#funded traders

Explore tagged Tumblr posts

Text

cost me $50 to order 180 otc sleeping aids from the us of a. and u could get a range of doses and even FLAVOURS? they’re not available otc or as funded prescriptions here so they’re usually $1 per pill and ur only allowed 30 at a time wahoo.

#may i emphasise they are Not addictive or even Good sleeping pills but they claim to not fund them because of fears of addiction#man. hate getting addicted to having uninterrupted sleep#my greatest vice (lover of sleep)#if i had been permitted my full and allotted time in LA (fuck u gastroenteritis and fuck u lufthansa) i would’ve been straight to CVS#i know healthcare is fucked but u have delightful quantities of OTC meds available for purchase#but its ok we got to wander around a trader joes and hobby lobby and i was thrilled by it

4 notes

·

View notes

Text

"The Funded Trader" Enabling traders to reach their full potential.

With the arrival of the booming prop firm industry, aiming to fund the traders to take their trading career to next levels, there is one name that stands out , a leading prop firm in the prop firm space "The Funded Trader".

With their carefully designed programs to help traders of all kids and styles. They provide upto $600000 in funded capital that can be scaled upto $1.5million allowing you to never depend on small capital and in the process helping you to take the big step towards a better future in financial markets.

Offering different account options to accomodate your trading style and your trading strategy. you can choose betwqeen regular or swing tading accounts.

Standard Challenge:

Choose account sizes ranging from $5000 to $400000. Pass two step varification process with leading industry standard rules and regulation.

phase 1 target: 8%

phase2 target 5%

Rapid Challenge:

With zero minimum trading days, to fast track your journey to be a funded trader.

Accounts ranging from $5000 to $200000.

Royal Challenge:

With the accounts ranging from $50,000 to $400,000. Royal challenge has no limits on EA's and the news trading is allowed.

Knight challenge:

One step challenge with unlimited days and 0 minimum days. you can select challenge accounts ranging from $25000 to $200000.

Why The Funded Trader is industry leader?

Social media presence: With their different accounts type and a bigger community of traders, The funded trader helps you to connect with like minded traders and take your trading journey to the next level.

Discord: A very active discord to help with any queries and the constant give aways keep you engage in the community.

Treasure Hunt app: very first of its kind, treasure hunt app to keep you engaged within the community and you can earn rewards every month. https://hunt.thefundedtraderprogram.com/r/adnanali?fbclid=IwAR3ZVgXIIRLB7yker6-I93290JdC8r57rUDdh5w3J9_vdToWgwwFfqtZQFU

Monthly trading competition: The biggest monthly trading competition in the industry where you can showcase your trading potential and earn rewards and different challenge accounts.

The funded trader is true industry leader in the prop firm industry. so take a leap of faith and embark on a trading journey to keep you financially independent.

Click on the Affiliate link below to buy a challenge today.

#the funded trader#stockmarket#crypto#finance#forex#marketing#crptocurrency#gold#sucess story#binance#lifestyle#life skills#forex online trading#forex education#forex trading#forexsignals#forextrading#forexmarket#forexmentor#trader

23 notes

·

View notes

Text

Start your prop firm -

In the fast-evolving landscape of financial markets, the concept of prop trading (proprietary trading) has gained significant traction. Aspiring traders are increasingly drawn to the idea of establishing their prop firms, leveraging technology and funded trading opportunities. This article delves into the world of FXPropTech, prop firms, and the journey to becoming a funded trader.

1. Understanding Proprietary Trading (Prop Trading): Proprietary trading, often referred to as prop trading, involves financial firms trading their own capital in the markets. This approach differs from traditional trading where institutions trade on behalf of clients. Prop trading firms seek to generate profits directly from market movements, utilizing various strategies and tools.

2. The Rise of FXProptech: FXProptech, the fusion of foreign exchange (FX) trading and financial technology (fintech), represents a new frontier in the trading landscape. These technologies empower traders with advanced analytics, algorithmic trading, and risk management tools. The marriage of FX and technology has given rise to innovative platforms and strategies, enabling traders to navigate the complex currency markets efficiently.

3. Prop Firms and Funded Trader Programs: Many traders embark on their journey by joining prop firms or participating in funded trader programs. These initiatives provide aspiring traders with an opportunity to trade firm capital, often with minimal personal risk. In return, traders share a percentage of their profits with the sponsoring firm. This arrangement aligns the interests of traders and firms, creating a mutually beneficial partnership.

