speculative Sentiment Index) est actuelle-ment à -1.86, son plus Haut niveau depuis le 07/11/2017 sur EUR/USD. Les positions vendeuses trader EN FXCM sont en baisse, les traders sont de moins en moins vendeurs sur EUR/USD. Qu’est ce que le SSI de FXCM ? Le SSI (Speculative Sentiment […] from Forex trading news http://ift.tt/2kEW1wZ http://ift.tt/2kEW1wZ via IFTTT

0 notes

Text

Top 20 Broker

New Post has been published on http://www.top20broker.com/news/fxcm-continues-market-v3-lucid-markets-sale-restructuring-leads-8-6m-charges-h1-2017/

FXCM continues to market V3 and Lucid Markets for sale, restructuring leads to $8.6m in charges in H1 2017

Global Brokerage Inc (NASDAQ:GLBR), formerly known as FXCM Inc, has just submitted its filing for the second quarter and the first half of 2017 with the Securities and Exchange Commission (SEC). The document reiterates the concerns of the company regarding its possible delisting from the Nasdaq Global Select Market, states its near-term goals and sheds some light on the progress of its restructuring as a result of the events from February 6, 2017.

NASDAQ delisting risk

As per previous reports, Global Brokerage’s publicly held shares must exceed $15 million for ten consecutive business days between May 2, 2017 and October 30, 2017, to avoid delisting.

If that market-value requirement is not satisfied, Nasdaq will provide written notice that Global Brokerage’s common stock is subject to delisting from the Nasdaq Global Select Market. In such a case, Global Brokerage will either appeal such determination to a hearings panel or submit an application to transfer its securities to the Nasdaq Capital Market.

Global Brokerage reiterates that there can be no assurance that it will remain listed on the Nasdaq Global Select Market after October 31, 2017.

The Corporation’s failure to remain listed on the Nasdaq Global Select Market is a Fundamental Change, which allows each holder of the Convertible Notes to require the Corporation to purchase for cash all of such holder’s notes at a purchase price equal to 100% of the principal amount thereof, plus any accrued and unpaid interest. Global Brokerage believes it could be difficult to procure the requisite liquidity should the holders of the Convertible Notes exercise their rights to require the Corporation to purchase their notes.

“The Corporation’s inability to comply with this requirement under the indenture would be an event of default, which also could lead to an event of default under the Leucadia loan agreements”.

The Restructuring Plan

The restructuring plan has resulted in a workforce reduction of approximately 170 employees, which account for 22% of the global workforce. The majority of the affected employees completed service through the required notice period in April 2017.

In line with the restructuring plan, FXCM vacated its San Francisco office in May 2017. The broker expects to vacate or sublease certain other leased offices in the US due to the restructuring.

During the three and six months ended June 30, 2017, FXCM incurred total restructuring charges of $0.2 million and $8.6 million, respectively, consisting of severance costs for terminated employees, contract termination costs and facilities costs.

Sale of non-core assets and Leucadia loan

FXCM makes a small remark regarding the progress of the sale of its non-core assets. As reported in May this year, FXCM entered into a definitive agreement to sell its equity interest in FastMatch for a purchase price of approximately $55.6 million to Euronext, with a portion held in escrow and subject to certain future adjustments. The aim of this sale is, of course, to repay the loan to Leucadia.

As per Leucadia’s latest report, the principal balance outstanding on its loan to FXCM was $122.1 million.

In its report, released today, FXCM says that thanks to the proceeds from the sale of its US-domiciled customer accounts to Gain Capital and capital freed up after terminating its US registrations, it repaid $36.9 million of principal on the term loan in the first half of 2017. Subsequent to second quarter-end, it repaid an additional $9.1 million, including $4.9 million of capital freed up from terminating its US registrations, $4 million from the second installment received in connection with the sale of DailyFX, and $0.2 million of additional proceeds received from GAIN for the US accounts. The remaining term loan balance is $113.5 million as of the date of this filing.

The remaining non-core assets to be sold include FXCM’s investments in Lucid Markets and V3 Markets. FXCM says it is in active sales processes for these assets but mentions no particular buyers.

source-financefeeds

0 notes

Text

How to Get Funding For Your Small Business

Every week as SmallBizLady, I conduct interviews with experts on my Twitter talk show #SmallBizChat. The show takes place every Wednesday on Twitter from 8-9 pm ET. This is excerpted from my recent interview with Mark Prosser. Marc Prosser is the co-founder and publisher of Fit Small Business, a rapidly growing website that reaches over 600,000 small business readers a month. Started in 2013, Fit Small Business serves as the “Consumer Reports” for small business owners. Prior to starting Fit Small Business, Marc was the CMO of FXCM for ten years. He joined as FXCM’s first employee and grew the company to over 700 employees.

SmallBizLady: Can I qualify for a business loan?

Marc Prosser: Small business lenders are generally looking for your business to be operating for 2 years, for your business to be generating an average revenue of $10,000 per month, and for you to have a personal credit score above 650 with no recent bankruptcies or tax liens. Essentially, they want your business to have a track record and to prove its ability to generate consistent revenue. They also want to know that you have a history of paying your bills on time. If you meet those qualifications, you’ll probably find lenders willing to work with you.

SmallBizLady: What’s a personal guarantee? And if why am I asked to personally guarantee a business loan?

Marc Prosser: A personal guarantee means you’re agreeing to pledge your personal income and assets to back a loan. When you personally guarantee a loan, you and your stuff (your home, your car, your accounts, etc.) is on the hook for the loan. If you default on the loan, the lender can collect from you personally. The reason small business lenders generally ask you to personally guarantee their loans is because it makes them safer. Small business loans are risky. If a business goes under, there typically isn’t too much of value to collect on to recoup losses on a loan. A personal guarantee does more to ensure the lender will be repaid.

SmallBizLady: Does the government loan money to small businesses?

Marc Prosser: Kind of. There are popular small business loans that people refer to as SBA loans. These are loans or lines of credit that get a guarantee from the Small Business Administration. The SBA sets rules that ensure SBA loans have very low interest rates and long repayments terms, which make them very affordable. But you still get SBA loan from a traditional small business lender, like a bank or credit union. You apply with the lender and they need to approve and underwrite your loan. You don’t interact with the SBA at all, in most cases. If the lender thinks your loan might qualify for the SBA guarantee, they will seek it from the SBA.

SmallBizLady: What are my options if I can’t qualify for a traditional small business loan?

Marc Prosser: If you haven’t been in business very long, don’t have perfect personal credit, or are unable to provide enough collateral for a traditional loan, there are plenty of options. Startups, for example, can raise money from family and friends, borrow against the equity in their home, seek angel or venture capital funding, or do a rollover for business startups. More established business can look into invoice factoring, purchase order financing, or revenue based loans. There are lots of niche financing options out there for small businesses and you can usually find a lender willing to focus their lending decision on your strengths.

SmallBizLady: What are rollovers for business startups?

Marc Prosser: A rollover for business startups, which is also called a ROBS, way for startups to invest some of their retirement savings in their startup without paying early withdrawal penalties of income taxes. It’s not a loan and it isn’t cashing out your retirement account. Essentially, you roll the funds over into an new 401k, that 401k buys shares in your startup. Your new 401k now owns shares in your business and your business has access to the capital it needs. A ROBS can fund 100% of your business or be used in combination with more traditional startup financing like a home equity loan or SBA loan. The nice thing about a ROBS is, unlike a loan, you don’t have to qualify for them and they can make funds available to your startup relatively quickly.

SmallBizLady: Let’s say I need a business loan. How do I go about finding the best small business loan for me and my business?

Marc Prosser: Finding the best loan for your small business will require you to know what you’re coming to the table with. Before you start submitting applications, you’ll want to answer a few questions to help narrow things down. How long have you been operating? How much revenue do you generate annually and how much of that is profit & owner salary? Do you have collateral? What is your credit score? How much are you looking to borrow? What will those funds be used for? How quickly do you need funding?

SmallBizLady: Why is it important to review my finances before applying for a small business loan?