4. The Benefits of Joining a Prop Firm: Joining a prop trading firm offers several advantages. Traders gain access to substantial capital, advanced trading tools, and often benefit from mentorship programs. Prop firms, in turn, diversify their trading strategies and tap into the potential of skilled and emerging traders.

5. My Funded FX Journey: A Personal Account: In this section, we explore real-life success stories of individuals who have embarked on their funded FX journeys. Understanding the experiences and challenges faced by funded traders can provide valuable insights for those considering a similar path.

6. Steps to Start Your Prop Firm: For those aspiring to establish their prop firms, this section provides a step-by-step guide. From legal considerations to technology infrastructure, we cover the essential elements required to launch and run a successful proprietary trading business.

Conclusion: Starting your prop firm is an exciting venture that combines financial acumen with technological innovation. With the rise of FXPropTech and the opportunities presented by prop firms and funded trader programs, aspiring traders have a unique chance to make their mark in the dynamic world of proprietary trading. Whether you're a seasoned trader or a newcomer to the industry, exploring these avenues can open new doors to success.

#proptech#forex prop firms funded account#ftmo#funded#fxproptech#prop firm#props firms#the funded trader#my funded fx#best trading platform#best prop firms#Start your prop firm

3 notes

·

View notes

Text

Mastering Trade Entry and Exits: Proven Buying and Selling Strategies

Trading involves timed buying and selling to reduce risks and maximize returns. Knowing when to enter and exit is a challenge for many retail traders, regardless of their level of experience. You can increase your success rate and prevent rash decisions by using a well-thought-out strategy. Let's explore essential strategies for being proficient trade entry and exits in this blog so you can trade with assurance and accuracy. Read more: https://640c2b10136d8.site123.me/blog/mastering-trade-entry-and-exits-proven-buying-and-selling-strategies

#Funded Trader#forex trading#funded forex trader programs#funded trading account#forex trading account

1 note

·

View note

Text

Multi-Currency Funding for IBKR Accounts Fund your account in 28 different currencies to simplify international trading. This feature provides flexibility for global traders. Learn more: https://brokeragetoday.com/interactive-brokers-to-trading-view/ #MultiCurrency #AccountFunding

0 notes

Text

#trader funding#fundx#best prop firm trading#Prop Trading Platform#best prop firms forex#Simulated trading accounts

1 note

·

View note

Text

TradeDay Review and Apex Trader Funding Coupon Insights

TradeDay Review and Apex Trader Funding Coupon Insights

Looking for exclusive discounts and honest reviews of top funded trader programs? You've come to the right place! This article dives into the details of TradeDay's offerings and provides valuable insights on how to maximize your savings with Apex Trader Funding coupon codes. Read on to discover how you can elevate your trading experience while keeping your costs low.

Apex Trader Funding Prop Firm Coupon Deals

Apex Trader Funding stands out as one of the leading platforms for traders seeking access to substantial trading capital. By using the NRWRQEYW coupon code, traders can save up to 90% on monthly fees. This Apex Trader Funding discount code is compatible with both Rithmic/NinjaTrader and Tradovate/NinjaTrader platforms, ensuring a seamless trading experience across robust futures markets.

Whether you're a novice or a seasoned trader, Apex Trader Funding offers funded accounts as large as $300,000, allowing you to trade mini or micro contracts while enjoying significant cost savings. This Apex Trader Funding 90% off code ensures that you can access top-tier trading tools and capital without breaking the bank.

TradeDay Review and Coupon Codes

TradeDay provides traders with an opportunity to access funded accounts with a straightforward and flexible evaluation process. With the LC2TPROMO code, you can save up to 60% on account fees. For example, a $50,000 funded account costs just $66 after applying this discount. Larger account tiers also benefit from similar savings, making TradeDay a cost-effective option for traders at all levels.

Key features of TradeDay include:

Day-one access to trading funds.

No minimum trading days, allowing for greater flexibility.

Free withdrawals for amounts over $250.

TradeDay’s evaluation process lets you demonstrate your trading strategies without stringent trading rules, making it an ideal choice for traders looking to showcase their performance in a less restrictive environment.

Start Saving Today

Whether you’re interested in TradeDay’s user-friendly platform or the comprehensive tools available through Apex Trader Funding, these discounts provide the perfect opportunity to enhance your trading potential while saving on costs. Take advantage of these exclusive deals today to elevate your trading journey!

Remember to use the NRWRQEYW coupon code for Apex Trader Funding and the LC2TPROMO code for TradeDay to unlock these exceptional savings.