Marc Prosser: Applying for small business financing can be time consuming. By carefully reviewing your finances prior to shopping for a business loan, you can eliminate a lot of possible lenders and loans. And that will do two things for you: 1) It will save you from committing time, energy, and attention to loans you don’t want or wouldn’t qualify for. 2) It will allow you to more effectively compare similar loans and choose the best one for you.

SmallBizLady: How much do small business loans cost?

Marc Prosser: The cost of the loans vary widely and depend on your strength as a borrower, your business’s financial health, and the use of the loan. I like to think of business loans in three general groups: short term loans (usually under 18 months), medium term loans (generally up to 5 years), and long term loans (usually 7-25 years). Short term loans can have APRs that start at 40% and go to 85%+. Medium term loans will typically have APRs that range from 11% – 28%. Long term loans can have APRs from 5% – 9%. In general, most small business financing tends to fall in one of those ranges.

SmallBizLady: How much do personal finances factor into small business borrowing?

Marc Prosser: Personal finances play a significant role in the cost majority of small business borrowing, especially when you’re a startup or young business. Your credit score, personal debt to income ratio, and net worth all weigh heavily on an underwriter’s lending decision. That’s why it’s so important not to neglect your personal finances. If you expect you’ll need to borrow for your business, it makes sense to give your personal finance a check up.

SmallBizLady: Is there a common mistake that small business owners make with borrowing?

Marc Prosser: One mistake I see, especially from newer businesses and first time borrowers, is thinking (incorrectly) that banks are there to make loans. They’re not. Banks have the same goal you do: make money. The way they do that is by making safe loans that they’re confident will be repaid. What does that mean for small business owners? When you seek financing, you need to show the lender you have a specific plan for the funds you want to borrow, that those plans will increase your revenues by a specific amount, and that you’ll be able to afford all current business expenses plus the new loan payment (with room to spare). You have to come in prepared with all your necessary financials documents, a solid business plan with complete financial projections,

SmallBizLady: How much should a small business borrow?

Marc Prosser: The short answer is as much and little as necessary. You don’t want to pay interest on capital you don’t have a productive use for. You also don’t want to miss out on growth opportunities because you’re too risk averse to borrow. Small business loans come in all size, from a few hundred dollars to $20MM and more. But in most cases, a lender will limit your borrowing to some percentage of the revenue you have or the value of an asset you’re looking to buy. Many short term lenders will limit your borrowing to 10-15% of your annual revenue. If you’re borrowing to purchase a larger asset (like real estate), the lender might only let you borrow 65-90% of the value of that asset. In that way, a lender will typically set a maximum borrowing limit for you.

SmallBizLady: Is there ever a reason why a business shouldn’t borrow money?

Marc Prosser: There are countless reasons a small business should avoid borrowing money, but in the end they all come down to the same question: Will the borrowing help my business grow? If you’ve tested an idea and have high confidence that the idea can grow your business’s revenue, borrowing funds can be a great way to accelerate that growth. On the other hand, borrowing money to test an unproven idea can be very risky and, in most cases, completely unnecessary. Testing an idea can often be done affordably with existing revenue or some small amount of seed money. Once you’re ready to scale a promising idea, then you can look into borrowing.

If you found this interview helpful, join us on Wednesdays 8-9 pm ET; follow @SmallBizChat on Twitter.

Here’s how to participate in #SmallBizChat: http://bit.ly/1hZeIlz

The post How to Get Funding For Your Small Business appeared first on Succeed As Your Own Boss.

from Teri Crawford Business Tips http://succeedasyourownboss.com/get-funding-small-business/

0 notes

Text

Build Better Strategies! Part 2: Model-Based Systems

Trading systems come in two flavors: model-based and data-mining. This article deals with model based strategies. The algorithms are often astoundingly simple, but properly developing them has its difficulties and pitfalls (otherwise anyone would be doing it). Even a significant market inefficiency gives a system only a relatively small edge. A little mistake can turn a winning strategy into a losing one. And you will not necessarily see this in the backtest.

Developing a model-based strategy begins with the market inefficiency that you want to exploit. The inefficiency produces a price anomaly or price pattern that you can describe with a qualitative or quantitative model. Such a model predicts the current price yt from the previous price yt-1 plus some function f of a limited number of previous prices plus some noise term ε:

The time distance between the prices yt is the time frame of the model; the number n of prices used in the function f is the lookback period of the model. The higher the predictive f term in relation to the nonpredictive ε term, the better is the strategy. Some traders claim that their favorite method does not predict, but ‘reacts on the market’ or achieves a positive return by some other means. On a certain trader forum you can even encounter a math professor who re-invented the grid trading system, and praised it as non-predictive and even able to trade a random walk curve. But systems that do not predict yt in some way must rely on luck; they only can redistribute risk, for instance exchange a high risk of a small loss for a low risk of a high loss. The profit expectancy stays negative. As far as I know, the professor is still trying to sell his grid trader, still advertising it as non-predictive, and still regularly blowing his demo account with it.

Trading by throwing a coin loses the transaction costs. But trading by applying the wrong model – for instance, trend following to a mean reverting price series – can cause much higher losses. The average trader indeed loses more than by random trading (about 13 pips per trade according to FXCM statistics). So it’s not sufficient to have a model; you must also prove that it is valid for the market you trade, at the time you trade, and with the used time frame and lookback period.

Not all price anomalies can be exploited. Limiting stock prices to 1/16 fractions of a dollar is clearly an inefficiency, but it’s probably difficult to use it for prediction or make money from it. The working model-based strategies that I know, either from theory or because we’ve been contracted to code some of them, can be classified in several categories. The most frequent are:

1. Trend

Momentum in the price curve is probably the most significant and most exploited anomaly. No need to elaborate here, as trend following was the topic of a whole article series on this blog. There are many methods of trend following, the classic being a moving average crossover. This ‘hello world’ of strategies (here the scripts in R and in C) routinely fails, as it does not distinguish between real momentum and random peaks or valleys in the price curve.

The problem: momentum does not exist in all markets all the time. Any asset can have long non-trending periods. And contrary to popular belief this is not necessarily a ‘sidewards market’. A random walk curve can go up and down and still has zero momentum. Therefore, some good filter that detects the real market regime is essential for trend following systems. Here’s a minimal Zorro strategy that uses a lowpass filter for detecting trend reversal, and the MMI indicator for determining when we’re entering trend regime:

function run() { vars Price = series(price()); vars Trend = series(LowPass(Price,500)); vars MMI_Raw = series(MMI(Price,300)); vars MMI_Smooth = series(LowPass(MMI_Raw,500)); if(falling(MMI_Smooth)) { if(valley(Trend)) reverseLong(1); else if(peak(Trend)) reverseShort(1); } }

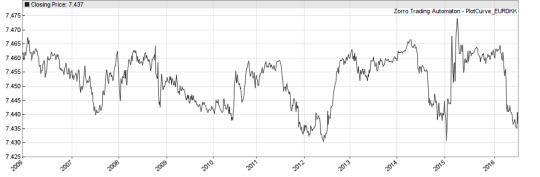

The profit curve of this strategy:

(For the sake of simplicity all strategy snippets on this page are barebone systems with no exit mechanism other than reversal, and no stops, trailing, parameter training, money management, or other gimmicks. Of course the backtests mean in no way that those are profitable systems. The P&L curves are all from EUR/USD, an asset good for demonstrations since it seems to contain a little bit of every possible inefficiency).

2. Mean reversion

A mean reverting market believes in a ‘real value’ or ‘fair price’ of an asset. Traders buy when the actual price is cheaper than it ought to be in their opinion, and sell when it is more expensive. This causes the price curve to revert back to the mean more often than in a random walk. Random data are mean reverting 75% of the time (proof here), so anything above 75% is caused by a market inefficiency. A model:

= price at bar t = fair price = half-life factor = some random noise term

The higher the half-life factor, the weaker is the mean reversion. The half-life of mean reversion in price series ist normally in the range of 50-200 bars. You can calculate λ by linear regression between yt-1 and (yt-1-yt). The price series need not be stationary for experiencing mean reversion, since the fair price is allowed to drift. It just must drift less as in a random walk. Mean reversion is usually exploited by removing the trend from the price curve and normalizing the result. This produces an oscillating signal that can trigger trades when it approaches a top or bottom. Here’s the script of a simple mean reversion system:

function run() { vars Price = series(price()); vars Filtered = series(HighPass(Price,30)); vars Signal = series(FisherN(Filtered,500)); var Threshold = 1.0; if(Hurst(Price,500) < 0.5) { // do we have mean reversion? if(crossUnder(Signal,-Threshold)) reverseLong(1); else if(crossOver(Signal,Threshold)) reverseShort(1); } }

The highpass filter dampens all cycles above 30 bars and thus removes the trend from the price curve. The result is normalized by the Fisher transformation which produces a Gaussian distribution of the data. This allows us to determine fixed thresholds at 1 and -1 for separating the tails from the resulting bell curve. If the price enters a tail in any direction, a trade is triggered in anticipation that it will soon return into the bell’s belly. For detecting mean reverting regime, the script uses the Hurst Exponent. The exponent is 0.5 for a random walk. Above 0.5 begins momentum regime and below 0.5 mean reversion regime.

3. Statistical Arbitrage

Strategies can exploit the similarity between two or more assets. This allows to hedge the first asset by a reverse position in the second asset, and this way derive profit from mean reversion of their price difference:

where y1 and y2 are the prices of the two assets and the multiplication factors h1 and h2 their hedge ratios. The hedge ratios are calculated in a way that the mean of the difference y is zero or a constant value. The simplest method for calculating the hedge ratios is linear regression between y1 and y2. A mean reversion strategy as above can then be applied to y.

The assets need not be of the same type; a typical arbitrage system can be based on the price difference between an index ETF and its major stock. When y is not stationary – meaning that its mean tends to wander off slowly – the hedge ratios must be adapted in real time for compensating. Here is a proposal using a Kalman Filter by a fellow blogger.

The simple arbitrage system from the R tutorial:

require(quantmod) symbols <- c("AAPL", "QQQ") getSymbols(symbols) #define training set startT <- "2007-01-01" endT <- "2009-01-01" rangeT <- paste(startT,"::",endT,sep ="") tAAPL <- AAPL[,6][rangeT] tQQQ <- QQQ[,6][rangeT] #compute price differences on in-sample data pdtAAPL <- diff(tAAPL)[-1] pdtQQQ <- diff(tQQQ)[-1] #build the model model <- lm(pdtAAPL ~ pdtQQQ - 1) #extract the hedge ratio (h1 is assumed 1) h2 <- as.numeric(model$coefficients[1]) #spread price (in-sample) spreadT <- tAAPL - h2 * tQQQ #compute statistics of the spread meanT <- as.numeric(mean(spreadT,na.rm=TRUE)) sdT <- as.numeric(sd(spreadT,na.rm=TRUE)) upperThr <- meanT + 1 * sdT lowerThr <- meanT - 1 * sdT #run in-sample test spreadL <- length(spreadT) pricesB <- c(rep(NA,spreadL)) pricesS <- c(rep(NA,spreadL)) sp <- as.numeric(spreadT) tradeQty <- 100 totalP <- 0 for(i in 1:spreadL) { spTemp <- sp[i] if(spTemp < lowerThr) { if(totalP <= 0){ totalP <- totalP + tradeQty pricesB[i] <- spTemp } } else if(spTemp > upperThr) { if(totalP >= 0){ totalP <- totalP - tradeQty pricesS[i] <- spTemp } } }

4. Price constraints

A price constraint is an artificial force that causes a constant price drift or establishes a price range, floor, or ceiling. The most famous example was the EUR/CHF price cap mentioned in the first part of this series. But even after removal of the cap, the EUR/CHF price has still a constraint, this time not enforced by the national bank, but by the current strong asymmetry in EUR and CHF buying power. An extreme example of a ranging price is the EUR/DKK pair (see below). All such constraints can be used in strategies to the trader’s advantage.