0 notes

Text

Be the Axe Trader Not the Target and Become a Surge Trader

Surge Trader was a prop firm that failed due to financial insolvency, Let’s Find out how you can stay away from prop firms that are unsustainable. More: https://www.axetrader.com/surge-trader

#forex #bestpropfirms #surgetrader #fundedoptions #forextrading #trading #riskmanagement #proptrading #propfirm #usa #unitedstates #axetrader

#prop firms#funded trading accounts#cheapest prop firms#instant funding prop firm#proprietary trading firm#trading risk management#the talented trader#prop firm trading#prop firm challenge#prop firms instant funding#surge trader#axe trader

0 notes

Text

Supply and demand trading is a strategy that focuses on identifying key price levels where the balance between buyers and sellers shifts, leading to potential price movements. By recognizing these supply (resistance) and demand (support) zones, traders can make informed decisions on when to enter or exit trades, aiming to capitalize on market fluctuations. More: https://www.axetrader.com/supply-and-demand-trading

#forex #instantfunding #bestpropfirms #supplyanddemandtrading #fundednext #forextrading #trading #riskmanagement #proptrading #propfirm #usa #unitedstates #axetrader

#Supply and demand trading#funded trading programs#instant funding prop firm#prop firms with instant funding#prop trading firms#prop firms with no time limit#buy forex trading account#forex market#forex#forex trading#axe trader

1 note

·

View note

Text

Introducing Hola Prime's Price Transparency Report!

In a decentralized forex market, we are proud to be the first and only prop firm to publish complete tick-by-tick data alongside its comparison with market prices. Our commitment to transparency ensures you have all the information you need to make informed trading decisions.

Why is this important?

- Full Transparency: Get a clear, detailed view of every market movement.

- Informed Decisions: Make smarter trades with precise data at your fingertips.

- Trustworthy Trading: Build confidence with our unmatched data transparency.

Join the revolution in transparent trading with Hola Prime.

#proprietary trading#ctrader#trading prop firms#what is a prop firm#meta trader 5#trader mt4#best prop trading firms#prop trading companies#prop trading firm#proprietary trading firm#propfirm#what is a pip in trading#prop traders#funded prop firms#trader funding#whats skrill#best prop firms forex#prop firms forex

0 notes

Text

youtube

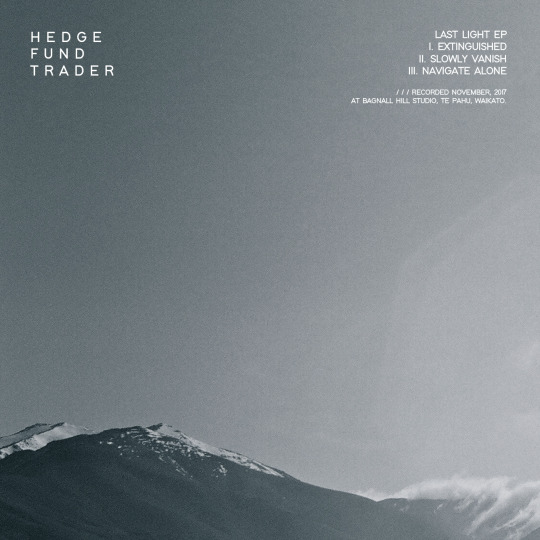

HEDGE FUND TRADER-AND I MADE UP LIES SO THEY ALL FIT NICE

#HEDGE FUND TRADER#GRINDCORE#GRIND#MATHCORE#SPAZZCORE#HEAVY METAL#METAL;#PUNK#DISCOGRAPHY#2017 EP#Youtube

1 note

·

View note

Text

Join our community of forex funded traders at Atlas Funded. We offer access to capital and resources that empower you to focus on trading without the financial burden, maximizing your profit potential.

#forex trading with leverage#leveraged fx trading#forex funded trader#funded forex trader#best prop firms forex#best futures prop firms#best proprietary trading firms#futures proprietary trading firms#best forex prop firms

0 notes

Text

Forex Funding Explained: What Traders Need to Know in Today’s Market

There are numerous opportunities in the Forex trading industry, but not without troubles of its own. The requirement for adequate capital is one of the main obstacles faced by ambitious traders. Trading forex is not easy, so you need to be ready with the suitable tools to handle this cutthroat and quick-paced market. We'll look at what Forex funding is, how it operates, and why it's crucial for traders hoping to make it, in this blog. Read more!

#Forex trading#funded trader#forex trading account#funded forex trader programs#funded trading account#funded trading programs

1 note

·

View note