5. Cycles

Non-seasonal cycles are caused by feedback from the price curve. When traders believe in a ‘fair price’ of an asset, they often sell or buy a position when the price reaches a certain distance from that value, in hope of a reversal. Or they close winning positions when the favorite price movement begins to decelerate. Such effects can synchronize entries and exits among a large number of traders, and cause the price curve to oscillate with a period that is stable over several cycles. Often many such cycles are superposed on the curve, like this:

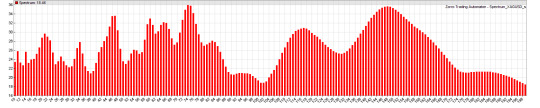

When you know the period Ci and the phase Di of the dominant cycle, you can calculate the optimal trade entry and exit points as long as the cycle persists. Cycles in the price curve can be detected with spectral analysis functions – for instance, fast Fourier transformation (FFT) or simply a bank of narrow bandpass filters. Here is the frequency spectrum of the EUR/USD in October 2015:

Exploiting cycles is a little more tricky than trend following or mean reversion. You need not only the cycle length of the dominant cycle of the spectrum, but also its phase (for triggering trades at the right moment) and its amplitude (for determining if there is a cycle worth trading at all). This is a barebone script:

function run() { vars Price = series(price()); var Phase = DominantPhase(Price,10); vars Signal = series(sin(Phase+PI/4)); vars Dominant = series(BandPass(Price,rDominantPeriod,1)); ExitTime = 10*rDominantPeriod; var Threshold = 1*PIP; if(Amplitude(Dominant,100) > Threshold) { if(valley(Signal)) reverseLong(1); else if(peak(Signal)) reverseShort(1); } }

The DominantPhase function determines both the phase and the cycle length of the dominant peak in the spectrum; the latter is stored in the rDominantPeriod variable. The phase is converted to a sine curve that is shifted ahead by π/4. With this trick we’ll get a sine curve that runs ahead of the price curve. Thus we do real price prediction here, only question is if the price will follow our prediction. This is determined by applying a bandpass filter centered at the dominant cycle to the price curve, and measuring its amplitude (the ai in the formula). If the amplitude is above a threshold, we conclude that we have a strong enough cycle. The script then enters long on a valley of the run-ahead sine curve, and short on a peak. Since cycles are shortlived, the duration of a trade is limited by ExitTime to a maximum of 10 cycles.

We can see from the P&L curve that there were long periods in 2012 and 2014 with no strong cycles in the EUR/USD price curve.

6. Clusters

The same effect that causes prices to oscillate can also let them cluster at certain levels. Extreme clustering can even produce “supply” and “demand” lines (also known as “support and resistance“), the favorite subjects in trading seminars. Expert seminar lecturers can draw support and resistance lines on any chart, no matter if it’s pork belly prices or last year’s baseball scores. However the mere existence of those lines remains debatable: There are few strategies that really identify and exploit them, and even less that really produce profits. Still, clusters in price curves are real and can be easily identified in a histogram similar to the cycles spectogram.

7. Curve patterns

They arise from repetitive behavior of traders. Traders not only produce, but also believe in many curve patterns; most – such as the famous ‘head and shoulders’ pattern that is said to predict trend reversal – are myths (at least I have not found any statistical evidence of it, and heard of no other any research that ever confirmed the existence of predictive heads and shoulders in price curves). But some patterns, for instance “cups” or “half-cups”, really exist and can indeed precede an upwards or downwards movement. Curve patterns – not to be confused with candle patterns – can be exploited by pattern-detecting methods such as the Fréchet algorithm.

A special variant of a curve pattern is the Breakout – a sudden momentum after a long sidewards movement. Is can be caused, for instance, by trader’s tendency to place their stop losses as a short distance below or above the current plateau. Triggering the first stops then accelerates the price movement until more and more stops are triggered. Such an effect can be exploited by a system that detects a sidewards period and then lies in wait for the first move in any direction.

8. Seasonality

“Season” does not necessarily mean a season of a year. Supply and demand can also follow monthly, weekly, or daily patterns that can be detected and exploited by strategies. For instance, the S&P500 index is said to often move upwards in the first days of a month, or to show an upwards trend in the early morning hours before the main trading session of the day. Since seasonal effects are easy to exploit, they are often shortlived, weak, and therefore hard to detect by just eyeballing price curves. But they can be found by plotting a day, week, or month profile of average price curve differences.

9. Gaps

When market participants contemplate whether to enter or close a position, they seem to come to rather similar conclusions when they have time to think it over at night or during the weekend. This can cause the price to start at a different level when the market opens again. Overnight or weekend price gaps are often more predictable than price changes during trading hours. And of course they can be exploited in a strategy. On the Zorro forum was recently a discussion about the “One Night Stand System“, a simple currency weekend-gap trader with mysterious profits.

10. Autoregression and heteroskedasticity

The latter is a fancy word for: “Prices jitter a lot and the jittering varies over time”. The ARIMA and GARCH models are the first models that you encounter in financial math. They assume that future returns or future volatility can be determined with a linear combination of past returns or past volatility. Those models are often considered purely theoretical and of no practical use. Not true: You can use them for predicting tomorrow’s price just as any other model. You can examine a correlogram – a statistics of the correlation of the current return with the returns of the previous bars – for finding out if an ARIMA model fits to a certain price series. Here are two excellent articles by fellow bloggers for using those models in trading strategies: ARIMA+GARCH Trading Strategy on the S&P500 and Are ARIMA/GARCH Predictions Profitable?

11. Price shocks

Price shocks often happen on Monday or Friday morning when companies or organizations publish good or bad news that affect the market. Even without knowing the news, a strategy can detect the first price reactions and quickly jump onto the bandwagon. This is especially easy when a large shock is shaking the markets. Here’s a simple Forex portfolio strategy that evaluates the relative strengths of currencies for detecting price shocks:

function run() { BarPeriod = 60; ccyReset(); string Name; while(Name = (loop(Assets))) { if(assetType(Name) != FOREX) continue; // Currency pairs only asset(Name); vars Prices = series(priceClose()); ccySet(ROC(Prices,1)); // store price change as strength } // get currency pairs with highest and lowest strength difference string Best = ccyMax(), Worst = ccyMin(); var Threshold = 1.0; // The shock level static char OldBest[8], OldWorst[8]; // static for keeping contents between runs if(*OldBest && !strstr(Best,OldBest)) { // new strongest asset? asset(OldBest); exitLong(); if(ccyStrength(Best) > Threshold) { asset(Best); enterLong(); } } if(*OldWorst && !strstr(Worst,OldWorst)) { // new weakest asset? asset(OldWorst); exitShort(); if(ccyStrength(Worst) < -Threshold) { asset(Worst); enterShort(); } } // store previous strongest and weakest asset names strcpy(OldBest,Best); strcpy(OldWorst,Worst); }

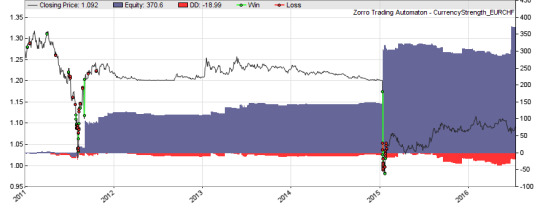

The equity curve of the currency strength system (you’ll need Zorro 1.48 or above):

The blue equity curve above reflects profits from small and large jumps of currency prices. You can identify the Brexit and the begin and end of the CHF price cap. Of course such strategies would work even better if the news could be early detected and interpreted in some way. Some data services provide news events with a binary valuation, like “good” or “bad”. For learning what can happen when news are used in more creative ways, I recommend the excellent Fear Index by Robert Harris – a mandatory book in any financial hacker’s library.

This was the second part of the Build Better Strategies series. The third part will deal with the process to develop a model-based strategy, from inital research up to building the user interface. In case someone wants to experiment with the code snippets posted here, I’ve added them to the 2015 scripts repository. They are no real strategies, though. The missing elements – parameter optimization, exit algorithms, money management etc. – will be the topic of the next part of the series.

0 notes